- 1College of Finance, Nanjing Agricultural University, Nanjing, China

- 2School of Economics and Management, Henan Agricultural University, Zhengzhou, China

Using data on Chinese A-share listed companies from 2010 to 2021, we employ the difference-in-differences (DID) estimation method as an exogenous impact of a quasi-natural experiment and analyze the effects of carbon risk on corporate financialization. We observe that increased carbon risk decreases with corporate financialization, which is more pronounced for financially constrained and state-owned enterprises. Furthermore, we find that carbon risk increases green innovation, which restrains corporate financialization. Our research not only enriches the relevant influence on carbon risk and corporate financialization but also provides Chinese evidence for the Porter hypothesis.

1 Introduction

According to the statistics of the International Energy Agency, global carbon dioxide emissions increased from 20.5 billion to 37.4 billion tons from 1990 to 2023. Over the past 30 years, China’s industrialization level and carbon dioxide emissions have continued to increase. In 1990, China contributed 10.3% to the global carbon dioxide emissions, a figure that swelled to 31.7%% by 2021. China is under increasing pressure to save energy and reduce its emissions.

The Kyoto Protocol was officially enacted on 16 February 2005, marking the first time that greenhouse emissions have been limited by regulations. The Kyoto Protocol was signed to protect humanity from the threat of climate change. The Paris Agreement stands as a collective pact embraced by 178 nations globally, serving as a unified framework for addressing climate change beyond the year 2020. The Paris Agreement was officially implemented on 4 November 2016. In a sense, the Paris Agreement was a successor to the Kyoto Protocol (Lv, 2016). According to Ministry of Ecology and Environment of the People’s Republic of China, in 2022 China’s carbon emission intensity has decreased by more than 51% compared to 2005. In 2020, China proposed the objective of “striving to reach the peak of carbon dioxide emissions prior to 2030 and attaining carbon neutrality by 2060” (commonly referred to as the double carbon goals) in response to the escalating global climate crisis. The double carbon goals are challenging for China and presents a severe challenge for enterprises. The added value of China’s secondary industry accounts for 39.9% of the GDP, which is the central pillar of China’s economic development at this stage. As of 31 October 2023, according to the industry distribution of the China Securities Regulatory Commission (CSRC), The secondary industry boasted a listing of 3,897 companies, constituting a substantial 73.42% portion of the total A-share listed companies. The collective market valuation stood at 52.87 trillion yuan, constituting 67.37% of the entire market capitalization of A-share listed companies. Secondary industries constituted a substantial portion of the national economy and encountered heightened environmental regulation. Consequently, such enterprises need urgent transformation and adaption to low-carbon and environmental development paths.

Long-term climate change caused by a series of production and operational activities is called environmental risks. Based on the uncertainty of environmental risks, the production and operational activities of enterprises may encounter a series of new challenges. If an enterprise fails to make relevant decisions, it will adversely affect its production, operations, and profits. (Romilly, 2007). As an essential component of environmental risk, carbon risk includes all the impacts of uncertainty on company value in the transformation of enterprises into a green economy (Gorgen et al., 2020). Carbon risk encompasses the array of uncertainties associated with climate change and the utilization of fossil fuels, encompassing three key components: regulatory, physical, and commercial risks (Labatt and White, 2007). The measurement of carbon risk is not only limited to the number of carbon emissions but also to the risk of uncertainty encountered by enterprises in their transition into a green economy. Therefore, this study defines carbon risk as the uncertainty risk of production, operation, and green transformation faced by enterprises under a tightening climate policy. The main causes of carbon risk can be summarized as follows: (1) enterprises may suffer greater economic penalties in the context of green environmental protection; (2) the use of fossil energy primarily generates carbon emissions, and enterprises may not be able to digest existing energy reserves in a timely manner, causing the risk of falling energy commodity prices; and (3) enterprises relying on fossil energy are vulnerable to new energy technology risks (Bolton and Kacperczyk, 2021).

Many companies tend to overly allocate resources into financial assets with the aim of achieving greater immediate profits. This trend is commonly referred to as corporate financialization, which is a crucial issue in corporate governance (Krippner, 2005). Because financial virtual assets are characterized by high liquidity, high speculation, and high return rates, enterprises invest extra capital in virtual assets to achieve the goal of exceeding real economic profits to maximize profits. Cai and Ren (2014) define corporate financialization from two aspects of behavior and results: enterprises are more focused on capital operations and investments rather than physical operations. Furthermore, corporate earnings stem from investments and capital transactions outside of production and operations, with a focus on capital appreciation rather than operational gains. With the increasing yield gap between real investment and financial investment, a considerable quantity of capital flows into the virtual economy, resulting in a price bubble for financial assets. Real enterprises turn to financial asset investment instead of the original main business, crowding out green technological innovation and further aggravating the carbon risk. On the one hand, the signing of the Paris Agreement enables countries to introduce corresponding policies, strengthen external supervision, limit the emissions of high-emission firms, and compel enterprises to undertake green upgrades to meet emission reduction requirements. On the other hand, energy conservation and emission reduction will impact the production and operation of traditional industries and increase the financing difficulty of high-emission firms, resulting in production and operation uncertainties. It is unknown whether the carbon risks posed by the Paris Agreement will lead to corporate financialization. Therefore, we intend to investigate this issue.

Enterprises face increasing risks under increasingly strict carbon emission policies. For corporations, excessive financialization does not support sustained growth. With this background, this study examines the impact of carbon risk on corporate financialization and finds that carbon risk can restrain corporate financialization. Furthermore, we explore the influence channel of carbon risk. We find that carbon risk can restrain corporate financialization by encouraging corporations to implement green innovation. Finally, we conduct a series of robustness tests and a channel test. Our research provides a path for Chinese enterprises and other emerging markets to develop robustly in a carbon risk environment.

Overall, this study’s contributions include the following: First, previous studies have mainly focused on micro level research on corporate financialization such as internal control, but few studies have considered corporate financialization from the perspective of carbon risk. This article employs the difference-in-differences (DID) estimation model to enhance and broaden the scope of pertinent research concerning the economic implications of carbon risk. Second, this article offers a valuable reference to the research concerning corporate investment and financing, focusing on the influence of environmental regulation. After China signed the Paris Agreement, facing stricter carbon regulation policies, there has been little in-depth discussion in the academic community on how corporations will adjust the proportion of their financial assets. Third, this research employs China’s ratification of the Paris Agreement as a quasi-natural experiment to elucidate the causal link between carbon risk and the financialization of corporations, which helps alleviate endogeneity issues in previous research. At the same time, this study provides an in-depth analysis of the impact mechanism, laying the foundation for future research. Taking the typical emerging market in China as the background, we found that carbon risk can effectively restrain corporate financialization, which has reference significance for other countries undergoing green transformations.

The remainder of this study is structured as follows. Section 2 reviews the related literature and develops the hypotheses on the effect of carbon risk on corporate financialization. Section 3 introduces the empirical methodology and data. Section 4 presents the main results and examines the channel mechanisms. Section 5 presents robustness checks. Section 6 summarizes our conclusions.

2 Literature review and research hypotheses

According to traditional neoclassic theory, environmental regulation policies affect enterprise management, increase the cost of pollution and emission controls, reduce enterprise productive investment funds, and cause a capital crowding-out effect, causing enterprises to fall into a survival crisis. However, the Porter hypothesis has a different perspective. This holds that reasonable and strict environmental regulation policies can stimulate enterprises’ innovation ability, improve their productivity, and their market competitiveness, and thus compensate for capital crowding caused by environmental regulation. Presently, secondary industries, such as manufacturing, are encountering greater environmental pressure. The requirements for green environmental protection and low-carbon emissions compel such enterprises to innovate and transform themselves. The high concentration of secondary industries such as industry and manufacturing in a specific region will aggravate the consumption of local energy and resources, along with the deterioration of the ecological environment and other problems. The Yangtze River Economic Belt has relatively serious environmental pollution caused by the overcapacity of the manufacturing industry and the relatively high proportion of highly polluting manufacturing industries (Ye et al., 2022). The geographical distribution of China’s industrial green innovation illustrates a notable diversity, highlighting a pattern of being “abundant in the eastern regions, scarce in the western regions, abundant in the southern regions, and limited in the northern regions”. It is evident that environmental regulation has a distinct threshold effect on the influence of green innovation (Duan et al., 2022). The customization of enterprises’ environmental strategies under environmental regulation has significant industry heterogeneity (Chen, 2022). Environmental regulation and green innovation are the key factors in China’s environmental governance. Environmental regulation significantly promote green technology innovation and exhibit heterogeneity across different regions (Kong et al., 2024). The development of marine economy in coastal cities in China mainly relies on green technology innovation, and environmental regulations are still in the initial stage (Ren and Ji, 2021). Thus, the main environmental problems are caused by high energy consumption and pollution in the production and operations of secondary industries. Enterprises must adapt to low-carbon green production through green innovation.

In 2013, China’s first carbon emissions trading platform established in Shenzhen. Carbon emission trading has a positive impact on the green technology innovation of energy enterprises, especially state-owned enterprises and large enterprises (Jia et al., 2024). After the introduction of the Chinese Certified Emission Reduction (CCER) trading and offsetting mechanism in the national carbon market, control and emission industries with high carbon emission intensities chose to buy additional CCER (Zhang and Pang, 2022). The carbon risk brought about by the Kyoto Protocol can effectively encourage enterprises to undertake green innovation, especially high-carbon emission enterprises such as cement manufacturing (Cary and Stephens, 2024).

Carbon risk and environmental regulation affect the capital structure of enterprises and their financing constraints. The correlation between carbon regulation policy risk and a company’s capital structure is quite noteworthy, showing that firms tend to decrease their financial leverage in response to heightened risks associated with carbon policies (Shu et al., 2023). Environmental regulation can effectively promote green innovation in enterprises but will weaken enterprises with strong financing constraints (Xie, 2021) and Abundant financial resources can alleviate the adverse effects of environmental regulatory penalties on enterprises (Wang et al., 2023). Based on regulation theory, the stricter the environmental regulation, the more intensive the supervision of enterprises with high pollution and emissions, the higher the cost of production and operation, the higher the risk of default, and the tighter the external capital supply. Wang and Sun (2021) delve into the ramifications of carbon risk on corporate capital structures, analyzing data from Shanghai and Shenzhen A-share listed companies spanning the decade from 2010 to 2020. The findings indicate that carbon risk could diminish the financial leverage of companies and exacerbate their financing limitations.

Several factors impact corporate financialization, which also impact enterprises’ investment behavior and decisions. Xing et al. (2022) used the 2016–2020 data of Chinese A-share listed companies to analyze the influence of environmental uncertainty on enterprise investment behavior. This demonstrated that environmental uncertainty reduces enterprise fixed asset and R&D investments and intensifies the degree of corporate financialization. The financialization of enterprises has hindered the development of China’s economy. The excessive financialization of real enterprises and the bubble of financial assets have weakened the basic role of the real economy in the national economy. Guo et al. (2022) found that there is a negative relationship between green innovation and financialization in enterprises and market competition can alleviate this negative relationship. Do environmental factors cause corporate financialization? Analyzing 2014–2016 A-share listed companies’ data, Yu and Ma (2021) used the Environmental Protection Law as a quasi-natural experiment. They observed through empirical research that environmental regulation prevented corporate financialization and to some extent promoted the transformation and upgrading of enterprises. This improved their R&D performance and reduced the extrusion of financialization in the real economy. Du et al. (2017) found that there are two effects on entity enterprises: one is the reservoir effect and the other is the crowding out effect. The financialization of a company undermines its future fundamental performance, highlighting that the extent of the displacement effect outweighs the extent of the resource effect.

According to the Porter hypothesis, carbon risk can help enterprises undertake green transformation and upgrading and stimulate enterprises to undertake technological innovation. Some high-energy, carbon-intensive enterprises reduce their carbon emissions through technological innovations. Meanwhile, if excess carbon emission indicators exist, they can be traded in the carbon market to stimulate the technological innovation of enterprises. The fluctuation of carbon trading prices and high-priced carbon trading encourages enterprises to undertake green innovation (Lv and Bai, 2021). Simultaneously, if the cost of innovation is high or industry innovation is difficult, enterprises carry out carbon emission trading and purchase carbon emission rights from the market to achieve normal production and operation. If the price of carbon emission rights in the market is high, or the number of carbon emission rights required by enterprises far exceeds the cost of green innovation, enterprises will be forced to carry out green innovation. Under the dual-carbon background, enterprises face increased operational risks and difficulties with external financing. Meanwhile, in the face of production and operation activities with high carbon emissions, they must upgrade technology or purchase emission amounts in the carbon market. This is bound to reduce enterprises’ investment in financial and fixed assets to improve innovation and solve the difficulties in production and operation. According to Yao et al. (2019), the disclosure of environmental information plays a crucial role in easing financial constraints for businesses, which is more pronounced for high-polluting firms. Based on this, we propose the first hypothesis:

Hypothesis 1. A rise in carbon risk can promote enterprises’ green technological innovation and restrain corporate financialization.

Environmental regulation increases the business risks of enterprises, increase the pressure for energy conservation and emissions reduction, increase costs, aggravate the financing constraints of enterprises, and worsen their business environment. Firms raise funds mainly through internal (retained earnings) and external (debt and equity) financing. When carbon risk increases, the external financing cost increases, and funds from banks decrease. Enterprises are more inclined toward internal financing (Brown et al., 2009). After the introduction of stricter carbon policies, enterprises need funds to mitigate carbon risks. As risks increase, financing constraints for enterprises are also increasing (Zhu and Hou, 2022). Carbon risk can influence corporate financialization through a financing constraint mechanism. The risk of carbon dioxide emissions is incorporated into enterprise valuation and risk management. The reassessment of investment prospects may affect the value of collateral, and access to credit conditions will be stricter, increasing the uncertainty and risk profile of enterprises’ future cash flows (Kabir et al., 2021). The Kyoto Protocol has curtailed the financial sway wielded by corporations emitting high levels of carbon, as a surge in carbon-related risks inevitably results in escalated financial strain for these enterprises (Nguyen and Phan, 2020). Carbon risk increases enterprises’ credit risk, decreases the value of mortgage assets, makes credit conditions stricter, and creates higher financing constraints. When carbon risk increases, enterprises with stronger financing constraints encounter greater difficulties with external financing. As enterprises need funds to pursue green transformation and innovation to alleviate the operating difficulties caused by carbon risk, they rely more on internal financing and reduce investments in financial assets to cover the increase in operating and innovation costs. Thus, we propose the second hypothesis:

Hypothesis 2. For enterprises with high financing constraints, carbon risk has an obvious inhibitory effect on corporate financialization.

To demonstrate whether the impact of carbon risk on enterprises is through green innovation channels, we divided the sample into state-owned and private enterprises. China is currently in an economic transition, and public ownership is the main body. In this context, the development processes between state-owned and private enterprises differ. Compared to state-owned enterprises, private enterprises are more motivated to invest in R&D and technological innovation (Yu et al., 2019). Environmental policies have different effects on enterprises with different property rights. Yan et al. (2024) studied the relationship between environmental regulation, property rights, and technological innovation, and observed that environmental regulation plays a greater role in promoting innovation in private enterprises than in state-owned enterprises. Considering property ownership, private enterprises generally have challenges in financing, high financing cost problems, and mortgage rates, and the loan term of private enterprise loans is significantly lower than that of state-owned enterprises. Consequently, they encounter stronger financing constraints (Wang and Tan, 2021). When enterprises suffer from a carbon risk impact, private enterprises have stronger financing constraints and shorter loan terms than state-owned enterprises. However, private enterprises have stronger innovation motivations and need more funds for green innovation. Therefore, they fail to invest additional funds in financial assets. Building upon the preceding discourse, we assert the subsequent third hypothesis:

Hypothesis 3a. Compared with state-owned enterprises, carbon risk has a more obvious inhibitory effect on the financialization of private enterprises.

Owing to this special system, state-owned enterprises and local governments have a mutual assistance relationship, and state-owned enterprises are a relevant medium for local governments to implement macro-control. When local governments implement the green transformation development strategy, state-owned enterprises need to play the role of “vanguard,” making them more inclined to green transformation (Shu and Liao, 2022). State-owned enterprises, as the most reliable force for the party and country to rely on, constitute an important force for promoting economic and social development while also ensuring and improving humanity’s lives. Consequently, they shoulder greater social responsibilities than private enterprises.

Hypothesis 3b. Compared with private enterprises, carbon risk has a more obvious inhibitory effect on the financialization of state-owned enterprises.

3 Data and methods

3.1 Data

We gathered data pertaining to A-share listed companies spanning the period from 2010 to 2021 to serve as our research specimens. This data was sourced from the China Stock Market and Accounting Research (CSMAR) database. We selected 2010 as the research starting point because it marks the commencement of China’s carbon emissions trading. Owing to the particularity of financial and insurance industry statements, the financial and insurance industries are excluded. Simultaneously, missing financial statements and key data in the statements were excluded from the listed companies, and Stocks containing ST or PT during the sample period were excluded. To minimize the impact of outliers, we winsorized all continuous variables at the top and bottom 1%. Finally, 32,494 “enterprise-year” observations were obtained.

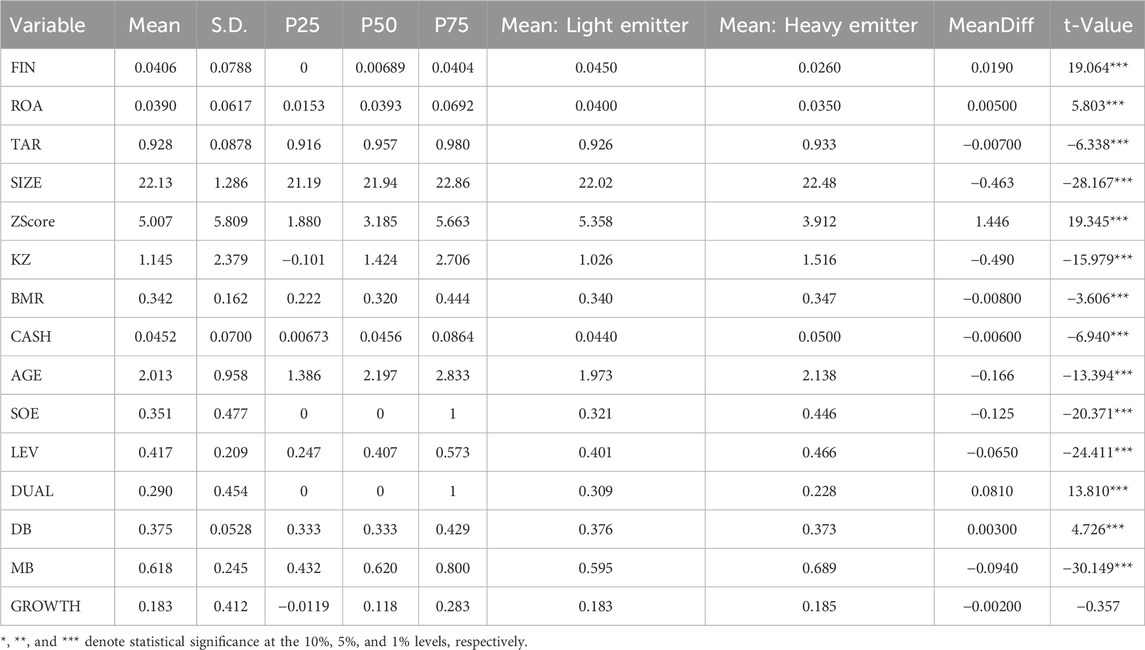

We use the methods proposed by Song and Lu (2015) and Du et al. (2017) to measure corporate financialization. Corporate financialization (Fin) refers to the ratio of financial assets relative to total assets within a corporate framework. Financial assets encompass an array of components, including traded financial assets, derivative financial assets, disbursed loans and advances, available-for-sale financial assets, held-to-maturity investments, and net investment in real estate. Return On Assets (ROA) is the ratio of net profit to total assets. Tangible assets ratio (TAR) is the ratio of total assets net of intangible assets, goodwill, and total assets. Enterprise Scale (SIZE) is the log of total assets. The Z-score represents financial distress. The KZ index is used to represent financing constraints. The book-to-market ratio (BMR) is the ratio of stockholder equity to market value. Cash flows are the ratio of net cash flows to the book value of assets. The listing age is the log of the time to market plus 1. A property right (SOE) of one indicates a state-owned enterprise. The debt-to-assets ratio (LEV) is total debt to total assets: Dual is a dummy variable, where one indicates that the chairperson and general manager are the same. The independent director ratio is the ratio of independent directors to all directors. Growth opportunity (MB) is the ratio of total assets to the market value. Growth ability is the total revenue growth rate.

3.2 Empirical methods

Difference-in-differences (DID) stands as a pivotal statistical method employed within the realms of quantitative research in both econometrics and the social sciences. It attempts to use observational research data to simulate experimental design by studying the differential effects between the “treatment group” and the “control group” in natural experiments. It estimates the effect of a treatment on an outcome by comparing the average change over time in the outcome variable for the treatment group, to the average change over time for the control group. According to the literature review, the carbon risks faced by enterprises are mainly due to the transformation risks brought about by carbon emission policies. Owing to the lack of corporate carbon emission data, this study uses the Paris Agreement signed in 2016 as a quasi-natural experiment to explore the relationship between carbon risk and corporate financialization. In traditional empirical studies, carbon risk and firm behavior have strong endogeneity owing to reverse causality (Levine et al., 2018). This study selected the Paris Agreement as a policy to measure carbon risk, which has a certain rationality. First, the Paris Agreement is an exogenous event for enterprises, and the implementation target is carbon-intensive enterprises. Therefore, it is easy to distinguish the experimental group from the control group by the nature of the industry which, to some extent, alleviates the endogenous problem caused by reverse causality. Second, we use the text analysis method to extract information about carbon risk from corporate social responsibility reports and conduct univariate and OLS regression analyses with the Paris Agreement. The results showed a strong positive correlation between the carbon risk and the Paris Agreement. Third, we sorted the comments of the State-owned Assets Supervision and Administration Commission of the State Council, the Ministry of Finance, and other relevant policies on carbon in 2016. We also excluded the impact of other policy effects. In summary, it is reasonable to use the policy effects of the Paris Agreement to measure carbon risk. Our baseline DID model takes the following form:

Post is a dummy variable for the period during which China signed the Paris Agreement. The value of Post was one in the year in which the event occurred and thereafter. Treat represents dummy variables of the experimental and control groups. Only carbon-intensive enterprises were affected by this policy. Therefore, the value of Treat is 1, indicating that the enterprise is carbon-intensive. In industry, emissions come primarily from burning fossil fuels to produce heat for industrial processes such as making paper or steel. According to the International Energy Agency, Largest source of CO2 emissions in China, 2021 is Electricity and heat producers, 56%. The proportion of carbon emissions in Chinese industries is attached in the Supplementary Figure S1. Owing to the lack of micro-carbon emission data at the enterprise level, we determined the experimental group (high carbon emission enterprises) according to the carbon emissions and energy consumption level of the industry in which the enterprise is located. Individual characteristics of enterprises can cause bias in regression analysis. Kruger (2015) believes that industries can be independent of individuals and can effectively alleviate these biases. Specifically, we will focus on electricity, heat, and gas production and supply industries; oil and natural gas mining industries; non-metal and non-ferrous metal mining industry; non-ferrous metal and ferrous metal smelting and rolling processing industry; chemical raw materials, chemical fiber and chemical products manufacturing industry; metal, ferrous metal, and non-metallic mineral products manufacturing industry; petroleum processing; coking, and nuclear fuel processing industry; building decoration industry; housing, civil engineering and other aspects of the construction industry; wood processing, paper and wood, bamboo, rattan, brown, grass, paper products industry, metal products machinery; and the equipment repair industry (Wang and Sun, 2021). Enterprises within these sectors are defined as high carbon emission enterprises (heavy emitters); others are low carbon emission enterprises (light emitters). The controls are a series of control variables referenced from Wang and Sun (2021) and Gu et al. (2022).

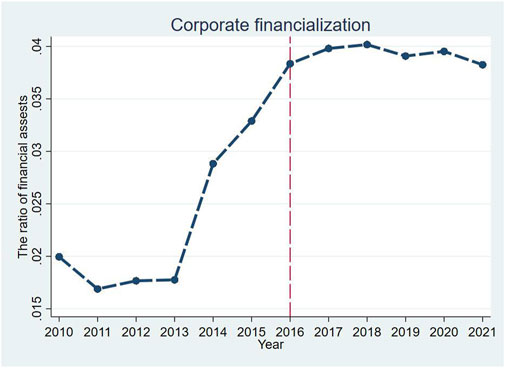

Table 1 provides a comprehensive breakdown of the specific details pertaining to the variables, while Table 2 offers an overview of the descriptive statistics associated with these variables. The results of a t-test show that all variables except growth are significant at the 1% level, and that there is a significant difference between high- and low-carbon emission enterprises. The characteristics of FIN, ROA, Zscore, Dual, and DB are significantly higher for low-carbon emission enterprises than for high-carbon emission enterprises. Similarly, we observe that TAR, SIZE, KZ, BMR, CASH, AGE, SOE, LEV, and MB are lower for low-carbon-emission than high-carbon-emission enterprises. Additionally, we analyze trends in corporate financialization. After the 2016 Paris Agreement, the upward trend in corporate financialization slowed and stabilized in Figure 1.

4 Empirical results

4.1 Analysis of baseline regression results

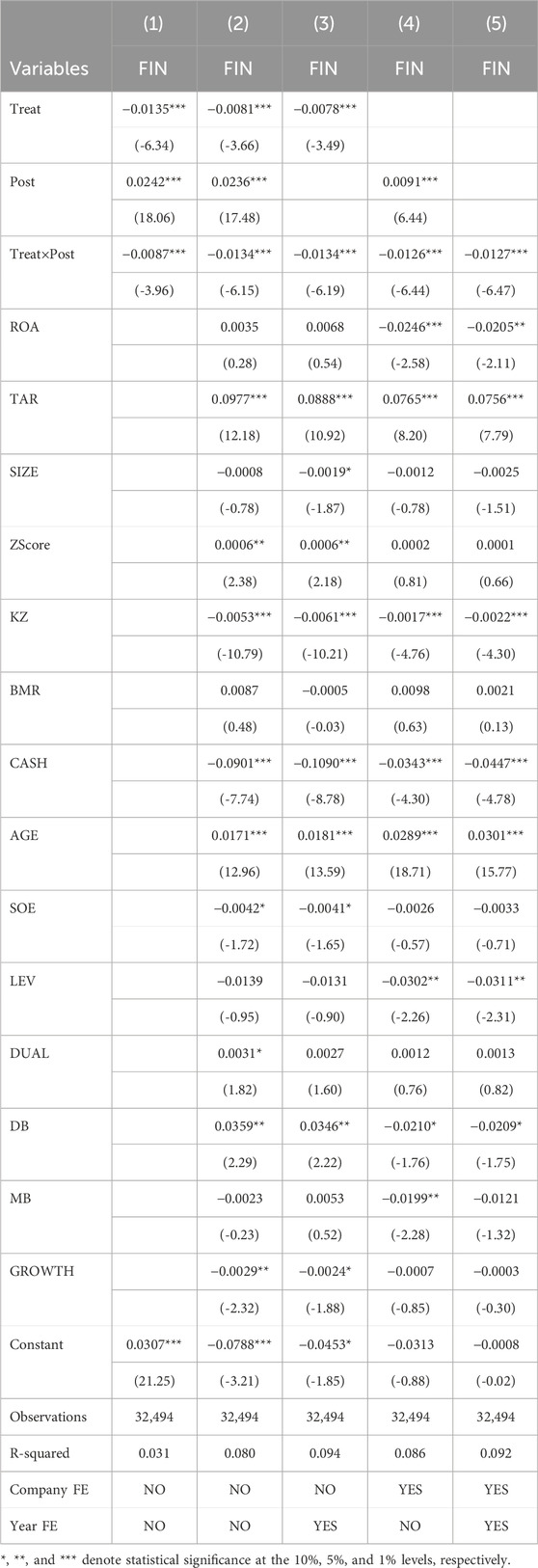

This section delves into the impact of the Paris Agreement on corporate financialization within a multivariate framework, wherein various other factors known to influence corporate financialization are carefully controlled for. We adopted the model of Eq. 1 for the regression analysis. The regression results are presented in Table 3. Column 1 excludes all control variables and firm- and year-fixed effects. Column 2 includes the control variables but excludes both firm- and year-fixed effects. In Column 3, we incorporate not only the control variables but also the firm-fixed effects. Moving on to Column 4, it encompasses both the control variables and the year-fixed effects. In Column 5, we incorporate the control variables along with firm- and year-fixed effects. The findings reveal that the coefficients associated with the interaction term Treat×Post exhibit negativity, falling within the range of −0.0134 to −0.0087. Importantly, these coefficients maintain statistical significance across all models. This implies a notable trend: heavy emitters experienced a reduction in their financialization leverage after the implementation of the Paris Agreement. The Post coefficient is positive in Column 4, indicating that from the perspective of time, the degree of financialization is on the rise. The Treat coefficient is negative in Column 3, indicating that the degree of corporate financialization is lower for heavy emitters than for light emitters. Therefore, the Paris Agreement offsets the aggravation of corporate financialization caused by a change in time, and the net benefit of the final implementation of the policy remains negative. If no policy is implemented, the degree of corporate financialization is expected to be more pronounced, which supports hypothesis H1.

Regarding the influence of control variables, the results indicate that the possible directions are almost consistent with our expectations. Columns 2 to 5 have added control variables, and the coefficients before KZ are all negative, indicating that financing constraints have an inhibitory effect on corporate financialization. This is consistent with the research findings of Chen et al. (2023) which indicate an inverse relationship between financing constraints and corporate financialization. Meanwhile, this conclusion also provides empirical evidence for hypothesis H2.

4.2 Test of parallel trend assumption

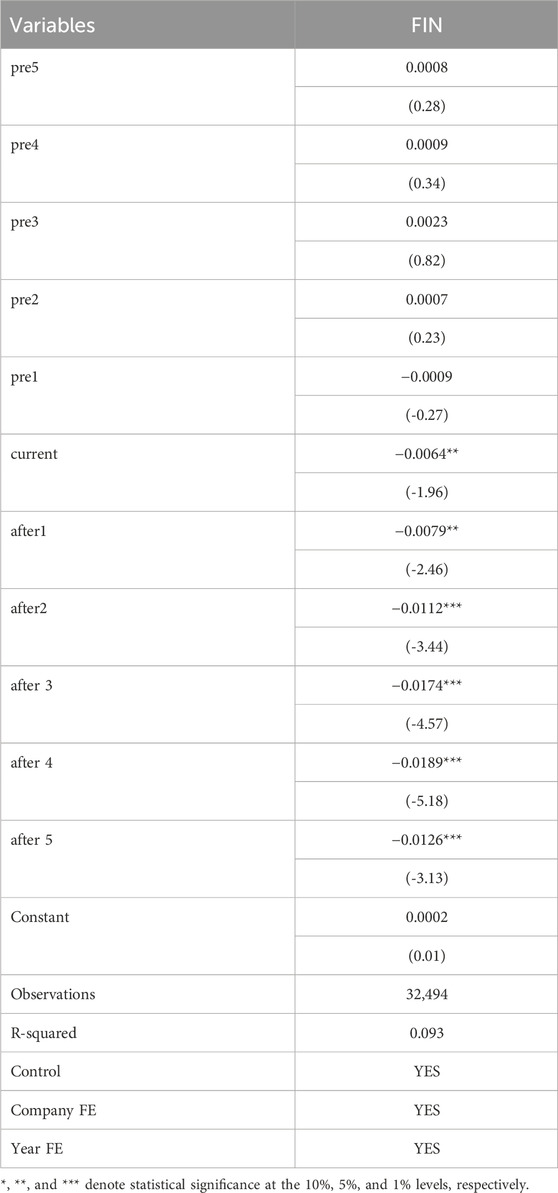

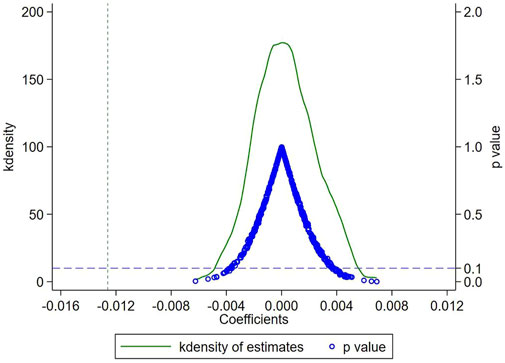

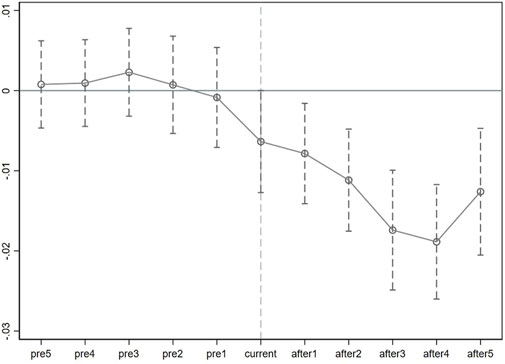

The DID model assumed that no shock is induced by the Paris Agreement and that the corporate financialization of the treated and control firms operates similarly. However, if the treatment and control firms exhibit systematic distinctions and their financialization diverge, the validity of our findings would be compromised, regardless of the existence of the Paris Agreement. Hence, we conduct falsification assessments employing the dynamic model delineated in Eq. 2 to authenticate the presumption of pretreatment parallel trends. Specifically, we created time indicator variables, including pre5, pre4, pre3, pre2, pre1, current, after1, after2, after3, after4, and after5. They refer to the 5 years before the Paris Agreement, the year of the Paris Agreement (2016), and the 5 years after the Paris Agreement, respectively.

The findings from the dynamic model estimation, as detailed in Table 4, reveal that the coefficients associated with the interaction variables Treat*pre5, Treat*pre4, Treat*pre3, Treat*pre2, and Treat*pre1 are statistically insignificant. This implies that both treated and control firms exhibit comparable trends in financialization leading up to the treatment period, indicating parallel pre-treatment trajectories. In Figure 2, we visually depicted the shifts in financialization trends among both the treated and control firms, both pre- and post-Paris Agreement, by plotting the coefficients outlined in Eq. 2.

Figure 2. Coefficients of Eq. 2.

4.3 Placebo test

4.3.1 Suppose the policy event happened before 2016

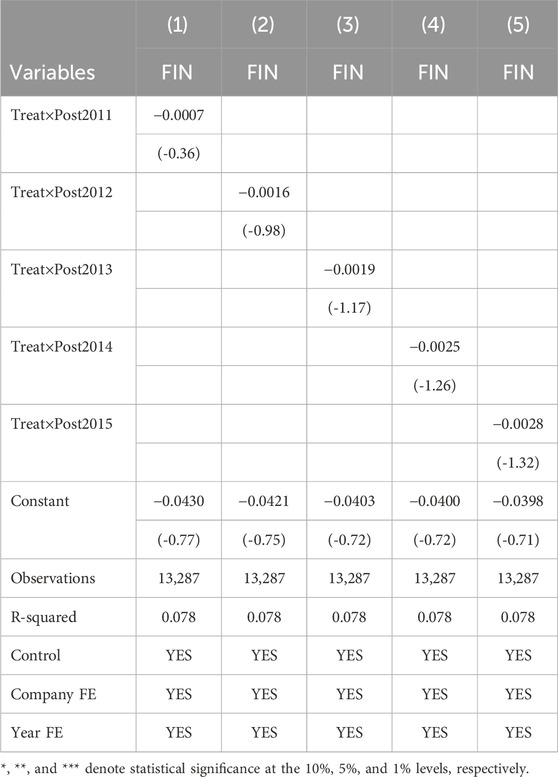

We set the sample period as 2010–2016. If the policy is assumed to have been enacted before 2016, the expected estimation coefficient will not be significant because the policy transpired in 2016. If the results are inconsistent with expectations, factors other than the Paris Agreement probably affect corporate financialization. We set the policy occurrence times as 2011, 2012, 2013, 2014, and 2015 to ensure the robustness of the results. Columns 1–5 in Table 5 report the corresponding regression results. According to Table 5, the estimated coefficients of the core variables are not significant. Therefore, the influence of other potentially unobservable factors on corporate financialization can be excluded.

4.3.2 Randomly selected experimental group

To eliminate interference from the sample processing effect, following Tan et al. (2020), some samples were randomly selected as the experimental group to conduct a placebo test. The sample contained 4,526 enterprises, and the number of carbon-intensive enterprises after 2016 was 1,099. Therefore, 1,099 enterprises were randomly selected from the 4,526 samples as the pseudo-experimental group and the remaining enterprises as the control group to construct the dummy variable

4.4 Analysis of heterogeneity

Considering the heterogeneity of corporate financialization in several dimensions, this section discusses the inhibition effect of possible heterogeneity on carbon risk associated with corporate financialization.

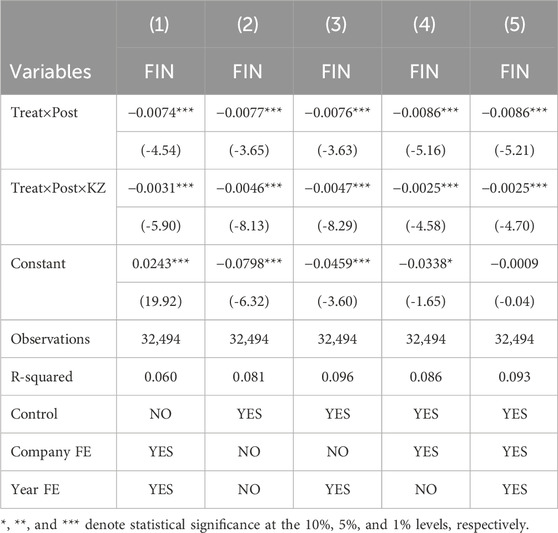

4.4.1 Financing constraints

The increased carbon risk brought about by the Paris Agreement has led to a credit crunch for enterprises, resulting in financing constraints and an increased risk of financial distress. In this case, enterprises increase the cost and availability of debt financing because of increased credit risk and reduced collateral asset value. Owing to environmental regulation and other factors, the carbon emissions of enterprises are limited. In this case, a carbon emissions trading market or green technological innovation can be adopted to mitigate the aggravation of carbon risk. Regardless of the manner enterprises adopt it, they all need financial support. When carbon risk increases, enterprises with higher financing constraints have a stronger motivation to obtain working capital by reducing the proportion of financial assets required to undertake green innovation or purchase carbon emission rights. Accordingly, we anticipate that carbon risk will exert a greater inhibitory impact on corporate financialization for firms facing tighter financing constraints.

To assess the restraining impact of financial constraints on the carbon risk associated with corporate financialization, we refer to Kaplan and Zingales (1997) and adopt the KZ index as an indicator of financing constraints. The greater the KZ value, the more pronounced the financing constraints on the enterprises. The cross-multiplication terms Treat×Post and KZ were introduced into the empirical model. The results are summarized in Table 6. Columns 1–5 indicate whether control variables and individual effects of the control time are available. The coefficients before the Treat, Post, and KZ interaction terms are significantly negative, indicating that the higher the financing constraint, the greater the inhibition effect of carbon risk on corporate financialization, which is consistent with H2. The study also tested hypotheses H2 through grouped regression, and the conclusion is consistent. Owing to the limited length of the article, the results of grouped regression are shown in Supplementary Table S1.

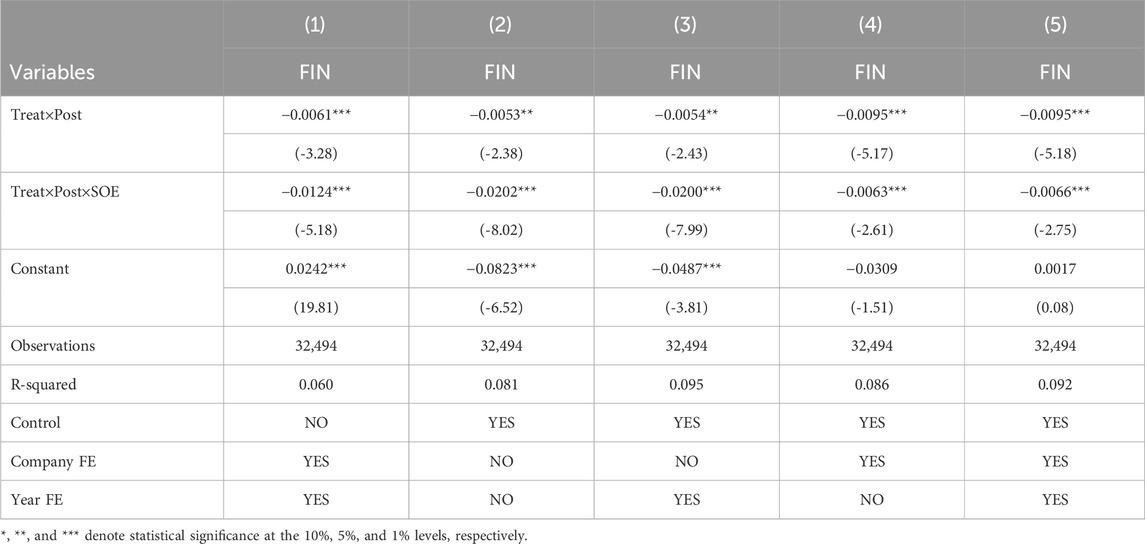

4.4.2 Nature of property right

To test the influence of the nature of property rights on corporate financialization with carbon risk inhibition, we use state-owned enterprises as the standard to measure the nature of property rights, with the value of state-owned enterprises being one and that of non-state-owned enterprises being zero. The cross-multiplication terms Treat×Post and SOE were introduced into the empirical model. The results are summarized in Table 7. The coefficients preceding the Treat, Post, and SOE interaction terms all exhibit significant negativity, suggesting that the carbon risk associated with state-owned enterprises exerts a more pronounced deterrent influence on corporate financialization compared to non-state-owned enterprises. This finding is consistent with hypothesis H3b. After signing the Paris Agreement, state-owned enterprises, as the leaders of industrial upgrades and the main force of economic development, should shoulder more environmental responsibilities and experience more carbon risk impacts (Tian and Xiao, 2023). The study also tested hypotheses H3 through grouped regression, and the conclusion is consistent. Owing to the limited length of the article, the results of grouped regression are shown in Supplementary Table S1.

4.5 Test of mechanism

The Porter hypothesis posits that environmental regulation incentivize corporates to delve into Innovation and R&D, which not only improves production efficiency but also compensates for cost losses caused by environmental regulation. According to the Porter hypothesis, the carbon risk brought to enterprises by the signing of the Paris Agreement can encourage enterprises to implement green innovation to mitigate the uncertain impact of carbon risk on their production and operation. Enterprises require large amounts of financial support to conduct green innovation. Owing to the increased difficulty of external financing caused by carbon risk, enterprises carry out green innovation through internal financing or their own funds. According to the above analysis, carbon risk can encourage enterprises to carry out green innovation and restrain corporate financialization. We construct the following model to test whether carbon risk can alleviate the degree of corporate financialization by improving green innovation:

Inpatents in Eq. 4 represent enterprises’ green innovation ability, Eq. 3 represents the direct impact of carbon risk on corporate financialization, Eq. 4 represents the impact of carbon risk on enterprises’ green technological innovation, and Eq. 5 further verifies the impact of carbon risk on corporate financialization under the control of enterprises’ green innovation. According to the regression idea of the mediating effect, if

Referring to Deng et al. (2021), this paper uses the number of green invention patent applications (Inpatent_Autt) as the patent measurement index. Green invention patent applications have a high technical threshold, requiring enterprises to conduct green research and develop technologies to improve the performance of their products. This reflects a high-level of green technological innovation ability. Simultaneously, the number of green invention patent authorizations (Inpatent_Appt) was used as an alternative index to test the robustness of the results.

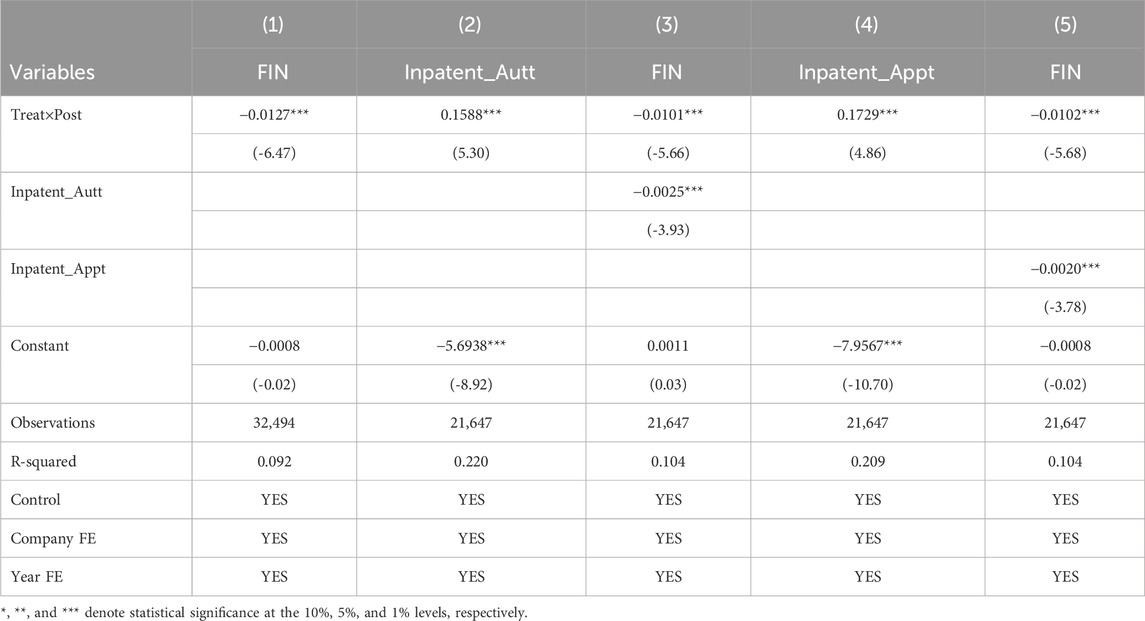

According to Columns 2 and 4 of Table 8, the Treat×Post coefficient is positive and significant at the 1% level, indicating that the increased carbon risk brought about by the Paris Agreement can encourage enterprises to implement green innovation. Hong et al. (2023) discovered that the implementation of the dual carbon policy had a markedly beneficial impact on fostering green innovation within heavily polluting enterprises. This is consistent with our empirical results. Columns 3 and 5, under the control of green innovation, show that the coefficients of Treat×Post and Inpatent were negative and significant at the 1% significance level, while the Treat×Post coefficient was greater than the coefficient of Treat×Post in Column 1, indicating that green innovation plays a partial mediating role in the carbon risk impact on corporate financialization (Sui and Yao, 2023).

5 Robustness checks

5.1 Replace key variables

To avoid the impact of measurement errors on the regression results, we refer to Gu et al. (2022) and redefine corporate financialization. We use the log of financial assets (FIN2) and the proportion of liquid financial assets to total assets (FIN3) to measure the dependent variable. Supplementary Table S2 presents the regression results after replacing the dependent variables. The findings indicate that all coefficients associated with Treat×Post exhibit a negative and statistically significant relationship, which lends support to hypothesis H1. At the same time, we also tested hypotheses H2 and H3 by replacing the dependent variable. As shown in Supplementary Table S3, the results support hypotheses H2 and H3b.

We also use text analysis to redefine carbon risk. We used the word frequency related to carbon risk in corporate social responsibility (CSR) reports to measure the carbon risk faced by enterprises (Luo et al., 2018). Specifically, the more keywords that appear, the greater the carbon risk faced by enterprises. Supplementary Table S4 presents the regression results obtained after replacing the dependent variables. The findings indicate that all carbon risk coefficients exhibit negativity and significance, thereby corroborating hypothesis H1.

5.2 Eliminate extreme events

In 2012, the China Securities Regulatory Commission revised its guidelines on the industry classification of listed companies; thus, samples before 2012 were excluded. Włodarczyk et al. (2024) find that COVID-19 deteriorated financial performance of companies with high carbon emission intensity. Because the COVID-19 outbreak at the end of 2019 greatly affected the production and operational activities of most enterprises, samples from 2020 to 2021 were excluded. The regression results are presented in Supplementary Table S5. The findings indicate that the coefficients for Treat×Post are uniformly negative and statistically significant at the 1% threshold, thereby providing strong support for hypothesis H1.

5.3 Exclude the impact of other policies

Considering that China might have introduced other policies that affected the financialization of enterprises in 2016, we sorted out the relevant policies that may have affected the financialization of enterprises issued by China in 2016. This led to other policy interference on the impact of the Paris Agreement in the empirical test. Furthermore, we observed that the Measures for the Supervision and Administration of the Transactions of State-owned Assets of Enterprises promulgated on 24 June 2016, may affect the financial assets of state-owned enterprises. Therefore, we repeat the regression after removing the state-owned enterprises sample data. The regression results are presented in Supplementary Table S6. The findings indicate that the coefficients for Treat×Post are uniformly negative and statistically significant at the 1% threshold, which supports hypothesis H1 and excludes other policy impacts.

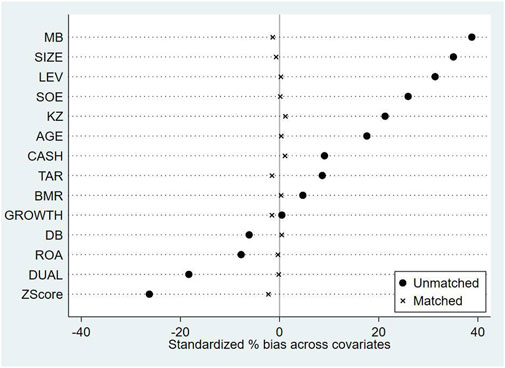

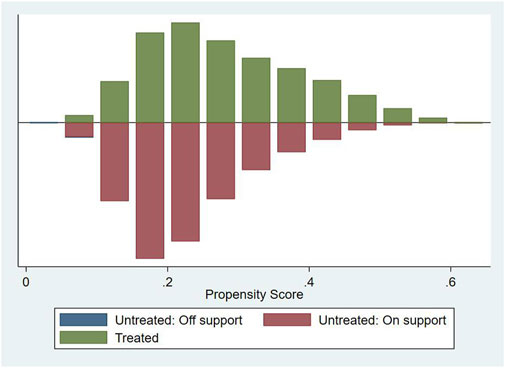

5.4 Propensity score matching–difference-in-differences (PSM–DID) method

The experimental and control groups may have been affected by individual-level systemic differences and regression results. To control for systemic differences between the experimental and control groups, we used PSM–DID method to effectively alleviate the endogeneity caused by the aforementioned problems. First, we used the propensity score matching method to match the samples of the experimental and control groups. Subsequently, we selected all the control variables in Eq. 1 as matching variables, and used the logit model to match the samples. Second, we adopted the nearest-neighbor matching of a 1:3 caliper, and the caliper value was set to 0.0243 after calculation. We matched 21,088 valid samples. As shown in Figure 4, the standard error of the variables in the experimental and control groups after matching decreased significantly compared to that before matching. Moreover, the t-test in Supplementary Table S7 shows that no significant difference was observed between the control variables in the experimental and control groups after matching. Figure 5 shows the results for the common support domain. Most of the samples were in the common support domain, indicating that the sample match was effective.

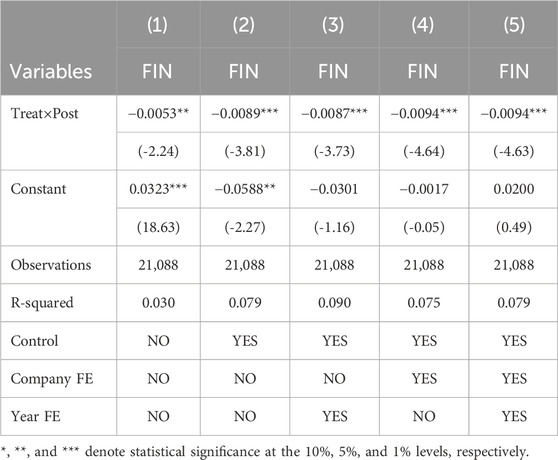

Finally, based on the PSM results, we used Eq. 1 model on the new sample to test the impact of carbon risk on corporate financialization. The regression results are presented in Table 9. The Treat×Post coefficients are all negative and significant, indicating that after controlling for sample deviation, carbon risk effectively inhibits corporate financialization, which again verifies the robustness of the results.

5.5 Endogeneity

The signing of the Paris Agreement has had a significant impact on high carbon emission enterprises, while low carbon emission enterprises are almost unaffected, resulting in the experimental group not being completely exogenous. Similarly, the model may have missing variables. In this case, the model produces endogenous problems, and the conclusion that carbon risk restrains corporate financialization is not accurate. Therefore, we address the endogeneity of the model using instrumental variables.

Based on Yu et al. (2020), we selected urban river density as the instrumental variable. In terms of correlation, cities with higher river densities have more developed shipping and lower transport costs, making it easy for industrial enterprises, especially pollution-oriented enterprises, to move in. The difference in transportation costs forms a location advantage for the manufacturing industry in coastal areas (Lin and Wang, 2006). Additionally, cities with developed rivers generate more hydropower, which makes it easier to attract enterprises with high energy consumption under the trends of energy conservation and emission reduction. Finally, urban river density is naturally formed and depends on local natural conditions, which have nothing to do with unobtainable factors, such as the urban and corporate economies, and meet the requirements of exogenesis.

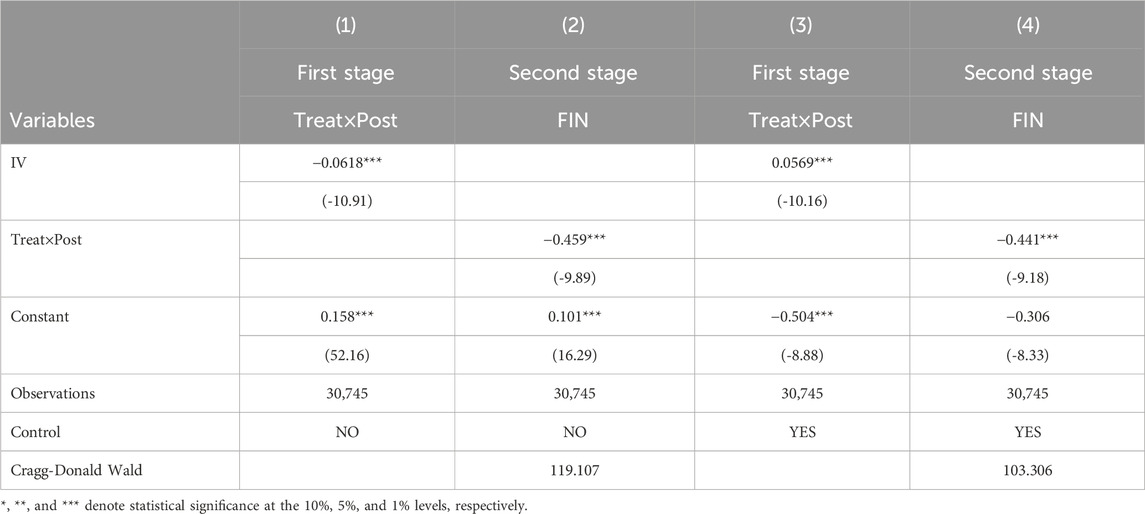

Table 10 presents findings from the instrumental variables’ two-stage estimation. All the statistical figures derived from the Cragg-Donald Wald test surpass the critical threshold of 16.38, as determined at the 10% significance level by Stock-Yogo (2005), indicating that the problem of weak instrumental variables does not exist. The coefficients before Treat×Post in Columns (2) and (4) were negative and significant at the 1% significance level, which was consistent with the results of the main regression.

6 Conclusion

This research enhances our comprehension regarding the impact of carbon risk on corporate financialization, while also shedding light on the significance of green innovation within this dynamic. We selected the data of A-share listed companies from 2010 to 2021 as samples, used the Paris Agreement signed in 2016 as a quasi-natural experiment to study the relationship between carbon risk and the degree of corporate financialization through difference-in-differences methods, and analyzed the transmission mechanism of green innovation. Through theoretical and empirical analysis, we draw the following conclusions. An increase in carbon risk can restrain corporate financialization and results pass the placebo and robustness tests. Next, we found that the higher the financing constraints of enterprises, the more evident the carbon risk inhibition on corporate financialization through the heterogeneity analysis. Under the special background of China, it is worth noting that as the leaders of high-quality development and pioneers of transformation and upgrading, state-owned enterprises must bear more responsibility for reducing emissions. Compared to non-state-owned enterprises, the carbon risk of state-owned enterprises has a more obvious inhibitory effect on corporate financialization. Finally, the mechanism analysis found that carbon risk encourages enterprises to undertake green innovation and inhibits corporate financialization.

Based on the above analysis, we propose the following suggestions from three aspects: government, enterprise, and the law. First, in the short term, the signing of the Paris Agreement will bring uncertainty and risks to enterprise operations. However, in the long term, carbon risk will accelerate enterprises’ green innovation, reduce the level of enterprise financialization, and improve the development level of the real economy. Therefore, China should implement commitments to the Paris Agreement and promote global climate governance. Second, carbon risk causes enterprises to face greater financing constraints and financial difficulties, hindering enterprises from carrying out green innovation and transformation. Henceforth, it is imperative for the government to institute a collaborative tripartite framework involving banks, governmental bodies, and enterprises. This framework should be geared towards devising a spectrum of policies aimed at alleviating the financial constraints faced by enterprises. Additionally, there is a pressing need to design financial instruments tailored specifically for the advancement of green technological innovation. Finally, improving external laws and regulations, guiding enterprises to use funds for long-term production and operation or emission reduction activities, and avoiding excessive investment of funds into the non-real economy results in a false high valuation of financial assets. This high valuation is not conducive to the long-term operation of enterprises.

The study still has certain limitations. Owing to the lack of micro carbon emission data from enterprises, this study could not directly measure or observe carbon risk. After the Chinese carbon trading market matures, carbon risk can be measured through corporate carbon emission trading. There is an optimal range for the degree of corporate financialization, and whether it is too high or too low will affect the company’s development. This study only suggests that carbon risk can restrain corporate financialization but fails to provide the optimal range for corporate financialization. Future research can be conducted from these two aspects.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YW: Conceptualization, Funding acquisition, Methodology, Writing–original draft. YX: Data curation, Methodology, Software, Writing–original draft, Writing–review and editing. CG: Data curation, Writing–review and editing. MX: Investigation, Validation, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. Major Project of Philosophy and Social Science Research of Guizhou Province (No. 22GZZB07) and Humanities and Social Science Fundamental Research Funds for Central Universities of the Nanjing Agricultural University (No. SKCX2023013).

Acknowledgments

We would like to thank Editage (www.editage.cn) for English language editing. All errors are authors’ own.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1429110/full#supplementary-material

References

Bolton, P., and Kacperczyk, M. (2021). Do investors care about carbon risk? J. Financial Econ. 142 (2), 517–549. doi:10.1016/j.jfineco.2021.05.008

Brown, J. R., Fazzari, S. M., and Petersen, B. C. (2009). Financing innovation and growth: cash flow, external equity, and the 1990s R and D Boom. J. Finance 64 (1), 151–185. doi:10.1111/j.1540-6261.2008.01431.x

Cai, M. R., and Ren, S. C. (2014). Corporate financialization: a literature review. Finance Econ. 07, 41–51. doi:10.3969/j.issn.1000-8306.2014.07.005

Cary, M., and Stephens, H. M. (2024). Economic, environmental, and technical gains from the Kyoto Protocol: evidence from cement manufacturing. Resour. Policy 91, 104926. doi:10.1016/j.resourpol.2024.104926

Chen, S. L. (2022). Study on heterogeneous environmental regulation and establishment of substantive environmental strategy of enterprises. Ecol. Econ. 38 (08), 139–145. [In Chinese].

Chen, Y. Y., Shen, B. H., Cao, Y. W., and Wang, S. Y. (2023). CEO social capital, financing constraints and corporate financialisation: evidence from Chinese listed companies. Finance Res. Lett. 60, 104781. Article. doi:10.1016/j.frl.2023.104781

Deng, Y. P., Wang, L., and Zhou, W. J. (2021). Does environmental regulation promote green innovation capability? —evidence from China. Stat. Res. 38 (07), 76–86. doi:10.19343/j.cnki.11-1302/c.2021.07.006

Du, Y., Zhang, H., and Chen, J. Y. (2017). The impact of financialization on future development of real enterprises’ core business: promotion or inhibition. China Ind. Econ. 12, 113–131. doi:10.19581/j.cnki.ciejournal.20171214.007

Duan, J. J., Yao, M. C., and Huang, Y. (2022). Empirical test of impact of environmental regulation on industrial green innovation. Statistics Decis. 38 (16), 157–162. doi:10.13546/j.cnki.tjyjc.2022.16.031

Gorgen, M., Nerlinger, M., and Wilkens, M. (2020). Carbon risk. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2930897.

Gu, L. L., Wang, H. Y., and Peng, Y. C. (2022). The long-term impact of large-scale public emergencies: epidemic experience, uncertainty expectations, and corporate financial investment. China Econ. Q. 22 (03), 1017–1038. doi:10.13821/j.cnki.ceq.2022.03.14

Guo, Y. E., Fan, L. J., and Yuan, X. H. (2022). Market competition, financialization, and green innovation: evidence from China's manufacturing industries. Front. Environ. Sci. 10, 836019. doi:10.3389/fenvs.2022.836019

Hong, Y. X. X., Jiang, X. L., Xu, H., and Yu, C. (2023). The impacts of China's dual carbon policy on green innovation: evidence from Chinese heavy-polluting enterprises. J. Environ. Manag. 350, 119620. doi:10.1016/j.jenvman.2023.119620

Jia, L. J., Zhang, X., Wang, X. N., Chen, X. L., Xu, X. F., and Song, M. L. (2024). Impact of carbon emission trading system on green technology innovation of energy enterprises in China. J. Environ. Manag. 360, 121229. doi:10.1016/j.jenvman.2024.121229

Kabir, M. N., Rahman, S., Rahman, M. A., and Anwar, M. (2021). Carbon emissions and default risk: International evidence from firm-level data. Econ. Model. 103, 105617. doi:10.1016/j.econmod.2021.105617

Kaplan, S. N., and Zingales, L. (1997). Do investment cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112 (1), 169–215. doi:10.1162/003355397555163

Kong, Z. H., Du, J. X., Kong, Y. L., and Cui, X. Y. (2024). Financial development, environmental regulation, and corporate green technology innovation: evidence from Chinese listed companies. Finance Res. Lett. 62, 105122. doi:10.1016/j.frl.2024.105122

Krippner, G. R. (2005). The financialization of the American economy. Socio-Economic Rev. 3 (2), 173–208. doi:10.1093/SER/mwi008

Krüger, P. (2015). Corporate goodness and shareholder wealth. J. Financial Econ. 115 (2), 304–329. doi:10.1016/j.jfineco.2014.09.008

Labatt, S., and White, R. R. (2007). Carbon finance: the financial implication of climate change. Hoboken: John Wiley and Sons.

Levine, R., Chen, L., Wang, Z., and Xie, W. (2018). Bank liquidity, credit supply and the environment. NBER Work. Pap. Ser. doi:10.3386/w24375

Lin, L. S., and Wang, Y. Q. (2006). Transport cost, labor mobility and the spatial distribution of manufacturing industries. Econ. Res. J. 03, 115–125. [In Chinese].

Luo, X. Y., Mao, Y., and Zhang, Y. (2018). Study on carbon intensity, ETS and carbon risk disclosure. Soft Sci. 32 (10), 92–96. doi:10.13956/j.ss.1001-8409.2018.10.21

Lv, J. (2016). Paris Agreement: new climate institutional arrangement, uncertainty, and China’s choices. Int. Rev. 03, 92–104. [In Chinese].

Lv, M., and Bai, M. (2021). Evaluation of China’s carbon emission trading policy from corporate innovation. Finance Res. Lett. 39, 101565. doi:10.1016/j.frl.2020.101565

Nguyen, J. H., and Phan, H. V. (2020). Carbon risk and corporate capital structure. J. Corp. Finance 64, 101713. doi:10.1016/j.jcorpfin.2020.101713

Ren, W. H., and Ji, J. Y. (2021). How do environmental regulation and technological innovation affect the sustainable development of marine economy: new evidence from China’s coastal provinces and cities. Mar. Policy 128, 104468. doi:10.1016/j.marpol.2021.104468

Romilly, P. (2007). Business and climate change risk: a regional time series analysis. J. Int. Bus. Stud. 38, 474–480. doi:10.1057/palgrave.jibs.8400266

Shu, H., Tan, W. Q., and Wei, P. (2023). Carbon policy risk and corporate capital structure decision. Int. Rev. Financial Analysis 86, 102523–102615. doi:10.1016/j.irfa.2023.102523

Shu, L. M., and Liao, Q. H. (2022). End-of-pipe treatment or green transformation? The impact of green credit on environmental protection investment enterprises in heavy polluting industries. Stud. Int. Finance 04, 12–22. doi:10.16475/j.cnki.1006-1029.2022.04.001

Song, J., and Lu, Y. (2015). U-shape relationship between non-currency financial assets and operating profit: evidence from financialization of Chinese listed non-financial corporates. J. Financial Res. 06, 111–127. [In Chinese].

Sui, B., and Yao, L. Y. (2023). The impact of digital transformation on corporate financialization: the mediating effect of green technology innovation. Innovation Green Dev. 2 (01), 100032–100039. doi:10.1016/j.igd.2022.100032

Tan, Y., Tian, X., Zhang, X., and Zhao, H. (2020). The real effect of partial privatization on corporate innovation: evidence from China’s split share structure reform. J. Corp. Finance 64, 101661–101723. doi:10.1016/j.jcorpfin.2020.101661

Tian, C., and Xiao, L. M. (2023). The impact of carbon emission right trading on low carbon transformation of enterprises: quasi natural experiment based on carbon trading pilot markets. East China Econ. Manag. 37 (02), 64–74. doi:10.19629/j.cnki.34-1014/f.220707002

Wang, A. L., Si, L. L., and Hu, S. (2023). Can the penalty mechanism of mandatory environmental regulations promote green innovation? Evidence from China's enterprise data. Energy Econ. 125, 106856. doi:10.1016/j.eneco.2023.106856

Wang, J. X., and Sun, M. N. (2021). The mystery of Porter hypothesis under green development and governance transformation: evidence from carbon risk’s leverage reduction. Bus. Manag. J. 43 (12), 41–61. doi:10.19616/j.cnki.bmj.2021.12.003

Wang, Z. F., and Tan, X. (2021). Are private enterprises more discriminated against in loan financing? Re-discussion based on the micro-data of land mortgage loans. J. Central Univ. Finance Econ. 08, 40–52. doi:10.19681/j.cnki.jcufe.2021.08.004

Włodarczyk, A., Szczepańska-Woszczyna, K., and Urbański, M. (2024). Carbon and financial performance nexus of the heavily polluting companies in the context of resource management during COVID-19 period. Resour. Policy 89, 104514. doi:10.1016/j.resourpol.2023.104514

Xie, Q. X. (2021). Environmental regulation, green financial development and technological innovation of firms. Sci. Res. Manag. 42 (06), 65–72. doi:10.19571/j.cnki.1000-2995.2021.06.009

Xing, M., Chen, D., and Zhang, H. M. (2022). The impact of environmental uncertainty on the “transforming the economy from substantial to fictitious” of enterprises—empirical evidence from Chinese listed companies. J. Industrial Technol. Econ. 41 (10), 124–131. doi:10.3969/j.issn.1004-910X.2022.10.015

Yan, Z. M., Yu, Y., Du, K. R., and Zhang, N. (2024). How does environmental regulation promote green technology innovation? Evidence from China's total emission control policy. Ecol. Econ. 2019, 108137. doi:10.1016/j.ecolecon.2024.108137

Yao, S., Hong, Y., and Lin, C. M. (2019). Environmental information disclosure and financial constraint. Asia-Pacific J. Financial Stud. 48 (5), 666–689. doi:10.1111/ajfs.12277

Ye, Y. L., Wu, C. Q., and Zhou, X. Y. M. (2022). Threshold effect of manufacturing agglomeration on environmental pollution in Yangtze River economic belt. Resour. Environ. Yangtze Basin 31 (06), 1282–1292. doi:10.11870/cjlyzyyhj202206009

Yu, M. G., Zhong, H. J., and Fan, R. (2019). Privatization, financial constraints, and corporate innovation: evidence from China’s industrial enterprises. J. Financial Res. 04, 75–91. [In Chinese].

Yu, M. M., and Ma, Y. Y. (2021). The influence of environmental regulation on the behavior of firms’ financialization—based on a quasi-natural experiment of “new environmental protection law.”. J. Beijing Inst. Technol. Soc. Sci. Ed. 23 (02), 30–43. doi:10.15918/j.jbitss1009-3370.2021.2846

Yu, Y. Z., Sun, P. B., and Xuan, Y. (2020). Do constraints on local governments’ environmental targets affect industrial transformation and upgrading? Econ. Res. J. 55 (08), 57–72. [In Chinese].

Zhang, N., and Pang, J. (2022). The economic impacts of introducing CCER trading and offset mechanism into the national carbon market of China. Clim. Change Res. 18 (05), 622–636. doi:10.12006/j.issn.1673-1719.2022.055

Keywords: carbon risk, difference-in-differences, corporate financialization, paris agreement, green innovation

Citation: Wang Y, Xu Y, Guo C and Xie M (2024) Can carbon risk restrain corporate financialization? Evidence from China. Front. Environ. Sci. 12:1429110. doi: 10.3389/fenvs.2024.1429110

Received: 07 May 2024; Accepted: 07 June 2024;

Published: 26 June 2024.

Edited by:

Ying Li, University of Missouri System, United StatesCopyright © 2024 Wang, Xu, Guo and Xie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yang Xu, eHV5YW5nQHN0dS5uamF1LmVkdS5jbg==

Yiqiu Wang1

Yiqiu Wang1 Yang Xu

Yang Xu Chong Guo

Chong Guo