94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 19 March 2025

Sec. Environmental Economics and Management

Volume 13 - 2025 | https://doi.org/10.3389/fenvs.2025.1555143

This article is part of the Research TopicAdvancing Carbon Reduction and Pollution Control Policies Management: Theoretical, Application, and Future ImpactsView all 34 articles

Financial globalization is one of the defining elements of the modern world, and climate change is a common challenge faced by governments. Understanding the relationship between these two phenomena can help countries implement strategies of financial openness and pursue sustainable development. This paper employs two-way fixed-effects and mediation models to analyze the relationship between financial globalization and climate change using annual panel data from 144 countries for the period 2000 to 2001. The findings are as follows. (1) There is an inverted U-shaped nonlinear relationship between a country’s financial openness and its carbon emission intensity. A low level of financial openness tends to attract foreign capital into industrial projects reliant on fossil fuels, thereby increasing carbon emission intensity. However, once financial globalization reaches a certain threshold, a higher share of foreign capital is invested in renewable energy, resulting in a negative marginal impact on carbon emission intensity. (2) The mechanism tests show that financial globalization has an inverted U-shaped nonlinear relationship with carbon emission intensity through its effects on energy efficiency and the share of renewable energy, while it could also reduce carbon emission intensity by promoting technological advancements. (3) An increase in a country’s financial openness not only impacts its own carbon emission intensity,but also it has a nonlinear spatial spillover effect of initially promoting and then inhibiting on the carbon emission intensity of neighboring countries. These findings suggest that financial globalization, if managed strategically, can contribute to both economic growth and environmental sustainability, highlighting the potential for policy interventions that encourage clean energy investment and technological innovation.

Climate change and global warming are issues that the countries of the world need to face together. Climate change can lead to rising sea levels, frequent extreme weather events, reduced food production, and even the melting of the Antarctic’s glaciers, which may reawaken ancient viruses. Given the severity of climate change, governments have become aware of the need to balance economic development with environmental protection and pursue a path of green, low-carbon, and sustainable development (Ma et al., 2024; Zhao et al., 2024). In 2023, the 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change was held in the United Arab Emirates, where countries reached what is known as the “UAE Consensus” on topics such as the global stocktake, mitigation, adaptation, finance, loss and damage, and just transition following the Paris Agreement. The parties called for significant, rapid, and sustained reductions in greenhouse gas emissions in line with the 1.5°C temperature goal. Understanding the factors driving carbon emissions is crucial for formulating reasonable carbon reduction policies and achieving sustainable development.

As globalization continues to shape the modern world, countries’ economic activities are increasingly interconnected. Financial globalization refers to the increasing interconnectedness of financial systems across the world. This global integration, particularly financial openness, can have a significant impact on both economic growth and environmental outcomes. While financial globalization can attract capital to renewable energy sectors and promote technological innovation and then decrease carbon emissions, it can also lead to increased investment in fossil-fuel industries, potentially exacerbating carbon emissions. Current empirical research on the topic often focuses on a limited number of countries and yields conflicting conclusions. Some studies find that for economies like those in the ASEAN and BRICS groups, the marginal impact of financial openness on carbon emission intensity is negative (Aydin and Turan, 2020; Ulucak et al., 2020). Other studies find that financial openness increases carbon emission intensity and leads to environmental degradation (Koengkan et al., 2018; Kostakis, 2024). Existing empirical research on this relationship employs very different country samples, which may be an important reason for the varying conclusions. In light of this,this paper aims to clarify this relationship by examining annual panel data from 144 countries between 2000 and 2020 using a two-way fixed-effects model, avoiding sample selection bias and offering a more comprehensive analysis.

Specifically, we try to answer the following questions in this paper: First, what is the direction of the impact of financial openness on carbon emission intensity? Second, what are the channels through which financial openness affects carbon emission intensity? Third, does a country’s level of financial openness have a spatial spillover effect on the carbon emission intensity of neighboring countries? Fourth, does the relationship between financial openness and carbon emission intensity differ depending on the level of financial development?

The marginal contributions of this paper are as follows. First, it examines the relationship between financial openness and carbon emission intensity in various countries, exploring the potential impact of financial openness policies on the environment. The empirical research on the topic is relatively limited and focuses on a few country samples, which yield significantly different conclusions (Tao et al., 2023; Kostakis, 2024; Zhang et al., 2022a). We find an inverted U-shaped relationship between financial openness and carbon emission intensity.

In the early stages of financial openness, the marginal impact of financial openness on carbon emission intensity is positive; however, once financial openness reaches a certain level, its marginal impact becomes negative. This, to some extent, explains the reasons for the differences in existing research conclusions. Many developing countries are currently undergoing profound changes in their financial openness. The findings here offer valuable insights for these countries to more effectively balance their economic development with environmental protection in the process of opening their capital markets.

Second, we examine the mechanism that explains the inverted U-shaped relationship between financial openness and carbon emission intensity observed in various countries. Mediation models are used to show that increased financial openness has an inverted U-shaped relationship with carbon emission intensity through several channels, including changes to the proportion of renewable energy consumption and energy efficiency; it can also inhibit carbon emission intensity by promoting innovation. This helps governments better understand the relationship between their policies of financial openness and carbon emission intensity.

Third,we study the potential spatial spillover effect, in concrete, we examine the impact of a country’s increased financial openness on the carbon emission intensity of its neighbors. To the best of our knowledge, no studies have considered the spatial spillover effects of financial openness on neighboring countries. Only a handful have investigated the spatial spillover effects of financial development on the environment of neighboring countries (Lv and Li, 2021). Countries in the same region tend to have similar economic systems, and the degree of financial globalization may exhibit spatial auto-correlation. As such, a country’s financial openness has a certain spatial spillover effect on the environmental conditions of neighboring countries. We find that a country’s financial openness has an inverted U-shaped spatial spillover effect on the carbon emission intensity of neighboring countries. This provides valuable insights for countries to coordinate financial openness and sustainable development.

The remainder of this paper is structured as follows. In Section 2, we present the literature review. Section 3 sets out the theoretical analysis and proposes the research hypotheses, and in Section 4, we present an empirical analysis of the impact of financial globalization on domestic carbon emission efficiency. Besides,we study the spatial spillover effects of financial globalization on carbon emission intensity are examined. Section 5 concludes with policy recommendations.

Financial development is an essential driver of economic growth, and its environmental implications have attracted considerable academic attention. However, there is a lack of consensus in current research regarding the direction of its impact on carbon emissions.

Some scholars argue that financial development can provide capital support for technological research, thereby promoting technological advancements and improving energy production efficiency (Zhao et al., 2024; Huang and Ren, 2024),which could contribute to the carbon emission reduction (Li and Li, 2023; Luo et al., 2024). Financial development could contribute to a reduction of carbon emission intensity during production. For instance, Ren et al. (2023) employ province-level panel data and use the PMG method to study the long- and short-term impacts of financial development on carbon emission intensity. They find that financial development significantly reduces carbon emissions in the long run. Similarly, using data from OECD countries, Tao et al. (2023) show that financial development significantly mitigates carbon emission intensity, and this impact is modulated by the level of ICT development.

Other studies show that financial development fosters economic growth (Xu et al., 2024), which in turn increases energy consumption, leading to a rise in carbon emissions per unit of GDP. For example, Khan et al. (2021) use cointegration and quantile panel regression to find a positive correlation between financial development and carbon emission intensity across the countries in their sample. Moreover, as carbon emission intensity increases, the positive impact of financial development gradually intensifies. Bui et al. (2012) use panel data from 100 countries to show that enhanced financial development increases energy demand, positively influencing carbon emission intensity.

Some scholars contend that the relationship between financial development and carbon emissions may be nonlinear. Shahbaz et al. (2021) find that financial development in these countries exhibits an M-shaped or N-shaped nonlinear influence on carbon emission intensity in G7 countries from 1870 to 2014.

Globalization is an important feature of contemporary economic development. As countries increase their level of financial openness, foreign capital investment inflows affect their economic system and inevitably impact the environment. As financial globalization has progressed, scholars have conducted a series of studies on the environment impact of financial openness on the environment. However, there is no consensus on whether the effects of financial globalization on the environment and carbon emissions are positive or negative.

Some literature suggests that financial openness helps increase investment in environmental protection and clean energy projects, positively affecting environmental conditions. For instance, Rehman et al. (2023) study the relationship between the KOF Globalization Index (KOF Index) and total carbon emissions from a global perspective using the auto-regressive distributed lag model. They find that negative globalization shocks positively impact global carbon emissions. Aydin and Turan (2020) use data from five BRICS countries (China, South Africa, etc.) from 1980 to 2016 and discover that an increase in financial openness significantly alleviates environmental pollution in India and South Africa. Ulucak et al. (2020) further point out that, for emerging market countries, financial globalization improves environmental quality. Fatima et al. (2023) find that increased financial globalization in OECD countries significantly reduces carbon emissions.

Other studies indicate that financial openness may increase investment in domestic industries reliant on traditional fossil fuels, thereby increasing carbon emission intensity and negatively impacting environmental protection domestically. This aligns with the “pollution haven” hypothesis. For example, Zhang et al. (2022b) use quantile regression to show that the KOF Index positively affects the ecological footprint of the five BRICS countries, suggesting that financial globalization leads to environmental degradation. Shahzad et al. (2022) examine the relationship between China’s level of financial globalization and its ecological footprint, concluding that financial globalization exacerbates the ecological burden and adversely affects the environment. Koengkan et al. (2018) use the panel autoregressive distributed lag (PARDL) model to study countries in Mercosur (the Southern Common Market) and find that an increase in financial globalization leads to an increase in total carbon emissions in the long and short term. Kostakis (2024) employs quantile regression to study seven ASEAN countries and finds that a deeper level of financial openness directly leads to an increase in per capita carbon emission intensity; specifically, for every one unit increase in capital openness, the per capita carbon emission level increases by an average of 3.6%.

The above analysis shows that existing research has been fruitful, and diverse conclusions have been drawn on the relationship between financial development and carbon emission intensity. However, research on the relationship between the two is still relatively scarce, and among existing studies, there are several deficiencies, specifically in the following respects.

First, the existing literature only considers the linear relationship between financial openness and carbon emission intensity, and the empirical conclusions are inconsistent across different country samples. We show an inverted U-shaped relationship between financial globalization and carbon emission intensity, offering a new explanation for these differences.

Second, existing studies have typically used samples from a few countries or have conducted a global analysis, which may lead to biased conclusions. To our knowledge, no studies have used data from multiple countries to study the impact of financial globalization on carbon emission intensity through cross-country panel regression. We use data from over 140 countries for panel regression analysis, complementing existing research to some extent and ensuring the accuracy of conclusions.

Third, the current literature lacks sufficient evidence of the mechanism through which financial openness affects carbon emission intensity. Most discussions remain at the theoretical level and lack rigorous econometric models for empirical testing. We deepen the analysis by using a mediation model to explore the impact mechanism in the relationship between financial openness and carbon emission intensity.

Fourth, most existing studies focus on the impact of a country’s increased financial globalization on its own carbon emission intensity, neglecting possible spatial spillovers. In addition to its direct impact on a country’s carbon emissions, an increase in financial globalization may also indirectly impact the carbon emission intensity of neighboring countries through capital flows, information exchange, and other channels. This aspect has not been fully explored in existing research.

Financial openness policies can enhance countries’ financial development and impact carbon emission intensity in two ways. In the early stages of financial openness, as openness increases, companies and individuals gain access to more convenient and less costly financial services. This stimulates increased investment and increased household consumption, both of which increase the country’s carbon dioxide emissions. Additionally, because foreign investors have a relatively limited understanding of the local economic system, they are more inclined to invest in enterprises reliant on traditional fossil fuels, further increasing carbon emission intensity (Kostakis, 2024). Zhang et al. (2022a) point out that financial globalization can encourage cross-border economic activities, promote domestic industrial development, and have a negative impact on the environment.

However, as the degree of financial globalization rises, domestic enterprises may be able to allocate additional funds to environmentally friendly sectors, particularly green technology and related fields, helping to reduce the country’s carbon emissions (Ulucak et al., 2020). When a country’s financial openness reaches a certain threshold, foreign capital investors gain a deeper understanding of the domestic economic structure and become more inclined to invest in areas that promise long-term sustainable developmentt (Zhao et al., 2023). At this point, this negative effect of financial openness on carbon emission intensity outweighs the previously noted promotional effect. Therefore, the development of financial globalization has an inverted U-shaped nonlinear relationship with carbon emission intensity overall, with carbon emission intensity first increasing and then decreasing as the level of financial openness rises. Based on this, the following hypothesis is proposed:

H1:. Financial openness has an inverted U-shaped nonlinear relationship with carbon emission intensity across countries, with the intensity first increasing and then decreasing.

Figure 1 have shown the mechanisms how financial openness affect carbon emission intensity. A country’s financial globalization has a U-shaped relationship with its renewable energy share and energy efficiency across countries, with an initial negative effect followed by a positive one. In the early stages of financial openness, global capital tends to prioritize investments in traditional industrial sectors, which mostly rely on traditional fossil fuels, such as oil and coal (Aydin and Turan, 2020). Due to their high capital requirements and the significant risk of trial and error, foreign investors during the initial phase of financial openness do not favor renewable energy projects. Therefore, in the short term, an increase in the level of financial globalization has a negative impact on the proportion of renewable energy use. Additionally, as these traditional industrial projects often require the consumption of substantial fossil fuel, energy efficiency also declines with the rising level of financial globalization, indicating that in the early stages, an increase in the degree of financial globalization has a negative effect on both the proportion of renewable energy consumption and energy efficiency (Zhang et al., 2022b).

However, as financial globalization reaches a higher level, the investment space for traditional industries gradually saturates. As a result, foreign capital becomes focused on new technological areas with relatively higher risks but also richer returns, increasing support for the renewable energy industry. Many countries face funding shortages in developing their renewable energy industries, and foreign capital can effectively alleviate the financing constraints encountered when converting renewable energy technologies into products. For individual consumers, financial openness provides financial support, enhancing their consumption capacity in the renewable energy sector (Koengkan et al., 2020; Wang et al., 2023). During production, firms have sufficient funds to improve technology and enhance their energy efficiency. At a higher level of financial openness, financial globalization has a positive effect on both the proportion of renewable energy use and energy efficiency. Based on the above analysis, an increase in the level of financial openness has a U-shaped relationship with the proportion of renewable energy use and efficiency, first inhibiting and then promoting these.

Numerous studies show that the proportion of renewable energy use and energy efficiency are negatively correlated with carbon emission intensity across countries (Wang, 2022; Zhu et al., 2023). Renewable energy generates significantly less carbon dioxide during use than traditional fossil fuels. Therefore, the higher the proportion of renewable energy in the energy mix, the lower the carbon emission intensity (Koengkan et al., 2018). Improvements in energy efficiency can reduce carbon dioxide emissions by lowering energy consumption during production (Zhang et al., 2022a). Based on this, the following Hypotheses 2, 3 are proposed:

H2:. Financial openness can have a nonlinear effect, which first increases and then decreases carbon emissions through renewable energy consumption.

H3:. Financial openness can have a nonlinear effect, which first increases and then decreases carbon emissions through energy efficiency.

Financial opening can also promote carbon reduction activities by facilitating technological progress. Innovative requires significant capital investment in the early stages. Therefore, enterprises may face financing constraints when engaging in product research and development and investing in innovation. As a country’s financial openness increases, enterprises can obtain funds for innovation, research and development at a lower cost (Kihombo et al., 2022). As technological levels improve, enterprises in industrial production can employ more advanced machinery and equipment, such as energy-intelligent management systems and big data technologies, to enhance their ability to monitor energy use. This allows for process-level improvements and reduced energy waste during production. As a result, the energy consumption per unit of output in production decreases, and energy efficiency improves, promoting carbon reduction (Zhang et al., 2022a). Based on this, the following Hypothesis 4 is proposed:

H4:. Financial openness can reduce carbon emission intensity by promoting technological progress.

A country’s process of financial opening may have a spatial spillover effect on the carbon emission intensity of neighboring countries. Climate change is a global issue, and a country’s carbon emissions can diffuse to adjacent regions, producing spillover effects on the neighboring countries. Furthermore, similar to economic behavior, cross-border financial investment also exhibits a geographical agglomeration effect (Portes and Rey, 2005). Therefore, an increase in the level of financial openness in a country may have an inverted U-shaped nonlinear relationship with the carbon emission intensity of adjacent regions; this impact is affected by technological innovation and changes in energy structure.

In the early stages of openness, investments in a country’s traditional industrial enterprises will increase. Trade between adjacent countries is more frequent than that between those more geographically distant, so the development of industrialization in one can lead to increased industrialization investments in neighboring countries through trade channels, both of which increase the carbon emission intensity of neighboring countries. Financial openness also enhances a country’s technological level, and this spills over to neighboring countries through channels such as information exchange. An improvement in a country’s technological level helps neighboring countries improve their production processes and reduce energy consumption during production, thereby lowering carbon emission intensity. Based on this, Hypothesis 5 is as follows:

H5:. A country’s financial openness has an inverted U-shaped nonlinear relationship with the carbon emission intensity of neighboring countries

We select annual data from 146 countries from 2000 to 2021, resulting in more than 3,200 observations. The sample size in this study is significantly larger than in previous research, which helps prevent potential biases due to insufficient country samples. The selection of the sample period is mainly based on the availability of data. During the COVID-19 pandemic in 2020-2021, the economic and financial structures of countries may have undergone significant changes, which could impact the conclusions of this study. We address this potential bias in the robustness checks section. The main explanatory variable is financial openness, and the dependent variable is carbon dioxide emission intensity. Data sources are from the WDI database. The selection and description of relevant variable indicators are as follows:

In related studies, carbon emission intensity (cei, average CO2 emissions per unit of GDP) and per capita carbon emissions (pce) are often used as proxies for carbon emissions (Dong et al., 2022). Following Dong et al. (2022), we adopt carbon emission intensity (cei) as the proxy for carbon emission levels in the baseline analysis; in the robustness check, we use each country’s per capita carbon emissions (pce) as the dependent variable. To reduce the characteristic of heteroskedasticity, we take the logarithm of the data indicators.

Drawing on Dong et al. (2022), we select the following control variables: economic development, urbanization level, trade openness and population density. The selection and description of indicators for each variable are as follows.

Drawing on Koengkan et al. (2018) and Shahzad et al. (2022), we adopt the financial sub-index from the KOF Index compiled by Gygli et al. (2019) as a proxy for the level of financial openness for the baseline analysis. This index encompasses several factual indicators of financial globalization: foreign direct investment, international debt, portfolio investments, balance of payments, and reserves. In the robustness check, we select the KA index compiled by Chinn and Ito (2008) as the proxy for financial openness in a legal sense. Higher values of KOF and KA indicate a higher level of financial globalization in a country.

Per capita GDP is used to represent the level of economic development; generally, a higher level of economic development is associated with lower carbon emission intensity.

The proportion of the urban population to the total population is used as a proxy for the level of urbanization, with data sourced from the World Development Indicators (WDI) database. Urbanization may increase population concentration and accelerate industrialization, increasing carbon emission activities. There is often a positive correlation between a country’s level of urbanization and its carbon emission intensity.

Trade openness is measured by the proportion of imports and exports to GDP, with data sourced from the WDI database. Trade openness affects consumption and the production of intermediate and final goods in a region; there is typically a positive correlation between trade openness and CO2 emissions (Zhang et al., 2017).

The per capita land area is used as the proxy for population density. Higher population density is associated with higher carbon emission intensity.

The proportion of renewable energy use in total energy consumption serves as the proxy variable for renewable energy use intensity. A higher value indicates a greater proportion of renewable energy use.

The energy intensity level of primary energy from the WDI database is used to represent energy efficiency. A higher value indicates higher energy consumption per unit of GDP.

Drawing on relevant references, we use the number of patent applications per capita as the proxy variable for technological progress. The number of patent applications is sourced from the WIPO database, and the total number of patent applications is divided by the total population to measure the technological level of each country.

Data Specification and description analysis could been seen in Table 1, 2.

We employ static panel regression to investigate the relationship between financial openness and carbon emission intensity. This method is the most common methodology in empirical studies. We could use this method to conduct further reserach such as spatial spillover effect. The PARDL model is commonly used in the related literature (Wang et al., 2023); this model is one of the panel time series models that are more suitable for data with a large number of time periods (T) and a small number of cross-sectional units (N). However, in this study, we have a relatively large number of countries and a short interval, making panel regression a more appropriate choice.

As shown in Equation 1, we employ a panel regression model to examine the relationship between the degree of financial globalization and carbon emission intensity across countries. We assume that the relationship between the financial openness and carbon emission intensity may be nonlinear. To mitigate the impact of potential omitted variables and endogeneity, the model includes both country and year-fixed effects. Given that the relationship between the two may be nonlinear, we include linear and quadratic terms of financial globalization in the baseline regression.

In this context,

In addition to having a direct impact on carbon emission intensity, financial globalization can also indirectly impact emission intensity by influencing factors such as the proportion of renewable energy use, energy use efficiency, and technological progress. We examine the mechanism through which the level of financial openness affects carbon emission intensity across countries using a mediation model as shown in Equations 2, 3.

In this context,

With the panel setting in Equation 1, we conduct panel regression using the degree of financial openness as the explanatory variable and the carbon emission intensity as the dependent variable. As presented in Column (1) of Table 3, only the first and second terms of financial openness were incorporated in the regression. The level of economic development is included as a control variable in Column (2), and all control variables are included in Column (3). The results in Columns (1), (2), and (3) of Table 3 show that the first term of kof is significantly positive at the 1% level, while the second term of kof is significantly negative at the 5% level.

Financial openness has a nonlinear U-shaped relationship with carbon emission intensity. For instance, as shown in Column (3), the regression coefficient of financial openness is 0.86, indicating that when financial openness lever increase by one standard deviation of 0.331,the carbon intensity per unit of GDP will decrease by an average of 28.5%. Among the relevant control variables, the coefficient of economic development is significantly negative, suggesting that an increase in income levels has a negative impact on carbon emissions. In contrast, an increase in levels of urbanization, trade openness, and population density has a positive effect on carbon emission intensity. Some studies find that financial openness on carbon emission intensity (Aydin and Turan, 2020; Ulucak et al., 2020). Other studies find that financial openness could lead to an increase carbon emission intensity (Koengkan et al., 2018; Kostakis, 2024). Our study provide a general conclustion about the relationship between the two variables.

In the results of the baseline analysis, following Gygli et al. (2019), the sub-index of finance of KOF globalization Index serves as the proxy variable for the level of financial openness. Another commonly used measure of financial openness is the Chinn–Ito Financial Openness Index (Chinn and Ito, 2008), which we then employ as the explanatory variable and re-run the panel regression, with the results summarized in Column (1) of Table 4.

We select carbon emission per unit of GDP as the proxy for the level of carbon emissions across countries as the dependent variable in the baseline regression. We then use carbon emission per capita (lnpce) as the dependent variable. The results are shown in Columns (2) and (3) of Table 4. As seen in Table 4, under different specifications, regardless of whether we use the Chinn–Ito Financial Openness Index or the KOF Index, the regression coefficient of the quadratic term is significantly negative at the 1% level; the regression coefficient of the linear term is significantly positive. Thus, there is a nonlinear inverted U-shaped relationship between financial openness and carbon emissions, which is consistent with the results of the baseline regression.

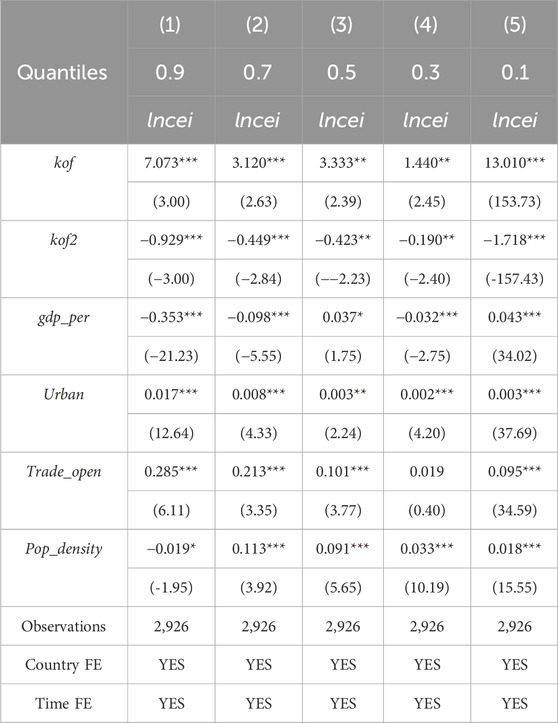

In the baseline analysis, we examine the overall relationship between financial openness and carbon emission intensity across countries using static panel regression. However, the relationship may vary at different values of carbon emission intensity. We investigate this using a panel quantile regression model. The results in Table 5 show that at various quantile points of carbon dioxide emission intensity, the regression coefficients of the linear term of financial openness are significantly positive, while the coefficients of the quadratic term are mostly significantly negative at the 1% level. This further demonstrates the inverted U-shaped nonlinear relationship between financial openness and carbon emissions across countries. The conclusions of this paper are robust.

Table 5. Impact of financial openness on carbon emission tensity at various quantile values of lncei.

In addition to changing the measures of the main variables and conducting panel quantile regression, we conduct several further robustness checks. First, to avoid the impact of the COVID-19 pandemic on our conclusions, we shorten the sample period and run the panel regression for the period 2000 to 2019, with the results summarized in Column (1) of Table 6. Second, in addition to its impact on current carbon emission intensity, financial openness may be affected by carbon emission intensity in reverse. We avoid the issue of reverse causality by lagging all explanatory variables by one period and re-run the regression, with the results summarized in Column (2) of Table 6.

Third, considering the potential issues of cross-section dependency, auto-correlation, and heteroskedasticity, we use the method proposed by Driscoll and Kraay (1998) to correct the covariance matrix and obtain robust standard errors, ensuring the accuracy of statistical inference. The regression results are summarized in Column (3) of Table 6. Fourth, extreme values of variables may have an impact on the regression results. Therefore, we winsorized all variables at the 1% and 99% levels for each year and re-run the regression analysis, with the results summarized in Column (4) of Table 6. Finally, to alleviate the issue of reverse causality and considering the lagged effect of carbon emission intensity in the preceding periods, we use the systematic GMM method to analyze the relationship between financial openness and carbon emission intensity through systematic dynamic panel regression, with the results summarized in Column (5) of Table 6.

The results in Columns (1) to (5) of Table 6 show the regression coefficients of the linear term of KOF are significantly positive at the 10% level, while the coefficients of the quadratic term are significantly negative. This verifies that the level of financial globalization has an inverted U-shaped relationship with carbon emission across countries, confirming the accuracy of Hypothesis 1.

In the theoretical analysis in Section 3.2, we found that the inverted U-shaped nonlinear relationship between financial openness and carbon emission intensity is effected through changes in the share of renewable energy consumption and energy efficiency, as well as by promoting technological progress to facilitate carbon reduction. We then use mediation effects to explore the mechanism by which financial openness impacts carbon emission intensity with these indicators as mediating variables. The results are summarized in Tables 7, 8, and 9.

As shown in Column (2) of Table 7, when the dependent variable is the share of renewable energy use in total energy consumption, the coefficient of the linear term of the KOF Index is −21.39, and the coefficient of the quadratic term is 2.48, both significant at the 10% level. It suggests that financial globalization has a U-shaped relationship with renewable energy use, initially causing an increase before leading to a decrease.

This conclusion also applies to energy efficiency. As shown in Column (2) of Table 8, when energy intensity is taken as the dependent variable, the coefficients of the linear and quadratic terms of the KOF Index are significantly positive and negative, respectively, at the 1% level. Because of the inverse relationship between energy intensity and energy efficiency, this result demonstrates the U-shaped effect of financial openness on energy efficiency.

In the early stages of financial openness, foreign capital invests in traditional industries and fossil energy sectors, increasing the proportion of traditional energy in the energy mix and reducing energy efficiency. However, when financial globalization reaches a certain level, foreign capital investment in renewable energy sectors increases and improves energy consumption in production processes, thereby exerting a negative effect on the share of renewable energy use and energy efficiency. Overall, financial globalization has a U-shaped nonlinear relationship with renewable energy consumption and energy efficiency across countries.

However, both the share of renewable energy usage and energy efficiency have consistently negative marginal effects on carbon emission intensity, as shown in Column (3) of Tables 7, 8. When carbon emission intensity is taken as the dependent variable, the coefficient of renewable energy use is negative, and that of energy intensity is significant at the 1% level. The above indicates that while financial globalization has a U-shaped relationship with the share of renewable energy consumption and energy efficiency, both have negative effects on carbon emission intensity. We verify the robustness of our conclusions by replacing the main explanatory variable from the KOF Index with the KA financial openness index in Columns (4) and (5) of Tables 7, 8; the conclusions are consistent with those obtained using the KOF Index, validating Hypotheses 2, 3.

Financial openness can also promote carbon reduction by facilitating technological progress. With reference to Yi et al. (2024), we use the number of patents granted per capita in each country as a proxy for the country’s level of technological progress and conduct mediation tests. As shown in Column (2) of Table 9, when the dependent variable is the degree of technological progress in each country, and only the linear term of the KOF Index is included, its regression coefficient is significantly positive at the 10% level. However, in Column (3), when both the linear and quadratic terms of the KOF Index are included in the regression model, neither is significant, indicating that financial globalization has a unilateral positive effect on the level of innovation.

However, as shown in Columns (4) and (5) of Table 9, technological progress has a unilateral negative impact on carbon emission intensity and per capita carbon emissions. This also suggests that an increase in the level of a country’s financial openness will decrease carbon emissions by promoting technological progress, validating Hypothesis 4. Financial globalization can alleviate financing constraints and funding constraints, thereby promoting technological innovation. With the improvement in the level of technological innovation, more environmentally friendly new materials can be used in industrial production, and processes can be improved, thereby reducing carbon emission intensity. In other words, financial openness can reduce carbon emission intensity by promoting technological innovation, validating Hypotheses 4.

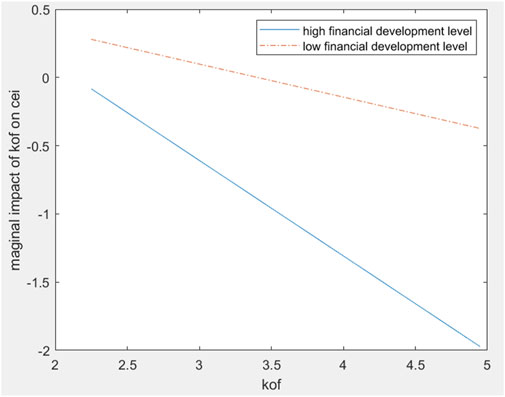

The relationship between the level of financial openness and carbon emission intensity may vary depending on the level of financial development. We investigate this potential heterogeneity by dividing the sample into a high-financial-development group and a low-financial-development group based on the median financial development of each country in each year. As shown in Table 10, within each sub-sample, the regression coefficient of the linear term of financial openness is significantly positive at the 1% level, while the regression coefficient of the quadratic term is significantly negative. There is, thus, an inverted U-shaped relationship between financial openness and carbon emission intensity, consistent with the results of the benchmark analysis.

We further consider heterogeneity by graphing the marginal impact of financial openness on carbon emission at each value of financial openness for each sub-sample. As shown in Figure 2, at a certain level of financial openness, the marginal coefficient of financial openness on carbon emission intensity is smaller for the sub-sample of countries with a high level of financial development than for the sub-sample with a low level of financial development. This suggests that for higher levels of financial development, the marginal negative impact of financial openness on carbon emission intensity is stronger.

Figure 2. The relationship between kof and marginal impact of financial openness on carbon emission intensity at different level of financial development. Note:Since kof has an inverse U-shaped relationship on cei,kof will have a linear relationship between financial openness with marginal impact of financial openness on carbon emission intensity.

When a country’s financial development is relatively high, the resource allocation efficiency of its financial market will be higher, the degree of competition in its financial system will be greater, and the development in areas such as green finance will be more advanced. Foreign capital entering the country may be more willing to invest in long-term sustainable development and low-carbon technologies, thereby increasing the negative effect of financial openness on carbon emission intensity.

Before examining spatial panel relationships, it is necessary to first establish a spatial distance matrix. Following the approach of Yao et al. (2023), we select the reciprocal of the squared distance between national capitals as the elements of this matrix. The data on distances between national capitals are sourced from the CEPII database. We first employ the global Moran’s index to test the presence of spatial dependency for carbon emission intensity and the KOF Index for each country, analyzing whether there is a significant positive correlation between the degree of financial globalization and carbon emission intensity among adjacent countries.

As shown in Table 11, between 2000 and 2021, the global Moran’s I index for carbon emission intensity ranged from 0.2 to 0.3, while for financial globalization, this value was mostly above 0.3, indicating the presence of positive spatial auto-correlation between countries’ financial globalization indices and carbon emission intensity. In terms of significance, the p-values of the Z-test statistics are all less than 0.01, suggesting that the spatial auto-correlation test is also statistically significant. For two geographically adjacent countries, the patterns of change in carbon emission intensity and financial openness are similar. Notably, over time, and especially in recent years, the Moran’s I index for carbon emission intensity among countries shows an upward trend. For instance, in 2010, the spatial Moran’s I index for carbon emission intensity among countries was 0.234, which rose to 0.332 in 2021. There is an increase in the spatial auto-correlation between countries’ carbon emission intensities. This suggests that when studying the impact of financial globalization on carbon emission intensity, the potential spatial spillover between variables should be considered. Therefore, we use a spatial panel model to analyze the impact of an increase in the level of countries’ financial openness on the carbon emission intensity of neighboring countries.

The development of the financial openness in a particular region influences the carbon emission levels within that region and may impact the carbon emissions of neighboring regions. Next, we employ a spatial panel regression model to investigate this potential effect.

First, we select the appropriate spatial panel regression model through the likelihood ratio (LR) test. The results of the LR test indicate that, at the 1% significance level, we can reject the null hypothesis that the spatial Durbin model (SDM) can be degraded into the spatial error model or spatial autoregressive model (with LR test values of 78.16 and 68.44, respectively, and corresponding p-values of less than 0.0001). Therefore, we choose the SDM model to study the spatial spillover effects of financial openness on carbon emission intensity in other regions. We use the Hausman test to compare the applicability of the fixed- and random-effects model. As shown in Table 12, at the 1% significance level, there are significant differences between the fixed- and random-effects model in the regression coefficients, suggesting that the fixed-effects model is more appropriate.

It is worth noting that the coefficient of spatial lagging terms might not fully capture the spatial spillover effects of financial globalization on carbon emission intensity in SDM (Elhorst, 2012). Therefore, we both summarize the coefficients estimated by the SDM model and the direct, indirect, and total impacts of each explanatory variable on carbon emission intensity. The indirect impact represents the spatial spillover from neighboring countries on a country’s carbon emission intensity. From Table 13, for the indirect effect of financial openness on neighboring countries, the regression coefficient for the first-order term of the KOF Index is 8.147, and the coefficient for the second-order term is −1.022, both significant at the 1% level (with the inflection point of the KOF index being 3.99). This indicates that a country’s financial globalization has an inverted U-shaped nonlinear spillover effect on carbon emission intensity in neighboring countries, confirming the accuracy of Hypothesis 5.

Climate change poses a global challenge, and financial globalization is an important feature of the modern economy. Analyzing the relationship between these two factors can help governments better implement carbon reduction policies. This paper uses cross-country panel data from 146 countries from 2000 to 2021 to study the impact of financial globalization indices on carbon emission efficiency across different countries. The research findings of this paper are as follows.

Firstly, there is an inverted U-shaped nonlinear relationship between a country’s degree of financial openness and its carbon emission intensity. That is, financial globalization initially has a positive effect on a country’s carbon emission intensity, but after a certain turning point, its impact turns negative. This conclusion remains valid after changing the measure for the explained and explanatory variables, conducting quantile regression, altering the sample interval, and employing dynamic panel regression. This result goes some way to explain the differences in the literature regarding the impact of financial openness on carbon emission intensity. At different stages of financial openness, the impact on carbon emission intensity will vary significantly. The turning point, where the relationship changes from positive to negative, is particularly significant in countries with more developed financial systems, which are better equipped to handle the technological and energy efficiency improvements associated with financial openness.

Second, we compared the impact of financial openness on carbon emission intensity under different levels of financial development. We showed that with a higher level of financial development, the negative effect of financial openness on carbon emission intensity is stronger. This suggests that countries at different stages of financial development experience different impacts from financial openness. Countries with more advanced financial systems are better able to leverage financial openness to promote clean technology and energy efficiency, thus mitigating the environmental impact of financial globalization.

Third, we used a mediation model to examine the mechanism by which financial openness impacts carbon emission intensity across countries. We found that financial openness has an inverted U-shaped nonlinear relationship with carbon emission intensity through the proportion of renewable energy use and energy efficiency. However, financial openness also unilaterally inhibits carbon emission intensity by promoting technological progress. The promotion of technological progress is a key factor in reducing carbon emissions, as it encourages more efficient energy use and facilitates the transition to renewable energy sources.

Fourth, considering the apparent spatial auto-correlation between financial globalization levels and carbon emission intensities among countries, we used an SDM model to study the impact of a country’s financial openness on the carbon emission intensity of neighboring countries. The results indicate that the development of a country’s financial openness may have an inverted U-shaped spatial spillover on the carbon emission intensity of neighboring countries, first increasing and then decreasing. Currently, there are few studies that consider the environmental impact of financial openness on neighboring countries, and this paper provides a useful supplement. At the same time, the research in this paper suggests that countries in a region should, to some extent, cooperate and coordinate in the process of financial openness. These research conclusions lead to the following insights. These spillover effects highlight the importance of regional cooperation in aligning financial and environmental policies to avoid negative externalities.

Firstly, governments should implement different strategies at different stages of financial openness to achieve optimal environmental effects. Our conclusions show that the impact of financial openness on carbon emission intensity exhibits phased changes as a country progresses in its process of opening. Therefore, in the initial stage of financial liberalization, countries need to focus their attention on identifying and mitigating the potential negative environmental impacts of financial globalization. At this stage, countries should strengthen their regulatory frameworks and prioritize investments in cleaner technologies to prevent the adverse environmental effects of early financial openness. Once financial openness reaches a relatively high level, countries should actively leverage international resources to incentivize domestic investment in green projects, aiming to reduce carbon emissions and thereby enhance the country’s overall environmental performance and efficiency.

Second, in the process of financial openness, governments should actively guide foreign capital flows to high-tech and environmentally friendly industries, giving new impetus to carbon reduction activities. This study points out that financial openness can effectively promote technological progress and increase the proportion of renewable energy in total energy consumption, thereby advancing carbon reduction. Therefore, policymakers wishing to reduce domestic carbon emissions should attract foreign investment through preferential measures into areas that improve energy use efficiency and optimize energy structures. Governments can also incentivize investment in green technologies and renewable energy by providing targeted subsidies or tax incentives.

Third, considering the potential spatial spillover effects of a country’s financial openness on the carbon emissions of neighboring countries, regional economies should establish coordination and cooperation mechanisms for financial openness to prevent carbon emission issues resulting from policy inconsistency. Regional agreements or platforms focused on green finance could help align environmental policies, promote shared investments in sustainable projects, and create a unified approach to addressing climate change. At the same time, building green financial cooperation platforms is an effective way for regional economies to jointly address the challenges of climate change and achieve efficient environmental governance.

In the current study, we focused on the impact of financial openness on carbon emission intensity. However, carbon emission levels are only one aspect of human activities’ impact on the environment. Future research could explore the effect of financial openness policies on ecological footprints. Additionally, it would be valuable to investigate the impact of financial openness on micro-level firms to enrich the content of the paper. Beyond financial openness itself, future studies could also examine the synergetic effects between financial openness and domestic financial policies (such as green finance) on environmental outcomes. We believe these directions for future research will provide new insights and contributions to the field.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

ZZ: Conceptualization, Data curation, Investigation, Methodology, Software, Writing–original draft, Writing–review and editing. SD: Data curation, Software, Writing–original draft, Writing–review and editing. JL: Conceptualization, Formal Analysis, Funding acquisition, Investigation, Supervision, Writing–original draft, Writing–review and editing.

The author(s) declare that financial support was received for the research and/or publication of this article. The work was supported by National Social Science Fund Project (No. 19VHQ004), Guangdong Social Science Fund Project (No. GD24XYJ31), Support Project for Innovative Research Teams at Zhaoqing University and Project for Enhancing the Research Capacity of Key Disciplines in Guangdong Province (2022ZDJS120). Young Teachers’ Scientific Research Funding Project of Zhaoqing University (qn202505).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declare that no Generative AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1555143/full#supplementary-material

Aydin, M., and Turan, Y. E. (2020). The influence of financial openness, trade openness, and energy intensity on ecological footprint: revisiting the environmental Kuznets curve hypothesis for BRICS countries. Environ. Sci. Pollut. Res. 27 (34), 43233–43245. doi:10.1007/s11356-020-10238-9

Bui, D. T. (2020). Transmission channels between financial development and CO2 emissions: A global perspective. Heliyon, 6 (11).

Chinn, M. D., and Ito, H. (2008). A new measure of financial openness. J. Comp. policy analysis 10 (3), 309–322. doi:10.1080/13876980802231123

Dong, F., Hu, M., Gao, Y., Liu, Y., Zhu, J., and Pan, Y. (2022). How does digital economy affect carbon emissions? Evidence from global 60 countries. Science of the Total Environment. 852, 158401.

Driscoll, J. C., and Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. statistics 80 (4), 549–560. doi:10.1162/003465398557825

Elhorst, J. P. (2012). Dynamic spatial panels: models, methods, and inferences. J. Geogr. Syst. 14, 5–28. doi:10.1007/s10109-011-0158-4

Fatima, N., Yanting, Z., and Guohua, N. (2023). RETRACTED ARTICLE: interrelationship among environmental policy stringency, financial globalization in OECD countries, and CO2 emission with the role of technological innovation and financial development. Environ. Sci. Pollut. Res. 30 (12), 34085–34100. doi:10.1007/s11356-022-24392-9

Gygli, S., Haelg, F., Potrafke, N., and Sturm, J. -E. (2019). The KOF globalisation index–revisited. The Review of International Organizations, 14, 543–574.

Huang, F., and Ren, Y. (2024). Harnessing the green frontier: the impact of green finance reform and digitalization on corporate green innovation. Finance Res. Lett. 66, 105554. doi:10.1016/j.frl.2024.105554

Khan, H., Khan, I., and Binh, T. T. (2020). The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: A panel quantile regression approach. Energy Reports, 6, 859–867.

Kihombo, S., Vaseer, A. I., Ahmed, Z., Chen, S., Kirikkaleli, D., and Adebayo, T. S. (2022). Is there a tradeoff between financial globalization, economic growth, and environmental sustainability? An advanced panel analysis. Environ. Sci. Pollut. Res. 29, 3983–3993. doi:10.1007/s11356-021-15878-z

Koengkan, M., Fuinhas, J. A., and Marques, A. C. (2018). Does financial openness increase environmental degradation? Fresh evidence from MERCOSUR countries. Environ. Sci. Pollut. Res. 25, 30508–30516. doi:10.1007/s11356-018-3057-0

Koengkan, M., Fuinhas, J. A., and Vieira, I. (2020). Effects of financial openness on renewable energy investments expansion in Latin American countries. J. Sustain. Finance and Invest. 10 (1), 65–82. doi:10.1080/20430795.2019.1665379

Kostakis, I. (2024). An empirical investigation of the nexus among renewable energy, financial openness, economic growth, and environmental degradation in selected ASEAN economies. J. Environ. Manag. 354, 120398. doi:10.1016/j.jenvman.2024.120398

Li, T., and Li, Y. (2023). Artificial intelligence for reducing the carbon emissions of 5G networks in China. Nat. Sustain. 6 (12), 1522–1523. doi:10.1038/s41893-023-01208-3

Luo, J., Zhuo, W., and Xu, B. (2024). A deep neural network-based assistive decision method for financial risk prediction in carbon trading market. J. Circuits, Syst. Comput. 33 (08), 2450153. doi:10.1142/s0218126624501536

Lv, Z., and Li, B. (2021). How financial development affects CO2 emissions: a spatial econometric analysis. Journal of Environmental Management. 277, 111397.

Ma, Q., Zhang, Y., Hu, F., and Zhou, H. (2024). Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? Evidence from 283 cities in China. Cities 154, 105323. doi:10.1016/j.cities.2024.105323

Portes, R., and Rey, H. (2005). The determinants of cross-border equity flows. J. Int. Econ. 65 (2), 269–296. doi:10.1016/j.jinteco.2004.05.002

Rehman, A., Alam, M. M., Ozturk, I., Alvarado, R., Murshed, M., Işık, C., et al. (2023). Globalization and renewable energy use: how are they contributing to upsurge the CO2 emissions? A global perspective. Environ. Sci. Pollut. Res. 30 (4), 9699–9712. doi:10.1007/s11356-022-22775-6

Ren, X., Zhao, M., Yuan, R., and Li, N. (2023). Influence mechanism of financial development on carbon emissions from multiple perspectives. Sustain. Prod. Consum. 39, 357–372. doi:10.1016/j.spc.2023.05.009

Shahbaz, M., Destek, M. A., Dong, K., and Jiao, Z (2021). Time-varying impact of financial development on carbon emissions in G-7 countries: Evidence from the long history. Technological Forecasting and Social Change. 171, 120966.

Shahzad, U., Ferraz, D., Nguyen, H. H., and Cui, L. (2022). Investigating the spill overs and connectedness between financial globalization, high-tech industries and environmental footprints: fresh evidence in context of China. Technol. Forecast. Soc. Change 174, 121205. doi:10.1016/j.techfore.2021.121205

Tao, M., Sheng, M. S., and Wen, L. (2023). How does financial development influence carbon emission intensity in the OECD countries: some insights from the information and communication technology perspective. J. Environ. Manag. 335, 117553. doi:10.1016/j.jenvman.2023.117553

Ulucak, Z. Ş., İlkay, S. Ç., Özcan, B., and Gedikli, A. (2020). Financial globalization and environmental degradation nexus: evidence from emerging economies. Resour. Policy 67, 101698. doi:10.1016/j.resourpol.2020.101698

Wang, L. (2022). Research on the dynamic relationship between China's renewable energy consumption and carbon emissions based on ARDL model. Resour. Policy 77, 102764. doi:10.1016/j.resourpol.2022.102764

Wang, L., Hafeez, M., Ullah, S., and Yonter, I. U. (2023). Cross-sectional dependence in financial openness and its influence on renewable energy consumption in Asia. Energy and Environ., 0958305X231219786. doi:10.1177/0958305x231219786

Xu, A., Siddik, A. B., Sobhani, F. A., and Rahman, M. M. (2024). Driving economic success: fintech, tourism, FDI, and digitalization in the top 10 tourist destinations. Humanit. Soc. Sci. Commun. 11 (1), 1549–1611. doi:10.1057/s41599-024-03978-3

Yao, W., Zhang, W., and Li, W. (2023). Promoting the development of marine low carbon through the digital economy. Journal of Innovation & Knowledge, 8 (1), 100285.

Yi, J., Dai, S., Li, L., Cheng, J., et al. (2024). How does digital economy development affect renewable energy innovation?. Renewable and Sustainable Energy Reviews, 192, 114221.

Zhang, L., Mu, R., Zhan, Y., Yu, J., Liu, L., Yu, Y., et al. (2022a). Digital economy, energy efficiency, and carbon emissions: evidence from provincial panel data in China. Sci. Total Environ. 852, 158403. doi:10.1016/j.scitotenv.2022.158403

Zhang, N., Yu, K., and Chen, Z. (2017). How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107, 678–687. doi:10.1016/j.enpol.2017.03.072

Zhang, W., Wang, Z., Adebayo, T. S., and Altuntaş, M. (2022b). Asymmetric linkages between renewable energy consumption, financial integration, and ecological sustainability: moderating role of technology innovation and urbanization. Renew. Energy 197, 1233–1243. doi:10.1016/j.renene.2022.08.021

Zhao, S., Zhang, L., An, H., Peng, L., Zhou, H., and Hu, F. (2023). Has China's low-carbon strategy pushed forward the digital transformation of manufacturing enterprises? Evidence from the low-carbon city pilot policy. Environ. impact Assess. Rev. 102, 107184. doi:10.1016/j.eiar.2023.107184

Zhao, S., Zhang, L., Peng, L., Zhou, H., and Hu, F. (2024). Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 77, 102520. doi:10.1016/j.techsoc.2024.102520

Keywords: financial openness, carbon emission intensity, inverse U-shaped relationship, renewable energy usage, cross-country analysis

Citation: Zhang Z, Ding S and Li J (2025) The nonlinear effect of financial openness on carbon emission intensity––evidence from 144 countries. Front. Environ. Sci. 13:1555143. doi: 10.3389/fenvs.2025.1555143

Received: 03 January 2025; Accepted: 27 February 2025;

Published: 19 March 2025.

Edited by:

Le Wen, University of Auckland, New ZealandReviewed by:

Matheus Koengkan, University of Aveiro, PortugalCopyright © 2025 Zhang, Ding and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jing Li, bGlqaW5nQG5mdS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.