- 1Department of Management in Digital Societies, Kozminski University, Warsaw, Poland

- 2American Institute for Economic Research, Great Barrington, MA, United States

Positive and normative claims that artificial intelligence (AI) will or should lead to adoption of a universal basic income policy (UBI) remain insufficiently empirically grounded to merit serious consideration. Long-term trends in individual/familial income portfolio adjustment (IPA) to business, economic, and technological change (BETC) point to continued incremental changes in the ways that individuals/families achieve life goals, not a fundamental structural break necessitating radical policy changes that may not be desirable in any event. Moreover, if AI proves a more rapid disruptor than anticipated, UBI-like payments can be made quickly, as recent bailouts and fiscal stimuli demonstrate.

Introduction

Business, economic, and technological change (BETC) occurs continuously but at variable speed (Lauterbach, 1977; Bakker et al., 2019). While the cumulative effects of periods of relatively rapid BETC, often termed “Revolutions” [e.g., Agricultural (Olmstead and Rhode, 2008), Communication (Albion, 1932), Financial (Sylla, 2002), Industrial/Industrious (De Vries, 1994), Institutional (Allen, 2011), Market (Majewski, 1997), Transportation (Seely, 2007)], have been substantial (Makridakis, 2017), they always occur over several years or decades. Waves of automation in the 20th century also caused substantial fears of job loss that never occurred (Terborgh, 1966).

The pace of change can be fast enough to create angst and to stir predictions of dire results that induce specific interest groups to take direct actions designed to slow the pace of BETC for their own benefit, as Luddites (who destroyed installed machines in Britain between 1811 and 1817) and unions (who destroy machines before they are produced by means of union contracts protecting jobs) did (Donnelly, 1986). Nevertheless, changes in individual/familial life strategies consistently proved more effective than interest group action because they occur more quickly than even the fastest revolutions, adapting to inevitable BETC rather than trying to stop or dramatically slow it [see, e.g., (Hopkins, 1982; Goolsbee, 2018)].

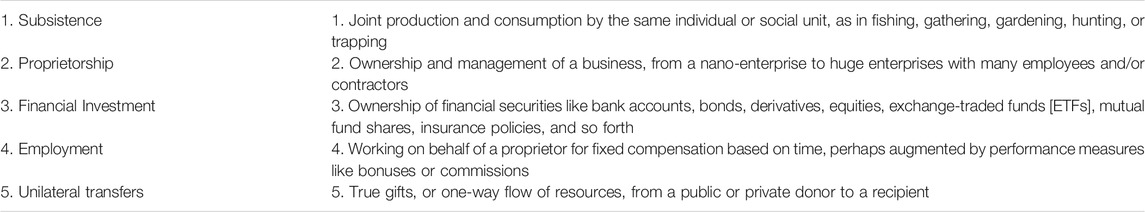

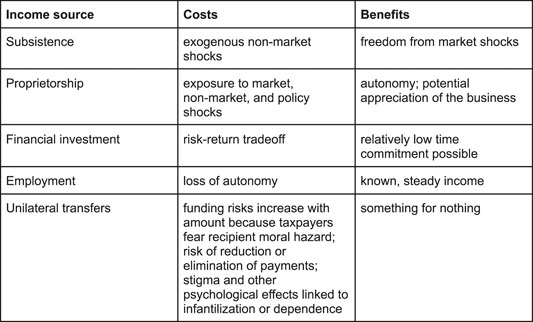

Individuals/families aspire to achieve goals that can be understood as a tradeoff between real (inflation-adjusted) consumption and leisure, i.e., about how long and hard to work. Those goals adapt to BETC and life cycle events (Dunn, 1979; Childers, 2011). Rational individuals [as defined by (Arrow, 2012)] form and frequently update expectations about strategies most likely to achieve their life goals (MacDonald and Peel, 1983). In essence, that means adjusting a portfolio of sources of real income (IPA), which stems from the five distinct1 sources described in Table 1 below:

Proponents of AI = UBI concentrate on income sources four and five without giving sufficient consideration to income sources one, two, and three. If AI causes employment to decrease, they reason, UBI [“periodic cash payment unconditionally delivered to all on an individual basis, without means-test or work requirement” (Haagh, 2019)] will be needed to meet the real income goals of unemployed/unemployable individuals. That reasoning, however, does not fully reflect reality for five reasons:

1. AI is not yet as powerful as many believe and hence is not as big a threat to employment as often claimed. In fact, as a general purpose assistive technology (GPT) it generates new jobs and reskills existing ones.

2. The net number of jobs continues to increase. Jobs that “disappear” do so because of the complex processes associated with BETC, not because of AI, the Internet of Things (iot), or edge computing.

3. If employment decreases in the future (due to AI and/or other causes), individuals may prefer to respond via IPA, by increasing the importance of subsistence, proprietorship, and financial investment in their income portfolios over acceptance of unilateral transfers.

4. If individuals prefer unilateral transfers, options other than UBI abound and may prove preferable from the standpoint of both public policy and individuals’ life goals.

5. If at some point employment decreases dramatically and individuals prefer UBI, it can be implemented quickly at that time.

Each of the points 1 through 5 above are explained in fuller detail in the explained in fuller detail below.

Artificial Intelligence Today

Artificial Intelligence is a general purpose technology (GPT), a label used to describe technologies, like the steam engine, electrification, and the Internet, that cause significant and widespread impacts on society and the workplace. GPTs may also generate numerous more specialized complementary innovations and technologies.

Current BETC, including the widespread application of AI, will impact how people live and work. The cumulative scope of AI-induced change must remain unknown, leading to alarmist dystopian visions of a future without human work despite the fact that the annual rate of change has shown no signs of unusual rapidity. AI today cannot supplant human workers; it can only increase their productivity by decreasing the gap between workers and technological enhancement.

Automation certainly changes the nature of work but AI’s impact on the future of work remains unclear. Some researchers [e.g., (Acemoglu and Restrepo, 2017)] connect the adoption of AI and robots to reduced employment and wages, suggesting the need for UBI adoption. Others claim that it will become easy to automate millions of jobs worldwide in a short period of time and significantly more jobs will disappear than will be created (Crawford et al., 2016; Goolsbee, 2018; Furman and Seamans, 2019). Some business consultants concur but others predict the contrary. According to studies conducted by McKinsey, PricewaterhouseCoopers and Skynet Today, AI will displace about one-third of the existing jobs worldwide within a decade, with the United States (up to 40%) and Japan (50%) among the hardest hit. According to the OECD AI Policy Observatory and Beyond Limits Study, AI will create more jobs than it destroys. Companies pioneering the development and scaling of AI have thus far not destroyed jobs on net. There are no indications that trend will not continue for the foreseeable future.

Working Together With AI

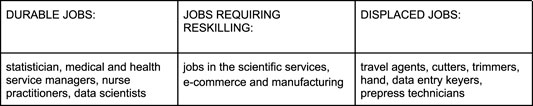

Threats to jobs posed by AI and similar technologies can be assessed by examining core skill sets, i.e., by distinguishing between durable jobs, those that will require reskilling, and those that will become obsolete (Latham and Humberd, 2018). Some jobs that were durable during previous periods of BETC will remain durable in the foreseeable future, as will others, at least in the short- and medium-term perspective. Some workers will need significant reskilling but for others reskilling will be relatively minor.

Sources:https://www.bls.gov/ooh/fastest-growing.htm; https://www.bls.gov/news.release/ecopro.nr0.htm; https://www.bls.gov/emp/tables/fastest-declining-occupations.htm

Currently, we can observe two parallel discourses regarding the future of work: 1) automation of work leading to the replacement of humans, and 2) cobotization, focusing on close collaboration with various assistive technologies in general, and AI in particular.2

As Autor (2015) notices, machines both substitute and complement human labor. Substituting for workers in routine tasks also amplifies the comparative advantage of workers in various problem-solving skills. Focusing on lost jobs, in other words, misses the fact that technology simultaneously increases “the value of the tasks that workers uniquely supply.” Automation has already affected mostly routine and low-skilled tasks. For instance, the initial wave of industrial robots primarily affected manufacturing processes. AI’s problem solving, reasoning, and perception capabilities mean that it can perform some non-routine cognitive tasks, like summarizing computer science research papers. Recent evidence shows that companies are already achieving productivity gains by using software robots to perform routine, rules-based service processes. If implemented well, such automation can result in high-performing human-robot teams, in which software robots and human employees complement one another. In some cases automation does substitute for labor (Autor and Salomons, 2018) but it also complements labor in many ways, raising output sufficiently to create higher demand for labor, and interacts with adjustments in labor supply, say by increasing familial income enough to induce a spouse to leave the labor force.

Moreover, artificial intelligence and automated tools will usually replace tasks rather than jobs. A key insight is that a job can be viewed as a bundle of tasks, some of which offer better applications for technology than others (Autor et al., 2000). Thus, particularly in the short term, researchers should think in terms of task replacement rather than unemployment. Some high-skilled professionals such as engineers, radiologists, or lawyers are at risk because most of the tasks they perform can be done by AI. Such highly educated professionals, however, may also be capable of applying AI in a way that complements their work.

Future Artificial Intelligence

Major developments in AI, deep learning, natural language understanding, and machine vision led to new collaboration-oriented systems (Haenlein and Kaplan, 2019). Initially, AI systems such as AlphaStar, AlphaGo or muZero (Wang et al., 2016; Vinyals et al., 2019; Schrittwieser et al., 2020; Shaikh, 2020) were created to prove that AI can compete with humans and actually beat them in complex games. Professional players, however, adapted rather than conceding defeat; their competition with AI led to significant performance improvement (Waters, 2018).

In the short- and medium-term, AI development will take two discrete paths. The first extrapolates what AI is today, highly specialized, deep learning algorithms applicable to clearly delineated problems in more complex, context aware, and nuanced ways. Because of their capacity to learn highly nonlinear functions with near-automatic input space transformations, deep neural nets (DNNs) are currently the algorithms with very high economic potential at the frontier of task automation. DNN software can be extended to new domains formerly closed to digitization through transfer learning (Torrey and Shavlik, 2010; Weiss et al., 2016).

The second path entails the creation of AI systems capable of processing information in a manner similar to the human brain. Today, deep nets rule AI in part because of an algorithm called backpropagation (Hecht-Nielsen, 1992; Lillicrap et al., 2020) that allows deep neural nets to learn from data and thus gain capabilities like language translation, speech recognition, and image classification. Real brains, however, likely do not rely on similar algorithms. Human brains are capable of abstract reasoning and learn more efficiently than current AI systems can (LeCun et al., 2015). Geoffrey E. Hinton, Yoshua Bengio and many other experts have been thinking about more biologically plausible learning mechanisms that might at least match the success of backpropagation and expand AI’s capacity to learn and adapt. Currently, feedback alignment, equilibrium propagation, and predictive coding seem particularly promising.3

The second path of biologically inspired AI development has a high potential of transforming AI’s capabilities and overcoming its current limitations, creating more robust and complex systems capable of more abstract levels of reasoning. It, however, remains nascent and hence many years away, as does Singularity (McAfee and Brynjolfsson, 2016; Tegmark, 2017; McAfee and Brynjolfsson, 2017).

The first path may develop without the second, or alongside it. It will not affect the number of jobs per se, but rather, like earlier BETC “revolutions,” it will produce a profoundly different economy. Large-scale technologies, like the Internet, the power grid, and roads and highways, will in the future rely on AI, as both solution complexity and demand continue to increase.

Long-Term Employment Trends shows that there are no indications at present that AI, or any other BETC, poses a threat to employment in the US or other rich nations, so long as human capital, from training programmes to formal education, adapts, as it always has (Goldin and Katz 2009).

Long-Term Employment Trends

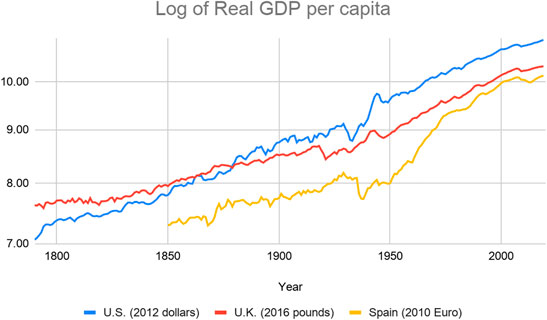

Real (inflation-adjusted) per capita income has trended steadily upward in much of Europe, Anglo-America, and the Far East for the last several centuries, subject only to the booms and busts associated with wars, the business cycle, and technological breakthroughs. Nations like Spain that lagged due to institutional deficiencies experienced rapid growth once growth-inducing institutions were created but the overall trend is one of steady, though not monotonic, growth (Acemoglu and Robinson, 2012).

Note the use of a log scale in the following charts of US, UK, and Spanish real per capita income, which is standard procedure when presenting long-term time series data of this nature so that year-over-year changes and long-term trends become visually evident. The Great Depression and World War II caused the big dip and subsequent fast growth evident especially in the data for the US and Spain, which also experienced a devastating civil war in the 1930s. Note, though, how real per capita growth returned to the long-term trend line in the postwar period in both the US and UK and that institutional improvement, not technological change, drove Spanish income convergence.

Sources: Louis Johnston and Samuel H. Williamson, “What Was the U.S. GDP Then?” MeasuringWorth, 2021. URL: http://www.measuringworth.org/usgdp/; Ryland Thomas and Samuel H. Williamson, “What Was the Consistent U.K. GDP Then?” MeasuringWorth 2021. URL: http://www.measuringworth.com/ukgdp/; Leandro Prados-de-la-Escosura, “What Was Spain’s GDP Then?” MeasuringWorth, 2021. URL: http://www.measuringworth.org/spaingdp/.

Sustained increases in real per capita incomes stem only from productivity improvements, i.e., creating more output from the same input, which is the point of BETC. Supply and demand conditions in labor and capital markets, along with public policies regarding taxation, unionization, and so forth, determine how the additional income comes to be distributed among employees, proprietors, financial investors (through their ownership of corporate securities), and governments.

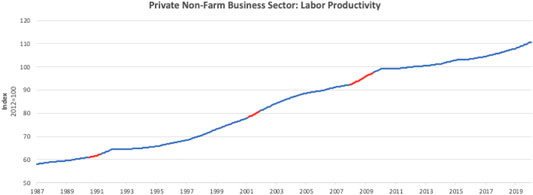

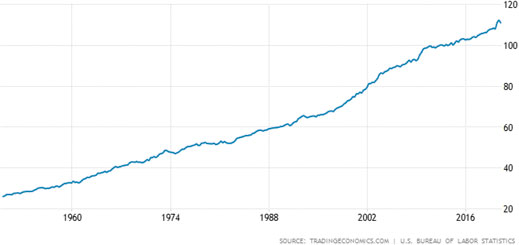

Private nonfarm business sector labor productivity in the United States has been climbing without interruption, though at variable rates of increase, for at least the last 3 decades and with minor reversals since at least World War II. Similar metrics show similar trends for OECD (Productivity, 2021) and EU countries (Baily et al., 2020).

Source: Federal Reserve Economic Data, “Private Non-Farm Business Sector: Labor Productivity, Index 2012=100, Annual, Not Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/graph/?id=MPU4910062.

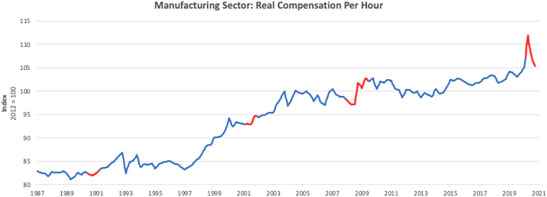

Nominal and real wage data suggest that labor productivity has been trending upwards for over two centuries. The average nominal wage of manufacturing workers in the United States increased from two cents per hour in 1790 to $32.36 in 2019 (Measuring Worth–Annual Wages in the United States, n. d.). Real total compensation per hour for those same worker cycles sometimes stagnates for several years to a decade but also trends upward over the long term:

Source: Federal Reserve Economic Data, “Manufacturing Sector: Real Compensation Per Hour, Index 2012=100, Quarterly, Seasonally Adjusted” FRED, 2021. https://fred.stlouisfed.org/series/COMPRNFB.

Long-term workers responded to higher real compensation by working fewer hours. In the early 19th century, for example, female textile workers in Lowell, Massachusetts worked on average 12 h per day, 300 days of the year (Little, 2001). Although some professionals (attorneys, investment bankers, physicians, professors) continue to work 60–100 h per week up to 50 weeks per year, most factory and office workers now work 40 or fewer hours per week, and must receive a higher rate of compensation to induce additional hours of work.

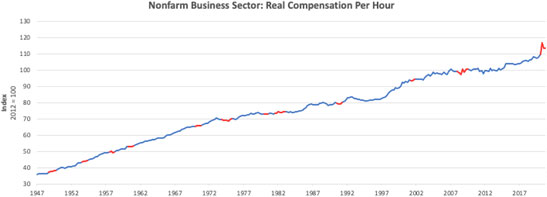

Some claim that real compensation has stagnated or declined in the United States over the last few decades [see, e.g., (Wage Stagnation in Nine Charts, 2021)] but only by conflating wages with total compensation. The latter includes benefits, including healthcare costs covered by employers and employer contributions to private retirement accounts. Rising healthcare costs due to America’s inefficient, employment-based healthcare system have caused the divergence between wages and total compensation (Flynn, 2019). The magnitude of the problem is revealed by that fact that half of the unilateral transfers made by the US federal government to the poor cover healthcare costs (Feldstein, 2016).

Source: Federal Reserve Economic Data, “Nonfarm Business Sector: Real Compensation Per Hour, Index 2012100, Quarterly, Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/series/COMPRNFB.

As others have noted [e.g., (D. H. Autor, 2015)], total jobs (employees) has trended steadily upwards in the United States since at least 1939, subject only to cyclical downturns or, at the extreme right of the graph, exogenous shocks like pandemics and the “lockdown” policies implemented in response (The Effect of Lockdown Measures on Unemployment, 2021).

Source: Federal Reserve Economic Data, “All Employees, Total Nonfarm, Thousands of Persons, Monthly, Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/series/PAYEMS.

For the last 20 years, between two and eight million jobs have gone unfilled in the United States each year due to mismatches between worker skills and job functions but also discrepancies between worker wage demands and what employers are willing to pay to fill open positions.

Source: Federal Reserve Economic Data, “Total Unfilled Job Vacancies for the United States, Persons, Monthly, Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/series/LMJVTTUVUSM647S.

The Labor Force Participation Rate (LFP), the total percentage of the working age population employed, has trended downward since its recent highs in the late 1990s but even at its current nadir due to Covid lockdowns remained above its lows in the 1950s. The economic interpretation of the LFP is difficult because increases or decreases are not unequivocally good or bad. In poorer countries today, and in the early histories of the US, UK, and other core rich nations, the LFP was over 100 percent by today’s definition of the labor force. Children as young as four worked, as did people now considered differently abled (blind, deaf, immobile, insane) or superannuated (too old to work). Similarly, the relatively low LFP in the 1950s and 1960s stemmed from America’s relative economic strength and cultural mores. Many women remained out of the labor force because families could meet their life goals without them taking jobs (Monthly Labor Review 2002). A low LFP due to a high percentage of people who want a job but cannot find one, by contrast, could signal economic trouble, like the big drop in the LFP during the 2020 pandemic and subsequent lockdowns (Bullard, 2014). But secular declines in LFP like that which started circa 2000 might simply signal preferences for the other four income sources (Juhn and Potter, 2006).

Source: Federal Reserve Economic Data, “Labor Force Participation Rate, Percent, Monthly, Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/series/CIVPART.

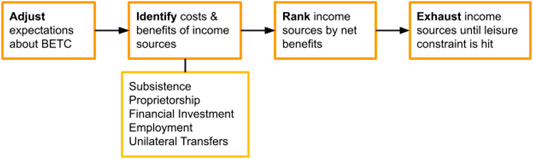

Cost-Benefit Analysis of IPA describes how individuals (and families) try to meet their life goals by splitting their work time into subsistence activities, proprietorship, investment in financial assets, employment, and the receipt of unilateral transfers based on the relative costs and benefits of each income source.

Cost-Benefit Analysis of IPA

Simply because someone remains outside of the official labor force does not mean that they do not work. In 1950s America, for example, many married women engaged in subsistence activities in lieu of paid employment. Many in rural and suburban areas gardened and did their own washing, sewing, and so forth instead of buying vegetables and laundry services in the market. Like other rational actors, they compared the expected costs and benefits of each the five main sources of income and chose the ones with the largest net benefits:

The flow chart above is more formally stated in Equation 1 below. [For more complex modelling of a portfolio of income streams with uncertain returns, see (Brennan, 1973).]

Where:

n = income source counter

w = weight of each income source

i = income source.

Historical examples of such reasoning abound. In 1848, for example, Abraham Lincoln suggested that his stepbrother, John D. Johnston, should ease out of subsistence-only farming by growing some cash crops (proprietorship) and by going “to work for the best money wages… you can get” (employment), with the ultimate goal of buying bank and railroad shares (financial investment) (Guelzo, 2000). Similarly, trappers sometimes made their own clothes from the furs of the animals they trapped, a subsistence activity. Sometimes they sold the furs to furriers, making them proprietors. Other times they worked for a fur company for a salary, rendering them employees. Sometimes they purchased shares in fur companies, making them financial investors. Often, the same person engaged in all those activities serially, and sometimes even simultaneously, to adjust to BETC (Wright, 2019).

The major costs and benefits of each of the five main sources of income are described below. The costs and benefits vary in intensity over time and place, thereby inducing IPA (Rose, 2017; Mason, 2020). The existence of AI of course in no way limits the ability of human beings to engage in subsistence activities, proprietorship, financial investment, or to receive unilateral transfers. It may, however, enhance their ability to engage in such activities. AI is already used to reduce the costs of frightening deer away from gardens and of finding government grants, franchise opportunities, and financial investments (Biswal, 2020). What it takes from employment, in other words, it may very well return to other sources of income.

Subsistence

Subsistence activities occur when an individual, family, or other social unit makes a good that s/he or they personally consume (Elwert and Wong, 1980). For most of human history, subsistence activities like hunting and gathering, complemented by trade (proprietorship), constituted the main source of consumption and may come to dominate once again in the face of climatic or other shocks (Gowdy, 2020).

A major benefit of subsistence activity is control over the quantity and quality of consumption goods free from exogenous market shocks (Chibnik, 1978). During the Great Depression, for example, many people who had grown accustomed to buying poultry (chicken, ducks, rabbits, turkeys) at market began to raise them for home consumption (Cook, 1998); hunting, fishing, and trapping increased in popularity (Wright, 2021b).

Subsistence activities, however, are subject to non-market shocks, like droughts or insect infestations (Gowdy, 2020). Another major cost of subsistence activities is the loss of gains from trade, specialization/division of labor, and scale economies (Kennedy, 1982). While raising chickens in the backyard ensures access to eggs (barring a visit from a hungry fox or other non-market shock), for example, the opportunity cost per egg may be too high compared to the monetary cost of eggs produced at commercial scale. So in 1900, an estimated 25 percent of U.S. households produced their own eggs, compared with 1.6 percent today (Kidd and Anderson, 2019).

Proprietorship

Much early proprietorship emerged from individuals or families scaling up subsistence activities and selling their surpluses into markets. That added to the risk of exogenous market and non-market shocks but came with the benefit of some cash income in addition to the imputed income of the products produced on, and consumed by, the farmstead (Johnson, 1998).

Generally, proprietors enjoy more control over the terms of their work than employees do, including the number of hours worked and its intensity (Burke et al., 2008). Most non-farm proprietors do not consume the products of their labor themselves, but they do own their own businesses and hence earn or lose wealth along with the fortunes of the business and the market prices of its assets (and liabilities) (Hamilton, 2000).

For those reasons, proprietorship was long the main goal of most people, especially in the United States (Wright, 2015; Wright, 2017b). Tax (Nelson, 2008) and regulatory changes influenced its relative attractiveness over time and space (Goetz and Rupasingha, 2009). Self-employment, which constitutes a major type of proprietorship, has made several large swings since World War II but note that the overall trend, as a percentage of all workers, is down.

Source: Federal Reserve Economic Data, “Employment Level - All Industries Self-Employed, Unincorporated, Thousands of Persons, Monthly, Seasonally Adjusted” FRED, 2021. URL: https://fred.stlouisfed.org/series/LNS12027714.

Financial Investment

Financial investors may engage in research to discern relatively inexpensive from relatively expensive financial assets and to forecast which asset classes are most likely to increase in value (bonds, derivatives, equities, insurance-linked securities, REITs, etc.) (Constable and Wright, 2011). It remains unclear, however, if such investors net of those research and forecasting costs actually earn higher risk-adjusted returns than investors who simply purchase diverse portfolios of financial assets (Malkiel, 2013). All investors are subject to the security market line, or the tradeoff between risk and return. In other words, financial investors can earn a low return with little risk of losing principal, or a high return with a commensurately high risk of losing principal, or anywhere in between (Modigliani and Pogue, 1974). One important benefit of financial investment is that it can consume very little time while generating market returns (Wermers, 2000), freeing individuals and families to engage in the other four main sources of income and/or leisure activities.

Employment

Employment means being paid for one’s time, be it for each hour worked (hourly wage) or for a variable number of hours worked over a fixed amount of calendar time (salary). It may be augmented with performance bonuses or commissions. It can be regular or irregular but generally only regular employment is called a “job,” which might be “fulltime” or “parttime” depending on the length of the time commitment each week (Asia, 1945). Employment may take place in facilities provided by the employer, in the employee’s home, and/or elsewhere and the location of work has shown significant and interesting variation over time suggesting that it often constitutes a major cost-benefit variable affecting the relative attractiveness of employment to both employers and employees (Juhász et al., 2020).

Employees give up part of their freedom in exchange for the wage or salary. By definition, employees are subject to the direction of their employers during working hours, including, but not limited to, the pace of their work, the time they may use the toilet, acceptable political speech, and whether or not they may wear a mask (NPR 2010; Anderson 2017). In fact, employment was considered akin to slavery in the United States in the 19th century (Wright, 2017a). Accepting a job was something people did when they could not meet their life goals via any combination of the other main sources of income (Steinfeld, 2001). Over time, however, an increasing percentage of the population moved from proprietorship (farming, shopkeeping) to employment as their major source of income as jobs became relatively less onerous and proprietorship relatively moreso (Gallman and Rhode, 2020). In addition, many small proprietors found that they could no longer compete against larger enterprises leveraging economies of scale in traditional proprietary sectors like farming and retailing (Boyd, 1997; Bennett et al., 2020).

Unilateral Transfers

One might think that everyone would always have a strong preference for receiving unilateral transfers because it appears to be all benefit and no cost. In fact, acquiring and maintaining transfers can be difficult and time-consuming (Mould, 2020). In addition, most people have a strong aversion to receiving unilateral transfers (Parsell and Clarke, 2020). They know that they are taking resources from other people, sometimes voluntarily given but increasingly involuntarily through taxation, and feel infantilized as a result (Misra et al., 2014). Even aid received after natural disasters carries a stigma (Fothergill, 2003; Stuber and Kronebusch, 2004).

Unilateral transfers follow the security market line in the sense that the larger they are, the more likely they are to be curtailed or even eliminated (Albert, 2000) for fear that they create dependence (Gottschalk and Moffitt, 1994). Many unilateral transfer recipients also fear that they may grow dependent on the transfers and hence beholden to the person, organization, or government providing the resources (Rank, 1994). A tailored approach to unilateral transfers may therefore better help people to achieve their life goals than a general policy, like UBI.

Tabular Summary of the Major Costs and Benefits of the Five Sources of Income

Cost-Benefit Analysis of UBI and Other Unilateral Transfer Policies categorizes the major types of unilateral transfers and describes the strengths and weaknesses of each in order to demonstrate that if unilateral transfers become a more important part of IPA in the future, transfers other than UBI may be preferred by policymakers and recipients.

Cost-Benefit Analysis of UBI and Other Unilateral Transfer Policies

Calls for a UBI policy date back to at least Thomas Paine, who in Agrarian Justice (1797) argued that governments should compensate all citizens at adulthood because they had allowed private individuals to control all of Europe’s land and hence constrained the ability of the landless to engage in subsistence or proprietary activities, effectively forcing them to rely on uncertain employment markets (Wright, 2021a).

Friedrich Hayek (Rallo, 2019) and Milton Friedman (Milton Friedman on Freedom and the Negative Income Tax) also discussed, without embracing, the need for UBI-like policies as a more efficient means of taking care of society’s poorest members by reducing the emotional costs and risks associated with certain types of unilateral transfers described in Tabular Summary of the Major Costs and Benefits of the Five Sources of Income (Bidadanure, 2019). The current US “welfare state” is extremely complex [see (Chaudry et al., 2016)], so switching to a single simple program promises significant administrative savings.

Numerous progressive pundits have discussed the pros and cons of a UBI (Allegri and Foschi, 2021). Rivers (2019) rejects it because he believes it would “calcify poverty and class structure … even more than the present arrangements.” Nobel laureate Paul Krugman rejects UBI in favor of more targeted approaches (Malter and Sprague, 2019). After waffling on the subject in his book on income inequality (Stiglitz, 2013), Nobel laureate Joseph Stiglitz soon came out in favor of UBI, presumably because it reduces the stigma associated with receiving unilateral transfers and the costs of qualifying for assistance (Widerquist, 2015).

Targeted UBI experiments in developing countries have been implemented on small and non-representative samples, rendering their results difficult to scientifically assess (Banerjee et al., 2019). Moreover, according to most recent studies (Stadelmann-Steffen and Dermont, 2020) the data collected through European Social Survey data in 21 countries indicated no association between risk of job automation and support for UBI. So-called Participation Income schemes that pay people for “participating” in civil society (voting, serving on juries, and such) do not solve the inherent problems with UBI while adding substantial administrative costs (Wispelaere and Stirton, 2007).

UBI’s biggest strength is also its major weakness. While paying everyone the same sum may reduce the stigma associated with receipt of unilateral transfers (Williamson, 1974) and also seems to protect it from the political risk of reduction or elimination, its very universality renders it fiscally impossible (Lee and Lee, 2021). Obviously, low income people will gain from a UBI on net but UBI will only reduce the tax burden of high income people, and necessarily by less than their taxes will have to increase to make the net unilateral transfer to the poor possible. In short, despite its superficial universality, UBI represents shallow accounting legerdemain. Ergo, like China’s dibao (Chen and Yang, 2016), it might create as much stigma (Handler and Hollingsworth, 1969), and shame (Parsell and Clarke, 2020) and other negative emotions (Goodban, 1985) in, net recipients as other types of unilateral transfers are known to induce. It might also create as much resentment in net donors (Marchevsky and Theoharis, 2000; Reese, 2005).

UBI implementation could also potentially threaten democratic traditions, especially if the number of net recipients (those whose UBI payments are greater than their taxes) ever exceeds fifty percent of the electorate, because they could use their majority power at the ballot box to demand increases (Nelson, 2018). Even if UBI began at a modest level, unless net UBI recipients lost the power to vote, or UBI faced a hard cap impervious to popular pressure, it could easily balloon to levels that could foment a crisis, especially in countries, like the US, already facing severe fiscal difficulties (US Government Accountability Office, 2021).

In addition, UBI will not ensure the end of poverty because nothing will prevent net recipients from consuming more instead of saving for future exigencies (Goolsbee, 2018). Moreover, if net recipients can borrow against future UBI payments, some may consume their future UBI payments today, rendering them in need of aid in the future (Fleischer and Hemel, 2020). If not allowed to borrow, however, net UBI recipients will find it more difficult to invest using leverage or to begin their own businesses. If employment has decreased or disappeared, subsistence will be the only practical income option available if UBI payments are insufficient to meet their life goals. Society therefore may remain filled with people who are non-poor in absolute terms but still at the bottom of the income distribution and hence unsatisfied with their lives and structurally prevented from improving their lot, or their income ranking (Boyce et al., 2010).

None of this is to argue, of course, that unilateral transfers have no place in IPA, just that other types of unilateral transfers, especially more targeted ones that provide greater benefits to the poorest individuals/families (Goolsbee, 2018), may be preferable to policymakers, donors, and recipients. Generally speaking, outcomes improve when individuals get to decide what best suits their needs than to have policies, even popular ones, forced upon them from above (Reamer, 1983; Banerjee, 2008).

Private Charity

Private charity has a long history in the United States, dating back to its colonial period (Olasky, 1994). The number and diversity of nonprofit organizations supported by voluntary contributions of money, goods, and labor that helped others astounded early foreign visitors like Alexis de Tocqueville and Gustave de Beaumont (Noll, 2014). Cash loans or grants, clothes, education, food, fuel, healthcare, and lodgings flowed to the poor in sizable quantities that fluctuated with economic conditions. Some of the aid was “outdoor,” given to individuals and families who lived in private residences. Some aid was “indoor,” requiring residence in an “asylum” for the poor, blind, deaf, orphaned, or insane (Katz, 1984).

Often, charitable giving was done without direct aid from the government, or with only modest and intermittent donations of land or other resources. Starting with the Great Depression and New Deal, however, government began playing an increasingly large role in unilateral transfers, some made via private charities but increasingly directly from government employees (Morris, 2009).

Governments presumably provided aid on an easier and fairer basis because government workers were not supposed to try to morally reform the poor the way that many private charities, even secular ones, often did. On the other hand, voluntary donations were more stable than political support for government unilateral transfer because donors felt they had more control over the disbursement of their funds, which were often directed at very specific groups thought most charity-worthy, like orphans or “lunatics” (Rothman, 2017), and away from abusers of drink or drugs (Carlson, 1998; Belletto, 2005), or shirkers (Charness and Rabin, 2002).

Government Vouchers

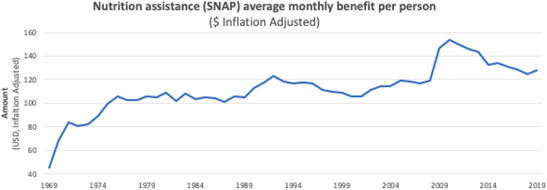

Major US government voucher programs include Supplemental Nutrition Assistance Program (SNAP), informally still referred to as “Food Stamps” for the form that the vouchers used to take.

Inflation-adjusted SNAP expenditures per recipient have more than doubled since 1970.

Source: USA Facts, “Nutrition assistance (SNAP) average monthly benefit per person,” USAFacts.org, 2021. URL: https://usafacts.org/data/topics/people-society/poverty/poverty-programs/nutrition-assistance-snap-avg-monthly-benefit-per-person/?adjustment=Inflation.

SNAP has grown because it allows low income individuals to purchase foods relatively innocuously, through a government-provided debit card that creates less stigma than the older, more conspicuous stamp-like technology did.

In addition, the illegal secondary market for stamps reduced support for the program when the public learned that recipients could sell their stamps for cash that could then be used to purchase drugs. Although food purchased with SNAP can be resold for cash or bartered for drugs, the transaction costs are significantly higher than under the older technology so taxpayers feel more confident that their taxes are not being misused.

Government Cash

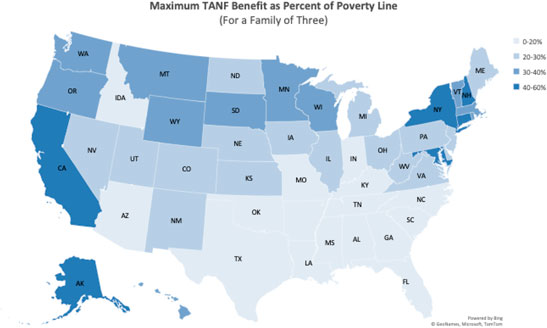

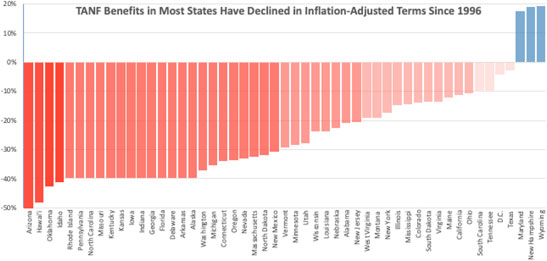

Governments also make outright grants of cash to low income individuals/families. The major federal cash grant program, Temporary Assistance for Needy Families (TANF), supplanted the older Assistance for Families with Dependent Children (AFDC) program, which was criticized for incentivizing people to become dependent on “welfare” payments. Because TANF is distributed through states, payments vary across the nation, with some states paying a much higher percentage of the putative “poverty line” than others. Taxpayers still fear creating a permanent “welfare” class if payments are too generous and do not want their money spent on illicit drugs or luxury goods that they might not feel they can afford themselves.

Note: TANF = Temporary Assistance for Needy Families. The Federal poverty level for a family of three in 2020 is $1,810 per month in the 48 contiguous states and Washington D.C.; Alaska and Hawaii have higher poverty thresholds.

Source: Center on Budget and Policy Priorities, “TANF Benefits Still Too Low to Help Families, Especially Black Families, Avoid Increased Hardship,” CBPP, 2016. URL: https://www.cbpp.org/research/family-income-support/tanf-benefits-still-too-low-to-help-families-especially-black

As a result, inflation-adjusted TANF payments have decreased in all but three states since 1996, and have declined by more than 30 percent in half of all US states.

Government Provision

Governments also sometimes directly provide goods for the use or consumption of the poor, either gifting it to them, as in the case of expired surplus foodstuffs, or leasing it to them at a below market rate, as in the case of government housing. In such cases, there is little concern that the poor will use the resources for untoward purposes.

Government provision, however, is often expensive for taxpayers because governments are not very efficient producers. Federal housing projects, for example, were notoriously ugly, shoddy, and expensive (Allen Hays, 2012) and created significant negative externalities for the neighborhoods in which they were located (Levy et al., 2013). Similarly, the US government did not make “government” cheese directly but rather contracted for its production as part of an expensive dairy price support program (Heien, 1977).

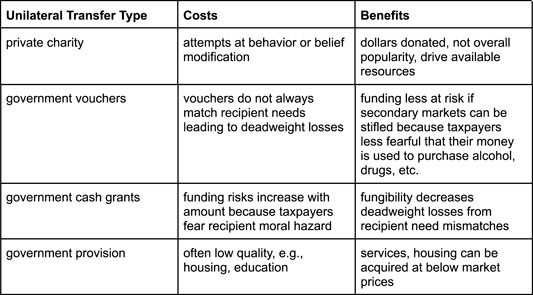

Tabular Summary of the Major Costs and Benefits of Different Types of Unilateral Transfers

The major costs and benefits of the major types of unilateral transfers are summarized in the table below:

Even if AI or other BETC eventually destroy jobs faster than people can engage in IPA, and policymakers and recipients believe that government cash grants are the best type of unilateral transfer to implement in response, initiating UBI now is not indicated because, as the next section explains, it can be implemented quickly if ever needed.

Limitations

This paper extrapolates centuries-long trends into the near future because, as shown in Artificial Intelligence Today and Long-Term Employment Trends, AI thus far is simply another in a long line of new technology. It has not palpably affected job, productivity, or output trends. Moreover, as shown in Cost-Benefit Analysis of IPA and Cost-Benefit Analysis of UBI and Other Unilateral Transfer Policies, individuals and families have long engaged in IPA and nothing inherent in AI changes their ability to do so.

That said, a transformative AI breakthrough capable of accelerating BETC faster than individuals and families can adapt remains possible. If that occurs, rich nations can implement UBI as quickly as government stimulus checks and corporate bailouts were distributed during the global financial crisis and pandemics of 2008 and 2020, i.e., within a few hours to weeks depending on the mechanisms employed and policy intent (Sahm et al., 2012; Wright, 2010). (The Fiscal Response to COVID-19 in Europe: Will It Be Enough?, 2021)

In short, implementing UBI now because of what AI might do to jobs in the future is not rational policy (Hoynes and Rothstein 2019; Commentary: Universal Basic Income Ma...; Would a universal basic income reduce...).

Conclusion

Claims that AI will, or should, lead to UBI display too little detailed knowledge of the limitations of AI (Artificial Intelligence Today), the nature of BETC (Long-Term Employment Trends), the adaptive solutions offered to individuals by IPA (Cost-Benefit Analysis of IPA), and alternative unilateral transfer policies (Cost-Benefit Analysis of UBI and Other Unilateral Transfer Policies) to warrant high confidence, especially given that UBI could be adopted almost instantaneously if ever needed (Limitations).

Specifically, AI is not nearly as powerful as widely believed and is unlikely to supplant humans in the foreseeable future. Jobs are not disappearing but even if they eventually do, individuals will have time to increase the parts of their real income/consumption that stem from subsistence, proprietorship, and financial investment. Even if individuals do desire to increase unilateral transfers as a percentage of their income portfolios, they may, in conjunction with policymakers, prefer other types of transfers over UBI, which suffers from several conceptual problems. Finally, in the unlikely scenario that AI ever proves rapidly destructive, rich countries can adopt immediate fiscal measures simulating a UBI.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.census.gov and https://fred.stlouisfed.org/.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Careful analysis may be needed to correctly differentiate between the five major sources of income, the legal definitions of which sometimes do not match underlying economic realities. A landlord is a proprietor whereas the owner of a real estate investment trust (REIT) is a financial investor. Similarly, a worker with a regular schedule paid a salary or a fixed wage based on time is an employee, but a worker paid solely by the task or contract fulfillment is an independent contractor, a form of proprietorship. Someone who grows her own tomatoes to eat engages in subsistence but when she sells her tomatoes she becomes a proprietor. An employee may simultaneously be a financial investor via an employee stock ownership plan (ESOP) (Pierce et al., 1991). A person with a disability who receives a stream of income may be the recipient of a unilateral transfer (for example, charity, or a publicly subsidized government disability program) and/or may be a financial investor in a disability insurance policy (Liebman, 2015). Differentiating between income sources, however, is more an intellectual exercise for purposes of analysis and exposition than a determinant of real world outcomes because most individuals, past, present, and future, engage in IPA, i.e., flexible income portfolios that vary with their life goals (Green, 2021) and over their life cycles (Browning and Crossley, 2001).

2Automation of work that includes 1) fixed automation, 2) programmable automation, and 3) flexible automation. It can be caused by robots or RPA software in addition to AI. https://www.britannica.com/technology/automation/Manufacturing-applications-of-automation-and-robotics

3Take, for example, one of the strangest solutions to the weight transport problem, courtesy of Timothy Lillicrap of Google DeepMind in London and his colleagues in 2016. The algorithm developed by Lilicrap and his team, instead of relying on a matrix of weights recorded from the forward pass, used a matrix initialized with random values for the backward pass. Once assigned, these values do not change, therefore no weights need to be transported for the backward passes. The network turned out to learn very efficiently (Singh et al., 2019).

References

Acemoglu, D., and Robinson, J. A. (2012). Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Publishers.

Albert, V. (2000). Reducing Welfare Benefits: Consequences for Adequacy of and Eligibility for Benefits. Social Work 45 (4), 300–311. doi:10.1093/sw/45.4.300

Albion, R. G. (1932). The "Communication Revolution". Am. Hist. Rev. 37 (4), 718–720. doi:10.2307/1843336

Allegri, G., and Foschi, R. (2021). Universal Basic Income as a Promoter of Real Freedom in a Digital Future. World Futures 77 (1), 1–22. doi:10.1080/02604027.2020.1792600

Allen, D. W. (2011). The Institutional Revolution: Measurement and the Economic Emergence of the Modern World. Albany, NY: University of Chicago Press.

Asia, B. S. (1945). Employment Relation: Common-Law Concept and Legislative Definition. Yale L. J. 55 (1), 76–116. doi:10.2307/792818

Autor, D. H. (2015). Why Are There Still So Many Jobs? the History and Future of Workplace Automation. J. Econ. Perspect. 29 (3), 3–30. doi:10.1257/jep.29.3.3

Autor, D., Levy, F., and Murnane, R. (2000). Upstairs, Downstairs: Computer-Skill Complementarity and Computer-Labor Substitution on Two Floors of a Large Bank. doi:10.3386/w7890

Autor, D., and Salomons, A. (2018). Is Automation Labor-Displacing? Productivity Growth, Employment, and the Labor Share (No. W24871). Cambridge MA: National Bureau of Economic Research. doi:10.3386/w24871

Baily, M. N., Bosworth, B., and Doshi, S. (2020). Productivity Comparisons: Lessons from Japan, the United States, and Germany. Washington, DC: Brookings Institution. Available at: https://www.brookings.edu/wp-content/uploads/2020/01/ES-1.30.20-BailyBosworthDoshi.pdf.

Bakker, G., Crafts, N., and Woltjer, P. (2019). The Sources of Growth in a Technologically Progressive Economy: The United States, 1899-1941. Econ. J. 129 (622), 2267–2294. doi:10.1093/ej/uez002

Banerjee, A., Niehaus, P., and Suri, T. (2019). Universal Basic Income in the Developing World. Annu. Rev. Econ. 11, 959–983. doi:10.1146/annurev-economics-080218-030229

Banerjee, A. V. (2008). Why Fighting Poverty Is Hard? Unpublished. MIT. Available at: https://www.bbvaopenmind.com/wp-content/uploads/2009/01/BBVA-OpenMind-Frontiers_Of_Knowledge.pdf#page=247..

Belletto, S. (2005). Drink versus Printer’s Ink: Temperance and the Management of Financial Speculation in the Life of P. T. Barnum. Am. Stud. 46 (1), 45–65.

Bennett, R. J., Smith, H., and Montebruno, P. (2020). The Population of Non-corporate Business Proprietors in England and Wales 1891-1911. Business Hist. 62 (8), 1341–1372. doi:10.1080/00076791.2018.1534959

Bidadanure, J. U. (2019). The Political Theory of Universal Basic Income. Annu. Rev. Polit. Sci. 22 (1), 481–501. doi:10.1146/annurev-polisci-050317-070954

Boyce, C. J., Brown, G. D. A., and Moore, S. C. (2010). Money and Happiness. Psychol. Sci. 21 (4), 471–475. doi:10.1177/0956797610362671

Boyd, D. W. (1997). From "Mom and Pop" to Wal-Mart: The Impact of the Consumer Goods Pricing Act of 1975 on the Retail Sector in the United States. J. Econ. Issues 31 (1), 223–232. doi:10.1080/00213624.1997.11505899

Brennan, M. J. (1973). An Approach to the Valuation of Uncertain Income Streams. J. Finance 28 (3), 661–674. doi:10.1111/j.1540-6261.1973.tb01387.x

Browning, M., and Crossley, T. F. (2001). The Life-Cycle Model of Consumption and Saving. J. Econ. Perspect. 15 (3), 3–22. doi:10.1257/jep.15.3.3

Burke, A. E., FitzRoy, F. R., and Nolan, M. A. (2008). What Makes a Die-Hard Entrepreneur? beyond the 'employee or Entrepreneur' Dichotomy. Small Bus Econ. 31 (2), 93–115. doi:10.1007/s11187-007-9086-6

Bullard, J. (2014). The Rise and Fall of Labor Force Participation in the U.S Federal Reserve Bank of St. Louis, Saint Luis

Carlson, D. W. (1998). "Drinks He to His Own Undoing": Temperance Ideology in the Deep South. J. Early Republic 18 (4), 659–691. doi:10.2307/3124783

Charness, G., and Rabin, M. (2002). Understanding Social Preferences with Simple Tests. Q. J. Econ. 117 (3), 817–869. doi:10.1162/003355302760193904

Chaudry, A., Wimer, C., Macartney, S., Frohlich, L., Campbell, C., Swenson, K., et al. (2016). Poverty in the United States: 50-Year Trends and Safety Net Impacts. Washington, DC: U.S. Department of Health and Human Services.

Chen, J., and Yang, L. (2016). Interactional Impacts on Claimants of Chinese Dibao. Int. J. Soc. Qual. 6 (2), 18–34. doi:10.3167/ijsq.2016.060203

Chibnik, M. (1978). The Value of Subsistence Production. J. Anthropological Res. 34 (4), 561–576. doi:10.1086/jar.34.4.3629650

Childers, R. G. (2011). Being One'S Own Boss: How Does Risk Fit in?. The Am. Economist 56 (1), 48–58. doi:10.1177/056943451105600107

Constable, S., and Wright, R. E. (2011). The WSJ Guide to the 50 Economic Indicators that Really Matter: From Big Macs to“ Zombie Banks,” the Indicators Smart Investors Watch to Beat the Market. Harper Collins.

Cook, S. R. (1998). The Great Depression, Subsistence, and Views of Poverty in Wyoming County, West Virginia. J. Appalachian Stud. 4 (2), 271–283.

Crawford, K., Whittaker, M., Elish, M. C., Barocas, S., Plasek, A., and Ferryman, K. (2016). The AI Now Report. The Social and Economic Implications of Artificial Intelligence Technologies in the Near-Term. Available at: http://acikistihbarat.com/Dosyalar/AINowSummaryReport-artificial-intelligence-effects-in-near-future.pdf.

De Vries, J. (1994). The Industrial Revolution and the Industrious Revolution. J. Eco. Hist. 54 (2), 249–270. doi:10.1017/s0022050700014467

Donnelly, F. K. (1986). Luddites Past and Present. Labour/Le Travail 18, 217–221. doi:10.2307/25142685

Dunn, L. F. (1979). Measurement of Internal Income-Leisure Tradeoffs. Q. J. Econ. 93 (3), 373–393. doi:10.2307/1883164

Elwert, G., and Wong, D. (1980). Subsistence Production and Commodity Production in the Third World. Review 3 (3), 501–522.

Feldstein, M. (2016). Reducing Inequality and Poverty. Project Syndicate. Available at: https://www.project-syndicate.org/commentary/reducing-inequality-in-america-by-martin-feldstein-2016-08.

Fleischer, M. P., and Hemel, D. (2020). The Architecture of a Basic Income. The University of Chicago Law Review. University of Chicago. L. Sch. 87 (3), 625–710.

Flynn, S. M. (2019). The Cure that Works: How to Have the World’s Best Health Care -- at a Quarter of the Price. Simon & Schuster.

Fothergill, A. (2003). The Stigma of Charity: Gender, Class, and Disaster Assistance. Sociological Q. 44 (4), 659–680. doi:10.1111/j.1533-8525.2003.tb00530.x

Furman, J., and Seamans, R. (2019). AI and the Economy. Innovation Policy and the Economy 19, 161–191. doi:10.1086/699936

Gallman, R. E., and Rhode, P. W. (2020). Capital in the Nineteenth Century. University of Chicago Press.

Goetz, S. J., and Rupasingha, A. (2009). Determinants of Growth in Non-farm Proprietor Densities in the US, 1990-2000. Small Bus Econ. 32 (4), 425–438. doi:10.1007/s11187-007-9079-5

Goldin, C., and Katz, L. (2009). The Race between Education and Technology. Harvard University Press.

Goodban, N. (1985). The Psychological Impact of Being on Welfare. Soc. Serv. Rev. 59 (3), 403–422. doi:10.1086/644308

Goolsbee, A. (2018). Public Policy In an AI Economy (No. W24653). Cambridge, MA: National Bureau of Economic Research. doi:10.3386/w24653

Gottschalk, P., and Moffitt, R. A. (1994). Welfare Dependence: Concepts, Measures, and Trends. Am. Econ. Rev. 84 (2), 38–42.

Gowdy, J. (2020). Our hunter-gatherer Future: Climate Change, Agriculture and Uncivilization. Futures 115, 102488. doi:10.1016/j.futures.2019.102488

Green, J. M. (2021). Diversify Your Income for Financial independence. Retrieved from: https://www.thebalance.com/diversify-your-income-sources-357629 (Accessed March 26, 2021).

Guelzo, A. C. (2000). Come-outers and Community Men: Abraham Lincoln and the Idea of Community in Nineteenth-Century America. J. Abraham Lincoln Assoc. 21 (1). Available at: https://cupola.gettysburg.edu/cwfac/32/.

Haenlein, M., and Kaplan, A. (2019). A Brief History of Artificial Intelligence: On the Past, Present, and Future of Artificial Intelligence. Calif. Manage. Rev. 61 (Issue 4), 5–14. doi:10.1177/0008125619864925

Hamilton, B. H. (2000). Does Entrepreneurship Pay? an Empirical Analysis of the Returns to Self‐Employment. J. Polit. Economy 108 (3), 604–631. doi:10.1086/262131

Handler, J. F., and Hollingsworth, E. J. (1969). Stigma, Privacy, and Other Attitudes of Welfare Recipients. Stanford L. Rev. 22 (1), 1–19. doi:10.2307/1227402

Hecht-Nielsen, R. (1992). “Theory of the Backpropagation Neural Network**Based on "nonindent" by Robert Hecht-Nielsen, Which Appeared in Proceedings of the International Joint Conference on Neural Networks 1, 593-611, June 1989. 1989 IEEE,” in Neural Networks for Perception (Elsevier), 65–93. doi:10.1016/b978-0-12-741252-8.50010-8

Heien, D. (1977). The Cost of the U.S. Dairy Price Support Program: 1949-74. Rev. Econ. Stat. 59 (1), 1–8. doi:10.2307/1924898

Hopkins, E. (1982). Working Hours and Conditions during the Industrial Revolution: A Re-appraisal. Econ. Hist. Rev. 35 (1), 52–66. doi:10.2307/2595103

Juhász, R., Squicciarini, M., and Voigtländer, N. (2020). Away from Home and Back: Coordinating (Remote) Workers in 1800 and 2020. Available at: https://papers.ssrn.com/abstract=3753983.

Katz, M. B. (1984). Poorhouses and the Origins of the Public Old Age home. Milbank Memorial Fund Q. Health SocietyHealth Soc. 62 (1), 110–140. doi:10.2307/3349894

Kennedy, L. (1982). The First Agricultural Revolution: Property Rights in Their Place. Agric. Hist. 56 (2), 379–390. doi:10.1016/0378-3774(82)90016-6

Kidd, M. T., and Anderson, K. E. (2019). Laying Hens in the U.S. Market: An Appraisal of Trends From the Beginning of the 20th Century to Present. J. Appl. Poult. Res. 28 (4), 771–784. doi:10.3382/japr/pfz043

Latham, S., and Humberd, B. (2018). Four Ways Jobs Will Respond to Automation: The Level of Threat to a Given Profession Depends on Two Factors, the Type of Value provided and How It’s Delivered. MIT Sloan Management Review.

Lauterbach, A. (1977). Employment, Unemployment and Underemployment: A Conceptual Re-examination. Am. J. Econ. Sociol. 36 (3), 283–298.

LeCun, Y., Bengio, Y., and Hinton, G. (2015). Deep Learning. Nature 521 (7553), 436–444. doi:10.1038/nature14539

Lee, J.-H., and Lee, J. (2021). South Korea Premier Says Universal Basic Income “Impossible”. New York: Bloomberg News. Available at: https://www.bloomberg.com/news/articles/2021-02-03/south-korea-premier-says-universal-basic-income-is-impossible..

Levy, D. K., McDade, Z., and Bertumen, K. (2013). Mixed-Income Living: Anticipated and Realized Benefits for Low-Income Households. Cityscape 15 (2), 15–28.

Liebman, J. B. (2015). Understanding the Increase in Disability Insurance Benefit Receipt in the United States. J. Econ. Perspect. 29 (2), 123–150. doi:10.1257/jep.29.2.123

Lillicrap, T. P., Santoro, A., Marris, L., Akerman, C. J., and Hinton, G. (2020). Backpropagation and the Brain. Nat. Rev. Neurosci. 21 (6), 335–346. doi:10.1038/s41583-020-0277-3

Little, J. I. (2001). A Canadian in Lowell: Labour, Manhood and Independence in the Early Industrial Era, 1840-1849. Labour/Le Travail 48, 197–263. doi:10.2307/25149166

MacDonald, R., and Peel, D. A. (1983). The Life Cycle Hypothesis and Rational Expectations : Some Further Empirical Results. Recherches Économiques de Louvain/Louvain Econ. Rev. 49 (4), 381–390.

Majewski, J. (1997). A Revolution Too Many?. J. Eco. Hist. 57 (2), 476–480. doi:10.1017/s0022050700018556

Makridakis, S. (2017). The Forthcoming Artificial Intelligence (AI) Revolution: Its Impact on Society and Firms. Futures 90, 46–60. doi:10.1016/j.futures.2017.03.006

Malkiel, B. G. (2013). Asset Management Fees and the Growth of Finance. J. Econ. Perspect. 27 (2), 97–108. doi:10.1257/jep.27.2.97

Malter, J., and Sprague, K. (2019). “I”m Not a UBI Guy’: Paul Krugman Says Money Could Be Better Spent on More Targeted Programs. TV Programme CNBC. Available at: https://www.cnbc.com/2019/04/23/paul-krugman-on-universal-basic-income-im-not-a-ubi-guy.html.

Marchevsky, D., and Theoharis, J. (2000). Correlation, Regression and Prediction. Am. Stud. 41 (2/3), 235–248. doi:10.1007/978-1-4615-4205-6_28

Mason, A. (2020). 6 Ideas to Diversify Your Income Streams. Available at: https://thecollegeinvestor.com/16174/6-ideas-to-diversify-your-income/.

McAfee, A., and Brynjolfsson, E. (2016). Human Work in the Robotic Future: Policy for the Age of Automation. Foreign Aff. 95 (4), 139–150.

McAfee, A., and Brynjolfsson, E. (2017). Machine, Platform, Crowd: Harnessing Our Digital Future. W. W. Norton & Company.

Measuring worth (2021). Annual Wages in the United States. Retrieved from: https://www.measuringworth.com/datasets/uswage/(Accessed March 25, 2021).

Misra, J., Moller, S., and Karides, M. (2014). Envisioning Dependency: Changing Media Depictions of Welfare in the 20th Century. Soc. Probl. 50 (4), 482–504.

Modigliani, F., and Pogue, G. A. (1974). An Introduction to Risk and Return: Concepts and Evidence, Part Two. Financial Analysts J. 30 (3), 69–86. doi:10.2469/faj.v30.n3.69

Morris, A. J. F. (2009). The Limits of Voluntarism: Charity and Welfare from the New Deal through the Great Society. Cambridge University Press.

Mould, T. (2020). Overthrowing the Queen: Telling Stories of Welfare in America. Indiana University Press.

Nelson, P. (2018). Universal Basic Income and the Threat to Democracy as We Know it. New York: Business Expert Press.

Nelson, S. C. (2008). Tax Policy and Sole Proprietorships: A Closer Look. Natl. Tax J. 61 (3), 421–443. doi:10.17310/ntj.2008.3.05

Noll, M. A. (2014). Tocqueville's America, Beaumont's Slavery, and the United States in 1831-32. Am. Polit. Thought 3 (2), 273–302. doi:10.1086/677734

Olmstead, A. L., and Rhode, P. W. (2008). Creating Abundance. Cambridge, MA: Cambridge Books. Available at: https://ideas.repec.org/b/cup/cbooks/9780521673877.html.

Parsell, C., and Clarke, A. (2020). Charity and Shame: Towards Reciprocity. Soc. Probl.. doi:10.1093/socpro/spaa057

Pierce, J. L., Rubenfeld, S. A., and Morgan, S. (1991). Employee Ownership: A Conceptual Model of Process and Effects. Acad. Manage. Rev. 16 (1), 121–144. doi:10.2307/258609

Productivity (2021). GDP Per Hour Worked - OECD Data. Retrieved from: https://data.oecd.org/lprdty/gdp-per-hour-worked.htm (Accessed March 31, 2021).

Rallo, J. R. (2019). Hayek Did Not Embrace a Universal Basic Income. Independent Rev. 24 (3), 347–359.

Rank, M. R. (1994). A View from the inside Out: Recipients’ Perceptions of Welfare. J. Sociol. Soc. Welfare 21 (2), 3.

Reamer, F. G. (1983). The Concept of Paternalism in Social Work. Soc. Serv. Rev. 57 (2), 254–271. doi:10.1086/644516

Reese, E. (2005). Backlash against Welfare Mothers. Backlash against Welfare Mothers. doi:10.1525/9780520938717

Rivers, R. (2019). A Progressive Rejection of Universal Basic Income - Ron Rivers - Medium. Medium.com. Available at: https://medium.com/@ronrivers/a-progressive-rejection-of-universal-basic-income-2604366c6d3a.

Rose, J. (2017). November 2). 5 Ways to Generate Different Sources of Income. Jersey City, NJ: Forbes Magazine. Available at: https://www.forbes.com/sites/jrose/2017/11/02/different-sources-income/.

Rothman, D. J. (2017). The Discovery of the Asylum: Social Order and Disorder in the New Republic. London: Routledge.

Sahm, C. R., Shapiro, M. D., and Slemrod, J. (2012). Check in the Mail or More in the Paycheck: Does the Effectiveness of Fiscal Stimulus Depend on How it Is Delivered?. Am. Econ. J. Econ. PolicyEconomic Pol. 4 (3), 216–250. doi:10.1257/pol.4.3.216

Schrittwieser, J., Antonoglou, I., Hubert, T., Simonyan, K., Sifre, L., Schmitt, S., et al. (2020). Mastering Atari, Go, Chess and Shogi by Planning with a Learned Model. Nature 588 (7839), 604–609. doi:10.1038/s41586-020-03051-4

Seely, B. E. (2007). Economic History as Technological History: George Rogers Taylor's the Transportation Revolution, 1815-1860. Technol. Cult. 48 (4), 824–830. doi:10.1353/tech.2007.0186

Shaikh, M. D. S. (2020). Insight of DeepMind Learning: Journey of Transformation from Natural Intelligence to Artificial Intelligence. Seattle, Washington: Amazon Digital Services LLC - KDP Print US.

Singh, A., Ramasubramanian, K., and Shivam, S. (2019). Building an Enterprise Chatbot: Work with Protected Enterprise Data Using Open Source Frameworks. New York: Apress.

Stadelmann-Steffen, I., and Dermont, C. (2020). Citizens' Opinions about Basic Income Proposals Compared - A Conjoint Analysis of Finland and Switzerland. J. Soc. Pol. 49 (2), 383–403. doi:10.1017/s0047279419000412

Steinfeld, R. J. (2001). Coercion, Contract, and Free Labor in the Nineteenth Century. doi:10.1017/cbo9780511549564

Stiglitz, J. (2013). The Price of Inequality. New Perspect. Q. 30 (Issue 1), 52–53. doi:10.1111/npqu.11358

Stuber, J., and Kronebusch, K. (2004). Stigma and Other Determinants of Participation in TANF and Medicaid. J. Pol. Anal. Manage. 23 (3), 509–530. doi:10.1002/pam.20024

Sylla, R. (2002). Financial Systems and Economic Modernization. J. Econ. Hist. 62 (2), 277–292. doi:10.1017/s0022050702000505

Tegmark, M. (2017). Life 3.0: Being Human in the Age of Artificial Intelligence. Knopf Doubleday Publishing Group.

The effect of lockdown measures on unemployment (2021). Economic Impact of COVID-19. Retrieved from: https://www.richmondfed.org/publications/research/coronavirus/economic_impact_covid-19_09-04-20 (Accessed March 25, 2021).

The fiscal response to COVID-19 in Europe: will it be enough? (2021). Bruegel: Rue de la Charité 33-1210 Brussels. Retrieved from: https://www.caixabankresearch.com/en/economics-markets/activity-growth/fiscal-response-covid-19-europewill-it-be-enough (Accessed March 31, 2021).

Torrey, L., and Shavlik, J. (2010). “Transfer Learning,” in Handbook of Research on Machine Learning Applications and Trends: Algorithms, Methods, and Techniques (Philadelphia: IGI Global), 242–264.

US Government Accountability Office (2021). The Nation’s Fiscal Health: After Pandemic Recovery, Focus Needed on Achieving Long-Term Fiscal Sustainability. Retrieved from: https://www.gao.gov/products/gao-21-275sp (Accessed March 25, 2021).

Vinyals, O., Babuschkin, I., Chung, J., Mathieu, M., Jaderberg, M., Czarnecki, W. M., et al. (2019). AlphaStar: Mastering the Real-Time Strategy Game StarCraft II. London, DeepMind Blog.

Wage Stagnation in Nine Charts (2021). Economic Policy Institute. Retrieved from: https://www.epi.org/publication/charting-wage-stagnation/(Accessed March 25, 2021).

Wang, F., Zhang, J. J., Zheng, X., Wang, X., Yuan, Y., Dai, X., et al. (2016). Where Does AlphaGo Go: from Church-Turing Thesis to AlphaGo Thesis and beyond. Ieee/caa J. Autom. Sinica 3 (2), 113–120. doi:10.1109/jas.2016.7471613

Waters, R. (2018). Techmate: How AI Rewrote the Rules of Chess. London; Financial Times. Available at: https://www.ft.com/content/ea707a24-f6b7-11e7-8715-e94187b3017e.

Weiss, K., Khoshgoftaar, T. M., and Wang, D. (2016). A Survey of Transfer Learning. J. Big Data 3 (1). doi:10.1186/s40537-016-0043-6

Wermers, R. (2000). Mutual Fund Performance: An Empirical Decomposition into Stock-Picking Talent, Style, Transactions Costs, and Expenses. J. Finance 55 (4), 1655–1695. doi:10.1111/0022-1082.00263

Widerquist, K. (2015). UNITED STATES: Nobel Laureate Joseph Stiglitz Endorses Unconditional Basic Income. Retrieved from: http://basicincome.org/news/2015/09/united-states-nobel-laureate-joseph-stiglitz-endorses-unconditional-basic-income/(Accessed March 30, 2021).

Williamson, J. B. (1974). The Stigma of Public Dependency: A Comparison of Alternative Forms of Public Aid to the Poor. Soc. Probl. 22 (2), 213–228. doi:10.1525/sp.1974.22.2.03a00050

Wispelaere, J. D., and Stirton, L. (2007). The Public Administration Case against Participation Income. Soc. Serv. Rev. 81 (3), 523–549. doi:10.1086/520939

Wright, R. E. (2019). America’s Fur Business Parts I, II, and III. Fur Traders & Rendezvous. Available at: https://www.alfredjacobmiller.com/explore/americasfurbusiness1/.

Wright, R. E. (2021b). History and Evolution of the North American Wildlife Conservation Model. Cham, Switzerland: Palgrave. doi:10.2139/ssrn.3673178

Wright, R. E. (2015). Little Business on the Prairie: Entrepreneurship, Prosperity, and Challenge in South Dakota. Sioux Falls, SD: Center for Western Studies.

Keywords: artificial intelligence, business, economic, and technological change, deep learning, machine learning, universal basic income

Citation: Przegalinska AK and Wright RE (2021) AI: UBI Income Portfolio Adjustment to Technological Transformation. Front. Hum. Dyn 3:725516. doi: 10.3389/fhumd.2021.725516

Received: 15 June 2021; Accepted: 02 August 2021;

Published: 24 August 2021.

Edited by:

Francesca Fulminante, University of Bristol, United KingdomReviewed by:

Doaa Abu Elyounes, Harvard Law School, United StatesPilar Rodriguez Martinez, University of Almeria, Spain

Copyright © 2021 Przegalinska and Wright. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alexandra K. Przegalinska, YXByemVnYWxpbnNrYUBrb3ptaW5za2kuZWR1LnBs

Alexandra K. Przegalinska

Alexandra K. Przegalinska Robert E. Wright

Robert E. Wright