- 1Department of Comprehensive Nursing, School of Nursing, College of Medicine and Health Science, Wachemo University, Hossana, Ethiopia

- 2Department of Disease Prevention and Promotion, Kembeta Tembaro Zone Health Department, SNNP, Hossana, Ethiopia

Background: Globally, 1.3 billion poor people have no access to health services due to their inability to afford payment when they need services. According to a report published by the WHO in 2014, globally 150 million people are pushed into poverty as a result of direct payment for health services.

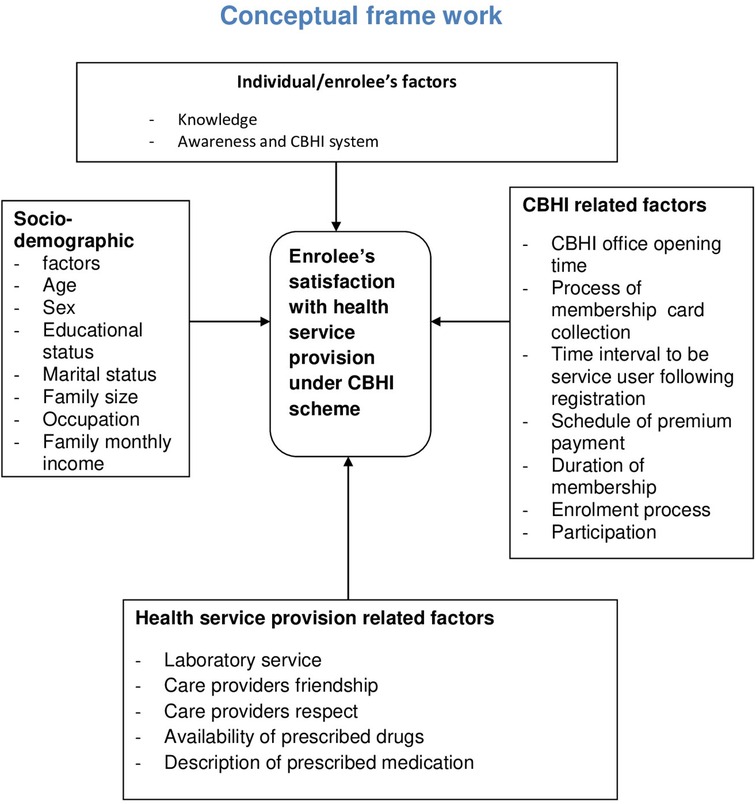

Objective: This study aims to assess the satisfaction level of clients and associated factors toward health services provided to members of a community-based health insurance (CBHI) scheme.

Methods: An institutional-based cross-sectional study design was employed. A total sample size of 393 people was estimated using a single population formula, and three health facilities (HFs) were selected using a simple random sampling method, whereas study participants were selected by using a systematic sampling method. All patients who visited the HFs were included, whereas women who visited the HFs for maternity service were excluded from the study. A reliability test (Cronbach’s alpha) was performed to determine the internal consistency for these items to measure the satisfaction level of the clients. Epi Info software version 7 was used to calculate the sample size and to enter data, whereas further data cleaning and analysis were conducted using SPSS software version 20.

Results: A total of 367 clients enrolled in the community-based health insurance scheme were interviewed, showing a response rate of 93%. The reliability test (Cronbach's alpha) value for the items used to measure level of client satisfaction was 0.817. The overall level of the clients’ mean satisfaction toward health service provision was 63.1% (3.95 + 0.47 SD). This study found that age with AOR = 0.11 [95% CI (0.01–0.79)], residence with AOR = 1.80 [95% CI (1.79–3.66)], number of family with AOR = 2.27 [95% CI (1.46–11.22)], frequency of visits to HFs with AOR = 13.62 [95% CI (2.09–88.58)], and clients’ level of knowledge with AOR = 3.33 [95% CI (1.06–10.42) had a statistical significant association with client satisfaction toward health service provision.

Conclusion: Our study found that the perceived level of client satisfaction is higher than previous studies. Residence, frequency of visits, level of knowledge, payment during referral time, number of family members, and frequency of visits were identified as predictors of client satisfaction on the health service provision.

Introduction

Health insurance (HI) is one of the nine components of the healthcare financing (HCF) mechanism, which was launched with an ultimate goal of improving health service provision (1). Moreover, it is a key factor in averting the financial hardship associated with paying for health services, which is comprehended through implementing the three HCF sub-functions: revenue collection, pooling of resources, and purchasing of services (2, 3). In the contemporary period, the increasing demand for medical care is contributing to the increasing healthcare costs. Subsequently, it is becoming a real barrier to the affordability and availability of the services (4, 5). However, HI became an emerging tool to guarantee the health of the families. Hence, once the families are enrolled in the scheme, they will have peace of mind, they will have no delay in seeking medical care when they become sick, and they will be free from predicting what their medical bill will be (5).

Under the umbrella of HI, community-based health insurance (CBHI) is an emerged opportunity for the pro-poor communities (6). Thus, it is a not-for-profit type of insurance and stands against the cost during seeking medical treatment for illness as well as reduces out-of-pocket (OOP) expenditure for healthcare (6–8). The CBHI scheme is a good alternative for the impoverished community. It must stand alone based on the premises of risk-pooling and community solidarity. In addition, it is characterized by a feature of volunteer membership and trust enrollment (9, 10). Eventually, this plays a critical role in attaining sustainable fully functioning universal health coverage (UHC) (11, 12).

However, different types of HI, CBHI, and social health insurance (SHI) are common in Ethiopia. They are potential strategies recognized as an instrument to finance healthcare by mobilizing resources for the citizens in the formal and small informal sectors, respectively (13). In Africa, the first initiative of CBHI began under the direction of emigrant workers, and it commenced in 1986 in the Democratic Republic of Congo (14). In Ethiopia, CBHI was introduced in 2010 and piloted within 13 districts after 1 year, those selected from four major regions (Amhara, Oromia, SNNPR, and Tigray) (15, 16).

Under CBHI, satisfaction of the enrollees is the desired outcome of healthcare services. Moreover, client satisfaction reflects the gap between the expected services and the experience of the service (17, 18). In fact, satisfaction influences a person who seeks medical advice and adherence to the treatment and assures continuous attractiveness of the service contracted. Furthermore, it is a fundamental tool that reflects how well the healthcare system is working (19, 20). Hence, it is an important indicator to predict the retention tendency of enrollees in the scheme (21).

Poor HCF has been seen as a major challenge for the healthcare system, and it leaves households (HHs) vulnerable to the impoverished from catastrophic health expenditure (22). Globally, 1.3 billion poor people have no access to health services due to their inability to afford the payment at the time. Consequently, they are subjected to financial hardship (23). According to a report published by the World Health Organization (WHO) in 2014, globally 150 million people suffered a financial catastrophe; out of them, 100 million were pushed to poverty as a result of direct payment for health service. Furthermore, they suffer financial shocks each year having unexpected expenditure for expensive emergency care (24–26). Thus, high reliance on OOP expenses leads an individual and families to reduced utilization of healthcare, ultimately worsening health, and enforcing the risk of impoverishment (27). To this end, recent studies conclude that a person is exposed to catastrophic spending, while a patient consumes more than 10% of the annual household income on healthcare. Approximately 12% of the population worldwide spent at least 10% of their HHs’ income to pay for healthcare. For instance, in Latin America, 5% of inhabitants spend more than 40% of their income on medical care per year (28, 29).

In low- and middle-income countries, more than 35% of health expenses per country come from OOP expenses (30). Moreover, OOP expenses also differ by type and level of income. For instance, in Ghana, Tanzania, and South Africa, it is reported to be 40%, 26%, and 18%, respectively (31). Most low-income countries have to cover medical bills through OOP expenses when they become sick. For instance, in India, Bangladesh, Pakistan, and Ethiopia, it is reported to be 86%, 88.3%, 78%, and 34%, respectively (32). In developing countries, the consequence of OOP for seeking medical care is enormous. More than 2 billion people are affected by inefficiency, inequitable access, and inadequate funding (33). In Ethiopia, HCF mainly relies on foreign donations of approximately 50%, and 33% is covered by OOP payment, whereas the domestic government covers only 17%. Consequently, poor people and communities are always at risk of impoverishment due to expensive medical care. In Ethiopia, having an unpredictable, poorly harmonized donor funding system, low government spending on the health sector financing, and a strong reliance on OOP expenditure result in gaps between aid commitment and actual disbursement. Thus, the cumulative effect of these affects satisfaction of the clients (33–35) (Figure 1).

Methods

Study design and setting

An institutional-based cross-sectional study design was employed between 1 July 2019 and 30 September 2019 in Hulbareg woreda, a Silte Administrative Zone in Southern Ethiopia. The Silte Zone is one of the central zones in the SNNPR among 17 zones and seven special woredas. According to the 2017–2018 zonal finance and economic development office census, the projected population of Hulbareg woreda was approximately 82,686. Within the woreda, there are four health centers (HCs). Currently, all HCs were providing services for more than 35,450 enrolled people in the CBHI. For the current physical year (2019), the CBHI coverage was 85%.

Source and study population

The source population were all household members enrolled in the CBHI scheme and who randomly visited selected health facilities (HFs) for any healthcare. The study population encompassed any member of HHs who visited facilities on the occasion of data collection who was selected by using a systematic sampling method.

Eligibility criteria

The study included all insured individuals (adults, guardians, or parents of children) who attended outpatient and inpatient departments, whereas members who were insured for less than 6 months and women who visited HFs for maternal service were excluded from the study.

Sample size determination

The sample size of the study was performed using a single population proportion formula by comparing values obtained from statistical software and manual calculation. The sample size was computed using Epi Info software version 7, by considering the following assumptions: a level of significance of 5% (with a corresponding critical value of Zα/2 = 1.96 for normal distribution), a margin of error of 5%, a proportion (P) level of satisfaction on health service provision under CBHI scheme of 42% (17), and taking a total number of 35,450 individuals enrolled in the CBHI scheme. Then, the estimated sample size (n) was 371. The sample size for the first specific objective was also calculated by considering the above assumptions using the following statistical formula:

An estimated sample size after adding a 5% non-response rate was 393. Finally, comparing the estimated sample size in both approaches, a sample size (n) of 393 was selected for the study.

Sampling technique and procedure

To select the study participants, two out of four HFs were selected using the simple random sampling method. Proportionate to population size (PPS) was employed to allocate a sample size for randomly selected HFs (Hulbareg, Ambarcho, and karate). Ahead of the proportional size allocation survey of a total number of clients, who were served during the last 2 months from the facilities, registration books were taken. Then, the estimated sample size (n) was divided into the total number of clients (N) served during the last 2 months in all selected HFs, which gave a proportionate value (P), and by multiplying it with the total served patients, PPS was allocated for each facility. Moreover, the study subjects were selected by using a systematic sampling method, considering the kth value (k = 2) for each HF. Finally, every nth patient was interviewed after completing the treatment at outpatient as well on the discharge date for inpatient.

Data collection instruments, techniques, and quality management

The structured questionnaire was prepared in English, and it was translated into Amharic and then into the local language Silitigna again. A structured interviewer-administered questionnaire was used to collect data, whereas a tool adapted from different literatures was used in this study. Data were collected by four grade 12 completed students and two nurse supervisors. For items related to satisfaction on CBHI, a five-point Likert scale ordinary response was used to assess the level of client satisfaction. Ahead of the actual data collection to monitor consistency, the protocol of the study tool and client's confidentiality, namely, pre-test, training, and reliability test (Cronbach's alpha), were performed.

Data processing and statistical analysis

Daily data were cleaned, coded, and then fed into Epi Info version 7. For further cleaning and analysis, the data were transferred into SPSS software version 20. A Likert scale measurement was used to compute the mean score of satisfaction items after extracting questions that fit the reliability test. Model fitness was checked by using Hosmer–Lemeshow goodness-of-fit test, and multicollinearity was also checked by computing the variance inflation factor (VIF). Then, variables had a statistical significance in bivariate analysis with 95% CI at a p-value of <0.05, which was considered a candidate variable for the next model. Finally, the statistically significant variables enter into the multivariate regression model to determine the predictors of the satisfaction levels of the clients.

Ethical consideration

Overall protocol of this study was approved by the Institution Review Board (IRB) of the college of medicine and health science. Ethical clearance and cooperation letters were written for the respective units from the vice president of the research and community service office. Ahead of the interviewer administering question purpose, benefit, and confidentiality issues addressed appropriately, a written informed consent was obtained from each participant.

Results

Socio-demographic characteristics

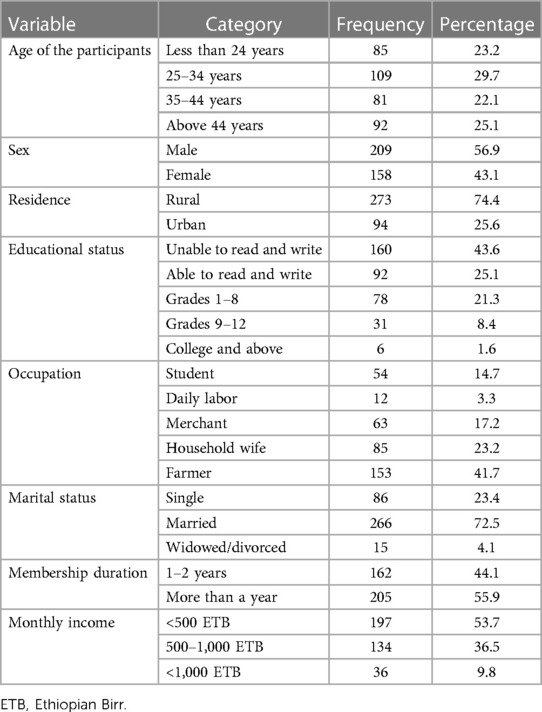

A total of 367 clients enrolled in the CBHI scheme were interviewed, showing a response rate of 93%. The mean age of the respondents was 35.47 (±13.14 SD) years, whereas their age ranged from 19 to 75 years. Among the participants who visited HFs, 209 (56.9%) were male. The mean household size was 5.8, whereas the highest proportion of family size was four and six members per HH, which constituted 74 (20.2%) and 72 (19.6%) of the study, respectively. Annual upper and lower limit membership payment per individual was 100 and 18.18 ETB (Table 1).

Table 1. Socio-demographic characteristics of clients who visit the health facilities in Hulbareg woreda, Silte Zone, Southern Ethiopia, 2019.

Knowledge of participants on CBHI

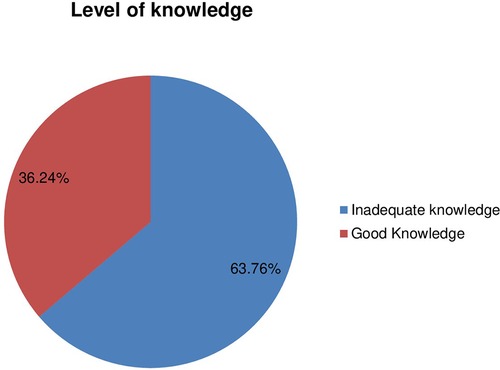

Out of the total participants, 207 (56.7%) have ever heard about CBHI. In addition, the level of knowledge of the clients was assessed by using 13 items. First, the questions were filtered, those that were developed to measure the level of knowledge among participants. Second, the level of knowledge of the individual was assessed by computing the average score of each item. Finally, based on the mean score of the participants, the level of knowledge was categorized as good and inadequate. Accordingly, the majority of the respondents (234, 63.7%) had inadequate knowledge about CBHI (Figure 2).

Experience of clients with health service provision

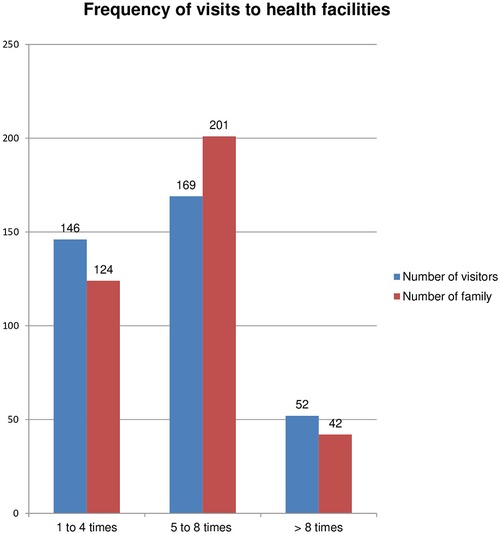

The average frequency visit to the HF during the last 12 months was 5.67 (±2.38 SD) times. However, the frequency of visits ranged from one to 13 times. More than one-fifth (73.4%) of the respondents visited HF three to five times. A descriptive analysis of the study has shown that the number of families within a single household increased and the number of health-seeking or visits to HFs also increased. More than 50% of the participants witness that the annual premium was very cheap compared with the service offered. An estimated maximum and minimum scale paid for a single visit were 200 and 15.00 ETB, respectively. Moreover, the highest proportion of visitors paid only 15.00 ETB per visit for all the services, which is much lower than the cost of a single antipain (Figure 3).

Among the total participants, only one-third of them had participated in the CBHI insurance concern issue. Moreover, 287 (78.2%) of participants could not get any sensitization training related to CBHI, and the internal or external referral system is one of the packages in the scheme. On top of that, out of them, 130 (36%) clients were referred to other HFs (hospitals), but only 40 (10.9%) were subjected to pay a service charge on the occasion of diagnosis and treatment. The upper and lower payments during the visit were 650 and 150 ETB, respectively.

Client satisfaction toward health service provision

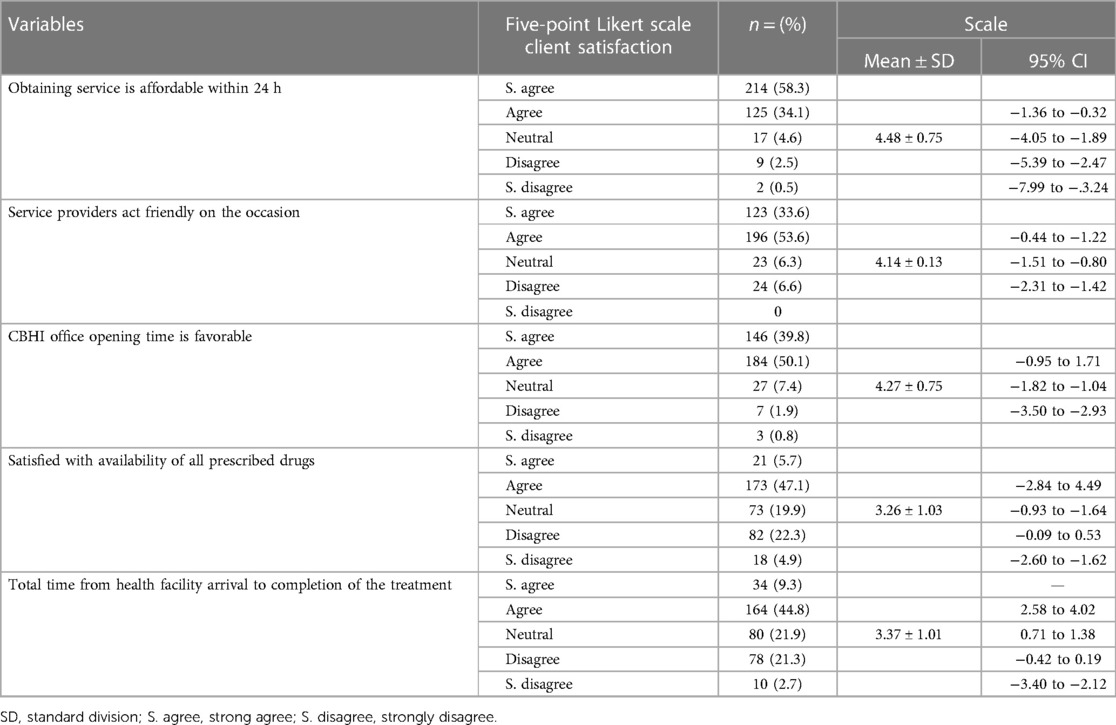

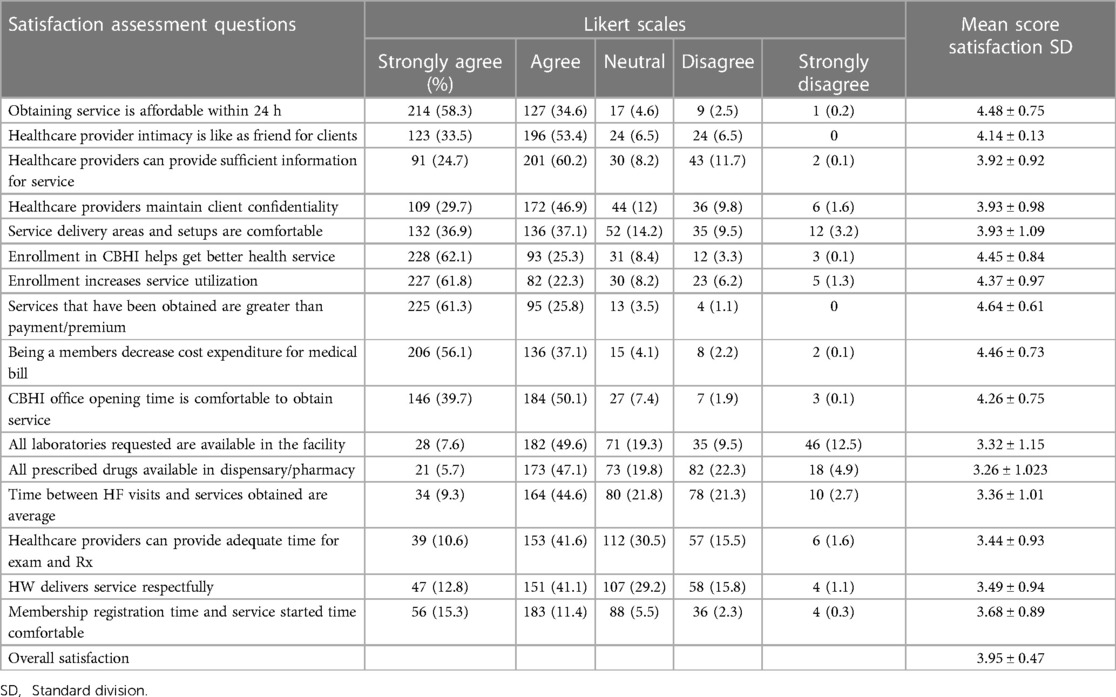

A five-point Likert scale measurement which ranges from 1 (strongly disagree) to 5( strongly agree) was used to assess client satisfaction toward health service provision. On top of that, to determine the internal consistency of the tools, Cronbach's alpha test was performed first. The items had a score of 0.817.

The possible range of satisfaction for each scale item is 16–80, and they reported the highest satisfaction rate, the services that were received more than the premium with an average score of 4.64 (±0.61 SD), and the services that were available within 24 h with a mean satisfaction rate of 4.48 (±0.75 SD). On the other hand, clients reported poor satisfaction with the item of availability of prescribed drugs (3.26±1.03 SD) and availability of all laboratory tests within the HF (average score 3.32 ± 0.15). The overall level of client mean satisfaction toward health service provision was just above the median score (3.95 ± 0.47 SD). Most of the patients were satisfied on service delivery time over 24 h, and enrollment decreased cost or OOP expenditure for medical bill. The overall level of client (percentage mean score) satisfaction with CBHI was 63.1%. Hence, 56.1% of participants enrolled in CBHI were satisfied with the health service provision (Table 2).

Table 2. Level of clients’ satisfaction on health service provision among the members of the community-based health insurance scheme, in Hulbareg woreda, Southern Ethiopia, 2019 (n = 367).

Ordinary regression analysis was performed for the items designed to identify the degree of factors that affects client satisfaction on health service provided under the CBHI scheme. Nearly 70% of respondents responded that they strongly agreed that enrollment in CBHI increased service utilization, while the highest proportion of respondents reported that they strongly disagreed on item availability of ordered tests within the respective facilities (Table 3).

Determinants of client satisfaction

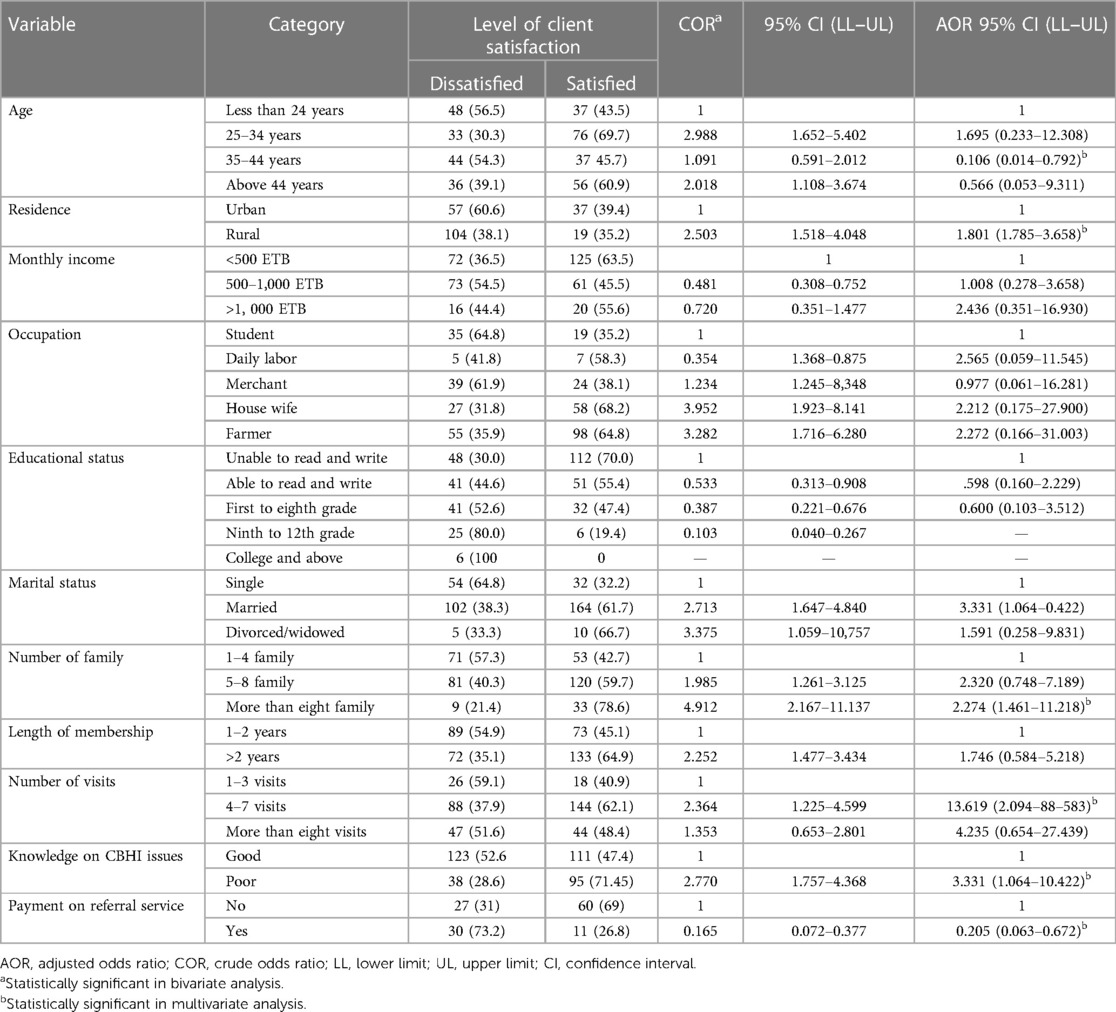

Binary logistic regression at a 5% level of confidence was conducted to select variables for multivariate regression. Among socio-demographic variables, sex is not statistically significant, whereas age, educational status, type of residence, occupation, size of the family, and marital status were statistically significant. Moreover, duration of enrollment, frequency of visits, and payment on the occasion of referral service had a significant statistical association with client satisfaction at p < 0.25.

To identify the predictors of client satisfaction, multivariate analysis was performed for the variables that fit the statistical significance on bivariate analysis at p < 0.25. This study revealed that age is one of the predictors of client satisfaction level increase by 89.4% (95% CI: 0.01–0.79), members enrolled in CBHI who have resided in rural area are 1.8 times more likely satisfied than urban inhabitants (95% CI: 1.99–3.66). The number of family members in single households increased by one digit clients satisfaction increased by twofold when compared with their counterparties. Clients who were paid a service charge on the occasion of the referral were 79.5% less likely to be satisfied with the service provided compared with those who were not subjected to pay a service charge. When the frequencies of clients' visits to the HFs were increased clients were at greater odds [AOR = 13.62 (95% CI: 2.09–88.58)] of satisfaction as compared with their counterparties and client who had good knowledge of the CBHI scheme increased odds of satisfaction by 3 [AOR = (95% CI: 1.06–10.42)] folds than their counterparties (Table 4).

Table 4. Predictors of client satisfaction on health service provision among members of the community-based health insurance, in Hulbareg Woreda, Southern Ethiopia, 2019.

Discussion

The study finding revealed that the level of client satisfaction on the health service provided among scheme members was high. The overall mean satisfaction rate was 3.95 ± 0.47 SD with a cumulative percentage mean score of 63.12%. The finding is higher than the studies conducted in Nigeria 42.1%, 46.7% (36, 37), India 42% (38), and 53.3% Istanbul, Turkey (20), whereas it is lower than the study conducted in Bangladesh with a mean score of 4.17 ± 0.04 (39). The higher proportion is possibly attributed to the status of participants. A study conducted in Usman was among the staff, so healthcare providers may have higher expectations toward service provision than other segments of the population, whereas in India, the partial annual premium is covered by the government once the annual payment for healthcare service is covered by the government. Servants may not be questioned for the medical service bill. In this case, this may lead to low satisfaction.

Client satisfaction and their level of knowledge were inversely associated. Participants who had poor knowledge on CBHI were at greater odds of satisfaction with the service provision. The study is in contrast with the study conducted in Nigeria (36). Our finding revealed that 36.3% of participants were knowledgeable about CBHI. According to our study, their level of knowledge toward CBHI was lower than the study conducted in Nepal (89.5%) (40). The possible reason for their low level of knowledge is possibly the difference/composition of study participants. However, their level of knowledge is higher than the study conducted in the Central Zone of Nigeria where only 28.7% (41) of the study population were knowledgeable. High proportion was attributed to the study design and participants. The Nigerian study encompasses both members and non-members of the insurance scheme.

We also found that the level of satisfaction of the participants varied for different satisfaction measurement items. The most client satisfied domain was the services delivered in the respective facilities were available throughout 24 h (4.68 ± 0.76 SD) and that clients strongly agreed on healthcare workers who act friendly while serving them. In turn, friendliness of the service providers increases client satisfaction by 33.6%; this finding is supported by a study conducted in Ghana (17) and is lower than the study conducted in Bangladesh (37.8%) (39). The lower proportion might be the commencement time of the CBHI scheme. In Bangladesh, CBHI began a longer time ago than the present study which may create a good opportunity, change the attitude of the health workers over time, and create strong, conducive, and impressive health service delivery setups. Unlikely, our study finding revealed that the clients were mostly dissatisfied with the availability of the prescribed drug and requested lab tests; this was supported by a study conducted in Turkey (20). However, this finding was lower compared with a study conducted in Pakistan (96%). The higher achievement of the Pakistan study is possibly attributed to the area where the study was conducted that was in an urban setup and may improve the supply of logistics more than our study area. Availability of logistics came with affording ordered drugs as well as requested tests that may lead to increased satisfaction of the client.

The finding of this study is contradictory in terms of participant address with the study conducted in Turkey (20): 64.0% of the urban respondents were more satisfied than the rural respondents, whereas in our study, the rural residents were 1.8 times more likely satisfied than the urban residents. The possible reason might be the service charge-free system being new for the rural community, and they become satisfied with slight services compared with the urban inhabitants. The study observed that the clients who are more likely to visit healthcare facilities tend to be satisfied. Visiting HFs four to seven times for medical advice 13 times increases the satisfaction level of the clients; the finding can be supported by a study conducted in Zaria, Nigeria (42).

The study revealed that those within the age range between 35 and 44 years were 89.4% times less likely to be satisfied than their counterparts which is similar to the study in Turkey (20). When the age of the respondents is more advanced, they tend to be satisfied with slight services because their expectation and perception may not be as high as the middle- and young-aged participants.

Conclusion and recommendation

The study finding revealed that the overall satisfaction level toward health service provision among the members of the CBHI scheme was high compared with the previous studies.

Our study found that age, residence, frequency of visiting the HFs, payment on the occasion of the referral services, level of knowledge of the client, and the size of the family were identified as predictors of client satisfaction.

Therefore, to improve enrollee satisfaction and client retention in the scheme health program manager, the respective facilities’ office chief executives should exhaustively engage on the availing laboratory test materials and drugs within the respective HFs and should have revised scheme issues as well as service delivery system for urban inhabitants.

The referral linkage from PHCU to the next-step HFs should be taken into account to avoid payment for service by Zonal and Woreda health offices through preparing a memorandum of understanding (MOU) between them.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical clearance was obtained from the Ethical Review Committee at the College of Health Science and Medicine in Wachemo University (WCU), with reference number 1278, dated on 02/12/11 (this date was written according to the Ethiopian calendar). The Committee has been working as the Institution Review Board/IRB of the university. An official letter was written to the Hulbareg Woreda Health Office/WoHO by the research and community service vice president of WCU. WoHO wrote a cooperation letter to respective HFs. The patients/participants provided their written informed consent to participate in this study.

Author contributions

GB initiated the research, wrote the research proposal, conducted the research and analysis, and wrote the manuscript. TA participated in the study conceptualization, research initiation, and data analysis. AH participated in quality control, data collection, and writing of the manuscript. TH participated in the data collection monitoring, entry, and quality control. All authors contributed to the article and approved the submitted version.

Acknowledgments

First of all, I would like to praise and give thanks to God for his grace and blessings over this work. Second, I would like to thank the Vice President’s Office of the Wachemo University Research and Community Service. Finally, I would also like to extend my heartfelt thanks to the comprehensive nursing department for the overall coordination since the conception to the submission of this study and Hulbareg Woreda Health Office.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frhs.2023.1237895/full#supplementary-material.

Abbreviations

CBHI, community-based health insurance; HHs, households; HFs, health facilities; HI, health insurance; OPD, outpatient department; OOP, out-of-pocket; OR, odds ratio; PPS, proportionate to population size; SSA, sub-Saharan Africa; SRS, simple random sampling; WHO, World Health Organization.

References

1. Zelelew H. Health care financing reform in Ethiopia: improving quality and equity. Health Systems. (2014) 20:20.

2. Carrin G, Waelkens MP, Criel B. Community-based health insurance in developing countries: a study of its contribution to the performance of health financing systems. Trop Med Int Health. (2005) 10(8):799–811. doi: 10.1111/j.1365-3156.2005.01455.x

3. Kansra P, Pathania G. A study of factor affecting the demand for health insurance in Punjab. J Manag Sci. (2012) 2(4):1–10. doi: 10.26524/jms.2012.37

4. Department of Health and Human Services. Agency for healthcare research and quality: advancing excellence in healthcare. Trop Med Int Health. (2011) 8(10). doi: 10.1111/j.1365-3156.2005.01455.x

5. Bovbjerg R, Hadley J. Why health insurance is important. Health policy briefs. Washington, DC: The Urban Institute (2007).

6. Swai DF. Assessment of factors influencing community health fund member’s satisfaction with treatment services offered through community health fun. Master’s dissertation. Tanzania: Mzumbe University (2015).

7. Jutting JP. The impact of health insurance on the access to health care and financial protection in rural developing countries: The example of Senegal. Washington, DC: World Bank (2001).

8. Tesfagiorgis E. The impact of community-based health insurance on health service utilization in Aneded woreda (2016).

9. Tesfay G. The impact of community based health insurance in health service utilization in Tigray: a case of Kilte Awlaelo woreda. Master’s thesis. Ethiopia: Mekelle University (2014).

10. Soors W, Devadasan N, Durairaj V, Criel B. Community health insurance and universal coverage: multiple paths, many rivers to cross. World health report 2010. WHO (2010) p. 45.

11. Uzochukwu B, Ughasoro MD, Etiaba E, Okwuoza C, Envuladu E, Onwujekwe OE. Health care financing in Nigeria: implications for achieving universal health coverage. Niger J Clin Pract. (2015) 18(4):437–44. doi: 10.4103/1119-3077.154196

12. World Health Organization. Community based health insurance schemes in developing countries: facts, problems and perspectives. Geneva, Switzerland: World Health Organization (2003).

13. Spaan E, Mathijssen J, Tromp N, McBain F, ten Have A, Baltussen R. The impact of health insurance in Africa and Asia: a systematic review. Bull World Health Organ. (2012) 90(9):685–92. doi: 10.2471/BLT.12.102301

14. Criel B, Richard F, Witter S, De Brouwere V. Community health insurance in developing countries. In: International encyclopedia of public health. Netherland: Elsevier (2008). p. 782–91.

15. Feleke S, Mitiku W, Zelelew H, Ashagari TD. Ethiopia’s community-based health insurance: A step on the road to universal health coverage. Washington, DC: World Bank Group (2015).

16. Mirach TH, Demissie GD, Biks GA. Determinants of community-based health insurance implementation in west Gojjam zone, Northwest Ethiopia: a community based cross sectional study design. BMC Health Serv Res. (2019) 19(1):1–8. doi: 10.1186/s12913-019-4363-z

17. Fenny AP, Enemark U, Asante F, Hansen K. Patient satisfaction with primary health care: a comparison between the insured and non-insured under the National Health Insurance Policy in Ghana. Glob J Health Sci. (2014) 6(4):9. doi: 10.5539/gjhs.v6n4p9

18. Assefa F, Mosse A, Hailemichael Y. Assessment of clients’ satisfaction with health service deliveries at Jimma University Specialized Hospital. Ethiop J Health Sci. (2011) 21(2):101–9. doi: 10.4314/ejhs.v21i2.69050

19. Westaway MS, Rheeder P, Van Zyl DG, Seager JR. Interpersonal and organizational dimensions of patient satisfaction: the moderating effects of health status. Int J Qual Health Care. (2003) 15(4):337–44. doi: 10.1093/intqhc/mzg042

20. Jadoo SAA, Puteh SEW, Ahmed Z, Jawdat A. Level of patients’ satisfaction toward national health insurance in Istanbul City (Turkey). World Appl Sci J. (2012) 17(8):976–85. ISSN: 1818-4952

21. Kruk ME, Freedman LP. Assessing health system performance in developing countries: a review of the literature. Health Policy. (2008) 85(3):263–76. doi: 10.1016/j.healthpol.2007.09.003

22. Addae-Korankye A. Challenges of financing health care in Ghana: the case of national health insurance scheme (NHIS). Int J Asian Soc Sci. (2013) 3(2):511–22. ISBN: 978-1-907345-34-0

23. Acharya A, Vellakkal S, Taylor F, Masset E, Satija A, Burke M, et al. Impact of national health insurance for the poor and the informal sector in low-and middle-income countries. London: The EPPI-Centre (2012).

24. Dror DM, Preker AS. Social reinsurance: a new approach to sustainable community health financing. London: The World Bank (2002).

25. Badacho AS, Tushune K, Ejigu Y, Berheto TM. Household satisfaction with a community-based health insurance scheme in Ethiopia. BMC Res Notes. (2016) 9(1):424. doi: 10.1186/s13104-016-2226-9

26. Workneh SG, Biks GA, Woreta SA. Community-based health insurance and communities' scheme requirement compliance in Thehuldere district, northeast Ethiopia: cross-sectional community-based study. Clinicoecon Outcomes Res. (2017) 9:353–9. doi: 10.2147/CEOR.S136508

27. Alkenbrack S, Lindelow M. The impact of community-based health insurance on utilization and out-of-pocket expenditures in Lao People’s Democratic Republic. Health Econ. (2015) 24(4):379–99. doi: 10.1002/hec.3023

28. Xu K, Evans DB, Kawabata K, Zeramdini R, Klavus J, Murray CJ. Household catastrophic health expenditure: a multicountry analysis. Lancet. (2003) 362(9378):111–7. doi: 10.1016/S0140-6736(03)13861-5

29. Peters DH. Better health systems for India’s poor: findings, analysis, and options. Washington, DC: World Bank Publications (2002).

30. Garedew MG, Sinkie SO, Handalo DM, Salgedo WB, Yitebarek Kehali K, Kebene FG, et al. Willingness to join and pay for community-based health insurance among rural households of selected districts of Jimma Zone, Southwest Ethiopia. Clinicoecon Outcomes Res. (2020) 12:45–55. doi: 10.2147/CEOR.S227934

31. Macha J, Harris B, Garshong B, Ataguba JE, Akazili J, Kuwawenaruwa A, et al. Factors influencing the burden of health care financing and the distribution of health care benefits in Ghana, Tanzania and South Africa. Health Policy Plan. (2012) 27(Suppl 1):i46–54. doi: 10.1093/heapol/czs024

32. Panda P, Dror I, Koehlmoos T, Hossain S, John D, Khan J, et al. What factors affect take up of voluntary and community based health insurance programmes in low-and middle-income countries. London: EPPI-Centre (2013). p. 59. doi: 10.2139/ssrn.2656059

33. Escobar M-L, Griffin CC, Shaw RP. The impact of health insurance in low-and middle-income countries. Washington, DC: Brookings Institution Press (2011).

34. Ali EE. Health care financing in Ethiopia: implications on access to essential medicines. Value Health Reg Issues. (2014) 4:37–40. doi: 10.1016/j.vhri.2014.06.005

36. Mohammed S, Sambo MN, Dong H. Understanding client satisfaction with a health insurance scheme in Nigeria: factors and enrollees experiences. Health Res Policy Syst. (2011) 9:20. doi: 10.1186/1478-4505-9-20

37. Kurfi MM, Aliero IH. A study on clients’ satisfaction on the national health insurance scheme among staff of Usmanu Danfodiyo University Sokoto. IOSR J Econ Financ (IOSR-JEF). (2017) 8(5):44–52.

38. Rajasekhar D, Manjula R. A comparative study of the health insurance schemes in Karnataka. India: Planning Department, Government of Karnataka (2012).

39. Sarker AR, Sultana M, Ahmed S, Mahumud RA, Morton A, Khan JAM. Clients’ experience and satisfaction of utilizing healthcare services in a community based health insurance program in Bangladesh. Int J Environ Res Public Health. (2018) 15(8):1637. doi: 10.3390/ijerph15081637

40. Subedi L, Regmi MC, Giri Y. Assessment of community based health insurance in Sunsari district. Kathmandu Univ Med J (KUMJ). (2018) 16(61):53–9.30631018

Keywords: community-based health insurance, client satisfaction, enrolled, health facilities, Ethiopia

Citation: Babore GO, Ashine TM, Heliso AZ and Habebo TT (2023) Client satisfaction and associated factors towards the health service provided to members of a community-based health insurance scheme in Southern Ethiopia. Front. Health Serv. 3:1237895. doi: 10.3389/frhs.2023.1237895

Received: 10 June 2023; Accepted: 10 October 2023;

Published: 3 November 2023.

Edited by:

Wameq Azfar Raza, World Bank Group, United StatesReviewed by:

Zeinab Gholamnia Shirvani, Babol University of Medical Sciences, IranAbraham Getachew Kelbore, Wolaita Sodo University, Ethiopia

© 2023 Babore, Ashine, Heliso and Habebo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Getachew Ossabo Babore Z29zc2FibzIwMDRAZ21haWwuY29t

Getachew Ossabo Babore

Getachew Ossabo Babore Taye Mezigebu Ashine

Taye Mezigebu Ashine Asnakech Zekiwos Heliso

Asnakech Zekiwos Heliso Teshome Tesfaye Habebo

Teshome Tesfaye Habebo