- 1School of Humanities and Social Sciences, Jiangsu University of Science and Technology, Zhenjiang, China

- 2School of Economics and Management, Gannan University of Science and Technology, Ganzhou, China

Introduction: Government-business relations are a concentrated manifestation of the interaction process and outcomes between the government and enterprises, directly influencing the social capital and institutional environment upon which businesses rely. Sound government-business relations are crucial for addressing environmental issues and promoting high-quality development in China.

Methods: This study extensively examines how New Government-business Relations (NGR) impact Corporate Environmental Performance (CEP) by analyzing A-share listed companies from 2017 to 2021 and applying the regulatory capture theory.

Results: The empirical findings show that NGR can prevent environmental regulatory capture, thereby improving CEP. After conducting several robustness tests, such as substituting the dependent variable, using instrumental variables, and performing dynamic panel analysis, the results remain consistent. Additionally, the mechanism analysis reveals that NGR can effectively thwart environmental regulatory capture resulting from rent-seeking behavior and political connections, leading to enhanced CEP. Moreover, additional research indicates that the beneficial impact of the NGR on the environmental performance of non-high-pollution industry enterprises, mature enterprises, and businesses operating in regions with stringent environmental regulations is more significant.

Discussion: Building on prior literature, this paper augments the body of relevant research on environmental regulatory capture within the Chinese context, offering fresh insights and empirical evidence to comprehend the evolving government-business relations in contemporary times and their significance in environmental conservation.

1 Introduction

The harmonious coexistence between humans and nature stands as a critical characteristic and indispensable requirement of Chinese-style modernization. The escalating pressure on the ecological environment has progressively rendered environmental issues a significant constraint on China’s pursuit of high-quality development and Chinese-style modernization. The 19th Party Congress report advocates for the establishment of an environmental governance system, wherein the government leads, enterprises serve as primary stakeholders, and active participation from social organizations and the public is encouraged. This concept has been reiterated several times in the 20th Party Congress report. Active engagement and proactive initiatives by enterprises in assuming environmental responsibilities, fulfilling environmental obligations, and enhancing environmental performance play a pivotal role in governing environmental issues effectively and achieving comprehensive green development. The proactive participation of enterprises in this context is crucial for steering society as a whole towards a more sustainable development model. However, given enterprises’ focus on profit maximization and the evident externalities of environmental pollution, relying solely on moral constraints proves challenging in encouraging enterprises to conscientiously embrace environmental responsibilities. Hence, external forces are necessary to impose mandatory constraints, fostering the coordinated development of the economy and the environment.

Confronted with mounting ecological challenges, the Chinese government actively embraces the new development paradigm, persistently enhancing endeavors to mitigate environmental pollution and institute a range of environmental regulatory frameworks to curb corporate pollution. These measures have partially mitigated China’s ecological issues. Nonetheless, the formulation of China’s environmental policies is primarily the domain of the government. Any distortion or estrangement in government-business relations could severely impede the effectiveness of environmental regulatory system implementation. Government officials, driven by personal gain or the pursuit of economic growth targets, may render environmental regulation ineffective, thereby leading to the phenomenon of environmental regulatory capture (Gong et al., 2015). Government-business relations encapsulate the interactions and outcomes between the government and enterprises, serving as pivotal social resources for businesses (Wang et al., 2024). Therefore, establishing sound government-business relations becomes one of the key steps in addressing China’s environmental issues and promoting high-quality development. Since President Xi Jinping introduced the concept of “close and clean” NGR in 2016, both the 20th Party Congress and the 2023 Government Work Report have highlighted the significance of fostering this relationship, emphasizing the imperative of implementing these NGR. “Close” emphasizes that the government should serve the development of enterprises in accordance with the law, and the interaction between leading cadres and entrepreneurs should be frank and sincere. “Clean” emphasizes that leading cadres should maintain integrity and discretion when dealing with entrepreneurs and should not abuse power for personal gain (Chen et al., 2023). However, existing literature predominantly examines the economic implications of the NGR, necessitating a more comprehensive investigation into its environmental ramifications. This paper takes this as a starting point and investigates how the NGR shape CEP through the lens of regulatory capture.

Given the growing importance of environmental concerns, enhancing CEP and preserving ecological balance have emerged as fundamental prerequisites for realizing Chinese-style modernization. Amidst this context, certain studies concentrate on investigating intrinsic and effective methods to encourage enterprises to improve environmental performance, beginning with the internal structural attributes of the companies. Studies suggest that various factors including executive personal traits, internal structures, organizational culture, and innovation profoundly impact a company’s inclination to enhance environmental practices (Aksoy et al., 2020; Cordeiro et al., 2020; Awan et al., 2023). Nevertheless, businesses primarily aim for profit maximization. In instances of conflict between corporate environmental and economic objectives, enterprises frequently lack the motivation to prioritize environmental enhancement (Guo et al., 2023a). Consequently, some scholars contend that businesses need external environmental pressures to prompt enhancements in their environmental practices. Previous studies have shown that environmental regulations can significantly mitigate corporate pollution, consequently enhancing environmental performance (Zhang et al., 2022; Li and Ramanathan, 2018; Guo et al., 2023b). In China, environmental regulations are primarily designed and enforced by governmental authorities. Acting as the architect and enforcer of the regulatory framework, the government plays a pivotal role in compelling enterprises to improve environmental practices (Zhang et al., 2022). Consequently, abnormal government-business relations may lead to regulatory capture issues, making it challenging for environmental regulatory policies to effectively constrain enterprises (Hu and Shi, 2021). The regulatory capture theory suggests that regulators may also pursue their own interests. Therefore, during the regulatory process, policy implementation is susceptible to the influence of interest groups, thereby providing regulations favorable to them (Laffont and Tirole, 1991). Cheng et al.'s study suggests that political connections significantly undermine the environmental disclosure (Cheng et al., 2017). Enterprises may engage in rent-seeking behavior to influence regulators, leading to relaxed regulatory oversight over regulated entities (Du et al., 2022).

The development of a nation is intricately linked to its enterprises, with government actions significantly shaping business growth (Wang and Wang, 2019). Sound government-business relations are essential for fostering the healthy development of both the economy and society. Viewed from this perspective, China’s economic transformation involves a restructuring of government-enterprise relations. The fiscal decentralization in China have increased the complexity of relations between the government and enterprises, as well as between government officials and entrepreneurs (Chen et al., 2011). This complexity, compounded by the self-interest of both government and enterprises, has resulted in distortions and alienation within government-business relations (Lin et al., 2014; Wang, 2015). Constructing a positive government-business relationship poses a significant global challenge. In 2016, Chairman Xi Jinping introduced the idea of fostering “close and clean” NGR, marking a new approach for China in establishing a strong government-business framework. Building these NGR relationships requires the government to reduce microeconomic interference, shifting its focus from resource allocation to strengthening market institutions and supplying public goods (Chen et al., 2023). Current studies indicate that NGR significantly improve the business environment, effectively drive corporate innovation, and accelerate corporate transformation and upgrading (Cammett, 2007; Tian et al., 2019; Fornes et al., 2021). While Li et al. emphasized the negative effects of “non-clean” government-business relations on energy and environmental efficiency in resource-abundant regions, the environmental impacts of NGR remain underexamined (Li et al., 2023). Related research suggests that NGR can help enterprises meet their social responsibilities, with a clean government-business relationship having a greater impact on corporate social responsibility than a close relationship (Jiang and Xu, 2020). Additionally, Luo et al. found that “close and clean” NGR significantly promote corporate green mergers and acquisitions (Luo et al., 2023). Although social responsibility, green innovation, and green mergers and acquisitions partially reflect the environmental impacts of NGR, they do not directly demonstrate the true effects of these relations on environmental protection.

The main contributions of this paper are as follows: Firstly, this paper is groundbreaking in its examination of how the NGR affect CEP. Previous studies have explored NGR’s influence on corporate green innovation, corporate social responsibility, and the consequences of corporate green mergers and acquisitions (Jiang and Xu, 2020; Luo et al., 2023; Shi et al., 2023). Unlike existing research, this paper uniquely examines their influence on CEP, offering direct empirical evidence and enriching the literature. Secondly, grounded in the theory of regulatory capture, this paper uncovers the underlying logic behind the environmental impacts of NGR through the lens of government-business interactions. This approach broadens the analysis of how NGR influences CEP. Previous research has primarily concentrated on explaining the effectiveness of NGR by examining factors such as financing constraints and investment opportunities (Gao et al., 2022; Chen et al., 2023). Unlike previous studies, this paper starts from the angle of regulatory capture, providing a novel viewpoint for explaining the environmental effects of the NGR. Lastly, this paper enhances the literature on regulatory capture and CEP. Given enterprises’ significant role as polluters, understanding and improving their environmental performance are vital for effective environmental governance and sustainable development. However, empirical research on CEP from the regulatory capture perspective in China is limited. Building on existing literature, this paper supplements research on environmental regulatory capture in the Chinese context, providing empirical references for preventing regulatory capture and promoting CEP.

2 Theoretical analysis and research hypotheses

Regulatory capture theory emerged as a critique of traditional regulatory theories and has since become integral to regulatory theory. George Stigler first introduced the concept of regulatory capture, critiquing traditional regulatory theories. The theory of regulatory capture suggests that regulators, seeking to maximize their utility, may be influenced by special interests, leading them to favor the interests of regulated industries. This stems from regulators forming mutually beneficial relationships with the industries they oversee (Stigler, 1971). The theory posits that government legislators, regulatory agencies, and enforcers will ultimately be captured by interest groups, potentially weakening regulatory efficiency or turning policies into tools for these groups to pursue their interests (Hellman et al., 2003). Narrowly defined, regulatory capture is when regulated monopolistic enterprises manipulate government institutions meant to regulate them. Broadly speaking, regulatory capture refers to the process by which beneficiaries influence government intervention in any form (Dal Bó, 2006). According to existing research, beneficiaries primarily engage in capture behaviors through direct bribery, coercion, lobbying, political donations, political connections (“revolving door”), and other means (Dal Bó and Di Tella, 2003). In the context of China, regulatory capture mainly involves the capture of law enforcement personnel, with beneficiaries primarily engaging in capture behaviors through corporate rent-seeking and political connections (Chen, 2015). Hence, this paper approaches the issue from two perspectives, analyzing whether NGR help prevent regulatory capture behaviors.

The success of governmental environmental regulation depends not only on the formulation of policies but also on their implementation. The “close and clean” NGR helps to address the dilemma of “clean but not close” and “close but not clean” in government-business relations, improve the efficiency of local government’s administrative services and administrative transparency, and prevent environmental regulation capture (Yang et al., 2023). The pressure on CEP mainly comes from external environmental demands, especially from government environmental regulations (Wang et al., 2023). On one hand, building NGR requires local governments to reform and optimize the administrative service environment and strengthen communication between government and enterprises. The government can comprehend enterprises’ environmental challenges effectively, while enterprises can articulate their demands efficiently. This helps the government to promptly adjust and improve policies, target help enterprises solve practical problems, and enable enterprises to obtain government services more effectively, thereby reducing the cost of environmental governance. On the other hand, the formation of NGR requires clear power structures, allowing for public scrutiny and limitations on governmental authority. Transparent power dynamics facilitate the strict enforcement of relevant environmental regulations. These stringent regulations increase pressure on businesses, encouraging them to proactively meet their environmental responsibilities. Consequently, NGR improve CEP. Therefore, this paper proposes Hypothesis 1.

Hypothesis 1. The establishment of NGR contributes to enhancing CEP.

If the expenses for companies to secure regulatory relaxation and environmental protection from the government through rent-seeking are lower than the costs of environmental governance, companies will allocate additional resources to rent-seeking from the government, potentially resulting in the environmental regulatory capture (Dong et al., 2016; Du et al., 2022; Luo et al., 2022). As the NGR continue to be enforced, disciplinary inspection and supervisory departments at various government levels are progressively enhancing the legalization and standardization of these interactions. This improvement can effectively prevent regulatory capture (Guo et al., 2024c). The establishment of “close and clean” government-business relations standardizes governmental interactions with businesses, fostering a fair and transparent institutional environment for business operations. This reduces opportunities for rent-seeking by companies, diminishes the motivation and demand for companies to seek environmental shelter through rent-seeking, and thereby effectively reduces regulatory capture facilitated by rent-seeking (Gao et al., 2021). Moreover, the establishment of “close and clean” government-business relations necessitates the government’s transition from a resource distributor to a market-oriented service provider. This transition further limits government power, reduces rent-seeking benefits for companies, and encourages companies to seek resources based on market principles (Shen et al., 2015). As a result of government environmental regulations, companies will redirect some of their rent-seeking resources towards environmental governance, contributing to the enhancement of CEP. Meanwhile, companies that originally relied on rent-seeking for environmental shelter will allocate more resources to pollution control to comply with environmental regulations. Based on this, Hypothesis 2 is proposed in this paper.

Hypothesis 2. The establishment of NGR contributes to reducing the environmental capture caused by rent-seeking behavior in enterprises.

Political connections enable enterprises to obtain a certain degree of protection when facing environmental violation penalties (Faccio, 2006; Jiang et al., 2021) Enterprises acquire social capital through political connections, thereby prompting local governments to provide protection and relax regulation for them. Therefore, politically connected enterprises can gain a competitive advantage, while those lacking political ties may face disadvantages in their operations (Allen et al., 2005; Sun and Zou, 2021). Certain enterprises can evade environmental responsibilities stemming from pollution by leveraging political connections, thereby reducing or circumventing penalties for breaching environmental regulations (Li et al., 2020). Motivated by maximizing benefits, enterprises tend to bolster political ties with the government and allocate more resources to engage with it, thereby squeezing investments in environmental protection. The enduring reciprocal relationship between politically connected enterprises and local governments prompts the exchange of resources and favors, fostering a dependency on political connections (Yuan et al., 2015). Enterprises possessing ample political resources are more likely to bolster their competitiveness through political connections. However, the NGR require increased transparency in administrative affairs, imposing strong supervision and constraints on government power. Local government environmental governance is more likely to face widespread public scrutiny and direct accountability from higher-level environmental departments. This diminishes the administrative discretion of local officials in shielding local polluting enterprises due to institutional constraints, making it harder for enterprises to maintain improper political-business relationships and thus reducing reliance on political connections. With the implementation of the NGR, the relationship between the government and enterprises becomes more standardized, with institutions replacing interpersonal relationships. This undermines the protective effect of political connections and effectively prevents regulatory capture facilitated by political connections. Consequently, enterprises that initially relied on political connections to seek environmental shelter will reallocate resources from maintaining political relationships to environmental governance to mitigate environmental penalties. Based on this, Hypothesis 3 is proposed in this paper.

Hypothesis 3. The establishment of NGR contributes to reducing the environmental capture caused by political connections.

3 Research design

3.1 Model settings

To effectively identify whether the NGR can improve CEP, this study constructs the following fixed-effects regression model:

Here,

3.2 Variables selection

3.2.1 Dependent variable

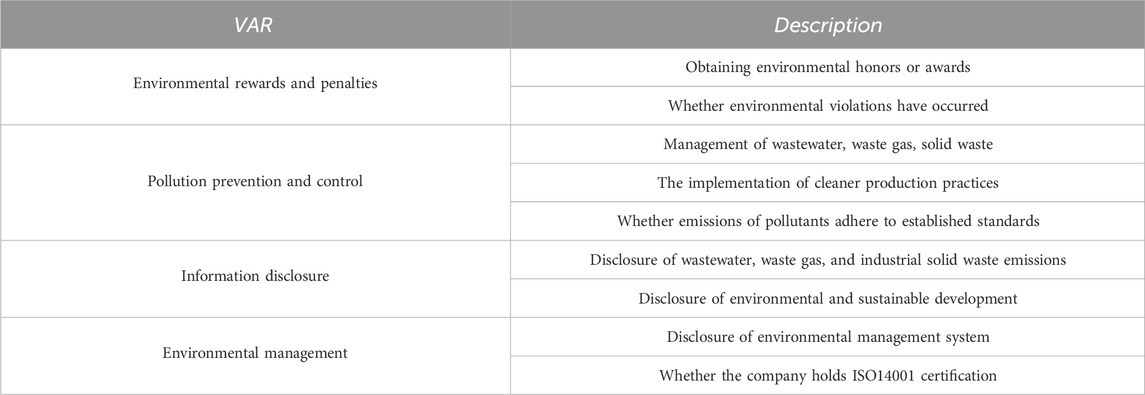

The CEP is the dependent variable (

3.2.2 Independent variable

The independent variable in this study is “NGR” (

3.2.3 Control variable

To account for the potential influence of other factors on CEP, this study references existing literature to select the following control variables (Guo et al., 2024a). At the firm level, enterprise age (

3.3 Data sources and descriptive statistics

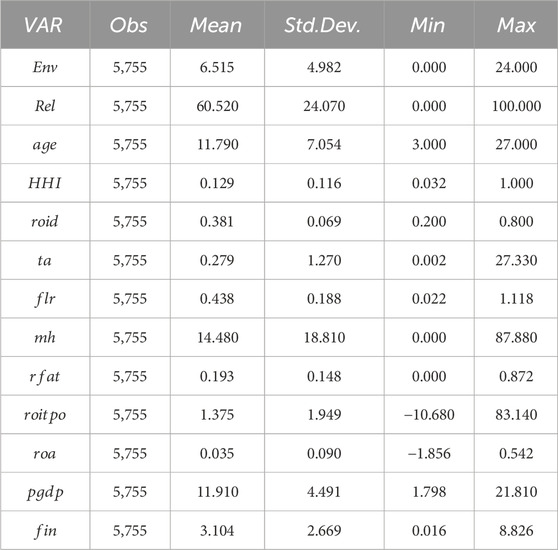

Considering data availability, the research sample for this study comprises A-share listed companies from 2017 to 2021. Samples with “ST” and “*ST” were excluded, as well as companies with significant data missing. In total, 5,755 observations were included in the final analysis. Enterprise patents from the China National Research Data Service Platform (CNRDS). The urban government-business relationship health index is sourced from the National Development and Strategic Research Institute of Renmin University of China. Other enterprise-level data are obtained from the China Stock Market and Accounting Research Database (CSMAR). City-level data are sourced from the EPS. Table 2 presents descriptive statistics.

4 Empirical results and analysis

4.1 Baseline regression analysis

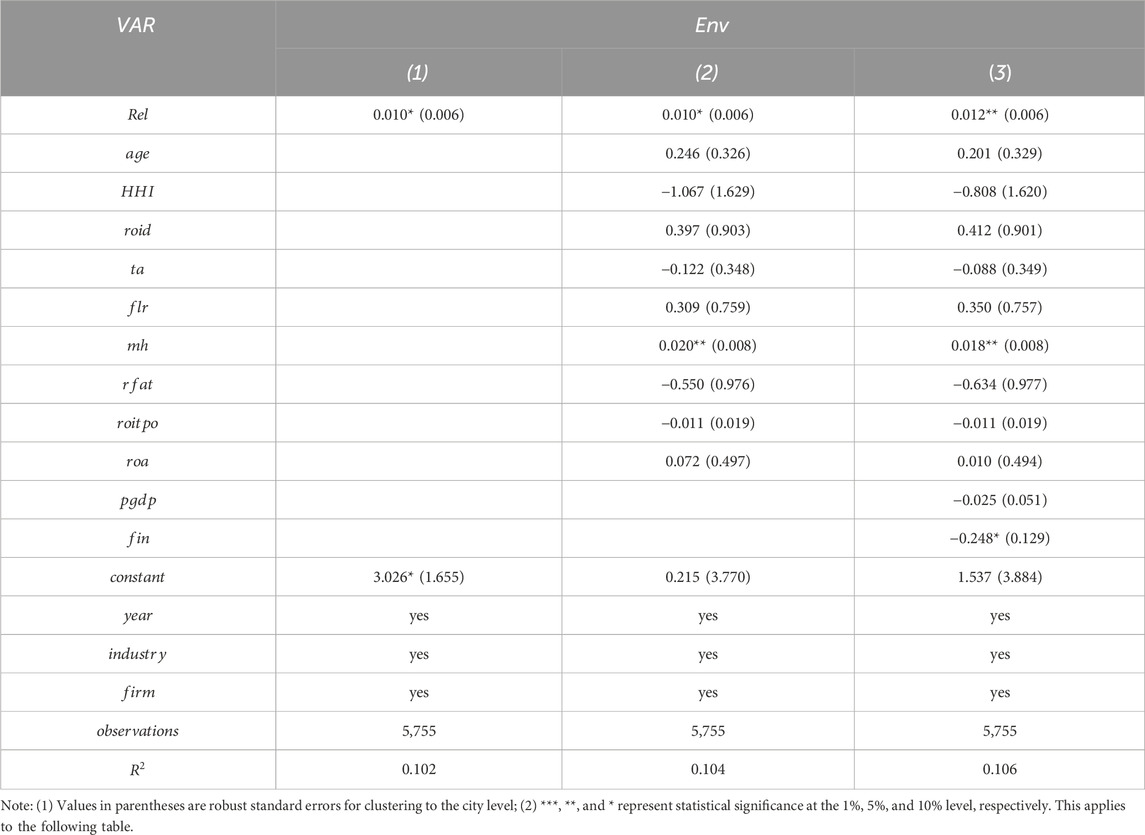

Table 3 displays the regression results illustrating the impact of NGR on CEP Equation 1. Column (1) depicts results without the inclusion of control variables, column (2) showcases results with enterprise-level control variables, and column (3) presents the regression results with all control variables included. From Table 3, it can be observed that the coefficient of

The coefficient of executive shareholding ratio (

4.2 Robustness tests

4.2.1 Endogeneity treatment

4.2.1.1 Instrumental variable

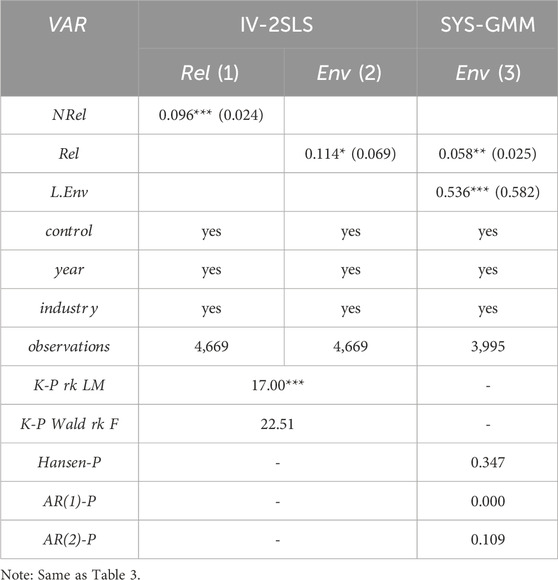

Endogeneity issues can lead to bias in regression coefficients, thereby affecting the conclusions of this study. The two main reasons for endogeneity are bidirectional causality and omitted variable problems. This study controls for differences in industry and city economic levels to minimize the impact of omitted variables. As micro-level entities, enterprises are unlikely to significantly influence the overall level of NGR in a region. Moreover, the data based on the UGBRHI are relatively advanced compared to the study period, reducing the likelihood of bidirectional causality. However, to enhance the robustness of conclusions, this paper still assumes the presence of bidirectional causality issues. Therefore, the instrumental variable is further employed to mitigate the regression bias caused by this problem. Drawing on previous literature (Chong et al., 2013), this study uses the average UGBRHI of all neighboring cities in a certain city in the same year (

From Table 4, it is observed that in column (1), the regression coefficient of

4.2.1.2 GMM dynamic panel analysis

Considering the potential autocorrelation in CEP, static panel results may suffer from endogeneity and estimation bias issues. Therefore, this study introduces the first-order lag of the dependent variable into the econometric model and employs system GMM for robustness testing. In column (3) of Table 4, the values indicate that AR (1)-P is less than 0.1, indicating the presence of first-order autocorrelation. However, AR (2)-P is greater than 0.1, suggesting the absence of second-order autocorrelation. The Hansen test statistic is greater than 0.1, failing to reject the hypothesis of instrument validity, validating the model’s soundness. Column (3) of Table 4 shows that the coefficient of

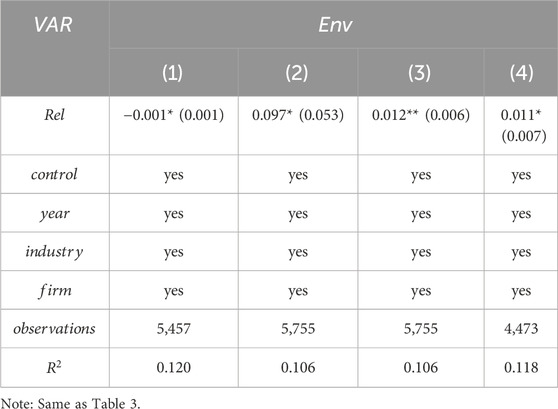

4.2.2 Other robustness tests

4.2.2.1 Replace the dependent variable

Existing literature varies in how environmental performance is measured. To enhance the reliability of the research findings, this paper revises its method of measuring CEP and performs a new regression analysis. Adopting approaches from the existing literature, it uses the amount of environmental taxes per unit of operating revenue (replaced by “pollution fees” before 2018) as a proxy indicator for CEP, and adds 1 before taking the natural logarithm to better conform to a normal distribution. This indicator is an inverse measure, where higher values indicate poorer CEP. From column (1) of Table 5, it can be seen that the coefficient of UGBRHI (

4.2.2.2 Group testing

The UGBRHI reflects the relative quality of the NGR in various cities, the score itself does not have much practical significance. Therefore, this paper divides the sample of companies into ten groups based on the government-business relations index, assigning values from 1 to 10 in ascending order. After reassigning values to the samples, a new regression analysis is performed. The result is displayed in column (2) of Table 5. The regression results show a significantly positive coefficient for the UGBRHI (

4.2.2.3 Winsorization

To ensure the reliability of the conclusions in this paper and account for the potential impact of extreme outliers on the regression results, Winsorization is applied to the continuous variables. This method involves setting values exceeding the 1st and 99th percentiles to their respective percentile values. The Winsorized samples are then regressed, and the regression results are shown in column (3) of Table 5. The regression analysis reveals that the coefficient for the UGBRHI (

4.2.2.4 Excluding municipalities directly under the central government

Given the distinct administrative status of municipalities directly under the central government in China, their government-business relations might be more affected by political factors, potentially influencing the regression outcomes of this study. Consequently, this paper excludes data from companies registered in these municipalities and performs a new regression analysis. The results are displayed in Table 5, column (4). The results indicate that the coefficient of the urban government-business relations index (

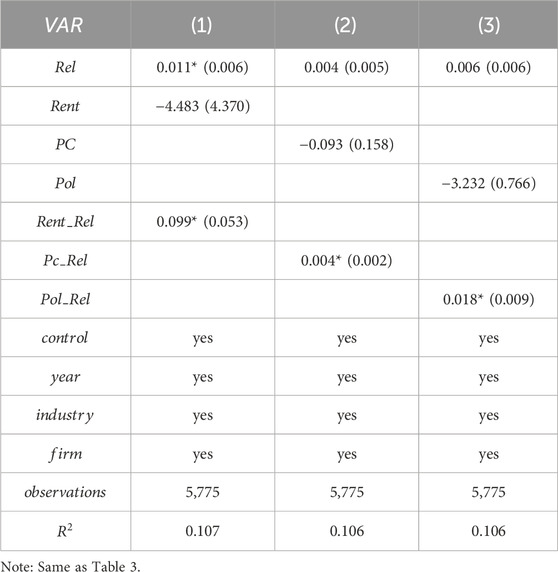

4.3 Mechanism tests

4.3.1 Corporate rent-seeking

The baseline analysis and a series of robustness tests in the previous sections indicate that the construction of NGR can effectively improve CEP. In order to evade environmental regulations, firms may engage in rent-seeking behavior, leading to regulatory capture rather than improving environmental performance. However, the establishment of NGR restrict the space for rent-seeking by firms, effectively preventing regulatory capture and forcing firms to focus on enhancing environmental performance. If this mechanism holds, the higher the degree of rent-seeking dependence of firms, the stronger the promotion effect of NGR on CEP. To further verify its mechanism, this study constructs an interaction term between firm rent-seeking and NGR (

Here,

The regression results Equation 2 incorporating the interaction term between corporate rent-seeking and the NGR (

4.3.2 Political connections

The existence of political connections may lead to a shelter effect for companies facing environmental violation penalties. Companies may seek to establish government-business relations to maximize profits, potentially diverting more resources toward government interactions while reducing investment in environmental protection. Companies leverage government-business relations to gain competitive advantages, evade environmental penalties, and potentially engage in regulatory capture. However, the establishment of NGR makes it more difficult for companies to obtain policy favors through political connections, thus weakening the shelter effect and effectively preventing regulatory capture caused by political connections. If this mechanism holds, companies with higher levels of political connections will experience a stronger promotion effect on environmental performance from NGR. To further verify its mechanism, this study constructs an interaction term between corporate political connections and NGR (

4.3.3 Environmental regulatory capture

If the establishment of the NGR can effectively prevent environmental regulatory capture, then the positive impact of the NGR on CEP should be more pronounced in regions with stronger environmental regulations. Since the start of the pilot phase of the ERTP coincides with the timeframe of the sample used in this study, it is chosen to further illustrate the effectiveness of the NGR in preventing environmental regulatory capture and improving CEP. In 2016, the National Development and Reform Commission issued the “Pilot Program for Paid Use and Trading of Energy-consuming Rights,” which officially began in 2017. As an important environmental regulatory system, it plays a significant role in pollution reduction and carbon reduction, significantly enhancing the intensity of environmental regulation in pilot areas. If the NGR is successful in preventing environmental regulatory capture, then enterprises located in pilot areas should experience a more pronounced impact from the NGR compared to those in non-pilot areas. To test this, this study incorporates an interaction term between the energy-consuming rights trading system and the NGR (

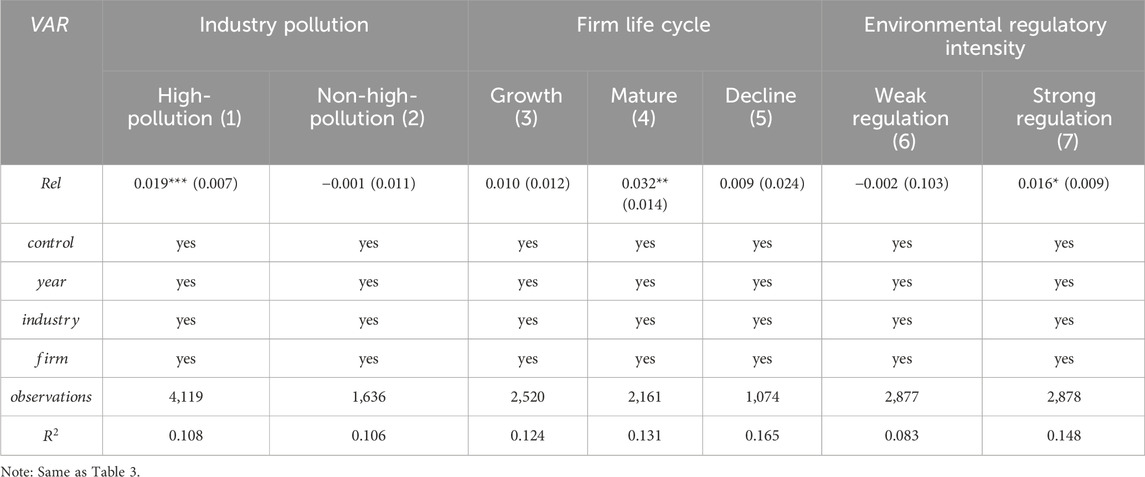

4.4 Heterogeneity analysis

4.4.1 Industry pollution

Different industries exhibit varying degrees of pollution resulting from their production activities, prompting enterprises to adopt different strategies when facing environmental regulations. Moreover, government regulations on different industries also vary. Therefore, the effects of government-business relations on the CEP differ across industries. To analyze the impact of the NGR on industries with different pollution levels, this study categorizes industries based on the “Industry Classification Management Catalog for Environmental Protection Inspection of Listed Companies”. Industries classified as high-polluting are considered high-pollution industries, while others are considered non-high-pollution industries, and group regression analysis is conducted. The results of the group regression in columns (1) and (2) of Table 7 indicate that the establishment of the NGR significantly affects the environmental performance of non-high-pollution enterprises, whereas its effect on high-pollution industry enterprises is not significant. The possible reason is that high-pollution enterprises generate more severe pollution during the production process and face stricter regulations, which increase the difficulty of rent-seeking or political capture. Therefore, the establishment of NGR does not significantly improve the environmental performance of high-pollution enterprises.

4.4.2 Firm life cycle

The lifecycle theory posits that companies at various stages of development display notable differences in their business strategies (Miller and Friesen, 1984). The environmental performance of enterprises is largely influenced by their own development needs and resource endowments. Therefore, the impact of the NGR on enterprises at different lifecycle stages also varies. Following the approach of previous studies (Dickinson, 2011), this study categorizes enterprises into different lifecycle stages, including the growth stage (introduction and growth), the mature stage, and the decline stage (shake-out and decline), based on cash flow conditions, and conducts group regression analysis. The results in columns (3), (4), and (5) of Table 7 indicate that the establishment of NGR has a more pronounced effect on mature stage enterprises. The possible reason is that for enterprises in the growth stage, the accumulation of political capital is relatively limited, making it more difficult for such enterprises to engage in regulatory capture. Therefore, the enhancement of government-business relations does not substantially impact the environmental performance of these enterprises. Conversely, companies in the decline stage generally encounter substantial operational pressures, limiting their ability to allocate resources for rent-seeking or sustaining political connections. In response to environmental constraints, they are more inclined to cut production in order to reduce pollution. Hence, the improvement in government-business relations does not significantly impact the environmental performance of enterprises in the decline stage.

4.4.3 Environmental regulatory intensity

Due to variations in the stringency of environmental regulations across different regions, the effect of NGR on the CEP also exhibits heterogeneity. To analyze the impact of NGR on CEP, this study conducts group regression analysis on enterprises across different regions, considering the varying stringency of environmental regulations. Based on existing research, an index of environmental regulation intensity is constructed using data on industrial wastewater, sulfur dioxide, and particulate matter emissions (Zhao et al., 2018). The formula for calculation is as follows:

Where

Based on the comprehensive index of environmental regulation intensity, this study conducts group regression analysis by categorizing samples into enterprises located in regions with strong environmental regulations and those in regions with weak environmental regulations. If NGR effectively prevents regulatory capture in environmental regulations, the influence of government-business relations on CEP should be more evident in regions with stringent environmental regulations. The results in columns (6) and (7) of Table 7 show that in areas with strong environmental regulations, the positive effect of NGR on CEP is more pronounced Equations 3, 4. These findings confirm that the establishment of NGR successfully prevents regulatory capture, thereby enhancing environmental performance.

5 Conclusion and policy implications

Government-business relations encompass the interactive processes and outcomes between governmental entities and enterprises. Establishing strong government-business relations is essential for addressing environmental challenges in China. This study takes A-share listed companies from 2017 to 2021 as a sample to analyze the impact of NGR on CEP. The findings are as follows: First, NGR significantly improve CEP, a conclusion supported by a series of robustness tests. Second, mechanistic analysis reveals that NGR effectively mitigate regulatory capture stemming from corporate rent-seeking and political connections, thereby enhancing CEP. Third, heterogeneity analysis shows that the positive impact of NGR on CEP is more significant in non-high-polluting industries, mature-stage enterprises, and regions with stringent environmental regulations.

This article elucidates the relationship between NGR and CEP from the perspective of regulatory capture, highlighting its importance in understanding modern government-business relations and their role in environmental protection. Based on these conclusions, the following recommendations are proposed: Firstly, for the government, it is imperative for the government to prioritize the enhancement of government-business relations to augment CEP. Proactive measures should be taken to improve government-business relations, focusing on both “close” and “clean” aspects, by establishing clear delineations of power and governance. This proactive stance will effectively mitigate issues related to regulatory capture, harnessing the government’s significant role in environmental governance, thereby bolstering CEP and fostering high-quality development. Secondly, for regulatory agencies, regulatory agencies must bolster environmental protection supervision, particularly in terms of enforcing environmental laws. Given that companies may resort to seeking environmental protection through political affiliations and rent-seeking amid environmental regulations, it is imperative to enhance environmental law enforcement supervision to ensure impartial and equitable enforcement. Regulatory agencies should intensify inspection and supervision efforts, foster a “close” and “clean” relationship in environmental law enforcement and responsibility, curtail avenues for seeking protection through political affiliations and rent-seeking, prevent regulatory capture, and effectively implement environmental regulatory frameworks to enhance CEP. Thirdly, for enterprises, it should discard traditional rent-seeking paradigms and extensive development models, opting instead for active engagement with the government through formal channels to achieve mutually beneficial economic and environmental outcomes. Enterprises must acknowledge that with the establishment of NGR, opportunities for benefiting from rent-seeking and political affiliations are dwindling. Transitioning to sustainable development models that align with market trends, seizing policy opportunities, and fostering communication and collaboration with local governments are essential for enterprises to achieve coordinated and harmonized development within the context of regional high-quality development initiatives.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

BG: Writing–original draft, Writing–review and editing. BZ: Writing–original draft, Writing–review and editing. PH: Writing–review and editing. TL: Funding acquisition, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This study was supported by the National Natural Science Foundation of China (Grant No: 72373135); the Philosophy and Social Sciences Foundation Project of Jiangxi Province (Grant No: 23YJ51D).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aksoy, M., Yilmaz, M. K., Tatoglu, E., and Basar, M. (2020). Antecedents of corporate sustainability performance in Turkey: the effects of ownership structure and board attributes on non-financial companies. J. Clean. Prod. 276, 124284. doi:10.1016/j.jclepro.2020.124284

Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. J. Financial Econ. 77, 57–116. doi:10.1016/j.jfineco.2004.06.010

Awan, F. H., Dunnan, L., Jamil, K., and Gul, R. F. (2023). Stimulating environmental performance via green human resource management, green transformational leadership, and green innovation: a mediation-moderation model. Environ. Sci. Pollut. Res. 30, 2958–2976. doi:10.1007/s11356-022-22424-y

Benkraiem, R., Dubocage, E., Lelong, Y., and Shuwaikh, F. (2023). The effects of environmental performance and green innovation on corporate venture capital. Ecol. Econ. 210, 107860. doi:10.1016/j.ecolecon.2023.107860

Cammett, M. (2007). Business–government relations and industrial change: the politics of upgrading in Morocco and Tunisia. World Dev. 35, 1889–1903. doi:10.1016/j.worlddev.2007.01.003

Chang, L., Li, W., and Lu, X. (2015). Government engagement, environmental policy, and environmental performance: evidence from the most polluting Chinese listed firms. Bus. Strategy Environ. 24, 1–19. doi:10.1002/bse.1802

Chen, C. J. P., Li, Z., Su, X., and Sun, Z. (2011). Rent-seeking incentives, corporate political connections, and the control structure of private firms: Chinese evidence. J. Corp. Finance 17, 229–243. doi:10.1016/j.jcorpfin.2010.09.009

Chen, L. (2015). Legal prevention of environmental regulatory capture: enlightenment based on American experience. Glob. Law Rev. 37, 153–164. doi:10.3969/j.issn.1009-6728.2015.01.011

Chen, N., and Yang, S. (2022). Executive stock ownership and enterprise digital transformation: interest convergence or trench defense. Discrete Dyn. Nat. Soc. 2022, e2956758. doi:10.1155/2022/2956758

Chen, Y., Peng, Z., Peng, C., and Xu, W. (2023). Impact of new government–business relations on urban digital economy: empirical evidence from China. Finance Res. Lett. 58, 104325. doi:10.1016/j.frl.2023.104325

Cheng, Z., Wang, F., Keung, C., and Bai, Y. (2017). Will corporate political connection influence the environmental information disclosure level? Based on the panel data of A-shares from listed companies in Shanghai stock market. J. Bus. Ethics 143, 209–221. doi:10.1007/s10551-015-2776-0

Chong, T. T.-L., Lu, L., and Ongena, S. (2013). Does banking competition alleviate or worsen credit constraints faced by small- and medium-sized enterprises? Evidence from China. J. Bank. and Finance 37, 3412–3424. doi:10.1016/j.jbankfin.2013.05.006

Cordeiro, J. J., Profumo, G., and Tutore, I. (2020). Board gender diversity and corporate environmental performance: the moderating role of family and dual-class majority ownership structures. Bus. Strategy Environ. 29, 1127–1144. doi:10.1002/bse.2421

Dal Bó, E. (2006). Regulatory capture: a review. Oxf. Rev. Econ. Policy 22, 203–225. doi:10.1093/oxrep/grj013

Dal Bó, E., and Di Tella, R. (2003). Capture by threat. J. Political Econ. 111, 1123–1154. doi:10.1086/376951

Deng, K., Zeng, H., and Zhu, Y. (2019). Political connection, market frictions and financial constraints: evidence from China. Account. and Finance 59, 2377–2414. doi:10.1111/acfi.12301

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. Account. Rev. 86, 1969–1994. doi:10.2308/accr-10130

Dong, Z., Wei, X., and Zhang, Y. (2016). The allocation of entrepreneurial efforts in a rent-seeking society: evidence from China. J. Comp. Econ. 44, 353–371. doi:10.1016/j.jce.2015.02.004

Du, Z., Zheng, L., and Lin, B. (2022). Does rent-seeking affect environmental regulation? evidence from the survey data of private enterprises in China. J. Glob. Inf. Manag. (JGIM) 30, 1–22. doi:10.4018/JGIM.288549

Faccio, M. (2006). Politically connected firms. Am. Econ. Rev. 96, 369–386. doi:10.1257/000282806776157704

Fornes, G., Cardoza, G., and Altamira, M. (2021). Do political and business relations help emerging markets’ SMEs in their national and international expansion? Evidence from Brazil and China. Int. J. Emerg. Mark. 17, 2084–2109. doi:10.1108/IJOEM-01-2020-0058

Fu, L., and Wu, F. (2019). Culture and enterprise rent-seeking: evidence from native place networks among officials in China. Emerg. Mark. Finance Trade 55, 1388–1404. doi:10.1080/1540496X.2018.1512851

Gao, Y., Cai, Y., Teng, Z., and Fang, Y. (2022). Government–business relations and corporate cash holdings: evidence from China. Asia-Pacific J. Financial Stud. 51, 914–944. doi:10.1111/ajfs.12406

Gao, Y., Teng, Z., Cai, Y., and Dong, X. (2021). The government-business relationship and eco-innovation: evidence from Chinese automobile industry. Ecol. Chem. Eng. S 28, 541–561. doi:10.2478/eces-2021-0036

Gong, Q., Lei, L., and Yuan, Y. (2015). Policy burden, regulation capture and food safety. Econ. Res. J. 50, 4–15.

Guo, B., Feng, W., and Lin, J. (2024b). Does market-based environmental regulation improve the residents’ health: quasi-natural experiment based on DID. Inq. A J. Med. Care Organ. Provis. Financing 61. doi:10.1177/00469580241237095

Guo, B., Feng, W., Yu, Y., Zhang, H., and Hu, F. (2023a). Can environmental tax improve the environmental investment? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 30, 113846–113858. doi:10.1007/s11356-023-30272-7

Guo, B., Feng, Y., Lin, J., and Wang, X. (2024a). New energy demonstration city and urban pollutant emissions: an analysis based on a spatial difference-in-differences model. Int. Rev. Econ. and Finance 91, 287–298. doi:10.1016/j.iref.2024.01.048

Guo, B., Feng, Y., and Wang, X. (2023b). The effect of environmental information disclosure on carbon emission. Pol. J. Environ. Stud. doi:10.15244/pjoes/173106

Guo, B., Hu, P., and Lin, J. (2024c). The effect of digital infrastructure development on enterprise green transformation. Int. Rev. Financial Analysis 92, 103085. doi:10.1016/j.irfa.2024.103085

Han, S., You, W., and Nan, S. (2019). Zombie firms, external support and corporate environmental responsibility: evidence from China. J. Clean. Prod. 212, 1499–1517. doi:10.1016/j.jclepro.2018.12.136

Hellman, J. S., Jones, G., and Kaufmann, D. (2003). Seize the state, seize the day: state capture and influence in transition economies. J. Comp. Econ. 31, 751–773. doi:10.1016/j.jce.2003.09.006

Hu, K., and Shi, D. (2021). The impact of government-enterprise collusion on environmental pollution in China. J. Environ. Manag. 292, 112744. doi:10.1016/j.jenvman.2021.112744

Jiang, X.-F., Zhao, C.-X., Ma, J.-J., Liu, J.-Q., and Li, S.-H. (2021). Is enterprise environmental protection investment responsibility or rent-seeking? Chinese evidence. Environ. Dev. Econ. 26, 169–187. doi:10.1017/S1355770X20000327

Jiang, Y., and Xu, D. (2020). Can the new type of political and business relationship guide private enterprises to fulfill their social responsibilities? —an empirical study based on the ranking of political and business relations in Chinese cities. J. Harbin Univ. Commer. Sci. Ed., 66–77. doi:10.3969/j.issn.1671-7112.2020.01.006

Laffont, J.-J., and Tirole, J. (1991). The politics of government decision-making: a theory of regulatory capture. Q. J. Econ. 106, 1089–1127. doi:10.2307/2937958

Li, J., Yang, X., Meng, G., and Guo, X. (2023). Is state-business interaction a cornerstone or an obstacle for improving energy-environmental efficiency? New insights on the resource curse. Mod. Econ. Sci. 45, 13–28. doi:10.20069/j.cnki.DJKX.202303002

Li, R., and Ramanathan, R. (2018). Exploring the relationships between different types of environmental regulations and environmental performance: evidence from China. J. Clean. Prod. 196, 1329–1340. doi:10.1016/j.jclepro.2018.06.132

Li, X., Li, W., and Zhang, Y. (2020). Family control, political connection, and corporate green governance. Sustainability 12, 7068. doi:10.3390/su12177068

Lin, H., Zeng, S. X., Ma, H. Y., Qi, G. Y., and Tam, V. W. Y. (2014). Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 64, 63–72. doi:10.1016/j.jclepro.2013.07.046

Liu, B., Lin, Y., Chan, K. C., and Fung, H.-G. (2018). The dark side of rent-seeking: the impact of rent-seeking on earnings management. J. Bus. Res. 91, 94–107. doi:10.1016/j.jbusres.2018.05.037

Luo, D., and Ying, Q. (2014). Political connections and bank lines of credit. Emerg. Mark. Finance Trade 50, 5–21. doi:10.2753/REE1540-496X5003S301

Luo, J., Wu, Y., Liu, H., and Zou, W. (2023). The green governance effect of cordial and clean government-business relationship: evidence from green M&A. J. Finance Econ. 49, 34–49. doi:10.16538/j.cnki.jfe.20230919.101

Luo, X., Zhang, R., and Liu, W. (2022). Environmental legitimacy pressure, political connection and impression management of carbon information disclosure. Carbon Manag. 13, 90–104. doi:10.1080/17583004.2021.2022537

Miller, D., and Friesen, P. H. (1984). A longitudinal study of the corporate life cycle. Manag. Sci. 30, 1161–1183. doi:10.1287/mnsc.30.10.1161

Nguyen, T. H. H., Elmagrhi, M. H., Ntim, C. G., and Wu, Y. (2021). Environmental performance, sustainability, governance and financial performance: evidence from heavily polluting industries in China. Bus. Strategy Environ. 30, 2313–2331. doi:10.1002/bse.2748

Sarfraz, M., He, B., and Shah, S. G. M. (2020). Elucidating the effectiveness of cognitive CEO on corporate environmental performance: the mediating role of corporate innovation. Environ. Sci. Pollut. Res. 27, 45938–45948. doi:10.1007/s11356-020-10496-7

Shen, Y., Fu, L., and Zhao, J. (2015). The impact of municipal party secretaries’ turnover on enterprise rent-seeking: an empirical study. China Ind. Econ., 37–52. doi:10.19581/j.cnki.ciejournal.2015.09.003

Shi, H., Yang, P., Xiao, R., and Yang, W. (2023). Does the new government-business relationship promote the quantity and quality of green Innovation?Evidence from Chinese listed firms. Sci. and Technol. Prog. Policy 40, 108–117. doi:10.6049/kjjbydc.2022050398

Stigler, G. J. (1971). The theory of economic regulation. Bell J. Econ. Manag. Sci. 2, 3–21. doi:10.2307/3003160

Sun, R., and Zou, G. (2021). Political connection, CEO gender, and firm performance. J. Corp. Finance 71, 101918. doi:10.1016/j.jcorpfin.2021.101918

Tian, F., and Yang, A. (2023). Capital constraints and corporate environmental investment decision: evidence from the most polluting listed firms. Econ. Problems, 51–59. doi:10.16011/j.cnki.jjwt.2023.08.007

Tian, Y., Wang, Y., Xie, X., Jiao, J., and Jiao, H. (2019). The impact of business-government relations on firms’ innovation: evidence from Chinese manufacturing industry. Technol. Forecast. Soc. Change 143, 1–8. doi:10.1016/j.techfore.2019.02.007

Wang, A., Si, L., and Hu, S. (2023). Can the penalty mechanism of mandatory environmental regulations promote green innovation? Evidence from China’s enterprise data. Energy Econ. 125, 106856. doi:10.1016/j.eneco.2023.106856

Wang, L. (2015). Protection or expropriation: politically connected independent directors in China. J. Bank. and Finance 55, 92–106. doi:10.1016/j.jbankfin.2015.02.015

Wang, M., Wang, Y., and Guo, B. (2024). Green credit policy and residents’ health: quasi-natural experimental evidence from China. Front. Public Health 12, 1397450. doi:10.3389/fpubh.2024.1397450

Wang, X., and Wang, L. (2019). State-enterprise relation, local economic priority, and corporate environmental responsibility. Appl. Econ. 51, 995–1009. doi:10.1080/00036846.2018.1524568

Wen, H., Lee, C.-C., and Song, Z. (2021). Digitalization and environment: how does ICT affect enterprise environmental performance? Environ. Sci. Pollut. Res. 28, 54826–54841. doi:10.1007/s11356-021-14474-5

Wu, S., Zhang, J., and Elliott, R. J. R. (2023). Green securities policy and the environmental performance of firms: assessing the impact of China’s pre-IPO environmental inspection policy. Ecol. Econ. 209, 107836. doi:10.1016/j.ecolecon.2023.107836

Yang, R., Chen, Y., Liu, Y., Feng, Y., Ji, J., Wong, C. W. Y., et al. (2023). Government–business relations, environmental information transparency, and Hu-line-related factors in China. Environ. Dev. Sustain 25, 7215–7238. doi:10.1007/s10668-022-02374-8

Yuan, J., Hou, Q., and Cheng, C. (2015). The curse effect of corporate political resources: an investigation based on political relevance and corporate technological innovation. J. Manag. World, 139–155. doi:10.19744/j.cnki.11-1235/f.2015.01.014

Zhang, B., Wang, Y., and Sun, C. (2023a). Urban environmental legislation and corporate environmental performance: end governance or process control? Energy Econ. 118, 106494. doi:10.1016/j.eneco.2022.106494

Zhang, Q., Li, J., and Wang, J. (2023b). Does energy-consuming right trading have double dividend effect on firm’s economic performance and carbon emission? Environ. Sci. Pollut. Res. 30, 105595–105613. doi:10.1007/s11356-023-29864-0

Zhang, W., Luo, Q., and Liu, S. (2022). Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Analysis Policy 74, 105–121. doi:10.1016/j.eap.2022.01.018

Keywords: corporate rent-seeking, new government-business relations (NGR), corporate environmental performance (CEP), regulatory capture, political connections

Citation: Guo B, Zhan B, Hu P and Liu T (2024) Does the new government-business relations improve corporate environmental performance? A perspective based on environmental regulatory capture. Front. Environ. Sci. 12:1506056. doi: 10.3389/fenvs.2024.1506056

Received: 04 October 2024; Accepted: 07 November 2024;

Published: 25 November 2024.

Edited by:

Huwei Wen, Nanchang University, ChinaReviewed by:

Liao Wenmei, Jiangxi Agricultural University, ChinaLu Liu, Shandong University of Finance and Economics, China

Congxian He, Jiangxi Normal University, China

Copyright © 2024 Guo, Zhan, Hu and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tangfa Liu, 9320230004@gnust.edu.cn

Bingnan Guo

Bingnan Guo