- 1Department of Business Administration, Qingdao University, Qingdao, Shandong, China

- 2Department of Political Science and International Relations, Florida International University, Miami, FL, United States

Introduction: Environmental concerns and the escalating impacts of climate change have prompted governments to set ambitious carbon emission reduction targets. Corporations, as major contributors to carbon emissions, play a critical role in achieving these goals through transparent carbon disclosure. This study investigates the impact of environmental penalties on corporate carbon disclosure practices among Chinese-listed firms from 2009 to 2019, drawing on organizational legitimacy theory.

Method: Using data from publicly available corporate reports, we employed multivariate regression analysis to examine how environmental penalties influence carbon disclosure. Additionally, we explored the moderating roles of firms’ financial resource conditions and social media scrutiny.

Result: The results revealed that environmental penalties significantly enhance carbon disclosure, particularly in resource-redundant firms, while their effect diminishes in resource-constrained enterprises. Social media scrutiny amplifies the positive impact of penalties by increasing public pressure, highlighting the role of external stakeholders in fostering transparency.

Discussion: These findings underscore the importance of integrating tailored regulatory frameworks with active public and social media engagement to enhance corporate accountability and transparency. This study contributes to the literature on corporate social responsibility, offering actionable insights for policymakers, regulators, and corporate managers aiming to advance sustainability goals.

1 Introduction

Carbon emissions have been recognized as the primary driver of global warming, and their detrimental impact on the environment has been consistently validated. Governments have proposed carbon emission reduction objectives, such as those outlined in the Kyoto Protocol and the Paris Agreement (Sustainable Development Goal (SDG) 7: SDGs 2030), to address global climate change and decrease greenhouse gas emissions. Corporate carbon information disclosure (CID) is a significant research focus in related sectors since it is vital for reducing carbon emissions. Enterprises play a crucial role in carbon emission reduction and trading as they are the main contributors to carbon emissions through their production and operation activities. Their efforts in reducing carbon emissions are essential for achieving a low-carbon economy and society. To reduce carbon emissions, governments must implement rules that specifically target significant polluters, such as corporations, and ensure their compliance with carbon emission standards.

The Chinese government has established emission reduction goals to reach the carbon emissions peak by 2030 and achieve carbon neutrality by 2060 (Tan et al., 2022; Wang et al., 2021; Pian-Pian et al., 2023). However, due to the low level of carbon reporting by highly polluting firms in China, firms’ carbon abatement efforts and disclosure still need to be debated (Bilal et al., 2022; Nguyen et al., 2021; Yu et al., 2020). As a result, the transformation and upgrading of China’s manufacturing industry now faces a significant challenge in transitioning to low-carbon practices. Naturally, the corporate sector has also shown interest in this objective, leading to increased corporate initiatives in carbon disclosure. Companies’ endeavors to transition to a low-carbon model contribute to their sustainable growth and get ongoing attention and recognition from external stakeholders. Consequently, the government, firms, and external stakeholders are highly concerned about enterprises’ endeavors to decrease carbon emissions and enhance information transparency regarding their carbon reduction initiatives. Given the pressing need for transparency and corporate accountability, understanding the factors that drive or hinder carbon disclosure is crucial for achieving these ambitious environmental goals.

Corporate carbon disclosure behavior has become more prevalent and is frequently regarded as a voluntary way for companies to make internal and external decisions. The current body of research on the factors influencing carbon disclosure may be classified into two main categories: the external pressures that companies encounter and the internal attributes of the companies themselves. External pressures on enterprises encompass various factors such as environmental regulations (Liu et al., 2018), market regulation (Xu et al., 2022), business environment (Kang et al., 2010), and financial market pressures (Zhao et al., 2014). These external pressures significantly influence the disclosure of corporate carbon information (Tang et al., 2022). Strict environmental regulation, in particular, can significantly improve China’s green productivity (Tong et al., 2022). In other words, when faced with substantial external pressure, enterprises tend to increase their carbon information disclosure to promote their development (He et al., 2019). In addition, stakeholders’ pressure will also affect the obstacles and motivations for decarbonizing operation management practices, and various obstacles and incentive factors will seriously affect the adoption of low-carbon operation management practices. Therefore, it is essential to establish a positive relationship with the stakeholders to overcome the external environment’s obstacles and improve the organization’s competitiveness (Jabbour et al., 2021). Firms’ internal characteristics encompass their corporate governance structure, which includes board characteristics and management shareholding (Wintoki et al., 2012). Financial characteristics such as profitability, leverage, opportunities for improvement, and managers’ attitudes and philosophies toward environmental protection are also considered. Studies have demonstrated that a company’s external carbon disclosure is of superior quality when its board governance is more effective in terms of corporate governance structure (Ben-Amar and McIlkenny, 2016). Regarding the financial attributes of businesses, there is a positive correlation between the size of the enterprise and its financial leverage, profitability, and R&D expenditures. Additionally, larger enterprises are more likely to voluntarily disclose information about carbon emissions (Cui and Hwang, 2018). Research surfaces in the current commercial market; organizations must cooperate to control rising levels of carbon emissions while gaining lasting economic benefits (Tiwari et al., 2019). The literature extensively examines the internal and external factors influencing corporate carbon disclosure. However, there remains uncertainty regarding the impact of government-imposed environmental penalties on corporate carbon disclosure, particularly in China’s centralized system. Due to pressure from public opinion, the government may impose strict regulations on corporations’ environmentally harmful actions in this system. Furthermore, it is still being determined if the internal limitations on resources within companies and the influence exerted by external stakeholders coincide with the imposition of environmental penalties by the government. Therefore, our study aims to fill this void by examining the correlation between corporate environmental fines and carbon disclosure.

Building on these considerations, organizational legitimacy offers a theoretical framework for understanding how external pressures like environmental penalties compel corporations to enhance their carbon disclosure practices. According to the idea of organizational legitimacy, we propose that environmental regulators imposing penalties on companies undermines their credibility. As a result, companies are compelled to enhance their carbon disclosure practices more favorably. Organizational legitimacy refers to the degree to which the actions of a social system align with laws, regulations, conventions, values, beliefs, customs, and other relevant factors (Suchman, 1995). An actual or possible conflict between the two parties raises doubts about the organization’s legitimacy, resulting in pressure for legitimacy. Environmental legitimacy refers to the perception that a firm’s environmental behavior or performance is desired and appropriate. It is a crucial aspect of organizational legitimacy. From the legitimacy perspective, scholars argue that the pressure for environmental legitimacy plays a crucial role in motivating enterprises to disclose information. This pressure primarily stems from regulatory requirements imposed by external governments and other entities, as well as the expectations of internal and external stakeholders. Additionally, media scrutiny and public opinion also contribute to the public pressure for information disclosure (Mahadeo et al., 2011; Li et al., 2018).

This framework becomes particularly relevant when analyzing the role of authority-driven systems, such as China, where regulatory penalties and external pressures interact in unique ways. In a system characterized by authority, such as China’s, regulatory authorities can apply administrative penalties for non-environmental actions, which can lead to direct or indirect economic setbacks or even undermine the legitimacy of companies. They are more worried about their lack of legitimacy than economic loss since it can result in forced closure. Carbon disclosure gives them a significant level of control in improving their legitimacy. Furthermore, we posit that the impact of environmental sanctions on corporate carbon disclosure will be contingent upon the organization’s internal resource limitations and the external pressure exerted by stakeholders. Within an enterprise’s internal structure, the diverse resources it possesses or manages form a cohesive entity with interrelated and interdependent components that sustain its operations. Enterprises use various tactics based on the extent of resource limitations during business administration.

Consequently, when enterprise resource alterations occur, the effect on the total internal interconnections will also vary. External stakeholders such as environmental organizations and audit institutions have the potential to enhance the extent to which corporations disclose their carbon emissions (Shen et al., 2020). With the increasing prominence of environmental protection organizations, auditing institutions, public education, and awareness, external institutions and mass media are becoming more attentive to enterprises’ environmental protection practices. Consequently, this heightened scrutiny will likely result in a surge in penalties imposed on companies for environmental violations.

In order to validate our assumptions, we analyze the influence of environmental penalties imposed on corporations on their carbon disclosure. This analysis is based on data about Chinese-listed enterprises from 2009 to 2019. Initially, we examine the impact of the penalty mechanism on companies’ carbon disclosure behavior. We discover that the penalty mechanism serves a dual purpose of motivating and exerting control over enterprises, particularly their carbon disclosure practices. Second, we investigate how the resource status of enterprises influences the connection between corporate environmental sanctions and corporate carbon disclosure. Because contracts based on enterprise performance play a positive role in driving sustainable improvement, this is consistent with the activities occurring in the industry (Ma et al., 2022). We specifically investigate how a company’s internal resources affect the connection between its environmental fines and its carbon disclosure. This analysis focuses on the company’s resource limitations and resource redundancy. We see that the penalty mechanism has a more pronounced beneficial effect on corporate carbon disclosure in companies facing limitations in obtaining funding. At the same time, its influence is less significant in companies with surplus resources. Third, this study investigates how social media influences the connection between corporate environmental penalties and corporate carbon disclosure. Critical assessments of companies’ fulfillment of social responsibility through social media can result in public opinion exerting pressure on corporations, strengthening the regulatory impact of environmental penalties on corporate carbon disclosure. To summarise, we contend that the environmental penalty mechanism directly and efficiently influences corporate carbon disclosure. However, the primary factors driving corporate carbon emission reduction and carbon disclosure are the adverse evaluations of corporations by social media users and the limitations imposed by the corporations’ resources.

This study addresses a critical research gap by investigating the impact of government-imposed environmental penalties on corporate carbon disclosure within the context of China’s centralized system. While previous research has extensively examined the internal and external factors influencing corporate carbon disclosure, the specific role of environmental penalties as a dual mechanism for motivation and regulation remains underexplored. Moreover, this study uniquely considers how internal resource conditions, such as scarcity and redundancy, mediate the effectiveness of these penalties, diverging from earlier studies that often treat penalties as universally effective. By integrating organizational legitimacy theory, this research further explores how external pressures, such as social media scrutiny, amplify the regulatory effects of penalties on carbon disclosure. Unlike traditional studies that primarily focus on internal governance or external regulatory pressures in isolation, our work highlights the interplay between resource availability, public opinion, and regulatory actions. This integrated perspective provides policymakers and regulators with nuanced insights into designing targeted interventions for improving corporate transparency and advancing a low-carbon economy.

The remain of this paper is structured as follows. Section 2 develops the research hypotheses, focusing on the significance of penalty mechanisms in influencing corporate carbon disclosure behavior, with particular attention to the moderating roles of enterprise resource restrictions and media social responsibility. Section 3 outlines the methodology, detailing the sample, data, and variable measures, as well as the estimation model used for analysis. Section 4 presents the results, including descriptive statistics, multivariate regression tests, robustness checks, endogeneity checks, and supplementary analysis to ensure the validity and reliability of the findings. Section 5 provides a comprehensive discussion of the results, highlights the study’s theoretical and practical contributions, acknowledges its limitations, and suggests directions for future research. The paper concludes with a summary of the key findings and their implications for advancing the field of corporate carbon disclosure and environmental policy.

2 Hypothesis development

2.1 The significance of penalty mechanisms and corporate carbon disclosure behaviour

From a theoretical perspective, environmental penalties can be seen as a form of comprehensive environmental regulation. They are a government policy tool to control and discourage corporate pollution and ensure effective environmental governance. Compared to other market-based governance tools like environmental protection taxes, environmental fines have more distinct administrative features. While environmental penalties primarily target firms with poor environmental performance, they can effectively discourage such firms and encourage those with high environmental performance; this mitigates the adverse effects originating from outside the organization, such as environmental contamination (Shevchenko, 2021). More precisely, on one side, imposing environmental fines can result in both direct and indirect economic costs for enterprises with poor environmental performance.

Additionally, these penalties can expose firms to various dangers and damage their reputation. Consequently, firms are motivated to enhance their environmental performance. On the other hand, governments can provide incentives to companies that actively enhance their environmental performance (Berry and Rondinelli, 1998; Kassinis and Vafeas, 2002), and the efficacy of these incentives has been extensively proven (Dasgupta et al., 2000). Companies facing environmental penalties must respond constructively to uphold their validity. Indeed, enterprises exhibit various responses, ranging from superficial enhancements to substantial actions that surpass the minimum regulatory obligations (Aragón-Correa et al., 2008; Shao and He, 2022), all of which are encompassed. China has adopted carbon emission reduction as a significant national strategy to achieve the objectives of “carbon peak” and “carbon neutrality.” The Chinese government has implemented significant measures at various levels, such as promoting the growth of new energy sectors and establishing a carbon trading system. Carbon reduction efforts and disclosure are crucial components of corporate social responsibility, serving as effective measures for corporations to address government-imposed environmental penalties. Hence, companies penalized for environmental violations must address the identified environmental issues and showcase their determination to enhance their environmental performance to avoid further penalties from environmental regulators. This, in turn, will significantly enhance their corporate legitimacy. Corporate carbon reduction efforts and disclosure are crucial for showcasing corporate environmental actions, and firms possess significant autonomy in carbon disclosure. Enterprises can reveal symbolic actions taken to reduce carbon emissions, such as setting carbon reduction goals, as well as the specific amount of carbon that has been reduced. Hence, enhancing carbon disclosure is crucial for reinstating a company’s credibility following its environmental conservation penalization. Considering this, we put forth the following conjecture:

Hypothesis 1. Imposing environmental sanctions on corporations has a notable and beneficial impact on their level of disclosure regarding carbon emissions.

2.2 The role of enterprise resource restrictions as a moderator

The comprehension of enterprise resources differs across different socio-economic stages. Enterprise resources, as defined by contemporary scholars, encompass the assortment of production elements that an enterprise possesses, governs, or can employ to deliver products or services to society, ultimately aiding in attaining the enterprise’s economic goals. Comprehended within a more expansive framework, corporate resource encompasses all tangible and intangible assets that can be utilized to provide assistance, support, and competitive advantage. Enterprises frequently utilize many resources concurrently in their company operations, and those who demonstrate flexibility are more likely to succeed in expanding into new markets or launching new products (Tasavori et al., 2018).

The operation of an enterprise involves continuous and dynamic changes in both the quantity and quality of resources. The enterprise possesses or has control over a diverse range of resources, which are interconnected, mutually influential, and collectively support the functioning of the enterprise. Hence, proficiently overseeing enterprise resources can yield economic advantages for businesses, conserve resources for society, and generate wealth for the nation.

Amidst the constraints of low-carbon development, firms increasingly opt to reveal carbon information and enhance penalties for corporate environmental protection. This is done in response to the national objective of reducing carbon emissions, aiming to mitigate the threats posed by climate change. Studies have demonstrated that companies can modify their corporate resources over time to stimulate economic expansion (Lee and Kim, 2021). Enterprises select business management strategies based on their internal resource limitations. Companies with higher firm value or more corporate resources tend to have better carbon accounting disclosure quality (Nazwa and Fitri, 2022). The variables that have the most significant influence on corporate carbon disclosure include capital structure, market value of stock (Saka and Oshika, 2014), and corporate property (Wang and Zhong, 2022). This phenomenon is especially conspicuous in developing nations (Jiang et al., 2021). The impact of government environmental regulation on green technological progress is more substantial when the enterprise has greater financial power or resources, according to Song et al. (2021).

Similarly, the influence of government environmental regulation is more significant when the enterprise has more financial power or resources (Song et al., 2021); this indicates that companies are more likely to raise environmental fines and improve their carbon disclosure practices when they have excess resources. On the other hand, organizations that operate well tend to have lower levels of carbon activities (Eleftheriadis et al., 2015). It demonstrates a strong correlation between favorable carbon performance and exceptional financial performance (Busch and Lewandowski, 2018). In this scenario, enterprises more inclined to disclose carbon information (Cui and Hwang, 2018) are more likely to signal the presence of significant carbon risks. This is done to prevent adverse market responses resulting from the concealment of such information (Lemma et al., 2019).

Furthermore, stakeholders must not overlook the correlation between carbon disclosure and business resources while making investment decisions (Shen et al., 2020); the reason for this is that elevated carbon disclosure and effective corporate governance have a crucial role in enhancing business performance (Kurnia et al., 2020). Corporate performance, corporate reputation, and corporate commercial value are all accurate indicators of corporate resources. Corporations, the primary entities responsible for using and controlling resources, play a crucial part in societal development.

Thus, enterprises with limited resources are unlikely to prioritize social responsibility and instead focus on maximizing their economic gains. This is because they need more resources to address environmental penalties and allocate their limited resources toward economic pursuits. On the other hand, while enterprises are the primary source of pollutant emissions and play a crucial role in environmental management, their primary financial objective is to maximize shareholder wealth. Managers are primarily focused on market competition and effectively controlling consumption. As a result, when corporations have limited resources, they may dedicate less effort toward maintaining environmental penalties. In cases of resource redundancy, firms consider decision-making uncertainty regarding inputs, production, and outputs due to constraints on their environmental behavior, specifically in environmental management. The imposition of environmental penalties prompts this consideration.

Consequently, companies can take proactive measures to address environmental concerns by modifying their management practices and systems. They can also enhance their strategic position by developing green supply chains and effectively communicating with stakeholders. Additionally, these actions help prevent future cost escalations from more stringent environmental regulations. Based on this, the presence or absence of sufficient resources in a business might have varying effects on the environmental penalties imposed on the business.

Amidst the widespread promotion of sustainable development and low carbon economy, firms must restructure themselves, considering the environmental costs and enhancing resource efficiency (Tao, 2016). This study posits that firms may allocate limited resources towards carbon disclosure. However, in situations of resource abundance, firms are more likely to allocate more significant effort toward carbon disclosure. Thus, we put forward the subsequent hypothesis:

Hypothesis 2a. More corporate resources can diminish the beneficial effect of corporate environmental sanctions on corporate carbon disclosure.

Hypothesis 2b. Excess corporate resources amplify the favorable effect of corporate environmental fines on corporate carbon disclosure.

2.3 The function of media social responsibility as a moderator

Social media encompasses the tools, routes, carriers, intermediates, or technological methods individuals employ to communicate and access information. Media reports serve as a means of sharing information and function as an external regulatory agency. The media’s social responsibility is receiving significant attention from media theorists, the press, and the public. This responsibility encompasses various aspects, such as media ethics, professional work ethics in the media, and information ethics. These aspects can be evaluated within the broader political, social, and cultural context (Polakova, 2010). The media plays a crucial role in the capital market by acting as a middleman for information. As a result, companies and their employees use social media more frequently. The evaluation of public opinion on social media has a varied impact on corporate social responsibility (CSR) disclosure. Social media allows firms to enhance CSR engagement (Zhang and Yang, 2021). This research contends that the imposition of corporate environmental penalties for disclosing corporate carbon emissions is influenced by the pressure of public opinion exerted by the media.

The significant impact of social media on the capital market is evident. Furthermore, extensive use of social media can influence the awareness and actions of various stakeholders, including environmental organizations, auditors, and the general public. This, in turn, can increase the company’s commitment to environmental responsibility and adherence to environmental regulations (Shen et al., 2020; Kalu et al., 2016). When companies face a media environment that is not actively expressing opinions, the expense of maintaining their environmental credibility and reputation can be much greater than the cost of investing in efforts to enhance their commitment to addressing climate change (Tavakolifar et al., 2021). Consequently, this encourages the company to fulfill its social responsibilities in a proactive manner (Jiang et al., 2022), which in turn helps to restore its diminished environmental credibility (Pan et al., 2022). Consequently, the media’s conduct in the capital market significantly impacts the implementation of corporate social responsibility practices. Additionally, the media’s social responsibility actions greatly influence the environmental penalties imposed on companies.

Due to industrial production’s climate and environmental effects, companies worldwide must disclose and aim to decrease their carbon emissions. This has led to the need for a pressure group in China, consisting of the government, the public, and investors, to promote corporate carbon disclosure (He and Wang, 2014). Social media can effectively fulfill this function, exerting pressure on companies to disclose information about their carbon emissions. As a means of disseminating information, this pressure can significantly enhance corporate carbon disclosure (Shao and He, 2022). Additionally, media coverage can improve carbon disclosure accuracy and reliability (Li et al., 2017). When a firm encounters a regulatory dilemma in the media, its motivations to participate in carbon disclosure impression management are more powerful (Mateo-Marquez et al., 2021). This phenomenon is especially noticeable in companies experiencing significant negative environmental legitimacy pressures (Luo et al., 2022). Thus, corporations can lessen the adverse effects of their carbon disclosure on the market by proactively releasing regular updates on their carbon-related activities through the media before disclosing them (Lee et al., 2015).

Furthermore, as public education and awareness continue to grow, media-induced public opinion will alter consumers’ preexisting perception of the company; companies also engage in socially responsible actions to ensure customer loyalty (Al-Haddad et al., 2022). The media has triggered a chain reaction that has compelled firms to enhance their carbon disclosure practices and elevate transparency (Kalu et al., 2016). Hence, it is evident that the public scrutiny exerted by social media platforms in response to firms publishing their social responsibility reports can compel companies to fulfill their social responsibilities and disclose their carbon emissions actively. Given this information, this study presents the following conjectures:

Hypothesis 3. Social media platforms’ social responsibility amplifies corporate environmental penalties’ positive influence on corporate carbon disclosure.

3 Methodology

3.1 Sample and data

For our research, we have selected all Chinese companies listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange from 2009 to 2019 to examine how environmental sanctions affect corporate carbon disclosure. Listed firms are the primary entities responsible for disclosing carbon information and are the primary focus of environmental regulatory organizations. We primarily gather data on corporate carbon disclosure information by manually extracting it from corporate social responsibility reports and business sustainable development reports. Furthermore, the environmental penalties data was acquired through cross-validation with two databases, namely the IPE database (https://www.ipe.org.cn/) and the BYU Legal Information Network (https://www.pkulaw.com/). The former database is the most extensive collection of environmental research in China, while the latter is the most reliable source of legal information in China. The data on press reports is sourced from the press and Opinion Module of listed firms in the CNRDS database. Additional data is sourced from the CSMAR database, renowned as one of the primary information repositories on publicly traded companies in China (Marquis and Bird, 2018). We compiled a preliminary panel dataset upon obtaining data from the sources above. Subsequently, we applied the following criteria, as outlined by Liu et al. (2021), to choose our sample. (a) Omit all data from foreign stocks listed in the Shanghai and Shenzhen B-share markets; (b) Exclude data from stocks with special treatment (ST), which refers to stocks that have incurred losses for two consecutive years; and (c) Exclude data from observations where all variables are missing (Song et al., 2015). There are a total of 25,956 firm-year observations belonging to 3,590 distinct firms.

3.2 Measures of dependent variable

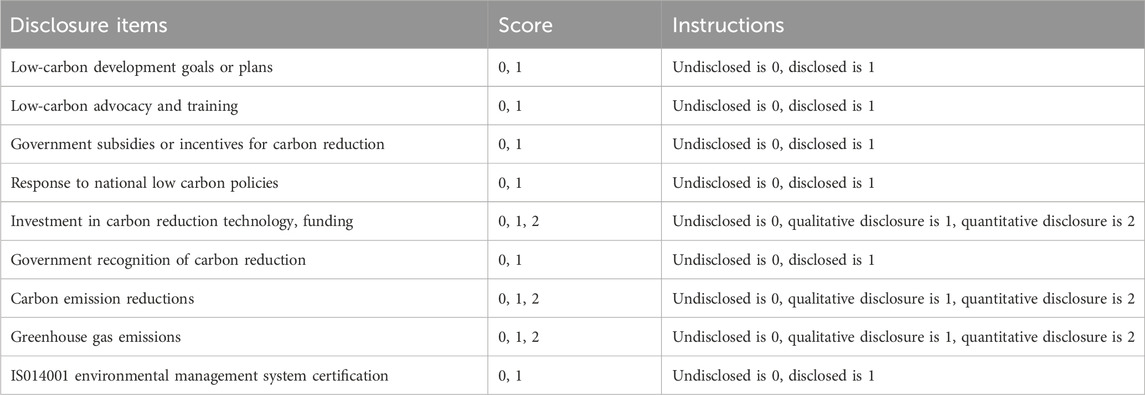

The dependent variable in this study is the corporate carbon disclosure score (CID), as indicated by Li et al. (2018), Li et al. (2017). Following the research technique of Aerts and Cormier (2009), we employ content analysis to evaluate the extent of corporate carbon disclosure. More precisely, we examine the extent to which companies disclose their carbon emissions by examining nine factors. We base our evaluation on the content of the Carbon Disclosure Project’s China report and consider the specific carbon information provided in the reports of the sample companies (as shown in Table 1 below). The carbon disclosure level is determined by adding the scores assigned to each of the nine factors. The nine items encompass Low-carbon development goals or plans, Low-carbon advocacy and training, Government subsidies or incentives for carbon reduction, Response to national low carbon policies, Investment in carbon reduction technology, funding, Government recognition of carbon reduction, Carbon emission reductions, Greenhouse gas emissions, IS014001 environmental management system certification. Regarding the handling procedures, we conducted a rating system based on whether all Chinese corporate social responsibility reports and corporate sustainable development reports listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange from 2009 to 2019 contained corresponding words. The disclosed items were rated as 0, while the undisclosed items were rated as 0.

3.3 Measures of independent variable

The study’s independent variable is the quantity of environmental penalties enforced on companies. The information regarding the administrative penalties and the corresponding fines imposed on each firm by environmental regulators on a specific date was collected manually from the IPE and BYU legal information databases (Marquis and Bird, 2018). After sorting, we obtained 2,250 records documenting environmental fines imposed on listed businesses. These penalties involved 924 companies, with the cumulative penalties reaching RMB 543.7 million. Based on the research conducted by Porteous et al. (2015), we calculate the firm’s environment for the current year by adding the number of penalties per firm-year.

Furthermore, in the robustness analysis, we employ the aggregated acceptable amount by firm-year, referred to as Environmental_penalty_value, as a substitute for Environmental_penalty. According to our data, companies that faced penalties from environmental regulators had an average CID score of 1.15, whereas companies that did not face penalties had an average CID score of 0.69. Furthermore, 60% of companies that have faced penalties from environmental regulators have engaged in carbon disclosure, but the number is 40% for companies that have not been penalized by environmental regulators. These findings indicate that companies that receive penalties from authorities tend to have higher ratings for disclosing their carbon emissions.

Furthermore, we selected three moderating variables. The variables Resource_Constraint and Resource Slack are two opposing moderator variables. Resource restriction in this context primarily pertains to financing constraints, which are the fundamental financial activity of a business and a significant means of acquiring external resources. Hence, we should utilize the firm’s finance constraint level to indicate its resource constraint. More precisely, we assess the extent of limitations on enterprises’ resources by employing the KZ index introduced by Kaplan and Zingales (1997). The KZ index is determined based on five factors: the capacity to create cash flow from operational activities, cash dividend distribution, cash reserve position, the extent of financial leverage, and the development potential of the company. The net cash flow ratio from operations to total assets measures resource slack. Seifert et al. (2004) argue that a firm’s financial performance only sometimes reflects the availability of surplus resources. Instead, they suggest that cash flow provides a more accurate measure of discretionary resources. According to Lehn and Poulsen, (1989), discretionary resources are calculated by subtracting non-discretionary expenses such as interest on debt, taxes, and dividends from a firm’s operating income before depreciation. Cash flow refers to surplus finances that are accessible for business operations. We have selected the media Negative_Coverage as another moderating variable. More precisely, we quantify Negative_Coverage by taking the logarithm of the quantity of adverse media reports. Negative media reports are often a significant way external stakeholders apply legitimacy pressures. This measure has been extensively employed in research on corporate environmental conduct (Burke, 2022; Shao and He, 2022).

3.4 Measures of control variable

We choose control variables at the executive team level (TMT), firm level, and industry level to account for potential influences on corporate carbon disclosure. We include the proportion of independent directors (Indep) and the duality of the chairman of the board and the managing director (Dual) at the executive team level, in line with prior research (Li et al., 2018; Li et al., 2017). Indep is calculated by dividing the independent directors by the total number of executives. Dual equals 1 when the chairman of the board and the managing director are the same person and 0 otherwise.

We also account for other business factors that could influence companies’ carbon disclosure. We utilize the natural logarithm of total assets as a metric for firm Size, the ratio of net profit to total assets for firm profitability (ROA), the ratio of total liabilities to total assets for leverage (Lev), the growth rate of firms’ operating revenues for Growth, the ratio of the sum of the market value of equity and the book value of liabilities to total assets for TobinQ, the ratio of the first most significant shareholder ownership for Top1, and the nature of ownership of the firm for SOE (Li et al., 2018; Li et al., 2017). At the industry level, heavy pollution is measured based on whether the firm belongs to a heavy-polluting industry (Luo, 2019). We adjust for year, industry, and provincial effects to account for CID variations across different periods, industries, and provinces.

3.5 Estimation model

We developed the test model to examine the assumptions Hypothesis 1, Hypothesis 2a, Hypothesis 2b, and Hypothesis 3 in this paper. The dependent variable CID is truncated at 0, meaning that 59.5% of firms do not report carbon information and have a carbon disclosure score of 0. We estimated the following equations using a Tobit model while accounting for year, industry, and province fixed effects (Li et al., 2017).

The variable CID represents the carbon disclosure score of firm i in year t. The study’s independent variable is environmental_penalty, which represents the frequency of penalties imposed on firm i by the environmental regulator in year t. The paper utilizes three moderating factors known as Resource_constraint, Resource_slack, and Negative_Coverage. Controls are a group of variables used to manage or influence a system or process.

4 Results

4.1 Descriptive statistics and correlation matrix

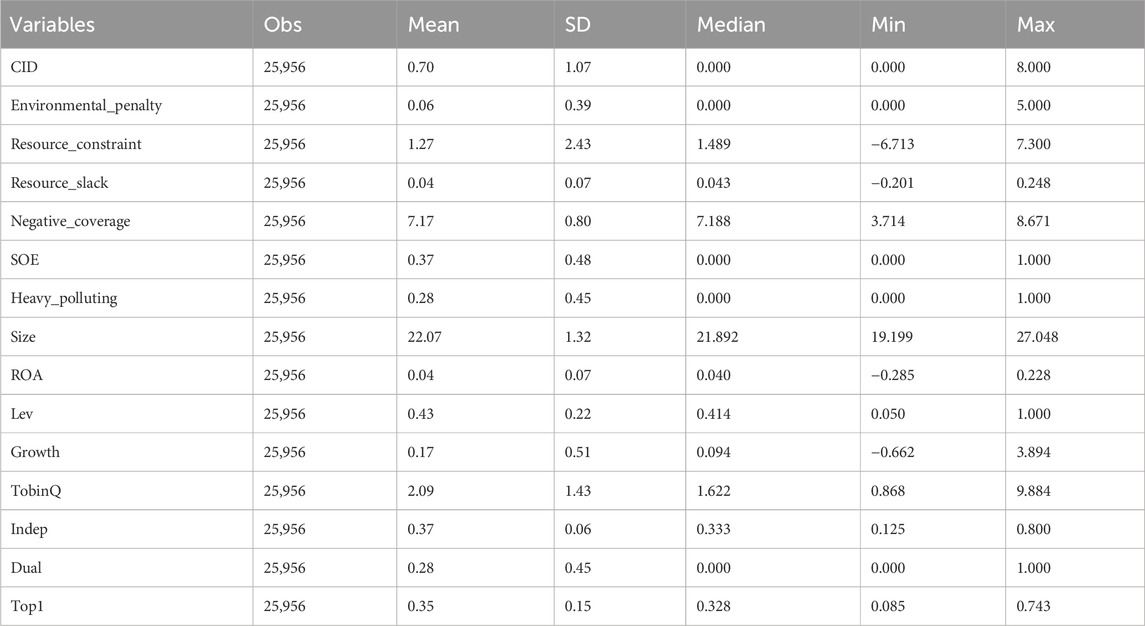

Table 2 presents the descriptive statistics for all variables in this study. The average value of the dependent variable carbon information disclosure (CID) is 0.70, suggesting that the level of corporate carbon disclosure is relatively low, consistent with findings from previous studies on corporate carbon disclosure (Li et al., 2017). Moreover, the highest number of penalties levied on enterprises by environmental regulators is 5, with the maximum value reaching 61 before tailing down and the lowest value being 0. Only a minuscule fraction of companies face administrative penalties from the regulator.

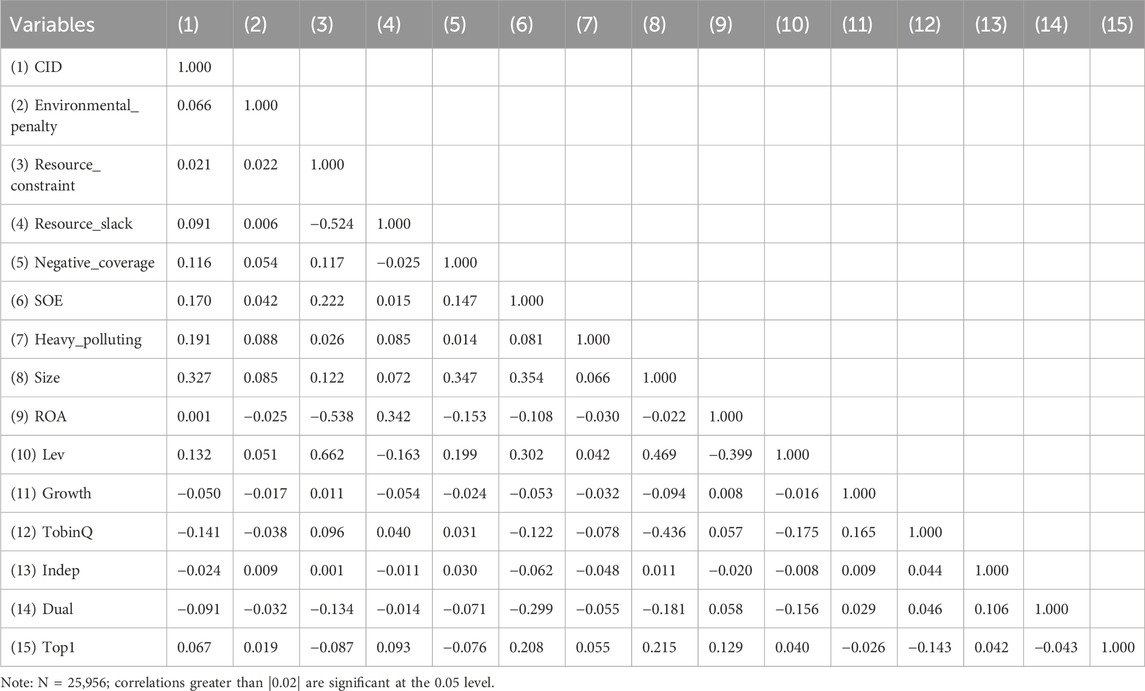

Table 3 displays the Pearson correlation coefficients for the variables. The corporate carbon disclosure score (CID) is positively correlated with the environmental penalties levied by the regulator, as hypothesized, with a correlation coefficient of 0.066. We computed variance inflation factors (VIFs) for each variable to verify that correlations between variables did not impact our results. The VIFs varied from 1.02 to 3.42, with an average of 1.57, all falling below the empirical criterion of 10, as per Greene (2003). Therefore, our analysis is not likely to have significant multicollinearity issues.

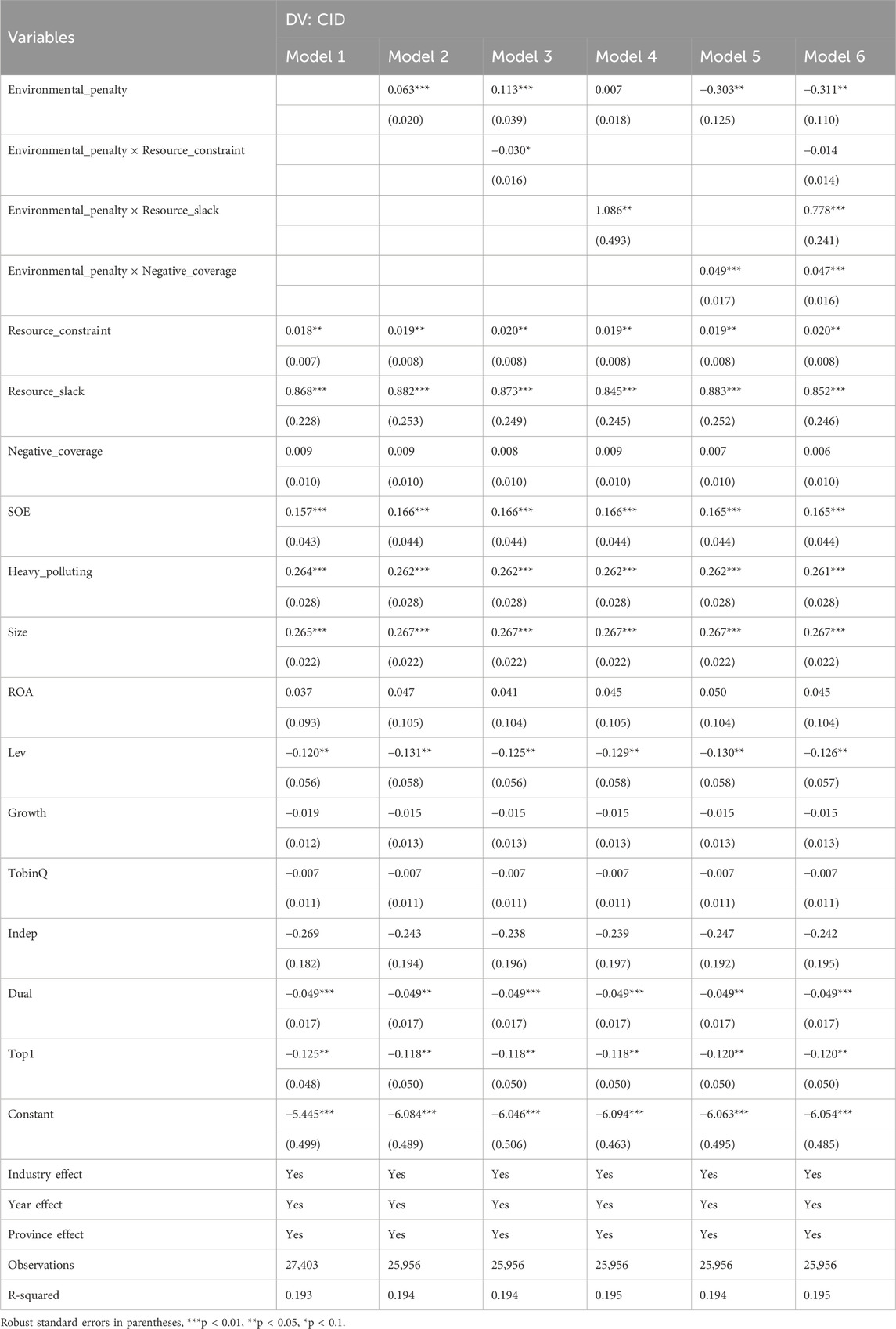

4.2 Multivariate regression tests

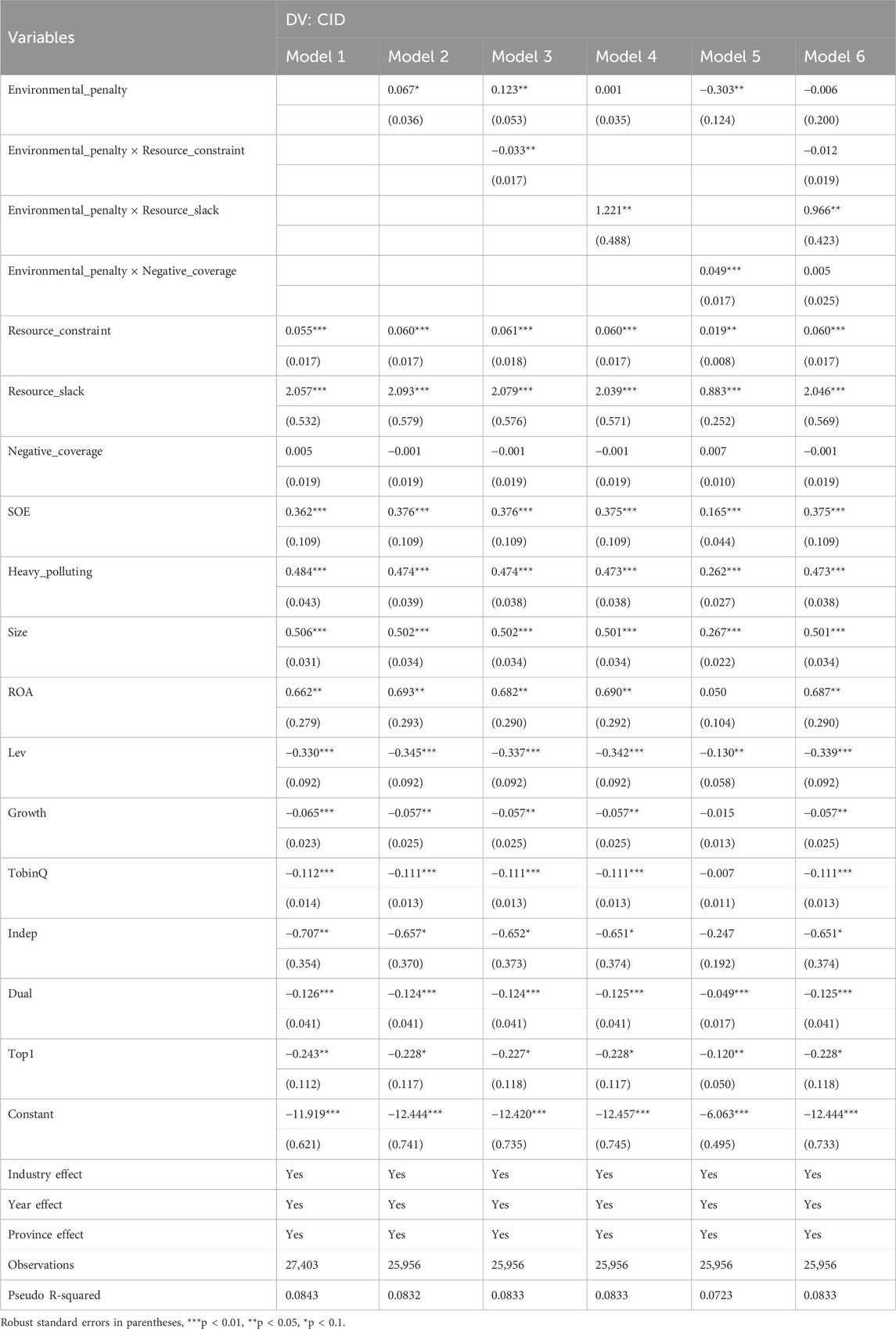

Based on our hypotheses, we used the Tobit model to analyze the link between Environmental_penalty and CID. Table 4 displays the regression results with clustered standard errors at the industry level. Model 1 serves as the baseline model, using solely control variables. Using Model 1, we included the variable Environmental_penalty to investigate Hypothesis 1. The findings indicate that Environmental_penalty has a statistically significant beneficial impact on corporate carbon disclosure at a 10% confidence level; this supports assumption 1. Calculating the marginal effect reveals that in samples where carbon disclosure scores exceed 0, the average impact of penalties from environmental authorities on firms’ carbon disclosure scores is 0.030. The average marginal effect for the entire sample is 0.023.

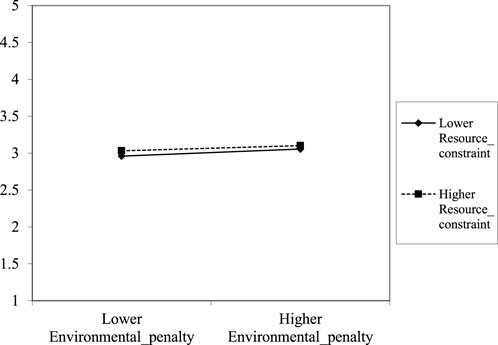

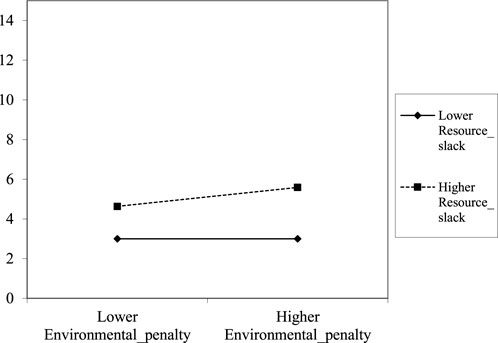

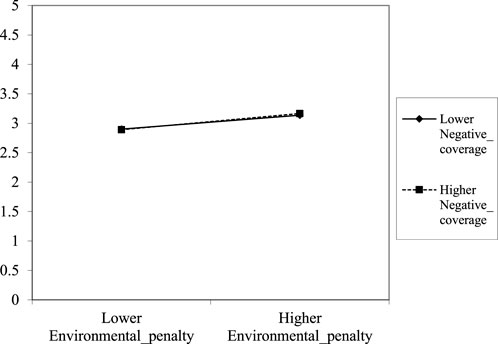

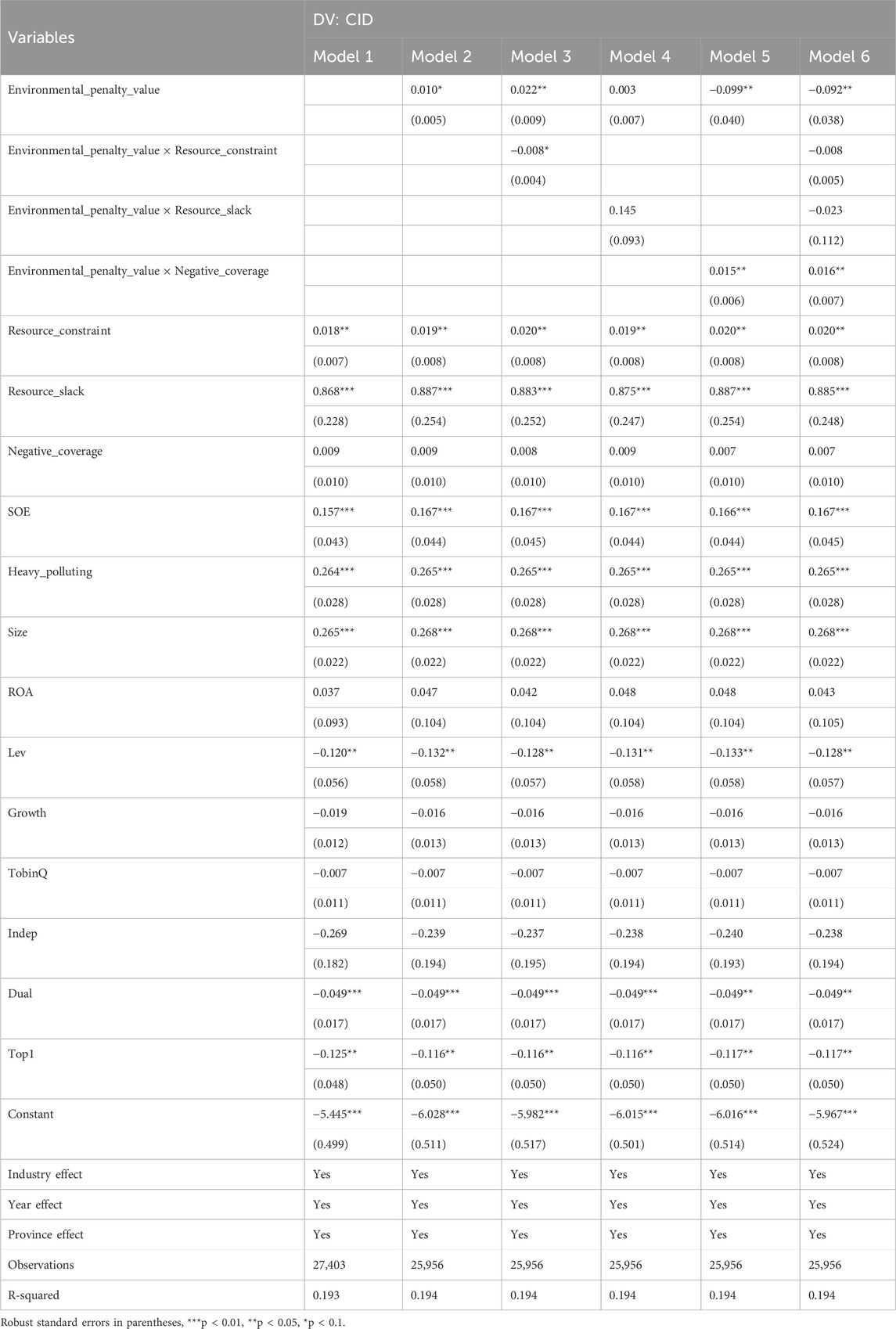

In addition, we also describe the moderating effects of the moderating variables Resource_constraint, Resource_slackfor, and Negative_Coverage fo in Models 3–Model 5 in Table 4. We describe the moderating effects of Resource_constraint for Model 3, Resource_slack for Model 4, and Negative_Coverage for Model 5. In Model 3 and Graph 1, we included the interaction terms of Resource_constraint and Environmental_penalty to test Hypothesis 2a. The findings indicate the coefficient of Environmental_penalty × resource_constraint has a strong negative impact and is statistically significant (

4.3 Robustness check

We verified the strength and reliability of our findings by conducting robustness assessments. We revised our regression methods and employed the ordinary least squares (OLS) regression to reassess all the assumptions. All findings are documented in Table 5. Models 2 to 5 indicate that the coefficients for Environmental_penalty, Environmental_penalty × Resource_constraint, Environmental_penalty × Resource_slack and Negative_Coverage × Environmental_penalty are all statistically significant (

4.4 Endogeneity check

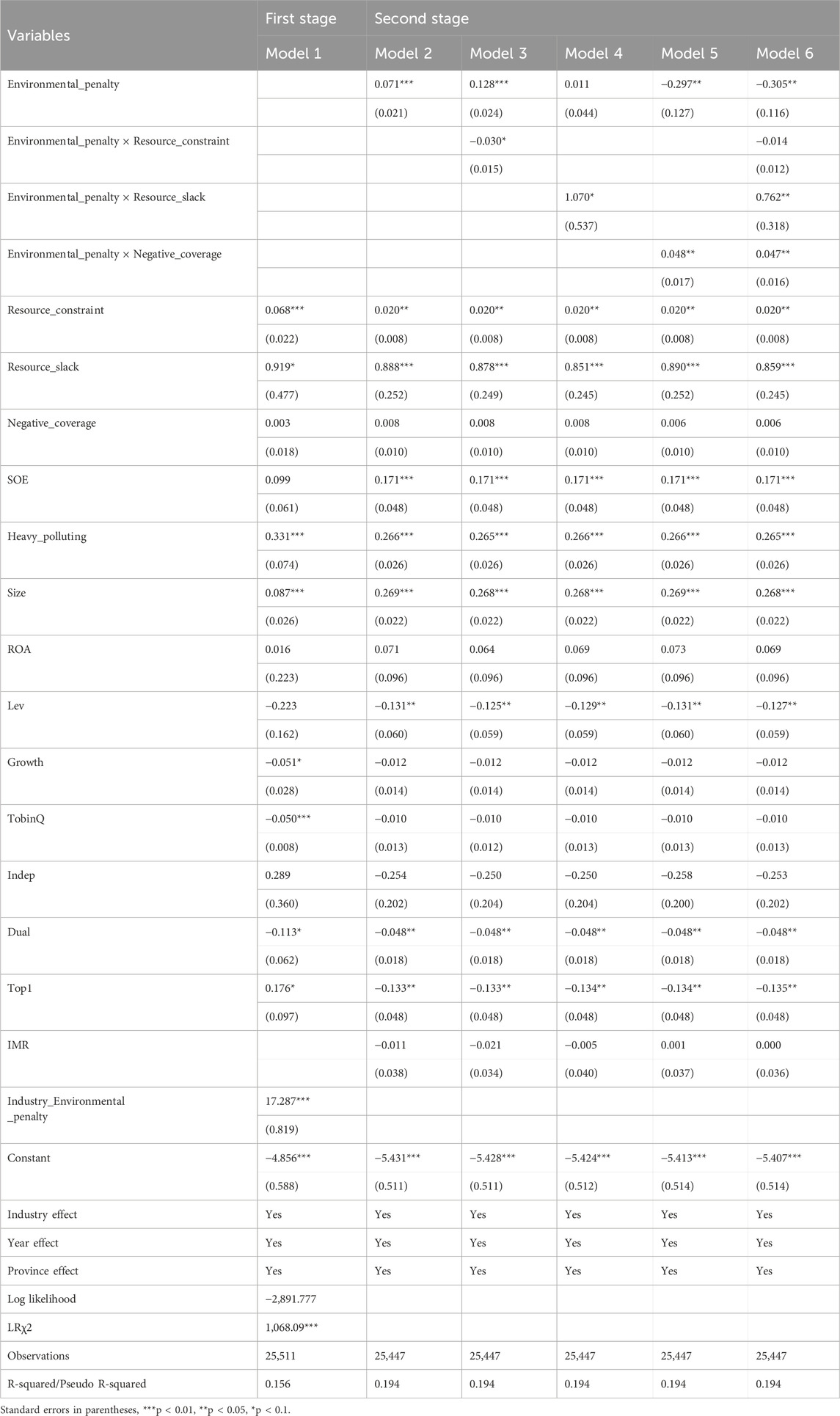

We must acknowledge the possibility of self-selection bias in our model. It is possible that corporations do not randomly incur environmental penalties from authorities. Firms in significantly polluting industries are more likely to attract the attention of authorities. To address selection bias, the study employs the Heckman two-stage model to correct self-selection bias (Heckman, 1979), with the industry means of penalties from environmental regulators (Industry_Environmental_penalty) used as the exclusion variable (Liu et al., 2021). The first stage involves determining if the firm has incurred a penalty from the environmental regulator (Penalty_Dummy) as the dependent variable, whereas the second stage involves the dependent variable Environmental_penalty. Penalty_Dummy is a binary variable that takes one if the corporation has incurred a penalty and 0 if not. Table 7 displays the outcomes of the Heckman two-stage model. In model 1, the coefficient of Industry_Environmental_penalty is positively and significantly associated (

4.5 Supplementary analysis

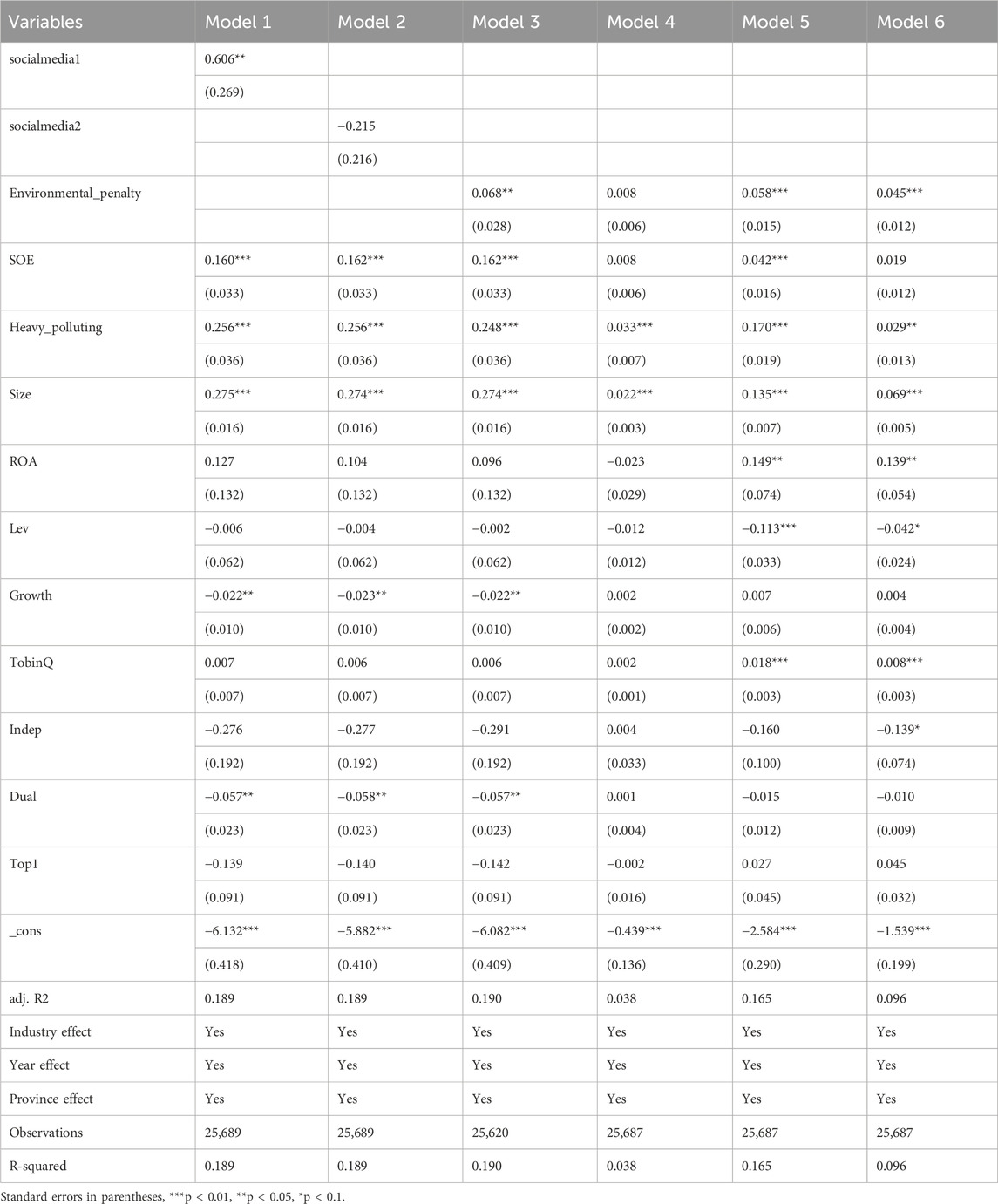

To further rationalize the research in this paper, we show that negative comments can better drive corporate carbon disclosure compared to positive social media comments by comparing the effects of positive and negative comments on corporate carbon disclosure, as there is a clear emotional bias in discussions or evaluations on social media platforms. From the perspective of social psychology, when social masses are faced with negative comments on anything, they are willing to spend more time to find out why and how things happen (Lange and Washburn, 2012; Kwahk and Kim, 2017). Conversely, when firms generate more negative reviews, they spread faster (Lu et al., 2013), which can further create implicit pressure on the firms. We used OLS regression to analyze this study further in this paper and also controlled for fixed effects of year, industry, and province (Li et al., 2017). The study results are shown in Table 8 below, where Models 1 and 2 are the negative and positive evaluations of firms facing social media, respectively. The results show that the degree of carbon disclosure generated when enterprises face negative evaluations from social media is much higher than that generated when enterprises face positive evaluations. On the other hand, we also explored the impact of the degree of penalties when firms face different environmental disclosures, where Model 3-Model 5 represent the degree of impact of environmental penalties on carbon disclosure, industrial solid waste generation, solid waste utilization and disposal, noise, light pollution, radiation, and other governance, respectively. Although the regression results of monthly noise, light pollution, radiation, and other governance of solid waste utilization and disposal are positive and significant, the regression coefficients can significantly indicate that carbon disclosure can have a more significant effect when firms are also subjected to environmental penalties, which validates our previous conclusions.

Table 8. The differential impact of social media on corporate carbon disclosure and the number of penalties on other environmental disclosures.

5 Discussion and conclusion

5.1 Discussion

This study contributes to the broader literature on corporate social responsibility, carbon disclosure, and regulatory mechanisms, offering both corroborative and novel insights. First, our findings align with the literature highlighting the role of regulatory mechanisms in improving environmental performance. Prior studies (e.g., Clarkson et al., 2008; Luo and Tang, 2014) have emphasized the effectiveness of penalties in incentivizing environmental compliance. However, we extend this literature by demonstrating the conditional nature of this effect, influenced by the resource status of firms. While studies like those of Hahn et al. (2015) have focused on institutional pressures, our research shows that internal resource limitations can weaken the regulatory impact on carbon disclosure, adding nuance to the understanding of corporate responses to environmental policies.

Second, our results differ from earlier studies that view penalties as universally effective tools for improving CID (e.g., Stanny and Ely, 2008). We reveal that Compared to enterprises with less resource constraints, the positive effect of environmental regulatory penalties on carbon information disclosure of enterprises with more resource constraints is weaker, firms with surplus resources not only respond more positively to penalties but also exhibit greater capacity for improving disclosure practices. This highlights the critical role of resource slack as a determinant of environmental behavior, a perspective underexplored in existing literature.

Third, our study advances the discussion on the role of social media in CSR. Unlike previous studies that have primarily focused on the direct role of traditional media in influencing corporate behavior (e.g., Dyck et al., 2008), our findings illustrate Social media can create an additional layer of accountability to amplify public pressure on companies. This suggests that social media platforms serve as a dynamic channel for enhancing transparency, reinforcing penalties’ impact on CID, and shaping corporate strategies.

Finally, our research enriches the theoretical framework of organizational legitimacy. While previous studies have framed legitimacy as an outcome of regulatory compliance (Suchman, 1995), we argue that it also operates through a dual mechanism involving resource conditions and public scrutiny. By integrating these elements, our study offers a more comprehensive understanding of how firms navigate the complex interplay of internal and external pressures.

5.2 Theoretical contributions

This study has the following theoretical contributions. Firstly, the main regulatory target for carbon information disclosure by environmental regulatory agencies is listed companies, so we chose companies listed on the Shanghai and Shenzhen stock exchanges for our research. We have also applied the theory of legality to the process of enterprises’ carbon information disclosure, enriching the literature in related fields. Secondly, we explored the moderating effect of corporate resource status on the relationship between corporate environmental penalties and corporate carbon disclosure. We concluded that in addition to the penalty mechanism, the resource status of the enterprise itself is also an important factor affecting its environmental behavior. This supplements the empirical data in the relevant field. Thirdly, the social responsibility of the media can pressure social public opinion on enterprises, effectively promoting them to improve their carbon disclosure behavior. We believe that negative evaluations of companies and their resource constraints on social media are key drivers of carbon reduction and disclosure, enriching the variable composition of related research fields.

5.3 Practical implications

This study offers information and insights to help policymakers develop regulatory policies in the carbon-neutral, carbon-cycle era.

Carbon disclosure is a symbolic management measure aimed at improving corporate reputation by voluntarily disclosing carbon emissions. Our research has shown that implementing a penalty mechanism can incentivize and regulate companies’ carbon disclosure behavior. The government can implement legislation requiring corporations to disclose their carbon emissions to prevent them from attempting to conceal their environmental impact using inexpensive methods, promoting more thorough carbon disclosure. Our study also demonstrates that corporate resource scarcity weakens the positive effect of corporate environmental penalties on corporate carbon disclosure. In contrast, corporate resource redundancy strengthens this effect, offering improved managerial insights into the carbon disclosure process.

Moreover, our research has also shown that social media effectively regulates corporate carbon disclosure. The media’s social responsibility can influence public opinion to pressure companies, prompting them to enhance their carbon disclosure practices. Social media’s criticism of companies for not fulfilling their social responsibilities can create public pressure on them, offering a new way to promote a low-carbon society.

5.4 Limitations and directions for future research

Our study has several constraints. First, a dependable and uniform methodology is required to evaluate the influence of carbon disclosure in China. Only nine carbon disclosure elements were used for this study to generate business carbon disclosure ratings due to limited data availability. These items include low-carbon targets, carbon emission reduction subsidies, and investments in low-carbon technology. This measurement approach may need more reliability.

Further investigation is required to determine if this study’s evaluation index method is comprehensive and can effectively represent the fluctuations in corporate carbon disclosure levels. Future studies should explore the development of standardized and robust evaluation frameworks for assessing carbon disclosure, ensuring consistency across different contexts and industries. Besides, corporate carbon disclosure rules differ, and the information may be slanted in firms’ favor. The corporate carbon trading market is still developing, and many enterprises in China voluntarily disclose carbon statistics due to the recent introduction of the country’s carbon trading pilot program. Research could focus on comparing disclosure practices across different regulatory environments to identify best practices and examine how varying regulatory frameworks influence the accuracy and transparency of carbon disclosure. As corporate carbon disclosure quality improves, additional carbon disclosure criteria must be chosen to calculate a company’s carbon disclosure score. Finally, the quality of carbon information disclosure regarding data collection was assessed manually. One should assess the data collection scope and the ratings’ impartiality.

5.5 Conclusion

This study revealed important findings about the mechanisms driving corporate carbon disclosure, addressing the objectives of understanding the effects of environmental penalties, resource conditions, and social media on disclosure practices. By analyzing data from Chinese-listed companies between 2009 and 2019, we found that environmental penalties served as effective incentives for carbon disclosure, especially in firms with surplus resources. However, the impact of these penalties was weaker in resource-constrained enterprises, indicating that internal resource availability plays a significant role in shaping corporate responses to regulatory measures. Additionally, social media was found to amplify the influence of environmental penalties by exerting public pressure on firms, highlighting its role as a powerful external force in fostering transparency and accountability. These findings align with the research aim of exploring how external pressures and internal conditions interact to influence corporate behavior. The results underscore the need for regulatory frameworks that are sensitive to firm-specific resource conditions and utilize social media as a complementary tool to enhance carbon disclosure practices. This study contributes to the literature on carbon disclosure and corporate social responsibility while providing practical guidance for policymakers and managers seeking to promote more transparent and sustainable corporate practices.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JS: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Project administration, Software, Supervision, Visualization, Writing–original draft, Writing–review and editing. WL: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Software, Writing–original draft. LH: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Software, Writing–original draft. YT: Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aerts, W., and Cormier, D. (2009). Media legitimacy and corporate environmental communication. Account. Organ. Soc. 34 (1), 1–27. doi:10.1016/j.aos.2008.02.005

Al-Haddad, S., Sharabati, A. A. A., Al-Khasawneh, M., Maraqa, R., and Hashem, R. (2022). The influence of corporate social responsibility on consumer purchase intention: the mediating role of consumer engagement via social media. Sustainability 14 (11), 6771. doi:10.3390/su14116771

Aragón-Correa, J. A., Hurtado-Torres, N., Sharma, S., and García-Morales, V. J. (2008). Environmental strategy and performance in small firms: a resource-based perspective. J. Environ. Manag. 86 (1), 88–103. doi:10.1016/j.jenvman.2006.11.022

Ben-Amar, W., and McIlkenny, P. (2016). Board effectiveness and the voluntary disclosure of climate change information. Bus. Strategy Environ. 24 (8), 704–719. doi:10.1002/bse.1840

Berry, M. A., and Rondinelli, D. A. (1998). Proactive corporate environmental management: a new industrial revolution. Acad. Manag. Perspect. 12 (2), 38–50. doi:10.5465/ame.1998.650515

Bilal, B., Tan, D., Komal, B., Ezeani, E., Usman, M., and Salem, R. (2022). Carbon emission disclosures and financial reporting quality: does ownership structure and economic development matter? Environ. Sci. and Policy 137, 109–119. doi:10.1016/j.envsci.2022.08.004

Burke, J. J. (2022). Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. J. Bus. Ethics 176 (4), 647–671. doi:10.1007/s10551-020-04715-x

Busch, T., and Lewandowski, S. (2018). Corporate carbon and financial performance: a meta-analysis. J. Industrial Ecol. 22 (4), 745–759. doi:10.1111/jiec.12591

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Account. Organ. Soc. 33 (4-5), 303–327. doi:10.1016/j.aos.2007.05.003

Cui, J., and Hwang, M. H. (2018). The effect of firm’s financial characteristics on voluntary disclosure of carbon emission information. Rev. Account. Policy Stud. 23 (3), 119–143. doi:10.21737/kjar.2018.08.23.3.119

Dasgupta, S., Hettige, H., and Wheeler, D. (2000). What improves environmental compliance? Evidence from Mexican industry. J. Environ. Econ. Manag. 39 (1), 39–66. doi:10.1006/jeem.1999.1090

Dyck, A., Volchkova, N., and Zingales, L. (2008). The corporate governance role of the media: evidence from Russia. J. Finance 63 (3), 1093–1135. doi:10.1111/j.1540-6261.2008.01353.x

Eleftheriadis, I. M., Anagnostopoulou, E. G., and Diavastis, I. E. (2015). Relationship between corporate performance, climate change disclosures and carbon intensity of business activities. Innovation, Entrepreneursh. Sustain. Value Chain a Dyn. Environ., 760–772.

Hahn, R., Reimsbach, D., and Schiemann, F. (2015). Organizations, climate change, and transparency: reviewing the literature on carbon disclosure. Organ. and Environ. 28 (1), 80–102. doi:10.1177/1086026615575542

He, P. L., Shen, H. Y., Zhang, Y., and Ren, J. (2019). External pressure, corporate governance, and voluntary carbon disclosure: evidence from China. Sustainability 11 (10), 2901. doi:10.3390/su11102901

He, S. B., and Wang, F. (2014). Discussion on corporate carbon disclosure drive mechanism in China. Adv. Educ. Res. 53, 344–348.

Jabbour, A. B. L. D., Jabbour, C. J. C., Sarkis, J., Latan, H., Roubaud, D., Godinho, M., et al. (2021). Fostering low-carbon production and logistics systems: framework and empirical evidence. Int. J. Prod. Res. 59 (23), 7106–7125. doi:10.1080/00207543.2020.1834639

Jiang, Y., Luo, L., Xu, J. F., and Shao, X. R. (2021). The value relevance of corporate voluntary carbon disclosure: evidence from the United States and BRIC countries. J. Contemp. Account. and Econ. 17, 100279. doi:10.1016/j.jcae.2021.100279

Jiang, Y. C., Zhang, L. Y., and Tarbert, H. (2022). Does top management team media exposure affect corporate social responsibility? Front. Psychol. 13, 827346. doi:10.3389/fpsyg.2022.827346

Kalu, J. U., Buang, A., and Aliagha, G. U. (2016). Determinants of voluntary carbon disclosure in the corporate real estate sector of Malaysia. J. Environ. Manag. 182, 519–524. doi:10.1016/j.jenvman.2016.08.011

Kang, D., Lee, J., and Kim, K. (2010). Alignment of business enterprise architectures using fact-based ontologies. Expert Syst. Appl. 37 (4), 3274–3283. doi:10.1016/j.eswa.2009.09.052

Kaplan, S. N., and Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112 (1), 169–215. doi:10.1162/003355397555163

Kassinis, G., and Vafeas, N. (2002). Corporate boards and outside stakeholders as determinants of environmental litigation. Strategic Manag. J. 23 (5), 399–415. doi:10.1002/smj.230

Kurnia, P., Darlis, E., and Putra, A. A. (2020). Carbon emission disclosure, good corporate governance, financial performance, and firm value. J. Asian Finance Econ. Bus. 7 (12), 223–231. doi:10.13106/jafeb.2020.vol7.no12.223

Kwahk, K.-Y., and Kim, B. (2017). Effects of social media on consumers’ purchase decisions: evidence from Taobao. Serv. Bus. 11, 803–829. doi:10.1007/s11628-016-0331-4

Lange, D., and Washburn, N. T. (2012). Understanding attributions of corporate social irresponsibility. Acad. Manag. Rev. 37, 300–326. doi:10.5465/amr.2010.0522

Lee, J., and Kim, S. J. (2021). How can David orchestrate resources to enhance firm performance? A dynamic approach to coping with resource constraints. Long. Range Plan. 54 (4), 102090. doi:10.1016/j.lrp.2021.102090

Lee, S. Y., Park, Y. S., and Klassen, R. D. (2015). Market responses to firms' voluntary climate change information disclosure and carbon communication. Corp. Soc. Responsib. Environ. Manag. 22 (1), 1–12. doi:10.1002/csr.1321

Lehn, K., and Poulsen, A. (1989). Free cash flow and stockholder gains in going private transactions. J. Finance 44 (3), 771–787. doi:10.1111/j.1540-6261.1989.tb04390.x

Lemma, T. T., Feedman, M., Mlilo, M., and Park, J. D. (2019). Corporate carbon risk, voluntary disclosure, and cost of capital: South African evidence. Bus. Strategy Environ. 28 (1), 111–126. doi:10.1002/bse.2242

Li, D., Huang, M., Ren, S., Chen, X., and Ning, L. (2018). Environmental legitimacy, green innovation and corporate carbon disclosure: evidence from CDP China 100. J. Bus. Ethics 150 (4), 1089–1104. doi:10.1007/s10551-016-3187-6

Li, L., Liu, Q., Tang, D., and Xiong, J. (2017). Media reporting, carbon information disclosure, and the cost of equity financing: evidence from China. Environ. Sci. Pollut. Res. 24 (10), 9447–9459. doi:10.1007/s11356-017-8614-4

Liu, W., De Sisto, M., and Li, W. H. (2021). How does the turnover of local officials make firms more charitable? A comprehensive analysis of corporate philanthropy in China. Emerg. Mark. Rev. 46, 100748. doi:10.1016/j.ememar.2020.100748

Liu, X. H., Wang, E. X., and Cai, D. T. (2018). Environmental regulation and corporate financing-quasi-natural experiment evidence from China. Sustainability 10 (11), 4028. doi:10.3390/su10114028

Lu, X., Ba, S., Huang, L., and Feng, Y. (2013). Promotional marketing or word-of-mouth? Evidence from online restaurant reviews. Inf. Syst. Res. 24, 596–612. doi:10.1287/isre.1120.0454

Luo, L. (2019). The influence of institutional contexts on the relationship between voluntary carbon disclosure and carbon emission performance. Account. and Finance 59 (2), 1235–1264. doi:10.1111/acfi.12267

Luo, L., and Tang, Q. (2014). Does voluntary carbon disclosure reflect underlying carbon performance? J. Contemp. Account. and Econ. 10 (3), 191–205. doi:10.1016/j.jcae.2014.08.003

Luo, X. Y., Zhang, R. M., and Liu, W. (2022). Environmental legitimacy pressure, political connection and impression management of carbon information disclosure. Carbon Manag. 13 (1), 90–104. doi:10.1080/17583004.2021.2022537

Ma, X., Talluri, S., Ferguson, M., and Tiwari, S. (2022). Strategic production and responsible sourcing decisions under an emissions trading scheme. Eur. J. Operational Res. 303 (3), 1429–1443. doi:10.1016/j.ejor.2022.04.003

Mahadeo, J. D., Oogarah-Hanuman, V., and Soobaroyen, T. (2011). Changes in social and environmental reporting practices in an emerging economy (2004–2007): exploring the relevance of stakeholder and legitimacy theories. Account. Forum 35 (3), 158–175. doi:10.1016/j.accfor.2011.06.005

Marquis, C., and Bird, Y. (2018). The paradox of responsive authoritarianism: how civic activism spurs environmental penalties in China. Organ. Sci. 29 (5), 948–968. doi:10.1287/orsc.2018.1212

Mateo-Marquez, A. J., Gonzalez-Gonzalez, J. M., and Zamora-Ramirez, C. (2021). Components of countries' regulative dimensions and voluntary carbon disclosures. Sustainability 13 (4), 1914. doi:10.3390/su13041914

Nazwa, N., and Fitri, F. A. (2022). Can carbon emission disclosure, environmental performance, and corporate social responsibility improve firm value in Indonesia? 2022. Int. Conf. Decis. Aid Sci. Appl. (DASA), 1163–1167. doi:10.1109/DASA54658.2022.9765049

Nguyen, T. H. H., Elmagrhi, M. H., Ntim, C. G., and Wu, Y. (2021). Environmental performance, sustainability, governance and financial performance: evidence from heavily polluting industries in China. Bus. Strategy Environ. 30 (5), 2313–2331. doi:10.1002/bse.2748

Pan, X., Chen, X. J., and Yang, X. (2022). Examining the relationship between negative media coverage and corporate social responsibility. Bus. Ethics, Environ. and Responsib. 31 (3), 620–633. doi:10.1111/beer.12430

Pian-Pian, X., Chen-Min, H., Sha, C., Wei-Yi, J., Jia, L., and Ke-Jun, J. (2023). Role of hydrogen in China's energy transition towards carbon neutrality target: IPAC analysis. Adv. Clim. Change Res. 14 (1), 43–48. doi:10.1016/j.accre.2022.12.004

Polakova, E. (2010). Theory and practice of ethics media and their social responsibility. Commun. Today 1 (2), 148–158. doi:10.1002/9781118591178.ch19

Porteous, A. H., Rammohan, S. V., and Lee, H. L. (2015). Carrots or sticks? Improving social and environmental compliance at suppliers through incentives and penalties. Prod. Operations Manag. 24 (9), 1402–1413. doi:10.1111/poms.12376

Saka, C., and Oshika, T. (2014). Disclosure effects, carbon emissions and corporate value. Sustainability Accounting.

Seifert, B., Morris, S. A., and Bartkus, B. R. (2004). Having, giving, and getting: slack resources, corporate philanthropy, and firm financial performance. Bus. and Soc. 43 (2), 135–161. doi:10.1177/0007650304263919

Shao, J., and He, Z. W. (2022). How does social media drive corporate carbon disclosure? Evidence from China. Front. Ecol. Evol. 10. doi:10.3389/fevo.2022.971077

Shen, H. Y., Zheng, S. F., Adams, J., and Jaggi, B. (2020). The effect stakeholders have on voluntary carbon disclosure within Chinese business organizations. Carbon Manag. 11 (5), 455–472. doi:10.1080/17583004.2020.1805555

Shevchenko, A. (2021). Do financial penalties for environmental violations facilitate improvements in corporate environmental performance? An empirical investigation. Bus. Strategy Environ. 30 (4), 1723–1734. doi:10.1002/bse.2711

Song, M., Ai, H., and Li, X. (2015). Political connections, financing constraints, and the optimization of innovation efficiency among China's private enterprises. Technol. Forecast. Soc. Change 92, 290–299. doi:10.1016/J.TECHFORE.2014.10.003

Song, M. L., Peng, L. C., Shang, Y. P., and Zhao, X. (2021). Green technology progress and total factor productivity of resource-based enterprises: a perspective of technical compensation of environmental regulation. Technol. Forecast. Soc. Change 174, 121276. doi:10.1016/j.techfore.2021.121276

Stanny, E., and Ely, K. (2008). Corporate environmental disclosures about the effects of climate change. Corp. Soc. Responsib. Environ. Manag. 15 (6), 338–348. doi:10.1002/csr.175

Suchman, M. C. (1995). Managing legitimacy: strategic and institutional approaches. Acad. Manag. Rev. 20 (3), 571–610. doi:10.5465/amr.1995.9508080331

Tan, X., Guo, W., Fan, J., Guo, J., Wang, M., Zen, A., et al. (2022). Policy framework and technology innovation policy of carbon peak and carbon neutrality. Bulletin of the Chinese Academy of Sciences 37 (4), 435–443.

Tang, Y. J., Zhu, J., Ma, W. C., and Zhao, M. X. (2022). A study on the impact of institutional pressure on carbon information disclosure: the mediating effect of enterprise peer influence. Int. J. Environ. Res. Public Health 19 (7), 4174. doi:10.3390/ijerph19074174

Tao, P. (2016). “Analysis of enterprise environment cost management from the perspective of low carbon economy,” in Proceedings of the fifteenth international symposium - management science and engineering, 203–206. doi:10.2991/icetss-14.2014.46

Tasavori, M., Kwong, C., and Pruthi, S. (2018). Resource bricolage and growth of product and market scope in social enterprises. Entrepreneursh. Regional Dev. 30 (3-4), 336–361. doi:10.1080/08985626.2017.1413775

Tavakolifar, M., Omar, A., Lemma, T. T., and Samkin, G. (2021). Media attention and its impact on corporate commitment to climate change action. J. Clean. Prod. 313, 127833. doi:10.1016/j.jclepro.2021.127833

Tiwari, S., Ahmed, W., and Sarkar, B. (2019). Sustainable ordering policies for non-instantaneous deteriorating items under carbon emission and multi-trade-credit-policies. J. Clean. Prod. 240, 118183. doi:10.1016/j.jclepro.2019.118183

Tong, L., Jabbour, C. J. C., Ben Belgacem, S., Najam, H., and Abbas, J. (2022). Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: empirical evidence from Asian region. J. Clean. Prod. 380, 134930. doi:10.1016/j.jclepro.2022.134930

Usman, M., Salem, R., Ezeani, E., and Song, X. (2022). The impact of audit characteristics, audit fees on classification shifting: evidence from Germany. Int. J. Account. and Inf. Manag. 30, 408–426. doi:10.1108/ijaim-12-2021-0252

Wang, X. Q., and Zhong, J. L. (2022). Influence mechanism of carbon accounting information disclosure in service industry and its factors. J. Environ. Prot. Ecol. 23 (3), 1094–1103.

Wang, Y., Guo, C.-H., Chen, X.-J., Jia, L.-Q., Guo, X.-N., Chen, R.-S., et al. (2021). Carbon peak and carbon neutrality in China: goals, implementation path and prospects. China Geol. 4 (4), 720–746.

Wintoki, M. B., Linck, J. S., and Netter, J. M. (2012). Endogeneity and the dynamics of internal corporate governance. J. Financial Econ. 105 (3), 581–606. doi:10.1016/j.jfineco.2012.03.005

Xu, Y., Li, S. S., Zhou, X. X., Shahzad, U., and Zhao, X. (2022). How environmental regulations affect the development of green finance: recent evidence from polluting firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020

Yu, H.-C., Kuo, L., and Ma, B. (2020). The drivers of carbon disclosure: evidence from China's sustainability plans. Carbon Manag. 11 (4), 399–414. doi:10.1080/17583004.2020.1796142

Zhang, Y. M., and Yang, F. (2021). Corporate social responsibility disclosure: responding to investors' criticism on social media. Int. J. Environ. Res. Public Health 18 (14), 7396. doi:10.3390/ijerph18147396

Keywords: sustainability strategy, transformation, punishment mechanisms, corporate resources management, social media, carbon disclosure, carbon reduction regulation

Citation: Shao J, Li W, Huang L and Tian Y (2025) Environmental penalties and corporate carbon disclosure in China: divergent effects of resource availability and the role of social media pressure. Front. Environ. Sci. 12:1426046. doi: 10.3389/fenvs.2024.1426046

Received: 20 May 2024; Accepted: 10 December 2024;

Published: 30 January 2025.

Edited by:

Saddam A. Hazaea, Southwestern University of Finance and Economics, ChinaReviewed by:

Godwin Norense Osarumwense Asemota, University of Rwanda, RwandaJusheng Liu, Shanghai University of Political Science and Law, China

Muhammad Ramaditya, University of Indonesia, Indonesia

Moodhi Raid, Al Yamamah University, Saudi Arabia

Copyright © 2025 Shao, Li, Huang and Tian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuanhao Tian, eXRpYW4wMjBAZml1LmVkdQ==

Jing Shao

Jing Shao Wenjie Li

Wenjie Li Lingtong Huang1

Lingtong Huang1 Yuanhao Tian

Yuanhao Tian