- School of Business, The George Washington University, Washington, DC, United States

Introduction: Corporate ESG (Environmental, Social, and Governance) performance has become a key factor in achieving sustainable and healthy development, as well as enhancing financial performance. This study examines the impact of corporate ESG performance on financial performance in the Chinese market, providing empirical evidence for its influence and implications.

Methods: Using panel data from Chinese A-share listed companies on the Shanghai and Shenzhen stock exchanges from 2009 to 2022, this study employs econometric models to analyze the relationship between ESG performance and financial performance. Endogeneity and robustness tests are conducted to ensure result reliability. Additionally, moderating effects and heterogeneity analyses are performed to explore influencing factors.

Results: The findings indicate that corporate ESG performance significantly enhances financial performance. This conclusion holds after accounting for endogeneity and robustness tests. Further analysis reveals that financing constraints positively moderate the ESG-financial performance relationship, whereas corporate innovation focus has a negative moderating effect. Heterogeneity analysis shows that the positive impact of ESG performance is more pronounced in enterprises located in eastern regions, state-owned enterprises, and high-pollution industries.

Discussion: This study provides empirical evidence from China, demonstrating the critical role of ESG in corporate financial performance. The results offer valuable insights for policymakers, investors, and corporate managers aiming to promote sustainable development and optimize investment strategies.

1 Introduction

Amidst the escalating challenges of global climate change and environmental crises, sustainable development has emerged as a global consensus. Governments worldwide, international organizations, and various sectors of society have increasingly focused on environmental protection, social responsibility, and corporate governance (collectively known as ESG). The ESG ethos is progressively integrated into corporate strategic planning and investment decisions. As the world’s second-largest economy, China has actively responded to the global call for sustainable development, advancing the construction of an ecological civilization and intensifying the requirements for corporate ESG disclosure. In recent years, regulatory bodies such as the China Securities Regulatory Commission and the Ministry of Environmental Protection have introduced a series of policies to encourage and mandate the disclosure of ESG-related information by listed companies, thereby enhancing market transparency and directing capital toward more environmentally friendly and sustainable enterprises (Li et al., 2021). Against this backdrop, a company’s ESG performance has become a significant measure of its social responsibility and an indispensable factor for investors when assessing corporate value and making investment decisions. Consequently, an in-depth exploration of the impact of corporate ESG performance on financial outcomes is of paramount importance for fostering high-quality economic development in China and achieving a harmonious coexistence of economic and environmental interests (Tsang et al., 2023).

Corporate financial performance, a pivotal metric for gauging operational outcomes and market competitiveness, has consistently been a focal point of research within the realms of management and economics (Griffin and Mahon, 1997). Extant literature indicates that corporate financial performance is influenced by a multitude of factors, including but not limited to corporate governance structures, market strategies, technological innovation, and external environments. However, despite the widespread dissemination of the ESG concept globally, research on how corporate ESG performance specifically impacts financial performance is relatively scarce (Soana, 2011). Particularly in a rapidly developing market like China, where policy orientation is pronounced, the intrinsic connections and mechanisms of action between corporate ESG performance and financial performance remain to be thoroughly investigated (Choi et al., 2010). In light of this, the present study aims to bridge this research gap by conducting empirical analysis to elucidate the direct impact of corporate ESG performance on financial performance, thereby providing robust evidence for both the academic and practical communities.

Utilizing data from listed companies on the Shanghai and Shenzhen stock exchanges from 2009 to 2021, this study employs a fixed-effects model to systematically investigate the impact of corporate ESG performance on financial performance. The findings reveal: (1) Enhancements in corporate ESG performance significantly bolster financial performance, a conclusion that holds true after robustness checks and endogeneity considerations, indicating that investments in green initiatives yield stable financial returns, providing economic incentives for sustainable development strategies. (2) Financial constraints negatively moderate the relationship between corporate ESG performance and financial performance, while a focus on innovation plays a positive moderating role, suggesting that improving the financing environment and enhancing innovative awareness can strengthen the positive impact of ESG performance on financial performance. (3) Heterogeneity analysis discloses that the positive influence of ESG performance on corporate financial performance is particularly pronounced among enterprises in the eastern regions, state-owned enterprises, and high-pollution industries, highlighting the significant moderating effects of geographical location, property rights, and industry characteristics on corporate ESG effects.

The innovation of this paper is primarily reflected in the following three aspects: Firstly, this paper integrates corporate ESG performance and financial performance within a unified analytical framework, providing systematic evidence to support a deeper understanding of how corporate ESG actions translate into financial outcomes. Unlike previous studies that focused on the enabling mechanisms of ESG performance or its singular impact on corporate performance (Elamer and Boulhaga, 2024), efficiency (Bilyay-Erdogan et al., 2024), division of labor (Su and Xue, 2024), and innovation (Cabaleiro-Cerviñ and Mendi, 2024), this paper adopts a sustainable development perspective, comprehensively dissecting the complex mechanisms through which ESG influences financial performance, thereby opening a new vantage point for assessing the economic effects of corporate ESG practices. Secondly, this paper meticulously examines the heterogeneous impact of ESG performance on financial performance across multiple dimensions, including corporate geographical location, property rights, and industry characteristics. This not only enriches empirical evidence on the variability of ESG effects but also provides empirical support for governments to formulate differentiated ESG governance policies based on distinct corporate characteristics, enhancing the effectiveness and targeting of policies. Thirdly, this paper innovatively introduces corporate financing environment and innovation focus as moderating variables. Based on information asymmetry theory (Bergh et al., 2019), signaling theory (Connelly et al., 2011), and Schumpeterian innovation theory (Dabic et al., 2011), it deeply analyzes how they affect the relationship between ESG performance and financial performance, expanding the boundary conditions of research on the relationship between ESG and corporate financial performance, and offering specific pathways and recommendations for optimizing corporate ESG practices and enhancing their financial incentive effects. These findings not only deepen our understanding of the interactive mechanisms between ESG and corporate financial performance but also provide new directions and methodological insights for future research.

2 Literature review

As global attention to sustainable development and corporate social responsibility intensifies, corporate ESG has emerged as a crucial metric for assessing comprehensive corporate performance. In terms of the correlation between ESG performance and corporate value and profitability, numerous studies have indicated a significant positive relationship. Aydoğmuş et al. (2022) found that overall ESG composite scores are positively correlated with corporate value, with social and governance scores showing significant positive correlations, while environmental scores did not exhibit a significant relationship. However, in terms of profitability, both the composite ESG score and the scores for environment, social, and governance are significantly positively correlated with corporate profitability, suggesting that companies with high ESG performance can achieve higher financial returns. Additionally, Chen et al. (2023) confirmed the positive correlation between ESG performance and corporate financial performance, particularly under high-risk scenarios, where the positive impact of ESG ratings on corporate financial performance is more pronounced. ESG performance not only affects internal financial performance but also has a profound impact on market performance. Zhou et al. (2022), through empirical analysis, found that an increase in the ESG performance of listed companies can enhance their market value, with the company’s financial performance demonstrating a significant mediating effect in this relationship. This finding indicates that ESG performance not only directly increases corporate value but also indirectly strengthens market performance by improving financial performance. Broadstock et al. (2021) further revealed the unique role of ESG performance during financial crises. They found that high ESG portfolios typically outperform low ESG portfolios during financial crises, and ESG performance helps mitigate financial risks. In the context of digital transformation, ESG performance has also shown new trends. Fang et al. (2023) demonstrated that corporate digitalization can significantly enhance ESG scores, particularly for non-politically connected companies and those located in regions with high-quality institutional environments, where this positive effect is more pronounced. Lu et al. (2024) also confirmed the promoting effect of digital transformation on ESG performance and revealed the key roles of internal control and green innovation in this process.

In the realm of corporate financial performance, a multitude of scholars have delved into the multifaceted factors influencing it from various perspectives, providing a wealth of theoretical underpinnings for corporate management and strategic formulation. Regarding corporate operations and management, effective managerial practices are deemed crucial for enhancing financial performance. Kober et al. (2012) discovered that while Total Quality Management (TQM) practices widely adopted in large enterprises did not significantly improve the financial performance of small and medium-sized enterprises (SMEs), this conclusion highlights the differential applicability of management practices across enterprises of different scales. Ma et al. (2019), by constructing fractional-order differential equation models, analyzed the impact of corporate management team characteristics—such as age, international experience, and educational level—on financial performance, underscoring the importance of management team heterogeneity. Furthermore, He et al. (2021), in their study of China’s electricity and gas industries, found no significant financial performance differences between state-owned and private enterprises, challenging the traditional bias towards state-owned enterprise performance. Technological innovation, as a driving force for corporate sustainability, has been widely validated for its positive impact on financial performance. Ji et al. (2020), in their study of Chinese listed companies, found that Information Technology (IT) investment, especially innovative IT investment, although not showing significant advantages over non-innovative investment in some financial indicators, can overall enhance corporate profitability. Similarly, Ren and Li (2022), in their study of renewable energy enterprises, pointed out that digital transformation significantly improves corporate financial performance by promoting green technological innovation. The external environment of enterprises, including market structure and policy orientation, also profoundly affects financial performance. Töyli et al. (2008), in their study of Finnish SMEs, showed that while the direct link between logistics performance and financial performance is not apparent, improving logistics performance could become an effective way for enterprises to gain competitive advantage. Wu and Huang (2022), focusing on Chinese new energy enterprises, found that digital finance can alleviate corporate financing constraints, thereby enhancing financial performance, with effects being more pronounced in SMEs and non-state-owned enterprises. Moreover, while pursuing economic benefits, enterprises must also consider social responsibility and sustainable development. Bartolacci et al. (2020), through a literature review, revealed research themes in SMEs regarding sustainability, innovation, entrepreneurship, corporate social responsibility, and green management, emphasizing the potential impact of these factors on financial performance. Boakye et al. (2020), in their study of UK SMEs, found a non-linear relationship between sustainable environmental practices and financial performance, suggesting that enterprises need to invest moderately in environmentally friendly practices to maximize financial returns.

In summary, research on corporate ESG performance and financial performance has shown a trend towards diversification and depth. Current studies on ESG performance primarily focus on its impact on corporate value, profitability, market performance, and digital transformation. Regarding financial performance, existing research delves into its influencing factors from various dimensions, including corporate operations and management, technological innovation, external environment, and social responsibility. Studies generally agree that effective management practices, investment in technological innovation, a favorable external environment, and proactive fulfillment of social responsibilities can significantly enhance corporate financial performance. However, despite the considerable depth of research in the field of ESG performance, the discussion on the relationship between ESG performance and corporate financial performance in existing literature is relatively limited, lacking profound and systematic analysis. Particularly in the Chinese market, empirical studies on listed companies in the Shanghai and Shenzhen stock markets are insufficient, failing to fully reveal how ESG performance specifically affects corporate financial performance and the heterogeneity of this relationship under different circumstances. In light of this, based on data from listed companies in the Shanghai and Shenzhen stock markets from 2009 to 2021, a fixed-effects model is employed to systematically examine the impact of corporate ESG performance on financial performance. This paper not only analyzes the heterogeneous impact of ESG performance on financial performance from multiple perspectives such as corporate geographical location, property rights, and industry characteristics but also further explores the moderating roles of corporate financing environment and innovation focus in this relationship. This study not only fills the research gap in the relevant field but also provides a new perspective for understanding the ESG value creation process, which is of significant theoretical and practical importance for guiding corporate practices, optimizing resource allocation, and promoting sustainable development.

3 Theoretical analysis and research hypothesis

When examining the impact of ESG performance on the financial performance of listed companies on China’s Shanghai and Shenzhen stock exchanges, it is necessary to discuss it from the perspectives of environmental, social responsibility, and corporate governance. Firstly, from an environmental standpoint, according to stakeholder theory (Freeman and Evan, 1990), corporations that assume environmental and social responsibilities can convey signals of trustworthiness to stakeholders, thereby enhancing their willingness to cooperate and improving the efficiency with which they participate in value creation. For instance, companies that prioritize employee welfare, community relations, and supply chain management can garner consumer and public trust and support, translating into brand value and, consequently, enhancing corporate financial performance (Waddock and Graves, 1997). Secondly, from the perspective of social responsibility, the resource dependence theory (Singh et al., 2011) further posits that corporations that undertake environmental and social responsibilities can access key strategic resources, thereby forging their competitive edge. A strong ESG performance signifies that a company can fulfill its contracts with stakeholders effectively, thereby earning their trust and support and securing the resources and environment needed for sustainable development (Branco and Rodrigues, 2006). Thirdly, from the perspective of corporate governance, efficiency theory emphasizes that improvements in management capabilities and technological levels resulting from ESG performance are significant factors affecting corporate efficiency. Companies with high ESG standards tend to have stronger management capabilities, fewer agency issues, and more effective incentive and restraint mechanisms for executives, prompting executives to be more diligent and responsible, which in turn enhances corporate financial performance (Flammer, 2015). In summary, theoretical analysis suggests that corporate ESG performance can positively motivate corporate financial performance by strengthening stakeholder cooperation, securing key strategic resources, and enhancing management efficiency and technological proficiency. Therefore, we propose the fundamental research hypothesis H1 for this paper.

H1:. Corporate ESG performance can positively motivate corporate financial performance.

When examining the impact of Environmental, Social, and Governance (ESG) performance on corporate financial performance, the degree of corporate financing constraints serves as a pivotal moderating factor, the significance of which cannot be overlooked. According to signaling theory (Connelly et al., 2011), a corporation’s robust ESG performance can convey positive signals to the market, bolstering investor confidence and consumer loyalty, which may subsequently foster the enhancement of financial performance (Godfrey et al., 2009). However, when corporations confront financing constraints, their capital allocation decisions tend to be more circumspect, favoring the safeguarding of short-term financial objectives over long-term ESG investments (Myers and Majluf, 1984). This is because, although ESG investments contribute to constructing a corporation’s long-term competitive edge, their returns are typically delayed and cannot immediately alleviate the corporation’s capital constraints. Consequently, under tighter financing constraints, corporations may reduce ESG-related expenditures to maintain necessary liquidity, a move that will undoubtedly diminish the positive promotional effect of ESG performance on financial performance (Tan et al., 2024). In summary, the degree of corporate financing constraints plays a negative moderating role in the relationship between ESG performance and financial performance, such that the more severe the financing constraints, the more likely the positive impact of ESG performance on financial performance is to be attenuated. Based on the aforementioned analysis, this paper posits research hypothesis H2:

H2:. The degree of corporate financing constraints exerts a negative moderating effect on the relationship between ESG performance and corporate financial performance.

When examining the impact of ESG performance on corporate financial performance, the emphasis on corporate innovation as a significant moderating variable, its positive role should not be overlooked. According to stakeholder theory, a company’s fulfillment of ESG responsibilities is not only related to environmental and social welfare but also directly affects the company’s long-term competitiveness and financial performance. The emphasis on corporate innovation plays a crucial moderating effect in this process. Firstly, corporate innovation can drive the optimization of products and processes, enhance resource efficiency, and reduce production costs, thereby strengthening the company’s profitability. For instance, through green technological innovation, companies can develop more competitive products that meet consumer demand for environmentally friendly products while reducing environmental pollution (Ambec and Lanoie, 2008). Such innovative actions not only align with ESG criteria but also bring additional financial returns to the company. Secondly, corporate innovation helps to build technological barriers and form competitive advantages, further enhancing corporate financial performance. In a highly competitive market environment, companies that can innovate in environmental protection, social responsibility, or governance mechanisms are more likely to gain investor favor and consumer trust, thereby expanding market share and improving profitability (Friede et al., 2015). Additionally, corporate innovation can promote the improvement of internal governance, reduce management costs, and increase decision-making efficiency, all of which will have a positive impact on corporate financial performance. In summary, the emphasis on corporate innovation plays a positive moderating role in the relationship between ESG performance and corporate financial performance. Companies that highly value innovation while fulfilling ESG responsibilities are more likely to achieve synergistic optimization of environmental, social, and governance objectives, thereby enhancing corporate financial performance. Therefore, we propose research hypothesis H3:

H3:. The emphasis on corporate innovation has a positive moderating effect on the relationship between ESG performance and corporate financial performance.

4 Research design

4.1 Sample selection and data sources

The research topic of this paper is the impact of ESG evaluation on corporate green innovation, for the consideration of data availability and reasonableness, the data sources of this paper include CSMAR Cathay Pacific database, WIND database, and CNRDS database, and merge the CSI ESG evaluation database according to the stock code and year, and the research interval includes the samples of listed companies in Shanghai and Shenzhen from 2009 to 2021. The research interval includes the samples of listed companies in Shanghai and Shenzhen from 2009 to 2021. In order to avoid the influence of outliers or other factors, this paper shrinks the data by 1% and 99% and does the following screening process:

(1) Exclude data on stocks labeled as S, ST, and ST*. These markers represent firms facing delisting risk, and such firms usually have more abnormal volatility, so these samples lack typicality and are not suitable for analyzing general patterns.

(2) Stock samples with significant missing values were excluded. This is done to ensure the completeness and accuracy of the data; samples with more missing values may affect the accuracy and credibility of the analyzed results.

(3) Exclusion of financial industry stocks. Due to the special characteristics of the financial market, its earnings volatility is quite different from listed companies in other industries, so the sample of stocks in the financial industry will be excluded to ensure the comparability and accuracy of the study.

Through the above processing, this paper finally obtained a total of 21,430 researchable samples. In addition, the data processing and regression analysis of this paper use stata16 software.

4.2 Variable selection and modeling

4.2.1 Variable selection

4.2.1.1 Explanatory variables

This paper adopts the Huazheng ESG rating system, which is widely recognized in China, as the proxy for ESG sustainable investment in this paper, which classifies the assessed entities into nine grades of “AAA-C”. The Huazheng ESG rating system draws on the core concepts of international ESG and combines them with China’s information disclosure and corporate characteristics to build an evaluation framework that includes first-level pillar indicators, second-level subject indicators, third-level topic indicators, and fourth-level bottom-level indicators for environmental, social, and governance aspects. Among them, there are more than 300 underlying data indicators and intelligent algorithms are applied to calculate them. The final rating covers the total ESG score as well as the scores of the first-, second- and third-level indicators, which are all between 0 and 100, with higher scores implying better performance on the indicator.

Although Huazheng ESG scores are widely used, there is no official ESG rating standard set by the relevant regulatory authorities, so ESG scores are provided by third-party organizations with different standards. However, as the ESG evaluation index can represent the level of a company’s sustainable development input, the index is valued by many investors as well as business operators, and therefore it is equivalent to a kind of external governance mechanism that pushes companies to operate in a more standardized manner. Considering that the ESG scores of enterprises may have a certain reverse causality with their green innovation ability, which may lead to a certain endogeneity in the model of this paper, for the sake of robustness, this paper refers to the practice of in the following paper, using the ESG scores of listed companies for the first time by the Business Way to Unite Green as an exogenous shock, and utilizing double-difference method to conduct the robustness test.

4.2.1.2 Explained variables

This paper selects Return on Assets (ROA) as the dependent variable for measuring corporate financial performance, and compared to other common metrics such as Return on Equity (ROE), Return on Assets (ROA), and Earnings Per Share (EPS), ROA possesses unique strengths. Firstly, ROA takes into account the entirety of a company’s assets, not just shareholder equity, thus providing a more comprehensive reflection of the firm’s overall profitability and asset utilization efficiency. Secondly, ROA mitigates the impact of equity structure changes on ROE, enhancing the comparability among firms with different capital structures. Moreover, compared to ROE, ROA offers a more straightforward computational method, facilitating understanding and application. Lastly, while EPS can intuitively reflect the profit level of common stock, it is susceptible to changes in equity and does not account for the efficiency of the firm’s total asset utilization. In conclusion, ROA, as an indicator of corporate financial performance, exhibits comprehensiveness, comparability, and intuitiveness, making it more suitable for the research objectives of this paper.

4.2.1.3 Control variables

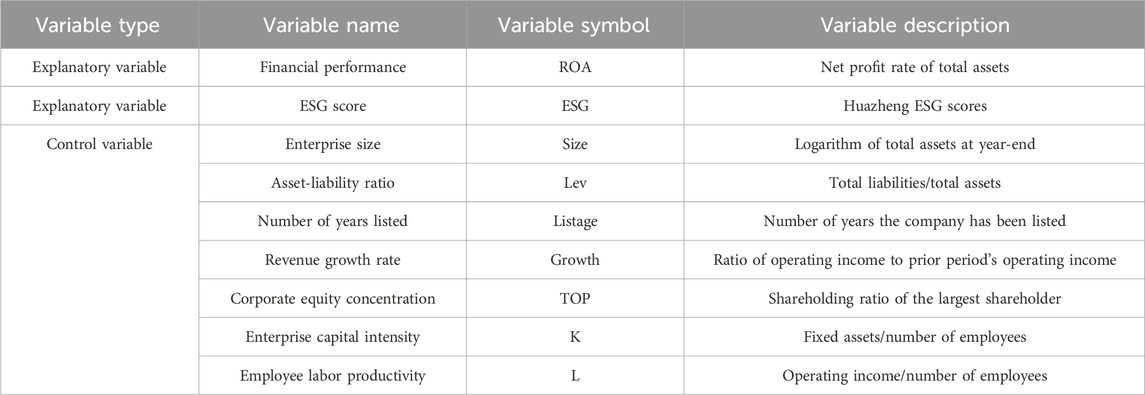

Regarding the selection of control variables, this paper draws on the study of and selects control variables related to the financial performance of the firm, including: firm size (Size); asset-liability ratio (Lev); number of years the company has been listed (ListAge); growth rate of the firm’s operating revenues (Growth); proportion of shares held by the first largest shareholder (Top1); capital density of the firm (K); and the firm’s labor productivity (L). The specific definitions of the variables are shown in Table 1. In order to make the data smoother and easier to be interpreted, all numerical variables are logarithmically manipulated in this paper.

4.2.2 Modeling

The subject of this paper is the impact of ESG evaluation on corporate financial performance, based on this reference to previous literature, in order to verify the hypothesis H1, this paper sets up the following econometric models. The following model controls for a suite of control variables that may influence corporate financial performance, as well as the impact of time and individual differences on corporate financial performance, effectively measuring the influence of corporate ESG performance on its financial outcomes. Its regression results can provide empirical evidence for the government to refine and optimize the ESG evaluation system and incentive mechanisms, and offer guidance for businesses to enhance their financial performance.

where

4.3 Descriptive statistics of variables

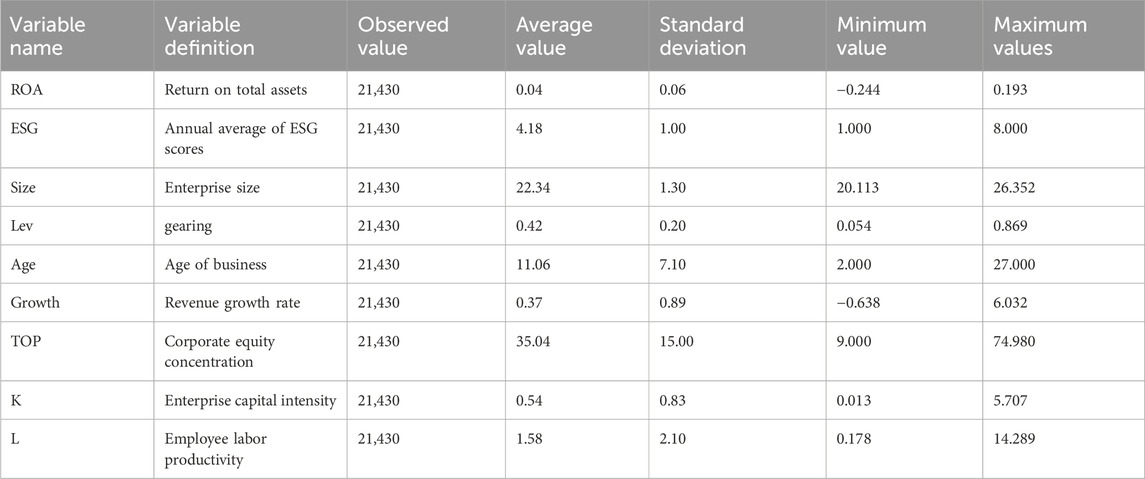

As can be seen from Table 2., the average value of return on total assets of Chinese listed companies is only 0.04, with a maximum of 0.193 and a minimum of −0.244, which indicates that the overall level of return on assets is low and varies considerably; the average ESG score is 4.18, with a maximum of 8, and the standard deviation is 1, which makes the overall level more concentrated.

From the control variables, the minimum value of enterprise size is 20.113, the maximum value is 26.352, and the standard deviation is 1.3, which shows that the distribution of enterprise size of Chinese listed companies is more concentrated. The minimum value of return on total assets is −0.244, the maximum value is 0.193, the mean value is 0.04, and the standard deviation is 0.06, which shows that there is a huge difference in return between different enterprises. It is also worth noting that the maximum value of enterprise capital density is 5.707, the minimum value is 0.013, and the difference is also large, and the average value of enterprise employee labor productivity is 1.58, and the standard deviation is 2.10, and the difference is also large.

4.4 Multicollinearity test

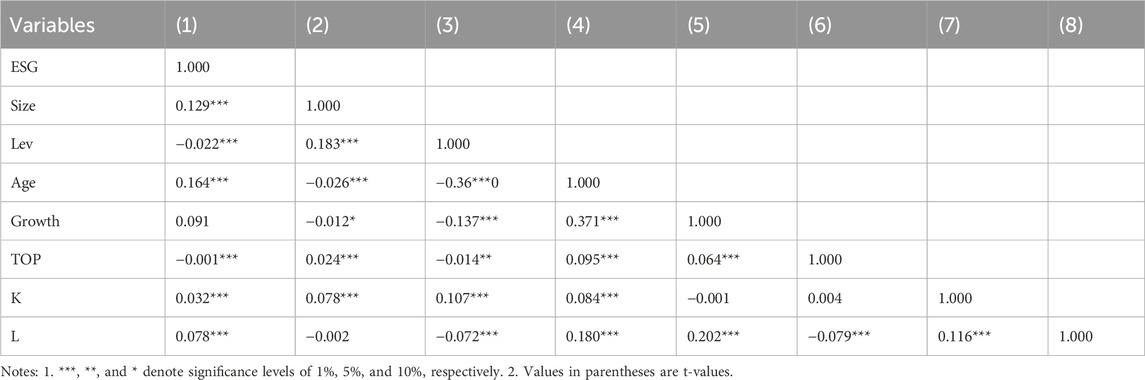

In order to assess the problem of multicollinearity between the explained variables, explanatory variables and control variables and its extent, this paper has conducted the correlation test analysis between the variables and the results are shown in Table 3. According to the correlation coefficient matrix, it is found that the correlation coefficients between the variables are small and it can be initially concluded that ESG evaluation positively affects corporate financial performance.

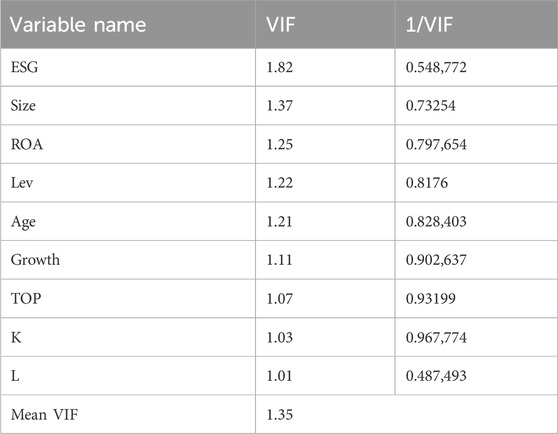

In order to exclude the effect of multicollinearity, this paper further conducted the vif test. As is shown in Table 4, the minimum value of variance expansion factor (VIF) of the explanatory variables is 1.01, the maximum value is 1.82, and the mean value is 1.35, which is much lower than the critical value of multicollinearity.10 Therefore, the multicollinearity between the variables is within the acceptable range, and further regression analyses can be carried out.

4.5 Model selection

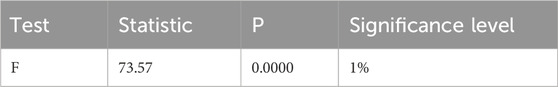

4.5.1 F-test

By performing an F-test as shown in Table 5., we find a p-value well below the commonly used significance level of 0.01. This result gives us good reason to reject the original hypothesis that there arve no individual effects in the model. It suggests that there may be unique individual characteristics of the individuals in the sample that are not adequately captured in the ordinary least squares (OLS) mixed regression model.

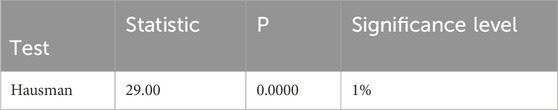

4.5.2 Hausman test

In addition, this paper also chose the Hausman test to determine whether fixed effects or random effects. As is shown in Table 6, the chi-square statistic of the test is 29.00, the p-value is less than 0.01, which significantly rejects the original hypothesis, so it can be concluded that the individual fixed effects are significantly better than the random effects model in this paper’s modeling design, and as a result, this paper chooses the fixed effects model.

5 Empirical results and analysis

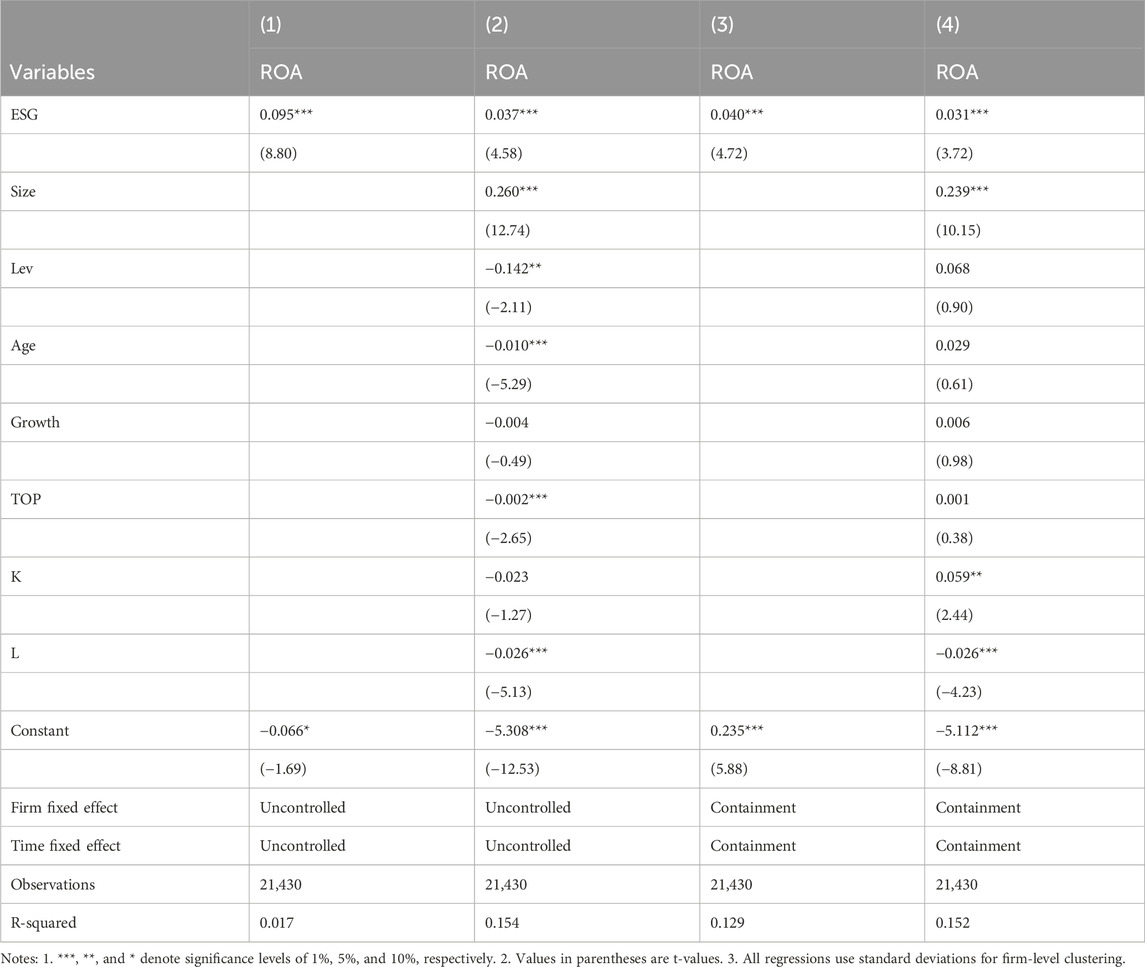

5.1 Benchmark regression

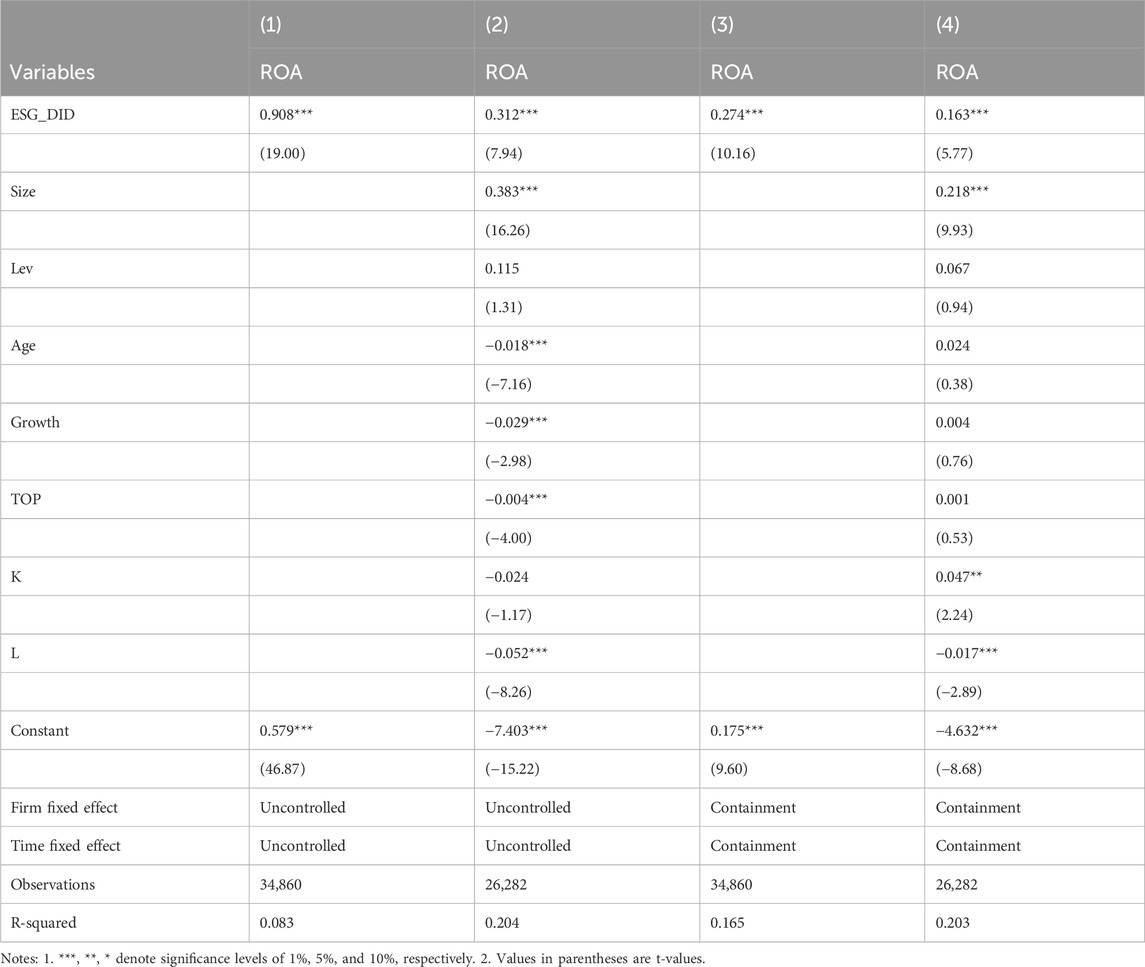

In order to further explore the role of ESG on financial performance, this regression analysis of data variables with reference to Equation 1 is presented in Table 7. Column (1) is a univariate regression of ESG evaluation on green innovation, and the result is positive and significant, indicating that there exists a significant positive relationship between the two, and it still holds after control variables are added in column (2). Column (3) adds fixed effects to column (1), and the coefficient of ESG evaluation is still positive and significant, indicating that the correlation between the two still holds after considering unobservable factors that change over time and region. The regression in column (4) adds both control variables and two-way fixed effects, and the coefficient of ESG evaluation level is 0.031 and significant at 1% confidence interval, which indicates that controlling for other factors unchanged, every 1% increase in the amount of ESG evaluation promotes an increase in the amount of corporate financial performance authorization by 0.031%. This suggests that the level of ESG evaluation positively influences the level of firms’ financial performance. Initially, it confirms the hypothesis of this paper. In order to further verify the hypotheses of this paper, the paper also does various robustness tests later on.

5.2 Robustness results

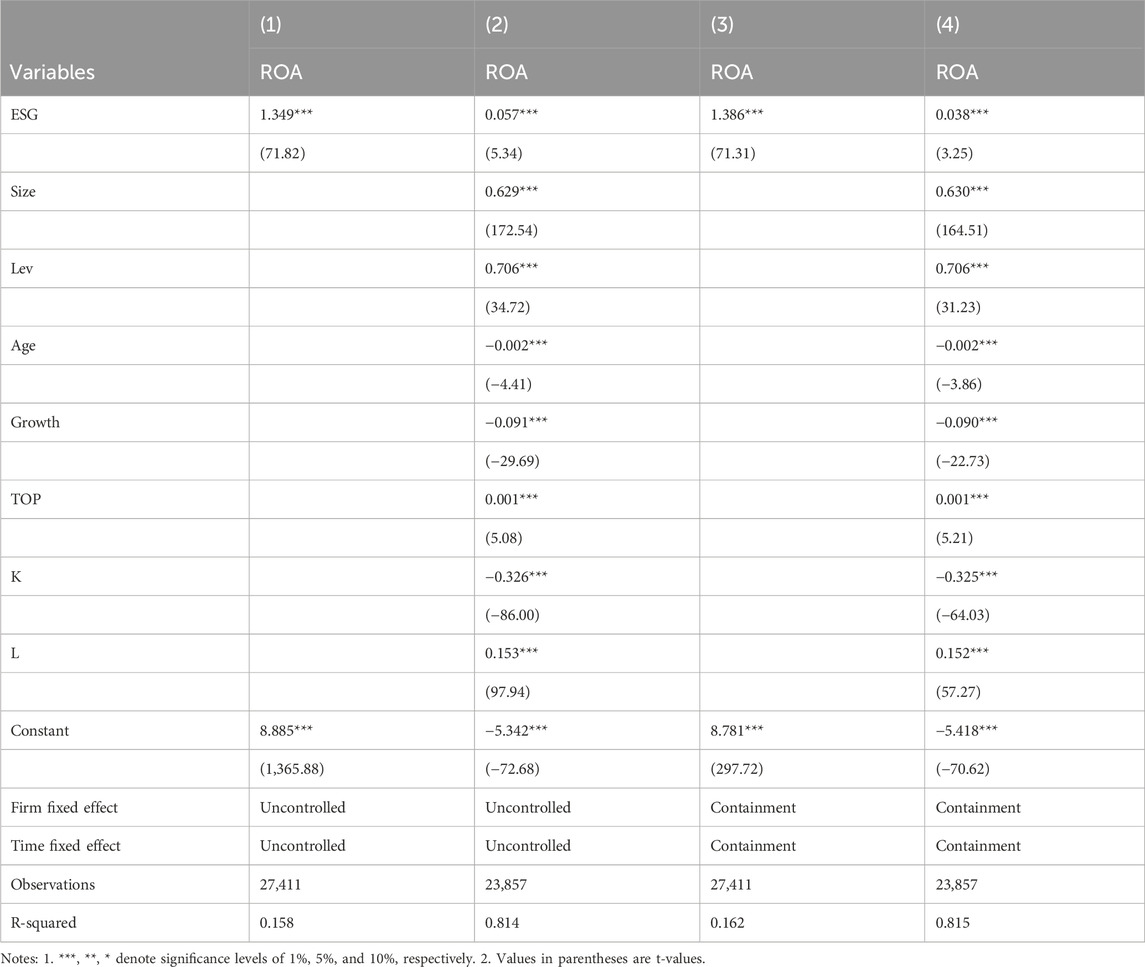

5.2.1 Replacement of explanatory variables

Enterprise financial performance refers to the transformation process of enterprises in the process of business management and development by adopting a series of environmental protection measures and strategies in order to reduce the negative impact on the environment, improve the efficiency of resource utilization, and achieve sustainable development. Since the enterprise green innovation variable only reflects the enterprise’s green innovation level, the measure of its transformation is still lacking, for this reason, this paper draws on the research of Wang et al. (2023) on the basis of the benchmark study to replace the green innovation level using the enterprise’s green total factor productivity, and for the sake of robustness, this paper calculates the total factor productivity by using the OP’s improved method, the LP method, which is brought into the original equation to conduct a regression. As is shown in Table 8, the result is still positive and significant, indicating that ESG evaluation significantly promotes the rise of enterprise green total factor productivity, which verifies the basic conclusion of this paper.

5.2.2 Substitution of explanatory variables

Considering that the enterprise’s ESG score itself may have a certain reverse causality with its green innovation capability, which may lead to a certain endogeneity in the model of this paper, for the sake of robustness, this paper refers to practice in this part, using the third-party organization’s first ESG score for each listed company as an exogenous shock, if the enterprise was announced ESG score in that year, the identifying variable ESG_DID is assigned a value of 1, and vice versa is 0. From this, a multi-temporal difference-in-difference method is constructed and used to conduct a robustness test. As is shown in Table 9, results are still significantly positive, indicating that ESG shocks have a strong positive impact on the financial performance of firms, and specifically, when the firm’s ESG scores are published in the market it usually leads to an increase in the firm’s financial performance by 0.163%.

5.2.3 Endogeneity test

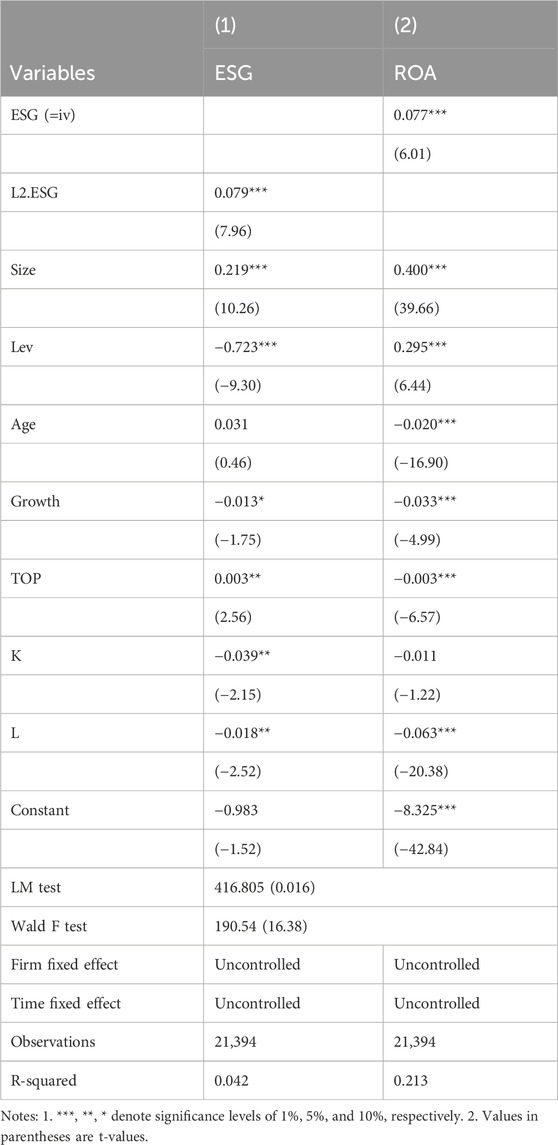

The endogeneity problem usually refers to the fact that the explanatory variables in the model are correlated with the error term, and this correlation can lead to bias and inconsistency in the parameters estimated by ordinary least squares (OLS). In this paper, we address the endogeneity problem by using explanatory variables lagged by two periods as instrumental variables based on previous literature (Angrist and Evans, 1998; Cools et al., 2017). From the perspective of exogeneity of instrumental variables, instrumental variables should only affect the dependent variable (corporate financial performance) through the endogenous explanatory variables (ESG evaluation index of the current period), i.e., the instrumental variables are not correlated with the error term of the model because the ESG evaluation index of the two lagged periods is correlated with that of the current period, which has little relationship with the corporate financial performance of the current period, and it does not significantly affect the current corporate financial performance situation, from which we can obtain consistent and unbiased estimation results.

Columns (1) and (2) of Table 10 show the instrumental variable regression results, column (1) shows the first stage regression results of the instrumental variables, the instrumental variables are regressed on the endogenous variables, the results are all positively correlated and significant at 1% confidence level, which indicates that the ESG evaluation level in the current period is developed from the lagged two-periods, which ensures that the instrumental variables are exogenous and at the same time also have a strong correlation. Column (2) presents the results of the second-stage regression of the instrumental variables, which show that after considering endogeneity, the conclusion that ESG evaluation promotes corporate financial performance still holds and is significant at the 1% confidence level, which further validates the accuracy of the benchmark regression in this paper. In addition, this paper takes into account the effect of heteroskedasticity and applies robust standard errors to the regression. For the test of under-identification of instrumental variables, the p-value of the LM statistic of Kleibergen-Paap rk is less than 0.01, which indicates that there is no under-identification of instrumental variables; for the test of weakly-identified instrumental variables, the Wald F statistic of Kleibergen-Paap rk is greater than the critical value of 16.38 at the Stock-Yogo weak identification test at the 10% level, indicating that there is no weak instrumental variable problem.

5.3 Moderator mechanism test

To ascertain the moderating effects of financial constraints and resource misallocation, this paper introduces the moderating variable M into model (1) to establish model (2), as illustrated below (Equation 2):

where

This paper incorporates two moderating variables. The first is the level of corporate financial constraints, measured using the FC index proposed by Hadlock and Pierce (2010), with FC values ranging from 0 to 1, indicating a more severe financial constraint issue as the value increases. The second is the level of corporate innovation focus, measured by taking the logarithm of the number of invention patent applications filed by the company in that year plus one, with a higher value indicating a greater focus on innovation.

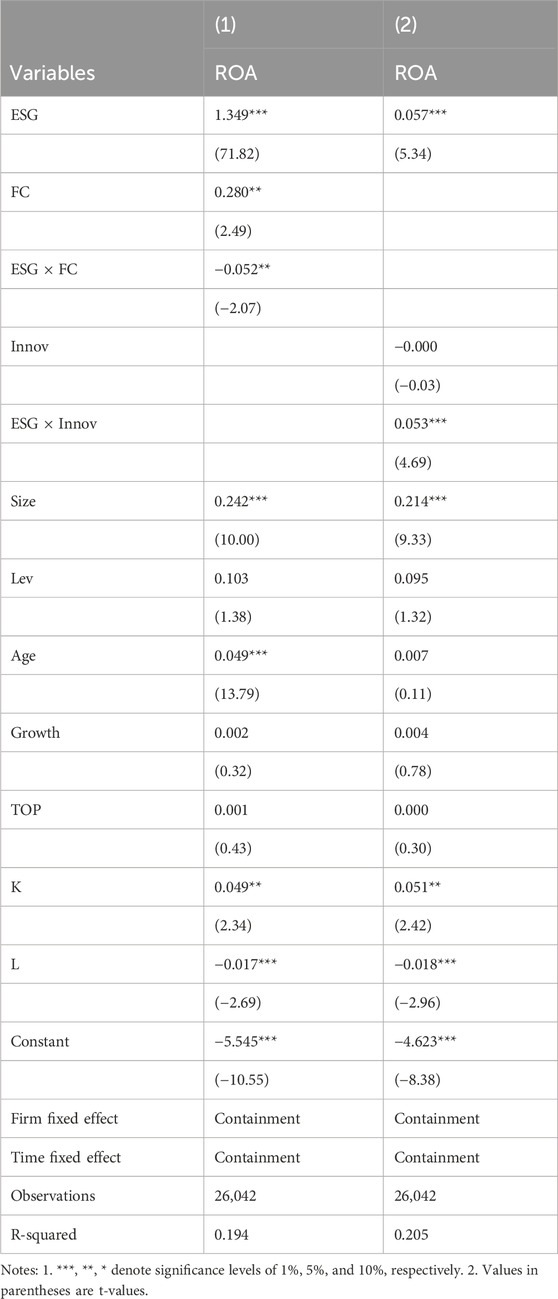

This paper considers the moderating role of financing constraints and innovation level in the impact of ESG evaluation on firms’ financial performance. As is shown in Table 11, column (1) represents the moderating role of financing constraints, and the coefficient of the interaction term (ESG × FC) is negative and significant, which suggests that financing constraints play a facilitating role in ESG evaluation in reducing the financial performance of firms. The possible reason is that when financing constraints are high, firms have greater financial constraints to carry out green innovation and may lack incentives for R&D, which leads to a partial suppression of the facilitating effect of ESG evaluation. Incorporating the aforementioned findings, the validation of Research Hypothesis H2 is confirmed.

As is shown in Table 11, column (2) represents the moderating effect of innovation level, and the interaction terms (ESG × Innov) are all positive and significant, indicating that innovation level plays a facilitating role in the impact of ESG evaluation on firms’ financial performance. The possible reason is that when the degree of innovation level is high, firms have a stronger level of technology, which can improve the overall operational efficiency of the firm and thus increase profitability. In addition, enterprises with higher innovation ability are more likely to obtain recognition and financial support from investors and reduce the cost of capital, thus further promoting the positive contribution of ESG to financial performance. Incorporating the aforementioned findings, the validation of Research Hypothesis H3 is confirmed.

5.4 Heterogeneity analysis

5.4.1 Regional heterogeneity

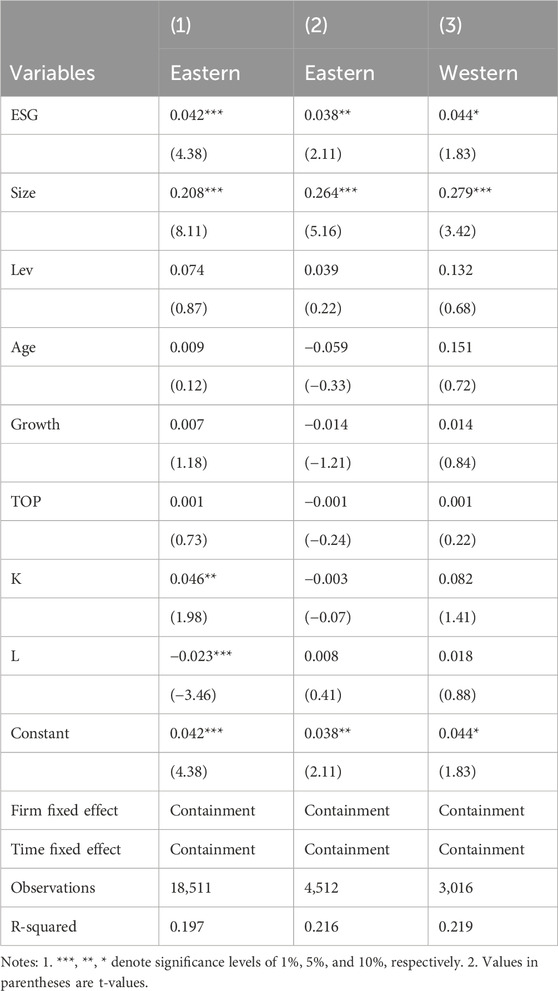

Considering the large differences in economic development between the eastern, central and western regions of China, this paper refers to the previous literature to distinguish the sample into eastern, central and western enterprises. As is shown in Table 12, the results show that ESG evaluation effectively promotes the financial performance of enterprises only in the eastern and central regions, and the effect of the eastern region is the most obvious. ESG’s role in the promotion of financial performance demonstrates obvious regional differences. The possible reason is that the market is more developed and information transparency is higher in the eastern and central regions, and the effect of ESG on the market is more obvious. In addition, from the perspective of human resources, there are more colleges and universities in the east and central regions, which have more high-quality talents and technical talents, and there is a relative lack of such talents in the west, while the financial performance of enterprises often requires more specialized talents, which may lead to the effect of financial performance of enterprises in the west is not obvious.

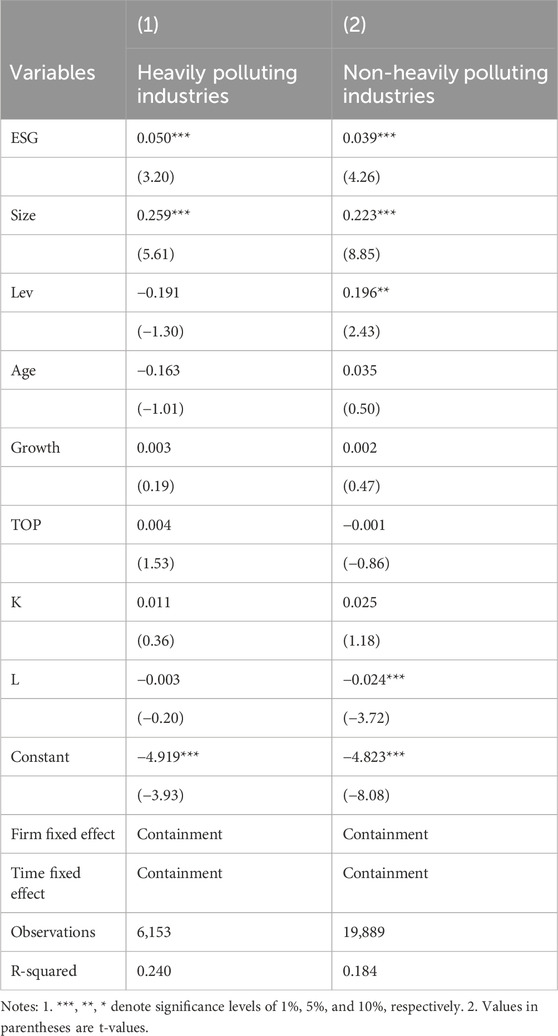

5.4.2 Industry heterogeneity

Considering that the difficulty and effect of financial performance in the heavy pollution industry is not the same as in other industries, and that the heavy pollution industry is the focus of attention in the field of sustainable development, in order to explore the heterogeneity of ESG evaluation for the industry, this paper refers to the previous literature to divide all the samples into the heavy pollution industry and the non-heavy pollution industry in this part. As is shown in Table 13, the results show that the ESG evaluation can promote the financial performance of the heavy pollution and non-heavy pollution enterprises at the same time. , but the effect of ESG on promoting firms’ financial performance is greater for firms in heavily polluted industries. The possible reason is that heavy polluting industries face greater environmental pressure and regulatory risks, such as stricter emission standards and greater pressure on environmental governance. In this case, heavy polluting enterprises may face greater business risks and market pressures if they do not perform financial performance, and in order to obtain investors’ recognition and financial support more easily, enterprises in heavy polluting industries may be more motivated to perform financial performance facilitated by ESG evaluation.

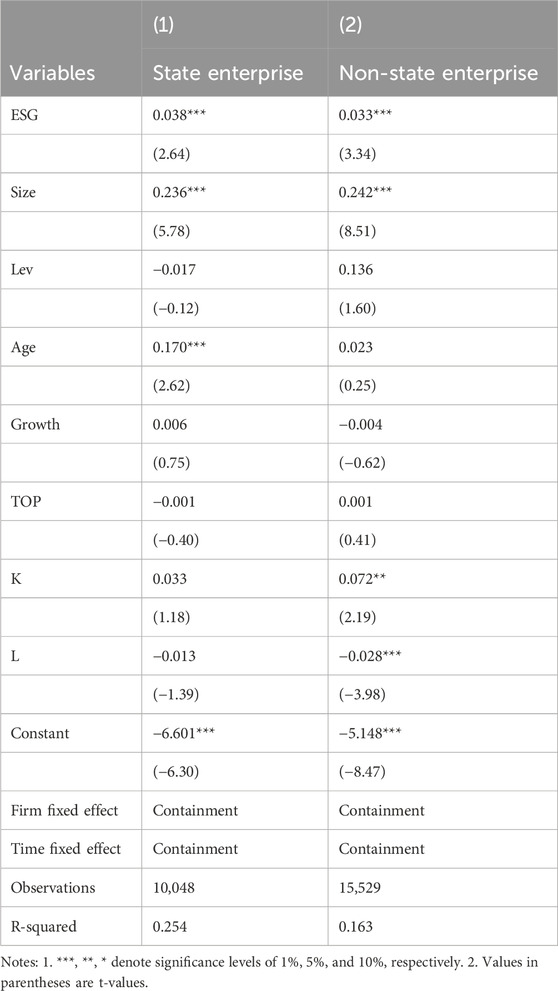

5.4.3 Heterogeneity of business ownership

Considering that the role of ESG evaluation in state-owned and non-state-owned enterprises is not certain, in order to improve the credibility of the conclusions, this paper in this part of the sample is divided into state-owned enterprises and non-state-owned enterprises, and group regression. As is shown in Table 14, the results show that ESG evaluation can promote the financial performance of state-owned and non-state-owned enterprises at the same time, but the effect of ESG evaluation in promoting the financial performance of the enterprise is greater for the non-state-owned enterprises. This is primarily due to the fact that non-state-owned enterprises face greater challenges in resource acquisition and market competition, and thus rely more heavily on robust ESG performance to craft their brand image, attract investors and consumers, and secure a competitive edge in the market. Moreover, the flexible decision-making mechanisms of non-state-owned enterprises allow them to swiftly respond to market opportunities presented by ESG, optimizing resource allocation and reducing environmental and social risk costs, thereby directly enhancing financial performance.

6 Conclusions and practical implications

6.1 Conclusions

This study employs panel data from Chinese A-share listed companies on the Shanghai and Shenzhen stock exchanges from 2009 to 2022 to conduct an empirical analysis of the impact of corporate ESG performance on its financial performance, and further explores the moderating effects of financing constraints and innovation levels on this relationship. It discusses the influence of corporate ESG performance on corporate financial performance from both theoretical and empirical perspectives, providing crucial micro-level evidence for assessing the economic effects of corporate ESG performance. The study reveals that: (1) Corporate ESG performance significantly enhances its financial performance, a finding that holds after a series of endogeneity and robustness tests. (2) Financing constraints and corporate innovation focus respectively strengthen and weaken the positive incentive effect of corporate ESG performance on corporate financial performance. (3) The impact of corporate ESG performance on corporate financial performance exhibits heterogeneity, with better incentive effects on the financial performance of enterprises in the eastern regions, state-owned enterprises, and high-pollution industries.

6.2 Practical implications

(1) The government should refine the ESG evaluation system and incentive mechanisms. Regulatory bodies should further perfect ESG assessment criteria to ensure their scientific rigor, comprehensiveness, and transparency, while establishing positive incentive mechanisms, such as tax incentives and government subsidies, to reward enterprises with outstanding ESG performance, thereby enhancing their motivation to improve ESG standards. Particularly for enterprises in the eastern regions, state-owned enterprises, and those in high-pollution industries, more targeted incentive measures should be formulated to leverage their leading role.

(2) Enterprises should alleviate financing constraints and diversify financing channels: Governments and financial institutions should collaborate to develop green financial products, such as green bonds and green credit, offering enterprises with good ESG performance a more diversified range of financing options, reducing financing costs, and alleviating financing constraints. Concurrently, establishing an ESG-oriented credit rating system can guide capital towards sustainable investment projects, facilitating enterprises in obtaining broader financial support by enhancing their ESG performance.

(3) The government should encourage corporate innovation to enhance core competitiveness. Governments should increase support for corporate research and development innovation, including providing R&D subsidies, tax incentives, and intellectual property protection, to motivate enterprises to integrate ESG principles into their innovation strategies, develop eco-friendly technologies, and improve the social impact of products and services. This can mitigate the negative moderating effect of innovation activities on the relationship between ESG and financial performance, achieving a win-win of economic benefits and social value.

(4) The government should implement differentiated policies to promote balanced regional and industry development. In light of the heterogeneity in the impact of ESG performance on corporate financial performance, the government should implement differentiated ESG policies based on the characteristics of different regions and industries. For eastern regions and state-owned enterprises, encouragement should be given to continue to lead and set industry benchmarks; for central and western regions and private enterprises, more policy support and technology transfer are needed to help them overcome obstacles in ESG practices, reduce disparities, and promote a comprehensive enhancement of ESG standards nationwide and balanced development among industries.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

L-SZ: Conceptualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ambec, S., and Lanoie, P. (2008). Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 22, 45–62. doi:10.5465/amp.2008.35590353

Aydoğmuş, M., Gülay, G., and Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanb. Rev. 22, S119–S127. doi:10.1016/j.bir.2022.11.006

Bartolacci, F., Caputo, A., and Soverchia, M. (2020). Sustainability and financial performance of small and medium sized enterprises: a bibliometric and systematic literature review. Bus. Strategy Environ. 29 (3), 1297–1309. doi:10.1002/bse.2434

Bergh, D. D., Ketchen Jr, D. J., Orlandi, I., Heugens, P. P., and Boyd, B. K. (2019). Information asymmetry in management research: past accomplishments and future opportunities. J. Manag. 45 (1), 122–158. doi:10.1177/0149206318798026

Bilyay-Erdogan, S., Danisman, G. O., and Demir, E. (2024). ESG performance and investment efficiency: the impact of information asymmetry. J. Int. Financial Mark. Institutions Money 91, 101919. doi:10.1016/j.intfin.2023.101919

Boakye, D. J., Tingbani, I., Ahinful, G., Damoah, I., and Tauringana, V. (2020). Sustainable environmental practices and financial performance: evidence from listed small and medium-sized enterprise in the United Kingdom. Bus. Strategy Environ. 29 (6), 2583–2602. doi:10.1002/bse.2522

Branco, M. C., and Rodrigues, L. L. (2006). Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 69, 111–132. doi:10.1007/s10551-006-9071-z

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Cabaleiro-Cerviño, G., and Mendi, P. (2024). ESG-driven innovation strategy and firm performance. Eurasian Bus. Rev. 14 (1), 137–185. doi:10.1007/s40821-024-00254-x

Chen, S., Song, Y., and Gao, P. (2023). Environmental, social, and governance (ESG) performance and financial outcomes: analyzing the impact of ESG on financial performance. J. Environ. Manag. 345, 118829. doi:10.1016/j.jenvman.2023.118829

Choi, J. S., Kwak, Y. M., and Choe, C. (2010). Corporate social responsibility and corporate financial performance: evidence from Korea. Aust. J. Manag. 35 (3), 291–311. doi:10.1177/0312896210384681

Connelly, B. L., Certo, S. T., Ireland, R. D., and Reutzel, C. R. (2011). Signaling theory: a review and assessment. J. Manag. 37 (1), 39–67. doi:10.1177/0149206310388419

Dabic, M., Cvijanović, V., and González-Loureiro, M. (2011). Keynesian, post-Keynesian versus Schumpeterian, neo-Schumpeterian: an integrated approach to the innovation theory. Manag. Decis. 49 (2), 195–207. doi:10.1108/00251741111109115

Elamer, A. A., and Boulhaga, M. (2024). ESG controversies and corporate performance: the moderating effect of governance mechanisms and ESG practices. Corp. Soc. Responsib. Environ. Manag. 31, 3312–3327. doi:10.1002/csr.2749

Fang, M., Nie, H., and Shen, X. (2023). Can enterprise digitization improve ESG performance? Econ. Model. 118, 106101. doi:10.1016/j.econmod.2022.106101

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manag. Sci. 61 (11), 2549–2568. doi:10.1287/mnsc.2014.2038

Freeman, R. E., and Evan, W. M. (1990). Corporate governance: a stakeholder interpretation. J. Behav. Econ. 19 (4), 337–359. doi:10.1016/0090-5720(90)90022-y

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. finance and Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Godfrey, P. C., Merrill, C. B., and Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strategic Manag. J. 30 (4), 425–445. doi:10.1002/smj.750

Griffin, J. J., and Mahon, J. F. (1997). The corporate social performance and corporate financial performance debate: twenty-five years of incomparable research. Bus. and Soc. 36 (1), 5–31. doi:10.1177/000765039703600102

He, X., Wang, C., Yang, X., and Lai, Z. (2021). Do enterprise ownership structures affect financial performance in China's power and gas industries? Util. Policy 73, 101303. doi:10.1016/j.jup.2021.101303

Ji, P., Yan, X., and Yu, G. (2020). The impact of information technology investment on enterprise financial performance in China. Chin. Manag. Stud. 14 (3), 529–542. doi:10.1108/cms-04-2019-0123

Kober, R., Subraamanniam, T., and Watson, J. (2012). The impact of total quality management adoption on small and medium enterprises’ financial performance. Account. and Finance 52 (2), 421–438. doi:10.1111/j.1467-629x.2011.00402.x

Li, T. T., Wang, K., Sueyoshi, T., and Wang, D. D. (2021). ESG: research progress and future prospects. Sustainability 13 (21), 11663. doi:10.3390/su132111663

Lu, Y., Xu, C., Zhu, B., and Sun, Y. (2024). Digitalization transformation and ESG performance: evidence from China. Bus. Strategy Environ. 33 (2), 352–368. doi:10.1002/bse.3494

Ma, W., Jin, M., Liu, Y., and Xu, X. (2019). Empirical analysis of fractional differential equations model for relationship between enterprise management and financial performance. Chaos, Solit. and Fractals 125, 17–23. doi:10.1016/j.chaos.2019.05.009

Myers, S. C., and Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 13, 187–221. doi:10.1016/0304-405x(84)90023-0

Ren, Y., and Li, B. (2022). Digital transformation, green technology innovation and enterprise financial performance: empirical evidence from the textual analysis of the annual reports of listed renewable energy enterprises in China. Sustainability 15 (1), 712. doi:10.3390/su15010712

Singh, P. J., Power, D., and Chuong, S. C. (2011). A resource dependence theory perspective of ISO 9000 in managing organizational environment. J. Operations Manag. 29 (1-2), 49–64. doi:10.1016/j.jom.2010.04.002

Soana, M. G. (2011). The relationship between corporate social performance and corporate financial performance in the banking sector. J. Bus. ethics 104, 133–148. doi:10.1007/s10551-011-0894-x

Su, J., and Xue, L. (2024). ESG performance, demographic trend, and labour investment efficiency in China. Appl. Econ. Lett. 31 (20), 2207–2213. doi:10.1080/13504851.2023.2212956

Tan, W., Cai, Y., Luo, H., Zhou, M., and Shen, M. (2024). ESG, technological innovation and firm value: evidence from China. Int. Rev. Financial Analysis 96, 103546. doi:10.1016/j.irfa.2024.103546

Töyli, J., Häkkinen, L., Ojala, L., and Naula, T. (2008). Logistics and financial performance: an analysis of 424 Finnish small and medium-sized enterprises. Int. J. Phys. Distribution and Logist. Manag. 38 (1), 57–80. doi:10.1108/09600030810857210

Tsang, A., Frost, T., and Cao, H. (2023). Environmental, social, and governance (ESG) disclosure: a literature review. Br. Account. Rev. 55 (1), 101149. doi:10.1016/j.bar.2022.101149

Waddock, S. A., and Graves, S. B. (1997). The corporate social performance–financial performance link. Strategic Manag. J. 18 (4), 303–319. doi:10.1002/(sici)1097-0266(199704)18:4<303::aid-smj869>3.0.co;2-g

Wu, Y., and Huang, S. (2022). The effects of digital finance and financial constraint on financial performance: firm-level evidence from China's new energy enterprises. Energy Econ. 112, 106158. doi:10.1016/j.eneco.2022.106158

Keywords: ESG performance, financial performance, financing constraints, innovation focus, heterogeneity analysis

Citation: Zhang L-S (2025) The impact of ESG performance on the financial performance of companies: evidence from China's Shanghai and Shenzhen A-share listed companies. Front. Environ. Sci. 13:1507151. doi: 10.3389/fenvs.2025.1507151

Received: 07 October 2024; Accepted: 23 January 2025;

Published: 17 February 2025.

Edited by:

Rangaswamy Mohanraj, Bharathidasan University, IndiaReviewed by:

Hamed Fazlollahtabar, Damghan University, IranLingli Qing, Guangzhou College of Commerce, China

Copyright © 2025 Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li-Sen Zhang, ZnRkdjk3QDE2My5jb20=

Li-Sen Zhang

Li-Sen Zhang