- 1School of Economics and Management, China University of Geosciences (Wuhan), Wuhan, Hubei, China

- 2School of Economics and Management, Hubei University of Education, Wuhan, China

- 3School of Foreign Languages, China University of Geosciences (Wuhan), Wuhan, Hubei, China

With the proposal of the carbon peaking and carbon neutrality strategy, the concept of green and low-carbon began to take root, and the influence of foreign direct investment on the progress of green technology is attracting more and more attention. Based on the panel data of 30 provinces in China from 2011 to 2020, this study examines the effect of green technology progress on FDI and its geographic and policy heterogeneity by using generalized least square regression method, and discusses its mechanism combined with the moderating effect of trade opening. The results show that: (1) the introduction of FDI has a significant positive effect on green technology progress, while the moderating effect of trade openness weakens the positive effect, which has a negative impact on green technology progress; (2) The results of the heterogeneity analysis suggest that the Belt and Road Initiative is an important factor in the moderating effect of trade openness. Beneficiary provinces along the Belt and Road are able to reap the positive effects of trade in terms of green technological advances, while regional differences based on geographic location gradually weaken. This study provides a new policy reference for boosting green technology progress in China and different provinces and helping to achieve the two-carbon goal from the two aspects of introducing FDI and coordinating trade openness.

Introduction

At present, the carrying capacity of global resources and environment is facing severe challenges. China, as a major energy consumer, actively embraced its responsibility for environmental stewardship, formally announcing its ambitious objectives of achieving carbon peaking and carbon neutrality1 in 2020, which puts forward higher requirements for accelerating the green transformation of its development mode. Meanwhile, the realization of green technology progress is considered as an important means of green transformation of economic development (Zhao et al., 2022). By regulating pollution generation, emission and treatment, as well as reducing energy consumption, green technology can effectively improve resource and environmental problems in the process of economic development (Levinson, 2009), thus promoting the realization of the two-carbon goal. What’s more, it has also become an important driving force for China to achieve high-quality economic growth in the new era. The sources of green technology progress are usually divided into two aspects: internal technology innovation and external technology introduction. The former mainly relies on independent innovation, while the latter relies on opening up to the outside world (Luo et al., 2021). Due to the unbalanced regional economic development, relying on green technology independent innovation is easy to cause such problems as underpowered and lagging development. Utilize the green technology advancement effect of opening up will be an essential supplement to improve the level of China’s green technology. As for developing countries, foreign direct investment is an important channel for international technology transfer and capital accumulation (Pan et al., 2020). Since the 1970s, China has begun to vigorously implement the economic policy of opening up to the outside world and continuously expand the introduction of foreign direct investment. As the largest recipient of foreign investment among developing countries, China’s total actual foreign direct investment climbed from US $40.7 billion in 2000 to US $163 billion in 2020, an increase of 300 percent over the past 20 years. Although the scale of foreign investment in China continues to expand, the accompanying environmental effects can not be ignored. On the one hand, foreign direct investment plays an important role in introducing international capital, promoting technological progress and increasing employment opportunities. On the other hand, due to low entry barriers and insufficient supervision at the early stage, the quality of foreign investment introduced in China in recent years is uneven, such as extensive utilization of resources and environmental pollution (Zhang et al., 2020). In the context of resource depletion and environmental degradation, which have severely hampered the current economic growth, the research on the impact of foreign direct investment (FDI) on the environment of the host country has become a hot topic for many scholars.

In studies on environmental effects of FDI, two typical hypotheses are pollution halo hypothesis and pollution paradise hypothesis. The pollution halo hypothesis holds that FDI can improve the environmental quality of the host country and effectively protect the ecological environment, which generally supports the promoting effect of FDI on green technology progress (Copeland and Taylor, 2001; Karen et al., 2004; Huang et al., 2022). The pollution paradise hypothesis, also known as the pollution refuge hypothesis, refers to the concentrated flow of pollution-intensive industries into countries and regions with low environmental standards, which results in concentrated pollution and serious damage to the ecological environment, and holds a negative view on the environmental effect of FDI (Markusen and Venables, 1999; List and Catherine, 2000; Singhania and Saini, 2021). A large number of scholars have tried to verify the validity of the two hypotheses by taking different countries or regions as research samples. Most of the classic studies have chosen developing countries as examples (Blomstrom, 1986; Kokko et al., 1996; Demena and Afesorgbor, 2020; Tian et al., 2023) to verify the pollution transfer behavior of developed countries or the “race to the bottom” behavior of underdeveloped regions. As the largest developing country at present, the research conclusions on whether the pollution halo hypothesis of FDI is true in China are still not uniform. Zhang and Zhou (2016), You and Xiao (2022) confirmed the establishment of the pollution halo hypothesis by studying provincial samples in China, while Lu et al. (2023) and Bakhsh et al. (2017) supported the pollution paradise hypothesis in their research conclusions. Based on the above literature review, a great major number of studies have gathered in the analysis of FDI environmental effects, but few literature have paid attention to the spillovers of FDI on green technology innovation. Indeed, the relevance of green technologies to improving environmental sustainability is well documented. In the latest study of Uche et al. (2023), it is discussed in detail how technological innovation can mitigate the negative impact of FDI on the ecological environment of BRICS countries. The realization path of environmental effect shows that green technological progress is conducive to the upgrading of industrial structure, realizing pollution and carbon reduction, and thus improving the ecological environment (Luo et al., 2020). Therefore, this study intends to analyze the impact of FDI on green technology in China to prove its environmental effect.

This study attempts to answer the following research questions: In the context of two-carbon, can the environmental effects of FDI contribute to the improvement of green technology level in China? In addition, will trade openness in foreign economy affect the effect of green technology progress brought by FDI? In order to answer the above research questions, this study started with the panel data of 30 provinces in China from 2011 to 2020, constructed the green technology level index with the green patent data, measured the FDI level with the actual amount of FDI utilized by each province in that year, and adopted the FGLS model regression in the consideration of the heteroscedasticity of panel data and serial correlation. The possible moderating effects of trade openness are comprehensively considered, and regional heterogeneity is studied by dividing sub-samples according to geographical location and policy influence. Based on the empirical test of FDI on China’s green technology progress, this study finally draws the research conclusion.

Compared with the existing studies, the marginal contribution of this study is as follows. First, trade openness is introduced as the moderating variable of FDI’s influence on green technology progress. Different from the existing literature, which often takes environmental regulation and industrial structure as the moderating or intermediary variables, this study pays attention to trade openness, which is also a component of foreign economy with FDI, and takes it as the moderating variable to observe its role in the process of FDI’s effect on green technology progress. Second, regional heterogeneity is discussed by dividing samples in different dimensions. Most studies often divide regions according to the standards of east, central and west. This study takes into account the dual influence of geography and policy on the introduction of foreign investment in the openness up and divides the total sample into three sub-samples according to the geographical location: coastal, inland and neighboring areas. According to the Belt and Road Initiative2, the provinces along the Belt and Road and other provinces are divided into two sub-samples. By analyzing the effect of FDI on green technology progress, this study discusses the relationship between foreign economy and green development in different regions of China, and makes a contribution to the study on spillover effect and environmental effect of opening up.

The rest of this study is as follows. The second part reviews the relevant literature. In the third part, hypothesis 1 and 2 are proposed based on the analysis of the influence mechanism and the moderating effect. The fourth part establishes the research model and estimation idea, empirically tests the previous hypothesis, and further discussion about the regression results is in the fifth part. The last part summarizes the research conclusions and puts forward some policy suggestions.

Literature review

Green technology is a general term for all types of modern technologies that reduce environmental pollution, energy consumption, and improve the ecological environment (Braun and Wield, 1994). The modern view prefers to distinguish and contrast green technology with traditional technology, and summarizes green technology innovation as technology innovation that achieves both ecological and economic benefits. There are numerous studies on the factors influencing green technological progress, and two paths exist in general: domestic technological innovation and foreign technology introduction (Wang et al., 2016), and an important way of foreign technology introduction is FDI and trade exchanges in the opening up of the country.

At present, there is a lot of research on the impact of FDI on green technology development, and there are three main views on whether FDI as an important international R&D channel can promote green technology progress in host countries: “promotion theory”, “suppression theory” and “uncertainty theory”. The “promotion theory” supports the pollution halo hypothesis (Letchumanan and Kodama, 2000), while the “suppression theory” is consistent with the pollution paradise hypothesis (Leonard, 1984). The “promotion theory” has been recognized by many scholars. Dating back to Romer (1986) who based on the new growth theory, emphasized the technology diffusion effect of international trade and suggested that foreign economic development could lead to domestic technological progress and thus domestic economic growth, and the “promotion theory” is supported by subsequent empirical studies (Amendolagine et al., 2021; Hasan and Du, 2023). The current consensus in academic research focuses on the flow of green technology and innovation through the movement of people and industry chain linkages in the process of industrial optimization, which can reduce carbon emissions and achieve the pollution halo effect (Ahmad et al., 2021; Luo et al., 2021). With the increasing maturity of green technology, the research directions extended from it are gradually enriched. Many scholars have started to discuss the green technology effect of FDI in cluster distribution from a spatial perspective, which also validates the “promotion theory”. Based on inter provincial panel data, Xu and Deng (2012) investigate the geographical clustering of FDI and environmental pollution in China, and reject the idea that the pollution paradise hypothesis is valid in China. Similar to this study, Yu et al. (2021) chose Chinese prefecture-level city data as a sample to demonstrate that the green technological progress effect of high aggregation of FDI significantly promotes the upgrading and aggregation of green total factor productivity in itself and neighboring cities.

Scholars who hold the “suppression theory” have also explored various directions (Feng et al., 2021; Qiu et al., 2021; Pathak et al., 2013), mainly focusing on the negative spillover effects of FDI. Haddad and Harrison (1993) conclude in their study of a Moroccan sample that there is no significant positive effect of FDI on the technological progress of the host country, and even a negative spillover effect. Combining the effects of environmental regulations, Behera and Sethi (2022) in their study of OECD (Organization for Economic Cooperation and Development) country panel data, empirically test the spillover effects of FDI in the short and long run respectively. The results show that FDI in both the long and short run exhibited negative spillover effects, which were detrimental to green technological progress, just validating this conclusion. Scholars who support the “uncertainty theory” suggest that there is uncertainty about the impact of FDI on green technological progress, and the specific direction of impact needs to consider the combined effect of multiple effects of FDI and many realistic problems in the process of investment inflow (Song and Han, 2022). Grossman and Krueger (1992) were the first to construct a “three-effect” model, which decomposed the environmental effects of FDI into scale effects, structural effects, and technology effects. Since then many scholars have attributed the ultimate impact of FDI on the environment and green technology to the superposition or extension of these three effects (Ning et al., 2023).

In addition to FDI, trade openness is another important area of the external economy. On the one hand, similar to FDI, it can also bring about various effects such as economic growth, technological spillovers, and environmental effects (Huang et al., 2018). The classic study by Copeland and Taylor (1994) analyzed the link between trade and technological progress, and proposed for the first time that the twin goals of pollution reduction and economic growth can only be achieved by accessing green technological advances in the context of openness to the outside world. Then the biased technological progress effect of trade openness thus led to a discussion (Acemoglu, 2015). It has been shown that international trade leads capital-intensive countries to focus on capital-oriented technological progress, while labor-intensive countries focus on labor-oriented technological progress (Miller and Upadhyay, 2000). As a labor-intensive country, China is therefore able to achieve green technological progress in favor of environmental protection in labor-intensive clean production (Cao and Wang, 2017). On the other hand, the interconnection between trade openness and FDI is also an important area of economic research. The relationship between trade and FDI can be regarded as the relationship between trade liberalization and capital flows, and there are two theories of substitution and complementarity in academia. The traditional FDI location choice theory represented by the “tariff jump” theory3 in the early days believed that the rise of tariff and other trade barriers would lead to the substitution effect of FDI on international trade. With the development of trade liberalization, the vertical industry chain argument suggests that expanding trade liberalization can promote FDI inflows to industry-linked countries. The theory of substitution is thus challenged. In recent years, green development has become a hot topic, and discussions related to trade and FDI are gradually linked to environmental standards. The negative outputs such as increased resource pressure and ecological damage caused by trade have pushed up the level of environmental regulations and restricted the inflow of different types of foreign investment into the domestic market. While this type of research cannot strongly support the theory of substitution relationship, it has challenged the theory of complementary relationship. Currently, there are more studies on the relationship between FDI and trade openness, and the relationship between trade openness and green technological progress in the existing literature. But there are still some gaps in the studies involving the enhanced or weakened regulatory role embodied by trade openness in the process of FDI exerting its green technological progress effect.

In summary, the existing literature has not reached a consensus on the study of the green technological progress effect of FDI, and this paper is necessary to examine the green technological progress effect of FDI again using Chinese provincial sample data as the research object. The existing literature provides a certain reference role for this paper, but when studying the green technological progress of FDI affecting host countries, little literature has focused on the direct and indirect impact effects played by trade openness as another important channel of international R&D. As the two major channels of foreign opening, can the green technological progress effect of FDI still exert the expected influence under the limitation of trade level in the host country? At the same time, along with the objective economic structure constraints such as industrial structure upgrading, China is now facing a new period of opening up to the outside world, which is more urgent in the process of achieving green technological progress and promoting green development. The issue of the green effect of FDI in China is worth further investigation.

Theoretical mechanism

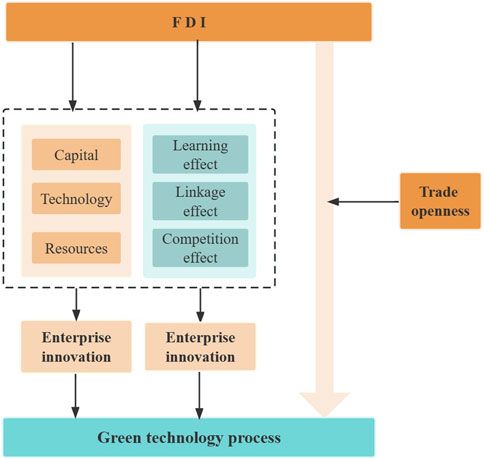

(1) FDI and Green Technology Progress

The direct impact of FDI on the progress of green technology is mainly reflected in many aspects such as capital, technology and material resources. Firstly, as the world’s largest developing country, China’s green technology development starts late compared with that of developed countries. The capital is relatively more scarce in China. Enterprises, as the main body of technology research and development, have a long-term shortage of technology research and development funds. The introduction of FDI can provide a large amount of financial support for China’s green technology development. Secondly, FDI can realize the flow and spillover of green technology through multinational enterprises, and improves the green technology innovation capability based on imitation and secondary innovation, which drives the overall green technology level of the market (Castellani et al., 2022). Finally, in terms of physical resources, the form of vertical industrial linkage promotes multinational enterprises to introduce advanced production equipment and high-quality raw materials from the parent company directly into the host country subsidiary to accelerate the formation of large-scale enterprise production (Ascani and Gagliardi, 2020). FDI also enhances international talent exchange through multinational corporations and others to improve the quality of green innovation talent and promote green technology progress. In addition, the adjustment of FDI introduction structure also affects the development of domestic green technology. When FDI flows more to high pollution and high energy consumption industries, it will increase environmental pollution and green technology pressure in the host country; while when FDI flows to low pollution and low energy consumption industries, it is beneficial to ecological environmental protection and stimulates green technology innovation (Wang et al., 2021). With the adjustment of China’s industrial structure, the proportion of tertiary industry output value rises, the type of FDI foreign investment flowing to the service industry increases, and the structure of FDI introduction is optimized, which stimulates enterprises’ innovation awareness of green technology.

FDI also brings a series of impact effects. When the difference in green technology level between the foreign capital out-flowing country and the in-flowing country is quite large (which usually occurs between developed and developing countries), as foreign enterprises enter the domestic market, local enterprises are more motivated to further increase R&D investment, focus on market demand orientation, and achieve green technology upgrading and reform based on imitation or seeking cooperation, resulting in a learning effect (Fosfuri and Saggi, 2002; Guo and Chen, 2011). In terms of industry chain linkage, due to the synergistic development of the upstream and downstream of the industry chain, the green production methods of the upstream enterprises link the environmental protection processes of the downstream manufacturers’ raw material supply, which makes them more competitive in order to improve the efficiency of resource utilization. And they are motivated to continuously improve the level of green technology, forming a linkage effect. In terms of market competition, foreign enterprises with advanced green technologies raise the green standards in the market, which may form green barriers and discourage domestic enterprises from green innovation on the one hand. On the other hand, it may also force domestic enterprises and trigger a new round of green technology reform. Therefore, there is a double competition effect of FDI (Bernard et al., 2003; Jin et al., 2019).

Based on the above analysis, this study proposes hypothesis H1: The introduction of FDI will have a catalytic effect on the progress of green technology in the host country.

(2) Trade Openness, FDI and Green Technology Progress

The influence of trade openness on the effect of FDI on green technological progress is mainly reflected in the following two directions. On the one hand, it is the advantage of attracting capital and competitive effect brought by expanding trade openness. First, when trade is highly open, foreign products and services will flow more to the domestic market, attracting overseas investment to set up factories and enterprises in China. Thus trade openness establishes a good production base for foreign investment, which can further bring into play the comparative advantage of FDI. It will expand the fields and ways of economic and technical cooperation, and promote the development of green technology on the basis of economic construction. Second, expanding trade openness will lead to domestic enterprises facing more overseas competitors, stimulating domestic enterprises to participate in international market competition and forcing green technology progress. On the other hand, trade openness will lead to capital crowding out and competition. First, the over-exploitation of resources and pollutant emissions caused by trade openness will increase production costs, crowd out capital investment in green innovation, and easily lead to high environmental regulations, which will affect the inflow of FDI and hinder the spillover and diffusion of green technology. Second, the expansion of market scale brought by trade openness will prompt some enterprises to take the “low-end” route of comparative advantage, which will also bring about the loss of FDI and inhibit the innovation and progress of green technology. In addition, the implementation of trade policy reflects the level of a country’s openness and is also an important factor affecting capital flows in the international capital market. Along with the frequent occurrence of international problems such as global regional wars, energy crises and the rise of trade protectionism, the trade policies of various countries have been fluctuating and generally tightened, leading to the obstruction of international capital flows, which is not conducive to the progress of green technology in developing countries.

Both trade openness and FDI belong to a country’s foreign economic development, and there are also technology spillover, competition effects and other influence mechanisms on green technology. This study takes trade openness as a moderating variable and introduces the interaction term of FDI and trade openness in the model to test the effect. Based on this, this study proposes the second hypothesis H2: there is a moderating effect of trade openness on the green technology progress effect of FDI, but the direction of the effect is uncertain. Figure 1 is a mechanism diagram that clearly shows the mechanism impact of this section.

Methods and data

(1) Methods

Since Griliches (1979), Griliches (1986) proposed the theory of knowledge production function, the function has become an important theoretical model basis for studying regional innovation and knowledge flow. Along with the development of endogenous growth theory, the knowledge production function has been widely used to analyze the input-output relationship of innovation activities, involving knowledge spillover effects within different fields. This study draws on the knowledge production function of the following Equation 1:

Referring to Griliches, the green technology progress effect of FDI is expanded and studied on the basis of technology spillover of FDI, and other influencing factors are summarized into the control variable set. The Equation 2 is obtained:

To eliminate the effect of heteroskedasticity, the selected data and variables were logarithmically processed and further organized to obtain the following model:

Where

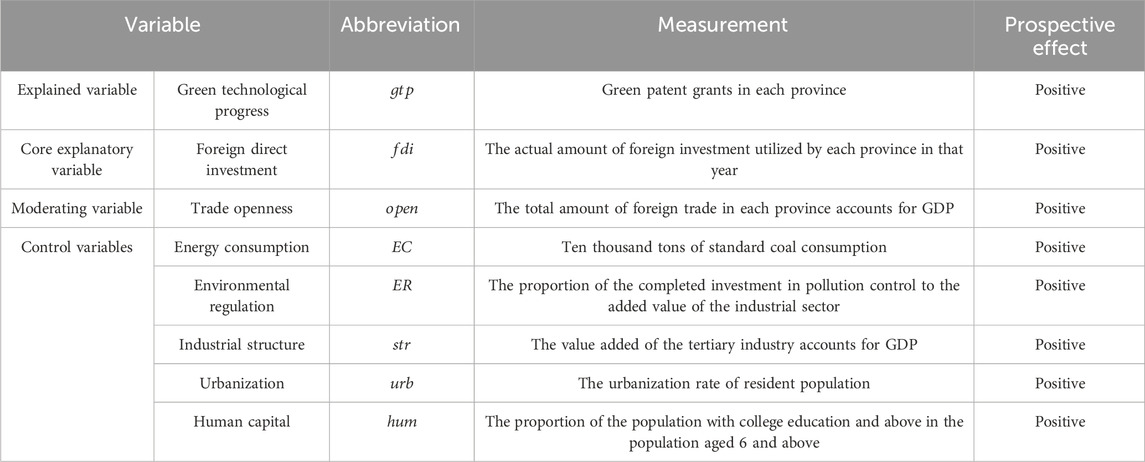

(2) Variables

Explained variable. Green technological progress (

Core explanatory variable. Foreign direct investment (

Moderating variable. Trade openness (

Control variables. By combing through the literature, the efficiency evaluation index system of green technological progress is usually built from three dimensions: financial input, physical input, and human input. In this study, environmental regulation variables measured by pollution control investment and energy consumption variables aimed at resource conservation are selected as indirect measures of governmental capital investment, while physical input is mainly reflected in the transformation and upgrading of industrial structure and the construction and improvement of infrastructure. In this paper, industrial structure variables and urbanization variables are selected to measure the intensity of physical input, and we choose human capital variables to measure human input.

Energy consumption (

Environmental regulation (

Industrial structure (

Urbanization (

Human capital (

(3) Data

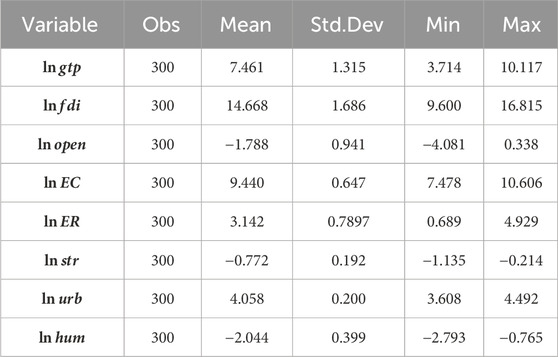

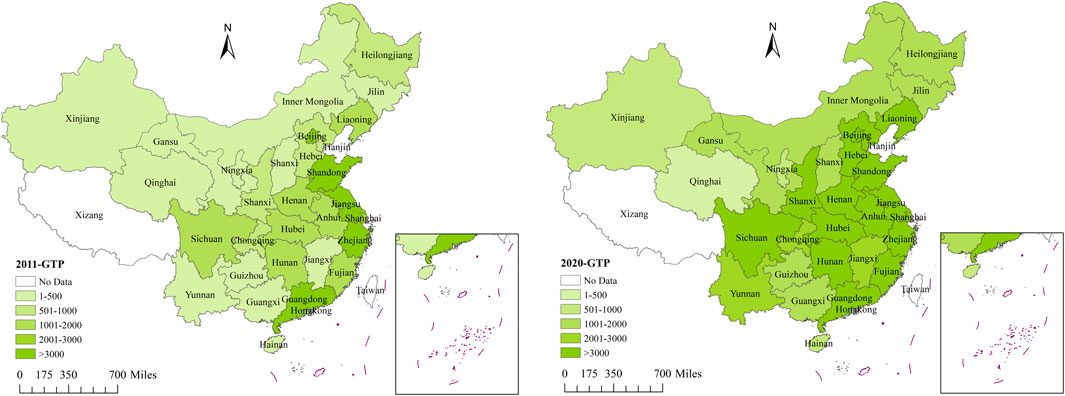

This study uses the panel data of 30 Chinese provinces from 2011 to 2020 as the research sample (except Tibet, Hong Kong, Macao and Taiwan). Green technological progress is measured by the number of green patents granted in each province, including green invention patents and green utility model patents, while green design patents are not included due to their low technical innovation. According to the Green Patent List issued by the World Intellectual Property Organization, the international patent classification codes of green patents are obtained, and green patent data can be obtained by searching the patent database of the State Intellectual Property Office of China. Other data are obtained from the China Statistical Yearbook (2012–2021), published by the National Bureau of Statistics of China4. The data of provinces in some years are missing, which have been filled by linear interpolation. The results of descriptive statistics are shown in Table 2.

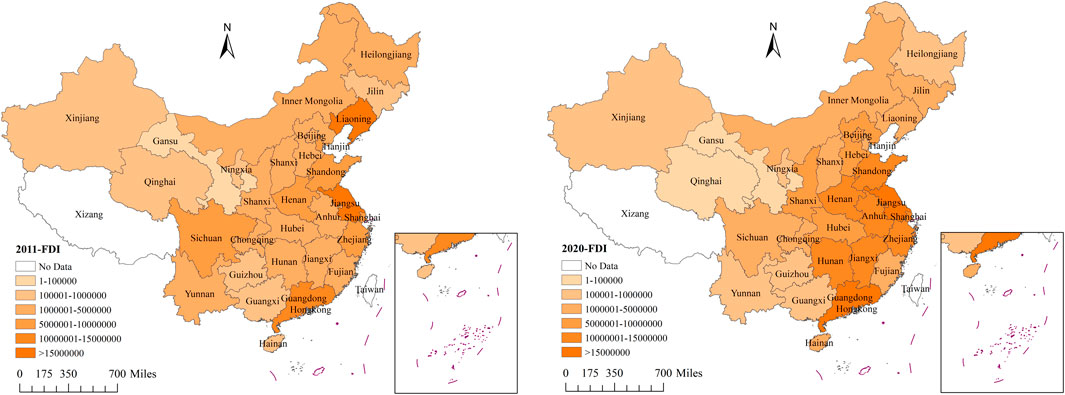

From Table 2, it can be seen that the average value of green technology level is 7.461, the standard deviation is 1.315, the minimum value is 3.714, and the maximum value is 10.117. Therefore, it can be seen that the green technology level of each region and province in China varies widely. According to the specific sub-provincial patent data, Jiangsu and Guangdong in coastal areas are strong provinces of green technology innovation with high green technology level, while Qinghai and Ningxia in inland areas are relatively lagging behind in green technology development. The changes of green patents in specific provinces can be seen in Figure 2, the changes of FDI in each province can be seen in Figure 3.

Results and discussion

(1) Benchmark Regression

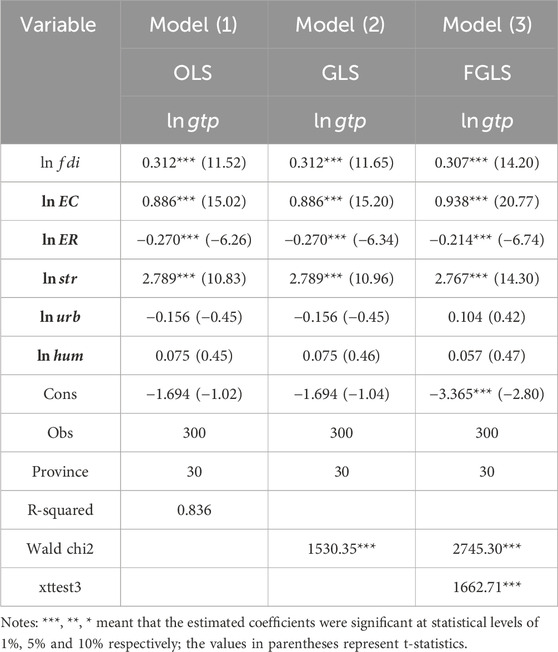

To evaluate the specific impact of FDI on green technological progress, it is essential to adopt appropriate econometric methods. It is worth noting that the FGLS method can maximize the advantage of panel data and minimize the estimation error, and is often used for regression estimation of panel data when heteroskedasticity and serial correlation problems exist in the sample data. In this study, there are large differences in the data between provinces in the research sample, and the disturbance terms may be different in different provinces. Based on the results of the panel stationarity tests, the FGLS is chosen as the benchmark regression method in this study. The results of the benchmark regression are shown in model (3) in Table 3 below, in addition, ordinary least squares (OLS) and generalized least squares (GLS) are also chosen in this study for regression testing again as shown in model (1) and (2) in Table 3 below to ensure the robustness of the regression results. The following specific results analysis are based on the FGLS model.

The regression results of models (1), (2) and (3) show that there is a significant positive promotion effect between FDI and green technology progress, which is consistent with the expectation of hypothesis 1, and also supports the pollution halo hypothesis. In model (3), the regression coefficient of FDI is 0.307 with positive sign and passes the 1% significance level test, indicating that the introduction of FDI is conducive to the improvement of green technology level, which in turn promotes local green development. Starting from 2012, China’s economy gradually enters the transition period of adjusting industrial structure and realizing innovation-driven adjustment, and the economic growth is dominated by medium-high growth rate. Under the influence of this, the amount of foreign capital utilized in China has declined, and the strategic orientation of actual foreign capital utilization has been adjusted. A notable tendency is to encourage foreign investors to introduce advanced technologies, invest in advanced industries, and support them to set up research centers, etc. Meanwhile, to improve the efficiency of resource allocation and reduce pollution and energy consumption, the structure of FDI attraction is adjusted to reinforce the inspection of the introduction of non-clean FDI and encourage the inflow of clean FDI. On the one hand, with the continuous introduction of clean and high quality FDI with high technology content, it will have a direct impact on the industrial environment, promote the continuous optimization of industrial structure, and provide development conditions for green technology progress. On the other hand, with the improvement of the quality of inflow foreign capital, the competition effect drives the green awareness of local enterprises, and the green standards in the economic market compete to improve, so that the realization of green technology progress will be the inevitable result.

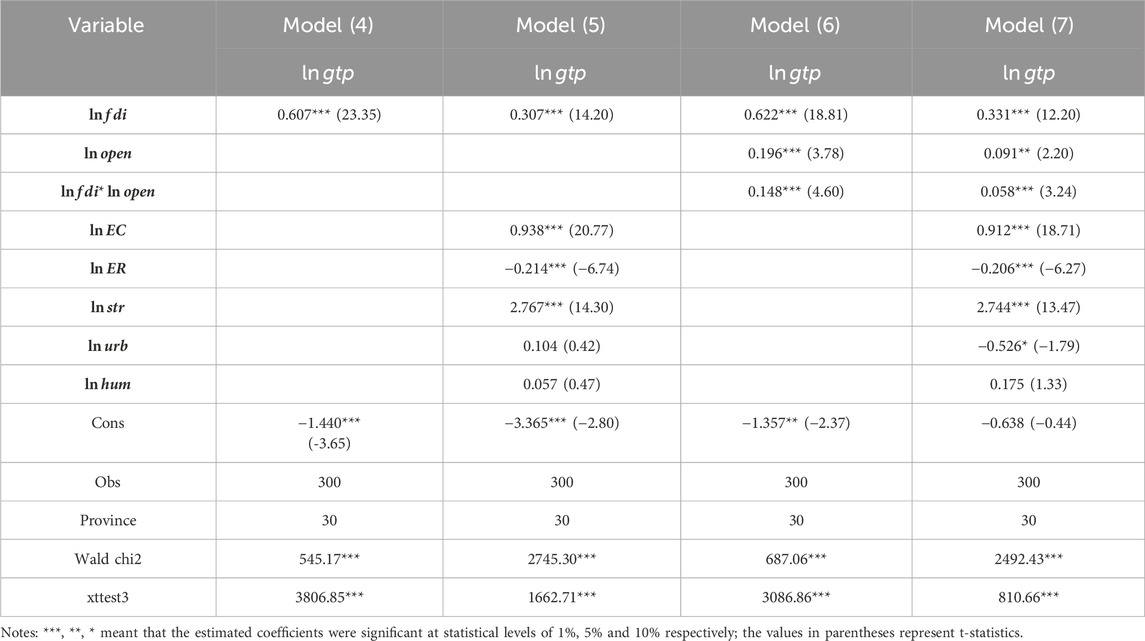

The moderating effect of trade openness is tested by adding the interaction term of FDI and trade openness based on the FGLS method. Models (4) and (5) test the direct effect of FDI on green technological progress, and models (6) and (7) test the moderating effect of trade openness on the effect of FDI on green technological progress. The regression results are shown in Table 4.

Models (4) and (5) are the benchmark regression results, and models (6) and (7) are the regression results after adding the trade openness moderating variable and the FDI and trade openness interaction term. The coefficient of FDI is positive when the interaction term between FDI and trade level is not included. After the inclusion of the interaction term, the coefficient of FDI expands, and the sign is still positive and significant at the 1% level. Meanwhile, the coefficient of the interaction term between FDI and trade openness is positive and passes the 1% level of significance test. This verifies and complements hypothesis 2, indicating that there is a reinforcing effect of trade openness as a moderating variable. That means there is a significant positive effect of trade openness on the green technological progress effect of FDI, which is consistent with the findings of Han et al. (2023). This is because: expanding trade openness will achieve a more liberal capital environment and attract more foreign capital inflows, while accelerating the cross-country flow and reallocation of resources, human resources, information and technology, and other factors to promote the green technology level in the home country. In particular, China has been actively participating in the international trade market, expanding the level of openness to the outside world, capturing the positive effects of technology spillovers in terms of trade imports and exports, and striving for a favorable situation in terms of capital flows since it joined the WTO in 2001. With the two-carbon background, green development has become an important issue for all countries. Green service trade and green low-carbon products continue to expand the circulation, leading to an important change in capital flow, and technological innovation has also been promoted. It has been significant that not only China’s domestic total factor productivity improved but also the green technological progress stimulated.

From the perspective of control variables, energy consumption level and industrial structure are significant at the 1% level with positive coefficient sign, which indicates that: energy consumption level push backwards green technology progress. The increasing energy consumption level forces localities to accelerate the R&D and application of green technology, and the influence of this variable is more prominent after the double carbon target is proposed when localities actively seek breakthroughs in carbon reduction and emission reduction. At the practice level, energy consumption anxiety can effectively drive backwards green technology innovation and improve energy use efficiency. The transformation and upgrading of industrial structure is an important force driving the development of green technology. The tertiary industry has low energy consumption, so promoting the development of the tertiary industry can promote the development of energy conservation and emission reduction in the region while the positive impetus exists for green technology progress. The level of human capital does not pass the significance level test of 10%. Referring to the findings of similar literature (Zhang and Hu, 2020), the possible reasons are as below: China’s human structure is not perfect enough to fully adapt to the development of green technology. There is a resource mismatch between high-level talent training and social demand. Creative thinking and innovative practice in higher education is still in short supply, and workers with higher education are unable to effectively translate their knowledge and skills into practical applications for green technology advancement.

Secondly, the regression coefficients of environmental regulation and urbanization are negative and pass the significance level test of 1% and 10%, respectively. As an important factor influencing green technological progress, the reason why environmental regulations inhibit green technological progress is believed to be the increase in production costs in the existing academic views, which weakens the innovation vitality of enterprises and restricts green technological progress. Urbanization inhibits the progress of green technology. The reform of urbanization in China has inevitably promoted the development of local basic industries. This preliminary development of basic industries in urban areas generally suffers from low environmental protection standards, substandard emissions and other problems that easily cause environmental pollution, which is not conducive to green technology progress. At the same time, it is also an urgent problem that we need to solve on the way to achieve the two-carbon goal.

(2) Heterogeneity Tests

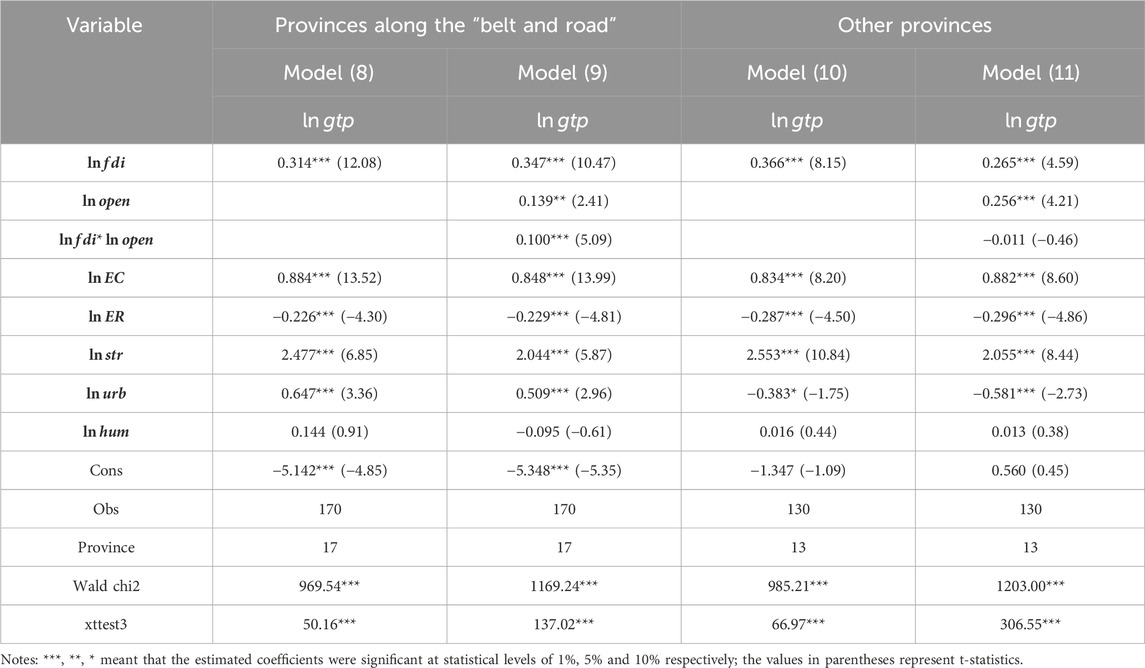

In order to compare the variability of green technological progress and FDI levels in different regions, this study divides the samples of 30 provincial-level administrative regions in China into two dimensions: policy influence and geographical location. First, the samples are divided into two parts: provinces along the “Belt and Road” and other provinces by policy influence5. Tibet, Hong Kong, Macao and Taiwan are not included in the scope of this study.

From the results in Table 5, it is clear that the sub-samples show significant regional heterogeneity when the moderating effect of FDI and trade openness is taken into account in the model. According to the regression results, the sign of the coefficient of the interaction term between FDI and trade openness is positive with a regression coefficient of 0.100 and significant at the 1% level in the provinces along the BRI region. The regression coefficient of FDI increases from 0.314 to 0.347, which again verifies hypothesis 2, indicating that in the provinces along the BRI. There is a positive reinforcement of the green technological progress effect of trade openness on FDI effect, and foreign economic development can have a positive desired impact on green technological progress. Among the sub-samples in other provinces, the sign of the coefficient of the interaction term between FDI and trade opening is negative, and it does not pass the significance test at the 10% level, which cannot verify the moderating effect of trade openness. Furthermore the regression coefficient of FDI decreases from 0.366 to 0.265 after adding the moderating variables with the interaction term, which proves that the conclusion of regional heterogeneity is supported by empirical evidence. This is because the implementation of the BRI helps the trade exchanges of Chinese provinces along the route, accelerates the flow of international capital, and generates effective incentives for FDI as well as trade openness. At the same time, the implementation of cooperative initiatives such as building the Green Silk Road is also conducive to China’s strengthening of green energy investment, promoting green and clean equipment and technologies, etc. The construction of Green BRI not only radiates the sustainable development of the international region, but also brings new opportunities for China’s own green development and international cooperation by advocating green capacity cooperation and sustainable infrastructure construction of Chinese enterprises.

Although there is still much controversy in the discussion on the topic of the BRI, most studies in the existing literature suggest that the BRI can promote international trade and encourage economic development of participating countries (Razzaq et al., 2021). A study by Yu et al. (2020) shows that BRI has a substantial positive impact on China’s export potential. There are also some studies in the literature that confirm the positive impact of the BRI on introducing FDI, enhancing positive effect of BRI on introducing FDI and enhancing China’s capital attraction structure (Li et al., 2022). Related studies have reached a relative consensus on the role of the BRI on green economic growth or trade export promotion in China and along the route. The results of this study, which examine the heterogeneity of Chinese provinces, are to a certain extent consistent with the findings of this literature. We also innovatively propose a new view with the different dimension: the beneficiary provinces along the BRI in China are also positively influenced in terms of green technological progress. This is a win-win situation for the implementation of the BRI. The findings of this study are positive for the practice of the BRI in China and have some reference value for other countries to deepen economic globalization and green growth.

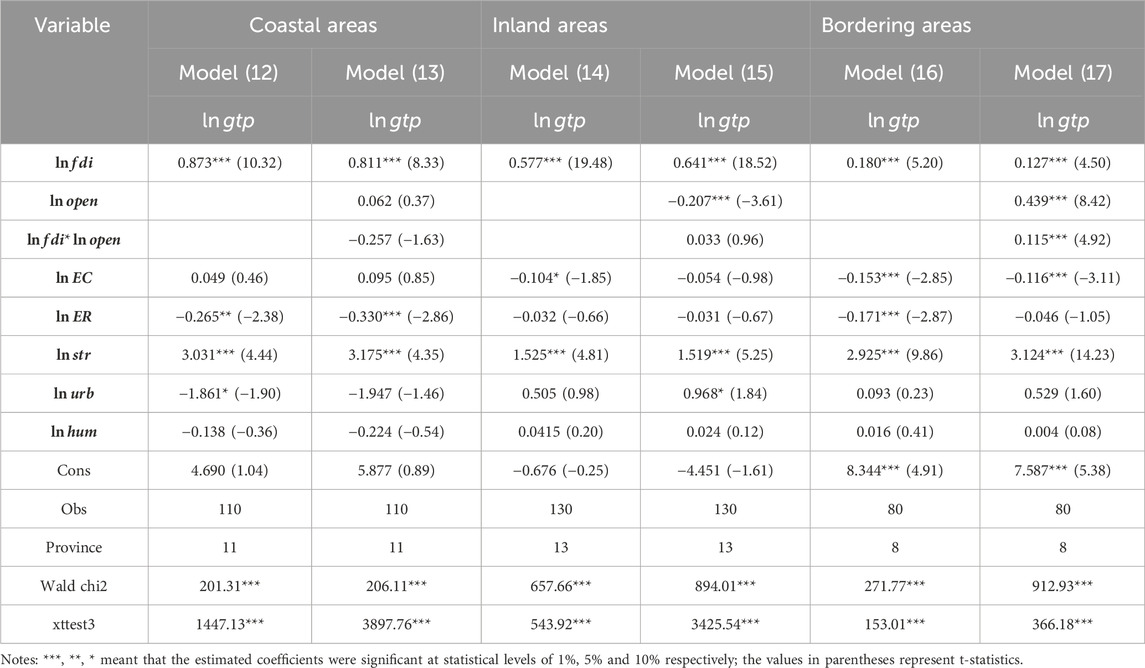

In addition to the sample division in terms of policy dimensions, this paper further enriches the discussion of regional heterogeneity by dividing the sample by geographical location. Different from the traditional geographical division of East, Central, West and Northeast regions in China, the actual situation of trade and foreign investment introduction is more closely linked to the proximity to the coast and neighboring countries’ contacts. So referring to Shi et al. (2018), the sample is divided into three parts by geographical location: coastal areas, inland areas, and bordering areas with neighboring countries. Among them, the division of coastal areas and bordering areas overlaps in Liaoning Province and Guangxi Province. Considering the actual situation, they are both included in coastal areas and bordering areas6. The sub-sample regressions are shown in Table 6 below.

The regression results in Table 6 show that there are certain differences in the influence of FDI on green technology progress in different geographical locations. The regression coefficient of FDI shows a sequential decline in coastal, inland and border regions, which corresponds to the economic development level of each region. The moderating effect of trade openness cannot be effectively verified in different geographical locations. The interaction terms between FDI and trade openness fail to pass the significance level test of 10% in both coastal and inland regions. Although the regression results of border regions pass the significance level test of 1%, the coefficient of FDI does not expand accordingly. It cannot be concluded that trade openness effectively enhances the effect of FDI on green technology progress.

The results of the discussion on regional heterogeneity in the two dimensions of policy and geography show that: although geographical location is the initial driving force for regional economic development and the spatial effect of FDI has always been proved by various studies, combined with the realistic background of The Times, artificial political factors have achieved a more important position in China’s economic development at the current stage of opening up, while the advantages and disadvantages of geographical factors are constantly being caught up and narrowed. In economic geography, Krugman (1991) pointed out in his classic study that transportation infrastructure can weaken the spatial blocking effect of geographical location on factor flow. Gawer and Cusumano (2008) also showed that with the rise of digital technology and Internet platform, geographical limitations of regional innovation are constantly being broken through. These also support the results of this study.

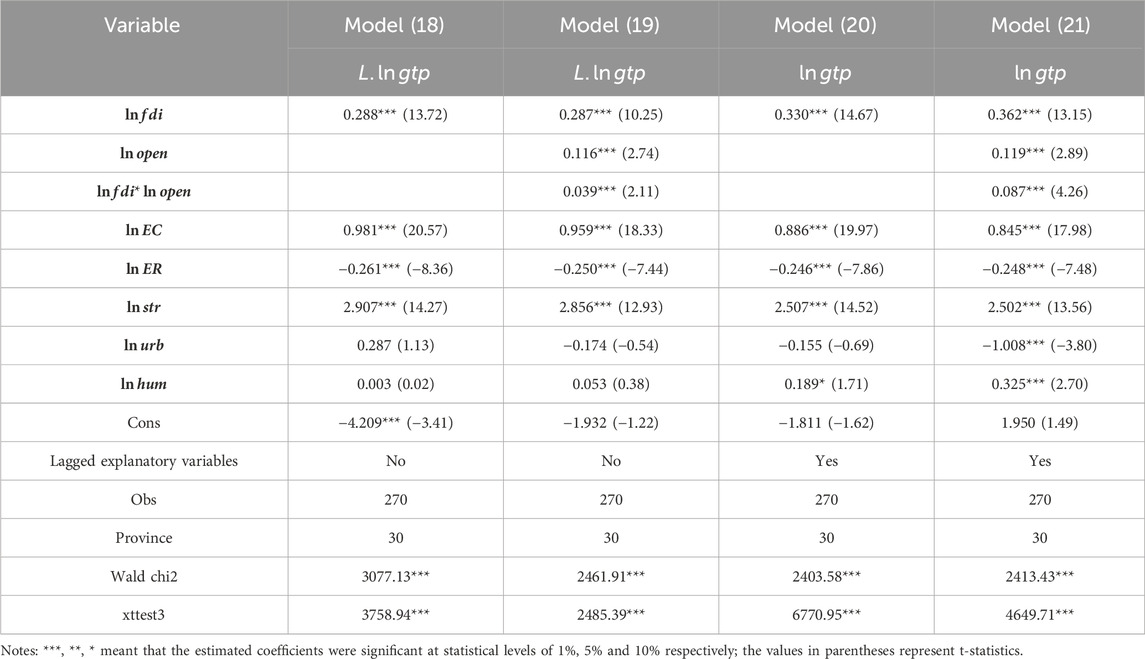

(3) Robustness Tests

Based on the previous empirical tests, the OLS, GLS, FGLS methods results and subsample regression results in Table 3 can test the robustness of the conclusions of this study to a certain extent. Considering that the R&D of green patents has long-term effects and the effects of each explanatory variable may have lags, this study uses lagged one-period explained variables and lagged one-period explanatory variables respectively to test the robustness of the regression results, while alleviating the possible endogeneity problem of the model. Table 7 below shows the lagged one-period explained variables in models (18) to (19) and all explanatory variables in models (20) to (21) with one period lag. According to the test results, it can be find that in the regression results of models (18) to (21), the coefficient signs of FDI and interaction terms are the same as the original results and remain significant; the coefficient signs of control variables are basically consistent with the regression results of the benchmark model. Therefore, the regression results have not changed significantly and the original benchmark regressions are robust.

Conclusion and policy implication

Under the Two-carbon background, the realization of green technological progress has become increasingly significant. This study uses data from 30 provinces in China from 2011 to 2020 as a sample and employs the OLS method to verify the impact of FDI on green technological progress, as well as the synergistic effect of FDI and trade openness. The following specific conclusions have been drawn: First, FDI has a significant promoting effect on China’s green technological progress, and the active introduction of foreign investment is conducive to upgrading green technology and promoting China’s green economic development. Second, trade openness has a positive moderating effect on the green technological progress effect of FDI. Expanding foreign trade can strengthen the promoting effect of FDI on China’s green technological progress. Third, the regional heterogeneity results in both policy and geography dimensions show that the policy implementation of the Belt and Road Initiative is an important factor for the moderating effect of trade opening, and the provinces along the Belt and Road Initiative can obtain the positive effect of trade in green technology progress. And the last one, energy anxiety caused by energy consumption and industrial structure upgrading are conducive to the improvement of China’s green technology level.

The policy implications implied in this study are mainly as follow. First of all, China should continue to create a green industrial environment that meets the demand for high-quality foreign investment, guide and regulate the introduction of foreign investment around the country, and promote the upgrading of green technology levels. In order to catch up with the existing gap between China’s actual FDI utilization and that of developed countries, and to make full use of the capital inflow and knowledge spillover effects of FDI, China still needs to actively expand the scale of FDI introduction. Meanwhile it also needs to adjust and improve the structure of domestic FDI introduction actively, and upgrade the green industrial environment, encourage more high-quality, low-pollution, and low-energy FDI inflow. Government should strengthen the local supervision of the introduction of foreign capital, pay attention to the improvement of prevention awareness. Secondly, while introducing FDI, China should coordinate the regulating effects of trade openness, give full play to the policy advantages of the Belt and Road initiative, include more provinces in the radiation of the policy effects, and further break the geographical restrictions of the region, and then make the most of the green technology progress effects of FDI by formulating scientific policies on the introduction of foreign investment. It is committed to expanding the radiation range of low-carbon technologies, and guiding the continuous transformation of the geospatial effect of foreign investment to the economic spatial effect. Thirdly, the national level should actively formulate local FDI encouragement policies, focus on green development fields, and deeply promote the investment attraction work of provinces benefiting from the Belt and Road Initiative. The local level should adjust the investment attraction policies according to the actual situation, reasonably assess the space for green technology development, and formulate different foreign opening policies to promote the inflow of foreign capital while improving the regional green technology innovation capacity should be improved at the same time. Fourthly, the objective environmental requirements for the development of green technology should be coordinated and planned, including the reasonable control of the speed of promoting pollution reduction and carbon reduction, and the promotion of industrial structure transformation and upgrading, etc.

Further research in the future can start from the changes in China’s trade situation, and deeply explore the possible changes in capital flow and the technological innovation brought about by the green effect, the impact of political factors and the influence of economic cycle in global economic development.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation. Requests to access the datasets should be directed to Longyu Xu, bG9uZ3l1eHVAY3VnLmVkdS5jbg==.

Author contributions

MY: Writing–review and editing, Conceptualization, Data curation, Formal Analysis, Investigation, Software, Writing–original draft. LX: Writing–review and editing, Conceptualization, Investigation, Methodology, Project administration, Resources, Supervision. TZ: Writing–review and editing, Formal Analysis. LA: Formal Analysis, Methodology, Supervision, Writing–review and editing. MS: Data curation, Methodology, Software, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. Green and Low-Carbon Transformation of Regional Manufacturing Industry, a 2024 Open Fund Project of the Soft Science Research Base for Monitoring and Analyzing Regional Innovation Capability in Hubei Province, with Project Number HBQY2024z04.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Correction note

A correction has been made to this article. Details can be found at: 10.3389/fenvs.2025.1701279.

Generative AI statement

The authors declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1On 22 September 2020, at the 75th session of the United Nations General Assembly, China clearly proposed to achieve the “dual carbon” goal of carbon peaking by 2030 and carbon neutrality by 2060.

2In September and October 2013, China proposed the cooperation initiative of building the “New Silk Road Economic Belt” and the “21st Century Maritime Silk Road”, referred to as the “Belt and Road”.

3The early empirical literature explains the high level of FDI in some economies as a result of “tariff jumping”: as tariffs increase the cost of exports, foreign firms prefer to skip tariffs and produce in protected markets.

4[Data accessed at http://www.stats.gov.cn/sj/ndsj/].

5Provinces along the Belt and Road include: Inner Mongolia, Liaoning, Jilin, Heilongjiang, Guangxi, Chongqing, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Shanghai, Zhejiang, Fujian, Guangdong, Hainan; Other provinces include: Beijing, Tianjin, Shandong, Jiangsu, Hebei, Henan, Hubei, Hunan, Sichuan, Shanxi, Guizhou, Jiangxi, Anhui.

6Coastal areas include: Shanghai, Guangdong, Fujian, Tianjin, Liaoning, Guangxi, Zhejiang, Hainan, Shandong, Jiangsu, Hebei; Inland areas include: Henan, Hubei, Chongqing, Sichuan, Shaanxi, Qinghai, Shanxi, Guizhou, Jiangxi, Hunan, Anhui, Ningxia, Beijing; The bordering regions include: Inner Mongolia, Jilin, Xinjiang, Yunnan, Heilongjiang, Gansu, Liaoning, Guangxi.

References

Acemoglu, D. (2015). Localised and biased technologies: atkinson and stiglitz's new view, induced innovations, and directed technological change. Econ. J. 125 (583), 443–463. doi:10.1111/ecoj.12227

Adeel-Farooq, R. M., Riaz, M. F., and Ali, T. (2021). Improving the environment begins at home: revisiting the links between FDI and environment. Energy 215, 119150. doi:10.1016/j.energy.2020.119150

Ahmad, M., Jabeen, G., and Wu, Y. (2021). Heterogeneity of pollution haven/halo hypothesis and Environmental Kuznets Curve hypothesis across development levels of Chinese provinces. J. Clean. Prod. 285 (20), 124898. doi:10.1016/j.jclepro.2020.124898

Amendolagine, V., Lema, R., and Rabellotti, R. (2021). Green foreign direct investments and the deepening of capabilities for sustainable innovation in multinationals: insights from renewable energy. J. Clean. Prod. 310 (1), 127381. doi:10.1016/j.jclepro.2021.127381

Ascani, A., and Gagliardi, L. (2020). Asymmetric spillover effects from MNE investment. J. World Bus. 55 (6), 101146. doi:10.1016/j.jwb.2020.101146

Bakhsh, K., Rose, S., Ali, M. F., Ahmad, N., and Shahbaz, M. (2017). Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J. Environ. Manag. 196, 627–632. doi:10.1016/j.jenvman.2017.03.029

Behera, P., and Sethi, N. (2022). Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ. Sci. Pollut. Res. 29 (35), 52940–52953. doi:10.1007/s11356-022-19458-7

Bernard, A. B., Eaton, J., Jensen, J. B., and Kortum, S. (2003). Plants and productivity in international trade. Am. Econ. Rev. 93 (4), 1268–1290. doi:10.1257/000282803769206296

Blomstrom, M. (1986). Foreign investment and productive efficiency: the case of Mexico. J. Industrial Econ. 35 (1), 97–110. doi:10.2307/2098609

Braun, E., and Wield, D. (1994). Regulation as a means for the social control of technology. Technol. Anal. &Strategic Manag. 6 (3), 259–272. doi:10.1080/09537329408524171

Cao, B., and Wang, S. (2017). Opening up, international trade, and green technology progress. J. Clean. Prod. 142 (2), 1002–1012. doi:10.1016/j.jclepro.2016.08.145

Castellani, D., Marin, G., Montresor, S., and Zanfei, A. (2022). Greenfield foreign direct investments and regional environmental technologies. Res. Policy 51 (1), 104405. doi:10.1016/j.respol.2021.104405

Copeland, B., and Taylor, M. (2001). Is free trade good for the environment? Am. Econ. Rev. 91 (4), 877–908. doi:10.1257/aer.91.4.877

Copeland, B. R., and Taylor, M. S. (1994). North-south trade and the environment. Q. J. Econ. 109 (3), 755–787. doi:10.2307/2118421

Demena, B. A., and Afesorgbor, S. K. (2020). The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy 138, 111192. doi:10.1016/j.enpol.2019.111192

Dong, J. C., Hou, J. Q., and Zhang, Q. (2021). The influence of economic and technological development zone on the adjustment of industrial structure. Manag. Rev. 33 (9), 16–24. doi:10.14120/j.cnki.cn11-5057/f.2021.09.002

Du, K. R., Li, P. Z., and Yan, Z. M. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Change 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Feng, Y., Wang, X., and Liang, Z. (2021). How does environmental information disclosure affect economic development and haze pollution in Chinese cities? The mediating role of green technology innovation. Sci. Total Environ. 775, 145811. doi:10.1016/j.scitotenv.2021.145811

Fosfuri, A., and Saggi, K. (2002). Foreign direct investment and spillovers through workers’ mobility. J. Int. Econ. 53 (1), 205–222. doi:10.1016/S0022-1996(00)00069-6

Gawer, A., and Cusumano, M. A. (2008). How companies become platform leaders. MIT Sloan Manag. Rev. 20 (2), 28–35.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 10 (1), 92–116. doi:10.2307/3003321

Griliches, Z. (1986). Productivity, R&D, and basic research at the firm level in the 1970s. Am. Econ. Rev. 76, 141–154.

Grossman, G. M., and Krueger, A. B. (1992). Environmental impacts of a north American free trade agreement. CEPR Discuss. Pap. 8 (2), 223–250. doi:10.3386/w3914

Guo, B., and Chen, X. (2011). How does FDI influence industry-level knowledge production efficiency in China? Asian J. Technol. Innovation 19 (2), 263–277. doi:10.1080/19761597.2011.630505

Haddad, M., and Harrison, H. A. (1993). Are there positive spillovers from direct foreign investment? evidence from panel data for Morocco. J. Dev. Econ. 42 (1), 51–74. doi:10.1016/0304-3878(93)90072-u

Han, X. F., Song, W. F., and Li, B. X. (2023). Could trade openness accelerate regional green innovation? Based on bidirectional FDI dynamic adjustment. Manag. Rev. 35 (3), 105–115. doi:10.14120/j.cnki.cn11-5057/f.2023.03.017

Hasan, M. M., and Du, F. (2023). The role of foreign trade and technology innovation on economic recovery in China: the mediating role of natural resources development. Resour. Policy 80, 103121. doi:10.1016/j.resourpol.2022.103121

Huang, J., Hao, Y., and Lei, H. (2018). Indigenous versus foreign innovation and energy intensity in China. Renew. and Sustain. Energy Rev. 81, 1721–1729. doi:10.1016/j.rser.2017.05.266

Huang, J. B., Berhe, M. W., Dossou, T. A. M., and Pan, X. M. (2022). The heterogeneous impacts of Sino-African trade relations on carbon intensity in Africa. J. Environ. Manag. 316, 115233. doi:10.1016/j.jenvman.2022.115233

Jin, B., Francisco, G., and Salomon, R. (2019). Inward foreign direct investment and local firm innovation: the moderating role of technological capabilities. J. Int. Bus. Stud. 50, 847–855. doi:10.1057/s41267-018-0177-1

Karen, F. V., Jefferson, G. H., Liu, H., and Tao, Q. (2004). What is driving China’s decline in energy intensity? Resour. Energy Econ. 26 (1), 77–97. doi:10.1016/j.reseneeco.2003.07.002

Kokko, A., Tansini, R., and Zejan, M. (1996). Local technological capability and productivity spillovers from FDI in the Uruguayan manufacturing sector. J. Dev. Stud. 32, 602–611. doi:10.1080/00220389608422430

Krugman, P. (1991). Increasing returns and economic geography. J. Political Econ. 99 (3), 483–499. doi:10.1086/261763

Leonard, H. J. (1984). Are environmental regulations driving. U.S. ind. overseas?[M]. Wash. D.C Conserv. Found., 226–297.

Letchumanan, R., and Kodama, F. (2000). Reconciling the conflict between the `pollution-haven' hypothesis and an emerging trajectory of international technology transfer. Res. Policy 29 (1), 59–79. doi:10.1016/s0048-7333(99)00033-5

Levinson, A. (2009). Technology, international trade, and pollution from US manufacturing. Am. Econ. Rev. 99 (5), 2177–2192. doi:10.1257/aer.99.5.2177

Li, J. T., Assche, A. V., Li, L., and Qian, G. (2022). Foreign direct investment along the belt and road: a political economy perspective. J. Int. Bus. Stud. 53 (5), 902–919. doi:10.1057/s41267-021-00435-0

List, J. A., and Catherine, Y. Co (2000). The effects of environmental regulations on foreign direct investment. J. Environ. Econ. Manag. 40 (1), 1–20. doi:10.1006/jeem.1999.1095

Lu, W. C., Kasimov, I., and Saydaliev, H. B. (2023). Foreign direct investment and renewable energy: examining the environmental Kuznets curve in resource-rich transition economies. Renew. Energy 208, 301–310. doi:10.1016/j.renene.2023.03.054

Luo, Y., Lu, Z., and Long, X. (2020). Heterogeneous effects of endogenous and foreign innovation on CO2 emissions stochastic convergence across China. Energy Econ. 91, 104893. doi:10.1016/j.eneco.2020.104893

Luo, Y., Salman, M., and Lu, Z. (2021). Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 759 (2), 143744. doi:10.1016/j.scitotenv.2020.143744

Markusen, J. R., and Venables, A. J. (1999). Foreign direct investment as a catalyst for industrial development. Eur. Econ. Rev. 43 (2), 335–356. doi:10.1016/s0014-2921(98)00048-8

Miller, S. M., and Upadhyay, M. P. (2000). The effects of openness, trade orientation, and human capital on total factor productivity. J. Dev. Econ. 63 (2), 399–423. doi:10.1016/s0304-3878(00)00112-7

Morgenstern, R. D., Pizer, W. A., and Shih, J. S. (2002). Jobs versus the environment: an industry-level perspective. J. Environ. Econ. and Manag. 43 (3), 412–436. doi:10.1006/jeem.2001.1191

Ning, L. T., Guo, R., and Chen, K. H. (2023). Does FDI bring knowledge externalities for host country firms to develop complex technologies? The catalytic role of overseas returnee clustering structures. Res. Policy 52 (6), 104767. doi:10.1016/j.respol.2023.104767

Pan, X., Li, M., Wang, M., Chu, J., and Bo, H. (2020). The effects of outward foreign direct investment and reverse technology spillover on China's carbon productivity. Energy Policy 145, 111730. doi:10.1016/j.enpol.2020.111730

Pathak, S., Xavier-Oliveira, E., and Laplume, A. O. (2013). Influence of intellectual property, foreign investment, and technological adoption on technology entrepreneurship. J. Bus. Res. 66 (10), 2090–2101. doi:10.1016/j.jbusres.2013.02.035

Qiu, S., Wang, Z., and Geng, S. (2021). How do environmental regulation and foreign investment behaviour affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J. Environ. Manag. 287, 112282. doi:10.1016/j.jenvman.2021.112282

Razzaq, A., An, H., and Delpachitra, S. (2021). Does technology gap increase FDI spillovers on productivity growth? Evidence from Chinese outward FDI in Belt and Road host countries. Technol. Forecast. Soc. Change 172 (1), 121050. doi:10.1016/j.techfore.2021.121050

Romer, P. M. (1986). Increasing returns and long-run growth. J. Political Econ. 94 (5), 1002–1037. doi:10.1086/261420

Shi, J. J., Xia, C. X., Zhao, Q. X., and Lu, L. (2018). Challenges and innovation in China's open economy. Manag. World 34 (12), 13–18+193. doi:10.19744/j.cnki.11-1235/f.2018.0029

Singhania, M., and Saini, N. (2021). Demystifying pollution haven hypothesis: role of FDI. J. Bus. Res. 123, 516–528. doi:10.1016/j.jbusres.2020.10.007

Song, W. F., and Han, X. F. (2022). The bilateral effects of foreign direct investment on green innovation efficiency: evidence from 30 Chinese provinces. Energy 261 (15), 125332–125332.15. doi:10.1016/j.energy.2022.125332

Tian, L., Zhai, Y. J., Zhang, Y. X., Tan, Y., and Feng, S. (2023). Pollution emission reduction effect of the coordinated development of inward and outward FDI in China. J. Clean. Prod. 391, 136233. doi:10.1016/j.jclepro.2023.136233

Uche, E., Das, N., Bera, P., and Cifuentes-Faura, J. (2023). Understanding the imperativeness of environmental-related technological innovations in the FDI - environmental performance nexus. Renew. Energy 206, 285–294. doi:10.1016/j.renene.2023.02.060

Wang, M., Zhang, X., and Hu, Y. (2021). The green spillover effect of the inward foreign direct investment: market versus innovation. J. Clean. Prod. 328, 129501. doi:10.1016/j.jclepro.2021.129501

Wang, Q. S., Yuan, X. L., Zuo, J., Zhang, J., and Hong, J. (2016). Optimization of ecological industrial chain design based on reliability theory--A case study. J. Clean. Prod. 124 (15), 175–182. doi:10.1016/j.jclepro.2016.02.096

Xu, H. L., and Deng, Y. P. (2012). Does FDI cause environmental pollution in China? -- Spatial metrology research based on China's provincial panel data. Manag. World 2, 30–43.

You, J. L., and Xiao, H. (2022). Can FDI facilitate green total factor productivity in China? Evidence from regional diversity. Environ. Sci. Pollut. Res. 32 (29), 49309–49321. doi:10.1007/s11356-021-18059-0

Yu, D., Li, X., Yu, J., and Li, H. (2021). The impact of the spatial agglomeration of foreign direct investment on green total factor productivity of Chinese cities. J. Environ. Manag. 290 (1), 112666. doi:10.1016/j.jenvman.2021.112666

Yu, L. H., Zhao, D., Niu, H. X., and Lu, F. (2020). Does the belt and road initiative expand China's export potential to countries along the belt and road? China Econ. Rev. 60, 101419. doi:10.1016/j.chieco.2020.101419

Zhang, C., and Zhou, X. (2016). Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. and Sustain. Energy Rev. 58, 943–951. doi:10.1016/j.rser.2015.12.226

Zhang, W., Li, G. X., Uddin, M. K., and Guo, S. (2020). Environmental regulation, foreign investment behavior, and carbon emissions for 30 provinces in China. J. Clean. Prod. 248, 119208–119208.11. doi:10.1016/j.jclepro.2019.119208

Zhang, Z., and Hu, Y. (2020). The effect of innovative human capital on green total factor productivity in the Yangtze River Delta: an empirical analysis based on the spatial Durbin model. China Popul. Resour. Environ. 30 (9), 106–120. doi:10.12062/cpre.20200408

Zhao, X., Nakonieczny, J., Jabeen, F., Shahzad, U., and Jia, W. (2022). Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol. Forecast. Soc. Change 185, 122021. doi:10.1016/j.techfore.2022.122021

Keywords: green technology progress, foreign direct investment, trade openness, feasible generalized least squares, heterogeneous effect

Citation: Yi M, Xu L, Zhang T, Ao L and Sun M (2025) The impact of foreign direct investment on green technology progress in China on two-carbon background: taking trade openness into consideration. Front. Environ. Sci. 12:1533146. doi: 10.3389/fenvs.2024.1533146

Received: 23 November 2024; Accepted: 16 December 2024;

Published: 07 January 2025; Corrected: 31 October 2025.

Edited by:

Hui Wang, Hunan University, ChinaReviewed by:

Peng Huatao, Wuhan University of Technology, ChinaXiaodong Hou, Henan University of Economic and Law, China

Copyright © 2025 Yi, Xu, Zhang, Ao and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tian Zhang, emhhbmd0aWFudEBjdWcuZWR1LmNu

Ming Yi

Ming Yi Longyu Xu1

Longyu Xu1 Tian Zhang

Tian Zhang