- 1School of Law and Business, Sanjiang University, Nanjing, China

- 2School of Management Science and Engineering, Nanjing University of Information Science and Technology, Nanjing, China

- 3School of Business, Jiangsu Open University, Nanjing, China

Introduction: The Yangtze River Economic Belt (YREB) is experiencing rapid economic development, while ecological and environmental problems are prominent. The development of green finance can help optimize the upgrade of regional industrial structure and promote the improvement of the ecological environment.

Methods: This study constructs an evaluation system for the development level of the YREB based on the panel data of 11 provinces (cities) in the YREB from 2010 to 2020. The entropy method is used to evaluate and analyze the current status of the ecosystem in the YREB, and a panel data model is used to conduct an in-depth investigation to explore the impact of green finance (GF) on the industrial structure upgrade (INS) of the YREB.

Results: The results of the study show that from 2010 to 2020, the level of GF development in the YREB has increased, and the INS has further developed. In addition, the growth of GF injects a strong impetus to the improvement of INS in YREB, but there are regional differences, which are more obvious in the eastern region and not significant in other regions.

Discussion: Finally, based on the research conclusions, relevant strategies and suggestions are proposed to assist the development of GF and INS in the YREB.

1 Introduction

China’ Carbon peaking and neutrality goals are imperative to its modern development and decisions (Zhang Yueting et al., 2022). Over the next three decades, China needs to invest approximately 100 and 500 trillion yuan in green and low-carbon projects (Hu et al., 2021). To achieve this, contributions from various sectors and industries are essential. Notably, the financial sector must be supportive for this dual-carbon target to be achieved (Li and Umair, 2023). Green finance (GF) is crucial to addressing climate change challenges and achieving the dual carbon goal under such a high demand for funding (Wang and Wang, 2021). Over the last decade, GF systems’ creation and market development have shown preliminary success in the country. In 2016, the nation published the Guiding Opinions on Building a GF System, establishing the legal foundation for GF development. This was a massive step towards achieving the country’s dual-carbon goal and expanding industrial structure. There is a need for greater research on the extensive functions and roles of GF development in the industrial structure and the growth of many sectors to accomplish this major goal in the nation. Identifying and understanding these functions, together with how changes in the industrial structure affect them, can help find other related processes and assist in policy creation (Yuan et al., 2022a). Changes in industrial structure and the rise of green financing are two crucial factors that can be used to determine the methods for promoting industries (Zhao et al., 2023).

China’s economic development has achieved remarkable results for the whole world since the reform and opening up, but the bearing capacity of the environment is a limitation (Yuan et al., 2023). It is imperative to promote GF to improve industrial structure (INS) and accelerate the formation of green production and lifestyle. GF is an important strategy for realizing the transition to economic growth and promoting the construction of an environmentally friendly society (Bao et al., 2023). The Yangtze River Economic Belt (YREB) is of tactical significance in China’s regional development, but it is worth noting the pace of spatial improvement of the INS is not the same because of the obvious differences in natural conditions, policies, and economic progress across diverse areas of China. Although with the continuous expansion and growth of the green industry, the construction of the GF system has also achieved certain results. However, some challenges and shortcomings still restrict the effective construction of the GF system. The YREB still suffers from outstanding ecological and environmental problems and unbalanced and uncoordinated regional development. Again, GF has been considered in various aspects of China’s recent economic development policies. However, the impact and role of GF in curbing environmental problems in the YREB sector is narrowly understudied, creating room for more studies that inculcate GF into the industrial structure.

To narrow this down, the study aims to uncover GF’s role in uplifting the industrial structure of the YREB and suggest policies that can help enhance its development. In this context, the study aims to answer the following questions. (1) Does the development of GF contribute to an upgrade in INS? (2) What is its specific operation mechanism for this development? In light of this, this study is novel in two major ways. First, this research adopts the entropy method as a gauge for developing GF in 11 provinces in the YREB. The novelty of this research lies in its departure from past studies that have neglected the application of the entropy method in analyzing the industrial structure of China’s YREB. By introducing this method, the research enhances the depth and sophistication of analysis, offering comprehensive insights into factors such as sectoral contribution to GDP, employment generation, environmental impact, and regional disparities. Second, it constructs a panel model that analyzes the regional differences in China and validates the functionalities of GF in promoting the overall INS.

By achieving the research objectives, providing answers to the questions, and filling the literary gaps, this study will greatly contribute to the body of literature and policymakers for advancing GF and INS in the following ways. To begin with, this study will provide a strong foundation for future study in this area or others. It will contribute massively towards the development of other methods to enhance research. Moreover, the study introduces control variables, constructs a panel model, analyzes the regional differences, focuses on evaluating the effect of GF, verifies the function of GF in the promotion of INS upgrading, and provides a scientific basis for promoting GF in the YREB and narrowing the synergistic development of INS. This will result in more robust and reliable results that can be used for reliable decision-making. It will help promote GF towards a sustainable industry and the world. Third, the policy implications provided will help policymakers formulate policies that guide the activities of the industries within the YREB. These policies will serve as a reference source for the decision-making institutions of the various governments around and within the YREB.

2 Comprehensive review of literature

2.1 Green finance

In China’s ecological civilization and sustainable development, GF plays an essential part (Zhang et al., 2020a). It originates from the sustainable development theory (Yao et al., 2022). The GF research in China is broadly divided into three major clusters. The first is the quantitative research that focuses on green credit. Banking gave rise to China’s GF products, and the early development was dominated by green credit throughout the various stages. Research in this area focuses on how green credit affects corporate investment behavior and INS. For instance, Hu et al. (Hu et al., 2020) found that green credit played a significant part in China’s industrial restructuring, with significant variations across regions. The study highlighted the importance of green credit in enhancing China’s industrial structure. In the same domain, the eastern region gained significant development driven by GF, while other regions failed to reach the same level with significant differences (Peng et al., 2023). According to Wang et al. (Wang E. et al., 2019), through improved disclosure in the lending process, the green credit policy will reduce emissions from extremely polluting firms. This highlights the potential of integrating GF mechanisms to mitigate environmental impacts and drive structural changes in industries, fostering innovation and resilience in the face of evolving sustainability challenges. Zhang et al. (Zhang et al., 2021) also emphasized that introducing green credit can accelerate the energy transition. Furthermore, they highlighted that implementing policies to incentivize green investments within financial institutions can significantly mitigate climate change and promote sustainable development.

Secondly, according to policy efficiency studies, China’s allocative efficiency of GF has not yet reached the desired level, and the government’s “green” policies do not impose significant financing constraints on polluters. From several perspectives, the government’s “green” policy system has played a positive part in enhancing the efficiency of green funding allocation. By region, the difference between the developed eastern regions and other lagging regions has narrowed further. From the perspective of policy deconstruction, the government still faces problems such as insufficient scale and inefficiency in implementing “green” fiscal policies, and the lack of regulation hinders the efficiency of GF allocation (Liu et al., 2019). Regarding this, Madaleno et al. (Madaleno et al., 2022) stated that comprehensive policies are necessary to successfully realize sustainable development goals. Additionally, they emphasized the importance of integrating environmental, social, and economic considerations into these policies to ensure holistic and effective implementation. Last is the study on constructing a GF system under the wave of international monetary innovation. On this, Cui et al. (Cui et al., 2020) emphasized the importance of establishing a GF system to help enhance innovation and realize a green economic transition in response to climate change, the ecological crisis, and energy security challenges. They argued that by fostering collaboration between government, industry, and academia, such a system can facilitate the development and dissemination of sustainable technologies, thereby driving economic growth while mitigating environmental risks. They opine that its soundness has significantly contributed to sustainable development and promoting clean production. Moreover, their research revealed that implementing this evaluation system improved resource management and environmental conservation practices significantly within the energy sector (Zhang and Wang, 2021).

Scholars have studied the influence of GF from multiple perspectives. Gilchrist et al. (Gilchrist et al., 2021) provide an in-depth study of green bonds and green loans. Their research delves into the mechanisms driving market growth and the impact of these financial instruments on sustainability initiatives within corporations and public entities alike. Nassani et al. (2017) emphasize the relevance of green policy instruments linked to the nation’s sustainable development, while Tolliver et al. (2019) validate the growing role of GF in the financial framework of climate change and sustainable development. Moreover, they argue that integrating GF into policy frameworks can significantly enhance the effectiveness of sustainability initiatives, ensuring a more robust approach towards mitigating climate change and fostering economic growth. Again, Li et al. (2022) emphasized that GF can help enterprises realize green transformation and guide listed companies to green development.

Notwithstanding, some scholars also point out that GF policies have a depressing effect on firms’ productivity. For instance, Peng et al. (2022) opine that heavily polluting firms are discouraged through green policies. This discouragement prompts firms to invest in cleaner technologies and practices, fostering environmental sustainability and mitigating ecological degradation. Iqbal et al. (2020) argued that policies regarding GF must be formulated by authorities to diminish ecological issues. Furthermore, they stress the importance of incorporating sustainable practices into these policies to ensure long-term environmental conservation and mitigate the impacts of global warming. For instance, they observed that in highly industrialized areas, implementing GF measures yielded more pronounced environmental benefits compared to regions that did not. These inter-regional differences in GF development, elucidated by Wang L. et al. (2021), underscore the critical need for tailored policy interventions to address disparities and foster sustainable financial ecosystems across diverse geographical contexts. In addition, Jeffrey (2015) argued that GF instruments can help improve environmental issues.

Moreover, they contend that by channeling investments toward sustainable projects, such instruments mitigate ecological harm and spur economic growth through innovation and job creation. Liddle and Messinis (2018) found a U-shaped association between environmental quality and economic expansion. They discovered that while initial economic growth often leads to a deterioration in environmental conditions, further development eventually allows for implementing more sustainable practices, thus improving environmental quality once again. Finally, Batrancea et al. (2020) discovered that financing green investments can boost economic growth and reduce global warming. Furthermore, their research elucidated that governments implementing policies to incentivize green financing witness environmental benefits and substantial improvements in socio-economic indicators such as employment rates and public health outcomes. Moreover, carbon finance is also a hot spot in GF research, and China’s carbon (CO2) emissions have entered a slow growth phase.

2.2 Industrial structure (INS) upgrading

Promoting industrial restructuring and optimization is essential for realizing sustainable development goals (Irfan et al., 2022). INS upgrading is a continuous reduction in the share of the primary sector in the early stage of economic development, while the output portion in the secondary and tertiary sectors continues to grow (Song et al., 2014). Shao et al. (2021) argued that green credit would effectively facilitate the development of tertiary industries. GF can optimize the distribution of finances and promote the revolution of INS, but its efficiency in promoting industrial optimization is decreasing (Gu et al., 2021). INS upgrading has been argued to possess the existence of regional heterogeneity (Liu et al., 2017; Ge et al., 2022). Tang et al. (2023) used the YREB as their study region to verify digital finance’s participation in encouraging INS upgrading. The movement of graduates from prestigious universities positively affected the upgrading of INS in each province (Zhao et al., 2022). In addition, urbanization and environmental regulation can also promote INS upgrading, which are considered control variables in this paper. Information infrastructure can ultimately contribute to upgrading the INS by enhancing urbanization (He and Zheng, 2023; Guan et al., 2022). Environmental regulations indirectly influence INS in a variety of ways (Wang J. et al., 2022). However, the type and geographical diversity of environmental regulations lead to uncertainty about the impact of environmental regulations on INS upgrading. Stavropoulos et al. (2018) found that in China, the association curve connecting environmental regulation and industrial competitiveness is U-shaped. Environmental regulations can promote regional technological innovation capacity, but this is limited to the eastern region, while the other regions have not yet developed this positive promotion effect (He and Zheng, 2023). Wang M. et al. (2021) explored that innovation plays a crucial part in upgrading INS by using panel fixed-effect and random-effect models, which inject a strong impetus into industrial growth. The upgrading of the INS directly reduces CO2 emissions and mediates technological innovation and CO2 emissions reduction (Zhu, 2022a). In addition, regional heterogeneity exists in the promotion of INS upgrading by innovative industries (Du et al., 2021). CO2 emission reduction, economic growth, and INS upgrading are complementary, and there is a balanced relationship between the three (Dong et al., 2020).

The notion of INS optimization has appeared as a basic common understanding (Zhang et al., 2020b). Optimization of INS is commonly decomposed into two dimensions. The first one is rationalization, and the other is advanced. There are three trends of rationalization and advanced INS at the provincial level in China, namely, rising, U-shaped, and inverted U-shaped (Zhu et al., 2019). Based on these perspectives, some scholars have found that low-carbon green transformation facilitates the rationalization of INS but inhibits the upgrading of INS (Wang X. et al., 2021). Emphasizing the Dagum Gini coefficient and the convergence method, some scholars have researched the spatial inequality characteristics of INS upgrading and found significant spatial differences in industrial rationalization and optimization in China (Gao et al., 2023). Industry-wise, some scholars find that the tertiary is replacing the secondary as the novel development engine. However, some scholars believe the secondary industry is still the largest growth engine (Wang Y. et al., 2021).

2.3 Green finance and industrial structure upgrading nexus

GF is a dynamic force in upgrading INS and a key approach to promoting sustainable economic and environmental growth in a region. Its impact is mainly reflected in financial assistance and information guidance (Xiong et al., 2023; Fang and Shao, 2022). Some countries have started to shift from economic growth to green productivity practices and have successfully encouraged INS upgrading (Chen et al., 2023). The role of GF in INS upgrading is mostly reflected in green industry and manufacturing settings (Xiang et al., 2023). Green industries stand out for their high technological content, excellent environmental benefits, and significant economic benefits. Green industry development is essential to achieving an environmentally friendly society and building a conservation-oriented society. Hang et al. (Hang et al., 2019) argued that the decoupling of manufacturing from CO2 emissions affects the success or failure of China’s green economy transition. This decoupling phenomenon underscores the importance of implementing stringent environmental regulations and investing in clean energy technologies to mitigate the environmental impact of China’s industrial activities. As a result, governments should proactively upgrade INS and innovation through GF (Batrancea et al., 2020). With the continuous innovation of the GF system, social capital is being transferred gradually to the green industry chain of ecological civilization, and through green financing, it provides policy support to traditional industries in terms of technological upgrading, new equipment procurement, and financing channel expansion, thus promoting environmental protection, and energy conservation (Nian and Dong, 2023). GF is favorable to INS, but the study of GF on INS in the YREB, as an important region for economic development, has not yet been discussed. In view of the above research, this study proposes.

Hypothesis 1:. GF plays a high facilitating role in INS in the YREB.

In addition, research based on different industries explored the impact of GF development on agriculture, environmental industries, and high energy-consuming industries (Mo et al., 2023; Jin et al., 2021). Also, Wang et al. (Wang F. et al., 2019) studied the role of GF from the perspective of technological progress. Their research delved into how advancements in technology have influenced the dynamics of global finance, offering valuable insights into the interconnectedness of innovation and economic systems. This emphasizes that GF development has significant spatial agglomeration effects and a large regional difference (Xie et al., 2020), while INS rationalization also has a spatial distribution aggregation. The upgrading of INS will also add to the green expansion of the region. Green credit not only directly promotes INS upgrading but also has a mediating effect through technological innovation (Zhu, 2022b). Based on the perspective of government regulation, Wang et al. (Wang L. et al., 2022) objectively assessed the effects of heterogeneous environmental regulation on INS upgrading and further examined its influence mechanism because there are apparent disparities in different locations and types of environmental regulation. They found that while stringent regulations in some regions prompted rapid INS upgrades, others with lax enforcement experienced slower progress, indicating a nuanced relationship between regulatory stringency and infrastructure development. Nie et al. (Nie et al., 2022) studied the spatial and temporal evolutionary characteristics of the coupling and coordination of GF and INS optimization and its influencing factors, indicating that the coupling of GF and INS upgrading in the central region is low and weak, and the coupling and coordination development is lagging. Regional development differences in the YREB are more obvious; however, there is less discussion on the regional differences of GF on industrial structure. In view of this, this study proposes its next hypothesis.

Hypothesis 2:. The effect of GF on regional differences in INS is obvious.

GF can alleviate the financing pressure on emerging enterprises, thus promoting continuous technological progress (Song et al., 2022). Financial markets have the function of risk redistribution, which can increase the incentives for enterprises to operate “green enterprises” (Xu et al., 2022; Wang and Li, 2022a). GF will bring more foreign investment and largely guide the scale of green capital investment to realize the redistribution of capital factors at the government level (Li et al., 2023). Policy guidance and signaling mechanisms can encourage polluting enterprises to adjust their internal structure and further promote the greening of INS (Cheng et al., 2022).

2.4 Literature gaps, novelty and contributions

The above studies explored the impact of GF on corporate investment efficiency, high-quality development, corporate green transformation and carbon emission reduction effects. The main differences between this paper and the referenced ones are as follows: (1) The most relevant literature to this paper (Wang and Wang, 2021; Wang L. et al., 2022) explored the role of GF in promoting INS. However, there is still room for expansion. This is because there are certain research gaps in the past studies. Most of the studies mainly focus on the national or provincial level, with a lack of research on a particular economic region and analysis of its regional heterogeneity. (2) Relative to the individual indicators of green bonds, green loans, and green policy instruments, this study provides an in-depth analysis through the entropy method. This study provides a holistic understanding of the economic landscape of the YREB, highlights new and emerging industries, and provides targeted policy information for balanced regional development. (3) Taking the GF and INS of YREB as the research object, drawing on the research results of existing scholars, this study constructs a comprehensive evaluation system to assess the level of GF, analyze the relationship between the two, and further analyze the regional heterogeneity of the two. This helps to deeply study the influence of GF on the optimization and upgrading of YREB’s inertial control system, further improve the theory of GF, and provide new ideas and solutions.

3 Empirical data and methodology

3.1 Explanatory variables

3.1.1 Assessment of the current status of green finance in YREB

Green Finance (GF): This paper constructs GF indicators from green credit, green investment, green insurance, green securities, and carbon finance (Xiong et al., 2023) using the entropy value method. The data are sourced from the Wind database, China Statistical Yearbook, China Industrial Statistical Yearbook, China Insurance Yearbook, and China Agricultural Statistical Yearbook. The specific calculation steps are described as follows.

3.1.1.1 Data standardization

In this paper, the indicators are normalized due to the need for a multi-indicator evaluation system. This is due to the fact that the use of raw data for analysis in a multi-indicator evaluation system will highlight the importance of high-value data in a comprehensive analysis. Therefore, the main purpose of this step is to eliminate quantitative relationships between variables, to make the data fall into smaller specific intervals, and to compare and weight indicators of different natures. First, m indicators for a total of n samples are selected, and then what is represented is the value of the jth in the ith sample; i = 1, 2, 3 … n; j = 1, 2, 3, … m.

We then normalize the data using the equations below. If the change in the impact of the indicator on the development of GF is positive, the following equation is used.

If the change in the impact of the indicator on the development of GF is negative, it is calculated using the equation below.

3.1.1.2 Calculate sample weights

The main purpose is to calculate the weight of the indicator for the ith sample under the jth indicator:

3.1.1.3 Calculating entropy

3.1.1.4 Calculation of the coefficient of variation for indicator j

3.1.1.5 Calculation of evaluation indicator weights

The main objective is to calculate the weight share of the jth indicator in the overall evaluation system, with entropy weights of

3.1.1.6 Calculation of the sample composite index

The final composite index of the sample in this paper is the GF Development Index.

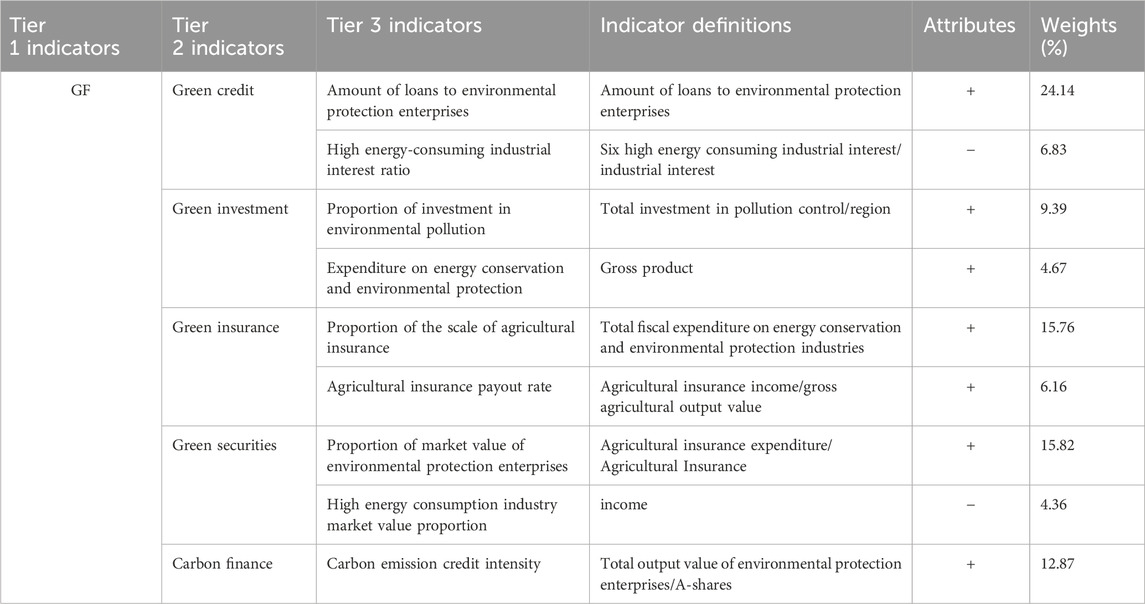

The entropy value method was used to synthesize the factors and make the indicators more objective. Table 1 describes this study’s primary, secondary, and tertiary indicators, the calculation method, and the weights. The GF Development Index is as follows:

Relevant data from 2010 to 2020 in China’s YREB consisting of 11 provinces and cities were used. To assess the level of GF development in the YREB, this study’s GF measurement includes five key indicators.

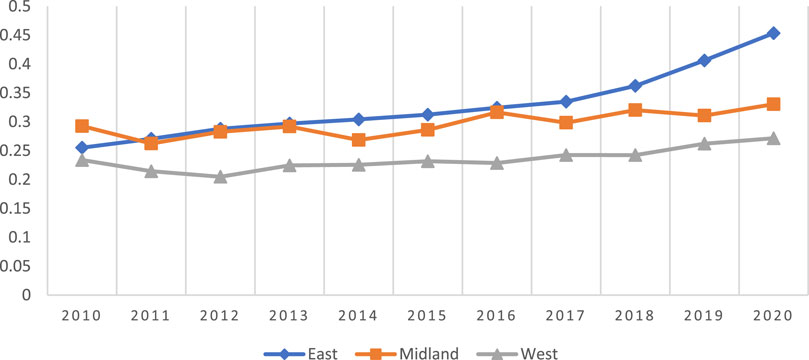

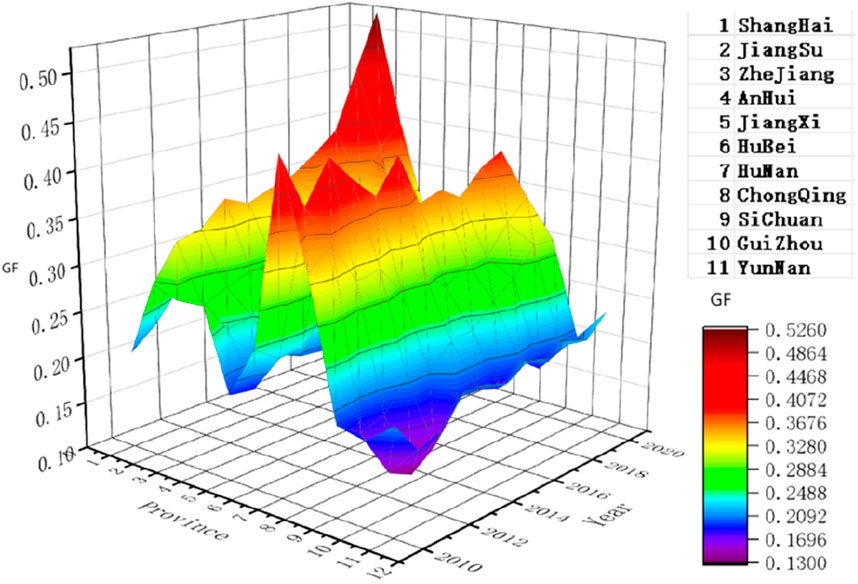

After obtaining the comprehensive weights, each province’s annual GF development level can be obtained by summing up the collected data. Based on the indicators in the five aspects of the table and the relevant data collected, the GF development level of each province in the YREB during 2010–2020 was measured by applying the entropy value method, and the corresponding development level values were obtained, which are shown in Figures 1, 2.

Figures 1, 2 show that all provinces in the YREB from 2010 to 2020 show a positive development trend in GF development. The eastern, central, and western provinces are all the same, although there are large variances in the expansion speed and the rate of increase. They generally show a good development trend, which indicates that all provinces in the YREB assign great relevance to the development of GF and have made unremitting efforts to realize sustainable development. From Figure 2, places with higher levels of GF development have higher corresponding economic development levels (EDL), such as Shanghai and Jiangsu. In contrast, Guizhou and Yunnan have the lowest levels of GF, and their EDLs are also low. GF is inseparable from their high economic growth, which is worthy of reference for other provinces, so this paper considers the EDL as a control variable.

3.1.2 Assessment of the current situation of the industrial structure of the YREB

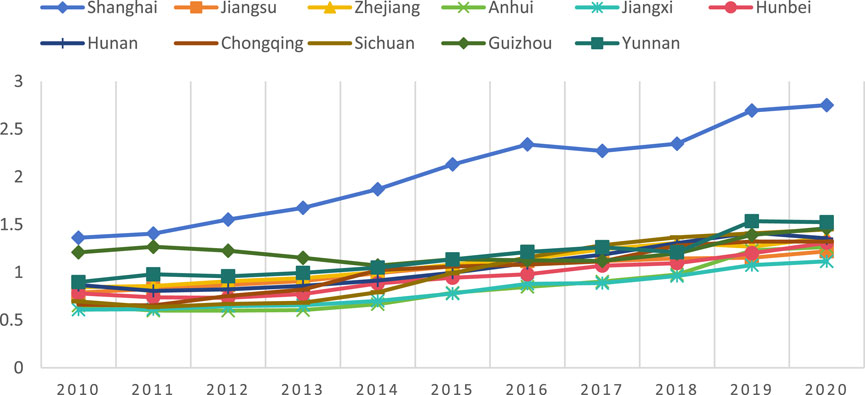

Industrial Structural Upgrading (ISU): It is measured using the ratio of tertiary to secondary output value. The data are mainly obtained from the CNRDS database, and the degree of advancement in each place is shown in Figure 3.

The INS of the YREB generally developed toward advanced in 2010–2020, and Guizhou had a certain downward trend. However, it rose slowly after 2014.

In summary, the INS of different regions in the YREB shows an overall upward trend from 2010 to 2020, but there are still differences in the degree of advancement, and the ISU shows an east-central-west “U”pattern.

3.2 Variable summary and description

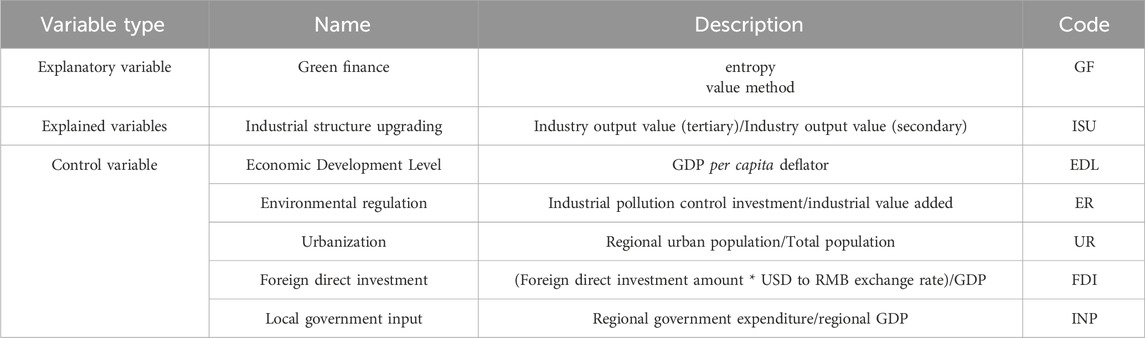

A summary and description of the variables are shown in Table 2.

3.3 Data description and descriptive statistics

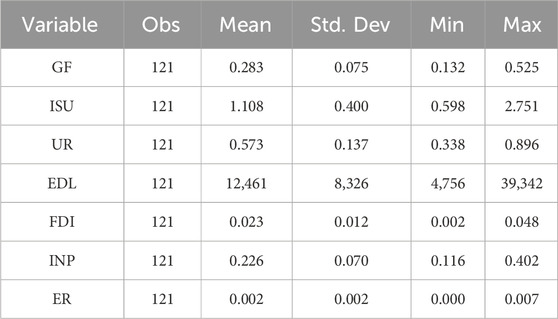

Eleven provinces and cities from 2010 to 2020 were selected as samples. The main sources of data for calculating the green development index are China’s major statistical yearbooks and the Wind database. The relevant data for calculating the industrial structure comes from the CNRDS database. Table 3 shows the mean, standard deviation (SD), maximum (Max), and minimum (Min) of the utilized variables. According to Table 3, GF recorded a mean value of 0.283, an SD of 0.0755, 0.525 as Max, and 0.132 as Min. The developmental level of the provinces’ and cities’ GF is within an acceptable range, which relatively stabilizes the data. ISU recorded a mean value of 1.108, an SD of 0.400, a Max of 2.751, and a 0.598 Min value; certain regional differences exist. Results from the control variables show that the SD ER and FDI are minute, and the gap between the Max and Min is very small, as well as stabilized data. This indicates that the regional differences in FDI and ER in the sampled data are insignificant. In contrast, the SD of EDL is larger, and there are also large differences between the Max and Min, depicting large variances between provinces and cities.

3.4 Correlation analysis of variables

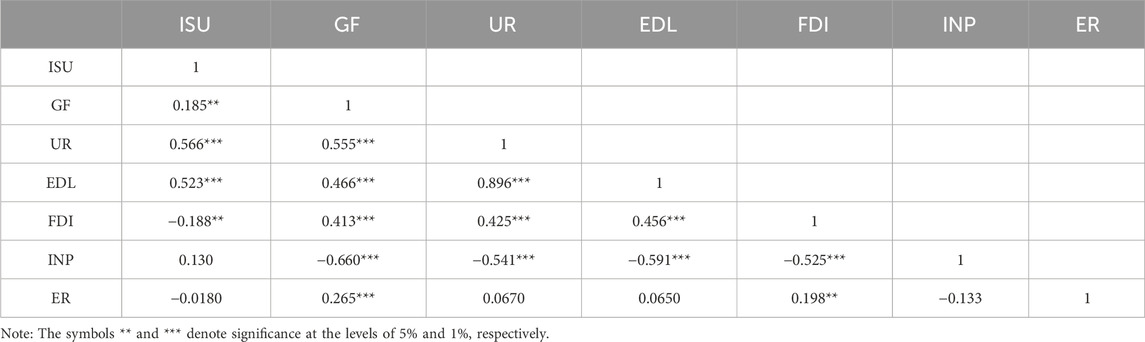

According to the Pearson correlation coefficient test, the correlation between the variables is shown in Table 4. It can be seen that the core explanatory variable GF is significantly and positively correlated with the level of ISU at the 5% level.

3.5 Multicollinearity test

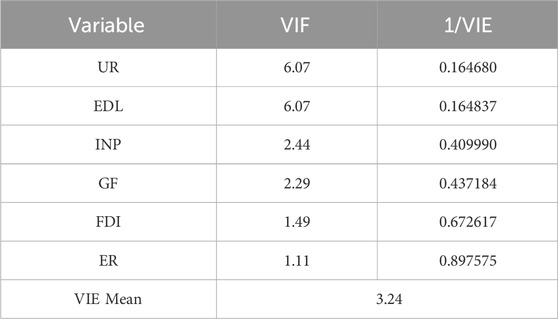

A multicollinearity test was conducted to test the existence of colinearity among the variables. From Table 5, the model has a maximum VIF value of 6.07 and a mean value of 3.24. This indicates that there is no multicollinearity problem within the data.

3.6 Model construction

The main research issue of this paper is the green finance and INS of the YREB, which belongs to the macroeconomic phenomenon, and the econometric method applies rigorous mathematical and statistical methods, which can provide accurate quantitative analysis of the macroeconomic phenomenon (Zhu, 2022a; Zhang et al., 2020b). GF calculated by the entropy method is the core explanatory variable, and ISU is the explanatory variable. A panel model is constructed by controlling for the level of economic development, the level of urbanization, environmental regulation, the degree of government intervention, and foreign direct investment.

In the above Equation 1, ISU represents the index of advanced INS, EDL signifies economic development, ER represents environmental regulation, UR represents the level of urbanization, INP represents the degree of government intervention, i denotes the province, t characterizes the year,

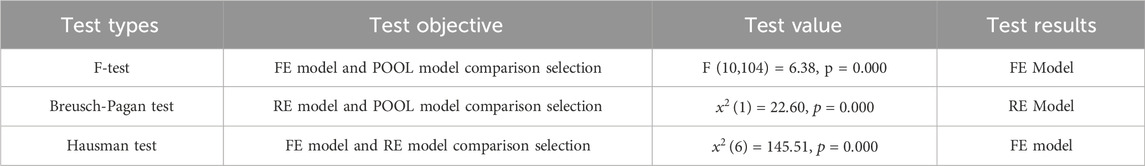

The model testing results are shown in Table 6. The result of the F-test shows that the fixed effect model is better than the mixed effect model, so we should choose the fixed effect model. However, the BP test was conducted, and it showed that the random effect model was also better than the mixed effect model. As such, the Hausman test was conducted, and it showed that the fixed effect model had higher accuracy and reliability. Therefore, the fixed effect model was chosen.

4 Empirical analysis and discussion

4.1 Regression analysis

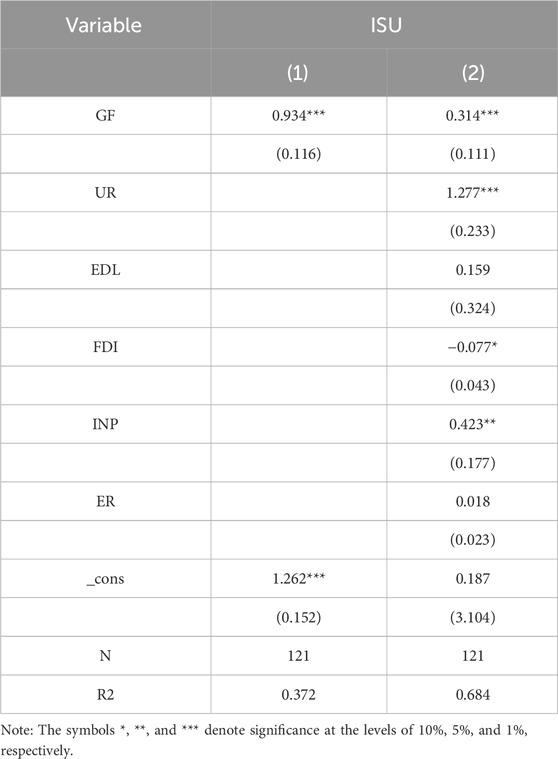

The regression analysis was conducted with GF, UR, EDL, FDI, INP, and ER as the independent variables. A fixed-effects model regression is used, and Table 7 is the baseline regression results of GF development affecting INS upgrading. (1) is the regression result without control variables, and the coefficient of the core explanatory variable is 0.934. (2) is the regression result after adding control variables; the coefficient of the core explanatory variable is 0.314 and positive. From the results in Table 6, the core explanatory variables of both models (GF) have significant effects on ISU, all significant at the 1% level. The UR, the EDL, and the INP are all significant at the 1% significant level, while environmental regulation and foreign direct investment are insignificant. This indicates that the ISU of the YREB is significantly and positively influenced by GF. The regression coefficient is 1.277 > 0, which indicates that UR has a positive impact on it. The regression coefficient of 0.159 > 0 indicates that EDL has a positive influence, the coefficient of −0.077 < 0 indicates that FDI has a mildly negative impact on it, and the regression coefficient of 0.423 > 0 indicates that INP has a significant positive effect.

The results showed a significant positive effect of GF on advanced ISU. This finding corroborates with existing literature (Zhang et al., 2020a; Cui et al., 2020; Nian and Dong, 2023; Liu et al., 2023), highlighting the pivotal role of GF in driving industrial transformation towards sustainability. GF mechanisms such as green credit have been instrumental in incentivizing firms to adopt environmentally friendly practices, thus contributing to industrial restructuring (Wang E. et al., 2019; Hang et al., 2019). Moreover, the study’s results align with previous research (Xiong et al., 2023; Xiang et al., 2023; Song et al., 2022), emphasizing the importance of GF’s financial assistance and policy support in promoting technological innovation and upgrading traditional industries.

The analysis also reveals significant positive impacts of urbanization (UR) and economic development levels (EDL) on ISU. This finding resonates with scholarly discourse emphasizing the role of urbanization and economic growth in driving industrial upgrading (Shao et al., 2021; Tang et al., 2023; Zhao et al., 2022). Urbanization contributes to industrial upgrading by enhancing information infrastructure and facilitating technological innovation (Zhang P. et al., 2022; Wang M. et al., 2021). Similarly, economic development provides the necessary impetus for industrial growth and innovation (Wang L. et al., 2021; Wang F. et al., 2019).

While foreign direct investment (FDI) has a mildly negative impact on ISU, government intervention (INP) has a significant positive effect. This relationship underscores the importance of policy guidance and signaling mechanisms in promoting industrial restructuring (Gu et al., 2021; Cheng et al., 2022). Government interventions, such as regulatory frameworks and financial incentives, are crucial in encouraging firms to adopt sustainable practices (Madaleno et al., 2022; Wang L. et al., 2022). However, the negative impact of FDI suggests the need for further examination into the specific dynamics of foreign investment and its influence on INS within the YREB.

Interestingly, according to the regression analysis, environmental regulation (ER) has an insignificant impact on ISU. This finding contrasts with the prevailing view in the literature (Zhang et al., 2021; Stavropoulos et al., 2018), underscoring the importance of stringent environmental regulations in driving industrial transformation towards sustainability. Further research may be needed to explore the effectiveness of existing environmental policies and their implications for industrial upgrading.

In summary, the results provide valuable insights, like other related studies (Yuan et al., 2022b; Yuan et al., 2024), into the factors shaping INS in China, especially the YREB. The significant positive influence of GF, urbanization, economic development, and government intervention underscores the interconnectedness between financial mechanisms, urbanization trends, economic growth, and policy interventions in driving sustainable industrial transformation (He et al., 2023).

4.2 Heterogeneity analysis

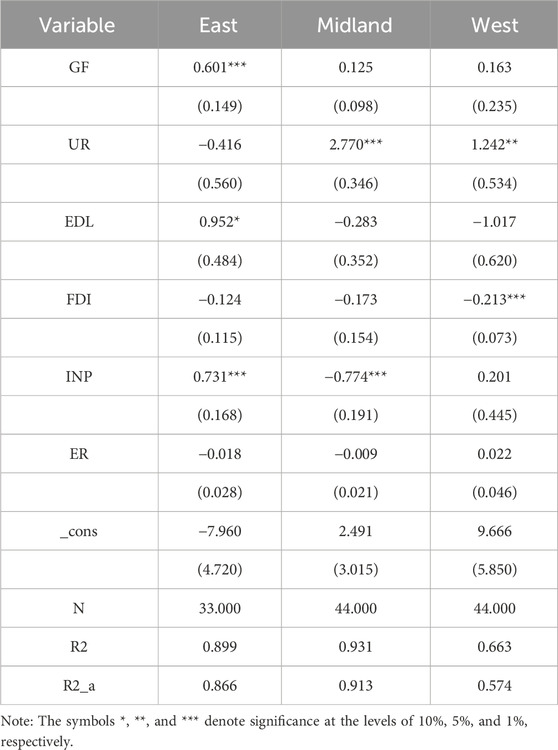

There are also regional variations in the influence of GF on INS across different provinces within the YREB due to EDL, UR, and INP. In this study, the YREB is further discussed by dividing it into Eastern, Central, and Western regions.

According to the results shown in Table 8, GF in the eastern part of the YREB catalyzes ISU model testing, while in the western and central parts of the country is insignificant. This indicates that GF has not been effectively utilized. The reason may be that the role of GF is more obvious in provinces with more advanced INS. In the East, the level of GF is high compared to the central and western parts of YREB. This might be because the East’s variety of GF products and rich financing instruments offer financial support for the green development of enterprises, which has significantly promoted the upgrading of INS. The eastern part of the YREB is one of the main regions carrying development factors, with a higher level of regional economic development, a better financial system, and stronger government credibility, which lays the foundation for the development of GF and, therefore, shows a significant positive impact. Conversely, there is a lower level of development and less attention to GF in the financial industry of the central and western parts of YREB. There is a big gap between the financial development foundation of the central and western regions and the eastern region, and GF as a capital factor may not be able to promote the rationalization of the industrial structure directly through the financial system. Also, there is the phenomenon of taking over the transmission of some high-polluting businesses from the eastern region. As such, the speed of transformation is relatively slow, and they are more influenced by environmental regulations. Therefore, the expansion of GF in the central and western areas plays a weaker role in upgrading the INS, while it has a more obvious effect in the eastern region.

5 Discussions

Against the background of prominent ecological and environmental problems, it is crucial to study the transformative effect of GF in the YREB. This study adopts the entropy method to measure the level of GF development in the provinces and cities of the YREB; it analyzes the impact of GF development on INS.

This study provides a new method to measure the level of GF. The results of the study show that the use of GF entropy method indicators is a more comprehensive measure of GF level relative to green credit, green bond and green loan indicators. The study finds that the level of GF development in eastern, central and western provinces shows a good upward trend, but there is a big difference in the increase rate; in general, it shows a good development trend.

As hypothesized, this study takes 11 provinces and cities in the YREB as the study area, and through the double fixed effects model, it is found that GF can influence the INS. This is consistent with the findings of Wang and Li (2022b). In the context of an environmental crisis, localities are confused about how to promote INS, and this study provides a solution to industrial advancedization by ensuring financial support through GF. The findings show that GF can accelerate INS. One possible explanatory reason is that financial support eases financing constraints, an explanation also supported by Zhang (2023).

This study finds that the impact of GF on INS varies by region. Wang and Wang (2021) found the same result. GF is significant in the eastern part of the Yangtze River. For this phenomenon, the eastern region has a relatively developed economy and a more INS, with a higher proportion of high technology content, high value-added, low-carbon and environmentally friendly industries, which provides a good industrial foundation for the implementation of GF. The financial market in the eastern region is more developed, with a large number and full range of financial institutions and more abundant and diverse GF products and services, which can better meet the financing needs of enterprises and projects. The central and western regions have a relatively weak economic foundation, a traditional industrial structure, and a high proportion of high-energy-consuming and high-polluting industries, which, to a certain extent, limits the effectiveness of the implementation of GF.

6 Conclusion and policy recommendations

6.1 Conclusion

The YREB occupies an important strategic position in China’s regional development, but it still suffers from outstanding ecological and environmental problems, and the industrial structure needs to be optimized and upgraded. The main part of this paper explores the impact of green finance on the INS of the YREB based on the panel data of 11 provinces (cities) in the YREB during the period of 2010–2020. The main conclusions are as follows: first, the overall level of green finance development and industrial structure optimization and upgrading in the YREB is on the low side, and there is an imbalance in inter-regional development, in which the performance of the eastern region is obviously better than that of the central and western regions, and there is not much difference between the central and western regions; second, China’s GF has a significant positive contribution to the optimization and upgrading of INS in the YREB; and third, there is regional heterogeneity in GF’s contribution to the optimization and upgrading of INS in the YREB.

6.2 Policy recommendations

Based on the above model regression results and the conclusions drawn, this paper puts forward the following suggestions to promote the high-quality development of GF and the upgrading of industrial structure.

First, in view of the differences in GF and INS between the East, central and west of the YREB, their comparative advantages should be given full play to innovate the mechanism of regional coordinated development, promote the free flow of factors across the region and improve the efficiency of resource allocation, so that it can play a more important role of demonstration leading and strategic support in the economic and social development of the whole country.

Second, promote the innovation of green financial tools to realize sustainable development. Most of the existing green financial products in China have the disadvantage of being small in scale, making it difficult to support the amount of capital required for green projects. It is also difficult to match the duration of green credit for some projects with long cycles. For this reason, it is important to promote the innovation of green credit guarantee and collateralization methods and increase the proportion of green credit in the total amount of loans to promote the transformation of the regional INS and the sustainable development of the economy.

Third, supporting the central and western regions of the YREB should be focused on. The central and western regions of the YREB have a weak economic foundation compared with the eastern region, a limited level of green financial development, and a relatively backward INS. However, with rich production resources and a huge potential market, it should actively utilize its geographical location and national support policies to further accelerate the transformation and upgrading of traditional polluting industries.

6.3 Limitations

Overall, this paper achieves the expected research objectives and analyzes the impact of GF on INS, but there are still the following shortcomings: First, due to data availability, this paper only chooses the data of 11 provinces and cities in the period of 2010–2020, so it fails to conduct a more detailed analysis. As the development of green investment, green insurance, and green securities in China is still incomplete, it may not be perfect for measuring the level of GF in the 11 provinces of the YREB. Future iterations of this study will delve into the following aspects: (1) Expand the breadth of the sample time and study data from more time years to examine the impact of GF on INS. (2) To make GF indicators more authoritative through more literature reading and analysis. (3) Explore the influence process and role mechanism of GF and INS.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

MY: Formal Analysis, Investigation, Methodology, Writing–original draft. ZS: Formal Analysis, Investigation, Methodology, Writing–original draft, Data curation, Software. DT: Conceptualization, Data curation, Formal Analysis, Project administration, Resources, Supervision, Validation, Writing–review and editing. JZ: Formal Analysis, Investigation, Supervision, Validation, Visualization, Writing–review and editing. JL: Data curation, Formal Analysis, Methodology, Resources, Software, Validation, Visualization, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bao, H., Liu, X., Xu, X., Shan, L., Ma, Y., Qu, X., et al. (2023). Spatial-temporal evolution and convergence analysis of agricultural green total factor productivity—evidence from the Yangtze River Delta Region of China. Plos one 18 (3), e0271642. doi:10.1371/journal.pone.0271642

Batrancea, I., Batrancea, L., Maran Rathnaswamy, M., Tulai, H., Fatacean, G., and Rus, M.-I. (2020). Greening the financial system in USA, Canada and Brazil: a panel data analysis. Mathematics 8, 2217. doi:10.3390/math8122217

Chen, J., Jaffar, A., Hina, N., Liu, J., and Abbas, J. (2023). Green technological innovation, green finance, and financial development and their role in green total factor productivity: empirical insights from China. J. Clean. Prod. 382, 135131. doi:10.1016/j.jclepro.2022.135131

Cheng, Q., Lai, X., Liu, Y., Yang, Z., and Liu, J. (2022). The influence of green credit on China’s industrial structure upgrade: evidence from industrial sector panel data exploration. Environ. Sci. Pollut. Res. 29, 22439–22453. doi:10.1007/s11356-021-17399-1

Cui, H., Wang, R., and Wang, H. (2020). An evolutionary analysis of green finance sustainability based on multi-agent game. J. Clean. Prod. 269, 121799. doi:10.1016/j.jclepro.2020.121799

Dong, B., Xu, Y., and Fan, X. (2020). How to achieve a win-win situation between economic growth and carbon emission reduction: empirical evidence from the perspective of industrial structure upgrading. Environ. Sci. Pollut. Res. 27, 43829–43844. doi:10.1007/s11356-020-09883-x

Du, K., Cheng, Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: the road to the green transformation of Chinese cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Fang, Y., and Shao, Z. (2022). Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int. J. Environ. Res. Public Health. 19, 3646. doi:10.3390/ijerph19063646

Gao, L., Tian, Q., and Meng, F. (2023). The impact of green finance on industrial reasonability in China: empirical research based on the spatial panel Durbin model. Environ. Sci. Pollut. Res. 30, 61394–61410. doi:10.1007/s11356-022-18732-y

Ge, H., Li, B., Tang, D., Xu, H., and Boamah, V. (2022). Research on digital inclusive finance promoting the integration of rural three-industry. Int. J. Environ. Res. Public Health. 19, 3363. doi:10.3390/ijerph19063363

Gilchrist, D., Yu, J., and Zhong, R. (2021). The limits of green finance: a survey of literature in the context of green bonds and green loans. Sustainability 13, 478. doi:10.3390/su13020478

Gu, B., Chen, F., and Zhang, K. (2021). The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Environ. Sci. Pollut. Res. 28, 47474–47491. doi:10.1007/s11356-021-13944-0

Guan, S., Liu, J., Liu, Y., and Du, M. (2022). The nonlinear influence of environmental regulation on the transformation and upgrading of industrial structure. Int. J. Environ. Res. Public Health. 19, 8378. doi:10.3390/ijerph19148378

Hang, Y., Wang, Q., Zhou, D., and Zhang, L. (2019). Factors influencing the progress in decoupling economic growth from carbon dioxide emissions in China’s manufacturing industry. Resour. Conservation Recycl. 146, 77–88. doi:10.1016/j.resconrec.2019.03.034

He, W., Zhang, K., Kong, Y., Yuan, L., Peng, Q., Degefu, D. M., et al. (2023). Reduction pathways identification of agricultural water pollution in Hubei Province, China. Ecol. Indic. 153, 110464. doi:10.1016/j.ecolind.2023.110464

He, Y., and Zheng, H. (2023). How does environmental regulation affect industrial structure upgrading? Evidence from prefecture-level cities in China. J. Environ. Manag. 331, 117267. doi:10.1016/j.jenvman.2023.117267

Hu, J., Wu, J., Zhao, C., and Wang, P. (2021). Challenges for China to achieve carbon neutrality and carbon peak goals: Beijing case study. PLoS One 16 (11), e0258691. doi:10.1371/journal.pone.0258691

Hu, Y., Jiang, H., and Zhong, Z. (2020). Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ. Sci. Pollut. Res. 27, 10506–10519. doi:10.1007/s11356-020-07717-4

Iqbal, N., Khan, A., Gill, A. S., and Abbas, Q. (2020). Nexus between sustainable entrepreneurship and environmental pollution: evidence from developing economy. Environ. Sci. Pollut. Res. 27, 36242–36253. doi:10.1007/s11356-020-09642-y

Irfan, M., Razzaq, A., Sharif, A., and Yang, X. (2022). Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol. Forecast. Soc. Change 182, 121882. doi:10.1016/j.techfore.2022.121882

Jeffrey, D. (2015). Sachs. The age of sustainable development. Columbia Univ. Press 98 (2), 667–669. doi:10.1093/ajae/aaw002

Jin, Y., Gao, X., and Wang, M. (2021). The financing efficiency of listed energy conservation and environmental protection firms: evidence and implications for green finance in China. Energy Policy 153, 112254. doi:10.1016/j.enpol.2021.112254

Li, C., and Umair, M. (2023). Does green finance development goals affects renewable energy in China. Renew. Energy. 203, 898–905. doi:10.1016/j.renene.2022.12.066

Li, G., Wang, L., Li, Z., and Guo, Z. (2023). Has pilot zones policy for green finance reform and innovations improved the level of green financial development and environmental quality? Environ. Sci. Pollut. Res. 30, 68667–68676. doi:10.1007/s11356-023-27243-3

Li, W., Cui, G., and Zheng, M. (2022). Does green credit policy affect corporate debt financing? Evidence from China. Environ. Sci. Pollut. Res. 29, 5162–5171. doi:10.1007/s11356-021-16051-2

Liddle, B., and Messinis, G. (2018). Revisiting carbon Kuznets curves with endogenous breaks modeling: evidence of decoupling and saturation (but few inverted-Us) for individual OECD countries. Empir. Econ. 54 (2), 783–798. doi:10.1007/s00181-016-1209-y

Liu, J., Hu, X., and Wu, J. (2017). Fiscal decentralization, financial efficiency and upgrading the industrial structure: an empirical analysis of a spatial heterogeneity model. J. Appl. Statistics 44 (1), 181–196. doi:10.1080/02664763.2016.1252733

Liu, Z., Tao, Y., and Tian, G. (2019). Change of China's “green” financial policy and its allocation efficiency-an empirical study based on the listed companies of China’s eco-industry. Ekoloji 28 (107), 3701–3714.

Liu, Z., Zhang, X., Wang, J., Shen, L., and Tang, E. (2023). Evaluation of coupling coordination development between digital economy and green finance: evidence from 30 provinces in China. Plos one 18 (10), e0291936. doi:10.1371/journal.pone.0291936

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Mo, Y., Sun, D., and Zhang, Y. (2023). Green finance assists agricultural sustainable development: evidence from China. Sustainability 15, 2056. doi:10.3390/su15032056

Nassani, A. A., Aldakhil, A. M., Abro, M. M. Q., and Zaman, K. (2017). Environmental Kuznets curve among BRICS countries: spot lightening finance, transport, energy and growth factors. J. Clean. Prod. 154, 474–487. doi:10.1016/j.jclepro.2017.04.025

Nian, W., and Dong, X. (2023). Corrigendum: spatial correlation study on the impact of green financial development on industrial structure upgrading. Front. Environ. Sci. 11, 1211606. doi:10.3389/fenvs.2023.1211606

Nie, L., Chen, P., Liu, X., Shi, Q., and Zhang, J. (2022). Coupling and coordinative development of green finance and industrial-structure optimization in China: spatial-temporal difference and driving factors. Int. J. Environ. Res. Public Health. 19, 10984. doi:10.3390/ijerph191710984

Peng, B., Yan, W., Elahi, E., and Wan, A. (2022). Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ. Sci. Pollut. Res. 29, 755–767. doi:10.1007/s11356-021-15587-7

Peng, G., Wang, T., Ruan, L., Yang, X., and Tian, K. (2023). Measurement and spatial–temporal analysis of coupling coordination development between green finance and environmental governance in China. Environ. Sci. Pollut. Res. 30, 33849–33861. doi:10.1007/s11356-022-24657-3

Shao, C., Wei, J., and Liu, C. (2021). Empirical analysis of the influence of green credit on the industrial structure: a case study of China. Sustainability 13 (11), 5997. doi:10.3390/su13115997

Song, M., Peng, L., Shang, Y., and Zhao, X. (2022). Green technology progress and total factor productivity of resource-based enterprises: a perspective of technical compensation of environmental regulation. Technol. Forecast. Soc. Change 174, 121276. doi:10.1016/j.techfore.2021.121276

Song, M., Wang, S., and Fisher, R. (2014). Transportation, iceberg costs and the adjustment of industrial structure in China. Transp. Res. Part D-transport Environ. 32, 278–286. doi:10.1016/j.trd.2014.08.005

Stavropoulos, S., Wall, R., and Xu, Y. (2018). Environmental regulations and industrial competitiveness: evidence from China. Appl. Econ. 50 (12), 1378–1394. doi:10.1080/00036846.2017.1363858

Tang, D., Zhao, Z., Shen, W., Zhang, J., Kong, Y., and Boamah, V. (2023). Research on the impact of digital finance on the industrial structure upgrading of the Yangtze River Economic belt from the perspective of R&D innovation. Sustainability 15, 425. doi:10.3390/su15010425

Tolliver, C., Keeley, A. R., and Managi, S. (2019). Green bonds for the Paris agreement and sustainable development goals. Environ. Res. Lett. 14 (6), 064009. doi:10.1088/1748-9326/ab1118

Wang, E., Liu, X., Wu, J., and Cai, D. (2019a). Green credit, debt maturity, and corporate investment—evidence from China. Sustainability 11, 583. doi:10.3390/su11030583

Wang, F., Yang, S., Reisner, A., and Liu, N. (2019b). Does green credit policy work in China? The correlation between green credit and corporate environmental information disclosure quality. Sustainability 11, 733. doi:10.3390/su11030733

Wang, J., Cheng, Y., and Wang, C. (2022a). Environmental regulation, scientific and technological innovation, and industrial structure upgrading in the yellow river basin, China. Int. J. Environ. Res. Public Health. 19, 16597. doi:10.3390/ijerph192416597

Wang, L., Su, M., Kong, H., and Ma, Y. (2021a). The impact of marine technological innovation on the upgrade of China's marine industrial structure. Ocean and Coast. Manag. 211, 105792. doi:10.1016/j.ocecoaman.2021.105792

Wang, L., Wang, Z., and Ma, Y. (2022b). Heterogeneous environmental regulation and industrial structure upgrading: evidence from China. Environ. Sci. Pollut. Res. 29, 13369–13385. doi:10.1007/s11356-021-16591-7

Wang, M., Li, Y., Li, J., and Wang, Z. (2021b). Green process innovation, green product innovation and its economic performance improvement paths: a survey and structural model. J. Environ. Manag. 297, 113282. doi:10.1016/j.jenvman.2021.113282

Wang, W., and Li, Y. (2022a). Can green finance promote the optimization and upgrading of industrial structures? based on the intermediary perspective of technological progress. Front. Environ. Sci. 10, 919950. doi:10.3389/fenvs.2022.919950

Wang, W., and Li, Y. (2022b). Can green finance promote the optimization and upgrading of industrial structures? based on the intermediary perspective of technological progress. Front. Environ. Sci. 10, 919950. doi:10.3389/fenvs.2022.919950

Wang, X., Song, J., and Duan, H. (2021c). Coupling between energy efficiency and industrial structure: an urban agglomeration case. Energy 234, 121304. doi:10.1016/j.energy.2021.121304

Wang, X., and Wang, Q. (2021). Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy. 74, 102436. doi:10.1016/j.resourpol.2021.102436

Wang, Y., Zhao, N., Lei, X., and Long, R. (2021d). Green finance innovation and regional green development. Sustainability 13, 8230. doi:10.3390/su13158230

Xiang, W., Lan, Y., Qi, Q., and Gan, L. (2023). The impact mechanism of China’s green finance on the transformation and innovation of high-energy-consumption enterprises. Plos one 18 (10), e0293022. doi:10.1371/journal.pone.0293022

Xie, H., Ouyang, Z., and Choi, Y. (2020). Characteristics and influencing factors of green finance development in the Yangtze River delta of China: analysis based on the spatial durbin model. Sustainability 12, 9753. doi:10.3390/su12229753

Xiong, X., Wang, Y., Liu, B., He, W., and Yu, X. (2023). The impact of green finance on the optimization of industrial structure: evidence from China. PLoS One 18 (8), e0289844. doi:10.1371/journal.pone.0289844

Xu, Y., Li, S., Zhou, X., Shahzad, U., and Zhao, X. (2022). How environmental regulations affect the development of green finance: recent evidence from polluting firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020

Yao, F., Xue, L., and Liang, J. (2022). Spatial and temporal evolution of urban economic development efficiency in China’s Yangtze River economic belt from the perspective of sustainable development. Plos one 17 (9), e0273559. doi:10.1371/journal.pone.0273559

Yuan, L., Li, R., He, W., Wu, X., Kong, Y., Degefu, D. M., et al. (2022a). Coordination of the industrial-ecological economy in the yangtze river economic belt, China. Front. Environ. Sci. 10, 882221. doi:10.3389/fenvs.2022.882221

Yuan, L., Li, R., He, W., Wu, X., Kong, Y., Degefu, D. M., et al. (2022b). Coordination of the industrial-ecological economy in the Yangtze River Economic belt, China. Front. Environ. Sci. 10, 882221. doi:10.3389/fenvs.2022.882221

Yuan, L., Li, R., Wu, X., He, W., Kong, Y., Ramsey, T. S., et al. (2023). Decoupling of economic growth and resources-environmental pressure in the Yangtze River Economic belt, China. Ecol. Indic. 153, 110399. doi:10.1016/j.ecolind.2023.110399

Yuan, L., Qi, Y., He, W., Wu, X., Kong, Y., Ramsey, T. S., et al. (2024). A differential game of water pollution management in the trans-jurisdictional river basin. J. Clean. Prod. 438, 140823. doi:10.1016/j.jclepro.2024.140823

Zhang, B., and Wang, Y. (2021). The effect of green finance on energy sustainable development: a case study in China. Emerg. Mark. Finance Trade 57 (12), 3435–3454. doi:10.1080/1540496X.2019.1695595

Zhang, G. (2023). The heterogeneous role of green finance on industrial structure upgrading-Based on spatial spillover perspective. Finance Res. Lett. 58, 104596. doi:10.1016/j.frl.2023.104596

Zhang, H., Shen, L., Zhong, S., and Elshkaki, A. (2020b). Coal resource and industrial structure nexus in energy-rich area: the case of the contiguous area of Shanxi and Shaanxi Provinces, and Inner Mongolia Autonomous Region of China. Resour. Policy 66, 101646. doi:10.1016/j.resourpol.2020.101646

Zhang, H., Zhang, Z., Dong, J., Gao, F., Zhang, W., and Gong, W. (2020a). Spatial production or sustainable development? An empirical research on the urbanization of less-developed regions based on the case of Hexi Corridor in China. Plos one 15 (7), e0235351. doi:10.1371/journal.pone.0235351

Zhang, K., Wang, Y., and Huang, Z. (2021). Do the green credit guidelines affect renewable energy investment? Empirical research from China. Sustainability 13, 9331. doi:10.3390/su13169331

Zhang, P., Wang, J., Li, M., Xiao, F., et al. (2022b). Research on the mechanism of information infrastructure affecting industrial structure upgrading. Sci. Rep. 12, 19962. doi:10.1038/s41598-022-24507-9

Zhang, Y., Chen, H., and He, Z. (2022a). Environmental regulation, R&D investment, and green technology innovation in China: based on the PVAR model. Plos one 17 (10), e0275498. doi:10.1371/journal.pone.0275498

Zhao, S., He, X., and Faxritdinovna, K. U. (2023). Does industrial structure changes matter in renewable energy development? Mediating role of green finance development. Renew. Energy. 214, 350–358. doi:10.1016/j.renene.2023.05.088

Zhao, Y., He, F., and Feng, Y. (2022). Research on the industrial structure upgrading effect of the employment mobility of graduates from China’s “double first-class” colleges and universities. Sustainability 14, 2353. doi:10.3390/su14042353

Zhu, B., Zhang, M., Zhou, Y., Wang, P., Sheng, J., He, K., et al. (2019). Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: a novel integrated approach. Energy Policy 134, 110946. doi:10.1016/j.enpol.2019.110946

Zhu, X. (2022a). Does green credit promote industrial upgrading? analysis of mediating effects based on technological innovation. Environ. Sci. Pollut. Res. 29, 41577–41589. doi:10.1007/s11356-021-17248-1

Keywords: entropy value method, yangtze river economic belt, industrial structure upgrading, green finance, synergistic relationship

Citation: Yuan M, Shi Z, Tang D, Zhu J and Li J (2024) Synergistic relationship between green finance and industrial structure upgrade in the yangtze river economic belt. Front. Environ. Sci. 12:1475497. doi: 10.3389/fenvs.2024.1475497

Received: 04 August 2024; Accepted: 02 September 2024;

Published: 12 September 2024.

Edited by:

Lin Zhang, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Latifa AlFadhel, Bahrain Polytechnic, BahrainRania Pasha, British University in Egypt, Egypt

Yuanyuan Hao, Jiangsu University of Technology, China

Copyright © 2024 Yuan, Shi, Tang, Zhu and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jie Zhu, emh1amllQGpzb3UuZWR1LmNu

Minglan Yuan1

Minglan Yuan1 Decai Tang

Decai Tang