- School of Statistics, Renmin University of China, Beijing, China

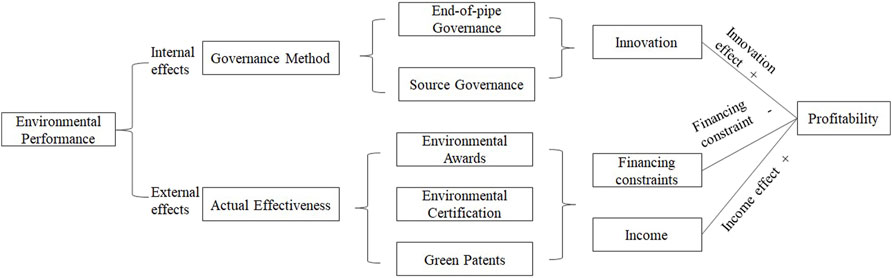

This study uses data from listed companies in China from 2008 to 2021, constructs a comprehensive evaluation of corporate environmental performance from the perspective of internal efficiency and externalities based on the text analysis method, and analyzes the impact and mechanism of environmental performance on profitability. In addition, we find that improving environmental performance can significantly increase profitability, especially if the company tackles pollution at the source. Furthermore, the impact of environmental performance on profitability tends to be driven by external markets. Obtaining environmental certifications, awards, and green patents can provide positive feedback and significantly increase profitability. In addition, the mechanism analysis shows that environmental performance affects firm profitability by improving green technology innovation, reducing financing constraints and increasing operating income. Finally, the results of the heterogeneity analysis show that the profitability-enhancing effect of environmental performance is stronger in non-state-owned firms, in clean industries firms and in regions with carbon emission trading.

1 Introduction

Environmental protection and sustainable development as a global consensus pose growing challenges and opportunities for Chinese companies (Ren et al., 2024; Wang et al., 2024; Ren et al., 2022; Wang et al., 2023a; Wang et al., 2023b). Companies are the main sources of pollutant emissions and bear the responsibility for environmental management (Wang et al., 2024). The Chinese government’s policy of “carbon neutrality and carbon peak” not only imposes strict requirements on corporate carbon emissions but also urges more companies to incorporate environmental performance into their social responsibility strategies. Some scholars have identified value enhancement (Freund et al., 2023; Lins et al., 2017), risk management (Miao et al., 2024a; Barnett et al., 2018), and altruism (Bénabou and Tirole, 2010; Xue et al., 2022) can motivate companies to improve environmental performance. However, there are currently no objective and uniform standards for evaluating corporate environmental performance in China, and whether Chinese listed companies can achieve both environmental and profitable sustainability needs further investigation.

Environmental performance has a significant impact on corporate sustainability and investment decisions. Most current research focuses on the impact of environmental performance from perspectives such as green innovation (Ma et al., 2024; Wang et al., 2022), environmental information disclosure (Ingram and Frazier, 1980; Clarkson et al., 2008; Meng et al., 2014), dividend policy (Li et al., 2024), risk-taking (Qiu et al., 2024) and firm value (Jacobs et al., 2010; Harahap et al., 2019; Aydoğmuş et al., 2022). For companies and stakeholders, however, the primary concern is whether environmental investments can bring economic benefits. More and more scholars underscore the increasing relevance of environment to corporate finance (Ren et al., 2024; Ren et al., 2022; Chen et al., 2024; Erhemjamts et al., 2024). Intuitively, environmental performance can have two opposite effects on profitability. On the one hand, according to the theory of increased costs and competitive disadvantage, companies that have to comply with strict environmental regulations incur higher compliance costs, which reduce profit margins and put them at a competitive disadvantage in price-sensitive markets, which has a negative impact on profitability (Friedman, 1970; Palmer et al., 1995; Walley and Whitehead, 1994; Li et al., 2017; Tao et al., 2020). On the other hand, environmental performance can bring both tangible and intangible benefits to companies (Giannarakis et al., 2018; Kassinis and Vafeas, 2006). The resource-based view states that the ability to address environmental aspects enhances organizational capabilities and that such intangible resource is valuable, rare, inimitable and non-interchangeable (Buysse and Verbeke, 2003). Stakeholder theory suggests that consideration of environmental issues beyond mere compliance can help to meet stakeholder expectations and enhance the organization’s reputation, which in turn promotes business growth and sustained value creation (Zou et al., 2015). Theoretically, it is difficult to determine whether the positive effects of environmental performance on profitability outweigh the negative ones. It is therefore important to investigate this question empirically.

The explanations for why the empirical results between environmental performance and profitability are inconclusive also vary. Konar and Cohen (2001), for example, argue that early empirical studies suffer from several problems, such as small sample size (Ambec and Lanoie, 2008), lack of objective environmental criteria (Ullmann, 1985; Cohen et al., 1997). Harahap et al. (2019) investigated the relationship between environmental performance and profitability in only 15 listed companies in Indonesia. Ramlawati et al. (2022) increased the sample size but still only included 22 listed companies, and conclusions drawn from such small sample sizes may not be representative. In additional, some scholars have used single indicators to measure environmental performance, such as energy efficiency (Vinayagamoorthi et al., 2015; Pan et al., 2024), environmental investment (Zhang et al., 2019) and carbon dioxide emissions (Qin and Wu, 2004). However, as environmental performance is a multidimensional construct (Margolis et al., 2007; Xie et al., 2019), relying on a single indicator may lead to incomplete and inaccurate conclusions. This article addresses the shortcomings of previous studies by examining 35,340 samples of 4,479 listed companies in China. Using text analysis methods, a comprehensive assessment of corporate environmental performance from the perspective of internal efficiency and externalities is provided. Our extensive data set and accurate measurement of environmental performance are critical to conducting a robust analysis.

Based on the above analysis, this study aims to investigate the impact of environmental performance on profitability and the underlying mechanisms in Chinese listed companies for the period 2008–2021. The main contributions of this study are as follows: (1) An innovative evaluation of corporate environmental performance was proposed. We utilize text and patent data of listed companies to provide a comprehensive assessment of corporate environmental performance that examines both internal efficiency and externalities, which provides valuable evidence for government regulators to identify companies with high environmental performance and provides data support for future related research. (2) This study provides valuable insights into the relationship between the environmental performance of enterprises and their profitability in China. While previous research has often focused on specific industries (Harahap et al., 2019; Pan et al., 2024), this study examines the impact of environmental performance on the profitability of Chinese listed companies. In addition, a decomposition analysis of environmental performance is conducted to show the different effects of internal efficiency and externalities on profitability. The results provide corporate managers with evidence to justify the mobilization of more resources for environmental performance. (3) The influence mechanism between environmental performance and profitability is systematically analyzed in this study. Previous research has not looked in depth at the underlying mechanisms of this relationship. By examining both internal and external channels, this study uncovers how environmental performance influences profitability through internal innovation effects, external financing constraints, and income effects, which helps to identify the motivations for corporate social responsibility. (4) the heterogeneity effects of environmental performance are closely examined and broaden the understanding of the focal relationship. This not only complements and enriches existing literature, but also provides a reference to achieve a win-win situation between development and environmental protection. It also helps governments in formulating more targeted environmental regulations for businesses instead of using a “one-size-fits-all” approach.

The remainder of this study is organized as follows. Section 2 is the literature review and theoretical hypotheses, in which the relevant literature is reviewed and our research hypotheses are developed. Section 3 presents the data source and the measurement of environmental performance. Section 4 reports the results of the empirical studies and Section 5 summarizes the conclusions and policy implications.

2 Literature review and theoretical hypotheses

2.1 Measurement of corporate environmental performance

Environmental performance is a measure for evaluating the results of environmental protection activities (Ayu et al., 2017). It is widely recognized as a multidimensional construct (Margolis et al., 2007; Xie et al., 2019), and the accurate measurement of environmental performance is challenging (Aydoğmuş et al., 2022). Due to the lack of environmental data, most scholars initially used a single indicator to measure environmental performance, such as emissions of pollutants like sulfur dioxide (Qin and Wu, 2004), environmental investments (Zhang et al., 2019), pollution charges per unit of income (Hu, 2012), and energy efficiency (Vinayagamoorthi et al., 2015; Pan et al., 2024).

As the theory and methods of environmental performance evaluation have matured, some scholars and institutions have begun to conduct the related evaluation research from different perspectives. Ramlawati et al. (2022) and Harahap et al. (2019) investigated the impact of environmental performance on the profitability of listed companies in Indonesia, using PROPER environmental performance ratings to categorize companies into five levels. However, this rating system requires high quality data and only 15 listed companies disclosed such information, making it difficult to apply widely. In addition, some studies have developed environmental performance rating systems that focus on specific industries or companies. For example, Fang et al. (2013) measured environmental performance in three specific dimensions—environmental management, resource and energy conservation, and pollution reduction—focusing only on Baoshan Iron and Steel Group in 2011. Similarly, Wu and Chen (2014) measured the environmental performance of a textile dyeing and printing company based on seven aspects: green procurement, eco-design, clean production, green transportation, green sales, green use, and building a green corporate culture. These indicator systems have limited applicability and cannot be generalized.

At present, the more mature standards for evaluating the environmental performance of listed companies mainly include environmental, social responsibility and governance (ESG), such as Awaysheh et al. (2020), which directly use the Corporate Environmental Responsibility Index. However, this has been criticized by scholars (Barnett and Salomon, 2012) because the company-level indices provided by different institutions are not identical, and the subjectivity of the institutions is too strong, resulting in limited effectiveness. Another reseacher has developed an environmental performance evaluation indicator from the perspective of corporate disclosure of environmental information, mainly using text data from the annual reports of listed company for content analysis. Christmann (2004) and Jose and Lee (2007) believe that companies have omitted information, vision, and strategic statements on environmental behavior from their annual reports that reflect the company’s environmental management policies and practices. Ilinitch and Thomas, (1998) classified corporate environmental and social responsibility disclosure into four environmental performance indicators, while Clarkson et al. (2008) divided the elements of environmental disclosure into hard and soft environmental disclosure, but this classification is too simplistic.

There are several problems with the existing environmental performance: (1) Most studies use a single indicator to measure environmental performance, which cannot fully and accurately reflect environmental performance; (2) In studies that use comprehensive indicators to measure environmental performance, some studies have developed environmental performance evaluation systems that focus on specific industries or companies, which is highly subjective and not complete; (3) Some scholars directly use ESG indices that are subject to institutional subjectivity. Therefore, in this study, we conduct an evaluation of the environmental performance of companies by using text-mining analysis, which has recently been widely used to measure attention level or sentiment changes and has proven quite effective (Liu et al., 2024; Sautner et al., 2023). This study not only provides an objective and truthful assessment of the environmental performance of listed companies in China, but also provides an effective reference for government regulators.

2.2 The impact of corporate environmental performance on profitability

Researchers of the neoclassical school argue that improved environmental performance leads to an increase in costs, which decreases the marginal net benefit (Palmer et al., 1995; Walley and Whitehead, 1994). With the development of the economy and the increasing urgency of environmental protection, companies are not only pursuing profits but also actively assuming social and environmental responsibilities. The two seemingly competing goals of environmental performance and corporate profitability can be balanced by the changes in the external environment and the adjustment of internal strategies. Thus, improving a company’s environmental performance can also lead to an increase in profitability (Giannarakis et al., 2018; Kassinis and Vafeas, 2006; Buysse and Verbeke, 2003).

From an external environmental perspective, as economic development accelerates, the public demand for a green environment increase, and the cost of violating environmental laws and regulations becomes higher, so the benefits of actively fulfilling environmental responsibilities outweigh the company’s investment in environmental protection (Sharma and Vredenburg, 1998; Chuang and Huang, 2018). On the one hand, according to the signal theory, fulfilling environmental responsibility sends a positive signal to the government and social stakeholders, which can effectively eliminate the problem of information asymmetry, help companies gain government recognition and public support, and thus gain advantages in obtaining funding, selling product, and using government resources (Donaldson and Preston, 1995; Liu et al., 2020; Luo et al., 2012). On the other hand, due to external pressure, it is becoming increasingly costly for companies to violate environmental regulations, and companies that do not behave in an environmentally conscious manner are penalized by the government and receive negative media coverage (Wong et al., 2018).

From an internal interest perspective, several factors such as social sustainable development of resources, environmental regulations, and public environmental awareness objectively form economic incentives and contractural incentives for companies to carry out effective environmental management (Orlitzky et al., 2003). The “Porter hypothesis” states that reasonable environmental regulations can generate innovative compensation effects, thereby improving a company’s productivity and ultimately generating economic benefits. Maxwell et al. (1997) believe that companies should pursue proactive environmental strategies, as these strategies can bring competitive advantages such as cost reductions, quality improvements, better corporate reputation and the development of new markets. In addition, the environmental reputation that companies gain by fulfilling their environmental responsibilities is a valuable and non-imitable resource that meets the expectations of the public and society (Buysse and Verbeke, 2003), thus helping to increase the company’s sales and profits and achieving a win-win situation of “green” and competitiveness (Porter and Vanderlinde, 1995).

H1. Improving environmental performance has a positive impact on profitability.

2.3 Channel analysis of the impact of corporate environmental performance on profitability

Environmental performance can form internal and external drivers that lead companies to implement more green innovations (Cai and Zhou, 2014). On the one hand, environmental performance may lead to stricter environmental regulations, which may encourage participants to undertake more green technology innovation to comply with the regulations and gain further benefits (Frondel et al., 2007; Darnall et al., 2008; Kammerer, 2009; Dubey et al., 2015). On the other hand, environmental performance can increase customers demand for better environmental quality, which in turn can spur further green technology innovation (Handfield et al., 2002). Moreover, the higher a company’s environmental performance, the fewer administrative regulations and restrictions there are on the company’s green technology innovation behaviour and the more government support it receives for research and investment (Xu et al., 2022). This can also bring benefits in the labour market, attract more creative employees and further promote the company’s green innovation (Xie and Zhu, 2021). According to the “Porter hypothesis”, well-designed environmental regulations can stimulate innovation and offset the cost increase caused by environmental regulations, creating a virtuous cycle to improve the environmental performance and profitability of enterprises. Green technology innovation is an important channel for companies to reduce costs, conserve resources (Marin, 2014) and improve corporate profitability (Wang et al., 2020).

Environmental performance has a halo effect that helps to improve competitiveness, product prices, and market share, which in turn increases sales and profitability. According to stakeholder theory, companies can gain competitive advantages by meeting the demands of shareholders, e.g., long-term stable relationships with suppliers and consumers as well as positive relationships with investors (Bansal and Roth, 2000; Hillman and Keim, 2001; Orlitzky et al., 2003; Ambec and Lanoie, 2008; Lankoski, 2008; Surroca et al., 2010). At the same time, a company’s environmental responsibility also influences consumers’ decisions. As consumer demand for low-emission, energy-efficient products increase, companies with good environmental performance can charge higher prices or sell more products and stock (Hillman and Keim, 2001; Hart and Dowell, 2011; Richardson and Welker, 2001). In additional, companies with good environmental performance have more low-cost intangible assets that increase their brand and market value, allowing them to command price premiums and gain greater market share (Porter and Vanderlinde, 1995).

Companies with good environmental performance receive more funding from governments, financial institutions and stakeholders. In recent years, the government has frequently introduced relevant policies on environmental protection and green financing, including the establishment of special funds, subsidies for certain industries, low-interest loans, and tax reductions and exemptions. According to the theory of a “financing advantage”, companies with good environmental performance tend to have better political connections (Xiao and Shen, 2022), politically connected firms have easier access to formal financing sources (Miao et al., 2024b). In addition, commercial banks and other financial institutions will also actively increase their financing support for green and low-carbon enterprises to better fulfill their own environmental and social responsibilities, such as green loans, green bonds and other green financing methods (Mai and Xu, 2015). This supports the improvement of companies’ environmental performance, significantly alleviates the problem of financing constraints for companies, and guarantees the improvement of their profitability.

The signal theory states that companies with good environmental performance create positive expectations among stakeholders such as investors and consumers, and are willing to pay a “green premium”, thereby increasing the company’s share price or cash flow and decreasing its financing costs.

We present the following hypothesis for examination:

H2. Improving environmental performance can increase profitability by increasing green technology innovation.

H3. Improving environmental performance can increase profitability by increasing operating income.

H4. Improving environmental performance can increase profitability by reducing financing constraints.

We present our research framework in Figure 1.

3 Data and measurement of environmental performance

3.1 Data

After the adoption of the “Environmental Information Disclosure Order” in 2008, Chinese listed companies have started to disclose their environmental information. Therefore, this study selects data from Chinese listed companies from 2008 to 2021, excluding ST companies, financial companies and observations with missing data. Annual observations from non-financial sector with less than 5 company observations were also deleted to ensure that there were sufficient observation results are available for data analysis. Finally, the continuous variables were trimmed at the 1% level so that the final dataset contained 35,340 valid observations from 4,479 listed companies. The annual reports of listed companies were obtained from the Wind Information Website, the data on green patent were obtained from the National Intellectual Property Administration, and the data for other variables from the China Stock Market and Accounting Research Database (CSMAR) and the China National Research Data Service platform (CNRDS).

3.2 Measurement of environmental performance

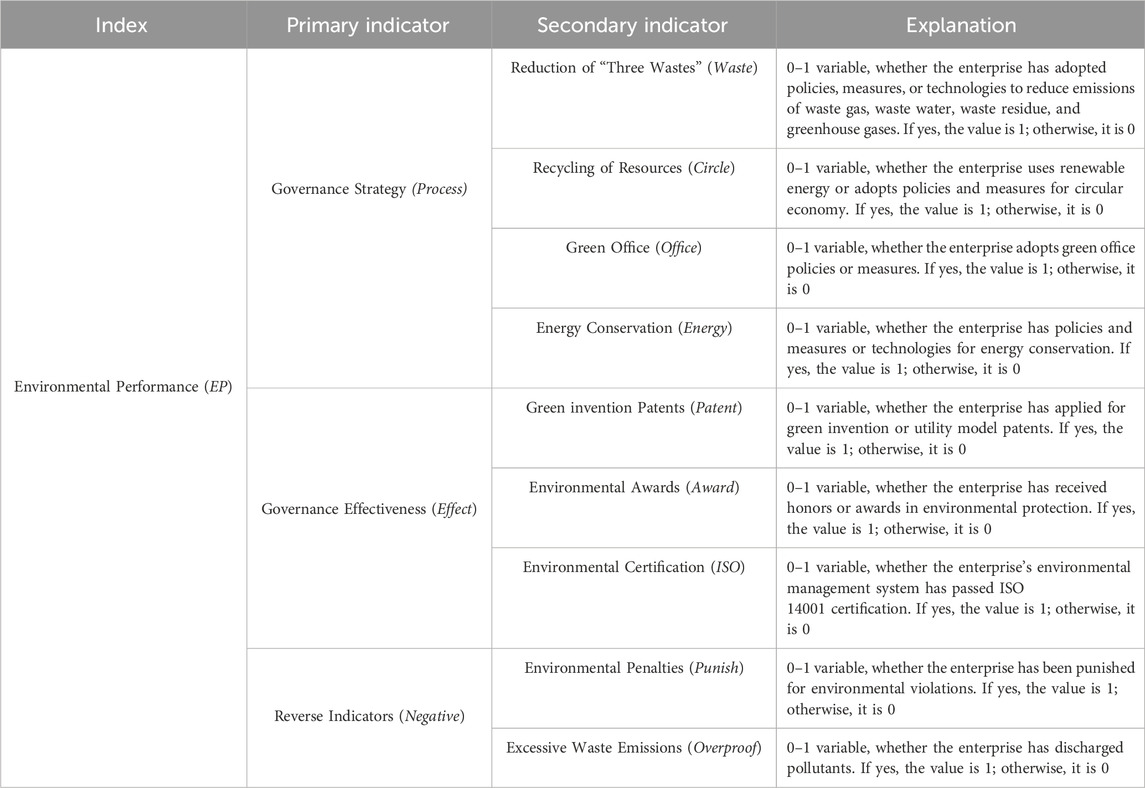

Single indicators, incomplete indicators, and missing data are some of the issues with the current environmental performance indicator system. We build an environmental performance evaluation based on Xiao and Shen (2022) using environmental governance methods, environmental governance effectiveness, and reverse indicators of environmental performance. This results in a more thorough assessment of corporate environmental performance, as indicated in Table 1. There are a total of 9 secondary indicators in this evaluation.

3.2.1 Environmental governance strategy

The environmental governance method mainly reflects in four aspects by classifying the contents of social responsibility reports of listed companies: the reduction of “three wastes”, recycling of resources, green office, and energy conservation. These indicators are a natural way to gauge how well the business is doing with environmental governance procedures. Some scholars have also introduced these indicators to measure environmental performance in their research. For example, Qin and Wu (2004) synthesized several important waste emission indicators into a comprehensive index to represent environmental performance; Kassinis and Vafeas (2006) use harmful gas emissions to measure environmental performance; Hao et al. (2014) studied the environmental impact of industrial enterprises using CO2 emissions as a proxy variable. Furthermore, it is feasible to explore the differences in the impact of different environmental governance strategies on profitability in a follow-up analysis. Therefore, this study concludes that it is essential to create four sub-indicators and take into account the environmental governance process dimension: the reduction of “three wastes”, resource recycling, green office, and energy conservation.

3.2.2 Environmental governance effectiveness

Environmental performance can bring both tangible and intangible benefits to companies (Giannarakis et al., 2018; Kassinis and Vafeas, 2006). Melnyk et al. (2003) analyzed that the ISO 14001 certification can significantly promote corporate environmental performance. Wu and Chen (2014) and Zou et al. (2016) used the environmental awards as a measure of environmental performance, believing that environmental awards can give the company favorable feedback. The application for green invention patents reflects the significant achievements in green investment. Therefore, this paper builds three sub-indicators: environmental awards, environmental certification, and green invention patents.

3.2.3 Reverse environmental performance indicators

Companies with good environmental performance have fewer environmental violations than polluting companies, and environmental performance is a concentrated reflection of environmental governance. Illegal behavior and environmental violations can greatly lower its environmental performance. Du et al. (2019) stated that a company’s environmental performance is determined by whether it has a history of environmental violations or has been penalized for excessive emissions. Therefore, the indicator system becomes more objective and complete when corporates’ bad environmental practices are taken into account. Two sub-indicators comprise this indicator: environmental penalties and excessive waste emissions.

3.3 Variables

3.3.1 Dependent variable

The existing literature on measuring corporate profitability are mainly based on accounting indicator, such as return on equity (ROE), return on assets (ROA), and earnings per share (EPS), which are easy to obtain and have strong applicability, and are widely used in current research. Among these indicators, ROA has better macroscopic and comprehensive characteristics, and reflects corporate profitability from the overall perspective of the enterprise. In this paper, we select ROA to measure corporate profitability (Deng, 2020), which is the percentage of net profit of listed companies and average total assets.

We also use the ROE as a replacement variable for robustness testing, and its specific calculation formula is the percentage of net profit of listed companies and average owner’s equity.

3.3.2 Independent variable

This paper follows Sautner et al. (2023). It uses a machine learning algorithms to identify environmental protection content in the annual reports of listed companies. A related words were built based on various aspects of the indicator system. If the company’s annual report mentions a keyword and it is neither negated nor related to the future, the company is considered to have implemented environmental measures or faced environmental penalties in that area. Finally, drawing on Flammer (2015), the paper measures environmental performance (EP) by subtracting the score of reverse environmental performance indicators from the total environmental advantage score. The higher the environmental performance value and the lower the reverse indicator value, the better the company’s environmental performance and the deeper involvement in environmental protection. The paper also uses a weighted average environmental performance indicator as an alternative to the environmental performance indicator for robustness checks.

3.3.3 Control variables

In order to minimize bias caused by omitted variables, this paper also controls for the following variables that may affect a company’s profitability: (1) Age, which is the logarithm of the difference between the current and established year plus one; (2) Size, measured by the natural logarithm of total assets; (3) Top1, measured by the shareholding ratio of the largest shareholder; (4) Number, measured by the number of independent directors; (5) Tobin-Q, measured by the ratio of market value to total assets; (6) Growth, measured by the ratio of current year revenue growth to previous year revenue; (7) Cur, measured by the ratio of revenue to average total current assets.

3.3.4 Descriptive statistics of variables

The descriptive statistics for each variable are presented in Table 2. Descriptive statistics show that the average environmental performance score is 1.31, showing that many enterprises have good environment performance. However, the minimum value is −2, representing that some companies not only do not have environmental advantages, but also receive environmental penalties, indicating specific differences in environmental performance among enterprises within the sample. Dependent variable ROA and ROE also fluctuates significantly, indicating substantial differences in profitability levels across firms, reflecting the effect of environmental performance and further testing is necessary. Regarding control variables, they show large fluctuations, indicating significant differences among listed companies in China. These facts provide good test material for the empirical investigation.

3.4 Econometric models

To verify whether environmental performance enhances a company’s profitability, we construct the following fixed effects panel data model:

Here, subscript

Finally, to verify whether environmental performance can enhance profitability by improving green technology innovation, increasing revenue, and reducing financing constraints, we construct a two-way effects model:

Where Medit represents green technology innovation (creativity), operating income (income), financing constraints (finance), respectively. The other variables in Equations 2 and 3 are the same as those in Equation 1.

4 Empirical analysis

4.1 Benchmark regression results

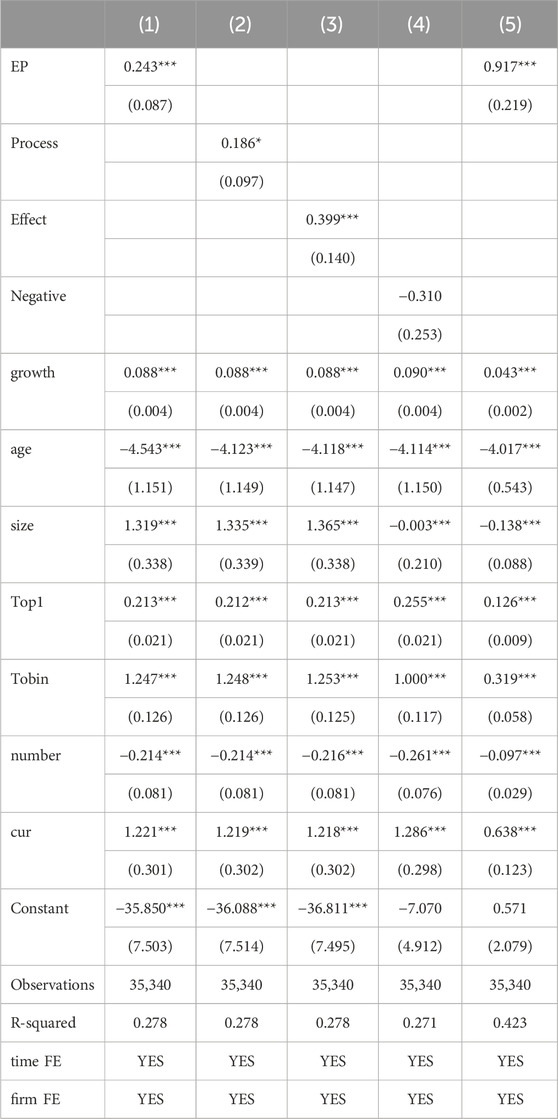

We used Equation 1 to evaluate the influence of environmental performance on profitability using a two-way fixed-effects model. Table 3 reports the estimation results, showing that environmental performance significantly improves the profitability. The regression model in Column (1) includes the independent variable and two-way fixed-effects without control variables, indicating that the impact of environmental performance on ROA is significantly positive at the 1% level. The model in Column (2) includes the control variables and firm fixed-effects, GDC was still positively correlated with profitability. The model in Column (3) presents the results of the full model, indicating that environmental performance improves the profitability. Taken together, these findings support Hypothesis 1. That is, environmental performance significantly increases profitability. This finding shows that, although environmental performance will raise the cost of compliance, it is also an economic resource that can increase profitability for enterprises.

Table 3. Results of the baseline regression on the impact of environmental performance on profitability.

As for the control variables, there is a negative correlation between enterprise age and profitability, mainly because older enterprises have larger asset scales, lower capital allocation efficiency and innovation capabilities, resulting in lower profitability. The number of independent directors has a negative impact on profitability, mainly because the larger the size of the independent board, the lower the decision-making efficiency, which will reduce profitability. Firm size, revenue growth rate, shareholding ratio of the largest shareholder, Tobin-Q ratio, and current asset turnover rate all have significant positive impacts on profitability.

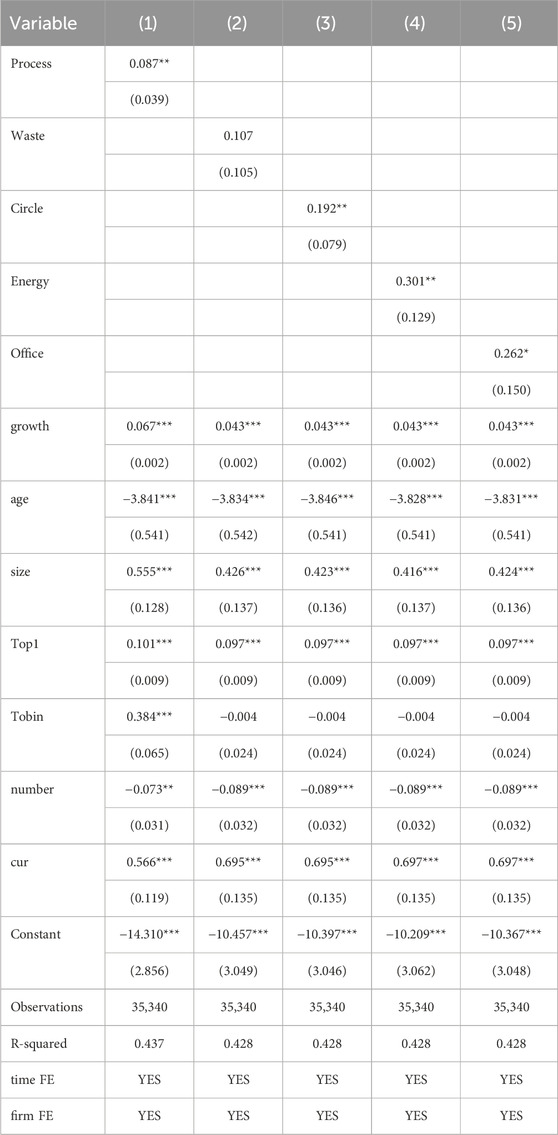

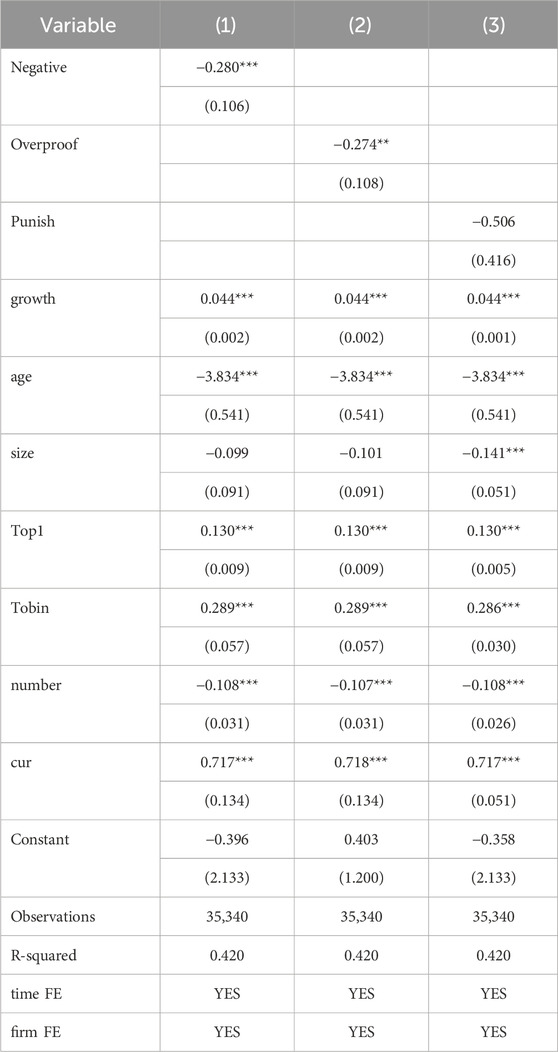

We further decompose the environmental performance and analyze how the sub-indices affect profitability. Environmental governance strategies can be mainly divided into end-of-pipe treatment and source control. End-of-pipe treatment refers to first discharging pollutants and then treating waste, while source control is to prevent and control pollution and emissions throughout the entire production process. Companies have different decisions and behaviors as a result of the growing environmental pressure and regulatory burden.

The paper will further explore the differences in the impact of different environmental governance strategies on profitability. From the estimation results in column (1) of Table 4, the estimated coefficient of governance strategy is significantly positive at the 5% level. For every one-unit increase in the performance level of environmental governance methods, profitability increases by approximately 0.087. Columns (2)–(5) of Table 4 report the estimation results of the impact of second-level environmental treatment methods on profitability. The estimated coefficients of “three waste”, circle resource, energy-saving, and green office are all positive, but the estimated coefficient of “three waste” is not significant, indicating that end-of-pipe treatment that discharges pollutants first and then treats waste cannot significantly improve profitability. Traditional end-of-pipe treatment has no economic benefits because too high running costs, treatment complexity, and investment requirements. Source control can not only achieve the unity of environmental and economic benefits and is also the fundamental way to achieve coordinated economic and environmental development.

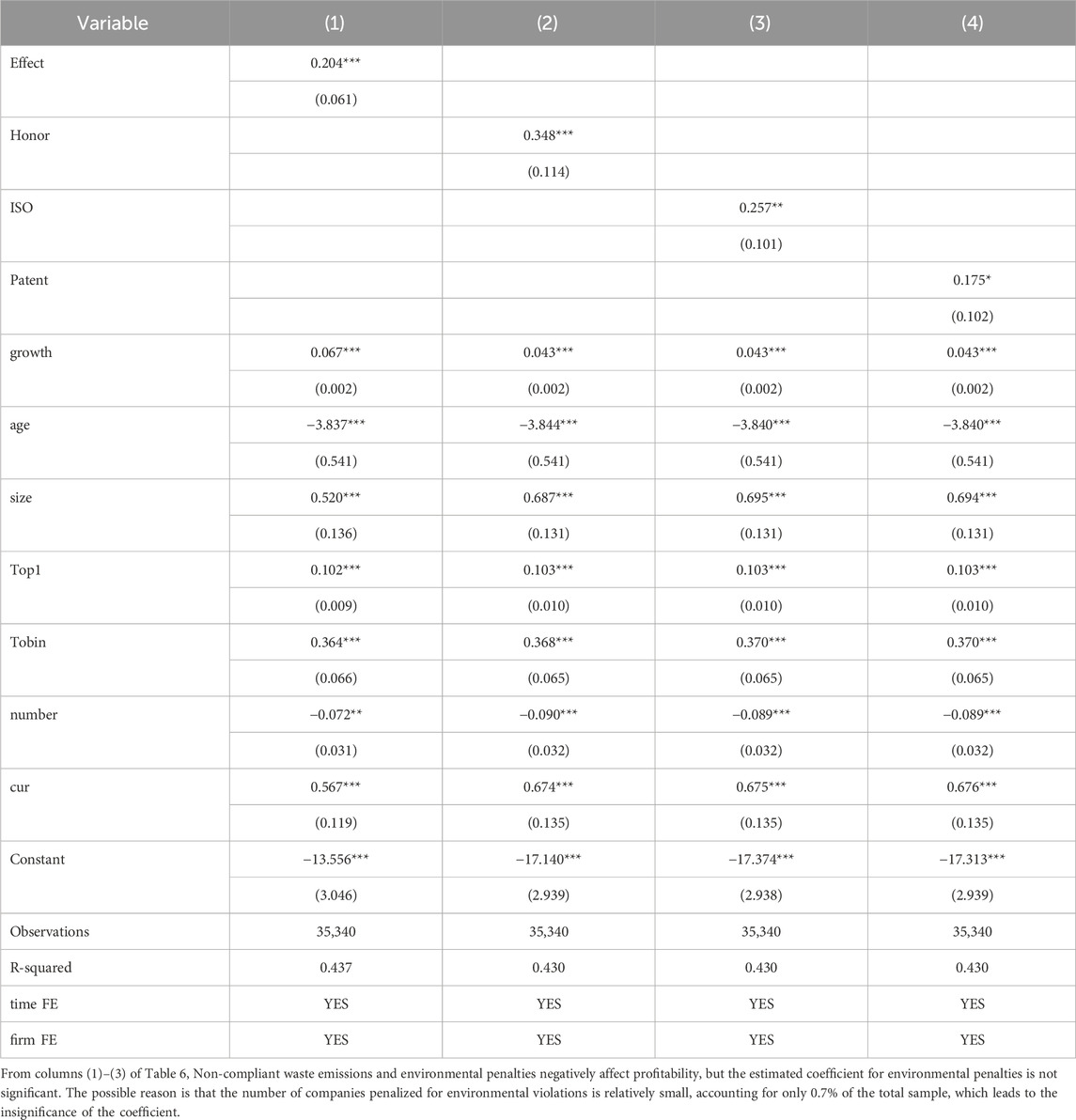

Based on the estimation results in the first column of Table 5, the coefficient of actual effectiveness is significantly positive at the 1% level, indicating that for every one unit increase in environmental effectiveness, the profitability of the enterprise increases by approximately 0.204. The estimated coefficient is larger than that of environmental governance measures, suggesting that the impact of corporate environmental performance on business capacity is driven more by market acceptance than internal efficiency. This conclusion is consistent with Orlitzky et al. (2003). Columns (2) to (4) of Table 5 report the impact of different types of environmental effectiveness on enterprise profitability. According to the estimation results, environmental awards, environmental qualifications certification, and invention of green patents all have a significantly positive impact on enterprise profitability, and the estimated coefficients are all significant. This indicates that environmental issues that exceed compliance standards can enhance a company’s ability to meet stakeholder expectations, leading to an outstanding reputation for the company, which fosters organizational growth and long-term value creation.

4.2 Underlying mechanism

4.2.1 Mediating effect of green technology innovation

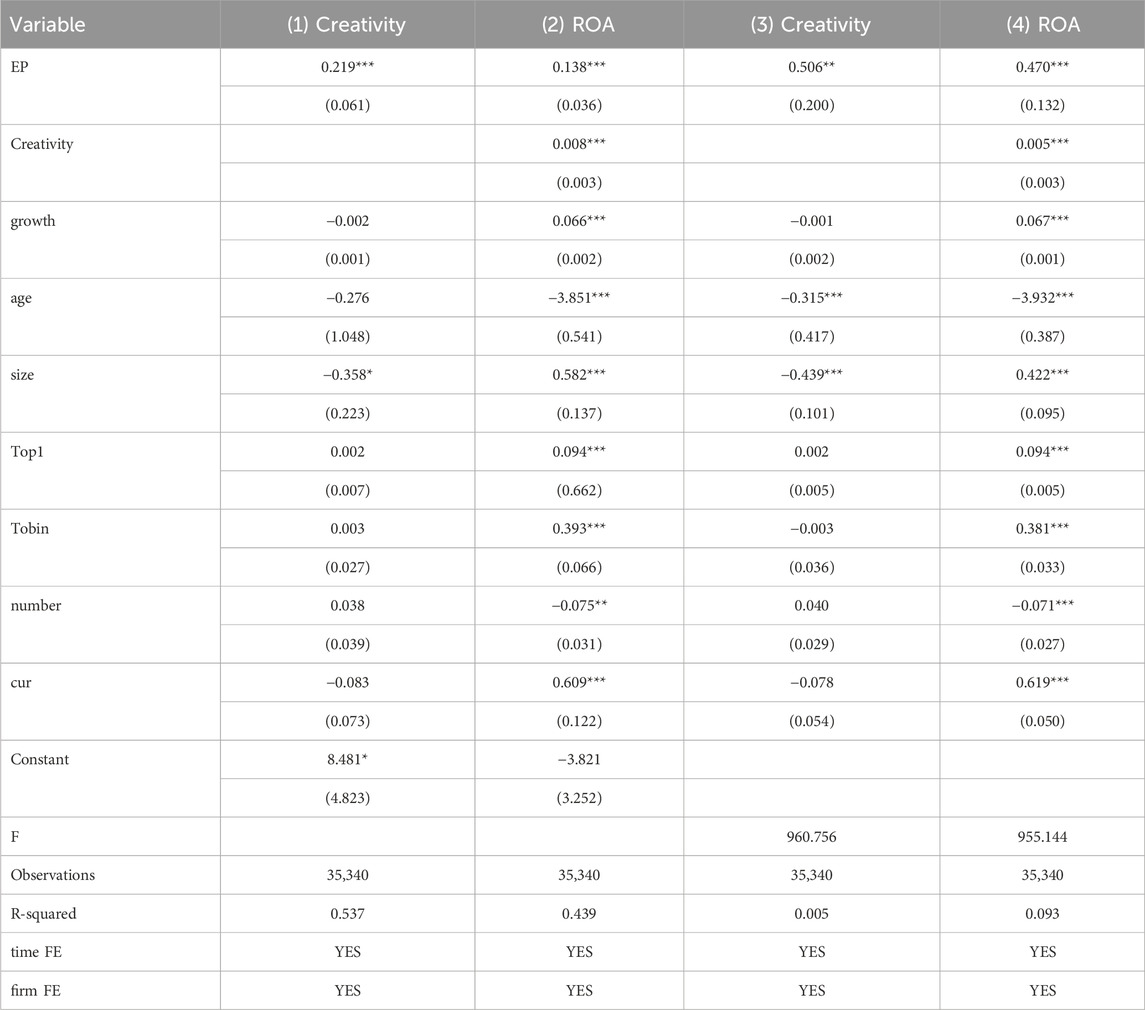

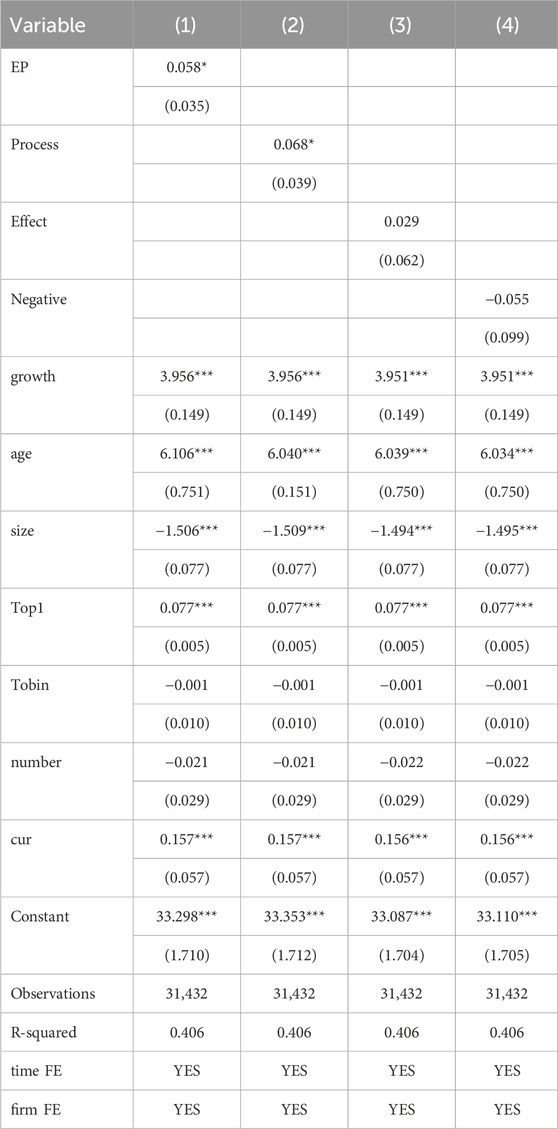

This paper draws on Chen and Ma (2021) to use the number of green invention patent as the mediating variable. Column (1) of Table 7 shows the OLS estimation results, where the improvement of environmental performance significantly improves innovation capability. Column (2) shows that the green innovation had a significant positive effect on profitability at the 1% level (β = 0.008). Moreover, environmental performance had a significant positive effect on profitability at the 1% level (β = 0.138). Compared with the baseline regression in Table 3, the environmental performance coefficient decreased from 0.156 to 0.138, indicating that the green innovation positively mediated the relationship between environmental performance and profitability. Column (3) and (4) show the 2SLS estimation results using industry average environmental performance as the instrumental variable, presenting the similar results of the OLS estimation. Above all, these results support Hypothesis 2. That is, environmental performance can enhance profitability by increasing green technology innovation. Environmental performance can form internal and external drivers to push firms to conduct more green innovation.

4.2.2 Mediating effect of income

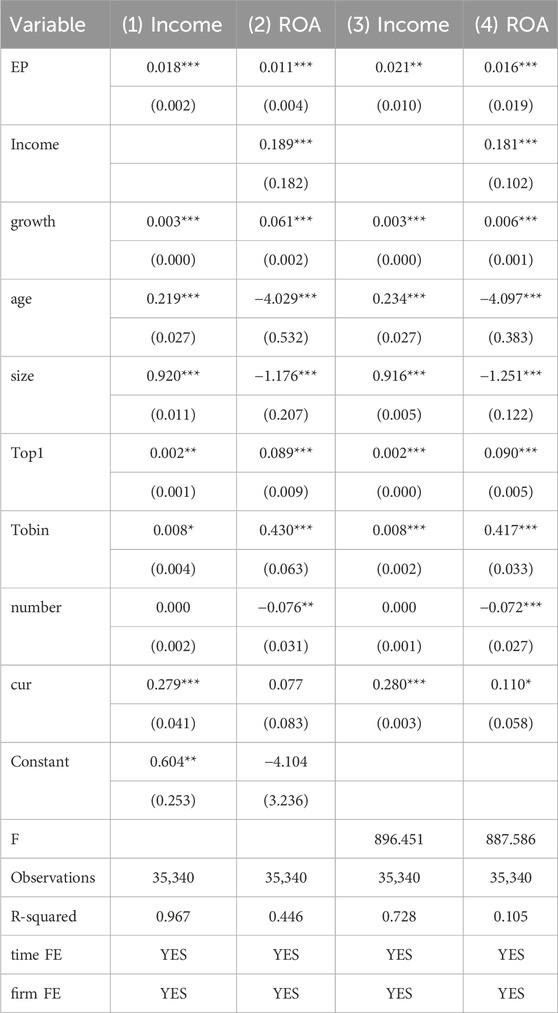

We use the logarithm of operating income as the mediating variable. Column (1) of Table 8 shows the OLS estimation results, where the improvement of environmental performance significantly increases operating income. Column (2) shows that the operating income had a significant positive effect on profitability at the 1% level. Column (3) and (4) shows the 2SLS estimation results using industry average environmental performance as the instrumental variable, and the results indicate that environmental performance still has a significant positive impact on operating income, indicating that environmental performance can improve profitability by increasing income, which supports Hypothesis 3. Environmental performance has a halo effect, helping to enhance competitiveness, product pricing, and market share, which increases revenue and profitability.

4.2.3 Mediating effect of financing constraints

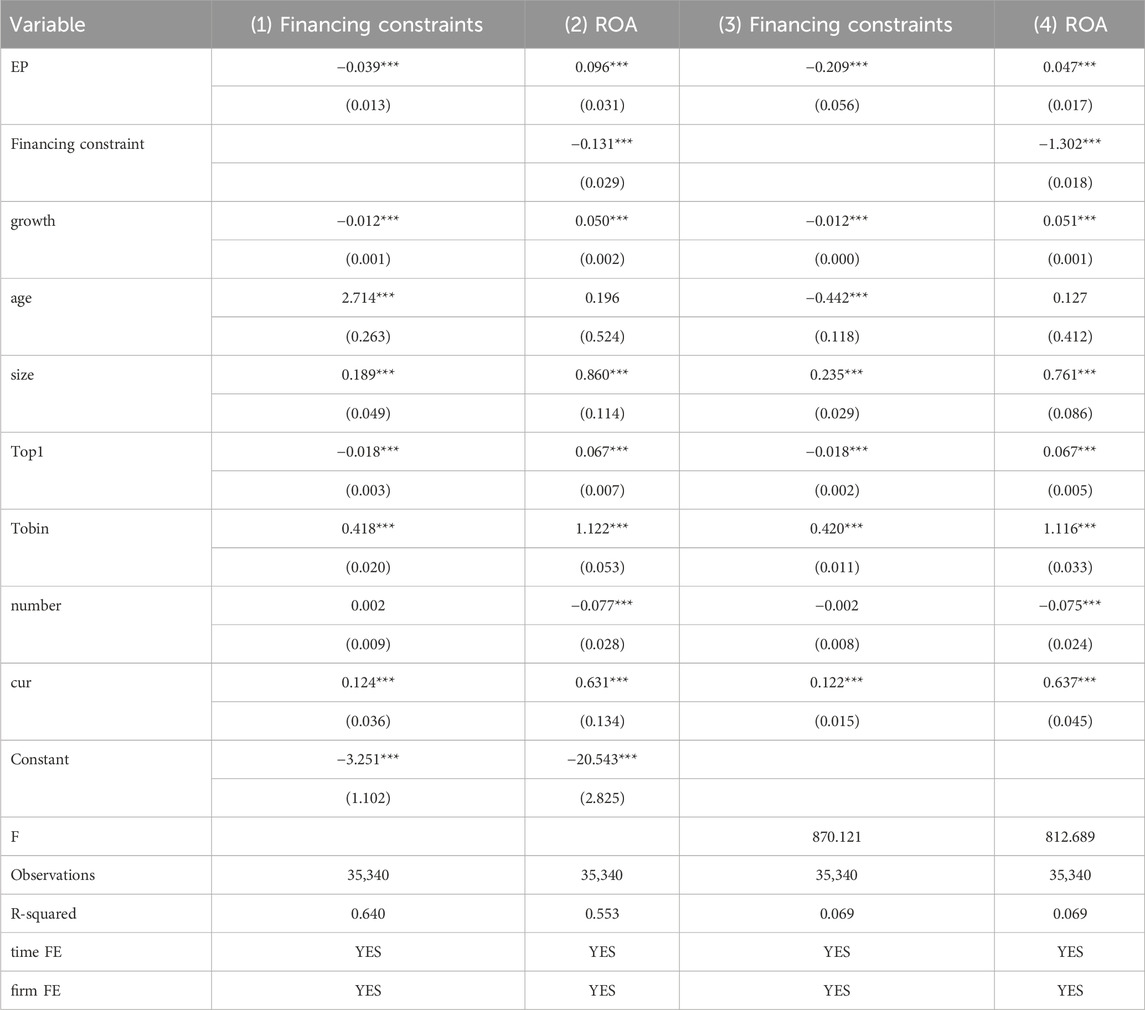

In theory, financing costs can be indirectly reflected through many key financial indicators. Kaplan and Zingales (1997) were the first to use five factors, including operating cash flow, cash holdings, dividend payout, debt level, and growth, as proxy variables for financing constraints and construct a composite index (KZ index) to measure the degree of a company’s financing constraints through regression analysis. Since then, this approach has been widely used in the field of financing constraints research (Almeida et al., 2004; Wei et al., 2014). Therefore, this paper borrows from Kaplan and Zingales (1997) and uses the KZ index as the measure of a company’s financing constraints. The smaller the KZ index, the smaller the financing constraints faced by the company. Column (1) of Table 9 shows the OLS estimation results, where the improvement of environmental performance can significantly reduce financing constraints. Column (2) shows that financing constraints had a significant negative effect on profitability at the 1% level. Column (3) and (4) show the 2SLS estimation results using industry average environmental performance as the instrumental variable, and the results support Hypothesis 4. Mainly because that companies with good environmental performance will receive more funding from governments, financial institutions and stakeholders.

4.3 Heterogeneous effects

4.3.1 Firm heterogeneity

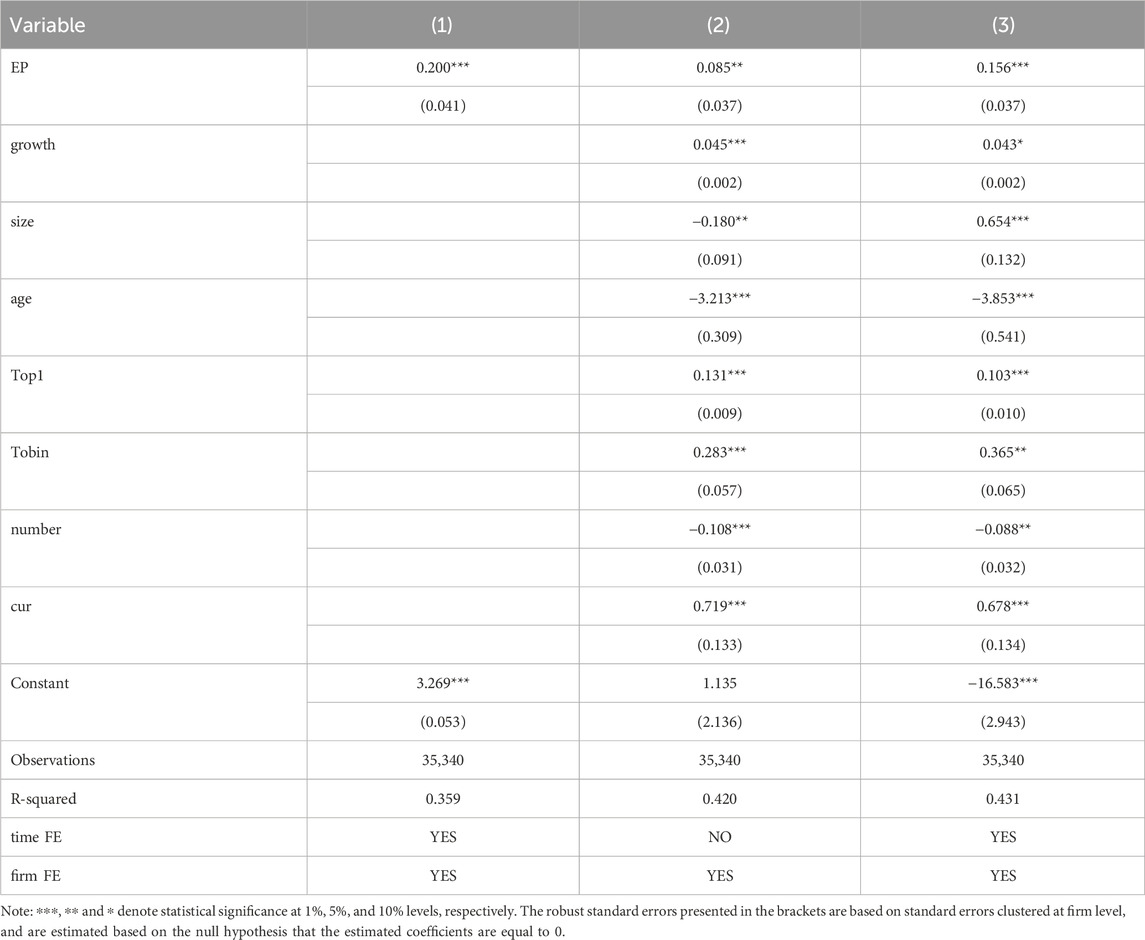

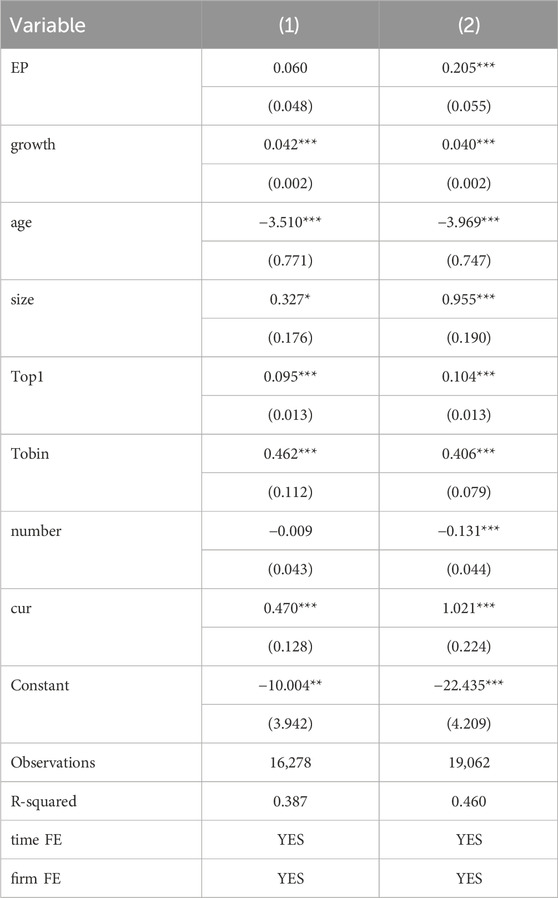

The equity structure of a company affects its operation and management, resulting in different behaviors, competition, and performance between state-owned and private companies. Therefore, it is necessary to explore the impact of environmental performance on profitability across different types of companies. Table 10 reports the estimation results of the baseline model after distinguishing the property rights. Column (1) shows that the coefficients of environmental performance in the state-owned enterprise subsample are all positive, but the estimated coefficients are not significant. However, column (2) shows that the coefficient of environmental performance in the private enterprise subsample is significantly positive, indicating that environmental performance has a more significant improvement effect on the profitability of private enterprises. Mainly because that state-owned companies should take on more environmental responsibilities, increasing the negative incentive effects and costs. By improving productivity to offset environmental protection costs, non-state-owned enterprises will show higher flexibility and innovation (Xu and Cui, 2020). Therefore, the special characteristics of state-owned enterprises determine that they need to undertake more social functions while pursuing profits, and they also face stronger regulatory constraints. The improvement of environmental performance may be relatively limited for state-owned enterprises.

Table 10. The impact of environmental performance on profitability for different types of companies.

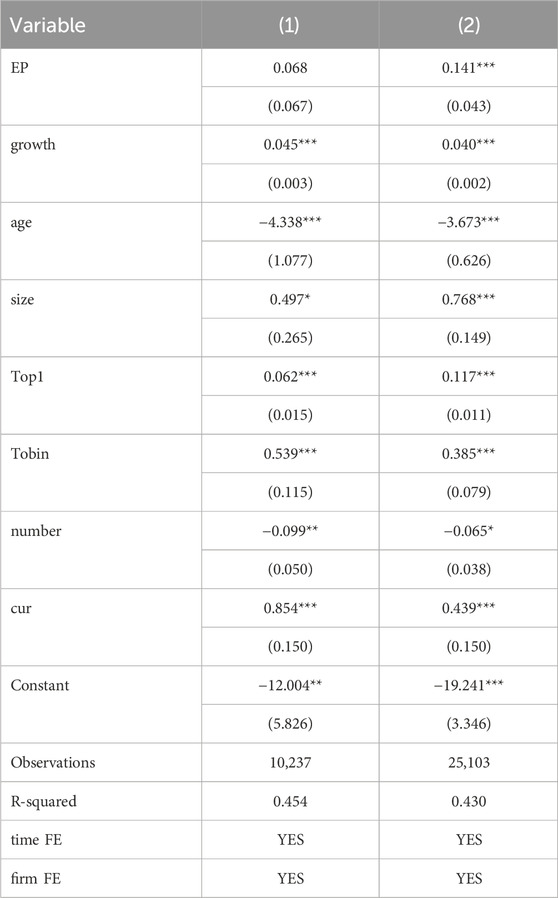

4.3.2 Industry heterogeneity

The pollution heterogeneity of companies may lead to different environmental compliance strategies. We investigate the profitability effect of environmental performance at different industry pollution levels. According to the draft of the “Guidelines for Environmental Information Disclosure of Listed Companies” issued by the State Environmental Protection Administration, 16 industries including thermal power, steel, cement, electrolytic aluminum, coal, metallurgy, chemical industry, petroleum, building materials, papermaking, brewing, pharmaceuticals, fermentation, textiles, leather, and mining are defined as heavily polluting industries. Table 11 reports the estimation results of the model after distinguishing the pollution level. Column (1) shows that the coefficients of environmental performance in the heavily polluting company sample are all positive, but the estimated coefficients are not significant. However, column (2) shows that the coefficient of environmental performance in the clean company sample is significantly positive, indicating that clean companies are more motivated to improve environmental performance, which has a more significant improvement effect on profitability. For highly polluting companies, they have the characteristics of high energy consumption, high pollution, and high carbon emission intensity, making governance difficult and compliance costs high. It is relatively difficult to achieve source reduction through technological innovation, and innovation activities have long cycles and high risks. Even if Porter’s hypothesis is true, higher compliance costs may still limit the improvement of profitability for highly polluting companies (Zhan et al., 2023).

Table 11. The impact of environmental performance on profitability for companies with different levels of pollution.

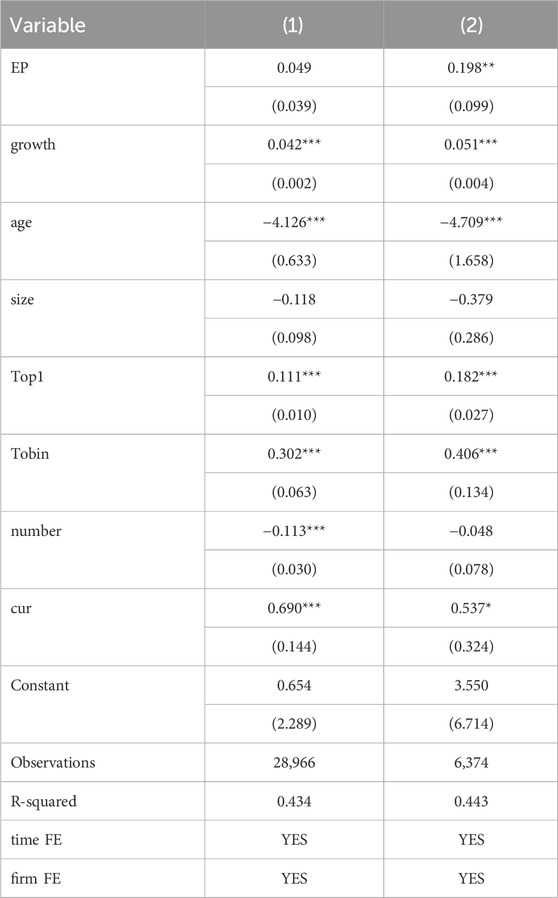

4.3.3 Regional heterogeneity

According to the arrangement of the carbon emission trading system, the carbon emissions of a unit cannot exceed the carbon emission quota within a certain period. If exceeded, the excess must purchase from units with surplus quotas, which is an effective means of controlling total carbon emissions and reducing decarbonization costs (Dong and Wang, 2021). According to the “Notice on Carrying out Pilot Work on Carbon Emission Trading” issued by the National Development and Reform Commission in October 2011, six provinces including Beijing, Tianjin, Shanghai, Chongqing, Hubei, and Guangdong (including Shenzhen) were approved to carry out regional carbon emission trading pilot, and Fujian Province started carbon emission trading pilot in 2016. Column (2) of Table 12 shows that environmental performance has a significant positive impact on the profitability of companies in the carbon emission trading provinces, while in column (1), environmental performance has no significant impact on profitability in non-carbon emission trading regions. This indicates that companies in carbon emission trading regions, under strong environmental regulation policies, are more able to promote green innovation technology, and the “Porter effect” is more significant. At the same time, the market has stronger positive incentives for high environmental performance enterprises, which significantly improves their profitability.

Table 12. The impact of environmental performance on profitability for companies in different regions.

4.4 Robustness tests

4.4.1 Alternative measurements of dependent and independent variables

In accounting indicators, another indicator that measures profitability is ROE, which is the percentage of a listed company’s net profit to the average owner’s equity. Columns (1)–(4) of Table 13 report the estimation results after changing the measurement method of the dependent variable. The coefficients of environmental governance methods and actual effectiveness are still significantly positive, and the estimated coefficient of environmental adverse indicators has a negative impact on profitability, indicating that improving environmental performance can significantly increase profitability. In terms of the measurements of explanatory variables, the environmental performance is measured using a weighted average. The estimation results in column (5) of Table 13 indicate that the empirical results did not change fundamentally after changing the measurement of environmental performance.

4.4.2 Dependent variable lagged one period

To “mitigate” endogeneity issues caused by reverse causality, the profitability indicator in Equation 1 was replaced with a lagged profitability level indicator for regression. Generally, there is no correlation between the lagged dependent variable and the current error term. Using the lagged profitability indicator instead of the current profitability indicator can alleviate endogeneity issues. From the estimation results in columns (1)–(4) of Table 14, the estimated coefficients of environmental performance and environmental governance methods are still significantly positive at the 10% level, the estimated coefficient of actual environmental effectiveness is positive but not significant, and the estimated coefficient of environmental adverse indicators is negative but not significant. The conclusion that environmental performance can improve profitability still holds.

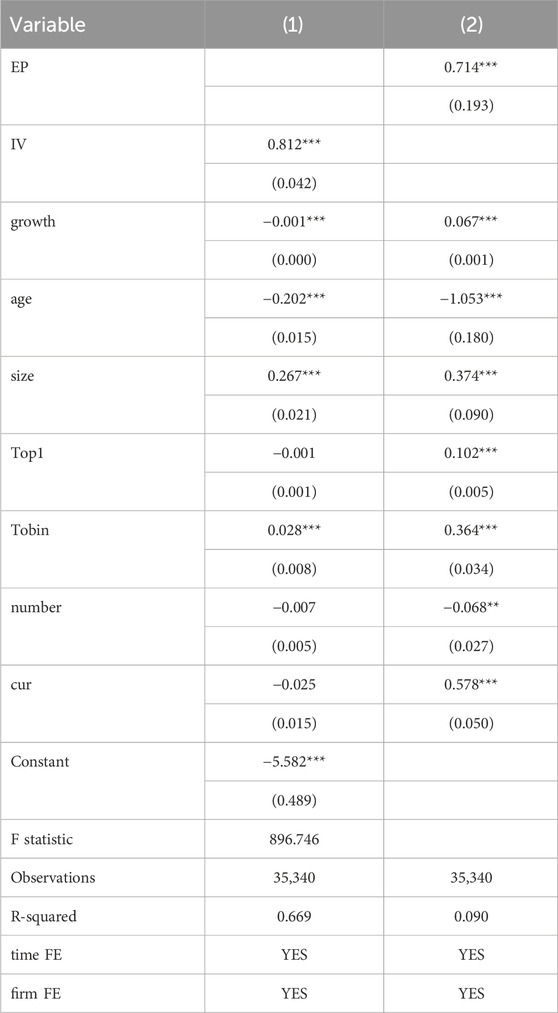

4.4.3 Instrumental variables

Since changing the measurement method of independent variables, changing the dependent variable, and using the lagged dependent variable still cannot completely solve endogeneity issues, we further use instrumental variable method to estimate regression model (1). Following the practice of Awaysheh et al. (2020) and Husted et al. (2016), we use the industry average environmental performance score of all companies in the same industry located in the same province as the instrumental variable for environmental performance. Because the choice of company location is usually made in the first few years of the company’s establishment and is unlikely to be related to the company’s recent performance. In addition, the average environmental performance score of other companies in the same industry is unlikely to affect the company’s performance in the current year, satisfying the exogeneity condition of instrumental variables. However, environmental performance between industries can affect environmental performance, resulting in a “catch-up effect”, satisfying the relevance condition of instrumental variables.

From the results in Table 15, column (1) shows the first-stage regression results, where the estimated coefficient of industry environmental performance is significantly positive at the 1% level, and the environmental performance of other companies in the same industry has a significant positive impact on environmental performance, with an F-statistic of 76.8, higher than the recommended value of 10. The Cragg-Donald Wald F-statistic is 896.746, also greater than the critical value of 16.38 for the weak instrumental variable test, rejecting the null hypothesis of weak instrumental variables. From the second-stage regression results in column (2), environmental performance is significantly positive at the 1% level, and the p-value of the over-identification Sargan test is also small, indicating that the selected instrument is effective and the research results are not affected by endogeneity issues. The conclusion that environmental performance can improve profitability still holds.

5 Conclusion and implications

We used text analysis methods to construct a comprehensive evaluation of environmental performance of Chinese listed companies and employed a panel regression model to explore the impact of environmental performance on corporate profitability, while also clarifying the underlying mechanisms. The conclusions indicate that environmental performance significantly improves corporate profitability, and a series of robustness tests support the conclusions. Moreover, a detailed index analysis reveals that the impact of environmental performance on profitability is largely driven by external markets. Environmental awards, certifications, and green patents obtained by companies in environmental protection all significantly boost profitability. In addition, channel analysis shows that companies with high environmental performance improve their profitability by increasing their green technology innovation, reducing financing constraints, and raising revenue. Finally, the heterogeneity analysis reveals that the improvement in environmental performance has a greater positive impact on the profitability of non-state-owned enterprises, while the effect on heavily polluting companies is weaker. In regions with carbon emissions trading pilots, the improvement in environmental performance is more pronounced, and its contribution to profitability is more significant.

Based on the above conclusions, this paper proposes the following policy recommendations:

(1) The government should encourage companies to improve environmental performance and actively fulfill their social responsibilities. On the one hand, the government should provide fiscal incentives such as tax reductions, subsidies, or low-interest loans to encourage companies to invest in advanced green technologies. This not only reduces environmental impacts but also lowers operating costs, improving profitability. On the other hand, companies should be encouraged to integrate environmental performance into their corporate social responsibility strategies. Companies actively participating in environmental protection initiatives can improve their reputation and customer loyalty, which drives sales and profitability.

(2) The government should remove barriers to enhancing corporate profitability. Financial constraints may negatively impact profitability, so the government should break these constraints and create financial instruments like green bonds or sustainability loans to support projects aimed at improving environmental performance. This would reduce capital costs and help companies achieve a win-win situation in terms of both environmentally friendly and profitable.

(3) The government should implement differentiated environmental performance management approaches. For state-owned and heavily polluting enterprises, mechanisms that link environmental performance with profitability should be established, encouraging companies to explore new profit models during the green transition. For non-state-owned enterprises and clean industry companies, promoting the disclosure of environmental performance information, enhancing public oversight, and improving consumer recognition of corporate brands can further boost profitability.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JH: Data curation, Formal Analysis, Methodology, Software, Writing–original draft, Writing–review and editing. YZ: Conceptualization, Formal Analysis, Funding acquisition, Supervision, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Almeida, H., Campello, M., and Weisbach, S. (2004). The cash flow sensitivity of cash. J. Finance 59 (4), 1777–1804. doi:10.1111/j.1540-6261.2004.00679.x

Ambec, S., and Lanoie, P. (2008). Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 22 (4), 45–62. doi:10.5465/amp.2008.35590353

Awaysheh, A., Heron, R. A., Perry, T., and Wilson, J. I. (2020). On the relation between corporate social responsibility and financial performance. Strategic Manag. J. 41 (6), 965–987. doi:10.1002/smj.3122

Aydoğmuş, M., Gülay, G., and Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanb. Rev. 22, 119–127. doi:10.1016/j.bir.2022.11.006

Ayu, I., Oki, P., Dewi, Y., and Yasa, G. W. (2017). Pengaruh ukuran perusahaan, profitabilitas, tipe industri dan kinerja lingkungan terhadap environmental disclosure. E-Jurnal Akunt. 20 (3), 2362–2391.

Bansal, P., and Roth, K. (2000). Why companies go green: a model of ecological responsiveness. Acad. Manag. J. 43 (4), 717–736. doi:10.5465/1556363

Barnett, M. L., Hartmann, J., and Salomon, R. M. (2018). Have you been served? Extending the relationship between corporate social responsibility and lawsuits. Acad. Manag. Discov. 4, 109–126. doi:10.5465/amd.2015.0030

Barnett, M. L., and Salomon, R. M. (2012). Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Manag. J. 33 (11), 1304–1320. doi:10.1002/smj.1980

Bénabou, R., and Tirole, J. (2010). Individual and corporate social responsibility. Economica 77, 1–19. doi:10.1111/j.1468-0335.2009.00843.x

Buysse, K., and Verbeke, A. (2003). Proactive environmental strategies: a stakeholder management perspective. Strategic Manag. J. 24 (5), 453–470. doi:10.1002/smj.299

Cai, W. G., and Zhou, X. L. (2014). On the drivers of eco-innovation: empirical evidence from China. J. Clean. Prod. 79, 239–248. doi:10.1016/j.jclepro.2014.05.035

Chen, Y., Ren, Y. S., Narayan, S., and Huynh, N. Q. A. (2024). Does climate risk impact firms' ESG performance? Evidence from China. Econ. Analysis Policy 81, 683–695. doi:10.1016/j.eap.2023.12.028

Chen, Y. F., and Ma, Y. B. (2021). Will green investments improve a company's environmental performance? Empirical evidence from China's energy listed companies. Econ. theory Econ. Manag. 5, 68–84.

Christmann, P. (2004). Multinational companies and the natural environment: determinants of global environment policy standardization. Acad. Manag. J. 47 (5), 747–760. doi:10.2307/20159616

Chuang, S. P., and Huang, S. J. (2018). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: the mediation of green information technology capital. J. Bus. ethics 150, 991–1009. doi:10.1007/s10551-016-3167-x

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Account. Organ. Soc. 33 (4-5), 303–327. doi:10.1016/j.aos.2007.05.003

Cohen, M. A., Fenn, S. A., and Konar, S. (1997). Environmental and financial performance: are they related? WP. Vanderbilt Univ. 44.

Darnall, N., Jolley, G. J., and Handfield, R. (2008). Environmental management systems and green supply chain management: complements for sustainability? Bus. strategy Environ. 17 (1), 30–45. doi:10.1002/bse.557

Deng, X. M. (2020). Competition experience, multi-market contact, and corporate performance: based on the perspective of Red Queen competition. Manag. World 11, 111–131.

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence and implications. Acad. Manag. Rev. 20 (1), 65–91. doi:10.5465/amr.1995.9503271992

Dong, Z. H. Q., and Wang, H. (2021). Test the effectiveness of market-oriented environmental regulation policies: empirical evidence from the perspective of carbon emission trading policy. Stat. Res. 38 (10), 48–61.

Du, W. C., Gong, X. Y., and Zhang, P. D. (2019). Industry heterogeneity, executive compensation, and environmental performance: empirical evidence from Chinese private listed companies. Environ. Econ. Res. 4 (01), 39–55.

Dubey, R., Gunasekaran, A., and Ali, S. S. (2015). Exploring the relationship between leadership, operational practices, institutional pressures and environmental performance: a framework for green supply chain. Int. J. Prod. Econ. 160, 120–132. doi:10.1016/j.ijpe.2014.10.001

Erhemjamts, O., Huang, K., and Tehranian, H. (2024). Climate risk, ESG performance, and ESG sentiment in US commercial banks. Glob. Finance J. 59, 100924. doi:10.1016/j.gfj.2023.100924

Fang, L. J., Zhong, T. L., and Geng, S. H. Q. (2013). Construction and application of evaluation index system for corporate environmental performance. Statistics Decis. 21, 179–181.

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science 61 (11), 2549–2568. doi:10.1287/mnsc.2014.2038

Freund, S., Nguyen, N. H., and Phan, H. V. (2023). Shareholder litigation and corporate social responsibility. J. Financial Quantitative Analysis 58, 512–542. doi:10.1017/s002210902200031x

Friedman, M. (1970). The social responsibility of business is to increase its profits. N. Y. Times Mag., 32–33.

Frondel, M., Horbach, J., and Rennings, K. (2007). End-of-pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Bus. strategy Environ. 16 (8), 571–584. doi:10.1002/bse.496

Giannarakis, G., Zafeiriou, E., Arabatzis, G., and Partalidou, X. (2018). Determinants of corporate climate change disclosure for European firms. Corp. Soc. Responsib. Environ. Management 25 (3), 281–294. doi:10.1002/csr.1461

Handfield, R., Walton, S. V., Sroufe, R., and Melnyk, S. A. (2002). Applying environmental criteria to supplier assessment: a study in the application of the Analytical Hierarchy Process. Eur. J. operational Res. 141 (1), 70–87. doi:10.1016/s0377-2217(01)00261-2

Hao, Z. H. Z. H., Li, J., and Han, H. B. (2014). Measurement and empirical research on industrial environmental performance in China. Syst. Engineering 32 (7), 1–11.

Harahap, C. D., Juliana, I., and Lindayani, F. F. (2019). The impact of environmental performance and profitability on firm value. Indonesian Manag. Account. Res. 17 (1), 53–70. doi:10.25105/imar.v17i1.4665

Hart, S. L., and Dowell, G. (2011). Invited editorial: a natural-resource-based view of the firm: fifteen years after. J. Manag. 37 (5), 1464–1479. doi:10.1177/0149206310390219

Hillman, A. J., and Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: what’s the bottom line? Strategic Manag. J. 22 (2), 125–139. doi:10.1002/1097-0266(200101)22:2<125::aid-smj150>3.0.co;2-h

Hu, Q. Y. (2012). Research on the correlation between environmental performance and financial performance of listed companies. Chinese resources and environment 22 (6), 232–32.

Husted, B. W., Jamali, D., and Saffar, W. (2016). Near and dear? The role of location in CSR engagement. Strategic Manag. J. 37 (10), 2050–2070. doi:10.1002/smj.2437

Ilinitch, A. Y., Soderstrom, N. S., and Thomas, T. E. (1998). Measuring corporate environmental performance. Account. Public Policy 17, 383–408. doi:10.1016/S0278-4254(98)10012-1

Ingram, R. W., and Frazier, K. B. (1980). Environmental performance and corporate disclosure. J. Account. Res. 18, 614–622. doi:10.2307/2490597

Jacobs, B. W., Singhal, V. R., and Subramanian, R. (2010). An empirical investigation of environmental performance and the market value of the firm. J. Operations Manag. 28 (5), 430–441. doi:10.1016/j.jom.2010.01.001

Jose, A., and Lee, S. M. (2007). Environmental reporting of global corporations: a content analysis based on website disclosures. J. Bus. Ethics 72 (4), 307–321. doi:10.1007/s10551-006-9172-8

Kammerer, D. (2009). The effects of customer benefit and regulation on environmental product innovation: empirical evidence from appliance manufacturers in Germany. Ecol. Econ. 68 (8-9), 2285–2295. doi:10.1016/j.ecolecon.2009.02.016

Kaplan, S. N., and Zingales, L. (1997). Do investment cash flow sensitivities provide useful measures of financing constraints. Q. J. Econ. 112 (1), 169–215. doi:10.1162/003355397555163

Kassinis, G., and Vafeas, N. (2006). Stakeholder pressures and environmental performance. Acad. Manag. J. 49 (1), 145–159. doi:10.5465/amj.2006.20785799

Konar, S., and Cohen, M. A. (2001). Does the market value environmental performance? Rev. Econ. Statistics 83 (2), 281–289. doi:10.1162/00346530151143815

Lankoski, L. (2008). Corporate responsibility activities and economic performance: a theory of why and how they are connected. Bus. Strategy Environ. 17 (8), 536–547. doi:10.1002/bse.582

Li, D., Zhao, Y., Sun, Y., and Yin, D. (2017). Corporate environmental performance, environmental information disclosure, and financial performance: evidence from China. Hum. Ecol. risk Assess. 23 (2), 323–339. doi:10.1080/10807039.2016.1247256

Li, W., Zhang, X., Cheng, S., and Ren, X. (2024). Clear the air via dividends: corporates' response to air pollution. Bus. Strategy Environ. 33 (4), 3383–3396. doi:10.1002/bse.3646

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J. Finance 72, 1785–1824. doi:10.1111/jofi.12505

Liu, Y., Wang, J., Wen, F., and Wu, C. (2024). Corporate responses to systemic risk: talk and action. Pacific-Basin Finance J. 87, 102493. doi:10.1016/j.pacfin.2024.102493

Liu, Y., Xi, B., and Wang, G. G. (2020). The impact of corporate environmental responsibility on financial performance-based on Chinese listed companies. Environ. Sci. Pollut. Res. 28, 7840–7853. doi:10.1007/s11356-020-11069-4

Luo, L., Lan, Y. C., and Tang, Q. (2012). Corporate incentives to disclose carbon information: evidence from the CDP global 500 report. Int. Finance Manag. Account. 23 (2), 93–120. doi:10.1111/j.1467-646x.2012.01055.x

Ma, H., Ning, W., Wang, J., and Wang, S. (2024). The impact of environmental pollution liability insurance on firms’ green innovations: evidence from China. Appl. Econ. Lett., 1–5. doi:10.1080/13504851.2024.2331658

Mai, J. H., and Xu, F. (2015). Research on the influencing factors of green finance in China based on conjoint analysis. Macroecon. Res. 5, 27–37.

Margolis, J. D., Elfenbein, H. A., and Walsh, J. P. (2007). Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Ann. Arbor 1001, 48109–41234. doi:10.2139/ssrn.1866371

Marin, G. (2014). Do eco - innovation harm productivity growth through crowding out? Results of an extended cdm model for Italy. Res. Policy 43 (2), 301–307. doi:10.1016/j.respol.2013.10.015

Maxwell, J., Rothenberg, S., Briscoe, F., and Marcus, A. (1997). Green schemes: corporate environmental strategies and their implementation. Calif. Manag. Rev. 39 (3), 118–134. doi:10.2307/41165902

Melnyk, S. A., Sroufe, R. P., and Calantone, R. (2003). Assessing the impact of environmental management systems on corporate and environmental performance. J. Operations Manag. 21 (3), 329–351. doi:10.1016/s0272-6963(02)00109-2

Meng, X. H., Zeng, S. X., Shi, J. J., Qi, G. Y., and Zhang, Z. B. (2014). The relationship between corporate environmental performance and environmental disclosure: an empirical study in China. J. Environ. Manag. 145, 357–367. doi:10.1016/j.jenvman.2014.07.009

Miao, S., Tian, G. G., Wen, F., and Xiao, J. (2024a). The Independence of judges and corporate social responsibility. J. Bus. Ethics 193 (3), 633–653. doi:10.1007/s10551-023-05540-8

Miao, S., Zhu, Z., Deng, W. X., and Wen, F. (2024b). Law, politics, and trade credit in China. J. Corp. Finance 88, 102643. doi:10.1016/j.jcorpfin.2024.102643

Orlitzky, M., Schmidt, F. L., and Rynes, S. L. (2003). Corporate social and financial performance: a meta-analysis. Organ. Stud. 24 (3), 403–441. doi:10.1177/0170840603024003910

Palmer, K., Oates, W. E., and Portney, P. R. (1995). Tightening environmental standards: the benefit–cost or the no-cost paradigm? J. Econ. Perspect. 9 (4), 119–132. doi:10.1257/jep.9.4.119

Pan, Y., Zhang, C. C., Lee, C. C., and Lv, S. (2024). Environmental performance evaluation of electric enterprises during a power crisis: evidence from DEA methods and AI prediction algorithms. Energy Econ. 130, 107285. doi:10.1016/j.eneco.2023.107285

Porter, M., and Vanderlinde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qin, Y., and Wu, C. Y. (2004). Theoretical research and model construction of the relationship between enterprise environmental performance and economic performance. Syst. Eng. Theory Practice 8, 112–114.

Qiu, Y., Tang, Y., Ren, X., Moro, A., and Taghizadeh-Hesary, F. (2024). Corporate environmental responsibility’s influence on risk-taking in Chinese A-share listed companies. Rev. Account. Finance 23, 715–741. doi:10.1108/raf-03-2024-0096

Ramlawati, R., Junaid, A., Alattas, S. N., and Muslim, M. (2022). The effect of environmental performance on profitability with environmental disclosure as moderating. J. Akuntansi 26 (2), 306–323. doi:10.24912/ja.v26i2.933

Ren, X., Li, W., and Li, Y. (2024). Climate risk, digital transformation and corporate green innovation efficiency: evidence from China. Technol. Forecast. Soc. Change 209, 123777. doi:10.1016/j.techfore.2024.123777

Ren, X. H., Li, Y. Y., Shahbaz, M., Dong, K. Y., and Lu, Z. D. (2022). Climate risk and corporate environmental performance: empirical evidence from China. Sustain. Prod. Consum. 30, 467–477. doi:10.1016/j.spc.2021.12.023

Richardson, A., and Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 26 (7), 597–616. doi:10.1016/s0361-3682(01)00025-3

Sautner, Z., Lent, L. V., Vilkov, G., and Zhang, R. (2023). Pricing climate change exposure. Manag. Sci. 69, 7540–7561. doi:10.1287/mnsc.2023.4686

Sharma, S., and Vredenburg, H. (1998). Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strategic Manag. J. 19 (8), 729–753. doi:10.1002/(sici)1097-0266(199808)19:8<729::aid-smj967>3.0.co;2-4

Surroca, J., Tribo, J. A., and Waddock, S. (2010). Corporate responsibility and financial performance: the role of intangible resources. Strategic Manag. J. 31 (5), 463–490. doi:10.1002/smj.820

Tao, K. T., Guo, X. Y., and Sun, N. (2020). Corporate environmental performance, environmental information disclosure, and financial performance: evidence from China. Hum. Ecol. risk assessment 2, 108–119.

Ullman, A. A. (1985). Data in search of a theory: a critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms. Acad. Manag. Rev. 10 (3), 540–557. doi:10.5465/amr.1985.4278989

Vinayagamoorthi, V., Selvam, M., and Lingaraja, K. (2015). Impact of firms’ profitability on environmental performance: evidence from companies in India. Mediterr. J. Soc. Sci. 6 (1), 109–119. doi:10.5901/mjss.2015.v6n1p109

Wang, Q. J., Wang, H. J., and Chang, C. P. (2022). Environmental performance, green finance and green innovation: what's the long-run relationships among variables? Energy Econ. 110, 106004. doi:10.1016/j.eneco.2022.106004

Wang, Y. N., Xu, F., and Zheng, L. K. (2020). Can digital finance drive urban innovation. Secur. Mark. Her. 7, 9–19.

Wang, Z., Fu, H., Ren, X., and Gozgor, G. (2024). Exploring the carbon emission reduction effects of corporate climate risk disclosure: empirical evidence based on Chinese A-share listed enterprises. Int. Rev. Financial Analysis 92, 103072. doi:10.1016/j.irfa.2024.103072

Wang, Z. R., Fu, H. Q., and Ren, X. H. (2023a). The impact of political connections on firm pollution: new evidence based on heterogeneous environmental regulation. Petroleum Sci. 20 (1), 636–647. doi:10.1016/j.petsci.2022.10.019

Wang, Z. R., Fu, H. Q., and Ren, X. H. (2023b). Political connections and corporate carbon emission: new evidence from Chinese industrial firms. Technol. Forecast. Soc. Change 188, 122326. doi:10.1016/j.techfore.2023.122326

Wei, Z. H. H., Zeng, A. M., and Li, B. (2014). Financial ecological environment and corporate financing constraints: empirical evidence from Chinese listed companies. Account. Res. 5, 73–95.

Wong, C. W. Y., Miao, X., Cui, S., and Tang, Y. (2018). Impact of corporate environmental responsibility on operating income: moderating role of regional disparities in China. Bus. Ethics 149 (2), 363–382. doi:10.1007/s10551-016-3092-z

Wu, L. H., and Chen, Y. (2014). Evaluation of corporate environmental management performance from a whole process perspective. China Popul. Resour. Environ. 3, 46–50.

Xiao, G., and Shen, S. C. (2022). To pollute or not to pollute: political connections and corporate environmental performance. J. Corp. Finance 74, 102214. doi:10.1016/j.jcorpfin.2022.102214

Xie, J., Nozawa, W., Yagi, M., Fujii, H., and Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 28 (2), 286–300. doi:10.1002/bse.2224

Xie, X. M., and Zhu, Q. M. (2021). How can enterprise green innovation practice solve the “harmonious coexistence” problem? Manag. World 37 (1), 128–149.

Xu, F., Pan, Q., and Wang, Y. N. (2022). Study on the impact of green low-carbon transformation on corporate profitability under the goal of dual carbon. J. Macroecon. Res. 1, 161–175.

Xu, J., and Cui, J. B. (2020). Low-carbon cities and green technology innovation of enterprises. China Ind. Econ. 12, 178–196.

Xue, F., Chen, Q., Chan, K. C., and Yi, Z. (2022). Is corporate social responsibility value relevant? Evidence from a quasi-natural experiment of anti-corruption campaign. J. Bus. Res. 140, 520–532. doi:10.1016/j.jbusres.2021.11.020

Zhan, Y. H., Lin, B. Q., and Sun, Ch W. (2023). How does pollution heterogeneity affect the role of cleaner production regulations? Evidence from Chinese enterprises' domestic value-added in exports. Energy Econ. 122, 106681. doi:10.1016/j.eneco.2023.106681

Zhang, Q., Yu, Z., and Kong, D. (2019). The real effect of legal institutions: environmental courts and firm environmental protection expenditure. J. Environ. Econ. Manag. 98, 102254. doi:10.1016/j.jeem.2019.102254

Zou, H. L., Zeng, R. C., Zeng, S. X., and Shi, J. J. (2015). How do environmental violation events harm corporate reputation? Bus. Strategy Environment24 24 (8), 836–854. doi:10.1002/bse.1849

Keywords: environmental performance, profitability, green technology innovation, financing constraints, text analysis

Citation: Hu J and Zhao Y (2024) Improving corporate profitability from the inside out with environmental performance: an empirical analysis based on Chinese listed company data. Front. Environ. Sci. 12:1489896. doi: 10.3389/fenvs.2024.1489896

Received: 02 September 2024; Accepted: 31 October 2024;

Published: 15 November 2024.

Edited by:

Wu Chen, University of Southern Denmark, DenmarkCopyright © 2024 Hu and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanyun Zhao, Y2FzLWtyaXVAcnVjLmVkdS5jbg==

Jing Hu

Jing Hu Yanyun Zhao*

Yanyun Zhao*