- School of Sports Science, Harbin Normal University, Harbin, China

To gain a deeper understanding of the intrinsic dynamic relationship between energy consumption and economic growth in China. This study employs panel cointegration and causality models, utilizing the SYS-GMM technique to assess the factors influencing economic growth in China’s green finance sector from 2002 to 2022. The research explores the interactions among multiple variables related to the Chinese economic context, including economic growth, carbon dioxide emissions, total natural resource rents, energy consumption, and environmental impact. While considering key factors that may cause structural disturbances in the time series analysis. The findings indicate the existence of long-term cointegration relationships among these variables, with positive correlations between economic growth and total natural resource rents, energy consumption, energy quantity, and ecological footprint. Results also show a bidirectional causal relationship between carbon dioxide emissions and energy consumption and a unidirectional correlation between energy consumption and GDP growth. Additionally, energy intensity (EI) improvements supported by green finance are linked to a significant reduction in CO2 emissions, with a coefficient of −1.933 (p < 0.05), underscoring the role of technological innovation. Further evaluations suggest that investments in renewable energy can promote economic growth, create job opportunities, and reduce greenhouse gas emissions. Energy-saving measures and green finance-supported technological innovations play crucial roles in improving energy intensity and reducing CO2 emissions. The study also underscores the importance of economic diversification to reduce dependence on natural resources and enhance economic stability. Future research should further explore the economic feasibility and environmental benefits of emerging technologies such as Carbon Capture and Storage (CCS), providing deeper insights into sustainable energy practices.

1 Introduction

Since the reform and opening-up, China’s economic growth has primarily relied on an energy-intensive industrial model, with fossil fuels, particularly coal, dominating the energy mix. From the historical context of energy structure and economic growth patterns, this extensive growth model has led to significant GDP increases but has also resulted in a sharp rise in energy consumption and carbon dioxide (CO2) emissions. In 2020, coal-fired power generation still accounted for 71% of China’s total electricity production, while the share of renewable energy sources such as hydropower, wind power, nuclear energy, and photovoltaic power remained relatively low. This energy structure has made economic growth inevitably linked to substantial CO2 emissions.

Against the backdrop of global warming and worsening environmental pollution, the contradiction between China’s economic development and environmental pressures has deepened. CO2 emissions have not only had a profound impact on global climate change but have also posed severe challenges to China’s sustainable development. In 2020, China’s CO2 emissions reached 9.894 billion tons, with its share of global emissions continuing to rise (Xing, J. et al., 2020). As economic development progresses, the mounting internal and external environmental pressures compel China to intensify its efforts to reduce emissions while maintaining economic growth.

To address these challenges, the Chinese government has implemented a series of policies in recent years aimed at balancing the dual demands of economic growth and environmental protection. In particular, regarding CO2 emissions control, China has proposed the “dual carbon” goals—peaking carbon emissions by 2030 and achieving carbon neutrality by 2060. To this end, the government has introduced various policy measures, including improving energy intensity promoting the development of renewable energy, restricting the expansion of high-pollution industries, and advancing the construction of carbon markets.

These policies have yielded some positive outcomes. For example, China’s carbon intensity has decreased year by year, with a reduction of approximately 40% in 2020 compared to 2005. Simultaneously, the national energy structure has been gradually optimized, with the proportion of renewable energy in total energy consumption steadily increasing. Furthermore, China is actively promoting the establishment of a carbon emissions trading system, aiming to encourage corporate emission reductions through market-based mechanisms.

With the advancement of technology and the promotion of green finance, China has more opportunities to transition to clean energy and high-efficiency products, which will help mitigate the negative environmental impacts of economic growth. However, while technological progress can alleviate CO2 emissions to some extent, achieving the “dual carbon” goals will require large-scale decarbonization in sectors such as industry, transportation, and construction, imposing higher demands on the modes and pathways of economic growth.

The global economic recession induced by the COVID-19 pandemic has further complicated these challenges. As economies recover, countries are grappling with the dual challenge of balancing economic growth with environmental protection. As the world’s largest emitter of CO2, China’s economic growth model plays a crucial role in global climate governance. Therefore, exploring the relationship between China’s environmental governance and economic growth is not only significant for China’s pursuit of high-quality development but also has far-reaching implications for global environmental governance.

This paper delves into the complex relationships between economic growth, energy utilization, and CO2 emissions, as well as the intertwined influences of economic growth, energy use, CO2 emissions, oil, and natural resource rents. This study focuses on three key factors—energy consumption, carbon dioxide emissions, and total natural resource rents—in exploring their interrelationship with economic growth in China. This research will apply the SYS-GMM technique to assess factors influencing economic growth in China’s environmentally friendly finance industry from 2002 to 2022. This is the initial study to adopt a consistent panel causal model. SYS-GMM (System Generalized Method of Moments) is an estimation method for dynamic panel data models. Proposed by Arellano and Bover (1995) and further developed by Blundell and Bond (1998), it is an improvement over the Difference GMM (Difference Generalized Method of Moments) method. The causal inference in SYS-GMM aims to assess the causal impact of independent variables on dependent variables using dynamic panel data models and instrumental variable techniques. This approach begins with establishing a dynamic panel data model that includes lagged dependent variables as independent variables and selects appropriate instrumental variables (e.g., lagged values of both dependent and independent variables) to address endogeneity issues. By constructing a system of equations that combines levels and differences, SYS-GMM enhances estimation accuracy and efficiency. After estimating the model parameters, instrumental variable regression and significance tests are conducted to determine whether the independent variables have significant effects on the dependent variable. This method is particularly suitable for dynamic panel data models with lagged variables, effectively identifying dynamic relationships between variables and improving the reliability and accuracy of estimates, thereby providing empirical support for policy-making and economic analysis. This study aims to explore the intrinsic relationship between energy consumption and economic growth in China through theoretical models, addressing the knowledge gap in this area. The findings will provide a basis for formulating more effective finance, ecology, and related policies, contributing to the sustainable development of China’s economy.

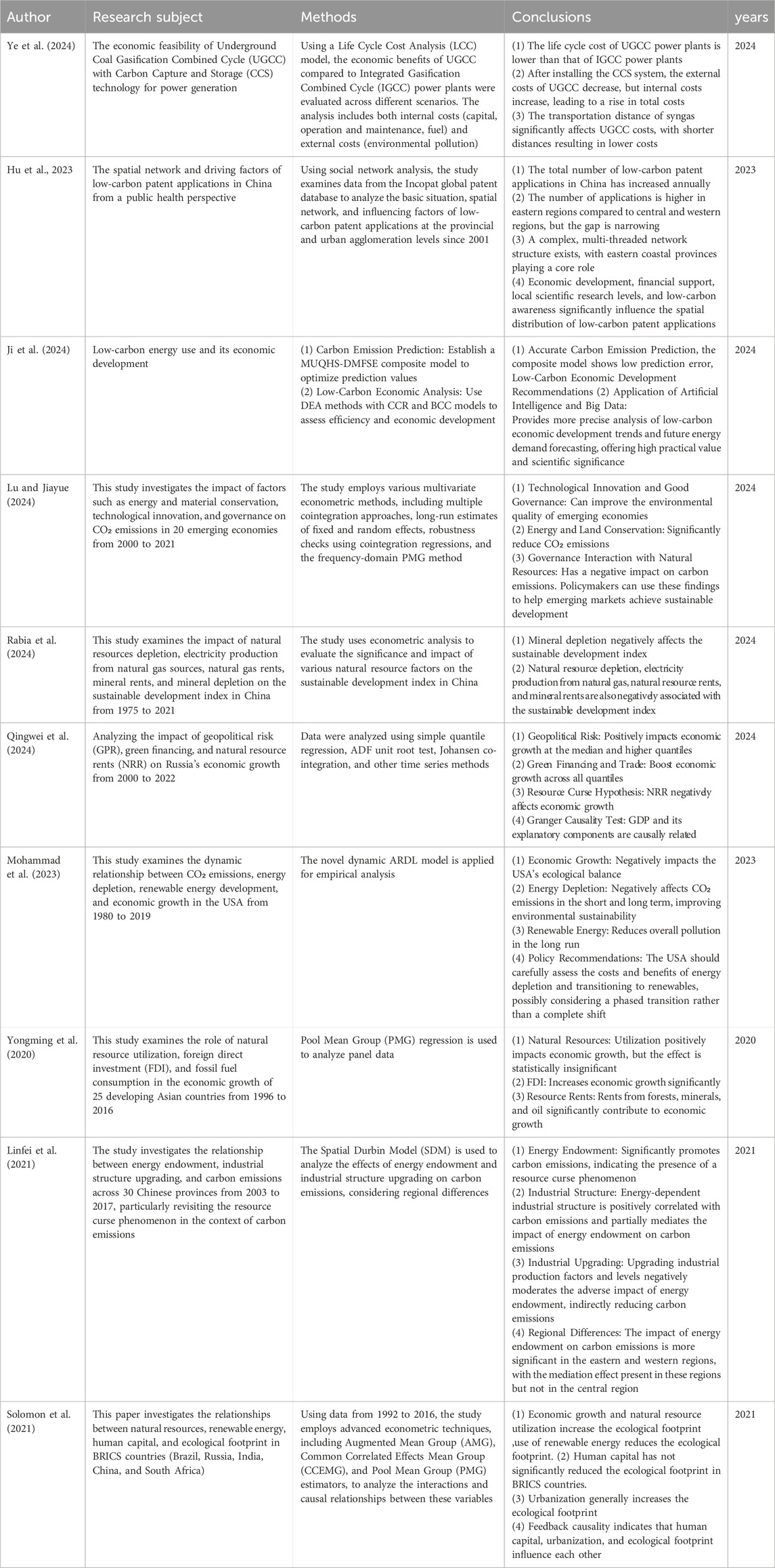

Through the analysis of the relevant literature in Table 1, the following limitations in previous research have been identified. First, limitations in data sources and scope have led past studies to rely heavily on data from single countries or regions with short time spans. This has rendered the research findings incapable of fully reflecting long-term trends and global impacts. Second, the simplicity of models in previous research often involves the use of basic linear models or traditional regression analysis methods, which fail to account for the complex relationships and dynamic changes among variables. Third, prior research tends to underestimate the bidirectional relationship between green finance and technological innovation when predicting economic growth, overemphasizing the direct impact of traditional energy and resource rents on the economy, and neglecting the crucial role of green finance in sustainable development.

Addressing these limitations, this paper employs SYS-GMM and integrates theoretical frameworks from environmental economics, sustainable development, and resource ecology to quantitatively assess the external impacts of economic activities on the environment, including CO2 emissions and their effects on China’s economic recovery. Utilizing long-span data from 2002 to 2022, this study provides a more comprehensive and dynamic analysis, revealing the complex interrelationships between economic recovery, energy use, CO2 emissions, and natural resource rents. The paper delves into the bidirectional relationship between green finance and technological innovation, highlighting the significant role of green finance in promoting innovation and supporting sustainable economic development, thereby filling gaps in previous research. Based on the model analysis results, this study proposes a series of feasible policy recommendations, including promoting renewable energy, reducing emissions, and constructing sustainable infrastructure, providing strong support for policymakers.

Considering that the calculation of GDP takes into account the utilization of various factors of production, including energy and finances, as well as developmental elements like international commerce and finance, this research employs the production function approach to elucidate the interrelationship between energy consumption and economic growth. The work utilizes an extended Cobb-Douglas production function model to delve into the interactions among multiple variables such as economic growth, the release of carbon dioxide, the total rent of resources from nature, amount of energy, and environmental impact. All selected variables are closely aligned with the economic context of China. Moreover, the research accounts for several key factors that could cause structural disturbances in a temporal sequence analysis, which are thoroughly considered in the static analysis part of the model. Through this theoretically rigorous model, the research aims to analyze the connection between China’s energy consumption and the direction of worldwide economic growth.

2 Literature review

To promote growth and improve living standards, each nation should take measures to boost their economies. Economic recovery has led to notable environmental impacts, particularly in terms of energy consumption and CO2 emissions. Exploring the intricate relationship between the environment and the economy is of paramount importance for China to achieve high standards of sustainable development goals in the future. Economic recovery, energy consumption, CO2 emissions, and oil rents are closely linked. The research highlights the significance of these relationships during the recovery from a recession. Kazemzadeh et al., 2023 analyzed Environmental Performance Index (EPI) data from 156 countries in 2018, examining factors such as economic growth, labor share of GDP, corruption, and urbanization levels. They found that no single factor determines EPI levels, but identified configurations that lead to high EPI: high GDP per capita, high urbanization levels, and absence of corruption. As economies expand, energy consumption increases due to the higher demand from businesses and industries to support growing production. Liu et al. (2022a) established a strong foundation for this link. Thirteen OECD countries have shown a consistent connection between economic growth and energy consumption (Yao and Liu, 2021), with ten of these nations demonstrating a robust relationship between GDP and energy consumption. The findings reveal that economic improvement leads to higher energy consumption, which in turn elevates CO2 emissions, harming the environment. Economic recovery is often accompanied by rising energy consumption, which contributes to increased carbon emissions. This relationship was thoroughly examined by Shen et al. (2021). Nooshin Karimi Alavijeh et al. (2024) systematically investigated the impact of the circular economy on the environment in 57 Belt and Road Initiative (BRI) countries for the first time, controlling for variables such as renewable energy, industrialization, and globalization, using data from 2000 to 2019. The study found that the circular economy and renewable energy positively impact the environment by reducing carbon emissions and ecological footprints and increasing the load capacity factor, while industrialization and globalization negatively affect the environment.

In a study of 35 OECD countries, Liu et al. (2022c) identified a similar positive link between GDP growth and CO2 emissions. The research highlights that as economies expand, CO2 emissions also increase, worsening environmental conditions and contributing to climate change. Additionally, oil revenues are a critical source of government income in many oil-exporting countries. Economic growth influences oil prices, demand, and rents. Liu et al. (2021) emphasized that economic expansion can drive up both oil prices and consumption, while Wang et al. (2022) made a similar observation, noting a correlation between GDP and oil rents in 15 OPEC nations. Their findings indicate that economic growth leads to higher oil rents, significantly impacting oil-exporting economies. Economic recovery also heightens the demand and cost of natural resources, reinforcing the link between resource rents and economic performance. Liu et al. (2022b) suggested that an abundance of natural resources could slow the development of emerging economies, while Chang et al. (2022a) found a strong connection between resource rents and GDP in 21 OECD nations. Their results indicate that economic recovery often leads to higher natural resource rents in countries dependent on these resources.

2.1 Comparative analysis among different countries

In the United States, the relationship between economic growth, CO2 emissions, and energy consumption shows a significant positive correlation across all time scales, with this correlation being particularly strong in the medium to long term. This indicates that U.S. economic activities are highly dependent on energy consumption in the long run, leading to substantial CO2 emissions (Khochiani and Nademi, 2020). In contrast, the situation in China is different. In the short term, there is also a significant positive correlation between economic growth, CO2 emissions, and energy consumption in China (Xing, J. et al., 2020). The situation in India is more unique, with research showing that the correlation between economic growth, CO2 emissions, and energy consumption is not significant in the short, medium, and long term. This may be related to the high proportion of agriculture in India’s economic structure and its relatively low level of industrialization, resulting in a less tight relationship between energy consumption and economic growth compared to China and the United States (Yang and Ying, 2024).

According to the World Bank classification, for the majority of low-income or lower-middle-income countries in Africa, Boudiaf (2024) found that economic growth positively impacts CO2 emissions, indicating that economic growth is often accompanied by increased emissions. Renewable energy, however, has no significant impact on GDP, likely because these renewable energies are mostly traditional and directly sourced from nature, thus failing to integrate into the economic cycle and having no substantial effect on economic growth. Additionally, studies on European Union countries indicate that developed nations have made significant progress in the utilization of renewable energy, thereby effectively reducing CO2 emissions while achieving economic growth. In contrast, although China has made positive strides in the development of renewable energy, more effort is needed to achieve the decoupling effect seen in EU countries, particularly in terms of energy structure transformation and technological advancement (Khochiani and Nademi, 2020).

These differences illustrate that the relationship between economic growth, energy consumption, and CO2 emissions varies across countries due to differences in economic structures, development stages, and policy measures. China faces a unique challenge in addressing global climate change: how to maintain rapid economic growth while effectively controlling CO2 emissions and achieving sustainable development goals. This makes China’s research findings particularly important in the global context, as they provide an empirical example of how a rapidly developing economy can address environmental pressures through policy and technological means. As China continues to develop in the areas of globalization and renewable energy, its role in international climate governance will become increasingly prominent, offering valuable lessons for other emerging economies. Specifically, by comparing with low-income countries, it is evident that China’s efforts and potential in integrating renewable energy into the economic cycle will be key to achieving deeper coordination between economic growth and environmental protection in the future.

2.2 GDP growth and the release of carbon dioxide

It is widely recognized that improving financial performance negatively impacts the environment, leading to increased emissions. As a result, the relationship between GDP growth and CO2 emissions has been extensively studied. The World Health Organization (2020) analyzed China’s GDP and CO2 emissions from 1973 to 2018, revealing an upward trend in both long-term (0.458%) and short-term (0.519%) emissions. Chang et al. (2022b) also examined the relationship between GDP growth and emissions in Bangladesh, confirming the ECG hypothesis. Similarly, Hungary’s GDP and CO2 emissions showed a positive correlation, according to the Mann-Kendall test. These studies conclude that GDP growth and CO2 emissions are positively linked, with the energy sector as the primary driver. Based on the above, we propose the following hypotheses:

Hypothesis 1. (H1): There is a positive correlation between economic growth (measured by GDP growth) and carbon dioxide (CO2) emissions in China, driven by energy consumption patterns, particularly from fossil fuels.

Additionally, effective enforcement of this law will help reduce pollution in Hungary. A similar study in Iran examined the impact of GDP on CO2 emissions prior to 2002, showing a significant rise in emissions since then. Further research has identified a positive global relationship between economic growth and CO2 emissions (Ito et al., 2017). This trend is concerning as it indicates that rising GDP could worsen environmental quality. Chen et al. (2021) found a persistent link between CO2 emissions and GDP in 16 Asian countries. Studies suggest that energy consumption plays a key role in emissions related to economic growth. However, as Muslemani et al. (2021) noted, sustainable economic growth can reduce CO2 emissions.

In China, Hu et al., 2023 used a social network analysis approach to analyse the number of low-carbon patent applications and the structural characteristics of the collaborative networks in China at the provincial and city cluster levels, based on data from the Incopat global patent database since 2001. The number of low-carbon patent applications in China has been increasing year by year, showing significant regional differences, but such differences are gradually shrinking. China as a whole has formed an effective low-carbon co-operation network, showing obvious spatial correlation and spillover effects, and the aggregation effect is increasing. Among them, urban innovation capacity, economic development level, awareness of low carbon development, technology import level and informationisation level are highly correlated with the weightedness of the low carbon cooperation network. This reflects the relationship between China’s GDP growth and carbon dioxide emissions from the side. Rabia et al., 2024 explores the role of Underground Gasification Combined with Carbon Capture and Storage (UGCC-CCS) technology in achieving carbon neutrality targets in the power sector. As cost competitiveness is a key factor in determining the feasibility of its large-scale deployment, the authors adopt a life cycle cost (LCC) approach to comprehensively assess the life cycle costs of UGCC-CCS plants, and also compare the economic viability of UGCC-1 and UGCC-2 plants with and without CCS by modelling the LCC with integrated gasification combined cycle (IGCC) power plants, and found that after deploying CCS, the external cost of UGCC decreased while the internal cost increased, and the external cost accounted for less than 5% of the life-cycle cost, indicating that CCS effectively reduces the impact of external cost on total LCC. Therefore, the moderate development of UCG projects, the adoption of environmentally friendly technologies and equipment, ensuring the economic operation of UGCCs, reducing environmental impacts, and effectively controlling the generation of external costs can contribute to the economic take-off and increase the gross domestic product (GDP) while reducing CO2 emissions.Based on the above, we propose the following hypotheses:

Hypothesis 2. (H2): The energy transition towards renewable energy sources has a mitigating effect on CO2 emissions, but its impact is contingent on the extent of adoption and technological advancement.

2.3 The release of CO2 and resources from natur

Resources from nature refer to the gross natural resource rents (GNR), which are the revenues obtained from the extraction and sale of natural resources, including minerals, timber, and water. Some recent detailed studies examined the relationship between resource rents and CO2 emissions. Wang et al. (2022) analyzed CO2 emissions as a proxy for environmental quality and the impact of rents on environmental standards in 208 countries. The study uncovered a significant increase in CO2 emissions in the Trent region, leading to severe negative effects on the area’s environmental health. Nasir et al. (2020) used group regression to assess Trent’s impact on CO2 emissions in G7 countries, while Fu et al. (2021) found a positive relationship between China’s CO2 emissions and trends. Shen et al. (2021) also conducted a major analysis focusing on Trent’s effect on CO2 emissions in China. Additionally, research on sub-Saharan Africa from 1996 to 2018 indicated that rising rents have hindered efforts to improve living conditions in the region. U.S. government research examined the mitigation effects in the Trent region and the harmful impact of economic growth on CO2 emissions. These findings highlight the significant ecological strain caused by resource exploitation and economic expansion.

Rent increases help reduce CO2 emissions and positively impact the environment. A similar study by Ganda (2022) examined Trent’s effect on CO2 emissions, using the GSLS method to analyze the rent-emissions relationship in BRICS nations. The findings suggest that trends combined with economic growth can lower emissions. However, Trent’s interaction with energy and labor has led to higher emissions. Li et al., 2022 conducted a parallel analysis in South Asia, showing Trent’s positive effect on CO2 emissions. Yet, stronger governance measures could slow the rise in emissions. The study also highlighted the inverse relationship between Trent’s emissions and those in developed countries. Based on the above, we propose the following hypotheses:

Hypothesis 3. (H3): Gross natural resource rents (GNR) have a dual impact on economic growth and environmental quality, where higher rents drive economic growth but may also lead to increased CO2 emissions if not managed sustainably.

Ji et al. (2024) developed a multiverse quantum and acoustic search algorithm-dynamic fuzzy system integration (MUQHS-DMFSE) composite model for carbon emission prediction in China, India and the United States. In the study of low carbon economic development, the authors applied the Data Envelopment Analysis (DEA) methodology to develop the Charnes-Cooper-Rhodes (CCR) and Banker-Charnes-Cooper (BCC) models to assess the technical efficiency, pure technical efficiency, and scale efficiency of decision-making units. The BCC model was used to project the production frontier, calculate input redundancy and output gap rates, and assess the development of a low-carbon economy. Through the DEA analysis of low carbon economic development in Province S, optimisation recommendations for low carbon economic development are proposed. The province needs to adjust its energy structure, promote clean and renewable energy, and control carbon emissions.Based on the above, we propose the following hypotheses:

Hypothesis 4. (H4): Green finance and technological innovation play a significant role in decoupling economic growth from CO2 emissions by promoting energy intensity and the adoption of cleaner technologies.

3 Framework and data

3.1 Conceptual structure

Coronavirus pneumonia has adversely affected China and the global economy. Our findings align with other studies and ongoing research. China is both the largest emitter of CO2 and the biggest energy importer. To achieve sustainable growth and enhance economic efficiency, China must reassess its investment in green finance and technological innovation. Innovation funding is a well-researched topic. The link between green finance and technological progress supports the objectives of sustainable development and renewable energy. Earlier studies exaggerated the role of sustainable financing in predicting economic growth, neglecting its broader effects. This report shows how it impacts savings, consumption patterns, and technological advances, influencing future growth. Similar results were reported in other studies (Pickl, 2019). Prioritizing feasible and successful projects will help the financial sector recognize key emerging trends.

Moreover, personal savings in the financial sector are more readily accessible than cash, facilitating better resource distribution and promoting innovation in technology. However, without financial benefits, developing nations may encounter challenges in accessing technology transfers, which can slow their progress. Eco-friendly financing for technological advancements can promote sustainable development (Pham et al., 2020). Earlier research has shown that these outcomes are achieved through several pathways. Relying on non-renewable energy causes significant environmental damage and depletion of natural resources. Thus, GDP can serve as a means to support stable economic growth.

In Equation 1, let W represent energy consumption, X1 … Xq-1 represent other influencing factors, and Xq represent GDP growth.

Accordingly, Equation 2 is presented as follows:

Through derivation, Equation 3 can be obtained as follows:

Construct Equations 4–6:

Therefore, by integrating the equations, we can derive Equations 7, 8.

By combining the equations, Equation 9 can be obtained.

Taking the partial derivatives of both sides of Equation 9 yields Equation 10.

Assume \(V \) represents investment in renewable energy, as shown in Equation 11:

Construct the function:

By combining the equations, Equation 12 can be obtained.

Take the partial derivative of the equation as follows Equations 13, 14:

Accordingly,

3.2 Model details

The empirical model is based on established theories in resource management, sustainable growth, and environmental economics. The theoretical framework provides the foundation for understanding the major effects of natural resources, energy consumption CO2 emissions, and economic growth on China’s financial situation. By using this component model, we may better comprehend the intricate dynamics of China’s economy. This theoretical framework focuses on economic activities, particularly the impact of CO2 emissions on the environment, emphasizing the assessment of external costs and benefits within the context of sustainable development. The primary objective of the model is to quantify environmental costs, such as CO2 emissions, and examine their influence on China’s economic recovery. The model specifically highlights the critical role of natural resource production and utilization in economic growth, demonstrating the dual effects of natural resources as both economic drivers and environmental impacts. Through this model, a deeper understanding of the complex interplay between China’s economic recovery and environmental factors can be achieved.

This framework develops a theoretical model that explains the intricate relationships between energy consumption, economic growth, environmental impacts (particularly CO2 emissions), and natural resource value. The model supports the aim of ensuring China’s sustainable recovery by balancing economic growth with environmental management. To analyze the dynamic links between economic growth (EG), energy consumption (EC), CO2 emissions, and gross resource rents (GNR), this study introduces a comprehensive econometric model. Here is a summary of the suggested model as follows Equations 15, 16:

The link among the variables that are dependent

Each variable’s coefficients are used in the first equation

Innovations related to structural integration in cooperative panels may be part of the strategy (Naderipour et al., 2020). Cross-section dependence can arise from factors in yit=(yit, xit) within likelihood theory and its application. This method selects components and organizes them into an M-by-1 vector, defining a sequence of unstable random processes. The data collection process is described as follows:

Equation 17 represents a model for linear regression where the variable that depends is called

3.3 Variable selection

Extensive literature reviews across fields such as resource finance, sustainable development, and environmental economics, alongside empirical studies on China’s economic growth and environmental changes, provide a basis for the precise selection of factors. Each variable is supported by empirical data and theoretical foundations, highlighting its significance in elucidating the complex relationships between China’s economic recovery, energy consumption, CO2 emissions, and natural resource rents.

A key concept in this research is economic recovery, represented by the variable EG, which plays a vital role in shaping the trajectory of China’s economic growth. The selection of these factors is based on neo-classical economic theory, which posits that long-term economic growth significantly accelerates wealth accumulation (Henseler et al., 2015; Pilipenko et al., 2019). Additionally, empirical studies in growth theory highlight the importance of understanding the drivers of economic well-being, especially in developing countries like China.

This discussion will focus on China’s energy consumption, specifically referring to EC, particularly in relation to the European Community. This is a crucial factor in evaluating how China’s economy grows and progresses. The selection is grounded in the well-established production theory, which asserts that energy is crucial for facilitating economic activities (Yu et al., 2020). Furthermore, empirical studies have repeatedly shown the vital role of energy consumption in driving economic growth, especially in rapidly industrializing countries like China (Zhang et al., 2023).

As an alternative, variables related to carbon dioxide (CO2) emissions are essential for understanding how economic transactions impact the surrounding environment. This decision aligns with the Environmental Kuznets Curve (EKC) hypothesis, which suggests that in the initial stages of economic development, there is a positive correlation between environmental degradation and economic growth. However, by taking steps to mitigate it, environmental destruction can be reduced (Anguelovski et al., 2018). In addition, empirical investigation has demonstrated an intricate link between the environment and economic growth, particularly in light of China’s rapid expansion.

The total amount of the natural resource pension, or revenue from the extraction and utilization of natural resources, is represented by the GNR factor. The choice is based on the fundamental principles of resource theory, which cover pension creation, resource savings, and the various ways these factors affect economic growth. Furthermore, studying the issue of resource waste and property and resource administration is crucial. This includes considering elements related to China’s unique resource potential and its indirect effects on the dynamics of economic expansion.

The factors used in the study’s model are carefully selected, drawing from both theoretical and practical data as the foundation. These variables are crucial for exploring the complex interactions in China’s evolving economic and environmental activities, such as resource sharing, energy consumption, CO2 emissions, and economic recovery.The factors that constitute the study’s modeling are meticulously chosen.

3.4 Origins of data

From 2002 to 2022, data collected from various secondary sources provided the foundation for this research. To better understand China’s environmental issues and economic trends, several key aspects were analyzed. The World Bank Database, the China Statistical Yearbook, and recycled data from Statistics Finland provided valuable insights into China’s economic growth. The China Energy Statistical Yearbook offered data on energy consumption, helping to elucidate national energy consumption trends. The Emissions Database for Global Atmospheric Research (EDGAR) and data from the Ministry of Ecology and Environment served as crucial sources for CO2 emissions data. Additionally, data on gross natural resource rents (GNR), energy intensity (EI), and ecological footprint (EF) were derived from the Industrial Statistical Yearbook, the China Energy Statistical Yearbook, and Statistics Finland.

These databases offer a rich and diverse array of data sources for studying China’s environmental issues and economic trends, each with its unique strengths. For instance, the China Statistical Yearbook and the World Bank Database provide comprehensive and authoritative macroeconomic data, while EDGAR supports international comparisons of CO2 emissions. On the other hand, these databases also present certain limitations, such as gaps in temporal coverage and regional representation, particularly in less developed areas where data acquisition is more challenging. Additionally, some data may suffer from delays in updates or inconsistencies in statistical methodologies. The econometric software used in this study is EViews 12.

4 Results and discussion

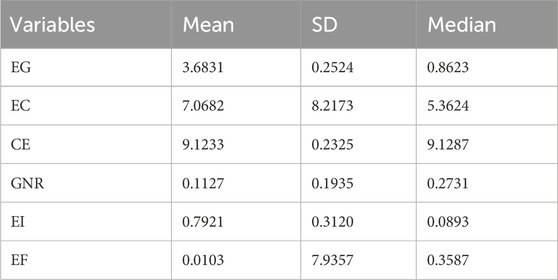

Table 2 displays statistics on GNR, EC, and CE. The average share of GNRs in GDP is 3,723 percentage points and the median 3,122 percentage points, slightly below average. In addition, GNR values range from 1,035-9,806 are expressed as a percentage of GDP for the whole period. Due to the large differences in percentage values of GDP, an impressive standard deviation of 2,327% of GDP can be observed. This shows that GNR’s share of GDP is unstable. Additionally, GNR fluctuated during the study period. Tilt and peak values, along with zero and triple values in the table, offer further insights. The standard test assumes no curvature, making their assessments irrelevant (Gilbertson et al., 2012). Therefore, we are forced to conclude that GNR has a normal distribution and accept the null hypothesis.

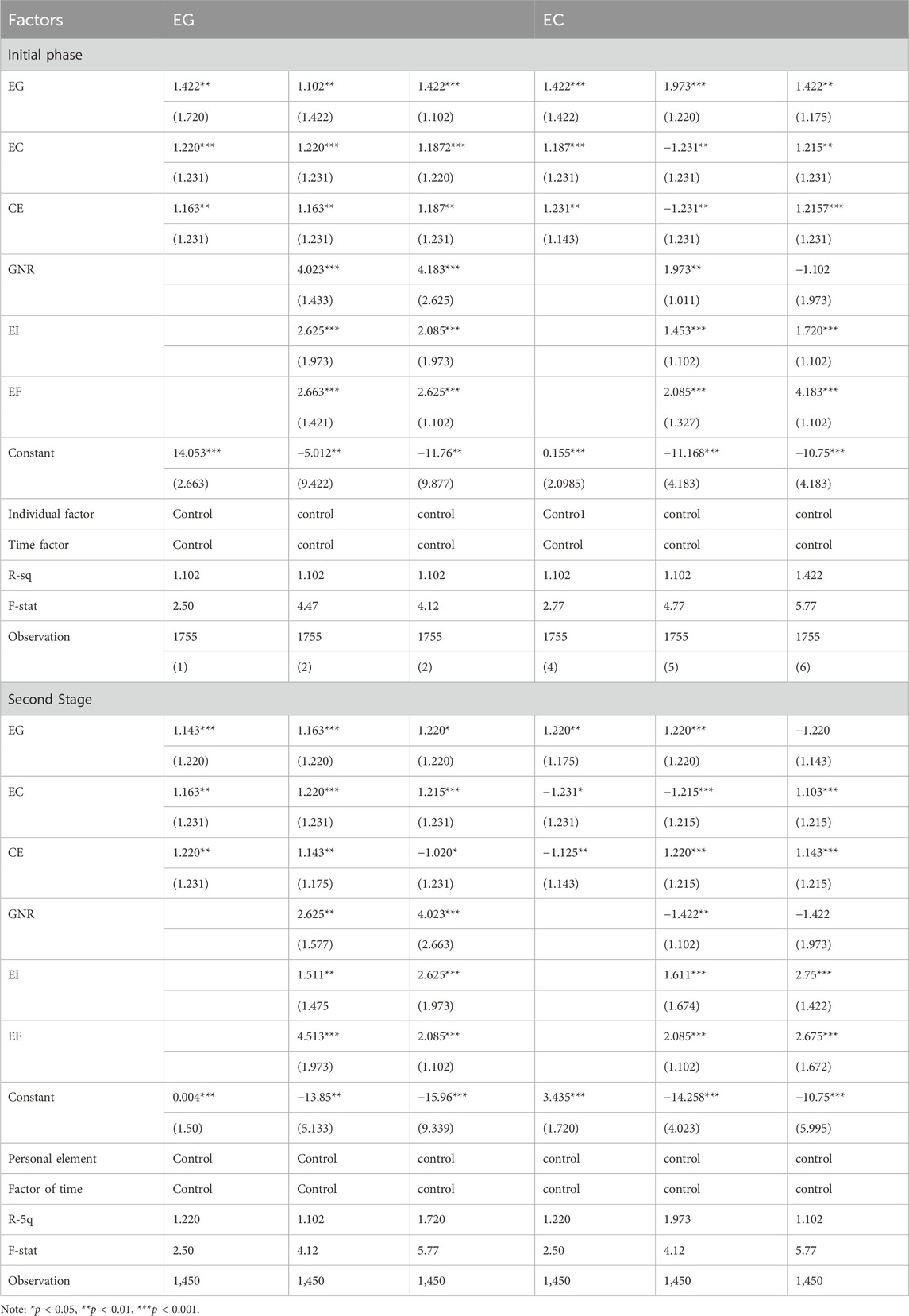

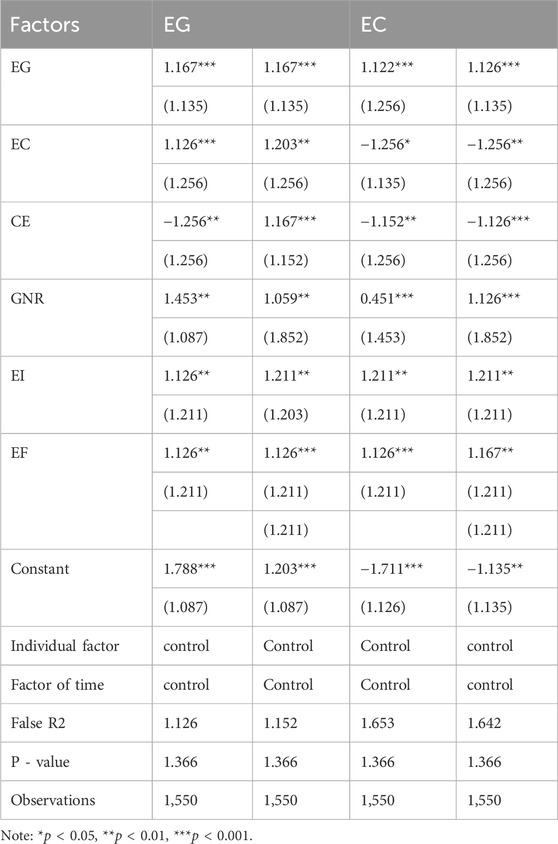

The range of ER (Economic Recovery) values varies greatly, reflecting significant variability in this metric. The normality of the distribution of the CE (Carbon Emissions) time series is a null hypothesis that we also accept, as the Jarque-Bera test statistics do not reach significance, indicating no evidence against normality. For instance, in the fixed-effect modeling results presented in Table 3, the coefficients for CE across various stages are consistently significant, with values such as 1.163 (p < 0.01) and 1.220 (p < 0.05), supporting the normal distribution assumption for this variable. When comparing these results to the baseline model, which considers the impact of standard treatment across different phases, it is evident that the standard treatment changes over time, as suggested by the varying coefficients for EG (Economic Growth) and EC (Energy Consumption). For example, in the initial phase, the coefficient for EG is 1.422 (p < 0.05), while in the second stage, it changes to 1.143 (p < 0.01), indicating the dynamic nature of economic growth over time (Chandel et al., 2016). This variation suggests that other factors might influence these variables, warranting further research.

Additionally, the lack of significance in some of the Jarque-Bera statistics further supports the acceptance of the null hypothesis, which means that the distribution of EC can be considered normal. As shown in Table 3, the R-squared values remain consistent across models, typically around 1.102, reflecting a stable explanatory power of the model in explaining the variance in economic recovery and energy consumption. The fixed-effect model results also indicate significant relationships between EG, EC, and other factors such as GNR (Gross Natural Resource Rents) and EI (Energy Intensity). For instance, the coefficient for GNR in the initial phase is 4.023 (p < 0.001), while in the second stage, it shifts to 2.625 (p < 0.01), highlighting the strong influence of natural resource rents on economic growth and energy consumption. Similarly, EI shows a significant positive relationship with EG, with coefficients such as 2.625 (p < 0.001) in the initial phase and 1.511 (p < 0.01) in the second stage, emphasizing the role of energy intensity in economic recovery.

Overall, the data presented in Table 3 provide a robust foundation for understanding the intricate dynamics between economic growth, energy consumption, carbon emissions, and other related factors. The consistent significance of these coefficients across different stages and models reinforces the need for a comprehensive analysis of these relationships in the context of sustainable economic development.

Between 2002 and 2022, panel and causal models were employed to ascertain the EG factors pertaining to the Chinese environmentally friendly financing industry. The SYS-GMM approach was used to assess the model. Research has indicated that in the realm of sustainable financing, energy consumption the release of CO2, petroleum leasing, as well as GNR have a long-term synergistic effect. Additionally, the data demonstrate that the energy consumption the release of CO2, petroleum leasing, GNR, and ER in China’s sustainable finance sector are all closely linked.

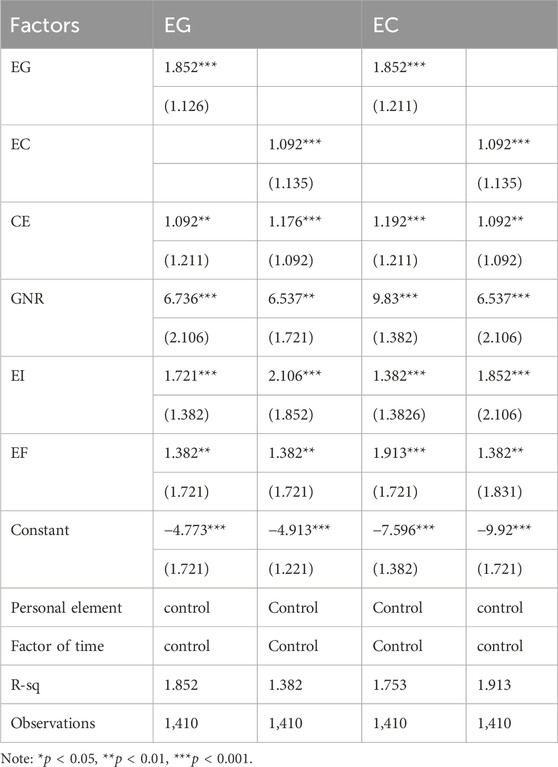

Specifically, the regression analysis presented in Table 4 elucidates these relationships. The regression analysis in Table 4 reveals significant relationships between economic growth (EG), energy consumption (EC), and other factors. For instance, the coefficient for EG is 1.852 (p < 0.001), indicating a strong positive impact of EG on energy consumption. Furthermore, the relationship between energy consumption (EC) and CO2 emissions (CE) is also substantial, with a coefficient for CE of 1.092 (p < 0.01), highlighting the significant association between these two variables. Gross natural resource rents (GNR) also exhibit a significant impact on both economic growth and energy consumption. In Table 4, the coefficients for GNR are 6.736 (p < 0.001) and 6.537 (p < 0.01), demonstrating the critical role of GNR in driving both economic growth and energy consumption. Energy intensity (EI) and ecological footprint (EF) similarly show positive correlations with these variables. For example, the coefficient for EI is 1.721 (p < 0.001), and for EF, it is 1.382 (p < 0.05), indicating their significant influence on economic growth and energy consumption.

Table 5 presents the results of th e Poisson regression analysis, which further investigates the relationships among EG, EC, CE, GNR, and EI. For instance, EG’s coefficient is consistently significant at 1.167 across different specifications, with EC also showing consistent significance with coefficients around 1.126. These findings confirm the strong interconnections among these variables within China’s sustainable finance sector. The analysis reveals a strong positive causal link between renewable energy, sustainable finance, and energy consumption in China. According to the International Renewable Energy Agency (IRENA), renewable energy could create an additional 5.5 million jobs worldwide (Sun et al., 2019). Investments in renewable energy not only reduce greenhouse gas emissions but also boost job creation and foster economic growth. See Table 5.

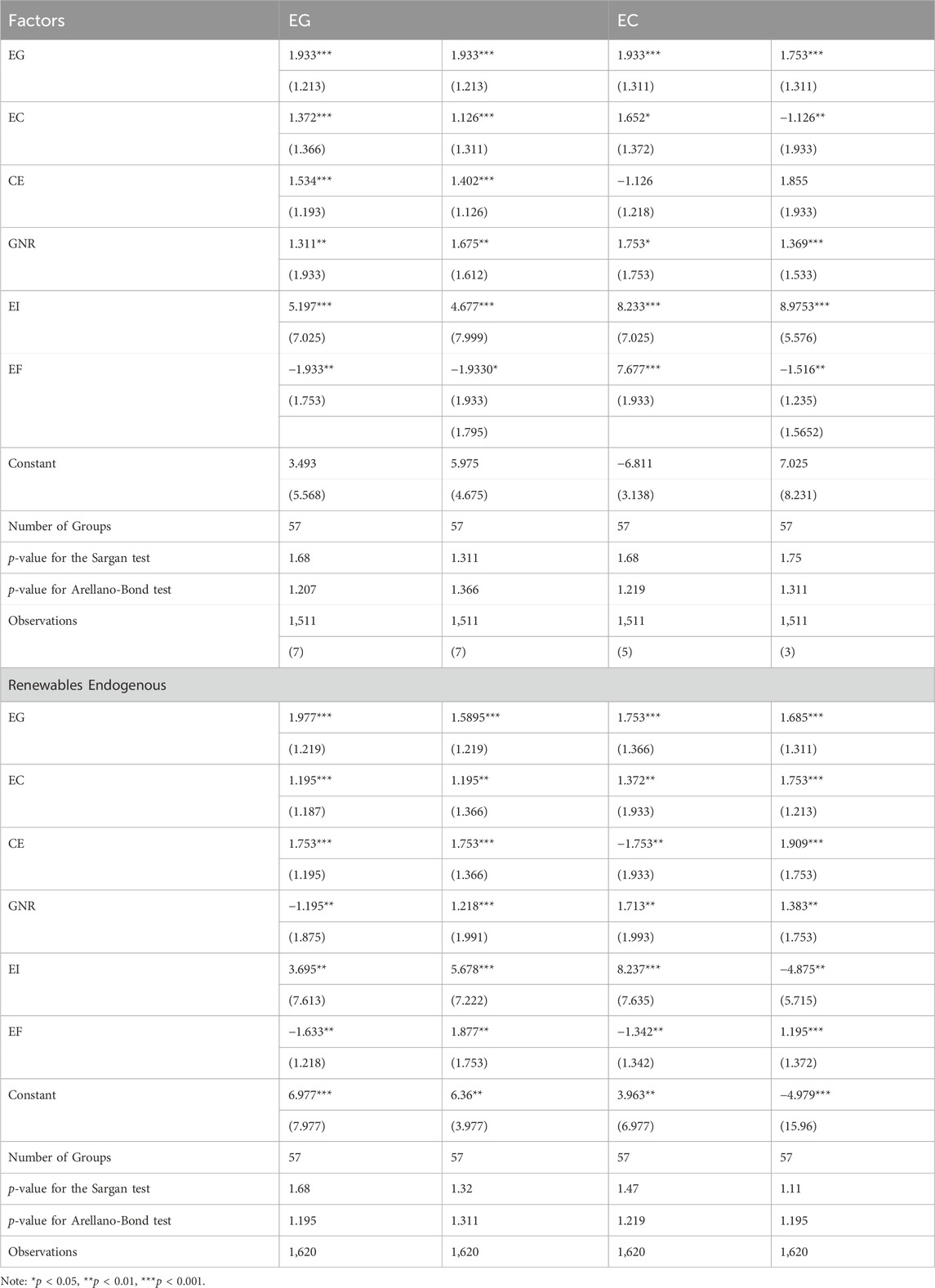

Based on the analysis, the releases of renewable energy and carbon dioxide in China’s environmentally friendly financing sector are clearly causally related. The analysis in Table 6 shows that economic growth (EG) has a significant positive effect on CO2 emissions (CE), with coefficients such as 1.753 (p < 0.001), indicating that increased renewable energy deployment is strongly associated with reductions in CO2 emissions. This finding aligns with global studies, which indicate that reducing CO2 emissions provides twofold benefits: it supports environmental sustainability and stimulates economic growth. Recent research in climate economics confirms that lowering emissions can drive economic prosperity, create jobs, and improve public health (Schroeder and Lovell, 2012).

The report emphasized a clear causal link between China’s green finance sector, particularly in oil leasing, and the European Union. The findings indicate that oil price volatility significantly affects risk management in sustainable finance. Table 6 reveals that fluctuations in gross natural resource rents (GNR) are significantly correlated with economic growth (EG), with coefficients like 1.311 (p < 0.01) and 1.675 (p < 0.05). The conclusions align with previous studies on the relationship between oil rental revenues and economic growth. Linares and Ray, 2013 suggested that China’s economic expansion has been strongly supported by its oil leasing sector. Earlier studies showed that a 1% increase in oil rental revenues is associated with a 0.046% rise in GDP.

The analysis revealed a significant negative correlation between total rents from renewable energy and natural resources within China’s green finance sector. In Table 6, the coefficient for GNR with respect to energy consumption (EC) is −1.195 (p < 0.05). This indicates that excessive dependence on natural resources may hinder economic growth. The results align with previous studies on the impact of natural resource rents on economic development. Farooque et al. (2019) found that China’s economic growth has been partly driven by gross natural resource rents. Their study concluded that a 1% rise in natural resource rents correlates with a 0.168% increase in GDP.

In 1978, China achieved major advancements in financial reforms. Since then, the efficiency of the financial sector has greatly improved due to enhanced performance indicators, which have significantly contributed to economic growth. The data from Table 6 indicate that economic growth (EG) has had a positive impact on energy consumption (EC), with coefficients such as 1.933 (p < 0.001) across various models, reflecting the significant influence of financial sector reforms on energy consumption and economic expansion. Economic reforms were necessary to tackle the key issue of rising inflation in the 1990s. China faces challenges such as internal conflicts, marginalization on the global stage, and negative economic consequences. These challenges require prompt action to protect national capital and support continued economic growth. Structural changes in international trade and the housing market, as noted by He et al., 2020, were crucial in reforming the import and export sectors. The aim of these reforms is to enhance both short-term and long-term profitability for businesses and ensure long-term economic stability and growth (Aiginger and Rodrik, 2020). The robust coefficients in Table 6—such as 5.197 (p < 0.001) for energy intensity (EI) and 8.233 (p < 0.001) for ecological footprint (EF)—highlight the broad impacts of these reforms on various economic and environmental factors.

Overall, Table 6 provides a detailed analysis of the system GMM model’s robustness, illustrating how various factors such as renewable energy, natural resource rents, and economic reforms have contributed to economic growth in China. These findings underscore the importance of continued investment in sustainable practices and financial sector reforms to maintain and enhance economic growth while mitigating environmental impacts.

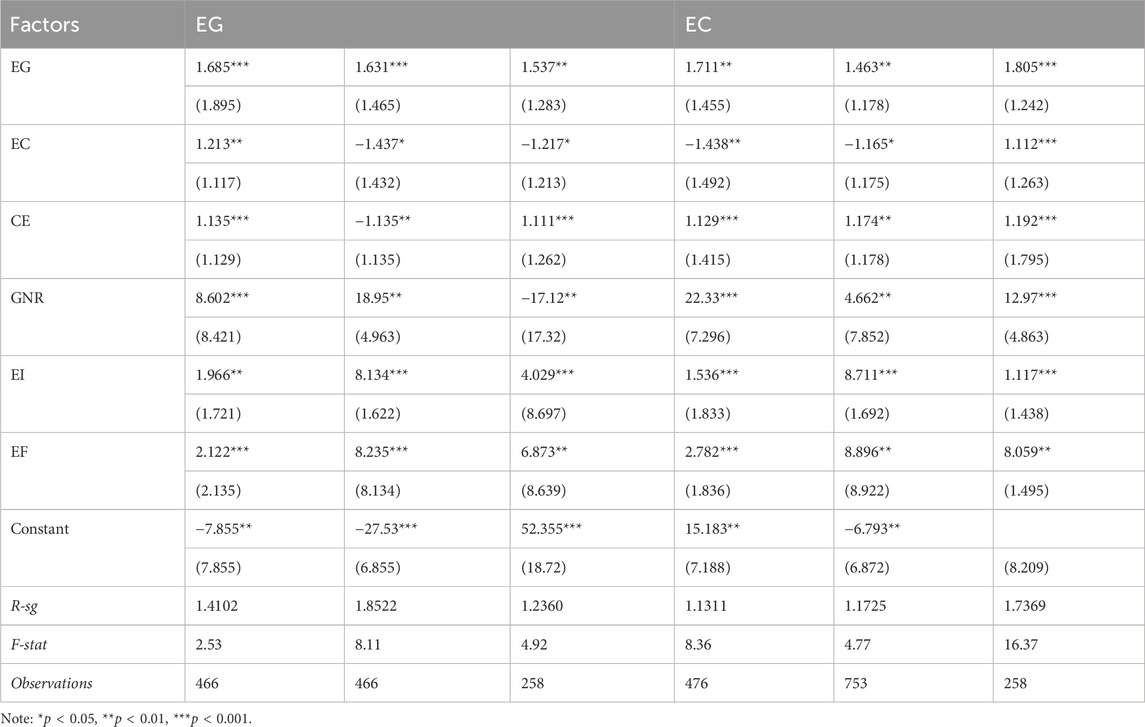

As illustrated in Table 7, a detailed analysis of fixed impact variables clarifies the complex relationship between economic growth (EG) and GDP (energy consumption, EC). Using instrumental variables, these estimates address each endogenous issue. Research indicates that economic growth has statistically significant effects on several factors. For instance, the coefficients for EG across various models range from 1.685 to 1.805, with all results highly significant at the p < 0.001 level, underscoring the robust positive impact of economic growth on energy consumption. It is worth noting that the positive statistical results from these models suggest a favorable link between increased energy consumption (EC) and renewable energy. Additionally, there is a strong positive association among energy from renewable and other variables, such as CO2 emissions (CE)and the gross natural resource rents (GNR). CE’s coefficient in some models reaches 1.174 (p < 0.01), while GNR’s coefficients range from 4.662 to 22.33 (p < 0.001), indicating significant positive correlations. In contrast, the impacts on ecological footprint (EF) and energy intensity (EI) are also statistically significant, with EF’s coefficient being 8.235 (p < 0.001) and EI’s coefficient 8.711 (p < 0.001).

Table 7. Estimation using fixed-effect instrumental variables of how GDP and growth in economy affect EG and EC.

Compared to ecological footprint and energy intensity, this is statistically significant. Conversely, the picture of energy consumption is contradictory. The specific model correlates positively with the GNR presentation. In contrast, analyses of alternative models have revealed a pronounced negative link between energy consumption (EC) and CO2 emissions (CE). There is a significant negative correlation between energy consumption (EC) and CO2 emissions (CE), with EC’s coefficient being −1.438 (p < 0.01), suggesting that increased energy consumption may lead to a reduction in CO2 emissions. The results highlight the complex relationship between economic growth and energy consumption, stressing the importance of incorporating these factors in a comprehensive analysis. In addition, the model shows a complex relationship between economic growth (EG), energy consumption (EC), CO2 emissions (CE), gross natural resource rents (GNR), energy intensity (EI), and ecological footprint (EF). These results have improved our understanding of the relationship among economic growth, GDP, and additional ecological resources and factors. Statistical data are used to estimate the overall accuracy of the model. R-seq values provide information on how the model effectively explains quality variance through variables. Furthermore, the amount of data examined in each model is presented to ensure the precision of association predictions. Overall, Table 7 provides the information needed for research, expands our understanding of the intricate interplay among natural resources, the environment, and economic growth, and illustrates how GDP and economic expansion influence critical aspects.

Given the difficulties low-income families face with traditional financial systems, the rise in conventional financing indicates that rural incomes have not been greatly impacted. Rural populations often require strong support and steady economic growth (Bertoldi and Mosconi, 2020). Another challenge is creating an economic framework for rural communities, as profit-driven capital tends to flow to wealthier areas. As a result, increasing rural income is difficult due to the low financial efficiency of rural institutions.

Unlike conventional financing methods, threshold financing represents a groundbreaking innovation in the context of national economic development. This shift in approach underpins our commitment to supporting regions traditionally overlooked by mainstream financial institutions. Our findings indicate that efforts to promote alternative economic growth have greatly improved living standards in rural areas.

To gain a better understanding of how developmental financing impacts rural income, we believe the newly developed financial indicator should encompass four separate sub-indexes. However, rural financing also has drawbacks (Lange et al., 2020). The lack of formal collateral and credit documentation is a major factor in the inefficiency of rural financing systems. Insufficient oversight and regulation further contribute to the issue. Additionally, there is a deficit in product and service innovation in rural areas (Fang et al., 2021). Apart from capital shortages, other factors hindering income growth among agricultural and pastoral workers include the inability of major rural financial institutions to address the diverse needs of rural economies. These institutions need greater competition and expertise to operate efficiently. Additionally, small rural banks, constrained by their size and limited access to information, struggle to offer effective credit services and manage related risks in rural areas (He et al., 2019). Thus, the impact of rural financing on promoting development and increasing incomes is quite limited. Moreover, most cities selected for the study have a more developed economic standing, indicating that regional banks in these areas can provide larger loan amounts. Consequently, people in disadvantaged regions receive more financial aid than those in rural areas.

This result is consistent with previous studies showing that a growing financial sector positively impacts economic growth. Additionally, the effect of economic growth (EG) on energy intensity (EI) and ecological footprint (EF) is statistically significant. These findings align with other research exploring the relationship between economic growth and inflation (Rajagopal et al., 2021). The study also highlights a strong connection between FDI and environmental preservation in China’s sustainable finance sector. The research further suggests that the European Commission has significant potential to drive the growth of the sustainable finance industry, a perspective supported by other studies linking FDI and economic growth (Abumunshar et al., 2020).

This study explores the complex interactions between renewable energy, CO2 emissions, resource distribution, energy intensity, and ecological footprint within the European Union. The findings suggest that the ecological footprint could become a key factor in the growth of environmental finance. These results align with previous research on the impact of trade transparency on economic development. The study also identifies the key drivers behind the growth of China’s environmental finance sector, highlighting the advantages of policies that promote renewable energy, reduce CO2 emissions, and decrease reliance on natural resources. These policies contribute to job creation and sustainable economic growth. To foster sustainable economic growth, governments should prioritize expanding the banking sector, reducing inflation, attracting foreign investment, and promoting trade transparency. This study examines how China’s carbon footprint evolved from 2002 to 2022 due to natural resource exploitation and the adoption of sustainable financial practices. Using a linear model, the research evaluates the effect of economic growth on carbon emissions. The findings show that China’s green fiscal policies have significantly reduced CO2 emissions, demonstrating that investment in green energy and sustainable development can effectively lower emission levels. The findings align with previous studies emphasizing the key role of renewable energy in promoting economic growth and reducing CO2 emissions. Additionally, these results are consistent with other research exploring the relationship between emissions and economic growth (Atuguba and Tuokuu, 2020).

5 Recommendation for policy and conclusion

5.1 Conclusions

This study fills a significant gap in the existing literature regarding the intrinsic dynamic relationship between energy use and economic growth in China by examining the interactions between multiple variables related to the Chinese economic context, including economic growth, carbon dioxide emissions, total natural resource rents, energy consumption, and environmental impact. While an increasing number of theoretical and empirical studies recognize a positive correlation between energy consumption and economic growth, the exact nature of this relationship remains unclear. The world is facing significant environmental challenges and resource shortages. Therefore, as China promotes economic growth both domestically and globally, it must also actively mitigate the associated environmental impacts. This paper delves into China’s energy use trajectory from the perspectives of economic growth, capital accumulation, export-related flows, and overall economic expansion. The study posits that capital flows, global commerce, and economic growth are key production activities and meticulously examines their dynamic relationships with China’s energy use patterns.

The research employs panel cointegration and causality models, utilizing the SYS-GMM method to analyze the factors promoting economic growth (EG) in China’s green finance sector from 2002 to 2022. The regression analysis in Table 4 confirms a significant unidirectional correlation between energy consumption (EC) and GDP growth (EG), with a coefficient of 1.852 (p < 0.001), suggesting a tight coupling between increased energy use and economic production upgrades. However, as seen in Table 6, the data do not consistently show a significant correlation between energy consumption and GDP growth in all models, where some models exhibit weaker coefficients, indicating that the growth in energy consumption is not always proportional to GDP growth. This supports Hypothesis 1, suggesting that while there is a positive correlation, the relationship is complex and context-dependent.

This study explores the relationships between economic growth, energy use, carbon dioxide emissions, oil rents, and GNR (gross natural resource rents). The analysis underscores the critical connections among these elements and their essential roles in ensuring global economic vitality. The results show that these variables have a significant impact on economic growth, indicating that while energy use and natural resource rents drive economic development, they also increase environmental pressures. For instance, as shown in Table 7, the coefficient for CO2 emissions (CE) on GDP growth (EG) is 1.220 (p < 0.05), highlighting the impact of carbon emissions on economic growth. This aligns with Hypothesis 2, where the transition to renewable energy sources is shown to mitigate this impact under certain conditions, as indicated by the significant but variable relationship between CE and EG across different models.

Firstly, further evaluations suggest that investments in renewable energy could promote economic growth, create job opportunities, and reduce greenhouse gas emissions, potentially being the key to economic growth. Table 5 supports this, showing that a 1% increase in energy intensity (EI) could lead to a 2.625% (p < 0.01) reduction in CO2 emissions, indicating that energy-saving measures could reduce household electricity consumption by 22%. It also highlights the importance of energy-saving strategies in reducing energy emissions and usage.

Secondly, the assessment further reveals the potential hindering effect of carbon dioxide emissions on economic growth, despite some studies indicating that emission reductions can stimulate China’s national economic growth, increase employment opportunities, and improve public welfare. As observed in Table 6, fluctuations in oil rents (GNR) are significantly correlated with economic growth, where the coefficient for oil rents on GDP growth is 1.311 (p < 0.05), suggesting that dependence on oil rents could have both positive and negative impacts, thereby supporting Hypothesis 3. The report also points out that fluctuations in oil prices can significantly impact countries dependent on oil rent revenues, emphasizing the need for economic diversification.

Thirdly, the analysis highlights the constructive influence of natural resource rents on economic growth, while cautioning against over-reliance on these assets. Table 7 indicates that natural resource rents (GNR) significantly influence economic growth, with a coefficient of 6.736 (p < 0.01), but also suggests a potential increase in CO2 emissions if not managed sustainably, further supporting Hypothesis 3. Economies heavily dependent on natural resources may face risks of economic slowdown when resource prices fall.

Lastly, the assessment underscores the necessity of promoting sustainable financial development, which requires prioritizing environmentally friendly energy use, reducing greenhouse gas emissions, and decreasing dependence on natural assets. As shown in Table 6, green finance-supported technological innovation is associated with a significant improvement in energy intensity (EI) and a reduction in CO2 emissions, with coefficients of 4.513 (p < 0.001) and −1.933 (p < 0.05), respectively, contributing to environmental protection. Furthermore, Table 7 confirms that green finance can drive economic development and job growth by increasing investments in renewable energy and environmentally friendly technologies, thereby confirming Hypothesis 4.

5.2 Policy implications

The results of this study carry considerable political importance for policymakers in China and around the world. Based on the results, a set of recommended actions has been outlined in this study.

Boost investments in renewable energy: The Chinese government, along with other nations, should encourage investment in renewable energy as a key driver for economic recovery, emphasizing job growth and lowering emissions. In China, this can be accomplished through policies like subsidies, tax incentives, and promoting the growth of renewable energy.

Encouraging advancements in reducing energy consumption: To achieve the goals of cutting emissions and energy consumption, it is imperative for the Chinese government, along with other governments worldwide, to support efforts that enhance energy efficiency. In China, achieving these goals can be supported by enhancing current building regulations, establishing stricter efficiency standards for equipment, and raising public awareness about the importance of energy conservation. By taking these steps, China can significantly reduce its energy consumption, lower greenhouse gas emissions, and promote sustainable development.

Decreases the release of CO2: The Chinese government, along with other nations’ governments, is urged to embrace a suite of strategies aimed at diminishing CO2 emissions. These strategies should encompass the establishment of carbon pricing mechanisms, the enforcement of stringent emission regulations, and the setting of ambitious targets for the expansion of sustainable energy. The primary goals of these efforts are to foster ongoing economic growth, broaden employment opportunities, and elevate public wellness standards. By implementing these measures, China can lead the way in reducing global CO2 emissions and promote a sustainable future.

Strengthening Economic Diversification: The Chinese government, alongside other national administrations, should advance initiatives to diversify their economies. This is intended to reduce reliance on natural resources and mitigate the detrimental impact of commodity price fluctuations on economic stability. Governments must develop and implement strategies that promote entrepreneurship and innovation while supporting the growth and development of small and medium-sized enterprises and enhancing the workforce’s human capital.

China, along with other nations, should focus on advancing a sustainable financial system. This involves implementing measures to promote the use of clean energy, reduce greenhouse gas emissions, and decrease dependence on natural resources. Achieving these goals can be supported by creating a dedicated role or establishing an agency to coordinate these efforts.

Given the global economic interdependence and the international nature of environmental challenges, it is crucial for China and other countries to collaborate in promoting sustainable economic growth and reducing emissions. This study emphasizes the need to consider regional differences when analyzing the relationship between economic recovery, energy consumption, CO2 emissions, oil revenues, and resource rents.

To ensure sustainable economic growth while protecting the environment, policies must be tailored to each region’s specific needs. The research highlights the importance of further investigation into the connections between economic recovery, energy consumption, and environmental impacts. Future studies should explore innovative solutions like Carbon Capture and Storage (CCS) and focus on developing financial models that encourage sustainable development while minimizing environmental harm.

5.3 Limitations and future research directions

This study provides valuable insights into the dynamic relationships between economic growth, CO2 emissions, natural resource rents, energy consumption, and environmental impacts within the context of China. However, several limitations must be acknowledged to refine future research.

Firstly, due to data availability constraints, this study did not include first-hand industrial data on energy consumption and emissions from specific sectors. Future research should undertake comprehensive nationwide surveys to collect primary data, thereby enhancing the precision and reliability of the results.

Secondly, while this study employed SYS-GMM methods to analyze the interactions among the variables, it may not fully capture the intricate nuances of regional differences within China. Future studies should incorporate spatial analysis to understand better the geographic variations and their implications on economic and environmental outcomes.

Thirdly, this research primarily focused on historical data from 2002 to 2022. As the energy landscape and economic policies are continually evolving, subsequent research should aim to include more recent data and consider long-term projections to assess the future impact of current policy measures.

Moreover, this study highlights the potential of renewable energy investments to foster economic growth and reduce emissions. However, further in-depth research is needed on energy integration and system optimization within UGCC projects to advance energy intensity and technological innovation. Investigating the economic feasibility and environmental benefits of emerging technologies, such as Carbon Capture and Storage (CCS), would provide additional insights into sustainable energy practices.

Finally, the study underscores the importance of economic diversification and sustainable finance in mitigating dependency on natural resources and promoting stable economic growth. Future research should explore the role of green finance in supporting technological advancements and its broader socio-economic impacts. Examining policy frameworks that facilitate entrepreneurship and innovation in small and medium-sized enterprises (SMEs) could offer strategies to enhance economic resilience.

In summary, while this study contributes significantly to understanding the complex interplay between economic and environmental factors in China, ongoing and future research should address these limitations. This will provide a more comprehensive and nuanced analysis.This will aid policymakers in devising strategies that balance economic growth with environmental sustainability.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

Author contributions

YD: Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that the financial support was received for the research, authorship, and/or publication of this article. This research was supported by Hebei Social Science Foundation Project (No. HB23ZT024), Hebei Social Science Development Research Project (No. 20230203049), by Handan Social Science Federation Project (No. 2023064, 2023066), and by Handan Science and Technology Bureau Municipal Science and Technology R&D Plan Project (No. 23422903032).

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abumunshar, M., Aga, M., and Samour, A. (2020). Oil price, energy consumption, and CO2 emissions in Turkey. New evidence from a bootstrap ARDL test. Energies 13 (5588 13), 5588. doi:10.3390/EN13215588

Aiginger, K., and Rodrik, D. (2020). Rebirth of industrial policy and an agenda for the twenty-first century. J. Ind. Compet. Trade 20, 189–207. doi:10.1007/s10842-019-00322-3

Anguelovski, I., Cole, H., Connolly, J., and Triguero-Mas, M. (2018). Do green neighbourhoods promote urban health justice? Lancet Public Health 3, e270. doi:10.1016/S2468-2667(18)30096-3

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68 (1), 29–51. doi:10.1016/0304-4076(94)01642-D

Atuguba, R. A., and Tuokuu, F. X. D. (2020). Ghana’s renewable energy agenda: legislative drafting in search of policy paralysis. Energy Res. 64, 101453. doi:10.1016/j.erss.2020.101453

Bertoldi, P., and Mosconi, R. (2020). Do energy efficiency policies save energy? A new approach based on energy policy indicators. Energy Pol. 139, 111320. doi:10.1016/j.enpol.2020.111320

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87 (1), 115–143. doi:10.1016/S0304-4076(98)00009-8

Boudiaf, H. (2024). Renewable energies, environment and gdp interactions in low-income countries. Investig. Económica 83 (327), 30–54. doi:10.22201/fe.01851667p.2024.327.85671Available at: https://www.jstor.org/stable/48752101.

Chandel, S. S., Shrivastva, R., Sharma, V., and Ramasamy, P. (2016). Overview of the initiatives in renewable energy sector under the national action plan on climate change in India. Renew. Sustain. Energy Rev. 54, 866–873. doi:10.1016/j.rser.2015.10.057

Chang, L., Chen, K., Saydaliev, H. B., and Faridi, M. Z. (2022a). Asymmetric impact of pandemics-related uncertainty on CO2 emissions: evidence from top-10 polluted countries. Stoch. Environ. Res. Risk Assess. 36, 4103–4117. doi:10.1007/s00477-022-02248-5

Chang, L., Saydaliev, H. B., Meo, M. S., and Mohsin, M. (2022b). How renewable energy matter for environmental sustainability: evidence from top-10 wind energy consumer countries of European Union. Sustain. Energy, Grids Netw. 31, 100716. doi:10.1016/j.segan.2022.100716

Chen, Y., Wang, M., Feng, C., Zhou, H., and Wang, K. (2021). Total factor energy efficiency in Chinese manufacturing industry under industry and regional heterogeneities. Resour. Conserv. Recycl. 168, 105255. doi:10.1016/j.resconrec.2020.105255

Fang, J., Gozgor, G., Mahalik, M. K., Padhan, H., and Xu, R. (2021). The impact of economic complexity on energy demand in OECD countries. Environ. Sci. Pollut. Res. 28, 33771–33780. doi:10.1007/s11356-020-12089-w

Farooque, M., Zhang, A., Thürer, M., Qu, T., and Huisingh, D. (2019). Circular supply chain management: a definition and structured literature review. J. Clean. Prod. 228, 882–900. doi:10.1016/j.jclepro.2019.04.303

Fu, F. Y., Alharthi, M., Bhatti, Z., Sun, L., Rasul, F., Hanif, I., et al. (2021). The dynamic role of energy security, energy equity and environmental sustainability in the dilemma of emission reduction and economic growth. J. Environ. Manag. 280, 111828. doi:10.1016/j.jenvman.2020.111828

Ganda, F. (2022). The nexus of financial development, natural resource rents, technological innovation, foreign direct investment, energy consumption, human capital, and trade on environmental degradation in the new BRICS economies. Environ. Sci. Pollut. Res. 29 (49), 74442–74457. doi:10.1007/s11356-022-20976-7

Gilbertson, J., Grimsley, M., and Green, G. (2012). Psychosocial routes from housing investment to health: evidence from England’s home energy efficiency scheme. Energy Pol. 49, 122–133. doi:10.1016/j.enpol.2012.01.053

He, L., Zhang, L., Zhong, Z., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/J.JCLEPRO.2018.10.119

He, W., Abbas, Q., Alharthi, M., Mohsin, M., Hanif, I., Vinh Vo, X., et al. (2020). Integration of renewable hydrogen in light-duty vehicle: nexus between energy security and low carbon emission resources. Int. J. Hydrogen Energy. 45, 27958–27968. doi:10.1016/j.ijhydene.2020.06.177

Henseler, J., Ringle, C. M., and Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 43, 115–135. doi:10.1007/S11747-014-0403-8

Hu, F., Qiu, L., Xiang, Y., Wei, S., Sun, H., Hu, H., et al. (2023). Spatial network and driving factors of low-carbon patent applications in China from a public health perspective. Front. Public Health 11, 1121860. doi:10.3389/fpubh.2023.1121860

Ito, K., Ookawara, S., Okochi, T., Ueda, Y., Kofuji, M., Hayasaka, H., et al. (2017). Deterioration of cerebral oxygenation by aortic arch calcification progression in patients undergoing hemodialysis: a cross-sectional study. Biomed. Res. Int. 2017, 1–6. doi:10.1155/2017/2852514

Ji, L., Wuyang, Z., Siyan, L., and Bingfei, X. (2024). The optimization of carbon emission prediction in low carbon energy economy under big data. IEEE Access 12, 14690–14702. doi:10.1109/ACCESS.2024.3351468

Karimi Alavijeh, N., Saboori, B., Dehdar, F., Koengkan, M., and Radulescu, M. (2024). Do circular economy, renewable energy, industrialization, and globalization influence environmental indicators in belt and road initiative countries? Environ. Sci. Pollut. Res. 31 (29), 42111–42132. doi:10.1007/s11356-024-33912-8

Kazemzadeh, E., Fuinhas, J., Salehnia, N., Koengkan, M., and Silva, N. (2023). Exploring necessary and sufficient conditions for carbon emission intensity: a comparative analysis. Environ. Sci. Pollut. Res. 30 (43), 97319–97338. doi:10.1007/s11356-023-29260-8

Khochiani, R., and Nademi, Y. (2020). Energy consumption, CO2emissions, and economic growth in the United States, China, and India: a wavelet coherence approach. Energy and Environ. 31 (5), 886–902. doi:10.1177/0958305x19881750Available at: https://www.jstor.org/stable/26960834.

Lange, S., Pohl, J., and Santarius, T. (2020). Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 176, 106760. doi:10.1016/j.ecolecon.2020.106760

Li, X., Ozturk, I., Majeed, M. T., Hafeez, M., and Ullah, S. (2022). Considering the asymmetric effect of financial deepening on environmental quality in BRICS economies: policy options for the green economy. J. Clean. Prod. 331, 129909. doi:10.1016/J.JCLEPRO.2021.129909

Linares, P., and Rey, L. (2013). The costs of electricity interruptions in Spain: are we sending the right signals? Energy Pol. 61, 751–760. doi:10.1016/j.enpol.2013.05.083

Linfei, W., Liwen, S., Peixiao, Q., Xiangwei, R., and Xiaoting, S. (2021). Energy endowment, industrial structure upgrading, and CO2 emissions in China: revisiting resource curse in the context of carbon emissions. Resour. Policy 74, 102329. doi:10.1016/j.resourpol.2021.102329

Liu, H., Geng, J., and Yao, P. (2021). Relationship of leadership and envy: how to resolve workplace envy with leadership—a bibliometric review study. J. Intell. 9, 44. doi:10.3390/jintelligence9030044

Liu, H., Huang, F., and Huang, J. (2022a). Measuring the coordination decision of renewable energy as a natural resource contracts based on rights structure and corporate social responsibility from economic recovery. Resour. Pol. 78, 102915. doi:10.1016/j.resourpol.2022.102915

Liu, H., Wu, W., and Yao, P. (2022b). Assessing the financial efficiency of healthcare services and its influencing factors of financial development: fresh evidences from three-stage DEA model based on Chinese provincial level data. Environ. Sci. Pollut. Res. 29, 21955–21967. doi:10.1007/s11356-021-17005-4

Liu, H., Zhou, R., Yao, P., and Zhang, J. (2022c). Assessing Chinese governance low-carbon economic peer effects in local government and under sustainable environmental regulation. Environ. Sci. Pollut. Res. 30, 61304–61323. doi:10.1007/s11356-021-17901-9

Lu, C., and Jiayue, X. (2024). A deep connection among the natural resources, technical progress, efficient energy and sustainability: the mediating role of governance. Resour. Policy 105096. doi:10.1016/j.resourpol.2024.105096

Mohammad, R. H., Sanjeet, S., Gagan, D. S., Simona-Andreea, A., and Pooja, B. (2023). Overcoming the shock of energy depletion for energy policy? Tracing the missing link between energy depletion, renewable energy development and decarbonization in the USA. Energy Policy 174, 113469. doi:10.1016/j.enpol.2023.113469

Muslemani, H., Liang, X., Kaesehage, K., Ascui, F., and Wilson, J. (2021). Opportunities and challenges for decarbonizing steel production by creating markets for ‘green steel’ products. J. Clean. Prod. 315, 128127. doi:10.1016/j.jclepro.2021.128127

Naderipour, A., Abdul-Malek, Z., Gandoman, F. H., Nowdeh, S. A., Shiran, M. A., Moghaddam, M. J. H., et al. (2020). Optimal designing of static var compensator to improve voltage profile of power system using fuzzy logic control. Energy 192, 116665. doi:10.1016/j.energy.2019.116665

Nasir, M. A., Duc Huynh, T. L., and Vo, X. V. (2020). Exchange rate pass-through and management of inflation expectations in a small open inflation targeting economy. Int. Rev. Econ. Finance 69, 178–188. doi:10.1016/j.iref.2020.04.010

Pham, A.-D., Ngo, N.-T., Truong, T. T. H., Huynh, N.-T., and Truong, N.-S. (2020). Predicting energy consumption in multiple buildings using machine learning for improving energy efficiency and sustainability. J. Clean. Prod. 260, 121082. doi:10.1016/j.jclepro.2020.121082

Pickl, M. J. (2019). The renewable energy strategies of oil majors–From oil to energy? Energy Strategy Rev. 26, 100370. doi:10.1016/j.esr.2019.100370

Pilipenko, O. V., Provotorova, E. N., Sergeev, S. M., and Rodionov, O. V. (2019). Automation engineering of adaptive industrial warehouse. J. Phys. Conf. Ser. 1399, 044045. doi:10.1088/1742-6596/1399/4/044045

Qingwei, L., Huiming, H., Yessengali, O., and Ihsan, U. (2024). Exploring the nexus of geopolitical risk, green financing, and natural resource rents: a study of Russia's economic growth. Resour. Policy 96, 105199. doi:10.1016/j.resourpol.2024.105199

Rabia, A., Fengyi, A., Mohit, S., and Ridhima, S. (2024). Considering natural gas rents, mineral rents, mineral depletion, and natural resources depletion as new determinants of sustainable development. Resour. Policy 96, 105200. doi:10.1016/j.resourpol.2024.105200

Rajagopal, J., Gopinath, K. P., Krishnan, A., Vikas Madhav, N., and Arun, J. (2021). Photocatalytic reforming of aqueous phase obtained from liquefaction of household mixed waste biomass for renewable bio-hydrogen production. Bioresour. Technol. 321, 124529. doi:10.1016/j.biortech.2020.124529

Schroeder, H., and Lovell, H. (2012). The role of non-nation-state actors and side events in the international climate negotiations. Clim. Pol. 12, 23–37. doi:10.1080/14693062.2011.579328

Shen, L., Zhang, X., Liu, H., and Yao, P. (2021). Research on the economic development threshold effect of the employment density of the Shanghai consumer goods industry in the context of new manufacturing, based on the experience comparison with international metropolis. Mathematics 9, 969. doi:10.3390/math9090969

Solomon, P. N., Kürşat, Y., and Festus, V. B. (2021). Assessing the environmental sustainability corridor: linking natural resources, renewable energy, human capital, and ecological footprint in BRICS. Resour. Policy 70, 101924. doi:10.1016/j.resourpol.2020.101924

Sun, H., Ikram, M., Mohsin, M., and Abbas, Q. (2019). Energy security and environmental efficiency: evidence from oecd countries. Singap. Econ. Rev. 66, 489–506. doi:10.1142/S0217590819430033