- 1Faculty of Business Administration, Guangzhou Institute of Science and Technology, Guangzhou, China

- 2Faculty of Business Administration, Guangzhou College of Technology and Business, Guangzhou, China

- 3National Digital Education Academy, Guangdong University of Finance and Economics, Guangzhou, China

The rapid expansion of the global economy has exacerbated environmental concerns, thereby prompting a shift in resource allocation from polluting industries to green sectors. This transition is pivotal for sustainable development, with capital playing a central role in mobilizing resources to foster green innovation. This study examines data from Chinese-listed companies between 2012 and 2022 to evaluate the impact of green investment on corporate green innovation. The analysis incorporates a comprehensive review of financial records and innovation metrics to establish a correlation between investment and innovation outcomes. The findings reveal a positive correlation between increased green investment and enhanced green innovation, with a more pronounced effect observed in private enterprises and industries characterized by high competition. Green investment primarily stimulates innovation by alleviating financial constraints. These results emphasize the crucial role of green investment in promoting sustainable corporate practices. Furthermore, they provide valuable insights for policymakers in formulating effective green investment strategies, which are essential for China’s transition toward a green economy.

1 Introduction

Due to the traditional economic development model’s neglect of environmental issues, rapid global economic growth has continuously exacerbated ecological degradation. Consequently, environmental problems have increasingly become unavoidable and critical aspects of economic development. According to the 2017 World Economic Outlook published by the IMF, for every degree increase in global temperature above the average of 22°C, the annual per capita GDP growth rate in developing countries decreases by 0.9–1.2 percentage points. Thus, environmental issues have emerged as significant obstacles to economic development. The production and business activities of enterprises are key contributors to the current environmental situation. While pursuing profits, enterprises must consider the environmental impact of their operations. It is essential to ensure that ecological protection is properly maintained while achieving profit growth, thereby striking a balance between business growth and environmental protection. Green innovation, positioned at the intersection of “innovation-driven” and “green development,” has become an effective means to overcome resource and environmental constraints and promote sustainable development. The “Implementation Plan for Further Improving the Market-Oriented Green Technology Innovation System (2023–2025)” issued by the National Development and Reform Commission and the Ministry of Science and Technology clearly proposes strengthening the main entities of enterprise green technology innovation. This plan aims to cultivate a group of leading green technology companies, green low-carbon technology companies, and national-level specialized and sophisticated “little giant” companies in the field of green technology innovation. Therefore, implementing green innovation activities and improving green innovation performance are not only crucial pathways for enterprises to promote their transformation and upgrading but also an inevitable choice for achieving sustainable development.

Green investment plays a pivotal role in economic transformation, with nations globally striving to establish comprehensive green investment systems to facilitate this transition. From a global perspective, developed countries in Europe and North America began initiating projects for the green transformation of physical industries through green investment as early as the 1970s. In 1992, the United Nations Environment Programme (UNEP) released the “Statement by Banks on the Environment and Sustainable Development.” Building on this, in 2003, leading global banks such as Barclays, Citigroup, and ABN AMRO introduced the “Equator Principles,” which have since become international standards for assessing environmental and social risks. In 2007, the European Investment Bank issued the first green bond for the 27 EU member states, followed by the continual introduction of green financial products, which rapidly propelled the international development of green investment. Consequently, developed countries have established a sophisticated green investment system that encompasses physical projects, behavioral standards, and financial products such as green bonds, green funds, and green insurance. From a domestic perspective, China has also begun to prioritize the construction of a green investment system. In September 2015, the Central Committee of the Communist Party of China and the State Council issued the “Integrated Reform Plan for Promoting Ecological Progress,” which for the first time explicitly proposed that China should establish a green investment system, including the development of green credit, green bonds, and green development funds. Since 2016, China has co-chaired the G20 Green Finance Study Group (GFSG) with international partners, co-founded the Network for Greening the Financial System (NGFS), jointly launched the Green Investment Principles (GIP), initiated the Global Green Finance Leadership Program (GFLP), actively participated in the establishment of the International Platform on Sustainable Finance (IPSF), and promoted various bilateral cooperation mechanisms with the United Kingdom, France, and the EU. China is emerging as a major participant and promoter of green investment.

To fully leverage the role of green investment in promoting corporate green innovation, it is crucial to enhance the transmission mechanism and functionality of green investment incentives. The government has established a series of incentives and regulatory mechanisms to reallocate resources such as capital, technology, and human resources from polluting industries to clean and green industries. In this resource redistribution process, other resources follow the capital into green industries, thereby establishing a relatively comprehensive green investment transmission mechanism. However, China still lacks a complete green investment framework to strengthen the functionality of green investment. According to the Financial Research Institute of the Development Research Center of the State Council, the demand for green investment in China is increasing annually, with financing needs for green industries exceeding 2 trillion yuan. To address this, various provinces, cities, and regions in China have increased green investment through fiscal policies, tax subsidies, and loan issuance. The People’s Bank of China, in its “Guiding Opinions on Building a Green Financial System,” also emphasized the need to fully utilize the securities market to guide social capital in supporting green investment. Given the tightening resource constraints and increasing demand for green development, it is imperative to enhance resource efficiency and scale up green investments to foster high-quality economic growth (Han and Qingxin, 2023). According to sustainable development theory, directing capital flows to green enterprises via market mechanisms is the most dynamic, broadly accepted, and promising form of incentive (Hou et al., 2024). However, current research on green investment is still fragmented and lacks systematic exploration, highlighting the urgent need to investigate how green investment influences corporate green innovation. This study, therefore, leverages data from Chinese listed companies between 2012 and 2022 to empirically analyze the mechanisms through which green investment impacts green innovation, aiming to address gaps in the existing literature.

2 Theoretical foundation and research hypotheses

2.1 The theoretical origins of innovation research

In existing economic growth theories, technology has always been a contentious key factor of production. Early classical economists like Adam Smith and David Ricardo viewed technology as exogenously given. Subsequently, the rise of neoclassical growth theory, represented by Marshall, introduced innovation research as a distinct theoretical category. This can be traced back to Joseph Schumpeter’s seminal work in 1912, “The Theory of Economic Development” (Schumpeter, 1990), where he pioneered the theory of technological innovation. Schumpeter posited that innovation entails creating novel combinations of production factors and conditions, thereby introducing new value into production systems. This theory begins with the potential maximization of profits and defines the innovation process as the recombination of production factors and conditions. Specifically, innovation encompasses five distinct forms: first, the introduction of new products; second, the adoption of new production processes; third, the development of new markets; fourth, the discovery of new sources of raw materials; fifth, the establishment of new forms of organizational enterprise.

Schumpeter’s theoretical research, meanwhile, delved into the relationship between innovation and economic growth, asserting that innovation constitutes the primary source of a nation’s economic advancement and development. Specifically, innovation functions as an endogenous factor influencing enterprise production activities, originating within and shaping the processes of business production to generate greater value. However, due to fluctuations in innovation across diverse economic sectors, varying initiation times, and differing durations, its impact varies significantly across economic domains. Moreover, Schumpeter’s theory proposes that the waves of innovation occurring at different times contribute to the formation of economic cycles (prosperity, recession, depression, recovery) in capitalist economies, offering a fresh theoretical perspective on innovation.

Schumpeter’s innovation theory, by highlighting for the first time the creative impact of innovation on a nation’s economic cycles, macroeconomic growth, and enterprise development, drew significant attention to the importance of innovation in the production process within the global academic community. Following Schumpeter’s assertion of innovation’s pivotal role in economic growth and enterprise development, traditional macro and microeconomic theories no longer treat technological innovation as a fixed production factor but rather as a variable one. This paradigm shift explores its critical role in a nation’s economic development and enterprise production, leading to the emergence of two major research avenues: technological innovation theory, focusing on technological advancements, and institutional innovation theory.

2.2 The development trajectory of green innovation theory

Green innovation theory, as a significant branch of innovation theory, has undergone considerable development over the past half-century. Specifically, Western economic theories have indicated that a nation’s economic growth may occur at the expense of environmental degradation. Balancing economic development with green environmental performance has thus become a critical aspect and theoretical focus in understanding how to foster long-term economic growth. Consequently, research in green innovation theory, aimed at achieving both economic and environmental benefits concurrently, has gained increasing attention, although related theoretical studies are still in their nascent stages.

Synthesizing theoretical research from scholars both domestically and internationally, several analogous theoretical concepts concerning green innovation have emerged since the mid-to-late 1990s. Fussler and James (1996), focusing on ecological innovation, defined green innovation as the introduction of new products and processes that not only enhance commercial value but also significantly diminish negative environmental impacts. Expanding on this framework, other similar concepts of green innovation have surfaced. Church et al. (2008) introduced sustainable innovation, describing it as technological changes that benefit the survival and wellbeing of humanity as a whole. Oltra and Saint Jean (2009) utilized environmental innovation to describe akin green innovation concepts, specifically addressing new or enhanced processes, practices, systems, and products that contribute positively to the environment. In essence, these concepts underscore the importance of innovation in substantially reducing environmental impacts or benefiting the environment to ensure the survival and wellbeing of all. While their descriptions vary slightly in precision, they can largely be used interchangeably to explore the common themes of green innovation (Tietze et al., 2014).

At the same time, existing theoretical literature has extensively examined the primary categories of green innovation. Initially, Porter and van der Linde (2000) define green innovation in terms of product innovation and process innovation. The former emphasizes the creation of new green products, while the latter involves adjustments to existing products. Building on this, Chen et al. (2006) introduced the theoretical concept of green management innovation, integrating green practices and goals into corporate strategies. Tseng et al. (2013) further developed the theory with green technological innovation, encompassing new green equipment and enhanced green production technologies. Overall, a mature and universally recognized theoretical framework for green innovation has yet to be fully established. Continuous theoretical research is necessary to address specific issues, enrich existing theories of green innovation, and refine its foundational theories.

2.3 The theoretical distinctions and connections between green innovation and general innovation

Current theories exploring green innovation are still in their infancy and have yet to establish a comprehensive theoretical framework. However, some theoretical studies have examined the theoretical distinctions and inherent connections between green innovation and general innovation. Specific areas of theoretical research focus on the following aspects:

Firstly, the fundamental difference between green innovation and general innovation lies in their emphasis on environmental friendliness. Green innovation emphasizes reducing the adverse environmental impacts of corporate economic activities (Church et al., 2008). The environmentally friendly characteristics of green innovation are manifested in two main ways. On one hand, green innovation underscores businesses’ intrinsic motivation to enhance the environment. This emphasis on environmental goals does not contradict the pursuit of profit maximization, provided that businesses integrate principles of sustainable development into their production and operations. On the other hand, green innovation requires that the direction and content of innovation be closely tied to environmental issues; innovation in environmentally related business practices constitutes its core focus.

Secondly, green innovation exhibits dual externality characteristics (Rennings, 2000), meaning it can have positive external spillover effects in both the research and development (R&D) and diffusion stages (Yan, 2013). On one hand, during the R&D stage, green innovation, like general innovation, has externalities because it can crowd out other investments by the enterprise, creating the first externality. However, unlike general innovation, green innovation generates environmental benefits, thereby producing positive externalities for social development, which is the second externality (Yan and Zou, 2005).

Thirdly, green innovation places greater emphasis on the pull effect of environmental regulation (Yang and Shao, 2011). Unlike general innovation, the economic benefits generated by corporate green innovation often fall short of the R&D costs, significantly reducing the incentive for enterprises to engage in green innovation. Therefore, the driving force formed by external government environmental regulation policies is crucial in influencing corporate R&D investment.

Fourthly, compared to general innovation, green innovation requires longer R&D cycles and higher R&D costs. As a special type of corporate innovation activity, green innovation aims to improve energy efficiency and reduce negative environmental impacts through innovation (Horbach, 2008). Consequently, compared to general innovation, green innovation is characterized by longer R&D cycles, higher technical requirements, and a greater likelihood of failure.

Overall, current theoretical distinctions between green innovation and general innovation have not yet formed a comprehensive theoretical framework. Existing literature has primarily focused on their differences, and further theoretical supplementation is needed to eventually develop a theoretical system that includes green innovation.

2.4 Theoretical development of green investment and its relationship with green innovation

The theoretical development of green investment is a gradual process that is closely intertwined with the concept of sustainable development. In the 1970s, as environmental challenges became increasingly severe, developed countries began to promote the green transformation of industry through various green investment projects. During this period, the theoretical foundations of green investment were primarily rooted in environmental economics and ecological economics, highlighting the significance of investment in enhancing environmental quality (Rennings, 2000). Entering the 21st century, with growing global concern regarding climate change, the theory of green investment further evolved to encompass a broader array of areas, including green finance, corporate social responsibility, and sustainable development strategies. The “Equator Principles,” introduced by the United Nations Environment Programme in 2003, established an international standard for green investment and facilitated its global development. In China, the theoretical advancement of green investment is closely linked to national environmental policies and development strategies. The 2015 release of the “Overall Plan for Ecological Civilization System Reform” explicitly proposed the establishment of a green investment system, marking a pivotal moment in the formalization of green investment theory in China. Subsequently, innovative practices in green finance—such as green credit, green bonds, and green funds—have provided a rich empirical foundation for the theory of green investment (Shen et al., 2023).

Innovation theory posits that multiple factors drive innovation, with investment being one of them. In an innovation-driven economic development context, enterprise investors tend to increase their funding to foster innovation, and when this funding aligns with green innovation, it is termed green investment. However, the extent to which investment can lead to innovation is contingent upon the investors’ willingness and the investment’s effectiveness. Green investment primarily encompasses investments in environmental pollution control, water conservation, and forestry. These investments are substantial and, in the short term, not only fail to yield immediate returns but also crowd out other operational investments. Nevertheless, if enterprise decision-makers possess a strong sense of environmental responsibility and adhere to social responsibility principles, they are more inclined to actively pursue pollution control measures, especially when supported by government subsidies.

Green investment exhibits a certain time lag; in the short term, the effects of such investment do not immediately manifest, potentially diverting funds from enterprise R&D and hindering innovation. However, in the long term, green investment gradually influences the transformation of enterprise production and operational methods. Enterprises invest in energy-saving and emission-reduction equipment, adopt green production processes, and enhance environmental awareness, progressively integrating green practices as fundamental principles. This process fosters the accumulation of green technology, environmental consciousness, and capital, ultimately culminating in a new wave of innovation—green innovation. Green innovation accelerates the economy’s green transition, improves resource recycling and comprehensive utilization efficiency, and ensures that green investments achieve their intended impact.

After enterprises engage in green investment, they continuously introduce and adopt green technologies to save energy, reduce emissions, and protect the environment. This emphasis on improving environmentally-friendly production processes and methods promotes the development of green innovation within enterprises. Currently, there is a scarcity of literature on the relationship between green investment and green innovation. Some scholars argue that green investment impacts corporate green innovation through two primary mechanisms: (1) Enhancing environmental performance. Green investment is often associated with the adoption of environmentally friendly technologies and practices, which directly improve a company’s environmental performance. This improvement not only enables firms to comply with regulatory requirements but also strengthens their competitiveness in the market (Tan et al., 2024). (2) Strengthening corporate image and competitiveness. Green investment contributes to an enhanced corporate image, earning higher evaluations from consumers and investors. This improved image can translate into increased market competitiveness, creating broader market opportunities for the firm’s green innovation activities (Gao et al., 2024a). This paper, grounded in innovation theory, posits that green investment is a driving force for green innovation, thereby promoting it. Based on this premise, we propose the following hypothesis:

H1. In the long term, green investment has a positive impact on enterprise green innovation.

2.5 The theoretical mechanism of the impact of green investment on enterprise green innovation

2.5.1 Financing constraint mechanism

Green investment can facilitate enterprise green innovation by easing financing constraints. Specifically, its impact operates across three dimensions: macro, meso, and micro. From a macro perspective, the stakeholders involved in green investment encompass not only enterprises and the public but also governments, international organizations, etc., acting as “gateways or public magnets” (Wei and Shu, 2018). They provide policy support for enterprise financing through policy frameworks, institutional environments, and market institution development. From a meso perspective, the selection of targets for green investment adheres to stringent environmental and technological standards. This not only regulates enterprise operations but also fosters industrial upgrades (Fu and Yuan, 2018), thereby contributing to industry standardization and mitigating information asymmetry in financing. From a micro perspective, the outcomes of green investment influence demand for enterprise stocks, potentially boosting stock prices (Wei and Shu, 2018). This not only encourages enterprises to engage in financing but also provides direct financial support to mitigate financing costs. Based on these observations, we propose the following hypothesis:

H2. Green investment impacts enterprise financing constraints and influences green innovation.

2.5.2 Short-sighted management mechanism

Enterprises often face long cycles and delayed outcomes in their green innovation endeavors. According to principal-agent theory, during extended research and development processes, management invests substantial time and effort while navigating inherent risks. This situation can tempt some executives to prioritize short-term gains, thereby obstructing the implementation of enterprise green innovation strategies. Incentive mechanisms for management aim to reduce agency costs between shareholders and management, aligning management interests with shareholder objectives. This alignment encourages management to engage patiently in innovative practices that contribute to the enterprise’s long-term development (Jia et al., 2017). Management’s short-sighted behavior is closely linked to the company’s investment decisions. Green investment provides long-term funding support, which can alleviate this short-sightedness and thus promote green innovation (Fussler and James, 1996). Several scholars have examined the impact of management equity stakes and corporate R&D expenditures on green innovation. Their research findings indicate that a higher proportion of management ownership is associated with increased R&D spending and higher levels of green innovation. This suggests that green investment plays a significant role in mitigating management’s short-sighted behavior (Balsmeier and Hickfang, 2017). Based on this analysis, we propose the following hypothesis:

H3. Green investment influences the short-term focus of enterprise management and impacts green innovation.

3 Empirical design

3.1 Research variables and definitions

3.1.1 Dependent variable

3.1.1.1 Green innovation level of enterprises (GIV)

Given that identifying enterprise green innovation is the primary focus and challenge of this section’s research, compared to general innovation identification, it proves to be relatively more intricate. Relevant studies are still in their nascent stages. Therefore, this paper solely examines the influence of green investment on changes in the quantity of green patents held by enterprises, specifically investigating its impact on enterprise green innovation levels. This study adopts methodologies from Amore and Bennedsen (2016) and Zhang et al. (2019), utilizing the Environmental Sustainability Technologies (EST) index table to ascertain whether each patent qualifies as a green patent based on its IPC classification. Currently, the EST Consistency Index categorizes environmental technologies into five major groups and aligns them with IPC classification codes. Accordingly, we primarily identify the green status of patents by cross-referencing their IPC classification codes with the EST table.

Furthermore, based on the literature review conducted earlier, for the measurement of green innovation, we exclude design patents lacking IPC classification numbers and focus solely on samples of utility model and invention patents. Concurrently, using the CPDP database, we aggregate green patents applied for by the same enterprise within the same year to determine the total number of green patents applied for by that enterprise annually. Recognizing the possibility of zero green innovation data for enterprises in a given year, we adhere to the common practice in existing literature (Brav et al., 2018; Qi et al., 2018; Jia and Cui, 2020a) of adding 1 to the count and then taking the logarithm to derive the dependent variable GIV in this paper, which serves as a measure of enterprise green innovation level.

3.1.2 Independent variable

3.1.2.1 Green Investment (GI)

Corporate green investment refers to the “expense” and “capitalization” investments made by enterprises in energy conservation, emission reduction, environmental restoration, and sustainability. “Expense” green investment specifically includes costs related to environmental protection, governance, waste disposal, and greening incurred by enterprises. “Capitalization” green investment not only contributes to ecological preservation but also generates economic benefits. This encompasses investments in green fixed assets, development of renewable and clean energy, research and development of energy-saving technologies, innovation in green technologies and products, and recycling of waste materials (Han and Rou, 2024). Therefore, based on detailed items provided in the annual financial notes of heavily polluting listed companies, this study aggregates “expense” and “capitalization” green investments and applies natural logarithms to measure green investments by heavily polluting enterprises.

3.1.3 Control variables

To mitigate potential confounding effects on the impact of green investment on enterprise green innovation at the company level and macroeconomic factors, this paper controls for two categories of control variables.

Firstly, controlling for company-level characteristic variables:

Enterprise Size (ES): Following the approach of Li et al. (2016), this is proxied by the logarithm of the number of employees in the current year. Larger employee numbers correspond to larger enterprise sizes. Given that innovation activities typically require significant investments and risk-taking capabilities, enterprise size is expected to positively correlate with innovation. Previous literature supports this relationship.

Enterprise Age (AGE): The natural logarithm of enterprise age indicates maturity. Generally, longer-standing enterprises operate more systematically and exhibit higher maturity levels. Existing studies (Zhang, 2015) find that older enterprises demonstrate stronger innovation awareness and motivation, investing more in R&D and innovation activities. Jia and Cui (2020a) further confirm the relationship between enterprise age and green innovation. Therefore, enterprise age is included as a control variable.

Capital Structure (CS): Represented by the ratio of total liabilities to total assets at the end of the period. A ratio equal to or exceeding 100% signifies potential insolvency. Generally, enterprises with lower debt-to-asset ratios face fewer financial constraints (Balsmeier et al., 2017) and exhibit less short-term management myopia, which fosters innovation activities.

Asset Liquidity (AL): Represented by the ratio of current assets to total assets (Fang et al., 2014). A higher proportion of current assets indicates sufficient short-term funds, which supports green innovation activities.

Technological Agglomeration (TA): A dummy variable indicating whether the enterprise is located in a high-tech zone (1 for yes, 0 for no). The impact of technological agglomeration on enterprise green innovation has been extensively discussed (Audretsch and Feldman, 1996; Xin and Lianshui, 2007). Given the high technological requirements for innovation, technological agglomeration facilitates knowledge spillover effects and enhances collaborative innovation possibilities.

Export (EXP): A dummy variable indicating whether the enterprise engages in exporting (1 for yes, 0 for no). Export-oriented enterprises may enhance their technological capabilities through the “learning effect from exports,” thereby influencing enterprise innovation (Zhang and Liu, 2009; Zhang et al., 2016). Controlling for these factors is essential to mitigate potential confounding effects.

Secondly, controlling for macro-level influencing factors. Considering that the macroeconomic conditions of the region where enterprises are located can influence their green innovation behaviors, this study further controls for provincial-level economic variables (Yongze and Zhang, 2017; Gang and Shen, 2018; Jia and Cui, 2020b), which include:

Economic Condition (GDP): Represented by the logarithm of provincial GDP (Giménez et al., 2015). Regional economic development levels impact local enterprise innovation behaviors. Generally, regions with higher economic development possess more innovation resources, thereby facilitating innovation activities by enterprises.

Population (POP): Measured by the logarithm of the total population at the end of each year for each province. Innovation activities heavily depend on the efforts of innovative personnel. Regions with concentrated populations may demonstrate stronger initiative in innovation (Ye et al., 2021).

Industrial Structure (IS): Measured by the proportion of value added by the secondary industry to GDP. Given that industrial enterprises are primary entities for technological innovation in many countries (Chataway and Wield, 2000), controlling for levels of industrialization and differences in industrial structures is essential to address potential impacts.

Capital Intensity (CI). It is calculated by dividing fixed assets by the average number of employees.

3.1.4 Sample selection and data sources

This study selects A-share listed companies on the Shanghai and Shenzhen stock exchanges from 2012 to 2022 as the research sample to investigate the impact mechanism of green investment on enterprise green innovation. Since the 18th National Congress of the Communist Party of China in 2012, the Chinese government has increasingly prioritized green development and ecological civilization construction, implementing a series of policies to promote the green economy and green innovation. Therefore, this study selects 2012 as the starting point. Taking into account data availability and the consistency of statistical standards, 2022 is chosen as the endpoint. Data on green innovation levels are sourced from the CNRDS (China National Research Data Sharing Platform), while data for other variables are obtained from the CSMAR database. To ensure data continuity and validity, ST and *ST companies were excluded. The final study sample comprises 1,358 non-balanced panel data enterprises, analyzed using Stata 18 for empirical research.

3.2 Model specification

This study presents the following empirical regression model (see Equation 1) to examine the effect of green investment on green innovation:

Here, GIV represents the level of enterprise green innovation, serving as the dependent variable. GI denotes green investment, the main explanatory variable. Control variables include both company-level and provincial-level controls as described earlier. To account for time-invariant company characteristics and time-varying trends, we further control for firm fixed effects and year fixed effects. To mitigate issues related to heteroscedasticity and serial correlation, and considering potential correlations among enterprises within the same province and industry, standard errors are clustered at the province-industry level (Shi and Xu, 2018).

4 Empirical results

4.1 Descriptive statistics

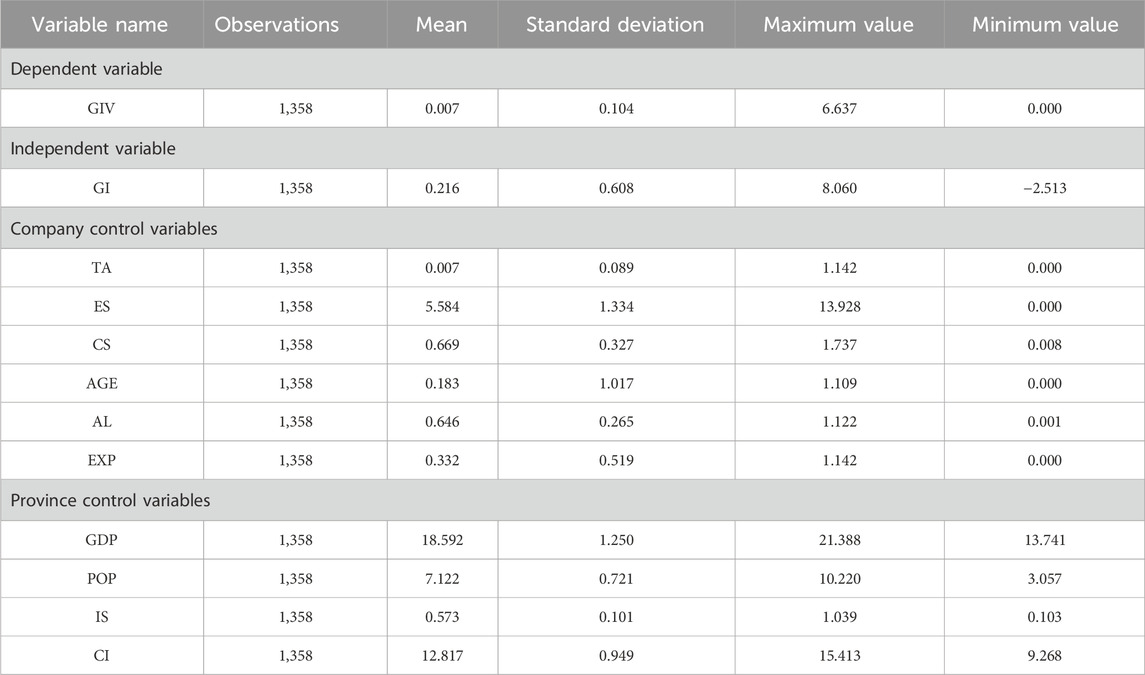

Table 1 presents the descriptive statistics. It reveals that over the sample period, the standard deviation of enterprise green innovation level (GIV) is 0.104, indicating considerable variability in green innovation capabilities among firms. Similarly, there is significant variation in green investment (GI), with a standard deviation of 0.608. Additionally, within the regression sample of this study, an average of 0.71% of enterprises are located in high-tech zones, while export-oriented enterprises make up an average of 33.21% of the total sample.

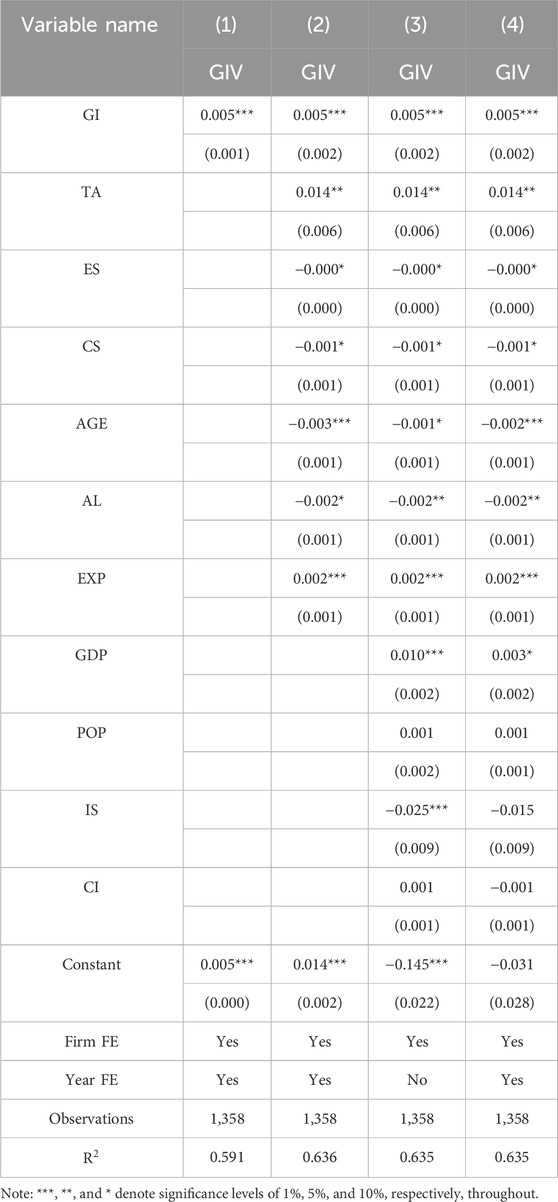

4.2 Baseline regression

Utilizing the Hausman test for model selection, we obtained a p-value of 0, which is less than 0.01, resulting in the rejection of the null hypothesis. This finding suggests that fixed effects are more suitable than random effects. Consequently, this paper adopts a two-way fixed effects model to investigate the impact of green investment on the level of green innovation in Chinese enterprises. Table 2 presents the baseline regression results. In the first column, it is preliminarily observed that the coefficient of green investment on enterprise green innovation is 0.005, significant at the 1% level, indicating that green investment promotes increased green innovation within enterprises. The second column includes enterprise-level control variables, showing a consistently positive impact coefficient of green investment on green innovation. Columns three and four expand on column two by incorporating provincial-level control variables. Column three relaxes control over annual fixed effects, confirming that green investment (GI) continues to significantly stimulate green innovation in enterprises. Column four adjusts for all variables and double fixed effects, presenting the final regression results, which consistently demonstrate a positive coefficient for the impact of green investment on green innovation, significant at the 1% level. Specifically, a 1% increase in green investment (GI) results in a 0.5% increase in enterprise green innovation level (GIV). It indicates that green investment can significantly enhance the level of green innovation within enterprises. This finding aligns with the research results of Gao et al. (2024b) and Gao et al. (2024c), further expanding on these areas. It provides new evidence not only for understanding how green finance promotes sustainable development through innovation but also for elucidating how green policies can achieve environmental goals by influencing corporate behavior.

Moreover, an examination of the control variables reveals the following impacts. Firstly, the variable TA indicates that enterprises situated in high-tech zones exhibit significantly stronger capabilities in green innovation. This is because such enterprises typically prioritize technological research and development, benefiting from the spillover and transfer effects of technology concentration, thereby enhancing their green innovation capabilities. Secondly, the variable ES shows a negative correlation between employee count and green innovation. This may be attributed to innovative enterprises relying more on technological competitiveness rather than labor costs, resulting in a lower overall staff count. Thirdly, the variable CS suggests that higher leverage ratios inhibit green innovation due to stricter financing constraints faced by these enterprises. Fourthly, the variable AGE demonstrates a negative relationship between enterprise age and green innovation level, potentially because longer-surviving enterprises feel less pressure from market competition, particularly regarding increased production costs due to environmental regulations, thus reducing their motivation for green innovation. Fifthly, the variable AL shows a negative association between asset liquidity and green innovation level, indicating that enterprises with higher liquidity have fewer resources available for long-term investments like green innovation, thereby limiting their efforts in this area. Sixthly, the variable EXP suggests that export-oriented enterprises are more inclined towards green innovation, likely due to their larger asset base and higher technological capabilities. Regarding provincial-level control variables, enterprises located in regions with higher economic development engage in more green innovation activities, consistent with existing literature. This trend may be attributed to lower financing constraints faced by enterprises in economically developed regions, thereby facilitating increased green innovation.

4.3 Robustness test

4.3.1 Change model specification

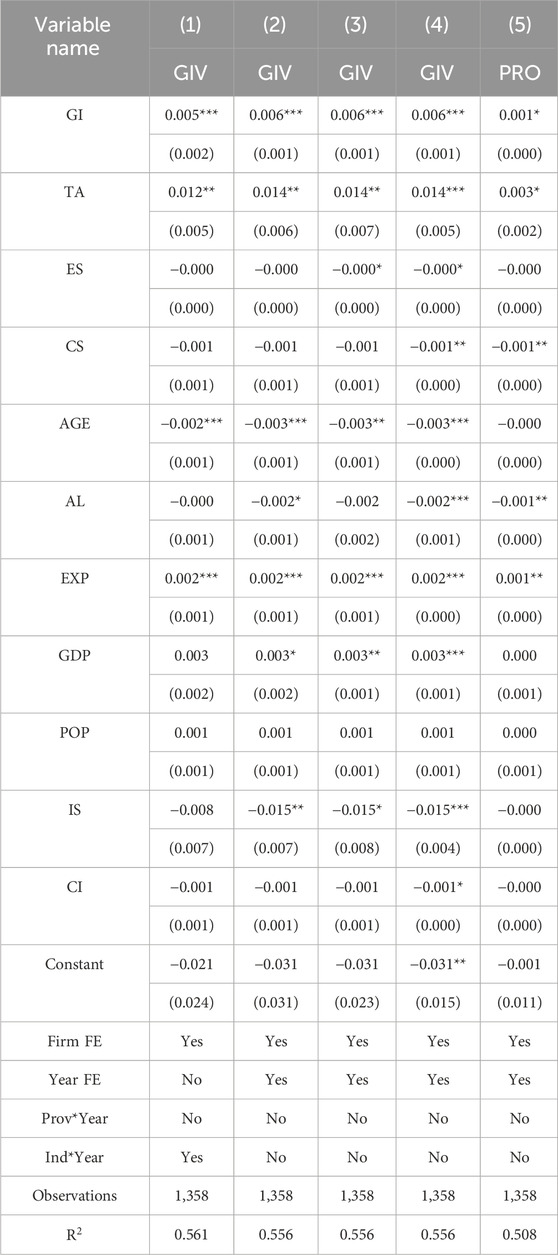

To bolster the credibility of our conclusions, we conducted additional robustness tests by adjusting model specifications. As noted in prior studies, substantial industry-specific variations exist in the green innovation behaviors of enterprises. These industry-specific traits may confound the baseline regression outcomes of this study, potentially introducing biases in our conclusions. Hence, we incorporated industry-time fixed effects into the regression model. Table 3, column (1), presents the primary outcomes, revealing that the impact coefficient of green investment (GI) on enterprise green innovation level (GIV) remains consistently positive and significant. This underscores the robustness of our initial findings.

Moreover, considering potential correlations among enterprises within the same industry and province, this study clustered standard errors at the province-industry level. To ensure the reliability of our conclusions under various clustering methods, standard errors were also clustered at the province, industry, and firm levels in columns (2), (3), and (4) of Table 3, respectively, with corresponding regression results reported. The results consistently show that the coefficient of green investment (GI) on enterprise green innovation level (GIV) remains significantly positive at the 1% significance level across all clustering approaches. Thus, clustering standard errors at different levels does not alter the regression outcomes of this study. This reaffirms that green investment (GI) effectively enhances enterprise green innovation level (GIV), underscoring the robustness of our findings.

4.3.2 Replace the dependent variable

In the baseline regression, the natural logarithm of one plus the number of green patents applied for by the company in a given year is used as a proxy variable for the company’s green innovation. Building on the approach from existing literature (Jia and Cui, 2020b), we further measure the company’s green innovation level using the green patent ratio (PRO), calculated as the ratio of green patents to total patents applied for in that year. This adjustment accounts for the overall increase in corporate innovation driven by the Chinese government’s heightened emphasis on innovation and environmental protection during the sample period. If the positive effect of green investment on the green patent ratio is absent, it suggests that the observed increase in corporate green innovation in the baseline regression may simply reflect a normal trend induced by government policies, rather than being attributable to higher levels of green investment.

Column (5) of Table 3 reports the regression results using the green patent ratio (PRO) as the dependent variable. The results show that the coefficient of green investment (GI) on the green patent ratio (PRO) is 0.001, significant at the 10% level, indicating that the current increase in green investment significantly raises the proportion of green innovation in Chinese enterprises. Green investment plays a crucial role in guiding corporate innovation strategies toward green innovation, with firms increasingly favoring green innovations in their strategic choices.

4.4 Heteroskedasticity test

4.4.1 Corporate ownership

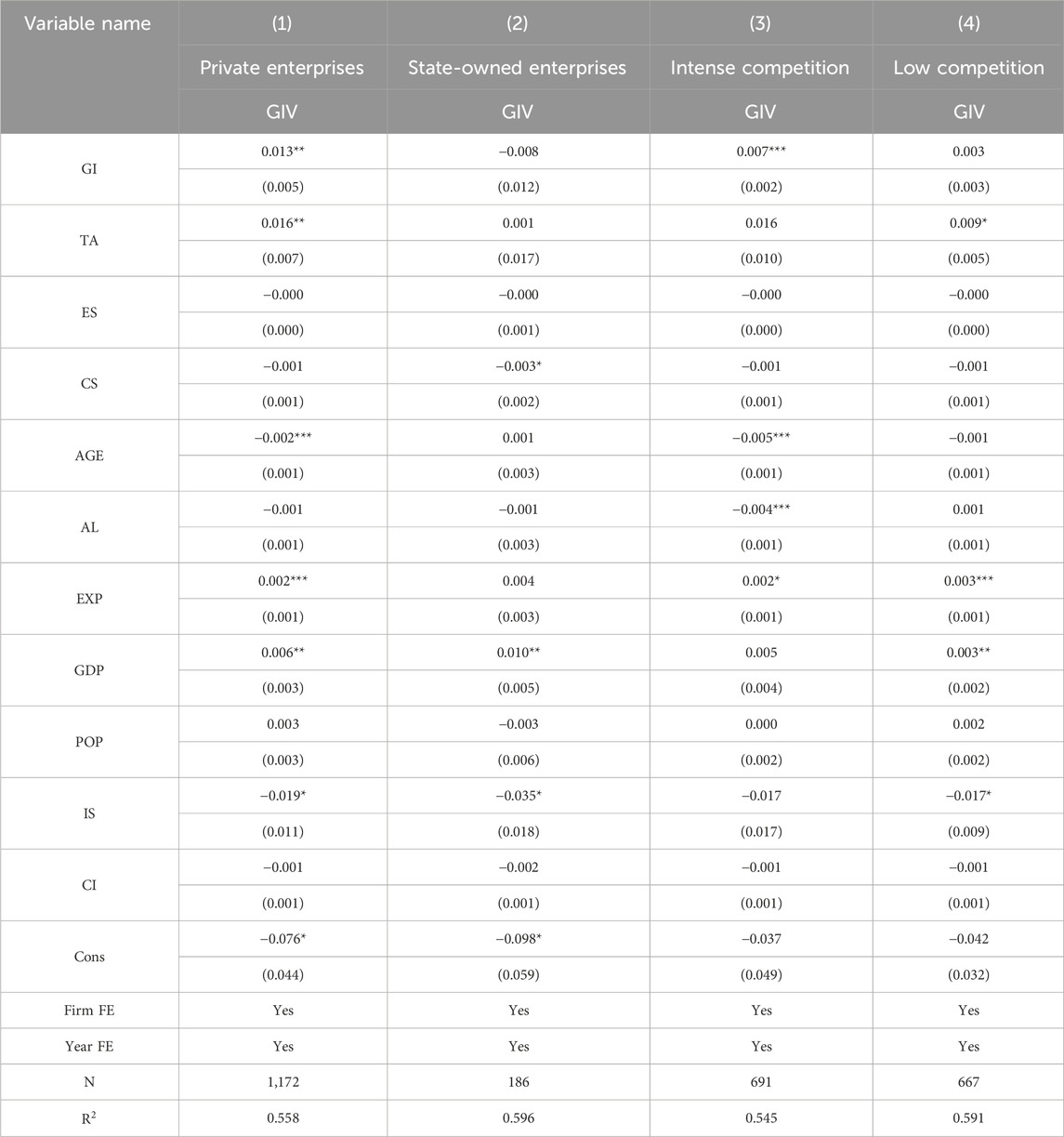

In China, enterprise types mainly include private enterprises and state-owned enterprises (SOEs). This study suggests that compared to private enterprises, Chinese SOEs are more likely to secure loans from domestic banks and other financial institutions, facing fewer financing constraints. Consequently, the financial support effect of green investment on SOEs is relatively limited. This can be attributed to two primary reasons: first, under potential government guarantees, SOEs have a lower probability of defaulting on debts, leading banks to prefer lending to SOEs after assessing repayment capability and risks (Shen and Liao, 2020); second, SOEs typically have longer survival durations and maintain stable relationships with banks, resulting in reduced information asymmetry issues. Thus, under similar circumstances, SOEs are more likely to obtain loans (Brandt and Li, 2003). Given that the ownership structure of enterprises can influence the impact of green investment on green innovation, this study further divides the overall sample into two sub-samples: private enterprises and SOEs for further investigation.

Columns (1) and (2) of Table 4 respectively present the effects of green investment on green innovation in private enterprises and SOEs. The findings reveal a significantly positive impact of green investment on green innovation in private enterprises, whereas for the SOE subgroup, the effect of green investment on green innovation is not statistically significant.

4.4.2 Industry competitiveness

Previous research has demonstrated that industry competitiveness influences firms’ innovation behaviors (Hashmi, 2013; Qiu et al., 2018). This study explores how the impact of green investment on enterprise green innovation varies depending on the level of industry competitiveness. Specifically, using the Herfindahl index, we calculate the share of total industry revenue accounted for by the top 5 firms in each two-digit industry sector, which serves as a measure of industry concentration (Matsumoto et al., 2012). Columns (3) and (4) of Table 4 present the distinct effects of green investment on enterprises operating in highly and less competitive industry environments.

The findings reveal that for enterprises in highly competitive industries, the coefficient of green investment on green innovation is 0.007 and statistically significant at the 1% level, indicating that green investment significantly stimulates green innovation in such competitive settings. However, for enterprises in less competitive industries, the impact of green investment on green innovation is not statistically significant. This differential effect may be attributed to the ability of green investment to attract additional capital, thereby fostering green innovation activities. In highly competitive industries, adequate capital is essential for expanding market share and increasing investments in research and development, thus bolstering green innovation.

4.5 Mechanism test

Previous theoretical mechanism research indicates that green investment impacts enterprises’ green innovation activities in two primary ways. Firstly, green investment provides enterprises with increased financial support, which alleviates the inhibitory effects of financing constraints on green innovation activities, thereby promoting such innovation. Secondly, beyond financial support, green investment introduces advanced corporate management practices to the invested enterprises. This helps reduce short-termism, where management focuses solely on immediate gains and neglects long-term innovation, thus motivating enterprises to increase R&D expenditures and pursue green innovation. We will empirically test the intrinsic mechanisms by which green investment influences green innovation from these two perspectives.

4.5.1 Financing constraint mechanism

Green investment, as a crucial financing channel, can supplement enterprises’ operating capital, providing sufficient funds for their green innovation activities. Adopting the methodology of Hadlock and Pierce (2010), this study constructs a comprehensive index, as shown in Equation 2, to measure the financing constraints faced by enterprises:

The SAIndex is used to measure financing constraints, where Asset represents the total assets of the enterprise and is taken in logarithmic form, and Age refers to the age of the enterprise. In this formula, a larger SAIndex indicates greater difficulty for enterprises in achieving green innovation.

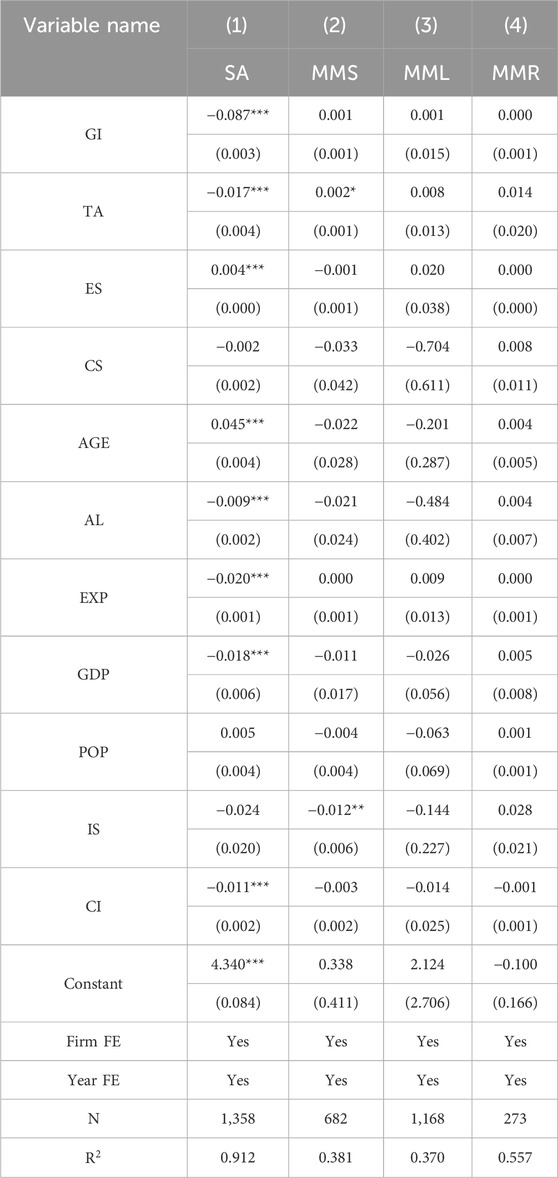

Column (1) of Table 5 reports the impact of green investment (GI) on the level of financing constraints (SAIndex), revealing that GI has a significant negative effect of −0.0765. This result indicates that green investment helps alleviate financing constraints faced by enterprises.

Moreover, existing literature has examined the impact of financing constraints on innovation activities (Brown et al., 2012; Amore et al., 2013; Cornaggia et al., 2015; Ju et al., 2013). Since R&D requires funding (Brown and Petersen, 2011), and the risks associated with R&D investments are difficult to assess (Zhou et al., 2017), the constraints on available capital for R&D are typically greater than for other investments. Therefore, the financing constraint mechanism warrants further examination (Zhang et al., 2012). Additionally, compared to general types of innovation, green innovation often requires larger investment amounts, yields lower returns, and has longer payback periods, leading to potentially more severe financing constraint issues (Yang and Yuting, 2019). This results in a greater reliance on green investment. Consequently, according to this mediating mechanism, green investment can enhance enterprises’ green innovation capabilities by relaxing the constraints on their available capital.

4.5.2 Management myopia mechanism

Green investment can introduce advanced management experience and managerial talent, which helps mitigate management myopia and thereby enhance the level of green innovation in enterprises. Given that innovation activities in enterprises involve high investment, high risk, high returns, and long payback periods, management may prioritize short-term performance due to considerations such as reputation (Narayanan, 1985) and the risk of dismissal (Chintrakarn et al., 2016). This can result in substantial funds being directed towards projects with short payback periods and low investment risks, while neglecting long-term investments like green innovation.

Based on existing literature, we use three indicators to measure the extent of management myopia in enterprises. First, considering that a primary manifestation of management myopia is increased short-term investments by the enterprise, the greater the proportion of short-term investments, the more severe the management myopia. Following the approach of Yihua et al. (2018), we use the ratio of short-term investments to total assets (MMS) to measure the degree of management myopia. Second, myopic management tends to reduce long-term investments like innovation, so the less the long-term investment, the more severe the management myopia. Therefore, we also use the ratio of long-term investments to total assets (MML) as a second measure of management myopia. Third, within long-term investments, R&D expenditures are a key input for innovation and are closely related to innovation outcomes. Thus, the degree of management myopia can be reflected in changes in R&D expenditures, with greater reductions indicating more severe management myopia. Following the approach of Bushee (1998), Tian and Estrin (2007), and Chen et al. (2015), we measure the variable MMR by taking the difference between R&D expenditure in period t and period t-1, scaled by total assets, to assess management myopia.

Columns (2), (3), and (4) of Table 5 report the impact of green investment on the three proxy variables for management myopia. The results show that regardless of the indicator used, the coefficients of green investment on management myopia do not pass the significance tests, ruling out measurement error interference with the conclusions. This indicates that green investment does not significantly impact management myopia. This may be because the amounts involved in green investment are usually limited and cannot fundamentally alter the ownership structure of Chinese enterprises, thus failing to sufficiently influence management’s investment decisions.

In summary, green investment can promote green innovation by alleviating financing constraints in enterprises, but it does not mitigate management myopia as an intermediate channel.

5 Conclusion and recommendations

A sustainable development strategy is fundamental for the long-term survival and growth of enterprises. Embracing green investment principles, enhancing innovation capabilities, and prioritizing green development are crucial drivers of China’s high-quality economic growth and essential pathways for accelerating the formation of new productive forces. This study, drawing on data from Chinese listed companies between 2012 and 2022, investigates the impact of green investment on corporate green innovation. The findings demonstrate that: First, green investment significantly enhances the green innovation levels of Chinese enterprises, and this result remains consistent even after adjusting the model specifications. Second, the impact of green investment on corporate green innovation is markedly heterogeneous. The positive effect of green investment on green innovation is more pronounced in private enterprises and those operating in highly competitive industries. Third, green investment primarily promotes corporate green innovation by alleviating financing constraints, while the intermediate mechanism of mitigating managerial myopia is not observed.

The research conclusions of this paper offer valuable insights for the government in formulating effective policies and guiding corporate practices. Accordingly, the following recommendations are proposed.

Firstly, given that green investment significantly promotes corporate green innovation, China should continue to introduce and refine green investment policies. Attention should also be focused on enterprises with green technologies, gradually easing restrictions on the scope of green capital investment, expanding the breadth and depth of green capital infusion, and fully harnessing the positive impact of green investment on enhancing local enterprises’ green innovation capabilities. Additionally, financial institutions should be encouraged to develop a wider range of financial products related to green investment, such as green bonds and green funds, to attract more private capital into the green sector. Through policy guidance, it is essential to promote green competition among enterprises, thereby stimulating corporate green innovation and facilitating the green transformation of entire industries.

Secondly, considering the substantial financing constraints faced by private enterprises domestically, green investment can offer substantial funding to support their green innovation activities. State-owned enterprises, benefiting from implicit government guarantees and longstanding stable bank-enterprise relationships, encounter fewer financing constraints. Therefore, domestic financial institutions such as banks should provide more supportive loans for green innovation initiatives of private enterprises, relax green credit approval criteria, actively cultivate green credit services, mitigate financing hurdles for both enterprise types, and ultimately enhance green innovation capabilities across all domestic enterprises. Additionally, state-owned enterprises should be encouraged to engage in green investment through market mechanisms to improve the efficiency and effectiveness of these investments.

Thirdly, the heterogeneous test results of this study indicate that green investment’s promotion of corporate green innovation is notably pronounced in highly competitive industries. Consequently, the government should foster healthy market competition within sectors, encourage all enterprises to proactively engage in green innovation endeavors, empower Chinese enterprises to achieve competitive advantages through innovation, and drive forward corporate green transformation, upgrading, and innovation enhancement. Enterprises should integrate green investment into their long-term development strategies by increasing their investments in green technologies, products, and processes to bolster their green innovation capacities. Furthermore, by optimizing their capital structures, they can lower financing costs and provide stable financial support for green innovation.

This paper presents empirical evidence of the relationship between green investment and green innovation among listed companies in China, thereby enriching interdisciplinary research in the fields of green finance and innovation management and providing new insights for policy formulation. However, this paper focuses on data analysis exclusively from listed companies in China, and future research could broaden its scope to include additional countries and regions, thereby enhancing the generalizability of the findings. Furthermore, the econometric model in this study may face limitations in analyzing the relationship between green investment and green innovation, including potential endogeneity issues, measurement errors, and challenges in accounting for critical context-specific factors. Future research should advance beyond traditional econometric models by adopting a multidimensional approach. Moreover, while this study primarily measures green investment through financial data, future investigations could integrate non-financial indicators, such as corporate environmental performance and social responsibility, to provide a more comprehensive evaluation of the effects of green investment. Finally, subsequent research could delve deeper into the multidimensional aspects of green innovation, encompassing product innovation, process innovation, and management innovation, and examine how these various dimensions are influenced by green investment.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YZ: Writing–original draft, Data curation, Funding acquisition. SS: Writing–review and editing, Methodology, Formal Analysis. YL: Writing–review and editing, Resources.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research is supported by the Fund Project: Analysis of the Path to Enhancing Green Technology Innovation Capability of Knowledge-Based Enterprises in the Guangdong-Hong Kong-Macao Greater Bay Area: A Study Based on the DPSIR-TOPSIS Model, funded by the Guangdong Provincial Special Fund for Science and Technology Innovation in 2024 (Project Number: pdjh2024b482).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Amore, M. D., and Bennedsen, M. (2016). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Amore, M. D., Schneider, C., and Žaldokas, A. (2013). Credit supply and corporate innovation. J. financial Econ. 109 (3), 835–855. doi:10.1016/j.jfineco.2013.04.006

Audretsch, D. B., and Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. Am. Econ. Rev. 86 (3), 630–640.

Balsmeier, B., Fleming, L., and Manso, G. (2017). Independent boards and innovation. J. Financial Econ. 123 (3), 536–557. doi:10.1016/j.jfineco.2016.12.005

Balsmeier, B., and Hickfang, M. (2017). Gewerkschaftlicher Einfluss auf F&E-Investitionen in KMU. ZfKE–Zeitschrift für KMU Entrep. 65 (1–2), 77–83. doi:10.3790/zfke.65.1-2.77

Brandt, L., and Li, H. (2003). Bank discrimination in transition economies: ideology, information, or incentives? J. Comp. Econ. 31 (3), 387–413. doi:10.1016/s0147-5967(03)00080-5

Brav, A., Jiang, W., Ma, S., and Tian, X. (2018). How does hedge fund activism reshape corporate innovation? J. Financial Econ. 130 (2), 237–264. doi:10.1016/j.jfineco.2018.06.012

Brown, J. R., Martinsson, G., and Petersen, B. C. (2012). Do financing constraints matter for R&D? Eur. Econ. Rev. 56 (8), 1512–1529. doi:10.1016/j.euroecorev.2012.07.007

Brown, J. R., and Petersen, B. C. (2011). Cash holdings and R&D smoothing. J. Corp. Finance 17 (3), 694–709. doi:10.1016/j.jcorpfin.2010.01.003

Bushee, B. J. (1998). The influence of institutional investors on myopic R&D investment behavior. Account. Rev., 305–333.

Chataway, J., and Wield, D. (2000). Industrialization, innovation and development: what does knowledge management change? J. Int. Dev. J. Dev. Stud. Assoc. 12 (6), 803–824. doi:10.1002/1099-1328(200008)12:6<803::aid-jid714>3.0.co;2-h

Chen, X., Cheng, Q., Lo, A. K., and Wang, X. (2015). CEO contractual protection and managerial short-termism. Account. Rev. 90 (5), 1871–1906. doi:10.2308/accr-51033

Chen, Y. S., Lai, S. B., and Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. ethics 67, 331–339. doi:10.1007/s10551-006-9025-5

Chintrakarn, P., Jiraporn, P., Sakr, S., and Lee, S. M. (2016). Do co-opted directors mitigate managerial myopia? Evidence from R&D investments. Finance Res. Lett. 17, 285–289. doi:10.1016/j.frl.2016.03.025

Church, R., Hecox, W., Dresner’s, S., et al. (2008). Sustainable development: oxymoron? Or opposed by morons. Sustain. Development-EV, 141.

Cornaggia, J., Mao, Y., Tian, X., and Wolfe, B. (2015). Does banking competition affect innovation? J. financial Econ. 115 (1), 189–209. doi:10.1016/j.jfineco.2014.09.001

Fang, V. W., Tian, X., and Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? J. finance 69 (5), 2085–2125. doi:10.1111/jofi.12187

Fu, J., and Yuan, Z. (2018). Research on the development Path of green finance in commercial banks: a new perspective based on the supply-demand reform connection. J. Jinan Univ. Philosophy Soc. Sci. 40 (01), 36–46.

Fussler, C., and James, P. (1996). Driving eco-innovation: a breakthrough discipline for innovation and sustainability. No Title.

Gang, J., and Shen, K. (2018). Is it a case of beggar thy neighbor or neighborly cooperation? Interaction of environmental regulation enforcement and urban productivity growth. Manag. World 34 (12), 49–61.

Gao, D., Feng, H., and Cao, Y. (2024c). The spatial spillover effect of innovative city policy on carbon efficiency: evidence from China. Singap. Econ. Rev., 1–23. doi:10.1142/s0217590824500024

Gao, D., Zhou, X., Mo, X., and Liu, X. (2024b). Unlocking sustainable growth: exploring the catalytic role of green finance in firms’ green total factor productivity. Environ. Sci. Pollut. Res. 31 (10), 14762–14774. doi:10.1007/s11356-024-32106-6

Gao, D., Zhou, X., and Wan, J. (2024a). Unlocking sustainability potential: the impact of green finance reform on corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 31, 4211–4226. doi:10.1002/csr.2801

Giménez, G., Sanaú, J., and López-Pueyo, C. (2015). Human capital measurement in OECD countries and its relation to GDP growth and innovation.

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. financial Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Han, J., and Qingxin, L. (2023). Historical achievements, contradictions and challenges, and Path choices of China's green development. Acad. Exch. (07), 5–15.

Han, N., and Rou, Yu (2024). Can digital finance promote corporate green investment? an empirical study based on listed companies in China's heavily polluting industries. J. Nanjing Audit Univ. 21 (04), 75–84.

Hashmi, A. R. (2013). Competition and innovation: the inverted-U relationship revisited. Rev. Econ. Statistics 95 (5), 1653–1668. doi:10.1162/rest_a_00364

Horbach, J. (2008). Determinants of environmental innovation—new evidence from German panel data sources. Res. policy 37 (1), 163–173. doi:10.1016/j.respol.2007.08.006

Hou, L., Cai, S., Ma, W., et al. (2024). How government green procurement enhances the sustainability of corporate green innovation [J/OL]. Sci. and Technol. Prog. Policy, 1–11. Available at: http://kns.cnki.net.http.zjlib.proxy.zyproxy.zjlib.cn/kcms/detail/42.1224.G3.20240723.1052.008.html.

Jia, F., Zhang, Y., and Guangzhong, Li (2017). The limited incentive role of informal institutions: an empirical study on the impact of regional trust environment on executive compensation incentives. Nankai Bus. Rev. 20 (06), 116–128+149.

Jia, X., and Cui, J. (2020a). Low-carbon cities and corporate green technology innovation. China Ind. Econ. 393 (12), 180–198.

Jia, X., and Cui, J. (2020b). Low-carbon cities and corporate green technological innovation. China Ind. Econ. (12), 178–196.

Li, B., Yue, Y., and Chen, T. (2016). Export and independent technological innovation in enterprises: an empirical study based on patent data. J. World Econ. 39 (12), 72–94.

Ju, X., Lu, D., and Yu, Y. (2017). Financing constraints, working capital management, and the sustainability of corporate innovation. Econ. Res. 48 (01), 4–16.

Matsumoto, A., Merlone, U., and Szidarovszky, F. (2012). Some notes on applying the herfindahl–hirschman index. Appl. Econ. Lett. 19 (2), 181–184. doi:10.1080/13504851.2011.570705

Narayanan, M. P. (1985). Managerial incentives for short-term results. J. Finance 40 (5), 1469–1484. doi:10.2307/2328125

Oltra, V., and Saint Jean, M. (2009). Sectoral systems of environmental innovation: an application to the French automotive industry. Technol. Forecast. Soc. Change 76 (4), 567–583. doi:10.1016/j.techfore.2008.03.025

Porter, M., and van der Linde, C. (2000). “Green and competitive,” in Harvard business review on business and the environment.

Qi, S., Lin, S., and Cui, J. (2018). Can the environmental rights trading market induce green innovation? Evidence from green patent data of listed companies in China. Econ. Res. J. (12), 129–143.

Qiu, L. D., Zhou, M., and Wei, X. (2018). Regulation, innovation, and firm selection: the porter hypothesis under monopolistic competition. J. Environ. Econ. Manag. 92, 638–658. doi:10.1016/j.jeem.2017.08.012

Rennings, K. (2000). Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol. Econ. 32 (2), 319–332. doi:10.1016/s0921-8009(99)00112-3

Shen, L., and Liao, X. (2020). Green finance reform and innovation and corporate social responsibility: evidence from green finance reform and innovation pilot zones. Financ. Forum (10), 69–80.

Shen, Y., Zheng, J., and Jiang, Y. (2023). The Path to green development: how green bonds promote green technology innovation. Sci. Technol. Prog. Policy 40 (24), 41–50.

Shi, X., and Xu, Z. (2018). Environmental regulation and firm exports: evidence from the eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 89, 187–200. doi:10.1016/j.jeem.2018.03.003

Tan, L., Gao, D., and Liu, X. (2024). Can environmental information disclosure improve energy efficiency in manufacturing? Evidence from Chinese enterprises. Energies 17 (10), 2342. doi:10.3390/en17102342

Tian, L., and Estrin, S. (2007). Debt financing, soft budget constraints, and government ownership evidence from China 1. Econ. Transition 15 (3), 461–481. doi:10.1111/j.1468-0351.2007.00292.x

Tietze, F., Schiederig, T., and Herstatt, C. (2014) What is green innovation? A quantitative literature review. in What is green innovation? A quantitative literature review: tietze, Frank| uSchiederig (Cornelius: Tim| uHerstatt).

Tseng, M. L., Wang, R., Chiu, A. S. F., Geng, Y., and Lin, Y. H. (2013). Improving performance of green innovation practices under uncertainty. J. Clean. Prod. 40, 71–82. doi:10.1016/j.jclepro.2011.10.009

Wei, P., and Shu, H. (2018). Does the Chinese capital market recognize green investment? An analysis based on green funds. J. Financial Res. 44 (05), 23–35.

Xin, Z., and Lianshui, Li (2007). Manufacturing agglomeration, knowledge spillover, and regional innovation performance: an empirical study based on the pharmaceutical, electronics, and communication equipment manufacturing industries in China. J. Quantitative and Tech. Econ. (08), 35–43.

Yan, X., and Zou, Ji (2005). A preliminary study on the theory of institutional innovation for the green economy. Theory Mon. (03), 89–92.

Yan, Y. (2013). Conceptual connotations and characteristics of ecological innovation: a comparison and reflection with general innovation. J. Northeast. Univ. Soc. Sci. 15 (06), 557–562.

Yang, G., and Yuting, Xi (2019). Empirical study on financing constraints of corporate green technology innovation activities. Industrial Technol. Econ. 313 (11), 70–76.

Yang, Y., and Shao, Y. (2011). Progress and prospects of ecological innovation research. Sci. Sci. Manag. S&T 32 (08), 107–116.

Ye, L., Xu, X., and Ma, H. (2021). The impact of urban human capital and population agglomeration on innovation output in China. Geogr. Sci. 41 (06), 923–932.

Yihua, Y., Qifeng, Z., and Xiaosheng, Ju (2018). Inventor CEOs and firm innovation. China Ind. Econ. (03), 136–154.

Yongze, Y., and Zhang, S. (2017). Urban housing prices, purchase restriction policies, and technological innovation. China Ind. Econ. (06), 98–116.

Zhang, D., Rong, Z., and Ji, Q. (2019). Green innovation and firm performance: evidence from listed companies in China. Resour. Conservation Recycl. 144, 48–55. doi:10.1016/j.resconrec.2019.01.023

Zhang, J. (2015). A study on the inhibitory effect of imports on patent activities of Chinese manufacturing enterprises. China Ind. Econ. (05), 68–83.

Zhang, J., Li, Y., and Liu, Z. (2009). Does export promote productivity improvement in Chinese enterprises? Empirical evidence from domestic manufacturing enterprises in China: 1999-2003. Manag. World (12), 11–26.

Zhang, J., Lu, Z., Zheng, W., and Chen, Z. (2012). Financing constraints, financing channels, and corporate R&D investment. World Econ. 35 (10), 66–90.

Zhang, R., Su, R., and Zhang, E. (2016). Economic openness and the relationship with productivity of Chinese enterprises: 'learning effect' or 'self-selection effect. World Econ. Stud. (04), 119–133.

Keywords: green investment, green innovation, mechanism of influence, financing constraints, managerial myopia

Citation: Zhang Y, Shou S and Li Y (2024) Do green investments impact corporate green innovation?empirical evidence from Chinese-listed companies. Front. Environ. Sci. 12:1468843. doi: 10.3389/fenvs.2024.1468843

Received: 22 July 2024; Accepted: 31 October 2024;

Published: 13 November 2024.

Edited by:

Huwei Wen, Nanchang University, ChinaReviewed by:

Abdul Majeed, Huanggang Normal University, ChinaDa Gao, Wuhan Institute of Technology, China

Copyright © 2024 Zhang, Shou and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Songtao Shou, NDY5MjgwMjcyQHFxLmNvbQ==

Yiru Zhang

Yiru Zhang Songtao Shou

Songtao Shou Youhuan Li3

Youhuan Li3