94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Future Transp. , 04 May 2021

Sec. Transportation Systems Modeling

Volume 2 - 2021 | https://doi.org/10.3389/ffutr.2021.660116

This article is part of the Research Topic Human Mobility and Transportation Impacts due to COVID-19 View all 4 articles

Before the COVID-19 pandemic, Indian firms have focused on interconnected and lean supply chains to ameliorate the gaps through increased efficiency of supply chains. However, the pandemic has exposed most Indian firms to severe supply chain disruptions (SCDs) due to undiscovered supply chain vulnerabilities. Against this background, we reviewed the existing relevant literature on SCDs and transportation disruption in general context and pandemic specific context and identified that there exists very little research on this issue especially in the context of Indian firms, and offered policy options by developing a new model of robust transport and advanced logistics system (ALS) for speedier supply chains recovery (SCR). We have utilized and analyzed the rich available literature on SCDs, transport intelligence (TI), and ALS using gray literature. The study revealed that many Indian firms have experienced major disruptions in transportation and logistics services, including impact on transportation and logistics data, time delays, and cargo cancellations due to cramped freight capacity, restricted circulation, closure of ports, and slow customs clearances. This has also impacted adversely the production and transport consignments including logistics services and led to delays and rerouting to final consumers. With the gradual removal of restrictions, firms are making concerted efforts to recover from SCDs; however, with weak applications of robust TI and ALS, the SCR is relatively very slow. This called for a review of current transport and ALS used by priority firms. Therefore, we offered a new model for addressing the SCDs using robust intelligence transportation systems and ALS.

The COVID-19 pandemic has spread across the world and infected a huge population (Sohrabi et al., 2020). Major production centers have been closed due to worldwide lockdown, which led to severe supply chain disruption (SCDs) in all manufacturing sectors. SCDs referred to the unplanned and unpredicted events that disturb the flow of goods and services across the supply chain (Craighead et al., 2007). With the shutdown in production activities and transportation disruption, the global prices of raw materials and intermediate supplies have increased (Maffioli, 2020). Border restrictions have led to a temporary stoppage in human mobility and transportation activities, which resulted in unparalleled pressure on shipping and road freights, and created severe impediments for international trade. Transportation disruptions have led to substantial interruptions in actual goods flows, product mobility, and have affected the entire supply chain, thereby leading to operations shutdown, sales loss, late deliveries, and reputational loss. Strong links between transport freight and trade have been observed. The surge in transport freight costs had significantly impacted the supply chain. Therefore, transportation has been considered a vital logistical driver, which impacted the responsiveness, efficiency, and performance of supply chains.

A responsive supply chain and transport flexibility can deliver products to customers more effectively (Ghavamifar et al., 2018). There are a variety of factors and sub-factors, which led to transportation disruptions in supply chains, for instance, adverse weather mostly disrupted transportation and adversely affected the supply chains (Sheffi, 2015). But a disruption like the COVID-19 pandemic is a potent risk to transportation in the supply chain and brought a meta-uncertainty. As an outcome of the COVID-19, supply chains in the transportation industry have been hampered, though differently across air, rail, road, and sea sectors. Therefore, there are various potential consequences for the supply chain due to transportation disruptions, which called for identifying the potential threats caused by transportation disruptions using innovative SCM practices through robust mitigation strategies via supply chain risk management (SCRM) to recover from business slowdown. The firms should design an effective mitigation and recovery plan in the event of logistics and transportation disruptions. However, relatively little research has been conducted on the impact of the COVID-19-induced transportation disruptions on SCDs. Against this background, we reviewed the related literature on supply chains, SCDs, and SCM vis-à-vis pandemics such as the COVID-19 to identify the research gaps and accordingly offered mitigation strategies including a logistics and transportation recovery model and prescribing the short-term and long-term measures for speedier recovery of firms from transportation disruptions in the Indian context.

In recent years, supply chain risks have received increasing attention in SCM research (Zsidisin, 2003) due to growing business uncertainty and vulnerability, which significantly lowered business practices like outsourcing, production, supplies, and inventories and in turn caused supply chains to become more susceptible to disruptions due to business risks (Craighead et al., 2007). This is linked to upstream and downstream supply agents, which caused supply chains more sensitive and complex than ever before (Blackhurst et al., 2005). Companies should strategically collaborate with their key suppliers and customers to survive and prosper. SCD risks have severely impacted the operational and financial performance of the firms based on their intensity (Hendricks and Singhal, 2003), which plays a significant role in building resilience against SCDs (Bode et al., 2011). Disruption in supply chains motivated the researchers to understand such risks and their impact on supply chains (Kleindorfer and Saad, 2005).

The lean and globalized business structures of many firms are currently affected by the COVID-19 (Ivanov, 2020). The pandemic hampered the resilience of supply chains and made the firms more vulnerable to SCDs due to a halt in production and logistics activities. With longer lockdown, the consumer demand has slowed down along with reduced demand for labor, supplies, and delivery, thereby severely impacting the supply chains without the established SCR mechanisms such as risk mitigation inventories, subcontracting capacities, backup supply and transportation infrastructures, robust channel distribution systems, and flexible production technologies (Araz et al., 2020). The COVID-19 has affected about 94% of the Fortune 1,000 companies due to SCDs in affected areas (Linton and Vakil, 2020). Both the demand and supply have declined substantially due to the pandemic-induced prolonged lockdown, which needed the governments' support to overcome the impact. SCR can be achieved by developing risk mitigation inventories, subcontracting, backup supply and transportation apparatus, and digital monitoring and visibility systems (Dolgui et al., 2020; Xu et al., 2020).

The COVID-19 pandemic has not been limited to a particular region or confined to a particular time. Different components of manufacturing, distribution centers, logistics, and markets have impacted the supply chains. The COVID-19-induced lockdown, economic shutdowns, and the SCDs have pushed many firms into bankruptcy (Tucker, 2020). For instance, many prominent US companies such as Sears, Hertz, and J. Crew have faced severe financial pressures. Besides manufacturing, the pandemic has caused widespread damage to the airline, tourism, and hospitality sectors (Asmelash and Cooper, 2020). For instance, Fiat Chrysler Automobiles NV and Hyundai temporarily have suspended production due to the harsh COVID-19-induced restrictions and SCDs (Ivanov, 2020). This has caused ripple effects in the industry and required robust SCRM strategies (Chen et al., 2019; Pournader et al., 2020) including sound data and more digitally enabled supply chains (Choi, 2020; WEF, 2020a,b) to improve the quality of the response (Ivanov et al., 2019).

The impact of the COVID-19 pandemic on SCDs is still to be adequately investigated (Sarkis et al., 2020). The unique nature of the COVID-19 crisis required robust policy challenges to address the SCDs, which must be different from earlier experiences of dealing with similar risks. The demand and supply have declined substantially due to prolonged lockdown in almost all productive activities, which needed substantial governmental supports. In the contemporary scenario, the COVID-19 pandemic could be the first global SCD, which called for robust management of global supply chains (GSCs) and also addressing the associated risks.

Researchers such as Mamani et al. (2013) and Büyüktahtakin et al. (2018) have focused on epidemic outbreaks and business operations. The COVID-19 pandemic has confirmed that supply chains acted as the veins of economic activities (Ivanov, 2020) at a large scale (Lin et al., 2020). The COVID-19 pandemic has threatened the global production network (GPN) severely and increased SCDs (Araz et al., 2020). Disruptions in manufacturing, distribution, and transportation have caused economy-wide repercussions, which are linked to reduced mobility and led to SCDs and normal functioning of businesses (Lin et al., 2020).

In the recent past, disruptions such as natural disasters (Tang and Musa, 2011; Sheffi, 2015) have immensely caused transportation and logistics disruptions. Transportation disruptions referred to the interruption in the actual flows which delayed the delivery from one node of a supply chain to another (Zhen et al., 2016). Disruptions in transport and logistics systems have significantly impacted the normal operations in supply chains (Baghalian et al., 2013; Chen and Chen, 2014; Tan et al., 2020). The COVID-19 pandemic-induced restrictions have led to the disablement of economical operations, and impacted transportation networks in maritime, rail, air, and trucking industries (de Vos, 2020; Gössling et al., 2020). Ultimately, trade restrictions, demand restraint, and transport disruptions have significantly impacted supply chains and consequently impacted freight volumes. The COVID-19 pandemic had caused a range of major disruptions in transport and logistics services, including flight cancellations, which also cramped air-freight capacity, disrupted global circulation, caused labor shortages and temporary closure of ports, and slowed down the customs clearance. This, in turn, delayed the production of goods and consignments in transit, which were rerouted or discharged short of their final destinations.

With the rising economy of e-commerce and online shopping in recent years, express shipping services (e.g., FedEx, DHL, and UPS) have played an important part in supply chains and logistics. Despite the COVID-19 pandemic, e-commerce service providers have experienced rapid growth in their businesses. The e-commerce market in India is likely to surge at a compound annual growth rate of 19.6% between 2019 and 2023, to become a US$98.4 billion market by 2023. E-commerce payments were expected to record a steep increase of 25.9% in 2020 due to a shift in consumers' preference from in-store to online store platforms (GD, 2020). Hence, transport and logistics services have a vital role in SCR from unpredicted pandemics like the COVID-19. Thus, transportation and logistics disruptions have been very sensitive to SCDs. In the context of the COVID-19, little attention has been paid to analyze the pandemic impact on transportation and logistics disruptions and its consequent effects on SCDs, specifically in the Indian context. Therefore, we made a modest attempt to fill the knowledge gap in this area and explored the impact of the pandemic on transportation and logistics systems of the Indian firms, and also offered an SCR mitigation model to tackle transportation and logistics disruptions and consequent SCDs.

To mitigate the negative effects caused by SCDs and transportation and logistics disruptions, a significant amount of work is required in the field of SCRM practices in the context of the pandemics such as the COVID-19 to suggest mitigation strategies. We reviewed the related literature on SCDs, transportation and logistics disruptions, and analyzed the COVID-19 impact on India's transportation and logistics systems and SCRM, and offered mitigation strategies including a transportation risk management model using short-term and long-term measures for speedier recovery of firms from the SCDs and transportation disruptions. The recent performance of India's transportation and logistics sector has also been presented. We also analyzed the challenges and opportunities in operationalizing the suggested model along with optimization of transport and logistics resources by the firms. In order to accomplish the intended goals, we analyzed the available literature using a web search and desk approach. The secondary data and information have also been analyzed using data triangulation and the theoretical method. We used the triangulation method to build a transportation risk management model by a systematic literature review to ensure a more comprehensive analysis. The application of the triangulation method increased the credibility and validity and improved the model creativity and validity by design and also clarified the concepts used for risk mitigation strategies and enhanced the testability of the model in the context of the COVID-19 pandemic-like future crisis.

Transportation refers to the movement of goods from one place to the other, while logistics refers to the transportation and delivery of goods including the storage, handling, inventory, packaging, and various other aspects. Transportation is the mode to execute logistics planning. Sustainable SCM required efficient and low-cost transport and logistics. New technologies and improved business processes have impacted both the logistics and transport sectors worldwide and India is no exception.

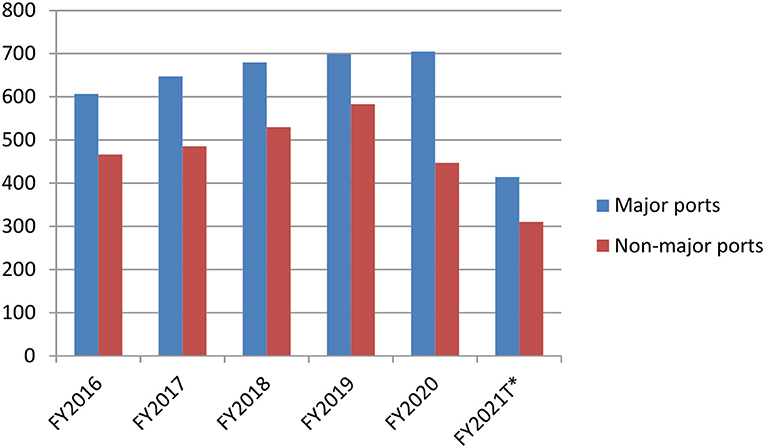

In recent years, India's maritime transport contributed about 95% and 70% of trading by volume and value. India has 12 major ports and 205 notified minor and intermediate ports. In India, the cargo capacity at major ports remained underutilized over the period. Figure 1 shows cargo traffic at major ports and non-major ports in India from 2016–2017 to 2020 to 2021. Major ports handled more than half of India's maritime transport, which declined by 10.5%−414 million tons (MT) during April–November 2020 compared with last year. The cargo traffic at non-major ports has declined by 10.8%−310 MT during April-October 2020. During the national lockdown period of April–May 2020, there has been a sharp decline in cargo traffic at both the major ports and non-major ports followed by a gradual improvement in cargo traffic since June 2020 due to a pickup in economic activity and trade both domestically and globally.

Figure 1. Cargo traffic at major ports and non-major ports in India (MT). Authors' creation based on Port Data Management Portal, Ministry of Ports, Shipping & Waterways, Government of India, New Delhi (2021) and Ports Sector Update, CARE Ratings, Mumbai (2021). FY refers to Indian financial year (April-March) and FY2021T* for major ports and non-major ports refers to April-November 2020 and April-October 2020, respectively.

In FY2012, the market share of major ports was recorded at 61% compared to non-major ports at 39%. Over the period, non-major ports have gained their share to reach 45% in FY2019. The growth in container traffic at major ports in India reached 9.98 TEUs (20-ft. equivalent units) in FY2020 at a growth of 1.12% year-on-year basis but declined to 4.93 TEUs during April-October 2020 due to the COVID-19-induced restrictions (Government of India, 2021). Massive investment in India's ports sector has been planned to improve maritime transport infrastructure. India's ports have received a cumulative foreign direct investment (FDI) of US$1.63 billion from 2000 to 2020 and US$1.9 billion were allocated for the upgrade of major ports from 2016 to 2019. From 2020 to 2021, US$257.22 million has been allocated for the development of the ports sector in India. The turnaround time at major ports stood at 64.69 h in 2019–2020. The additional port capacity is expected to reach 275–325 MT at a compound annual growth rate (CAGR) of 5–6% by 2022. India's cargo traffic at ports is likely to reach 1695 MT in 2021–2022 (IBEF, 2020a).

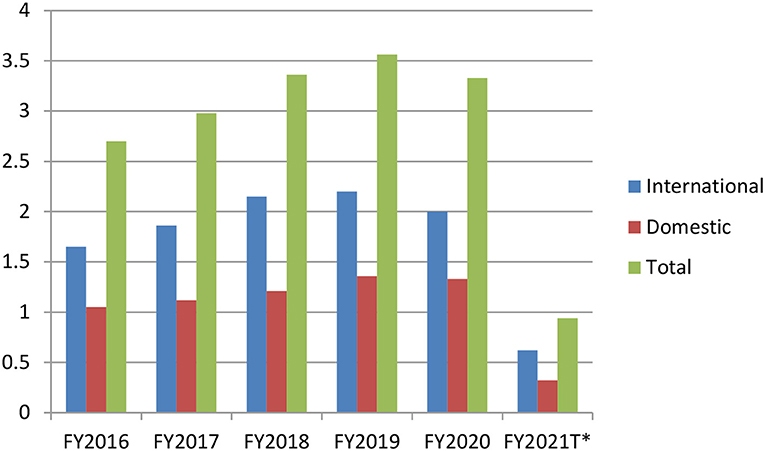

The air cargo handled in India has increased substantially from 703,000 in FY2000 to 3,328,296 in FY2020. In FY2020, the share of domestic and international airfreight traffic was 39.8 and 60.2%, respectively. Figure 2 shows the growth performance of air freight traffic in India from FY2016 to FY2021. In India, total air freight traffic increased from 2.7 to 3.33 MT at a CAGR of 5.32% from FY2016 to FY2020. However, air freight traffic has declined sharply to 0.99 MT during April–September 2020 due to the lockdown restrictions. The air freight traffic is likely to reach 4.14 MT in FY2023 and 17 MT in FY2040. India's air transport sector (including air freight) has received an FDI inflow of US$2.79 billion between FY2000 and FY2020 and is expected to receive an investment of US$4.99 billion by FY2024. Airport infrastructure is expected to receive an additional investment of US$1.83 billion by FY2026. The National Air Cargo Policy Outline 2019 envisaged making India's cargo and logistics the most efficient and effective globally by 2030 (IBEF, 2020b).

Figure 2. Air freight traffic in India (MT). Authors' creation based on Airports Authority of India (2020) and Ministry of Statistics and Programme Implementation, Government of India, New Delhi (2020). FY refers to Indian financial year (April-March).

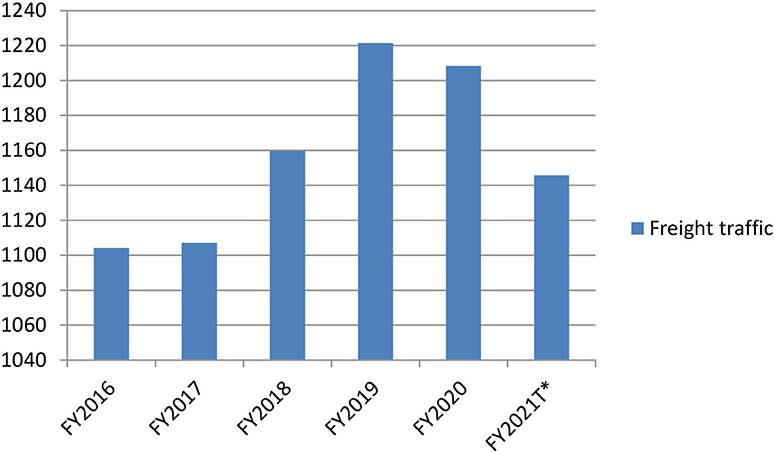

Indiaś rail network consisted of 123,236 km, which catered 9,146 freight trains and transporting 3 MT of freight per day. Figure 3 shows that rail freight traffic increased to 1208.34 MT in FY2020 from 1104.2 MT in FY2016 at a CAGR of 2.28%. The COVID-19 pandemic has provided an opportunity for India railways to improve their freight capacity. In FY2021, rail freight traffic has increased to 1145.68 MT and likely to achieve the 2024 MT mark by FY2024. The revenue growth of Indian Railways remained robust over the years. The rail freight revenue has increased up to FY2019 and then declined modestly in FY2020 and accounted for 65.1% of total rail revenue. In FY2020, the share of passenger segment and freight earnings stood at US$24.78 and US$16.24 billion, respectively. Rail freight movement has increased significantly due to enhanced carrying capacity, cost-effectiveness, and improved service quality. The COVID-19-induced road transport restrictions have led to an increase in rail freight loading, which stood at 108.16 million tons in October 2020 compared to 93.75 million tons and contributed US$1.40 billion of freight earnings, higher by US$117.41 million compared to US$1.28 billion in October 2019. Investment in rail infrastructure has increased considerably from US$31.03 billion during 2008–2012 to US$58.96 billion during 2013–2018 and planned to invest US$124.13 billion during 2018–2022. India requires US$545.26 billion by 2032 for capacity addition and modernization. The dedicated freight corridors are expected to transport 182 MT in FY2021 from 140 MT in 2016–2017. Indian railways planned to increase its freight traffic from 1.1 billion tons (BT) in 2017 to 3.3 BT by 2030 (IBEF, 2020c).

Figure 3. Rail freight traffic in India (MT). Authors' creation based on Ministry of Railways, Vision 2020, and Railway Statistics, Government of India, New Delhi (2020). FY refers to Indian financial year (April-March), FY2021T* refers to up March 11, 2021.

India's road network has consisted of 5.89 million kms, which catered transportation of 64.5 and 90%, respectively, of goods and passenger traffic. Highway construction increased substantially at 21.44% CAGR between FY2016–FY2019. The roads sector is expected to receive 18% of capital expenditure from US$1.4 trillion worth National Infrastructure Pipeline during 2019–2025. Investment in road infrastructure has remained unstable since FY2017. India planned to construct 65,000 km of national highways for US$741.51 billion by 2022. The National Highway Authority of India (NHAI) became fully digital using a cloud-based and artificial intelligence (AI)-powered big data analytics platform in the mid-2020. India envisaged an investment of US$545.26 billion by 2032 for capacity addition and modernization of road infrastructure (IBEF, 2020d).

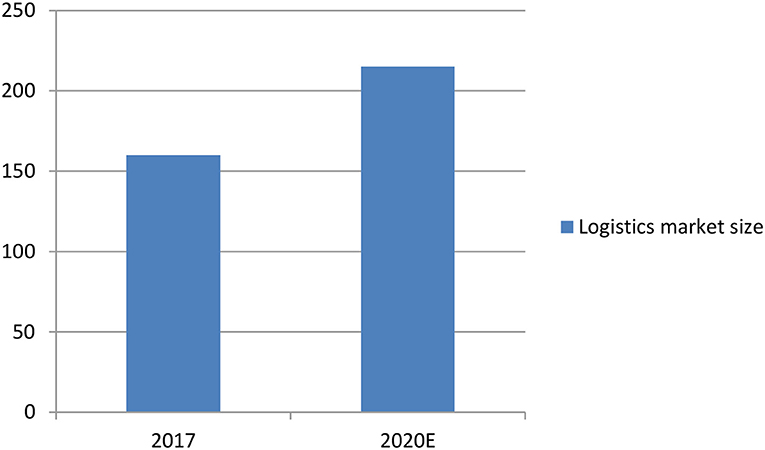

In a post-COVID-19 period, the global logistics market size is estimated to increase from US$2,734 billion in 2020 to US$3,215 billion by 2021 due to an increase in the supply of essential commodities, and supply chain stabilization initiatives (IBEF, 2020e). In India, the logistics sector was given infrastructure status in 2017. Figure 4 shows that India's logistics market is estimated at US$215 billion in 2020 from US$160 billion in 2017 (Research and Markets., 2020). Between 2019 and 2025, the logistics sector is projected to grow at a CAGR of 10.5% with an investment of US$500 billion annually. Between 2018 and 2020, investment in warehousing increased by US$7.12 billion. Currently, the share of organized players in the logistics industry stood at only 10–15% (Government of India, 2018). Thus, unorganized players dominated India's logistics industry. Therefore, there is a need to organize the highly fragmented logistics market.

Figure 4. Logistics market size in India (US$ billion). Authors' creation based on data from Research and Markets, Dublin (2020). E refers to estimated.

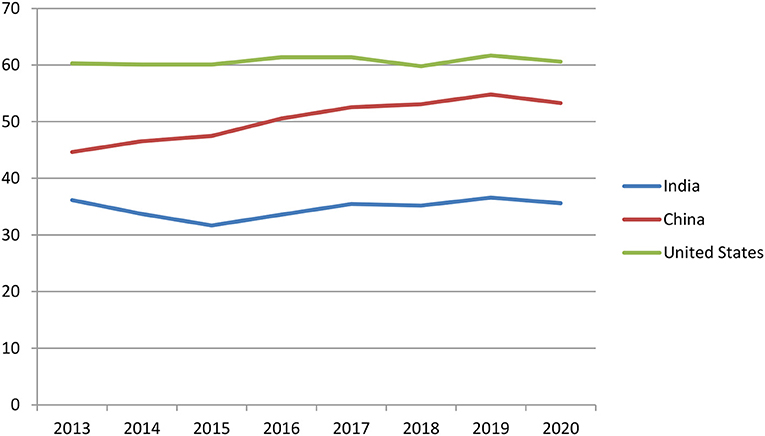

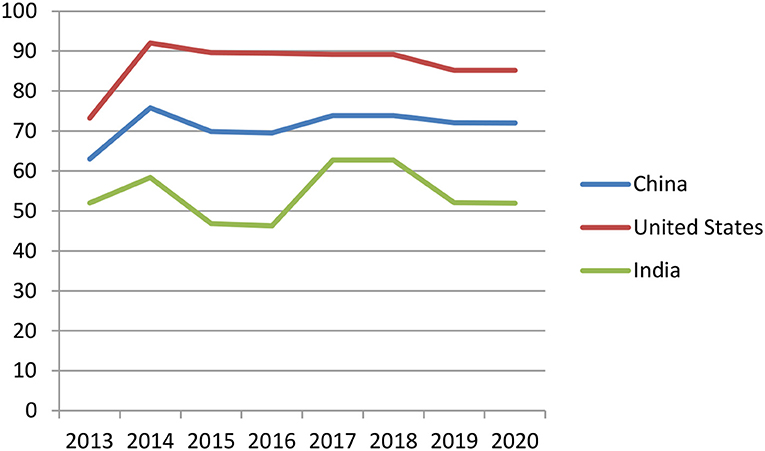

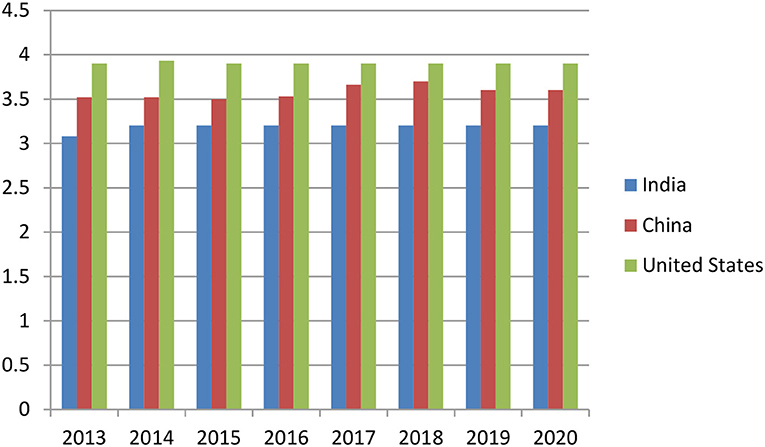

In 2018, India was ranked 44 out of 167 countries in the World Bank's Logistics Performance Index 2018. India was ranked second in the 2019 Agility Emerging Markets Logistics Index. The government invested substantially in national highway construction to improve logistics. India's Logistics Performance Index improved significantly from 54th rank in 2016 to 35th rank in 2018. Figure 5 reveals the level of innovation in India, China, and the United States (US) in terms of global innovation index score. The US followed by China remained the top innovation performer compared to India (Cornell University, INSEAD, and WIPO, 2020). This is one of the reasons for the weak transport and logistics system in India (Cornell University, INSEAD, and WIPO, 2020). Figure 6 reveals that the US remained the top logistics performer in 2020 with a score of 85.2 compared to India's score of 51.9. India's low logistics performance has been attributed to a lack of advanced technologies and poor optimization of supply chain drivers such as modern transportation, information, and warehousing. Figure 7 shows the comparative value of logistics performance in the global innovation index of China, India, and the US (Cornell University, INSEAD, and WIPO, 2020). India spends about 14% of its gross domestic product (GDP) on logistics compared to Japan at 11% and the US at around 9–10%. Therefore, logistics costs should be reduced by improving infrastructure, and adopting advanced and innovative technologies including digitalization. The application of emerging technologies and rapid digitalization of logistics operations can significantly improve the efficiency and performance in freight management and port operations to ease supply-chain cost pressures.

Figure 5. Global innovation index of China, India, and United States (Score). Authors' creation based on data from Cornell University, INSEAD, and WIPO (2020).

Figure 6. Logistics performance of China, India, and United States. Source: Authors' creation based on data from Cornell University, INSEAD, and WIPO (2020).

Figure 7. Global innovation index and logistics performance of China, India, and United States. Authors' creation based on data from Cornell University, INSEAD, and WIPO (2020).

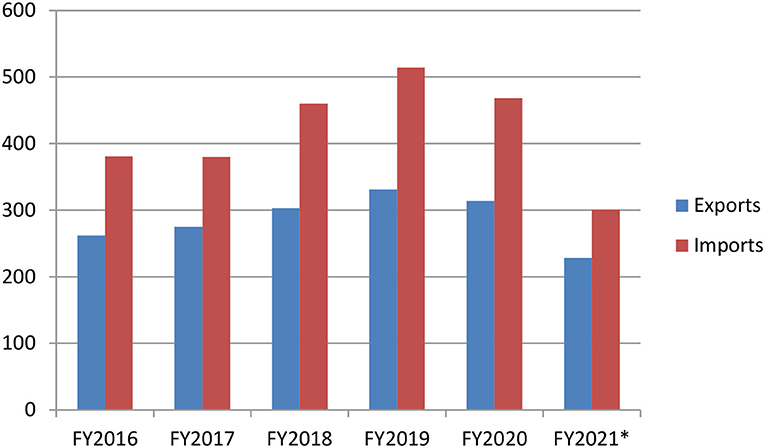

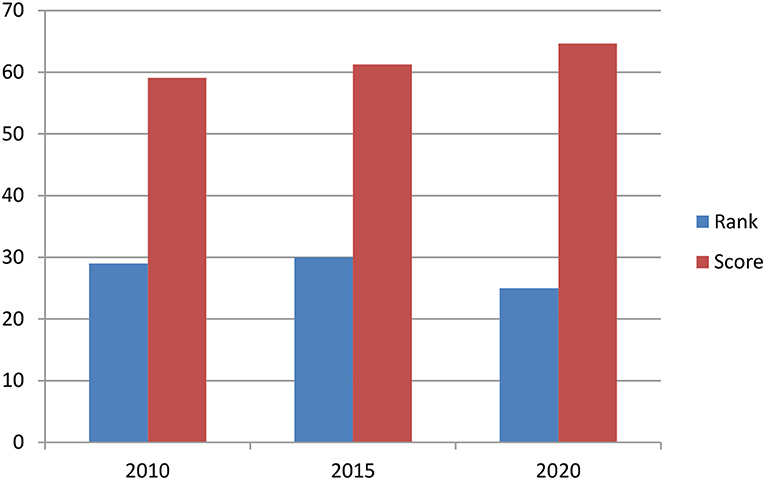

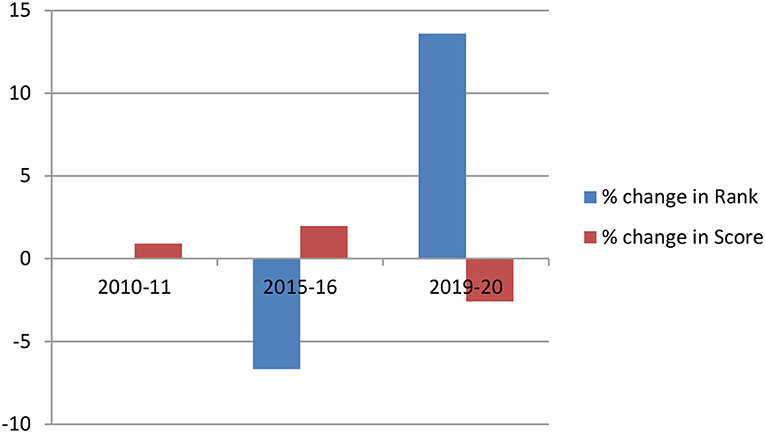

Figure 8 shows that India's merchandise exports and exports recorded negative growth of 13.58 and 25.92%, respectively, in April–January 2020 to 2021 over the same period last year with a trade deficit of US$72.01 billion. Figures 9, 10 show the rank and score of the market access and transport infrastructure of India and their percentage change, respectively. India's rank in market access and transport had declined from 2015 to 2020 with a negative performance of 2.58% in score in 2019–2020 (Legatum Institute, 2020). This has significantly impacted the performance of India's logistics sector.

Figure 8. India's external (merchandise) trade (US$ billion). Authors' creation based on data from Ministry of Commerce and Industry, New Delhi, 2021. FY refers to Indian financial year (April-March). FY2021* refers to the period up to February 15, 2021.

Figure 9. Market access and transport infrastructure of India (Rank and score). Source: Authors' creation based on data from Legatum Institute, London (2020).

Figure 10. Market access and transport infrastructure of India (% change in rank and score). Authors' creation based on data from from Legatum Institute, London (2020).

The Indian e-commerce market is likely to increase from US$38.5 billion in 2017 to US$200 billion by 2026 mainly due to the rapid increase in Internet and smartphone penetration. Online retail market sales increased to US$32.7 billion in 2018. Internet connections and smartphone shipments increased to 760 million and above 50 million by mid-2020. The e-commerce sector saw new developments during the pandemic. For instance, Flipkart acquired a 7.8% stake with an investment of US$203.8 million in Aditya Birla Fashion and Retail in the third quarter of 2020. Flipkart also partnered with PayTM to increase its market. Amazon India invested over US$95.4 million into its payment unit, Amazon Pay. Recent government initiatives such as Digital India, Make in India, Start-up India, Skill India, and Innovation Fund supported the growth of e-commerce. India's e-retail market increased to US$ 25.75 billion in 2020 and is projected to reach US$100–120 billion by 2025 (IBEF, 2020f). However, last-mile delivery for India's e-commerce remained a cause of serious concern. Therefore, technology-driven solutions are essential to address the existing lags in supply chains and to move forward with an adaptive approach in the new normal economy.

In brief, the COVID-19-induced national lockdown has led to a slowdown in trade, which is likely to reduce the growth performance of all types of freights in India. India's capacity growth of different freight segments is likely to exceed demand due to lower consumer confidence. India's logistics sector is expected to improve operational efficiencies with significant investments in technology adoption. This can increase India's exports substantially. The application of AI in designing transport route optimization can enable optimum utilization of freight assets. Real-time global positioning system (GPS)-based vehicle tracking can improve the transparency and reliability of India's transportation and logistics substantially. Application of the Internet of Things (IoTs), data assessment, and automation can ease the moving and tracking of cargos and help businesses smoothly operate their distribution network. Besides, the make use of digital GPS and Radio-frequency identification (RFID) systems can minimize the cost of identification and location of the products along the supply chain and improve profitability.

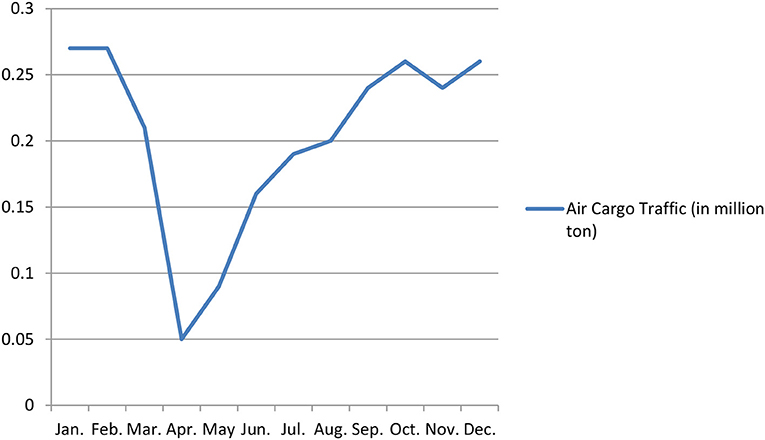

The COVID-19-induced lockdown measures have disrupted transport mobility severely, which also restricted international trade and added fuel to the fire in the logistics sector. Restrictions on transport freights have slowed down the mobility of goods sharply. Lockdown restrictions have brought first- and last-mile transportation and intermodal movement of goods to a complete halt for an initial period, and were eased later. These restrictions have caused a sharp reduction in vessel capacity and equipment shortages and impacted both domestic and external trade substantially. India's air freight volume has been expected to contract by 17–20% during 2020–2021 due to the government-imposed capacity restrictions to reduce the impact of the COVID-19 pandemic (ICRA, 2020). Figure 11 shows that air freight volume had recovered faster since April 2020, even there was a decline of 45% in the air freight volumes from April to September 2020 compared to the corresponding previous period (ICRA, 2020).

Figure 11. India's cargo traffic in 2020-2021 (January-December) (MT). Authors' creation based on data from Airport Authority of India, New Delhi (2021).

A heavy decline in freight volumes had forced major air cargo carriers to cancel their services including empty sailings to and from India and the Middle East, Europe, and the Mediterranean. Aviation has been one of the worst-affected segments due to pandemic-induced restrictions. The Indian government has suspended all passenger flights but allowed the movement of cargo flights. All these have adversely impacted the transportation and logistics performance to achieve the predicted future potential.

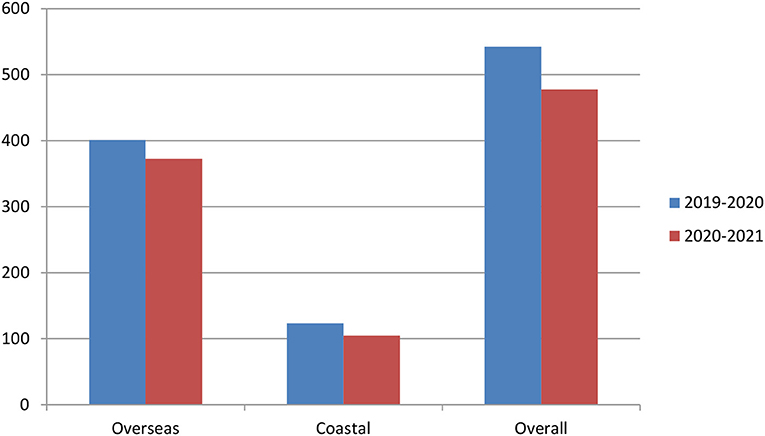

The COVID-19-induced disruptions in transportation and logistics systems required robust responses to mitigate the SCDs in India. The complete revival of shipping and ports at the pre-pandemic level can be one of the responses. India's shipping sector had strongly participated in global trade and linked the domestic market with the global markets. The widespread lockdown has caused immense transportation vulnerabilities and unexpected contraction in the supply and demand, which in turn reduced shipping demand and port traffic. Figure 12 reveals that both the overseas and domestic cargo traffic flows showed a negative trend during April–December 2019–2020 to April–December 2020–2021. The overall cargo traffic has registered a negative growth of 9%, while coastal cargo traffic declined sharply by 15.1% compared with overseas cargo traffic during the same period.

Figure 12. Port cargo traffic flows in 2019-2020 to 2020-2021 (April-December) (MT). Authors' creation based on Port Data Management Portal, Ministry of Ports, Shipping & Waterways, Government of India, New Delhi (2021).

Thus, the COVID-19 pandemic-induced restrictions have affected cargo traffic volume immensely at 12 major ports of India. The disruption in shipping transportation has integrated with the disruption in the road and air freight transportations and caused severe SCDs. For instance, more than 50,000 sea containers were laid uncleared at 23 Container Freight Stations and private container terminals at the major ports of Chennai, Kamajarar, and Kattupalli due to the unavailability of road transportation facilities and lacked strong supply chain visibility due to the COVID-19 pandemic. Therefore, the decline in cargo traffic volume has slowdown other transport modes, which in turn disrupted the supply chains substantially. This had caused indirect short-term impacts via reduced production, collapsed the supply chains, confused the inland logistics, and contracted offline consumption including indirect medium to long-term impacts through reduced demand in raw materials, contracted demand and consumption, reduced merchandise trade, and disrupted the supply chains.

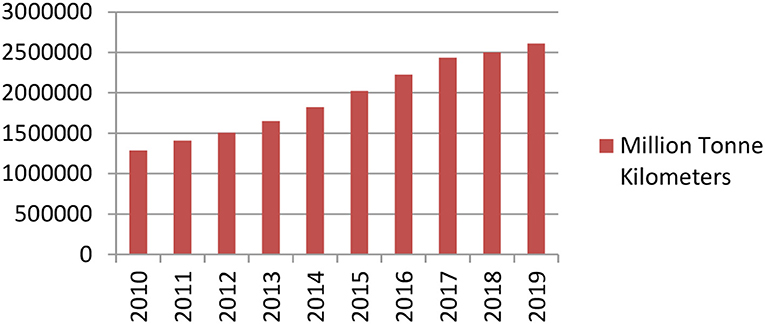

Indian roadways have been the second largest and one of the busiest transport networks in the world, which covered over 5.23 million kms and carried 65% of domestic freight and 80% passenger traffic (TCI, 2015). The National Highways of India carried about 40% of total road traffic and contributed just 2% of the total road network. However, the Indian ports have facilitated 96 and 70%, respectively, in terms of quantity and value of foreign trade (Frost and Sullivan, 2020). Figure 13 shows the increasing trend in the volume of road freight transportation in the last decade.

Figure 13. Volume of road freight transport in India, 2010–2019 (MT kms). Authors' creation based on data from the Ministry of Road Transport and Highways, Government of India, New Delhi (2020).

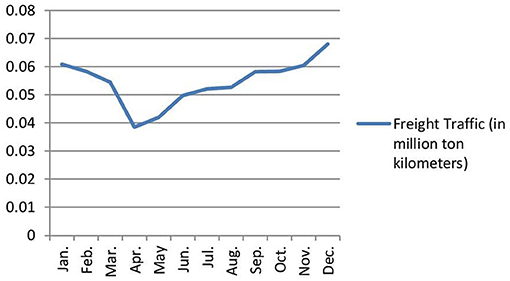

However, the vulnerability of India's transport and logistics network has been widely exposed due to the COVID-19 pandemic. The domestic road transport sector has been estimated to decline by 20%, which may lead to backward movement from stable to negative growth due to inadequate technology interventions and lack of sound mitigation strategy. The pandemic-induced restrictive measures have also impacted the growth prospects of the Indian logistics sector adversely due to restricted road freight mobility. Figure 14 shows the significant decline in road freight traffic during the initial period of strict lockdown measures, and then the freight mobility picked up gradually to cross the pre-pandemic level. However, it had caused severe disruptions in supply chains and logistics.

Figure 14. Monthly road freight traffic during January-December 2020 (Net ton kms). Authors' creation based on data from Ministry of Road Transport and Highways, Government of India, New Delhi (2021).

The freight availability has declined sharply, which led to a sharp decline in aggregate revenues by 18–20% on a 2020–2021 year-on-year basis (ICRA, 2020). Additionally, the near-term profitability metrics of the transport sector have been estimated to remain under pressure due to low fleet utilization levels and high fixed costs of salaries, truck EMIs, and routine maintenance. The manufacturing halt has reduced demand for logistics services, which caused downward pressure on prices across warehousing, freight, and logistics. Approximately, 50% of India's trucking fleet had been wrecked due to labor unavailability and disruptions in road transportation. The local transportation system was less impacted and managed with reduced capacities.

The government has also announced some relief to the transport sector during the lockdown. Despite this, inland logistics companies' volume is likely to fall by 10–15% in 2020–2021 as the consumption demand could take a longer time for recovery. The operational recovery for logistics players will be gradual and prolonged over 2020–2021. The volume of inland logistics players is expected to be down by 10–15% in 2020– 2021 year-on-year (ET Bureau, 2020).

Indian e-commerce logistics market has been segmented into service type, operational area, and end-user. Based on service types, the logistics market has been further segmented into transportation, warehousing, and value-added services. In the recent past, the transportation segment captured the largest share of the market. In terms of the operational area, the logistics market has been also segmented into domestic and international. The domestic segment is expected to register the highest returns in near future. Based on end-user, the logistics market has also been bifurcated into business-to-business (B2B) and business-to-consumer (B2C). The B2C segment had contributed substantially to the market in the pre-pandemic period.

Despite severe transportation disruptions and a lack of modern technological intervention in the sector, the e-commerce logistics sector had achieved significant growth during the pandemic. E-commerce players have sought alternative warehousing locations to help the continuity of their businesses, along with mitigating the delivery delays. With the rising awareness for social distancing among Indians, people have started opting for online platforms more than before, even in rural areas. E-commerce logistics players have leveraged options, such as contactless deliveries to mitigate the risk of infection, thereby boosted the demand for online sales. Several retailers across the country have switched online to expand their reach, which offered a wider choice of goods to the customers at competitive pricing and thus boosted e-commerce sales. The Unicommerce report on E-commerce Trends 2020 has noticed an overall order-volume growth of 17% in the COVID-19 period up to June 2020. Numerous leading companies have been operational in India's e-commerce logistics market. These companies have focused on adopting organic growth strategies, such as supply chain expansions to sustain their position in expanding the Indian market. For instance, in January 2020, Mahindra Logistics Ltd. had launched a distribution center for the pharmaceutical industry in North India, which managed the distribution and warehousing for its clients. The e-commerce sector may have performed better if smart transportation and logistics existed in India. However, despite substantial growth in road mileage and entry of foreign players in the Indian commercial automotive sector, the Indian commercial transportation and logistics systems have failed to integrate with the digital supply chains (DSCs) and transport intelligence.

In India, the manufacturing sector has been estimated to contribute 25–30% of the GDP by 2025, which will drive the growth of the warehousing segment. The port capacity is likely to grow at a CAGR of 5–6% by 2022, with substantial additional capacity. Indian Railways have planned to increase their freight volume from 1.1 BT in 2017 to 3.3 BT in 2030, whereas air freight traffic has been estimated to reach 17 MT by 2040 (Frost and Sullivan, 2020), despite lack of supporting infrastructure, and automated material handling systems. Thus, there is a need to adopt the robust transportation risk management model to strengthen India's transportation and logistics from the COVID-19like pandemic in the future. At the same time, there is a need to build DSCs using AI and enabling digital payments as a solution to deal with emergencies such as the COVID-19 pandemic.

The suggested model in Figure 15 has focused on transportation disruptions and risk management for the revival and recovery of the Indian firms from the COVID-19-like pandemic crisis in the future.

Transport disruption referred to disruption in the distribution, which negatively impacts the SC performance and customer safety (Zsidisin, 2003). In the model, sources of risk comprised hazards and vulnerability. Hazards such as the COVID-19 pandemic are the disruption events, which have badly disrupted the whole supply chain. Vulnerability referred to exposure of the system within which the mitigation strategies are compromised and diminished. Transportation disruption risk management involved decision-making at every stage of the process: identification of the sources of risk and vulnerability, risk analysis, and risk mitigation strategies (Kleindorfer and Saad, 2005).

Transportation risks consisted of internal and external disruptions. Internal disruption referred to the disruptions in the suppliers and retailers in the domestic markets, and external disruption referred to disruptions in the shippers to the overseas market. The internal and external disruptions have often led to disruptions in manufacturing, supply, and demand in the supply chains. For instance, demand for supply chains of the auto components and products have been unable to meet due to pandemic-induced SCDs. Likewise, the demand for numerous services has declined rapidly due to lockdown in the affected regions. Transportation disruptions have economy-wide repercussions due to restricted mobility and led to the SCD in manufacturing, distribution, and normal functioning of businesses (Lin et al., 2020).

Manufacturing disruptions referred to disruptions in internal processes caused by a delivery interruption in raw materials or auto components in case of a crisis. Supply disruption referred to disruptions linked with inbound supply from suppliers and shipment and supply market failures. Demand disruption implied the risks associated with unstable environments, demand complexity, dynamic customer needs, and demand uncertainty, which influenced the logistics and transportation system. To mitigate disruption risks like the COVID-19 crisis, firms must follow short-term and long-term risk management strategies.

Short-term risk management strategies should include the crisis response team and contingency planning, backup route, third party logistics (3PLs), transport cost structure, transport event management, outsourcing transport, transportation audit, supplier collaboration, and flexible contract.

A crisis response team should help the firms to identify the planning gaps in the transportation system and requisite internal and external resources for an improved response. Analyzing the response capabilities and vulnerability analysis can help in understanding the negative impact of transport disruptions in supply chains and quickly respond to the disruption risks.

Contingency planning should focus on the financial influence of the shortage of auto components and products due to disruptions in internal and external transportation systems. Researchers have paid increasing attention to the contingency plan using alternate suppliers (Sheffi, 2007; Tomlin and Wang, 2010), which is also known as contingent rerouting (Tomlin, 2006).

The transportation and logistics diversification strategies required the firms to make significant investments in advance of any potential disruptions like the COVID-19. The companies must absorb the direct and indirect transportation costs associated with the backup supply route strategy when a disruption occurs. Backup supply route strategy should integrate the expenditure of resources with the occurrence of a disruption. Analogously, a company can avail of an emergency transportation mode if their standard mode has been disrupted, which is aimed at reducing the lead time disruption risk. Researchers also paid attention to the disruptions in transportation and discussed how “backup transportation” can help (Zhen et al., 2016). Venkatesan and Goh (2016) explored the optimal “multi-objective” supplier route problem when transportation disruption occurred.

Firms should adapt to unpredicted events like the COVID-19 pandemic. The 3PLs have the potential to support supply chains at the time of disruption. Earlier the 3PLs made the provision for transportation and warehousing (Yang, 2016) and provided new and innovative ways to reduce the contact distance between suppliers, manufacturers, and consumers. Regardless of mode or freight volume, the 3PLs can assess and tailor solutions to a company's requirements by gathering transportation and logistics information to forecast accurate needs, influence supply chain decisions, and can ultimately grow the processes efficiency and customer services. Partnering with a 3PL can help in mitigating the short-term impact of transportation disruption on firms.

Firms should focus on routine transportation management and cost structure in the short run to survive the pandemic. Transportation cost consisted of two aspects: unit costs and production cost. Focusing on unit costs or carrier rates can only result in creating instability in the transportation network. The opportunity cost during a disruption is the productivity costs. This can help the firms in understanding the criticality of the transportation cost structure to mitigate the disruption in transportation and improve transportation responsiveness and visibility in the supply chains. The real goal should be the negotiation of carrier rates as fair, competitive, and equitable to all the parties. But the sustained cost reduction cannot be realized through infrequent transportation network designs.

Daily event management and hour-to-hour focus on waste identification and reduction should be targeted. Daily transportation plan and its execution in compatibility with the actual condition should also be accomplished. Any detected waste should be documented and followed using problem-solving techniques such as creating daily route designs, completing a real-time track, and tracing and generating real-time metrics to complete daily problem-solving. Transport outsourcing should also be reported if required.

Implementing a comprehensive transportation audit across all modes and geographies should be targeted. Transportation audit can help in the carrier and regulatory compliance by identifying the saving opportunities upstream in the sourcing, planning, and execution areas. A transportation audit can be performed for reviewing carriers, shipping needs, and transportation procedures currently employed within a supply chain.

Strong collaboration and cooperation are needed with various domestic suppliers. Firms working with suppliers located in different regions should identify and develop a relationship with backup suppliers. Whenever transportation disruption occurred, the existing relationships may put the firms in an advantageous position over their competitors who were similarly impacted by disruption and also reduced the disruption impact. This can result in building flexibility into the transportation contracts and provide an opportunity to transit between land, air, or sea delivery methods in the case of potential disruptions like the COVID-19.

Long-term risk management strategies can help the firms in revival and resilience against the disruption risks, which include supply chain collaboration, intelligent transportation system (ITS), Industry 4.0, vendor management system, supply chain freight visibility, carrier relationship management, and digital supply network (DSN).

The collaboration in logistics processes referred to the continuity of flow, transport, and warehousing activities in the supply chains. It provided the effective conditions to facilitate the B2B and B2C relations to achieve the transport cost reduction in supply chains. This can help the firms in building transportation resilience in supply chains. Strong collaboration demanded robust cooperation between different stakeholders, including the firms, suppliers, and customers for sharing resources, information, and technology to create synergy and to recover from disruption to remain competitive.

Firms can implement their logistics and transportation systems with strong application of information technology for effective and efficient transport management using techniques such as ITS and other administrative tools for operation management and decision making. ITS referred to the interconnection of different information systems aimed to capture, communicate, compute and assist the decision making and allow proper management of the flow of vehicles and transportation means. Proper management of a transport system required the integration of technologies such as the internet, electronic data exchange, wireless communications, computer technology, programming, and technologies designed to capture and analyze the required information. ITS also provided solutions for cooperation and a reliable platform for transport management. Electronic toll collection (ETC), highway data collection (HDC), traffic management systems (TMS), vehicle data collection (VDC), transit signal priority (TSP), and emergency vehicle preemption (EVP) are some of the widely used applications for ITS. The application of these tools can help the firms in building robust transportation and improve efficiency during transportation disruptions. These systems provided efficient transport management to produce economically efficient and safe routes and also allowed relevant information to users to be delivered such as controlling congestion and traffic, managing cargo fleets and vehicles, optimizing infrastructure, and managing communication between these elements. The most recent generation of ITS, generation 4.0 made use of multimodal systems incorporating personal mobile devices, vehicles, infrastructure, and information networks for system operations as well as personal contextual mobility solutions.

Firms should adopt and integrate their logistics and transportation system with Industry 4.0 to form logistics 4.0. Logistics 4.0 referred to the combination of using logistics with the innovations and applications added by the cyber-physical system. An efficient and strong logistics 4.0 must rely on and use the following technological applications such as resource planning, warehouse management systems, transportation management systems (TMS), intelligent transportation systems, and information security. These applications can build agility and flexibility in transportation and facilitate better recovery from disruptions. Flexibility, agility, and redundancy have helped the firms to strengthen resilience in supply chains (Parast and Shekarian, 2019). With the massive use of the IoTs and the inevitable road to Industry 4.0, a TMS is an essential element in the concept of logistics 4.0. Logistics 4.0 had used real-time and inline data to achieve more efficiency and effectiveness in a logistic process. TMS system has been important for a company to use the GPS technology to accurately locate its vehicles while on the road, monitor freight movement, negotiate with carriers, consolidate shipments, and use the platform's advanced functionalities and interacted with ITS.

Vendor-managed inventory (VMI) has been one of the successful business models used by Wal-Mart and other retailers. VMI can help the firms in closer understanding and collaboration between suppliers, manufacturers, distributors, and retailers. VMI model shared the information (inventory level and demand data) between the chain's members via electronic data interchange (EDI), which can help in understanding the transportation disruption for upstream and downstream partners in crisis. It can also help in analyzing demand and supply disruptions caused by transportation disruptions. Using EDI, the manufacturer can control distributors' inventory and decide the requirements of automotive for a distributor. The supplier can also check the raw material inventory level of the manufacturer based on the production planning via the EDI, and take business decisions.

When firms faced a disruption risk like the COVID-19, the supply chain partners must have information related to supply chain freight operations, which has termed as supply chain freight visibility. Transportation systems can focus on implementing cutting-edge supply chain visibility solutions into their operations for quick response to change using real-time data during the crisis. Therefore, firms should analyze real-time strategic information such as traffic patterns, weather, or road and port conditions to take action and reshape demand or redirect supply and optimize routes. Logistics companies that used fully integrated supply chains have more efficiency than those without integration. IoT sensor technology has been a crucial asset for tracking shipments. The connected IoT devices on parcels allowed the warehouses to track inventory, vehicles, and equipment through cloud services. At the same time, the container management powered by IoT made it easier through real-time monitoring, increased fuel efficiency, implemented preventative maintenance, and made container operations proactive instead of reactive. With that in mind, partnerships between the IoT and logistics companies should be vital to recover and mitigate the effect of transportation disruption in logistics during a crisis.

When shippers, providers, and carriers joined together to form a team dedicated to balancing cost and performance, the outcomes can be more successful in the long run. This is called carrier relationship management. When each team member understands and respects the goals of the others, it can open all eyes to a broader perspective, and allow the team to visualize and explore the shared solutions. For example, when capacity is tight yet predictable, carriers require longer lead times to accommodate agreed-upon service demands. At the same time, facing increasing customer expectations for same-day pickup, expedited delivery, and personal service, shippers can require even shorter-than-usual schedules. In the traditional competitive environment, these two sets of requirements would be seen as mutually exclusive. Each player would be at odds with the other, arguing, blaming, and clutching tightly to their positions. In today's more collaborative approach, the shipper and carrier should work together to identify common goals, complementary needs, and practical options to arrive at win-win solutions in the long run. This can help the firms to cope up with the change in opportunities due to disruption risks like the COVID-19 crisis.

Most firms lack end to end view of the supply chain and agility to face the volatility of today's unpredicted marketplace. DSN referred to the digitally linked information and transportation networks that provided the firms an unlimited level of real-time visibility. DSNs can solve various issues in the supply chain such as lack of visibility, poor response times, conflicting priorities, and insufficient risk management model. Four characteristics are required to build the DSNs: rapid, scalable, intelligent, and connected. Firms can enhance the supply chain responsiveness toward the disruption risks by developing robust data analytics capabilities. Replacing the traditional supply chain with the DSNs can enhance the integration of talent, physical, financial, and information in supply chains to promote collaboration and open communications with both the upstream and downstream suppliers. Such measures can help the firms in mitigating the risks posed by the transportation disruption in the context of the COVID-19 crisis.

In India, most transport and logistics operations are primarily handled manually, which led to high costs and low-profit margins (Mitra, 2011). Robust and advanced transport and logistics infrastructure played a vital role in SCM by enhancing the speed and efficiency of the logistics system and reducing the impact of SCDs. India's large and diverse transport and logistics sector faced numerous challenges in the adoption of ITS and Industry 4.0 due to skill and resource constraints. Advanced information technology tools such as GPS technology and tracking and tracing of shipments have been successfully adopted by only 2% of the supply chain companies in India (Luisa et al., 2013). Several international logistics companies in India adopted Industry 4.0 tools like IoT, AI, and machine learning for smart warehousing and logistics.

In the recent past, India also gained experience in implementing small-scale ITS projects in most cities through traffic regulatory management systems, automated traffic control, automated terminal information services, advanced public transportation system, bus rapid transport, and rapid bus transitways. Under the Digital India campaign, India attempted to improve digital skills. Some technology front logistics players utilized RFID systems using vehicle tracing technologies and warehouse control systems. However, India still lacks a robust digital policy to transform the traditional transport and logistics sector. Large gaps existed in the adaptation of new communication canals in the transport and logistics sector due to lack of technical competency (Arnold et al., 2016) and inadequate awareness among the key stakeholders (Sauvage, 2003) including the government (Govindan et al., 2014) to effectively regulate the transport and logistics sector (Mitra, 2011). Therefore, India's transport and logistics sector requires substantial technological improvement through heavy investment in digital transportation infrastructure and skill development (Abdulrahman et al., 2014; Govindan et al., 2014, Thai et al., 2011).

India's past experiences in the diffusion of ITS and Industry 4.0 in the transport sector should be replicated for adaptation and promotion of advanced modern technologies in emergency management, advanced vehicle control system, and congestion management to strengthen the transportation and logistics system for mitigating SCDs. The development of robust transport and logistics system in India should focus on the modeling, technology development, and interconnectivity of engineering branches such as transportation, communication, electronics, and information technology through the substantial application of sensors, detectors, communication devices, and global navigation satellite system along with advanced modern technologies like ITS, ALS and Industry 4.0 to digitize supply chains. This requires a cooperative and responsive collaboration between the government, the private sector, and academic research institutions. The COVID-19 pandemic has pushed India to address these challenges and to adopt advanced modern technologies like ITS, ALS, and Industry 4.0 along with focusing on the short-term and long-term risk management strategies to strengthen the transport and logistics sector. The application of these advanced modern technologies in the transport and logistics sector demonstrated the initial agreement on the deployment of the transportation risk management model and provided a conceptual basis and research challenges for the implementation of advanced transport and logistics systems in India. Therefore, robust communication canals using advanced digital technologies are one of the key elements for the implementation of a suggested mitigation methodology for dealing with a COVID-19 pandemic-like future crisis.

In a post-COVID-19 economic recovery scenario, companies must integrate the short-term and long-term risk mitigation strategies with flexible and innovative use of available resources to smoothen and safeguard the supply chain across the industry. Besides, following recommendations should be considered for flexible use of resources in post-COVID-19 recovery of supply chains such as shifting of ocean cargo to air, transformation of empty passenger aircraft to passenger-freighters by inclusion of belly cargo, freight consolidation, warehousing close to point-of-origin or destination, conversion of stores into distribution and fulfillment hubs, strategic use of ocean freight as floating storage through careful timing of orders and deliveries, use of efficient alternative airport, ports, and trucking routes, vehicle routing and scheduling solutions to reroute shipments, efficient staff-vehicle utilization and redeployment of assets in real-time, use trailer and product sensors to help monitor and locate critical items moving through the supply chain, diversifying sourcing strategies, use of interoperable set of e-freight systems to provide real time data, substituting cargo cycles for delivery vans, shared mobility pick-up and drop-off zones, delivery and loading zones, multi-sourced key commodities or strategic components to diversify their supply chains from a geographic perspective, evaluate alternative inbound logistics options, collaboration with domestic suppliers, use of drones for delivery and use of supplier specialization programs to reduce supply delivery risk by supplier development training. Soon, the demand is likely to be uncertain and there will be huge pressure on the transport and logistics industry to work effectively by flexible and innovative use of resources to provide a high-performing logistics system. Therefore, there is a need to identify planning gaps and requisite internal and external resources for an improved response through an autonomous plan.

Indian firms have focused on interconnected and lean supply chains to overcome the supply gaps in normal business operations. The COVID-19 pandemic has led to massive SCDs due to undiscovered supply chain vulnerabilities caused by government-imposed economic restrictions including transportation disruptions worldwide including India, which adversely impacted the normal functioning of the firms. Many Indian firms have experienced severe disruptions in transportation and logistics services, including stronger impact on transportation and logistics data, time delays, and cargo cancellations due to drastically reduced freight capacity, limited mobility, ports shutdown, and problems in routine customs clearances. All this has also severely delayed the production of goods, transport consignments, and logistics services thereby caused massive delays and rerouting to final consumers. The suggested model of robust transport and ALS can be widely used by firms for speedier SCR in the context of economic crises like the COVID-19 pandemic. Over the period, the government has gradually removed most of the restrictions and the firms have made concerted efforts to speedily recover from SCDs, however, inadequate applications of robust TI and ALS have delayed the SCR by the firms. This calls for reviewing current transport and ALS used by firms on priority for speedier SCR. Therefore, the suggested model can be widely applied to address the SCDs using robust intelligence transportation systems and ALS. The challenges and opportunities in operationalizing the suggested model along with optimization of transport and logistics resources should also be considered by the firms.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Abdulrahman, M. D., Gunasekaran, A., and Subramanian, N. (2014). Critical barriers in implementing reverse logistics in the Chinese manufacturing sectors. Int. J. Product. Econ. 147, 460–471. doi: 10.1016/j.ijpe.2012.08.003

Araz, O. M., Choi, D. O., and Salman, F. S. (2020). Data analytics for operational risk management. Decision Sci. 51, 1316–1319. doi: 10.1111/deci.12443

Arnold, C., Kiel, D., and Voigt, K. (2016). How the industrial Internet of Things changes business models in different manufacturing industries. Int. J. Innovat. Manage. 20, 1–25. doi: 10.1142/S1363919616400156

Asmelash, L., and Cooper, A. (2020). Nearly 80% of Hotel Rooms in the US are Empty According To New Data. CNN. Available online at: https://edition.cnn.com/2020/04/08/us/hotel-rooms-industry-coronavirus-trnd/index.html (accessed December 9, 2020).

Baghalian, A., Rezapour, S., and Farahani, R. Z. (2013). Robust supply chain network design with service level against disruptions and demand uncertainties: a real-life case. Euro. J. Oper. Res. 227, 199–215. doi: 10.1016/j.ejor.2012.12.017

Blackhurst, J., Craighead, C. W., Elkins, D., and Handfield, R. B. (2005). An empirically derived agenda of critical research issues for managing supply-chain disruptions. Int. J. Prod. Res. 43, 4067–4081. doi: 10.1080/00207540500151549

Bode, C., Wagner, S. M., Petersen, K. J., and Ellram, L. M. (2011). Understanding responses to supply chain disruptions: insights from information processing and resource dependence perspectives. Acad. Manage. J. 54, 833–856. doi: 10.5465/amj.2011.64870145

Büyüktahtakin, E., des-Bordes, E., and Kibiş, E. Y. (2018). A new epidemics–logistics model: insights into controlling the Ebola virus disease in West Africa. Eur. J. Oper. Res. 265, 1046–1063. doi: 10.1016/j.ejor.2017.08.037

Chen, H. Y., Das, A., and Ivanov, D. (2019). Building resilience and managing post-disruption supply chain recovery: lessons from the information and communication technology industry. Int. J. Inf. Manage. 49:330–342. doi: 10.1016/j.ijinfomgt.2019.06.002

Chen, Y., and Chen, Y. (2014). Strategic outsourcing under technology spillovers. Naval Res. Logist. 61, 501–514. doi: 10.1002/nav.21599

Choi, T. M. (2020). Innovative ‘bring-service-near-your-home’ operations under coronavirus (COVID-19/SARS-CoV-2) outbreak: can logistics become the messiah? Transp. Res. E Logist Transp Rev 140:101961. doi: 10.1016/j.tre.2020.101961

Cornell University, INSEAD, and WIPO. (2020). The Global Innovation Index 2020 Who Will Finance Innovation. Ithaca, NY, Fontainebleau, Geneva: Cornell University, INSEAD, and the World Intellectual Property Organization.

Craighead, C., Blackhurst, J., Rungtusanatham, M., and Handfield, R. (2007). The severity of supply chain disruptions: design characteristics and mitigation capabilities. J. Decision Sci. 38, 131–156. doi: 10.1111/j.1540-5915.2007.00151.x

de Vos, J. (2020). The effect of COVID-19 and subsequent social distancing on travel behavior. Transport. Res. Interdiscip. Perspect. 5:100121. doi: 10.1016/j.trip.2020.100121

Dolgui, A., Ivanov, D., and Rozhkov, M. (2020). Does the ripple effect the bullwhip effect? An integrated analysis of structural and operational dynamics in the supply chain. Int. J. Product. Res. 58, 1285–1301. doi: 10.1080/00207543.2019.1627438

ET Bureau (2020). Inland Logistics Players' Volume May Fall 10-15% in Current Financial Year: India Ratings. The Economic Times. Available online at: https://economictimes.indiatimes.com/markets/stocks/news/inland-logistics-players-volume-may-fall-10-15-in-current-financial-year-india-ratings/articleshow/75297111.cms (accessed December 15, 2020)

GD (2020). Covid-19 to further drive e-commerce payments in India. Global Data. Available online at: https://www.globaldata.com/covid-19-to-further-drive-e-commerce-payments-in-india-says-globaldata/ (accessed December 17, 2020)

Ghavamifar, A., Makui, A., and Taleizadeh, A. A. (2018). Designing a resilient competitive supply chain network under disruption risks: a real-world application. Transp. Res. E Logistics Transp. Rev. 115, 87–109. doi: 10.1016/j.tre.2018.04.014

Gössling, S., Scott, D., and Michael Hall, C. (2020). Pandemics, tourism and global change: a rapid assessment of COVID-19. J. Sustain. Tourism 29, 1–20. doi: 10.1080/09669582.2020.1758708

Government of India (2018). Economic Survey 2017-18, Ministry of Finance. New Delhi: Government of India.

Government of India (2021). Annual Report 2019-20, Ministry of Ports, Shipping & Waterways. New Delhi: Government of India.

Govindan, K., Kaliyan, M., Kannan, D., and Haq, A. N. (2014). Barriers analysis for green supply chain management implementation in Indian industries using analytic hierarchy process. Int. J. Product. Econ. 147, 555–568. doi: 10.1016/j.ijpe.2013.08.018

Hendricks, K. B., and Singhal, V. R. (2003). The effect of supply chain glitches on shareholder wealth. J. Operat. Manage. 21, 501–522. doi: 10.1016/j.jom.2003.02.003

ICRA (2020). ICRA Maintains Negative Outlook on Domestic Road Transportation Sector; Revenues Expected to Contract by 18-20% in FY2021. Investment Information and Credit Rating Agency of India Limited. Available online at: https://www.icra.in/Media/OpenMedia?Key=b5e83de2-e948-46c2-accc-20f9977009ab (accessed December 27, 2020).

Ivanov, D. (2020). Predicting the impact of epidemic outbreaks on the global supply chains: a simulation-based analysis on the example of coronavirus (COVID-19 / SARS-CoV-2) case. Transport. Res. E 136, 19–22. doi: 10.1016/j.tre.2020.101922

Ivanov, D., Dolgui, A., and Sokolov, B. (2019). The impact of digital technology and industry 4.0 on the ripple effect and supply chain risk analytics. Int. J. Prod. Res. 57, 829–846. doi: 10.1080/00207543.2018.1488086

Kleindorfer, P., and Saad, G. (2005). Managing disruption risks in supply chains. Product. Operat. Manage. 14, 53–68. doi: 10.1111/j.1937-5956.2005.tb00009.x

Lin, Q., Zhao, S., Gao, D., Lou, Y., Yang, S., Musa, S. S., et al. (2020). A conceptual model for the coronavirus disease (2019). (COVID-19) outbreak in Wuhan, China with individual reaction and governmental action. Int. J. Infect. Dis. 93, 211–216. doi: 10.1016/j.ijid.2020.02.058

Linton, T., and Vakil, B. (2020). Coronavirus is Proving we Need More Resilient Supply Chains. Harvard Business Review. Available online at: (accessed December 19, 2020).

Luisa, C., Vieira, S., Coelho, A. S., Maria, M., and Luna, M. (2013). ICT implementation process model for logistics service providers. Indust. Manage. Data Syst. 113, 484–505. doi: 10.1108/02635571311322757

Maffioli, E. M. (2020). How is the world responding to the 2019 coronavirus disease compared with the 2014 West African Ebola epidemic? The importance of China as a player in the global economy. Am. J. Trop. Med. Hygiene 102, 924–925. doi: 10.4269/ajtmh.20-0135

Mamani, H., Chick, S. E., and Simchi-Levi, D. (2013). A game-theoretic model of international influenza vaccination coordination. Manage. Sci. 59, 1650–1670. doi: 10.1287/mnsc.1120.1661

Mitra, S. (2011). The 2008 survey of Indian Third-Party Logistics (3PL) service providers: comparisons with the 2004 survey. Int. J. Appl. Logistics 2, 57–75. doi: 10.4018/jal.2011010104

Parast, M. M., and Shekarian, M. (2019). “The impact of supply chain disruption on organisation performance: a literature review,” in Revising Supply Chain Risk, ed G. A. Zsidisin (Cham: Springer), 367–389. doi: 10.1007/978-3-030-03813-7_21

Pournader, M., Kach, A., and Talluri, S. (2020). A review of the existing and emerging topics in supply chain risk management literature. Decision Sci. 51, 867–919. doi: 10.1111/deci.12470

Sarkis, J., Cohen, M. J., Dewick, P., and Schr, P. (2020). A brave new world: Lessons from the COVID19 pandemic for transitioning to sustainable supply and production. Resour. Conserv. Recycl. 159:104894. doi: 10.1016/j.resconrec.2020.104894

Sauvage, T. (2003). The relationship between technology and logistics third-party providers. Int. J. Phys. Distrib. Logistics Manage. 33, 236–253. doi: 10.1108/09600030310471989

Sheffi, Y. (2007). The Resilient Enterprise: Overcoming Vulnerability for Competitive Advantage. Cambridge, MA: The MIT Press. doi: 10.5860/choice.43-3481

Sheffi, Y. (2015). Preparing for disruptions through early detection. MIT Sloan Manage. Rev. 57, 30–42.

Sohrabi, C., Alsafi, Z., O'Neill, N., Khan, M., Kerwan, A., Al-Jabir, A., et al. (2020). World Health Organization declares global emergency: a review of the 2019 novel coronavirus (COVID-19). Int. J. Surg. 26, 71–76. doi: 10.1016/j.ijsu.2020.02.034

Tan, Z., Xu, M., Meng, Q., and Li, Z. (2020). Evacuating metro passengers via the urban bus system under uncertain disruption recovery time and heterogeneous risk-taking behaviour. Transport. Res. C Emerg. Technol. 119:102761. doi: 10.1016/j.trc.2020.102761

Tang, O., and Musa, N. (2011). Identifying risk issues and research advancements in supply chain risk management. Int. J. Product. Econ. 133, 25–34. doi: 10.1016/j.ijpe.2010.06.013

TCI (2015) Operational Efficiency of Freight Transportation by Road in India. Gurugram: Transport Corporation of India.

Thai, V. V., Cahoon, S., and Tran, H. T. (2011). Skill requirements for logistics professionals: findings and implications. Asia Pacific J. Marketing Logistics 23, 553–574. doi: 10.1108/13555851111165084

Tomlin, B. (2006). On the value of mitigation and contingency strategies for managing supply-chain disruption risks. Manag. Sci. 52, 639–657. doi: 10.1287/mnsc.1060.0515

Tomlin, B., and Wang, Y. (2010). “Operational strategies for managing supply chain disruption risk,” in Handbook of Integrated Risk Management in Global Supply Chain eds P. Kouvelis, L. Dong, O. Boyabatli, and R. Li (New York, NY: John Wiley and Sons), 79–101. doi: 10.1002/9781118115800.ch4

Tucker, H. (2020). Coronavirus Bankruptcy Tracker: These Major Companies are Failing Amid the Shutdown. Forbes. Available online at: https://www.forbes.com/sites/hanktucker/2020/05/03/coronavirus-bankruptcy-tracker-these-major-companies-are-failing-amid-the-shutdown/ (accessed December 16, 2020).

Venkatesan, P., and Goh, M. (2016). Multi-objective supplier selection and order allocation under disruption risk. Transport. Res. E Logistics Transport. Rev. 95, 124–142. doi: 10.1016/j.tre.2016.09.005

WEF (2020a). How China can Rebuild Global Supply Chain Resilience After COVID-19. Geneva: World Economic Forum. Available online at: https://www.weforum.org/agenda/2020/03/coronavirus-and-global-supply-chains/ (accessed December 23, 2020).

WEF (2020b). What Past Disruptions Can Teach us About Reviving Supply Chains After COVID-19. Geneva: World Economic Forum. Available online at: https://www.weforum.org/agenda/2020/03/covid-19-coronavirus-lessons-past-supply-chain-disruptions/ (accessed December 23, 2020).

Xu, S., Zhang, X., Feng, L., and Yang, W. (2020). Disruption risks in supply chain management: a literature review based on bibliometric analysis. Int. J. Product. Res. 58, 3508–3526. doi: 10.1080/00207543.2020.1717011

Yang, C. (2016). Leveraging logistics learning capability to enable logistics service capabilities and performance for international distribution center operators in Taiwan. Int. J. Logistics Manage. 27, 284–308. doi: 10.1108/IJLM-09-2014-0157

Zhen, X., Li, Y., Cai, G., and Shi, D. (2016). Transportation disruption risk management: business interruption insurance and backup transportation. Transport. Res. E Logistics Transport. Rev. 90, 51–68. doi: 10.1016/j.tre.2016.01.005

Keywords: supply chain disruptions, supply chain recovery, COVID-19 pandemic, transport intelligence, advanced logistics systems, India, policy options

Citation: Sudan T and Taggar R (2021) Recovering Supply Chain Disruptions in Post-COVID-19 Pandemic Through Transport Intelligence and Logistics Systems: India's Experiences and Policy Options. Front. Future Transp. 2:660116. doi: 10.3389/ffutr.2021.660116

Received: 28 January 2021; Accepted: 30 March 2021;

Published: 04 May 2021.

Edited by:

Peter John Morgan, Asian Development Bank Institute (ADBI), JapanReviewed by:

Ilgin Guler, Pennsylvania State University (PSU), United StatesCopyright © 2021 Sudan and Taggar. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tapas Sudan, dGFwYXNzdWRhbjY5QGdtYWlsLmNvbQ==; Rashi Taggar, cmFzaGkudGFnZ2FyQHNtdmR1LmFjLmlu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.