- 1School of Economics and Management, China University of Geosciences (Beijing), Beijing, China

- 2School of Economics and Management, China University of Geosciences (Wuhan), Wuhan, Hubei, China

- 3Henley Business School, University of Reading, Reading, United Kingdom

- 4School of Economics, Tianjin University of Commerce, Tianjin, China

- 5School of Energy, China University of Geosciences (Beijing), Beijing, China

- 6School of Management, Rennes School of Business, Rennes, France

Introduction: Green finance plays a pivotal role in the transition to a low-carbon economy by influencing energy consumption patterns. Despite growing interest in this area, the relationship between green finance and the optimization of end-use energy consumption remains underexplored, particularly in the context of regional disparities.

Methods: This study investigates the impact of green finance on end-use energy consumption structure across 30 provinces in China from 2014 to 2021. A system Generalized Method of Moments (GMM) model and a panel threshold model are employed to analyze the relationship, incorporating nonlinearities and regional heterogeneities.

Results: The findings indicate that green finance significantly reduces reliance on high-carbon energy sources and fosters cleaner energy consumption, particularly in provinces with advanced green financial systems. The effects are nonlinear, becoming evident only after green finance surpasses a certain threshold. Stronger impacts are observed in eastern regions due to mature financial infrastructures, whereas central and western regions experience comparatively weaker outcomes.

Discussion: Contrary to expectations, mediating factors such as industrial structure, energy efficiency, and green innovation have limited explanatory power for the observed impacts. These results highlight the need for tailored green financial policies and enhanced regional support mechanisms to accelerate sustainable energy transitions. This research underscores the transformative potential of green finance in energy governance and its contribution to achieving sustainable development goals.

1 Introduction

As global carbon emissions continue to soar, reaching an estimated 31.5 billion tons in 2023, nearly matching the peak levels of 2019 (IEA, 2023), the urgency for effective climate action is more pronounced than ever. The energy industry chain, a substantial contributor to these emissions, stands at the forefront of the decarbonization challenge (Peng et al., 2023a; 2023b). Greening this chain involves intricate upgrades across all sectors—upstream, midstream, and downstream—with the downstream sector playing a critical role in driving green transformations from a market demand perspective (Zhang et al., 2022).

China, as the world’s largest emitter, contributing approximately 30% of global emissions (BP, 2023), faces significant scrutiny. Its energy structure, heavily reliant on coal, which accounts for 60%–70% of its total energy consumption, positions the country at a critical point for achieving substantial carbon footprint reductions (Liu et al., 2019; Zhao et al., 2022). Addressing this, the study highlights how optimizing the energy consumption structure (ECS) not only serves as an environmental imperative but also represents a critical strategy for achieving China’s carbon neutrality goals.

In this context, green finance emerges as a powerful lever for sustainable development, aimed at supporting projects that minimize pollutant emissions and promote environmental benefits. Despite its pivotal role, empirical studies scrutinizing the specific impacts of green finance on the adjustment of energy consumption structures, especially considering regional disparities, remain scarce (Jin et al., 2021; Wu et al., 2023). Prior research has affirmed green finance’s role in bolstering renewable energy and enhancing the accessibility of low-carbon technologies (Shang et al., 2023); however, its nonlinear spillover effects on energy consumption structures have not been extensively explored.

This manuscript not only fills this gap by systematically assessing the influence of green finance across different regions of China but also delves into the nonlinear spillover effects and the mediating role of industrial structure in transforming the energy landscape. By building on the existing literature, this study extends the discourse by providing nuanced insights into the implementation effects of green finance policies, thereby offering robust policy recommendations aimed at optimizing the national energy structure and advancing sustainable development goals.

For the contributions, our study is the first to reveal the systematic impact of green finance on the structure of end-use energy consumption in China. Additionally, we highlight the issue of regional heterogeneity, which has not been thoroughly explored in related research. This heterogeneity poses a real challenge faced by many countries (not just China, as mentioned in this study) in implementing policies. Finally, our research provides financial tools for implementing the clean-up of the energy supply chain, driven by the green upgrading of end-use energy consumption, offering new suggestions for green development.

The remainder of this study is structured as follows: Section 2 briefly reviews the related literature. Section 3 presents the methodology, variables, and data sources. Section 4 presents and discusses the corresponding estimation results and findings. Section 5 concludes the study.

2 Literature review

2.1 Green finance and energy consumption structure

In recent years, as the global climate crisis has intensified, green finance has emerged as a crucial instrument for governments committed to sustainable development and energy transition. It supports the reduction of dependence on high-carbon energy sources and enhances the energy consumption structure by financially backing clean energy initiatives, energy-saving projects, and environmental technology innovations. Numerous studies have documented the pivotal role of green finance in facilitating new energy transformations. For instance, Wang et al. (2023) underscored that green finance could effectively reduce the public’s reliance on high-carbon sources like coal, thereby fostering a shift toward low-carbon technologies. Similarly, research by Peng et al. (2023a) and Fan et al. (2024) demonstrates that green finance significantly bolsters environmental stewardship and supports the renewable energy sector.

Furthermore, Lee and Lee (2022) delved into the broader implications of green finance for the evolution of the global energy structure, highlighting its potential to bolster clean energy investments. However, most existing research has primarily focused on the overarching impact of green finance on energy structures, with less attention given to the specific mechanisms at play. The direct influence of green finance on structural changes in energy consumption through resource optimization remains a fertile area for future investigation, as does the empirical exploration of how green finance interacts with energy consumption structures across different Chinese regions.

Recent advancements in this field reveal regional disparities in the impact of green finance on energy structure optimization. For example, Lv et al. (2021) observed that while the eastern regions of China experience significant enhancements in energy structure optimization through green finance, the impact is considerably weaker in the central and western regions, which suffer from less favorable green economic conditions. Zhao et al. (2022) utilized panel data from various provinces to demonstrate that green finance policies are particularly influential in energy-intensive industries and are crucial for promoting technological innovations in clean energy. Supporting this view, Sun and Chen (2022) provided empirical evidence that green finance policies indirectly promote energy efficiency, especially among new energy firms.

Additionally, Wu et al. (2023) noted that green finance not only facilitates the transformation of traditional energy sectors but also accelerates the shift toward renewable energy by fostering green technological innovations. Zhou et al. (2022) further argued that green finance is vital for spurring innovations in energy technologies, which are essential for the rapid deployment of clean power systems. Liu et al. (2023) found that while green finance policies are effective in developed regions, they do not significantly impact less-developed areas due to inadequate infrastructure and financial support.

Finally, studies by Lee et al. (2023), Hu et al. (2023), and Liang and Li (2024) emphasize the importance of green finance in supporting infrastructure development and environmental protection projects, improving energy efficiency, and reducing the reliance on high-carbon energy. Hu et al. (2023) compared green finance policies across leading economies, highlighting the necessity for policy coherence and durability to foster low-carbon technologies and mitigate greenhouse gas emissions. Wu et al. (2024) suggested that investments in green finance facilitate the development of low-carbon energy systems through energy technology innovation, propelling the transition toward greener energy consumption and helping achieve emission reduction targets.

Thus, hypothesis 1 is proposed: Green finance has a significant positive impact on China’s end-use energy consumption structure.

2.2 Nonlinear spillover effects of green finance

As the global promotion of green finance continues, scholars have increasingly focused on its nonlinear spillover effects on the energy consumption structure. Research indicates that the impact of green finance on energy structures is not straightforwardly linear but may exhibit threshold effects. Once green finance investment reaches a certain scale, its influence on optimizing energy structures becomes particularly pronounced. Hansen (1999) introduced the threshold model as an effective tool for analyzing such nonlinear relationships, and this approach has been extensively applied to study the nonlinear effects across various contexts. Sun and Chen (2022) observed a distinct nonlinear relationship between the development of green finance and its impact on energy consumption structures at certain investment levels. Furthermore, Zhou et al. (2022) highlighted that at high investment levels, the spillover effects of green finance are more evident, fostering significant advancements in new energy technologies.

Gu et al. (2023) provided empirical evidence showing variations in the energy consumption engineering structure between China’s eastern and western regions, thus underscoring the differential impacts of green finance across these diverse geographic areas. They emphasized that green finance has a more substantial impact on industries in the eastern part of China than those in the western regions. Similarly, Zhao et al. (2022) noted that the policy effects of green finance demonstrate nonlinear trends across regions with varying levels of economic development. High-income areas experience marked improvements in energy structure transformation due to green finance, whereas low-income regions experience relatively minor effects. Although these studies offer valuable insights into the nonlinear spillover effects of green finance, comprehensive and systematic research exploring these effects across different regions of China is still limited.

Therefore, hypothesis 2 is proposed: Green finance has a nonlinear spillover effect on the end-use energy consumption structure.

2.3 Analysis of the mediating effects of green finance on energy consumption structure

The mediating role of industrial structure in the impact of green finance on energy consumption has been a key focus in the literature. Studies, such as those by Baron and Kenny (1986), have explored mediation models to understand the links between financial and economic variables, including how green finance indirectly influences energy consumption through industrial adjustments. Hayes (2009) noted the significant impact of industrial transformation on regional energy structures, although empirical research on this mediation is still lacking.

Recent studies have further examined this relationship. Ge et al. (2022) found that optimized industrial structures enhance the positive effects of green finance on energy optimization. Xiong et al. (2023) similarly concluded that green finance indirectly affects energy consumption by driving industrial restructuring, especially in highly industrialized regions. These findings suggest a feedback effect where green finance and industrial structure interplay to influence energy consumption, although regional variations in this mechanism require further exploration. In addition to the industrial structure, factors like energy efficiency and green innovation also serve as mediators in the relationship between green finance and energy consumption.

Energy efficiency is particularly significant, reducing carbon intensity in energy use. Wang et al. (2016) highlighted that green finance supports investments in energy-saving technologies, improving firm energy efficiency and thus enhancing the energy structure. Zhang et al. (2019) also demonstrated that green finance boosts energy efficiency, notably in energy-intensive industries. Additionally, green innovation serves as a crucial channel; green finance drives research and deployment of new energy technologies, supporting green patents and clean energy innovations (Zhang et al., 2022). Guo et al. (2023) emphasized green finance’s role in supporting R&D for green technologies, reducing production costs, and speeding up technology commercialization, which aids in energy transformation.

Recent empirical findings support these concepts. Zhao et al. (2022) observed that green finance more effectively enhances energy efficiency in the eastern provinces than in the central provinces. Zhou et al. (2022) noted that green finance plays a significant role in aiding green technological innovation, which is crucial for optimizing energy structures, particularly in traditional sectors. Xu et al. (2023) found that green finance is instrumental in promoting technological innovation in energy conservation, influencing energy usage structure on the demand side, and facilitating structural transformations in power consumption. Wang et al. (2022) discussed how green finance accelerates market-oriented adoption of new energy technologies through financial subsidies to clean energy projects, optimizing the energy consumption structure. Finally, Cai and Zhang (2024) confirmed that as green finance policy application intensifies, its impact on enhancing energy efficiency in high-pollution industries strengthens. Li et al. (2022) examined path dependency in energy structure transformation and emphasized the importance of policy continuity in restructuring energy consumption.

Thus, hypothesis 3 is proposed: Green finance affects the end-use energy consumption structure through the mediating effects of industrial structure, energy efficiency, and green innovation.

2.4 Regional heterogeneity analysis of green finance

The uneven development across China’s regions results in varied impacts of green finance on local energy structures, which exhibit distinct regional characteristics. Research has shown that green finance is more developed in the eastern regions, leading to stronger policy effects, whereas the central and western regions face development lags due to economic disparities (Zhao et al., 2022). Zhou et al. (2022) noted that although the influence of green finance policies on energy consumption structures in eastern China is nearing saturation, it is significantly less effective in the central and western regions due to imbalances in infrastructure and financial support. Wang et al. (2022) highlighted that although there is greater potential for green finance development in the central and western regions, realizing this potential requires enhanced resources and support. This underscores the necessity for research into regional heterogeneity to ensure a well-balanced deployment of energy policies across all areas.

With the increasing maturity of green finance policies, researchers have focused on how regional disparities influence policy outcomes. Wang et al. (2016) observed that the impact of green finance on optimizing energy consumption structures is more pronounced in the eastern regions, which benefit from stronger economic foundations and financial support. Conversely, the effectiveness of green financial policies in the central and western regions is constrained by infrastructural and economic developmental limitations, resulting in lesser benefits (Zhang et al., 2022). Fang et al. (2024) also pointed out challenges in promoting new energy technology innovation and reducing carbon emissions in these regions as limited capital and technology availability impede the effectiveness of green finance policies.

Additionally, the heterogeneity of regional economies is influenced not only by tangible factors like economic development levels but also by intangible aspects such as policy implementation intensity, financial market maturity, and social capital participation. Zhang et al. (2023) found that in the eastern region, a well-developed financial market and efficient policy implementation lead to more significant and rapid effects of green finance on energy structure changes. In contrast, in the central and western regions, lower social capital participation results in delayed policy impacts, thereby weakening the effectiveness of green finance initiatives.

Based on this, hypothesis 4 is proposed: The impact of green finance on China’s end-use energy consumption structure shows regional heterogeneity.

2.5 Research gaps

In summary, existing studies have preliminarily examined the link between green finance and energy consumption structure, yet several research gaps remain. However, there has been little systematic research into the regional heterogeneity of its impact on energy consumption structure in China. Second, the existing research mainly focuses on the direct effects of green finance on energy consumption structure, without specifically examining how it operates through industrial structure to influence such this structure. Last but not least, a few studies argued that green finance has nonlinear spillover effects; however, such nonlinearity remains largely unverified in empirical studies. Hence, in this context, by establishing an empirical model to comprehensively assess the impacts on China’s energy consumption structure and exploring its nonlinear spillover effects and regional heterogeneity, this study can help fill the gap in previous research.

3 Data and methodology

3.1 Data and description

This study uses panel data collected from 30 provinces in China (excluding Tibet, Hong Kong, Macau, and Taiwan) between 2014 and 2021. The data mainly come from Chinese Statistical Yearbook, the China Industrial Statistical Yearbook, and the annual statistical bulletins on economic and social development of provincial-level regions, published by province-level statistics departments across the country. Additional data are sourced from other local yearbooks, which are also available in databases like Wind or CSMAR. These data provide comprehensive statistical information on the economy, industry, and energy in individual provinces, serving as a reliable empirical basis for academic research on regional economic development.

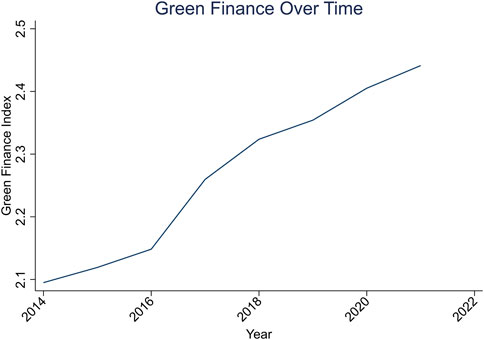

The time series chart of China’s Green Finance Index from 2014 to 2022 shows a clear upward trend, indicating a steady improvement in the level of green finance development during this period (Figure 1). From 2014 to 2016, the growth was relatively slow, with the index increasing slightly from approximately 2.1 to 2.2, suggesting that green finance was still in its early stages. However, between 2016 and 2018, there was a noticeable acceleration in growth as the index increased sharply to approximately 2.3, reflecting heightened policy support and the introduction of innovative financial instruments. After 2018, although the rate of increase moderated, the upward trajectory remained consistent, with the index reaching approximately 2.5 by 2022. This indicates that China’s green finance market is maturing, with a broader adoption of green financial tools. The growth during this period is likely driven by the Chinese government’s strong push toward achieving its “dual carbon” goals, along with the expansion of green bonds, green credit, and other financial instruments. Looking ahead, that green finance development is expected to continue growing, although at a potentially more stable pace, reflecting the maturation of the green finance system.

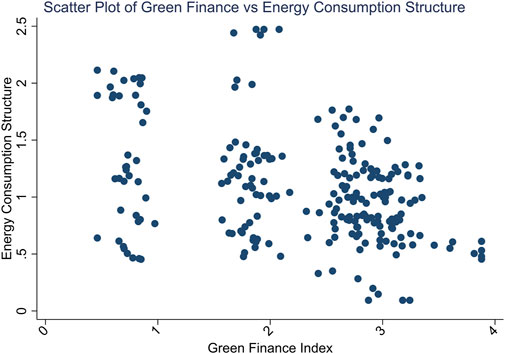

The scatter plot in Figure 2 reveals a complex relationship between green finance and energy consumption structure. The relationship exhibits clear nonlinear characteristics: at lower levels of the Green Finance Index, the energy consumption structure shows high variability. As the index increases, the energy consumption structure becomes more concentrated, but at higher levels (above 3), the variability increases again. This suggests that the relationship between green finance development and changes in the energy consumption structure is not a simple linear one.

Additionally, the scatter plot reflects significant regional heterogeneity. At various levels of green finance development, different regions display distinct patterns in energy consumption structure, especially at the lower and higher ends of the Green Finance Index, where regional disparities are more pronounced. This indicates that beyond green finance, factors such as local energy policies and economic structures also play key roles in shaping energy consumption patterns across regions.

3.2 Model

The baseline regression model is formulated as follows Equation 1:

where

Regarding the issue of endogeneity, a bidirectional causal relationship may exist between green finance and the energy consumption structure. Specifically, green finance may influence adjustments in the energy consumption structure, while changes in the energy consumption structure could also feed back into the development strategies of green finance. Additionally, unobservable characteristics of provinces, such as local policies and environmental regulations, may simultaneously affect both green finance and the energy consumption structure, leading to potential endogeneity. To address this issue, the study employs the system GMM model, using the lagged first-order explanatory variables as instrumental variables to mitigate potential endogeneity bias. During the model validation process, the Arellano–Bond test is used to check for autocorrelation issues (e.g., AR (1) and AR (2)), and Sargan and Hansen tests are applied to verify the validity of the instrumental variables. Furthermore, the difference-in-Hansen test (GMM levels and IV levels) further validates the robustness of the model’s treatment of endogeneity.

Next, the study adopts a panel threshold model to examine the nonlinear contagion effect of green finance on the energy consumption structure. The scale of green finance may undergo significant changes, and due to its characteristics, it alters the structure of energy consumption only after reaching a certain threshold. Traditional linear regression models cannot completely grasp these nonlinear relationships. The panel threshold model is helpful in discovering differentiated impacts of green finance on the energy consumption structure at various points, offering a clear advantage over linear models by accounting for nonlinear effects. The single-threshold model is as follows Equation 2:

where

This study uses a mediation effect model to assess the mediating role that green finance plays in the transition of the energy consumption structure. Industrial structure is chosen as the mediator variable since changes in the industrial structure impact the mode and amount of energy consumption. Baron and Kenny (1986) and Hayes (2009) indicated that upgrading the industrial structure positive contributes to improving energy efficiency. The intermediary role of the industrial structure, thus, can rationally explain how green finance will change industry-related factors and then reshape the energy consumption structure. The mediation effect model is divided into two steps: first, the impact of green finance on the mediator variable (i.e., industrial structure) is regressed as follows Equation 3:

Then, the combined impact of green finance and the mediator variable on the energy consumption structure is regressed as follows Equation 4:

By testing whether

3.3 Variables

The key variables selected in this study include energy consumption structure, green finance, and industrial structure, along with a series of control variables to comprehensively analyze the impact of green finance on the energy consumption structure. The first level of the energy consumption pattern was used as the dependent variable in this study. China has large reserves of coal, but high carbon content of coal production and utilization is one of the main sources of China’s carbon emissions; it contributes to approximately 60%–70% of the nation’s overall carbon emissions (Zhao et al., 2022). Accordingly, it is important to cut down on coal as a key step in meeting carbon reduction targets. This study uses the proportion of coal consumption to total energy consumption to represent the energy consumption structure. Specifically, coal consumption includes the terminal consumption of seven coal-related energy sources, while total energy consumption comprises the terminal consumption of 20 related energy sources. This indicator allows the assessment of regional differences and progress in optimizing the energy consumption structure.

Second, green finance is the explanatory variable, and its calculation is based on the comprehensive evaluation framework proposed by Fan et al. (2024). The calculation steps for the green finance index are as follows:

Construction of the original matrix: we create a matrix with

where

Normalization of the data: we calculate the proportion of the

The entropy value of the

The weight of the

The green finance index for province

Third, the industrial structure is considered the intermediary variable in this paper, measured by the level of industrialization. The transition in both the energy consumption structure and industrial structure, as intermediary factors, is of great significance.

The influence of urbanization on the energy consumption structure is reflected by the proportion of the permanent population to the total population, with a higher proportion indicating a more urbanized city. The education level is represented by a province’s investment in education relative to GDP, explaining the potential for human capital to optimize the energy consumption structure. A measure of innovation input is included to investigate the effect of innovation on changes in the energy consumption structure, which measures the amount of money spent on R&D investment using the ratio of R&D expenditure to GDP. Similarly, the per capita GDP growth rate is included to capture changes in energy demand due to local economic expansion. The urbanization rate, which may also influence the population concentration in urban areas, can affect energy demand. The effect of foreign direct investment (FDI) on the regional economy and energy consumption structure is represented by the FDI measure. Finally, the air quality index (AQI) compliance rate reflects improvements in air quality, which could potentially increase the demand for clean energy in different regions.

4 Results and discussion

4.1 Benchmark regression

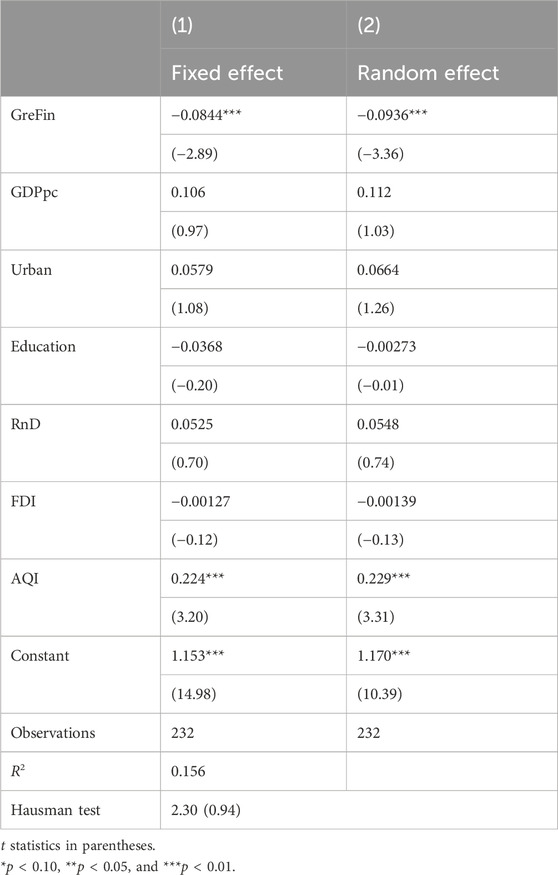

Table 1 presents the results of the benchmark regression. The Hausman test (p = 0.94) suggests that the random-effects model is more appropriate for data analysis than the fixed-effects model. The coefficient of green finance (GreFin) in the random-effects model is −0.0936 and is highly significant at the 1% level, indicating that green finance has a significant negative impact on the energy consumption structure. This implies that as the green finance develops, it helps suppress high-carbon energy consumption, thus adjusting the structure of energy consumption. The GDP per capita coefficient is approximately 0.112, but it is insignificant, indicating that economic growth does not have an obvious direct influence on shaping the energy consumption structure in this context.

Moreover, the coefficient of the urbanization level is 0.0664, although it is not statistically significant. However, the positive coefficient suggests that urbanization may promote energy demand, thus reshaping the structure of energy consumption. The education coefficient (−0.00273) shows that education has no significant impact on the structure of energy consumption. The coefficient for innovation input (R&D), which is 0.0548, is also not significant, suggesting that the RnD does not have a substantial impact on the energy consumption structure. The FDI coefficient is −0.00139 and is not significant, indicating that the consumption structure of energy is relatively little affected by foreign capital. Notably, the AQI with a coefficient of 0.229 is significant at 1% level, suggesting that air quality improvements are associated with a better energy consumption composition.

4.2 Robustness test

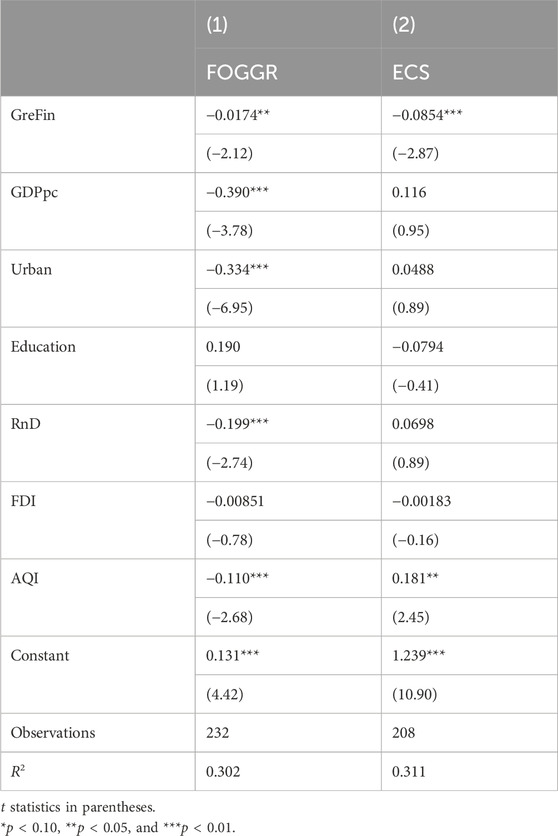

In the robustness test, key variables were first replaced. In the first model, the average annual growth rate of coal, natural gas, and oil production (FOGGR) was used to replace the ECS. The replacement is based on the production of coal, natural gas, and oil changes in reflecting changes in fossil fuel energy used as raw material to structure changes, which is representative of adjustments in the energy consumption structure. For the second model, data from the four direct-controlled municipalities (Beijing, Shanghai, Tianjin, and Chongqing) were excluded because these cities have different economic structures compared to other provinces and may show different energy consumption patterns and policy orientations, which could potentially affect the regression results. The robustness of the regression results is, thus, ensured by removing the data from these municipalities.

As can be observed from Table 2, the coefficients for GreFin are negative and significant in the two models, which proves that our results relating green finance to the energy demand structure are robust. The results reveal that green finance exerts significant negative effects on the average annual growth rate of coal, natural gas, and oil production at a 5% level in model 1, implying that greener modes of financing decrease the proportion of high-carbon energy consumption (GreFin coefficient is −0.0174). In model 2, the GreFin coefficient is −0.0854 with a level of significance less than 1%, which proves the significantly negative impact of green finance on the energy consumption structure. The results of the robustness tests provide further evidence for the fact that green finance can promote structural optimization of energy consumption by showing that the negative impact of green finance on the consumption structure is significant even when key variables are substituted or when data from municipalities are deleted, thus demonstrating the robustness of this conclusion.

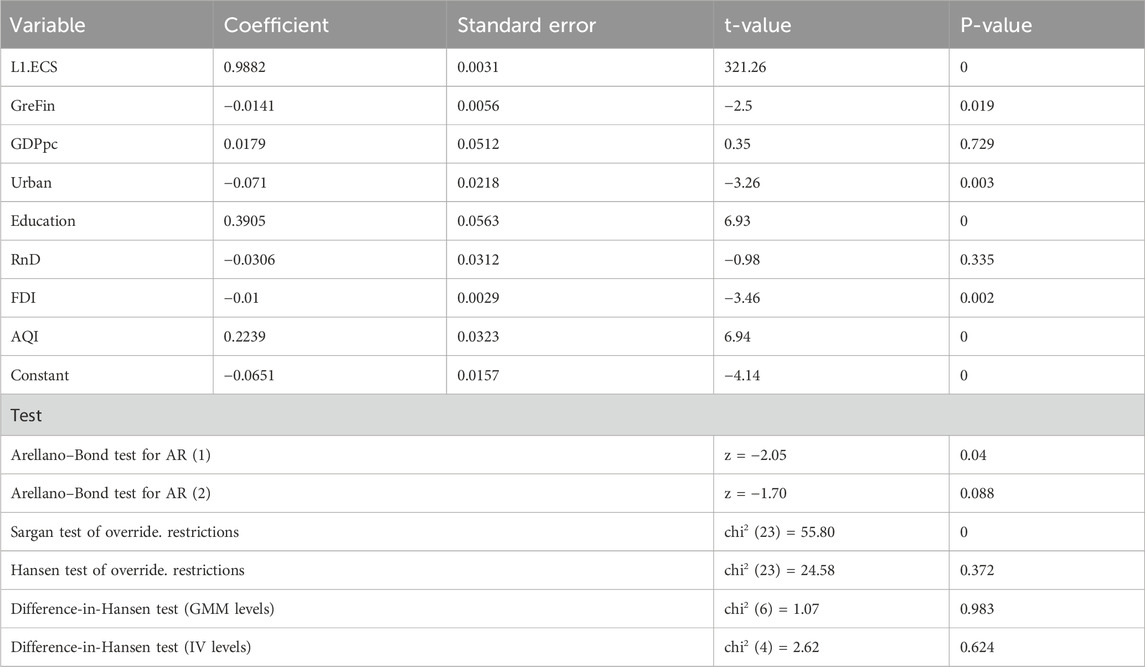

4.3 Endogenous checks

This study will use a system GMM model to control potential endogeneity and analyze the impact of green finance on the energy consumption structure (Table 3). The results show that the coefficient of lagged structure energy consumption is 0.9882, reflecting dynamic properties, with the current state of energy consumption closely linked to its previous state. The estimated coefficient of green finance is −0.0141, which is statistically significant at a 5% level, which suggests that a well-established green financial system will help fundamentally optimize the energy consumption structure by decomposing dependence on high-carbon energy sources.

For the endogeneity tests, the Arellano–Bond test of serial correlation shows that there is first-order autocorrelation, while second-order autocorrelation is insignificant. Hence, one can contend that the system GMM model fits well. We also conducted Sargan and Hansen tests to confirm the instrumental variables’ validity. The p-value for the Sargan test is 0, which suggests that the instruments used are problematic under this test. Still, the p-value for the Hansen test is 0.372, which really indicates the validity of instruments in the model. Although the tests differ in their results, the latter Hansen test is considered more robust when faced with heteroscedastic cases. In addition, difference-in-Hansen tests validate the instruments further in both GMM and IV stages. The fact that the p-value of GMM levels is equal to 0.983 and IV levels is equal to 0.624; both values are greater than 0.05, which shows that these instruments are correctly specified at both levels.

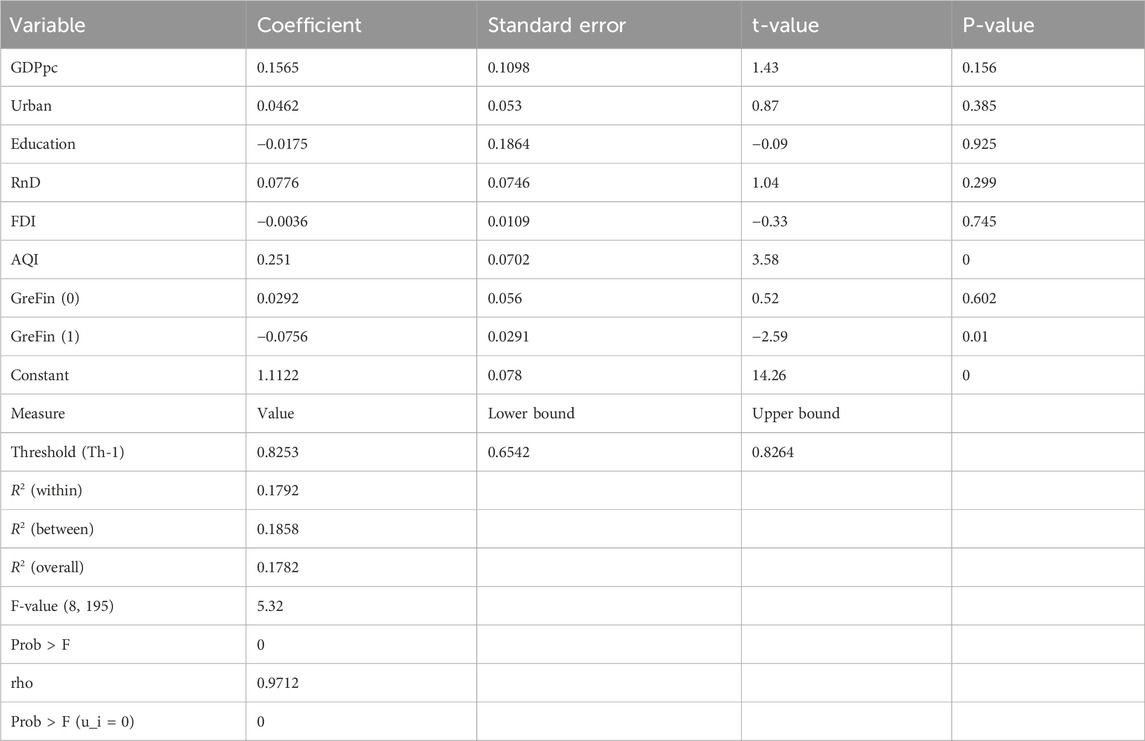

4.4 Threshold effect

The threshold effect model was used to show the nonlinear effects of green finance on the energy consumption structure (Table 4). The threshold effect test indicates that the threshold value is 0.8253, with bounds between 0.6542 and 0.8264, suggesting that green finance levels within this range will be considered low. When the level of green finance development is lower than the threshold, function GreFin(0) has no significant effect on the energy consumption structure, and its influencing coefficient is only 0.0292, indicating that at low levels of green finance development, there are no obvious optimization effects toward the energy consumption structure. However, when green finance reaches the threshold of GreFin(1), its coefficient is −0.0756, and it is significant at a 1% level, gauging that over a certain point, it shows significant improvement in avoiding high-carbon energy structures.

The control variables have some different performances. The coefficient of the AQI is 0.251, which indicates that a better AQI can also promote the optimized energy consumption structure. On the contrary, other control variables like GDP, education level, and R&D input are insignificant, which might be substituted by green finance or difference of place. The threshold model estimation reveals that while the advancement of green finance positively contributes to constraining the energy consumption structure beyond a certain threshold, a little effect is observed for those lower levels regardless of the energy consumption structure. The R-squared values for the model (within 0.1792, between 0.1858, and overall 0.1782) indicate good model fit, and the F-value of 5.32, with Prob > F being 0, further validates the overall effectiveness of the model.

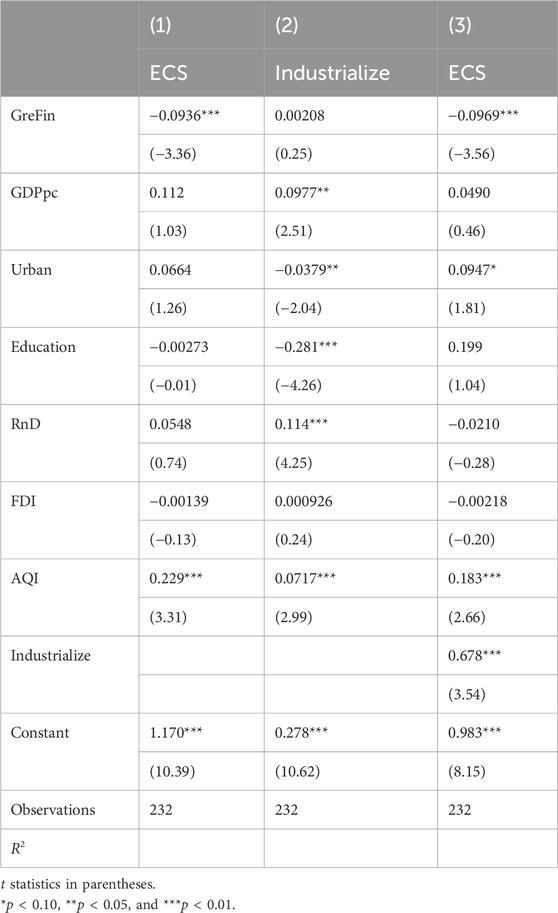

4.5 Mediation analysis

The mediation analysis results show a weaker indirect influence of green finance on the energy consumption structure through the industrial structure, which may be attributable to the lack of a direct driving effect of green finance on the industrial structure (Table 5). In the first model, GreFin plays a significant role in decreasing volume production costs with a coefficient of −0.0936, which is statistically significant at a 1% level. This means that green finance could help energy by increasing the efficiency of using forms. With regard to the second model, although the impact effect of green finance on the industrial structure is 0.00208, it is not significant, indicating that green finance has not effectively driven industrial structural adjustment or optimization. The reason is that the green finance policy implementation focuses more on short-term financial innovation and investment in green projects instead of having a significant impact on the transformation or upgrading of the industrial structure in a short period.

The influence of the industrial structure on the energy consumption structure is quite evident in the third model, with a coefficient of 0.678, and it turns out that it plays an important role in adjusting the energy consumption structure by regulating the industrial structure. However, since green finance’s influence on the industrial structure is weak, its indirect effect on the energy consumption structure through the industrial structure is not significant. The reason could be that green finance policies lag in industrial structural adjustment or barriers to the implementation of these policies, such as the shortage of technological innovation and weak incentives, can block green finance from transmitting along with the industrial structure for optimizing energy consumption structures. To summarize, the former channels of green finance have a more powerful direct impact on the energy consumption structure, while the latter indirect impact is weak. This may be because green finance has not yet generated enough momentum to drive industrial structural adjustment, and as a result, industrial structure has not emerged as a significant mediating factor in this process.

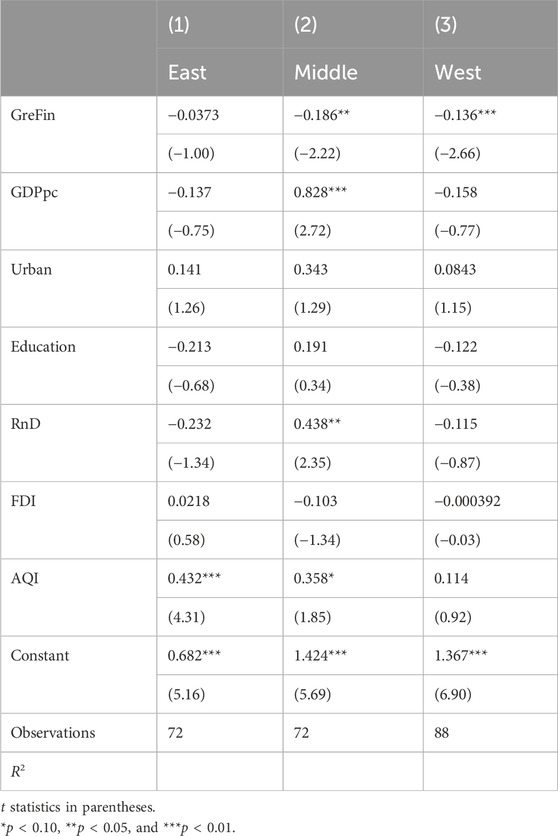

4.6 Heterogeneity analysis

The heterogeneity analysis results show significant differences in the impact of green finance on the energy consumption structure across eastern, central, and western regions (Table 6). The impact of green finance on the energy consumption structure has been different in eastern, central, and western regions. The coefficient of green finance in the eastern part is −0.0373, which is insignificant, suggesting that the promoting effect of green finance on the energy consumption structure in this region is relatively negligible. Given that the eastern region is more economically developed, green finance policies may have a higher marginal effect due to richer experience. However, the coefficient of central part is −0.186, which is significant at a 5% level; this means that green finance has a negative but significant effect on the energy consumption structure, significantly promoting its optimization. This may be because the central region is in a critical phase of economic transformation and industrial restructuring, where the introduction of green finance plays a more prominent role in optimizing the energy consumption structure.

The coefficient of green finance in the western region is −0.136 and is significant at a 1% level, indicating that it has a positive promoting effect on energy savings in the western region. Green finance policies will be more effective in the western region because it is less developed than the eastern region. In short, the heterogeneity analysis reveals that the impact of green finance varies significantly across regions, with the central and western regions benefiting more from the optimization of their energy consumption structures. These findings suggest that green finance policies should be tailored to regional differences to maximize their effectiveness in promoting energy structure transformation.

4.7 Discussion

The results of this study not only corroborate the enhancing effects of green finance on China’s energy consumption structure adjustment, which is consistent with previous studies (for instance, Wang et al., 2016; Zhao et al., 2022) but also enrich the literature by inferring nonlinear spillover impacts and spatial differences. Although the early literature emphasizes the linear relationship between green finance and energy consumption structure, our threshold model beyond a certain level also shows that there may be an objective existence of threshold effects. This enriches the existing literature by highlighting the nonlinear dynamics, suggesting that the policy effects intensify once green finance development reaches a certain level.

Our findings suggest that green finance is crucial for optimizing the energy consumption structure, and existing research indicates that optimizing the terminal energy consumption structure plays a key guiding role in the green upgrading of the entire energy industry chain (Peng et al., 2023b; Lu et al., 2024; Peng et al., 2024). Green finance channels fund into low-carbon and renewable energy projects, reducing reliance on fossil fuels and effectively promoting the increased use of clean energy. By adjusting the energy consumption structure, green finance not only guides innovation and investment in the upstream and midstream of the industrial chain but also plays a vital role in driving the green transformation of the entire industrial chain.

5 Conclusion

This study evaluated the influence of green finance on China’s energy consumption structure, revealing both significant impacts and distinct regional heterogeneity. The research confirmed green finance’s crucial role in promoting sustainable energy practices, especially in reducing greenhouse gas emissions from high-carbon sources. Through empirical analyses, including a baseline regression model and a threshold regression model, it was determined that the effects of green finance are nonlinear, becoming prominent only after surpassing a specific threshold. This provides a solid theoretical foundation for understanding how green finance facilitates the transition toward sustainable energy consumption, although the anticipated indirect effects through the industrial structure were not significant, possibly due to the delays in industrial upgrading.

In light of these findings, it is recommended that government support for green finance be further expanded, enriching mechanisms such as issuing more green bonds, extending green credit, and establishing new green funds to reduce financial costs for green projects and enhance capital flow toward clean energy. Moreover, differentiated green financial policies should be implemented based on regional economic development levels and energy consumption characteristics, with enhanced policy support in central and western regions to accelerate local energy structure optimization. Additionally, increasing requirements for high-energy and high-pollution industries and encouraging the adoption of low-carbon technologies and fuels through incentives like tax relief and subsidies could further support the clean energy transition.

However, there is a limitation to this study. Existing studies have not paid much attention to the impact of changes in energy consumption on both ends of the industrial chain, upstream and midstream, and its economic driving force. Subsequent studies can further explore these impact mechanisms to develop a more comprehensive view of how green finance affects the whole chain in the energy industry via changes in consumption patterns. Moreover, the inclusion of other possible intervening variables and a longer follow-up period could contribute to increased richness in terms of research results. Future research should explore the lagging effects of green finance on industrial restructuring and consider other mediating variables, such as green technology innovation. This could deepen the understanding of the interaction between energy consumption, the industrial chain, and policy implementation, contributing to a more comprehensive framework for sustainable development. By addressing these limitations and exploring new avenues, future studies can offer more nuanced insights into the mechanisms driving the energy industry’s transformation and the broader implications for enhancing the energy consumption structure.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

MD: conceptualization, formal analysis, funding acquisition, investigation, methodology, supervision, validation, visualization, writing–original draft, and writing–review and editing. XL: conceptualization, formal analysis, methodology, supervision, visualization, writing–original draft, and writing–review and editing. RT: conceptualization, data curation, formal analysis, methodology, software, visualization, writing–original draft, and writing–review and editing. YX: conceptualization, formal analysis, methodology, software, supervision, validation, visualization, writing–original draft, and writing–review and editing. SS: conceptualization, data curation, formal analysis, methodology, software, validation, visualization, writing–original draft, and writing–review and editing. RG: conceptualization, data curation, software, validation, visualization, writing–original draft, and writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The research is funded by the Chinese Red Cross Society National Center for Cause Development (CRCSNACD2024-1302).

Acknowledgments

The authors are sincerely grateful to the editor and reviewers for very valuable and constructive comments and suggestions. Nevertheless, any shortcomings that remain in this research paper are solely the authors’ responsibility.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

BP (2023). Statistical review of world energy. Available at: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

Cai, L., and Zhang, J. (2024). Does green finance improve industrial energy efficiency? Empirical evidence from China. Energies 17 (19), 4818. doi:10.3390/en17194818

Fang, X., Khalaf, O. I., Guanglei, W., Cristia, J. F. E., and Almasabi, S. (2024). Exploring impact of green finance and natural resources on eco-efficiency: case of China. Sci. Rep. 14 (1), 20153. doi:10.1038/s41598-024-70993-4

Fan, G., Peng, C., Wang, X., Wu, P., Yang, Y., and Sun, H. (2024). Optimal scheduling of integrated energy system considering renewable energy uncertainties based on distributionally robust adaptive MPC. Rene. Energy. 226, 120457.

Ge, T., Cai, X., and Song, X. (2022). How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renew. Energy 197, 1106–1114. doi:10.1016/j.renene.2022.08.046

Gu, X., Qin, L., and Zhang, M. (2023). The impact of green finance on the transformation of energy consumption structure: evidence based on China. Front. Earth Sci. 10, 1097346. doi:10.3389/feart.2022.1097346

Guo, W., Yang, B., Ji, J., and Liu, X. (2023). Green finance development drives renewable energy development: mechanism analysis and empirical research. Renew. Energy 215, 118982. doi:10.1016/j.renene.2023.118982

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93 (2), 345–368. doi:10.1016/S0304-4076(99)00025-1

Hayes, A. F. (2009). Beyond Baron and Kenny: statistical mediation analysis in the new millennium. Commun. Monogr. 76 (4), 408–420. doi:10.1080/03637750903310360

Hu, M., Sima, Z., Chen, S., and Huang, M. (2023). Does green finance promote low-carbon economic transition? J. Clean. Prod. 427, 139231. doi:10.1016/j.jclepro.2023.139231

IEA (2023). World Energy Outlook 2023. Paris: IEA. Available at: https://www.iea.org/reports/world-energy-outlook-2023.

Jin, Y., Gao, X., and Wang, M. (2021). The financing efficiency of listed energy conservation and environmental protection firms: evidence and implications for green finance in China. Energy Policy 153, 112254. doi:10.1016/j.enpol.2021.112254

Lee, C. C., and Lee, C. C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Lee, C. C., Wang, C. S., He, Z., Xing, W. W., and Wang, K. (2023). How does green finance affect energy efficiency? The role of green technology innovation and energy structure. Renew. Energy 219, 119417. doi:10.1016/j.renene.2023.119417

Li, W., Fan, J., and Zhao, J. (2022). Has green finance facilitated China’s low-carbon economic transition? Environ. Sci. Pollut. Res. 29 (38), 57502–57515. doi:10.1007/s11356-022-19891-8

Liang, J., and Li, G. (2024). RETRACTED ARTICLE: the role of green financing in enabling sustainable energy transition and economic development. Econ. Change Restruct. 57 (3), 108. doi:10.1007/s10644-024-09639-4

Liu, H., Zhu, Q., Khoso, W. M., and Khoso, A. K. (2023). Spatial pattern and the development of green finance trends in China. Renew. Energy 211, 370–378. doi:10.1016/j.renene.2023.05.014

Liu, J., Wang, K., Zou, J., and Kong, Y. (2019). The implications of coal consumption in the power sector for China’ s CO2 peaking target. Appl. Energy 253, 113518. doi:10.1016/j.apenergy.2019.113518

Lu, X., Xiao, J., Wang, X., Wen, L., and Peng, J. (2024). “Government regulation and China's natural gas price distortion: A sectoral perspective,” in Natural Resources Forum. Oxford, UK: Blackwell Publishing Ltd.

Lv, C., Bian, B., Lee, C. C., and He, Z. (2021). Regional gap and the trend of green finance development in China. Energy Econ. 102, 105476. doi:10.1016/j.eneco.2021.105476

Peng, J., Chen, H., Jia, L., Fu, S., and Tian, J. (2023a). Impact of digital industrialization on the energy industry supply chain: evidence from the natural gas industry in China. Energies 16 (4), 1564. doi:10.3390/en16041564

Peng, J., Shi, W., Xiao, J., and Wang, T. (2023b). Exploring the nexus of green finance and renewable energy consumption: unraveling synergistic effects and spatial spillovers. Environ. Sci. Pollut. Res. 30 (45), 100753–100769. doi:10.1007/s11356-023-29444-2

Peng, J., Zhou, M., Yi, M., and Fu, S. (2024). Unveiling the impact of digital industrialization on synergistic governance of pollution and carbon reduction in China: a geospatial perspective. Environ. Sci. Pollut. Res. 31 (25), 36454–36473. doi:10.1007/s11356-023-31225-w

Shang, Y., Zhu, L., Qian, F., and Xie, Y. (2023). Role of green finance in renewable energy development in the tourism sector. Renew. Energy 206, 890–896. doi:10.1016/j.renene.2023.02.124

Sun, H., and Chen, F. (2022). The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 76, 102588. doi:10.1016/j.resourpol.2022.102588

Wang, J., Tian, J., Kang, Y., and Guo, K. (2023). Can green finance development abate carbon emissions: evidence from China. Int. Rev. Econ. and Finance 88, 73–91. doi:10.1016/j.iref.2023.06.011

Wang, R., Zhao, X., and Zhang, L. (2022). Research on the impact of green finance and abundance of natural resources on China’s regional eco-efficiency. Resour. Policy 76, 102579. doi:10.1016/j.resourpol.2022.102579

Wang, Z., Zhang, B., and Zeng, H. (2016). The effect of environmental regulation on external trade: empirical evidences from Chinese economy. J. Clean. Prod. 114, 55–61. doi:10.1016/j.jclepro.2015.07.148

Wu, H. (2023). Evaluating the role of renewable energy investment resources and green finance on the economic performance: evidence from OECD economies. Resour. Policy 80, 103149. doi:10.1016/j.resourpol.2022.103149

Wu, X. Q., Wen, H. X., Nie, P. Y., and Gao, J. X. (2024). Utilizing green finance to promote low-carbon transition of Chinese cities: insights from technological innovation and industrial structure adjustment. Sci. Rep. 14 (1), 16844. doi:10.1038/s41598-024-67958-y

Xiong, X., Wang, Y., Liu, B., He, W., and Yu, X. (2023). The impact of green finance on the optimization of industrial structure: evidence from China. PLoS One 18 (8), e0289844. doi:10.1371/journal.pone.0289844

Xu, X. (2023). Does green finance promote green innovation? Evidence from China. Environ. Sci. Pollu. Res. 30 (10), 27948–27964.

Zhang, L., Saydaliev, H. B., and Ma, X. (2022). Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals? Renew. Energy 193, 991–1000. doi:10.1016/j.renene.2022.04.161

Zhang, Z., Wang, J., Feng, C., and Chen, X. (2023). Do pilot zones for green finance reform and innovation promote energy savings? Evidence from China. Energy Econ. 124, 106763. doi:10.1016/j.eneco.2023.106763

Zhang, D., Zhang, Z., and Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Fina. Rese. Letters. 29, 425–430.

Zhao, T., Zhou, H., Jiang, J., and Yan, W. (2022). Impact of green finance and environmental regulations on the green innovation efficiency in China. Sustainability 14 (6), 3206. doi:10.3390/su14063206

Keywords: green finance, end-use energy consumption structure, sustainable energy transition, GMM model, threshold effects

Citation: Deng M, Lu X, Tong R, Xue Y, Shi S and Guo R (2025) The role of green finance in reshaping end-use energy consumption: insights from regional evidence in China. Front. Environ. Sci. 13:1539987. doi: 10.3389/fenvs.2025.1539987

Received: 05 December 2024; Accepted: 09 January 2025;

Published: 04 February 2025.

Edited by:

Hui Wang, Hunan University, ChinaReviewed by:

Qi Tan, Beijing Normal University, ChinaYou Zheng, China University of Geosciences Wuhan, China

Copyright © 2025 Deng, Lu, Tong, Xue, Shi and Guo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiangyi Lu, bHV4aWFuZ3lpQGN1Zy5lZHUuY24=

Mingzheng Deng

Mingzheng Deng Xiangyi Lu

Xiangyi Lu Ruibin Tong3

Ruibin Tong3