- 1School of Civil, Commercial and Economic Law, China University of Political Science and Law, Beijing, China

- 2School of Business, The George Washington University, Washington, DC, United States

Introduction: In the dynamic landscape of digital technologies, the crucial role of digital transformation in enhancing ESG (Environmental, Social, and Governance) performance, especially concerning the utilization of mineral and fossil fuel resources, has become evident, significantly affecting corporate value. This study aims to explore the relationship between ESG performance and corporate valuation in the Chinese mining industry (especially in high-pollution sectors), as well as the moderating role of digital transformation in this process.

Methods: This study employs a quantitative analysis method, utilizing panel data from Chinese mining companies and conducting regression analysis to examine the relationship between ESG performance, digital transformation, and corporate valuation. We construct a model that includes multiple variables such as resource utilization efficiency, corporate financial conditions, and environmental impact assessments to analyze the pathways through which digital transformation affects resource utilization efficiency and corporate valuation.

Results: The study finds a significant positive correlation between ESG performance and corporate valuation, meaning that as mineral resource utilization efficiency improves, the market value of the company increases. Digital transformation plays a positive moderating role in this relationship, specifically by enhancing resource utilization efficiency through digital technologies, thereby strengthening ESG performance and ultimately driving up corporate value.

Discussion: Therefore, companies should place more emphasis on digital transformation and integrate it with their ESG strategies to improve resource utilization efficiency, thereby enhancing their market competitiveness and long-term value.

1 Introduction

The Environmental, Social, and Governance (ESG) concept, introduced by the United Nations Global Compact in 2003, signifies a paradigm shift in corporate assessment. It advocates for a holistic approach that goes beyond financial metrics, encompassing a company’s impact on the environment, its commitment to social welfare, and the integrity of its governance practices (Fang et al., 2023). As of September 2022, the global landscape witnessed a substantial increase in ESG-focused entities, managing assets totaling around US$121 trillion, highlighting the growing importance of sustainable investment practices on a global scale. This surge is fueled by a combination of policy support, regulatory frameworks, and widespread adoption of ESG principles, encouraging firms worldwide to engage in ESG-oriented investments for sustainable development (Garcia and Orsato, 2020).

Within this context, the role of natural resource consumption in the ESG debate is significant.

Companies are under increasing pressure to manage their natural resource consumption responsibly, as it directly impacts their environmental footprint and social license to operate. Integrating sustainable practices related to natural resources is amoral imperative and a strategic move for long-term business viability. In essence, the incorporation of natural resource consumption into the ESG framework underscores the interconnectedness of environmental stewardship, social equity, and effective governance. Companies that prioritize sustainable resource management are fulfilling their ESG obligations and positioning themselves as leaders in responsible business practices, which is crucial in today’s evolving business landscape.

The 20th CPC National Congress has propelled the swift expansion of the digital economy, encouraging the melding of digital and conventional sectors and the formation of competitive digital industry clusters. By the end of 2020, the digital economy in China was estimated to have soared to $5.4 trillion, boosting its share of GDP from 27% in 2015 to 38.6%. This surge underscores the pivotal role that digitization plays in contemporary technological progress. Digital transformation involves extensive improvements in business practices, spanning production, services, and management by integrating cutting-edge technologies. This transformation revolutionizes business operations and reshapes engagements with customers, suppliers, and various stakeholders, catalyzing innovation in business models and enhancing value creation (Du and Li, 2019).

In the past few years, leading global index providers and ratings agencies, such as MSCI and FTSE, have expanded their evaluative reach to include China’s A-share listed companies, broadening the scope of their company assessments. From 2019 up to October 2022, FTSE’s coverage for ESG scoring of these firms consistently exceeded that of MSCI (Singh et al., 2020). Specifically, FTSE’s coverage ranged between 17% and 18%, whereas MSCI’s coverage exhibited a gradual increase, culminating at 12.63%. By October 2022, FTSE had included 843 A-share companies in its ESG ratings and data model, in contrast to MSCI, which had recorded ESG data for 628 companies (Xiao et al., 2021). However, it is essential to acknowledge that the ESG ratings assigned by these international entities to A-share companies are predominantly low, highlighting the substantial challenges these companies face in attaining competitiveness on a global scale. As of the same timeframe, not a single A-share company evaluated by MSCI had secured an AAAESG rating; only five companies achieved AA ratings, representing just 0.80% of the total.

The bulk of the ratings, encompassing 213 companies, were at the B level, making up 33.92% of the evaluated companies. An additional 160 companies were rated CCC, comprising 25.48% of the total evaluated pool. Furthermore, the average Environmental, Social, and Governance (ESG) score of 843 A-share companies, as evaluated by FTSE, was approximately 1.36 on a five-point scale. Among these companies, 436, which account for 51.72%, registered scores below 1.3, highlighting their generally weak ESG performance (Zhong et al., 2022). These findings indicate that only a small fraction of A-share listed companies secure high ESG ratings under the MSCI and FTSE frameworks, with a significant portion achieving low scores.

Although numerous studies have explored the relationship between ESG and corporate financial performance, most of these studies focus on the traditional relationship between social responsibility and financial performance (Margolis and Walsh, 2003), and have not delved into the role of digital transformation in improving resource utilization efficiency, mitigating environmental impact, and promoting sustainable development. Digital transformation can, to some extent, enhance a company’s resource utilization efficiency, thereby driving sustainable development (Hsu and Lee, 2020). However, research in this field is still in its early stages, and the majority of it is focused on developed markets, with relatively scarce studies on emerging markets and resource-intensive industries such as China. Furthermore, the introduction of digital technologies helps companies achieve greater progress in resource utilization efficiency, environmental management, and the execution of social responsibility (Barnewold, 2019). However, there is a lack of research on how digital transformation can improve mineral resource utilization efficiency to enhance ESG performance and drive corporate valuation. This gap provides an opportunity for this study and highlights the unique contribution of this research.

In summary, Corporate Social Responsibility (CSR) and Sustainability have become core topics in corporate strategy and policy. As the importance of Environmental, Social, and Governance (ESG) performance grows, academic research has explored this issue from multiple dimensions. However, despite extensive studies on the impact of ESG on corporate financial performance, market valuation, and social responsibility, digital transformation, as a key factor driving corporate sustainability, has not been adequately addressed in the existing literature, especially in the context of resource-intensive, high-pollution industries. This study aims to fill this research gap by exploring the moderating role of digital transformation in the relationship between ESG performance and corporate valuation in the Chinese mining industry, with a focus on their combined impact on enhancing company value. It also intends to examine digital transformation’s role in modulating ESG effects on corporate value. This inquiry is paramount for corporate managers, investors, and other stakeholders. The research addresses critical questions, including how ESG performance impacts company value, the role of digital transformation in the nexus between ESG factors and corporate value, and whether the influence of digital transformation as a moderating factor differs across various highly polluting industries (HIPs). This study aims to deepen the understanding of the connection between ESG performance and value enhancement in businesses, particularly exploring the mechanisms through which digital transformation can alter this relationship.

2 Theoretical analysis and research hypotheses

2.1 ESG performance contributes to enterprise value through mineral resources utilization efficiency

The importance of Corporate Environmental, Social, and Governance (ESG) practices in enhancing a company’s overall value and benefiting various stakeholders is becoming increasingly acknowledged. Implementing effective ESG management contributes to human resources advantages by attracting and retaining top talent, boosting job satisfaction and loyalty, and fostering an environment conducive to innovation and creativity in the workforce. These elements are crucial for leading to enhanced corporate performance and fostering innovative growth (Wong et al., 2021). Moreover, effective ESG strategies play a crucial role in reducing agency conflicts—the divergences between manager and shareholder interests. Strengthening corporate governance, enhancing transparency, and implementing differentiated share rights are essential in nurturing trust and promoting positive engagements between corporate leaders and shareholders. Furthermore, a robust performance in ESG metrics is critical for improving a company’s brand image. Active engagement in social responsibilities, commitment to environmental sustainability, and the promotion of an ethical business culture are significant in markedly improving a company’s market presence. Such enhancements subsequently increase customer loyalty and market share, thereby contributing to revenue growth (Aouadi and Marsat, 2018). An increasing number of studies indicate that ESG practices can effectively enhance a company’s overall value and bring benefits to various stakeholders. For example, implementing effective ESG management helps attract and retain top talent, improves employee satisfaction and loyalty, and creates an environment conducive to innovation and creativity, thereby driving innovation growth and improving corporate performance (Barney, 1991). In addition, ESG strategies help reduce agency conflicts between managers and shareholders. By strengthening corporate governance, improving transparency, and implementing differentiated shareholding rights, trust is built, and positive interactions between corporate leaders and shareholders are promoted (Elkington and Rowlands, 1999).

The significance of Environmental, Social, and Governance (ESG) in fostering transparency and garnering the trust of investors, owners, and creditors is significant. In addition, strong ESG performance is crucial for enhancing a company’s brand image. Actively engaging in social responsibility, committing to environmental sustainability, and promoting the implementation of an ethical business culture help significantly improve the company’s influence in the market. These improvements further increase customer loyalty and market share, thereby driving revenue growth. ESG initiatives are pivotal in reducing informational asymmetries between corporations and their various stakeholders, including shareholders, investors, employees, and suppliers. Effective disclosure, strengthened governance, and prioritization of stakeholders are indispensable for achieving robust ESG outcomes. Such measures enhance the understanding among investors and creditors regarding corporate risks and values, which in turn attracts more investment and fosters trust (Eriandani and Winarno, 2024). Additionally, companies that consistently exhibit strong ESG credentials often receive more favorable financing terms from banks, enjoy reduced borrowing costs, and gain access to a wider range of financing options. Such companies are often able to secure more financing opportunities at lower borrowing costs. Implementing robust ESG policies and transparent disclosure practices significantly enhances the company’s credibility, reduces its risk premium, and thus increases its attractiveness to investors (Guerdjikova and Quiggin, 2019). These factors work together to make companies with strong ESG performance more appealing, improving their valuation and financing conditions. This positive ESG performance attracts a broader investor base, thereby enhancing the company’s valuation and long-term growth potential. The adoption of solid ESG policies and the practice of transparent disclosure significantly boost a firm’s credibility and reduce its risk profile, resulting in better loan conditions and increased investment attraction (Dhaliwal et al., 2011). Moreover, firms with strong ESG performance generally attract a broader base of investors, which enhances their valuation and financial terms. Financial analysts tend to prefer companies with robust ESG profiles, recognizing their improved borrowing capacity and potential for long-term growth. Thorough evaluations of a company’s ESG strategies enable analysts to spot potential risks and opportunities, thereby elevating the company’s ratings and making it more appealing to investors (Deng and Cheng, 2019). Based on the above theoretical analysis, this study proposes the following hypothesis:

Hypothesis H1. ESG performance enhances corporate value through the improvement of mineral resource utilization efficiency. That is, a company’s strong ESG performance in improving resource utilization efficiency and environmental management can drive the growth of its market value.

2.2 The moderating role of digital transformation in corporate ESG performance to help enhance enterprise value

ESG promotes socio-economic growth primarily through its interactions with non-market factors, aiming to meet the needs of diverse stakeholders including shareholders, consumers, suppliers, and the broader community. In addition to the conventional benefits of asset ownership, ESG also facilitates improved internal and external information sharing, enhances resource allocation efficiency, and boosts green innovation performance through stronger collaborations with external stakeholders such as consumers, suppliers, and community groups (Li et al., 2017). This collaboration not only enhances the performance of green innovation but also promotes the integration of resource and environmental data with research and development (R&D) efforts, encouraging companies to initiate more green innovation projects (Johnson et al., 2003).

Based on this theoretical background, digital transformation plays a crucial role in enhancing corporate ESG performance. Digital technologies enable companies to efficiently collect, analyze, and utilize the vast amounts of data generated during production and operations, thereby strengthening the mechanisms for green innovation. Digital transformation not only improves resource management efficiency but also allows companies to respond more precisely and quickly to the demands of green innovation. This directly drives the development of sustainable products and services, enhances brand value, and ultimately contributes to the enhancement of corporate value. This evolution of ESG principles also accelerates resource and environmental data integration with research and development (R&D) efforts, encouraging companies to initiate more green innovation projects (Chen et al., 2022).

ESG supports the credibility of investments in green technologies and lowers the costs associated with transferring these technologies, while enhancing the brand reputation and institutional structures that stem from ESG practices. It effectively reduces legal barriers related to green innovations, equips firms with adaptable strategies for green innovation, and aids in the development of green innovation resources, thus expanding the scope of such innovations. Additionally, digital technologies play a crucial role in enhancing corporate ESG performance by leveraging mechanisms of green innovation. These technologies enable firms to meticulously monitor vast amounts of data produced during production and operations, facilitating intelligent data usage (Lu et al., 2023). Digital transformation aids in efficiently managing this information, which in turn enhances the speed and quality of product development. Through green innovation, companies are able to produce environmentally friendly and sustainable products and services, fulfill the increasing environmental expectations of consumers, improve resource and energy efficiency, minimize waste and pollution, foster a responsible corporate image, and bolster brand value and reputation. This supports long-term sustainable growth and ultimately boosts corporate value.

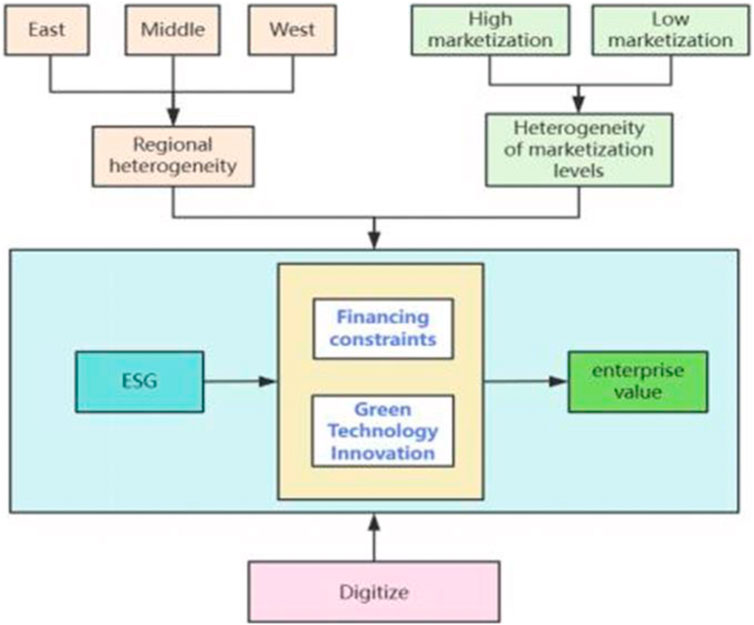

Firms often encounter financing obstacles in imperfect markets. Strong ESG performance serves as a valuable tool for disclosing non-financial data, which enables lenders to gain a better understanding of a company’s operations, reduces information asymmetry, and facilitates easier access to external funding. Companies committed to socially responsible investments strive to enhance the precision and reliability of their financial reports to maintain their reputation and public image. Enhanced corporate disclosures aid firms in securing financial support and alleviating financing restrictions. Furthermore, outstanding ESG performance helps firms access external financial resources such as government subsidies. With the strong support of green finance policies, companies with stellar environmental records are more likely to receive favorable conditions on bank loans (Wang and Esperança, 2023). The implementation of digital technology allows companies to manage their operations more effectively, overcoming traditional barriers related to time, space, and information. This leads to more accurate, efficient, authentic, transparent, and reliable corporate ESG reporting, as depicted in Figure 1. As a result, it enhances compliance and reputation, builds investor confidence, and eases financial constraints, which in turn improves future profitability and overall company value.

Hypothesis H2. Digital transformation plays a positive moderating role in corporate ESG performance, promoting green innovation and thereby enhancing corporate value. That is, digital transformation enhances a company’s green innovation capabilities, which, in turn, fosters the development of sustainable products and services, promoting long-term sustainable growth for the company.

Hypothesis H3. Digital transformation plays a positive moderating role in corporate ESG performance, alleviating financing constraints and thereby enhancing corporate value. That is, digital transformation improves a company’s non-financial information disclosure, reduces information asymmetry, and helps the company obtain more financing support, thus enhancing its market performance and profitability.

3 Research design

3.1 Sample selection and data sources

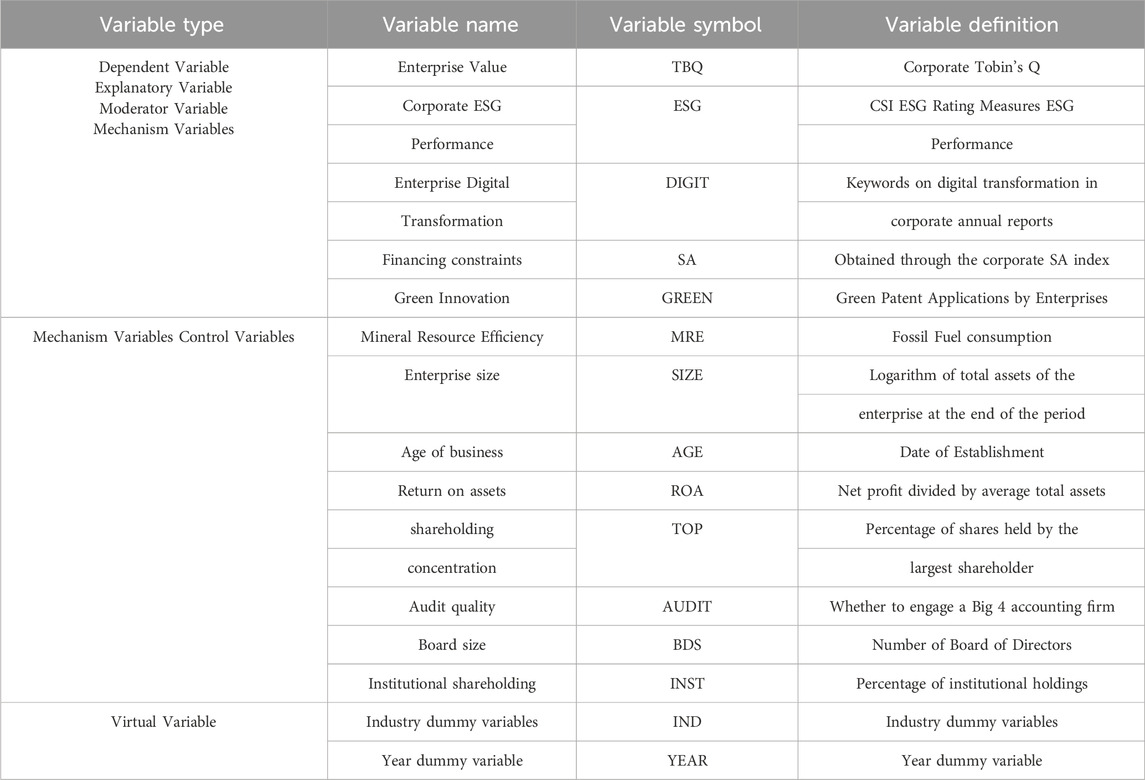

3.1.1 Dependent variable

The primary measure of firm value in this study is Tobin’s Q ratio, a metric renowned for its robustness in evaluating enterprise value by encapsulating factors reflective of market performance and potential earnings. Tobin’s Q is calculated by adding the year-end market values of all shares (both outstanding and non-outstanding) to net liabilities, then dividing this total by the firm’s year-end total assets (Alareeni and Hamdan, 2020).

3.1.2 Independent variables

The evaluation of business ESG performance is based on data from the CSI ESG indices. These indices are celebrated for their comprehensive scope and reliability, featuring a uniform grading system that spans from C to AAA and assigns numerical values from one to nine in ascending order. This system ensures that the evaluation of corporate ESG performance is both objective and precise.

3.1.3 Moderating variable

The degree of digitalization within each firm is assessed through an analysis of public annual reports. This study employs text mining techniques to detect the presence of keywords associated with digital transformation, using the frequency of these keywords as a proxy to gauge the level of technological adoption and strategic digital orientation (Chang et al., 2023).

3.1.4 Mechanism variables

The impact of ESG performance on enterprise value is further explored through two specific mechanisms: corporate green innovation and financing constraints. Green innovation is quantified by the number of green patents held by a firm, while financing constraints are measured using the SA index formula: SA = −0.737Size +0.043Size ^ 2–0.04*Age, where Size is the logarithm of total assets, and Age denotes the age of the firm. A higher SA index indicates more pronounced financing constraints (He et al., 2023).

3.1.5 Control variables

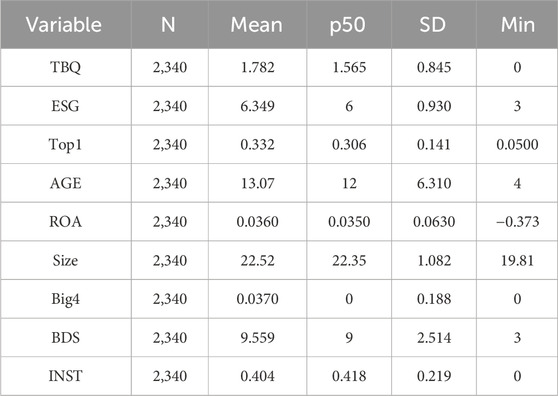

Selected as company size, age, growth, audit quality, board size, INST, TOP, etc. IND is the industry dummy variable and YEAR is the year dummy variable. This paper takes the data of A-share listed companies in China’s heavy pollution industry from 2015 to 2020 as a sample and refers to the research of Li and Xiao (2021) (Li et al., 2023). The heavy pollution industry is the target of the supply-side structural reform “three go, one down, one supplement”, and the relevant data is easy to obtain, so this paper chooses A-share listed companies in the heavy pollution industry as the sample with strong practical value (Zhang et al., 2020). The financial data of this paper is from CSMAR and WIND database. The specific variable definitions are shown in Table 1.

3.2 Modeling

Setting up model 1) with firm value as the explanatory variable and ESG performance as the explanatory variable, adding industry fixed effects and year fixed effects (Equation 1):

Among them:

To investigate the existence of multiple forms of role mechanisms between corporate ESG performance, digital transformation and firm value enhancement, this paper constructs model (2) to test the moderating effect of digital transformation on the relationship between ESG and firm value. This paper constructs model (2) to test the moderating effect of digital transformation on the relationship between ESG and enterprise value. In this paper, green innovation and financing constraints are used as mechanism variables, and the specific model setting is shown in model (Equation 2):

Where

3.3 Software used

The econometric analyses in this study were performed using STATA (version 16) for regression analysis and panel data modeling. STATA was chosen due to its powerful capabilities for handling large datasets, its robust regression and panel data techniques, and its widely accepted use in econometric research. For data visualization and descriptive statistics, Microsoft Excel was used to generate tables and plots.

4 Empirical results and analysis

4.1 Baseline regression results

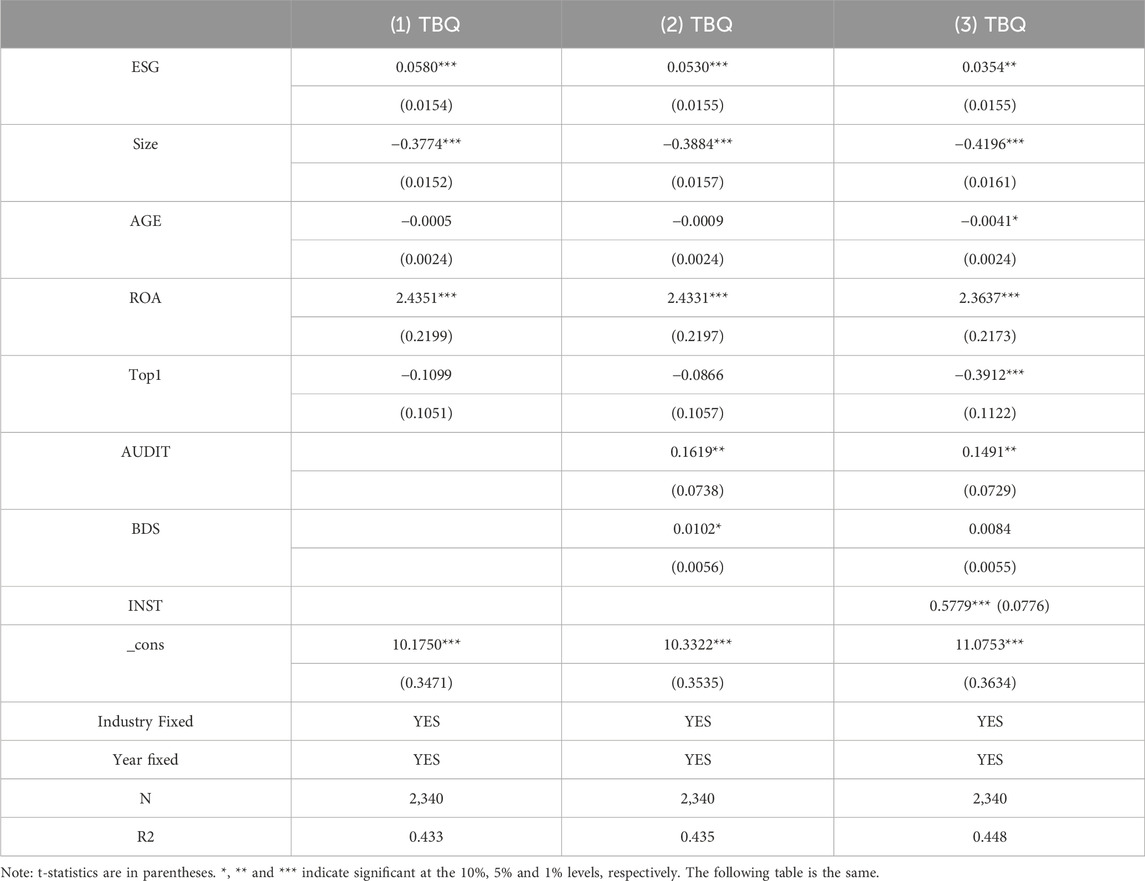

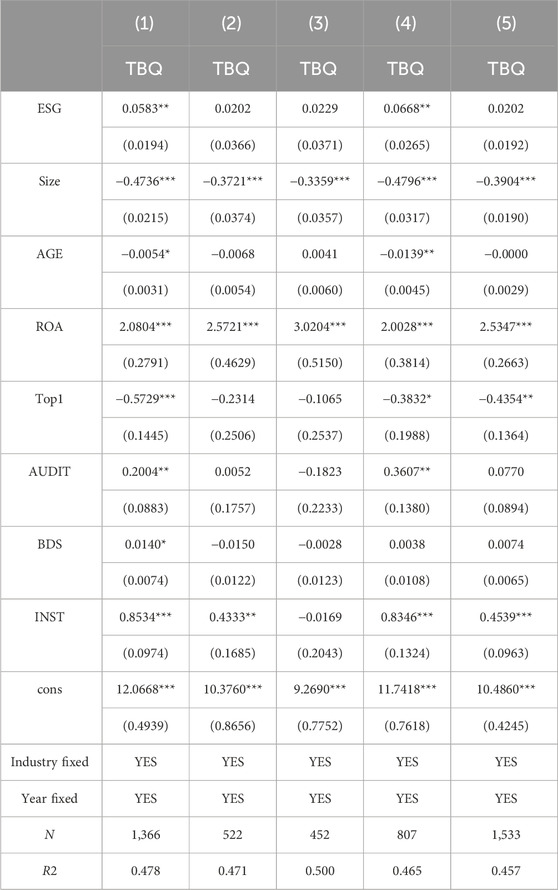

In this academic discussion, we present the results of a regression analysis that examines the influence of companies’ environmental, social, and governance (ESG) performance on their market valuation. Table 3 shows the baseline regression results. The analysis is conducted across three distinct columns, each adding more control variables to thoroughly examine the factors affecting the relationship between ESG performance and firm value. The initial regression, presented in Column (1), includes financial indicators as control variables. The results display a statistically significant ESG coefficient at the 5% level, indicating that robust ESG performance is positively associated with an increase in a company’s market capitalization.

The analysis in Column (2) expands the range of control variables to include audit quality (AUDIT) and board size (BDS), along with financial indicators. Here, the ESG coefficient continues to show positive significance at the 10% level, suggesting that companies with strong ESG scores generally achieve higher market valuations, factoring in their internal governance structures. In Column (3), the analysis is further broadened to incorporate external governance metrics such as institutional shareholding (INST), in addition to the variables included in the previous columns. Despite these additions, the ESG coefficient remains positively significant at the 10% level.

These findings suggest that while elements of corporate governance may alter the way ESG performance impacts firm value, the positive effect of solid ESG practices on market capitalization is still apparent. The reduction in the magnitude of the ESG coefficient with the introduction of governance variables indicates that effective ESG practices might be partially integrated within internal corporate governance frameworks, thereby affecting firm value. Moreover, aspects of corporate governance could also influence and modify the implementation and effectiveness of ESG practices. Ultimately, the regression results confirm that companies with strong ESG performance are more likely to experience enhanced market capitalization, supporting Hypothesis 1. Additionally, the analysis highlights the essential role of corporate governance frameworks in determining how ESG metrics influence firm value.

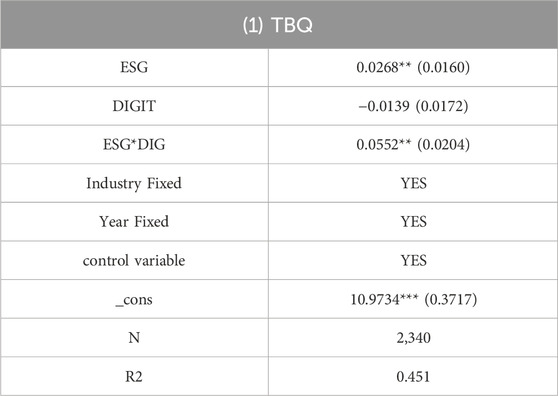

4.2 The moderating effect of digital transformation on the ESG performance of firms to help enhance corporate value

Table 4 provides valuable insights into how corporate environmental, social, and governance (ESG) performance interacts with digital transformation initiatives, exploring their combined influence on firm value during the digital transformation journey. The results show that both ESG performance and digital transformation exert a positive influence on firm value independently, suggesting that firms can elevate their overall valuation by concurrently advancing their ESG initiatives and digital transformation strategies. Previous research has highlighted the positive impact of ESG performance on firm value (Eccles et al., 2014), which found that strong ESG performance is linked to improved financial performance and higher valuation. Similarly, digital transformation is highly effective in improving operational efficiency and enterprise performance (Porter and Kramer, 2011). However, the novelty of this study lies in examining the synergistic effects between ESG and digital transformation, as digital transformation not only enhances ESG performance but also amplifies its impact on firm value, which has been less explored in prior literature. While studies have discussed the independent benefits of ESG and digital strategies (Bocken et al., 2014), this study emphasizes the interactive relationship between these two factors, providing a unique perspective on how they mutually reinforce each other to maximize firm value.

Digital transformation facilitates enhanced ESG performance by enabling more effective data gathering, processing, and analysis, which subsequently fosters the advancement of ESG practices. On the other hand, a robust ESG foundation contributes to creating a stable and reliable platform for the company, thus amplifying its enterprise value. Notably, the interaction coefficient for ESG*DIGIT is 0.0552, demonstrating statistical significance at the 5% level.

This outcome reveals that digital transformation acts as a positive moderator in the relationship between ESG performance and firm value, implying that the advantageous impacts of ESG on firm value are amplified when digital transformation initiatives are effectively executed. These findings highlight the importance for firms to adopt a dual approach that prioritizes both digital innovation and strong environmental, social, and governance commitments. By focusing on enhancing these areas synergistically, companies not only maximize their value but also benefit from the synergistic effects arising from the dynamic interplay between digital transformation and ESG initiatives.

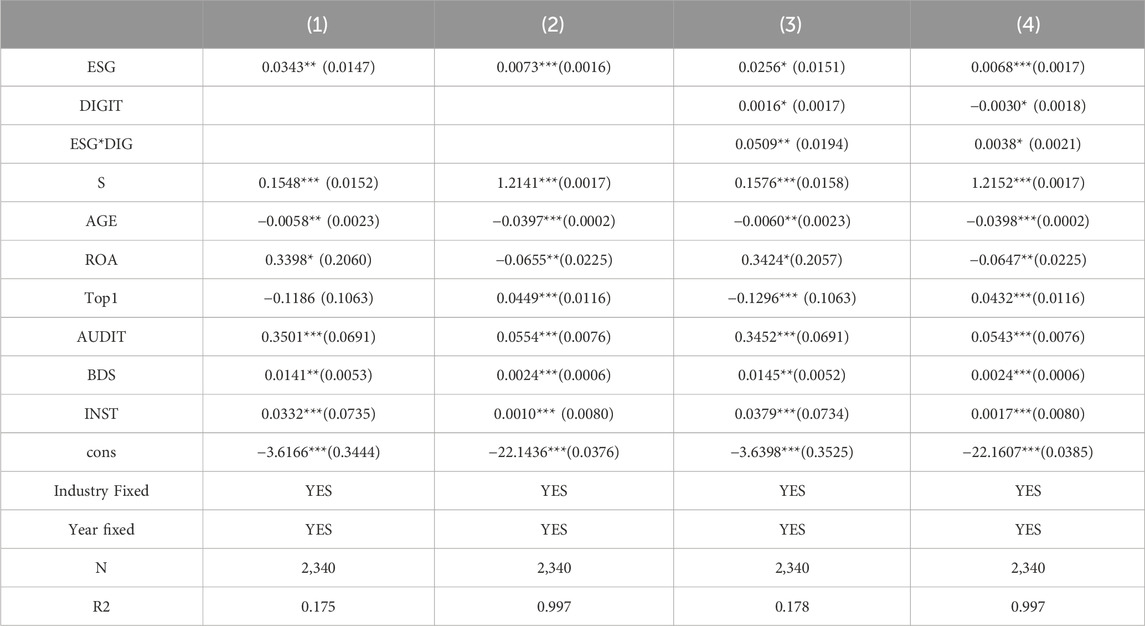

4.3 Mechanism analysis

Table 5 elucidates the mechanisms through which environmental, social, and governance (ESG) performance, in conjunction with digital transformation, impacts corporate value. The analysis is segmented into two parts: initially, it assesses how ESG performance influences green innovation and alleviates financing constraints; subsequently, it delves into how digital transformation moderates theses effects.

In the initial segment, Columns (1) and (2), a direct correlation is identified between ESG performance and two critical corporate dimensions the enhancement of green innovation and the reduction of financing constraints. The findings indicate that strong ESG performance bolsters corporate value by promoting green innovation and easing financial barriers, setting the groundwork for a deeper investigation into the moderating role of digital transformation. Previous studies have highlighted the positive impact of ESG on firm value, which discusses how ESG practices correlate with long-term corporate success and value (Whelan and Fink, 2016). However, unlike these studies, which primarily treat ESG performance and business strategies independently, this study emphasizes the synergistic effects between digital transformation and ESG.

The latter segment, encompassed in Columns (3) and (4), investigates how digital transformation impacts the effects of ESG performance on corporate value, particularly through its support of green innovation and relief from financing difficulties. In Column (3), the interaction term ESG*DIGIT is marked by a significant positive coefficient at the 5% level, suggesting that digital transformation intensifies the impact of green innovation initiatives when synergized with robust ESG practices. This synergistic interaction substantially enhances firm value.

Column (4) illustrates that the positive coefficient of the interaction term, with respect to financing constraints, highlights that digital transformation, coupled with ESG performance, favorably affects the alleviation of these constraints. This demonstrates that digital transformation and ESG practices jointly act to mitigate the negative impacts of financing constraints on firm value. Existing literature discusses how digitization can impact financial performance by increasing efficiency and reducing risk (Bai and Chang, 2020), this study extends that research by linking digital transformation to ESG performance in a moderating role, amplifying the benefits of ESG practices on firm value. The findings highlight the complementary relationship between these two elements, where the focus was solely on the impact of digital capabilities on operational performance without considering their interaction with ESG (Teece, 2014).

In summation, this study corroborates Hypothesis H2, H3, affirming that digital transformation positively influences ESG performance enhancement, which in turn fosters green innovation and mitigates financial constraints, ultimately augmenting corporate value. The results underscore the synergistic and complementary roles of digital transformation and ESG performance in lifting corporate value by facilitating green innovation and reducing financial barriers.

4.4 Endogeneity test

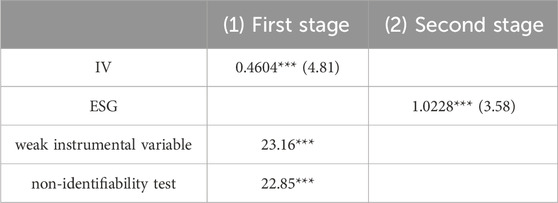

4.4.1 Endogenous issues

To tackle potential endogeneity issues such as omitted variables or reverse causality, this study adopts an instrumental variable approach, utilizing industry-year averages as tools for ESG ratings. Using these averages helps counteract distortions due to industry-specific elements, changes in policies, or firm-specific decisions. It also reduces the impact of subjective biases in ESG ratings, thus decreasing data noise in the findings. Employing effective instrumental variables is crucial for addressing endogeneity, thereby improving the reliability and validity of the causal interpretations within the research.

The instrumental variable analysis was carried out using the two-stage least squares (2SLS) method, with the findings detailed in Table 6. The first stage of the analysis shows that the regression involving the instrumental variables and the endogenous explanatory variables (ESG ratings) is statistically significant at the 1% level. Furthermore, the F-value from the weak instrumental variable test stands at 23.16, surpassing the critical threshold of 10, which indicates a strong correlation between the instrumental and the endogenous variables and confirms that the instrument is not weak.

In the second-stage results, the coefficients for ESG ratings remain significantly positive, suggesting that the favorable link between a company’s ESG performance and its market value is sustained even after controlling for endogeneity. This supports the robustness of the positive relationship post adjustment for potential endogeneity issues using the instrumental variable technique.

By leveraging industry-year averages as instruments for ESG ratings, the study meets the exogeneity requirement necessary for instrumental variables. These averages are less likely influenced by specific corporate actions or characteristics, rendering them exogenous and suitable for addressing potential endogeneity, thus reinforcing the trustworthiness of the causal conclusions drawn from this analysis.

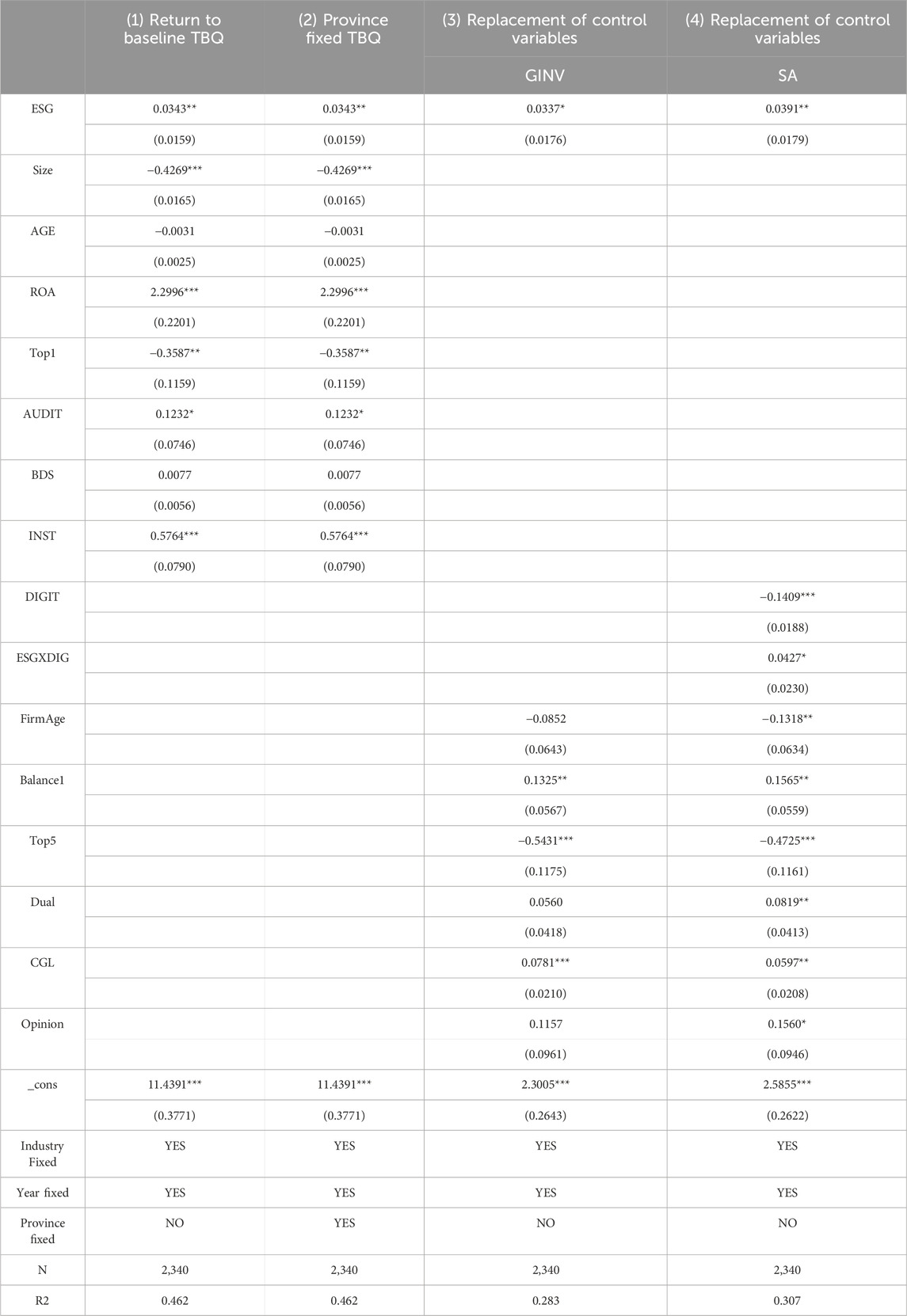

4.4.2 Robustness testing

The inclusion of province fixed effects is crucial in the robustness tests, ensuring the stability of the effects of ESG indicators on firm value across different regions. Variations in policy, economic conditions, and regulatory environments among provinces can have a significant impact on firm value. By integrating province fixed effects, the study effectively controls for these regional discrepancies, facilitating a more accurate assessment of the independent influence of ESG indicators on firm value. The robustness tests demonstrate that, even with the inclusion of province fixed effects, the impact of ESG on enterprise value remains significant and positive, highlighting the robust and reliable nature of the relationship between ESG indicators and enterprise value. This result provides a solid foundation for decision-making by corporate managers and investors.

Furthermore, the substitution of control variables addresses potential omitted variable biases. This modification involves replacing previous control variables with a new set, thereby reducing the influence of potential unobserved variables. For instance, the measurement of firm size now utilizes the value of the firm’s fixed assets (FIXED) rather than the logarithm of total assets. The firm ‘sage is captured by the duration the firm has been operational (FIRMAGE), replacing the years since its listing. Instead of using the growth rate of operating revenues, growth is now assessed by the profitability of total net assets (ROA). The indicator for shareholder concentration has also been updated, substituting the proportion of shares owned by the top five shareholders for the stake held by the primary shareholder. The composition of the board now considers the dual roles (DUAL) held by directors, and factors in both the quality of corporate governance and the issuance of standard audit opinions. This approach enhances the rigor of the analysis by ensuring a broader and more nuanced evaluation of factors potentially influencing firm performance.

Table 7 shows the regression results. The table reveal that even after these adjustments, ESG continues to positively impact corporate value. The mechanisms through which ESG influences corporate value—enhancing green innovation and easing financing constraints—remain consistent. Additionally, corporate digital transformation further strengthens the impact of ESG performance on these mechanisms.

By incorporating province fixed effects and updating control variables, this research effectively tackles regional variations and issues related to omitted variables, thereby strengthening the reliability and robustness of the findings. The persistent positive relationship between ESG performance and firm value, along with the mechanisms of green innovation and easing financing constraints, is reaffirmed by these supplementary tests. This reinforcement underscores the importance of ESG practices and digital transformation in enhancing corporate value.

5 Heterogeneity test

This study explores show variations in ESG performance influence firm value, suggesting that factors such as geographic location and regional marketization levels might affect this relationship.

The research initially examines potential differences in the impact of ESG performance on firm value depending on a company’s geographic location. It organizes firms into three regional categories: Eastern, Central, and Western China. Sub-sample regression analysis, presented in the table, indicates that ESG performance notably enhances firm value, especially in Eastern China, as shown in columns (1) to (3). This positive effect is likely since firms in Eastern China are more responsive to evolving investor expectations and financial market trends that favor ESG considerations. These companies are perhaps better positioned to adopt new environmental, social, and governance standards, which boosts their ESG performance and, consequently, their market valuation. This adaptability may stem from the region’s advanced markets and dynamic business climates, which facilitate the recognition of the strategic advantages of ESG initiatives in attracting investment and securing higher valuations.

Furthermore, the study utilizes a marketization index to assess how the broader institutional environment influences the relationship between ESG performance and firm value. This index, a quantifiable indicator of the macro-institutional environment, is employed to gauge various aspects 387 of enterprise performance, providing a precise analysis of the impacts of ESG. Enterprises are categorized into groups of high and low marketability based on the regional average of this marketization index. The regression results displayed in columns (3) and (4) of Table 8 reveal that firms in regions with high marketization experience a more substantial positive impact of ESG performance on enterprise value.

Table 8. Heterogeneity test for the nature of firms ‘property rights and marketization characteristics.

This phenomenon could stem from the benefits such as increased innovation and competition prevalent in highly marketized zones. By prioritizing ESG objectives and adopting sustainable practices, companies in these areas can secure a competitive edge in product and service innovation, resource efficiency, and cost management, all of which contribute to elevating their value and drawing more investment. Additionally, areas with high marketization are often characterized by a larger investor base and more mature capital markets, where ESG factors play a pivotal role in investment decisions. Such an environment propels firms in highly marketized regions to enhance their ESG performance, which in turn amplifies their overall value.

In summary, the research highlights the varied impacts of ESG performance on firm value, significantly moderated by geographic location and the level of regional marketization. The findings suggest that firms in Eastern China and regions with greater marketization derive more benefits from strong ESG performance, likely due to dynamic market conditions, investor preferences, and the forces of competition.

6 Conclusion and policy implications

This investigation focuses on the effects of Environmental, Social, and Governance (ESG) performance on corporate value while assessing how corporate digital transformation can amplify this impact. The empirical data underscore that ESG performance exerts a positive influence on corporate value. Additionally, corporate digital transformation acts as a significant enhancer, boosting the influence of ESG performance on corporate value. Digital transformation within enterprises strengthens the reliability and promptness of ESG disclosures, resulting in heightened stakeholder recognition and diminishing financial barriers. Moreover, digital transformation facilitates the efficient and intelligent creation of environmentally friendly products, which boosts ESG performance and, in turn, augments corporate value.

The degree to which ESG performance enhancement affects corporate value can vary across different companies, influenced by industry-specific, regional, and size-related factors. From these observations, several policy recommendations emerge:

Firstly, it is advocated that governmental and regulatory authorities impose requirements on companies to incorporate ESG data within their financial reporting. This step would improve transparency and urge companies to prioritize ESG considerations, potentially elevating their performance and value. Additionally, governments should advocate for proactive ESG engagement and digital transformation by offering incentives such as tax reliefs, subsidies, or rewards, spurring enterprises to invest in these areas to enhance competitiveness and value.

Furthermore, it is critical for governments to bolster the monitoring and enforcement of corporate ESG practices to ensure adherence to regulations. More stringent penalties for non-compliance with ESG standards should be instituted to raise market standards and foster trust. 429 Governments should also support companies in their digital transformation journeys by providing financial aid, expertise, and training, and by promoting cross-sector collaboration to create a cohesive policy framework and standards for digital transformation.

For financial institutions, the recommendations include the development and execution of ESG integration strategies that embed ESG factors into investment and risk management practices. This approach entails utilizing ESG assessment tools and incorporating ESG considerations into portfolio and risk management frameworks to evaluate their influence on portfolios. Financial institutions are also encouraged to support the creation of sustainable financial products, such as green bonds and loans, and to ensure precise, reliable, and timely disclosure of ESG information.

Lastly, it is imperative for enterprises to formulate a comprehensive ESG strategy that weaves environmental, social, and governance considerations into their core business operations and decision-making. This strategy should include establishing explicit ESG objectives, improving internal governance, enhancing transparency, and engaging in green innovation and digital transformation. A robust ESG performance management system should also be developed to effectively monitor and report on ESG metrics.

Despite the valuable insights provided by this study, there are several limitations. Firstly, the sample is limited to A-share listed companies in China’s heavy pollution industry from 2015 to 2020, which may not fully represent the diversity of industries or companies in other regions. Secondly, the reliance on text mining techniques for evaluating digital transformation may not capture the full complexity of digital strategies adopted by firms, as it is based on the presence of specific keywords in annual reports. Finally, while this study examines ESG performance and digital transformation, other potentially significant factors influencing corporate value, such as corporate culture or external market conditions, were not considered.

Future research could explore a broader range of industries and countries to generalize the findings beyond the specific context of heavy pollution industries in China. It would also be beneficial to incorporate more qualitative measures of digital transformation, perhaps through in-depth interviews or case studies, to better understand how digital strategies are implemented. Additionally, further studies could investigate the long-term effects of digital transformation on ESG performance, exploring whether the relationship between ESG performance and corporate value evolves over time. Another potential direction is to examine the impact of digital transformation on ESG in different regulatory environments, comparing countries with varying levels of government support for ESG practices.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

Y-CL: Writing–original draft, Writing–review and editing, Data curation, Methodology, Conceptualization, Formal analysis, Project administration, Investigation, Visualization, Software. S-JL: Writing–original draft, Writing–review and editing, Data curation, Methodology, Supervision, Conceptualization, Formal analysis, Project administration, Validation, Investigation, Resources, Visualization. L-SZ: Conceptualization, Data curation, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alareeni, B. A., and Hamdan, A. (2020). ESG impact on performance of US S& 500-listed firms. Int. J. Bus. Soc. 20 (7), 1409–1428. doi:10.1108/cg-06-2020-0258

Aouadi, A., and Marsat, S. (2018). Do ESG controversies matter for firm value? Evidence from international data. J. Bus. Ethics 151, 1027–1047. doi:10.1007/s10551-016-3213-8

Bai, C., and Chang, J. (2020). Digital transformation, business performance, and the role of technology in green innovation. Technol. Forecast. Soc. Change 158, 120138. doi:10.1016/j.techfore.2020.120138

Barnewold, L. (2019). Digital technology trends and their implementation in the mining industry. Mining Goes Digital.

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Bocken, N. M. P., Short, S. W., Rana, P., and Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 65, 42–56. doi:10.1016/j.jclepro.2013.11.039

Chang, K., Cheng, X., Wang, Y., Liu, Q., and Hu, J. (2023). The impacts of ESG performance and digital finance on corporate financing efficiency in China. Appl. Econ. Lett. 30 (4), 516–523. doi:10.1080/13504851.2021.1996527

Chen, H. M., Kuo, T. C., and Chen, J. L. (2022). Impacts on the ESG and financial performances of companies in the manufacturing industry based on the climate change related risks. J. Clean. Prod. 380, 134951. doi:10.1016/j.jclepro.2022.134951

Deng, X., and Cheng, X. (2019). Can ESG indices improve the enterprises' stock market performance? -An empirical study from China. sustainability 11 (17), 4765. doi:10.3390/su11174765

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting. Account. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Du, K., and Li, J. (2019). Towards a green world: how do green technology innovations affect total-factor carbon productivity. Energy Policy 131, 240–250. doi:10.1016/j.enpol.2019.04.033

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 60 (11), 2835–2857. doi:10.1287/mnsc.2014.1984

Elkington, J., and Rowlands, I. H. (1999). Cannibals with forks: the triple bottom line of 21st century business. Alternatives Journal, 25 (4), 42.

Eriandani, R., and Winarno, W. A. (2024). Esg risk and firm value: the role of materiality in sustainability reporting. Qual. Innov. Prosper./Kval. Inovácia Prosper. 28 (2). doi:10.12776/qip.v28i2.2019

Fang, M., Nie, H., and Shen, X. (2023). Can enterprise digitization improve ESG performance? Econ. Model. 118, 106101. doi:10.1016/j.econmod.2022.106101

Garcia, A. S., and Orsato, R. J. (2020). Testing the institutional difference hypothesis: a study about environmental, social, governance, and financial performance. Bus. Strategy Environ. 29 (8), 3261–3272. doi:10.1002/bse.2570

Guerdjikova, A., and Quiggin, J. (2019). Market selection with differential financial constraints. econometrica 87 (5), 1693–1762. doi:10.3982/ecta15328

He, X., Jing, Q., and Chen, H. (2023). The impact of environmental tax lawson heavy polluting enterprise ESG performance: a stakeholder behavior perspective. J. Environ. Manag. 344, 118578. doi:10.1016/j.jenvman.2023.118578

Hsu, P. H., and Lee, S. (2020). Digital transformation and its impact on ESG performance in developing countries: evidence from China. J. Bus. Res. 113, 115–125. doi:10.1016/j.jbusres.2020.07.025

Johnson, J. L., Lee, P. W., Saini, A., and Grohmann, B. (2003). Market-focused strategic flexibility: conceptual advances and an integrative model. J. Acad. Mark. Sci. 31 (1), 74–89. doi:10.1177/0092070302238603

Li, J., Lian, G., and Xu, A. (2023). How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. J. Bus. Res. 158, 113648. doi:10.1016/j.jbusres.2023.113648

Li, Y., Gong, M., Zhang, X., and Koh, L. (2017). The impact of environmental, social, and governance disclosure on firm value: the role of ceo power. Br. Account. Rev. 50, 60–75. doi:10.1016/j.bar.2017.09.007

Lu, Y., Xu, C., Zhu, B., and Sun, Y. (2023). Digitalization transformation and ESG performance: evidence from China. Bus. Strategy Environ. 33, 352–368. doi:10.1002/bse.3494

Margolis, J. D., and Walsh, J. P. (2003). Misery loves companies: rethinking social initiatives by business. Adm. Sci. Q. 48 (2), 268–305. doi:10.2307/3556659

Porter, M. E., and Kramer, M. R. (2011). Creating shared value. Harv. Bus. Rev. 89 (1-2), 62–77. doi:10.1108/01409171011030160

Singh, S. K., Del Giudice, M., Chierici, R., and Graziano, D. (2020). Green innovation and environmental performance: the role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Change 150, 119762. doi:10.1016/j.techfore.2019.119762

Teece, D. J. (2014). The foundations of innovation: understanding the role of innovation in the digital economy. Industrial Corp. Change 23 (3), 555–586. doi:10.1093/icc/dtu001

Wang, S., and Esperança, J. P. (2023). Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 419, 137980. doi:10.1016/j.jclepro.2023.137980

Whelan, T., and Fink, C. (2016). The ESG advantage: why environmental, social, and governance matters. Harv. Bus. Rev.

Wong, W. C., Batten, J. A., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Finance Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Xiao, L., Bai, M., Qin, Y., Xiong, L., and Yang, L. (2021). Financial slack and inefficient investment decisions in China. Manag. Decis. Econ. 42 (4), 920–941. doi:10.1002/mde.3282

Zhang, F., Qin, X., and Liu, L. (2020). The interaction effect between ESG and green innovation and its impact on firm value from the perspective of information disclosure. sustainability 12 (5), 1866. doi:10.3390/su12051866

Keywords: ESG performance, mineral resources, fossil fuel, digital transformation, value enhancement, moderating effect

Citation: Lin Y-C, Liu S-J and Zhang L-S (2025) ESG practices, mineral resources exploitation and value creation: insights from Chinese mining companies’ digital transformation. Front. Environ. Sci. 13:1503524. doi: 10.3389/fenvs.2025.1503524

Received: 29 September 2024; Accepted: 23 January 2025;

Published: 04 March 2025.

Edited by:

Hongye Feng, Chinese Academy of Geological Sciences, ChinaReviewed by:

Sorinel Capusneanu, Titu Maiorescu University, RomaniaKhoa Tran, University of Economics Ho Chi Minh City, Vietnam

Copyright © 2025 Lin, Liu and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shao-Jun Liu, c2hhb2p1bWxAY3VwbC5lZHUuY24=

Ying-Chieh Lin1

Ying-Chieh Lin1 Li-Sen Zhang

Li-Sen Zhang