- 1School of Economics and Management, East China Jiaotong University, Nanchang, Jiangxi, China

- 2Business School, Guilin University of Technology, Guilin, China

- 3School of Public Economics and Management, Shanghai University of Finance and Economics, Shanghai, China

This study investigates the impact of ESG performance on enterprise carbon emission intensity, using panel data from A-share listed companies over 2011–2022. The findings suggest that ESG can encourage enterprises to actively engage in environmental governance, enhancing their profitability and reducing carbon emission intensity, thereby achieving dual optimization of environmental and economic benefits. The mechanism test reveals the intermediary roles of institutional investors’ participation, total factor productivity, and green technology innovation. Heterogeneity analysis indicates that the relationship between ESG performance and enterprise carbon emission intensity varies with different degrees of management shortsightedness, ownership separation, equity balance, legitimacy status, and industrial pollution characteristics, reflecting the heterogeneous influence driven by Intrinsic motivation and external factors. Notably, the mitigating influence of ESG on enterprise carbon emission intensity is mainly attributed to enhanced corporate profitability, which effectively decelerates the growth rate of enterprise carbon emissions, albeit insufficient to arrest the overall increase. This observation points to a certain degree of “green paradox” phenomenon. Overall, the analysis underscores the significant contribution of ESG in promoting enterprises’ green transformation efforts.

1 Introduction

Since the ratification of the Kyoto Protocol, climate change and sustainable development have emerged as indispensable global concerns that brook no neglect. Adhering to the blueprint outlined in the Bali Roadmap, governments worldwide are mandated to, under the auspices of the United Nations Framework Convention on Climate Change, relying on industrial structure, energy structure transformation and technological innovation to achieve energy conservation and emission reduction. These endeavors collectively aim to mitigate the adverse impacts of climate change and foster a more sustainable development trajectory globally. As the world’s foremost populous developing nation and the second-largest economy globally, China’s rapid economic ascendancy has concomitantly generated substantial energy demands and escalating carbon emissions. In view of this, China has established the goal of attaining carbon peaking by 2030 and achieving carbon neutrality by 2060, aimed at fostering a green economic structural transformation and ensuring sustainable, high-quality development. This transition entails a fundamental shift away from the conventional paradigm of high investment, energy consumption, and emissions toward an intensive, efficient, low-energy, green, and low-carbon development path. Such a transformation not only enhances resource utilization efficiency and economic toughness but also constitutes a pivotal approach to ameliorating environmental quality and safeguarding public health. China’s energy conservation and emission reduction work is not only related to domestic economic, environmental and social development issues, but also related to Global Climate Governance and international cooperation, thus making important contributions to the global response to climate change.

Concurrently, enterprises, as the cornerstone of economic endeavors, occupy a pivotal position in driving both economic and societal progress. In particular, the issue of carbon emissions of enterprises is directly related to the trend of global warming, and has become one of the important indicators to measure the environmental responsibility of enterprises, making their performance in environmental protection, social responsibility and corporate governance (ESG performance) more and more concerned by investors, regulators and the public. The concept of ESG originated from the ethical and responsible investment of the last century, and as the global emphasis on sustainable development has increased, ESG has gradually been widely adopted as an important tool to measure the long-term value and risk management ability of enterprises. Enterprises can improve their ESG performance by implementing various environmental measures, paying attention to the wellbeing of employees and communities, and improving corporate governance, the ESG evaluation system can provide investors with a more comprehensive perspective of enterprise evaluation and help them make more prudent investment decisions. At present, there has been a progressive enhancement in ESG (Environmental, Social, and Governance) disclosure rules and pertinent legislation. The sustainable financial disclosure regulations introduced by the European Union, along with the Environmental, Social, and Governance Report guidelines established by the Hong Kong Stock Exchange, and so on, have furthered the deepening understanding and application of ESG. Following the issuance of the guidance on social responsibility for central enterprises by the State-owned Assets Supervision and Administration Commission of the State Council, the regulatory regulations on ESG have also been continuously improved, consistently motivating businesses to carry out sustainable development. Existing studies have also found that ESG will promote the improvement of green investment level (Lu and Li, 2024), and can also reduce the carbon emissions of enterprises by easing the financing constraints of enterprises and solving agency problems (Li and Xu, 2024), so as to promote the green transformation of enterprises and ultimately achieve green and sustainable economic development.

At present, countries around the world have taken various measures to reduce carbon dioxide emissions, including environmental regulation (Yang et al., 2022), green credit, Green Finance and so on (Cong et al., 2020; Zhang Yingying et al., 2024). Although relevant studies believe that environmental regulation can achieve pollution prevention and carbon emission reduction (Gao et al., 2022), based on the “Porter Hypothesis”, existing studies have put forward different views on the “innovation compensation effect” and “compliance cost effect” brought by environmental regulation (Dou and Han, 2019; Ouyang et al., 2020). Dou and Han (2019) believes that when facing high-intensity environmental regulation, the “innovation compensation effect” of high pollution industries is not obvious, and they often choose to transfer industries to areas with relatively loose environmental regulation, which further proves the existence of the “pollution paradise hypothesis”. The latter found that although environmental regulation will hinder technological innovation in the short term, in the long term, with stricter environmental regulation, technological innovation will eventually be promoted, that is, the so-called “innovation compensation effect” (Ouyang et al., 2020). It can be found that whether environmental regulation can promote energy conservation and emission reduction and achieve green development is still in doubt. In particular, high-intensity environmental regulation may also damage the competitiveness of enterprises (Murty and Kumar, 2003), hence, it is not conducive to the realization of sustainable development for enterprises. From the perspective of internal subjective motivation, the green initiatives of top executives are regarded as a key factor in influencing the green transformation of enterprises (Jiang et al., 2024). To enhance their ESG performance and secure a “legitimacy” position, certain high-energy-consumption and high-pollution enterprises need to foster sustainable development by enhancing their environmental performance (Lokuwaduge and Heenetigala, 2017). In addition to this, companies actively disclose ESG information to demonstrate their commitment to social responsibility (Qian and Liu, 2024), enabling stakeholders to fully understand the company’s environmental and social performance (Drempetic et al., 2020). This can effectively alleviate financing constraints for companies, thereby promoting green technological innovation (Tan and Zhu, 2022), which in turn helps to further improve the environmental performance of companies (Qian and Liu, 2024; Li and Xu, 2024). As Hu J. et al. (2024) stated, ESG plays an important role in promoting the transformation of companies towards green and sustainable development, which can be achieved by constructing a governance system that is both incentive compatible and market-oriented, thereby encouraging various stakeholders to participate in corporate environmental governance, including but not limited to the collaboration of investors and partners. This not only promotes the improvement of corporate environmental performance but also further enhances the long-term competitiveness of companies, thereby motivating companies to actively engage in environmental governance (Li and Xu, 2024). This fully reflects the significant impact of “active participation” in environmental governance by companies under the influence of ESG concepts on low-carbon transformation.

ESG emerges as a pivotal driver in fostering global sustainable development, with profound implications for the production and operational landscapes of enterprises. Firstly, investors’ escalating green aspirations notably expedite enterprises’ green transformation trajectory, fueled by the adoption of ESG investment principles. Secondly, stellar ESG performance, encapsulating enterprises’ dedication to environmental stewardship and other sustainable development endeavors, serves as a catalyst for securing robust support from regulatory bodies and the broader public. ESG practices have been empirically demonstrated to not merely facilitate enterprises in attaining a “legitimacy” status (Lokuwaduge and Heenetigala, 2017), but also to refine their financial performance and augment market valuation significantly (Chen and Xie, 2022; Zhou et al., 2022). Motivated by these multifaceted benefits, the promotion of ESG principles enables enterprises to holistically balance environmental stewardship with economic gains, maximizing both environmental benefits and their own interests. Consequently, ESG will propels enterprises towards proactive engagement in environmental protection endeavors and low-carbon transformations, the effect may be even more pronounced. However, it is important to note that due to the existence of “greenwashing” and “performative ESG” phenomena, coupled with the current lack of uniformity and completeness in regulations related to ESG, as well as the punishment for violations of disclosure standards is relatively low, it is difficult to impose strict constraints on ESG information disclosure by listed companies. Furthermore, the substantial investment in carbon emission reduction technology research and development may hinder the effect of ESG in facilitating corporate low-carbon transformation. Therefore, whether ESG can drive companies to actively adopt low-carbon development strategies still requires further discussion. Additionally, the influence mechanism remains unclear, and there has been no further exploration of the impact of heterogeneity in internal and external incentive mechanisms on the relationship between ESG and corporate carbon emission intensity.

Furthermore, the concept of green development, as its very nomenclature suggests, encapsulates both the dimensions of “greenness” and “development,” which is a long-term issue of human society. It is imperative to eschew the historical pitfalls of merely “switching off and limiting power” approaches in energy conservation and emission mitigation endeavors. Instead, there is a need to foster the harmonious coexistence of enterprise expansion and pollution abatement, thereby achieving sustainable development characterized by both emission reductions and economic growth over the long haul, so as to truly realize the green development of economic society. Hence, the potential marginal contribution of this study, in comparison to preceding research, lies primarily in these aspects. Firstly, as opposed to estimating corporate carbon emission levels, this paper compiles actual carbon emissions data from corporate disclosures and relevant public sources. After analysis, it is found that, unlike enterprises’ passive compliance with traditional command based environmental regulations, ESG, as a tool to promote enterprises to achieve sustainable development, can promote enterprises to actively fulfill social obligations such as environmental protection, and the improvement of ESG performance can also improve the financial performance of enterprises, thereby achieving a balance between environmental and economic benefits, and ultimately reduce the intensity of carbon emissions of enterprises. Subsequently, the mechanistic analysis uncovered the pivotal roles played by institutional investor participation, advancements in total factor productivity, and the impetus of green technological innovation. Delving into the heterogeneity analysis, by examining the endogenous motivations and external factors influencing corporate environmental governance, it was discerned that ESG effectively mitigated the carbon emission intensity of enterprises exhibiting low levels of executive myopia, low separation of ownership and control, and strong equity checks and balances, and vice versa. Furthermore, among firms with suboptimal ESG performance and those not categorized as heavy polluters, ESG implementation also facilitated reductions in carbon emission intensity, suggesting that to expedite the low-carbon transformation of heavily polluting enterprises, complementary environmental policies are imperative to impose “rigid constraints” on corporate pollution behaviors. Finally, this paper also found that ESG in reducing the intensity of corporate carbon emissions, mainly due to the growth of corporate profitability, although the improvement of ESG performance can not reduce corporate carbon emissions, but can reduce the growth rate of corporate carbon emissions, indicating that there is a certain degree of “green paradox”, but still recognized the role of ESG in promoting the green transformation of enterprises. Consequently, the research offers empirical and theoretical insights into leveraging the green transformation potential of ESG strategies, thereby fostering the sustainable development of low-carbon enterprises and navigating the balance between economic growth and environmental stewardship.

2 Literature review and hypothesis analysis

2.1 ESG

The discourse surrounding ESG remains ongoing and contentious. Part of the research is based on the assumption of “rational person” in neoclassical economics, denying the rationality of ESG from a value perspective (Friedman, 1970; Pollman, 2022). The former believes that the social responsibility of enterprises is to obtain profits, and the investment in social responsibility will damage the competitiveness of enterprises, so enterprises should put more energy into profit creation activities, while the latter believes that enterprises should not consider the ESG factors they do not need to consider out of the principle of faithfulness. Another study questioned the practical significance of ESG (Mao et al., 2024), they believed that ESG was not conducive to earnings management of enterprises and could not have a positive impact on financial performance of enterprises. In addition, the harm brought by “greenwashing”, selective disclosure and performative ESG also gradually attracted academic attention. Conversely, a substantial segment of research continues to uphold the rationality and scientific merit of ESG. Drawing upon the perspective of the antecedents that affect the performance of ESG, Drempetic et al. (2020) contend that enterprise size constitutes a notable factor in shaping ESG outcomes. Furthermore, enterprises with insufficient financial performance will choose to enhance their competitive advantage by improving their ESG performance (Dasgupta, 2022). Notably, even enterprises with normal financial health, motivated by the quest for ‘legitimacy,’ are inclined to accommodate stakeholder demands, improve their ESG performance, and thereby garner stakeholder support to sustain their competitive edge (Lokuwaduge and Heenetigala, 2017; Bhandari et al., 2022). In recent years, amidst the proliferation of behavioral economics, a growing body of scholars has turned their attention to the nuanced effects of political orientation, cultural factors, and other intangible variables on corporate ESG performance (Gupta et al., 2017; Bai et al., 2024). However, constrained by data accessibility, research delving into these intangible influencing factors remains relatively underdeveloped and insufficiently explored.

In comparison, the existing studies pay more attention to the actual impact generated by ESG. Contrary to the conclusion of Mao et al., 2024, relevant studies believe that ESG disclosure can significantly improve the financial performance of enterprises (Chen and Xie, 2022), which strongly refutes the Friedman doctrine. Furthermore, Zhou et al. (2022) established that enhancing ESG performance through the fulfillment of social responsibilities does not impose a detrimental effect on enterprises’ production and operational costs, rather, it ultimately fosters the growth of enterprise value by bolstering financial performance and serves as a foundation for assessing corporate legitimacy, thereby mitigating information asymmetry (Cho et al., 2013), so as to alleviate the financing constraints of enterprises and promote the growth of enterprises themselves. In addition, ESG emerge as a potent factor for fostering green technological innovation within enterprises, with this innovation-driving effect exhibiting notable spillover implications (Li et al., 2023). This underscores the potential of ESG to incentivize and contribute to green sustainable development endeavors. However, there is little literature on ESG and corporate carbon emission governance, and relevant research mainly focuses on the relationship between ESG and corporate green innovation, although some studies believe that ESG rating can promote enterprises’ carbon emissions governance through mechanisms such as promoting green technology innovation and easing financing constraints (Li and Xu, 2024; Ye and Xu, 2023), due to the availability of data, the actual carbon emissions of enterprises have not been obtained. The final results and the impact mechanism need to be further discussed. From the vantage point of advancing sustainable development goals (SDGs), Lokuwaduge and Heenetigala (2017) posit that ESG disclosure serves as a factor for enterprises to attain sustainability. Concurrently, another research contends that the interplay between ESG and sustainable development is intricate and nonlinear, but emphasizing that advancements in enterprise environmental performance constitute a pivotal factor in fostering sustainable growth (Bagh et al., 2024). Therefore, how to use ESG to achieve sustainable development while controlling enterprise carbon emissions has certain theoretical and practical significance.

2.2 Green transformation of enterprises

The pursuit of green sustainable development and the orchestration of green transformation within enterprises constitutes a protracted yet paramount agenda for humanity, necessitating the identification of a viable trajectory that not only fosters ecological transformation but also sustains economic prosperity in the long haul. Extant scholarship has extensively addressed the modalities of achieving corporate green transformation, with a preponderance of researchers highlighting the pivotal function of green technological innovation in this endeavor (Li and Xu, 2024; Ye and Xu, 2023; Yu et al., 2023), furthermore, enhancing green technology innovation capability is poised to foster an elevation in enterprise credit ratings (Wang Y et al., 2024), thereby mitigating financing constraints to a considerable degree and fostering the long-term sustainable green development of firms. Moreover, recent studies have discovered that factors like green finance (Yu et al., 2023), digital transformation in enterprises (Zhang S. et al., 2024), pilot policies for low-carbon cities (Jiang et al., 2024), ESG (Li and Xu, 2024), and executive green awareness (Jiang et al., 2024) can all facilitate enterprises in achieving green and sustainable development. In terms of the mechanisms of influence, capital aggregation, information transmission, financing constraints, internal control, and green technology innovation are playing crucial role in it, however, it remains questionable whether environmental regulations can foster green technology innovation (Yan et al., 2024), excessive stringency in regulatory policies may impose acute financial strains on enterprises in the short run (Murty & Kumar, 2003), thereby hindering their sustainable development. Conversely, overly lenient regulatory frameworks risk failing to fully internalize the externalities associated with environmental pollution within corporate production and operational decisions, ultimately limiting their effectiveness in propelling green development. Furthermore, from an institutional economics standpoint, how to obtain the “double dividend” of maximizing economic and environmental benefits through an environmental policy has also become the focus of scholars’ attention (Pearce, 1991). While the discourse surrounding the double dividend has predominantly centered on environmental tax reforms, it is still unclear whether other policy ideas to promote sustainable development can produce the same effect, that is, to promote pollution control while improving economic efficiency.

2.3 ESG and sustainable development

From the perspective of Porter hypothesis and the development of behavioral economics, the rational man hypothesis in neoclassical economics does not conform to reality, and enterprises are not just ruthless “money making machines”. Therefore, starting from the motivation that affects the decision-making behavior of enterprises, improving the green cognition of managers (Jiang et al., 2024) and the cultivation of corporate culture (Bai et al., 2024) have become important driving forces to promote the green transformation of enterprises, so as to promote the pollution control of enterprises from the subjective motivation to realize the green transformation, in view of this, Li and Xu (2024) found that based on the “stakeholder” theory and the “dual vehicle integration” goal analysis, ESG can encourage managers to recognize the sustainable development goal, and then internally encourage enterprises to carry out green transformation. Similarly, Qian & Liu (2024) found that improvements in corporate ESG performance can effectively enhance carbon emission efficiency based on corporate governance theory and signaling theory. Moreover, from a macro perspective, the enhancement of national ESG performance significantly promotes green innovation, thereby contributing to sustainable development (Long et al., 2023). From the perspective of impact mechanism, green technology innovation (Li and Xu, 2024; Qian and Liu, 2024; Ye and Xu, 2023), stakeholder support (Lokuwaduge and Heenetigala, 2017; Qian and Liu, 2024) and financing constraints (Li and Xu, 2024) play a key role in this process. It can be found that when analyzing the impact of ESG on the sustainable development of enterprises, relevant studies focus on the role of stakeholder participation. This is because the improvement of corporate ESG information transparency and response to stakeholder interests can help build a stronger relationship and gain strong support from key stakeholders (Bagh T. et al., 2024). Therefore, it is of theoretical and practical significance to analyze the underlying logic of ESG in promoting corporate carbon emission management from the perspective of internal motivation factors. Besides, in light of increasingly stringent environmental protection regulations, external pressures to reduce emissions also compel businesses to actively adopt eco-friendly production methods. Therefore, under the influence of external factors, what kind of relationship emerges between corporate ESG performance and their carbon emission intensity? Moreover, there exists a contrary view that an increase in ESG ratings does not lead to a reduction in corporate carbon emissions (Treepongkaruna S. et al., 2024). Thus, the exact nature of the relationship between ESG and corporate carbon emissions, as well as carbon emission intensity, remains a subject for further exploration.

2.4 Literature review

It is discernible that despite the neoclassical economic perspective, where some scholars cast doubt on ESG, positing that enterprises ought to prioritize profit generation over societal responsibilities (Friedman, 1970; Pollmann, 2022), and contend that investments in social responsibility may undermine corporate competitiveness, another part of the research upholds the inherent value and practical significance of ESG, and maintains that ESG initiatives contribute to enhancing enterprise value and financial performance. Consequently, the question of whether ESG can facilitate the green transformation of enterprises while concurrently bolstering their financial performance remains an open issue, deserving of further research. From the perspective of driving factors behind enterprises’ green transformation, traditional policy tools have diminished efficacy due to issues such as inconsistent systems, disorganized supervision, and passive corporate compliance. According to the theory of environmental economics, to encourage enterprises to undertake green transformations, it is imperative to internalize the pollution externalities of enterprises, this approach can influence enterprise decision-making and motivate managers to actively invest in environmental protection projects. ESG not only contributes to the enhancement of enterprise value and financial performance, but also significantly fosters green technology innovation and green transformation. Consequently, enterprises’ investment in ESG projects yields not only economic benefits but also advances in green technology innovation and environmental performance. While discussions on the “double dividend” are predominantly focused on environmental tax reforms, it is essential to explore other policies and concepts, such as whether improvements in corporate ESG performance can simultaneously maximize economic and environmental benefits, thus realizing outcomes akin to a “double dividend”. Moreover, compared to merely complying with environmental policies, ESG leads managers to more readily embrace environmental protection objectives, facilitating green transformation alongside enterprise growth, and effectively synergizing “carbon reduction” with “growth” objectives. Hence, the role of ESG in advancing green sustainable development warrants significant attention. In delving into the propulsive influence of ESG factors on green development, a preponderance of extant literature has centered its attention on green technological innovation, yet the elaboration of the underlying impact mechanism remains incomplete. Moreover, another study suggests that companies with high ESG or environmental ratings do not necessarily have lower carbon emissions (Treepongkaruna S. et al., 2024). Therefore, whether ESG can promote corporate carbon emission decrease without compromising their competitiveness, based on the synergy of “carbon reduction” and “growth” goals, remains to be further explored. In summary, it is necessary to further analyze the relationship between corporate ESG performance and carbon emission intensity, and identify the underlying transmission mechanisms as well as the impacts of internal and external factors. This holds practical significance for related theoretical research and the future improvement of the ESG system.

2.5 Theoretical analysis

Modern mainstream economics mainly examines economic phenomena from the perspective of “economic man”. However, this hypothesis is far from the real world. More practical, we should use multiple perspectives to examine economic phenomena, and analyze an economic phenomenon in combination with a series of factors such as the hypothesis of economic man, psychological culture and institutional system.

In stark contrast to neoclassical economics, modern enterprise theory believes that the objective of enterprises transcends mere shareholder value maximization, positing that investments in societal endeavors, including environmental conservation, do not impede but rather foster enterprise development. Thus, in direct opposition to the Friedman doctrine, current researches discover the view that advancements in an enterprise’s ESG (Environmental, Social, and Governance) performance not only propel the enhancement of its financial performance (Chen and Xie, 2022), but also augment its market valuation (Zhou et al., 2022). This body of finding underscores the practical value that ESG improvements can confer upon enterprises. As the main body of the market, the decision-making behavior of enterprises should be affected in many ways. Economic incentives, psychological underpinnings, institutional cultures, and other factors converge to mold the behavioral contours of enterprises. Firstly, from a rational economic agent’s perspective, enterprises are inherently driven by the pursuit of profit maximization. Consequently, the enhancement of financial performance and market valuation through the promotion of ESG initiatives inherently incentivizes enterprises to augment their investments in ESG-related projects, thereby improving the environmental performance of enterprises. Secondly, grounded in the stakeholder theory framework, enterprises need to meticulously contemplate the diverse demands of their stakeholder constellation (Lokuwaduge and Heenetigala, 2017). By integrating these stakeholder needs into their decision-making processes, enterprises can capture the support of their stakeholder. This in turn helps to obtain the necessary “legitimacy” status to maintain the long-term competitiveness of enterprises (Deegan, 2011). Ultimately, grounded in institutional theory, the introduction of the “green development concept” during the Fifth Plenary Session of the 18th Central Committee of the Communist Party of China (CPC), coupled with the sign of the Paris Agreement, has profoundly embedded the notion of sustainable green development into the societal psyche, constituting an implicit norm of conduct across society. Institutional scholars posit that this pervasive informal institutional framework exerts an intangible yet potent pressure on entrepreneurs, influencing corporate decision-making processes (DiMaggio and Powell, 1983). Consequently, enterprises are compelled to adhere to the developmental paradigm of “green waters and green mountains being tantamount to golden and silver mountains,” fostering a proactive stance towards low-carbon transformation among entrepreneurs, at this time, enterprises can embark on a green transformation trajectory by investing in ESG projects, thereby communicating their eco-friendly attributes to external stakeholders. This endeavor serves to garner the support of these stakeholders, subsequently reinforcing their “legitimacy” within the marketplace. Conversely, a failure to adhere to the prescribed code of conduct may subject enterprises to various forms of “sanctions,” encompassing but not limited to the cessation of commercial collaborations and the imposition of governmental administrative penalties. Through strategic investments in ESG projects, enterprises can concurrently attain ‘legitimacy’ and sustain their competitive edges (Porter and Kramer, 2006), and effectively improve their green technology innovation ability (Tan and Zhu, 2022), while improving their environmental performance (Li and Xu, 2024; Ye and Xu, 2023), so as to take into account the environmental and economic benefits. Due to the investment in ESG projects can maximize environmental and economic benefits, which can encourage enterprises to voluntarily increase the investment in social responsibility projects such as environmental protection, and ultimately reduce the carbon intensity of enterprises.

Due to the existence of information asymmetry, the mastery of relevant information by various personnel is different, and enterprises with insufficient information disclosure may face certain financing constraints (Ross, 1977). Green transformation methods such as green technology innovation have problems such as long cycle, high investment and high risk (Tan and Zhu, 2022). Insufficient funds will restrict the green transformation of enterprises, and will have a significant impact on the normal production and operation activities of enterprises, which is not conducive to reducing the intensity of carbon emissions of enterprises. By assessing the ESG performance of enterprises, intermediary institutions not only reveal corporate efforts in environmental stewardship and sustainable development but also substantially mitigate the severity of information asymmetry (Cho et al., 2013). This disclosure attracts green investors (Chen and Xie, 2022), effectively alleviating financing constraints for these enterprises (Tan and Zhu, 2022), thereby offering robust financial backing for their green transformation. With the attention and support of green investors and institutional investors, based on the motivation of green value creation and social utility, they can actively communicate and intervene in the green operation decisions of controlling shareholders, thus promoting the green transformation of enterprises (Zhang Yun et al., 2024). Furthermore, the enhancement of an enterprise’s ESG performance has augmented its reputation in both the product market and society (Hall and Lee, 2014), as well as its technological innovation capability (Li et al., 2023). Excellent reputation attracts consumers to purchase the enterprise’s products. Additionally, suppliers and business partners, recognizing the enterprise’s superior social and governance performance, opt to deepen their cooperation with the enterprise. This collaboration is further strengthened through business credit, open innovation, and other means, thereby enhancing the enterprise’s competitive edge. Based on the excellent ESG performance of enterprises, the government will provide regulatory and policy support, thereby enhancing enterprise competitiveness (Fan et al., 2023). Under the influence of the above factors, which will significantly improve profitability, environmental performance and ultimately reduce carbon intensity. Consequently, this paper proposes Hypothesis 1.

Hypothesis 1. the improvement of ESG performance can reduce the carbon emission intensity of enterprises.

According to the stakeholder theory, enterprises need to consider the demands of stakeholders when managing daily production and operation activities (Bhandari et al., 2022), so as to survive in an environment-friendly economic society. Within enterprises, ownership structure can significantly affect the environmental performance of enterprises (Lyu et al., 2024; Chen et al., 2020), promote the green transformation of enterprises through external supervision, easing the principal-agent problem and other mechanisms. Enterprise ESG ratings serve as a crucial metric for investors to assess the sustainability and developmental potential of companies, effectively mitigating the issue of information asymmetry between investors and corporations (Cho et al., 2013). By investing in social responsibility initiatives such as environmental conservation, businesses can enhance their ESG performance, thereby achieving higher ESG scores. Superior ESG performance not only elevates the corporate market value (Zhou et al., 2022), but also demonstrates the company’s strengths in sustainable growth and corporate governance, attracting stakeholder trust and support (Bhandari et al., 2022). As a significant stakeholder of the corporation (Zhao et al., 2022), institutional investors play a crucial role in the capital market and actively consider the ESG performance of corporations when making portfolio decisions (Chen et al., 2020). The enhancement of a corporation’s ESG performance can attract institutional investors due to their confidence in the growth of corporate value and trust in the corporation’s sustainable development strategy (Wei and Chengshu, 2023), and the participation of institutional investors can foster the green transformation of enterprises. Firstly, based on the communication and reputation mechanism, institutional investors will monitor managers’ green governance (Zhang Yun et al., 2024) and actively interact to mitigate the effects of principal-agent issues, thereby enhancing enterprise environmental performance. Secondly, institutional investors tend to have a long-term investment perspective and a vision of sustainable development (Wei and Chengshu, 2023), this perspective leads institutional investors to mitigate potential compliance risks for the companies in their portfolios, (Chen et al., 2020), such as the cost of violations and reputation losses caused by environmental pollution. Therefore, institutional investors tend to promote enterprises’ continuous investment in social responsibility projects such as environmental protection, so as to avoid avoidable losses caused by the damage to the reputation of enterprises and investment institutions. Furthermore, based on the principle of value investing, investments in social responsibility endeavors, such as environmental conservation, do not impede the production and operational activities of corporations. Instead, these efforts can fulfill stakeholder expectations, thereby securing a legitimate status for the enterprise (Lokuwaduge and Heenetigala, 2017) and enhancing its market valuation (Zhou et al., 2022). As the key for enterprises to cultivate long-term competitive advantage, the “legitimacy” status can continue to promote the growth of corporate profitability, and institutional investors, as one of the shareholders, can also benefit from it, therefore, institutional investors have a strong motivation to promote green governance in enterprises. Finally, there has been a progressive enhancement in the laws and regulations pertaining to green investment, this development encourages institutional investors to intervene in listed companies’ green business decisions based on ESG information and other paths (Zhang Yun et al., 2024) and cultivate enterprises’ environmental awareness (Wei and Chengshu, 2023), so as to promote enterprises to increase investment in environmental protection projects and help enterprises improve management efficiency by relying on investors’ own information advantages (Zhang Yun et al., 2024), subsequently boosting profitability and ultimately diminishing carbon emission intensity. Consequently, this paper puts forth hypothesis 2.

Hypothesis 2. the improvement of ESG performance reduces the carbon emission intensity of enterprises by attracting institutional investors.

Since the introduction of the Solow residual concept, academic comprehension of total factor productivity has progressively clarified. Total factor productivity can be defined as the average output per unit of input, wherein fluctuations in its level mirror alterations in various determinants including the unit’s technical prowess and managerial efficacy. Notably, technological innovation is an important source of total factor productivity improvement, and the driving effect of ESG on enterprise technological innovation (Li et al., 2023; Li and Xu, 2024) is bound to significantly promote the growth of enterprise total factor productivity. ESG rating enables enterprises to show their environmental, social and governance performance to stakeholders, and can ease financing constraints for enterprises (Tan and Zhu, 2022), so as to provide sufficient financial support for enterprise technological innovation. Based on the stakeholder theory and considering the demands of stakeholders, enterprises will increase investment in ESG projects to obtain the support of various stakeholders (Lokuwaduge and Heenetigala, 2017). With the assistance of multiple stakeholders, it will not only help to promote the formation of open innovation capability, but also help to realize the sharing of resources, so as to improve the efficiency of resource allocation among enterprises and further enhance the technological innovation capability of enterprises. Moreover, the enhancement of ESG performance directly correlates with improved governance capabilities and resource utilization. ESG encourage enterprises to implement pollution control measures, thereby enhancing their resource efficiency, which results in an increased input-output ratio for unit factors (Li and Xu, 2024; Ye and Xu, 2023). Therefore, the improvement of ESG performance can improve the total factor productivity of enterprises (Xue et al., 2024), and the improvement of total factor productivity is bound to reduce the carbon emission intensity of enterprises. Firstly, the improvement of total factor productivity means technological progress, which, as the key to transforming the mode of economic growth (Tan and Zhu, 2022), is bound to help reduce the intensity of carbon emissions of enterprises. Secondly, the improvement of total factor productivity also means the improvement of the efficiency of resource allocation, and attracts innovative talents to continuously gather in enterprises (Xue et al., 2024), so as to promote the continuous improvement of enterprise management efficiency and resource utilization, and reduce the waste of resources caused by inefficient production process through lean production and digital logistics management. Finally, enhancing total factor productivity allows enterprises to increase output per unit of input, thereby bolstering their competitiveness (Xue et al., 2024). This, in turn, fosters growth in enterprise operating income and ultimately diminishes the intensity of carbon emissions from enterprises. Consequently, this paper posits hypothesis 3.

Hypothesis 3. the improvement of ESG performance can reduce the carbon emission intensity of enterprises by improving the total factor productivity of enterprises.

Technological innovation is pivotal in transforming economic growth modes and facilitating the low-carbon transformation of enterprises. Enhancing an enterprise’s ESG performance inherently augments its capacity for green technology innovation (Li and Xu, 2024; Ye and Xu, 2023), subsequently diminishing the enterprise’s carbon emission intensity. Technological innovation is characterized by a lengthy research and development (R&D) cycle, substantial capital investment, and high risk. Financing constraints can significantly diminish an enterprise’s willingness to innovate. As an essential tool for addressing information asymmetry, ESG can enhance the transparency of corporate information (Cho et al., 2013), consequently easing the financing constraints of enterprises, and then promote enterprises to carry out green technology innovation. The enhancement of ESG performance suggests that enterprises have made significant contributions to the environment, society, and governance. By investing in social responsibility projects like environmental conservation over a long period, businesses can foster an awareness of environmental protection, and the awareness of environmental protection of senior executives has a significant role in promoting the green transformation of enterprises (Jiang et al., 2024), under the influence of the concept of sustainable green development of enterprise managers, they promote enterprises to fulfill social obligations such as environmental protection, and take green technology innovation as an important means for enterprises to protect the environment (Tan and Zhu, 2022). Furthermore, enterprises with higher ESG performance tend to have higher resource allocation efficiency and sufficient talent allocation (Xue et al., 2024), consequently, they possess an inherently stronger technological innovation capacity, facilitating the realization of green technological advancements with greater ease. Therefore, the improvement of enterprise ESG performance can improve its green technology innovation ability. And the improvement of enterprises’ green technology innovation ability, first of all, it can reduce the waste of resources and the environmental pollution caused by the production process (Li et al., 2024), by harnessing the resource-conserving efficacy stemming from advancements in green technology, it stands to notably diminish the carbon emission intensity embedded within the production cycle. Secondly, grounded in the tenets of risk management theory, enterprises ought to prioritize the effective discernment and stewardship of diverse risks, encompassing but not confined to those pertaining to brand image and societal reputation. The enhancement of enterprises’ green technology innovation capabilities fosters an upward trajectory in their creditworthiness (Wang Z et al., 2024), thereby cultivating a favorable reputation within both product and capital markets. This, in turn, bolsters the competitiveness of their offerings and alleviates financing constraints, subsequently catalyzing further green technological advancements, augmenting corporate profitability, and ultimately mitigating the intensity of carbon emissions. Finally, as a kind of technological innovation, green technology innovation can save resources by reducing production investment and unnecessary loss of production materials, and at the same time, it also promotes the reduction of production costs of enterprises, so as to achieve the dual consideration of economic benefits and environmental benefits, so it is bound to reduce the intensity of carbon emissions of enterprises. To sum up, this paper proposes hypothesis 4.

Hypothesis 4. the improvement of ESG performance can reduce the carbon emission intensity of enterprises by promoting green technology innovation.

3 Data and methods

To investigate the relationship between corporate ESG performance and carbon emission intensity, and to ascertain whether enhanced ESG performance can mitigate carbon intensity, this study utilized panel data from China’s A-share listed companies spanning 2011 to 2022, excluding those in the financial sector, insolvent firms, and delisted entities. Moreover, since the carbon emission data were derived from corporate social responsibility and environmental reports, etc., samples with incomplete disclosures were omitted. Consequently, the final dataset comprised 1,566 listed companies, totaling 18,792 samples. Specifically, the measurement methods of each variable are as follows:

The dependent variable: Carbon emission intensity (CIit). Following the methodology of Wang et al., 2022, we manually collected data on enterprise carbon emissions from various sources such as social responsibility reports, sustainability reports, environmental reports, company websites, environmental department websites, and annual reports. Our collection includes only scope I and II carbon emissions. If a company has disclosed its annual carbon emissions, we record them directly. If the enterprise does not disclose its annual carbon emissions, it will be calculated according to the fossil energy consumption, power consumption and heat consumption of the enterprise through formula E=AD × EF. E is the carbon emissions, AD is the fossil energy, purchased power and heat consumption, EF is the carbon emission factor, the carbon emission factor refers to the official data, and the thermal carbon emission factor is still selected as 0.11tCO2/GJ according to the method of Wang et al., 2022, add up all carbon emissions to get the annual carbon emissions (CO2it) of the enterprise, with the unit of 100,000 tons. At the same time, the annual main business income (Revenueit) of each enterprise is selected to represent its economic output, and the carbon emissions (CO2it) of each enterprise in the current year is divided by the main business income (Revenueit) of each enterprise in the current year, so as to obtain the carbon emission intensity (CIit) of each enterprise in the current year, that is, CIit = CO2it/Revenueit. In order to facilitate the interpretation of the final results, only the units of the above data are adjusted, and no other processing is carried out.

Explanatory variable: Enterprise ESG performance (ESGit). Selecting the Huazheng ESG evaluation system, giving the score according to the ESG rating of each period of the enterprise in the current year, and c ∼ aaa respectively give the score of 1–9 points. Sum up the ESG scores of each company in the third quarter of the current year and the first quarter of the following year and calculate the average value, and take the average value of the calculated ESG rating as the explanatory variable.

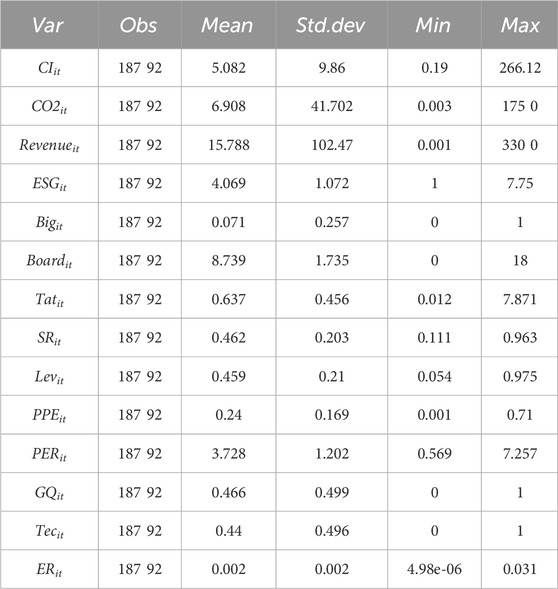

Control variable: referring to the research of Ye and Xu (2023), Li and Xu (2024) and Tan and Zhu (2022), the selection of control variables is as follows: ① Whether it is a Big Four Accounting Firm (Bigit): If yes, the value is 1, otherwise it is 0. ② Total asset turnover (Tatit) ③ shareholding ratio of top ten shareholders (SRit) ④ asset liability ratio (Levit) ⑤ fixed asset ratio (PPEit): select the proportion of fixed assets in total assets to measure. ⑥ Price earnings ratio (PERit): select the logarithm of the enterprise stock price divided by earnings per share. ⑦ Equity nature (GQit): the value assigned to the state-owned enterprise is 1, otherwise it is 0. ⑧ Board size (Boardit): measured by the number of board members in the current year. ⑨ Technological innovation (Tecit): it is measured by whether the enterprise applies for a patent in the current year. If the enterprise applies for a patent in the current year, it is assigned a value of 1, otherwise it is 0. ⑩ Environmental regulation (ERit): Choose the proportion of industrial pollution control investment in each region to the industrial added value. The above variables are from CSMAR and CNRDS databases. The descriptive statistics of each variable are shown in Table 1:

In order to analyze whether the improvement of enterprise ESG performance can reduce the intensity of enterprise carbon emissions, according to the research design and variable selection, and considering the factors that are difficult to capture at the individual and temporal levels, this article subsequently found through the Hausman test that the fixed effects model is suitable for this study, this paper selects the double fixed effect model for analysis in the benchmark effect regression and subsequent analysis. And to avoid heteroscedasticity and autocorrelation issues between clustered observations, we chose robust clustering standard errors and clustered them at the enterprise level, same below. See Formula 1 for the specific model:

Among them, CIit is the dependent variable, representing enterprise carbon emission intensity, ESGit represent ESG performance of enterprises, Controlit is the control variable, λ and γ are individual and time fixed effects, μit is the random error term, in which the positive and negative and significance of α1 are the key of this paper.

4 Empirical analysis

4.1 Benchmark effects regression

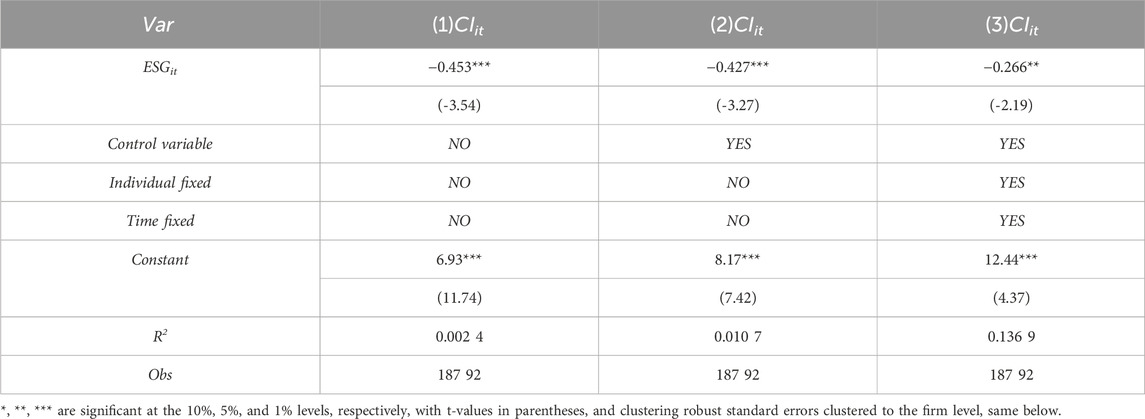

To determine whether, under the influence of ESG system, enterprises will choose to increase investment in social responsibility projects such as environmental protection to improve their ESG performance and reduce the intensity of enterprise carbon emissions, benchmark effect regression is carried out according to model 1, and the specific results are shown in Table 2. It can be seen from the results in Table 2 that the core explanatory variables are significantly negative whether control variables and fixed effects are added or not, and after controlling all control variables and fixed effects, the goodness of fit is significantly improved, which indicates that the model selected in this paper is reasonable, and also proves that the promotion and improvement of ESG concept and system has formed an atmosphere of pursuing sustainable development goals among enterprises, investors and society, which makes enterprises actively follow the concept of sustainable development, increase investment in environmental protection and other projects, so as to improve their own ESG performance, while the improvement of ESG performance drives the optimization of corporate financial performance and is committed to environmental pollution control, and ultimately reduces the intensity of enterprise carbon emissions, this outcome indicates that the enhancement of a company’s ESG performance can simultaneously achieve economic and environmental objectives, according to the regression coefficient, for every 1% increase in ESG performance, carbon emission intensity can decrease by 26.6%, hypothesis 1 is proved.

4.2 Robustness check

4.2.1 Replacement of explanatory variable

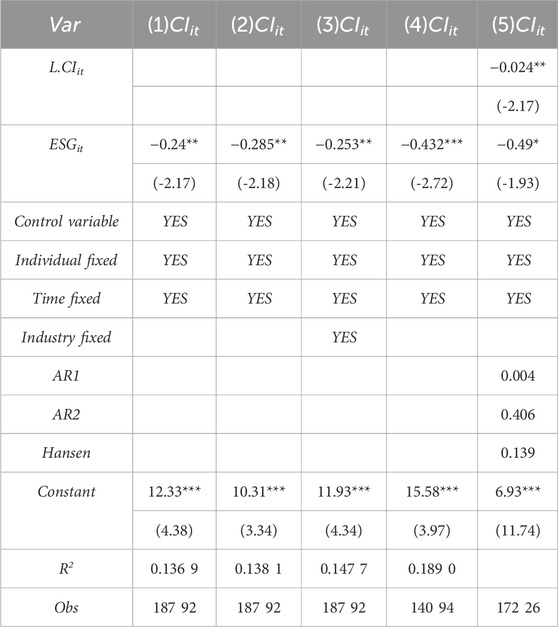

In this paper, the core explanatory variable is replaced by the average value of Wind ESG rating of each enterprise in the current year, which is included in model one for test. The specific results are shown in column 1 of Table 3. From the results, it can be seen that the original hypothesis is still valid after replacing the core explanatory variable.

4.2.2 Adding additional control variables and industry fixed effects

In order to avoid the endogenous problems caused by the omission of control variables, this paper adds the following control variables on the basis of the original control variables: entrepreneurship, intelligent transformation, cash ratio, firm size and corporate governance ability. The measurement of entrepreneurship refers to Zhang, 2024, for the measurement of intelligent transformation, refer to the method proposed by Wu et al. (2021), and for the measurement of enterprise governance capability, refer to the method proposed by Zhou Qian et al. (2020), the enterprise size is represented by the logarithmic value of the total assets of the enterprise in the current year. Each control variable is added into Model one for regression, the specific results are shown in column 2 of Table 3. According to the results, the original hypothesis is still valid after the control variables are added. Moreover, this study further incorporates the fixed effect of the industry into model 1. The specific results can be found in column 3 of Table 3. These results indicate that the core explanatory variable retains its significant negative impact even after controlling for the industry’s fixed effect.

4.2.3 Abnormal year exclusion

Given the impacts of the 2020 epidemic, international unrest, and a deceleration in macroeconomic growth on business operations—which could potentially induce firms to neglect carbon emission controls, affecting their revenue—this study excludes data from 2020 onwards. We then re-executed the regression analysis utilizing Model 1. The specific results can be found in column 4 of Table 3. The result indicates that, after removing the anomalous year, the core explanatory variable is still significantly negative, and the original hypothesis is still valid.

4.2.4 Replacement model

Since the System GMM model is suitable for handling situations with autocorrelation and data non stationarity, and does not require strict model assumptions such as independence or homoscedasticity of error terms, and can also avoid certain endogeneity issues, hence, this paper re-examines the relationship between corporate ESG performance and carbon emission intensity using the System Generalized Method of Moments (GMM) model. The specific results are presented in column 5 of Table 3. The values displayed by AR and Hansen represent the p-values of the test results, with Z-values shown in brackets. The results indicate that both the AR test and Hansen test support the suitability of this study for the dynamic GMM model. Furthermore, the core explanatory variable remains significantly negative, confirming the validity of the original hypothesis.

4.2.5 Endogenous problem

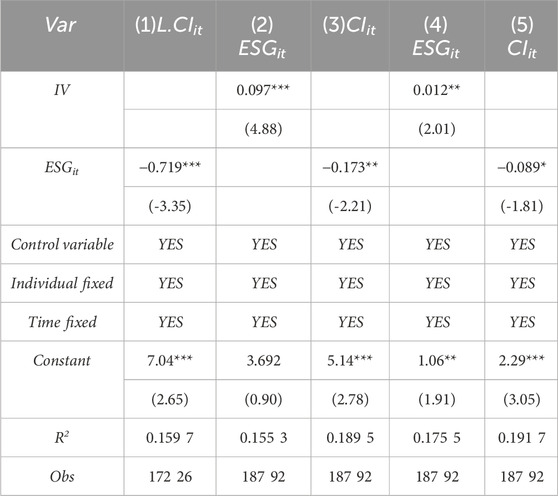

To mitigate potential bias from endogenous issues, this study adopts the methodology of Luo and Tang (2023) by regressing the dependent variable, carbon intensity, with a one-period lag. For detailed outcomes, consult column 1 of Table 4. The result indicates that the primary explanatory variable remains significantly negative, thereby sustaining the validity of the initial hypothesis.

Subsequently, the instrumental variable method is employed to re-examine the relationship between ESG and corporate carbon emission intensity. The chosen instrumental variables are as follows. Firstly, this article selects the number of shares held by “Pan ESG” funds in each company’s annual equity structure as the instrumental variable. As the holdings of “Pan ESG” funds can have a positive impact on the company’s ESG performance through methods such as “Voting with feet”, however, “Pan ESG” funds do not directly meddle with the company’s investment and operational decisions, maintaining primarily private contact with senior executives, so the instrumental variable meet the principle of relevance and exclusivity. For detailed regression outcomes, refer to columns 2 and 3 of Table 4. The results indicate that both the first and second stage regressions yield significant results, with the second stage regression still displaying significantly negative results. This suggests that the original hypothesis remains valid even when considering the endogenous issue.

Secondly, the logarithmic transformation of the count of chastity memorial archways within the province where the company is situated is reselected as the instrumental variable. These chastity memorial archways, deeply rooted in Confucian thought, exhibit a notable correlation with corporate ESG performance (Bai et al., 2024). Nonetheless, these structures, embodying the central tenets of Neo-Confucianism and honoring female fidelity, will not to influence the environmental actions or fiscal outcomes of the company, thereby satisfying the criteria for relevance and exogeneity. The detailed regression findings are presented in columns four and five of Table 4. Per the one-stage and two-stage regression outcomes, the core explanatory variable remains significantly negative, the original hypothesis is still true.

4.3 Mechanism analysis

To investigate if enhancing corporate ESG performance can diminish the magnitude of corporate carbon emissions by garnering institutional investors’ interest, enhancing overall productivity, and fostering green technological innovation, given the advantages of the double fixed effects model, this study employs Model 2 for analysis:

Among them, Medit is the mediating variable, and the other variables are the same as those in model 1. The significance and positive and negative of β1 is the key to judge whether there is a mediating effect. Specifically, the mediation variables selected in this paper are as follows:

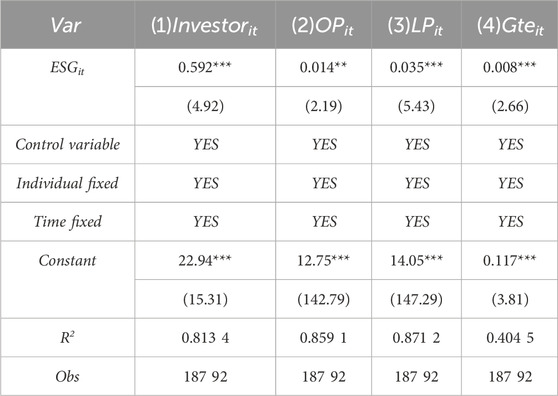

①Institutional investors (Investorit): Institutional investors’ shareholding ratios are measured using the average institutional shareholding ratio for each quarter of each enterprise within the current year. ②Total factor productivity (TFPit) is calculated using the Olley-Pakes (OP) and Levinsohn-Petrin (LP) methods. The output is defined as the main business income of each enterprise per year. The capital input is represented by the net value of fixed assets, while the labor input is the number of employees annually. Capital expenditures encompass cash payments for the acquisition and disposal of fixed assets, intangible assets, and other long-term assets. Intermediate inputs are determined by the net cash paid for goods purchased and services rendered. ③Green technology innovation (Gteit) should not be solely measured by the quantity of green patent applications, as this metric does not necessarily indicate a greater propensity for enterprises to engage in green technology innovation. Instead, the enhancement of green technology innovation capability must be reflected in the proportion of green patents relative to total patent applications. Consequently, this study employs the ratio of green patent applications to total patent applications within a given year as an indicator of enterprise green technology innovation capability. These variables are then incorporated into Model two for regression analysis. The detailed results can be found in Table 5. From the data in column 1, it is evident that the primary explanatory variable exhibits a significant positive correlation. The enhancement of an enterprise’s ESG performance tends to draw institutional investors’ attention, leading to an increase in their shareholdings ratio, and according to the size of the regression coefficient, it can be found that the ESG performance of enterprises can significantly attract the attention of institutional investors. This is largely driven by institutional investors’ commitment to green investments and the concept of sustainable development, which compels enterprises to prioritize environmental protection and governance. Furthermore, when enterprises invest in social responsibility initiatives like environmental conservation, it not only optimizes their financial performance but also enhances their market value. Based on the value investment goal, institutional investors are also more willing to promote enterprises to carry out environmental governance, thus promoting the reduction of enterprise carbon emission intensity. Hypothesis 2 is proved. From the results presented in columns 2 and 3, it is evident that the core explanatory variable exhibits a significant positive correlation. This suggests that enhancements in enterprise ESG performance contribute to improvements in overall enterprise total factor productivity, according to the regression coefficient, for every 1% increase in ESG performance, the total factor productivity of the enterprise increases by at least 1.4%. Such improvements are manifested specifically in the realms of technological innovation capability, resource allocation efficiency, and input-output efficiency. Consequently, this enhances enterprise profitability and curtails resource wastage, thereby mitigating the intensity of corporate carbon emissions. Hypothesis 3 is proved. The results in column 4 indicate a significant positive correlation between the core explanatory variable and the increase in the proportion of green technology patents. This suggests that improvements in enterprise ESG performance can enhance the ability of enterprises to innovate green technologies, according to the regression coefficient, for every 1% increase in ESG performance, the green technology innovation capability of enterprises improves by 0.8%, thereby achieving resource conservation, environmental protection, and cost savings. Consequently, this leads to a reduction in the intensity of enterprise carbon emissions, confirming Hypothesis 4.

4.4 Heterogeneity analysis

4.4.1 Incentive of intrinsic motivation

In order to actively encourage enterprises to implement the sustainable development strategy, so as to improve the environmental performance of enterprises without affecting the production and operation activities of enterprises, and realize the dual consideration of economic benefits and environmental benefits, it is necessary to start with the internal management decision-making activities of enterprises, and analyze how to promote enterprises to adopt the sustainable development strategy. This section analyzes the heterogeneous relationship between ESG performance and carbon emission intensity from the perspective of short-sightedness of management, separation of two rights and equity balance.

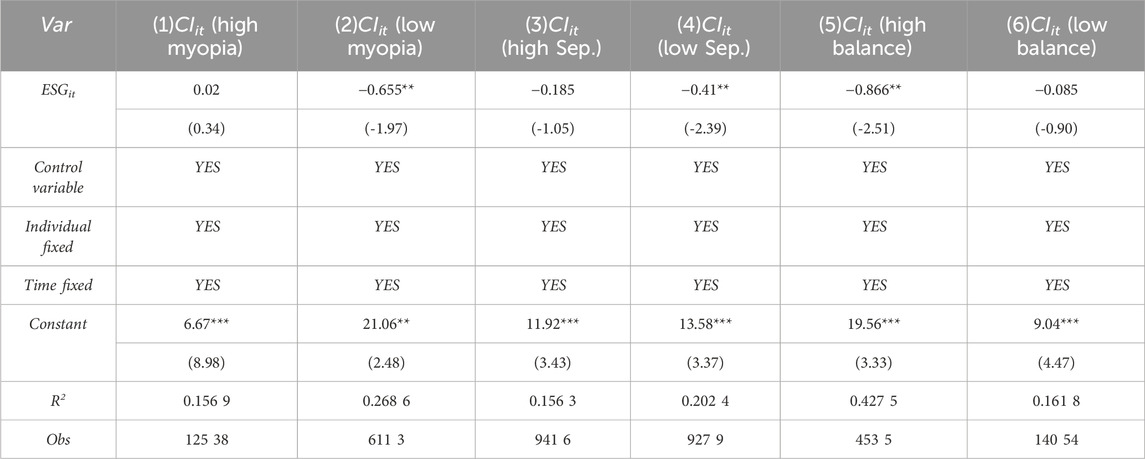

1. Short sightedness of management (Myopia): In the contemporary business landscape, the sustainable growth of corporations has increasingly garnered attention from various stakeholders. The executive consciousness significantly influences the development direction and strategic decision of the enterprise (Jiang et al., 2022). Green transformation, characterized by substantial investments, high risks, and uncertainties, necessitates the foresight of executives to facilitate the low-carbon transition of corporations and nurture their long-term competitiveness. If managers are myopic, they prioritize activities that rapidly generate value, consequently, neglecting the environmental governance of enterprises, which is not only not conducive to the cultivation of long-term competitiveness of enterprises, but also hinders the investment of enterprises in social responsibility projects such as environmental protection, ultimately, such actions are detrimental to both the improvement of ESG performance and the reduction of carbon emission intensity within enterprises. Therefore, this paper takes the proportion of management shareholding as the proxy variable of executives’ short-sightedness. If the proportion of management shareholding is higher, it will be more vulnerable to the rise in share price brought by the promotion of enterprise value, which makes managers focus on the long-term development goals such as the sustainable development strategy of enterprises, and to alleviate the principal-agent problem to a certain extent, so as to inhibit the managers’ short-sighted behavior. Therefore, according to the shareholding ratio of the management of each enterprise, the sample with the top 30% of the shareholding ratio of the management is divided into the low myopia group of managers, and the remaining sample is divided into the high myopia group, so as to carry out grouping regression. The specific results are shown in column 1 and column 2 of Table 6. The results indicate that in the high myopia group sample, the core explanatory variable is not significant. However, in the low myopia group (Low Myopia) sample, the core explanatory variable is significantly negative. This suggests that executives are more inclined to consider the long-term development strategy and future market value of the enterprise when receiving equity incentives. This approach helps to discourage managers from making short-sighted decisions, thereby improving the performance of ESG and exerting an inhibitory effect on carbon emission intensity.

2. Separation degree of two rights (Separation): The hallmark of the contemporary corporate system is the bifurcation of ownership and control, which has led to the rise of professional managers. This emergence not only enhances the proficiency and efficacy of corporate governance but may also precipitate the “principal-agent problem”, so as to diminish the efficiency of corporate management and potentially incite opportunistic behavior among managers, causing a deviation between the strategic objectives of the corporation and its actual conduct. This discrepancy can adversely affect the execution of long-term sustainable development strategies. Therefore, the high separation of the two rights may result in management prioritizing personal career progression and immediate performance metrics over the needs and interests of shareholders and stakeholders. Which will diminish investments in ESG projects and carbon emission management strategies. In this study, a grouping regression analysis is performed based on the median value of the dual rights separation degree observed in enterprises. Those above the median are categorized under the high dual rights separation degree group, while the remainder are classified under the low dual rights separation degree group. For detailed regression outcomes, refer to columns 3 and 4 in Table 6. The results indicate that the core explanatory variable exhibits a significant negative correlation in samples with low separation between two rights (Low Sep.). This suggests that the duality can effectively mitigate the “principal-agent problem”. Consequently, it aligns the management’s behavior and decision-making with the company’s long-term interests and social responsibility. This alignment encourages enterprises to enhance their investment in ESG projects. The enhancement of an enterprise’s ESG performance not only fosters environmental protection but also boosts the profitability of the enterprise. This, in turn, results in a reduction in the intensity of carbon emissions.

3. Equity balance (Balance): In modern enterprise management, equity balance, as an important part of corporate governance structure, can have a certain heterogeneous impact on the relationship among ESG performance and carbon emission intensity. The degree of equity balance directly affects the decision-making process and efficiency of the company. When the equity distribution of the company is relatively balanced, it can avoid the complete control of a single shareholder or small group over the company, which may promote a more democratic and fair decision-making process, and help promote the sustainable development strategy and environmental protection of the company. Additionally, enhancing equity balance can effectively curb the opportunistic behavior of major shareholders, safeguard the interests of all stakeholders, including minority shareholders, and thereby enhance overall corporate governance. Sound corporate governance forms the foundation for outstanding ESG performance, and a high level of governance is inevitably influential in shaping a company’s long-term profitability and environmental performance. Consequently, in companies with more balanced equity concentrations, effective oversight mechanisms lead to a stronger focus on long-term development over short-term profits, thereby favoring initiatives to reduce carbon emissions and achieve carbon neutrality. In companies with high equity concentration, due to lack of sufficient equity checks and balances, controlling shareholders might neglect environmental protection in their pursuit of short-term economic maximization. Furthermore, the diminished governance capacity resulting from such concentration can negatively impact a company’s profitability, which in turn affects its carbon emission intensity. Therefore, this paper utilizes the equity balance degree of enterprises as the criterion for grouping regression. The proportion of the second to fifth largest shareholders’ shareholding in the first largest shareholders’ shareholding in each enterprise during the current year serves as the proxy variable for equity balance degree. Samples with the top 30% equity separation degree are categorized into the high equity balance degree sample group, while the remaining samples are placed in the low equity balance degree sample group. For specific regression results, refer to column 5 and column 6 of Table 6. The findings reveal that in the high equity balance sample group (High Balance), the core explanatory variable is significantly negative. This indicates that a high equity balance enhances corporate governance capabilities and safeguards the rights and interests of shareholders and stakeholders. Consequently, enterprises invest in environmental protection and other social responsibility projects under the supervision of multiple parties, thereby boosting their long-term competitiveness. Thus, reducing the carbon emission intensity of enterprises.

4.4.2 Driven by external factors

In addition to intrinsic motivation, external environmental factors encountered by corporations also compel them to allocate resources towards social responsibility initiatives, such as environmental conservation. This not only enhances corporate ESG performance but also simultaneously diminishes carbon emission intensity. Consequently, this article analyzes the heterogeneity relationship between corporate ESG performance and carbon emission intensity from the perspectives of legitimacy factors and industry characteristics.

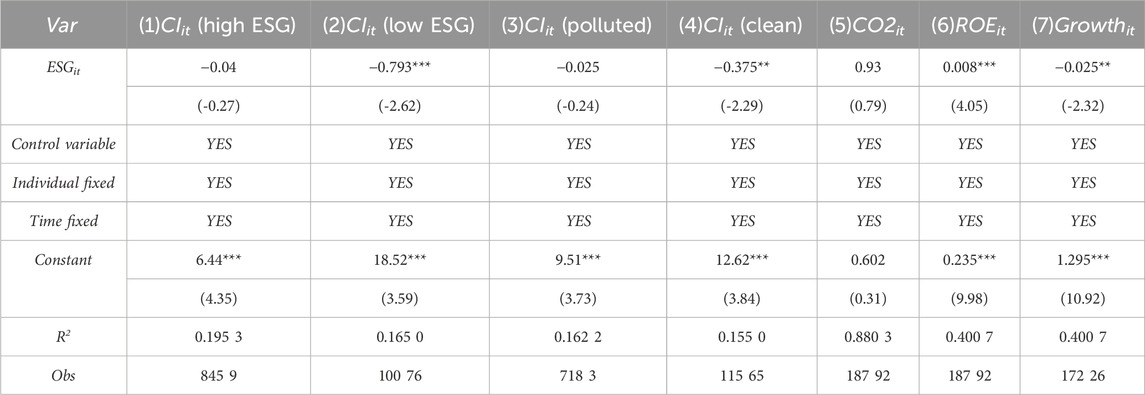

1. Crisis of legitimacy. Enterprises are granted the right to utilize natural resources and engage in production and operational activities by society (Deegan, 2011). Should they breach the stipulations of the social contract, penalties will be imposed on the organization (Iokuwaduge and Heenetigala, 2017). Consequently, legitimacy is of paramount importance for enterprises. Concurrently, due to the comparability of ESG strategic performance (lokuwaduge and Heenetigala, 2017), if an enterprise performs very well in ESG in its industry, it will receive the attention and support of stakeholders, so as to obtain the “legitimacy” status in its industry. Conversely, enterprises with poor ESG performance may encounter opposition or resistance from stakeholders, or even face penalties from environmental regulatory bodies due to subpar environmental practices. Compared to high-performing counterparts, these enterprises could experience a “legitimacy crisis”. Therefore, such enterprises may be more inclined to enhance their ESG performance by investing in social responsibility initiatives, such as environmental protection. This not only helps them gain governmental recognition but also reduces their carbon emission levels and maintains long-term competitiveness, and finally realize the control of carbon emission intensity. This paper performs a grouping regression based on the average ESG rating of industries in which companies are situated. The samples that exceed the industry’s average ESG rating for that year are grouped into one group (High ESG). These companies demonstrate superior ESG performance within their respective industries. Conversely, those samples below the industry’s average ESG rating for that year are classified into another group (Low ESG). These companies display subpar ESG performance within their industries. The specific results can be found in columns 1 and 2 of Table 7. The results suggest that companies with poor ESG performance within the same industry tend to increase their investment in social responsibility initiatives such as environmental conservation, so as to improve enterprise ESG performance and obtain legitimacy status, so as to reduce carbon emission intensity.

2. Emission reduction pressure.

With the gradual stringency and diversification of China’s environmental laws and regulations, compared with other industries, listed companies in the heavy pollution industry are facing a more serious situation. In order to meet the regulatory requirements of China’s environmental authorities, they must bear the brunt of green transformation, otherwise they will face a variety of penalties. Therefore, compared with other industries, under the influence of external environmental laws and regulations, enterprises in the heavy pollution industry may need to urgently increase investment in social responsibility projects such as environmental protection, so as to improve ESG performance and reduce their carbon emission intensity, so as to obtain legitimacy to avoid punishment and opposition from the regulatory authorities and other stakeholders. While ESG serves as a mechanism to foster sustainable development, its regulatory influence on corporate behavior is similar to a “soft constraint”, in contrast to environmental policies that impose a “hard constraint” on corporate environmental performance, such as environmental regulations, the restraining force on highly polluting companies remains inadequate, it is unable to effectively restrain the environmental performance of highly polluting enterprises. Therefore, based on the industry codes of listed companies, this study categorizes heavily polluting enterprises into one group (Polluted) and enterprises from other industries into another group (Clean), to conduct a regression analysis by groups and examine the heterogeneity of ESG’s impact on heavily polluting and clean industries. The specific results are presented in columns 3 and 4 of Table 7. The results indicate that the core explanatory variable is not significant in the sample of heavily polluting enterprises, suggesting that ESG does not effectively facilitate energy conservation and emission reduction in these enterprises. However, in non-heavily polluting enterprises, improved ESG performance can reduce their carbon emission intensity. The likely reason is that green transition demands substantial investment and has high-risk characteristics. For heavily polluting enterprises, the cost of carbon emission reduction is higher, and the benefits from enhancing their ESG performance do not justify the transition costs. Consequently, the “soft constraints” imposed by ESG cannot drive the green transition of heavily polluting enterprises.

4.4.3 Double control of total amount and intensity?