94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 26 March 2025

Sec. Environmental Economics and Management

Volume 13 - 2025 | https://doi.org/10.3389/fenvs.2025.1559458

This article is part of the Research TopicEnvironmental degradation, health, and socioeconomic impactsView all 7 articles

This study examines the interplay and spatial convergence of the digital economy, green finance, and green urbanization in the Yellow River Basin from 2001 to 2022, with a focus on their roles in promoting sustainable development. Utilizing a “pattern-process-mechanism” framework, the study employs the Global Moran Index, the Dagum Gini Coefficient, and the β-convergence model to analyze spatiotemporal dynamics and the coupling coordination across 77 cities in the region. The findings reveal a steady improvement in coordination, primarily driven by advancements in the digital economy, although regional disparities remain. Downstream cities benefit from industrial and resource advantages, while upstream areas continue to face significant challenges. The β-convergence analysis further suggests a narrowing of the regional gap, with spatial factors playing a key role in enhancing coordination. Based on these results, policy recommendations include strengthening regional cooperation, optimizing industrial structures, and increasing government support to foster balanced green development. These insights provide both theoretical and practical guidance for the formulation of sustainable economic strategies in ecologically sensitive regions.

In order to achieve long-term peace and stability in the Yellow River Basin, the Central Committee of the Communist Party of China (CPC) has elevated ecological protection and high-quality development of the region to a national strategy, on par with other key national initiatives such as the coordinated development of the Beijing-Tianjin-Hebei region, the Yangtze River Economic Belt, the Guangdong-Hong Kong-Macao Greater Bay Area, and the integrated development of the Yangtze River Delta. In September 2019, China formally proposed to elevate the ecological protection and high-quality development of the Yellow River Basin to a major national strategic priority. From the perspective of the strategic significance of watershed ecological protection, the ecological vulnerability of the basin dictates that green development is not only a prerequisite for economic development but also a crucial component of its high-quality advancement. The Yellow River Basin has historically been at the heart of China’s ecological security, as well as its economic and social development, yet it remains a region confronted with numerous challenges and pressing issues. The Yellow River is China’s second-longest river, with a basin area exceeding 750,000 square kilometers, traversing nine provinces and autonomous regions. In 2018, the total population of the basin reached 420 million, accounting for 30.3% of the national population, and the regional GDP amounted to 23.9 trillion yuan, or 26.5% of the national total. Additionally, the Yellow River Basin encompasses several major agricultural production areas, contributing 29.5% of the country’s total grain output.

China’s economy has made remarkable strides over the past 4 decades of reform and opening-up. However, the long-standing development model—characterized by high consumption, low efficiency, and an emergency-driven approach—has increasingly proven unsustainable. This model has led to a series of resource and environmental challenges, including resource depletion, environmental pollution, and ecological degradation (Shi, Rubiao, et al., 2024), which have significantly hindered the nation’s ability to achieve high-quality development. Confronted with these severe resource and environmental constraints, China must transition to a new development paradigm focused on green, low-carbon, and sustainable growth—a central pillar of the country’s vision for ecological civilization construction. At the same time, the global proliferation of emerging digital technologies has positioned the digital economy as a critical driver of socio-economic progress worldwide (Zhou et al., 2022). This transformation is poised to catalyze a comprehensive green transition that spans production factors, productivity, and production relations. Moreover, it will spur innovations in green finance and provide vital support for green urbanization. The 14th Five-Year Plan for National Informatization emphasizes the importance of advancing the development of a green, smart, and ecological civilization, advocating for the integration of digitization and sustainability. In this context, the digital economy, green finance, and green urbanization emerge as three interconnected drivers of China’s high-quality development, each deeply influencing the others. Digital economic activities that are disconnected from environmental considerations cannot effectively contribute to sustainable development (George et al., 2021). Similarly, green urbanization must provide the necessary support and strategic guidance for the digital economy to ensure its continued growth. Therefore, embedding green principles within digital economic activities, fostering green finance, and advancing green urbanization are essential steps toward achieving a sustainable future. In turn, green urbanization practices should leverage data-driven approaches to accelerate the growth of the digital economy and foster innovation in green financial models. As such, effectively coordinating these three dimensions—digital economy, green finance, and green urbanization—has become a critical agenda for the Chinese government and a key focus of academic research.

A review of the existing literature reveals that current research primarily focuses on the independent impacts of the digital economy, green finance, and green urbanization, or examines the unidirectional influence of the digital economy on the latter two. Concerning the interaction between the digital economy and green urbanization, digital technologies play a critical role by providing robust technical support. For example, digital city management systems enhance the efficiency of resource management and environmental monitoring (Adriaens and Ajami, 2021), while big data analytics optimize traffic flow and reduce energy consumption. At the same time, green urbanization generates significant application scenarios and market demands for the digital economy, with sectors such as smart buildings and smart city services emerging as new growth areas (Tian et al., 2024). The link between the digital economy and green finance lies primarily in the capacity of digital technologies to empower financial systems (Lin and Ma, 2022). Advancements in fintech, such as blockchain, facilitate traceability and transparency in green financial products, thereby enhancing market credibility (Agrawal et al., 2024). Additionally, big data and artificial intelligence enable financial institutions to perform more precise risk assessments (Țîrcovnicu and Hațegan, 2023) and develop accurate pricing models for green projects (Tian et al., 2022), thereby broadening and deepening green financial services (Ciocoiu, 2011). Green urbanization and green finance exhibit a symbiotic relationship. Green finance provides essential funding for green urbanization, supporting infrastructure development and the strategic layout of green industries. In turn, the progress of green urbanization creates significant investment opportunities, driving innovation in green financial products and expanding their market reach. For example, renewable energy projects within green cities (Dong et al., 2021) can be financed through instruments like green bonds (Sachs et al., 2019), while the development of ecological industrial parks attracts investments from green funds (Owen et al., 2018). However, research on the integrated development of the digital economy, green finance, and green urbanization remains in its early stages. Key areas, such as the construction of collaborative mechanisms and the design of coordinated policies, require further exploration. Achieving deep integration and synchronized progress across these three dimensions is critical for realizing global sustainable development goals and fostering a resilient, green future.

In summary, while extensive research exists on the digital economy, green urbanization, and green finance individually, studies examining their coordinated development remain limited. Future research should adopt more interdisciplinary and integrative approaches to explore their interconnectedness and synergies in greater depth, thereby providing robust theoretical support for policy formulation and practical applications. Notably, green urbanization in China exhibits significant regional imbalances. The lack of comprehensive quantitative assessments of the digital economy, green finance, and green urbanization hinders our ability to evaluate whether their development is synchronized or to identify areas that may be lagging behind. As a result, the intricate relationships among these three domains remain insufficiently understood. This study seeks to bridge this knowledge gap by providing nuanced insights into the spatiotemporal characteristics and dynamic mechanisms of the interplay between the digital economy, green finance, and green urbanization. Focusing on China’s Yellow River Basin, the research examines 77 cities across eight provinces (or autonomous regions) over the period 2001–2022, using a “pattern-process-mechanism” framework. By employing the Global Moran Index and the Dagum Gini Coefficient, the study investigates the coupling and coordination dynamics of these three dimensions. This approach contributes to the field of economic geography, particularly in the context of the digital economy and green development, and offers valuable insights for advancing national strategies related to green urbanization and high-quality development in the Yellow River Basin.

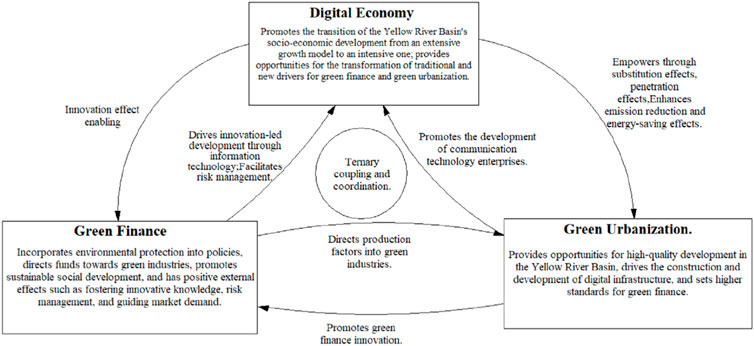

Research on multi-system coordination is essential for deepening our understanding of the synergistic effects between green development and high-quality development in the Yellow River Basin. Evaluating the ternary coupling and coordination among the digital economy, green finance, and green urbanization involves a multitude of indicators and complex interrelationships, including factor flows and mutual influences. This paper proposes a theoretical framework (Figure 1) to clarify the coupling mechanisms of these three systems in the Yellow River Basin.

Figure 1. The mechanism framework of the ternary coupling and coordination of digital economy, green technology innovation and ecological protection in the Yellow River Basin.

From the digital economy perspective, the socio-economic development of the Yellow River Basin urgently requires a transition from a growth model focused on quantity and speed to one that emphasizes quality and sustainability (Wang et al., 2022). The digital economy presents a pivotal opportunity for this transformation, driving both green finance and green urbanization. In green finance, the digital economy fosters innovation and modernization. Through technological advancements and network effects, digital technologies enhance financial systems, stimulate green financial innovation, and facilitate the transition to more sustainable economic models within the basin. In green urbanization, the digital economy exerts influence through substitution, penetration, and efficiency effects. By replacing traditional inputs with more efficient digital alternatives, it optimizes resource utilization and reduces energy consumption and emissions. This transition enhances resource efficiency and mitigates pollution, promoting sustainable urban growth. Ultimately, the integration of digital technologies not only revitalizes green finance but also provides a structural foundation for green urbanization. Understanding and leveraging these interactions is essential for achieving coordinated, high-quality, and sustainable development in the Yellow River Basin.

From the perspective of the green finance system, green finance refers to the integration of environmental protection into fundamental financial policies, with the objective of guiding capital toward green industries through financial services, thereby promoting sustainable social development. It has positive externalities in terms of innovative knowledge, risk management, and guiding market demand. On the one hand, from an innovation-driven perspective, green finance favors projects focused on environmental protection and sustainable development, thereby stimulating innovation among digital economy enterprises. It supports the development of related sectors by providing financing channels and risk-sharing mechanisms for innovative firms, attracting talent, and fostering an ecosystem conducive to innovation, which accelerates the development process. In terms of risk management, the rapid growth of the digital economy necessitates the processing of large volumes of data, making data security critically important. Green finance, in supporting the digital economy, encourages firms to prioritize data security and privacy protection, invest accordingly, reduce risks, and ensure the healthy and stable operation of the digital economy. On the other hand, through its resource allocation function, green finance directs key factors such as capital, labor, and technology toward green industries, thereby accelerating their development. At the same time, it imposes strict limitations on high-pollution, high-energy-consuming, resource-based, and overcapacity industries, driving industrial transformation and upgrading while achieving energy conservation, emission reduction, and the goals of green urbanization.

From the perspective of the green urbanization system, green urbanization in the Yellow River Basin represents a high-quality development opportunity under the regulatory framework of national strategic policies. On the one hand, green urbanization requires the construction of modern infrastructure systems, which directly drives the development of digital infrastructure. The burgeoning demand for digital infrastructure opens up vast market opportunities for ICT enterprises, bringing unprecedented growth prospects. This, in turn, accelerates the rapid development and widespread application of information and communication technologies such as 5G, optical fiber broadband, satellite communication, cloud computing, and big data. On the other hand, the development of green urbanization imposes higher demands on green finance. This forces green finance to continuously innovate, including expanding service areas, upgrading service models, developing diversified product systems, and improving relevant mechanisms, in order to align with the development pace and practical needs of green urbanization.

The entropy weight method is a standard approach for comprehensive scoring. In this study, the entropy weight method is applied to calculate the digital economy index, green technology innovation index, and ecological protection index for the Yellow River Basin. Detailed steps can be found in Zhang et al. (2014).

The coupling coordination model is typically used to analyze the coordination level between different systems. Coupling degree reflects the interdependence and mutual constraint relationships between systems, while the coupling coordination degree indicates the harmonious coexistence and sustainable development relationship among systems. The formula for calculating the three-system coupling degree C is:

Equation 1: C represents the coupling degree (0 ≤ C ≤ 1). According to the classification method of coupling degree and coupling types by Li et al. (2012), the system coupling degree and corresponding types are divided into six categories (see Table 1).

Equation 2: T represents the comprehensive benefit index, and D represents the coupling coordination degree of the composite system. α, β, and γ are the undetermined weights of the green urbanization subsystem, the green finance subsystem, and the digital economy subsystem, respectively. Referring to the classification method of coupling coordination degree and coupling coordination type by Dong et al., (2021), this paper divides the coupling coordination development status of the system into three major categories and ten subcategories (see Table 1).

By calculating the Moran’s I index, the spatial correlation (among prefecture-level cities) of the coupling coordination degree between the digital economy, green urbanization, and green finance in the Yellow River Basin can be determined. Specific formulas can be found in reference (Bivand and Wong, 2018).

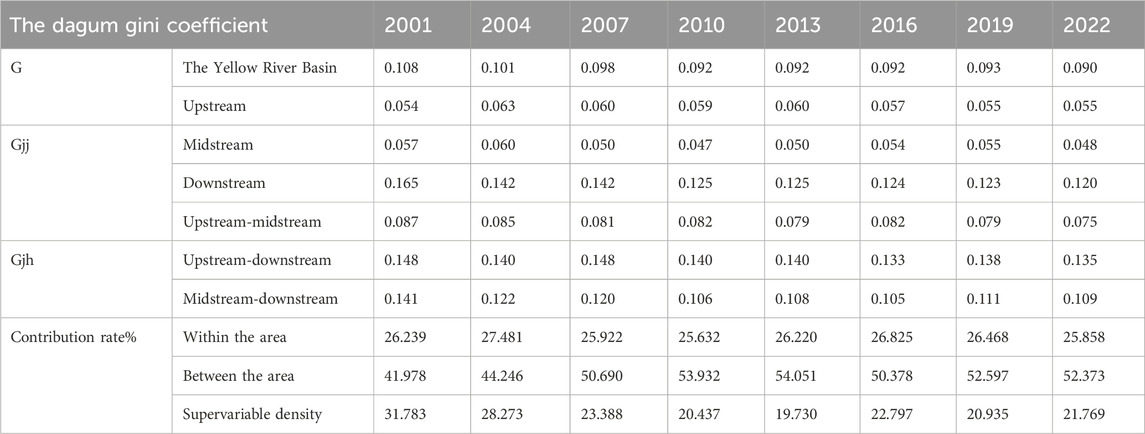

The Dagum Gini coefficient method is widely used in spatial disparity research. Unlike the Theil index, coefficient of variation, and traditional Gini coefficient, it decomposes the overall disparity of a specific variable into intra-regional disparity, inter-regional disparity, and transvariation density, allowing for an accurate analysis of each part’s contribution to the total disparity. The formula for the Dagum Gini coefficient

Equation 3:

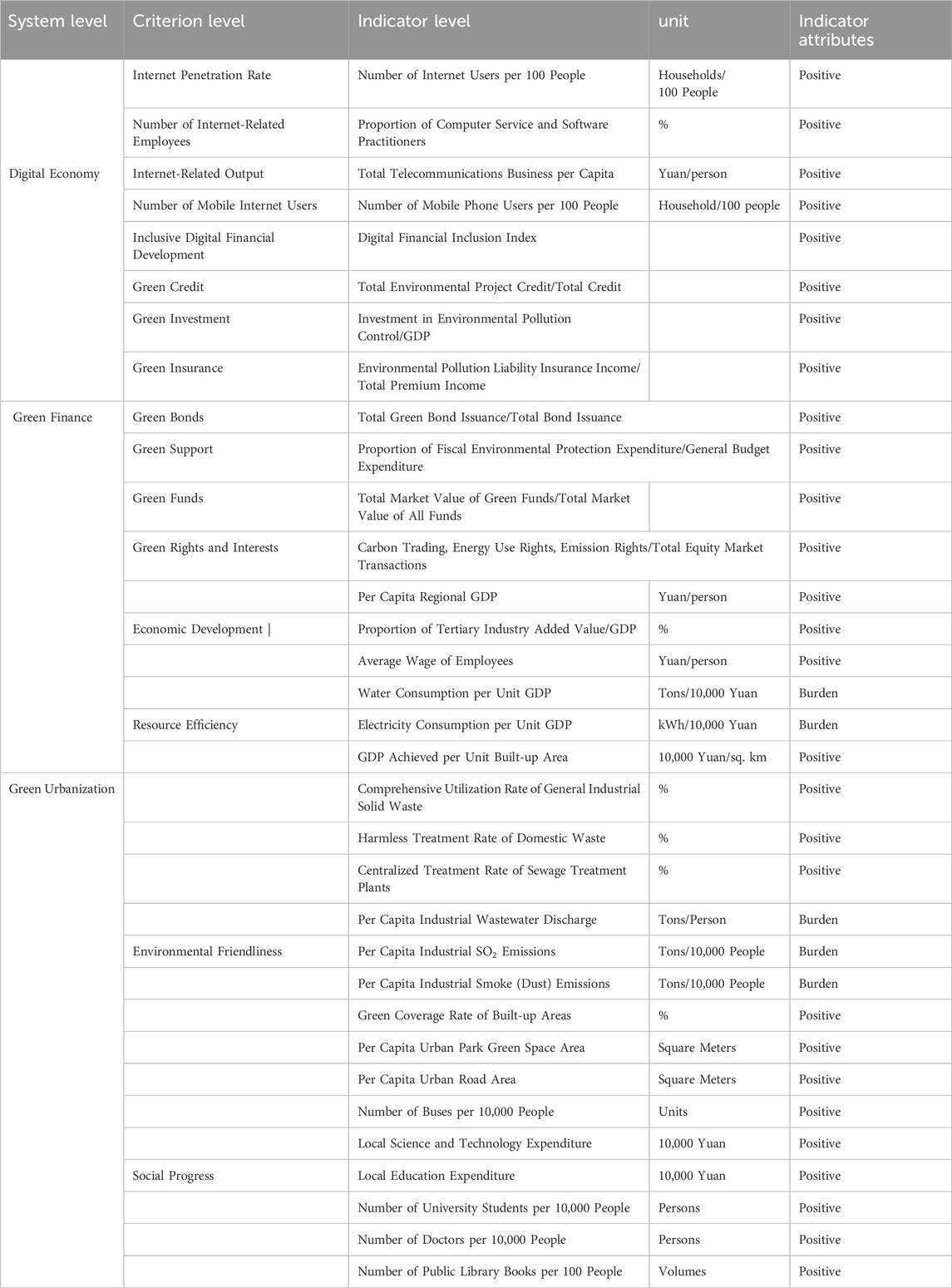

The evaluation index system for the digital economy is based on the research of Bukht, and Richard (2017); the evaluation index for green finance is derived from the works of Ozili (Ozili, 2022), Berrou et al. (2019), and Meo and Abd karim (2022), the evaluation index system for green urbanization is constructed based on the research of Borck and Pflüger, (2019) and Eeckhout and Hedtrich (2021) The system is developed from four dimensions: economic development, resource efficiency, environmental friendliness, and social progress, as shown in Table 2. In addition, from a geographical perspective, the Yellow River flows through nine provinces (autonomous regions). However, Sichuan Province is included in the Yangtze River Economic Belt Development Strategy, while Chifeng, Tongliao, Hulunbuir, and Xingan League in eastern Inner Mongolia are part of the Northeast Regional Revitalization Plan, and Laiwu in Shandong Province was merged into Jinan City in 2019. Therefore, this study excludes these administrative regions and uses data from 77 prefecture-level cities across eight provinces (regions) within the Yellow River Basin. The basin is divided into three regions: upstream, midstream, and downstream. The upstream region includes 23 cities from Qinghai, Gansu, Ningxia, and Inner Mongolia; the midstream region includes 34 cities from Shaanxi, Shanxi, and Henan (above Zhengzhou Taohua Valley); and the downstream region includes 20 cities from Henan (below Zhengzhou Taohua Valley) and Shandong. The study period spans from 2001 to 2022, with data primarily sourced from the China City Statistical Yearbook, China Environmental Statistical Yearbook, China Science and Technology Statistical Yearbook, and the statistical reports of various prefecture-level cities. Missing data for certain regions were supplemented using interpolation methods.

Table 2. Three-way coordinated comprehensive evaluation index system of digital economy, green finance, and green urbanization in the Yellow river basin.

From 2001 to 2022, the indices for the digital economy, green finance, and green urbanization, along with their coupling coordination degree, showed a steady upward trend (see Figure 2). Specifically, the digital economy index increased steadily from 0.10 to 0.365, a growth of 243.52%. The green finance index showed moderate growth, rising from 0.1732 to 0.348, with a growth rate of approximately 100%. The green urbanization index increased from 0.0185 to 0.0222 between 2001 and 2010, showing a small but stable fluctuation. However, in the last decade of the study period, it saw a rapid increase to 0.0425, reflecting a growth rate of 129.72%. The ecological vulnerability of the Yellow River Basin has long made it difficult to balance economic and green development. Despite the leapfrog growth of the digital economy, the dual constraints of traditional development models and resource-environment limitations have made green development still challenging. As a result, the overall growth in green finance and green urbanization has been slower compared to the rapid development of the digital economy.

Figure 2. Digital economy index, green finance index, and green urbanization index, and their coupling coordination degree.

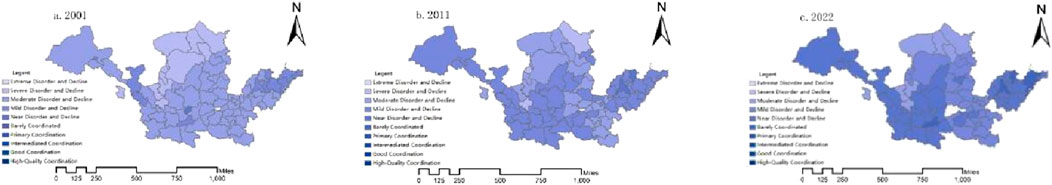

As shown in Figure 2, the coupling coordination degree among the digital economy, green finance, and green urbanization in the Yellow River Basin exhibits a steady upward trend, increasing from 0.249 at the beginning of the study period to 0.405 by the end, representing a growth of 62.5%. This indicates that the coupling coordination level among the three systems in the Yellow River Basin is continuously improving, with positive externalities and mutual reinforcement evident among the digital economy, green finance, and green urbanization. The spatial evolution of the coupling coordination levels of the three systems in 2001, 2011, and 2022 is shown in Figure 3. At the beginning of the study period, 12 cities experienced severe imbalance, primarily located in Ningxia, Qinghai, and Inner Mongolia, all within the upper and middle reaches of the Yellow River. Additionally, 53 cities exhibited moderate imbalance, indicating that the majority of cities in the basin were moderately imbalanced at that time. There were 11 cities with mild imbalance, including Lanzhou, Jiayuguan, and Wuwei in the upper reaches, Xi’an in the middle reaches, and the rest located in Shandong Province. Only Tongchuan was classified as near imbalance.

Figure 3. Spatial evolution pattern of the coupling coordination of digital economy, green finance, and green urbanization in the yellow river basin.

With the continuous development of the digital economy, green finance, and green urbanization in the Yellow River Basin, all cities had escaped the severe imbalance category by the end of the study period. The number of cities experiencing moderate imbalance decreased from 53 to 8, while those classified as mildly imbalanced rose to 29. The number of near-imbalanced cities increased from 1 to 35. In terms of distribution, the 35 near-imbalanced cities are spread across the entire Yellow River Basin, indicating a balanced improvement in coordination throughout the region. The number of cities in a coordinated state also grew over the study period. Notably, in addition to Xi’an in the midstream, Dongying, Yantai, Jinan, and Qingdao in the downstream region reached a marginally coordinated level. Overall, compared to the upstream region, cities in the midstream and downstream regions exhibit better coupling coordination development in digital economy, green finance, and green urbanization. This may be due to the relatively weaker resource endowments and more fragile ecological environment in the upstream areas. In contrast, the midstream and downstream regions benefit from richer development endowments and innovative resources, contributing to a stronger momentum in coupling coordination development.

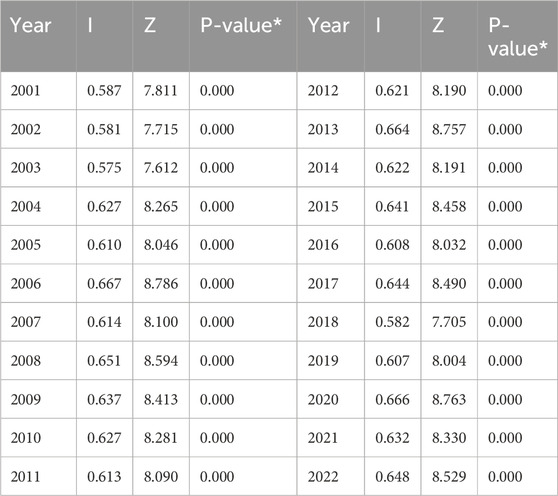

The global Moran’s I index for the coupling coordination degree of the digital economy, green finance, and green urbanization in the Yellow River Basin from 2001 to 2022 is shown in Table 3. Throughout the study period, the global Moran’s I index exhibited some fluctuations but remained significantly positive at the 1% level (i.e., p < 0.01). This indicates a clear positive spatial clustering effect in the coupling coordination degree of these systems across the cities in the Yellow River Basin. However, global spatial autocorrelation assumes spatial stationarity and considers only one of three trends—aggregation, dispersion, or random distribution—for the entire region. As a result, it may obscure local instabilities. The Moran’s I scatter plot is an effective tool for examining local spatial clustering and instability. It primarily describes the correlation between observed variables of spatial units and their spatial lag variables (i.e., the weighted average of observed values from neighboring spatial units). Using Stata software, Moran scatter plots for the spatial clustering patterns of the digital economy, green finance, and green urbanization in 2006, 2012, 2018 and 2022 were generated. The scatter plots are divided into four quadrants (HH, LH, LL, HL) based on the differences between provinces and their surrounding areas.

Table 3. Global Moran’s I index of the coupling coordination degree of digital economy, green finance, and green urbanization in the Yellow river basin.

Table 4. The Dagum Gini coefficient of the coupling and coordination degree of digital economy, green finance and green urbanization in the Yellow River Basin.

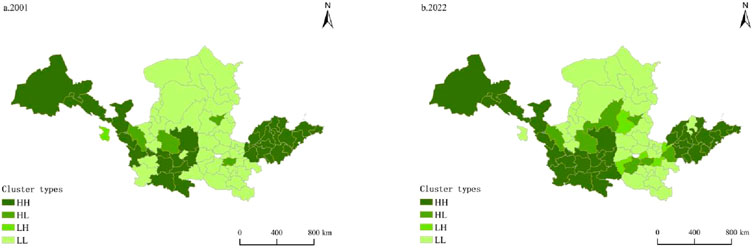

As shown in Figure 4, the Moran’s I values for the spatial autocorrelation of coupling coordination degrees in the Yellow River Basin were all positive over the 4 years examined: 2006 (0.6668), 2012 (0.6208), 2018 (0.5815), and 2022 (0.477). This indicates a significant positive spatial autocorrelation in the coupling coordination degrees across the cities in the basin. In other words, when a city exhibits a higher (or lower) coupling coordination degree, its neighboring cities tend to have similarly higher (or lower) values. From 2006 to 2018, Moran’s I showed a declining trend, suggesting that the spatial clustering of the coupling coordination degrees for digital economy, green finance, and green urbanization within the Yellow River Basin gradually weakened. This change implies an increasing divergence in the coordinated development of these three aspects among the cities. In terms of scatterplot distribution, the points in 2006 were relatively concentrated near the 45-degree reference line, with a balanced distribution across the four quadrants. High-High (HH) and Low-Low (LL) clustering phenomena were particularly evident. By 2018, the scatterplot became more dispersed, with more points deviating from the reference line. This may reflect that some cities increasingly diverged from the developmental trajectories of their neighboring cities in terms of coordinated development, indicating a growing imbalance within the region. In 2022, the Moran’s I value rebounded to 0.639, showing a resurgence in spatial autocorrelation. The scatterplot distribution became more concentrated around the reference line again, suggesting a recovery in the spatial interconnection of coupling coordination degrees among the cities. In each figure, most scatter points are distributed in the first and third quadrants. This indicates that in the Yellow River Basin, areas with high coupling coordination degrees tend to be surrounded by other high-coordination areas (High-High, HH), while areas with low coupling coordination degrees are often surrounded by other low-coordination areas (Low-Low, LL). Specifically, regions where digital economy, green finance, and green urbanization are well-coordinated also see strong performance in their neighboring areas. Conversely, underdeveloped regions are often surrounded by similarly underperforming areas, reflecting positive spatial autocorrelation, where cities with similar levels of development tend to cluster spatially.

Figure 4. A localized spatial autocorrelation map of the coupling and coordination degree between digital economy, green finance, and green urbanization in the Yellow River Basin.

The results show that, in terms of regional distribution characteristics, the high-high promoting areas in the upstream have expanded, while the high-high promoting areas in the downstream remain relatively stable. This indicates that the agglomeration effect of high values in these regions is continuously strengthening, suggesting that regions with better coupling coordination are further consolidating their advantages. In contrast, the low-low lagging areas have remained largely unchanged. Additionally, the low-high clustered areas in the midstream have increased, indicating that cities with lower levels of development are gradually being surrounded by more developed regions, likely benefiting from spillover effects and coordinated regional development.

The Dagum Gini coefficient for the coupling coordination degree of the digital economy, green finance, and green urbanization in the Yellow River Basin is shown in the table. As indicated in the Table 4, the overall Dagum Gini coefficient for the coupling coordination degree decreased from 0.108 at the beginning of the study period to 0.0897 by the end, suggesting that the overall disparity in coupling coordination across the basin is gradually narrowing. In terms of intra-regional differences, the Dagum Gini coefficient for the midstream and downstream regions exhibited a fluctuating upward trend, decreasing from 0.057 to 0.165 to 0.048 and 0.12 by the end of the period, respectively. Meanwhile, the upstream region consistently fluctuated around 0.55. This indicates that the internal development gap in coupling coordination within the midstream and downstream regions is gradually narrowing, while the disparity among cities in the upstream region has remained relatively stable.

From an inter-regional perspective, the Dagum Gini coefficient between the upstream and midstream regions decreased from 0.082 to 0.075, and between the upstream and downstream regions from 0.148 to 0.135. The midstream-downstream coefficient also fell from 0.141 to 0.109 during the study period. This suggests that the development disparity between the upstream and the other regions is gradually expanding, though the overall widening is less pronounced than in the midstream and downstream areas. The likely reason is that provinces in the lower Yellow River region have better resource endowments and developmental advantages. Notably, Shandong, as a leading province in the basin, has a large economic scale, an early start in digital economy development, and a richer pool of innovative talent compared to the midstream and upstream regions. This provides superior conditions for the coordinated development of the digital economy, green finance, and green urbanization. Thus, the issue of unbalanced development between the downstream and upstream regions has become increasingly prominent during the study period. In terms of contribution rates, the inter-regional difference contributes the most and shows an overall upward trend, rising from 41.98% at the beginning of the study period to 52.37%. In contrast, the intra-regional difference contribution rate is relatively low, fluctuating downward from 26.24% to 25.86%. This indicates that the digital economy, green finance, and green urbanization in the Yellow River Basin urgently require enhanced coordination mechanisms to foster overall coordinated development, and that inter-regional disparities need to be progressively reduced.

To further explore the future dynamic trend of regional differences in coupling coordination, especially whether these differences will narrow and eventually disappear over time, this paper introduces the β-convergence model for analysis. Specifically, if regions with initially low levels of coupling coordination exhibit higher growth rates and eventually catch up with high-level regions, achieving a uniform steady-state level of coupling coordination, this is considered an indication of β-convergence. β-convergence can be classified into two types: absolute convergence and conditional convergence. Absolute convergence refers to the ideal scenario where, over time, the coupling coordination degrees of different regions gradually approach the same stable level, without being affected by external factors such as local resources or policy support. The specific model is as follows:

Equation 4,

The above Equations 5–7 refers to the Spatial Autoregressive Model (SAR), Spatial Error Model (SEM), and Spatial Durbin Model (SDM). In these models, ρ is the spatial lag coefficient, which represents the spatial spillover effect of the dependent variable; λ is the spatial error coefficient, indicating the spatial effect in the random disturbance term; γ is the spatial lag coefficient of the independent variable, reflecting the spatial spillover effect of the explanatory variable.

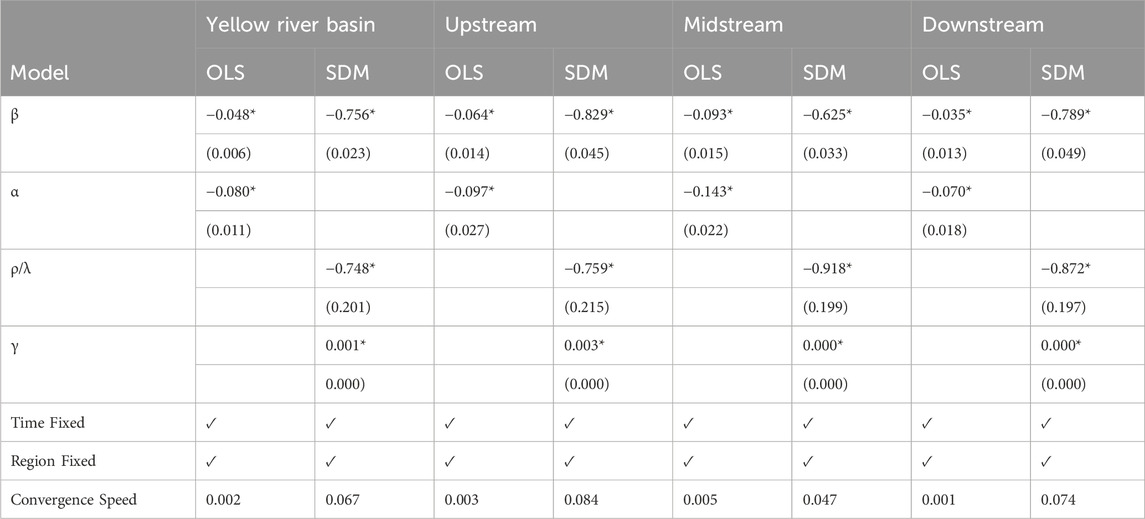

Table 5 presents the results of the absolute β-convergence test. As shown in Table 5, the absolute β-convergence coefficients for all regions are significantly negative. This indicates that, without considering other influencing factors, there is absolute β-convergence in the coupling coordination of digital economy, green finance, and green urbanization in the Yellow River Basin. The central region exhibits a faster development speed, and the coupling coordination degrees of various regions may converge to the same level over time. When spatial correlation is considered, the above conclusion still holds, and the convergence speed for each region accelerates under the spatial weight matrix. This suggests that communication and cooperation between neighboring regions have significantly reduced the regional development gap. In terms of convergence speed, without considering spatial factors, the central region has a faster convergence speed, which is higher than the overall basin level, while the upstream region is below the overall basin level. When spatial factors are taken into account, the convergence speed of all regions significantly improves. The convergence speed of both upstream and downstream regions accelerates notably, and both regions have already surpassed the central region. Furthermore, the spatial lag correlation coefficient ρ for each region is significantly negative, indicating that the coupling coordination of digital economy, green finance, and green urbanization in the Yellow River Basin is subject to negative spatial spillover effects from neighboring cities within the region. This suggests a noticeable siphon effect, and an overall convergence along with a “core-periphery” pattern is gradually emerging within the basin. Since absolute β-convergence does not account for other influencing factors, there may be a “spurious correlation” issue. Therefore, in the next section, control variables will be included for conditional β-convergence analysis.

Table 5. Absolute β-Convergence Test Results for the Coupling Coordination Degree of Digital Economy, Green Finance, and Green Urbanization in the Yellow River Basin.

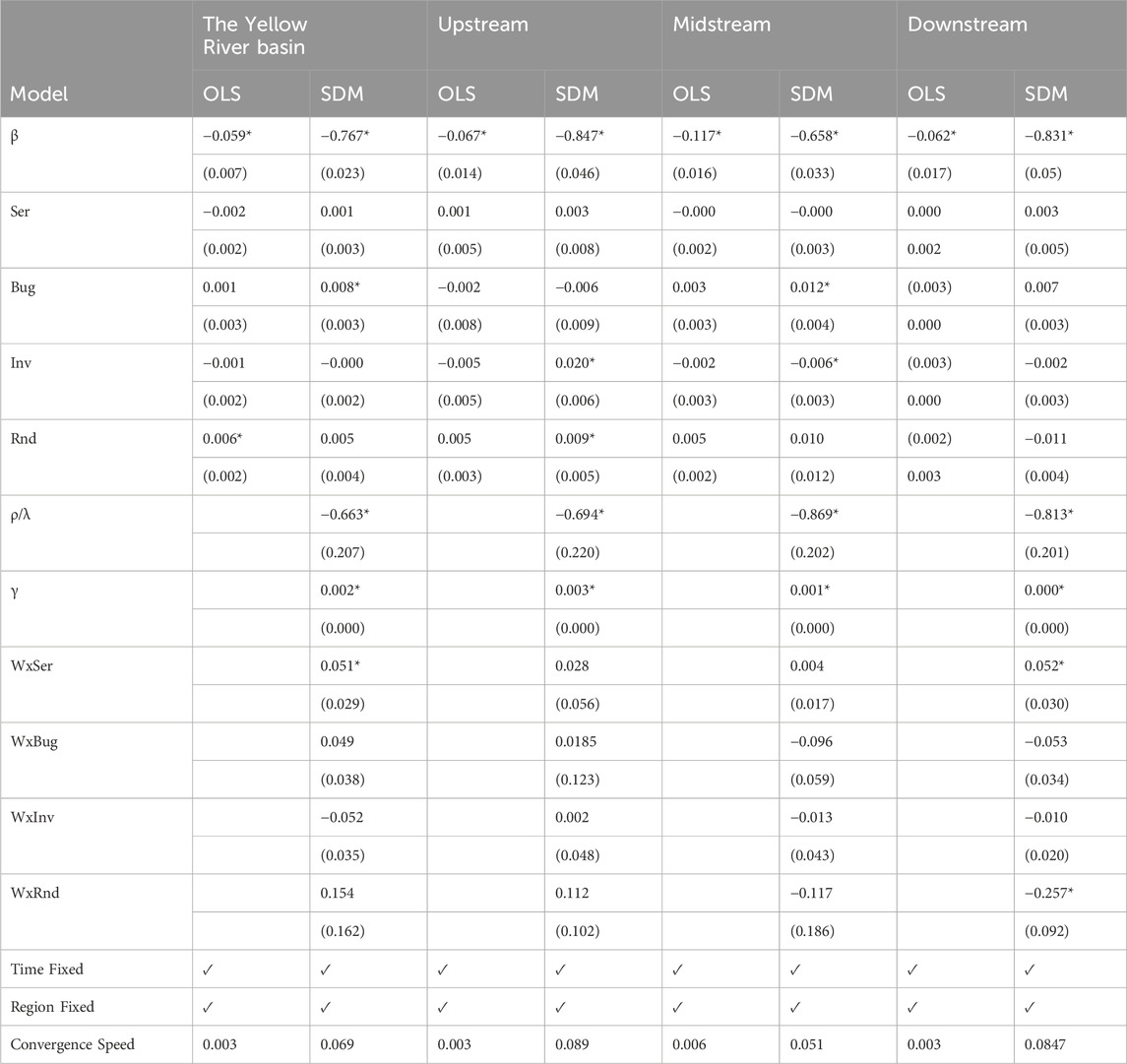

Table 6 presents the results of the conditional β-convergence test. As shown in Table 6, the conditional β-convergence coefficients for the coupling coordination degrees in the Yellow River Basin and its three subregions are all significantly negative at the 1% level. This indicates that, after considering factors such as industrial structure optimization, government intervention, foreign investment, and technological innovation, the coupling coordination degrees in the Yellow River Basin and its subregions exhibit conditional β-convergence. In other words, the convergence characteristics of digital economy, green finance, and green urbanization are determined by their intrinsic properties, and other influencing factors do not fundamentally alter their convergence trends. By comparing convergence speeds, it can be observed that spatial conditional β-convergence is faster than general conditional convergence across all regions. This suggests that interactions and cooperation among neighboring cities within the basin significantly reduce regional development disparities. After accounting for factors such as industrial structure optimization, government intervention, foreign investment, and technological innovation, the spatial lag coefficients for the Yellow River Basin and its subregions remain significantly negative. From Table 6, it is evident that the processes of conditional β-convergence are affected differently by the factors considered:

Table 6. Conditional β-Convergence Test Results for the Coupling Coordination Degree of Digital Economy, Green Finance, and Green Urbanization in the Yellow River Basin.

In the spatial Durbin model for the entire Yellow River Basin and its subregions, the coefficients for industrial structure are all positive, though small in magnitude and in some cases not statistically significant. This may imply that an increase in the share of the tertiary sector in GDP has a positive but relatively weak effect on convergence in coupling coordination. This weak effect could be due to a lag in the impact of the tertiary sector’s development on the coordination of digital economy, green finance, and green urbanization, as evidenced by the coefficients of lagged variables.

Regardless of whether spatial factors are considered, government intervention has a significantly positive impact on coupling coordination across the Yellow River Basin and the central and downstream regions. This demonstrates that government spending plays a crucial role in promoting convergence in regional coupling coordination. Investments in infrastructure, industry guidance, and policy support help narrow regional gaps in digital economy, green finance, and green urbanization, fostering coordinated development. However, the effect of government spending on the upstream region is negative. This may be attributed to an irrational allocation of government expenditure, with excessive funding directed toward non-essential areas such as redundant administrative costs, rather than key sectors like digital economy, green finance, and urbanization. This leads to resource misallocation and hinders coordinated development. Alternatively, a lack of foresight and coordination in government planning might result in large-scale infrastructure projects misaligned with the region’s needs, wasting resources and impeding the convergence of coupling coordination.

The impact of actual foreign capital utilized is only significantly positive in the upstream region, while it is not significant for the entire Yellow River Basin or the central and downstream regions. This suggests that in the upstream region, an increase in foreign investment positively influences convergence in coupling coordination, likely due to the introduction of advanced technology, management expertise, and capital that facilitate the synergy between digital economy, green finance, and green urbanization. However, in other regions, the effect of foreign investment might be less pronounced or constrained by other factors.

The impact of technological innovation is significantly positive for the entire Yellow River Basin as well as the upstream and central regions, but significantly negative for the downstream region. This indicates that in most parts of the Yellow River Basin, an increase in R&D personnel and innovation activities promotes convergence in coupling coordination. The clustering of technological talent and innovation activities helps integrate digital economy, green finance, and green urbanization. However, in the more developed downstream region, intense competition in the tech and innovation labor market may lead to short-term focus on individual achievements rather than long-term contributions to regional synergy. Furthermore, fierce competition among enterprises to attract talent raises labor costs, reducing funds available for R&D investment and green industry development. This diversion of resources ultimately hampers convergence in coupling coordination in the downstream region.

To ensure the accuracy of the β-convergence test results, this study conducts a robustness test using an adjacency weight matrix. The results are presented in Appendix Tables 7, 8. It is evident that under the adjacency weight matrix, the direction and speed of both absolute β-convergence and conditional β-convergence show little variation. This indicates that the β-convergence test results for the Yellow River Basin and its three subregions are robust.

This study provides a comprehensive analysis of the development and coupling coordination of the digital economy, green finance, and green urbanization across 77 cities in 8 provinces (or autonomous regions) within the Yellow River Basin from 2001 to 2022, and draws the following conclusions:

Over the study period, the indices for the digital economy, green finance, and green urbanization in the Yellow River Basin showed an upward trend, though green urbanization lagged behind the development of the digital economy. The degree of coupling coordination among the three components continuously improved, rising from 0.249 in 2001 to 0.405 in 2022. While the overall coordination levels improved, some cities reached a state of barely coordinated development. Initially, cities in the upper and middle reaches of the Yellow River exhibited severe imbalances, but over time, this disparity has lessened. Cities in the middle and lower reaches of the basin demonstrated better performance in terms of coupling coordination development.

The Global Moran’s index for coupling coordination degree is significantly positive, indicating a strong positive spatial agglomeration effect. The local Moran scatter plot shows that High-High (HH) promoting areas are predominantly clustered downstream, while Low-Low (LL) lagging areas are concentrated upstream. The Dagum Gini coefficient reveals a narrowing of overall disparity in the basin, although regional differences have increased. The contribution rate of inter-regional differences has risen, while intra-regional differences have declined. The imbalance in development between the downstream and upper-middle reaches is especially pronounced.

Both absolute and conditional β-convergence tests indicate that the coupling coordination degrees across the Yellow River Basin and its subregions follow a convergence trend. After accounting for spatial factors, the convergence speed has accelerated, and the spatial lag coefficients are significantly negative. In the conditional β-convergence model, the effects of industrial structure optimization are weak and delayed. Government expenditure promotes convergence in the central, downstream, and overall basin regions, but has a negative impact in the upstream region due to structural or planning issues. Foreign investment positively influences convergence only in the upstream region, while technological innovation fosters convergence in most regions, though it hinders convergence in the downstream due to factors such as talent competition. These results were tested for robustness using the adjacency weight matrix, confirming their reliability. In conclusion, while the Yellow River Basin has made notable progress in the coordinated development of the digital economy, green finance, and green urbanization, it still faces challenges related to regional disparities and the integration of these sectors. Further optimization of development strategies is necessary to address these issues and achieve more balanced and synchronized growth across the region.

Promote Overall Coordinated Development: Given the relative lag in green urbanization, it is essential to increase investment and support in this area. Efforts should focus on promoting the green upgrading of urban infrastructure, improving resource utilization efficiency, and enhancing environmental sustainability to narrow the gap with the development of the digital economy and green finance. Achieving balanced development across these sectors can strengthen synergies and improve overall coupling coordination. Initiatives could include the application of green building technologies and environmentally friendly materials, the development of green transportation systems to reduce energy consumption and emissions, and the strategic allocation of digital economy and green finance resources toward key areas of green urbanization to foster industrial integration.

Strengthen Regional Interaction and Cooperation: To address the issue of widening regional disparities, it is crucial to establish a cross-regional cooperation mechanism within the basin. Strengthening collaboration and exchange between upstream, midstream, and downstream cities in the fields of digital economy, green finance, and green urbanization will promote more balanced development. Downstream cities, with their industrial advantages, can drive the development of upstream and midstream cities through industrial transfers, technology exports, and talent sharing. Midstream and upstream cities should actively accept industrial transfers, leverage their resource advantages, and collaborate with downstream cities to co-build industrial parks, achieving complementary strengths. Joint initiatives, such as green technology innovation projects and the sharing of research and development outcomes, can facilitate inter-regional resource flows and optimal allocation, narrowing regional development gaps and enhancing the overall competitiveness of the basin.

Optimize Industrial Structure and Layout: Although the current impact of industrial structure optimization on convergence is weak, it remains an important long-term objective. Each city should develop and nurture distinctive clusters of the digital economy, green finance, and green industries based on its resource endowments and developmental foundation. Agricultural cities can leverage digital technologies to advance smart agriculture, promote green agricultural processing and sales, and attract green finance to support ecological agriculture projects. Industrial cities should accelerate the digital and green transformation of traditional industries, develop high-end manufacturing and strategic emerging industries, and direct financial resources toward green industrial innovation. The optimization and upgrading of industrial structures will facilitate the deep integration and coordinated development of these three systems.

Allocate Government Resources Effectively: Governments play a crucial role in guiding regional development. Public spending structures should be optimized to reduce administrative inefficiencies and ensure precise investment in key areas that promote the synergy of the digital economy, green finance, and green urbanization. Project planning should emphasize forward-looking, coordinated research to align infrastructure projects with local industrial development needs, avoiding resource misallocation and waste. For example, when planning digital infrastructure, the specific needs of local digital economy enterprises and green industries should be considered to provide tailored facilities, such as networks and data centers, thus improving resource utilization efficiency and promoting coupling coordination.

Precisely Guide Foreign Investment and Technological Inputs: Upstream regions should continue to attract foreign investment and implement preferential policies to encourage investments that integrate the digital economy, green finance, and green urbanization. This will maximize the advantages of foreign investment in technology, management expertise, and funding, thereby promoting local collaborative development and enhancing coupling degrees. For midstream and downstream regions, it is crucial to select projects that align with local industries, strengthen the regulation of foreign investments, and ensure alignment with regional development goals. To address technological talent challenges in downstream regions, governments and enterprises must work together to create an innovation-friendly environment, improve talent incentive mechanisms, and encourage cross-disciplinary and cross-regional research collaborations. Businesses should be guided to compete fairly, ensure stable R&D investments, and mitigate the adverse effects of excessive competition for talent and resources on coupling development. This approach will position technology and innovation as core drivers for enhancing coupling coordination.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

RM: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing. CX: Supervision, Conceptualization, Visualization, Writing–original draft, Writing–review and editing. YL: Data curation, Formal Analysis, Software, Supervision, Writing–review and editing.

The author(s) declare that no financial support was received for the research and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declare that no Generative AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adriaens, P., and Ajami, N. (2021). Infrastructure and the digital economy: reinventing our role in the design, financing, and governance of essential services for society. J. Environ. Eng. 147 (5), 02521001. doi:10.1061/(ASCE)EE.1943-7870.0001866

Agrawal, R., Agrawal, S., Samadhiya, A., Kumar, A., Luthra, S., and Jain, V. (2024). Adoption of green finance and green innovation for achieving circularity: an exploratory review and future directions. Geosci. Front. 15 (4), 101669. doi:10.1016/j.gsf.2023.101669

Berrou, R., Dessertine, P., and Migliorelli, M. (2019). “An overview of green finance,” in The rise of green finance in Europe: opportunities and challenges for issuers, investors and marketplaces, 3–29. doi:10.1007/978-3-030-22510-0_1

Bivand, R. S., and Wong, D. W. (2018). Comparing implementations of global and local indicators of spatial association. Test 27 (3), 716–748. doi:10.1007/s11749-018-0599-x

Borck, R., and Pflüger, M. (2019). Green cities? Urbanization, trade, and the environment. J. Regional Sci. 59 (4), 743–766. doi:10.1111/jors.12423

Bukht, R., and Heeks, R. (2017). Defining, conceptualising and measuring the digital economy. Dev. Inf. Work. Pap. (68). doi:10.2139/ssrn.3431732

Ciocoiu, C. N. (2011). Integrating digital economy and green economy: opportunities for sustainable development. Theor. Empir. Res. Urban Manag. 6 (1), 33–43. Available online at: https://link.gale.com/apps/doc/A277271017/AONE?.

Dong, G., Ge, Y., Zhu, W., Qu, Y., and Zhang, W. (2021). Coupling coordination and spatiotemporal dynamic evolution between green urbanization and green finance: a case study in China. Front. Environ. Sci. 8, 621846. doi:10.3389/fenvs.2020.621846

Dong, L., Shang, J., Ali, R., and Rehman, R. U. (2021). The coupling coordinated relationship between new-type urbanization, eco-environment and its driving mechanism: a case of Guanzhong, China. Front. Environ. Sci. 9, 638891. doi:10.3389/fenvs.2021.638891

Eeckhout, J., and Hedtrich, C. (2021). Green urbanization. Plos one 16 (11), e0260393. doi:10.1371/journal.pone.0260393

George, G., Merrill, R. K., and Schillebeeckx, S. J. (2021). Digital sustainability and entrepreneurship: how digital innovations are helping tackle climate change and sustainable development. Entrepreneursh. theory Pract. 45 (5), 999–1027. doi:10.1177/104225871989942

Li, Y., Li, Y., Zhou, Y., Shi, Y., and Zhu, X. (2012). Investigation of a coupling model of coordination between urbanization and the environment. J. Environ. Manag. 98, 127–133. doi:10.1016/j.jenvman.2011.12.025

Lin, B., and Ma, R. (2022). How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 320, 115833. doi:10.1016/j.jenvman.2022.115833

Meo, M. S., and Abd Karim, M. Z. (2022). The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb. Rev. 22 (1), 169–178. doi:10.1016/j.bir.2021.03.002

Owen, R., Brennan, G., and Lyon, F. (2018). Enabling investment for the transition to a low carbon economy: government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 31, 137–145. doi:10.1016/j.cosust.2018.03.004

Ozili, P. K. (2022). Green finance research around the world: a review of literature. Int. J. Green Econ. 16 (1), 56–75. doi:10.1504/IJGE.2022.125554

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F.(2019). Importance of green finance for achieving sustainable development goals and energy security. Handb. green finance, 3: 3–12. doi:10.1007/978-981-13-0227-5_13

Shi, R., Gao, P., Su, X., Zhang, X., and Yang, X. (2024). Synergizing natural resources and sustainable development: a study of industrial structure, and green innovation in Chinese region. Resour. Policy 88, 104451. doi:10.1016/j.resourpol.2023.104451

Tian, J., Wang, Y., and Sun, S. (2024). Two sides of a coin: digital economy and the supply of basic public services. J. Knowl. Econ. 15, 16943–16968. doi:10.1007/s13132-024-01743-0

Tian, X., Zhang, Y., and Qu, G. (2022). The Impact of digital economy on the efficiency of green financial investment in China’s provinces. Int. J. Environ. Res. Public Health 19 (14), 8884. doi:10.3390/ijerph19148884

Țîrcovnicu, G. I., and Hațegan, C. D. (2023). Integration of artificial intelligence in the risk management process: an analysis of opportunities and challenges. J. Financial Stud. 8 (15), 198–214. doi:10.55654/JFS.2023.8.15.13

Wang, Y., Yin, S., Fang, X., and Chen, W. (2022). Interaction of economic agglomeration, energy conservation and emission reduction: evidence from three major urban agglomerations in China. Energy 241, 122519. doi:10.1016/j.energy.2021.122519

Zhang, X., Wang, C., Li, E., and Xu, C. (2014). Assessment model of ecoenvironmental vulnerability based on improved entropy weight method. Sci. World J. 2014 (1), 1–7. doi:10.1155/2014/797814

Keywords: digital economy, green finance, green urbanization, coupling and coordination development, Yellow river

Citation: Ma R, Xi C and Li Y (2025) Ternary coordination and spatial convergence of digital economy, green finance, and green urbanization in the Yellow river basin of China. Front. Environ. Sci. 13:1559458. doi: 10.3389/fenvs.2025.1559458

Received: 12 January 2025; Accepted: 11 March 2025;

Published: 26 March 2025.

Edited by:

Gabriela Mustata Wilson, University of Louisiana at Lafayette, United StatesReviewed by:

Weifeng Gong, Qufu Normal University, ChinaCopyright © 2025 Ma, Xi and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Cunhu Xi, MTE0NjQwMzQ0ODdAcXEuY29t

†These authors have contributed equally to this work

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.