- 1 Sinounited Investment Group Corporation Limited Postdoctoral Programme, Jiaotong University, Beijing, China

- 2 School of Public Finance and Taxation, Zhejiang University of Finance and Economics, Hangzhou, Zhejiang, China

- 3 Nanjing University Of Finance and Economics Hongshan College, Nanjing, Jiangsu, China

- 4 Ningbo City College of Vocational Technology, Hangzhou, Zhejiang, China

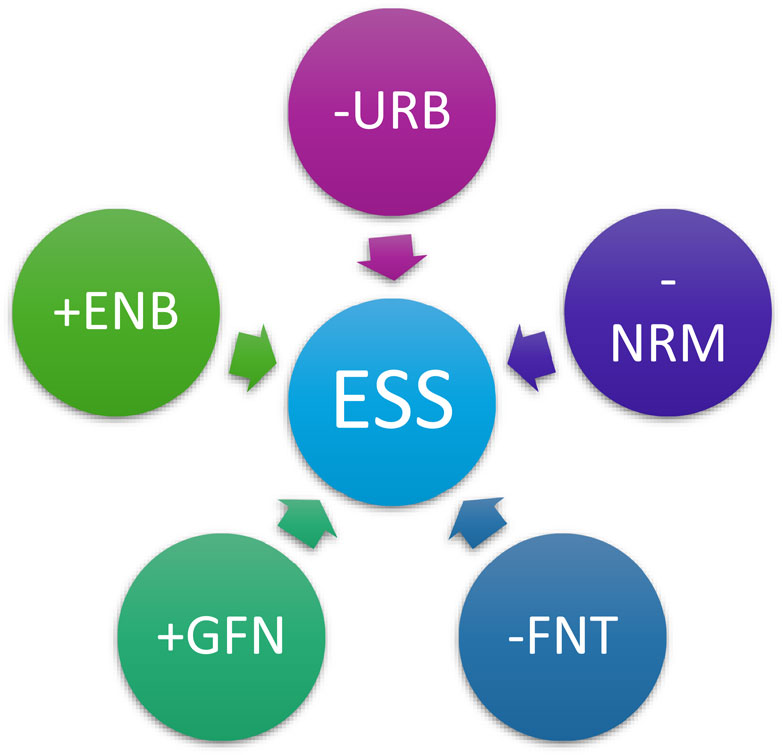

Green finance (GFN) plays a critical role in reducing greenhouse gas emissions and air pollution, serving as a key financial mechanism to promote green growth and economic sustainability (ESS). This paper explores how GFN, along with fintech (FNT), environmental benefits (ENB), urbanization (URB), and natural resource management (NRM), influences ESS in E7 countries from 2000 to 2022. While fintech’s rapid technological advancements offer significant economic potential, they also introduce increased complexity and systemic risks. Using rigorous methods such as method of moments quantile regression (MMQR) and Westerlund analysis, this study validates the relationships and heterogeneity among these variables through preliminary tests, including matrix correlation, cross-sectional dependence (CSD), slope heterogeneity (SH), and CIPS unit root tests. The findings indicate that GFN, ENB, and FNT positively contribute to ESS, while URB and NRM have an inverse relationship with ESS. These insights not only deepen our understanding of how ecological factors influence economic sustainability but also provide practical policy recommendations for E7 countries. The study’s conclusions offer valuable guidance for optimizing ESS and advancing toward sustainable development goals (SDGs).

1 Introduction

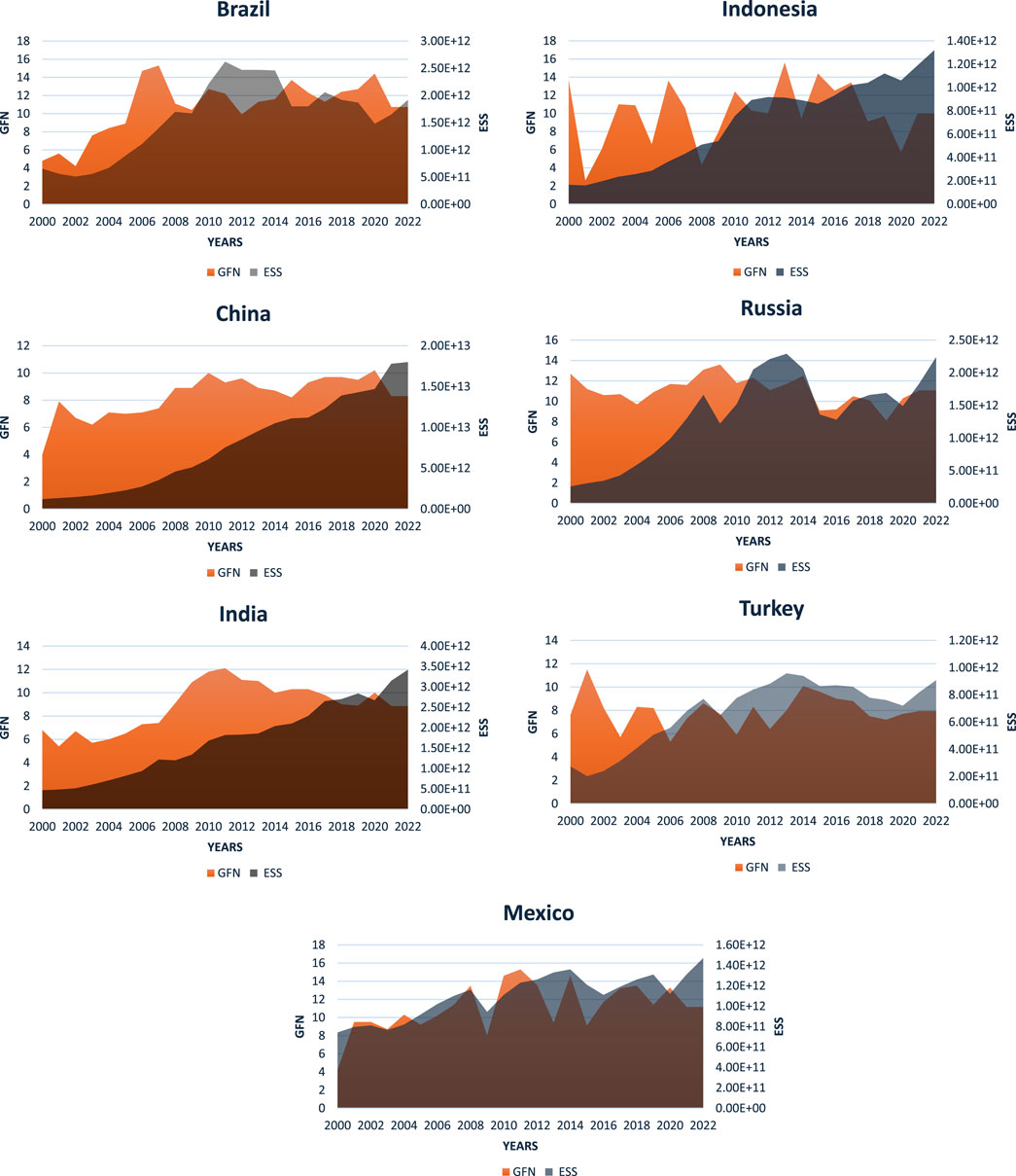

Globalization has linked economies globally by creating ever-greater opportunities for commerce, employment, and progress, but it also eventually tends to bring up a number of environmental risks (Liu et al., 2024; Ma et al., 2024; Zhao et al., 2024). Climate change, natural disasters, and ecosystem alterations are just a few of the environmental issues that this worldwide phenomenon presents (Hu et al., 2024; Wang S et al., 2023; Zhao et al., 2023). The main reason for ecological and climate concern is the continuous reliance on fossil fuels to meet energy needs (Nicoletti et al., 2015). Green Finance (GFN) plays a transformative role in advancing economic sustainability by channelling financial resources into environmentally friendly and sustainable practices. It includes instruments and investments that promote renewable energy, energy-efficient technologies, and green innovations. Figure 1 is displaying the trends of GFN and ESS in E7 regions. It is evident that China and India have experienced a progressive rise in the ESS pattern in tandem with GFN (Chen et al., 2023; Shang and Luo, 2021; Xue et al., 2023). In contrast, there has been a sharp drop and rise in GFN in Indonesia, Turkey, Brazil, and Mexico. Academic research should be done on the significance of GFN, FNT, NRM, URB, and ENB’s roles and their combined effects on ESS in these countries.

For E7 economies—characterized by significant environmental challenges such as carbon emissions, deforestation, and air pollution—GFN provides a critical mechanism for transitioning to low-carbon economies. By facilitating investments in renewable energy and eco-friendly projects, GFN helps mitigate climate risks and supports adaptation efforts, particularly in resource-dependent economies. Additionally, GFN aligns closely with Sustainable Development Goals (SDGs) such as SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action), making it an indispensable tool for achieving long-term economic and environmental objectives in these nations. GFN involves eco-friendly activities, which are crucial for ESS. GFN can be encouraged through the implementation of incentive programs, such as corporate tax reductions, green loan interest rate subsidies, and the creation of a green credit guarantee program to promote sustainable future (Chin et al., 2024; Fu et al., 2024). However, FNT also has the potential to accelerate the expansion of GFN, which tackles climate change and environmental concerns and has emerged as a means for industrialized nations to attain sustainable growth (Tu et al., 2022; Yu and Zhou, 2024; Zheng and Chen, 2023).

Income, urbanization, digitization, sports employment, tourism, and green energy have been identified by Tan et al. (2024) as fundamental factors influencing sustainability in certain European economies from 2010 to 2021. Through the use of several estimators, it was established that income, urbanization, sports, and tourism are the primary factors contributing to environmental development (ED). Conversely, digitization and green energy provide substantial contributions to sustainable development. The study by Abbas et al. (2024a) establishes that the competitiveness of the product market has a beneficial impact on the determination of firm performance. Furthermore, the study reveals that digital financial innovation acts as a mediator, that has a partially favourable impact on business performance. The evidence indicates that the concept of corporate financial innovation does not completely explain business performance. The results of a separate study conducted by Abbas et al. (2024b) indicate that sustainable tourism experiences growth as a result of the beneficial influence of mega-infrastructure development, thereby enhancing the qualitative wellbeing of the local population. Significantly, the absence of any direct impact of mega-infrastructure development on quality of life highlights the crucial need of sustainable tourism. Hence, during the COVID-19 pandemic, the various aspects of sustainable tourism - economic, commercial, socio-cultural, and environmental - contributed to ensuring the beneficial effects of mega-infrastructure development on the quality of life of the local population.

On the other hand, natural resource management (NRM) is essential for economic activities. It plays a critical role in mitigating environmental degradation and promoting sustainable growth (Wei et al., 2024). Utilizing natural resources might make achieving environmental goals more difficult. It is imperative to switch to the production of renewable energy to lower carbon dioxide emissions and foster sustainability. The growing number of people living in urban areas, or URB, has a significant impact on both environmental and economic outcomes. Also, reduction of carbon emissions is essential for environmental benefits (ENB) since they play a major role in both warmer temperatures and environmental deterioration (Climate Change, 2021—The Physical Science Basis, 2021; Intergovernmental Panel on Climate Change, 2023).

Fintech (FNT), short for financial technology, represents the integration of innovative technologies like artificial intelligence (AI), blockchain, and digital payment systems into the financial sector. In the context of E7 economies, fintech fosters economic sustainability by enhancing financial inclusion and improving the efficiency of financial operations. Digital tools enable underbanked populations to access financial services, broadening economic participation and driving sustainable growth. Moreover, fintech innovations optimize green finance mechanisms by providing AI-powered risk assessments and blockchain-enabled transparency for green projects. This technological integration supports resource efficiency and aligns financial services with environmental goals, creating a synergistic effect between economic and ecological priorities. The convergence of FNT, and sustainability has been a major topic of concern for policy and study in recent years, especially in the context of the E7 countries. These nations—China, India, Indonesia, Mexico, Russia, Turkey, and Brazil—combine to form a substantial bloc of developing economies with a variety of ecological problems and developmental trajectories (Mushtaq, 2024).

While the benefits of GFN are well-documented (Shah et al., 2023), its integration into E7 economies remains complex due to varying levels of institutional quality, governance, and technological adoption. Similarly, FNT, with its rapid technological advancements, holds the potential to enhance economic sustainability (ESS) by improving financial inclusion and resource efficiency. Studies such as Abbas et al. (2021) have highlighted how digital transformation supports economic recovery and growth, particularly in emerging markets. Yet, the scalability of fintech in E7 economies often encounters systemic risks, including regulatory challenges and digital divides.

Environmental benefits (ENB), urbanization (URB), and natural resource management (NRM) also play critical roles in shaping economic sustainability. While ENB, such as reduced air pollution, positively influence ESS, rapid urbanization and inefficient NRM often exacerbate ecological pressures. Li et al. (2022) emphasizes the importance of institutional quality and corporate social responsibility in balancing resource use and sustainable performance. However, contrasting findings suggest that urban centres in E7 economies, such as those in China and India, can act as hubs for green innovation despite contributing to overall environmental degradation (Zhang et al., 2022). Addressing these contradictions is vital to comprehensively understanding the dynamics of ESS in E7 countries. Accordingly, this study aims to address a number of essential queries:

1. How GFN impacts the ESS of E7 countries?

2. To which extent does developments in FNT can facilitate the utilization and accessibility of GFN in terms of ESS?

3. How ESS and URB interact in E7 nations?

4. What effects does NRM have on these countries’ ENB and ESS?

To answer these questions this inquiry has applied MMQR approach, allowing solid analysis across various economic segments (Machado and Santos Silva, 2019). MMQR can identify the relationships and impacts of independent variables (GFN, ENB, NRM, URB and FNT) on dependent variable (ESS) at different quantiles. Matrix correlation analysis has been used to find interdependencies between variables, which is important for understanding complicated networks like the ones affecting sustainability in the E7 countries. Since CSD can identify possible distortions from related errors throughout various quantiles, panel data can be trusted (Joe, 2006). The Slope Heterogeneity (SH) Test provides a more sophisticated understanding of how characteristics affect economic outcomes disproportionately by uncovering variations. Longitudinal research is broadened when the time series features of the data are appropriately handled, as demonstrated by panel unit root tests like CIPS (Cerasa, 2008) and panel cointegration tests like Westerlund (Westerlund, 2008).

Apart from this, current study is aligned with several SDGs that are addressed in this study. Goal 7 (Affordable and Clean Energy), Goal 9 (Industry, Innovation, and Infrastructure), Goal 11 (Sustainable Cities and Communities), Goal 13 (Climate Action), and Goal 15 (Life on Land) are among the SDGs that have been investigated by this assessment (Feng et al., 2024; Luo et al., 2023). This research further contributes to our understanding of the tactics that can be used to achieve SDGs in a range of worldwide contexts by examining the interactions between ESS, ENB, GFN, FNT, URB and NRM.

The rationale behind this study stems from the urgent need to address economic sustainability challenges in E7 economies, which are characterized by rapid urbanization, resource dependency, and evolving financial ecosystems. Despite significant advancements in green finance, fintech, and natural resource management, the interplay of these factors with urbanization and economic sustainability remains underexplored. The E7 economies face unique pressures, such as balancing growth with environmental conservation and integrating technological innovations into traditional economic frameworks. By examining these dynamics, the study aims to bridge the knowledge gap and provide actionable insights. This research is particularly relevant as E7 countries strive to align their policies with Sustainable Development Goals while managing the complexities of resource utilization, urban development, and digital transformation. By focusing on the interactions among GFN, FNT, NRM, URB, and economic sustainability, the study contributes to a holistic understanding of how these variables shape the trajectory of sustainable development in emerging economies. This focus not only underscores the importance of sustainable growth but also offers evidence-based recommendations for policymakers to address systemic challenges effectively.

This study makes several important contributions to the literature and policy discourse on GFN, FNT, and ESS. Theoretically, it enhances our understanding of how GFN and FNT contribute to ESS, offering new insights into the role of financial innovations in promoting sustainability. By examining the association between ENB, GFN, FNT, URB and ESS, the study provides valuable empirical evidence on the environmental-economic nexus in E7 countries. From a policy perspective, the study offers practical recommendations that can help E7 authorities optimize ESS and advance towards the achievement of Sustainable Development Goals (SDGs). These recommendations are grounded in empirical findings, ensuring that they are relevant and actionable for policymakers. Additionally, the study’s use of advanced econometric techniques, including MMQR and Westerlund analysis, along with preliminary tests, contributes to the methodological rigor of sustainability research, providing a robust framework for analysing complex relationships in this field.

The paper is patterned in following way, an extensive overview of literature, theoretical framework and study gap is provided in Section 2. Section 3 encapsulates the data and methodologies. Section 4 present results and discussions, and Section 5 offers conclusion and policy ramifications.

2 Literature review

Significant research interest has been sparked by the pursuit of sustainability in the areas of ESS, ENB, GFN, FNT, URB, and NRM especially in relation to the E7 countries due to their considerable economic growth and environmental imprints, these growing economies are essential to global sustainability initiatives (Kaur and Sharma, 2024). The intersections of these areas are examined in this literature review, with an emphasis on how they work together to promote ESS.

The study by Al-Sulaiti (2023) examined the fundamental elements contributing to environmental degradation in Qatar, Oman, UAE, KSA, and other specifically chosen Arab countries. The findings demonstrated the substantial impact of culture and diet on environmental sustainability. The transportation, tourism, and restaurant sectors contribute to increased emissions. The analysis conducted by Iorember et al. (2024) utilizes yearly panel data from the BRICS countries (Brazil, Russia, India, China, and South Africa) spanning the years 1990–2019. This study utilises the CS ARDL method and the Tapio decoupling index to evaluate the level of decoupling among the BRICS countries. The findings substantiate the separation of carbon emissions among the BRICS countries. Using observation data obtained from 780 manufacturing firms listed on the Karachi Stock Exchange (KSE), Yan et al. (2024) employed a GMM (generalized method of moments) model to test our hypothesis. The findings of this study indicate that CEO power exerts a detrimental influence on the sustainable performance of corporations. However, the mediating function of green innovation effectively and fully controls the consequence of CEO power on the sustainable performance of companies.

Adoption of environmental related technologies is an important indicator of GFN because it can cater financial support for initiatives aimed at cutting carbon emissions to gain more ENB and improving resource efficiency. A rapid growth in industrialization and URB in E7 countries put strain on NRM and ecological performance which makes GFN is essential factor to tackle these concerns. Research has demonstrated that through encouraging innovation in sustainable technologies and GFN may considerably lower carbon footprints and stimulate economic growth (Wang and Zhi, 2016). One example of how GFN can assist economic development is China’s aggressive investment in renewable energy projects and green bonds (Yan and Lyu, 2023). GFN profoundly impacts the evolution of ecological protection, fiscal efficacy, and finance structure, all of which have a major impact on quality economic growth in India (Nenavath and Mishra, 2023). Also, Ronaldo and Suryanto et al. (2022) concluded that GFN can assist efficiently to accomplish the SDGs through economic and environmental sustainability, green finance can support green technology innovation and green microenterprises. Asghar et al. (2024) investigated the potential influence of technological progress, urbanization, and industrialization on the shift towards green alternatives. The study employed panel-corrected standard errors regression and quantile regression analytical techniques on data spanning from 1985 to 2020. The empirical evidence indicated that technology advancements expedite the integration of renewable energy sources and hinder the progress of non-renewable energy sources. Zhang et al. (2024) aimed to evaluate the impact of renewable energy on Natural Resource Protection (NRP) in 22 emerging economies. The paper examined the non-linear correlation between renewable energy and nitrogen reduction potential (NRP). Furthermore, the effects of governance efficiency, financial technology, urbanization, and foreign direct investment on the NRP were also evaluated. Moreover, the analyses additionally investigate the NRP-Kuznets curve by scrutinizing the influence of economic growth on the NRP. Li et al. (2023) aimed to identify, assess, and prioritize the elements and sub-indicators of green finance, as it is a fundamental concern for achieving sustainable development. This study used the Delphi and fuzzy Analytical Hierarchy Process methodologies to examine the primary elements and sub-elements of green finance. Tan et al. (2023) assessed the impact of fintech development, renewable energy consumption, foreign direct investment, and government effectiveness on the efficient use of natural resources. This article utilised a panel of 22 specifically chosen countries, analysing annual data from 2006 to 2021.

Sustainable development requires productive utilization of natural resources. An essential component of NRM is the revenue obtained from the extraction of natural resources. NRM can promote ESS without endangering the quality of the environment. The natural resource curse affects nations that rely heavily on agriculture but have poor governance (low levels of corruption control). However, when countries that depend on agricultural resources are bolstered by solid governance practices that prioritize political stability, government effectiveness, and voice and accountability, then the natural resource truly becomes an asset (Iskandar et al., 2020). The E7 nations are endowed with an abundance of natural resources, authorities of E7 are supposed to handle manage these resources responsibly. Mismanaged NRM can be resulted in resource curse, which can lead to slower economic expansion and environmental degradation (Liang et al., 2023). Sustainable management can contribute to ecological sound practices and economic resilience. Furthermore, studies of Dickens et al. (2019) and Sutherland et al. (2021) suggest that attaining sustainable objectives can be achieved through strong institutional quality, transparent resource management, and good governance.

Similarly, ENB is significant, particularly those that may be measured by lowered carbon emissions. Climate change is mostly caused by carbon emissions. These emissions should be minimized to reach climate targets (Intergovernmental Panel on Climate Change (IPCC), 2023). Relationship between ecological damage and financial development and economic expansion in the BRICS countries between 1980 and 2007 using a panel cointegration technique, was investigated by Pao and Tsai (2011). The study’s conclusions showed that spending money on ecologically friendly technologies and green farming methods can significantly decrease carbon emissions. Furthermore, even regeneration of URB is problematic but it also presents chances to implement sustainable policies that might lower greenhouse gas emissions and raise urban living standards (United Nations, 2018). URB pose two distinct challenges regarding sustainability. It drives ESS on the one hand by stimulating innovation and concentrating economic activity. Contrary to this, incompetent URB management could result in increased carbon emissions and decreased ecological performance. Well-designed URB can lower carbon emissions and offer more financial stability (Angel, 2020).

In addition, FNT has revolutionized the financial services industry by increasing productivity, mobility, and inclusivity. Net financial account access, which measures the public’s ability to use digital financial services, is a barometer of FNT advancement. For the E7 countries, FNT development is important since it makes financial inclusion and GFN programs possible. For instance, financial services are now more easily accessible in underserved in remote communities due to digital wallets and mobile banking (Demirguc-Kunt et al., 2018). FNT platforms can also raise funds for green projects, linking environmental sustainability and fiscal diversity (Ahmad et al., 2022; Dunbar et al., 2024; Najaf et al., 2023).

Additionally, Xia and Liu, (2024) discovered that FNT reduces ecological footprints in G7 nations. Outcomes obtained from the investigation of Murshed, (2024) emphasize the need of continuously scale loan extensions to FNT startup-based enterprises in order to reduce the initial effects of FNT development that worsen ecological deficits. Murshed, (2024) also suggested that mineral-exporting countries should think about luring environmentally beneficial foreign direct investments and implementing sustainable URB strategies in order to become ecological superfluity in the long run.

2.1 Theoretical framework

This paper’s theoretical framework explores how the E7 countries—Brazil, China, India, Indonesia, Mexico, Russia, and Turkey—are strengthening durability through the use of GFN, ENB, FNT development, and NRM. It accomplishes this by including relevant concepts and actual data.

Sustainable Development Theory serves as a foundational framework that emphasizes the interconnectedness of economic growth, environmental protection, and social equity. This theory posits that for economic development to be sustainable, it must meet the needs of the present without compromising the ability of future generations to meet their own needs. Applying this to the study, GFN and FNT are seen as crucial mechanisms that can align financial systems with environmental goals, driving the transition toward a more sustainable economy in E7 countries. By channelling investments into green projects and leveraging technology to enhance financial inclusion and efficiency, GFN and FNT can reduce environmental degradation and promote resource efficiency. Sustainable Development Theory thus underpins the study’s exploration of how these financial innovations can balance economic progress with ecological sustainability, ensuring that growth is not achieved at the expense of the environment (Sharma et al., 2024). Moreover, the theory highlights the importance of integrating URB and NRM into sustainability strategies, as these factors play a critical role in shaping long-term economic and environmental outcomes. This holistic approach reflects the essence of Sustainable Development Theory, which seeks to harmonize economic, social, and environmental dimensions in pursuit of global sustainability goals.

Likewise, GDP serves as a proxy for ESS, which is the capacity of an economy to expand and mature over an extended period of time without depleting natural resources or seriously harming the environment. In order to attain long-term prosperity, sustainable development theory emphasizes the convergence of economic, environmental, and social goals (WCED, 1987). However, ESS in the E7 countries is affected by the interaction of NRM, URB, ENB, FNT and NRM. GFN investments can boost the economy and lessen their negative effects on the environment. FNT innovations help economic activity and resource allocation by improving financial inclusion and efficiency. Sustainable economic development is guaranteed when natural resource wealth is properly managed. Sustainable URB strategies improve economic output and lessen their negative effects on the environment, which supports sustainability. Graphical relationship between the variables has been shown in Figure 2.

Integration of GFN policies with urban planning, digital innovation strategies, and environmental regulations ensures a cohesive approach to ESS. For instance, coordinated policies in Brazil and China have demonstrated how green bonds and urban sustainability initiatives can drive economic and ecological benefits. FNT and digital platforms act as enablers for integrating GFN and urbanization strategies. For example, AI-driven analytics in FNT can assess the environmental impact of urban development projects, ensuring that they align with ESS goals. Governance structures in E7 economies play a pivotal role in resource management and policy implementation. Strong institutions are essential for enforcing environmental regulations, promoting public-private partnerships, and incentivizing sustainable practices. Multi-stakeholder engagement, including governments, private sectors, and civil society, ensures that diverse perspectives are integrated into decision-making processes. This is particularly relevant in E7 economies, where resource-dependent communities are directly affected by policy shifts.

2.2 Literature gap

Even though these topics have been the subject of previous investigations, there are still a lot of unanswered questions in the literature, especially when it comes to how these components work together and how they affect ESS. By using strong approaches like MMQR and early tests like Westerlund, CIPS, cross-sectional dependence, SH, and matrix correlation, this work seeks to close these gaps. A lot of the research that has already been done ignores how GFN helps to support technical advancements that can stimulate long-term ESS. The economic advantages of environmental improvements are, however, not well quantified by study, particularly in the E7 nations. Also, studies have frequently fall short of offering a detailed analysis of how particular ENB translates into ESS. This gap necessitates integrated research that takes into account the financial effects of environmental laws and carbon-emission-reducing technology. Furthermore, few empirical research work has examined the interactions between FNT development and other sustainability drivers in the E7 nations, despite the fact that certain studies suggest FNT can enhance financial access in underserved regions and mobilize money for sustainable initiatives. This discrepancy underscores the need for further inquiry for scrutinizing the potential synergies between FNT and GFN to support ESS.

Moreover, there is still much to learn about how NRM affects ESS in the E7 nations. There is a lack of comprehensive analysis of sustainable URB in context of ESS as well. Specifically, studies that integrate URB with GFN, FNT, and NRM are limited. Besides, traditional econometric techniques are frequently used in existing research, which may not adequately capture the intricacies and heterogeneities inherent in the data. A more in-depth study can be attained by MMQR, which looks at the impacts of independent variables across various quantiles of ESS. To ensure the robustness of findings, preliminary tests including matrix correlation, SH, cross-sectional dependency, CIPS for panel unit roots, Westerlund for panel cointegration, and cross-sectional reliance are crucial. But these sophisticated approaches are not fully employed in the existing literature, especially in studies that concentrate on the E7 nations. Thus, this study aims to fill these gaps by employing robust methodologies and providing empirical evidence on the interconnected roles of these variables. By addressing these gaps, the inquiry will contribute to a more comprehensive understanding of sustainable development in emerging economies. The study’s integrated approach aligns with the SDGs, providing actionable insights for resource management, digital innovation, and urban planning. It underscores the need for collaborative efforts among policymakers, private sector actors, and financial institutions to optimize the impacts of GFN, FNT, NRM, and URB. By advancing the understanding of these interactions, the research contributes to developing targeted, context-specific strategies for sustainable growth in E7 economies.

3 Data and methodologies

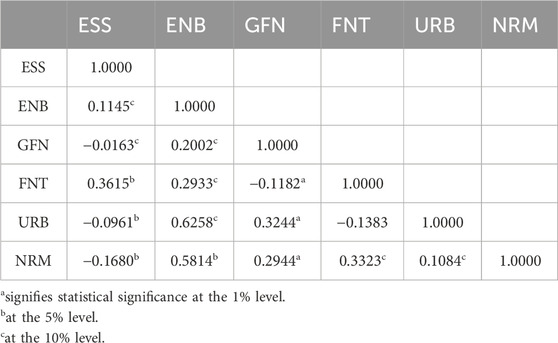

The dataset covers annual observations from 2000 to 2022. The variables included in the analysis are ESS, ESS, FNT, ENB, URB and NRM. These variables capture a comprehensive view of both financial mechanisms and ecological factors relevant to ESS. Missing data were addressed using multiple imputation, ensuring that any potential biases due to incomplete data were minimized. Measurements and sources for these variables have been shown in Table 1.

Previous research has used diverse methodologies to study relationship between socio-economic variables (Abbas et al., 2021; Li et al., 2022; Shah et al., 2023). This research has utilized the method of MMQR suggested by Machado and Santos Silva, (2019), to scoop out the effects of covariance in scenarios with little variation. Before applying MMQR matrix correlation (Joe, 2006), SH, CSD, CIPS unit root (Cerasa, 2008) and Westerlund (Westerlund, 2008) have also been conducted. However, MMQR permits the individual effects to have an impact throughout the whole value range. Also, dependent variable’s conditional distribution is evaluated using MMQR to look at correlations between variables at various intervals. This technique is particularly valuable when the consequence of the independent factors on the dependent variable varies over quantiles, as it delivers a broader picture than ordinary mean regression models. This methodology has been successfully employed in various studies (Adebayo et al., 2022; Fareed et al., 2022; Miao et al., 2022; Qi et al., 2023).

The Equation 1 shows the MMQR model in the present study.

Where,

Error term is denoted by

The MMQR technique has the advantage of supplying an extensive comprehension of how each independent variable influences the dependent variable (ESS) throughout its administration, rather than only at the mean, because it accounts for multiple effects throughout numerous quantiles. This is especially handy for ESS exploration since different triggers may have diverse impacts at various ESS degrees.

Equation 2 depicts the summarization of SH test.

Where,

However, to find out if panel data exhibits cointegration, the Westerlund (2008) test has also been implied. A long-term equilibrium relationship between the dependent variable and one or more independent variables is indicated by cointegration. When applying the Westerlund test in a scenario where the independent variables are ENB, GFN, FNT, URB and NRM and the dependent variable is ESS, the following Equation 3 has to be used:

Dependent variable for the cross-section

The flowchart of methodology is displayed in Figure 3. Moreover, matrix correlation helps identify correlations between different variables, providing a thorough grasp of interdependencies. By taking into account the possibility that different cross-sectional units will exhibit a variety of behavioural inclinations. SH increases the accuracy of model estimates. Similarly, cross-sectional dependence tests, such as the CIPS unit root test, addresses potential correlations between units, guarantee the validity of panel data results. Westerlund’s cointegration tests offer robust methods for determining long-term equilibrium relationships, even when cross-sectional dependence or structural fractures are present. Furthermore, MMQR analysis provides a better understanding of the association between all variables over many quantiles, which facilitates the detection of heterogeneity in the response variable distribution and the development of more specialized decisions. By combining these techniques, the statistical conclusions’ breadth, dependability, and practical importance are maximized.

4 Results

Table 2 displays the correlation coefficients among ESS, ENB, GFN, FNT, URB and NRM. Notable correlations include the positive relationship (0.6258) between URB and ENB, suggesting implies that increased URB is linked to better environmental outcomes. Furthermore, NRM exhibits a positive association with FNT (0.3323) and ENB (0.5814), indicating a relationship between improved NRM and the advancement of FNT and the environment. On the other hand, GFN shows a negligible direct link with ESS with a weak negative correlation with FNT (−0.1182) and ESS (−0.0163).

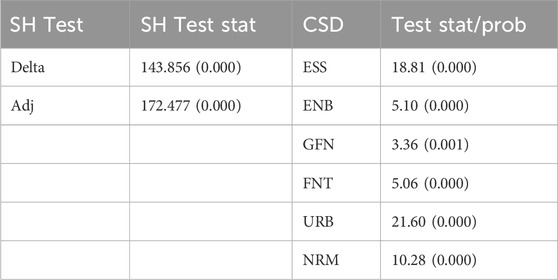

Table 3 is illustrating the aftermath of CSD analysis. Significant CSD is indicated by the very low p-values (0.000 or 0.001) and high-test statistics for all variables. Table 3 given below is showing the observations of SH test. The test statistics and p-values for the Delta and adjusted Delta tests are reported. Significant SH can be detected by both tests, with statistics of 143.856 (p = 0.000) and 172.477 (p = 0.000), respectively. This shows that different E7 countries have varied relationships between the independent variables and ESS, reinforcing the necessity for models that may compensate for these variations.

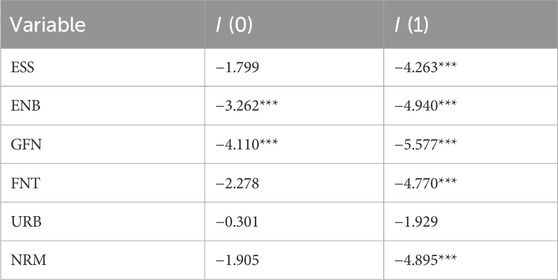

Table 4 portrays the outcomes of CIPS unit root tests. Variables are analysed in two forms: at level I (0) and at difference I (1). Only ENB and GFN exhibit significant findings (***) for the level I (0), suggesting stationarity. All variables, with the exception of URB, are significant for the first difference I (1), pointing out that they become stationary upon differencing. However, the asterisks (***) denote the significance level of the coefficients. Typically, *** signifies statistical significance at the 1% level, ** at the 5% level, and * at the 10% level.

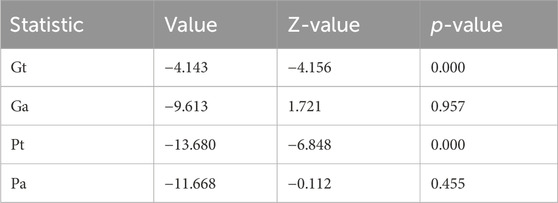

Four statistics (Gt, Ga, Pt, and Pa) are presented in the Westerlund cointegration analysis (Table 5) to check for cointegration between the variables. Significant p-values (0.000) for the Gt and Pt statistics provide evidence of cointegration. However, the strong p-values of the Ga and Pa statistics (0.957 and 0.455) indicate that there is no cointegration, based on these tests. This inconsistent result suggests that although certain features of the data point to long-term equilibrium relationships, others do not, underscoring the difficulty of conclusively proving cointegration.

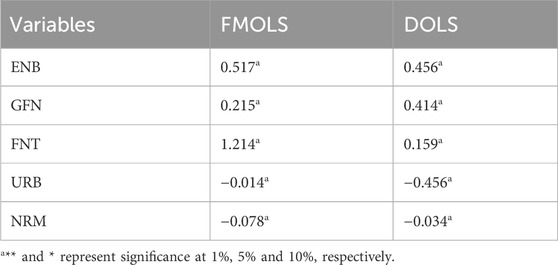

The estimated coefficients of the independent variables (GNB, FNT, URB, NRM, and GFN) across various quantiles (0.25, 0.50, 0.75, and 0.90) of the dependent variable (ESS) are listed in Table 6. Asterisks indicate significant coefficients: *p < 0.05, **p < 0.01, ***p < 0.001. We have also applied FMOLS, and DOLS, tests for robustness check as shown in Table 7. The outcomes of these tests produced similar results. The results indicate that URB, and NRM, are negatively associated with ESS, while ENB, GFN, and FNT, are positively associated with ESS.

4.1 Discussions

Higher quantiles (0.75 and 0.90) exhibit positive and significant coefficients as shown in Table 6, suggesting that ENB have a bigger positive effect on ESS at higher GDP levels. This is consistent with the finding of Zhang et al. (2019), in advanced phases of economic development, investments in environmental technologies considerably increase economic expansion. Relationship between GFN and ESS is also positive (as depicted in Figure 4). This is similar to the conclusions from the examinations by Zhang, (2023) and Zhou et al. (2020) who argue that GFN approaches become more successful as countries grow and adopt more sophisticated financial tools. Moreover, FNT has a favourable impact that rises dramatically at higher quantiles (0.75 and 0.90), indicating that it is becoming increasingly crucial in fostering ESS in wealthier economies. The study observes that ENB and FNT exhibit more significant positive impacts on ESS at higher quantiles (0.75 and 0.90), compared to lower quantiles (0.10 and 0.25). This divergence highlights the heterogeneity in how economic and environmental conditions influence sustainability outcomes across different levels of ESS. In lower quantiles, representing regions with limited economic sustainability (often corresponding to lower-income or resource-constrained areas), several conditions may inhibit the positive impacts of ENB and FNT. Lower-income areas often lack the financial and institutional capacity to capitalize on environmental benefits. For example, investments in renewable energy or pollution mitigation may be minimal, reducing the tangible impacts of ENB on ESS. The benefits of FNT, such as improved financial inclusion and efficiency, depend on robust digital infrastructure. In lower-income regions, limited access to technology, internet connectivity, and digital literacy restricts the adoption of fintech solutions, diminishing their positive effects on ESS. Lower quantiles may face severe environmental degradation due to over-dependence on natural resources for subsistence. High pollution levels and deforestation can offset the potential advantages of ENB, limiting its contribution to ESS. Weak governance and regulatory frameworks in these regions often fail to integrate ENB and FNT effectively into broader sustainability strategies. This reduces the ability to leverage these factors for long-term economic gains. By addressing the unique challenges in lower quantiles, policymakers can unlock the untapped potential of ENB and FNT to promote ESS across all regions, fostering inclusive and equitable sustainable development.

The positive link of FNT with ESS aligns with the study of Sahay et al. (2020), it focuses on how FNT is boosting financial inclusion and efficiency, especially in higher-income areas, and how this is boosting economic growth. This corroborates the noteworthy and affirmative influence of FNT advancement at elevated GDP quantiles as observed in this investigation. Conversely, NRM and URB are in an inverse relationship with ESS. It underlines the obstacles that these countries have in maintaining a balance between resource utilization, URB, and sustainable economic practices. The inverse relationship between NRM and URB with ESS in E7 economies reflects structural challenges and inefficiencies in resource management and urban development. These negative correlations arise from specific factors intrinsic to E7 nations, characterized by rapid growth, resource dependency, and uneven urbanization. Many E7 economies rely heavily on natural resource extraction to fuel economic growth. Unsustainable practices lead to resource depletion and environmental degradation, undermining long-term economic sustainability. Inadequate governance and corruption often hinder the effective implementation of policies designed to manage resources sustainably, resulting in inefficiencies and economic disparities. Overreliance on natural resource exports can divert attention from other sectors, reducing economic diversification and resilience against market fluctuations. Rapid and unplanned urban expansion in E7 economies strains infrastructure, increases pollution, and exacerbates resource inefficiencies, negatively impacting ESS. Urbanization often leads to uneven development, where benefits are concentrated in affluent areas while low-income communities face poor living conditions and limited access to resources. High population densities in urban areas drive increased energy consumption and waste production, contributing to environmental degradation and reduced economic sustainability. The aftermath of the research supports the claims made by Henderson et al. (2003) on the detrimental impacts of an over-reliance on natural resources affecting environmental sustainability and constant fiscal stability.

Development of financial technology has the capacity to enable small entrepreneurial companies to create strong strategies for reducing risks. Financial technology platforms have the potential to improve the financial literacy of individuals and provide them with education on efficient resource allocation to attain economic sustainability. The present research findings corroborate the conclusions made by Nenavath and Mishra, (2023), who have identified a substantial contribution of green finance and fintech in fostering sustainable economic development. The current investigation indicates a substantial association between the management of natural resources and the long-term economic viability. Implementing efficient natural resource management practices can mitigate the potential hazards of resource scarcity and promote governments to adopt a more balanced approach to resource consumption. In order to guarantee the preservation of natural resources, another tenet of efficient natural resource management is the inclination towards utilizing limitless resources rather than exhaustible ones. The utilization of limitless resources can enable a nation to circumvent resource constraint and reduce reliance on resources imported from other nations (Abbas, 2023; Wang Z et al., 2023; Zhang et al., 2022). Furthermore An et al. (2023), emphasize the significant socio-economic advantages of natural resource management and its capacity to improve sustainable development.

5 Conclusion and policy recommendations

The present research has probed the complicated interactions and impacts of independent variables (GFN, ENB, FNT, URB and NRM) on the dependent variable (ESS) from 2000 to 2022 in E7 regions. Interestingly, the statistical findings of this study demonstrate how interconnected these components are and how they establish the ESS setting. It is obvious that ESS is positively supported by FNT, GFN, and ENB. The positive association indicates ESS may be driven by investments in ecologically friendly banking structures and technologies. On the other hand, there is a negative correlation is found between ESS and URB and NRM. Rapid URB, which is frequently unplanned and poorly managed, degrades the environment, increases carbon emissions, and puts a pressure on resources, all of which impede the advancement of ESS. Long-term economic stability is further jeopardized by ineffective NRM, which also lead to resource depletion and environmental damage. These results emphasize how critical it is for the E7 nations to implement more environmentally friendly urban design and resource management practices in order to reduce adverse effects and guarantee their economic longevity. Anyways, following policy suggestions are put forth for the E7 countries to improve economic sustainability in accordance with the SDGs:

Governments of E7 countries ought to encourage investments in GFN by offering low-interest loans, tax incentives, and subsidies for initiatives that benefit the environment. Capital from the private sector can be directed toward environmentally beneficial projects through the creation of green bonds and sustainable investment vehicles. Reiterating legislative frameworks should be done for urging financial institutions to consider environmental risk when making lending and investment choices. Transparency and inclusivity in financial services could be enhanced by leveraging FNT development. Digital financial services can help small and medium-sized businesses (SMEs) by making it simpler for them to obtain funding for projects that are green. FNT corporations might be able to support sustainable business practices and accountability by motivating collaboration. Collaboration can also facilitate the monitoring and reporting of ecological consequences. The social implications of FNT in E7 economies are profound, as it has the potential to significantly enhance financial inclusion and social equity. By providing previously unbanked or underbanked populations with access to financial services such as credit, savings, and insurance through digital platforms, FNT can empower marginalized groups and reduce income inequality. Additionally, FNT fosters job creation, particularly among the tech-savvy youth in urban areas, and promotes digital literacy, which is essential for building a workforce adaptable to the demands of a digital economy. Furthermore, FNT’s ability to integrate with green finance initiatives can drive social impact by funding sustainable projects focused on poverty alleviation, education, and healthcare, ultimately supporting the achievement of SDGs.

There should be mandatory execution of URB projects with creation of smart towns and cities, which proficiently handle resources and reduce carbon emissions through innovation for sustainability. Adequate NRM is also important for E7 territories. The E7 nations ought to adopt comprehensive resource management plans that can promote equitable distribution, sustainable extraction, and preservation. Plus, regulatory frameworks of E7 administrations should be reinforced to control waste, curb emissions, and protect natural zones.

Meanwhile, the E7 economies are supposed to establish mechanisms for compliance and monitoring along with enforcement of environmental laws. International cooperation and collaboration may assist in acquiring funding and technical support for ecological endeavours as well. Similarly, cooperation between the public and commercial sectors is beneficial too for accomplishing sustainable development objectives. It can ease the flow of information, assets, and technology which is required for a prospering future. Consequently, through bringing these proposals into action, E7 may improve their ESS and participate in the worldwide attempt to achieve the SDGs.

The study’s implications are profound for E7 countries aiming to enhance ESS. GFN emerges as a key driver, reducing emissions and fostering sustainable growth, highlighting the need for policies that encourage green investments. FNT also plays a crucial role, offering economic potential while requiring careful management of associated risks. The positive impact of ENB suggests aligning policies with ecological goals to strengthen resilience. However, the negative effects of URB and current NRM practices underscore the need for sustainable urban planning and re-evaluation of resource use strategies. Integrating green finance, fintech, and sound environmental policies can help E7 countries optimize ESS and advance toward the SDGs.

6 Limitations and future research prospects

One limitation of this study is the potential constraints posed by data availability and quality across E7 countries from 2000 to 2022, which may affect the robustness of the findings and limit their generalizability to other regions or periods. Additionally, variables like GFN, FNT, and ENB may be subject to measurement errors due to the complexity in defining and quantifying these concepts. Methodologically, the study’s reliance on specific econometric techniques, such as MMQR and Westerlund cointegration analysis, introduces sensitivity to the assumptions underlying these models, which could influence the outcomes and interpretations. Finally, while the study explores multiple factors, it may not fully account for other unobserved variables or external shocks that could impact economic sustainability.

The current study opens several avenues for future research. First, expanding the scope to include other emerging and developed economies beyond the E7 countries could provide a broader understanding of the role of GFN and FN) in enhancing ESS. Comparative studies between different regions could yield insights into how varying institutional, cultural, and economic contexts influence the effectiveness of GFN and FNT. Second, future research could explore the long-term impacts of fintech advancements on systemic risks and their mitigation strategies, considering the rapid pace of digitalization. Additionally, incorporating more granular data, such as firm-level or sector-specific analysis, could help identify which industries benefit most from green finance and technology adoption. Finally, examining the interplay between URB, NRM, and ESS in a dynamic context could uncover temporal changes and their implications for sustainable development. Longitudinal studies that track the evolution of these variables over time would provide deeper insights into the sustainability transition.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.worldbank.org/.

Author contributions

XD: Supervision, Formal analysis, Investigation, Funding acquisition, Writing–review and editing. JW: Formal analysis, Investigation, Funding acquisition, Resources, Writing–review and editing. SF: Conceptualization, Writing–original draft. YZ: Writing–original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. 2021 General Project of Philosophy and Social Science Research in Jiangsu Universities “Mechanism and Empirical Test of the Impact of Digital Inclusive Finance on Enterprise Innovation” (No. 2021SJA2289).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., Balsalobre-Lorente, D., Amjid, M. A., Al-Sulaiti, K., Al-Sulaiti, I., and Aldereai, O. (2024a). Financial innovation and digitalization promote business growth: the interplay of green technology innovation, product market competition and firm performance. Innovation Green Dev. 3, 100111. doi:10.1016/j.igd.2023.100111

Abbas, J., Mamirkulova, G., Al-Sulaiti, I., Al-Sulaiti, K. I., and Dar, I. B. (2024b). Mega-infrastructure development, tourism sustainability and quality of life assessment at world heritage sites: catering to COVID-19 challenges. Kybernetes. doi:10.1108/K-07-2023-1345

Abbas, J., Mubeen, R., Iorember, P. T., Raza, S., and Mamirkulova, G. (2021). Exploring the impact of COVID-19 on tourism: transformational potential and implications for a sustainable recovery of the travel and leisure industry. Curr. Res. Behav. Sci. 2, 100033. doi:10.1016/j.crbeha.2021.100033

Abbas, M. (2023) Innovation, self-efficacy and creativity-oriented HRM: what helps to enhance the innovativeness of organization employees ? 1, 54–67.

Adebayo, T. S., Akadiri, S. S., Adedapo, A. T., and Usman, N. (2022). Does interaction between technological innovation and natural resource rent impact environmental degradation in newly industrialized countries? New evidence from method of moments quantile regression. Environ. Sci. Pollut. Res. 29 (2), 3162–3169. doi:10.1007/S11356-021-17631-Y

Ahmad, M., Ahmed, Z., Gavurova, B., and Oláh, J. (2022). Financial risk, renewable energy technology budgets, and environmental sustainability: is going green possible? Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.909190

Al-Sulaiti, K., Abbas, J., and Al-Sulaiti, I. (2023). Resetting the hospitality redux through country-of-origin effects: role of tourism, culture, transportation and restaurants selection in Arab countries in Country origin effects.

An, L. J., Jiang, X. J., Liu, Z., and Li, Q. (2023). RETRACTED: socio-economic impact of natural resource management: how environmental degradation affects the quality of life. Geol. J. 58, 3310–3325. doi:10.1002/gj.4787

Angel, S. (2020). Making room for a planet of cities in The city reader. doi:10.4324/9780429261732-77

Asghar, M., Ali, S., Hanif, M., and Ullah, S. (2024). Energy transition in newly industrialized countries: a policy paradigm in the perspective of technological innovation and urbanization. Sustain. Futur. 7, 100163. doi:10.1016/j.sftr.2024.100163

Cerasa, A. (2008). CIPS test for unit root in panel data: further Monte Carlo results. Econ. Bull. 3 (16).

Chen, L., Chen, T., Lan, T., Chen, C., and Pan, J. (2023). The contributions of population distribution, healthcare resourcing, and transportation infrastructure to spatial accessibility of health care. Inq. J. Health Care Organ. Provis. Financing 60, 469580221146041. doi:10.1177/00469580221146041

Chin, M. Y., Ong, S. L., Ooi, D. B. Y., and Puah, C. H. (2024). The impact of green finance on environmental degradation in BRI region. Environ. Dev. Sustain. 26 (1), 303–318. doi:10.1007/s10668-022-02709-5

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., and Hess, J. (2018). The global findex database 2017: measuring financial inclusion and the fintech revolution in The global findex database 2017: measuring financial inclusion and the fintech revolution. doi:10.1596/978-1-4648-1259-0

Dickens, C., Smakhtin, V., McCartney, M., O’Brien, G., and Dahir, L. (2019). Defining and quantifying national-level targets, indicators and benchmarks for management of natural resources to achieve the sustainable development goals. Sustain. Switz. 11 (2), 462. doi:10.3390/su11020462

Dunbar, K., Sarkis, J., and Treku, D. N. (2024). FinTech for environmental sustainability: promises and pitfalls. One Earth 7 (1), 23–30. doi:10.1016/j.oneear.2023.12.012

Fareed, Z., Rehman, M. A., Adebayo, T. S., Wang, Y., Ahmad, M., and Shahzad, F. (2022). Financial inclusion and the environmental deterioration in Eurozone: the moderating role of innovation activity. Technol. Soc. 69, 101961. doi:10.1016/j.techsoc.2022.101961

Feng, Y., Chen, J., and Luo, J. (2024). Life cycle cost analysis of power generation from underground coal gasification with carbon capture and storage (CCS) to measure the economic feasibility. Resour. Policy 92, 104996. doi:10.1016/j.resourpol.2024.104996

Fu, C., Lu, L., and Pirabi, M. (2024). Advancing green finance: a review of climate change and decarbonization. Digital Econ. Sustain. Dev. 2 (1), 1. doi:10.1007/s44265-023-00026-x

Henderson, V. (2003). The urbanization process and economic growth: the so-what question. J. Econ. Growth 8 (1), 47–71. doi:10.1023/A:1022860800744

Hu, F., Zhang, S., Gao, J., Tang, Z., Chen, X., Qiu, L., et al. (2024). Digitalization empowerment for green economic growth: the impact of green complexity. Environ. Eng. Manag. J. 23 (3), 519–536. doi:10.30638/eemj.2024.040

Intergovernmental Panel on Climate Change (IPCC) (2023). Annex III: tables of historical and projected well-mixed greenhouse gas mixing ratios and effective radiative forcing of all climate forcers in Climate change 2021 – the physical science Basis. doi:10.1017/9781009157896.017

Iorember, P. T., Gbaka, S., Işık, A., Nwani, C., and Abbas, J. (2024). New insight into decoupling carbon emissions from economic growth: do financialization, human capital, and energy security risk matter? Rev. Dev. Econ. 28 (3), 827–850. doi:10.1111/rode.13077

Iskandar, D., Hendarto, R. M., and Reza, A. (2020). Good governance and natural resource curse; which hypothesis is prevailing in asean economies? J. Ekon. Dan. Pembang. 28 (1), 45–54. doi:10.14203/jep.28.1.2020.45-54

Joe, H. (2006). Generating random correlation matrices based on partial correlations. J. Multivar. Analysis 97 (10), 2177–2189. doi:10.1016/j.jmva.2005.05.010

Kaur, A., and Sharma, V. (2024). Nexus between climate change and mitigation approaches for sustainable development: a bibliometric review. Glob. Knowl. Mem. Commun. doi:10.1108/GKMC-11-2023-0418

Li, C., Solangi, Y. A., and Ali, S. (2023). Evaluating the factors of green finance to achieve carbon peak and carbon neutrality targets in China: a Delphi and fuzzy ahp approach. Sustainability 15 (3), 2721. doi:10.3390/su15032721

Li, Y., Al-Sulaiti, K., Dongling, W., Abbas, J., and Al-Sulaiti, I. (2022). Tax avoidance culture and employees’ behavior affect sustainable business performance: the moderating role of corporate social responsibility. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.964410

Liang, H., Shi, C., Abid, N., and Yu, Y. (2023). Are digitalization and human development discarding the resource curse in emerging economies? Resour. Policy 85, 103844. doi:10.1016/j.resourpol.2023.103844

Liu, X., Zhu, C., Kong, M., Yin, L., and Zheng, W. (2024). The value of political connections of developers in residential Land leasing: case of chengdu, China. Sage Open 14 (2). doi:10.1177/21582440241245226

Luo, J., Zhuo, W., and Xu, B. (2023). A deep neural network-based assistive decision method for financial risk prediction in carbon trading market. J. Circuits, Syst. Comput. 33. doi:10.1142/S0218126624501536

Ma, Q., Zhang, Y., Hu, F., and Zhou, H. (2024). Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? Evidence from 283 cities in China. Cities 154, 105323. doi:10.1016/j.cities.2024.105323

Machado, J. A. F., and Santos Silva, J. M. C. (2019). Quantiles via moments. J. Econ. 213 (1), 145–173. doi:10.1016/j.jeconom.2019.04.009

Miao, Y., Razzaq, A., Adebayo, T. S., and Awosusi, A. A. (2022). Do renewable energy consumption and financial globalisation contribute to ecological sustainability in newly industrialized countries? Renew. Energy 187, 688–697. doi:10.1016/J.RENENE.2022.01.073

Murshed, M. (2024). The role of Fintech financing in correcting ecological problems caused by mineral resources: testing the novel ecological deficit hypothesis. Resour. Policy 88, 104439. doi:10.1016/j.resourpol.2023.104439

Najaf, K., Haj Khalifa, A., Obaid, S. M., Rashidi, A. A., and Ataya, A. (2023). Does sustainability matter for Fintech firms? Evidence from United States firms. Compet. Rev. 33 (1), 161–180. doi:10.1108/CR-10-2021-0132

Nenavath, S., and Mishra, S. (2023). Impact of green finance and fintech on sustainable economic growth: empirical evidence from India. Heliyon 9 (5), e16301. doi:10.1016/j.heliyon.2023.e16301

Nicoletti, G., Arcuri, N., Nicoletti, G., and Bruno, R. (2015). A technical and environmental comparison between hydrogen and some fossil fuels. Energy Convers. Manag. 89, 205–213. doi:10.1016/j.enconman.2014.09.057

Pao, H. T., and Tsai, C. M. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36 (1), 685–693. doi:10.1016/j.energy.2010.09.041

Qi, Y., Ibrahim, R. L., and Saleh Al-Faryan, M. A. (2023). Exploring aggregated and disaggregated environmental impacts of biofuels: do affluence, green technological innovation and green finance matter for top biofuel-abundant economies? Energy and Environ. doi:10.1177/0958305X231181673

Ronaldo, R., and Suryanto, T. (2022). Green finance and sustainability development goals in Indonesian Fund Village. Resour. Policy 78, 102839. doi:10.1016/j.resourpol.2022.102839

Sahay, R., Allmen, U., Eriksson von Lahreche, A., Khera, P., Ogawa, S., Bazarbash, M., et al. (2020). The promise of fintech; financial inclusion in the post COVID-19 Era in IMF departmental papers/policy papers from international monetary fund.

Shah, S. A. R., Zhang, Q., Abbas, J., Tang, H., and Al-Sulaiti, K. I. (2023). Waste management, quality of life and natural resources utilization matter for renewable electricity generation: the main and moderate role of environmental policy. Util. Policy 82, 101584. doi:10.1016/j.jup.2023.101584

Shang, M., and Luo, J. (2021). The Tapio decoupling principle and key strategies for changing factors of Chinese urban carbon footprint based on cloud computing. Int. J. Environ. Res. Public Health 18 (4), 2101. doi:10.3390/ijerph18042101

Sharma, V., Gupta, M., and Taneja, S. (2024). Does FinTech adoption impact on sustainability of small businesses: mediating role of financial well-being. Glob. Knowl. Mem. Commun. doi:10.1108/GKMC-04-2024-0225

Sutherland, D. L., McCauley, J., Labeeuw, L., Ray, P., Kuzhiumparambil, U., Hall, C., et al. (2021). How microalgal biotechnology can assist with the UN Sustainable Development Goals for natural resource management. Curr. Res. Environ. Sustain. 3, 100050. doi:10.1016/j.crsust.2021.100050

Tan, Q., Yasmeen, H., Ali, S., Ismail, H., and Zameer, H. (2023). Fintech development, renewable energy consumption, government effectiveness and management of natural resources along the belt and road countries. Resour. Policy 80, 103251. doi:10.1016/j.resourpol.2022.103251

Tan, X., Abbas, J., Al-Sulaiti, K., Pilař, L., and Shah, S. A. R. (2024). The role of digital management and smart technologies for sports education in a dynamic environment: employment, green growth, and tourism. J. Urban Technol., 1–32. doi:10.1080/10630732.2024.2327269

Tu, Y., Liu, R., and Li, H. (2022). The development of digital economy and the future of the trade union law of the people’s Republic of China. J. Chin. Hum. Resour. Manag., 76–85. doi:10.47297/wspchrmWSP2040-800507.20221302

United Nations (2018). 2018 revision of world urbanization prospects | multimedia library - united nations department of economic and social affairs. United Nations: Department of Economic and Social Affairs.

Wang, S., Abbas, J., Al-Sulati, K. I., and Shah, S. A. R. (2023). The impact of economic corridor and tourism on local community’s quality of life under one belt one road context. Eval. Rev. 48, 312–345. doi:10.1177/0193841X231182749

Wang, Y., and Zhi, Q. (2016). The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104, 311–316. doi:10.1016/j.egypro.2016.12.053

Wang, Z., Teng, Y. P., Wu, S., and Chen, H. (2023). Does green finance expand China’s green development space? Evidence from the ecological environment improvement perspective. Systems 11, 369. doi:10.3390/systems11070369

WCED (1987). World commission on environment and development the brundtland commission report 1987 our common future. New York: Oxford University Press.

Wei, H., Yue, G., and Khan, N. U. (2024). Uncovering the impact of fintech, natural resources, green finance and green growth on environment sustainability in BRICS: an MMQR analysis. Resour. Policy 89, 104515. doi:10.1016/j.resourpol.2023.104515

Westerlund, J. (2008). Panel cointegration tests of the Fisher effect. J. Appl. Econ. 23 (2), 193–233. doi:10.1002/jae.967

Xia, A., and Liu, Q. (2024). Modelling the asymmetric impact of fintech, natural resources, and environmental regulations on ecological footprint in G7 countries. Resour. Policy 89, 104552. doi:10.1016/j.resourpol.2023.104552

Xue, Q., Xu, D. R., Cheng, T. C., Pan, J., and Yip, W. (2023). The relationship between hospital ownership, in-hospital mortality, and medical expenses: an analysis of three common conditions in China. Archives Public Health 81 (1), 19. doi:10.1186/s13690-023-01029-y

Yan, B., and Lyu, J. (2023). How does an innovative decision-making scheme affect the high-quality economic development driven by green finance and higher education? Environ. Sci. Pollut. Res. Int. 30 (54), 115721–115733. doi:10.1007/s11356-023-30170-y

Yan, Q., Yan, J., Zhang, D., Bi, S., Tian, Y., Mubeen, R., et al. (2024). Does CEO power affect manufacturing firms’ green innovation and organizational performance? A mediational approach. Sustainability 16 (14), 6015. doi:10.3390/su16146015

Yu, B., and Zhou, X. (2024). Land finance and urban Sprawl: evidence from prefecture-level cities in China. Habitat Int. 148, 103074. doi:10.1016/j.habitatint.2024.103074

Zhang, D., Zhang, Z., and Managi, S. (2019). A bibliometric analysis on green finance: current status, development, and future directions. Finance Res. Lett. 29, 425–430. doi:10.1016/j.frl.2019.02.003

Zhang, H., Jing, Z., Ali, S., Asghar, M., and Kong, Y. (2024). Renewable energy and natural resource protection: unveiling the nexus in developing economies. J. Environ. Manag. 349, 119546. doi:10.1016/j.jenvman.2023.119546

Zhang, X., Husnain, M., Yang, H., Ullah, S., Abbas, J., and Zhang, R. (2022). Corporate business strategy and tax avoidance culture: moderating role of gender diversity in an emerging economy. Front. Psychol. 13, 827553. doi:10.3389/fpsyg.2022.827553

Zhang, Y. Q. (2023). Impact of green finance and environmental protection on green economic recovery in South Asian economies: mediating role of FinTech. Econ. Change Restruct. 56 (3), 2069–2086. doi:10.1007/s10644-023-09500-0

Zhao, S., Zhang, L., An, H., Peng, L., Zhou, H., and Hu, F. (2023). Has China’s low-carbon strategy pushed forward the digital transformation of manufacturing enterprises? Evidence from the low-carbon city pilot policy. Environ. Impact Assess. Rev. 102, 107184. doi:10.1016/j.eiar.2023.107184

Zhao, S., Zhang, L., Peng, L., Zhou, H., and Hu, F. (2024). Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 77, 102520. doi:10.1016/j.techsoc.2024.102520

Zheng, C., and Chen, H. (2023). Revisiting the linkage between financial inclusion and energy productivity: technology implications for climate change. Sustain. Energy Technol. Assessments 57, 103275. doi:10.1016/j.seta.2023.103275

Keywords: green finance, environmental benefits, natural resource, MMQR, sustainability

Citation: Dai X, Wu J, Fan S and Zhou Y (2025) Advancing economic sustainability in E7 economies: the impact of green finance, environmental benefits, and natural resource management. Front. Environ. Sci. 12:1509564. doi: 10.3389/fenvs.2024.1509564

Received: 11 October 2024; Accepted: 12 December 2024;

Published: 06 January 2025.

Edited by:

Sanjay Taneja, Graphic Era University, IndiaReviewed by:

Vikas Sharma, Chandigarh University, IndiaAmar Johri, Saudi Electronic University, Saudi Arabia

Copyright © 2025 Dai, Wu, Fan and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanqi Zhou, ZmFkaWFzdW1yZWVucHVAZ21haWwuY29t; Junyu Wu, d3VqdW55dUB6dWZlLmVkdS5jbg==

Xulong Dai1

Xulong Dai1 Yanqi Zhou

Yanqi Zhou