95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 05 November 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1486855

This article is part of the Research Topic Climate Risk and Green and Low-Carbon Transformation: Economic Impact and Policy Response View all 18 articles

The low-carbon city pilot policy (LCCPP) is an important part of achieving “dual carbon” goals and promoting green technology innovation (GTI) in Chinese export enterprises. This study integrates Green Technical Barriers to Trade (GTBTs), LCCPP, and the GTI of exporting enterprises into a unified framework based on data from A-share market Chinese non-financial export enterprises from 2007 to 2021 and discusses how export enterprises should optimize green innovation resource structure with support from LCCPP to facilitate enterprise GTI when facing GTBTs. Several findings are uncovered: (1) GTBTs have a significant negative impact on the GTI of Chinese export enterprises, and the LCCPP significantly mitigates the negative impact of GTBTs on export enterprises’ GTI. (2) After distinguishing the heterogeneous characteristics of export enterprises, the moderating effect of the LCCPP becomes even more pronounced in non-state-owned enterprises, general trade enterprises, and enterprises whose export destinations are high-income countries. (3) Further exploration of the moderating effect of the LCCPP with different policy instruments and intensities is needed. We found the best moderating effect on export enterprises’ GTI under high policy intensity, and only market-based policy instruments had a significant moderating effect. These findings provide direction for policymakers expanding the pilot scope of low-carbon cities as well as theoretical support for realizing foreign trade growth for sustainable development.

With the rise in emissions from agricultural, livestock, and industrial sectors (Elahi et al., 2024; Buntaine et al., 2024; Abbas et al., 2023; Yu et al., 2022; Kang and Silveira, 2021), the global climate continues to warm, and severe weather events such as floods and droughts are occurring frequently, severely impacting human survival and sustainable economic development. To protect their ecological environment and public health, some countries have adopted Green Technical Barriers to Trade (GTBTs) within international trade, these are trade measures, regulations, and standards, that restrict or prohibit the import of highly polluting products (Liu et al., 2020). However, as international trade gradually expands and governments become more involved in trade, GTBTs have become the most frequently used non-tariff barrier for creating trade friction in the international market (Liu et al., 2023). Unlike most non-tariff barriers, GTBTs have four main characteristics: rationality, crypticity, targeting, and effectiveness (Crowley et al., 2018). Therefore, some countries that promote trade protectionism in the name of environmental protection have set strict environmental standards to boycott imports of goods from other countries (Peng et al., 2024). According to the WTO’s annual Technical Barriers to Trade reports, there were 556 environment-related technical barriers to trade (TBT) notifications in 2021, accounting for approximately 1/4 of all TBT notifications. GTBTs’ role as sanction tools in international trade negatively impacts developing countries’ trade exports which cannot be ignored (Zhou et al., 2023).

As China continues its high-level opening-up to the outside world, green technological innovation (GTI) has become a new advantage to cultivate international economic cooperation and competition (Du et al., 2021). In recent years, China’s foreign trade has faced unpredictable uncertainties owing to trade protectionism, the coronavirus disease 2019 (COVID-19) pandemic, global climate action, and supply chain restructuring (Wible, 2021). Weakening international demand and increasing pressure to maintain stable growth in imports and exports have significantly weakened the positive impact on sustainable economic development (Yan et al., 2024). The impact of non-tariff barriers on China’s export trade has received widespread attention from academia. However, the existing literature mainly focuses on the effect of anti-dumping and countervailing on changes in export scale (Crowley et al., 2018), export product quality (Zhang, 2022), and supply chain efficiency (Grossman et al., 2024), among others, and insufficient attention has been paid regarding how GTBTs affect the GTI of export enterprises. Given China’s massive export volume and significant global market share, it is vulnerable to restrictions on GTBTs in international trade with Chinese enterprises lagging behind developed nations in green production and environmental protection practices (Chandra, 2016). Accordingly, GTBTs have become an important academic topic for researchers in the field of non-tariff barriers to trade and sustainable development.

Furthermore, to ensure the coordinated achievement of pollution prevention and high-quality economic development, the Chinese government proposed the low-carbon city pilot policy (LCCPP). Since it began in 2012, the scope of the pilot has continuously expanded; it now includes six provinces, 80 cities, and one region (Shi et al., 2024). The LCCPP represents a significant strategic measure by China to actively pursue green, sustainable, and innovative development. Low-carbon cities have strengthened clean production standards, energy-saving low-carbon technology standards, and carbon footprint evaluation standards, promoting the alignment of domestic environmental standards with international environmental standards (Emerick et al., 2016). Low-carbon cities also explicitly encourage enterprises to increase investment in green technology research and development (R&D), provide a favorable policy environment and innovative resources to support enterprises in conducting high-quality, high-tech, and high-value-added GTI, and promote the effect of pollution reduction and carbon reduction through green low-carbon technology R&D, thereby contributing to the achievement of the “dual carbon” goals (Zhou et al., 2022). Meanwhile, to avoid imposing carbon tariffs due to GTBTs from developing countries, export enterprises need to follow the global low-carbon development trend, stay close to the forefront of international green technology, and continuously achieve the GTI to adapt to the global low-carbon technology revolution and low-carbon industry transformation (Li et al., 2022). This ultimately ensures that the products or services produced by the enterprise meet the environmental requirements of international consumers and further promotes the sustainable development of export enterprises.

This study explores the impact of the LCCPP on the GTI of export enterprises with the effect of GTBTs. Scholars have studied the relationship between GTBTs and enterprise innovation but have not reached a consensus. First, GTBTs negatively impact enterprises’ innovation activities. Some studies have suggested that carbon tariffs increase trade costs and reduce enterprises’ expected earnings. Enterprises tend to reduce innovation investments to avoid the risks posed by trade risks (Chandra and Long, 2013). GTBTs also improve international market access conditions and limit opportunities for enterprises to access overseas markets and resources. Mayer et al. (2014) found that GTBTs cause market competition, price stimulation, and income inhibition effects, which negatively impact enterprise innovation. However, the theory of optimal allocation of resources and the resource-based theory suggest that GTBTs have positive effects on enterprise innovation. Pan et al. (2022) found that, in the face of trade barriers and external challenges, some enterprises with low production efficiency have retreated from international markets (Pan et al., 2022). Export enterprises that continue to operate in the original market increase their investment in R&D, which improves their total factor productivity and innovation capabilities to bear risks and occupy market vacancies. The GTBTs may also induce transnational capital flows and trade transfers (Liu et al., 2023). Export enterprises meet the demands of new markets by developing new products and improving market competitiveness, which reflect the process of enterprises seeking independent innovation and development to cope with GTBTs.

Little research has been conducted on the relationship between the LCCPP and GTI of export enterprise, and there are three common views in the academic community: promoting, inhibiting, and uncertainty theories. Some studies suggest that export enterprises continuously engage in technological and product innovation through scale and scope economy, competition, and learning effects to adapt to foreign environmental standards and consumer preferences while participating in international market competition. Chen et al. (2021) used the green patent data of listed companies and found that the constraints of the LCCPP improved the GTI willingness of export enterprises and promoted the GTI behavior of high-carbon industries through government support, public participation, and financing constraints (Chen et al., 2021). Du et al. (2021) studied the impact of GTI willingness from the perspective of environmental regulation, finding that strict environmental regulations stimulate enterprises’ enthusiasm for green innovation and that market-based environmental regulations more significantly impact green innovation willingness (Du et al., 2021). In addition, Chen et al. (2022) not only explored the role of the LCCPP in promoting green innovation in cities, but they also analyzed their spatial spillover effects. The results indicate that the LCCPP can accelerate the green innovation process in both local and surrounding cities and achieve better spatial spillover effects in high-level, large, and eastern cities (Chen et al., 2022). Different from the above conclusions of scholars, Tian et al. (2021) found that the LCCPP not only failed to positively influence the green innovation of export enterprises but also reduced the GTI level of the city where the enterprises were located (Tian et al., 2021). Peng et al. (2024) studied the “pollution haven hypothesis” and environmental regulation in China and pointed out that pollution-intensive industries can avoid environmental regulations by changing their location without improving their own green technologies (Peng et al., 2024). Qiu et al. (2021) have explored the effects of the command-and-control type of the LCCPP, and found that there have insufficient incentives to promote the development of green technologies (Qiu et al., 2021).

The previous studies have clear shortcomings. First, most studies regard the GTI as an intermediary variable to explore the impact on the export quantity, export quality, or export performance of enterprises through innovation channels, and do not consider the effect of the LCCPP on the GTI of export enterprises. Second, in the face of frequent trade friction and the development trend of global low-carbon trade, the innovation effect of GTBTs has not focused on export enterprises. Export enterprises are vulnerable to the effects of international environmental regulations and economic policy uncertainty. Based on existing research, this study focuses on China’s A-share listed export enterprises between 2007 and 2021, using the difference-in-differences (DID) approach to empirically explore the effects of GTBTs on China’s export enterprises’ GTI. Then, the LCCPP is taken as quasi-natural experiments to analyze whether the LCCPP can help export enterprises cope with the impact of the GTBT. The possible contributions of this study are as follows. First, based on trade cost theory, the framework incorporates enterprise GTI decisions, trade breadth, and government policy support, thereby expanding the micro-theoretical framework for how GTBTs and the LCCPP influence export enterprises’ GTI. Second, beyond the negative effects of GTBTs, this study explores government support for export enterprises’ GTI through the LCCPP and the moderating effect of lthe LCCPP with different policy instruments and intensities. This research provides a detailed demonstration for export enterprises to optimize innovation resource structures, increasing the high-tech, high-value-added green products to breaking through the GTBTs, thus promoting the GTI to the greatest extent with government support, increasing the breadth and depth of international market participation, and facilitating national low-carbon development and green transformation.

To maintain sustainable development and balance the relationship between trade and environmental protection, environmental protection clauses are increasingly being incorporated into agreements concerning the import and export of trade products, mandating strict environmental certification for imported products. Importing countries have established a range of technical standards and regulatory frameworks to limit or ban the import of foreign products, emphasizing the need to safeguard the ecological environment, natural resources, and human health. By increasing trade costs through tax collection, GTBTs have intensified financing constraints, which have a “destructive effect” on existing enterprises in the export market and a “fear effect” on new entrants (Chandra, 2016), this situation ultimately leads to a decline in the competitiveness of export products, a loss of competitive advantage in target markets, and may cause enterprises exit the international market or change the trade flow (Song et al., 2020).

Specifically, (1) GTBTs lead to loss of market access rights and even punishment for shutdown if export enterprises fail to meet the standards in the short term (Crowley et al., 2018). The existence of a “green technology threshold” suggests that export enterprises are unable to surpass GTBTs and choose to delayed export with lower productivity, a single product structure, and limited risk resilience. This behavior not only worsens the cash flow situation of enterprises, but also limits domestic companies’ access to cutting-edge GTI and participation in international technology cooperation. Consequently, it fails to grasp the update direction of GTI and the goal of export enterprises’ green technology R&D and innovation in time (Pan et al., 2022). (2) Export enterprises can circumvent GTBTs by trade diversion, enterprises do not need to modify or innovate their own technology. When enterprises encounter GTBTs set up by a certain country, in addition to actively adapting to maintain market access rights in that country, they can also change their export decisions, transfer exports to other countries without GTBTs, thereby diminishing their motivation to engage in GTI (Chen et al., 2021). (3) For enterprises aiming to meet cleaner production standards, the development of green production and pollution control technologies requires significant investment in research personnel and long-term financial support, and the advancement of GTI research and development cannot yield substantial returns in the short term. Furthermore, the purchase of new pollution control equipment, advanced green production facilities, and the import of green intermediates increase production costs, raising export prices to cover trade and green technology transformation costs leads to decreased product demand and reduced earnings (Shi et al., 2024). Consequently, this situation dampens the enthusiasm and initiative of enterprises to implement green technology R&D activities. (4) In response to negative signals from enterprises facing GTBTs, financial institutions are reluctant to bear trade risks and reduce credit availability, resulting in intensifying financing constraints (Liu and Ma, 2020). Under the pressure of cost fluctuations and uncertainty, increasing R&D investment to enhance a firm’s long-term innovative capabilities is considered a high-risk and low-return behaviors. Changes in cash flow and financing structure will lead export enterprises to increase cash flow holdings and reduce investment in green technology R&D to face the special risks.

Hypothesis 1. GTBTs negatively impact the GTI of Chinese export enterprises.

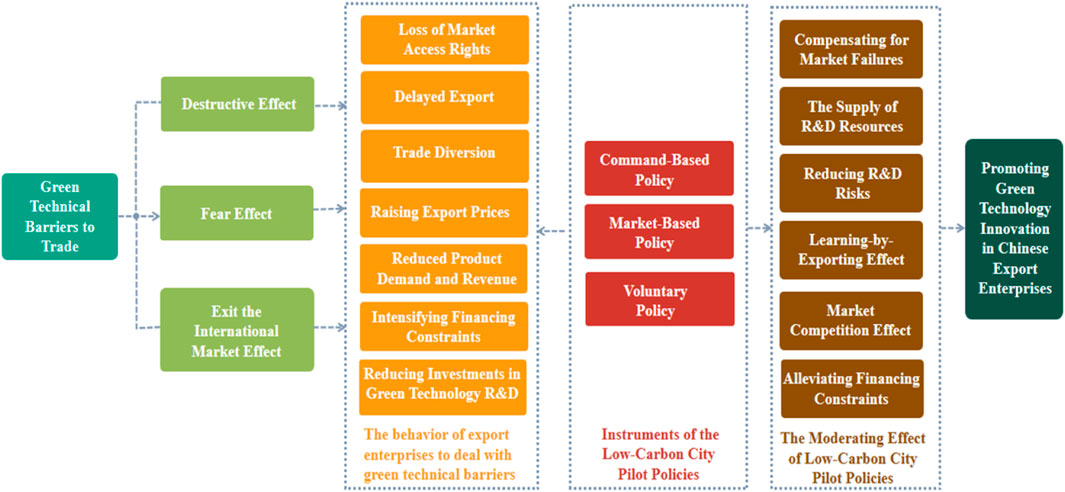

GTI activities are characterized by high risk, substantial investment, continuous processes, and uncertain outcomes. The government developed policy packages for low-carbon pilot cities to foster regional low-carbon development, including financial subsidies, talent policies, and tax relief. The GTI impacts of the LCCPP in coping with GTBTs for export enterprises are primarily reflected in the following: (1) From the perspective of R&D investment, under the guidance of the LCCPP, innovation resources disrupt the original distribution pattern, improve the supply of regional R&D resources, and accelerate knowledge and technology spillover effects (Chen and Wang, 2022). Enterprises obtain high-level human capital and R&D funds through the government to compensate for market failure and underinvestment in R&D activities and help enterprises realize the GTI by reducing R&D risks (Peng et al., 2021). (2) From the perspective of the learning-by-exporting effect, enterprises conduct a series of innovative activities, including understanding the environmental standards of developed countries, improving the added value of green products, introducing green intermediate products, and improving green production processes by contacting foreign competitive products, competitors, and suppliers (Hong et al., 2021). According to the demonstration, collaboration, and export learning effects, export enterprises acquire knowledge about green product characteristics, green technology, cleaner production processes, and cleaner management through information exchange, resource sharing, knowledge absorption, transnational cooperation, technology application, and achievement promotion, which is conducive to enterprises’ realization of the GTI (Du et al., 2021). (3) From the perspective of the market competitive effect and resource allocation among enterprises, the constraints of LCCPP may lead to the exit of high-energy-consumption and high-emission export enterprises from the market. At this point, low carbon export enterprises will likely increase investment in GTI through the “winner effect” and further occupy the capital, labor and technological resources released by the exiting enterprises. (4) From the perspective of alleviating financing constraints for enterprises, pilot cities will also implement green financial policies which effectively make up for the gap in green innovation funds for export enterprises (Liu and Ma, 2020). Enterprises receive support and convey to the outside world that they have more environmentally friendly products, which helps improve their business credit, allowing them to obtain required R&D funds from different channels and break through the GTBTs. Accordingly, the LCCPP help export enterprises realize the leap over of GTBTs through GTI (Figure 1).

Figure 1. Mechanism diagram of the effect of GTBTs and the LCCPP on GTI of Chinese Export Enterprises.

Hypothesis 2. The LCCPP can alleviate the negative impact of GTBTs on the GTI of Chinese export enterprises.

Based on the methods of Liu and Ma (2020), this study builds Model (1) to examine the impact of GTBTs on the GTI of Chinese export enterprises (Liu and Ma, 2020).

Furthermore, this study examined the impact of GTBTs and the LCCPP on the GTI of export enterprises. As the pilot work progressed, the National Development and Reform Commission issued pilot lists for low-carbon provinces and cities in 2012, selecting 92 cities included in the pilot scope as the experimental group, and the remaining cities as the control group. By constructing a multi-period DID model to evaluate the policy effect, exploring the response effect of the LCCPP on GTBTs and the effect of GTI, a model including interaction terms was constructed as follows:

Where

Green technical barriers to trade (

Both the number of patent applications and authorizations serve as innovation output to measure GTI. Given the delayed nature of innovation, this paper chooses the green patent applications (

The LCCPP is represented as a moderating variable with a dummy variable

Drawing on the methods of Qiu et al. (2021) and Liu and Gao (2024), this study controls the variables such as enterprise age (age), enterprise size (siz), return on assets (roa), asset liability ratio (alr), tobin’s Q (TQ), urban per capita GDP (GDP), proportion of urban foreign direct investment (FDI) (Qiu et al., 2021; Liu and Gao, 2024).

The main data sources include macro and micro data from the WTO Environmental Database, CNRDS, and CSMAR. This study uses Chinese A-share listed companies in Shanghai and Shenzhen from 2007 to 2021 as the research object to explore the impact of the GTBTs on the GTI of Chinese export enterprises. Considering the availability and validity of the data, the samples were screened and processed as follows. First, the data on GTBTs come from the WTO Environmental Database, which collects all the environment-related TBT notifications submitted by members to the WTO annually, including industry codes, countries submitting TBT notifications, HS6-digit codes, scope and targets of TBT application, and notification time. Second, using data from CSMAR, we sifted through the “sub-items” of “operating income” within the “profit and loss items” of each enterprise. We used the presence of the terms “foreign,” “foreign trade,” and “export” in any field to determine whether there was export behavior among A-share listed companies in Shanghai and Shenzhen from 2007 to 2021. We matched the HS6-digit codes and industry classification codes involved in the GTBTs from the WTO environmental database with the 2012 industry classification codes of the China Securities Regulatory Commission to obtain the industries of listed export enterprises affected by the GTBTs. Finally, financial listed companies, ST, ST*, PT enterprises, and enterprises with missing data related to the main research variables were excluded.

The data for measuring Chinese export enterprises’ GTI were obtained from the China Research Data Service Platform (CNRDS). Referring to Pan et al. (2022), this study identified the green patent data of listed export enterprises based on the “International Patent Classification Green List” launched by the World Intellectual Property Organization in 2010, combined with the International Patent Classification number, to obtain the annual green patent application and authorization number of enterprises, including green invention patents and green utility model patents (Pan et al., 2022). The quality of authorized green patents is higher than their quantity. The urban characteristic data and environmental indicators in this article are sourced from the “China Urban Statistical Yearbook.” All continuous variables were Winsorized at the 5% level to avoid the impact of outliers. Table 1 shows the definitions of all variables, and Table 2 presents the specific descriptive statistical results.

The regression results for the GTBTs and GTI of Chinese export enterprises are reported in Table 3, controlling for the fixed effects at the enterprise level, fixed effects at the industry level, and fixed effects at the region year of the enterprise. Columns (1) and (2) show the results without control variables, and columns (3) and (4) show the results after adding control variables. Considering both green patent applications and authorizations, the results show that the coefficient of GTBTs is negative and significant at the 1% level, regardless of whether the control variable is added, indicating that Chinese export enterprises experience a decline in both the number of green technology patent applications and authorizations when confronted with GTBTs. This indicates that the GTBTs negatively impact the GTI of Chinese export enterprises, thus verifying Hypothesis 1.

Table 4 shows the impact of the GTBTs on the GTI of Chinese export enterprises from the perspective of the moderating effect of the LCCPP. Columns (1) and (2) show the regression results, with the number of green technology patent applications and authorizations of enterprises in year t+1 as the explanatory variables. The impact coefficient of GTBTs on enterprises’ GTI is significantly negative, so when export enterprises suffer from GTBTs, the number of green technology patent applications and authorizations show a significant downward trend, which is consistent with Hypothesis 1. However, the interaction coefficient

GTBTs and the LCCPP have heterogeneous GTI effects on enterprises exporting to different destinations. The World Bank categorizes countries into various income groups based on their GNI per capita, typically low-, middle-, and high-income countries (Liu et al., 2020). Columns (1) and (2) of Table 5 present the regression results for export destinations as high-income countries, Columns (3) and (4) display the results for middle-income countries, while Columns (5) and (6) show the results for low-income countries. When Chinese export enterprises encounter GTBTs, the estimated coefficients for

Table 6 reports the impact of GTBTs on GTI of Chinese export enterprises adopting different trade modes, and the moderating effect of the LCCPP on export enterprises’ GTI will have a different result due to different trade modes. The results indicate that the regression coefficients for the green patent applications and authorization of export enterprises using the general trade mode are significantly negative. However, heterogeneity is observed in export enterprises engaged in processing trade, with the coefficients becoming insignificant. From the perspective of the moderating effect of the LCCPP, compared with processing trade, the LCCPP play a positive role in resisting the negative impact of GTBTs on GTI, this is even more pronounced in general trade enterprises, as Columns (1) and (2) in Table 6 show. This may occur because processing and trade enterprises largely rely on international orders, which typically outline specific product specifications and production requirements. This situation can reduce their innovation drive, especially when customers are more sensitive to product costs than GTI (Li et al., 2022). Enterprises that are mainly responsible for processing and assembly are often at the lower end of the global value chain, while high value-added activities, such as GTI, are usually controlled by the ordering party or upstream enterprises. When facing GTBTs, these enterprises focus more on avoiding risks rather than engaging in GTI. Conversely, enterprises in general trade mode tend to seize opportunities when facing GTBTs, continuously improving their product competitiveness and added value through GTI (Chandra and Long, 2013). As China’s export enterprises’ position in the global value chain has gradually improved, the development of general trade enterprises has a strong dependence on resource allocation in GTI. The LCCPP attracts foreign investment, induces talent aggregation, and promotes green finance to encourage enterprises to GTI in response to GTBTs. Therefore, compared to processing trade enterprises, general trade enterprises have a high sensitivity to the LCCPP and have a greater promotion of GTI when facing GTBTs.

Considering the reality of China’s political system (Yan et al., 2024), the impact of GTBTs on export enterprises’ GTI will have a selective effect owing to different property rights. We divided enterprises into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). Columns (5)–(8) of Table 6 show that the GTBTs coefficients of SOEs and non-SOEs are each negative when the explained variable is the number of green technology patent applications and authorizations, but the GTBTs coefficients of non-SOEs are larger and significant, which proves that, compared with SOEs, GTBTs have a more negative impact on the GTI of non-SOEs. The reasons are as follows: first, SOEs have a long-term innovation strategy, so they can obtain a large amount of low-cost financing from banks and rapidly increase their investment in green technology R&D (Peng et al., 2021). Second, SOEs have a significant market share in various important fields of China’s economy, and their profits are derived from domestic monopolies. Quitting the international market has little impact on expected revenue, leading to insufficient GTI willingness (Liu and Gao, 2024). Therefore, GTBTs will not significantly inhibit the GTI of SOEs. From the perspective of the moderating effect of the LCCPP in Columns (7) and (8) of Table 6, the LCCPP can help non-SOEs effectively resist the negative impact of GTBTs on the GTI compared to SOEs. China’s non-SOEs find it more difficult to obtain government resources when they encounter GTBTs. Non-SOEs face stronger pressure from GTBTs and also have a greater degree of survival crisis, therefore, GTI is an important way for non-SOEs to seize market opportunities, resolve the negative impact of GTBTs, and improve enterprise competitiveness. However, the moderating effect of the LCCPP on the GTI of SOEs is not significant. SOEs also benefit from other types of government policy support, resulting in the LCCPP having no significant impact on GTI of SOEs.

Before the implementation of the LCCPP, whether in the experimental or control group, the GTI of export enterprises impacted by GTBTs should have the same trend. It should be pointed out that 1 year before the implementation of pilot policies is taken as the default comparison group here. Referring to the research method of Peng et al. (2021), the advantage of empirical testing of model (3) is that it can not only test whether the changes in GTI of export enterprises in the experimental group and control group meet the linear homo-trend hypothesis before the policy impact, but also explore the dynamic impact of pilot policies on GTI of export enterprises affected by GTBTs (Peng et al., 2021), the following dynamic effect test formula was constructed:

Specifically, the variable

We employed a year-by-year matching approach to mitigate the effects of sample selection bias, data discrepancies, and other confounding variables (Liu et al., 2020). This allowed us to distinguish export enterprises affected by GTBTs into pilot and non-pilot regions for the propensity score matching difference-in-differences (PSM-DID) test (Chen et al., 2021). We calculated the average covariate values for each period in the control group, yielding cross-sectional data comprising these average values. These cross-sectional data were then used to perform PSM matching with the experimental group and to identify enterprises in the control group. Taking age, siz, exp, ROA, HHI, and SA as covariates, the propensity matching score was calculated, and the 1:1 no return matching was performed (Qiu et al., 2021; Liu and Gao, 2024). A regression test was then performed on Model (2). The PSM-DID test results are listed in Column (1)–(2) of Table 8. After PSM control, the impact of GTBTs negatively impacts the GTI of export enterprises in both pilot cities and non-pilot cities. Meanwhile, the interaction coefficient is significantly positive, indicating that the LCCPP has alleviated this negative impact, and the PSM-DID test results are consistent with the benchmark regression results.

Following the approach of Brucal et al. (2019), this article uses the inverse probability weighted matching (IPW) method to solve the endogenous problem caused by self-selection effects and identify the causal effect of the implementation of LCCPP on the GTI of export enterprises under the impact of GTBTs (Brucal et al., 2019). Firstly, for the industries, provinces, and years of the experimental group and control group, a Probit model was used to estimate the propensity score, and the propensity score was used as a weight for IPW matching. Then, A regression test was then performed on Model (2), and the PSM-DID test results are listed in Column (3)–(4) of Table 8. The results based on IPW-DID indicate that even if other methods are used for sample matching, the regression results remain robust.

Column (5) and (6) of Table 8 report the results of a placebo test, which was conducted by using sample of 2011 and 2010 in the regression before the occurrence of the LCCPP in 2012 to test whether the GTI of export enterprises difference between LCCPP and non-LCCPP also changes significantly. The results show that the estimated coefficient of

In Table 8, we use the number of green patent applications independently and green patent applications in cooperation as independent variables to measure the GTI. Column (7) uses the logarithm of the number of green patent applications independently plus 1 as the green patent application variable to re-estimate the model (Chen et al., 2021). Column (8) uses the logarithm of the number of green patent applications in cooperation plus 1 as the green patent authorization variable to re-estimate the model (Chandra, 2016). Independent green patents show that the knowledge and technology required for patents are relatively simple, or that the technology is easy to master and absorb. Cooperative green patents refer to patent applicants that include two or more enterprises, indicating that the knowledge and technology required for patents are complex, which is difficult for a single enterprise to complete and requires team cooperation to succeed in R&D. The above data were obtained from the CNRDS. The results show that the coefficient of is still significantly positive, indicating that, after the GTBTs, the LCCPP will help export enterprises effectively resist the negative impact of the GTBTs on the GTI. This also verifies the robustness of the results of this study.

To consider the intensity of GTBTs encountered by the industry, this study refers to Chen’s method and uses the number of environment-related TBT notifications encountered by the industry multiplied by the industry’s export dependence (the proportion of the industry’s export volume to its total industrial output value) as another measure of GTBTs (Chen H. et al., 2021). The results are presented in Columns (9)–(10) of Table 8. The coefficient signs and significance results of the explanatory variables are consistent with previous empirical research conclusions.

If a few export enterprises in low-carbon cities enjoy substantial government support, this could create a crowding-out effect for those without such support, resulting in a misallocation of GTI resources and subsequently hindering the enhancement of export enterprises’ GTI capabilities. How can the intensity of a low-carbon city be quantified? First, we quantified the number of the LCCPP documents issued by governments between 2010 and 2021, with each city serving as a single unit. A higher number indicates a local government’s dynamic adjustment of green innovation goals and implementation of a precise policy supply, reflecting greater urban policy intensity. Consequently, the low-intensity group comprised cities with one to three policies, the medium-intensity group, four to six policies, the high-intensity group, seven or more policies, and the control group, with no policies. The generalized propensity score was estimated using a multinomial logit, yielding four propensity scores for cities categorized by intensity levels: 0, low, medium, and high. Subsequently, the reciprocal of each propensity score was calculated to generate the sampling weights (Guo and Fraser, 2015). e (Xa,b) = pr (B = b |X = x) is the generalized tendency value of sample a under the influence of policy strength b, X represents the observed covariate, and 1/e (Xa,b) denotes the sampling weight of sample a under the influence of policy strength b. Regression analysis is employed to assess the impact of policy strength. Based on the cities categorized by intensity levels, the regression of Equation 2 was carried out in groups, and the results are shown in Table 9.

When policy intensity is low, the interaction coefficient

The implementation of the LCCPP encompasses various policy instruments that may differently influence the moderating effect of GTBTs on export enterprises’ GTIs. Referring to the classification of Du et al. (2021), this study divides policy instruments into three categories (Du et al., 2021). First, command-based policy instruments mainly restrict enterprise emissions by formulating strict emission reduction targets and green technical standards, which will significantly achieve cleaner production standards through the transformation of production equipment, but also increase the cost of pollution control for enterprises, forcing enterprises to choose the path of technological transformation to achieve green transformation. Market-based policy instruments comprise a range of incentive policies, including carbon trading mechanisms, clean development mechanisms, subsidies for green innovation, incentives for talent, green finance and funds, and tax preferences. These policies guide enterprises to conduct green technology R&D in accordance with the latest technical regulations and standards, reduce R&D risks, and precisely incentivize enterprises to achieve green transformation using market-oriented approaches, such as pricing, subsidies, and taxation. Third, voluntary policy instruments like implementing the LCCPP, including the construction of a low-carbon transportation system and preparing for low-carbon industrial parks, will encourage enterprises’ spontaneous environmental protection behavior through publicity.

The performance of the GTI by export enterprises in response to the GTBTs, with the moderating effect of the three types of the LCCPP instruments, is presented in Table 10. The results show that only market-based policy instruments have a significant moderating effect and that the interaction coefficient

While trade protectionism measures and GTBTs have brought many negative impacts in the new era, the LCCPP is an important choice to achieve the “dual carbon” goal and to promote green innovation in Chinese export enterprises. This study integrates GTBTs, the LCCPP, and the GTI of exporting enterprises into a unified framework based on data from Chinese non-financial export enterprises listed in the A-share market from 2007 to 2021 and discusses how export enterprises should optimize the green innovation resource structure with the support of the LCCPP to facilitate enterprise green innovation when facing GTBTs. The main conclusions are as follows: (1) GTBTs have a significant negative impact on the GTI of Chinese export enterprises, and the LCCPP significantly mitigates the negative impact of GTBTs on the GTI of export enterprises. (2) After distinguishing the heterogeneity characteristics of export enterprises, the moderating effect of the LCCPP was even more pronounced in non-SOEs, general trade enterprises, and enterprises whose export destinations were high-income countries. (3) Further exploration of the moderating effects of different the LCCPP instruments and policy intensity on the impact of GTBTs on the GTI of export enterprises is required. After distinguishing the intensity of the LCCPP, we found that the LCCPP had the best moderating effect on export enterprise GTI under high policy intensity. After distinguishing between the pilot policy instruments for low-carbon cities, we found that only market-based policy instruments had a significant moderating effect.

Based on the above conclusions, this study puts forward the following suggestions: (1) Faced with the impact of GTBTs, governments should establish a GTBT warning mechanism and accelerate trade liberalization. By international cooperation, we will attract top talents to China and encourage export enterprises to break through the cutting-edge GTI (Sampson, 2023). According to the moderating effect of LCCPP on GTI, policymakers should take LCCPP support as the starting point to compensate for the cost increase and market failure caused by GTBTs, and help export enterprises obtain innovative resources to cope with the negative impact of GTBTs. (2) The findings of heterogeneity analysis carry important policy implications. Scientific, precise and targeted policies should be implemented by fully consider the heterogeneity of enterprises, actively encourage and guide various social entities to engage in GTI, and maximize the beneficial impact of LCCPP on GTI, such as policy support should be provided to non-SOEs, general trade enterprises, and enterprises with high-income export destinations (Song et al., 2020). (3) There were significant differences in the effectiveness of the different policy instruments. Specifically, local governments should promote coordination and cooperation between different types of policy instruments and establish a diversified LCCPP framework. At present, market-based policy instruments are the main approach, with command-based policy instruments as a supplement, to maximizing the synergistic effect of market incentives, moral constraints, and government supervision to establish a long-term sustainable development concept among enterprises. Give full play to the social supervision role of consumer associations, environmental organizations, trade unions, and online media to supervise the behavior of export enterprises, and gradually promote voluntary policy instruments. (4) From the perspective of different policy intensities, policymakers should continue to further expand the scope and support of LCCPP to effectively enhance the green innovation capabilities of export enterprises. At the same time, the pilot city governments should summarize the implementation experience of LCCPP and form demonstration effects in order to quickly form a higher-level and broader low-carbon city construction model, and advancing the “dual carbon” goal (Liu et al., 2020).

This study is an important first step in establishing a unified framework that integrates GTBTs, LCCPP, and GTI of export enterprises, and discusses how export enterprises should optimize green innovation resource structure with support from LCCPP to facilitate enterprise GTI when facing GTBTs. But there are still some limitations. Firstly, the article does not empirical test the specific mechanisms through which the LCCPP supports GTI, answers this question is central to a full understanding of the LCCPP impact on GTI of exporting enterprises. Secondly, considering the availability of data, the empirical research only utilizes data from 2007 to 2021. Although the time span is long, the timeliness is not enough to observe the recent development. Furthermore, there is a significant loss in sample size after data matching, making it difficult to conduct more detailed research on the heterogeneity innovation effects of GTBTs and LCCPP by industry and region. Therefore, these limitations need to be revised and expanded in further research.

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

PX: Conceptualization, Formal Analysis, Methodology, Writing–original draft, Writing–review and editing. ZJ: Conceptualization, Supervision, Writing–original draft, Writing–review and editing. XW: Conceptualization, Formal Analysis, Methodology, Writing–original draft, Writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This article was funded by the Key Project of the Higher Education Research Program of Anhui Provincial Department of Education: “Research on the Impact of Talent Introduction Policies on Export Enterprises’ Innovation under Trade Policy Uncertainty” (2023AH051643). Youth Project of the Humanities and Social Sciences Research Program of the Ministry of Education: “Research on the Impact and Countermeasures of Digital Technology-Driven Factor Flow on Rural-Urban Integration Development” (23YJC790147). Anhui Provincial Social Science Innovation Development Research Project: “Research on the Intrinsic Mechanism, Innovative Path and Policy Optimization of Digital Technology Empowering Rural-Urban Integration Development in Anhui” (2023CX048). National Social Science Fund Project “Research on the Dilemma and Precise Governance of the Sandwich Class in Housing under the Background of Urban Policies” (21BGL193). Anhui Province Youth Student Growth Plan Special Project (QNXR202460).

The authors are grateful to the editor and reviewers for their insightful and helpful comments.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1486855/full#supplementary-material

Abbas, A., Mushtaq, Z., Ikram, A., Yousaf, K., and Zhao, C. (2023). Assessing the factors of economic and environmental inefficiency of sunflower production in Pakistan: an epsilon-based measure model. Front. Environ. Sci. 11. doi:10.3389/fenvs.2023.1186328

Brucal, A., Javorcik, B., and Love, I. (2019). Good for the environment, good for business: foreign acquisitions and energy intensity. J. Int. Econ. 121, 103247. doi:10.1016/j.jinteco.2019.07.002

Buntaine, M. T., Greenstone, M., He, G., Liu, M., Wang, S., and Zhang, B. (2024). Does the squeaky wheel get more grease? The direct and indirect effects of citizen participation on environmental governance in China. Am. Econ. Rev. 114, 815–850. doi:10.1257/aer.20221215

Chandra, P. (2016). Impact of temporary trade barriers: evidence from China. China Econ. Rev. 38, 24–48. doi:10.1016/j.chieco.2015.11.002

Chandra, P., and Long, C. (2013). Anti-dumping duties and their impact on exporters: firm level evidence from China. World Dev. 51, 169–186. doi:10.1016/j.worlddev.2013.05.018

Chen, C., Lin, Y., Lv, N., Zhang, W., and Sun, Y. (2022). Can government low-carbon regulation stimulate urban green innovation? Quasi-experimental evidence from China’s low-carbon city pilot policy. Appl. Econ. 54, 6559–6579. doi:10.1080/00036846.2022.2072466

Chen, H., Guo, W., Feng, X., Wei, W., Liu, H., Feng, Y., et al. (2021a). The impact of low-carbon city pilot policy on the total factor productivity of listed enterprises in China. Resour. Conservation Recycl. 169, 105457. doi:10.1016/j.resconrec.2021.105457

Chen, L., and Wang, K. (2022). The spatial spillover effect of low-carbon city pilot scheme on green efficiency in China’s cities: evidence from a quasi-natural experiment. Energy Econ. 110, 106018. doi:10.1016/j.eneco.2022.106018

Chen, S., Mao, H., and Sun, J. (2021b). Low-carbon city construction and corporate carbon reduction performance: evidence from a quasi-natural experiment in China. J. Bus. Ethics 180, 125–143. doi:10.1007/s10551-021-04886-1

Crowley, M., Meng, N., and Song, H. (2018). Tariff scares: trade policy uncertainty and foreign market entry by Chinese firms. J. Int. Econ. 114, 96–115. doi:10.1016/j.jinteco.2018.05.003

Du, K., Cheng, Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: the Road to the green transformation of Chinese cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Elahi, E., Zhu, M., Khalid, Z., and Wei, K. (2024). An empirical analysis of carbon emission efficiency in food production across the yangtze river basin: towards sustainable agricultural development and carbon neutrality. Agric. Syst. 218, 103994. doi:10.1016/j.agsy.2024.103994

Emerick, K., de Janvry, A., Sadoulet, E., and Dar, M. H. (2016). Technological innovations, downside risk, and the modernization of agriculture. Am. Econ. Rev. 106, 1537–1561. doi:10.1257/aer.20150474

Grossman, G., Helpman, E., and Redding, S. J. (2024). When tariffs disrupt global supply chains. Am. Econ. Rev. 114, 988–1029. doi:10.1257/aer.20211519

Guo, S., and Fraser, M. W. (2015). Propensity score analysis: statistical methods and applications. CA: Sage Publications. Second Edition.

Hong, M., Chen, S., and Zhang, K. (2021). Impact of the “low-carbon city pilot” policy on energy intensity based on the empirical evidence of Chinese cities. Front. Environ. Sci. 9. doi:10.3389/fenvs.2021.717737

Kang, K., and Silveira, B. S. (2021). Understanding disparities in punishment: regulator preferences and expertise. J. Political Econ. 129, 2947–2992. doi:10.1086/715415

Li, S., Xu, Q., Liu, J., Shen, L., and Chen, J. (2022b). Experience learning from low-carbon pilot provinces in China: pathways towards carbon neutrality. Energy Strategy Rev. 42, 100888. doi:10.1016/j.esr.2022.100888

Li, Z., Bai, T., and Tang, C. (2022a). How does the low-carbon city pilot policy affect the synergistic governance efficiency of carbon and smog? Quasi-experimental evidence from China. J. Clean. Prod. 373, 133809. doi:10.1016/j.jclepro.2022.133809

Liu, L. J., Creutzig, F., Yao, Y. F., Wei, Y. M., and Liang, Q. M. (2020). Environmental and economic impacts of trade barriers: the example of China–us trade friction. Resour. Energy Econ. 59, 101144. doi:10.1016/j.reseneeco.2019.101144

Liu, Q., and Ma, H. (2020). Trade policy uncertainty and innovation: firm level evidence from China’s WTO accession. J. Int. Econ. 127, 103387. doi:10.1016/j.jinteco.2020.103387

Liu, Y., and Gao, Q. (2024). Economic policy uncertainty and enterprise innovation in China: from the perspective of equity financing and financing structure. Econ. Analysis Policy 81, 17–33. doi:10.1016/j.eap.2023.11.026

Liu, Z., Zhang, M., Li, Q., and Zhao, X. (2023). The impact of green trade barriers on agricultural green total factor productivity: evidence from China and OECD countries. Econ. Analysis Policy 78, 319–331. doi:10.1016/j.eap.2023.03.011

Mayer, T., Melitz, M. J., and Ottaviano, G. I. P. (2014). Market size, competition, and the product mix of exporters. Am. Econ. Rev. 104 (2), 495–536. doi:10.1257/aer.104.2.495

Pan, A., Zhang, W., Shi, X., and Dai, L. (2022). Climate policy and low-carbon innovation: evidence from low-carbon city pilots in China. Energy Econ. 112, 106129. doi:10.1016/j.eneco.2022.106129

Peng, H., Shen, N., Ying, H., and Wang, Q. (2021). Can environmental regulation directly promote green innovation behavior? based on situation of industrial agglomeration. J. Clean. Prod. 314, 128044. doi:10.1016/j.jclepro.2021.128044

Peng, X., Wu, J., Chen, Y., Sumran, A., and Xie, Q. (2024). Does the carbon emission trading pilot policy promote green innovation cooperation? Evidence from a quasi-natural experiment in China. Financ. Innov. 10, 14. doi:10.1186/s40854-023-00556-5

Qiu, S., Wang, Z., and Geng, S. (2021). How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J. Environ. Manag. 287, 112282. doi:10.1016/j.jenvman.2021.112282

Sampson, T. (2023). Technology gaps, trade, and income. Am. Econ. Rev. 113, 472–513. doi:10.1257/aer.20201940

Shi, L., Wang, Y., and Jing, L. (2024). Low-carbon city pilot, external governance, and green innovation. Finance Res. Lett. 67, 105768. doi:10.1016/j.frl.2024.105768

Song, M., Zhao, X., and Shang, Y. (2020). The impact of low-carbon city construction on ecological efficiency: empirical evidence from quasi-natural experiments. Resour. Conservation Recycl. 157, 104777. doi:10.1016/j.resconrec.2020.104777

Tian, Y., Song, W., and Liu, M. (2021). Assessment of how environmental policy affects urban innovation: evidence from China’s low-carbon pilot cities Program. Econ. Analysis Policy 71, 41–56. doi:10.1016/j.eap.2021.04.002

Wible, B. (2021). Environmental bias in trade policy. Science 371, 478.4–479. doi:10.1126/science.371.6528.478-d

Yan, X., He, T., Qian, P., and Liu, Z. (2024). Does the construction of pilot free trade zones promote the development of green economy? - a quasi-natural experiment evidence from China. Econ. Analysis Policy 81, 208–224. doi:10.1016/j.eap.2023.11.032

Yu, H., Jiang, Y., Zhang, Z., Shang, W.-L., Han, C., and Zhao, Y. (2022). The impact of carbon emission trading policy on firms’ green innovation in China. Financ. Innov. 8, 55. doi:10.1186/s40854-022-00359-0

Zhang, D. (2022). Environmental regulation, green innovation, and export product quality: what is the role of greenwashing? Int. Rev. Financial Analysis 83, 102311. doi:10.1016/j.irfa.2022.102311

Zhou, K., Yu, L., Jiang, X., and Kumar, S. (2023). Trade policy uncertainty and pollution emissions of export enterprises—the case of China-asean free trade area. Rev. Int. Econ. 31, 1719–1750. doi:10.1111/roie.12684

Keywords: low-carbon city pilot policy, green technical barriers to trade, green technology innovation, policy intensitie, policy instrument

Citation: Xu P, Jin Z and Wu X (2024) Effect of green trade barriers on export enterprise green technological innovation from the perspective of the low-carbon city pilot policy. Front. Environ. Sci. 12:1486855. doi: 10.3389/fenvs.2024.1486855

Received: 27 August 2024; Accepted: 22 October 2024;

Published: 05 November 2024.

Edited by:

Jinyu Chen, Central South University, ChinaReviewed by:

Adnan Abbas, Nanjing University of Information Science and Technology, ChinaCopyright © 2024 Xu, Jin and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xianghua Wu, eGlhbmdodWF3QHNpbmEuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.