- School of Business, Anhui University, Hefei, Anhui, China

Climate change has become a global issue in the 21st century due to the excessive use of non-renewable energy sources. To mitigate this issue, the world has been shifting towards green growth. For this purpose, researchers and policymakers are struggling to explore the factors that significantly impact green growth. Although several determinants of green growth have been investigated in the available literature, the impact of (dis)-aggregated natural resources rents (i.e., minerals rent, coal rent, oil rent, natural gas rent, and total natural resources rent) have been scantly investigated. To fill this gap, this study aims to examine the impact of coal rent, oil rent, minerals rent, natural gas rent, and total natural resources rent on the green growth in G7 countries. The findings from the panel ARDL approach elucidate that coal rent, natural gas rent, and total natural resources rent have a negative impact on green growth in the long-run. Further, oil rent has a positive impact, while minerals rent has an insignificant impact on green growth in the long-run. The study proposes several policy recommendations based on the findings.

1 Introduction

Over the last 2 decades, environmental concerns, including environmental degradation, climate change, and global warming, have grown at an unprecedented pace. The estimates show that the average global temperature increased from 0.43°C in 2000 to 1.18°C in 2023.1 This clearly indicates the severe pace of global warming all around the globe. Due to these environmental concerns, environmental disasters have also surged, elucidating that the world has now frequently been confronting environmental disasters.2 It is worth noting that economic cost is also associated with environmental issues. For instance, in a recent study, it has been revealed that the economic cost of climate change is about $16 million per hour.3 These arguments reflect that environmental issues have escalated, and the associated cost has risen.

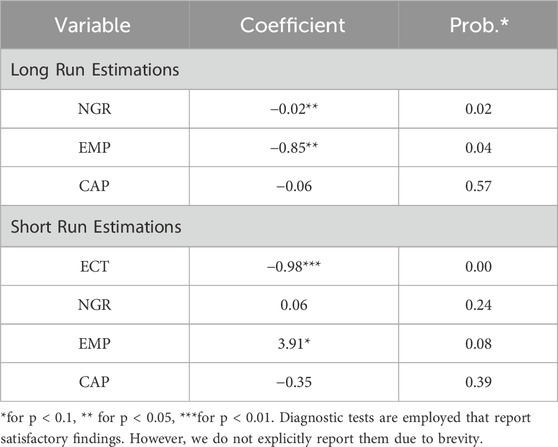

While discussing the factors behind the aforementioned environmental issues, anthropogenic activities are worth discussing. Anthropogenic activities mainly consist of the industrialization process and urbanization, among others. Whether it is industrialization or urbanization, both are imperative for economic development. However, these anthropogenic activities heavily rely on fossil fuel energy sources associated with greenhouse gas emissions. It is worth reporting that per person global carbon emissions increased from 1.2 tonnes in 1900 to 4.7 tonnes in 2022 (see Figure 1), highlighting the unprecedented growth in emissions. Hence, the global community has been focusing on curbing greenhouse gas emissions to replenish environmental sustainability and circumvent climate change, global warming, etc.

Figure 1. Per person global carbon emissions. Source: https://ourworldindata.org/co2-emissions.

There exist several worth highlighting global efforts in confronting climate change. For instance, the Paris Agreement, the series of COP conferences, and the Sustainable Development Goals are noteworthy international efforts for climate change. However, climate change has not yet been plunging at a desirable pace, calling for more serious efforts by the entire world. Therefore, policymakers and researchers emphasize the transition toward a green economy. A green economy implies establishing an economic system that can produce output while not affecting the environmental quality. Recently, COP29 has focused on the transition to a green economy to impede environmental issues.

One of the avenues to switch to a green economy is promoting green growth (GGDP). GGDP is often used to describe the preservation and enhancement of the natural environment. Pierce, a British economist, introduced the concept of a “green economy” in 1989 through the publication of the “Green Economy Blue Book.” The author argues that if economic expansion surpasses the capacity of existing natural resources, it will lead to a permanent halt in economic progress. The upcoming advancement of GGDP, marked by a transition towards sustainable practices and the use of renewable energy sources, is expected to significantly influence the resource revenue landscape. The goal of aiming for sustainable economic development is to steer the economy towards consumption patterns and technological advancements that promote economic growth and employment opportunities, while also minimizing impact on the environment.

Based on the indispensability of GGDP, policymakers and researchers focus on finding the socioeconomic factors that can influence GGDP. Therefore, the existing literature tries to examine the determinants of GGDP. Prior literature reveals that technology is a key influencing driver of GGDP (Liu et al., 2022). In addition to this, renewable energy utilization is also considered a key driver of GGDP (Fang et al., 2022). Further, financial development (Abro et al., 2023), tourism (Marsiglio, 2015), economic uncertainty (Gu et al., 2015), geopolitical risk (Caijuan et al., 2024), green innovation (Sarkar, 2013), fintech innovation (Zhou et al., 2022), digital finance (Razzaq et al., 2023), environmental regulation (Guo et al., 2017), among others, are impact factors of GGDP.

One line of research in the context of GGDP explores natural resources as the determinant of GGDP. Although the existing literature extensively evaluates the impact of natural resources on economic growth (i.e., the resource curse hypothesis), the relationship between natural resources and GGDP remains understudied. One strand of literature on natural resources and the GGDP nexus documents a negative influence of natural resource rents on GGDP, hence validating the resource curse hypothesis (Lin et al., 2023; Li and Gong, 2023). Contrarily, another strand of research reveals a positive impact of natural resources on GGDP, invalidating the resource curse hypothesis (Baafi, 2024). The inconsistent findings related to the impact of natural resources on GGDP call for further investigation in this research area.

It is worth reporting that existing literature frequently uses total natural resources rent to evaluate the relationship between natural resources and GGDP (Yu et al., 2024). Since total natural resource rent is a composition of rents from many natural resources, these resources might have a heterogeneous impact on GGDP. For instance, coal, natural gas, and oil rents contribute to economic output, but carbon emissions are extensively associated with them. As a result, GGDP can be decreased due to these natural resources. On the contrary, several minerals such as aluminum, copper, and silver are used to produce renewable energy-producing items (e.g., solar panels, etc.), which might lead to higher GGDP. Thus, it is imperative to explore how different natural resources impact GGDP.

The literature on the relationship between disaggregated natural resources rent and GGDP is still scant. Recently, Fang et al. (2023) noted that mineral extraction harms GGDP, validating the resource curse hypothesis. Similar findings are reported by Chien et al. (2023) in the context of G7 countries. In the case of the South Asian region, Yang et al. (2021) documented the negative impact of minerals on GGDP and, hence, validated the resource curse hypothesis. Further, Li and Li (2021) also validated the resource curse hypothesis while examining the mineral-GGDP nexus for China. On the contrary, Xu et al. (2022) reported that natural resources rent, such as coal and gas rents, escalates GGDP, thereby invalidating the resource curse hypothesis. This indicates three points: 1) the literature on the disaggregated natural resources rent and GGDP is limited; 2) this literature provides contrasting outcomes; 3) no study simultaneously examines the impact of coal, gas, natural gas, total natural resources rent and minerals rent on GGDP.

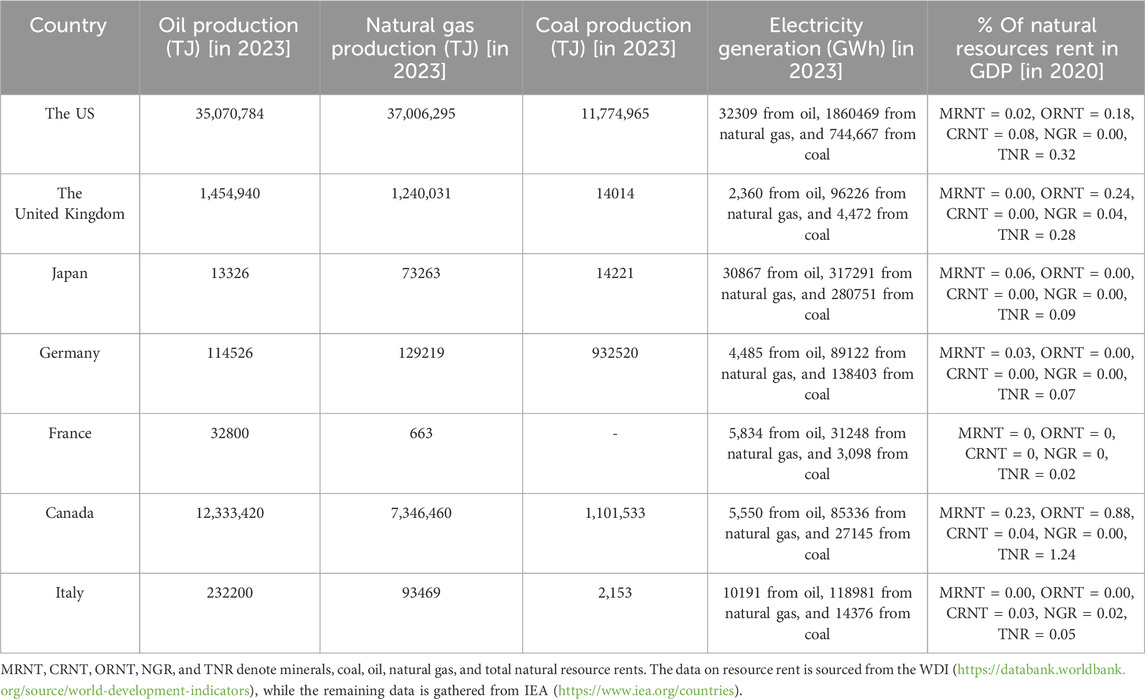

Based on these aforementioned research gaps, this study aims to explore the impact of aggregated and dis-aggregated natural resources rents (i.e., total natural resources rent, coal, natural gas, oil gas, and mineral rents) on GGDP in the case of G7 countries. The motivation to opt for G7 countries is based on the fact that these countries are the world’s leading economies. Not only this, but these economies are also confronting environmental issues and striving to pursue a green growth path. In addition to this, G7 countries also rely on natural resources for their economic activities. Table 1 displays several statistics related to natural resources for G7 countries.

In terms of contribution to the existing literature, limited literature exists on the impact of natural gas rent on GGDP; hence, we fill this research lacuna. Second, scant literature is available on the coal-GGDP nexus; thus, we bridge this research gap. Third, the literature on mineral-GGDP is sparse and provides contrasting outcomes; therefore, we fill this research gap by re-investigating the minerals-GGDP relationship. Fourth, the impact of different natural resource rents (coal, gas, and minerals) on GGDP is missing in the context of G7 countries. Therefore, we mainly fill this research gap. Finally, we consider the GGDP index developed by Sarkodie et al. (2023). This index covers five critical aspects of the green economy, including environmental productivity, policy response, quality of life, socio-economic outcomes, and natural asset basis. Hence, this index provides robust outcomes.

2 Literature review

This section reviews the relevant literature on the under-investigated line of research. For instance, claimed that governments could alleviate the economic downturn resulting from global financial crises by utilizing the GGDP. The concept of GGDP was introduced in 1990, but it did not garner significant attention from policymakers until 2005. In order to tackle carbon emissions and advance environmental sustainability, the adoption of GGDP policies is imperative (Chishti et al., 2021; Dogan, 2022). The importance of GGDP may be seen in the context of SDGs, as it is widely recognized as a crucial term related to resource efficiency (Weimin and Chishti, 2021). Imasiku et al. (2019) established a correlation between GGDP and SDG 8, which specifically emphasizes the promotion of decent labor and economic growth. Thus, GGDP plays a key role in promoting sustainable economic growth.

It is worth reporting that GGDP is essential for guaranteeing the long-term sustainability of an economy by promoting the efficient and optimal use of natural resources (Hussain et al., 2021; Naqvi et al., 2021; Rizvi et al., 2022). This refers to promoting economic growth in a way that guarantees the continued capacity of natural resources to maintain environmental sustainability, without replacing the idea of sustainable development. Moreover, it is a feasible strategy to achieve environmental superiority by limiting carbon emissions and conserving energy. Tawiah et al. (2021) examined both well-established and emerging economies in the literature area. The levels and pathways of sustainable development differ among economies. The empirical data demonstrated a clear and direct relationship between GGDP and economic development. In their groundbreaking research, Hussain et al. (2021) investigated the relationship between GDP and GGDP in high-income nations, revealing a direct and positive association. Nevertheless, their findings indicate that the relationship between GDP and GGDP is adverse, particularly when accounting for non-linear influences. In addition, the authors determined that green technology has a positive impact on GGDP, resulting in environmental sustainability. Fernandes et al. (2021) conducted an analysis of the economic aspects of OECD countries by employing dynamic panel methodologies. Empirical research suggests that promoting green practices have a positive impact on GGDP, which in turn benefits the region’s GDP. Zhou et al. (2022) conducted a study that utilized panel data analysis to investigate the impact of green innovation on GGDP in China. The empirical research demonstrated a positive association between the utilization of green practices and the promotion of GGDP.

Parallel to this, Zhao et al. (2024) investigated the impact of digital transformation on the pollution emitted from Chinese manufacturing enterprises. The outcomes from the dynamic fixed effect model stated that digital transformation significantly reduces CO2 emissions in manufacturing industries. Using the Chinese provincial data, Hu et al. (2024) analyzed a relationship between digital transformation and GGDP. The outcomes stated that digital transformation significantly boosts the GGDP in the western regions of China but inhibits GGDP in the central region. Wang et al. (2023) explored the influence of green finance on GGDP by using the panel data of 30 Chinese provinces. The outcomes reveal that green finance significantly upsurges the GGDP in China. Using data of Xian City, Shang and Luo (2021) measured the carbon carrying capacity and net carbon footprint pressure index. The findings from the partial least square regression model stated that the marginal effect of carbon footprint is greater than economic growth, thus promoting the growth of urban space. Jabeen et al. (2024) investigated a relationship between green HRM and environmental performance using the data of 570 hotels. The outcomes from Smart PLS concluded that GHRM positively impacts the EP in the presence of green ambidexterity and green behavior.

The literature on the relationship between oil rents and economic growth is characterized by inconsistency. However, the following set of studies provide further information concerning this relationship (Hong et al., 2022; Umar et al., 2022). Conducted an empirical study employing to investigate the relationship between oil rents and economic growth. The empirical evidence demonstrated a positive and long-term link between oil rents and economic growth. Okoye et al. (2022) examined the phenomenon of the resource curse in the context of Nigeria. The results suggest that oil rents have had a beneficial impact on economic growth, thereby challenging the notion of the resource curse. A recent study conducted in Nigeria has revealed that oil rents significantly contribute to the country’s economic growth (Joshua et al., 2021). In their study, Sweidan and Elbargathi (2022) examined the influence of oil rent on the economic growth of Saudi Arabia. The findings demonstrate a positive connection between economic growth and oil rents across long-term and short-term periods.

Contrarily, Badeeb et al. (2021) validated the resource curse hypothesis by illustrating that changes in oil revenue have an adverse effect on economic growth in several sectors of the economy. However, the general response to oil rent shocks is varied, encompassing both positive and negative reactions. Fuinhas et al. (2015) conducted a study that explored the negative impact of oil rents on economic growth and the positive impact of oil prices on growth. Inuwa et al. (2022) also recorded the detrimental impact of oil rents on Nigeria’s economic growth. Ofori and Grechyna (2021) explored that oil rents have a harmful impact on economic growth in Sub-Saharan Africa. Furthermore, through threshold analysis, it is seen that the negative impact of oil rents is offset once the influx of remittances occurs. Mohammed et al. (2020) employed panel VAR model to investigate the relationship between oil rents and economic growth in oil-producing economies. The results revealed the substantial and beneficial influence of oil rents on economic growth. Next, in their study, Singh et al. (2023) examined the influence of natural resource rent on the economic growth of the United Kingdom, the United States, Germany, France, China, and Russia. These countries are recognized as significant affluent economies. The analysis uncovered a detrimental relationship between natural resources and economic growth for the entire sample, however, the influence differs among various quantiles in each country. Mumuni and Mwimba (2023) employed a panel ARDL model and FGLS methods for 24 African countries to examine the resource-growth nexus. The study concludes that the revenues derived from natural resources in Africa have positive effects on economic growth in the short term, but these effects are not statistically significant in the long term.

There is scant literature on the impact of gas rent on economic growth, emissions, or GGDP. Mahmood et al. (2023) explored a relationship between gas rent and CO2 emission in the MENA region and found an insignificant relationship. In the study of Europe, Belucio et al. (2022) investigated the impact of gas rent on CO2 emission and reported that gas rent significantly boosts CO2 emission. Explored a relationship between gas rent and economic growth in the case of the Russian Federation. The outcomes from the ARDL model reported that gas rent has a negative influence on economic growth. Similarly, Adabor and Buabeng (2021) examined the influence of gas rent on economic growth in Ghana. The findings reported that gas rent has a negative influence on economic growth.

In a case study of G7 countries, Wang et al. (2020) investigated the influence of natural resource rents on CO2 emission using the ARDL and stated that natural resources significantly enhance CO2 emission. Danish (2020) also explored a significant positive association between natural resources and CO2 emission. Adedoyin et al. (2020) examined the impact of natural resource rent on CO2 emission in BRICS countries and concluded that natural resources significantly boost CO2 emission. Moreover, Royal et al. (2022) reported a positive association between TNR and CO2 emission in G7 countries with the help of the fully modified least square method. Saqib et al. (2022) investigated the impact of natural resource rents on CO2 emission in GCC countries and found that natural resources enhance CO2 emission effectively. Tufail et al. (2021) explored the impact of natural resources on CO2 emissions in OECD countries. The findings from CS-ARDL stated that natural resources significantly reduce emissions. Nwani and Adams (2021) also analyzed the impact of natural resources on consumption and production-based CO2 emissions in 93 countries. The outcomes show an insignificant impact of natural resources on consumption-based CO2 emission while significantly reducing production-based CO2 emission.

By conducting a study on Pakistan and India, Mehar et al. (2018) analyzed the impact of natural resources on economic growth. The outcomes from the vector error correction model stated that natural resource rents significantly enhance economic growth in Pakistan and India. Yu (2023) conducted research to investigate the relationship between natural resources and economic growth in selected developing countries. The outcomes reveal that natural resource rents significantly boost economic growth in the long run. Ampofo et al. (2020) analyzed the top ten minerals-rich countries with the help of NARDL and found that natural resource rents increase economic growth. Further, Salha et al. (2021) and Arslan et al. (2022) analyzed the impact of natural resources on economic growth. The outcomes reported that natural resources significantly reduce economic growth. A negative relationship has also been reported in some studies between natural resources and economic growth. Khan et al. (2021) analyzed the impact of natural resources on economic growth in the United States. The outcomes from GMM stated a negative relationship between natural resources and economic growth. Similarly, Qian et al. (2021) explored the impact of natural resources on economic growth in the coal mining cities of China. They concluded that there is a negative association between natural resources and economic growth. Moreover, Vasilyeva and Libman (2020) investigated the influence of natural resources on economic growth and found a negative relationship between them.

Researchers have conducted analyses on the relationship between economic growth and coal rent in multiple case studies focused on individual/groups of countries. Li and Li (2011) concluded the relationship between economic growth and coal extraction in China and India. Nevertheless, Apergis and Payne (2010) have shown that the relationship between economic growth and coal usage can be negative in the short-run. The extensive analysis conducted by Wang A. et al. (2023), Shi et al. (2023), and Chen et al. (2023) on the impact of mineral rent on economic growth also established the mineral-growth nexus. In addition, several studies conducted by Sweidan and Elbargathi (2022), Okoye et al. (2022), and Badeeb et al. (2021) have examined the effects of oil rent on economic growth. There is a limited amount of research available on the connection between specific natural resource rent and GGDP. In a recent study by Fang et al. (2023), it was observed that mineral extraction had a detrimental impact on GGDP, thereby confirming the validity of the resource curse concept. Chien et al. (2023) have revealed similar findings about G7 countries. Yang et al. (2021) have provided evidence for the resource curse theory in the South Asian region by documenting the detrimental effect of minerals on GGDP. In addition, Li et al. (2024) confirmed the validity of the resource curse concept while investigating the relationship between minerals and GGDP in China. In contrast, Xu et al. (2022) found that the increase in natural resources rent, such as coal and gas rentals, leads to a rise in GGDP, thereby disproving the resource curse concept. There are three key aspects to consider: 1) There is a scarcity of research on the specific topic of disaggregated natural resources rent and GGDP. 2) The existing literature on this topic presents conflicting results. 3) Currently, no study has investigated the combined effects of coal, gas, natural gas, and minerals rent on GGDP.

3 Methods

3.1 Model

This study employs an empirical model incorporating a conventional production function. Adopting a production function as a growth model is considered more advantageous when compared to alternative models owing to its integration of micro-foundations. Equation 1 embodies the production function in its fundamental and widely prevalent manifestation:

In Equation 1, Y, CAP, and EMP represent production, capital, and labor, respectively. In our analysis, we substituted production (growth) with green growth (GGDP). EMP and CAP are fundamental pillars of growth, and an increase in CAP and EMP could stimulate GGDP. Nguyen (2023) found that the CAP significantly impacts the GGDP. Moreover, implementing CAP can exert substantial influence on the distribution of resources towards environmentally friendly investments, eco-friendly technologies, and R&D. Therefore, incorporating CAP in GGDP plays a vital role in enabling the shift towards a sustainable and eco-friendly economy. CAP significantly impacts the GGDP due to its economic and environmental consequences. Moreover, adopting CAP incentivizes individuals to adopt a sustainable and environmentally aware lifestyle (Yao et al., 2023). Thereafter, we incorporate our key independent variables in Equation 1, and the resultant equation are expressed as follows:

Model 1:

Model 2:

Model 3:

Model 4:

Model 5:

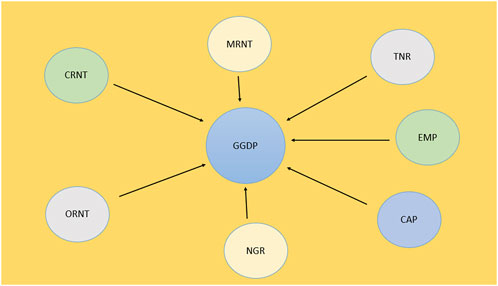

In Equations 2–6, TNR, MRNT, CRNT, ORNT, and NGR represent the total natural resources rent, minerals rents, coal rents, oil rents, and natural gas rents, respectively. The graphical presentation of Equations 2–6 is shown in Figure 2.

3.2 Data

This analysis utilizes a panel dataset encompassing G7 countries from 1990 to 2020. The dependent variable is green growth, which is proxied by the GGDP index developed by Sarkodie et al. (2023). It is worth reporting that “green growth means fostering economic growth and development while ensuring that natural assets continue to provide the resources and environmental services on which our wellbeing relies” (Hallegate et al., 2012). The existing literature mainly considers the multifactor productivity index of the OECD database as the proxy of GGDP, which covers only two aspects: economic growth and environmental cost. Sarkodie et al. (2023) formulated the green growth index by incorporating five key dimensions: the natural asset base, policy response, socio-economic outcomes, quality of life, and environmental productivity. The GGDP index is a quantitative measure that ranges from 0 to 1, indicating the comparative scale of green economic activity within a nation. A numerical value of 0 denotes the least green growth performance. In contrast, a numerical value of 1 signifies a high level of GGDP performance. It is worth highlighting that this index is constructed using a novel summary index technique with a generalized least squares attributed-standardized-weighted index.

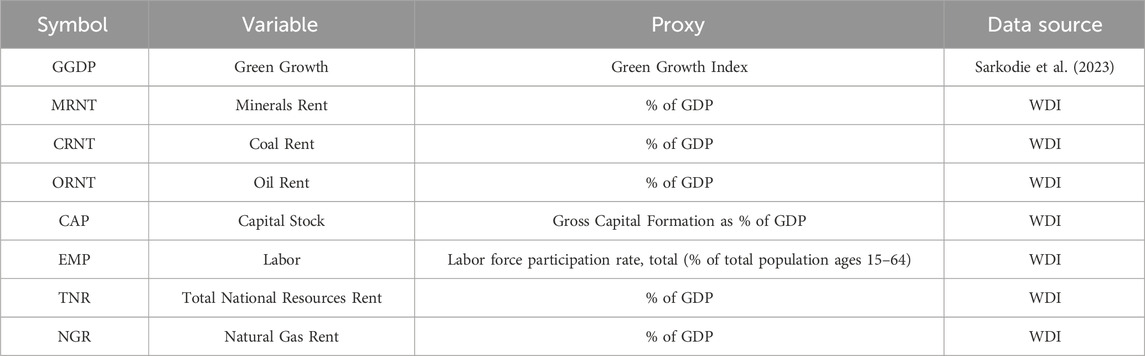

Next, minerals rent (MRNT), coal rent (CRNT), oil rent (ORNT), gas rent (NGR), and total natural resources rent (TNR) are the key independent variables and have been sourced from the World Development Indicator (WDI). These variables are measured as the percentage of GDP. Moreover, the empirical data related to the control variables (i.e., labor (EMP) and capital stock (CAP)) have been sourced from the WDI. We utilize the labor force participation rate, total (% of total population ages 15–64) (modeled ILO estimate) as an indicator of EMP. At the same time, gross fixed capital formation is a proxy for CAP. Each variable is transformed into a natural logarithmic form. Table 2 shows the description of the variables.

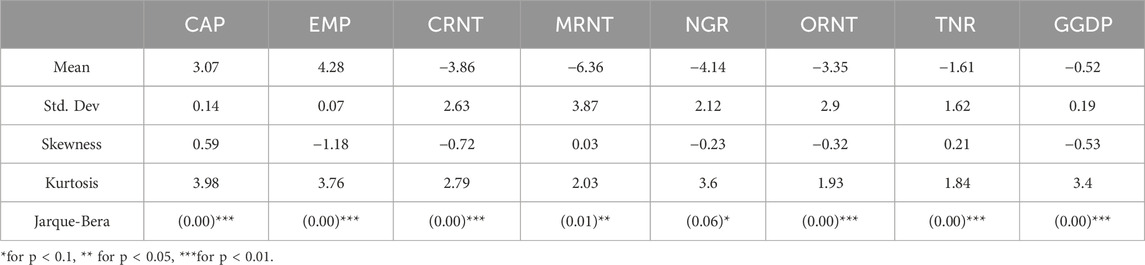

Table 3 displays descriptive statistics of the dataset. EMP and MRNT have the largest and the lowest mean values, respectively. MR exhibits the highest level of variation, whilst the EMP shows the lowest level of variation. CAP, MRNT, and TNR exhibit positive skewness, while EMP, CRNT, NGR, ORNT, and GGDP display negative skewness. In addition, the Jarque-bera test confirmed that the data does not follow a normal distribution.

4 Methodology

There are multiple methods available for examining dynamic relationships in panel datasets. However, the panel autoregressive distributed lag (panel ARDL) approach is a widely used model for the long- and short-run estimates. It is worth noting that panel ARDL has three specifications: pooled mean group (PMG) estimator, mean group (MG) estimator, and dynamic fixed effects (DFE) estimator. Pesaran et al. (1999) introduced the PMG-ARDL model, which offers a comprehensive framework for analyzing dynamic panel data. This pertains to aggregating and calculating the average coefficient across different cross-sectional units. Pesaran et al. (1999) argue that applying the PMG-ARDL approach is relatively efficient when examining panel time series datasets. The PMG-ARDL methodology generates estimates for the coefficients of short-term and long-term impacts, allowing for potential differences in the timing of changes between the analyzed variables. Furthermore, this approach can be employed in situations where the variables display varying degrees of integration, such as being integrated of the first order [I (1)] or integrated at level [I (0)].

Next, Weinhold (1999) proposed the dynamic fixed effect (DFE) model. It is an econometric model used to examine the relationship between the dependent and independent variables when the dependent variable is influenced by its lag value. This model is beneficial in controlling heterogeneity issues across cross-sections and helps to improve consistency. Further, Pesaran et al. (1999) proposed the mean group (MG) estimator. Basically, it is used to estimate the long-run relationships in dynamic panel data models. The MG model is applicable when individual estimators are weakly cross-correlated and biased. It can be used for both linear and non-linear models. The MG model is different from the PMG model as this constrains the long-run coefficients from being identical across the groups but also allows the short-run coefficients and error variances to differ. Considering our study, the general expression of panel ARDL model is displayed as follows:

In Equation 7, GGDP is the dependent variable, while TNR is the matrix of independent variables (i.e., CRNT, MRNT, ORNT, NGR, or TNR). CAP and EMP are control variables, and t and i are the time and cross sections. The variables represented ∆ correspond to short-term estimations, while the remaining ones correspond to long-term estimations. At the end, Eit represents the error term in the model. Since this study aims to explore the dynamic impact of natural resource rents on GGDP, we employ the panel ARDL model. It is worth noting that the appropriate specification of panel ARDL (i.e., PMG, MG, or DFE) is selected based on the Hausman test.

5 Empirical findings

In this section, we report empirical findings. Initially, we test cross-sectional dependence (CSD) followed by a unit root test. Thereafter, we test cointegration using Westerlund (2007) test. Next, we estimate the long- and short-run results using the panel ARDL model.

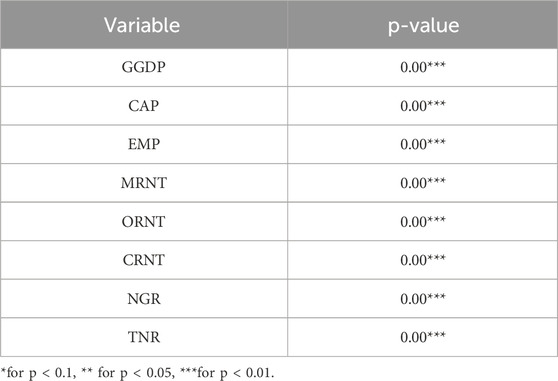

Starting from the CSD analysis, it is worth noting that CSD is the spillover effect of a shock from one economy to another. This is critical to explore CSD in a panel dataset to provide reliable results. In this study, we use the Pesaran CSD test, which has a null hypothesis of no CSD. The findings from the test are reported in Table 4. As can be seen in the case of each variable, we can reject the null hypothesis. This indicates the validity of CSD.

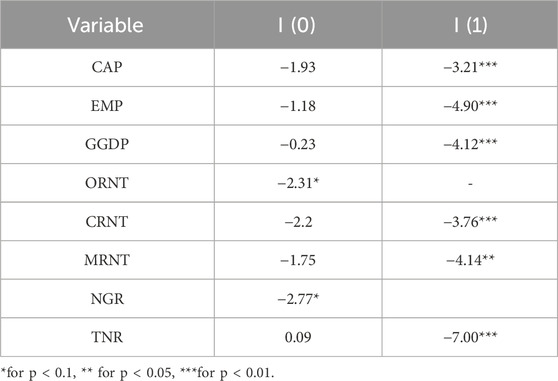

After conducting a comprehensive CSD examination, the CIPS unit root test is implemented to explore the order of integration. Table 5 presents the outcomes derived from the CIPS test. The empirical evidence suggests that the null hypothesis of unit root is not rejected for the entire dataset except for ORNT, implying that ORNT is integrated at I (0). Further, the remaining variables are integrated at the first order (i.e., I (1)). It is worth noting that the PMG-ARDL approach assumes that the dependent variable must be I (1), and the independent variables should have either integrated at I (1) or I (0). Hence, we can employ the panel ARDL approach.

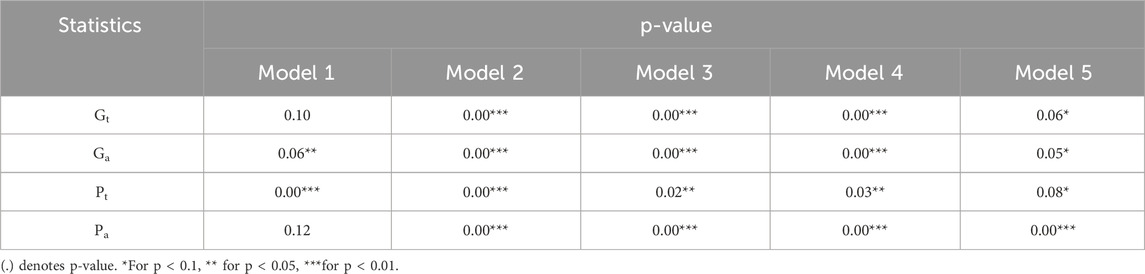

Next, we test cointegration using Westerlund (2007) test before estimating the panel ARDL approach. The findings from the cointegration test of Model 1 are reported in Table 6. The null hypothesis is “no cointegration,” while the H1 assumes “cointegration.” Since we can reject the null hypothesis of Ga and Pt, we conclude that a long-term association exists between the variables considered in Model 1. In Models 2-5, Gt, Ga, Pt, and Pa reject the null hypothesis. Thus, we confirmed the existence of a long-run association between natural resource rents and GGDP.

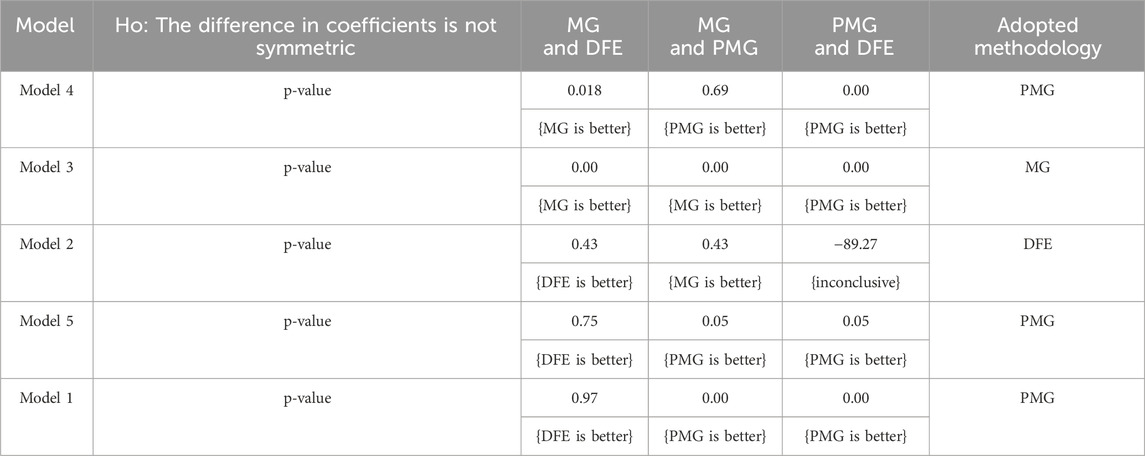

After the Westerlund test (2007), we conducted the Hausman test (1978) to check which model is appropriate among PMG, MG, and DFE. The findings from the Hausman test are reported in Table 7.

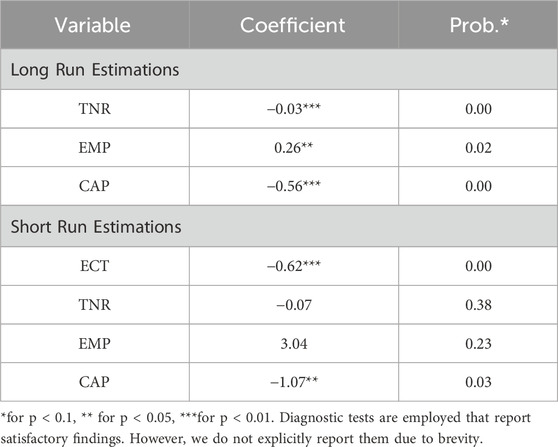

Considering the long-run estimates of Model 1 from PMG-ARDL (see Table 8), a negative but significant relationship is observed between TNR and GGDP. Results stated that a 1% increase in TNR would decrease GGDP by 0.03%. This implies that TNR decreases GGDP in the G7 countries during the long-run. Moreover, EMP has a positive and significant relationship with the GGDP in the long-run. Results declare that a 1% increase in the EMP results in an increase of 0.26% in GGDP. Further, CAP has a negative but significant relationship with the GGDP in the long-run. The results stated that a 1% increase in the CAP results in a decrease of 0.56% in the GGDP. While considering the short-run outcomes, the results declare that TNR and EMP have an insignificant impact on the GGDP. In the case of CAP, it has a negative but significant impact on the GGDP. Results stated that a 1% increase in the CAP results in a decrease of 1.07% in GGDP. This indicates that CAP decreases the GGDP in the short-run. Finally, the error correction term (ECT) remains statistically significant with a negative coefficient, indicating that any deviation in this system will be covered in the long-run.

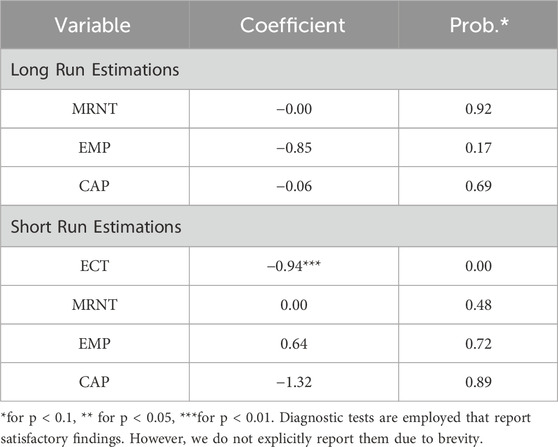

Considering the long-run estimates from DFE related to Model 2 (see Table 9), an insignificant relationship has been found between the MRNT and GGDP. This indicates that MRNT does not impact GGDP in the long-run. Moreover, EMP and CAP have an insignificant relationship with GGDP in G7 countries in the long run. In the short-run findings, MRNT, EMP, and CAP have an insignificant impact on the GGDP. This implies that MRNT, EMP, and CAP do not impact GGDP in the short-run.

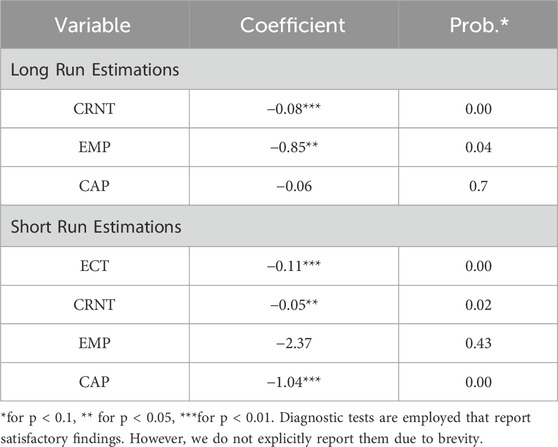

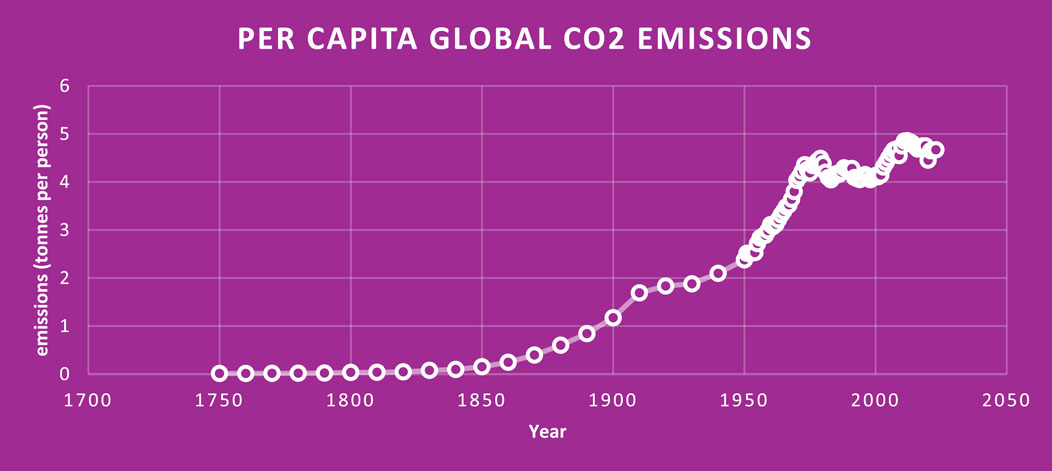

Focusing on the long-run estimates of Model 3 from the MG estimator (see Table 10), a negative but significant relationship is observed between CRNT and GGDP. Results declare that a 1% increase in the CRNT results in a decrease of 0.08% in the GGDP in the long-run. This stated that CRNT mitigates the GGDP in G7 countries. Further, EMP has a significant but negative impact on the GGDP. Results declare that a 1% increase in EMP results in a decrease of 0.85% in GGDP. Moreover, CAP has an insignificant relationship in the long-run, indicating that CAP does not impact GGDP. While considering the short-run findings, results declare that CRNT has a negative but significant impact on the GGDP. Results reported that a 1% increase in the CRNT results in a decrease of 0.05% in GGDP. Moreover, CAP has a negative but significant impact on the GGDP, while EMP has an insignificant impact on the GGDP. Similarly, ECT is negative and statistically significant, elucidating that any deviation in the system will eventually be covered.

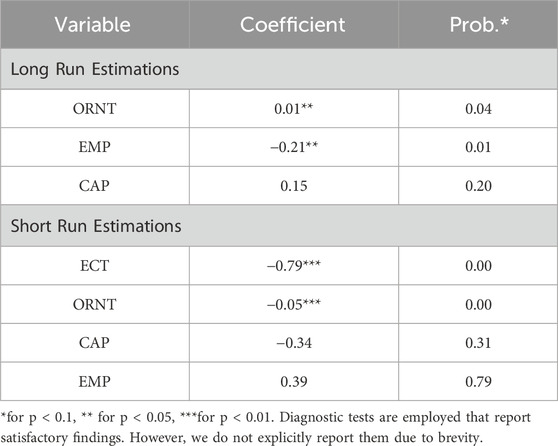

Next, Table 11 provides the results of Model 4 using the PMG-ARDL approach. A positive but statistically significant relationship is observed between ORNT and GGDP in the long-run. Hence, results stated that a 1% increase in ORNT would increase 0.01% in GGDP. Furthermore, long-run estimations declare that EMP has a negative but statistically significant impact on GGDP. Moreover, CAP has an insignificant impact on GGDP. Analyzing the short-run findings, ORNT has a negative but significant impact on the GGDP. This implies that ORNT decreases GGDP in the G7 countries in the short-run. It has been reported from the results that a 1% increase in the ORNT results in a decrease in the GGDP by 0.05% in the short run. CAP and EMP do not affect GGDP in the short-run since the p-value of their coefficients is higher than 0.1. Finally, ECT remains statistically significant with a coefficient between 0 and -1.

Table 12 provides empirical findings of Model 5 using the PMG-ARDL approach. Considering the long-run estimates, the coefficient of NGR is negative and statistically significant, indicating that natural gas rent decreases green growth in G7 during the long-run. In particular, a 1% increase in NGR would result in a decrease of 0.02% in GGDP. EMP has a negative but significant relationship with the GGDP in the long-run. Results declare that a 1% increase in the EMP results in a decrease of 0.85% in the GGDP. Further, CAP has an insignificant impact on the GGDP. In the short-run, the coefficient of NGR is statistically insignificant, indicating that natural gas rent does not impact GGDP in the short-run. EMP is positive and statistically significant, elucidating that EMP leads to higher GGDP in the short-run. Next, ECT is statistically significant, with a value between 0 and -1.

6 Discussion on results

This section delineates the discussion related to empirical results. We report that TNR has a negative impact on GGDP in the long run, hence validating the natural resource curse hypothesis within the framework of GGDP. These outcomes align with the conclusion by Cheng et al. (2020), who noted that natural resources reduce green total factor productivity. There are several reasons for this outcome, e.g., the high dependency on natural resources often results in reduced investment in the renewable energy sector and innovation, leading to low GGDP. Moreover, overdependency on natural resources upsurges environmental degradation that directly affects GGDP in the form of an increase in CO2 emission. However, TNR has an insignificant effect on GGDP in the short-run because revenue from natural resource rents frequently ensures economic stability and addresses immediate development requirements in the short-run. Nevertheless, the transition to green growth typically necessitates sustained governmental initiatives and substantial structural modifications, which require time to yield outcomes.

Next, a negative impact of CRNT on GGDP is revealed. The long-run estimates declare that CRNT decreases GGDP in G7 countries, validating the natural resource curse hypothesis. The increased revenues associated with coal significantly impact the overall economy, potentially posing challenges for energy-intensive businesses. It also hurts the overall state of the economy. This slowdown may hinder crucial investment streams, including those for environmentally friendly technologies that play a vital role in fostering growth and innovation in the industry. When coal prices increase, it typically disproportionately impacts low-income households. This causes the issue of inequality and poses challenges in accessing cleaner energy alternatives. This discrepancy hinders the attainment of fairness and inclusivity, which are crucial for the long-term sustainability of green growth. The findings of our study are similar to the study of Wang A. et al. (2023), Wenlong et al. (2023), and Huang et al. (2021). In short-run, CRNT has a negative impact on the GGDP in the short-run. This is due to the over-extraction of coal and the higher dependency that leads to CO2 emission. The over-extraction creates a hindrance in reinvesting in sustainable practices.

Further, a positive impact of ORNT on GGDP is reported in the long-run. This implies that ORNT enhances GGDP in the G7 countries during the long-run. Advanced economies usually reinvest the revenue generated from the oil rents in clean technology projects, sustainable development initiatives, and renewable energy projects. This helps them to boost economic growth and to reduce environmental degradation. Moreover, they adopted the policy framework of the conservation of their resources into productive and environment friendly investments. This framework of resource utilization helps to boost economic growth in the presence of green policies. The outcomes of our research are familiar with the findings of Mahmood and Saqib (2022) and Udemba and Yalcintas (2023). ORNT has a negative impact on the GGDP in the short-run. It has been noticed that higher oil rent attracts investors to halt renewable energy investment in the short-run, leading to low GGDP. Similarly, oil rents can be used to finance some non-green energy projects in the short run, leading to low GGDP.

Considering the negative impact of NGR on GGDP in the long-run, we validate the natural resource curse hypothesis for natural gas. As highlighted earlier, this is due to the overextraction of natural gas that reduces the investment in clean technologies while generating carbon emissions. Although natural gas extraction has economic benefits, but the emissions of greenhouse gases eventually lead to low GGDP in the long-run. The outcomes of our research (i.e., NGR hinders GGDP) are familiar with the findings of Zeng et al. (2024) and Meng and Li (2023). While considering the short-run outcomes, NGR has an insignificant relationship with GGDP. It is worth reporting that MRNT impacts GGDP neither in the long-run nor in the short-run. The reason could be the fact that minerals do not directly burn like other natural resources (e.g., oil, coal, and natural gas), and hence, their environmental impact is profoundly low. In addition, the life span of mineral-related products is high, compels the extraction industry not to extract minerals frequently. Hence, either a meager or negligible impact of minerals can be envisaged.

7 Conclusion

The world strives to pursue a high level of GGDP for economic and environmental sustainability. Hence, it is crucial to investigate the factors that boost GGDP. Based on this, we examine the effect of CRNT, MRNT, ORNT, NGR and TNR on GGDP in G7 countries. We used a panel dataset of G7 countries covering the years from 1990 to 2020. We observed CSD during the empirical inquiry. By using the Westerlund (2007) test, we declare that the variables used in this study have a long-run association. We employed panel ARDL models (i.e., PMG, MG, and DFE estimators) in our study. The findings stated that coal rent, natural gas rent, and total natural resources rent have a negative impact on green growth in the long-run. Further, oil rent has a positive impact, while minerals rent has an insignificant impact on green growth in the long-run.

While analyzing our long-run research findings, we put forward various policy implications. For instance, facilitating the transition to a low-carbon economy can be achieved by reallocating revenues from the extraction of natural resources to investments in sustainable development programs and infrastructure that utilize renewable energy sources. This involves providing subsidies and tax incentives to encourage renewable energy sources such as solar, wind, and hydroelectric power. This will aid in the reduction of dependence on fossil fuels. To reduce the ecological impacts of natural resources, policymakers must also prioritize the implementation of stringent environmental legislation and sustainable mining practices. By dedicating resources to R&D of extraction methods that are more environmentally sustainable, as well as by advocating for the principles of recycling and circular economy, it is possible to mitigate the adverse environmental effects associated with resource extraction significantly.

Focusing on the limitations of this study, it is important to highlight that this study focuses exclusively on G7 countries. Therefore, the recommendations may not apply to other countries. In addition, the methodology fails to consider the nonlinear or asymmetric influence that oil rent, coal rent, gas rent, total natural resources rent, and minerals rent have on green growth. The limited dataset compels us not to use second-generation methods such as Augmented Mean Group (AMG), Cross-sectional Autoregressive Distributed Lag (CS-ARDL), and continuously updated fully modified (CUP-FM) approaches. In addition, the limited sample does not allow the consideration of various control variables such as technical innovation and human capital. Scholars may explore strategies to surmount these constraints in subsequent research to broaden the study’s range.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://databank.worldbank.org/source/world-development-indicators.

Author contributions

JQ: Writing–original draft. LC: Conceptualization, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The authors acknowledge the use of Grammarly to improve the language.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://climate.nasa.gov/vital-signs/global-temperature/?intent=121

2https://www.cfr.org/timeline/ecological-disasters

3https://www.weforum.org/agenda/2023/10/climate-loss-and-damage-cost-16-million-per-hour/#:∼:text=Writer%2C%20EcoWatch-,The%20global%20cost%20of%20climate%20change%20damage%20is%20estimated%20to,climate%20change%20become%20more%20severe

References

Abro, A. A., Alam, N., Murshed, M., Mahmood, H., Musah, M., and Rahman, A. A. (2023). Drivers of green growth in the Kingdom of Saudi Arabia: can financial development promote environmentally sustainable economic growth? Environ. Sci. Pollut. Res. 30 (9), 23764–23780. doi:10.1007/s11356-022-23867-z

Adabor, O., and Buabeng, E. (2021). Asymmetrical effect of oil and gas resource rent on economic growth: empirical evidence from Ghana. Cogent Econ. and Finance 9 (1), 1971355. doi:10.1080/23322039.2021.1971355

Adedoyin, F. F., Gumede, M. I., Bekun, F. V., Etokakpan, M. U., and Balsalobre-Lorente, D. (2020). Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci. Total Environ. 710, 136284. doi:10.1016/j.scitotenv.2019.136284

Ampofo, G. K. M., Cheng, J., Asante, D. A., and Bosah, P. (2020). Total natural resource rents, trade openness and economic growth in the top mineral-rich countries: new evidence from nonlinear and asymmetric analysis. Resour. Policy 68, 101710. doi:10.1016/j.resourpol.2020.101710

Apergis, N. A., and Payne, J. E. (2010). Coal consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38, 1353–1359. doi:10.1016/j.enpol.2009.11.016

Arslan, H. M., Khan, I., Latif, M. I., Komal, B., and Chen, S. (2022). Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: new insights from China. Environ. Sci. Pollut. Res. 29 (39), 58746–58761. doi:10.1007/s11356-022-19952-y

Baafi, J. A. (2024). Unraveling Ghana’s resource curse hypothesis: analyzing natural resources and economic growth with a focus on oil exploration. Economies 12 (4), 79. doi:10.3390/economies12040079

Badeeb, R. A., Szulczyk, K. R., and Lean, H. H. (2021). Asymmetries in the effect of oil rent shocks on economic growth: a sectoral analysis from the perspective of the oil curse. Resour. Pol. 74, 102326. doi:10.1016/j.resourpol.2021.102326

Belucio, M., Santiago, R., Fuinhas, J. A., Braun, L., and Antunes, J. (2022). The impact of natural gas, oil, and renewables consumption on carbon dioxide emissions: european evidence. Energies 15 (14), 5263. doi:10.3390/en15145263

Caijuan, G., Durani, F., Hamid, A., Syed, Q. R., Keoy, K. H., and Anwar, A. (2024). Navigating the green growth spectrum: exploring the synergy between geopolitical risk, environmental policy stringency, and green production practices. Energy and Environ., 0958305X241248377. doi:10.1177/0958305x241248377

Chen, F., Tiwari, S., Mohammed, K. S., Huo, W., and Jamróz, P. (2023). Minerals resource rent responses to economic performance, greener energy, and environmental policy in China: combination of ML and ANN outputs. Resour. Policy 81, 103307. doi:10.1016/j.resourpol.2023.103307

Cheng, Z., Li, L., and Liu, J. (2020). Natural resource abundance, resource industry dependence and economic green growth in China. Resour. Policy 68, 101734. doi:10.1016/j.resourpol.2020.101734

Chien, F., Hsu, C. C., Zhang, Y., and Sadiq, M. (2023). Sustainable assessment and analysis of energy consumption impact on carbon emission in G7 economies: mediating role of foreign direct investment. Sustain. Energy Technol. Assessments 57, 103111. doi:10.1016/j.seta.2023.103111

Chishti, M. Z., Ahmed, Z., Murshed, M., Namkambe, H. H., and Ulucak, R. (2021). The asymmetric associations between foreign direct investment inflows, terrorism, CO2 emissions, and economic growth: a tale of two shocks. Environ. Sci. Pollut. Res. 28, 69253–69271. doi:10.1007/s11356-021-15188-4

Danish (2020). Moving toward sustainable development: the relationship between water productivity, natural resource rent, international trade, and carbon dioxide emissions. Sustain. Dev. 28 (4), 540–549. doi:10.1002/sd.2007

Doğan, B. Ö. (2022). Does inclusive green growth in türkiye have an impact on global warming? Eskişehir Osman. Üniversitesi Sos. Bilim. Derg. 25 (2), 342–358. doi:10.17494/ogusbd.1462323

Fang, C., Cheng, J., You, Z., Chen, J., and Peng, J. (2023). A detailed examination of China’s clean energy mineral consumption: footprints, trends, and drivers. Sustainability 15 (23), 16255. doi:10.3390/su152316255

Fang, W., Liu, Z., and Putra, A. R. S. (2022). Role of research and development in green economic growth through renewable energy development: empirical evidence from South Asia. Renew. Energy 194, 1142–1152. doi:10.1016/j.renene.2022.04.125

Fernandes, C. I., Veiga, P. M., Ferreira, J. J., and Hughes, M. (2021). Green growth versus economic growth: do sustainable technology transfer and innovations lead to an imperfect choice? Bus. Strat. Environ. 30, 2021–2037. doi:10.1002/bse.2730

Fuinhas, J. A., Marques, A. C., and Couto, A. P. (2015). Oil rents and economic growth in oil producing countries: evidence from a macro panel. Change Restruct. 48, 257–279. doi:10.1007/s10644-015-9170-x

Hallegatte, S., Heal, G., Fay, M., and Treguer, D. (2012). From growth to green growth-a framework (No. w17841). UK: National Bureau of Economic Research.

Hong, Y., Wang, L., Liang, C., and Umar, M. (2022). Impact of financial instability on international crude oil volatility: new sight from a regime-switching framework. Resour. Pol. 77, 102667. doi:10.1016/j.resourpol.2022.102667

Hu, F., Zhang, S., Gao, J., Tang, Z., Chen, X., Qiu, L., et al. (2024). Digitalization empowerment for green economic growth: the impact of green complexity. Environ. Eng. and Manag. J. (EEMJ) 23 (3), 519–536. doi:10.30638/eemj.2024.040

Huang, S. Z., Sadiq, M., and Chien, F. (2021). The impact of natural resource rent, financial development, and urbanization on carbon emission. Environ. Sci. Pollut. Res. 30, 42753–42765. doi:10.1007/s11356-021-16818-7

Hussain, Z., Mehmood, B., Khan, M. K., and Tsimisaraka, R. S. M. (2021). Green growth, green technology, and environmental health: evidence from high-GDP countries. Front. Public Health 9, 816697. doi:10.3389/fpubh.2021.816697

Imasiku, K., Thomas, V., and Ntagwirumugara, E. (2019). Unraveling green information technology systems as a global greenhouse gas emission game-changer. Adm. Sci. 9 (2), 43. doi:10.3390/admsci9020043

Inuwa, N., Adamu, S., Sani, M. B., and Modibbo, H. U. (2022). Natural resource and economic growth nexus in Nigeria: a disaggregated approach. Lett. Spatial Resour. Sci. 15, 17–37. doi:10.1007/s12076-021-00291-4

Jabeen, R., Mehmood, S., Ahmed, M., Ghani, T., Javaid, Z. K., and Popp, J. (2024). The role of green HRM on environmental performance: mediating role of green ambidexterity and green behavior and moderating role of responsible leadership. J. Chin. Hum. Resour. Manag. 15 (2), 70–90.

Joshua, U., Ameh, A. ˙ I., and Alola, A. A. (2021). Investment-driven economic growth in Nigeria: the role of oil rent. Kırklareli Üniversitesi ˙ Iktis. ve ˙ Idari Bilim. Fakültesi Derg. 10, 1–18.

Khan, I., Hou, F., and Le, H. P. (2021). The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci. Total Environ. 754, 142222. doi:10.1016/j.scitotenv.2020.142222

Li, C., and Gong, K. (2023). Does the resource curse hypothesis hold in China? Evaluating the role of trade liberalisation and gross capital formation. Resour. Policy 86, 103975. doi:10.1016/j.resourpol.2023.103975

Li, J., and Li, Z. (2011). Causality analysis of coal consumption and economic growth for China and India. Nat. Resour. 2, 54–60.

Li, Y., Durani, F., Syed, Q. R., and Sallam, O. A. A. J. (2024). Role of minerals rent, geopolitical risk, and economic policy uncertainty in achieving green growth: evidence from novel wavelet quantile correlation approach. Resour. Policy 93, 105084. doi:10.1016/j.resourpol.2024.105084

Lin, S., and Yuan, Y. (2023). China's resources curse hypothesis: evaluating the role of green innovation and green growth. Resour. Policy 80, 103192. doi:10.1016/j.resourpol.2022.103192

ling Guo, L., Qu, Y., and Tseng, M. L. (2017). The interaction effects of environmental regulation and technological innovation on regional green growth performance. J. Clean. Prod. 162, 894–902. doi:10.1016/j.jclepro.2017.05.210

Liu, X., Fan, S., Cao, F., Peng, S., and Huang, H. (2022). Study on the drivers of inclusive green growth in China based on the digital economy represented by the Internet of Things (IoT). Comput. Intell. Neurosci. 2022 (1), 8340371–8340415. doi:10.1155/2022/8340371

Mahmood, H., and Saqib, N. (2022). Oil rents, economic growth, and CO2 emissions in 13 OPEC member economies: asymmetry analyses. Front. Environ. Sci. 10, 1025756. doi:10.3389/fenvs.2022.1025756

Mahmood, H., Saqib, N., Adow, A. H., and Abbas, M. (2023). Oil and natural gas rents and CO2 emissions nexus in MENA: spatial analysis. PeerJ 11, e15708. doi:10.7717/peerj.15708

Marsiglio, S. (2015). Economic growth and environment: tourism as a trigger for green growth. Tour. Econ. 21 (1), 183–204. doi:10.5367/te.2014.0411

Mehar, M. R., Hasan, A., Sheikh, M. A., and Adeeb, B. (2018). Total natural resources rent relation with economic growth: the case of Pakistan and India. Eur. J. Econ. Bus. 3 (3), 14–22.

Meng, L., and Li, J. (2023). Efficient natural resource rents and carbon taxes in BRICS green growth. Resour. Policy 86, 104043. doi:10.1016/j.resourpol.2023.104043

Mohammed, J. I., Karimu, A., Fiador, V. O., and Abor, J. Y. (2020). Oil revenues and economic growth in oil-producing countries: the role of domestic financial markets. Resour. Pol. 69, 101832. doi:10.1016/j.resourpol.2020.101832

Mumuni, S., and Mwimba, T. (2023). Modeling the impact of green energy consumption and natural resources rents on economic growth in Africa: an analysis of dynamic panel ARDL and the feasible generalized least squares estimators. Cogent Econ. and Finance 11 (1), 2161774. doi:10.1080/23322039.2022.2161774

Naqvi, B., Mirza, N., Rizvi, S. K. A., Porada-Rochon, M., and Itani, R., 2021. Is there a green fund premium? Evidence from twenty seven emerging markets. Glob. Finance J. 50, 100656. doi:10.1016/j.gfj.2021.100656

Nguyen, H. K. (2023). Climate justice in Vietnam’s green transformation: a three-dimensional analysis of the green growth and climate change mitigation sectors. VMOST J. Soc. Sci. Humanit. 65 (1), 90–99. doi:10.31276/vmostjossh.65(1).90-99

Nwani, C., and Adams, S. (2021). Environmental cost of natural resource rents based on production and consumption inventories of carbon emissions: assessing the role of institutional quality. Resour. Policy 74, 102282. doi:10.1016/j.resourpol.2021.102282

Ofori, P. E., and Grechyna, D. (2021). Remittances, natural resource rent and economic growth in Sub-Saharan Africa. Cogent Econ. and Finance 9, 1979305. doi:10.1080/23322039.2021.1979305

Okoye, L. U., Adeleye, B. N., Okoro, E. E., Okoh, J. I., Ezu, G. K., and Anyanwu, F. A. (2022). Effect of gas flaring, oil rent and fossil fuel on economic performance: the case of Nigeria. Resour. Pol. 77, 102677. doi:10.1016/j.resourpol.2022.102677

Pesaran, M. H., Shin, Y., and Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94 (446), 621–634. doi:10.2307/2670182

Qian, X., Wang, D., Wang, J., and Chen, S. (2021). Resource curse, environmental regulation and transformation of coal-mining cities in China. Resour. Policy 74, 101447. doi:10.1016/j.resourpol.2019.101447

Razzaq, A., Sharif, A., Ozturk, I., and Skare, M. (2023). Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew. Energy 202, 310–319. doi:10.1016/j.renene.2022.11.082

Rizvi, S. K. A., Naqvi, B., and Mirza, N. (2022). Is green investment different from grey? Return and volatility spillovers between green and grey energy ETFs. Ann. Oper. Res. 313, 495–524. doi:10.1007/s10479-021-04367-8

Royal, S., Singh, K., and Chander, R. (2022). A nexus between renewable energy, FDI, oil prices, oil rent and CO2 emission: panel data evidence from G7 economies. OPEC Energy Rev. 46 (2), 208–227. doi:10.1111/opec.12228

Saqib, N., Duran, I. A., and Hashmi, N. I. (2022). Impact of financial deepening, energy consumption and total natural resource rent on CO2 emission in the GCC countries: evidence from advanced panel data simulation. Int. J. Energy Econ. Policy 12 (2), 400–409. doi:10.32479/ijeep.12907

Sarkar, A. N. (2013). Promoting eco-innovations to leverage sustainable development of eco-industry and green growth. Eur. J. Sustain. Dev. 2 (1), 171.

Sarkodie, S. A., Owusu, P. A., and Taden, J. (2023). Comprehensive green growth indicators across countries and territories. Sci. Data 10 (1), 413. doi:10.1038/s41597-023-02319-4

Shang, M., and Luo, J. (2021). The tapio decoupling principle and key strategies for changing factors of Chinese urban carbon footprint based on cloud computing. Int. J. Environ. Res. Public Health 18 (4), 2101. doi:10.3390/ijerph18042101

Shi, J., Liu, Y., Sadowski, B. M., Alemzero, D., Dou, S., Sun, H., et al. (2023). The role of economic growth and governance on mineral rents in main critical minerals countries. Resour. Pol. 83, 103718. doi:10.1016/j.resourpol.2023.103718

Singh, S., Sharma, G. D., Radulescu, M., Balsalobre-Lorente, D., and Bansal, P. (2023). Do natural resources impact economic growth: an investigation of P5+ 1 countries under sustainable management. Geosci. Front., 101595.

Sweidan, O. D., and Elbargathi, K. (2022). The effect of oil rent on economic development in Saudi Arabia: comparing the role of globalization and the international geopolitical risk. Resour. Pol. 75, 102469. doi:10.1016/j.resourpol.2021.102469

Tawiah, V., Zakari, A., and Adedoyin, F. F. (2021). Determinants of green growth in developed and developing countries. Environ. Sci. Pollut. Control Ser. 28, 39227–39242. doi:10.1007/s11356-021-13429-0

Tufail, M., Song, L., Adebayo, T. S., Kirikkaleli, D., and Khan, S. (2021). Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ. Sci. Pollut. Res. 28 (35), 49179–49190. doi:10.1007/s11356-021-13865-y

Udemba, E. N., and Yalçıntaş, S. (2023). Economic and environmental implications of resource rent: a dual analysis of Venezuela's sustainability. Int. Soc. Sci. J. 73 (247), 215–231. doi:10.1111/issj.12378

Umar, M., Mirza, N., Hasnaoui, J. A., and Rochon, M. P., 2022. The nexus of carbon emissions, oil price volatility, and human capital efficiency. Resour. Pol. 78, 102876, doi:10.1016/j.resourpol.2022.102876

Vasilyeva, O., and Libman, A. (2020). Varieties of authoritarianism matter: elite fragmentation, natural resources and economic growth. Eur. J. Political Econ. 63, 101869. doi:10.1016/j.ejpoleco.2020.101869

Wang, A., Ahmad, M., Gu, X., Ismailova, N., and Ismailov, D. (2023a). Does the individual effect of resource rents imperative in the attainment of environmental sustainability? Evidence of Southeast Asian economies. Environ. Sci. Pollut. Res. 30 (47), 103718–103730. doi:10.1007/s11356-023-29605-3

Wang, L., Vo, X. V., Shahbaz, M., and Ak, A. (2020). Globalization and carbon emissions: is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? J. Environ. Manag. 268, 110712. doi:10.1016/j.jenvman.2020.110712

Wang, Z., Teng, Y. P., Wu, S., and Chen, H. (2023). Does green finance expand China’s green development space? Evidence from the ecological environment improvement perspective. Systems 11 (7), 369. doi:10.3390/systems11070369

Weimin, Z., and Zubair Chishti, M. (2021). Toward sustainable development: assessing the effects of commercial policies on consumption and production-based carbon emissions in developing economies. Sage Open 11 (4), 21582440211061580. doi:10.1177/21582440211061580

Weinhold, D. (1999). A dynamic fixed effects model for heterogeneous panel data. London: London School of Economics.

Wenlong, Z., Nawaz, M. A., Sibghatullah, A., Ullah, S. E., Chupradit, S., and Minh Hieu, V. (2023). Impact of coal rents, transportation, electricity consumption, and economic globalization on ecological footprint in the USA. Environ. Sci. Pollut. Res. 30 (15), 43040–43055. doi:10.1007/s11356-022-20431-7

Xu, J., Zhao, J., She, S., and Liu, W. (2022). Green growth, natural resources and sustainable development: evidence from BRICS economies. Resour. Policy 79, 103032. doi:10.1016/j.resourpol.2022.103032

Yao, X., Durani, F., Syed, Q. R., Lean, H. H., and Tabash, M. I. (2023). Does tourism promote green growth? A panel data analysis. Environ. Dev. Sustain., 1–12. doi:10.1007/s10668-023-03972-w

Yu, Q., Zuo, X., Ding, H., and Yin, X. (2024). Resource rent, economic stability and the legal landscape of China's green growth. Resour. Policy 89, 104704. doi:10.1016/j.resourpol.2024.104704

Yu, Y. (2023). Role of Natural resources rent on economic growth: fresh empirical insight from selected developing economies. Resour. Policy 81, 103326. doi:10.1016/j.resourpol.2023.103326

Zeng, C., Ma, R., and Chen, P. (2024). Impact of mineral resource rents and fin-tech on green growth: exploring the mediating role of environmental governance in developed economies. Resour. Policy 89, 104547. doi:10.1016/j.resourpol.2023.104547

Zhao, S., Zhang, L., Peng, L., Zhou, H., and Hu, F. (2024). Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 77, 102520. doi:10.1016/j.techsoc.2024.102520

Keywords: green growth, coal rent, mineral rent, oil rent, natural gas rent, total natural resources rent, resource curse hypothesis, G7 countries

Citation: Qian J and Chen L (2025) Impact of natural resources rents on green growth: evidence from G7 countries. Front. Environ. Sci. 13:1482812. doi: 10.3389/fenvs.2025.1482812

Received: 18 August 2024; Accepted: 02 January 2025;

Published: 18 February 2025.

Edited by:

Jinyu Chen, Central South University, ChinaReviewed by:

Mohamed R. Abonazel, Cairo University, EgyptOusama Ben-Salha, Northern Border University, Saudi Arabia

Copyright © 2025 Qian and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lai Chen, c3Joa2Vjb0BnbWFpbC5jb20=

Jiangyunze Qian

Jiangyunze Qian Lai Chen

Lai Chen