- 1Department of Business Administration, Faculty of Economics and Administrative Sciences, European University of Lefke, Lefke, Türkiye

- 2Department of Economics, Adnan Kassar School of Business, Lebanese American University, Beirut, Lebanon

- 3Department of Banking and Finance, Faculty of Economics and Administrative Sciences, European University of Lefke, Lefke, Türkiye

This study investigates the impact of financial stability on environmental degradation in Turkey, controlling for economic growth, renewable energy consumption, and primary energy consumption between 1990 and 2019. The study employs various statistical methodologies, including LS Unit Root, Fourier ARDL, DOLS, and FMOLS tests. The findings reveal an inverse relationship between financial stability and environmental degradation. Both economic growth and primary energy consumption are found to exacerbate environmental degradation. This study recommends that policymakers incorporate financial stability into policies aimed at reducing CO2 emissions. Furthermore, it emphasizes the importance of investing in renewable energy infrastructure and the transportation sector to effectively mitigate environmental degradation.

1 Introduction

Energy is a vital resource necessary for heating, lighting, transportation, and the use of modern technological products. As technology progresses, the demand for energy keeps rising. The increase in environmental degradation has become a significant issue for countries within both underdeveloped and developing regions. Particularly due to the adverse effects on the global economy, numerous theories and policies have been developed to mitigate this damage. It has been identified that the primary cause of environmental degradation is the rise in greenhouse gases (Pata, 2018). Among these gases, carbon emissions (CO2) hold the highest share (Pata, 2018). CO2 emissions result from the combination of carbon, released through the combustion of fossil fuels, with oxygen, forming carbon dioxide. The increase in environmental pollution due to CO2 emissions occurs when carbon dioxide emissions exceed the world’s emission capacity (Çetin and Yüksel, 2018). The nexus between financial stability, primary energy consumption, and the correlation between energy utilization and CO2 emissions constitutes a pivotal domain of inquiry within environmental economics. The theoretical underpinnings of these interconnections are frequently grounded in the principles of sustainable development and the Environmental Kuznets Curve (EKC) hypothesis (Çetin and Yüksel, 2018). Financial stability, characterized by the resilience and robustness of financial institutions and markets, is indispensable in facilitating investments in renewable energy technologies and efficient energy systems (Nwani et al., 2023). These investments are crucial for the diminution of primary energy consumption and the mitigation of CO2 emissions. Healthy financial markets enable the allocation of capital towards green technologies and infrastructure, which are imperative for the transition to a sustainable energy future (Farooq et al., 2022). The EKC hypothesis postulates an inverted U-shaped relationship between economic growth and environmental degradation (Farooq et al., 2022). According to this hypothesis, CO2 emissions tend to escalate during the initial stages of economic growth (Kirikkaleli and Adebayo, 2024). However, as an economy continues to develop and mature, emissions eventually decline due to the adoption of cleaner technologies and the implementation of stringent environmental regulations (Kirikkaleli and Adebayo, 2024). This perspective underscores the dynamic interplay between economic development and environmental quality (Adekunle et al., 2024). In this context, financial mechanisms and policies are paramount in the pursuit of energy efficiency and sustainability. Effective financial policies and incentives can support the adoption of green technologies and research and development in sustainable practices, and ensure that economic growth is congruent with environmental preservation (Nwani et al., 2023).

This study aims to explain the impact of financial stability on environmental degradation while controlling economic growth, renewable energy, and energy consumption in Turkey. The study analyzes data between 1990-Q1 and 2019-Q4. Unlike other research that spans multiple countries, this study focuses solely on Turkey, differentiating itself by the current period analyzed and the unique methodologies employed. Research on the connection between renewable energy, financial stability, and environmental degradation in Turkey is sparse. The methods used are prevalent in the literature and their combined use enables comparative analysis. Additionally, the study separately assesses the relationships between financial stability and environmental degradation, economic growth, renewable energy, and energy consumption. The use of such sophisticated analytical techniques makes this study unique, as it addresses a gap in the existing literature by applying these specific methodologies to Turkey. The study’s findings contribute to a deeper understanding of the complex dynamics between financial stability and environmental outcomes in Turkey. Turkey is increasingly focusing on boosting its energy production to decrease dependence on fossil fuels and imports.

The paper is structured as follows: Section 2 explains the evolution of environmental regulations in Turkey. Section 3 provides a review of related literature. Section 4 describes the data and methodology, while Section 5 provides empirical findings. Finally, Section 6 concludes the study.

2 Evolution of environmental regulations in Turkey

In the 1970s, Turkey began prioritizing environmental concerns due to increased awareness and the 1973 oil crisis that underscored the importance of diversifying energy sources. Initially, development plans centered on economic growth with little focus on environmental protection. The Third Five-Year Development Plan (1973–1977) marked the first significant attention to environmental issues (Isik and Kilic, 2014). The 1982 constitution included environmental protection clauses, and the Ministry of Environment was created in 1991. Turkey’s international environmental involvement expanded in the 1990s, adopting sustainable development after the 1992 Rio Conference (Isik and Kilic, 2014). In 2015, Turkey committed to global sustainability by ratifying “The 2030 Agenda for Sustainable Development.” (Newell et al., 2015). The United Nations in Turkey works on the Sustainable Development Goals (SDGs) to address global challenges like poverty, inequality, and climate change. The SDGs aim to enhance human development, eliminate poverty, ensure health, promote education, and achieve gender equality, with a strong focus on environmental sustainability (Gultekin et al., 2017). The UN supports sustainable agriculture, food security, proper water management, resilient infrastructure, sustainable industrialization, innovation, and responsible consumption (Gultekin et al., 2017). Collaborating with the government, civil society, the private sector, and international organizations, the UN seeks to mobilize resources and implement sustainable strategies to achieve these objectives by 2030 (Gultekin et al., 2017).

Turkey’s environmental regulation has been significantly influenced by European Union treaties and agreements, such as the Single European Act, Maastricht Treaty, Treaty of Amsterdam, and Treaty of Nice, along with the EU’s environmental action plans since 1973 (Suleymanoglu-Kurum, 2018). This influence is reflected in Turkey’s constitutional framework, with the 1961 Constitution addressing the environment in terms of health and the 1982 Constitution explicitly recognizing the right to a healthy environment, imposing duties on both the state and citizens (Suleymanoglu-Kurum, 2018). Since the 20th century, efforts have focused on understanding and mitigating greenhouse gas emissions, particularly carbon dioxide from fossil fuels, which drive global warming and climate change (Saboori and Sulaiman, 2013). This has led to a shift towards renewable energy sources like solar, wind, and hydroelectric power due to the depletion and environmental impact of fossil fuels. Governments and organizations have promoted this transition through policies emphasizing energy efficiency, carbon pricing, and green technologies (Artan et al., 2015). The move towards renewable energy and sustainable policies demonstrates a commitment to fostering economic growth without harming the planet, addressing climate change, and reducing the carbon footprint (Artan et al., 2015).

During the 1950–1974 period, known as the Golden Age, economic prosperity came at the cost of significant environmental degradation (Pamuk and Bektas, 2014). This period’s economic growth often overlooked the environmental damage caused by manufacturing processes that relied on non-renewable energy sources (Kolsuz and Yeldan, 2017). Environmental degradation from fossil fuels led to global warming, air pollution, and climate change. As a result, there has been a shift towards examining macroeconomic parameters to create a more livable environment, emphasizing the importance of qualitative growth alongside quantitative growth for sustainability. Environmental quality has become a key concern, measured through parameters such as CO2, NO2, SO2, PM10 emissions, heavy metals in water, pathogen levels, ecological footprints, and deforestation (Artan et al., 2015). Despite the increasing prevalence of renewable energy sources, Turkey continues to import significant amounts of natural gas, primarily through pipelines and liquefied natural gas (LNG), highlighting an ongoing reliance on fossil fuels.

According to the IMF’s latest report, Turkey, one of the world’s top 20 largest economies, experienced strong economic growth in 2023, with a 4.5% increase in GDP and a per capita income of USD 11,939 (World Bank, 2024). Turkish banks are increasingly integrating sustainability into their operations by assessing the environmental impact of their credit and investment portfolios, including CO2 emissions. They consider environmental and social risks in their lending processes, with renewable energy projects now comprising 50% of their energy generation financing. Notably, Turkey Garanti Bank, Turkey Halk Bank, and Sınai Kalkınma Bank conduct extensive environmental analyses, with Halk Bank focusing on CO2 emissions and Sınai Kalkınma Bank prioritizing high-risk sectors to support the transition to a “Green Economy” (Borsaistanbul, 2017). The trend of reporting on financing for high CO2 emission sectors, which began in 2017, highlights the growing commitment to integrating environmental sustainability into financial practices (Borsaistanbul, 2017).

The transportation sector is vital for economic growth but significantly increases carbon emissions, especially from road transport, which accounts for over 70% of global transport emissions. In Turkey, this sector contributes 22.2% of the energy sector’s emissions and 15% of national emissions (Isik and Kilic, 2014). While countries like Germany and the UK have reduced their emissions, Turkey’s have doubled since 1990, with a 181% increase in its carbon footprint from 1990 to 2015. This rise is largely due to increased use of diesel and LPG (Isik and Kilic, 2014). The need for Turkey to implement effective measures to reduce transportation-related emissions is crucial, given the stark contrast with European countries’ achievements in emission reductions.

3 Review of the related literature

While Meo et al. (2023) focused on the asymmetric impact of temperature, energy use, population, economic growth, and water scarcity on CO2 emissions in Pakistan, utilizing the NARDL model to analyze data from 1960 to 2016, Tuncsiper’s (2023) study examined the relationship between Turkey’s GDP, CO2 emissions, and renewable energy consumption from 2003 to 2020, using Granger causality analysis and a deep learning network to model these dependencies. Both studies highlight the significant negative effects of economic growth on the environment. Kirikkaleli et al. (2023); Kalmaz and Kirikkaleli (2019) highlighted the connections between financial stability, economic growth, and environmental impact. Kirikkaleli et al. (2023) argue that financial stability can deter environmental degradation and note a positive correlation between economic growth and carbon emissions, while also emphasizing the beneficial role of renewable energy in reducing emissions, particularly in Norway. Kalmaz and Kirikkaleli (2019) focus on Turkey, employing modern econometric techniques to explore the long-term effects and causal relationships between CO2 emissions and factors like energy consumption, economic growth, urbanization, and trade openness. Their findings offer valuable insights for policymakers aiming to mitigate carbon emissions and foster sustainable development in Turkey. Akbar et al. (2021) examine the connections between healthcare spending, CO2 emissions and the Human Development Index (HDI) in OECD countries using a panel Vector Autoregression (VAR) model. The study is based on the Environmental Kuznets Curve (EKC) hypothesis, which suggests that environmental degradation initially worsens with economic growth but improves after a certain income level is reached. Additionally, the research incorporates the theory of sustainable development, highlighting the need to balance economic growth, social inclusion, and environmental protection. Based on these outcomes, we constructed the following hypothesis:

H1: There is a positive relationship between economic growth and environmental degradation.

Wang et al. (2023) assert that the relationship between various renewable energy sources and economic growth in ten selected Asian countries. It utilizes panel data analysis and advanced econometric techniques to investigate how hydropower, wind, solar, biomass, and geothermal energy, along with factors like trade openness and capital investment, influence economic expansion. The findings reveal a positive and significant impact of these renewable energy sources on the economic growth of Asian economies, offering valuable insights for stakeholders. Pata (2018), Jebli et al. (2016), and Ohlan (2015) each provide nuanced examinations of the relationship between CO2 emissions, economic factors, and renewable energy within different contexts. Pata and Yurtkuran focus on Turkey from 1981 to 2014, finding that while population density, financial development, and economic growth increase CO2 emissions, renewable energy consumption improves environmental quality. Ben Jebli et al., analyzing OECD countries from 1980 to 2010, support the environmental Kuznets curve (EKC) hypothesis, indicating that CO2 emissions initially rise with economic growth before eventually declining as renewable energy adoption increases. Ohlan’s study, spanning 1970 to 2013, also confirms that higher population density leads to greater CO2 emissions, employing advanced statistical methods to explore both short- and long-term dynamics and validate the EKC hypothesis. Collectively, these studies underscore the critical role of renewable energy in mitigating environmental degradation amidst economic growth and urbanization. Chang et al. (2022); Ali and Meo (2024) also argued the role of renewable energy in reducing CO2 emissions. Based on these arguments, we constructed the following hypothesis;

H2: There is a negative relationship between renewable energy consumption and environmental degradation.

Gov and Kaya (2022), Kızılkaya and Dag (2021), and Katircioglu (2014) present varied perspectives on the factors influencing CO2 emissions in Turkey. Kosaroglu and Kaya (2022) study, covering 1998–2019, highlights that foreign direct investments, economic growth, motor vehicles, financial development, primary energy consumption, and advanced technology exports increase CO2 emissions, whereas environmental tax reduces them. Kızılkaya and Dag (2021), analyzing 1975–2019, reveal a complex relationship where higher CO2 emissions correlate with increased healthcare spending and potentially hinder economic growth, using Fourier cointegration and causality tests. Katircioglu’s (2014) research, focusing on the tourism sector, demonstrates that tourism and energy consumption are significantly linked to CO2 emissions, emphasizing the need for sustainable practices in these sectors. Together, these studies underscore the multifaceted drivers of CO2 emissions in Turkey and the importance of integrating environmental considerations into economic and sectoral policies. The following hypothesis is constructed based on these arguments:

H3: There is a positive relationship between primary energy consumption and environmental degradation.

Khan and Yoon (2021) explore the theoretical linkages suggested by economic theory between financial instability and environmental quality. The findings indicate that income, trade openness, investment, and financial instability contribute to increased carbon dioxide (CO2) emissions, whereas financial instability has a mitigating effect. Akbar et al. (2021) highlight that environmental protection investments positively impact the accounting and market performance of financially non-constrained Chinese listed firms. In contrast, these investments negatively affect the performance of financially constrained firms. Nasreen et al. (2017) estimate the relationship between financial stability, economic growth, energy consumption, and carbon dioxide (CO2) emissions in South Asian countries from 1980 to 2012. The analysis employs the bounds test for cointegration and the Granger causality approach. Financial stability is found to improve environmental quality, whereas increases in economic growth, energy consumption, and population density harm environmental quality in the long run. The results also support the environmental Kuznets curve (EKC) hypothesis. Serener et al. (2022) study indicates that renewable energy consumption reduces environmental degradation while economic growth increases it, and renewable energy lowers carbon dioxide emissions in Sweden. The above literature leads to the development of the following hypothesis:

H4: There is a negative relationship between financial stability and environmental degradation.

4 Methodology

Economic growth, primary energy consumption, energy consumption and financial stability were chosen as the explanatory variables. This selection is grounded in both theoretical frameworks and empirical studies that highlight their significant roles in generating and exacerbating carbon dioxide emissions (Kalayci and Hayaloglu, 2019). To ensure consistency and comparability across the variables, all data were transformed into their logarithmic forms. This approach helps to normalize the data and mitigate issues related to different scales of measurement (Kalayci and Hayaloglu, 2019).

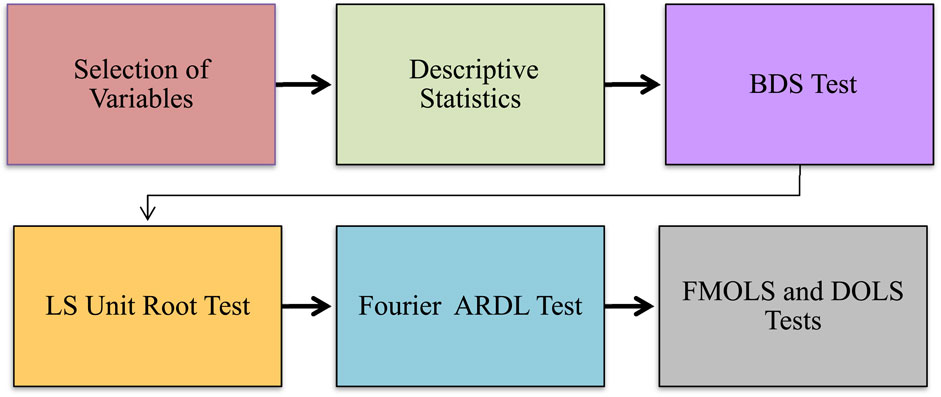

The study employed a variety of advanced econometric methods, including the LS unit root test, Fourier ARDL, DOLS, and FMOLS tests. As an initial test, the present study employed the LS unit root test with two structural breaks to capture the integration order of the variables. As a main estimator, the Fourier ARDL test is employed to capture the effect of financial stability, primary energy consumption, economic growth, and renewable energy consumption on environmental degradation in Turkey between 1990Q1 and 2019Q4. In Fourier ARDL, structural changes are identified by using Fourier functions. Therefore, there is no need to run an additional structural change test or modify the estimated model. In the study, we also applied DOLS and FMOLS tests to support the outcomes of the Fourier ARDL. This study stands out due to its use of advanced analytical techniques, filling a gap in the current literature by applying these particular methodologies to Turkey. This study aims to explain financial stability’s impact on environmental degradation while controlling economic growth, renewable energy, and energy consumption in Turkey. Based on this aim, the following the Eq. 1 is constructed;

To eliminate the multicollinearity and heteroscedasticity issues in the estimated model, all parameters are used in their natural logarithms;

Where in Eq. 2 t shows time which is between 1990-Q1 and 2019-Q4, i indicates Turkey, while

5 Empirical findings and discussion

5.1 Data and sources

As shown in Figure 1, this study focuses on the asymmetric effects of economic growth, renewable energy consumption, energy consumption, and financial stability on CO2 emissions between 1990Q1 and 2019Q4. All variables are shown in log form. In other words, this study aims to capture the effect of financial stability on environmental degradation in Turkey while controlling economic growth, energy consumption, and renewable energy in Turkey 1990Q1 and 2019Q4 analyzes with LS unit root test, DOLS, FMOLS, and Fourier ARDL.

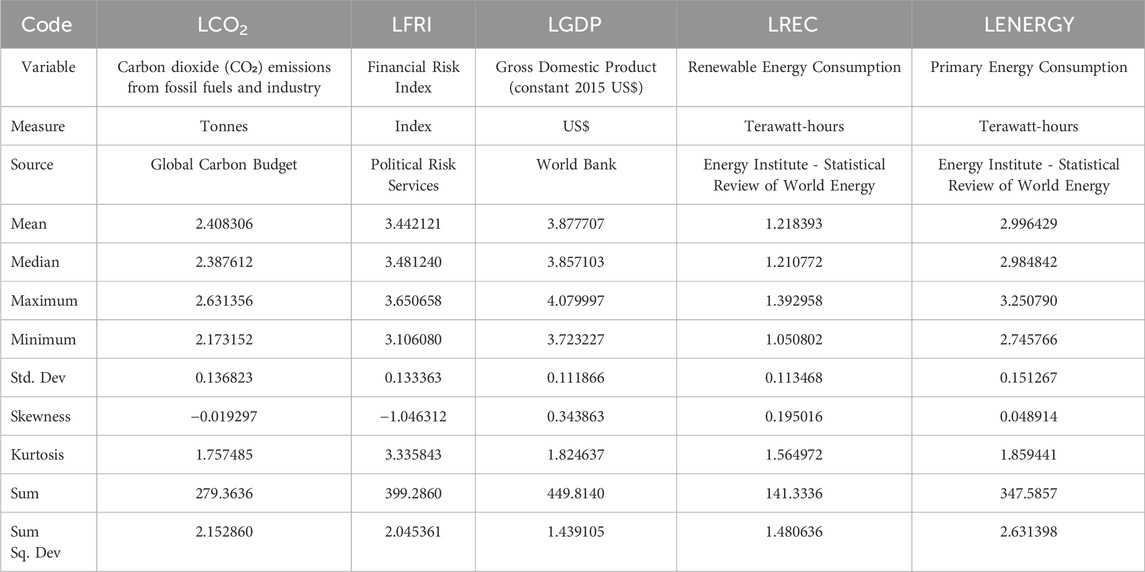

Based on the empirical model, Table 1 shows a descriptive statistical analysis of the parameters. Table 1 shows that the mean values of LCO2, LFRI, LGDP LREC, and LENERGY are 2.408306, 3.442121, 3.877707, 1.218393, and 2.996429, respectively. In this study, the time series variables are used in their natural logarithmic form.

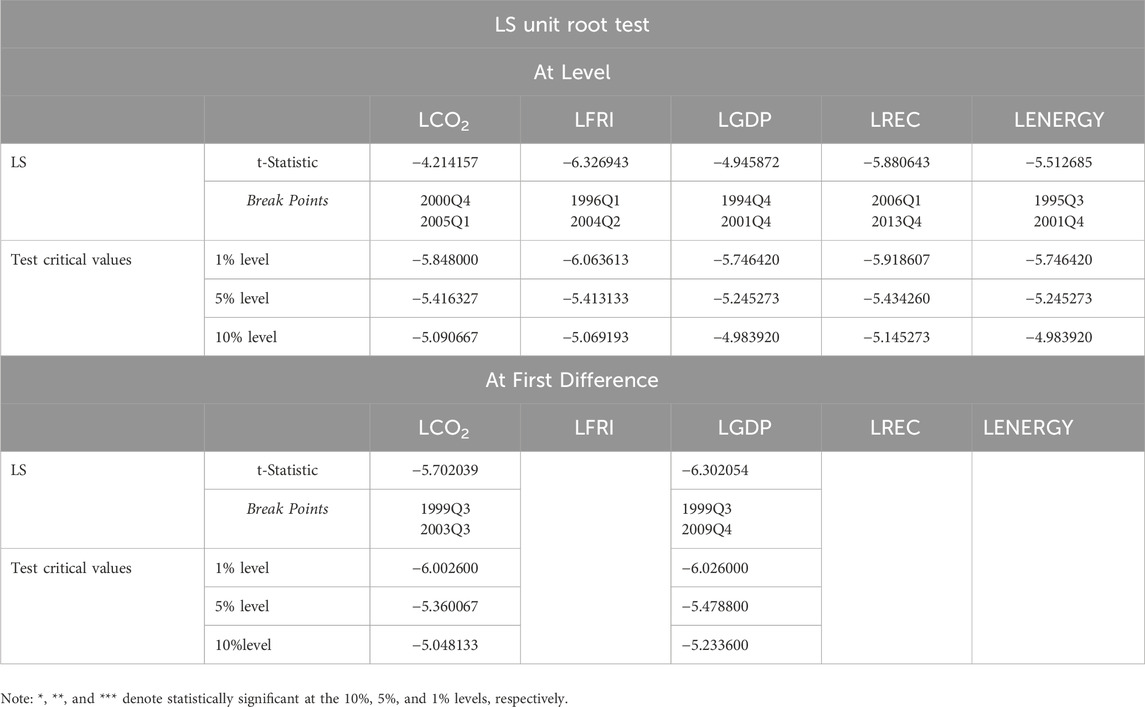

Table 2 displays the results of the LS unit root test. The LS unit root tests with breakpoints are used to analyze the series’ integration order. LS unit root test results presented in Table 2 clearly show that LFRI, LREC, and LENERGY are not stationary at levels. LCO2 and LGDP, however, become stationary after taking the first difference. The breakpoints of the time series variables are: CO2 (1999Q3; 2003Q3) and LGDP (1999Q3; 2009Q4).

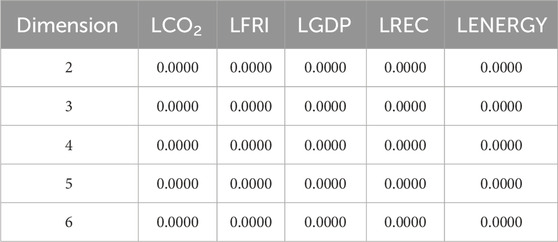

As shown in Table 3, the BDS nonlinearity test examines the hypothesis that all research variables are not uniformly distributed. Therefore, dynamic asymmetric skeletons are crucial to constraining nonlinear interactions. As clearly seen in Table 3, the time series variables have a nonlinearity behavior. After confirming the structural breakdowns and asymmetry in the series, the authors estimate the coefficients using the Fourier ARDL model. BDS test has many advantages over the alternatives.

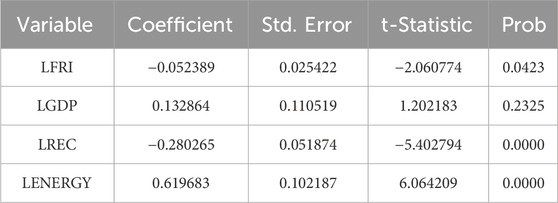

The analysis detailed in Table 4 shows that the Fourier ARDL long-run estimates for all coefficients are statistically significant. For LREC and LFRI, the coefficients are negative, indicating that a unit increase in these variables leads to a decrease in CO2 emissions by 0.28% and 0.05%, respectively. This suggests that LREC and LFRI play significant roles in reducing CO2 emissions in Turkey. Conversely, the coefficients for LGDP and LENERGY are positive, meaning that a unit increase in these factors results in a 0.13% and 0.62% increase in CO2 emissions, respectively.

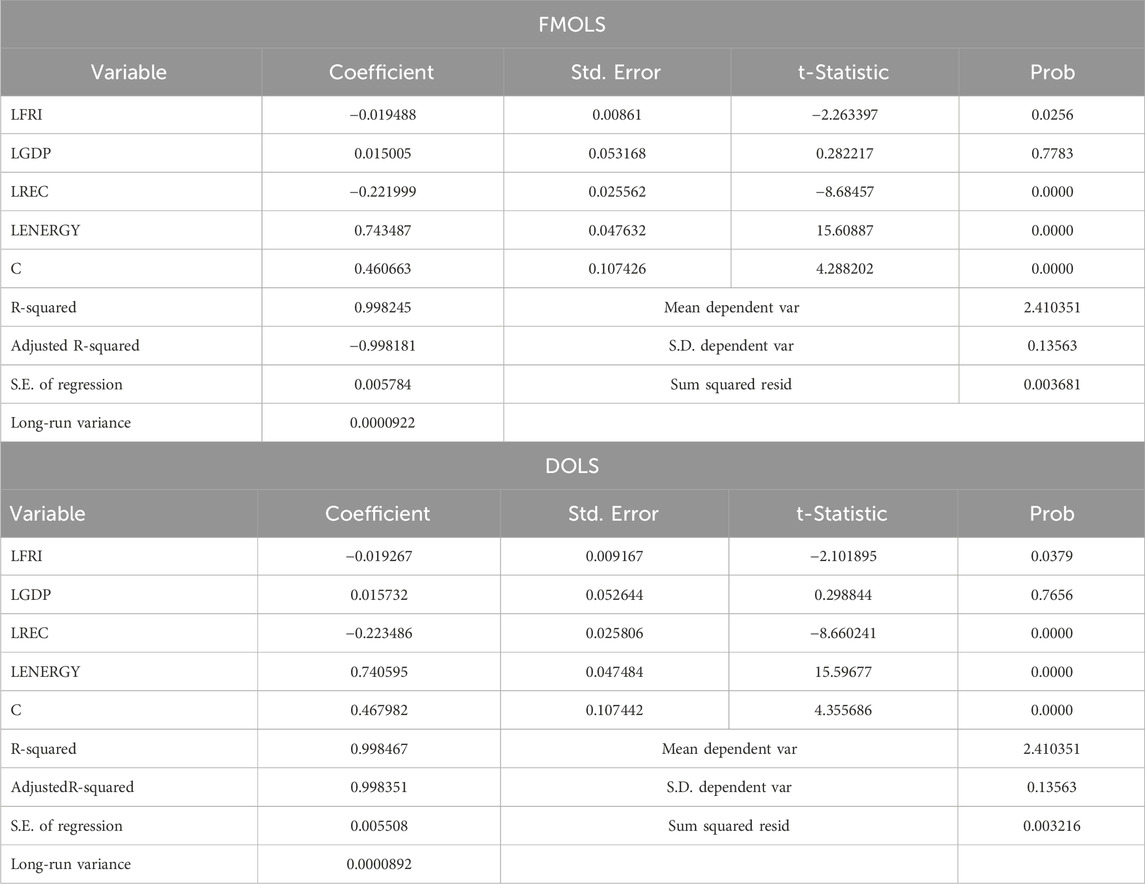

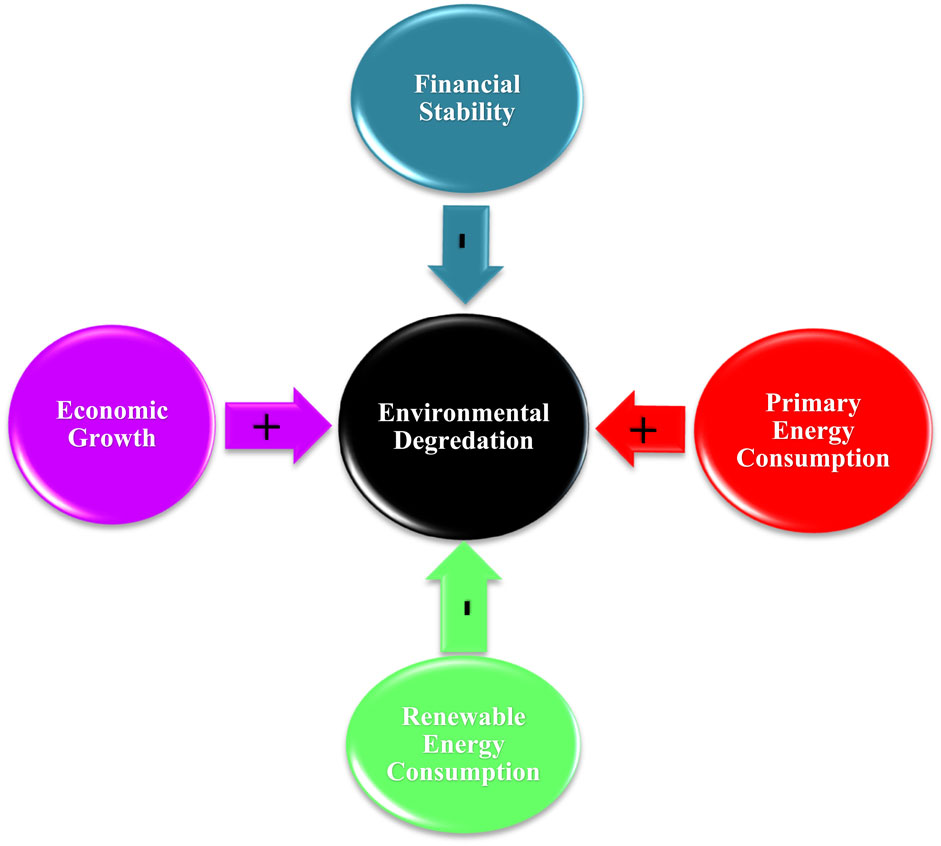

The outcomes of the FMOLS and DOLS estimates (Table 5) for model robustness indicate that the independent variables cumulatively (i.e., LFRI, LGDP, LREC, and LENERGY) can explain the dependent variable, CO2 emissions, by 98% using FMOLS and 99% using DOLS estimators respectively. As previously demonstrated by the Fourier ARDL results, the estimated model is statistically significant and has the expected signs. In other words, the effect of LFRI and LREC on carbon dioxide emissions in Turkey is negative and significant, while primary energy consumption and economic growth are positive and have a positive effect on environmental degradation. The main findings of the present study are illustrated in Figure 2.

6 Conclusion

The objective of this study is to explore the effects of economic growth, renewable energy consumption, energy consumption, and financial stability on CO2 emissions between 1990Q1 and 2019Q4. Unlike studies that cover multiple countries, this research is exclusively focused on Turkey, distinguishing itself through its analysis of a recent period and the unique methodologies it employs. There is a scarcity of research examining the relationship between renewable energy, financial stability, and environmental degradation in Turkey. The use of advanced analytical techniques makes this study unique, addressing a gap in the current literature by applying these specific methodologies to Turkey. According to the Fourier ARDL long-run analysis results for Turkey, financial stability and renewable energy resources have a negative impact, while economic growth and primary energy consumption have a positive impact on environmental degradation. These findings align with the work of Raza and Shah (2018), which indicates that economic growth contributes to higher CO2 emissions in the long run, while renewable energy consumption reduces them. This pattern is also observed in other studies. For instance, research on Thailand from 1980 to 2018 shows that renewable energy consumption has a negative and statistically significant impact on CO2 emissions (Boontome et al., 2017). Similarly, a study in Ireland found that primary energy consumption increases environmental degradation, reinforcing the conclusions of this study (Kirikkaleli and Sofuoğlu, 2023). Comparative analysis shows that the variables and outcomes are consistent across different contexts. Renewable energy consumption improves environmental quality due to its zero emissions. This conclusion is further validated by Safi et al. (2021), who indicate that financial stability and renewable energy consumption both decrease CO2 emissions in their study. According to Serener et al. (2022), the Fourier ARDL long-run estimation shows that renewable energy negatively affects environmental degradation. However, financial development and economic growth positively affect Sweden’s environmental degradation. Cetin and Yuksel (2018) identify a positive link between energy consumption and carbon emissions in Turkey, indicating a significant reliance on fossil fuels. This finding supports hypotheses two and 3, underscoring the critical need to promote and utilize renewable energy sources such as biofuel, solar, wind, hydroelectric, and geothermal energy, which are cleaner alternatives. Kirikkaleli et al. (2023) found that financial stability is beneficial for the environment in Norway. The results align with our expectations and Hypotheses 1 and 4, particularly because a stable financial system ensures efficient resource allocation, effective risk management, maintenance of employment levels close to the natural rate of unemployment, and stabilization of real or financial asset prices to support monetary stability and employment levels. Financial stability refers to the financial system’s capacity to mitigate imbalances caused by adverse and unexpected events. This stability helps prevent disruptions to the real economy and other financial systems by absorbing shocks through self-correcting mechanisms (Khan and Yoon, 2021). This finding aligns with the traditional understanding that as economies grow, industrial production, transportation, and energy consumption increase, leading to higher CO2 emissions. Economic growth often entails a rise in manufacturing and industrial activities, which are typically associated with significant carbon emissions due to the reliance on fossil fuels (Wang et al., 2023). The expansion of economic activities, while beneficial for development, poses a challenge for environmental sustainability, highlighting the need for a balanced approach to growth that incorporates environmental considerations. In contrast, the study found that renewable energy consumption negatively impacts environmental degradation. Renewable energy sources such as wind, solar, and hydroelectric power do not produce CO2 emissions during their operation, making them a cleaner alternative to traditional fossil fuels. The increased utilization of renewable energy in Turkey has contributed to a reduction in CO2 emissions, underscoring the importance of transitioning to a more sustainable energy mix. This shift towards renewable energy not only helps in mitigating environmental degradation but also promotes energy security and reduces dependence on imported fossil fuels (Wang et al., 2023). Primary energy consumption, which encompasses the total energy used by the economy, was found to have a positive influence on environmental degradation. Higher energy consumption generally correlates with increased CO2 emissions, particularly when the energy mix is heavily reliant on fossil fuels. This finding suggests that while energy consumption is essential for economic development, it also poses significant environmental challenges. Managing energy consumption through enhanced energy efficiency measures and promoting the use of cleaner energy sources are crucial steps to mitigate the environmental impact. Conversely, the study highlighted that financial stability negatively impacts environmental degradation. Financial stability can facilitate better investment in clean technologies and infrastructure that reduce emissions. Stable financial systems are more likely to support long-term investments in environmental projects and renewable energy, providing the necessary funding for sustainable development initiatives. This relationship indicates that strengthening financial institutions and mechanisms can play a pivotal role in promoting environmental sustainability.

6.1 Policy recommendation and future research

Drawing from these findings, the study presents several actionable policy suggestions to address environmental degradation in Turkey. The study underscores the importance of implementing targeted policy measures, particularly in the transportation sector, to curb emissions effectively. It proposes the adoption of a multifaceted approach encompassing carbon taxation, biofuel quotas, and incentives for zero and low-emission technologies. By incentivizing cleaner energy sources and technologies, such policies aim to mitigate the adverse environmental impact associated with transportation activities. The study advocates for the establishment of investment support schemes to accelerate the transition towards renewable energy and clean technologies. Government-backed initiatives and financial incentives can play a pivotal role in fostering the adoption of sustainable energy solutions, thereby reducing reliance on fossil fuels and mitigating environmental degradation. By broadening the geographical focus, future studies can provide a more comprehensive understanding of environmental degradation patterns and identify common trends and policy implications across diverse regions. This study relies on macroeconomic data and future research could complement this by incorporating microeconomic data.

6.2 Limitations

This study provides valuable insights into the relationship between financial stability and environmental degradation in Turkey through the use of Fourier ARDL approaches. However, several limitations need to be acknowledged. The focus on Turkey may restrict the general applicability of the findings to other nations with varying economic, social and environmental conditions. Time series data utilized in this study from 1990Q1 to 2019Q4. Incorporating more recent and detailed datasets as they become accessible could strengthen the credibility of future research.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

OT: Conceptualization, Formal Analysis, Investigation, Methodology, Resources, Validation, Visualization, Writing–original draft. DK: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

ADF, Augmented Dickey-Fuller; ARDL, Autoregressive Distributed Lag; CO2, Carbon dioxide; DOLS, Dynamic Ordinary Least Square; LGDP, Economic Growth; LFRI; Financial Stability; FMOLS, Fully Modified Ordinary Least Square; IMF, International Monetary Fund; LNG, Liquefied Natural Gas; NO2, Nitrogen Dioxide; NARDL, Nonlinear Autoregressive Distributed Lag; PM10, Particulate Matter; LENERGY, Primary Energy Consumption; LREC, Renewable Energy Consumption; PP, Phillips-Perron; SO2, Sulfur Dioxide; SDGs, Sustainable Development Goals; UN, United Nations; WLMC, Wavelet Local Multiple Correlation.

References

Adekunle, S. A., Okere, O. O., Kokogho, E., Loretta, E. Z. E., and Odio, P. E. (2024). Board characteristics and corporate performance: evidence from the Nigerian oil and gas companies. Oradea J. Bus. Econ. 9 (1), 87–97. doi:10.47535/1991ojbe184

Akbar, M., Hussain, A., Akbar, A., and Ullah, I. (2021). The dynamic association between healthcare spending, CO 2 emissions, and human development index in OECD countries: evidence from panel VAR model. Environ. Dev. Sustain. 23, 10470–10489. doi:10.1007/s10668-020-01066-5

Ali, S., and Meo, M. S. (2024). How wind-based renewable energy contribute to CO2 emissions abatement? Evidence from Quantile-on-Quantile estimation. Int. J. Environ. Sci. Technol. 21, 6583–6596. doi:10.1007/s13762-023-05409-3

Artan, S., Hayaloglu, P., and Seyhan, B. (2015). The relationship between environmental pollution, openness and purchasing power in Turkey. J. Manag. Econ. Res. 13 (1), 308–325. doi:10.11611/JMER435

Boontome, P., Therdyothin, A., and Chontanawat, J. (2017). Investigating the causal relationship between non-renewable and renewable energy consumption, CO2 emissions and economic growth in Thailand. Energy Procedia 138, 925–930. doi:10.1016/j.egypro.2017.10.141

Borsaistanbul. (2017). Borsaistanbul. Available at: https://borsaistanbul.com/files/borsa-istanbul-2017-entegre-faaliyet-raporum (Accessed May, 2024).

Çetin, M., and Yüksel, Ö. (2018). Türkiye ekonomisinde enerji tüketiminin karbon emisyonu üzerindeki etkisi. Mehmet Akif Ersoy Üniversitesi İktisadi ve İdari Bilim. Fakültesi Derg. 5 (2), 169–186. doi:10.30798/makuiibf.409119

Chang, L., Saydaliev, H. B., Meo, M. S., and Mohsin, M. (2022). How renewable energy matter for environmental sustainability: evidence from top-10 wind energy consumer countries of European Union. Sustain. Energy, Grids Netw. 31, 100716. doi:10.1016/j.segan.2022.100716

Farooq, S., Ozturk, I., Majeed, M. T., and Akram, R. (2022). Globalization and CO2 emissions in the presence of EKC: a global panel data analysis. Gondwana Res. 106, 367–378. doi:10.1016/j.gr.2022.02.002

Gultekin, A. B., Dikmen, Ç. B., Erciyes, A. H., and Orgu, D. (2017). “An examination of sustainability and united nations sustainable development Goals: Turkey case,” in international sustainable buildings symposium (Cham: Springer International Publishing), 252–271.

Isik, N., and Kilic, E. (2014). The relationship between CO2 emissions and R&D energy expenditures in the transportation sector. Socioeconomics 22 (22). doi:10.17233/se.51323

Jebli, M. B., Youssef, S. B., and Ozturk, I. (2016). Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 60, 824–831. doi:10.1016/j.ecolind.2015.08.031

Kalayci, C., and Hayaloglu, P. (2019). The impact of economic globalization on CO2 emissions: the case of NAFTA countries. Int. J. Energy Econ. Policy 9 (1), 356–360. doi:10.32479/ijeep.7233

Kalmaz, D. B., and Kirikkaleli, D. (2019). Modeling CO2 emissions in an emerging market: empirical finding from ARDL-based bounds and wavelet coherence approaches. Environ. Sci. Pollut. Res. 26 (5), 5210–5220. doi:10.1007/s11356-018-3920-z

Katircioglu, S. T. (2014). International tourism, energy consumption, and environmental pollution: the case of Turkey. Renew. Sustain. Energy Rev. 36, 180–187. doi:10.1016/j.rser.2014.04.058

Kızılkaya, F., and Dag, M. (2021). OECD Ülkelerinde Sağlık Harcamalarının Yakınsaması: Kırılmalı Fourier Birim Kök Testinden Bulgular Convergence of Health Expenditures in OECD Countries: Evidence from Fourier Unit Root Test with Break. JoY 16 (62), 587–600.

Khan, M., and Yoon, S. M. (2021). Financial instability and environmental degradation: a panel data investigation. Appl. Econ. 53 (54), 6319–6331. doi:10.1080/00036846.2021.1937508

Kirikkaleli, D., and Adebayo, T. S. (2024). Political risk and environmental quality in Brazil: role of green finance and green innovation. Int. J. Finance Econ. 29 (2), 1205–1218. doi:10.1002/ijfe.2732

Kirikkaleli, D., Awosusi, A. A., Adebayo, T. S., and Otrakçı, C. (2023). Enhancing environmental quality in Portugal: can CO2 intensity of GDP and renewable energy consumption be the solution? Environ. Sci. Pollut. Res. 30 (18), 53796–53806. doi:10.1007/s11356-023-26191-2

Kirikkaleli, D., and Sofuoğlu, E. (2023). Does financial stability matter for environmental degradation? Geol. J. 58 (9), 3268–3277. doi:10.1002/gj.4707

Kolsuz, G., and Yeldan, A. E. (2017). Economics of climate change and green employment: a general equilibrium investigation for Turkey. Renew. Sustain. Energy Rev. 70, 1240–1250. doi:10.1016/j.rser.2016.12.025

Kosaroglu, S. M., and Kaya, H. I. (2022). Analysis of the relationship between renewable energy and foreign direct investments for Turkey. Uluslararası Ticaret ve Ekonomi Araştırmaları Dergisi 6 (2), 52–56. doi:10.30711/utead.1202239

Meo, M. S., Nathaniel, S. P., Khan, M. M., Nisar, Q. A., and Fatima, T. (2023). Does temperature contribute to environment degradation? Pakistani experience based on nonlinear bounds testing approach. Glob. Bus. Rev. 24 (3), 535–549. doi:10.1177/0972150920916653

Nasreen, S., Anwar, S., and Ozturk, I. (2017). Financial stability, energy consumption and environmental quality: Evidence from South Asian economies. Renew. Sustain. Energy Rev. 67, 1105–1122. doi:10.1016/j.rser.2016.09.021

Newell, A., Nuttall, P., and Holland, E. A. (2015). United nations global sustainable development report 2015.

Nwani, C., Bekun, F. V., Gyamfi, B. A., Effiong, E. L., and Alola, A. A. (2023). Toward sustainable use of natural resources: nexus between resource rents, affluence, energy intensity and carbon emissions in developing and transition economies. Nat. Resour. Forum 47 (2), 155–176. doi:10.1111/1477-8947.12275

Ohlan, R. (2015). The impact of population density, energy consumption, economic growth and trade openness on CO2 emissions in India. Nat. Hazards 79, 1409–1428. doi:10.1007/s11069-015-1898-0

Pamuk, M., and Bektas, H. (2014). The relationship between education expenditures and economic growth in Turkey: ARDL bounds test approach. J. Polit. Econ. Manag. Res. 77–90.

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J. Clean. Prod. 187, 770–779. doi:10.1016/j.jclepro.2018.03.236

Raza, S. A., and Shah, N. (2018). Testing environmental Kuznets curve hypothesis in G7 countries: the role of renewable energy consumption and trade. Environ. Sci. Pollut. Res. 25, 26965–26977. doi:10.1007/s11356-018-2673-z

Saboori, B., and Sulaiman, J. (2013). Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60, 892–905. doi:10.1016/j.enpol.2013.05.099

Safi, A., Chen, Y., Wahab, S., Zheng, L., and Rjoub, H. (2021). Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J. Environ. Manag. 293, 112908. doi:10.1016/j.jenvman.2021.112908

Serener, B., Kirikkaleli, D., and Addai, K. (2022). Patents on environmental technologies, financial development, and environmental degradation in Sweden: evidence from novel Fourier-based approaches. Sustainability 15 (1), 302. doi:10.3390/su15010302

Suleymanoglu-Kurum, R. (2018). Conditionality, the EU and Turkey: from transformation to retrenchment. London: Routledge. doi:10.4324/9781351214667

Tuncsiper, C. (2023) “A deep learning network for modelling the relationship of the real GDP,” in CO2 emission and renewable energy consumption for Turkiye. doi:10.47760/cognizance.2023.v03i01.003

Wang, J., Ramzan, M., Makin, F., Mahmood, C. K., Ramos-Meza, C. S., Jain, V., et al. (2023). Does clean energy matter? The dynamic effects of different strategies of renewable energy, carbon emissions, and trade openness on sustainable economic growth. Environ. Dev. Sustain. 1–10. doi:10.1007/s10668-023-03505-5

World Bank. (2024). World Bank. Available at: https://www.worldbank.org/tr/country/turkey/overview (Accessed May, 2024).

Keywords: financial stability, environmental degradation, economic growth, trade, Turkey

Citation: Topalcık O and Kirikkaleli D (2024) Financial stability and environment degradation in Turkey: evidence from fourier ARDL approach. Front. Environ. Sci. 12:1420019. doi: 10.3389/fenvs.2024.1420019

Received: 19 April 2024; Accepted: 27 June 2024;

Published: 23 July 2024.

Edited by:

Minhas Akbar, COMSATS University Islamabad, PakistanReviewed by:

Muhammad Ramzan, Lebanese American University, LebanonSher Ali, Islamia College University, Pakistan

Muhammad Saeed Meo, Sunway University, Malaysia

Copyright © 2024 Topalcık and Kirikkaleli. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dervis Kirikkaleli, ZGVydmlzX2tpcmlra2FsZWxpQHlhaG9vLmNvbQ==

Olgun Topalcık

Olgun Topalcık Dervis Kirikkaleli

Dervis Kirikkaleli