- 1School of Economics and Finance, Huaqiao University, Quanzhou, China

- 2Xiamen National Accounting Institute, Xiamen, China

- 3Business School, Nankai University, Tianjin, China

Green and low-carbon development transformation of enterprises is of great significance to climate governance and sustainable economic development. It is a realistic problem worth to study whether carbon risk will affect the bankruptcy pressure of corporates. This paper empirically analyzes the impact of carbon risk shocks on the corporates bankruptcy pressure based on the quasi-natural experiment of the implementation of the Paris Agreement. The results indicated that carbon risk significantly alleviated corporates bankruptcy pressure. Specifically, mechanistic analysis uncovered that the increase in carbon risk may reduce the bankruptcy pressure of corporates was mediated by lowering corporate financing costs and elevating green innovation levels. Finally, it was found through the heterogeneity analysis that the negative correlation between carbon risk and bankruptcy pressure was more pronounced for non-state-owned enterprises, small-scale corporations, and companies located in highly competitive industries.

1 Introduction

Climate change caused by carbon emissions is threatening human society and requires active coping from all countries in the world (Subramaniam et al., 2015; Anastasiou et al., 2024). The Paris Agreement signed in December 2015 is a legally binding climate agreement which marks a new historical stage in global climate governance (Bose et al., 2021; Dewaelheyns et al., 2023). As a responsible global player, the Chinese government implements the Paris Agreement actively that achieved remarkable results in key areas such as strategic mechanism building, industrial structure optimization, carbon market construction, and social awareness raising. Meanwhile accession to the Paris Agreement reflects determination and efforts of China to promote green and low-carbon development and also sends a signal that China would strengthen carbon emission supervision that undoubtedly would increase the uncertainty of the policy environment and then makes enterprises face a new and more severe carbon risk situation. Specifically, carbon risk includes policy risk, market risk, technical risk, economic risk and supply chain risk that arise from the uncertainty of enterprise’s expected and regulatory activities in the transition to a low-carbon economy (Hoffmann and Busch, 2008; Labatt and White, 2011). Therefore, it is a major realistic problem for enterprises to take the path of green and low-carbon development while avoiding the potential impact from carbon risk.

Based on the above background, it is an important theoretical basis for the low-carbon development path of Chinese enterprises to investigate the relationship between carbon risk and firm bankruptcy pressure. Whether the increase of carbon risk would increase the bankruptcy pressure of corporate has been widely concerned by the academic circle. To address this gap, this paper formulate a competitive hypothesis regarding the potential ways in which carbon risk could influence corporate insolvency pressure. On one hand, certain studies suggest that carbon risk may theoretically exacerbate the financial leverage of enterprises (Dumrose and Hock, 2023), elevate both equity and debt costs (Chava, 2014), and increase operational expenses for businesses (Gorgen et al., 2020; Zhang and Du, 2020). This risk arises from the fact that high-carbon companies face greater financial penalties when mandated to reduce emissions (Bolton and Kacperczyk, 2021), with escalating costs potentially rendering these firms unsustainably profitable, thereby jeopardizing their capital structure and heightening bankruptcy risks. Therefore, a perspective grounded in cost theory posits that if companies are compelled to lower carbon emissions due to stricter environmental regulations, they will incur higher operating costs alongside more volatile cash flows (Subramaniam et al., 2015). Under the strain of carbon risk, enterprises must implement measures such as production reductions to alter resource allocation efficiency that could adversely affect innovation capabilities (Millimet et al., 2009; Greenstone et al., 2012). On the other hand, as carbon risk increases, the constriction of financing availability for carbon-intensive industries effectively diminishes the financial leverage, alters the debt maturity structure, and curtails investment expenditures of polluting enterprises (Wang et al., 2019). Additionally, Nguyen and Phan (2020) demonstrate that carbon risk leads to a reduction in financial leverage within carbon-intensive firms, with this effect being more pronounced for those facing greater financial constraints. Furthermore, such as the green credit policy implemented in response to carbon risk also can modify the debt maturity structure and mitigate excessive investment behaviors among these enterprises (Liu et al., 2017). It is worth noting that according to Porter’s hypothesis, enterprises would escalate their investments in research, development, and innovation in order to diminish production costs and enhance competitiveness (Wang and Sun, 2021; Wu and Lin, 2022). This emphasis on process and product innovation may alleviate some of the negative impacts associated with rising costs due to carbon risk and ultimately lessen the financial pressures that could lead firms toward bankruptcy (Porter, 1996; Bai and Tian, 2020). Given the divergent predictions present within existing theories regarding reduction versus enhancement effects, empirical data is crucial for assessing the impact of carbon risk on corporate bankruptcy pressure.

Therefore, in order to test the hypothesis above, this paper applies a difference-in-differences (DID) method using the data of Chinese companies listed on the Shanghai and Shenzhen stock exchanges from 2011 to 2021 to explore the impact of carbon risk on corporate bankruptcy pressure and its possible influence channels. Different from previous studies, this paper mainly has the following contributions: firstly, although previous research has investigated some other micro-effects of carbon risk, the effect of carbon risk on corporate bankruptcy pressure has not yet been considered. This paper enhances understanding of the micro-effects of corporate bankruptcy pressure by examining carbon risk management behaviors and furnishes micro-empirical evidence that contributes to the evaluation of the effects of carbon risk. Secondly, this study finds that since the signing of the Paris Agreement, the improvement of enterprise green innovation levels and the alleviation of financing constraints have become important channels for reducing the bankruptcy pressure of carbon venture corporate. This finding offers concrete support for the Porter hypothesis and provides an important practical reference for realizing the green transformation of enterprises. Thirdly, this paper explores the diverse impacts of carbon risk on bankruptcy pressure across varying company sizes, property rights, and industry competition intensities. In addition to providing a more comprehensive view of the economic consequences associated with carbon risk, this study also offers theoretical guidance for businesses to customize their strategies in response to environmental regulations.

This study is structured as follows: Section 2 presents a brief overview of relevant literature and introduces our hypothesis. Section 3 outlines the research methodology and data. Section 4 provides a comprehensive analysis of the empirical findings and a range of robustness tests to ensure their validity. Section 5 examines the heterogeneity of the results. Section 6 summarizes the study’s results and offers suggestions for further exploration.

2 Theoretical hypothesis

Some scholars believe that carbon risk could alleviate the pressure of corporate bankruptcy to a certain extent. At first, based on the “green transformation” hypothesis, under environmental regulations, the increase in carbon risk can force enterprises to develop low-carbon technologies and improve production efficiency and industry competitiveness, thus enhancing sustainable management ability and proactive green transformation (Porter and Linde, 1995). Meanwhile the external pressure of environmental regulation can prompt enterprises to reflect on their shortcomings in carbon emission reduction and actively seek technological innovation (Ambec and Barla, 2006; Chen et al., 2023; Deng et al., 2024). Secondly, stakeholder theory holds that green transformation by enterprises can promote the achievement of broader social goals, increase the trust between enterprises and stakeholders, and guide enterprises to realize the unity of environmental problem-solving practices and sustainable development goals (Donaldson and Preston, 1995; Gong and Grundy, 2019). In relation to society and the public, enterprises that actively carry out green transformation are more likely to obtain public support. Thirdly, researchers have found that the increase in carbon risk will force companies to improve their management in carbon risk. And actively managing carbon risk helps companies build a positive social image, reducing the spread of negative publicity and the likelihood of public resistance (Bednar, 2012). Through proactive carbon management and environmental initiatives, companies can convey a sense of responsibility and sustainability, enhancing public goodwill and approval (Hartmann et al., 2005; Olsen et al., 2014; Bi et al., 2023). Fourthly, according to the long-term value investment theory, although green innovation may increase enterprise costs in the short term, it has long-term, sustainable investment returns (Pástor et al., 2021), making enterprises that actively carry out green innovation attractive to investors. Investors believe that companies that actively carry out green innovation will obtain higher quantitative investment returns (Edmans, 2011; He et al., 2022).

Based on the analysis above, carbon risk may reduce the bankruptcy pressure of enterprises in the following two ways. Firstly, enterprises enhance their profitability and competitive position through innovation, which then improves their financial status (McGahan and Silverman, 2006). A stronger financial position means that companies face less pressure of going bankrupt. Secondly, enterprises that actively deal with carbon risks and participate in green innovation are more likely to be favored by investors, thereby reducing bankruptcy pressure (Riedl and Smeets, 2017). As a result, therefore this paper propose the following hypothesis.

Hypothesis 1a:. The increase in carbon risk could ease the enterprise bankruptcy pressure.

On the contrary, some scholars also indicate that carbon risk would increase the risk of corporate bankruptcy. Firstly, the cost competition hypothesis holds that carbon risk will bring compliance costs to enterprises, causing them to fall into financial difficulties. Previous research has shown that the costs of disclosure, management, and technology upgrades caused by carbon risk may erode the normal production and operation of enterprises, thus having a negative impact on enterprise value (Gorgen et al., 2020; Zhang and Du, 2020; Chen et al., 2023). Particularly asset-heavy businesses typically require significant capital investments to build and maintain assets, and these investments often have long payback cycles. The emergence of carbon risk may lead these enterprises to face dilemmas of asset depreciation and reduced return on investment, harming their financial performance. Secondly, due to the risks associated with carbon emissions and climate change, many investors and financial institutions are beginning to consider low-carbon and climate-friendly investments. Hence, high-carbon industries may face financing pressures, while low-carbon projects and companies may attract more funds (Bolton and Kacperczyk, 2021). Such impacts could lead to short-term increases in production costs and rising financial risks, elevating the risk of bankruptcy for businesses (Jung et al., 2018).

Based on the above analysis, carbon risk may affect the bankruptcy pressure of corporates by increasing the cost, expenditure, and uncertainty of the cash flow of enterprises, thus increasing their bankruptcy pressure (Ilhan et al., 2021; Giglio et al., 2021). As a result, this paper propose the following hypothesis.

Hypothesis 1b:. Carbon risk is positively correlated with corporate bankruptcy pressure.

3 Data collection and model building

3.1 Data collection and processing

This study selects listed companies in Shanghai and Shenzhen A-shares from 2011 to 2021 as the sample. Companies engaged in the following industries are defined as high carbon emission enterprises: oil and gas extraction, electricity, heat, and gas production and supply, metal products manufacturing, petroleum processing, coking and nuclear fuel processing, ferrous metal smelting and rolling, chemical raw materials and chemical products manufacturing, non-ferrous metal smelting and rolling, chemical fiber manufacturing, non-metallic mineral products manufacturing, housing construction, non-ferrous metal mining, civil engineering construction, metal products machinery and equipment repair, construction decoration and other construction industries, non-metallic mineral mining, paper and paper products manufacturing, and wood processing and wood, bamboo, rattan, palm, and straw products manufacturing. Other companies in addition to the above companies are classified as low carbon emission enterprises.

Based on this classification, the sample was further screened as follows: (1) exclusion of ST, SST, and *ST companies; (2) exclusion of the financial and real estate industries; (3) exclusion of samples with significant missing values. Ultimately, 24,956 observations were obtained in this study. To avoid the effect of extreme values, all continuous variables are winsorized at the one percent level. In this study, companies from carbon-intensive industries are designated as the experimental group, while the remaining companies serve as the control group. All data utilized in the analysis are sourced from the CSMAR database and the CNRDS database.

3.2 Specification of the model

To empirically assess the impact of carbon risk on corporate bankruptcy pressure, this study employs a DID model, a methodology commonly utilized in research to examine policy effects (Drysdale and Hendricks, 2018; Dewaelheyns et al., 2023; Cheng et al., 2024). The setup of the model is shown in Equation 1 below:

where,

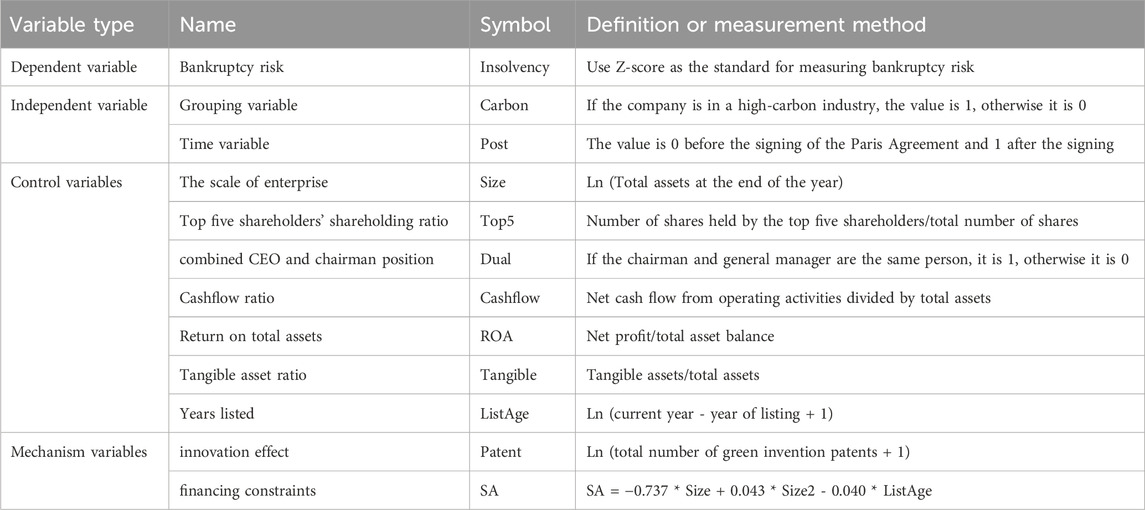

3.3 Selection of variables

3.3.1 Explained variable

Bankruptcy pressure. The Altman Z-Score (Altman, 1968) is employed as the measure for bankruptcy pressure in this study. The Altman Z-Score is widely recognized for its accuracy and is considered one of the more reliable models for predicting a company’s financial stress and health (Almamy et al., 2016). The formula used to calculate the Z-score is shown in Equation 2 below:

where, Q1 = the market value of equity/book value of total liabilities ratio; Q2 = earnings before interest and taxes (EBIT)/total assets ratio; Q3 = the retained earnings/total assets ratio; Q4 = the operating capital/total assets ratio; and Q5 = the revenue/total assets ratio. The Z-score is negatively correlated with the bankruptcy pressure of a company, meaning that the higher the Z-score, the lower the bankruptcy pressure; conversely, the lower the Z-score, the higher the bankruptcy pressure.

3.3.2 Explanatory variable

Carbon × Post. Referring to the research of Nguyen and Phan (2020), we categorize firms as either high-carbon or low-carbon emitters, depending on the emission characteristics of their respective industries. High-carbon companies include those in industries that are considered “carbon intensive” and are the largest emitters of greenhouse gases or consumers of energy. With the tightening of carbon control regulations, heavy emitters are anticipated to face a substantial increase in carbon costs. The individual variable “Carbon” is a dummy variable that measures whether a company belongs to a high-carbon or low-carbon industry. We use the 2012 China Securities Regulatory Commission industry classification to define high-carbon industries. “Post” is a time dummy variable in the DID model that measures exogenous shocks in the Paris Agreement. Given that the Paris Agreement was signed in December 2015, this study assigns a value of 1 for the year 2016 and onwards, and 0 otherwise. The interaction term “Carbon × Post” represents the magnitude of the impact of the Paris Agreement’s implementation on the bankruptcy pressure of carbon-intensive corporates before and after its adoption.

3.3.3 Control variables

We also include tangible asset ratio (Tangible), age (List Age), top five customers′ share of revenue (Top 5), Dual, Cashflow, and return on assets (ROA) as company-specific control variables (Gangi et al., 2020). The specific definitions of each variable are shown in Table 1.

3.4 Summary statistics

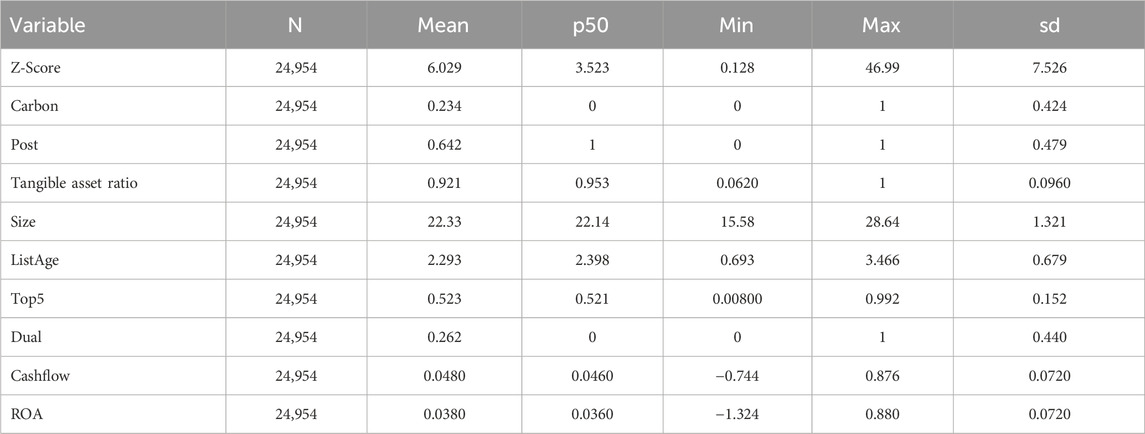

Table 2 shows descriptive statistics. The mean of the Z-score is 6.029, with a standard deviation of 7.526. The Z-score ranges from 0.128 to 46.992, which indicates that the bankruptcy pressure of the listed companies is highly different. Our Z-score values and those of Ji et al. (2022) are consistent. The mean value of Carbon is 0.234, which signifies that the experimental group accounts for 22.4% of the population, suggesting that most firms have low carbon risk. Summary statistics for other variables generally align with the patterns observed in the existing literature (Pang et al., 2023).

4 Empirical results

4.1 Baseline result analysis

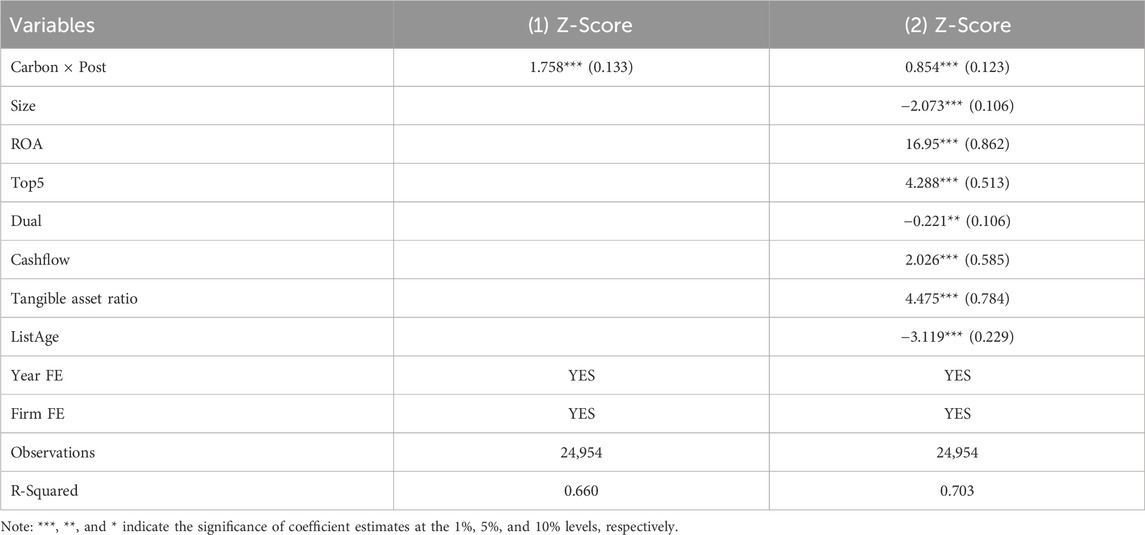

The implementation of the DID model allowed us to evaluate the impact of carbon risk on the bankruptcy pressure faced by businesses. Table 3 reports the empirical results. In column (1), only the variable Carbon × Post is taken into consideration. In column (2), control variables are introduced to assess the impacts of other factors. Irrespective of the inclusion of control variables, the coefficients associated with the interaction term (Carbon × Post) exhibit significant positive values at the 1% significance level. This suggests a substantial alleviation of bankruptcy pressure following the implementation of the Paris Agreement, thereby supporting Hypothesis 1a.

In terms of control variables, our results are consistent with existing empirical studies that find that Size, Dual, and ListAge can significantly increase the bankruptcy pressure of corporates (Cho et al., 2021; Qin et al., 2023; Dewaelheyns et al., 2023). We also find that ROA and Cashflow can significantly reduce the bankruptcy pressure of corporates, which is consistent with our expectation and existing research. For example, Aziz et al. (2021) observed that enterprises with good performance in ROA and Cashflow have high profitability and low bankruptcy risk. All the other control variables exhibited statistical significance across all specifications, affirming the appropriateness of our selection of control variables.

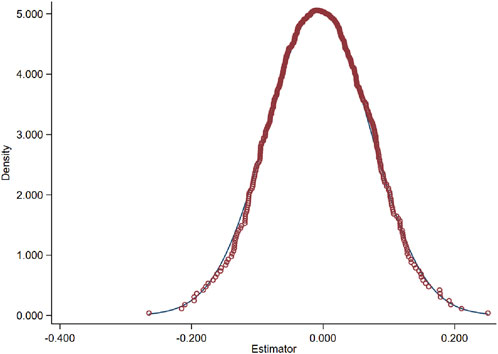

4.2 Parallel trend test

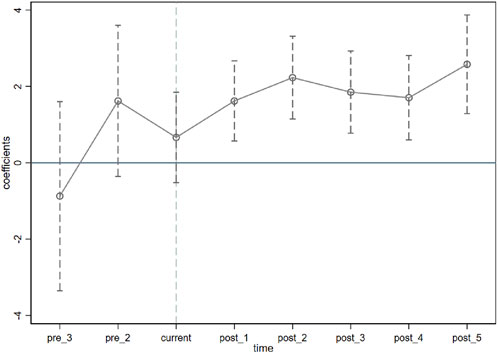

An important premise for the use of the DID method is that the experimental group and the control group should exhibit a parallel trend before the implementation of the policy; otherwise, the estimated results will be biased. Specifically, we created time indicator variables including pre_3, pre_2, pre_1, current, and post_1, post_2, post_3, post_4, post_5. These variables represent 3 years before the implementation of the Paris Agreement, 2 years before, 1 year before, the first year of implementation of the Paris Agreement, the second year, third year, fourth year, and fifth year, respectively. As shown in Figure 1, the middle point in each vertical line is the parameter estimate value, and the two ends are the confidence interval when the confidence level is 95%. Pre_1 as the base year was removed from the regression. The coefficients of the regression terms in the years before the policy shock are not significantly different from zero. The coefficients are significant after the policy was implemented. Hence, the results satisfy the parallel trend test well.

4.3 Test of robustness

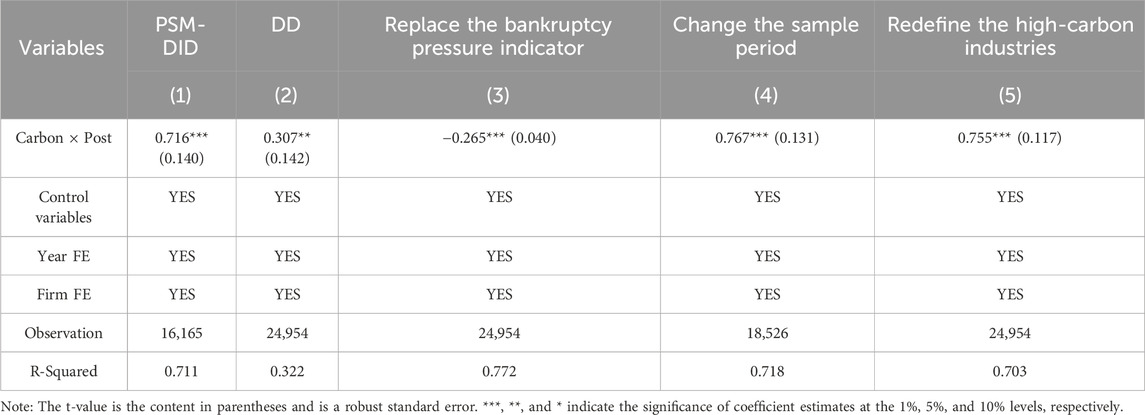

We conducted a series of robustness tests to ensure the robustness of the empirical results, which included adopting a PSM-DID method, replacing explanatory variables, changing the sample period, redefining high-carbon industries, and conducing placebo tests. Irrespective of the specific robustness test applied, all the empirical results consistently reinforce the main conclusion of this study.

4.3.1 The PSM-DID method

While the DID method can control some endogeneity problems, it cannot control those caused by “selection bias.” However, PSM-DID can effectively alleviate these problems. Accordingly, this paper uses the PSM-DID model for further analysis. First, all control variables in model (1) were selected as covariables, and a logit model was used to score whether the samples were affected by China’s signing of the Paris Agreement. Second, the 1:1 nearest neighbor matching principle was adopted for non-repeated matching in each year to ensure that samples from different experimental groups would not match the same control group samples. The same or similar scores meant that the two samples had similar characteristics. Finally, model (1) was used for regression analysis of the obtained samples, and the result is presented in column (1) of Table 4. We observe that the coefficient of the interaction term (Carbon × Post) remains significantly positive at the 1% significance level, affirming the robustness of the baseline regression results.

4.3.2 Replace the bankruptcy pressure indicator

In order to ensure the robustness of the research conclusion, we change the measurement method of corporates bankruptcy pressure and carries out benchmark regression again. The initial approach involves utilizing the O-score introduced by Ohlson (1980) as a measurement tool, the calculation method is shown in Equation 3:

where, WCTA = Working Capital/Total Assets; CHIN = (NIt-NIt−1)/(|NIt|+|NIt−1|), where NI represents net income; CLCA = Current Liabilities/Current Assets; FUTL = Net Operating Cash Flow/Total Liabilities; SIZE = Ln (Total Assets); INTWO = 1 if net income is negative for the past 2 years, otherwise 0; OENEG = 1 if Total Liabilities > Total Assets, otherwise 0; TLTA = Total Liabilities/Total Assets; and NITA = Net Income/Total Assets. The larger the O-score value, the greater the bankruptcy pressure of the corporates. Secondly, the KMV model is used to measure the bankruptcy pressure of corporates. The specific formula is as follows:

where, V is the market value of corporate assets, which is composed of the market value of corporate debt (D) and the market value of equity (E), that is, V = D + E, while the market value of debt (D) is composed of current liabilities and non-current liabilities, that is, current liabilities +0.5 × non-current liabilities. U is the expected return on assets, which is assumed to be the stock return of the enterprise in the previous year. Is the volatility of enterprise asset value, which consists of stock volatility and debt volatility, Debt volatility

4.3.3 Change the sample period

The COVID-19 pandemic had a profound impact on the global economy, causing significant adverse effects on businesses. To assess the influence of carbon risk on corporate bankruptcy pressure without the potential distortions introduced by the pandemic, this study excluded the data for the years 2020 and 2021. The aim was to analyze a more robust and pandemic-free dataset. The results of this analysis are presented in Table 1 column (3). According to the results, after excluding the samples from 2020 to 2021, the coefficient of the core explanatory variable is 0.674. This coefficient is statistically significant at the 1% level and positively significant. This suggests that the main regression results remain robust even after removing the 2020 and 2021 data, indicating that carbon risk continues to have a significant impact on corporate bankruptcy pressure in a pandemic-free context.

4.3.4 Redefine the high-carbon industries

In previous studies, the transportation industry has also been classified as a carbon-intensive industry, but this paper does not include the transportation industry as a high-carbon industry because it has made effective progress in low-carbon technologies in recent years (Wang and Sun, 2021). Therefore, in the robustness test, enterprises in the transportation industry were added as part of the explanatory variables, and the model was regressed again. According to the data presented in column (4) of Table 4, the core explanatory variables continue to display significant positive coefficients, which align with the findings of the baseline regression analysis.

4.3.5 Placebo test

To eliminate the interference of a sample processing effect, this study, referring to Shu et al. (2023), disrupted the order of the explanatory variables, randomly selected some samples, and artificially set the virtual experimental group and virtual control group to construct a new virtual variable and a new interaction term

As shown in Figure 2, the mean value of the estimated coefficients is close to 0 and much smaller than the benchmark regression coefficient (0.860***). This suggests that the observed reduction in bankruptcy pressure in this study is not attributable to random factors.

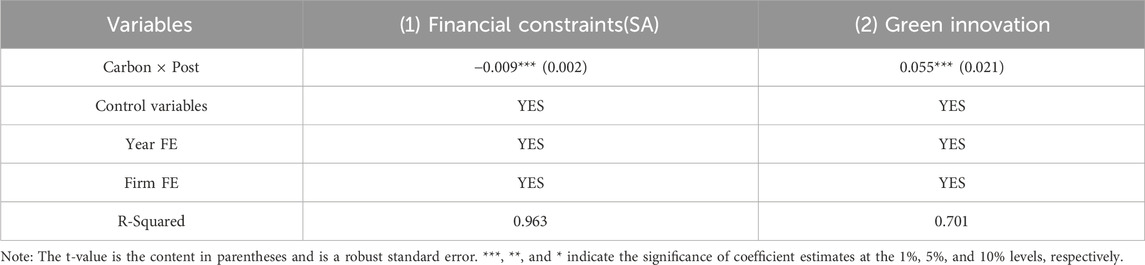

4.4 Channel analysis

The analysis in this study explores the impact of carbon risk on firm bankruptcy pressure under the Paris Agreement. This section is based on theoretical analysis and aims to reveal the mechanisms through which this impact occurs.

Previous research has found a significant positive relationship between carbon risk and corporate innovation, with environmentally related innovative technologies tending to increase as pollution control costs rise, especially within heavily polluting enterprises (Lanjouw and Mody, 1996; Luo et al., 2023). According to the “green transformation” hypothesis discussed earlier, carbon risk will prompt enterprises to attach importance to technological innovation, optimize management processes, improve production efficiency, obtain competitive advantages and other resources, and reduce pollutant emission (Li, 2014).

Due to the characteristics of carbon emission risks, they pose multiple threats within the commercial environment, and their impact may become pronounced due to constraints on corporate financing. A series of regulations enacted to achieve green transformation are believed to mitigate the information asymmetry problem faced by high-carbon-emitting enterprises in this context (Zhu and Zhang, 2012). With the gradual strengthening of carbon risk, investors are becoming increasingly concerned about a company’s environmental performance (Pástor et al., 2021). Therefore, to meet the expectations of the government and investors, high-carbon emission enterprises will likely become more actively involved in information disclosure and carbon emission management to win the favor of investors and government funds.

In the context outlined above, enterprises can reduce bankruptcy pressure in the following two ways. First, through green innovation, they can improve their production efficiency, using green competitive advantages to enhance market share and their business capacity. Second, by disclosing information about their carbon emissions, enterprises can actively obtain the support of government funds and investors, solve the problems of high financing costs, and reduce the pressure of bankruptcy. In other words, enterprises can reduce bankruptcy pressure by increasing green innovation to alleviate financing constraints.

Referring to Hadlock and Pierce (2010), this paper uses the SA index to measure the financing constraints faced by enterprises. The SA index, which is constructed solely with variables such as company size and company age, which do not significantly change over time, exhibits strong exogeneity. This makes it a suitable proxy for financing constraints as it can help mitigate endogeneity problems. For the measurement of green innovation, this paper follows Jia et al. (2023) in using the natural logarithm of the total number of green invention patents of a company as the proxy variable of green innovation.

Drawing inspiration from Jiang (2022), the Equation 4 is constructed for mechanism testing:

where,

The empirical results, displayed in column (1) of Table 5, reveal a notable negative coefficient for the SA index, which suggests that carbon risk can mitigate a company’s bankruptcy pressure by reducing its financing constraints. The above conclusion is also consistent with previous empirical evidence that carbon risk can mitigate corporates’ bankruptcy pressure by easing financing constraints and promoting green innovation (Stamolampros and Symitsi, 2022). The empirical results, as presented in Table 5 column (2), show a significant positive coefficient for green innovation, implying that carbon risk can reduce corporate bankruptcy pressure by promoting green innovation within companies. Comparatively, while studies like those by Porter (1996), Bai and Tian, (2020) suggest innovation offsets regulatory costs, our findings further this by demonstrating how specific types of green innovation contribute to financial stability.

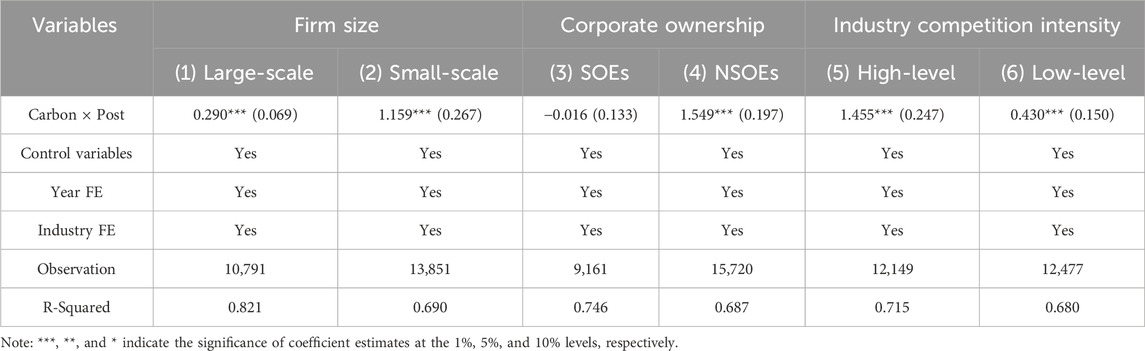

5 Heterogeneity analysis

Carbon risk may have different effects on bankruptcy pressure for different types of businesses. Therefore, this paper carries out heterogeneity tests based on the property rights of the enterprise, the scale of the enterprise, and the degree of competition intensity in the industry in which the enterprise is located.

5.1 Heterogeneity test of firm size

In the process of addressing carbon risk, enterprises of different sizes exhibit starkly different responses (Siedschlag and Yan, 2021). Based on the study of Tian et al. (2020), we establish average-sized companies as the standard and categorize companies into two groups: large-scale enterprises and small-scale enterprises. In Table 6, column (3) represents the regression results for large-scale enterprises, and column (4) represents the regression results for small-scale enterprises. These columns show that carbon risk significantly reduces bankruptcy pressures for small-scale companies, but its impact on large-scale companies is not statistically significant. This may be because although large companies desire to innovate and their R&D investment increases with the size of the company when facing pressure from outside (Wakasugi and Koyata, 1997), the defects in large enterprises’ flexibility and information accessibility tend to lead to inefficient innovation activities. This makes enterprise size irrelevant or even negatively correlated with innovation (Rogers, 2004). For small businesses, innovation incentives are more flexible when the businesses are faced with carbon risk, and simple corporate structures allow for more effective collaboration while avoiding bureaucracy (Simonen and mccnn, 2008). Therefore, carbon risk more effectively alleviates corporates bankruptcy pressure among small-scale companies than among large-scale companies.

5.2 Heterogeneity test of property rights

Corporate ownership is a crucial boundary that demarcates different groups of enterprises as firms with diverse ownership structures exhibit significant differences in their cognitive logic, resource endowments, and operational approaches. Consequently, when facing carbon risk, these enterprises may adopt varying strategies. This study delves into the impact of carbon risk on bankruptcy pressures for state-owned enterprises (SOEs) and non-SOEs as differentiated groups. In Table 6, column (1) presents the regression results for non-SOEs, and column (2) presents the regression results for SOEs. These results show that carbon risk significantly reduces bankruptcy pressures for non-SOEs, while its effect on SOE remains insignificant.

This observation can be attributed to several factors. One plausible explanation is that non-SOEs possess a higher degree of flexibility and innovativeness (Wang et al., 2023). Generally, SOEs will inevitably undertake more corporate social responsibility (Liu et al., 2021), while SOEs tend to exhibit lower responsiveness to corporate performance. Conversely, managers in non-SOEs generally face heightened market pressures (Bradshaw et al., 2019), resulting in increased career apprehensions regarding the possibility of corporates bankruptcy. Therefore, non-SOEs are more able to reduce their bankruptcy pressure through green innovation than SOEs are. Moreover, non-SOEs tend to prioritize cost control and efficiency enhancement due to heightened market competition (Tang and Li, 2013). This focus on lean operations drives them to seek energy-efficient and emission-reducing solutions when faced with carbon risk, consequently mitigating carbon-related costs. In summary, the superior adaptive capacity of non-SOEs to mitigate bankruptcy pressures stemming from carbon risk is primarily attributed to their agility and innovation, as well as their emphasis on cost control and efficiency enhancement.

5.3 Heterogeneity test of different industry competition intensity

According to signal theory, intense market competition fosters adversarial relationships among companies (Muhmad et al., 2021). The more intense the market competition, the more competitors are eager to showcase their advantages through various means. Referring to Haushalter et al. (2007), this study adopts the Herfindahl-Hirschman Index (HHI) to measure the intensity of industrial competition. The specific calculation formula is

6 Conclusion and policy implications

Can the increased carbon risk caused by tighter environmental regulations force enterprises to actively implement green transformation and reduce their bankruptcy pressure which is a realistic problem worth exploring. In order to examine this question, this paper employs a based on the Paris Agreement.

In order to investigate the impact of carbon risk on the bankruptcy pressure of enterprises and then to provide the theoretical basis for the sustainable development of enterprises, this paper chooses the Paris climate agreement as a quasi-natural experiment to test the impact and its internal mechanism of carbon risk on corporate bankruptcy pressure which based on DID mode. The results of this paper show that carbon risk can reduce the pressure on enterprises to go bankrupt and high-carbon enterprises reduce their bankruptcy pressure more significantly than the low-carbon enterprises. Furthermore, enterprises primarily mitigate their bankruptcy pressure by engaging in green innovation and alleviating financing constraints, suggesting that both the willingness of enterprises to pursue green innovation and their readiness to disclose carbon risks are enhanced under the pressures associated with carbon risk. The above effect is especially significant for non-SOEs, small-scale enterprises, and companies located in higher competition intensity. Based on the above results, this paper puts forward the following policy recommendations:

Firstly, from a corporate perspective, enterprises should be encouraged to increase investment in R&D while embracing low-carbon technologies. Enterprises engaged in green technology development can effectively curtail carbon emissions, reduce operational costs, and prepare for potential carbon taxes or limitations in the future. Through technological innovation, businesses can also reconfigure their supply chains and foster the development of environmentally friendly products, bolstering their overall resilience and mitigating the impact of carbon risks on bankruptcy susceptibility.

Secondly, governments need to establish a comprehensive system to aid vulnerable enterprises in their green transition. At first, it is essential to establish a carbon risk assessment and monitoring system. Regular assessments and monitoring of carbon risks can help enterprises promptly detect and anticipate potential carbon risk issues, assisting them in formulating mitigation measures. Then the government should provide more carbon reduction technology support, financial subsidies, and tax incentives for small-scale enterprises and SOEs, thereby lowering their carbon reduction costs and risks and enhancing their motivation and capacity for carbon reduction.

Thirdly, carbon risk could effectively reduce the bankruptcy pressure of corporates, but it still needs a system of fund guarantee to ensure the success of corporate low-carbon transitions. The government should institute a carbon financial support program that offers low-interest loans and financing guarantees or subsidies to facilitate carbon reduction investments by enterprises. It can also create or strengthen carbon markets, enabling companies to reduce carbon emissions in cost-effective ways through carbon emission trading, thereby providing additional economic incentives to alleviate funding shortages.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JL: Writing–original draft, Writing–review and editing. ZL: Conceptualization, Data curation, Methodology, Validation, Writing–original draft. TL: Conceptualization, Methodology, Writing–review and editing. YG: Methodology, Visualization, Writing–original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was supported by the National Social Science Foundation (Nos. 21CJY014).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The reviewer AZ declared a shared affiliation with the author YG to the handling editor at the time of review.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Almamy, J., Aston, J., and Ngwa, L. N. (2016). An evaluation of Altman’s Z-score using cash flow ratio to predict corporate failure amid the recent financial crisis: evidence from the UK. J. Corp. Finance 36, 278–285. doi:10.1016/j.jcorpfin.2015.12.009

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. finance 23 (4), 589–609. doi:10.2307/2978933

Ambec, S., and Barla, P. (2006). Can environmental regulations be good for business? An assessment of the Porter hypothesis. Energy Stud. Rev. 14 (2). doi:10.15173/esr.v14i2.493

Anastasiou, D., Ballis, A., Kallandranis, C., and Lakhal, F. (2024). Analyzing the effects of climate risk on discouraged borrowers: deciphering the contradictory forces. Risk Anal. doi:10.1111/risa.15071

Aziz, S., Rahman, M., Hussain, D., and Nguyen, D. K. (2021). Does corporate environmentalism affect corporate insolvency risk? The role of market power and competitive intensity. Ecol. Econ. 189, 107182. doi:10.1016/j.ecolecon.2021.107182

Bai, Q., and Tian, S. (2020). Innovate or die: Corporate innovation and bankruptcy forecasts. J. Empir. Finance 59, 88–108. doi:10.1016/j.jempfin.2020.09.002

Bednar, M. K. (2012). Watchdog or lapdog? A behavioral view of the media as a corporate governance mechanism. Acad. Manag. J. 55 (1), 131–150. doi:10.5465/amj.2009.0862

Bi, C., Jin, S., Li, S., and Li, Y. (2023). Can green advertising increase consumers' purchase intention of electric vehicles? An experimental study from China. J. Clean. Prod. 419, 138260. doi:10.1016/j.jclepro.2023.138260

Bolton, P., and Kacperczyk, M. (2021). Do investors care about carbon risk? J. financial Econ. 142 (2), 517–549. doi:10.1016/j.jfineco.2021.05.008

Bose, S., Minnick, K., and Shams, S. (2021). Does carbon risk matter for corporate acquisition decisions? J. Corp. Finance 70, 102058. doi:10.1016/j.jcorpfin.2021.102058

Bradshaw, M., Liao, G., and Ma, M. S. (2019). Agency costs and tax planning when the government is a major shareholder. J. Account. Econ. 67 (2-3), 255–277. doi:10.1016/j.jacceco.2018.10.002

Chava, S. (2014). Environmental externalities and cost of capital. Manag. Sci. 60 (9), 2223–2247. doi:10.1287/mnsc.2013.1863

Chen, J., Geng, Y., and Liu, R. (2023). Carbon emissions trading and corporate green investment: the perspective of external pressure and internal incentive. Bus. Strategy Environ. 32 (6), 3014–3026. doi:10.1002/bse.3284

Chen, X., Xu, L., and Wen, F. (2023). Attention to climate change and downside risk: evidence from China. Risk Anal. 43 (5), 1011–1031. doi:10.1111/risa.13975

Cheng, B., Ma, Y., and Lu, S. (2024). Carbon emission risk and corporate employment creation: evidence from a quasi-natural experiment based on the Paris Agreement. Manag. Decis. Econ. 45 (2), 685–701. doi:10.1002/mde.4034

Cho, E., Okafor, C., Ujah, N., and Zhang, L. (2021). Executives’ gender-diversity, education, and firm’s bankruptcy risk: evidence from China. J. Behav. Exp. Finance 30, 100500. doi:10.1016/j.jbef.2021.100500

Deng, W., Zhang, Z., and Guo, B. (2024). Firm-level carbon risk awareness and Green transformation: a research on the motivation and consequences from government regulation and regional development perspective. Int. Rev. Financial Analysis 91, 103026. doi:10.1016/j.irfa.2023.103026

Dewaelheyns, N., Schoubben, F., Struyfs, K., and Van Hulle, C. (2023). The influence of carbon risk on firm value: evidence from the European Union Emission Trading Scheme. J. Environ. Manag. 344, 118293. doi:10.1016/j.jenvman.2023.118293

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Acad. Manag. Rev. 20 (1), 65–91. doi:10.2307/258887

Drysdale, K. M., and Hendricks, N. P. (2018). Adaptation to an irrigation water restriction imposed through local governance. J. Environ. Econ. Manag. 91, 150–165. doi:10.1016/j.jeem.2018.08.002

Dumrose, M., and Höck, A. (2023). Corporate carbon-risk and credit-risk: the impact of carbon-risk exposure and management on credit spreads in different regulatory environments. Finance Res. Lett. 51, 103414. doi:10.1016/j.frl.2022.103414

Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financial Econ. 101 (3), 621–640. doi:10.1016/j.jfineco.2011.03.021

Gangi, F., Daniele, L. M., and Varrone, N. (2020). How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus. Strategy Environ. 29 (5), 1975–1991. doi:10.1002/bse.2482

Giglio, S., Maggiori, M., Rao, K., Stroebel, J., and Weber, A. (2021). Climate change and long-run discount rates: evidence from real estate. Rev. Financial Stud. 34 (8), 3527–3571. doi:10.1093/rfs/hhab032

Gong, N., and Grundy, B. D. (2019). Can socially responsible firms survive competition? An analysis of corporate employee matching grant schemes. Rev. Finance 23 (1), 199–243. doi:10.1093/rof/rfx025

Görgen, M., Jacob, A., Nerlinger, M., Riordan, R., Rohleder, M., and Wilkens, M. (2020). Carbon risk. SSRN 2930897.

Greenstone, M., List, J. A., and Syverson, C. (2012). The effects of environmental regulation on the competitiveness of US manufacturing (No. w18392). Cambridge, MA: National Bureau of Economic Research.

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. financial Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hartmann, P., Apaolaza Ibáñez, V., and Forcada Sainz, F. J. (2005). Green branding effects on attitude: functional versus emotional positioning strategies. Mark. Intell. and Plan. 23 (1), 9–29. doi:10.1108/02634500510577447

Haushalter, D., Klasa, S., and Maxwell, W. F. (2007). The influence of product market dynamics on a firm's cash holdings and hedging behavior. J. financial Econ. 84 (3), 797–825. doi:10.1016/j.jfineco.2006.05.007

He, F., Yan, Y., Hao, J., and Wu, J. G. (2022). Retail investor attention and corporate green innovation: evidence from China. Energy Econ. 115, 106308. doi:10.1016/j.eneco.2022.106308

Hoffmann, V. H., and Busch, T. (2008). Corporate carbon performance indicators: carbon intensity, dependency, exposure, and risk. J. Industrial Ecol. 12 (4), 505–520. doi:10.1111/j.1530-9290.2008.00066.x

Ilhan, E., Sautner, Z., and Vilkov, G. (2021). Carbon tail risk. Rev. Financial Stud. 34 (3), 1540–1571. doi:10.1093/rfs/hhaa071

Ji, Y., Shi, L., and Zhang, S. (2022). Digital finance and corporate bankruptcy risk: evidence from China. Pacific-Basin Finance J. 72, 101731. doi:10.1016/j.pacfin.2022.101731

Jia, J., He, X., Zhu, T., and Zhang, E. (2023). Does green finance reform promote corporate green innovation? Evidence from China. Pacific-Basin Finance J. 82, 102165. doi:10.1016/j.pacfin.2023.102165

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Ind. Econ. 5, 100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

Jung, J., Herbohn, K., and Clarkson, P. (2018). Carbon risk, carbon risk awareness and the cost of debt financing. J. Bus. ethics 150, 1151–1171. doi:10.1007/s10551-016-3207-6

Labatt, S., and White, R. R. (2011). Carbon finance: the financial implications of climate change. John Wiley and Sons.

Lanjouw, J. O., and Mody, A. (1996). Innovation and the international diffusion of environmentally responsive technology. Res. policy 25 (4), 549–571. doi:10.1016/0048-7333(95)00853-5

Li, Y. (2014). Environmental innovation practices and performance: moderating effect of resource commitment. J. Clean. Prod. 66, 450–458. doi:10.1016/j.jclepro.2013.11.044

Liu, J.-Yu, Xia, Y., Fan, Y., Lin, S. M., and Wu, J. (2017). Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 163, 293–302. doi:10.1016/j.jclepro.2015.10.111

Liu, Y., Wang, A., and Wu, Y. (2021). Environmental regulation and green innovation: evidence from China’s new environmental protection law. J. Clean. Prod. 297, 126698. doi:10.1016/j.jclepro.2021.126698

Luo, G., Guo, J., Yang, F., and Wang, C. (2023). Environmental regulation, green innovation and high-quality development of enterprise: evidence from China. J. Clean. Prod. 418, 138112. doi:10.1016/j.jclepro.2023.138112

McGahan, A. M., and Silverman, B. S. (2006). Profiting from technological innovation by others: the effect of competitor patenting on firm value. Res. Policy 35 (8), 1222–1242. doi:10.1016/j.respol.2006.09.006

Michalakelis, C., Varoutas, D., and Sphicopoulos, T. (2010). Innovation diffusion with generation substitution effects. Technol. Forecast. Soc. Change 77 (4), 541–557. doi:10.1016/j.techfore.2009.11.001

Millimet, D. L., Roy, S., and Sengupta, A. (2009). Environmental regulations and economic activity: influence on market structure. Annu. Rev. Resour. Econ. 1 (1), 99–118. doi:10.1146/annurev.resource.050708.144100

Muhmad, S. N., Ariff, A. M., Majid, N. A., and Kamarudin, K. A. (2021). Product market competition, corporate governance and esg. Asian Acad. Manag. J. Account. and Finance 17 (1), 63–91. doi:10.21315/aamjaf2021.17.1.3

Nguyen, J. H., and Phan, H. V. (2020). Carbon risk and corporate capital structure. J. Corp. Finance 64, 101713. doi:10.1016/j.jcorpfin.2020.101713

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 18, 109–131. doi:10.2307/2490395

Olsen, M. C., Slotegraaf, R. J., and Chandukala, S. R. (2014). Green claims and message frames: how green new products change brand attitude. J. Mark. 78 (5), 119–137. doi:10.1509/jm.13.0387

Pang, J., Liu, Z., Hou, W., and Tao, Y. (2023). How does the Paris Agreement affect firm productivity? International evidence. Finance Res. Lett. 56, 104150. doi:10.1016/j.frl.2023.104150

Pástor, Ľ., Stambaugh, R. F., and Taylor, L. A. (2021). Sustainable investing in equilibrium. J. financial Econ. 142 (2), 550–571. doi:10.1016/j.jfineco.2020.12.011

Porter, M. (1996). America’s green strategy. Bus. Environ. a Read. 33, 1072. doi:10.1038/scientificamerican0491-168

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qin, Y., Nguyen, D. K., Cifuentes-Faura, J., and Zhong, K. (2023). Strong financial regulation and corporate bankruptcy risk in China. Finance Res. Lett. 58, 104343. doi:10.1016/j.frl.2023.104343

Riedl, A., and Smeets, P. (2017). Why do investors hold socially responsible mutual funds? J. Finance 72 (6), 2505–2550. doi:10.1111/jofi.12547

Rogers, M. (2004). Networks, firm size and innovation. Small Bus. Econ. 22, 141–153. doi:10.1023/b:sbej.0000014451.99047.69

Shu, H., Tan, W., and Wei, P. (2023). Carbon policy risk and corporate capital structure decision. Int. Rev. Financial Analysis 86, 102523. doi:10.1016/j.irfa.2023.102523

Siedschlag, I., and Yan, W. (2021). Firms’ green investments: what factors matter? J. Clean. Prod. 310, 127554. doi:10.1016/j.jclepro.2021.127554

Simonen, J., and McCann, P. (2008). Innovation, R&D cooperation and labor recruitment: evidence from Finland. Small Bus. Econ. 31, 181–194. doi:10.1007/s11187-007-9089-3

Stamolampros, P., and Symitsi, E. (2022). Employee treatment, financial leverage, and bankruptcy risk: evidence from high contact services. Int. J. Hosp. Manag. 105, 103268. doi:10.1016/j.ijhm.2022.103268

Subramaniam, N., Wahyuni, D., Cooper, B. J., Leung, P., and Wines, G. (2015). Integration of carbon risks and opportunities in enterprise risk management systems: evidence from Australian firms. J. Clean. Prod. 96, 407–417. doi:10.1016/j.jclepro.2014.02.013

Tang, G. P., and Li, L. H. (2013). Ownership structure, property right nature and corporate environmental investment—empirical evidence from China’s A-share listed companies. Res. Financial Econ. Issues 3, 93–100. doi:10.19654/j.cnki.cjwtyj.2013.03.014

Tian, J. F., Pan, C., Xue, R., Yang, X. T., Wang, C., Ji, X. Z., et al. (2020). Corporate innovation and environmental investment: the moderating role of institutional environment. Adv. Clim. Change Res. 11 (2), 85–91. doi:10.1016/j.accre.2020.05.003

Wakasugi, R., and Koyata, F. (1997). R&D, firm size and innovation outputs: are Japanese firms efficient in product development? J. Prod. Innovation Manag. 14 (5), 383–392. doi:10.1111/1540-5885.1450383

Wang, E., Liu, X., Wu, J., and Cai, D. (2019). Green credit, debt maturity, and corporate investment—evidence from China. Sustainability 11 (3), 583. doi:10.3390/su11030583

Wang, J., Ma, M., Dong, T., and Zhang, Z. (2023). Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao Green Finance's ESG ratings. Int. Rev. Financial Analysis 87, 102623. doi:10.1016/j.irfa.2023.102623

Wang, J., and Sun, M. (2021). The mystery of Porter’s hypothesis in green development and governance transition: evidence of corporate deleveraging under carbon risk. Econ. Manag. doi:10.19616/j.cnki.bmj.2021.12.003

Weerawardena, J., O'Cass, A., and Julian, C. (2006). Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. J. Bus. Res. 59 (1), 37–45. doi:10.1016/j.jbusres.2005.02.004

Wu, R., and Lin, B. (2022). Environmental regulation and its influence on energy-environmental performance: evidence on the Porter Hypothesis from China's iron and steel industry. Resour. Conservation Recycl. 176, 105954. doi:10.1016/j.resconrec.2021.105954

Zhang, D., and Du, P. (2020). How China “Going green” impacts corporate performance? J. Clean. Prod. 258, 120604. doi:10.1016/j.jclepro.2020.120604

Keywords: Paris climate agreement, carbon risk, bankruptcy pressure, financial constraints, green innovation

Citation: Liu J, Liao Z, Liu T and Geng Y (2025) Carbon risk and corporate bankruptcy pressure: evidence from a quasi-natural experiment based on the Paris agreement. Front. Environ. Sci. 13:1537570. doi: 10.3389/fenvs.2025.1537570

Received: 02 December 2024; Accepted: 07 January 2025;

Published: 27 January 2025.

Edited by:

Wu Chen, University of Southern Denmark, DenmarkCopyright © 2025 Liu, Liao, Liu and Geng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tianqi Liu, bGl1dGlhbnFpQHhuYWkuZWR1LmNu

Jingxing Liu

Jingxing Liu Zihang Liao1

Zihang Liao1 Tianqi Liu

Tianqi Liu