95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 04 December 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1485614

This article is part of the Research Topic Climate Risk and Green and Low-Carbon Transformation: Economic Impact and Policy Response View all 18 articles

Introduction: This paper analyzes the influence of green finance innovation on the green innovation ability of Shanxi Huangtupo Coal Industry Group Co., Ltd.

Methods: By constructing a fixed-effect model. This study uses the number of green patent applications by enterprises as indicator to measure green innovation, with the green finance development index as a key explanatory variable, while controlling for other factors such as asset-liability ratio and listing time.

Results: The results show that there is a significant positive correlation between green finance innovation and the green innovation of enterprises, indicating that the development of green finance has effectively promoted the green technology innovation in enterprises, which helps to achieve carbon neutrality.

Discussion: The study provides a reference for policymakers to promote the development of lowcarbon economy through financial policies. Linking green finance innovation with the green innovation capabilities of specific high emission sector enterprises provides new insights into the role of green finance in promoting enterprise carbon neutrality.

Climate change has become one of the biggest challenges worldwide, with greenhouse gas emissions being one of the main driving forces (Indriastuty and Widiantoro, 2020). Carbon dioxide is one of the most important greenhouse gases, mainly produced by fossil fuels, industrial activities and land use changes. At present, global greenhouse gas emissions are still very high. According to the International Plant Protection Convention (IPCC), it is necessary to rapidly reduce global greenhouse gas emissions to avoid the worst effects of climate change. Although the international community has taken some steps to reduce greenhouse gas emissions, such as those stipulated in the Paris Agreement, achieving these goals remains challenging. Carbon neutrality means balancing carbon dioxide emissions from human activities through various means, such as improving energy efficiency, developing renewable energy, afforestation, and adopting carbon capture and storage technologies, so as to achieve net zero emissions. This concept plays a vital role in addressing global climate change, protecting the ecological environment and achieving sustainable development. Realizing carbon neutrality has become a common goal faced by the international community. China is one of the largest carbon dioxide emitting countries in the world, committing to reaching carbon peak by 2030 and achieving carbon neutrality by 2060. This commitment not only reflects China’s responsibility in global climate governance, but also poses new challenges and requirements for domestic enterprises, especially those in high-emission industries such as coal (Hsu et al., 2021; Tolliver et al., 2021). Realizing carbon neutrality also needs to consider the economic impacts associated with it, including potential impacts on different industries and labor markets. Policymakers need to find a balance between promoting economic growth and meeting environmental protection. In addition, innovative financial instruments and mechanisms are crucial to achieve carbon neutrality. Green financial innovation aims to support and promote low-carbon and environmentally friendly economic development through financial instruments and mechanisms, and promote the effective allocation and management of financial resources. Green financial innovation can not only promote economic green transformation, but also bring new business opportunities and competitive advantages to financial institutions. However, many challenges remain in implementing green financial innovation and carbon neutrality strategies. This includes investors’ risk perception of Green Finance (Gf) projects, the ability of financial institutions to design and sell Gf products, as well as government regulatory policies and standards, etc (Wu et al., 2023; Bandola-Gill, 2023).

Shanxi Huangtupo Coal Industry Group Co., Ltd. is selected as the research object to explore how green financial innovation affects the green innovation ability of enterprises, so as to promote carbon neutrality. Shanxi Huangtupo Coal Industry Group Co., Ltd. is an important enterprise in China’s coal industry, and its efforts in green transformation and carbon emission reduction have exemplary significance for the sustainable development of the entire industry. Huangtupo Group not only has deep technical accumulation and rich management experience in coal mining and utilization, but also shows a positive attitude in promoting green innovation and implementing carbon neutral strategies. Although existing studies have explored the relationship between Gf and enterprise innovation, there are relatively few empirical analyses on specific industries and enterprises in China, especially on enterprises in high-emission industries, such as the coal industry, whose efforts in green transformation and carbon emission reduction have exemplary significance for the sustainable development (Sun et al., 2023). In addition, there are methodological limitations in the existing literature. For example, time series data lacks in-depth analysis and specific industry backgrounds are not adequately considered, which limit a comprehensive understanding of the impact of Gf innovation. Moreover, although Gf innovation is considered to be a key factor in promoting low-carbon development and improving energy efficiency, it faces many challenges in the implementation process, such as investors’ risk perception of Gf projects, financial institutions’ product design and sales capabilities, and government regulatory policies and standards (Azar et al., 2021). Research needs to come up with effective strategies and policy recommendations to overcome these bottlenecks. This paper aims to fill this gap, and analyzes the influence of Gf innovation on the green innovation ability of Shanxi Huangtupo Coal Industry Group Co., Ltd. by constructing a fixed-effect model. The number of green patent applications is used to measure green innovation, and other factors such as asset-liability ratio and listing time are controlled. The findings will provide new insights into the role of Gf in promoting companies’ carbon-neutral capabilities and provide practical guidance for policymakers and business management.

The contribution of the research is to reveal the intrinsic link between green financial innovation and enterprises green innovation ability, and to empirically analyze how this link contributes to the enterprises carbon neutrality goal. Through the fixed-effect model, the study not only investigates the influencing factors of green innovation in Shanxi Huangtupo Coal Industry Group Co., Ltd., but also provides a reference case for enterprises in other high emission industries. The research results have enriched the literature in the field of Gf and enterprise sustainable development, providing theoretical and practical support for achieving the green transformation of the Chinese economy. The successful experience of Shanxi Huangtupo Coal Industry Group Co., Ltd. in Gf innovation and green technology shows how Gf can effectively promote the green innovation ability of enterprises. This empirical case not only validates the hypothesis proposed in the study, but also provides a reference for other enterprises to implement Gf strategies. In addition, with regard to theoretical value, the successful experience of this enterprise can provide a new perspective on the relationship between Gf and corporate innovation. The strategies and measures adopted by the enterprise in green transformation provide important theoretical basis for understanding the role of Gf in different corporate contexts.

The article has four parts. The first part is the literature review section, which discusses the current research status of Gf innovation and carbon neutrality both domestically and internationally. The second part analyzes the sustainable Gf innovation development path and carbon neutrality policies. The third part empirically analyzes the green innovation development strategy implemented by Shanxi Huangtupo Coal Industry Group Co., Ltd. The fourth part summarizes the research results.

Gf innovation is a new financial product, tool, and service that serves environmental protection and sustainable development in the financial field. Gf innovation encompasses many fields. Green economic growth is the best strategy to achieve sustainable development. Green economic growth is an economic mode, which is based on ecological environmental capacity and resource carrying capacity. In economic development, emphasis should be placed on improving resource utilization efficiency, reducing pollution emissions, increasing economic output, and achieving coordinated development between the economy and the environment. Su et al. discussed the impact of green environmental protection technology, financial innovation and environmental regulations on green economic growth by controlling the impact of renewable energy consumption, trade and education. The research results indicated that the positive impact of green environmental technology, financial innovation, and environmental regulation promoted green economic growth (Su and Gao, 2022). Public-Private Partnership (PPP) projects are an important component of socialist market economy, which plays a crucial role in generating income in the national economy. Therefore, Sun et al. focused on the Gf innovation system based on PPP. This research discussed the significance of the Gf innovation system. These two were combined to build a Gf innovation system. The research results indicated that the PPP projects in this system reduced carbon dioxide emissions by 30% (Sun and Li, 2021). The potential mechanism for measuring the relationship between ESG ratings in developing countries and green innovation in enterprises has not yet been explored. Therefore, Tan et al. conducted a quasi natural experiment based on the 2015 ESG rating of commercial Gf institutions. The research results indicated that ESG ratings promoted the quantity and quality of enterprise green innovation. Relieving financial constraints adjusted the ESG rating (Tan and Zhu, 2022). Aastvedt et al. used the environmental innovation score to measure green innovation. The research estimated two panel datasets of oil and gas companies in the United States and Europe from 2010 to 2018. From the research results, the innovation scores had a positive impact on the financial performance of American and European companies. The impact of environmental pillar ratings was not linear (Aastvedt et al., 2021). Effectively utilizing inclusive Gf is crucial for realizing green innovation, promoting sustainable economic transformation, and addressing climate change. Irfan et al. used regional data from China between 2010 and 2019 to analyze the difference, mediation effects, and panel vector auto-regressive models. The Gf significantly promoted green innovation. These effects remained consistent across different estimators (Irfan et al., 2022). There was limited literature on the impact of financial technology and Gf on green growth. Zhou et al. constructed a comprehensive indicator to evaluate regional economic green growth. The study tested the impact and mechanism of financial technology innovation and Gf on green growth. The research results indicated that this indicator had promoting effects (Zhou et al., 2022).

Carbon neutrality is a hot research topic in recent years, which aims to achieve a net reduction in carbon emissions by absorbing and emitting equal amounts of carbon dioxide, ultimately achieving zero carbon emissions. Yao et al. manufactured a structurally novel photovoltaic thermal module to address the efficient co-generation in the construction industry. The average electrical efficiency and thermal efficiency in the experiment were 17.93% and 109.4%, respectively. Compared with other conventional technologies, the comprehensive utilization efficiency of solar energy significantly was improved. This technology had a positive impact on Shanghai’s “carbon neutrality” strategy (Udeagha and Muchapondwa, 2023). The energy consumption of heating and cooling buildings, as well as the relatively short building life-cycle can help explain the increase in greenhouse gas emissions in the construction sector. Amoruso et al. compared the life-cycle assessment results of greenhouse gas emissions per unit area of building envelope components certified for different passive houses. The research results indicated that the highest greenhouse gas emissions were related to the primary service energy demand for renovated buildings, followed by windows and material transportation (Khurshid et al., 2023). In response to the core sustainable development of the 2022 FIFA World Cup, Qatar set a track to achieve carbon neutrality and committed to hosting the world’s first large-scale carbon neutral event. Meer et al. proposed a new method to offset carbon emissions. Compared with the maximum carbon sequestration potential of treated wastewater and specific fertilizer mixtures, the carbon reduction potential of tree nursery projects was 21.902% (Meer et al., 2022). Global cement production has increased by 30 times, becoming the third largest source of carbon dioxide. Souza et al. used graphene-based nano-sheets to reduce the environmental impact. The research results indicated that graphene-based nano-sheets reinforcement could become a cost-effective strategy for reducing the environmental impact, providing effective methods for reducing carbon dioxide emissions and achieving carbon neutrality (Souza et al., 2022). Based on literature analysis, Hou et al. conducted quantitative comparative analysis on carbon peak and carbon neutrality targets. Key indicators were selected for comparative analysis and summary. On the carbon emission path, various institutions generally believe that China’s carbon emissions will peak around 2028 and achieve carbon neutrality between 2050 and 2060 (Hou et al., 2023). The greenhouse gas emissions generated by bio-fuels, as well as the energy required in the production process, exceeded the emissions reduced by bio-fuels that replace fossil fuels. Kuittinen et al. evaluated the sustainability of the entire value chain based on the EU Renewable Energy Directive. The greenhouse gas emissions reduction from bio-fuels production was compared with reference fossil fuels. The research results indicated that Salix bio-ethanol production achieved a 60% reduction in emissions compared to fossil fuels (Kuittinen et al., 2021). The regression panel model plays an important role in the empirical analysis. Zhang et al. used this model to verify that investment in renewable energy by private enterprises is a key pathway to achieving sustainable development goals. The research showed that Gf and inclusive finance had a positive role in promoting global development, and the effect was more significant (Zhang et al., 2022). As a region with a large population and rapid development, Asia is under enormous pressure to cope with climate change and environmental externalities while maintaining economic growth. Tolliver et al. analyzed various factors affecting the transition of Asian countries to sustainable growth models through regression panel models (Tolliver et al., 2021).

To sum up, researchers have conducted in-depth research and comprehensive evaluation on green financial innovation and carbon neutral strategy, sustainable development paths, and policy framework and other fields. The above literature have made significant contributions in their respective research fields, providing strong theoretical support and empirical basis for understanding, evaluating and promoting green innovation, green economic growth and carbon neutrality. On this basis, the research focuses on green financial innovation and carbon neutral strategies, sustainable development paths and policies.

Based on the Resource-Based View (RBV) and Institutional Theory, this study constructs a theoretical framework to analyze how green financial innovation affects the green innovation ability of enterprises. RBV theory emphasizes the role of internal resources and capabilities in obtaining competitive advantage. Institutional theory focuses on the external environment, especially the influence of institutional factors on enterprise behavior. According to the theoretical framework, the following hypothesis is proposed. First, green financial innovation is positively correlated with enterprise green innovation. By providing financial support and risk management tools, Gf innovation promotes enterprises’ investment in research and development of green technologies and products, thereby enhancing their green innovation capabilities. Second, green financial innovation has a positive impact on the carbon neutral ability of enterprises. The funds and resources obtained by enterprises through green financial innovation can be used to invest in energy-saving and emission reduction projects and clean energy technologies, thereby improving the carbon neutral ability of enterprises. Third, enterprise characteristics regulate the relationship between green financial innovation and green innovation. The size, age, and financial condition of enterprises may affect the effect of green financial innovation on the green innovation ability. In order to test these hypotheses, this study uses a fixed-effect model to analyze the relationship between Gf innovation and green innovation capability of Shanxi Huangtupo Coal Industry Group Co., Ltd., and examines the moderating effect of enterprise characteristics. According to RBV, the heterogeneity and uniqueness of resources are the source of competitive advantage. In the context of Gf, it is assumed that Gf innovation, as a key resource, can provide capital and risk management tools for enterprises, thus promoting green innovation in enterprises.

The research is innovative in its empirical analysis of the relationship between green financial innovation and enterprise carbon neutrality, particularly in the context of China’s coal industry. This study not only fills the gap in the existing literature on the impact of Gf in specific high-emission industries, but also explores how Gf innovation can promote the improvement of enterprises’ green innovation ability and further promote carbon neutrality by constructing a fixed-effect model. In addition, this study also considers the potential moderating effect of enterprise characteristics such as size, age and financial status on this relationship, providing a more nuanced perspective for understanding the role of green financial innovation in different types of enterprises.

Based on the existing research, in order to further understand the relationship between carbon neutrality strategy and enterprise green innovation, a comprehensive theoretical framework that integrates sustainable development theory, innovation diffusion theory, institutional theory, resource-based perspective, dynamic capacity theory, and environment-innovation interaction model is proposed. This framework reveals how environmental policy can drive innovation by increasing environmental pressures, policy incentives, technological development, market opportunities, and risk management. Specifically, environmental pressures may force enterprises to seek innovative solutions to adapt to more stringent emission standards. Policy incentives such as subsidies and tax incentives may stimulate enterprises’ innovative activities. Technological progress, especially in clean energy and low-carbon technologies, is an innovative manifestation. The growing market demand for low-carbon products and services provides the impetus for business innovation. Innovation can also help enterprises better manage the risks associated with carbon emissions. In the research methodology, qualitative and quantitative methods are used to evaluate the implementation effect of carbon neutrality strategy. By constructing a fixed-effect model, this paper analyzes the impact of green financial innovation on the carbon neutrality of enterprises. In addition, a case study approach is used to explore how the company Shanxi Huangtupo Coal Industry Group Co., Ltd. can achieve its carbon neutrality goal through green financial innovation.

Carbon emissions are closely related to coal production. In recent years, China’s coal production has experienced significant fluctuations, which are the result of multiple factors such as policy regulation, energy structure transformation, and environmental protection. To address environmental pollution and greenhouse effect, the country has taken a series of measures and policies to restrict coal production, such as restricting the construction of new coal mines and closing small and backward coal mines, and optimizing the industrial structure (O’Keeffe et al., 2021; Liao et al., 2020). At the same time, the state actively promotes the transformation of energy structure, reduces dependence on coal and increases the proportion of clean energy. These measures include increasing investment and development of renewable resources, promoting clean energy such as natural gas, and reducing coal-fired power generation (Zhang and Ma, 2022; Yadav et al., 2021). However, there are significant fluctuations in coal production, as shown in Figure 1.

In the future, with the continuous optimized energy structure and the enhanced environmental awareness, the change in coal production will continue. From 2010 to 2013, it increased from 3.428 billion tons to 3.974 billion tons. Since then, it has been declining year by year. In 2016, it even fell to the lowest point in 10 years. Since 2016, China’s coal production has continued to grow. In 2020, the growth rate of raw coal production in the coal industry decreased, increasing by 1.4% year-on-year, which reached 3.9 billion tons. During the 13th Five Year Plan period, China’s coal production capacity has been phased out with an average annual output of over 1 billion tons. At the end of 2020, the number of coal mines in China has sharply decreased to 4,700. The national average single well scale has increased from 350,000 tons to 1.1 million tons per year, with an increase of 214.3%. After taking various measures, the quality of coal supply in China has been significantly improved. Since 2006, various regions across the country have successively canceled coal export tax rebates, as well as coke export tariffs and thermal coal import taxes. Affected by the national policy of “controlling exports and promoting imports,” coal imports have increased significantly, while exports have decreased significantly. In 2020, the import volume of raw coal for the national coal industry was 304 million tons. Compared with the same period last year, it increased by 1.5%, reaching the highest level since 2014, as displayed in Figure 2.

From monthly data, in 2020, China’s coal imports showed an upward, downward and further upward trend. From January to April, the import volume increased significantly compared with the same period last year. There was a significant decrease in imports in May and November compared with the same period last year. The decrease in October reached 46.56%. In December, coal imports rebounded sharply. Compared with the same period last year, it increased by 1,309.63%, reaching 39.075 million tons. From monthly data analysis, China’s coal imports generally follow “first rising, then falling” and “rising.” In 2020, the imports in January and April increased rapidly year-on-year. The imports in May and November decreased significantly year-on-year. The decline in October was as high as 46.56%. In December, coal imports rebounded significantly, with a year-on-year increase of 1,309.63%, reaching 39.075 million tons. The coal import volume surged in December. This is mainly influenced by policies, which have relaxed the coal imports to alleviate the pressure on domestic coal-fired power supply. Carbon neutrality provides new opportunities for China’s coal industry, promoting the continuous innovation of cutting-edge technologies in the industry. From the perspective of China’s coal technology development, the coal industry has a strong reserve for technological innovation (Long et al., 2020; Zhou, 2022). The aggregation of innovative resource elements is relatively active. Table 1 displays the current development of cutting-edge technologies in China’s coal industry.

China’s carbon neutrality policy refers to achieving a balance between carbon emissions and absorption by absorbing and reducing carbon emissions on the basis of reducing greenhouse gas emissions. Carbon neutrality policy is an important measure to address global climate change. It is also a meaningful strategy for China to actively respond to climate change (Huang, 2021; Kluza et al., 2021; Samarawickrama, 2022). China’s carbon neutrality policy includes multiple measures and policies, as shown in Figure 3.

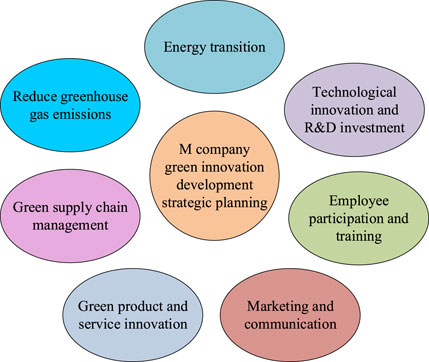

Implementing carbon neutrality policies can help protect the ecological environment, mitigate the impact of climate change, and improve the quality and sustainability of economic development. Carbon neutrality policies also provide new opportunities and impetus for China’s industrial transformation and upgrading, promoting economic development towards low-carbon, green, and sustainable directions. The impact of policies on enterprise green innovation is usually achieved by providing incentives and guidance. For example, the government can reduce the R&D costs and risks of enterprises in green technologies and products through financial subsidies, tax incentives, R&D funding support, and other means. In addition, policies can also promote green innovation by setting emission standards and environmental regulations to force enterprises to reduce pollution and improve resource efficiency. Policies can also provide low-cost financing for green projects by establishing Gf systems such as green credits, green bonds and green funds, and encourage enterprises to invest in environmental protection technologies and sustainable development projects. Based on the background mentioned above, Shanxi Huangtupo Coal Industry Group Co., Ltd. can formulate the following strategic plans for green innovation development, as shown in Figure 4.

Figure 4. Strategic plans of green innovation development of Shanxi Huangtupo Coal Industry Group Co., Ltd.

Based on the strategic plan formulated above, Shanxi Huangtupo Coal Industry Group Co., Ltd. can gradually achieve green innovation development, reduce environmental impact, enhance corporate competitiveness, and contribute to sustainable development within the policy framework of carbon neutrality. The green innovation development strategic planning of Shanxi Huangtupo Coal Industry Group Co., Ltd. is to reduce the negative impact on the environment, improve resource utilization efficiency, and realize the sustainable development of the company through a series of measures. Shanxi Huangtupo Coal Industry Group Co., Ltd. has set clear green development goals, such as reducing carbon emissions and improving resource recycling. In response to the goal, the company team has developed a detailed green innovation plan, including advanced environmental protection equipment and technology, optimized production processes, and promotion of green products and services. Shanxi Huangtupo Coal Industry Group Co., Ltd. actively seeks cooperation with suppliers, customers, research institutions and other external partners to jointly develop green innovation. By sharing resources and technologies with partners, Shanxi Huangtupo Coal Industry Group Co., Ltd. is able to quickly implement green innovation strategies. Through the clear implementation process and effective measures, the green innovation development strategy plan of Shanxi Huangtupo Coal Industry Group Co., Ltd. has achieved environmental performance improvement, economic benefits growth, brand image enhancement, and innovation capability enhancement. These results fully prove the importance of green innovation development strategy for the enterprise to achieve sustainable development.

The green and sustainable development of coal resources mainly involves the comprehensive recovery and utilization of coal resources, mine water, coalbed methane and associated gangue produced in mining production. The core content is to intensively develop coal resources and recycle various resources. There are many technologies for green mining of coal resources besides coal mines. The efficient and clean utilization of coal and related resources such as coal, coalbed methane, mine wastewater, and coal gangue can maximize economic, environmental, and social benefits (Wu et al., 2023; Desalegn and Tangl, 2022; Busch et al., 2022a; Wang et al., 2023a). On this basis, based on the green development of coal and related resources in Shanxi Huangtupo Coal Industry Group Co., Ltd., two ideas are proposed: safe and efficient development of coal resources and comprehensive waste recycling and utilization. Shanxi Huangtupo Coal Industry Group Co., Ltd. mainly mines coal resources through resource recycling. The green mining process is shown in Figure 5.

In Figure 5, green mining of coal resources protects the production and development of coal mining areas, and promotes the comprehensive recycling of associated resources such as coal resources, mine water, coal seam gas and associated gangue generated in the production process. Its core lies in the intensive mining of coal resources and the recycling of various resources. The green coal mining process involves various technologies, aiming at the efficient and clean use of coal, coalbed methane, mine water and coal gangue resources to maximize the economic, environmental and social benefits.

Shanxi Huangtupo Coal Industry Group Co., Ltd. is the safest and most effective coal mining enterprise in the world. It is also one of the top 100 enterprises in China. The company currently has an annual production of 1.2 million tons, and an annual coal production of 3 million tons. Guided by the concept of “high efficiency,” Shanxi Huangtupo Coal Industry Group Co., Ltd. has gradually developed an advanced coal mining process. It has greatly improved unit output, labor productivity, resource utilization, economic benefits, safety conditions, working conditions, environmental protection, and other aspects (Wang et al., 2023b; Yu et al., 2022; Zhang et al., 2024). One is to promote technological progress. Firstly, on the basis of comprehensive investigation of geological occurrence status, enterprises consider how to overcome practical problems such as uneven distribution of reserves and complex geological conditions, and actively promote green mining of coal resources. Therefore, the study proposes a new approach, which is that Shanxi Huangtupo Coal Industry Group Co., Ltd. can optimize the mine and mining area according to actual situations. The second is to transform the technology and equipment of Shanxi Huangtupo Coal Industry Group Co., Ltd., improve product quality, and construct high-intensity mines. Shanxi Huangtupo Coal Industry Group Co., Ltd. can adopt the corresponding advanced processes to expand the washing and beneficiation industry, increase the proportion of washing and beneficiation plants, and promote the clean and efficient utilization of coal. Shanxi Huangtupo Coal Industry Group Co., Ltd. promptly adjusts its production plan according to market needs to reduce coal mining and non-essential mining costs, maximizing the benefits for the enterprise. Based on the existing drainage system, water quality, distribution of surrounding industrial and mining enterprises, and the industrial and domestic water use in the mining area, the study proposes a plan for a comprehensive utilization system of mining wastewater. Developing the non-coal industry is an important measure for Shanxi Huangtupo Coal Industry Group Co., Ltd. to implement the “Beyond Coal” strategy. It can fully utilize the internal and external resource advantages of Shanxi Huangtupo Coal Industry Group Co., Ltd., and play a greater role in the external environment. This fully exploits the diversified development potential of Shanxi Huangtupo Coal Industry Group Co., Ltd., and realizes its business value. Specifically, to enhance its own advantages for Shanxi Huangtupo Coal Industry Group Co., Ltd., it must possess six major competencies. One is to have a unique core competitiveness that is scarce and difficult to transfer and replicate. The company has the ability to innovate core production technology and management system mechanisms, form core competitiveness, and enhance enterprise competitiveness. To achieve a competitive advantage in both cost and quality, while maintaining low costs, it is necessary to manufacture high-quality products. It puts forward higher requirements for the technology and industrial selection of Shanxi Huangtupo Coal Industry Group Co., Ltd., forming irreplaceable resources. Irreplaceable resources can establish a company’s development advantage, prevent them from losing due to the decline of competitive advantage, and select industries and enterprises suitable for enterprise development. Shanxi Huangtupo Coal Industry Group Co., Ltd. has its own advantages and disadvantages, not every industry can enter. Therefore, enterprises should carefully make decisions based on their own conditions to ensure lasting competitiveness. Without sustainable development resources, it is meaningless. The company should maximize its own advantages and transform them into sustainable competitiveness. To develop the non-coal industry, it is necessary to have sufficient tangible assets such as personnel, finance, and materials, as well as a good corporate image and brand characteristics to support it.

On the basis of sorting and summarizing the connotation, function, and development status, the research determines three Gf indicators, including green credit, green securities, and green insurance. The Entropy Method (EM) is used to construct the Gf index. Green credit, green credit balance, and RMB loan balance are references. The A-share market share ratio of six heavily polluting industries in the A-share market measures the green securities index. The proportion of agricultural insurance cost in agricultural insurance and the proportion of total premiums measure the green insurance index (Hao et al., 2023; Haque and Ntim, 2022; Cordova et al., 2021; He et al., 2022; Elsayih et al., 2021). Table 2 displays the specific indicator definitions and their attributes.

When performing dimensionless processing, the research takes the extremum method to make some data values 0, which makes the obtained data meaningless and detrimental to subsequent research. Therefore, the entire data must be moved to the right to prevent any impact on subsequent calculations. The Gf development level measurement is a process that requires a comprehensive evaluation. The study comprehensively measures the development status of Gf in China from the above three aspects. Firstly, it is necessary to determine the weights of each evaluation index. The EM analyzes the information entropy of sampling values for each index. The impact degree on the overall population determines the index weight (Busch et al., 2022b; Bolton et al., 2022; Chen et al., 2022). On this basis, the dimensionless method eliminates dimensional differences between variables. The entropy weight method calculates the weights of each indicator. Finally, the comprehensive scores of Gf for each year are linearly weighted and summed. The data processing steps in the EM are as follows. Before normalizing each variable, the dimensions of each variable are uniform. Non-dimensional processing eliminates dimensional differences between these variables. Each indicator data can be processed. When performing dimensionless processing, the extremum method makes some data values 0, which can make the obtained data meaningless and detrimental to subsequent research. Therefore, the entire data must be moved to the right to prevent any impact on subsequent calculations (Luo and Tang, 2021; Bolton et al., 2021; Yuan et al., 2022; Agrawal et al., 2024), as shown in Equation 1.

In Equation 1, the research selects the right shift distance, and

In Equation 2,

In Equation 3,

In Equation 4,

In Equation 5,

In Equation 6,

In Equation 7,

Gf can promote the green innovation of Shanxi Huangtupo Coal Industry Group Co., Ltd., but it is also affected by the company itself, such as debt level, maturity, scale, senior management quality, etc. To minimize the impact of these factors on empirical results, properly adjusting key variables in the model can ensure the rationality and accuracy of empirical results. Some economic indicators at the company level are selected as control variables, including asset-liability ratio, listing time, accounts receivable ratio, book to market ratio, directors, independent director ratio, and management expense ratio, as displayed in Table 3.

Table 3 defines the variables used in the study, among which “green patent” is the explained variable. The green innovation level of enterprises is measured by the number of green patent applications converted by natural logarithm. The explanatory variable is “Green Finance Development Index,” which is used to measure the Gf. The control variables include “asset-liability ratio” to assess financial risk, “listing time” to measure market experience, “accounts receivable ratio” to reflect the ability to recover funds, “book-to-market ratio” to indicate the relationship between market valuation and intrinsic value, “number of directors” and “ratio of independent directors” to reflect the corporate governance structure, and “management expense ratio” to show management efficiency. These variables jointly ensure the accuracy and rationality of research results, which helps to reveal how green financial innovation affects the green innovation ability of enterprises. This study focuses on analyzing the green innovation development strategy of Shanxi Huangtupo Coal Industry Group Co., Ltd. under the carbon neutrality goal. Given that this company is a single entity, the time series analysis approach is used to track the company’s green innovation and financial development from 2014 to 2021. Time series analysis can observe and analyze the dynamic changes and development trends of Shanxi Huangtupo Coal Industry Group Co., Ltd. during this period. The dataset contains annual observations of the company, allowing the study to analyze green innovation activity and its relationship to financial development. Based on this method, the research can more accurately assess the impact of green financial innovation on the green innovation of Shanxi Huangtupo Coal Industry Group Co., Ltd., and explore its strategy and performance on the sustainable development path. In this study, the panel data of 5,000 effective observations from Shanxi Huangtupo Coal Industry Group Co., Ltd. in 2019–2020 are selected. Table 4 displays the descriptive statistical results of the main variables for green innovation.

According to Table 4, the average green patent of the company is 1.435. The minimum and maximum values are 0 and 11.25. The significant difference between the minimum value and the maximum value shows that the green innovation level of different projects of Shanxi Huangtupo Coal Industry Group Co., Ltd. is uneven. The average Gf index is 0.0634. The maximum and minimum values are 0.0846 and 0.0154. The difference between the two is significant, reflecting the significant fluctuations in the Gf development in different years. The average value of Huangtupo Group in the Gf is higher than the average level of the industry, indicating that its investment and effectiveness in Gf innovation are relatively significant. The fixed panel model performs benchmark regression on enterprise green innovation. Table 5 displays the results.

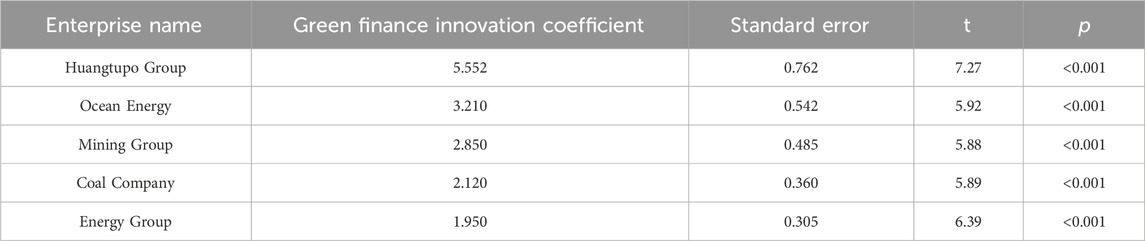

In Table 5, the effect coefficient of Green_patent on Gf is positive and significant at the 1%. The impact of Gf on enterprise green innovation is positive. The Gf development is conducive to improving the green innovation to a certain extent. Based on the comparative analysis between Shanxi Huangtupo Coal Industry Group Co., Ltd. and other enterprises, the benchmark regression results of green financial innovation on enterprise green innovation ability are shown in Table 6.

Table 6. Benchmark regression results of green financial innovation on enterprise green innovation ability.

From Table 6, the Gf innovation coefficient of Huangtupo Group is the highest, reaching 5.552, which is much higher than other enterprises, indicating that Huangtupo Group has significantly higher investment and effectiveness in green technology innovation and carbon emission reduction projects than other enterprises. This may be related to the active adoption of green financial products and strategies, as well as close cooperation with financial institutions. The coefficient of other enterprises is also significantly positive, but the influence is relatively small. The green financial innovation coefficient of Huangtupo Group is 5.552, which means that each unit increases the investment in green financial innovation, and the average number of green patent applications of Huangtupo Group increases by about 5.55 units. This indicates that Huangtupo Group’s investment in green financial innovation has a significant innovation output effect. According to the research in literature (O’Keeffe et al., 2021; Wu et al., 2023), Gf can promote enterprises’ innovation in clean technology and environmental protection products by providing necessary financial support and reducing R&D risks. The high coefficient of Huangtupo group reflects its utilization efficiency of green financial resources. The high coefficient of green financial innovation reflects its leverage effect in promoting corporate green innovation, where a small amount of financial investment stimulates greater innovation activities.

To verify the accuracy and reliability of the above regression results, the study conducts robustness tests through three methods: replacing the dependent variable, the sample study period, and the control variable. The enterprise green invention patent applications are replaced by the enterprise green patent applications as the dependent variable. The regression estimation uses the fixed panel model again. Table 7 displays the regression results.

In Table 7, after changing the measurement method of the dependent variable, the regression coefficient remains positive and significant at the 1%. The Gf has promoting effects on green innovation. The green patent applications and the green invention patent applications in enterprises has promoting effects on green innovation. The Gf has positive effects on green innovation in enterprises. It further strengthens the effect, once again verifying the regression results mentioned above. The experiment changes the sample study period. Green credit balance serves as a sub-index in the Gf development index. Based on this study, the regression analysis is conducted again using data from Shanxi Huangtupo Coal Industry Group Co., Ltd. between 2014 and 2021, as shown in Table 8.

In Table 8, Gf not only promotes green innovation in enterprises, but also further enhances its role, verifying the regression results mentioned above. The control variables are replaced. In the previous section, the listing time serves as the control variables. To further test the regression results, the control variable is replaced with a company’s establishment time that has a similar meaning. Table 9 displays the regression results.

In Table 9, listing time and establishment time are the control variables to measure the maturity of enterprises. The effect coefficient of Gf on green innovation of the enterprise is positive. The results further validate the regression results mentioned above. The research takes Pearson correlation test to conduct correlation analysis on the variables of sample Shanxi Huangtupo Coal Industry Group Co., Ltd. Table 10 displays the results.

In Table 10, when analyzing the correlation between the green innovation capability of enterprises and the Gf development index, Pearson correlation coefficient is used to measure their linear relationship. The results show that the Pearson correlation coefficient between the Gf development index and the number of green patent applications is 0.175 (p < 0.01), indicating a strong positive correlation between them. In addition, a multiple regression analysis is conducted to control for other variables that may affect enterprises’ ability to innovate green. After controlling factors such as enterprise scale, age and financial status, the coefficient of Gf development index is still significantly positive, which further confirms the positive impact of Gf on enterprises’ green innovation. The correlation coefficient matrix clearly indicates that there is a positive correlation between the Gf innovation of Shanxi Huangtupo Coal Industry Group Co., Ltd. and Lev, ListAge, REC, BM, Board, Indep, and Mfee, all of which are positively correlated at the 1%. Instrumental Variable (IV) estimation method is used to deal with possible endogeneity problems and ensure the accuracy of estimation results when performing robustness check and endogeneity test. The selection of IVs follows strict criteria to ensure that they are correlated with green financial innovation as an explanatory variable. Meanwhile, they are not related to the error term of corporate green innovation capability as an explanatory variable to meet the requirements of externalities. Specifically, the study selects the number of green financial policies issued as an IV, which is closely related to green financial innovation, because the policy environment is an important driving force to promote financial innovation. At the same time, considering that the direct correlation between the number of policies promulgated and the green innovation ability of enterprises is weak, this helps to reduce endogenous bias. The results of robustness test and endogeneity test are shown in Table 11.

In Table 11, the basic model shows the significant positive impact of Gf innovation on corporate green innovation. The robustness tests of logarithmic transformation, multi-variable control and sub-sample analysis show that the coefficients of different model specifications are significant, indicating that the results are robust. The IV estimation and fixed effects endogeneity test show that the positive impact of Gf innovation is still significant even after taking into account potential endogeneity problems. These test results confirm the reliability of the benchmark regression results. Whether under different model specifications or after taking corrective measures for endogenous problems, the positive impact of green financial innovation on enterprise green innovation is still significant. In order to verify the rationality of IV, correlation tests were conducted to ensure that there was a strong correlation between instrumental variables and endogenous explanatory variables, including overidentification tests and strength tests of instrumental variables to ensure that instrumental variables were not affected by model error terms, as shown in Table 12.

In Table 12, the F statistic value of the F statistic in the first stage is greater than the critical value 10.00, indicating that there is a strong correlation between instrumental variables and endogenous variables. The statistic value of the Stock-Yogo weak instrumental variable test is greater than the critical value 10.00, indicating that the instrumental variable is not too weak. The p values of Sargan overrecognition test and Hansen overrecognition test were greater than 0.05, indicating that the instrumental variables met the exogenous conditions. The Durbin-Wu-Hausman endogeneity test statistic value is greater than the critical value of 3.84, indicating that there are endogeneity problems in the model, and the use of instrumental variable method is reasonable. Through the test of these quantitative indicators, it can be considered that the selected instrumental variables are reasonable and effective.

Based on time series, this study analyzes the change trend of green innovation indexes of Shanxi Huangtupo Coal Industry Group Co., Ltd. over time, which reveals the dynamic characteristics of green innovation development, predicts the future development trend, and normalizes the green innovation index, as shown in Figure 6.

As shown in Figure 6, the green innovation index of Shanxi Huangtupo Coal Industry Group Co., Ltd. almost always shows an upward trend over time and finally tends to be stable. It shows that Gf has a positive impact on green innovation of enterprises, and Gf is conducive to improving the green innovation of enterprises to a certain extent. Finally, the fixed-effect model proposed in this study is compared with the evolutionary game model in literature (Long et al., 2020) to analyze the accuracy and interpretation ability of the analysis results, as shown in Figure 7.

In Figure 7A, the accuracy of the analysis results of the proposed fixed-effect model is higher than that of the evolutionary game model in literature (Long et al., 2020), indicating that the fixed-effect model shows higher accuracy in capturing and analyzing the inherent laws and patterns of specific datasets. In Figure 7B, the fixed-effect model proposed in this study has stronger explanatory ability than the evolutionary game model in literature (Long et al., 2020), indicating that the fixed-effect model has more advantages in explaining the relationship between variables and predicting results.

By constructing a fixed-effect model, this paper deeply analyzes the influence of Gf innovation on the green innovation ability of Shanxi Huangtupo Coal Industry Group Co., Ltd. The results show that there is a significant positive correlation between the Gf and the number of green patent applications. With each unit increase in the Gf, the average increase in green patent applications is about 5.55 units, which is statistically significant, highlighting the positive role of Gf in promoting green technology innovation of enterprises. After controlling enterprise characteristic variables, including asset-liability ratio, listing time, accounts receivable ratio, book-to-market ratio, number of directors, independent directors ratio and management expense ratio, the time to market coefficient is 0.849, and the significance level is 5%, which emphasizes the importance of enterprise market experience to green innovation ability. These findings are in line with existing literature, such as Zhang et al. (2022), which points out that market experience can significantly improve the adaptability and innovation ability of enterprises to new technologies. In addition, the coefficient of asset-liability ratio is 0.047, and financial soundness has a positive impact on green innovation. This is consistent with the research results of literature (O’Keeffe et al., 2021), which shows that financial soundness is a key factor for enterprises to make long-term investment and innovation. The findings of the study not only confirm the key role of Gf in promoting technological innovation of enterprises and promoting low-carbon development, but also reveal the regulatory role of enterprise characteristics in green innovation.

With the increasing global demand for sustainable development, Gf innovation has become a focus of attention. The study analyzes the green innovation development strategy of Shanxi Huangtupo Coal Industry Group Co., Ltd. under the carbon neutrality goal. Then, the research conducts systematic research on its green financial innovation, providing strategic guidance and policy research for enterprises to achieve green and sustainable development. According to the research results, the average green patent of Shanxi Huangtupo Coal Industry Group Co., Ltd. is 1.435. The minimum and maximum values are 0 and 11.25. The significant difference between the minimum value and the maximum value shows that the green innovation level of different projects of Shanxi Huangtupo Coal Industry Group Co., Ltd. is uneven. The average Gf index is 0.0634. The maximum and minimum values are 0.0846 and 0.0154. The difference between the minimum and maximum is significant, reflecting the significant fluctuations in Gf development level in different years. There is a positive correlation between the Gf innovation of Shanxi Huangtupo Coal Industry Group Co., Ltd. and Lev, ListAge, REC, BM, Board, Indep, and Mfee, all of which are correlated at the 1%. Gf innovation and carbon neutrality strategies are important means to achieve sustainable development, which can promote economic green transformation and environmental protection. The conclusions not only enrich the research on the relationship between Gf and enterprise innovation in theory, but also provide practical guidance and suggestions for relevant stakeholders in practice. Through Gf innovation, businesses, governments and financial institutions can work together to promote green economic transformation and achieve sustainable development.

Based on the research findings, the following policy recommendations are proposed to further promote green financial innovation and accelerate the green transformation of enterprises and the industry as a whole. Strengthen Gf policy support: The government should continue to expand and deepen Gf policies and provide more financial instruments such as green credit, green bonds, and green funds to enterprises to motivate their research and development and investment in green technologies and products. Optimize the tax incentive mechanism: Tax relief and other measures should be taken to encourage enterprises to increase investment in green innovation, especially in the fields of clean energy, energy conservation and emission reduction, and circular economy. Establish a Gf risk compensation mechanism: Considering the higher risks that green innovation projects may face, it is suggested that the government and financial institutions jointly establish a risk compensation fund to reduce the financial risks of green innovation enterprises. Promote innovation in green financial products and services: Financial institutions are encouraged to develop more financial products and services related to the green low-carbon economy to meet the specific needs of different enterprises in green transformation. Enhance the green innovation ability of enterprises: Technology upgrading, personnel training and management innovation are used to support enterprises to improve their green innovation ability and filly utilize green financial resources. Strengthen international cooperation and exchange: International cooperation projects and platforms are established to promote international exchanges and cooperation in Gf and green innovation, and to introduce international advanced Gf practice and innovation experience.

However, there are limitations in this study, which mainly focuses on the impact of financial factors on enterprise green innovation, and relatively ignores the role of other policy factors. In the future, different types of policies can be deeply explored. For example, how tax policies affect corporate profitability and investment decisions, how labor policies affect corporate employment costs and talent attraction, and how financial policies affect corporate financing costs and financing channels.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

XD: Data curation, Investigation, Writing–original draft. DD: Investigation, Writing–original draft. QY: Supervision, Writing–review and editing.

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Aastvedt, T. M., Behmiri, N. B., and Lu, L. (2021). Does green innovation damage financial performance of oil and gas companies? Resour. Policy. 73 (1), 102235–102245. doi:10.1016/j.resourpol.2021.102235

Agrawal, R., Agrawal, S., Samadhiya, A., Kumar, A., Luthra, S., and Jain, V. (2024). Adoption of green finance and green innovation for achieving circularity: an exploratory review and future directions. Geosc. Front. 15 (4), 101669. doi:10.1016/j.gsf.2023.101669

Azar, J., Duro, M., Kadach, I., and Ormazabal, G. (2021). The big three and corporate carbon emissions around the world. J. Financ. Econ. 142 (2), 674–696. doi:10.1016/j.jfineco.2021.05.007

Bandola-Gill, J. (2023). Our common metrics? Our common agenda report and the epistemic infrastructure of the sustainable development goals. Glob. Policy. 1 (1), 8–12. doi:10.1111/1758-5899.13176

Bolton, P., Halem, Z., and Kacperczyk, M. (2022). The financial cost of carbon. J. Appl. Corp. Fin. 34 (2), 17–29. doi:10.1111/jacf.12502

Bolton, P., Reichelstein, S. J., Kacperczyk, M. T., Leuz, C., Ormazabal, G., and Schoenmaker, D. (2021). Mandatory corporate carbon disclosures and the path to net zero. Manag. Bus. Rev. 1 (3), 21–28. doi:10.1177/2694105820210103003

Busch, T., Bassen, A., Lewandowski, S., and Sump, F. (2022a). Corporate carbon and financial performance revisited. Organ. Env. 35 (1), 154–171. doi:10.1177/1086026620935638

Busch, T., Johnson, M., and Pioch, T. (2022b). Corporate carbon performance data: quo vadis? J. Ind. Ecol. 26 (1), 350–363. doi:10.1111/jiec.13008

Chen, S., Mao, H., and Sun, J. (2022). Low-carbon city construction and corporate carbon reduction performance: evidence from a quasi-natural experiment in China. J. Bus. Eth. 180 (1), 125–143. doi:10.1007/s10551-021-04886-1

Cordova, C., Zorio-Grima, A., and Merello, P. (2021). Contextual and corporate governance effects on carbon accounting and carbon performance in emerging economies. Corp. Gov. Int. J. Bus. Soc. 21 (3), 536–550. doi:10.1108/CG-10-2020-0473

Desalegn, G., and Tangl, A. (2022). Forecasting green financial innovation and its implications for financial performance in Ethiopian financial institutions: evidence from ARIMA and ARDL model. NAR 4 (2), 95–111. doi:10.3934/nar.2022006

Elsayih, J., Datt, R., and Tang, Q. (2021). Corporate governance and carbon emissions performance: empirical evidence from Australia. Australas. J. Environ. Manage. 28 (4), 433–459. doi:10.1080/14486563.2021.1989066

Hao, J., Peng, M., and He, W. (2023). Digital finance development and bank liquidity creation. Int. Rev. Financ. Anal. 90, 102839. doi:10.1016/j.irfa.2023.102839

Haque, F., and Ntim, C. G. (2022). Do corporate sustainability initiatives improve corporate carbon performance? Evidence from European firms. Bus. Strat. Env. 31 (7), 3318–3334. doi:10.1002/bse.3078

He, R., Luo, L., Shamsuddin, A., and Tang, Q. (2022). Corporate carbon accounting: a literature review of carbon accounting research from the Kyoto Protocol to the Paris Agreement. Acc. Fin. 62 (1), 261–298. doi:10.1111/acfi.12789

Hou, F., Liu, Y., Yuan, M. A., Liu, C., Zhang, S., Yang, F., et al. (2023). Study of the carbon neutral path in China: a literature review. Chin. J. Urban Environ. Stud. 11 (02), 1–23. doi:10.1142/S2345748123500082

Hsu, C. C., Quang-Thanh, N., Chien, F., Li, L., and Mohsin, M. (2021). Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. ESPR 28 (40), 57386–57397. doi:10.1007/s11356-021-14499-w

Huang, Z. X. (2021). Environmental, social and governance factors and assessing firm value: valuation, signalling and stakeholder perspectives. A&F. 62 (S1), 1983–2010. doi:10.1111/acfi.12849

Indriastuty, D. E., and Widiantoro, A. (2020). Policy direction and regulation of green bonds in Indonesia. JLPG 101 (30), 1–20. doi:10.7176/jlpg/101-03

Irfan, M., Razzaq, A., Sharif, A., and Yang, X. (2022). Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol. Forecast Soc. Change 182 (10), 121882. doi:10.1016/j.techfore.2022.121882

Khurshid, A., Rauf, A., Qayyum, S., Calin, A. C., and Duan, W. (2023). Green innovation and carbon emissions: the role of carbon pricing and environmental policies in attaining sustainable development targets of carbon mitigation—evidence from Central-Eastern Europe. Environ. Dev. Sustain. 25 (8), 8777–8798. doi:10.1007/s10668-022-02422-3

Kluza, K., Ziolo, M., and Spoz, A. (2021). Innovation and environmental, social, and governance factors influencing sustainable business models-Meta-analysis. JCLP 303 (20), 127015–127015.14. doi:10.1016/j.jclepro.2021.127015

Kuittinen, S., Hietaharju, J., Kupiainen, L., Hassan, K., Pappinen, A., Kaipiainen, E., et al. (2021). Bioethanol production from short rotation S. schwerinii E. Wolf is carbon neutral with utilization of waste-based organic fertilizer and process carbon dioxide capture. J. Clean. Prod. 293 (15), 126088–126088.8, April. doi:10.1016/j.jclepro.2021.126088

Liao, H., Yang, L., Ma, H., and Zheng, J. (2020). Technology import, secondary innovation, and industrial structure optimization: a potential innovation strategy for China. PER. 25 (2), 145–160. doi:10.1111/1468-0106.12326

Long, H., Feng, G. F., Gong, Q., and Chang, C. P. (2023). ESG performance and green innovation: an investigation based on quantile regression. Bus. Strat. Env. 32 (7), 5102–5118. doi:10.1002/bse.3410

Long, Q., Tao, X., Shi, Y., and Zhang, S. (2020). Evolutionary game analysis among three green-sensitive parties in green supply chains. IEEE Trans. Evol. Comput. 25 (3), 508–523. doi:10.1109/TEVC.2021.3052173

Luo, L., and Tang, Q. (2021). Corporate governance and carbon performance: role of carbon strategy and awareness of climate risk. Acc. Fin. 61 (2), 2891–2934. doi:10.1111/acfi.12687

Meer, B. A., Prakash, S., Spanos, I., Lundberg, O., Kutty, A. A., Alkhereibi, A. H. A., et al. (2022). How FIFA world Cup 2022? Can meet the carbon neutral commitments and the united nations 2030 agenda for sustainable development? Reflections from the tree nursery project in Qatar. Sust. Dev. 30 (1), 203–226. doi:10.1002/sd.2239

O'Keeffe, S., Clancy, R., O'Sullivan, D., and Bruton, K. (2021). Total site heat integration in carbon neutral industrial manufacturing-A systematic mapping study. AIDIC Trans. 88 (12), 2302–2304. doi:10.3303/CET2188022

Ragazou, K., Passas, I., Garefalakis, A., Zafeiriou, E., and Kyriakopoulos, G. (2022). The determinants of the environmental performance of EU financial institutions: an empirical study with a GLM model. Energies 15 (15), 5325, July. doi:10.3390/en15155325

Samarawickrama, M. (2022). AI governance and ethics framework for sustainable AI and sustainability. CAS 32 (1), 65–77. doi:10.48550/arXiv.2210.08984

Souza, F. B. D., Yao, X., Gao, W., and Duan, W. (2022). Graphene opens pathways to a carbon-neutral cement industry. Sci. Bull. 67 (1), 5–8. doi:10.1016/j.scib.2021.08.018

Su, Y., and Gao, X. (2022). Revealing the effectiveness of green technological progress and financial innovation on green economic growth: the role of environmental regulation. Environ. Sci. Pollut. Res. 29 (48), 72991–73000. doi:10.1007/s11356-022-20978-5

Sun, X., Xiao, S., Ren, X., and Xu, B. (2023). Time-varying impact of information and communication technology on carbon emissions. Energy Econ. 118, 106492. doi:10.1016/j.eneco.2022.106492

Sun, Y., and Li, X. (2021). Constructing a green financial innovation system with the PPP environmental protection industry fund. Int. J. Technol. Manage. 85 (2/3/4), 319. doi:10.1504/IJTM.2021.115272

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers' environmental awareness. Technol. Soc. 68 (2), 101906–101906.13. doi:10.1016/j.techsoc.2022.101906

Tolliver, C., Fujii, H., Keeley, A. R., and Managi, S. (2021). Green innovation and finance in Asia. AEPR 16 (1), 67–87. doi:10.1111/aepr.12320

Tsioptsia, K. A., Zafeiriou, E., Niklis, D., Sariannidis, N., and Zopounidis, C. (2022). The corporate economic performance of environmentally eligible firms nexus climate change: an empirical research in a bayesian VAR framework. Energies 15 (19), 7266. doi:10.3390/en15197266

Udeagha, M. C., and Muchapondwa, E. (2023). Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Int. J. Sustain. Dev. World Ecol. 30 (6), 633–649. doi:10.1080/13504509.2023.2183526

Wang, N., Wan, J., Ma, Z., Zhou, Y., and Chen, J. (2023a). How digital platform capabilities improve sustainable innovation performance of firms: the mediating role of open innovation. J. Bus. Res. 167, 114080. doi:10.1016/j.jbusres.2023.114080

Wang, N., Xie, W., Huang, Y., and Ma, Z. (2023b). Big Data capability and sustainability oriented innovation: the mediating role of intellectual capital. Bus. Strat. Env. 32 (8), 5702–5720. doi:10.1002/bse.3444

Wu, Z. Y., Zhao, Y., and Zhang, N. (2023). A literature survey of green and low-carbon economics using natural experiment approaches in top field journal. Journal. GLCE. 1 (1), 2–14. doi:10.47852/bonviewGLCE3202827

Yadav, D., Mekhilef, S., Singh, B., and Rawa, M. (2021). Carbon trading analysis and impacts on economy in market-to-market coordination with higher PV penetration. IEEE Trans. Ind. Appl. 57 (6), 5582–5592. doi:10.1109/TIA.2021.3105495

Yu, M., Zhou, Q., Cheok, M. Y., Kubiczek, J., and Iqbal, N. (2022). Does green finance improve energy efficiency? New evidence from developing and developed economies. Econ. Change Restruct. 1-25, 485–509. doi:10.1007/s10644-021-09355-3

Yuan, L., Chen, Y., He, W., Kong, Y., Wu, X., Degefu, D. M., et al. (2022). The influence of carbon emission disclosure on enterprise value under ownership heterogeneity: evidence from the heavily polluting corporations. Environ. Sci. Pollut. Res. 29 (46), 69753–69770. doi:10.1007/s11356-022-20705-0

Zhang, L., Saydaliev, H. B., and Ma, X. (2022). Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew. ENERG 193 (1), 991–1000. doi:10.1016/j.renene.2022.04.161

Zhang, L., Sun, H., Pu, T., Sun, H., and Chen, Z. (2024). Do green finance and hi-tech innovation facilitate sustainable development? Evidence from the Yangtze River Economic Belt. Econ. Anal. Policy 81, 1430–1442. doi:10.1016/j.eap.2024.02.005

Zhang, X., and Ma, X. (2022). Feasible carbon-trade model for low-carbon density ecosystem. J. Appl. Ecol. 59 (4), 1086–1097. doi:10.1111/1365-2664.14119

Zhang, X., Song, Y., and Zhang, M. (2023). Exploring the relationship of green investment and green innovation: evidence from Chinese corporate performance. J. Clean. Prod. 412, 137444. doi:10.1016/j.jclepro.2023.137444

Zhou, G. Y., Zhu, J. Y., and Luo, S. M. (2022). The impact of fintech innovation on green growth in China: mediating effect of green finance. Ecol. Econ. 193 (6), 107308. doi:10.1016/j.ecolecon.2021.107308

Keywords: green finance, carbon neutrality, entropy method, sustainable development, fixed-effect model

Citation: Dong X, Dong D and Yu Q (2024) Green finance innovation and carbon neutrality strategies: sustainable development pathways and policy frameworks. Front. Environ. Sci. 12:1485614. doi: 10.3389/fenvs.2024.1485614

Received: 27 August 2024; Accepted: 31 October 2024;

Published: 04 December 2024.

Edited by:

Xiaohang Ren, Central South University, ChinaReviewed by:

Yan Zheng, Hainan University, ChinaCopyright © 2024 Dong, Dong and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qing Yu, eXVxaW5nY2l0eXVAMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.