- 1Business School, Wuchang University of Technology, Wuhan, Hubei, China

- 2School of international economics, China Foreign Affairs University, Beijing, Beijing Municipality, China

Introduction: Reconciling economic development and emission reduction of polluting gases requires balancing long-term and short-term goals across various markets. As a new production cost, the price of carbon allowances is assumed to affect the supply and demand of carbon-intensive sectors. Therefore, this study examines the dynamic price spillover effects between China as the largest carbon emission market and the carbon-intensive building materials industry in a unified time-frequency framework.

Methods: This study measures the dynamic overall and directional spillover effects of carbon and building materials markets in three frequency bands, considering eight carbon pilots and the national carbon market in China and four important building materials.

Results: The empirical results show that the bi-directional spillover between carbon and the building materials market shows pronounced characteristics in the time-frequency domain, especially in the short-term frequency band of one day to one week, with strong connectivity. After the launch of the national carbon market, the information spillover from the building materials market to the carbon pilots become stronger. Both the carbon pilots and the national carbon market have significant short- and long-term impacts on the building materials market. In addition, there are differences in the impact of carbon markets on various types of carbon intensive building materials.

Discussion: Compliance cycles in carbon markets are likely to induce sharp fluctuations in spillovers between the two markets. Therefore, balancing industrial development and stabilizing carbon prices requires a refined policy design that considers the diversified impacts of carbon markets on different industries at across frequencies.

1 Introduction

Carbon dioxide emissions are undoubtedly a major cause of global warming, which restricts the sustained and rapid development of high-emitting industries. To stabilize the emission of greenhouse gases (GHG1), particularly carbon dioxide, at an appropriate level and cope with climate change, many countries have signed the United Nations Framework Convention on Climate Change and its supplementary provisions to the Kyoto Protocol. According to the International Energy Agency (IEA), in 2023, global carbon emissions from the energy sector increased by 1.1%–37.4 billion tons, of which China contributed 12.6 billion tons, ranking first in the world (IEA, 2024). Among all emission sources, the construction industry contributes a significant amount due to the heavy use of materials and equipment (Lu et al., 2016). In the context of carbon peak and carbon neutrality targets, China urgently needs to reduce energy consumption and carbon emissions. Carbon trading is a significant market-based carbon reduction mechanism to achieve the goal of “double carbon,” and also a crucial tool to promote the reform of industrial structure. Chinese government departments issued the Action Plan on Further Strengthening the Construction of Carbon Peak and Carbon Neutral Standard Measurement System (2024–2025)2, which clearly requires accelerating the promotion of carbon emission accounting standards for enterprises in key industries such as building materials, reflecting the importance of the building materials industry to China’s carbon emission reduction. Cutting emissions too fast could create a mismatch between supply and demand for goods, which could feed through to the price of building materials. In the context of the “double carbon” target, is the carbon cost transmitting to the building materials industry? Quantifying the cross-market spillover effects between carbon and building materials markets provides an important policy basis for promoting carbon emission reduction actions.

As one of the pillar industries to promote economic growth, emission reduction actions in the building materials industry are crucial to achieving the global carbon neutrality target. Carbon trading markets are the most fundamental economic instrument to internalizing external costs arising from greenhouse gas emissions. As an incentive-based tool for carbon reduction, carbon markets have flourished in many countries under the development route of the Kyoto Protocol (Zhang et al., 2021). China’s carbon market was a late starter, with carbon pilots in eight provinces and cities across the country starting in 2011. After a 10-year pilot program, China officially launched the national online carbon trading market on 16 July 2021, marking the gradual unification and maturity of China’s carbon trading system. By 30 September 2024, about 3 years after the operation, the cumulative transaction volume of carbon emission quota in China’s national carbon trading market reached 480 million tons, and the cumulative transaction volume reached 28.421 billion yuan. China’s carbon market is the world’s largest carbon market covering GHG, and the carbon market has performed well in controlling GHG emissions (Zhang et al., 2020). However, previous studies find that carbon markets with highly volatile prices can affect the quality and stability of economic development through financial developments and energy and non-energy consumptions (Nasreen et al., 2017; Xu and Salem, 2021; Xu and Li, 2023). In many countries, the construction sector is both a major driver of economic growth and one of the largest energy consumers and carbon emitters, accounting for over 30% of global CO2 dioxide emissions (Shi et al., 2017). Meanwhile, the production and transportation of building materials are the highest carbon emission stages in the whole life cycle of buildings. The building materials industry accounts for 9% of the total energy consumption, making it one of the six energy-intensive industries in China (Luo et al., 2021). Nevertheless, the energy conservation and emission reduction potential of the building materials industry is huge, which is of great significance for the realization of the national long-term carbon emission reduction target, and also provides an important reference for the transformation of all industries to low-carbon development.

As globalization increases and barriers to factor spillovers between financial markets decrease, research interest in the connection between different markets increases. While there are many studies on carbon markets, there are few that have conducted in-depth research on the link between carbon and building materials markets. Many studies find that carbon markets have catalytic effects on CO2 emission reductions in the construction industry (Li et al., 2021; Woo et al., 2021), and the effect is even more pronounced than some other carbon reduction policies (Lu et al., 2012). Due to urbanization and large-scale infrastructure construction, the issue of carbon emissions in the building materials industry has received increasing attention (Zhang et al., 2017). Thereby, in-depth analysis of spillovers between carbon and building materials markets is needed to better leverage the role of carbon emission reduction support tools. Additionally, short- and medium-term development goals should be weighed against the relationship between economic development and emission reduction. Therefore, it is of great significance to study the price transmission characteristics of carbon and building materials markets at time and frequency scales for formulating policies that balance economic development and carbon emission reduction.

Motivated by the policy importance of the inner-connections between carbon and building materials markets, this study attempts to analyze the connectedness between the two within a time-frequency framework. This study contributes to relevant research in three main ways. First, this study empirically measures the spillovers between the carbon emission market and the building materials industry, which to the best of our knowledge has not yet been revealed. The empirical findings show significant spillovers between prices of carbon allowances and building materials. Second, based on the time-frequency spillover approach, this study demonstrates that the dynamic spillover effects existing between carbon and building materials markets are frequency dependent. The short-term spillovers are generally stronger than the medium- and long-term effects, showing the rapid transfer of information between carbon and building materials markets. Meanwhile, the compliance cycle of the carbon market exhibits important impacts on the spillovers between the two markets. Finally, the establishment of a national carbon market does not seem to significantly change the relationship between carbon pilots and the building materials industry. This study has prominent implications for constructing carbon market policies and exploring the links between carbon markets and other industries.

The rest of this study is organized as follows. Section 2 reviews related research. Section 3 provides a brief introduction of the method and descriptive analysis of data. Section 4 reports the empirical results and discussions. Section 5 summarizes this study.

2 Literature review

A large number of studies on carbon emissions from the building materials industry have emerged in recent years. However, only a small part of them highlights the interrelation between the building materials industry and the carbon trading market.

As one of the important sources of global energy consumption and carbon emissions, the emission reduction actions of the building materials industry are crucial to achieve the global carbon neutrality target. Achieving carbon neutrality by 2060 is relatively challenging than the goal of peaking carbon by 2030 (Ayoub et al., 2020). Governments and companies are seeking effective emission reduction strategies to cope with the increasingly severe global climate change problem. As one of the pillar industries to promote economic growth, the building materials industry also suffers from high demand for energy-intensive materials, high resource consumption and high carbon emissions (Luo et al., 2021). Between 1994 and 2012, emissions related to building materials increased by 224.2 billion kg, an average increase of 27.2% per year, contributing to 63% of the total increase of carbon emissions in China (Lu et al., 2016). With the rapid economic development, the construction industry has higher requirements for building materials, which brings more energy consumption and carbon emissions. For example, in the past, materials such as paint and gypsum were used as decoration for the external walls of civil buildings, while now materials such as stone and glass curtain walls are used as facade, which uses more machinery and equipment in the construction process and consumes more resources (Nadoushani and Akbarnezhad, 2015). Reducing the emission intensity of upstream material industries such as cement and controlling cement consumption are important for reducing carbon emissions in the construction sector (Zhu et al., 2021). Compared with the construction industry, the shadow price of CO2 is lower in the supporting materials industry, which indicates that the carbon reduction potential of the building materials industry is greater (Wang et al., 2018).

Two market-based mechanisms, carbon tax and carbon trading, are superior to emission standard policies in effectively achieving emission targets while maintaining production stability in the construction sector (Lu et al., 2012). Carbon emission trading system (ETS) as a new carbon emission reduction policy tool provides new emission reduction power and opportunities for the building materials industry. Specifically, carbon trading can help reduce the carbon footprint of the construction industry, and the development of a blockchain digital reporting verification (MRV) system can effectively promote the construction industry’s participation in the carbon credit market (Woo et al., 2021). Additionally, carbon market prices and building materials may have a tow-way linkage. Specifically, changes in the price of building materials for real estate and commercial business have an impact on China’s carbon price and vice versa (Xu et al., 2022). Therefore, carbon prices and building material prices are sensitive to changes in each other.

Various markets and sectors have become increasingly connected in terms of price, information, and risks, especially between markets with similar assets that can be subject to pass-through effects (Wang and Guo, 2018). Many different approaches have been used in measuring spillover effects, e.g., multivariate GARCH models including the Markov system switching dynamic correlation GARCH (Balcılar et al., 2016), FIEC-HYGARCH (Liu and Chen, 2013), the full BEKK-GARCH model and the threshold Dynamic Conditional Correlation GARCH (DC-GARCH) (Zhang and Sun, 2016). However, in the analysis of heavy-tailed distributions, the GARCH model has difficulty in dealing with unbounded unconditional moments, and cannot reveal the direction of any time-varying spillovers. Thus, the copula function becomes a more popular tool in recent years. For instance, the GAS-DCS-Copula approach which captures asymmetric risk spillovers (Yuan and Yang, 2020) and the combination of the conditional Value at Risk (CoVaR) and copula method (Xu, 2021). Additionally, the spillover index proposed by Diebold and Yilmaz (2009, 2014) is widely used in investigating spillover effects on energy and environmental assets, for example, Ji et al. (2018a), Ji et al. (2018b), and Chen et al. (2022). Frequency methods such as spectral analysis and wavelet analysis are also used in measuring spillover effects, e.g., Creti et al. (2014), Reboredo and Rivera-Castro (2014), Ftiti et al. (2016), and Chen et al. (2024).

Many studies research the spillover effects of the carbon market or the building market respectively. For example, the spillover effects between carbon and energy prices such as natural gas, coal, electricity (Wu et al., 2020; Zhu et al., 2020). The link between carbon and energy markets changes across frequencies (Dai et al., 2021). In addition, many studies pay attention to the spillover effects between the carbon market and the macro economy, and find that economic uncertainty, economic policy changes and financial markets have produced price, risks or information spillover effects on the carbon market (Pástor and Veronesi, 2013; Jurado et al., 2015; Aloui et al., 2016). Turning to the spillover effects in the construction sector, much of the research is devoted to the spillover effects arising from building energy transformations. For example, temporal spillovers exist from private residential energy transformations, because they lead to new retrofit activities once they are first initiated (Sachs et al., 2019; Egner and Klöckner, 2021).

Overall, previous studies reveal significant relationships between carbon and building materials markets. However, given the importance of building materials in carbon reductions, whether and how carbon prices interact with building materials prices are under-explored. Particularly, most studies resort to the time-domain methods to measure spillover effects, which cannot reveal the frequency-domain properties. Given the importance of the building materials industry in balancing short- and long-term economic development and carbon reductions, this study investigates the time-frequency spillovers between carbon and building materials market. This study considers the different characteristics of the prices in the carbon market and the building materials market in the time domain and frequency domain, and measures the time-frequency spillover effect between the two. Based on the findings, this study contributes to the understanding of the correlation between the two markets, which can help policymakers to better formulate coordinated policies across markets and promote the stability and sustainable development of the markets.

3 Methodology and data

3.1 Time-frequency spillover effects

To our knowledge, no studies investigate the spillover effects between carbon and building materials markets, much less to the time-frequency scale changes. The spillover effects are likely to vary with frequency due to the different time horizons of participations and activities in distinct markets. This study adopts the time-frequency spillover method put forward by Baruník and Křehlík (2018), which applies the variance decomposition from the Vector Autoregression (VAR) framework to the frequency domain using a spectral representation of the variance decomposition associated with the frequency response to shocks. This approach is an expansion of the method of Diebold and Yilmaz (2012) in assessing the spillover index, which allows for the measurement the dynamic connectedness at different frequencies.

Following the Diebold and Yilmaz connectedness index (Diebold and Yilmaz, 2012), this work considers the following n-variable VAR model:

where

where

The method of variance decomposition captures the relationship between variables and gives information on the relative importance of each perturbation term that has an effect on the variables in the VAR model as in Equation 2.

In view of Diebold and Yilmaz (2012), the connectedness measure is shown in Equation 3, which describes the share of prediction variance contributed by errors other than their own.

where the trace operator is denoted by Tr

As shown in Equation 4,

The GFEVD on frequency

where

Baruník and Křehlík (2018) derive a connectedness table for how shocks to one variable affect other variables, based on which, the accumulative connectedness in a frequency band

Then, the overall connectedness within the frequency band

For

The frequency connectedness is obtained by weighting the spectral power of a time series in a given frequency band. This study uses

3.2 Data

According to the China Building Energy Consumption Research report3, the carbon emissions in the production stage of building materials account for up to 55.7% of the total emissions in the construction sector, especially in the cement industry and flat glass production. Due to the high energy consumption associated with the production and manufacture of construction materials, the material production stage is one of the phases of construction industries’ life cycle that causes the most carbon emissions and costs after the operation phase (Luo et al., 2021). The large amount of energy-intensive manufacturing of building materials is produced and consumed by the large number and area of buildings and therefore generate significant carbon emissions during the manufacturing process, contributing over 90% of the total building carbon emissions (Bribi’an et al., 2011; Chuai et al., 2015). According to Chen et al. (2022), cement and glass are two of the most important basic building materials in China, and cement is the material with the largest share of embodied carbon in building materials. Therefore, this study focuses on two main indices, i.e., China cement price index and glass futures price. For glass futures, this study uses the closing price of the active contract. The China cement price index is compiled by China Cement Network on the basis of sampling the national cement market survey, reflecting the national cement market price level and fluctuation. To cover as many types of building materials as possible, this study also considers the China clinker price index and fiberboard futures price. Similarly, this study uses the closing price of the active contract of fiberboard futures. The China clinker price index is also compiled by China Cement Network on the basis of the national clinker market survey, reflecting the national cement market price level and fluctuation.

Since 2011, China has set up eight different carbon pilots, all incorporated the building materials industry. Therefore, this study considers the carbon price of the carbon pilots and the carbon price of the national carbon market and compares the two. Specifically, the average of the average transaction prices of eight carbon pilots is used to represent the pilot price following Zhang et al. (2018). For the national carbon market, this study uses the closing price following Xu et al. (2024). Therefore, this study considers two carbon prices and four carbon-intensive building materials. The sample period extends from 19 November 2018 to 30 September 2024, covering 1,396 daily observations. The sample starts at the date decided by the announcement of China cement price index and ends at the time of the end of this study. The data of building materials market and carbon prices are available from the WIND database.

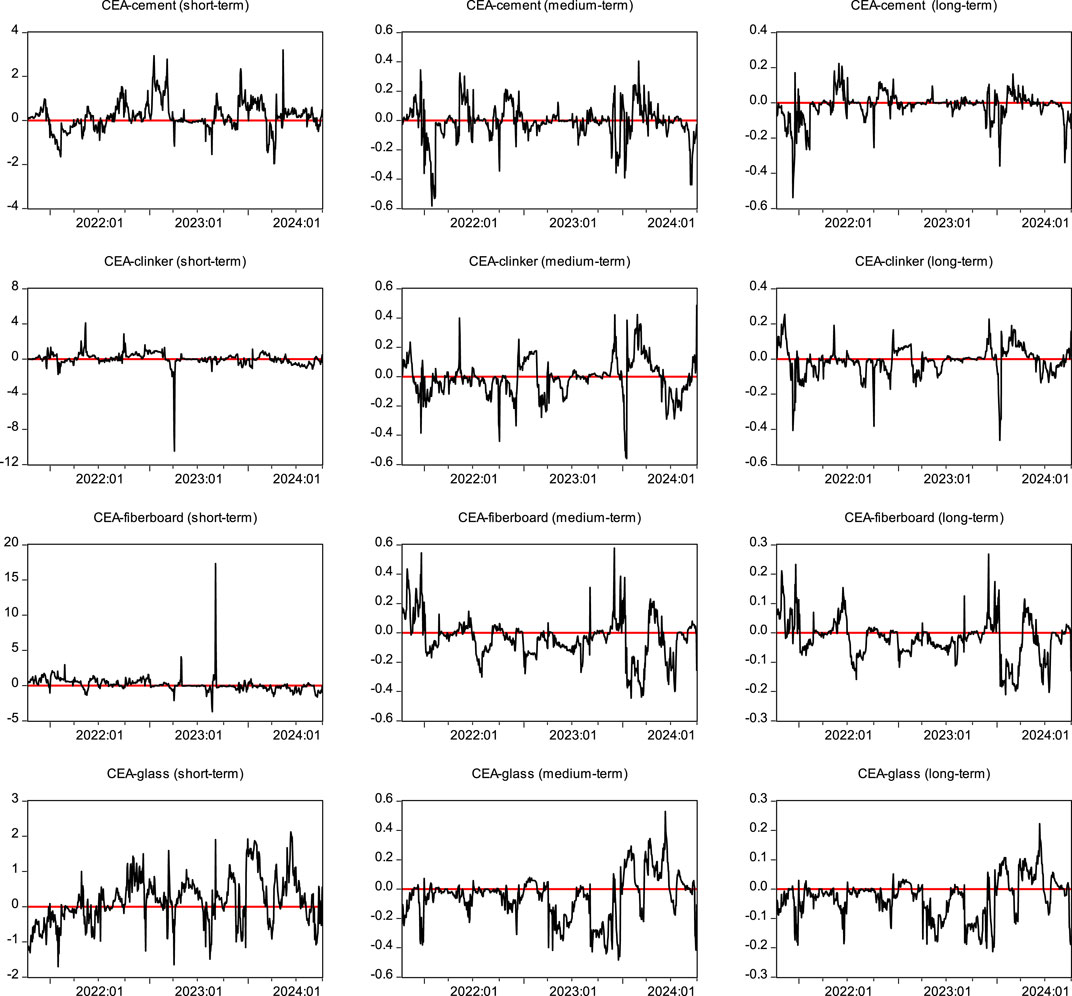

The results of descriptive statistics of the six prices (indices) are shown in Table 1. The standard deviations of glass and fiberboard prices are much larger than those of the other two price indicators, indicating that glass and fiberboard have wild price swings. The median value of return for carbon allowances and most building materials is positive. The only exception is fiberboard return, which is negative. Similar with price fluctuations, the standard deviation suggests that the glass returns are the most volatile among the various building materials. The carbon return of pilots is more fluctuating than of building materials. China’s national carbon emission trading market started online trading in 16 July 2021. Therefore, the observation of the national carbon market, i.e., carbon emission allowances (CEA), is less than that of pilots and the building materials industry. The start of the new trading mode appears to cause a certain impact on traders’ psychology and behaviors (Xu et al., 2023), which may then be transmitted to the returns of carbon allowances, resulting in relatively high volatility. According to the results of the Jarque-Bera test, the null hypothesis of normality is rejected for all return series. Specifically, the return of each index has a kurtosis larger than three, which means that they have thicker tails than the normal distribution. According to the Augmented Dickey-Fuller (ADF) tests, all return series are stationary, which satisfies the requirements of Diebold-Yilmaz method.

Table 1. Descriptive statistics of prices of carbon market and building materials (19 November 2018 to 30 September 2024).

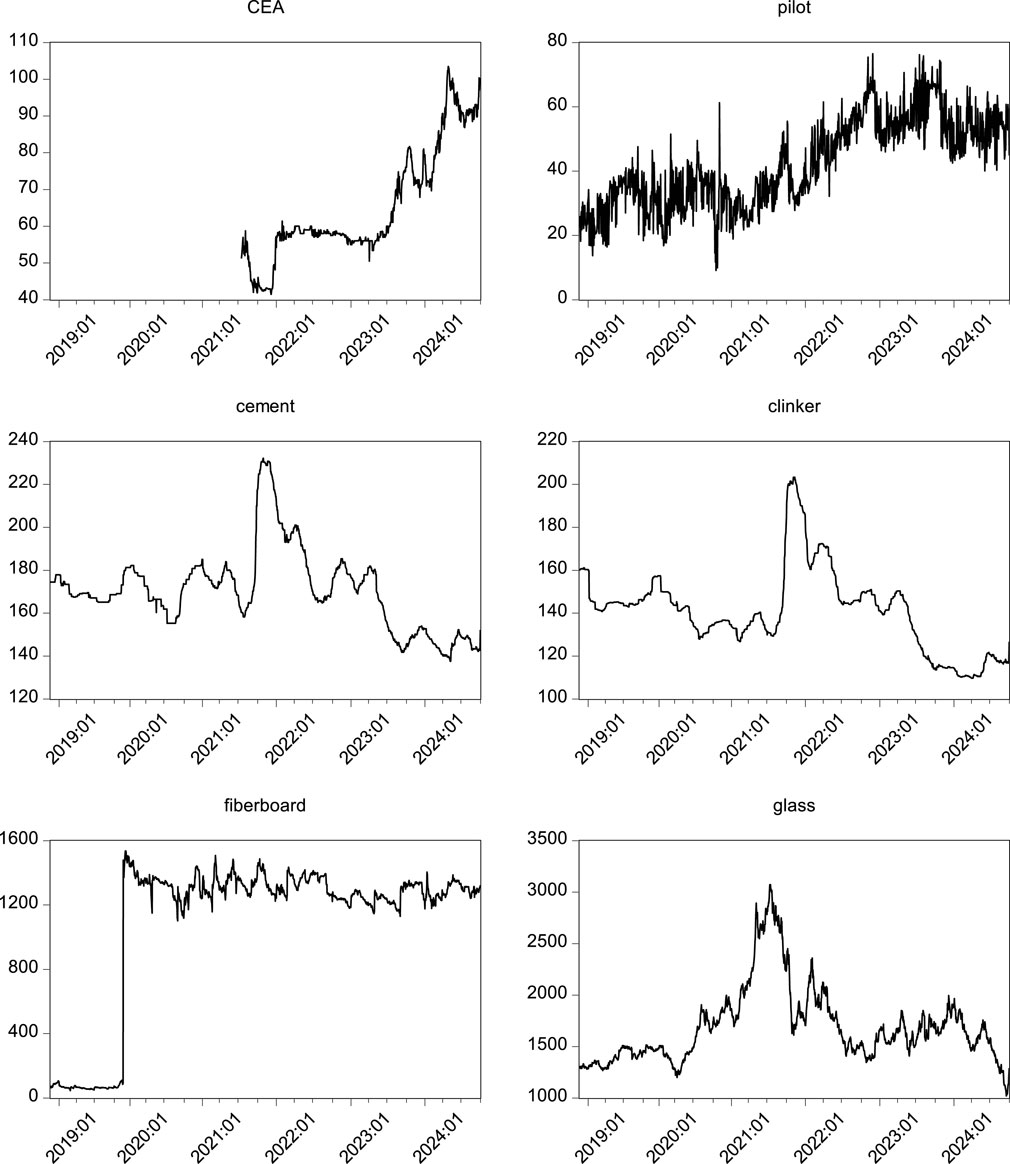

Figure 1 displays the price changes of carbon allowances and building materials. Accordingly, the price trends of cement and clinker between November 2018 and September 2024 are similar, which is reasonable since cement is one of the most important raw materials for clinker. However, the price of glass, another key production material in the construction industry, shows somewhat different trends. Between January 2021 and October 2021, cement price maintains increasing, whereas glass price fells sharply. The movements of cement and glass are similar to each other since then. Cement is the front-end demand of real estate, whereas glass is the back-end demand of real estate. Therefore, this study can observe differences in the prices changes of these two building materials. Differently, the price of fiberboard fluctuates quite sharply. The demand of the downstream industry, i.e., the construction industry, has a great impact on the price of fiberboard. When the economy enters an upward cycle, the downstream demand of real estate, wood furniture and other industries becomes strong, driving up the price of fiberboard. When the economy enters a downward cycle, the demand of downstream industries weakens, leading to a decline in fiberboard prices. However, upstream factors also impact the price of fiberboard. For example, fiberboard is highly dependent on the stable supply of wood, and shortage of wood raw materials is inevitable, particularly during the pandemic, which will lead to an increase in the production cost and price of fiberboard. Before 2021, there is a negative correlation between the carbon price in the pilot areas and the cement and clinker price index. However, different from the price trend of building materials, the carbon price in China’s national carbon market remains relatively stable from January 2022 to June 2023, while the price in the pilot areas continues to rise. Carbon price, as a new cost, seems to be supposed to dampen demand in the construction sector, leading to a decline in the demand and price of building materials. Therefore, there should be a negative relationship between the two. Price movements before October 2021 appears to support this assumption. However, the price trend of carbon and building materials do not show a significant negative correlation thereafter.

4 Time-frequency connectedness between carbon and building materials markets

In this section, this study analyzes the connectedness between carbon and building materials markets using the methodology proposed by Baruník and Křehlík (2018) based on the log returns of prices and indices summarized in Panel B of Table 1. To show the dynamic spillovers between markets under different frequencies, this study applies the rolling window estimation of three frequency bands: 1 day to 1 week, 1 week to 1 month, and more than 1 month according to the studies such as Caporin et al. (2021) and Xu and Lien (2024). The fixed rolling window is set to 60 observations. Trading in the national carbon market may have altered the spillover effects of the pilot regions with the building materials market. Therefore, this study compares the dynamic spillover effects between the carbon price and the building materials market in the pilot regions before and after July 2021. In addition, the carbon market price trend in the pilot areas is significantly different from those in the national market (see Figure 1). Therefore, this study also provides a comparative analysis between the results of the national carbon market and carbon pilots for the period from July 2021 to September 2024.

4.1 Overall connectedness

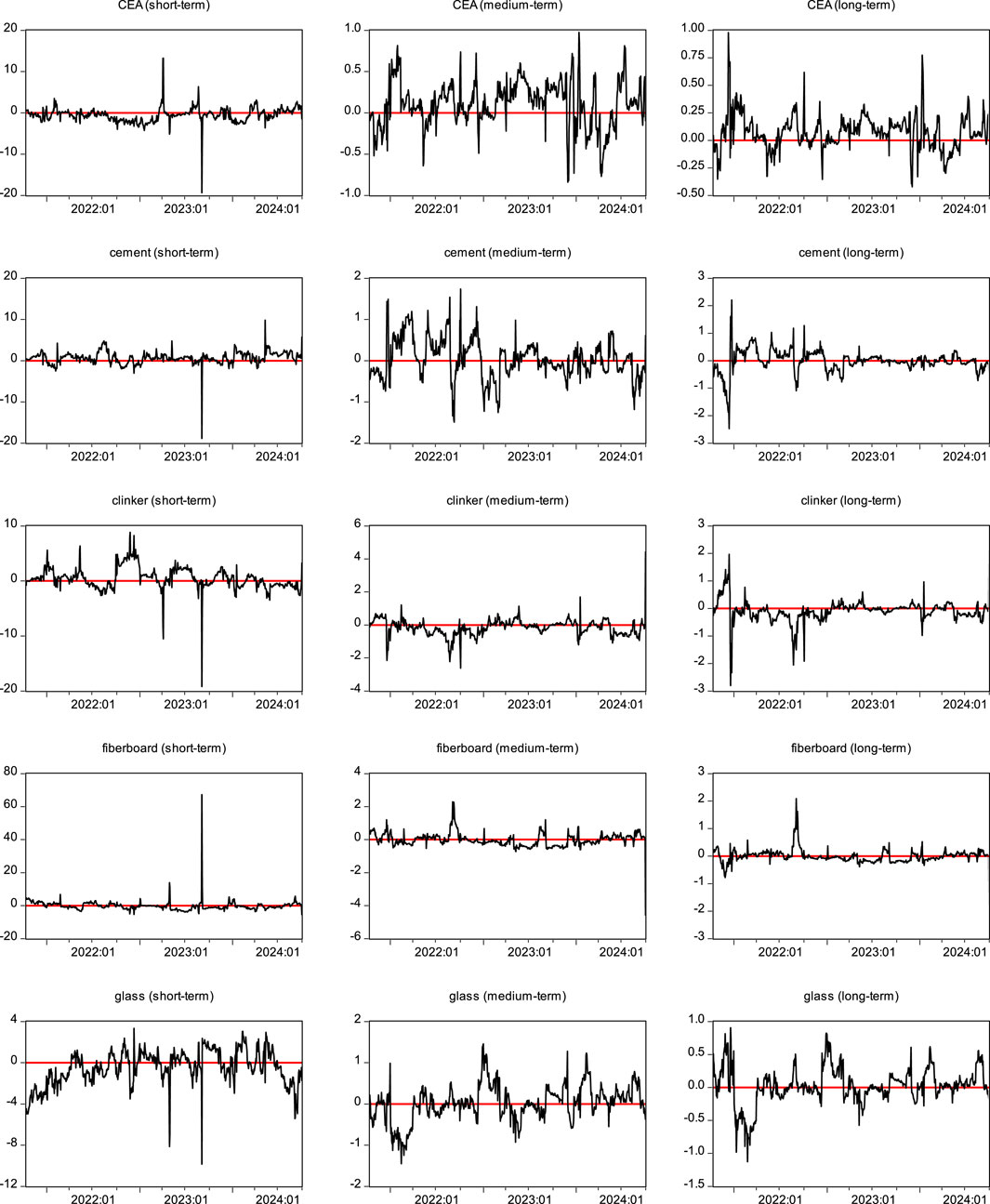

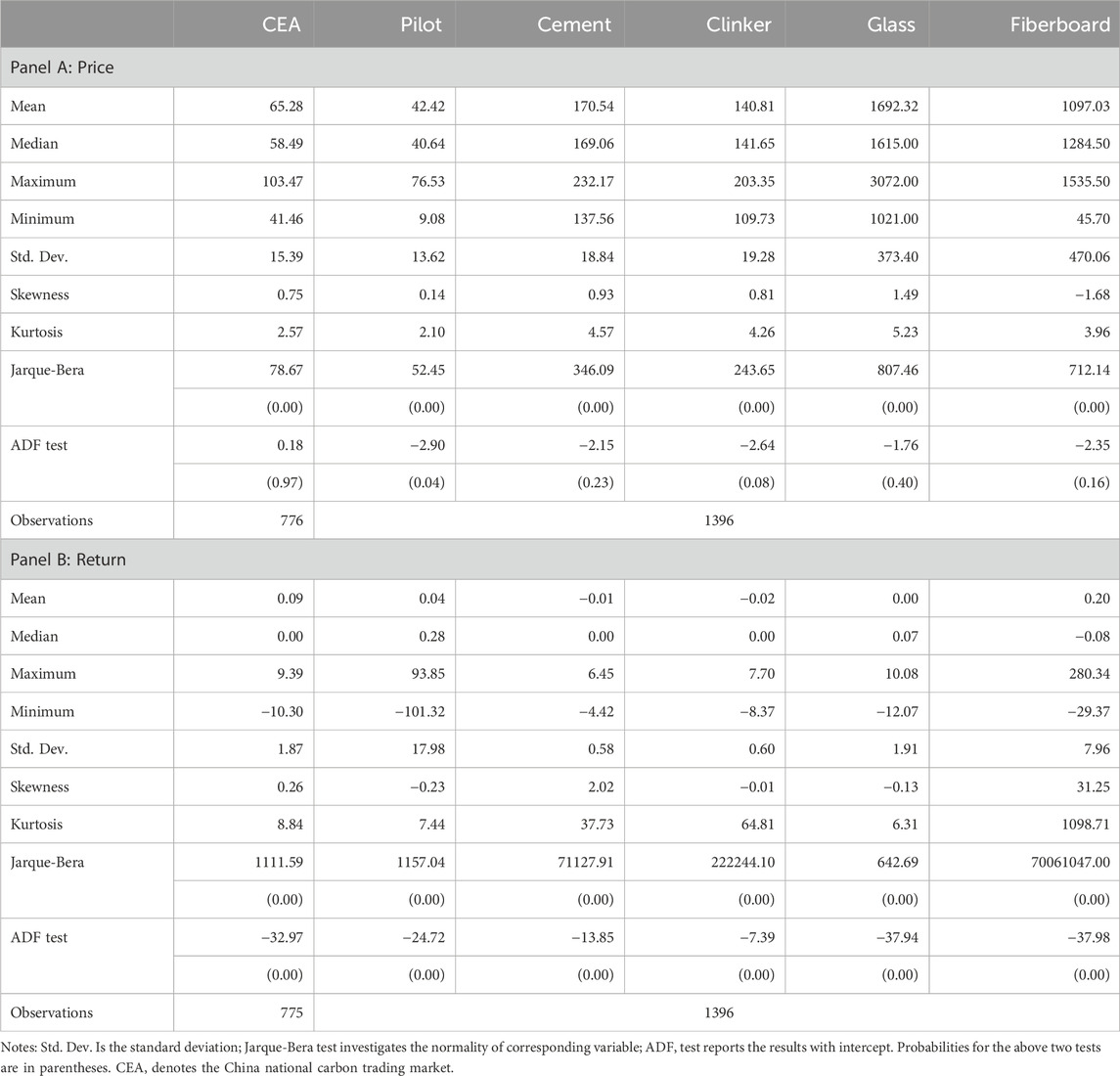

Figure 1 displays the dynamic overall connectedness of carbon and building materials markets in the three frequency bands. Plots (a) and (b) show the results for the pilots and the national market, respectively. The overall connectedness is relatively high for most sample periods at short frequencies. Although the spillovers in the other two frequency bands are relatively low, there are some significant increases in certain phases in the time domain, thus suggesting a tight linkage between carbon markets and building materials markets. According to Figure 1, for the pilots, the overall connectedness ranges from 8.76% to 79.50%, from 0.35% to 24.61%, and from 0.14% to 47.78% for the frequencies of 1 day to 1 week, 1 week to 1 month, and more than 1 month, respectively. For the national carbon trading market, the overall connectedness ranges from 9.07% to 78.04%, from 1.18% to 20.15%, and from 0.41% to 10.56% in the short-, medium-, and long-term, respectively. Therefore, the results indicate that the connectedness between carbon and building materials markets appears to be much stronger in the short-term than in the medium- and long-term for both pilot and national carbon markets. This finding is consistent with Ferrer et al. (2018) that correlations in higher frequency bands are stronger than in lower frequency bands. The above results show that the information transmission between price returns of carbon and building materials markets is relatively rapid in the short-term frequency band within 1 week, and the overall connectedness between the two markets is strong due to high frequency shocks.

For the national carbon market, this study observes four peaks of the short-term overall connectedness, which occur in January 2022, the end of November 2022, August 2023 and the end of 2023 (highlighted by the grey area). The average overall connectedness in January 2022 exceeds 26%, well above the average for the entire sample period (16.30%). Similarly, the average overall connectedness reaches 23% at the end of November 2022, and the peaks reach 78% and 23% in August 2023 and at the end of 2023, respectively. For the medium- and long-term frequency bands, three peaks around January 2022, December 2022 and December 2023 can also be observed. In other words, some of the pronounced peaks in medium- and long-term overall connectedness are similar with the short-term fluctuations, but the magnitude is weaker than in the short-term. The peak in overall connectedness generally appears around the beginning and end of the carbon market compliance cycle. The compliance cycle refers to the time from the allocation of quotas to the handover of quotas by key emission units to the competent government departments. Since its official launch in July 2021, China’s national carbon market has successfully completed two compliance cycles. The first is 2019–2020, and the second is 2021–2022. The year of 2021 is the compliance year of the first performance cycle, and 2023 is the compliance year of the second compliance cycle. The compliance cycle enables participants to adjust the carbon allowance according to the actual emissions and quota ownership during the compliance period, which helps to reduce short-term carbon price fluctuations and reduce emission reduction costs. Therefore, when carbon trading is active at the beginning and end of the compliance cycle, the connectedness between carbon and building materials markets also becomes stronger. In August 2023, the price and activity of the national carbon market rise sharply, with the closing price exceeding 70 yuan/ton for the first time. This is mainly influenced by policy, market demand and peak summer energy consumption, which in turn affects production costs and prices in the building materials industry, leading to a surge in short-term spillovers between the two markets.

For the pilot market, four prominent peaks appear for the short-term overall connectedness, which occur in December 2019, January 2022, December 2022, and January 2024. The compliance cycle of local carbon pilots is usually 1 year, which is a departure from the national carbon market. Thereby, Figure 2 shows that the overall spillover effect between the carbon pilot and the building materials market also surges around the start or end date of the compliance cycle. Similarly to the national carbon market, the medium- and long-term spillovers between carbon pilots and building materials industry are weaker than the short-term effects and also show changes related to the compliance cycle (see Figure 2).

Figure 2. The overall connectedness between carbon pilots and the building materials market (plot a) and between the national carbon market and the building materials market (plot b).

Our findings are consistent with Adekoya et al. (2021), which argues that the overall connectivity between the EU carbon market and financial and commodity markets has similar characteristics in the time domain at different frequencies. However, Adekoya et al. (2021) attribute the fluctuation of the connectivity between carbon market and other markets to Brexit, the collapse of oil prices, stock market fluctuations and the global COVID-19 pandemic. Differently, this work finds that the design of carbon trading policy in China’s carbon market, that is, the setting of compliance cycle, seems to have a more prominent impact on the overall relationship between carbon and building materials markets, because external factors such as macro environment and market adjustment do not cause prominent changes in the overall spillover effects.

4.2 Directional connectedness

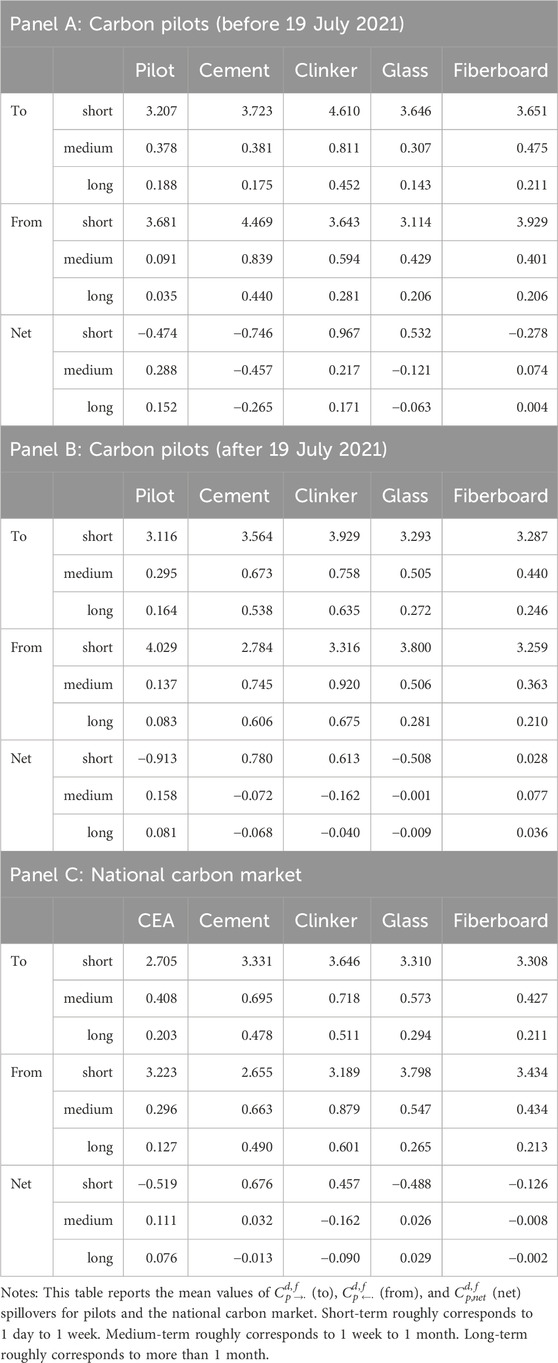

To analyze the directional spillover effect between the carbon market and the building materials market in China, this study summarizes the mean values of the frequency-to connectedness (

For the carbon pilots, before the establishment of the national carbon market, the mean value of the frequency-to connectedness for the building materials market in each frequency band is close to that for the carbon market. However, since 19 July 2021, the mean value of the frequency-to connectedness for the carbon pilots appears to be smaller than that for the building materials industry in each frequency band. For example, in the short-term, i.e., the band of 1 day to 1 week, the mean value of the frequency-to connectedness for the carbon pilots is 3.116%. In the same frequency band, fiberboard has the smallest mean value of frequency-to connectedness (3.287%) and clinker has the largest one (3.929%) among four building materials. Statistically, the mean frequency-to connectedness for the carbon pilots is significantly smaller than that of the selected building materials (the probability of unilateral test is smaller than 1%). The differences are also significant in the medium- and long-term, which indicates that the information spilled out from the building materials market is more than that from the carbon pilots after the establishment of the national carbon market. This finding is in line with Adekoya et al. (2021) that carbon markets transmit less impact compared with other markets (commodity and financial markets). Comparing Panels A and B, Table 2 suggests that the importance of carbon pilots for the building materials market increases after the launch of the national carbon market. By contrast, the national carbon market transmits less information to the building materials market than the pilots. Panel C suggests that the mean value of the frequency-to connectedness for the national carbon market is 2.705%, which is statistically smaller than the mean value of the carbon pilots in Panel B (3.116%). Meanwhile, in line with carbon pilots, the national carbon market transmits less impact compared with the building materials market Similar with the overall connectedness, the frequency-to connectedness in the short-term frequency band for all variables is significantly greater than that in the other two bands in three panels.

The frequency-from connectedness shows some similar characteristics with the frequency-to connectedness. First, the frequency-from connectedness for the building materials market is smaller than that for the carbon pilots over time horizons of less than 1 week after the launch of the national carbon market, which indicates that the carbon pilots receive more information than the building materials markets. Second, in the medium- and long-term, the impact of the carbon pilots (after July 2021) and the national carbon market on the building materials market is weaker than the reverse impact. Third, the medium-term spillover effects are relatively stronger than long-term ones. Finally, in the short term, the impact of the national carbon market on the building materials market is less than that of the pilots, and the opposite is true in the medium- and long- term.

Table 2 indicates that, in the short-term, the carbon market is quite sensitive to shocks from building materials industry, but has a smaller impact on the building materials market. The result that the carbon price has a limited impact on the price of building materials is consistent with previous empirical results (Xu et al., 2022), which can be attributed to the fact that the coverage of the carbon market is not extensive enough. Although the carbon pilots have covered the building materials sector, there are obvious regional restrictions. The national carbon market has not yet included the building materials industry. Therefore, it can be explained that the spillover effect of the carbon market on the building materials industry is limited.

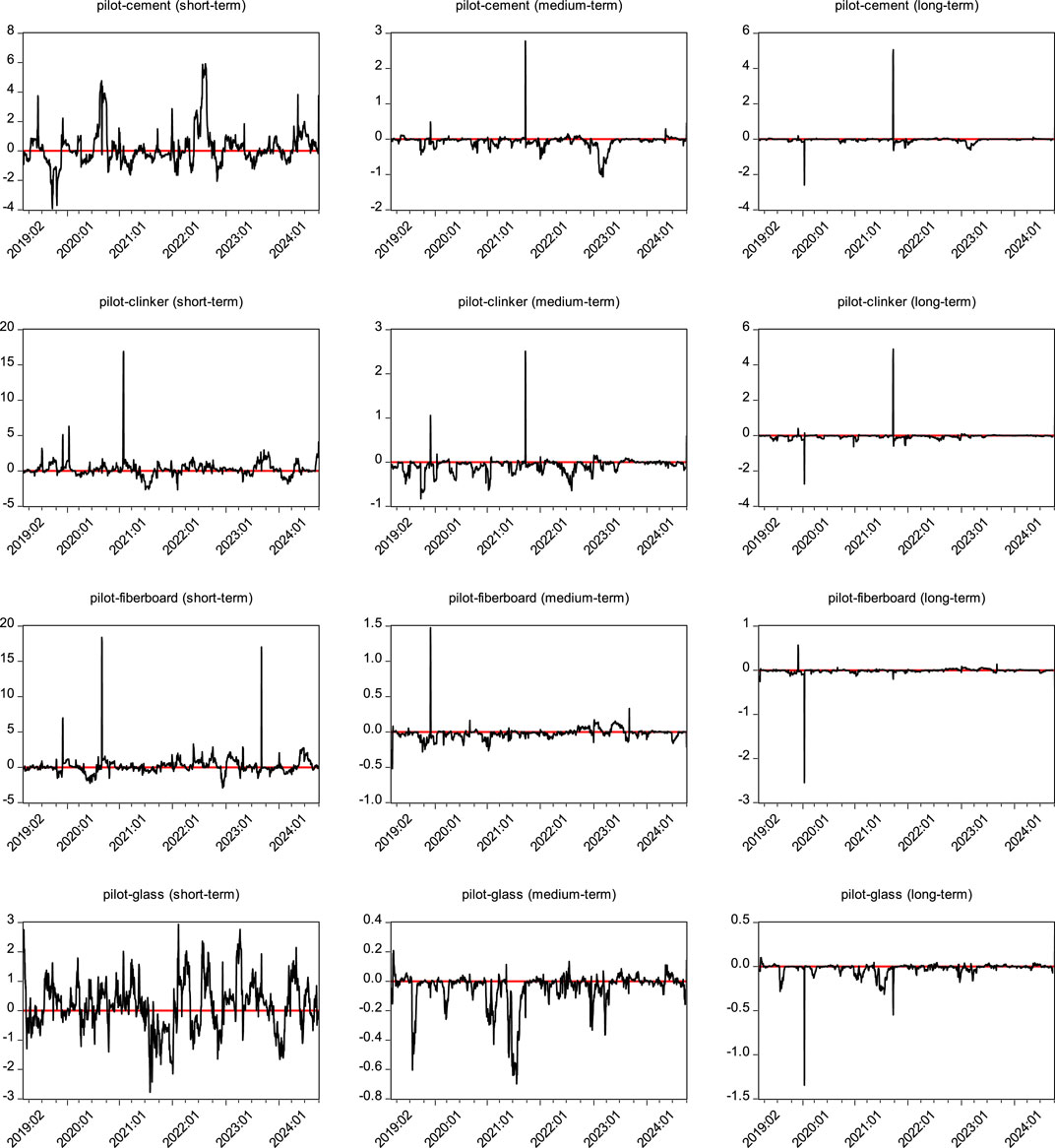

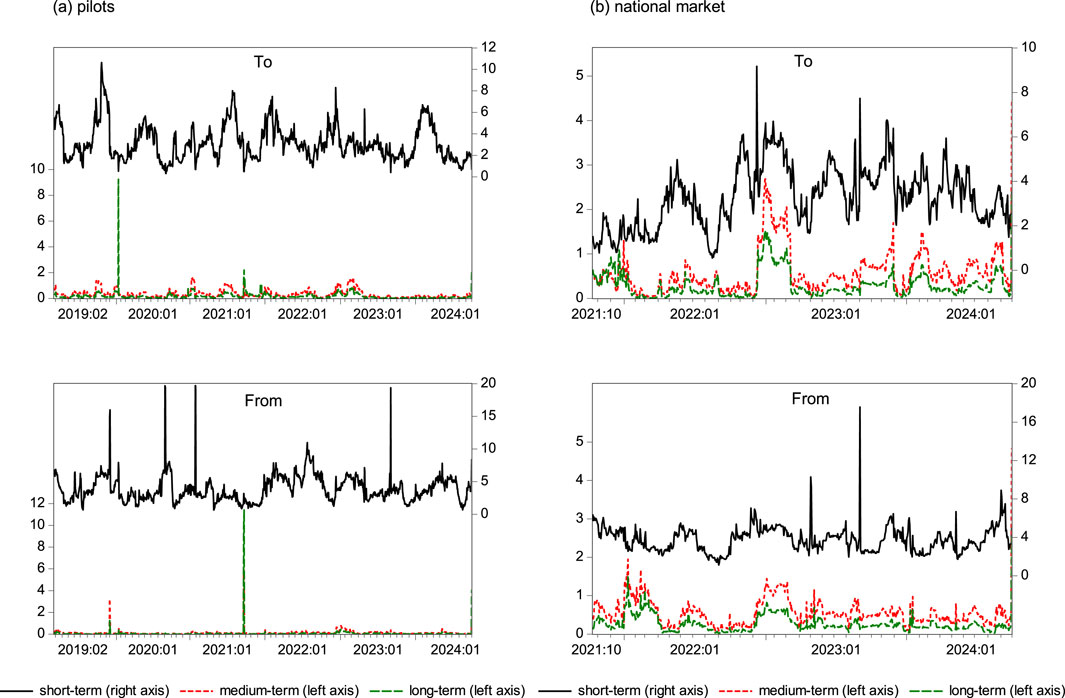

Figure 3 shows the movements of the frequency-to connectedness and frequency-from connectedness for the pilots (plot (a)) and the national carbon market (plot (b)) at three frequencies. According to Figure 3, for the national carbon market, there is a temporary surge in frequency-to connectedness across all frequency bands at the end of the compliance cycle. For pilots, however, surges typically occur at the beginning of the compliance cycle. Besides the impact of the compliance cycle, the surge can be linked to the Glasgow Climate Agreement, which was signed at the 26th Conference of the Parties to the United Nations Framework Convention on Climate Change on 13 November 2021. The agreement further strengthens the fight against climate change. The conference also reached a consensus on the implementation rules for Article six of the Paris Agreement, which has addressed the issue of double accounting of carbon emissions, and established the basic institutional framework of a global carbon market (COP26, 2021). This has created conditions for the development and influence of carbon markets from a macro policy perspective. Consequently, a significant growth is observed in late November 2021 of the frequency-to spillover for the national carbon market. However, the conference appears to have a limited impact on the pilots, with no major changes in the frequency-to connectedness around November 2021. It can be seen that the impact of global climate policy on the national carbon market is more prominent than that of the pilots.

Figure 3. The frequency-to and frequency-from connectedness for the carbon pilots (plot a) and the national carbon market (plot b).

The short-term frequency-from connectedness in Figure 3 is relatively more fluctuating than the frequency-to connectedness for the carbon market. Even so, this study also observes significant increases in the frequency-from connectedness at the beginning and end of compliance cycles. In addition, compliance cycles appear to tend to reduce frequency-from connectedness. Specifically, the frequency-from connectedness around the beginning and end of the compliance cycle of the pilots and the national carbon market is significantly reduced. For example, the frequency-from connectedness of the pilots is reduced at the end of 2019, 2021 and 2022, and the frequency-from connectedness of the national carbon market at the end of 2021 and 2023 is also significantly reduced. Therefore, the impact of the compliance cycle is bidirectional, increasing the information sent by the carbon market while reducing the information received by the carbon market. Compared with the short term, the frequency-from connectedness of the medium- and long-term is much weaker, indicating that the carbon market is mainly affected by the building materials market in the short-term. Since 2019, China’s construction and building materials sectors in general have maintained steady growth, but the rate of growth has slowed down. In 2019–2023, the value added of the construction industry increased by 5.68%, −3.5%, 2.5%, 4.4%, and 7.1% year-on-year. Correspondingly, the frequency-from connectedness of the national carbon market on the building materials industry has also gradually increased, indicating that the influence of the carbon market on the expanded building materials industry becomes stronger. However, the impact of the pilots on the building materials industry does not seem to have this feature. In addition, the operation of the national carbon market does not seem to significantly alter the directional spillover effect between the pilots and the building materials industry.

4.3 Net connectedness

The net connectedness reflects whether a market is the primary sender or recipient of the overall spillover effect. Table 2 also summarizes the mean values of the frequency-net connectedness (

Different from directional connectedness, the medium- and long-term net connectedness of the carbon market, including the pilots after the establishment of the national market, is relatively strong comparing with the building materials industry, which indicates that the influence that carbon markets transmit out is stronger than most building materials. This result is somewhat different from the finding of Jiang and Chen (2022), which find that the carbon market has a small impact on other energy markets.

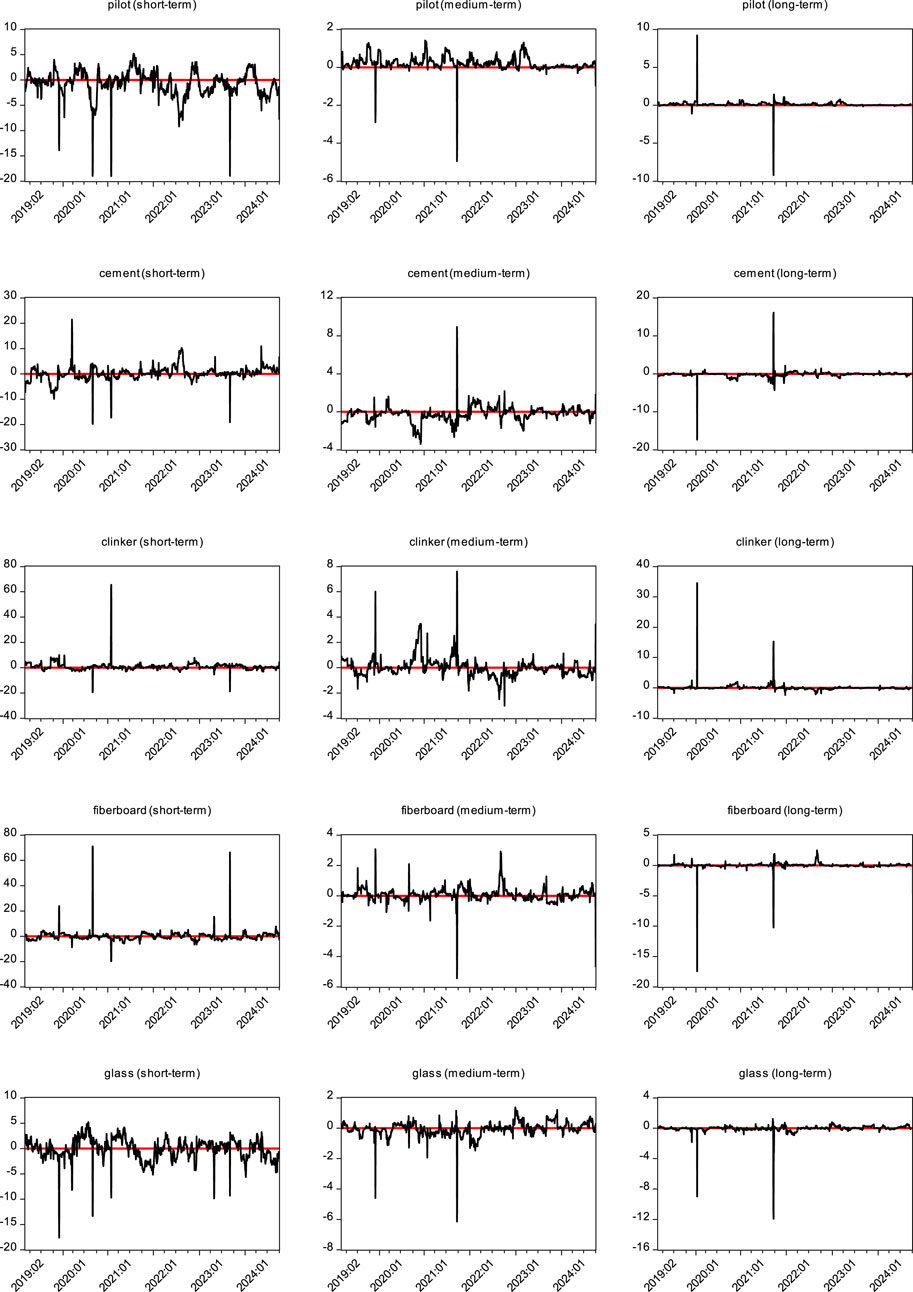

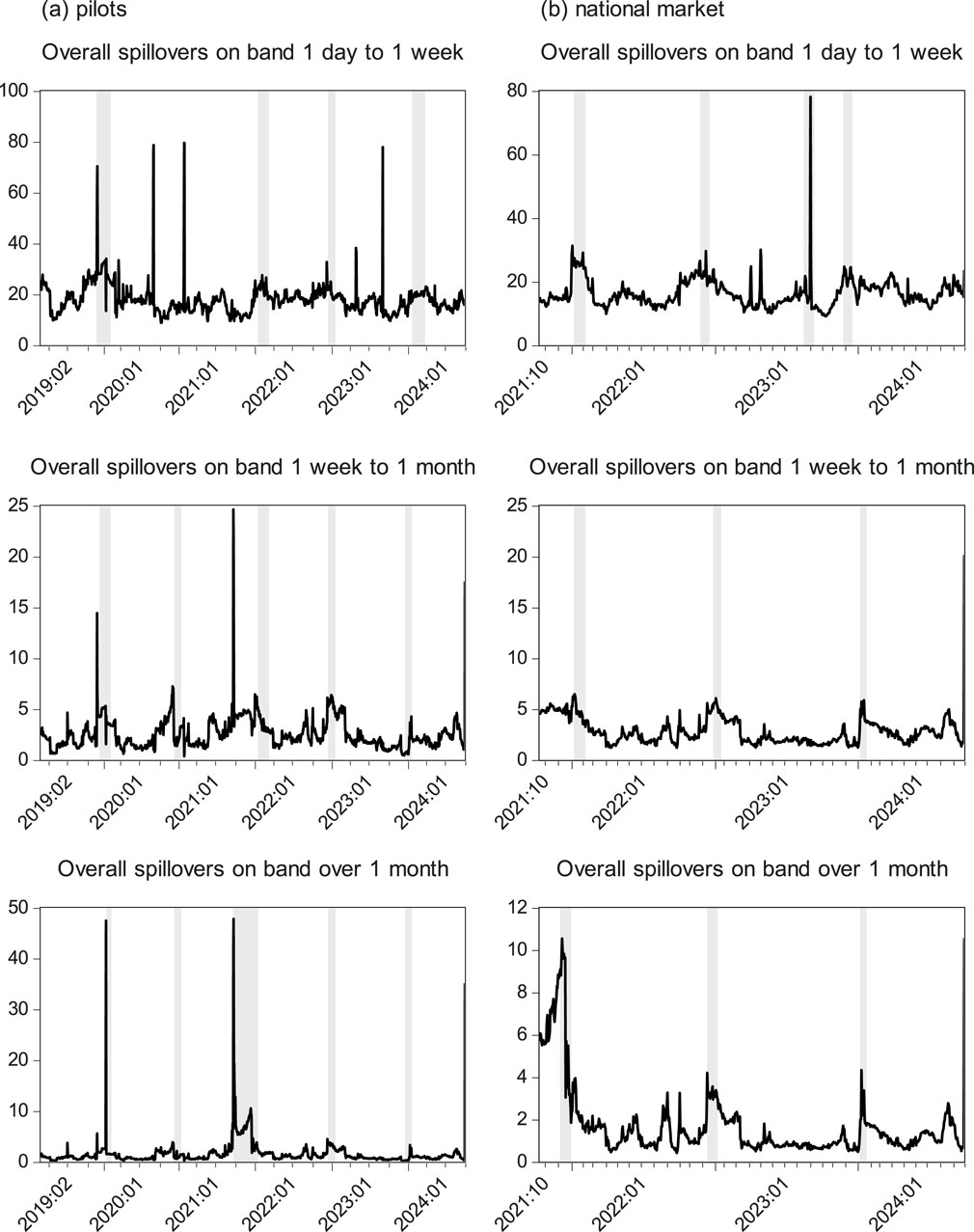

Figures 4, 5 display the fluctuations of net connectedness at three frequencies for pilots and the national carbon market, respectively. After the establishment of the national market, the pilots are mainly the information receiver of the building materials market, as the net connectedness of the pilots is negative during many periods, especially from July 2021 to December 2021. However, in the medium- and long-term, pilots are mainly an information transmitter, although their net spillovers are numerically small. The short-term net connectedness of the national carbon market fluctuates slightly around zero most of the time and is generally stable. Since August 2022, the national carbon market is generally a net information receiver from the building materials market in the short-term with negative net spillovers. However, in March 2023, the national carbon market shows a large net spillover exceeding 5%, showing that the national carbon market transmits information to the building materials market during this period. After that, it returns to the previous level rapidly. Therefore, this study can conclude that the national carbon market and pilots are generally information receivers over the short-term frequency band of 1 day to 1 week. Nevertheless, over the medium- and long-term horizons, the net spillovers of the national carbon market and pilots are positive in most time periods, suggesting that it becomes a net information transmitter in the long run. The spillovers of carbon and building materials markets are neither persistently positive nor negative, thus meaning that each market can be either an information transmitter or receiver in certain periods.

4.4 Pairwise connectedness

Figures 6, 7 show the net pairwise connectedness between carbon and building materials over three frequency bands for the pilots and the national market, respectively. For the pilots, in the short-term frequency band, the carbon market is generally a net information transmitter for clinker and fiberboard. However, for some periods, the pilots can be a net information receiver. Therefore, it appears that the carbon cost has passed through to the building materials market in the short-term, and the impact of carbon pilots on various building materials is different. The average net spillover in the short-term frequency band is positive for all building materials, with the largest for clinker (0.23%) and smallest for fiberboard (0.15%). While the average net spillover is small, the maximum values for fiberboard and clinker exceed 16%, thus showing a strong effect of carbon market on building materials markets. Nevertheless, the medium- and long-term results are somewhat different from the short-term results. As shown in Figure 6, main building materials are generally net information transmitters to the carbon pilots. In the frequency band over 1 week, the average net spillover for all paired variables is negative, in line with the observation of Figure 4. The short-term effects are generally greater than the medium- and long-term impact.

For the national carbon market, the results are slightly different from the pilots. In the short-term, the national carbon market is generally a net information transmitter of clinker and fiberboard until 2022 and an information receiver after that. For glass, the national carbon market is primarily an information receiver until June 2022. From July 2022, the national market becomes a net information transmitter. In the medium- and long-term, the net connectedness between the national market and the building materials industry is much weaker than in the short-term. Therefore, this study can conclude that the impact of carbon markets on the building materials industry mainly exists in the short-term.

4.5 Robustness tests

To ensure the robustness of the empirical test, this study comprehensively considers various tests. First, this study changes the fixed rolling window to 100 observations when estimating time-varying spillovers. When expanding the rolling window from 60 observations to 100 observations, the main findings remain unchanged. For instance, the short-term spillovers are stronger than the medium- and long-term results, and the carbon market is a net information receiver in the short-term frequency band. Second, this study fine-tunes the value of

5 Conclusions and policy recommendations

Under the carbon peak and carbon neutrality targets, carbon emission reduction has become an urgent task for the Chinese government. In this context, China has launched a unified online carbon trading market, which schedules to cover the building materials industry. Regulated enterprises trading in the unified market are subject to carbon quota constraints, which facilitates the advancement of regulated companies to optimize their industrial structures and better transformation to low-carbon production management mode. As a major contributor to carbon emissions, building material prices are supposed to have an important effect on carbon prices. Conversely, as a new production cost, the price of carbon allowances should affect the supply and demand in the building materials market, thus impacting the price of building materials. However, the spillover effects between building materials and carbon markets are under-explored. Therefore, this study measures and compares the dynamic spillovers between carbon and building materials markets in a time-frequency framework.

There are several major findings. First, the overall and directional spillover effects between the carbon allowance and the four important building materials show significant time-varying characteristics, which are closely related to the compliance cycle of the carbon market. At the beginning and end of the compliance cycle, i.e., in January and December of each calendar year, overall and directional spillovers between the carbon pilots and the building materials market tend to be stronger and more volatile than at other times. Similarly, the spillover effect of the national carbon market fluctuates sharply at the beginning and end of its compliance cycle. Second, the empirical results show that the carbon market affects the building materials market differently in the short and long run. The carbon neutrality target requires the building materials industry to develop towards low carbon emissions. However, the spillover effects of the two markets mainly appear in the short-term, which indicates that the design of carbon market policies should balance their short- and long- term effects. The overall strong connectedness between the carbon market and the building materials industry, especially in the short-term, indicates that the price transmission between the two markets is faster and thus exhibits high market efficiency in the short-term. Third, after the establishment of the national carbon market, the frequency-to connectedness of the carbon market (including the pilots and the national market) tends to be lower than that of the building materials market, while the frequency-from connectedness is higher than that of the building materials market. This makes the carbon market a short-term information receiver of the building materials market. In the medium- and long-term, the carbon market becomes the information transmitter of the building materials market, but the impact is weak. Finally, focusing on various building materials, carbon markets work differently.

These findings generate some important policy implications. Analysis of the price transmission mechanism between carbon and other markets is conducive to promoting industrial synergies and portfolio diversifications. Given the significant bi-directional spillovers between carbon and building materials markets, policymakers should consider additional price shocks when including the building materials sector in carbon market trading. Meanwhile, the connectedness at different frequencies provides important implications for the balance between short- and long-term targets of economic developments and carbon reductions. As one of the most efficient mechanisms for carbon reduction, maintaining the stability of caron price is conducive to promoting the internalization of external costs and optimizing spatial and temporal distribution of carbon emissions. Therefore, shocks in the building materials market should be considered when constructing carbon price policies.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: WIND database.

Author contributions

YX: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Writing–original draft. YZ: Funding acquisition, Investigation, Supervision, Writing–original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China [grant number 72203019], the Fundamental Research Funds for the Central Universities of China [grant number 3162021ZYKA02].

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

ADF, Augmented Dickey-Fuller; CEA, Carbon Emission Allowances; CoVaR, Conditional Value at Risk; DC-GARCH, Dynamic Conditional Correlation GARCH; DYCI, Diebold and Yilmaz Connectedness Index; ETS, Emission Trading System; GHG, Greenhouse Gases; IEA, International Energy Agency; MRV, Reporting Verification; VAR, Vector Autoregression.

Footnotes

1The relevant abbreviations are summarized in the abbreviations.

2https://www.gov.cn/zhengce/zhengceku/202408/content_6967197.htm

3https://www.163.com/dy/article/J111CTB305198SOQ.html

References

Adekoya, O. B., Oliyide, J. A., and Noman, A. (2021). The volatility connectedness of the EU carbon market with commodity and financial markets in time- and frequency-domain: the role of the U.S. economic policy uncertainty. Resour. Policy 74, 102252. doi:10.1016/J.RESOURPOL.2021.102252

Aloui, R., Gupta, R., and Miller, S. M. (2016). Uncertainty and crude oil returns. Energy Econ. 55, 92–100. doi:10.1016/j.eneco.2016.01.012

Ayoub, A. N., Gaigneux, A., Brun, N. L., Acha, S., and Shah, N. (2020). The development of a low carbon roadmap investment strategy to reach Science Based Targets for commercial organisations with multi-site properties. Build. Environ. 186, 107311. doi:10.1016/j.buildenv.2020.107311

Balcılar, M., Demirer, R., Hammoudeh, S., and Nguyen, D. K. (2016). Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Econ. 54, 159–172. doi:10.1016/j.eneco.2015.11.003

Baruník, J., and Křehlík, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. J. Financ. Econ. 16 (2), 271–296. doi:10.1093/jjfinec/nby001

Bribi’an, I. Z., Capilla, A. V., and Us´on, A. A. (2011). Life cycle assessment of building materials: comparative analysis of energy and environmental impacts and evaluation of the eco-efficiency improvement potential. Build. Environ. 46 (5), 1133–1140. doi:10.1016/j.buildenv.2010.12.002

Caporin, M., Naeem, M. A., Arif, M., Hasan, M., Vo, X. V., and Shahzad, S. J. H. (2021). Asymmetric and time-frequency spillovers among commodities using high-frequency data. Resour. Policy 70, 101958. doi:10.1016/j.resourpol.2020.101958

Chen, W., Yang, S., Zhang, X., Jordan, N. D., and Huang, J. (2022). Embodied energy and carbon emissions of building materials in China. Build. Environ. 207, 108434. doi:10.1016/j.buildenv.2021.108434

Chen, Y., Msofe, Z. A., and Wang, C. (2024). Asymmetric dynamic spillover and time-frequency connectedness in the oil-stock nexus under COVID-19 shock: evidence from African oil importers and exporters. Resour. Policy 90, 104849. doi:10.1016/j.resourpol.2024.104849

Chen, Y., Wang, C., and Zhu, Z. (2022). Toward the integration of European gas futures market under COVID-19 shock: a quantile connectedness approach. Energy Econ. 114, 106288. doi:10.1016/j.eneco.2022.106288

Chuai, X., Huang, X., Lu, Q., Zhang, M., Zhao, R., and Lu, J. (2015). Spatiotemporal changes of built-up land expansion and carbon emissions caused by the Chinese construction industry. Environ. Sci. Technol. 49 (21), 13021–13030. doi:10.1021/acs.est.5b01732

COP26 (2021). The glasgow climate pact. Available at: https://ukcop26.org (Accessed November 1, 2021).

Creti, A., Ftiti, Z., and Guesmi, K. (2014). Oil price and financial markets: multivariate dynamic frequency analysis. Energy Policy 73, 245–258. doi:10.1016/j.enpol.2014.05.057

Dai, X., Xiao, L., Wang, Q., and Dhesi, G. (2021). Multiscale interplay of higher-order moments between the carbon and energy markets during Phase III of the EU ETS. Energy Policy 156, 112428. doi:10.1016/J.ENPOL.2021.112428

Diebold, F., and Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ. J. 119 (534), 158–171. doi:10.1111/j.1468-0297.2008.02208.x

Diebold, F., and Yilmaz, K. (2014). On the network topology of variance decompositions: measuring the connectedness of financial firms. J. Econom. 182 (1), 119–134. doi:10.1016/j.jeconom.2014.04.012

Diebold, F. X., and Yilmaz, K. (2012). Better to give than to receive: predictive directional measurement of volatility spillovers. Int. J. Forecast. 28 (1), 57–66. doi:10.1016/j.ijforecast.2011.02.006

Egner, L., and Klöckner, C. (2021). Temporal spillover of private housing energy retrofitting: distribution of home energy retrofits and implications for subsidy policies. Energy Policy 157, 112451. doi:10.1016/J.ENPOL.2021.112451

Ferrer, R., Shahzad, S. J. H., López, R., and Jareño, F. (2018). Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 76, 1–20. doi:10.1016/j.eneco.2018.09.022

Ftiti, Z., Fatnassi, I., and Tiwari, A. K. (2016). Neoclassical finance, behavioral finance and noise traders: assessment of gold–oil markets. Finance Res. Lett. 17, 33–40. doi:10.1016/j.frl.2016.01.002

International Energy Agency (IEA) (2024). “CO2 emissions in 2023,”. Paris: IEA. Available at: https://www.iea.org/reports/co2-emissions-in-2023 (Accessed March, 2024).

Ji, Q., Xia, T., Liu, F., and Xu, J. (2018a). The information spillover between carbon price and power sector returns: evidence from the major European electricity companies. J. Clean. Prod. 208, 1178–1187. doi:10.1016/j.jclepro.2018.10.167

Ji, Q., Zhang, D., and Geng, J. (2018b). Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 198, 972–978. doi:10.1016/j.jclepro.2018.07.126

Jiang, W., and Chen, Y. (2022). The time-frequency connectedness among carbon, traditional/new energy and material markets of China in pre- and post-COVID-19 outbreak periods. Energy J. 246, 123320. doi:10.1016/J.ENERGY.2022.123320

Jurado, K., Ludvigson, S. C., and Ng, S. (2015). Measuring uncertainty. Am. Econ. Rev. 105 (3), 1177–1216. doi:10.1257/aer.20131193

Křehlík, T., and Baruník, J. (2017). Cyclical properties of supply-side and demand-side shocks in oil-based commodity markets. Energy Econ. 65, 208–218. doi:10.1016/j.eneco.2017.05.003

Li, L., Duan, M., Duan, X., and Wang, Y. (2021). The stimulation and coordination mechanisms of the carbon emission trading market of public buildings in China. Front. Energy Res. 9, 715504. doi:10.3389/FENRG.2021.715504

Liu, H., and Chen, Y. (2013). A study on the volatility spillovers, long memory effects and interactions between carbon and energy markets: the impacts of extreme weather. Econ. Model 37, 840–855. doi:10.1016/j.econmod.2013.08.007

Lu, Y., Cui, P., and Li, D. (2016). Carbon emissions and policies in China's building and construction industry: evidence from 1994 to 2012. Build. Environ. 95, 94–103. doi:10.1016/j.buildenv.2015.09.011

Lu, Y., Zhu, X., and Cui, Q. (2012). Effectiveness and equity implications of carbon policies in the United States construction industry. Build. Environ. 49, 259–269. doi:10.1016/j.buildenv.2011.10.002

Luo, W., Zhang, Y., Gao, Y., Liu, Y., Shi, C., and Wang, Y. (2021). Life cycle carbon cost of buildings under carbon trading and carbon tax system in China. Sustain. Cities Soc. 66, 102509. doi:10.1016/j.scs.2020.102509

Nadoushani, Z. S. M., and Akbarnezhad, A. (2015). Effects of structural system on the life cycle carbon footprint of buildings. Energy Build 102, 337–346. doi:10.1016/j.enbuild.2015.05.044

Nasreen, S., Anwar, S., and Ozturk, I. (2017). Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew. Sust. Energ. Rev. 67, 1105–1122. doi:10.1016/j.rser.2016.09.021

Pástor, J., and Veronesi, P. (2013). Political uncertainty and risk premia. J. Financ. Econ. 110 (3), 520–545. doi:10.1016/j.jfineco.2013.08.007

Reboredo, J. C., and Rivera-Castro, M. A. (2014). Wavelet-based evidence of the impact of oil prices on stock returns. Int. Rev. Econ. Finance 29, 145–176. doi:10.1016/j.iref.2013.05.014

Sachs, J., Schmidt-Traub, G., Kroll, C., Lafortune, G., and Fuller, G. (2019). Sustainable development report 2019, bertelsmann stiftung and sustainable development solutions Network. NY, USA: SDSN.

Shi, Q., Chen, J., and Shen, L. (2017). Driving factors of the changes in the carbon emissions in the Chinese construction industry. J. Clean. Prod. 166, 615–627. doi:10.1016/j.jclepro.2017.08.056

Wang, K., Yang, K., Wei, Y., and Zhang, C. (2018). Shadow prices of direct and overall carbon emissions in China’s construction industry: a parametric directional distance function-based sensitive estimation. Struct. Change Econ. D. 47, 180–193. doi:10.1016/j.strueco.2018.08.006

Wang, Y., and Guo, Z. (2018). The dynamic spillover between carbon and energy markets: new evidence. Energy J. 149, 24–33. doi:10.1016/j.energy.2018.01.145

Woo, J., Fatima, R., Kibert, C. J., Newman, R. E., Tian, Y., and Srinivasan, R. S. (2021). Applying blockchain technology for building energy performance measurement, reporting, and verification (MRV) and the carbon credit market: a review of the literature. Build. Environ. 205, 108199. doi:10.1016/j.buildenv.2021.108199

Wu, Q., Wang, M., and Tian, L. (2020). The market-linkage of the volatility spillover between traditional energy price and carbon price on the realization of carbon value of emission reduction behavior. J. Clean. Prod. 245, 118682. doi:10.1016/j.jclepro.2019.118682

Xu, Y. (2021). Risk spillover from energy market uncertainties to the Chinese carbon market. Pac-basin Financ. J. 67, 101561. doi:10.1016/j.pacfin.2021.101561

Xu, Y., Dai, Y., Guo, L., and Chen, J. (2024). Leveraging machine learning to forecast carbon returns: factors from energy markets. Appl. Energy 357, 122515. doi:10.1016/j.apenergy.2023.122515

Xu, Y., and Li, X. (2023). Green or grey stocks? Dynamic effects of carbon markets based on Chinese practices. Empir. Econ. 65, 2521–2547. doi:10.1007/s00181-023-02439-1

Xu, Y., Li, X., Yuan, P., and Zhang, Y. (2023). Trade-off between environment and economy: the relationship between carbon and inflation. Front. Environ. Sci. 11, 334. doi:10.3389/fenvs.2023.1093528

Xu, Y., and Lien, D. (2024). Together in bad times? The effect of COVID-19 on inflation spillovers in China. Int. Rev. Econ. Finance 91, 316–331. doi:10.1016/j.iref.2024.01.015

Xu, Y., and Salem, S. (2021). Explosive behaviors in Chinese carbon markets: are there price bubbles in eight pilots? Renew. Sust. Energ. Rev. 145, 111089. doi:10.1016/j.rser.2021.111089

Xu, Y., Xu, Z., Zhou, Y., Su, C., and Guo, L. (2022). Interactions between carbon prices and the construction industry in China: evidence based on Network-SVAR. Build. Environ. 215, 108936. doi:10.1016/J.BUILDENV.2022.108936

Yuan, N., and Yang, L. (2020). Asymmetric risk spillover between financial market uncertainty and the carbon market: a GAS–DCS–copula approach. J. Clean. Prod. 259, 120750. doi:10.1016/j.jclepro.2020.120750

Zhang, L., Yang, W., Yuan, Y., and Zhou, R. (2017). An integrated carbon policy-based interactive strategy for carbon reduction and economic development in a construction material supply chain. Sustainability 9 (11), 2107. doi:10.3390/su9112107

Zhang, W., Li, J., Li, G., and Guo, S. (2020). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy J. 196, 117117. doi:10.1016/j.energy.2020.117117

Zhang, Y., Guo, S., Shi, X., Qian, X., and Nie, R. (2021). A market instrument to achieve carbon neutrality: is China’s energy-consumption permit trading scheme effective? Appl. Energy 299, 117338. doi:10.1016/J.APENERGY.2021.117338

Zhang, Y., Liu, Z., and Xu, Y. (2018). Carbon price volatility: the case of China. PloS one 13 (10), e0205317. doi:10.1371/journal.pone.0205317

Zhang, Y., and Sun, Y. (2016). The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 112, 2654–2663. doi:10.1016/j.jclepro.2015.09.118

Zhu, B., Huang, L., Yuan, L., and Wang, P. (2020). Exploring the risk spillover effects between carbon market and electricity market: a bidimensional empirical mode decomposition based conditional value at risk approach. Int. Rev. Econ. Finance 67, 163–175. doi:10.1016/j.iref.2020.01.003

Keywords: carbon market, pilot, building materials, carbon cost, spillovers

Citation: Xu Y and Zhu Y (2024) Are carbon costs transmitting to the building materials industry?. Front. Environ. Sci. 12:1463060. doi: 10.3389/fenvs.2024.1463060

Received: 11 July 2024; Accepted: 21 October 2024;

Published: 30 October 2024.

Edited by:

Jiachao Peng, Wuhan Institute of Technology, ChinaReviewed by:

Yufeng Chen, Zhejiang Normal University, ChinaYaohui Jiang, Fujian Normal University, China

Yishuang Liu, Wuhan University, China

Copyright © 2024 Xu and Zhu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yinglun Zhu, emh1eWluZ2x1bkBjZmF1LmVkdS5jbg==

Yingying Xu

Yingying Xu Yinglun Zhu2*

Yinglun Zhu2*