- 1School of Business, Hohai University, Nanjing, China

- 2School of Culture and Tourism, Zhejiang International Studies University, Hangzhou, China

Greening and digital transformation have become the new driving forces of China’s economic development. The environmental protection tax (EPT) represents a significant economic measure for environmental protection in China, with the primary objective of safeguarding the environment. Using a 2012–2021 sample of Shanghai and Shenzhen A-share listed companies and the difference-in-differences (DID) method, we empirically investigate the effect of the implementation of China’s EPT on green total factor productivity (GTFP) of heavily polluting enterprises. The results show a significant increase in firms’ GTFP after the implementation of the tax. A mechanism test reveals that firms’ digital transformation has a masking effect, which inhibits the growth of firms’ GTFP. Further analyses investigate the variations in effects based on ownership type, firm size, and market concentration. The positive effect is more pronounced for state-owned enterprises, large enterprises, and those operating in highly concentrated markets. This paper provides theoretical support and empirical evidence for the digital transformation and green development of heavily polluting enterprises, the rational optimization of EPT policies, and the promotion of sustainable economic development.

1 Introduction

“Low-carbon global” is in vogue, and attaining sustainable development is the shared goal of all countries on the planet. Governments all throughout the world create pertinent laws and policies to encourage the concurrent growth of the economy and the environment. Rich resources and inexpensive labor have fueled China’s industrialization since the country’s reform and opening up, propelling the economy of the nation to new heights. But due to resource exploitation and excessive emissions brought on by rapid growth, environmental pollution has not only upset the balance of economic development but has also put people’s physical and mental health in threat, raising new concerns among the public (Khan et al., 2021; Li et al., 2022; Yang et al., 2023). At the same time, with the development of China’s economy entering the growth speed shift period, the painful period of structural adjustment and the previous stimulus policy digest period superimposed on each other (Three Periods Overlapped), the tightening of resource constraints and the disappearance of demographic dividend have reduced the economic growth rate (Esen et al., 2021). The growth mode of the extensive economy, which in the past relied solely on large-scale input factors to obtain output, is no longer applicable to China’s current development status under the new normal. Accordingly, a shift from the extensive economy to an intensive economy is urgent to transform China’s economy from high-speed to high-quality development (Silva et al., 2021).

Total factor productivity (TFP) is a key indicator of production efficiency when it comes to the idea of high-quality development, and increasing it is a valuable strategy for fostering high-quality economic development (Albrizio et al., 2017; Sun, 2022). The concept of green development is consistent with GTFP, which is a crucial indicator to evaluate the viability of high-quality sustainable economic development. Considering environmental factors, GTFP integrates energy consumption and environmental pollution into the measurement framework. The comprehensive enhancement of GTFP has emerged as a crucial strategy for encouraging the harmonious development of environment and economy in China (Cai and Ye, 2020; Yang et al., 2023).

China investigates the EPT policy as a means of resolving the conflict between ecological environment and economic development and of fostering high-quality economic development. The environmental economics literature classifies environmental regulations into four categories: market incentives, public engagement, command-and-control, and voluntary organizations (Ramanathan et al., 2017). In the early stage of environmental governance, the Chinese government mainly implemented command-and-control environmental laws and regulations and assumed full responsibility for environmental protection (Karplus et al., 2021). After nearly 40 years of practice, China officially implemented the “Environmental Protection Tax Law of the People’s Republic of China” on 1 January 2018. Environmental taxation is a flexible and typical kind of market incentive environmental regulation. Based primarily on operational and product prices, it is an economic strategy to shift the costs of pollution from society to the private pockets of enterprises (Chiroleu-Assouline and Fodha, 2014; Dong and Zheng, 2022). Compared with the traditional sewage fee system, EPT is collected by the tax department according to law, and the emission reduction incentive mechanism of “more emission, less emission, less collection, no emission, no collection” is constructed (Lin et al., 2023). This model makes the collection of EPT more mandatory and normative, helps to increase the intensity of collection and management, increase the rigidity of law enforcement, and thus force and encourage enterprises to achieve green transformation. According to Porter’s hypothesis, environmental regulation will affect activities such as enterprise resource integration and technological innovation, and then affect total factor productivity (TFP) of enterprises. As the key object of EPT, heavy polluters’ R&D investment, technological innovation and resource allocation will all be affected by EPT. Therefore, whether EPT can stimulate heavy polluting enterprises to improve GTFP and achieve the goal of “economic dividend” of EPT is an important basis for evaluating its policy effect.

As the world strives to transition to a low-carbon economy, digital transformation has become a force for change, providing new opportunities for heavy polluters in a changing regulatory environment. Through digital transformation, businesses can improve resource efficiency, enhance process optimization, and develop innovative green solutions (Gelenbe and Caseau, 2015). The convergence of digital transformation and sustainability offers a unique opportunity for heavily polluting industries to improve business productivity while achieving environmental goals. So in the context of the implementation of the environmental protection tax system, how do heavy polluting enterprises that are undergoing digital transformation react? What is the impact on GTFP? These are urgent issues that need to be addressed.

In order to explore the above issues, this study adopts the panel data of A-share listed enterprises from 2012 to 2021, and uses the DID model to evaluate the impact of EPT on the GTFP of heavily polluting enterprises and the mediating role of digital transformation. In addition, we also explore the impact of EPT law on the heterogeneity of heavy polluting enterprises with different ownership, different sizes and different market concentration.

Relative to the current literature, the possible contributions in this article include the following four aspects: Firstly, investigating EPT, digital transformation, and GTFP into the same framework, which allows a more complete knowledge of how environmental policy affects heavily polluting enterprises’ GTFP. Secondly, many studies employ relevant economic variables, such as the amount of environmental tax paid by businesses, to proxy for environmental regulations, but there may be measurement errors. In this paper, an EPT quasi-natural experiment is used to study the influence of EPT on the GTFP of heavy polluting enterprises at the micro level. Thirdly, this paper introduces environmental pollution indicators into the analysis of SBM-DDF approach. Finally, China implemented the EPT somewhat belatedly. There are few empirical studies on the impact of the policy after the tax, and most domestic research focuses on theoretical analysis and prediction prior to the levy. Thus, this paper broadens the literature on EPT and GTFP by examining the impact and mechanism of EPT on GTFP from a theoretical and empirical perspective. It is anticipated to promote China’s GTFP growth in the new development period and offer helpful insights for future EPT advancement.

The remainder of the study is structured as follows: The term “literature review” gives a summary of pertinent literature. The theoretical analysis and research hypothesis are presented in “Research hypothesis.” “Method and data” explains the data source, the model, and how important variables were constructed. “Empirical results” offers analytical and empirical findings. The research is summarized, and implications are given in the “Conclusions and recommendations” section.

2 Literature review

The influence of the EPT system on firms’ GTFP has emerged as a significant realm of economic research, though the outcomes remain inconclusive. Some argue that the imposition of EPT hampers firms’ GTFP. From the perspective of neoclassical economics, regulatory pressures induced by environmental policies elevate costs associated with pollution and increase the tax burden on enterprises. This compels businesses to reallocate their resources, diverting resources from traditional production toward pollution control and environmental protection endeavors. Consequently, this generates a “crowding out effect” that detracts from the production efficiency of these enterprises (Hancevic, 2016; Yang et al., 2017; Yuan et al., 2017; He et al., 2020; Li et al., 2021). A number of scholars have embarked on empirical investigations centered around specific environmental tax policies. Utilizing the DID method, Tu et al. (2019) discovered that reforms in pollution tax standards can stifle GTFP through the avenue of technological change. Similarly, Cai and Ye (2020) observed that China’s newly implemented EPT law exerted a continuous inhibitory effect on the firms’ GTFP over a span of 2 years. This phenomenon was chiefly attributed to the exacerbation of financial constraints and its detrimental impact on the efficiency of technological innovation and resource allocation. In a related study, Su and Li (2023) employed the spatial difference in difference model and revealed that China’s EPT law significantly impairs green total factor energy efficiency. The underlying mechanisms for this adverse effect include a decline in green technology innovation and a shift in industrial structure.

Another perspective is that EPT could promote firms’ GTFP. Porter hypothesis asserts that strict and appropriate environmental regulations can enable firms to actively adapt through leveraging innovation incentives, efficiency improvements, and internal redistribution, thereby increasing productivity. Both market-based and command-based environmental regulations contribute to the rise of GTFP, but their mechanisms of action differ (Cheng and Kong, 2022). The EPT law stands as a market-oriented instrument. Scholars have delved into the nexus between this law and GTFP through diverse research methodologies. Sun and Zhang (2023), employing the triple difference method, affirmed that EPT markedly enhances the firms’ TFP by spurring technological innovation and optimizing resource allocation. Yang et al. (2024) identified enterprise value augmentation and green innovation incentives as potential pathways through which EPT law bolsters firms’ TFP, as evidenced by their DID analysis. Yao and Xi (2023), utilizing the comprehensive control method, corroborated that EPT significantly elevates GTFP by influencing industrial structure and fostering green technological advancements.

There exists a perspective asserting a nonlinear interplay between the EPT and firms’ GTFP. Certain scholars contend that the influence of environmental regulation on enterprises’ TFP emerges from the interplay between the “compliance cost hypothesis” and the “Porter hypothesis” (Albrizio et al., 2017; Peng et al., 2021). Drawing from provincial data in China, Qiu et al. (2021) employed the generalized least square method and the dynamic generalized moment method model, unveiling a “U”-shaped relationship between environmental regulations and GTFP. Similarly, Xu et al. (2022) discovered a comparable relationship between these variables.

Digitalization has been identified as a catalyst for enhancing economic and environmental performance (Buer et al., 2018; Wen et al., 2021). Enterprise digital transformation enables organizations to innovate by leveraging digital technologies to reshape their production processes, organizational structures, and business models (Borenstein and Saloner, 2001). Numerous scholars have extensively examined the impact of environmental regulations and digital transformation on the firms’ TFP. Based on the data of China’s A-share resource-based listed enterprises, Xu et al. (2023) found that digital transformation significantly improved the environmental performance of enterprises by stimulating green technology innovation, accelerating human capital accumulation, increasing environmental information disclosure and strengthening environmental governance. Wen et al. (2022) found that digitalization can enhance the total factor productivity of manufacturing firms by reducing transaction costs, promoting servitization, and stimulating innovation investments. However, those who are less optimistic believe that digital transformation will take away investment in green development, thereby inhibiting enterprises’ GTFP. Han et al. (2023) conducted an empirical analysis using the dynamic panel GMM model, revealing that environmental regulations had not yet crossed the Porter turning point and continued to have a restraining effect on the efficiency of green development. Other scholars perceive a dynamic relationship between digital transformation and GTFP. Wang and Li (2023) found that digital transformation inhibited GTFP, carbon emission efficiency, and joint emission reduction efficiency of firms in the short term, but promoted them in the long term. However, there is limited research on the EPT system in the context of digital transformation and its impact on the enterprises’ GTFP, particularly regarding how enterprises respond to digital transformation under EPT law. Although digital transformation is considered an emerging driver of green sustainable growth, it is crucial to harmonize the relationship between digital transformation and green transition (Schnebelin et al., 2021; Lee and He, 2022; Wen et al., 2022).

In summary, existing studies on the impact of EPT on GTFP have yielded significant findings. However, consistent findings have not been established due to variations in environmental tax regulations, sample selections, and research methodologies across different countries. Furthermore, there are even fewer studies focusing on the impact of China’s EPT law at the micro level. Additionally, the potential role of digital transformation in the relationship between EPT and corporates’ GTFP remains unexplored. In light of this, based on the implementation of China’s EPT in 2018, this study investigates the impact of EPT on the heavily polluting enterprises’ GTFP, as well as the role of digital transformation, thereby extending previous research.

3 Research hypothesis

Firstly, the Porter Hypothesis asserts that appropriate environmental regulations can stimulate corporate innovation, enhance productivity, and improve product quality, which can offset the costs of environmental regulations and increase profitability, thus providing a competitive advantage (Cheng and Kong, 2022; Yang et al., 2023). The public goods nature of ecological environments and the significant asymmetry between the costs and benefits of environmental governance result in weak motivation for pollution control among heavily polluting enterprises. Faced with high pollution control and equipment renewal costs, enterprises often prefer to pay fines to mitigate the financial impact of pollutant discharge. Therefore, timely government intervention is necessary. The introduction of EPT embodies the principle of “the more you emit, the more you pay; emit less, pay less; no emissions, no payment” (Kong et al., 2024). On one hand, this positive incentive mechanism can enhance the initiative of enterprises to reduce emissions. On the other hand, heavily polluting enterprises, characterized by high emissions, face significantly increased costs for environmental violations under a “more pollution, more tax” policy design (He et al., 2022). Additionally, the enforcement of the EPT law is stricter than that of pollution charges, and enterprises committing serious tax evasion may also face criminal penalties. To reduce the costs of environmental violations and production, heavily polluting enterprises are incentivized to eliminate outdated production capacities and adopt advanced production technologies (Khan et al., 2021; Yao and Xi, 2023). Therefore, from the perspective of the innovation compensation effect, the environmental protection tax can promote technological innovation in heavily polluting enterprises, thereby enhancing green total factor productivity.

Secondly, the Porter hypothesis asserts that scientific environmental regulation can expose inefficiencies in enterprise resource allocation and provide guidance for optimizing resource allocation efficiency (Rubashkina et al., 2015). Following the implementation of the EPT, in order to reduce the costs of environmental violations and production, and to maximize benefits, heavily polluting enterprises must reduce emissions and enhance production efficiency (Sun and Zhang, 2023). Given the current level of technology, heavily polluting enterprises often enhance resource utilization efficiency by optimizing internal resource allocation. For example, by strengthening the supervision of the production process to minimize resource waste, such as incomplete utilization of materials; reducing pollution emissions per unit of output by using clean and efficient raw materials; and reallocating capital and labor from pollution-intensive projects to pollution prevention and control, thus rationally allocating production factors to cleaner and more efficient sectors (Shuli et al., 2016; Sun and Zhang, 2023). Therefore, from the perspective of resource allocation efficiency, the EPT can promote heavily polluting enterprises to enhance their GTFP by improving resource allocation efficiency.

Finally, the EPT is a market-oriented environmental system. From the perspective of institutional theory, the EPT increases the legitimacy pressure on enterprises. On one hand, the government and relevant departments investigate the environmental tax payment and green production status of enterprises, determining whether to impose administrative penalties or provide subsidies, tax incentives, and other resources based on the investigation results. On the other hand, external stakeholders, such as suppliers and investors, assess the compliance with environmental taxes to determine the risks to the company and decide whether to continue their business relationships. To establish a green image and gain support from the government and investors, enterprises will proactively implement green transformations, reduce pollutant emissions, and minimize the use of inefficient energy (Yang et al., 2023). The EPT can incentivize enterprises to engage in environmental governance, achieve excellence in green R&D and environmental performance evaluations, thereby securing additional financial support. Therefore, from the perspective of legitimacy pressure, the EPT can promote heavily polluting enterprises to enhance GTFP through environmental governance. Based on the above analysis, we propose Hypothesis 1.

Hypothesis 1:. The EPT positively impacts the GTFP of heavily polluting enterprises.

Digitalization and greening are the primary directions for enterprise transformation during the technological revolution (DeStefano et al., 2018). As a crucial step towards achieving the “dual carbon” goal, digital transformation presents an opportunity for enterprises to enhance their GTFP (Guo and Huang, 2023; Liu and Zhao, 2024). The digital transformation of heavily polluting enterprises can enhance production and operational efficiency, reduce energy consumption and resource waste, and improve their GTFP (Han et al., 2023; Su et al., 2023; Si et al., 2024). As a stringent environmental regulation tool, the EPT raises the environmental costs and regulatory pressure on heavily polluting enterprises, compelling them to increase their investment in clean technology and environmental protection (Xiao et al., 2021). However, due to resource constraints, enterprises need to reallocate resources, such as R&D and human capital, from digital technology investment to green production (Ai et al., 2021; Liu et al., 2024). Additionally, to reduce the corporate tax burden caused by rising environmental costs and to increase profits, companies may reduce other aspects of cash flow, potentially including investments needed for digital transformation.

Although digital transformation can foster a new era of digital and green collaborative development in manufacturing enterprises by optimizing the combination of production factors such as labor, capital, data, and energy, it necessitates substantial capital and resource investment from enterprises. Under a high environmental tax burden, investment in digital transformation by heavily polluting enterprises may have a crowding-out effect on their green development. Therefore, the digital transformation of heavily polluting enterprises may obscure the promoting effect of the EPT on their GTFP. Therefore, we propose Hypothesis 2.

Hypothesis 2:. Digital transformation may obscure the role of EPT in promoting GTFP of heavily polluting enterprises.

4 Method and data

4.1 Data source and processing

The Chinese A-shares of listed firms from 2012 to 2021 make up the study sample. Based on the extent of the EPT’s influence, the listed companies are split into two groups: the “treatment group” and the “control group.” The “control group” is made up of non-heavy pollution industries firms that are less or virtually unaffected by the EPT, and the “treatment group” is composed of the heavy pollution industry enterprises, which are the primary focus of the EPT in China. Therefore, the research objects that most directly reflect the microeconomic impact of EPT are the heavy pollution industrial firms (He and Jing, 2023). Since China upgraded sewage fees in several provinces in 2012 and the EPT went into effect in 2018, we selected this time frame as the sample period.

We processed the raw data based on the following rules: first, we eliminated any values that are missing. Secondly, the sample identified firms that had the ST and *ST designations removed. Thirdly, the financial firm samples were eliminated. Fourth, we employed the interpolation approach to fill in the missing values. Finally, 11,049 observations were gathered, of which 405 observations belonged to the treatment group and 701 observations to the control group. The 1% and 99% quantiles were used to winsorize the continuous variables in order to remove the interference caused by aberrant values. The variable measurement data in this paper are all from the China Energy Statistical Yearbook (2013–2022), China Environmental Statistical Yearbook (2013–2022), Chinese urban Statistical Yearbook (2013–2022) and the National Bureau of Statistics. Sample firms’ financial information comes from the China Stock Market and Accounting Research database (CSMAR).

4.2 Variable description

4.2.1 Dependent variable

In this paper, GTFP serves as the explanatory variable. The typical application of data envelopment analysis (DEA) is to assess the effectiveness of multiple input-output systems. However, the conventional DEA directional distance function exhibits radiality and directivity deviations, making it unable to address the issue of input and output indicator relaxation (Fukuyama and Weber, 2009). Even if the SBM model takes non-radiality and non-directivity into account, there are still some issues where the efficiency is overstated and the input and output cannot be enhanced radially. An approach that combines SBM with DDF (directional distance function) is called SBM-DDF. Because of its non-radial and non-directional directional distance function based on relaxation, it can more effectively overcome the aforementioned issues and measure GTFP with greater accuracy (Yao and Xi, 2023). Thus, the SBM-DDF approach is used in the paper to measure GTFP and the SBM-DDF model is constructed as follows:

In Model 1, if we assume that each measurement unit uses

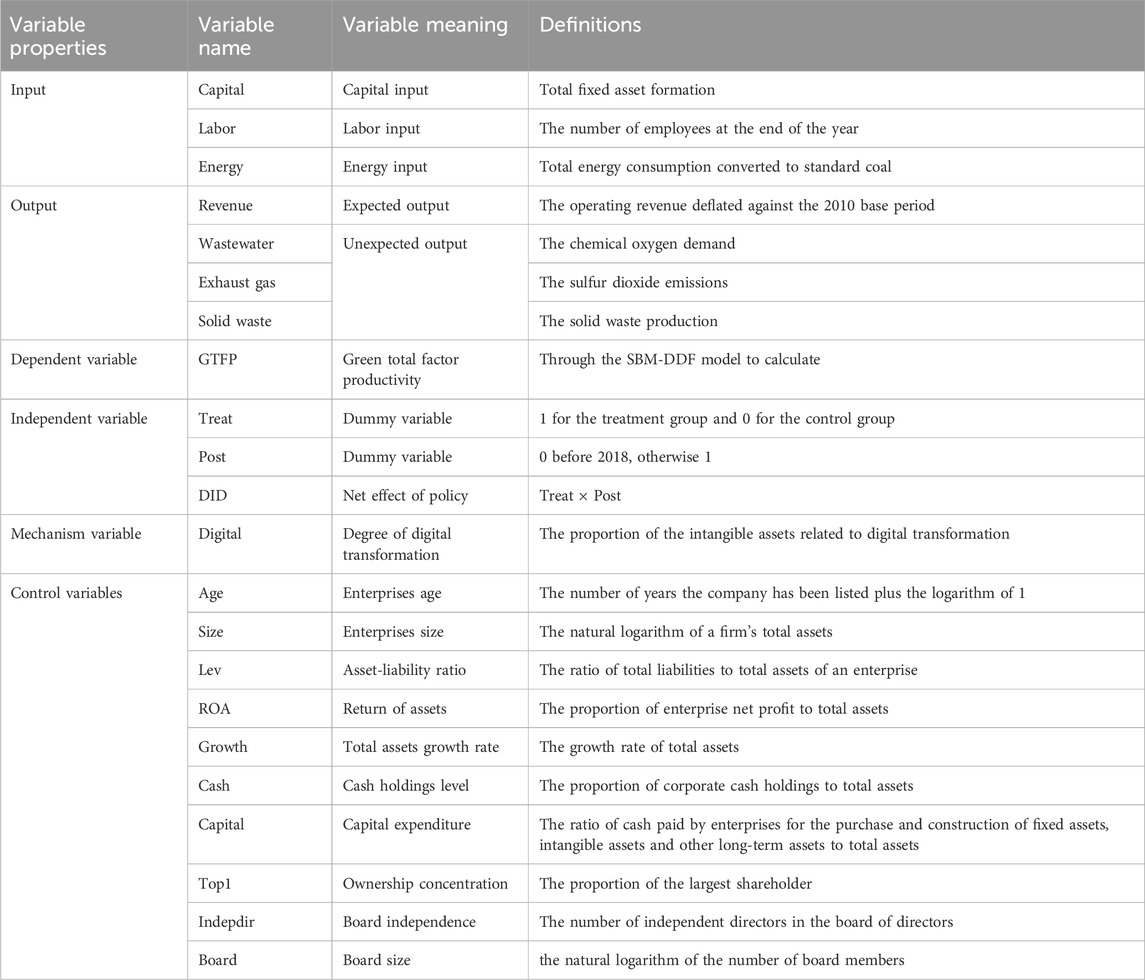

In this paper, the specific input–output indicators are as follows: (1) Capital input. The capital input is calculated by using Zhang et al. (2004)’s perpetual inventory approach (i.e., capital stock = total fixed asset formation). (2) Labor input. Labor input uses the number of employees at the end of the year. (3) Energy. Energy input is expressed as total energy consumption converted to standard coal. (4) Revenue output. Revenue output is expressed by the heavily polluting enterprises’ gross operating revenue for each year. Considering the price influence, the operating revenue was deflated against the 2010 base period. (5) Wastewater output. Waste water output selects the chemical oxygen demand (COD) of the most discharged industrial water pollution. (6) Exhaust gas output. Exhaust gas output selects the sulfur dioxide emission, which accounts for the largest proportion of industrial production emissions in atmospheric pollution. (7) Solid waste output. Solid waste output is expressed by industrial solid waste production volume.

4.2.2 Independent variable

The independent variable in this paper is the Treati*Postt interaction term, denoted as DIDit, that is, the cross-multiplying term of EPT implementation, which is used to indicate whether heavy polluters have levied EPT. Treati and Postt are used as virtual variables, in which Treati is used to classify the experimental group and the control group. The value of 1 is for enterprises that are heavily polluting and are more affected by EPT, however, 0 is for enterprises that are less affected by EPT. Postt is used to distinguish the time before and after the occurrence of policies, and 2018 is selected as the policy impact time, that is, the Postt value is 0 from 2012 to 2017, but the Postt value is 1 from 2018 to 2021.

According to Wang and Li (2023), the listed enterprises are divided into 16 heavy polluting industries, including iron and steel, building materials, mining and metallurgy and other industries according to the classification standards of heavy polluting industries in the Listed Companies Environmental Protection Verification Industry Classification Management Directory issued by the Ministry of Ecology and Environment, PRC.

4.2.3 Mechanism variable

The mechanism variable in this paper is the digital transformation of heavily polluting enterprises. Digital transformation mainly refers to the use of big data, internet of things, artificial intelligence and other digital technologies to transform the business model and production process of the enterprise, and then optimize the business mode of the enterprise, and finally complete the process of industrial upgrading (He and Liu, 2019). Based on Zhang et al. (2021), this paper measures the digitalization level by taking the proportion of the intangible assets related to digital transformation in the year-end intangible assets details disclosed in the notes to the financial reports of listed companies to the total intangible assets. More specifically, when the intangible asset details include keywords related to digital transformation technologies such as “software”, “client” and “intelligent platform”, the detailed items are defined as “digital technology intangible assets”, and then multiple digital technology intangible assets of the same company in the same year are summed up. Calculate the proportion of intangible assets in the current year, which is a proxy variable for the degree of digital transformation of enterprises.

4.2.4 Control variables

Referring to Yang et al. (2024), Kong et al. (2024) and Yao and Xi (2023), this research selects the control variables from three aspects of corporation characteristics, financial position and firm governance: enterprises age (Age), enterprises size (Size), asset liability ratio (Lev), return of assets (ROA), total assets growth rate (Growth), cash holdings level (Cash), capital expenditure (Capital), ownership concentration (Top1), board independence (Indepdir) and board size (Board). See Table 1 for specific variable definitions.

4.3 Model setting

4.3.1 DID model

The DID model is one of the most commonly used non-experimental methods of policy evaluation, which can be used to evaluate the micro effects of macro policies. Drawing on the research of Lin et al. (2023), this paper takes the introduction of the EPT law in 2018 as a quasi-natural experiment to investigate the impact of EPT on GTFP of heavily polluting enterprises, and builds the following initial model:

where, GTFPit represents the level of sustainable economic and social development, DIDit represents the interaction term of policy variables, Xit represents a group of control variables, γi is the time fixed effect, μi is the individual fixed effect and εit is the residual term.

4.3.2 Intermediate effect model

In order to investigate the mediating role of digital transformation in the impact mechanism of EPT on GTFP, this paper refers to the mediating effect test method proposed by Baron and Kenny (1986), and further constructs (Equations 3, 4) on the basis of Equation 2. The specific forms are as follows:

where, Digitalit represents development level of digital economy of enterprises, GTFPit represents the level of sustainable economic and social development, DIDit represents the policy variable interaction term, Xit represents a group of control variables, γi is the time fixed effect, μi is the individual fixed effect and εit is the residual term.

5 Empirical results

5.1 Descriptive statistics

According to the results of descriptive statistics analyses from Table 2, it can be found that: the total sample size is 11,049, the mean value of Treat is 0.367, which indicates that about 36.7% of the enterprises in the sample are in the heavy polluting industry; the mean value of Post is 0.400, which indicates that the sample of enterprises affected by EPT policies from 2012 to 2021 accounts for about 40.0%. The mean value of GTFP is 1.003, the maximum value is 1.359, the minimum value is 0.739, and the standard deviation is 0.099, which indicate to a certain extent that the GTFP of A-share listed companies is generally low and the level of greenness among different companies is uneven.

5.2 Baseline regression results

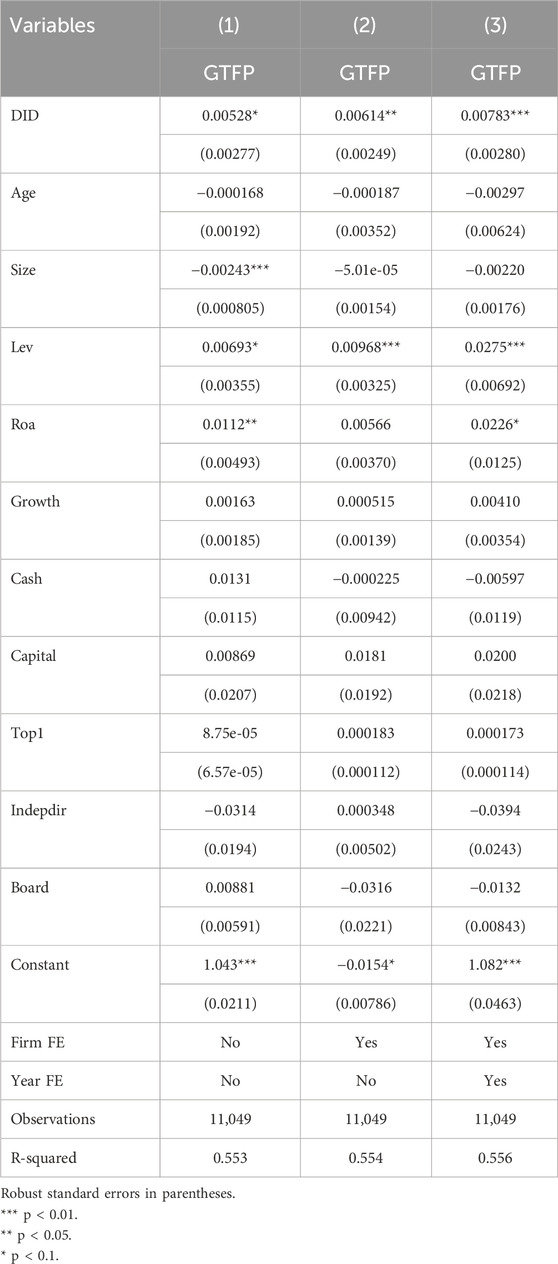

Table 3 reports the benchmark regression results of EPT on GTFP of heavily polluting enterprises based on Equation 2. Column (1) shows no firm or year fixed effect but with control variables added. The estimator value of regression coefficient is significant positive at the 10% level. Column (2) controlled for firm fixed effect after adding control variables, and the result still shows that the impact of EPT on GTFP has passed the test under the 5% significance level. Column (3) continues to add the year fixed effect based on Column (2), and the estimated regression coefficient rises again considerably. According to Table 3, there is a positive relationship exists in EPT and GTFP. The GTFP can increase by approximately 0.78 percentage points on average when the EPT is published, which verifies hypothesis 1 of this paper. Furthermore, the stepwise test results also demonstrate that those factors that impact EPT are under good control, and the selective control variables are scientific and receivable.

These results indicate that EPT can promote the heavy polluting enterprises’ GTFP. This may be due to the fact that EPT can promote the GTFP of heavy polluting enterprises by stimulating technological innovation, improving resource allocation efficiency and increasing legal pressure. First of all, according to the Porter hypothesis, appropriate environmental regulations can encourage enterprises to carry out technological innovation. The principle of “pay more for more discharge, pay less for less discharge, and pay less for no discharge” of EPT forces heavy polluting enterprises to face high environmental violation costs, thus promoting them to eliminate backward production capacity and improve production technology. Secondly, in order to reduce the cost of environmental violations and production costs, enterprises must optimize the allocation of resources, improve the efficiency of resource utilization by strengthening the supervision of the production process, using clean and efficient raw materials and rationally allocating production factors. Finally, EPT increases the legitimacy pressure of enterprises, and the government and external stakeholders evaluate enterprises according to their environmental performance, prompting enterprises to take the initiative to carry out green transformation and reduce pollutant emissions in order to establish a green image and obtain more financial support. Through these mechanisms, EPT effectively promotes the GTFP of heavy polluting enterprises.

5.3 Intermediate effect test

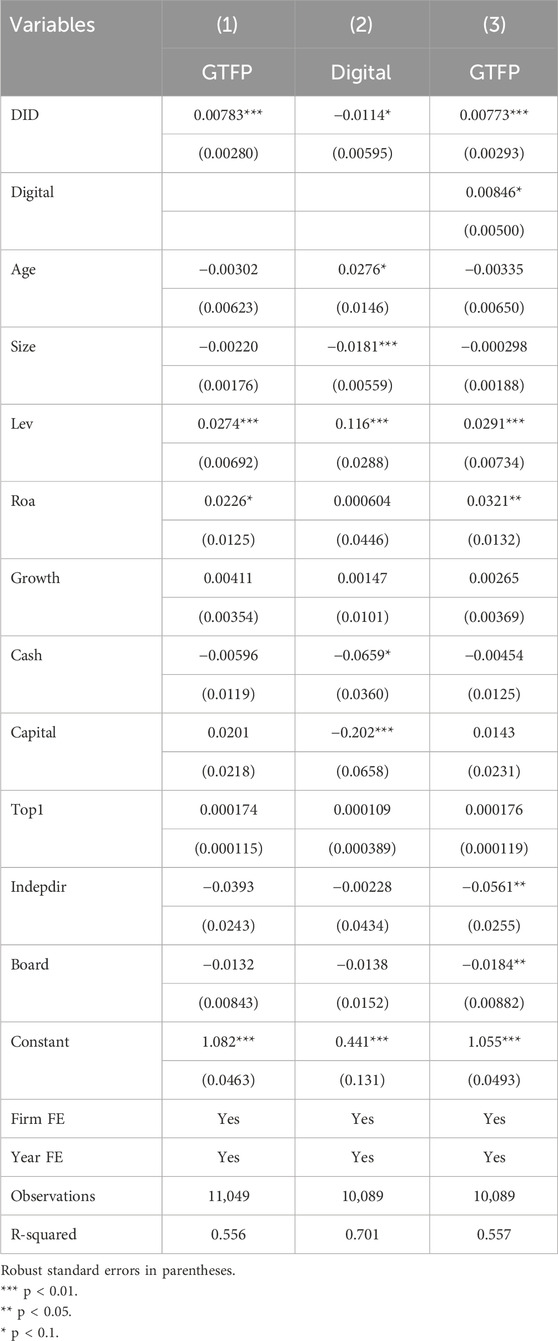

According to the intermediary effect model proposed by Baron and Kenny (1986), the digital transformation of the medium variable was added to model 2 to form model 3, and through model 3, the intermediary role of the digital transformation of heavy polluting enterprises in EPT and GTFP was tested.

As can be seen from Table 4 column 1, the regression coefficient α1 between EPT and GTFP of enterprises is 0.00783, which is positively significant at 1% level. The regression coefficient β1 of EPT and digital transformation is −0.0114, which has a significant negative correlation at 1% level. It shows that EPT can significantly inhibit the digital transformation of heavily polluting enterprises, which is consistent with Hypothesis 2. The regression coefficient η2 of digital transformation and GTFP is 0.00846, which is significantly positive at the level of 10%, indicating that the indirect effect is significant. It can be seen that after the addition of digital transformation, the regression coefficient η1 between EPT and GTFP decreases from 0.00783 to 0.00773, indicating that the direct effect is significant, but the product symbol of indirect effect coefficient β1*η2 is opposite to that of direct effect coefficient η1. It shows that digital transformation will obscure the promoting effect of EPT on GTFP of heavily polluting enterprises. Hypothesis 3 is verified.

According to the empirical results in this section, the digital transformation of heavily polluting enterprises can obscure the enhancement effect of EPT on their GTFP. This may be because although heavily polluting enterprises can promote green transformation and improve GTFP through digital transformation, the resources of enterprises are limited, especially the capital flow. When heavily polluting enterprises vigorously carry out digital transformation, it is bound to occupy a lot of capital and human resources, thus squeezing the space for green development of enterprises.

5.4 Robustness tests

5.4.1 Parallel trend test

The premise of performing DID model is that the parallel trend test holds, that is to say, there is a low variability between the treatment group (heavily polluting enterprises) and the control group (non-heavily polluting enterprises) prior to EPT law implement. In this case, the estimated results of causal effects are feasible due to the slight discrepancy. Accordingly, this paper follows relevant literature to use the event analysis method to verify whether the research sample satisfies the parallel trend (Li et al., 2016), and constructs the following model:

In Equation 5, Treat × Postin is the dummy variable represents whether the research samples are affected by EPT, where n indicates n years before or after the policy implement when n is negative or positive, respectively. We consider the 1 year before the policy implement as the base year, and then dropped n = −1. Accordingly, βn reports the difference the treatment group suffered policy shock in comparison with the corresponding control group in the first n year.

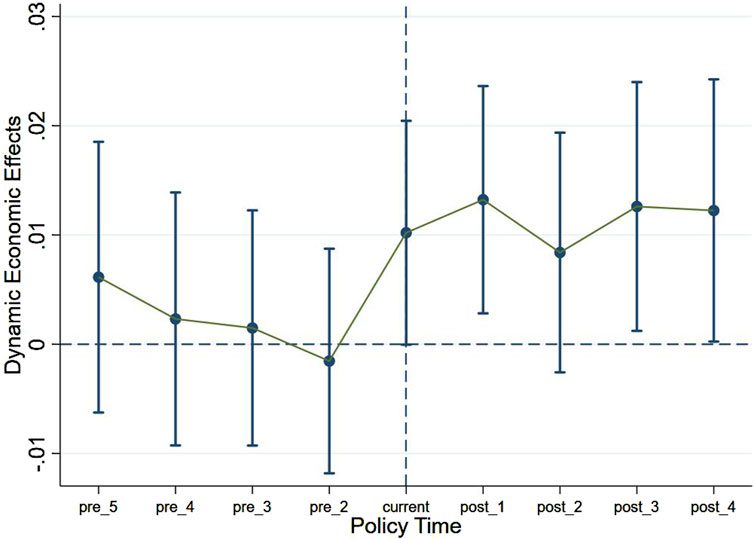

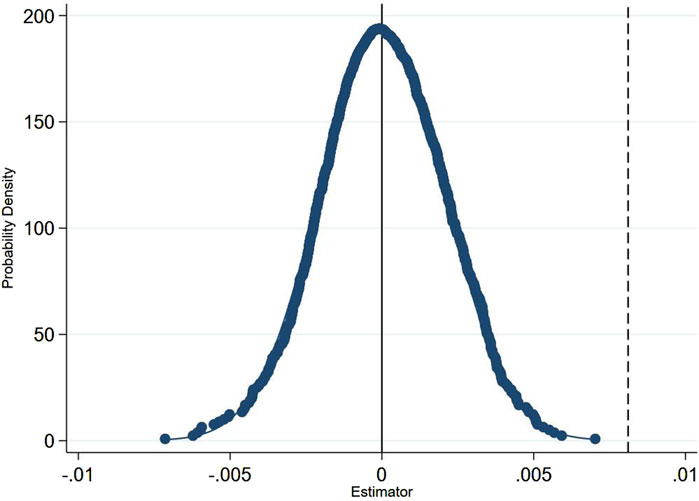

Figure 1 describes the estimated values of a 95% confidence interval in control of time trend effects for firms and years. The estimators of βn are insignificant under the 5% level before the policy coming on, showing that there is no discernible difference between the treatment group and the control group before the occurrence of the policy. However, the estimators of coefficient have an overall growth period and almost passed the significance test under the 5% level after the policy came into effect. Therefore, the DID model applied to measures the impact of EPT on GTFP of heavily polluting enterprises fulfills the parallel trend test.

5.4.2 Placebo test

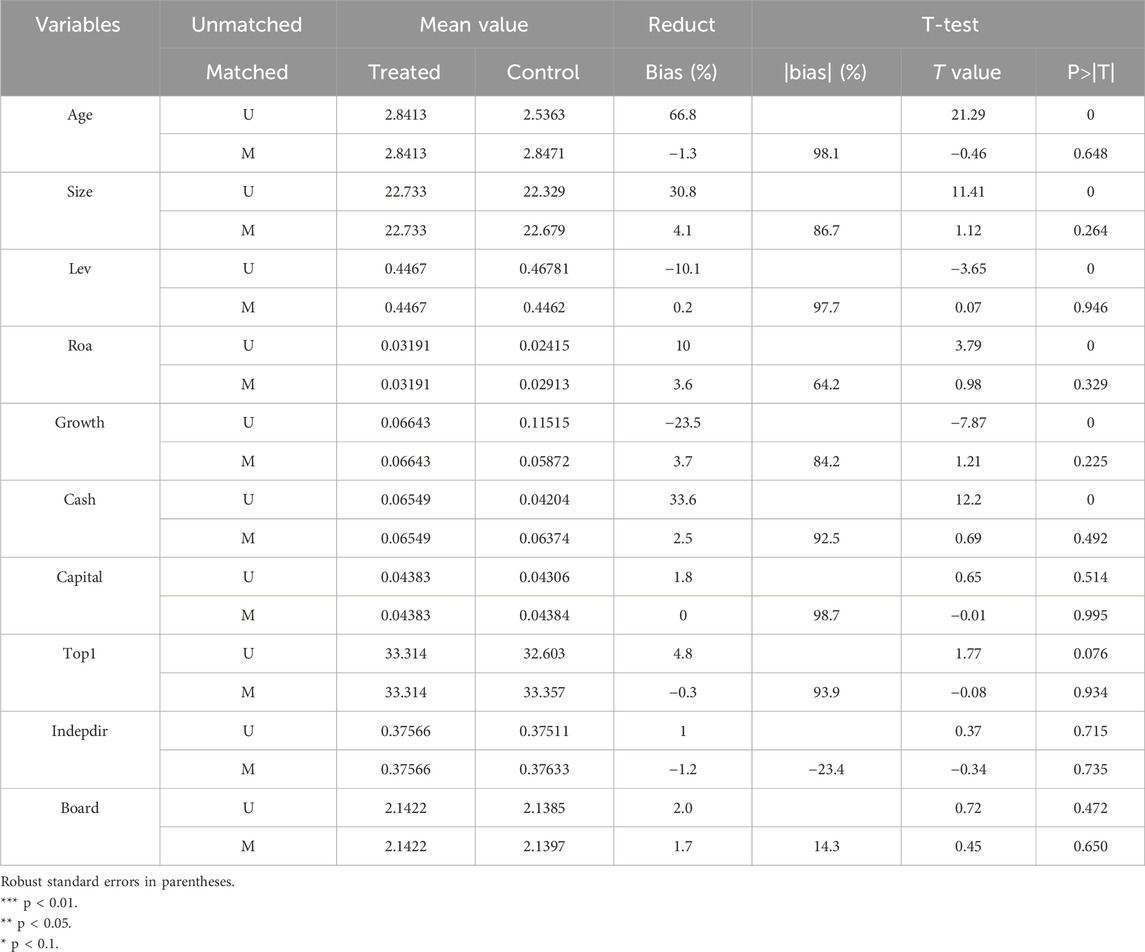

To exclude the impact on benchmark results caused by omitted variables and unobservable factors, we select a placebo test to test whether the EPT is exogenous variable. More specifically, a virtual treatment group was generated randomly from the whole sample and time-frame, and conduct baseline regression on it. Then the above regression process was repeated 1,000 times.

Figure 2 describes the kernel density distribution of the estimated coefficients for randomly generated virtual treatment groups. As shown, the solid blue line indicates the coefficient estimates for the virtual treatment group, and the vertical dotted line marks the impact coefficient of the true baseline regression. In Figure 2, the result represents that the virtual estimators of coefficient are distributed around zero, while the coefficient of the real benchmark regression model in this paper is 0.00783, which is far outside the range of the virtual regression coefficient. Therefore, we can be sure that the EPT fulfills placebo test expectations, and its effect is less likely to be interpreted by random factors, which further verify the benchmark regression results are robust.

5.4.3 PSM-DID

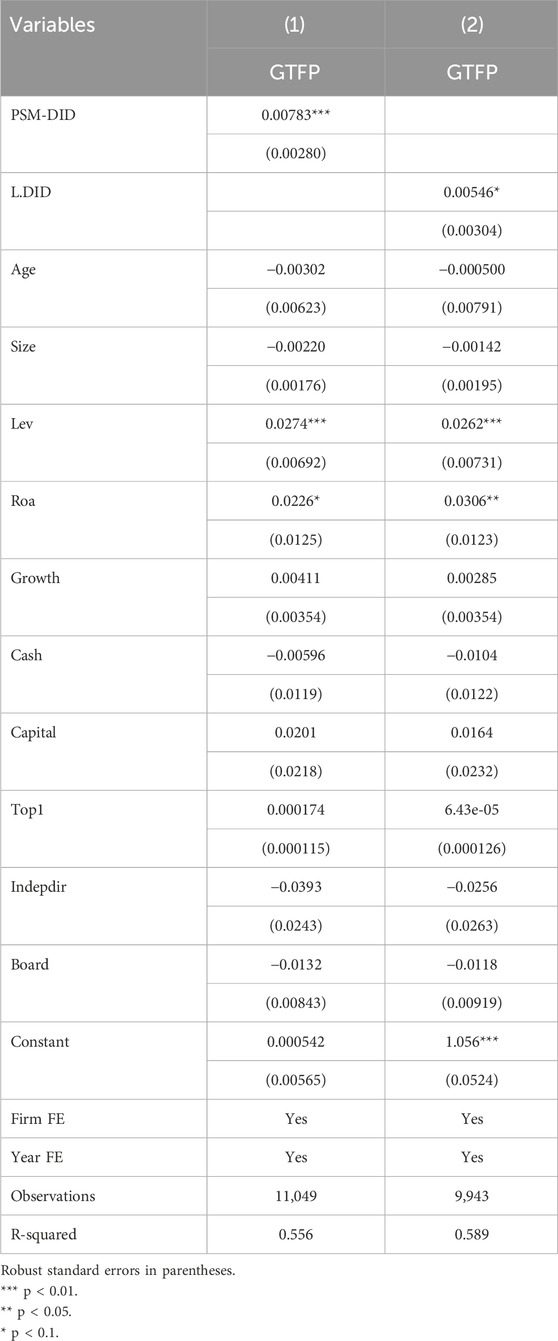

In order to eliminate the interference of estimation bias caused by sample selection error to the estimation results and alleviate the endogenous problem caused by omitted variables, we used the PSM-DID model to further analyze the impact of environmental protection tax policy on GTFP of heavily polluting enterprises. More specifically, this paper takes DIDit as the explained variable and control variables as the covariable, the logit model was used to estimate the probability of each sample being selected into the experimental group. Then, the nearest neighbor matching method is used to match 1∶1 samples. If there is no significant difference between matching variables after matching, the PSM-DID method is feasible.

Table 5 depicts the results of the propensity score matching balance test. The result shows that the absolute values of all standard deviations are less than 10%, and the P-value of T-test after matching is more than 10%, which indicates that the matching results are reasonable. On this basis, this paper uses the DID model to conduct a regression on the matched sample data, as shown in column (1) of Table 6. After matching the propensity score, the promotion effect of environmental protection tax on the GTFP of heavily polluting enterprises is still significant at the confidence level of 5%. The test results are basically consistent with the above reference regression results, which demonstrates that the research conclusions can be considered robust.

5.4.4 Lagged explanatory variables

Considering that the regression results likely to be interpreted by the endogenous factors, the explanatory variable was re-estimated with a one period behind lag to alleviate the problem of simultaneity. Table 6 column (2) represents the estimated results of α1, and the regression coefficient remained positive. The estimated value was 0.00546, which was in close proximity to the regression result. Therefore, the EPT’s effect in increasing GTFP is robust.

5.5 Heterogeneity analysis

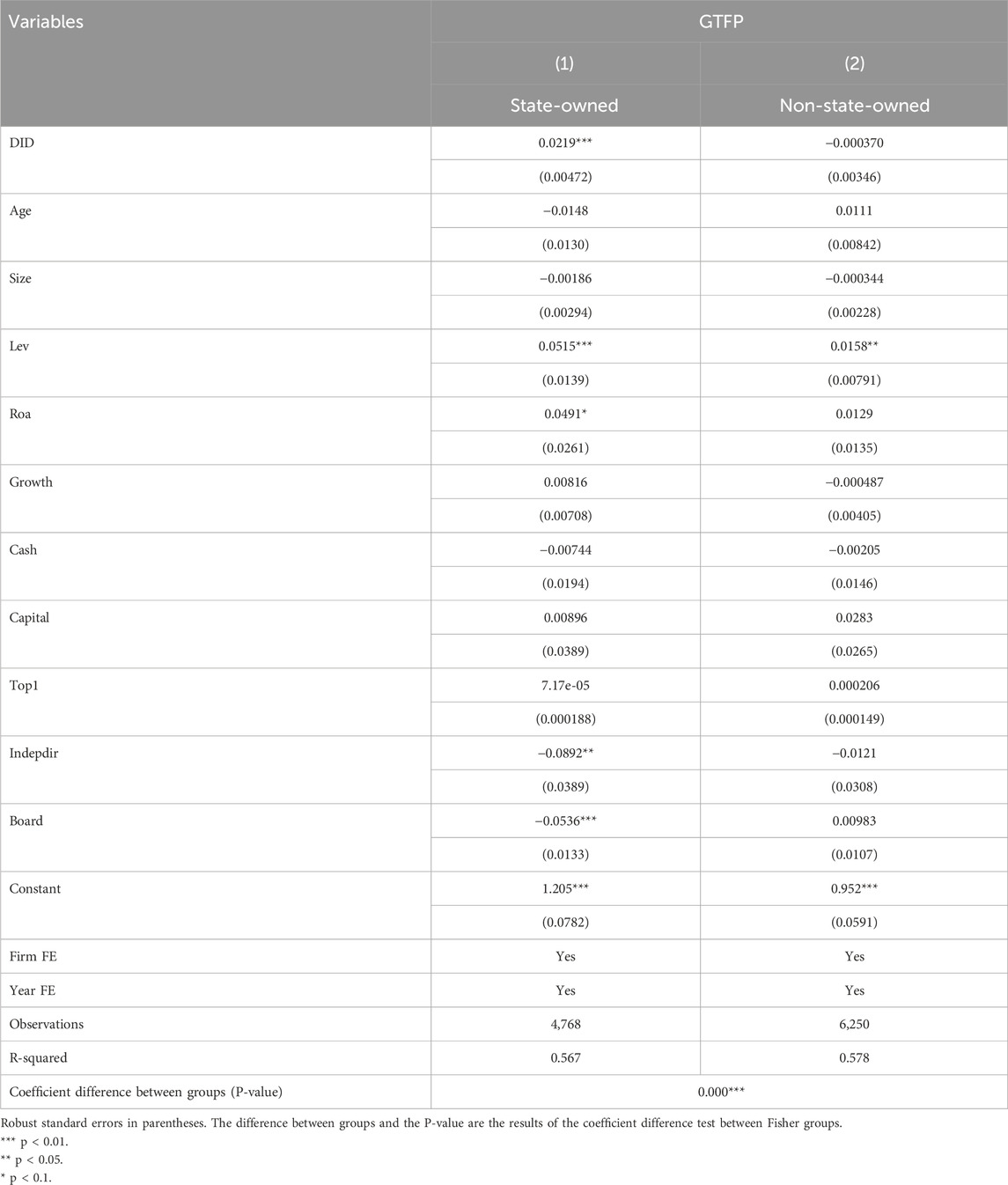

5.5.1 Heterogeneity of ownership

The nature of property rights can affect the management system and operation system of enterprises, so enterprises with different owners may make different decisions in the face of environmental regulations. According to the different property rights of enterprises, this paper divides the sample listed enterprises into two categories: state-owned enterprises and non-state-owned enterprises. The sub-samples of state-owned enterprises and non-state-owned enterprises are used to test whether there are differences in the impact of EPT on heavily polluting enterprises of two different ownership types. After re-estimated model (1), as can be seen from Table 7, column (1) indicates that the coefficient between the GTFP of state-owned enterprises and EPT is 0.0219, with a significant positive correlation at 1% level. Column (2) indicates that the coefficient between the GTFP of non-state-owned enterprises and EPT is −0.000370. It does not reach a significant level, which indicates that the promulgation of the EPT law has played a positive role in promoting the green and sustainable development of state-owned heavily polluting enterprises, but has not played a significant role in the green and sustainable development of non-state-owned enterprises. After analysis, it is found that, on the one hand, in the face of the implementation of the new environmental protection law, state-owned enterprises, as an important tool for local governments to achieve political performance demands, will tend to increase investment in environmental protection and improve the level of green development. On the other hand, state-owned enterprises have a strong political background, easy to obtain government support and preferential policies, and easier to protect the green development of enterprises.

5.5.2 Heterogeneity of size

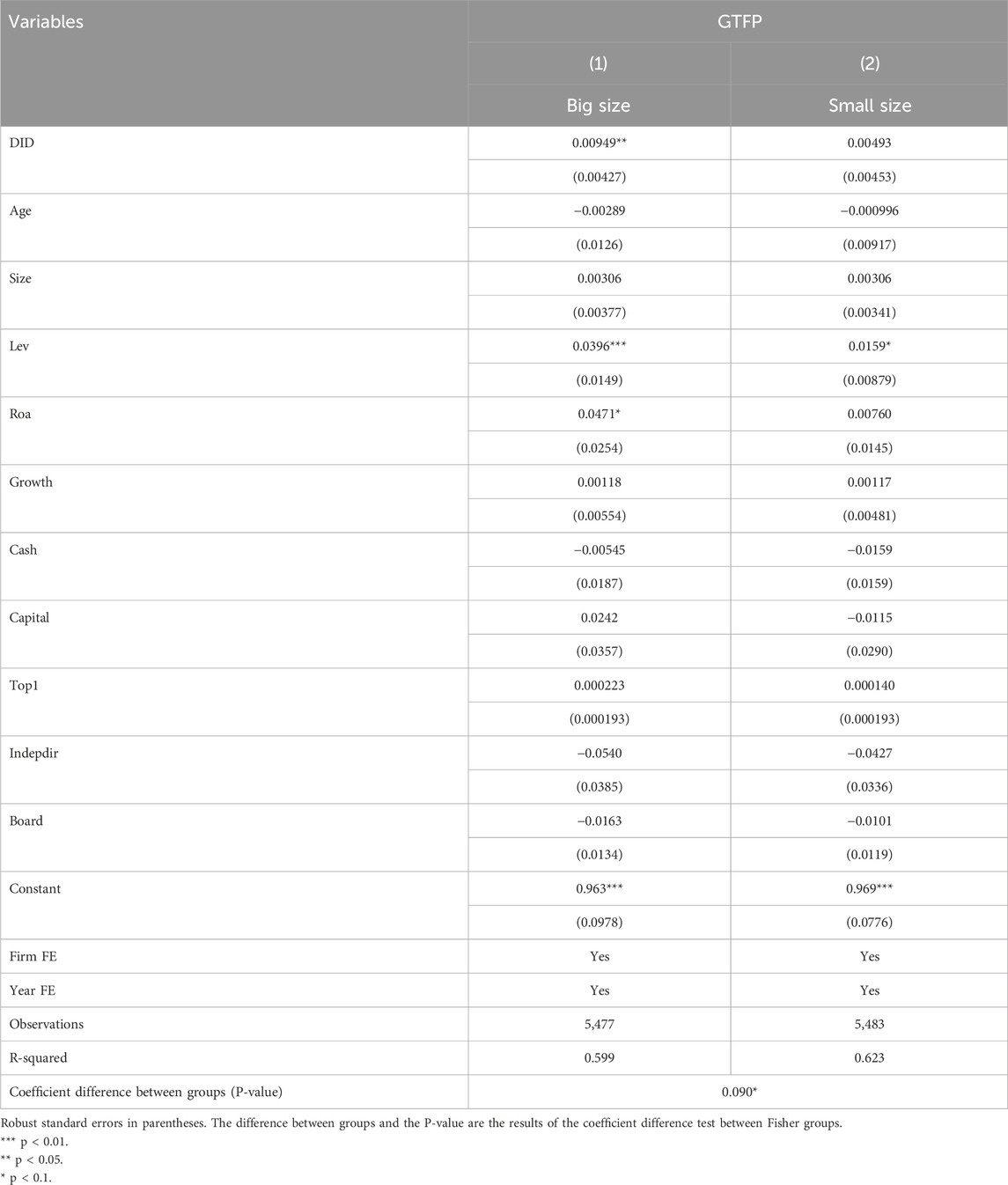

The scale of enterprises can affect the economic benefits, technological innovation and social responsibility of enterprises. In order to study the impact of different sizes of enterprises on EPT and GTFP of enterprises, we divided the sample enterprises into small enterprises and large enterprises based on the median of total assets of enterprises. Through regression analysis, it is found that the coefficient between GTFP and EPT in large enterprises is 0.00949, which is significantly positively correlated at the 5% level in Table 8. But the coefficient between GTFP and EPT in small enterprises is 0.00493, which is not significant. This shows that the implementation of EPT law has promoted the green innovation level of large enterprises. The reason may be that small enterprises have difficulties in carrying out green technology innovation activities due to their limited financial situation and capacity. Large enterprises can invest more research and development investment and technical resources, and it is easier to obtain the attention and support of the government and financial institutions. At the same time, large enterprises are more capable and willing to undertake social responsibilities and carry out green development.

5.5.3 Heterogeneity of market concentration

Enterprises in industries with high market concentration tend to have high profit margins and strong anti-risk ability, which makes enterprises may maintain a high profit level under the background of strong environmental regulations. Therefore, it is an empirical topic worth studying to test whether the EPT can improve the GTFP of monopoly industries. Herfindahl-hirschman Index (HHI) is a common index to measure industrial concentration. The larger the Herfindahl index is, the higher the industrial market concentration is.

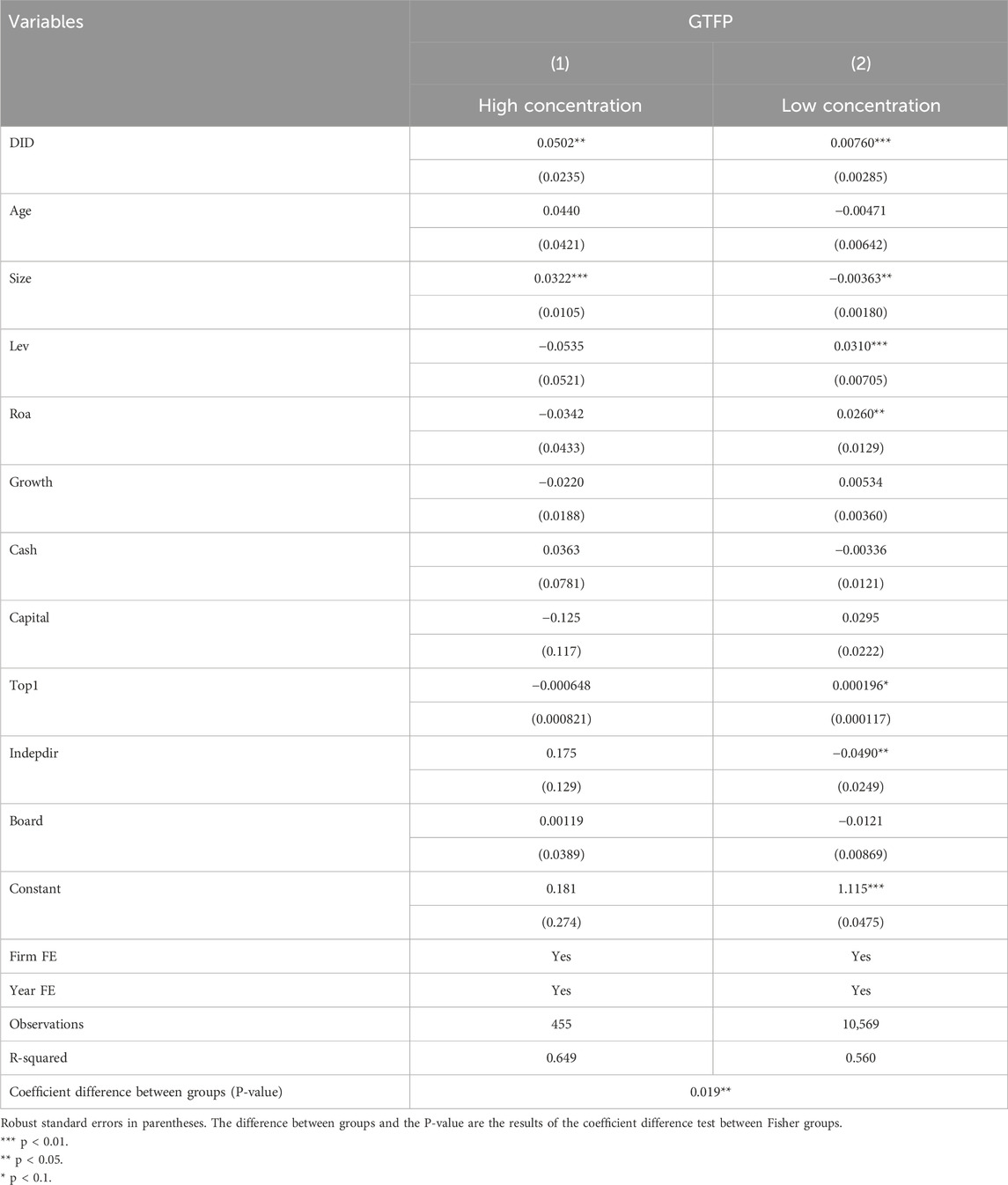

Therefore, according to the difference in industry concentration, that is, whether the Herfindahl index is greater than 0.5, this paper divides the sample listed enterprises into two categories: high market concentration and low market concentration, and tests whether the EPT will produce significant differences between the two groups of samples. As can be seen from Table 9, the promotion effect of EPT on GTFP of heavily polluting enterprises with low market concentration is significant at 1% confidence level, and the promotion effect on industries with high market concentration is significant at 5% confidence level.

Companies with high market concentration tend to face stronger social supervision, so companies will tend to regulate their environmental violations to maintain their reputation. Enterprises with low market concentration are usually in a market structure with fierce competition and a relatively poor market development environment. Should they bear the tax burden cost of EPT or increase investment in green transformation? It often becomes a prudent choice for enterprises. Therefore, the exogenous policy impact of EPT on the GTFP of such enterprises is not as strong as that of heavy polluting enterprises with high market concentration.

6 Conclusion and recommendations

In this study, a DID model was used to analyze the impact of EPT on the GTFP of heavily polluting enterprises. The results show that compared with non-heavily polluting enterprises, the GTFP of heavily polluting enterprises will increase by 0.78 percentage points after the implementation of EPT law. The implementation of digital transformation by heavily polluting enterprises can obscure the role of EPT in improving their GTFP. After the robustness test, the conclusion is still valid. We consider heterogeneity in terms of ownership, firm size, and market concentration. Relative to non-state-owned enterprises, EPT has a stronger role in promoting GTFP in state-owned enterprises. Moreover, this positive effect is more pronounced among large enterprises and those with high market concentration.

Overall, EPT has a good incentive effect on the green development of heavily polluting enterprises. After the pilot policy, the GTFP level of heavily polluting enterprises has been significantly improved. However, the balance between digital transformation and green development of heavily polluting enterprises needs further consideration. In order to achieve the goal of green development and digital development of heavily polluting enterprises, the following suggestions are put forward: firstly, in view of the EPT will promote the GTFP of heavily polluting enterprises, enterprises should take advantage of the trend, respond to policy requirements, actively fulfill tax obligations, and enhance the awareness of green sustainable development. Secondly, considering the masking effect of digital transformation, heavily polluting enterprises should carefully consider and weigh the relationship between digital investment and green investment when carrying out digital transformation, and strive to achieve a benign balance. Finally, the government is supposed to flexibly adjust preferential policies based on the characteristics of enterprises, strengthen the management of EPT for non-state-owned enterprises, small-scale enterprises and enterprises with low market concentration, release the regulatory role of market-oriented environmental regulations on the environmental responsibility of heavily polluting enterprises, and realize the “positive” effect of environmental regulations on green technology innovation.

Despite its value and interest, our research has obvious limits. First of all, China serves as the backdrop for our EPT policy, and the study data are also gathered inside the framework of Chinese listed firms. As a result, this document has limited reference value for examining how environmental protection tax laws are implemented in other nations. Second, measurements of GTFP indicators can be more precise because of the restricted data availability. To strengthen the outcomes, the variable index system’s measurement dimensions may be expanded in the future. Finally, as the EPT policy was only put into place in 2018, we could only look at sample data until 2021, making it challenging to assess the policy’s long-term effects. To provide more accurate results, further discussion of the policy’s long-term implications is required.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JZ: Writing–original draft, Writing–review and editing, Conceptualization, Data curation, Funding acquisition, Supervision, Validation. HH: Writing–original draft, Writing–review and editing, Conceptualization, Data curation, Investigation, Methodology. LY: Writing–original draft, Writing–review and editing, Conceptualization, Funding acquisition, Project administration, Supervision. ZN: Writing–review and editing, Conceptualization, Project administration, Supervision.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. National Social Science Fund General Program, “Research on Mechanisms, Pathways, and Strategies of Digital Technology Empowering the Upgrading of the Environmental Protection Industry” (Project No.: 23GBL006).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ai, H., Hu, Y., and Li, K. (2021). Impacts of environmental regulation on firm productivity: evidence from China’s Top 1000 Energy-Consuming Enterprises Program. Appl. Econ. 53 (7), 830–844. doi:10.1080/00036846.2020.1815642

Albrizio, S., Kozluk, T., and Zipperer, V. (2017). Environmental policies and productivity growth: evidence across industries and firms. J. Environ. Econ. Manag. 81, 209–226. doi:10.1016/j.jeem.2016.06.002

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037//0022-3514.51.6.1173

Borenstein, S., and Saloner, G. (2001). Economics and electronic commerce. J. Econ. Perspect. 15 (1), 3–12. doi:10.1257/jep.15.1.3

Buer, S.-V., Strandhagen, J. O., and Chan, F. T. S. (2018). The link between Industry 4.0 and lean manufacturing: mapping current research and establishing a research agenda. IJPR 56 (8), 2924–2940. doi:10.1080/00207543.2018.1442945

Cai, W., and Ye, P. (2020). How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. J. Clean. Prod. 276, 124105. doi:10.1016/j.jclepro.2020.124105

Cheng, Z., and Kong, S. (2022). The effect of environmental regulation on green total-factor productivity in China's industry. Environ. Impact. Asses. 94, 106757. doi:10.1016/j.eiar.2022.106757

Chiroleu-Assouline, M., and Fodha, M. (2014). From regressive pollution taxes to progressive environmental tax reforms. Eur. Econ. Rev. 69, 126–142. doi:10.1016/j.euroecorev.2013.12.006

DeStefano, T., Kneller, R., and Timmis, J. (2018). Broadband infrastructure, ICT use and firm performance: evidence for UK firms. J. Econ. Behav. Organ. 155, 110–139. doi:10.1016/j.jebo.2018.08.020

Dong, F., and Zheng, L. (2022). The impact of market-incentive environmental regulation on the development of the new energy vehicle industry: a quasi-natural experiment based on China's dual-credit policy. Environ. Sci. Pollut. R. 29 (4), 5863–5880. doi:10.1007/s11356-021-16036-1

Esen, Ö., Yıldırım, D. Ç., and Yıldırım, S. (2021). Pollute less or tax more? Asymmetries in the EU environmental taxes – ecological balance nexus. Environ. Impact. Asses. 91, 106662. doi:10.1016/j.eiar.2021.106662

Fukuyama, H., and Weber, W. L. (2009). A directional slacks-based measure of technical inefficiency. Socio-econ. Plan. Sci. 43 (4), 274–287. doi:10.1016/j.seps.2008.12.001

Gelenbe, E., and Caseau, Y. (2015). The impact of information technology on energy consumption and carbon emissions. Ubiquity 2015, 1–15. doi:10.1145/2755977

Guo, B. R., and Huang, X. X. (2023). Role of digital transformation on carbon performance: evidence from firm-level analysis in China. Sustainability 15 (18), 13410. doi:10.3390/su151813410

Han, J. B., Sun, R. Y., Zeeshan, M., Rehman, A., and Ullah, I. (2023). The impact of digital transformation on green total factor productivity of heavily polluting enterprises. Front. Psychol. 14, 1265391. doi:10.3389/fpsyg.2023.1265391

Hancevic, P. I. (2016). Environmental regulation and productivity: the case of electricity generation under the CAAA-1990. Energ. Econ. 60, 131–143. doi:10.1016/j.eneco.2016.09.022

He, F., and Liu, H. (2019). Evaluation of performance enhancement effect of digital transformation in physical enterprises from the perspective of digital economy. Reformation (04), 137–148.

He, G., Wang, S., and Zhang, B. (2020). Watering down environmental regulation in China. Q. J. Econ. 135 (4), 2135–2185. doi:10.1093/qje/qjaa024

He, X., and Jing, Q. (2023). The influence of environmental tax reform on corporate profit margins—based on the empirical research of the enterprises in the heavy pollution industries. Environ. Sci. Pollut. R. 30 (13), 36337–36349. doi:10.1007/s11356-022-24893-7

He, Y., Zhu, X., and Zheng, H. (2022). The influence of environmental protection tax law on total factor productivity: evidence from listed firms in China. Energ. Econ. 113, 106248. doi:10.1016/j.eneco.2022.106248

Karplus, V. J., Zhang, J. J., and Zhao, J. H. (2021). Navigating and evaluating the labyrinth of environmental regulation in China. Rev. Env. Econ. Policy 15 (2), 300–322. doi:10.1086/715582

Khan, S. A. R., Ponce, P., and Yu, Z. (2021). Technological innovation and environmental taxes toward a carbon-free economy: an empirical study in the context of COP-21. J. Environ. Manage. 298, 113418. doi:10.1016/j.jenvman.2021.113418

Kong, L., Wang, S., and Xu, K. (2024). The impact of environmental protection tax reform on total factor energy efficiency. Clean. Technol. Envir. 26 (4), 1149–1164. doi:10.1007/s10098-023-02668-z

Lee, C.-C., and He, Z.-W. (2022). Natural resources and green economic growth: an analysis based on heterogeneous growth paths. Resour. Policy 79, 103006. doi:10.1016/j.resourpol.2022.103006

Li, P., Lin, Z., Du, H., Feng, T., and Zuo, J. (2021). Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J. Environ. Manage. 295, 113112. doi:10.1016/j.jenvman.2021.113112

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 123, 18–37. doi:10.1016/j.jdeveco.2016.07.002

Li, X., Shu, Y., and Jin, X. (2022). Environmental regulation, carbon emissions and green total factor productivity: a case study of China. Environ. Dev. Sustain. 24 (2), 2577–2597. doi:10.1007/s10668-021-01546-2

Lin, Y., Liao, L., Yu, C., and Yang, Q. (2023). Re-examining the governance effect of China's environmental protection tax. Environ. Sci. Pollut. Res. Int. 30 (22), 62325–62340. doi:10.1007/s11356-023-26483-7

Liu, J., and Zhao, Q. Y. (2024). Mechanism testing of the empowerment of green transformation and upgrading of industry by the digital economy in China. Front. Env. Sci-switz. 11. doi:10.3389/fenvs.2023.1292795

Liu, Y. B., Deng, W. F., Luo, K., and Tang, M. Y. (2024). Impact of environmental taxation on financial performance of energy-intensive firms: the role of digital transformation. Emerg. Mark. Financ. Ttr. 60 (3), 598–616. doi:10.1080/1540496x.2023.2228462

Peng, J., Xie, R., Ma, C., and Fu, Y. (2021). Market-based environmental regulation and total factor productivity: evidence from Chinese enterprises. Econ. Model. 95, 394–407. doi:10.1016/j.econmod.2020.03.006

Qiu, S., Wang, Z., and Geng, S. (2021). How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J. Environ. Manage. 287, 112282. doi:10.1016/j.jenvman.2021.112282

Ramanathan, R., He, Q., Black, A., Ghobadian, A., and Gallear, D. (2017). Environmental regulations, innovation and firm performance: a revisit of the Porter hypothesis. J. Clean. Prod. 155, 79–92. doi:10.1016/j.jclepro.2016.08.116

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental regulation and competitiveness: empirical evidence on the Porter Hypothesis from European manufacturing sectors. Econ. Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Schnebelin, É., Labarthe, P., and Touzard, J.-M. (2021). How digitalisation interacts with ecologisation? Perspectives from actors of the French Agricultural Innovation System. J. Rural. Stud. 86, 599–610. doi:10.1016/j.jrurstud.2021.07.023

Shuli, W., Siqi, W., and Zewei, T. (2016). Total factor productivity growth in the service industry in China under environmental constraints. J. Financ. Econ. 42 (5), 123–134. doi:10.16538/j.cnki.jfe.2016.05.011

Si, H. C., Tian, Z., Guo, C. Y., and Zhang, J. (2024). The driving effect of digital economy on green transformation of manufacturing. Energ. Environ-UK. 35 (5), 2636–2656. doi:10.1177/0958305x231155494

Silva, S., Soares, I., and Afonso, O. (2021). Assessing the double dividend of a third-generation environmental tax reform with resource substitution. Environ. Dev. Sustain. 23 (10), 15145–15156. doi:10.1007/s10668-021-01290-7

Su, J. Q., Wei, Y. Y., Wang, S. B., and Liu, Q. L. (2023). The impact of digital transformation on the total factor productivity of heavily polluting enterprises. Sci. Rep. 13 (1), 6386. doi:10.1038/s41598-023-33553-w

Su, S., and Li, S. (2023). Energy efficiency suppression and spatial spillover effect: a quasi-natural experiment based on China’s environmental protection tax law. Environ. Dev. Sustain. doi:10.1007/s10668-023-04146-4

Sun, X. K., and Zhang, C. Y. (2023). Environmental protection tax and total factor productivity-Evidence from Chinese listed companies. Front. Env. Sci-switz. 10. doi:10.3389/fenvs.2022.1104439

Sun, Y. (2022). Environmental regulation, agricultural green technology innovation, and agricultural green total factor productivity. Front. Env. Sci-switz. 10. doi:10.3389/fenvs.2022.955954

Tu, Z. G., Zhou, T., and Zhang, N. (2019). Does China's pollution levy standards reform promote green growth? Sustainability 11 (21), 6186. doi:10.3390/su11216186

Wang, S., and Li, J. (2023). Does digital transformation promote green and low-carbon synergistic development in enterprises? A dynamic analysis based on the perspective of Chinese listed enterprises in the heavy pollution industry. Sustainability 15 (21), 15600. doi:10.3390/su152115600

Wen, H., Lee, C.-C., and Song, Z. (2021). Digitalization and environment: how does ICT affect enterprise environmental performance? Environ. Sci. Pollut. R. 28 (39), 54826–54841. doi:10.1007/s11356-021-14474-5

Wen, H. W., Wen, C. Y., and Lee, C. C. (2022). Impact of digitalization and environmental regulation on total factor productivity. Info. Econ. Pol. 61, 101007. doi:10.1016/j.infoecopol.2022.101007

Xiao, J., Li, G., Zhu, B., Xie, L., Hu, Y., and Huang, J. (2021). Evaluating the impact of carbon emissions trading scheme on Chinese firms’ total factor productivity. J. Clean. Prod. 306, 127104. doi:10.1016/j.jclepro.2021.127104

Xu, Q., Li, X., and Guo, F. (2023). Digital transformation and environmental performance: evidence from Chinese resource-based enterprises. Corp. Soc. Resp. Env. Ma. 30 (4), 1816–1840. doi:10.1002/csr.2457

Xu, X. P., Li, X. W., and Zheng, L. (2022). A blessing or a curse? Exploring the impact of environmental regulation on China's regional green development from the perspective of governance transformation. Int. J. Env. Res. Pub. He. 19 (3), 1312. doi:10.3390/ijerph19031312

Yang, S. W., Wang, C., Lyu, K., and Li, J. P. (2023). Environmental protection tax law and total factor productivity of listed firms: promotion or inhibition? Front. Env. Sci-switz. 11. doi:10.3389/fenvs.2023.1152771

Yang, Z., Fan, M., Shao, S., and Yang, L. (2017). Does carbon intensity constraint policy improve industrial green production performance in China? A quasi-DID analysis. Energ. Econ. 68, 271–282. doi:10.1016/j.eneco.2017.10.009

Yang, Z., Zeng, Q., and Wang, Y. (2024). The impact of environmental protection tax on green total factor productivity: China’s exceptional approach. Environ. Dev. Sustain. doi:10.1007/s10668-024-04860-7

Yao, C., and Xi, B. (2023). Does environmental protection tax improve green total factor productivity? Experimental evidence from China. Environ. Sci. Pollut. R. 30 (48), 105353–105373. doi:10.1007/s11356-023-29739-4

Yuan, B., Ren, S., and Chen, X. (2017). Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry?A panel data analysis of 28 sub-sectors. J. Clean. Prod. 149, 11–24. doi:10.1016/j.jclepro.2017.02.065

Zhang, J., Wu, G., and Zhang, J. (2004). Estimation of China's interprovincial physical capital stock: 1952-2000. Econ. Res. (10), 35–44.

Keywords: environmental protection tax, green total factor productivity, digital transformation, difference-in-differences model, heavily polluting enterprise, green development

Citation: Zhang J, Hua H, Yang L and Nie Z (2024) Impact of China’s environmental protection tax on green total factor productivity: based on the perspective of digital transformation. Front. Environ. Sci. 12:1484910. doi: 10.3389/fenvs.2024.1484910

Received: 22 August 2024; Accepted: 23 September 2024;

Published: 09 October 2024.

Edited by:

Guoxiang Li, Nanjing Normal University, ChinaReviewed by:

Zhujia Yin, Changsha University of Science and Technology, ChinaZongwei Ma, Nanjing University, China

Copyright © 2024 Zhang, Hua, Yang and Nie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lianfen Yang, MTMwNjAzNzg0NEBxcS5jb20=

Jie Zhang

Jie Zhang Hongyan Hua

Hongyan Hua Lianfen Yang2*

Lianfen Yang2*