- 1Archiland (Tianjin) Architectural Design Co., Ltd., Tianjin, China

- 2College of Architecture and Urban Planning, Tongji University, Shanghai, China

- 3Innovation and Research Center, Shanghai Tongji Urban Planning and Design Institute Co., Ltd., Shanghai, China

In the face of global climate change challenges, China’s implementation of the carbon emission trading (CET) pilot policy has provided new empirical research opportunities. Based on a dataset covering 281 Chinese cities from 2005 to 2021, this paper employs econometric models to conduct an in-depth analysis of the policy’s impact on urban green innovation (UGI). The findings indicate that the CET pilot policy has significantly promoted green innovation activities in affected cities, with positive effects observed both directly in pilot cities and indirectly in non-pilot cities through spatial spillover effects. In addition, the policy has been found to encourage technological investment and enhance public environmental awareness (PEA), further advancing green innovation. The paper also unveils comprehensive policy effects, indicating that the Big Data Comprehensive Test Zone policy and the New Energy Demonstration City policy work synergistically with the CET pilot policy in advancing green innovation. These findings provide valuable experiences and insights for designing environmental policy tools at the national level, promoting green development, and constructing climate change response strategies.

1 Introduction

Global climate change has emerged as one of the most pressing environmental challenges facing the world today. Greenhouse gases released by human activities, particularly carbon dioxide (CO2), are the primary drivers of global temperature rise. Climate change poses significant threats to natural ecosystems, economic activities, and societal wellbeing, necessitating urgent action from the international community to reduce carbon emissions and mitigate its impacts. Carbon emissions trading, as a market-based mechanism, aims to reduce the overall volume of greenhouse gas emissions by establishing a cap on carbon emissions and allowing the trading of emission allowances. This mechanism is predicated on the “polluter pays” principle, incentivizing emission reductions by putting a price on carbon emissions (Zhang et al., 2020). Globally, the European Union Emissions Trading System (EU ETS) stands as one of the earliest implemented and largest carbon markets. Other regions, such as California, Quebec, and New Zealand, have also established their own carbon trading systems (Narassimhan et al., 2018). These practices demonstrate that carbon markets can serve as effective tools for reducing greenhouse gas emissions and promoting the development of green, low-carbon technologies.

Emissions trading, originating in the 1970s, has emerged as a pivotal ecological and environmental economic policy in market-oriented economies. Nations such as the United States, Germany, Australia, and the United Kingdom have successively implemented emissions trading policy measures. In 2006, at the Sixth National Environmental Protection Conference, China announced its intention to collaborate with relevant departments to promote reforms in the paid acquisition and trading of emission rights. The following year, seven provinces and municipalities were selected to initiate pilot programs for total emission control and trading of pollutants such as sulfur dioxide. Faced with the challenges of climate change and international pressure to reduce greenhouse gas emissions, the Chinese government formally launched carbon emissions trading pilot programs in 2011. Concurrently, pilot regions were instructed to research and formulate management measures for carbon emissions trading pilots, elucidate fundamental rules, calculate and establish regional greenhouse gas emission control targets, and develop allocation schemes for greenhouse gas emission quotas. Beginning in 2013, seven provinces and municipalities, including Beijing, Shanghai, and Guangdong, officially commenced carbon emissions trading operations. China’s carbon emissions trading pilot program comprises two main components: the carbon emission allowance trading market and the Chinese Certified Emission Reduction market. These pilots encompass multiple high-carbon-emitting industries such as electricity, steel, and chemical sectors, accumulating valuable experience for the construction of China’s national carbon market. Furthermore, these policies reflect China’s increasingly proactive role in global climate governance and its determination to transition towards a green, low-carbon economy. On one hand, carbon emissions trading requires pilot regions to enhance the quality of development in high-carbon industries, continuously adjust economic structures, eliminate polluting processes, equipment, and enterprises, and implement stringent emission standards for all enterprises, thereby raising entry barriers for heavily polluting industries such as steel, non-ferrous metals, traditional construction, and electricity. On the other hand, considering local industrial characteristics and development strategies, pilot regions are expected to accelerate low-carbon technological innovation and promote low-carbon development and industrialization. Through the implementation of these pilot policies, China aims not only to effectively control and reduce domestic carbon emissions but also to stimulate technological innovation and green low-carbon development through market mechanisms, thereby advancing the optimization and upgrading of its economic structure. Consequently, studying the impact of China’s carbon emissions trading pilot policy on UGI is significant not only for understanding the practices and challenges of the carbon market in China but also for providing important references and insights for the implementation of similar policies in other regions globally.

CET has been recognized as an important environmental regulatory tool for reducing CO2 emissions and mitigating climate change (Zhang et al., 2023). Since its implementation, China’s CET pilot policy has attracted widespread attention. Existing literature has discussed the policy’s effects on emission reduction (Sun et al., 2020) and socioeconomic impacts (Wei, 2015), among other aspects. For instance, Lu and Luo (2020), based on panel data from 30 provinces and municipalities in China and employing the difference-in-differences approach, analyzed the policy’s impact on CO2 emission volume and intensity, finding that the carbon trading policy has produced significant and sustained positive effects on the reduction of both regional CO2 emission volumes and intensities. Additionally, Shi et al. (2015), using a computable general equilibrium model (CGE) to build a simulation CGE model of the carbon trading mechanism, quantitatively estimated the impact of the carbon trading mechanism on China’s economic and social system, finding that it can effectively reduce carbon and energy intensity, promoting energy conservation and emission reduction processes, but at the same time having a certain negative impact on economic output.

Furthermore, an increasing number of scholars have begun to focus on the impact of CET on green innovation (Yu et al., 2022; Zhang W. et al., 2022). Most studies have found that CET effectively promotes green innovation. For instance, Chen et al. (2021), based on a quasi-natural experiment from China’s carbon trading pilot, used a difference-in-differences model and patent data to discover that carbon trading significantly reduced the proportion of green patents in pilot regions. Similarly, Liu and Li (2022) also used a difference-in-differences model and demonstrated that China’s carbon trading pilot policy induced green innovation in pilot regions, with a more pronounced effect on invention patents. Zhou and Wang (2022) employed a mediation effect model and found that carbon trading improved urban carbon emission efficiency through two pathways: corporate innovation and resource allocation. Zhang M. et al. (2022) utilized a panel data model and concluded that while CET inhibited renewable energy development in the implementation areas, it promoted renewable energy development in surrounding areas through spatial spillover effects, resulting in an overall positive effect. However, a few studies have concluded that CET suppresses green innovation. Zhang W. et al. (2022), using a difference-in-differences method, found that CET hindered immediate green technology innovation, as firms opted to reduce output rather than increase green innovation to meet emission reduction targets. Du et al. (2021), based on empirical results from provincial panel data in China from 2008 to 2018, revealed that the carbon trading pilot policy significantly reduced the proportion of green patents in pilot regions. The primary reason was that carbon trading crowded out corporate R&D investment and increased carbon prices, thereby inhibiting green innovation. It is noteworthy that each of these conflicting conclusions has its theoretical origins. On one hand, following neoclassical theory, when technology, resource allocation, and consumer demand are fixed, enterprises have already made cost-minimizing decisions, and introducing environmental regulations only increases environmental capital expenditures, weakening competitiveness and inevitably exerting certain displacement effects on technological innovation. On the other hand, according to the “Porter Hypothesis,” well-designed environmental regulations can lead to an “innovation compensation” effect on enterprises under changing constraints, thereby encouraging technological innovation.

Existing literature has also analyzed various factors influencing the effects of CET on green innovation. Liu and Li (2022) found significant differences in the sensitivity of state-owned enterprises and high-pollution industries to carbon trading policies. Xin-gang et al. (2023) identified that the success of the carbon trading pilots in Beijing and Guangdong was due to factors such as the refinement of quota accounting mechanisms, the use of compensated allocation methods, larger enterprise sizes, and increased R&D investments. Zhou and Wang (2022) indicated that the degree of marketization and the concept of green consumption positively moderated the impact of carbon trading on green innovation, with industrial structure upgrading playing a positive mediating role between the two. Yao et al. (2021) emphasized the importance of carbon market design, noting that active quota trading, ambitious auction mechanisms, and a focus on the largest emitting entities were key factors in the success of the Hubei pilot.

In summary, existing research primarily focuses on emerging economies such as China, employing quasi-natural experiments and econometric models. Most studies support the notion that CET promotes green innovation, though some have reached contrary conclusions. Factors influencing these effects include carbon market design, firm heterogeneity, and external environmental conditions. Overall, research on the relationship between CET and green innovation remains underdeveloped and unsystematic, with factors needing further refinement and empirical testing. Moreover, studies on the spatial spillover effects of carbon trading, its dynamic impact patterns, and its coupling and synergy with other emission reduction policy tools are still relatively weak and require further investigation. To advance research in this field and extend the analysis of the mechanisms involved, this study examines the relationship between China’s CET pilot policies and UGI using data from 281 cities. The specific contributions of this research are as follows. Firstly, this study not only assesses the overall impact of CET policies on UGI but also delves into the mediating roles of technological investment and PEA, thereby expanding the understanding of the policy’s impact pathways. Secondly, by employing various empirical methods such as difference-in-differences (DID) and spatial Durbin models (SDM), the study ensures the robustness and reliability of the findings while enriching the research on spatial spillover effects of carbon trading and providing new insights into the regional collaborative effects of the policy. Finally, the study explores the coupling and synergy effects of CET with other emission reduction policy tools, revealing the potential for multiple policy tools to jointly promote green innovation and offering references for future policy optimization.

2 Theoretical analysis

2.1 Economic incentive mechanisms

In global climate governance strategies, the CET system offers an innovative economic incentive mechanism, which achieves the goal of reducing greenhouse gas emissions through market means. By establishing a carbon market, this mechanism integrates the cost of carbon emissions into the operational expenses of companies, encouraging them to seek economically efficient ways to reduce emissions (Ellerman et al., 2007; Stavins, 2008). The core advantage of this system is its ability to stimulate market actors’ innovative drive, fostering the research, development, and application of low-carbon technologies, thereby achieving environmental protection goals without sacrificing economic growth (Porter and Linde, 1995).

Through economic incentives, the carbon trading mechanism not only promotes green innovation at the enterprise level but also drives green development in cities. As hubs of population and industrial activity, cities are primary sources of carbon emissions. Implementing CET encourages city administrators to adopt measures to improve energy efficiency, develop public transportation, and promote green buildings to reduce overall carbon emissions (Bulkeley and Betsill, 2005). Additionally, the emergence of the carbon market fosters the development of green financial instruments, providing financial support for sustainable city projects (Kamal-Chaoui et al., 2009).

However, the successful implementation of a carbon trading system must overcome many challenges, such as ensuring the stability of carbon prices, enhancing market participation, optimizing policy design, and strengthening regulation (Zhang et al., 2014). This demands close cooperation between policymakers, businesses, and market participants to realize the long-term objectives of the CET system.

2.2 Analysis of the direct impact of China’s CET pilot policy on UGI

The impact of China’s CET pilot policy on UGI is a multidimensional issue. The economic incentive mechanism is one of the key theories explaining how environmental policies encourage enterprises to engage in green innovation (Liu et al., 2021). According to the Porter Hypothesis (Porter, 1991), well-designed environmental regulations can internalize external costs, providing innovation incentives that enable enterprises to achieve both environmental and economic benefits. Specifically, China’s CET pilot policy exerts economic incentives in several ways. First, the CET mechanism internalizes the environmental costs of carbon emissions into the actual costs for enterprises, compelling them to consider the impact of carbon emissions on their operating costs (Zhao et al., 2022). To reduce carbon emission costs, enterprises are more inclined to adopt green technologies and processes, thereby promoting green innovation. Second, the CET mechanism increases the operating costs for high-carbon-emission enterprises, motivating them to invest in technology R&D to reduce emission intensity and thus lower carbon emission costs. Simultaneously, the carbon trading market provides new market opportunities for green technologies, encouraging enterprises and research institutions to invest more in the development of environmental technologies. Lastly, with the rising prominence of global climate change issues and the proliferation of green consumption concepts, enterprises with advanced green technologies will gain a competitive advantage in future markets (Li et al., 2022). The CET policy offers enterprises the opportunity to gain market share and brand reputation through green innovation, further enhancing their motivation to innovate.

When faced with institutional pressure, enterprises actively adjust their behavior to comply with external environmental requirements to gain legitimacy and resource support. China’s CET pilot policy exerts institutional pressure on enterprises through several mechanisms, promoting green innovation: The government enforces legal regulations and policy documents, mandating enterprises to participate in CET and meet corresponding emission reduction targets. This coercive pressure forces enterprises to adopt measures to reduce carbon emissions, promoting the application and innovation of green technologies. During the implementation of the CET pilot policy, leading enterprises that successfully adopt green technologies set an example for other enterprises. To remain competitive, other enterprises will imitate and learn from these leading enterprises’ green innovation strategies, creating a diffusion effect of green innovation within the industry (Tian et al., 2022). The implementation of the CET policy is accompanied by the establishment of related standards and industry norms, which require enterprises to adhere to green development principles in their production and operations. Normative pressure drives enterprises to upgrade technologies and innovate in management practices to comply with industry standards and norms, thereby achieving green innovation (Liu et al., 2020).

In summary, the economic incentive mechanism motivates enterprises to innovate through cost internalization, technological R&D investment, and competitive market advantages, while institutional pressure forces enterprises to adjust their behavior through coercive, mimetic, and normative pressures. The combined forces of these two mechanisms propel enterprises from passively responding to environmental regulations to actively pursuing green development, thereby achieving the goal of UGI. Therefore, we propose the research hypothesis H1:

H1. China’s CET pilot policy contributes to promoting UGI.

2.3 Analysis of the indirect impact of China’s CET pilot policy on UGI

2.3.1 China’s CET pilot policy, technological investment, and UGI

China’s CET pilot policy not only directly promotes UGI but also drives green innovation through indirect mechanisms such as increased technological investment. Technological investment is a critical factor in promoting green innovation. By investing in the research and application of technology, enterprises can significantly enhance resource efficiency, reduce pollution emissions, and foster sustainable urban development. Through increased investment in green technology research and application, enterprises can develop more efficient and environmentally friendly production processes and products, thus achieving efficient energy use and effective pollution control (Zhao et al., 2022). Technological investment also facilitates iterative upgrades in technology, enabling enterprises to continuously improve their green innovation capabilities and gain a competitive edge in the market (Chen et al., 2021). As technological investment increases, the overall level of green technology and innovation capacity in cities will also rise, steering cities towards green and sustainable development.

China’s CET pilot policy promotes technological investment in enterprises through various mechanisms, thereby indirectly fostering UGI. Firstly, the CET policy internalizes the cost of carbon emissions through market mechanisms, providing strong economic incentives. This compels enterprises to pay for their emissions, motivating them to invest more in green technology research and development to reduce carbon emission costs and enhance competitiveness (Feng et al., 2017). Secondly, the policy optimizes resource allocation, forcing enterprises to invest more in technological research and innovation to improve production efficiency and reduce emissions (Wu et al., 2021). Additionally, the policy stimulates external funding and resource investment, with the government and social capital increasing their investments in green technology projects, providing financial support and tax incentives, and attracting more enterprises and research institutions to participate in green technology research and development (Li et al., 2022; Wang et al., 2024). Lastly, the CET policy enhances the efficiency of technological investment by promoting collaboration and exchange. It encourages technical cooperation, joint research, and knowledge sharing between enterprises and research institutions, enabling quicker mastery of advanced green technologies and improving innovation efficiency.

In summary, China’s CET pilot policy indirectly promotes UGI through increased technological investment. Driven by economic incentives and policy support, enterprises actively engage in the research and application of green technologies. This not only achieves environmental protection goals but also enhances their competitiveness, driving sustainable urban development and green transformation. Therefore, the following research hypothesis H2 is proposed:

H2. China’s CET pilot policy promotes UGI through increased technological investment.

2.3.2 China’s CET pilot policy, PEA, and UGI

In addition to technological investment, enhancing PEA is a crucial factor in promoting UGI. PEA refers to the public’s understanding and concern about environmental issues, as well as their propensity to choose eco-friendly products and services in their daily lives and consumption habits (Yan et al., 2010). The enhancement of PEA can stimulate market demand for green products and technologies, thereby driving enterprises to engage in green innovation (Xu et al., 2021). As environmental problems become increasingly severe, public concern for environmental protection has risen, leading to a greater preference for eco-friendly products and services. This shift in market demand forces enterprises to continuously develop and provide products that meet environmental standards to satisfy consumer needs. Under this market pressure, enterprises actively pursue technological innovation and product improvement, thereby advancing the overall process of UGI. Additionally, the rise in PEA can also facilitate the enactment and implementation of environmental regulations and policies, creating external pressure on enterprises and further promoting green innovation (Zheng et al., 2014).

China’s CET pilot policy enhances PEA through various mechanisms, thereby indirectly promoting UGI. Firstly, the policy raises public awareness of carbon emissions and environmental protection through extensive publicity and educational activities. During policy implementation, the government and environmental organizations utilize various media channels to widely disseminate information and educate the public about CET and its significance. This dissemination of knowledge enhances public understanding and support for environmentally friendly technologies and products, thereby stimulating market demand for green products and technologies (Fan and Xiao, 2021). Secondly, the CET policy boosts public engagement in environmental actions through economic incentive mechanisms. During the policy’s implementation, measures such as tax incentives and subsidies are used to encourage public participation in environmental protection activities. For example, the government may provide subsidies to consumers who purchase eco-friendly products or offer tax incentives to individuals participating in CET (Ji et al., 2017). These economic incentives not only directly promote public environmental behavior but also indirectly drive enterprises to innovate green products to meet market demands (Cai and Ye, 2022). Furthermore, the policy fosters cooperation between enterprises and communities, enhancing public participation in green innovation. During the implementation of the CET pilot policy, the government encourages enterprises to collaborate with communities on environmental projects and activities. This cooperation not only strengthens public recognition and involvement in environmental protection but also provides enterprises with opportunities for direct interaction with the public. This interaction helps enterprises better understand market needs, allowing them to conduct targeted technological innovations and product improvements.

In summary, China’s CET pilot policy indirectly promotes UGI by enhancing PEA through various means. The policy leverages publicity and education, economic incentives, and community cooperation to strengthen public understanding and support for environmental protection. This, in turn, stimulates market demand for green products and technologies, driving enterprises to innovate and promoting sustainable urban development and green transformation. The following research hypothesis H3 is put forth:

H3. China’s CET pilot policy promotes UGI by increasing PEA.

2.4 China’s CET pilot policy, spatial spillover effects, and UGI

In addition to its direct and indirect impacts, China’s CET pilot policy also exerts positive influences on green innovation in neighboring cities through spatial spillover effects. Spatial spillover effects refer to the phenomenon where policies or economic activities in one region affect the economic and innovation activities of surrounding regions through various channels such as technology diffusion, knowledge transfer, and market linkages (Du et al., 2021). This effect is particularly important in the realm of environmental policy and green innovation, as environmental issues and innovation activities often transcend regional boundaries (Guo et al., 2023).

China’s CET pilot policy can generate positive spatial spillover effects on neighboring cities through technology diffusion and knowledge transfer. Following the implementation of the carbon trading policy, pilot cities actively develop and apply green technologies. These technologies and knowledge can then spread to neighboring cities through inter-firm cooperation, personnel mobility, and information exchange. For instance, enterprises in pilot cities may establish collaborative relationships with enterprises in neighboring cities to jointly develop and promote green technologies, thereby driving green innovation in those neighboring areas (Yang et al., 2022). Additionally, the movement of technical personnel and experts within the region facilitates the dissemination of knowledge and the application of technologies, enabling green innovation to be promoted and implemented over a broader area.

The CET policy also impacts neighboring cities through market linkage mechanisms. The establishment and operation of the carbon trading market not only affect the pilot cities but also have profound implications for the market environment and economic activities of the entire region. After implementing the carbon trading policy, pilot cities may develop more sophisticated green markets and industrial chains, attracting enterprises from surrounding cities to participate and fostering regional industrial collaboration. For example, enterprises in neighboring cities can engage in the carbon trading market to gain access to more green technologies and financial support, thereby enhancing their green innovation capabilities (Bai et al., 2023). Moreover, the increasing demand for green consumption within the region stimulates enterprises in neighboring cities to develop and promote eco-friendly products and services, further advancing regional green innovation.

In summary, China’s CET pilot policy generates positive spatial spillover effects on green innovation in neighboring cities through mechanisms such as technology diffusion, market linkages, and policy demonstration. The successful implementation of the pilot policy not only aids the green development of the pilot cities themselves but also, through regional interaction and cooperation, drives green innovation and sustainable development across the entire region. This spatial spillover effect not only amplifies the overall impact of the policy but also provides valuable insights and lessons for other regions seeking to implement similar policies. Hence, the following research hypothesis H4 is proposed:

H4. China’s CET pilot policy stimulates green innovation in neighboring cities.

3 Methodology

3.1 Model design

3.1.1 Baseline regression model

In this study, we use a dataset from 281 Chinese cities spanning the years 2005–2021 and treat the CET pilot policy as a quasi-natural experiment to explore its impact on UGI using the Difference-in-Differences (DID) method. The DID method is chosen for its effectiveness in leveraging the differences before and after the policy implementation as well as between pilot and non-pilot cities, allowing for an accurate estimation of the policy’s causal effect by controlling for potential unobserved heterogeneity and time trends. Moreover, the introduction of a two-way fixed effects model further enhances the accuracy of the estimations by controlling for city-specific effects that do not change over time and for time effects common to all cities, ensuring the robustness of the results. This methodological approach aims to provide a rigorous and scientific analytical framework to assess and interpret the specific role of China’s CET pilot policy in promoting UGI, offering strong empirical support for the formulation and optimization of related policies.

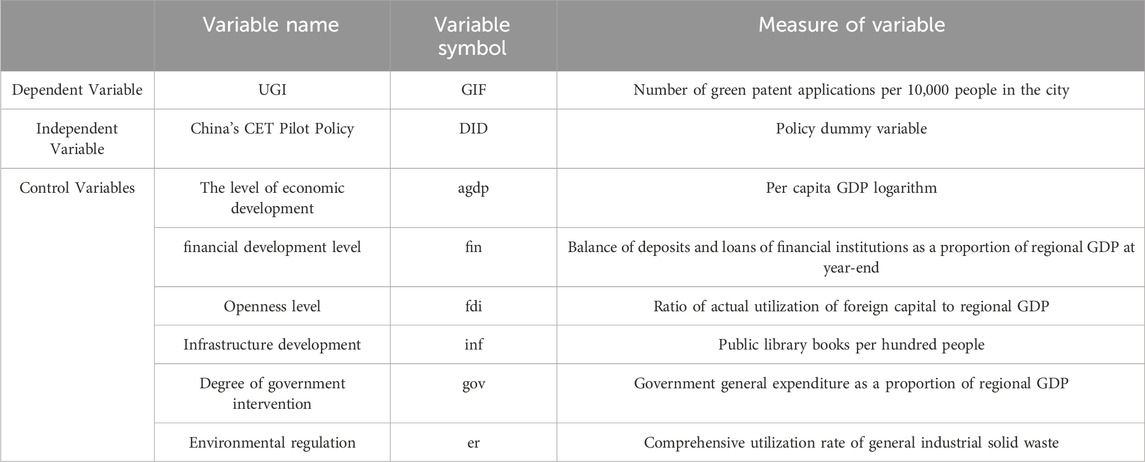

Here, GIF represents urban-level green innovation, DID represents the dummy variable for China’s CET pilot policy, and X represents various control variables, including economic development level (agdp), financial development level (fin), openness level (fdi), infrastructure development (inf), government intervention (gov), and environmental regulation (er). In addition,

3.1.2 Mechanism test model

To test the mechanisms through which the new energy demonstration city policy affects UGI capability, the study employed a mediation effect model and examined the mechanisms from two aspects: technology investment and PEA.

Here, ‘middle’ represents technology investment (sci) and PEA (car) in Equation 3 and Equation 4, and Equation 2 is the same as Equation 1.

3.1.3 Spatial regression model

To delve into the spatial dimension of the impact of China’s CET pilot policy, this study introduced the spatial Durbin model shown below to investigate the spatial spillover effects of this policy on UGI. This method allows us to evaluate not only the impact of the policy on the implementing cities themselves but also to examine whether this impact is transferred to neighboring cities through interregional economic connections, thus creating a spillover effect. A common spatial economic distance matrix was used for the analysis.

In Equation 5,

3.2 Variable selection

3.2.1 Dependent variable

Urban Green Innovation (GIF). This study chooses the amount of green patent applications to measure UGI. First, as a forward-looking indicator of innovative activities, the number of green patent applications directly reflects the results of a city’s R&D and innovative efforts, providing a timely perspective on the latest trends in innovative activities. Moreover, compared to granted patents, the number of applications reduces the interference of administrative approval processes, more accurately reflecting the dynamics of a city’s green innovation. Data collection is based on the International Patent Classification (IPC) codes of the World Intellectual Property Organization (WIPO), ensuring the international standardization and reliability of the data. Meanwhile, to eliminate the influence of different city sizes, we adopted the method of dividing the number of green patent applications by city population for normalization. This practice enhances the accuracy and fairness in comparing the green innovation capabilities of different cities. Through this approach, we aim to ensure the robustness and credibility of the research results, providing strong data support for evaluating the green innovation effects of the CET pilot policy. For uniformity of measurement, borrowing the practice of Rao et al. (2024), the number of green patent applications is divided by the city population (in tens of thousands).

3.2.2 Independent variable

China’s CET Pilot Policy (DID). In 2013, seven local carbon markets in cities such as Beijing and Shanghai successively began trading. Following the approach of Zhang et al. (2023), the dummy variable of cities chosen as “carbon trading” pilot cities is used as the core explanatory variable. CET pilot cities are treated as the experimental group, assigning the policy dummy variable DID a value of 1 for the year of approval and subsequent years, and 0 before approval.

3.2.3 Control variables

This study uses economic development level (agdp), financial development level (fin), level of openness (fdi), infrastructure development (inf), degree of government intervention (gov), and environmental regulation (er) as control variables. These variables comprehensively account for other factors influencing UGI capabilities, allowing for a more accurate identification of the green innovation effects of China’s CET pilot policy.

The variable definitions are shown in Table 1.

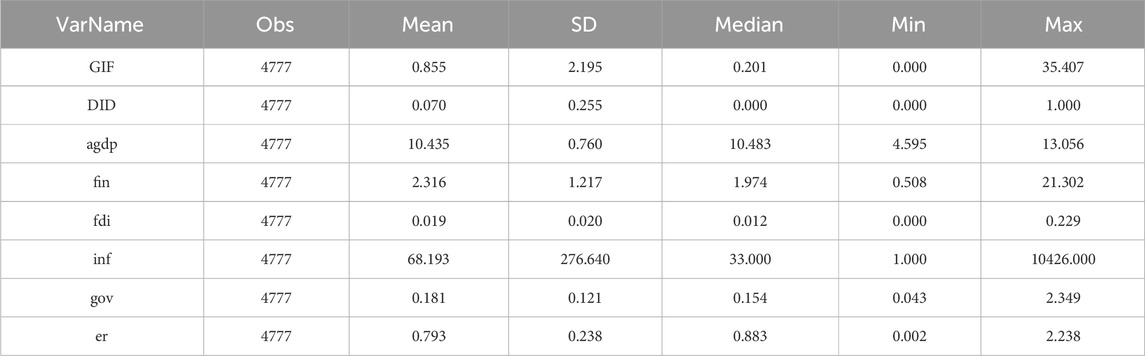

3.3 Data description

Considering the availability and continuity of urban data, this paper selects balanced panel data from 281 Chinese cities for the years 2005–2021 as the empirical research basis. Green patent application data are sourced from the China National Intellectual Property Administration, while other city data are from the China City Statistical Yearbook and the China Statistical Yearbook. Additionally, linear interpolation is used to fill in some missing values. A descriptive statistic of the variables is shown in Table 2.

4 Results

4.1 Baseline regression results

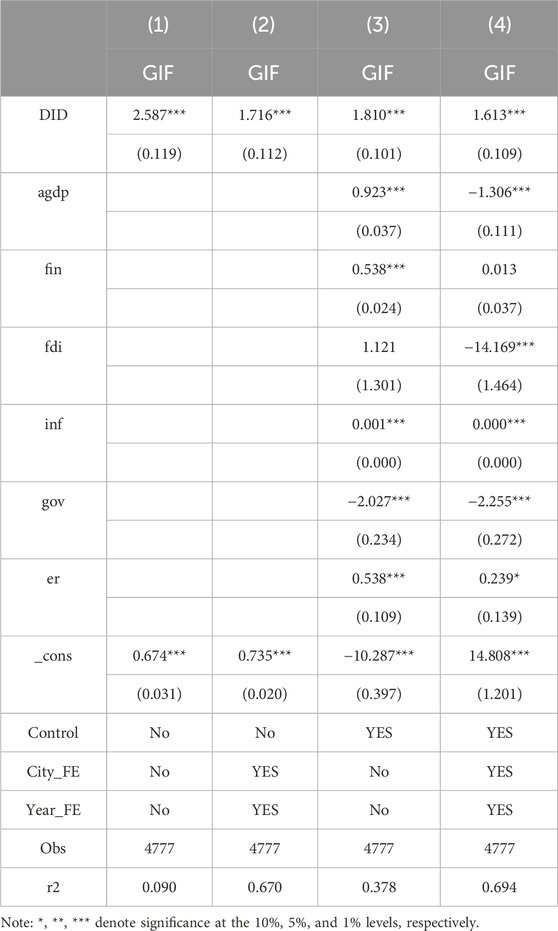

Table 3 presents the test results of the impact of China’s CET pilot policy on UGI. Among them, columns (1)–(4) represent the regression results with gradually added control variables and fixed effects, respectively. We observe that the coefficient for DID is significantly positive, indicating that China’s CET pilot policy has significantly promoted UGI, thus confirming research hypothesis H1. Specifically, the CET pilot policy in China, through the establishment of a carbon market, offers economic incentives for emissions reductions and encourages enterprises and cities to adopt more green innovation measures for reducing carbon emissions. This market-based incentive mechanism motivates firms to invest in green technology development, accelerating the application and promotion of environmental protection technologies, and thereby enhancing the overall level of UGI.

This discovery empirically strengthens the notion that the CET policy is an effective market mechanism capable of promoting technological innovation through economic incentives, especially in the field of environment-friendly technology. This finding not only aligns with theoretical expectations but also provides important empirical backing for policymakers, showing that facilitating green innovation through market-based approaches is feasible and efficient.

4.2 Robustness test results

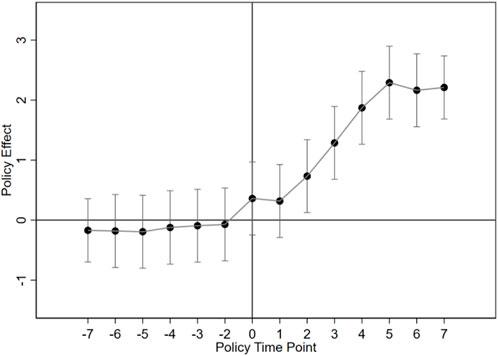

4.2.1 Parallel trends test

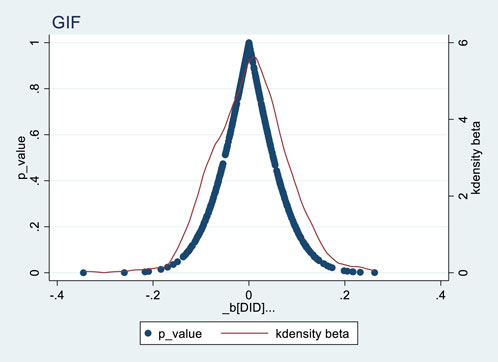

To ensure the effectiveness of the Difference-in-Differences (DID) model and to enhance the robustness of the regression results, we conducted a parallel trends test, a key prerequisite for applying the DID method. The parallel trends assumption requires that the pre-policy green innovation capabilities of treated (pilot cities) and control (non-pilot cities) groups must follow a consistent trend. If the assumption holds, it can be inferred that other external factors influence both groups similarly, aside from the policy implementation, allowing the treatment effects to be attributed to the policy impact.

In this study, employing the event study approach and referencing Jacobson et al. (1993), the period immediately before the implementation of China’s CET pilot policy was taken as the base period, and data from 7 years before and after the policy implementation were tested. By comparing the changes in green innovation capabilities of treated and control groups before and after the policy implementation, we can test the validity of the parallel trends assumption.

The test results are shown in Figure 1. The results indicate that, before the policy implementation, the differences in green innovation capabilities between the treatment group and the control group were not significant, meaning the trends between the two groups were parallel prior to the policy implementation. Notably, the policy effect in the immediate post-implementation period (the first time point after the policy implementation) is not significant. This can be attributed to several possible reasons. On one hand, the immediate period following the implementation of a new policy often involves an adjustment phase. During this phase, enterprises and local governments may be adapting to new regulations, setting up necessary infrastructure, and understanding compliance requirements. As stakeholders gradually align their operations with the new policy, this transition period can temporarily weaken the immediate effect of the policy. On the other hand, the introduction of the carbon trading mechanism may require significant initial investments and a learning curve for both enterprises and regulatory bodies. Firms may need time to invest in green technologies, train personnel, and optimize their operations to meet the new standards. This initial phase of investment and learning may delay the direct impact of the policy on green innovation. Additionally, there may be lags in effective communication and awareness of the policy among stakeholders. Comprehensive understanding and proactive engagement from all involved parties are crucial for the policy to have a significant impact. Any delays in these aspects can result in the immediate effect of the policy not being significant. These factors collectively suggest that while the policy did not show a significant impact immediately after implementation, this does not undermine the overall effectiveness of the CET pilot policy in promoting green innovation. The significant positive effects observed in subsequent periods affirm the policy’s role in driving sustainable development and innovation.

4.2.2 Placebo test

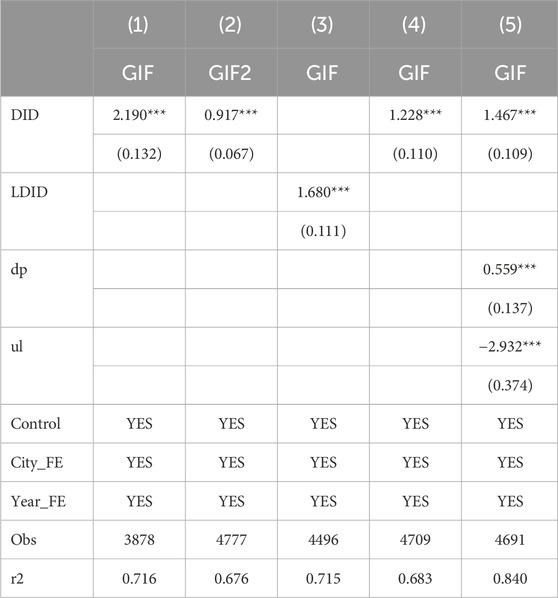

To ensure that our estimated results are not affected by endogeneity problems such as unobservable omitted variables or reverse causality, we conducted a placebo test to strengthen the study’s robustness and credibility. The placebo test evaluates the randomness of the empirical results by creating fictitious policy pilots and checking whether the model still shows similar significant effects in the absence of policy intervention.

For this procedure, we conducted 500 random samplings, randomly selecting a subset of cities as a “treated” group for each sample, when in fact these cities did not implement the CET pilot policy. Then, we re-estimated the regression for these 500 samples, observing the distribution of the estimated values.

Figure 2 displays the distribution of the placebo test estimated coefficients, where most coefficients are close to zero, and their p-values are mostly greater than 0.1, indicating a very low probability of obtaining significant estimates at random. This outcome is clearly different from the coefficient estimates of the baseline regression, which show significant statistical and practical significance. Therefore, the placebo test results suggest that our baseline regression outcomes are unlikely due to random chance factors or unobserved omitted variables, further confirming the robustness of our baseline conclusions.

4.2.3 PSM-DID test

To address any potential selection bias arising from the selection mechanism of China’s CET pilot policy, we employed a combined propensity score matching (PSM) and difference-in-differences (DID) method (PSM-DID) for a more robust estimation. The PSM-DID method can effectively reduce systematic differences in observable variables between the treated and control groups, enhancing the credibility of causal inferences.

In the PSM step, the study used control variables such as economic size, industrial structure, population density as matching variables, and through radius matching, we matched each pilot city with non-pilot cities that have similar characteristics, thus constructing a new treated and control group. The balance test results after propensity score matching show that the differences in matching variables between the treated and control groups are effectively controlled, indicating a good match quality.

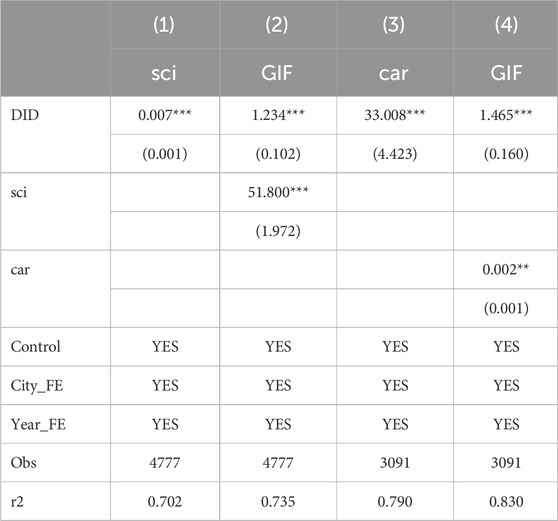

Next, we applied DID regression analysis on the matched sample, and the results are displayed in column (1) of Table 4. The results indicate that after controlling for selection bias, the coefficient for DID remains significantly positive, consistent with our baseline regression results. This finding reinforces our conclusion that China’s CET pilot policy significantly promotes UGI.

4.2.4 Other robustness tests

To ensure the robustness and credibility of the research results, this study conducted a series of additional robustness checks, including replacing the dependent variable, adjusting the timing of the core explanatory variable, excluding specific samples, and adding control variables to mitigate the omitted variable bias.

First, to verify the robustness of the measurement of UGI capability, the study replaced the dependent variable with the amount of green patent grants per 10,000 people in the city as another measure of UGI capability. The regression results after replacing the variable (shown in column 2 of Table 4) reveal that the DID coefficient remains significantly positive, confirming that the positive impact of the CET pilot policy on UGI is consistent and robust regardless of the measure used—patent applications or grants.

Second, considering the potential lag effect of policy impact, the study processed the core explanatory variable and control variables with a one-period lag to explore the durability of the policy effect and to weaken potential reverse causality. The regression results after the lag processing (shown in column 3 of Table 4) still show a significantly positive coefficient for the policy effect, indicating a certain permanence of the carbon trading policy’s positive impact on UGI.

In addition, as municipalities directly under the central government have special political and economic status, they may influence research results. To ensure the universality of the research findings, the study excluded samples of municipalities and performed the regression, and the results (shown in column 4 of Table 4) remain consistent, indicating that the research conclusions are not affected by the specificity of the municipality samples.

Lastly, to further mitigate possible omitted variable issues, the study added control variables such as population density, and urbanization level to the regression. These variables help control for the potential impact of city size, economic activity intensity, and urbanization level on green innovation. The regression results with these additional control variables (shown in column 5 of Table 4) indicate that the DID coefficient remains significantly positive, further affirming the robustness of the research conclusions.

4.3 Mechanism test results

4.3.1 Technology investment mechanism test

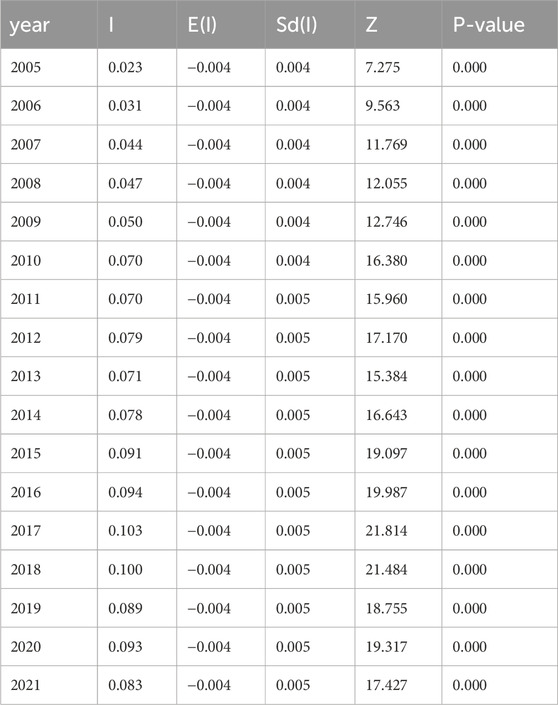

The study used the ratio of expenditures on science and technology to local government general public budget expenditures as a measure of the level of technology input and conducted regression on the mechanism test models (3) and (4). The regression results indicate that in model (3), the DID coefficient is significantly positive (shown in column 1 of Table 5), suggesting that cities implementing the CET pilot policy have experienced significantly higher growth in technology investment than cities without such a policy. These results show that the carbon trading pilot policy has not only a direct role in promoting green innovation but also a positive effect in encouraging local governments to increase spending on scientific research.

Additionally, in model (4), both the DID and technology investment (sci) coefficients are significantly positive (shown in column 2 of Table 5), pointing out that the increase in technology investment has a direct and positive impact on enhancing UGI capability. This finding not only highlights the role of technology investment as a key channel through which the carbon trading policy influences green innovation but also reveals that increasing technology investment is crucial for promoting UGI. Research hypothesis H2 is verified.

These results provide strong evidence on how the CET pilot policy promotes UGI by influencing technology investment. Theoretically, this finding supports the innovation-driven development theory that technology investment is an important driver for UGI. From a practical standpoint, these results offer insights to policymakers, suggesting that the policy’s role in stimulating research investment should be considered to comprehensively promote green innovation and sustainable development. Such mechanism tests not only enrich existing research on CET policy but also provide an empirical basis for policy optimization.

4.3.2 PEA mechanism test

Drawing on the research of Wu et al. (2022), we explored how China’s CET pilot policy promotes UGI by enhancing public awareness of environmental issues using the Baidu smog search index as a proxy for PEA. This internet search behavior data provides a timely and accurate reflection of public interest and is a powerful tool for understanding shifts in public consciousness.

Regression results show that the CET pilot policy significantly raised PEA (results in column 3 of Table 5), indicating that cities implementing the carbon trading policy have significantly higher public concern for air quality and environmental pollution compared to cities without the policy. This boost may be driven by policy-induced media coverage, public discussion, and educational activities, reflecting the policy’s effectiveness in raising environmental consciousness.

Further, the positive association between PEA and UGI capability (results in column 4 of Table 5) reveals an important mechanism: heightened public environmental concern may encourage the government and enterprises to adopt more environmental and green innovation measures in response to public demand and expectations for the environment. This finding validates the route through which the policy promotes green innovation by raising public environmental consciousness, aligned with theoretical expectations. Research hypothesis H3 is verified.

These results not only deepen our theoretical understanding of the mechanisms by which the CET pilot policy works but also provide empirical evidence for policymakers, emphasizing the need to consider the impact on public consciousness and behavior when formulating and implementing environmental policies. Through such mechanism tests, this study further underscores a multi-dimensional perspective on policy assessment, offering valuable references and insights for subsequent research and policy optimization.

4.4 Spatial spillover effect results

First, a spatial autocorrelation test was conducted (using the global Moran’s I, see Table 6) to confirm the spatial clustering of UGI. The significantly positive Moran’s I value indicates a positive spatial correlation in UGI. This step is necessary as it sets the stage for further analysis of spatial spillover effects.

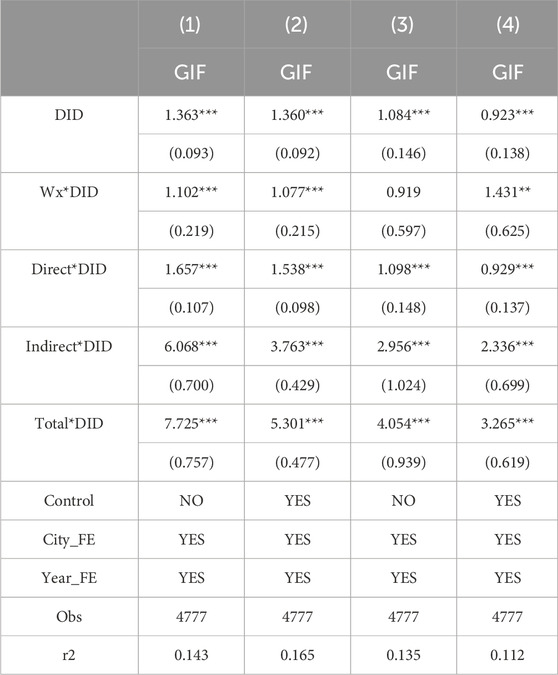

The further spatial Durbin model regression results are shown in Table 7, where columns (1)–(4) represent the regression results of the economic distance matrix and the nested economic geography matrix without and with control variables, respectively. The results reveal that the CET pilot policy has a significant direct effect on promoting green innovation in the cities where it is implemented, as well as a positive indirect effect or spillover effect on neighboring cities. The coefficients of the spatial Durbin term and indirect effects term are significantly positive, emphasizing the spatial transmission and diffusion of policy effects—that the policy not only impacts the implementation region but also positively influences surrounding areas through economic connections and geographic proximity. This finding validates research hypothesis H4.

This discovery holds important theoretical and practical implications. Theoretically, it enriches the spatial-economic analysis of the effects of CET policy, emphasizing the importance of considering interregional interactions when evaluating policy outcomes. Practically, it provides insights to policymakers, suggesting that the positive influence of CET policy may be propagated through interregional interactions, and therefore, the potential regional linkage effects should be considered when formulating and implementing related policies.

4.5 Extended analysis

4.5.1 Testing the incentive effects of the “National Big Data Comprehensive Pilot Zone” policy

Against the backdrop of the high-speed development of the digital economy, the Chinese government has established “National Big Data Comprehensive Pilot Zones” to promote the widespread application of big data technology across various industries and drive the digital transformation of the social economy. These pilot zones are not only hotspots for technological innovation but also important platforms for studying how big data can contribute to economic and social development. The “National Big Data Comprehensive Pilot Zone” policy has significant synergies with the CET policy in several key areas. The big data policy enhances data management and transparency, supports the development of green technologies, facilitates policy implementation and compliance, promotes smart city development, and encourages cross-sector collaboration. These elements provide a robust technical and data foundation for CET, helping to improve the operational efficiency of the carbon market, ensure accurate emissions monitoring and reporting, and promote the adoption and innovation of green technologies. With the support of big data, the CET policy can more effectively drive UGI and sustainable development, achieving broader environmental and economic benefits. Within this context, this study set out to explore whether the “National Big Data Comprehensive Pilot Zone” policies have enhanced the effect of China’s CET pilot policy in promoting UGI.

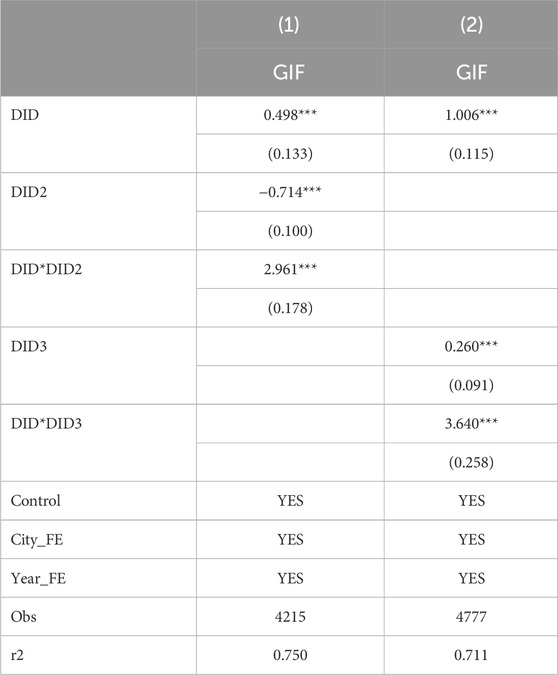

Combining the lists of National Big Data Comprehensive Pilot Zones announced by the Chinese government in 2015 and 2016, the study designates the included provinces and municipalities as the experimental group and the rest as the control group to construct a multi-period difference-in-differences model. This analyzes the potential influence of the National Big Data Comprehensive Pilot Zone policy (DID2) on the effectiveness of the CET pilot policy in promoting UGI.

Regression results (column 1 of Table 8) show a significantly positive coefficient for the interaction term between DID and DID2, implying that the “National Big Data Comprehensive Pilot Zone” policy strengthens the effect of the CET pilot policy in promoting green urban transformation. This outcome indicates that big data technology integration and application provide new momentum and platforms for green innovation, enhancing the implementation effect of the CET policy.

Theoretically, this finding enriches our understanding of the mechanism through which big data technology affects environmental policy outcomes, suggesting that a combination of technological advancement and policy innovation can create a synergistic effect that further promotes green innovation. Practically, it offers valuable insights to policymakers, indicating that advanced technologies like big data should be fully utilized to enhance the comprehensive benefits of policies and more effectively drive green transformation and sustainable development.

4.5.2 Testing the incentive effects of the “new energy demonstration city” policy

Amid global environmental challenges and energy transition, the Chinese government has placed high importance on the development of new energy and environmental protection, elevating these tasks to a strategic national level. To accelerate the dissemination and application of new energy technologies and promote green economic restructuring, the Chinese government officially announced 81 new energy demonstration cities and eight new energy demonstration industrial parks in 2014. The establishment of these demonstration areas is crucial for exploring the application of new energy technologies across various sectors and for pushing forward the green transformation of social and economic systems (Guo et al., 2024).

Against this backdrop, this study further explores the potential impact of the “New Energy Demonstration Cities” pilot policy on the effectiveness of China’s CET pilot policy in promoting urban green transformation. By including the new energy demonstration cities as an experimental group and comparing them with other provinces and cities, this study constructs a multi-period difference-in-differences (DID) model to reveal how the new energy demonstration cities policy (DID3) interacts with the CET policy to jointly promote urban green transformation. To further isolate the impact of the new energy demonstration cities on the study’s results, this study incorporates the effect of the new energy demonstration cities as a control variable in the model analysis. Regression results show a significantly positive coefficient for the interaction term between DID and DID3 (column 2 of Table 8), indicating that the new energy demonstration city policy enhances the effect of the CET policy in promoting UGI and transformation.

This result is significant both theoretically and practically. Theoretically, it indicates the importance of policy synergy in driving green transformation and innovation, particularly how policies supporting the new energy sector actively contribute to accelerating carbon emission reduction and environmental improvement. Practically, it provides insights to policymakers, showing that integrating and coordinating different policy tools, such as new energy technology promotion and CET mechanisms, can enhance policy outcomes and achieve the goal of regional coordinated development.

5 Discussion

5.1 Direct promotion of green innovation by CET policy

Through the Difference-in-Differences (DID) method, this study thoroughly examined the impact of China’s CET pilot policy on UGI. The empirical results showcase a significantly positive effect of the policy, which aligns not only with previous research indicating that market-based environmental policies can provide innovation incentives (Ambec and Lanoie, 2008; Johnstone et al., 2010) but also supports a series of hypotheses regarding China’s environmental regulation and technology innovation incentives. The findings suggest that the policy implementation has created a positive economic incentive by internalizing the cost of carbon emissions, stimulating companies to adopt cleaner and more efficient new technologies or to improve existing ones to enhance energy efficiency and reduce emissions. This perfectly reflects the Porter Hypothesis (Porter, 1991), which posits that environmental regulations can drive technological innovation.

Concerning the mechanism between CET and technological innovation, a portion of the literature provides a theoretical foundation. Rennings (2000) argues that environmental policies can promote technological innovation through two major pathways: by providing pressure and incentives for innovation (“push” and “pull” effects) and by providing companies with resources to research and test new technologies. In this case, China’s carbon market provides a direct financial “push” and “pull” through its pricing mechanism, altering the incentive structure for firms to shift from a focus on emissions to making investment decisions centered around green technology research and development.

5.1.1 Driving green innovation by increasing technology investment

The study demonstrates that the CET policy effectively promotes UGI through increasing technology investment. This outcome is in line with the research by Popp (2002), who found that environmental policies can encourage R&D activities by enhancing the market potential value of environmentally friendly technologies. Economic incentives of environmental policies such as tax breaks and subsidies directly affect the marginal cost and revenue associated with corporate R&D in environmental technologies, which can greatly stimulate the innovation motives of companies (Jaffe and Stavins, 1994).

The increase in technology investment by companies is not just a direct response to immediate cost savings but also a forward-looking investment in anticipation of future market opportunities. On one hand, the growing market demand for green technologies is accompanied by intensifying global climate change discussions; on the other hand, advances in clean technology offer new opportunities for businesses to enhance their competitiveness (Acemoglu et al., 2012). Consequently, in anticipation of stricter future government regulations on emissions, firms seek to adapt to market changes proactively by increasing their investment in green technologies, thereby securing a first-mover advantage.

5.1.2 Enhancing PEA to promote green innovation

Empirical results from this article indicate that besides the increase in technology investment, enhancing PEA is also crucial for achieving green innovation. This finding echoes the view of Kesidou and Demirel (2012), which suggests that environmental innovation is significantly driven by market demand changes. As concerns about the environment intensify, public interest in health and sustainable living quality spurs demand for green products and services. Therefore, society’s willingness to understand and recognize environmental technologies rises, offering innovative commercial motivations for businesses (Oltra and Saint Jean, 2009). Moreover, economic incentives and social consciousness form a mutually reinforcing cycle where technology supply innovation and the steadily rising level of public awareness create a virtuous circle.

Policies significantly enhance societal understanding of environmentally friendly technologies and products through various means, such as education, knowledge dissemination, and media promotion. This spread of knowledge may change consumer purchasing behavior, thereby increasing market demand for such products and motivating companies to continue investing in green innovation (Frondel et al., 2007). The elevation of public awareness also offers value signals to companies, aiding them to identify which technologies and products can meet the market’s future trajectory, which directly supports the CET policy’s push for green innovation.

5.1.3 Spatial spillover effects of CET policy

Furthermore, the study reveals a significant spatial spillover effect of the CET policy. This effect means that the green innovation activities of pilot cities are not confined to their locality, but can also influence and propel the innovation dynamics of the entire region or neighboring cities through regional networks and collaborative relationships. This finding suggests that knowledge and innovation are not only shared within corporations but also spread across cities and regions through various channels (Jaffe et al., 1993; Audretsch and Feldman, 1996).

When inter-regional communication and competitive relationships are optimized, the effects of knowledge spillover play a decisive role in promoting a region’s innovative environment. The theory of absorptive capacity by Cohen and Levinthal (1989) emphasized the role of knowledge spillovers as social capital in innovation and the role of corporate learning capacity in the chain of innovation. Such absorptive capacity enables firms to beneficially utilize both external and internal knowledge and convert it into concrete technological innovations. The spatial spillover effect found in this study indicates that by strengthening collaboration and knowledge exchange mechanisms between regions, the environmental innovation capacity of the entire area can be further enhanced. The CET policy, as a catalyst, plays an important role in forming such collaborative and learning networks.

5.1.4 Discussion on extended analysis

Our extended analysis focused on different aspects of the incentive effects of the “National Big Data Comprehensive Pilot Zone” policy and the “New Energy Demonstration City” policy as complements to the CET policy’s incentives. The results show that these policies related to carbon market trading complement each other and play an active role in promoting UGI. The analysis of these integrated policies not only highlights the impact of single policies but also reveals the combined effects of policy portfolios in advancing technology investment and PEA.

The study discussed the synergistic effects of different policy stimulus measures, which is crucial for evaluating policy impacts. Similar to the complementary policy effects in environmental economics, a combination of multiple strategies may display non-linear synergistic enhancement (Lehmann, 2012). When considering strategies for promoting UGI, beyond the core CET mechanisms, the support of peripheral policies could be key to achieving comprehensive green transformation.

6 Conclusion

6.1 Research findings

This study focused on China’s CET pilot policy, utilizing data from 281 Chinese cities from 2005 to 2021 to comprehensively assess the policy’s impact on UGI. The empirical analysis consistently shows that CET policy significantly and positively incentivizes green innovation activities at the urban level, a conclusion confirmed in various robustness tests. By identifying the increase in technology investment and the rise in PEA as key intermediate channels, this research elucidates how the CET policy fosters the research and application of green technologies by businesses and cities. The policy’s spatial spillover effect broadens its range of influence, allowing non-pilot cities to benefit indirectly. Furthermore, the extended analysis explored the National Big Data Comprehensive Pilot Zone policy and the New Energy Demonstration City policy, revealing the dual role of both individual policies and their combined application in incentivizing green innovation. These findings provide important references for future policy formulation.

6.1.1 Policy recommendations

Based on the conclusions of the research, we propose the following policy recommendations to further propel the effectiveness of the CET policy in terms of UGI:

Firstly, the government should continuously strengthen and refine market-based environmental policy tools, such as CET mechanisms, to ensure they provide sufficient incentives for green technology innovation. Moreover, the government should promote the successful experiences of pilot policies among different cities to build a network of knowledge sharing and technological cooperation between regions.

Secondly, policymakers should value the introduction and optimization of supporting policies, such as the National Big Data policy and the New Energy Demonstration City program. Through a combination of policy portfolios, a more comprehensive and effective green innovation incentive system can be formed.

Lastly, given the spatial spillover effect of incentive policies, local governments should promote cooperation and exchange between cities, enhancing regional environmental innovation capabilities through resource sharing, collaborative research, and development, and support for businesses to continue investing and researching in the green technology field.

6.1.2 Limitations and future directions

While this study provides new insights into how CET policy impacts UGI, it has certain limitations. The research focused on policy effects within Chinese cities, and the applicability may differ in other countries and regions. Also, due to the focus on quantitative analysis, it may not capture in-depth information on policy implementation details or individual corporate behavior changes. Future research could include comparative analyses of multiple countries or regions to verify the wider applicability of the Chinese experience. Additionally, qualitative research methods could provide a more detailed understanding of the actual feedback and suggestions from firms and policy implementers, further optimizing existing models and theoretical frameworks.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

KT: Conceptualization, Formal Analysis, Methodology, Writing–original draft, Writing–review and editing. DZ: Data curation, Methodology, Software, Writing–original draft, Writing–review and editing. SH: Formal Analysis, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Research Project of Shanghai Tongji Urban Planning & Design Institute Co., Ltd. and China Intelligent Urbanization Co-creation Center for High Density Region (KY-2023-YB-B04).

Conflict of interest

Author KT were employed by Archiland (Tianjin) Architectural Design Co., Ltd. Author DZ were employed by Innovation and Research Center, Shanghai Tongji Urban Planning and Design Institute Co., Ltd.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102 (1), 131–166. doi:10.1257/aer.102.1.131

Ambec, S., and Lanoie, P. (2008). Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 22 (4), 45–62. doi:10.5465/amp.2008.35590353

Audretsch, D. B., and Feldman, M. P. (1996). Innovative clusters and the industry life cycle. Rev. Industrial Organ. 11, 253–273. doi:10.1007/bf00157670

Bai, T., Qi, Y., Li, Z., and Xu, D. (2023). Will carbon emission trading policy improve the synergistic reduction efficiency of pollution and carbon? Evidence from 216 Chinese cities. Manag. Decis. Econ. doi:10.1002/mde.4014

Bulkeley, H., and Betsill, M. (2005). Rethinking sustainable cities: multilevel governance and the'urban'politics of climate change. Environ. Polit. 14 (1), 42–63. doi:10.1080/0964401042000310178

Cai, W., and Ye, P. (2022). Local-neighborhood effects of different environmental regulations on green innovation: evidence from prefecture level cities of China. Environ. Dev. Sustain. 24, 4810–4834. doi:10.1007/s10668-021-01635-2

Chen, Z., Zhang, X., and Chen, F. (2021). Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 168, 120744. doi:10.1016/j.techfore.2021.120744

Cohen, W. M., and Levinthal, D. A. (1989). Innovation and learning: the two faces of R and D. Econ. J. 99 (397), 569–596. doi:10.2307/2233763

Du, G., Yu, M., Sun, C., and Han, Z. (2021). Green innovation effect of emission trading policy on pilot areas and neighboring areas: an analysis based on the spatial econometric model. Energy Policy 156, 112431. doi:10.1016/j.enpol.2021.112431

Ellerman, A. D., and Buchner, B. K. (2007). The European Union emissions trading scheme: origins, allocation, and early results. Rev. Environ. Econ. Policy 1, 66–87. doi:10.1093/reep/rem003

Fan, J., and Xiao, Z. (2021). Analysis of spatial correlation network of China’s green innovation. J. Clean. Prod. 299, 126815. doi:10.1016/j.jclepro.2021.126815

Feng, C., Shi, B., and Kang, R. (2017). Does environmental policy reduce enterprise innovation? evidence from China. Sustainability 9 (6), 872. doi:10.3390/su9060872

Frondel, M., Horbach, J., and Rennings, K. (2007). End-of-Pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Bus. Strategy Environ. 16 (8), 571–584. doi:10.1002/bse.496

Guo, B., Feng, Y., and Hu, F. (2023). Have carbon emission trading pilot policy improved urban innovation capacity? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 31, 10119–10132. doi:10.1007/s11356-023-25699-x

Guo, B., Feng, Y., Lin, J., and Wang, X. (2024). New energy demonstration city and urban pollutant emissions: an analysis based on a spatial difference-in-differences model. Int. Rev. Econ. and Finance 91, 287–298. doi:10.1016/j.iref.2024.01.048

Jacobson, L. S., LaLonde, R. J., and Sullivan, D. G. (1993). Earnings losses of displaced workers. Amer. Econ. Rev., 685–709.

Jaffe, A. B., and Stavins, R. N. (1994). The energy-efficiency gap what does it mean? Energy Policy 22 (10), 804–810. doi:10.1016/0301-4215(94)90138-4

Jaffe, A. B., Trajtenberg, M., and Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Q. J. Econ. 108 (3), 577–598. doi:10.2307/2118401

Ji, Q., Li, C., and Jones, P. (2017). New green theories of urban development in China. Sustain. cities Soc. 30, 248–253. doi:10.1016/j.scs.2017.02.002

Johnstone, N., Haščič, I., and Popp, D. (2010). Renewable energy policies and technological innovation: evidence based on patent counts. Environ. Resour. Econ. 45 (1), 133–155. doi:10.1007/s10640-009-9309-1

Kesidou, E., and Demirel, P. (2012). On the drivers of eco-innovations: empirical evidence from the UK. Res. Policy 41 (5), 862–870. doi:10.1016/j.respol.2012.01.005

Lehmann, P. (2012). Justifying a policy mix for pollution control: a review of economic literature. J. Econ. Surv. 26 (1), 71–97. doi:10.1111/j.1467-6419.2010.00628.x

Li, X., Guo, D., and Feng, C. (2022). The carbon emissions trading policy of China: does it really promote the enterprises’ green technology innovations? Int. J. Environ. Res. Public Health 19 (21), 14325. doi:10.3390/ijerph192114325

Liu, B., Sun, Z., and Li, H. (2021). Can carbon trading policies promote regional green innovation efficiency? Empirical data from pilot regions in China. Sustainability 13 (5), 2891. doi:10.3390/su13052891

Liu, C., Ma, C., and Xie, R. (2020). Structural, innovation and efficiency effects of environmental regulation: evidence from China’s carbon emissions trading pilot. Environ. Resour. Econ. 75, 741–768. doi:10.1007/s10640-020-00406-3

Liu, M., and Li, Y. (2022). Environmental regulation and green innovation: evidence from China's carbon emissions trading policy. Finance Res. Lett. 48, 103051. doi:10.1016/j.frl.2022.103051

Lu, Z. N., and Luo, Y. S. (2020). Analysis of the emission reduction effectiveness of China's carbon trading policy—the application and test of the difference-in-differences method. J. Arid Land Resour. Environ. (04), 1–7. doi:10.13448/j.cnki.jalre.2020.087

Narassimhan, E., Gallagher, K. S., Koester, S., and Alejo, J. R. (2018). Carbon pricing in practice: a review of existing emissions trading systems. Clim. Policy 18 (8), 967–991. doi:10.1080/14693062.2018.1467827

Oltra, V., and Saint Jean, M. (2009). Sectoral systems of environmental innovation: an application to the French automotive industry. Technol. Forecast. Soc. Change 76 (4), 567–583. doi:10.1016/j.techfore.2008.03.025

Popp, D. (2002). Induced innovation and energy prices. Am. Econ. Rev. 92 (1), 160–180. doi:10.1257/000282802760015658

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Rao, J., Zhang, X., and Zhai, D. (2024). Does the upgrading of development zones improve land use efficiency under the net-zero carbon city goal? prefectural-level evidence from quasi-natural experiments in China. Land 13 (8), 1245.

Rennings, K. (2000). Redefining innovation — eco-innovation research and the contribution from ecological economics. Ecol. Econ. 32 (2), 319–332. doi:10.1016/s0921-8009(99)00112-3

Shi, J. R., Cai, H. L., Tang, L., and Yu, L. A. (2015). Study on the economic and environmental impact of carbon trading mechanism based on CGE model. Chin. Manag. Sci. (S1), 801–806.

Stavins, R. N. (2008). Addressing climate change with a comprehensive US cap-and-trade system. Oxf. Rev. Econ. Policy 24, 298–321. doi:10.1093/oxrep/grn017

Sun, Z. Q., Li, H. H., and Liu, B. L. (2020). Study on regional emission reduction potential under carbon trading policy—dual perspectives of industrial structure adjustment and technological innovation. Sci. Technol. Prog. Countermeas. (15), 28–35.

Tian, H., Lin, J., and Jiang, C. (2022). The impact of carbon emission trading policies on enterprises’ green technology innovation—evidence from listed companies in China. Sustainability 14 (12), 7207. doi:10.3390/su14127207

Wang, M., Wang, Y., and Guo, B. (2024). Green credit policy and residents’ health: quasi-natural experimental evidence from China. Front. Public Health 12, 1397450. doi:10.3389/fpubh.2024.1397450

Wei, Q. P. (2015). Analysis of the compatibility of carbon trading and carbon tax—also on China's emission reduction path choice. China Popul. Resour. Environ. (05), 35–43.

Wu, Q., Tambunlertchai, K., and Pornchaiwiseskul, P. (2021). Examining the impact and influencing channels of carbon emission trading pilot markets in China. Sustainability 13 (10), 5664. doi:10.3390/su13105664

Wu, L., Yang, M., and Sun, K. (2022). The impact of public environmental awareness on corporate and government environmental governance. China Population, Resources and Environment (02), 1–14.

Xin-gang, Z., Wenjie, L., Wei, W., and Shuran, H. (2023). The impact of carbon emission trading on green innovation of China's power industry. Environ. Impact Assess. Rev. 99, 107040. doi:10.1016/j.eiar.2023.107040

Xu, L., Fan, M., Yang, L., and Shao, S. (2021). Heterogeneous green innovations and carbon emission performance: evidence at China's city level. Energy Econ. 99, 105269. doi:10.1016/j.eneco.2021.105269

Yan, G., Kang, J., Xie, X., Wang, G., Zhang, J., and Zhu, W. (2010). Change trend of public environmental awareness in China. China Popul. Resour. Environ. 20, 55–60.

Yang, Z., Yuan, Y., and Zhang, Q. (2022). Carbon emission trading scheme, carbon emissions reduction and spatial spillover effects: quasi-experimental evidence from China. Front. Environ. Sci. 9, 824298. doi:10.3389/fenvs.2021.824298

Yao, S., Yu, X., Yan, S., and Wen, S. (2021). Heterogeneous emission trading schemes and green innovation. Energy Policy 155, 112367. doi:10.1016/j.enpol.2021.112367

Yu, H., Jiang, Y., Zhang, Z., Shang, W. L., Han, C., and Zhao, Y. (2022). The impact of carbon emission trading policy on firms’ green innovation in China. Financial Innovation 8 (1), 55.

Zhang, D., Rausch, S., and Karplus, V. J. (2014). Regional emissions trading in China: an analysis of chongqing's carbon market pilot. MIT Jt. Program Sci. Policy Glob. Change. Report No. 264.

Zhang, J., Shen, J., and Xu, M. (2023). Does the carbon emission trading promote the transformation and upgrading of industrial structure? empirical evidence from China's carbon emission trading pilot policy. Econ. Issues (08), 84–91. doi:10.16011/j.cnki.jjwt.2023.08.010

Zhang, M., Ge, Y., Liu, L., and Zhou, D. (2022b). Impacts of carbon emission trading schemes on the development of renewable energy in China: spatial spillover and mediation paths. Sustain. Prod. Consum. 32, 306–317. doi:10.1016/j.spc.2022.04.021

Zhang, W., Li, G., and Guo, F. (2022a). Does carbon emissions trading promote green technology innovation in China? Appl. Energy 315, 119012. doi:10.1016/j.apenergy.2022.119012

Zhang, Y. J., Liang, T., Jin, Y. L., and Shen, B. (2020). The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 260, 114290. doi:10.1016/j.apenergy.2019.114290

Zhao, Z., Zhou, S., Wang, S., Ye, C., and Wu, T. (2022). The impact of carbon emissions trading pilot policy on industrial structure upgrading. Sustainability 14 (17), 10818. doi:10.3390/su141710818

Zheng, S., Kahn, M. E., Sun, W., and Luo, D. (2014). Incentives for China’s urban mayors to mitigate pollution externalities: the role of the central government and public environmentalism. Reg. Sci. Urban Econ. 47, 61–71. doi:10.1016/j.regsciurbeco.2013.09.003

Keywords: carbon emission trading, urban green innovation, technological investment, public awareness, spatial spillover effect

Citation: Tian K, Zhai D and Han S (2024) Impact of carbon emission trading on urban green innovation: empirical evidence from China’s carbon emission trading pilot policy. Front. Environ. Sci. 12:1419720. doi: 10.3389/fenvs.2024.1419720

Received: 19 April 2024; Accepted: 27 August 2024;

Published: 10 September 2024.

Edited by:

Ji Zheng, The University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Bingnan Guo, Jiangsu University of Science and Technology, ChinaFang Qu, Xihua University, China

Copyright © 2024 Tian, Zhai and Han. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Duanqiang Zhai, emhhaWR1YW5xaWFuZ0B0b25namkuZWR1LmNu

Kun Tian1

Kun Tian1 Duanqiang Zhai

Duanqiang Zhai