- College of Economics, Sichuan Agricultural University, Chengdu, China

Introduction: China’s rural financial landscape has long been characterized by exclusion, leaving countless farmers without access to essential financial services. However, the advent of digital financial inclusion presents a promising solution, offering low-cost, high-penetration avenues to bolster agricultural sustainability. This paper unravels how “Byte-Sized Finance” can yield “Bushel-Sized Benefits” in China’s agricultural green development.

Methods: Methodologically, we pioneer a novel system to gauge agricultural green development across 31 Chinese provinces spanning from 2013 to 2021. Empirically, employing fixed-effect, mediation effect, and spatial Durbin models.

Results: Our study reveals the intricate pathways through which digital financial inclusion influences agricultural green development. We find that it exerts its impact through the lenses of industrial structure and entrepreneurship, operating at both macro and micro levels. Furthermore, our analysis uncovers spatial spillover effects, shedding light on the differential roles played by these mechanisms across regions.

Discussion: This groundbreaking discovery underscores the transformative potential of leveraging digital financial inclusion to propel China toward agricultural green development. By shedding light on these crucial dynamics, our findings offer insights for policymakers, researchers, and practitioners striving to foster sustainability within China’s agricultural sector.

1 Introduction

In modern societies, the importance of an inclusive financial system cannot be overstated. Nevertheless, the inherent bias of capital favoring the affluent while excluding the less privileged has resulted in a stark disparity in financial services. A considerable concentration of high-quality financial resources in urban areas, large corporations, and affluent segments has led to the exclusion of rural regions, small and medium-sized enterprises (SMEs), and low-income groups (Leyshon and Thrift, 1993; Leyshon and Thrift, 1994; Leyshon and Thrift, 1995; Morrison and O’Brien, 2001; Leyshon et al., 2008). Scholars have extensively demonstrated the role of financial development and financing behaviors in fostering sustainable economic, social, and environmental progress while curbing car-bon emissions (Scholtens and Dam, 2007; Shahbaz et al., 2013). However, global financial exclusion remains widespread (Demirgüç-Kunt et al., 2008). In 2012, the World Bank estimated that approximately 2.7 billion adults globally lacked access to formal financial services, particularly in impoverished rural households, where basic financial services are severely deficient (Koku, 2015; Khanal and Omobitan, 2020).

Agriculture, by its nature, is an environmentally sensitive industry, demanding significant investment and enduring lengthy harvest cycles. Yet, the adoption of green farming practices entails even greater costs. The traditional financial system has failed to meet the financing needs of farmers, necessitating a quest for new financial impetus to propel China’s agricultural green development.

Financial inclusion and financial exclusion are different perspectives on the same issue. Alternatively, financial inclusion is needed precisely because of financial exclusion. Studies show that instability in the long-term development of finance is detrimental to the poor (Akhter and Daly, 2009; Wang et al., 2022b) and leads to increased income inequality (Altunbaş and Thornton, 2020; deHaan et al., 2023). Additionally, financial services are less accessible to poor residents (Ndlovu and Toerien, 2020; Alharbi et al., 2022). You et al. (2022) argue that regions with low economic growth are likely to face further disparity. The Pareto principle, as followed by the financial market, also raises the threshold of access for poor groups. According to a World Bank report (2018), nearly a third of adults were financially excluded, with their bank accounts not recorded in the official financial system. It was not until the advent of inclusive finance that new possibilities emerged for finance to truly serve a broader range of users.

The United Nations introduced the notion of inclusive finance in 2005 to facilitate the International Year of Microfinance. Inclusive finance is defined as a financial system that can efficiently and universally provide services to all levels and groups of society. The main goal of inclusive finance is to offer a wide range of financial services to society at an affordable cost, which is particularly significant for financially disadvantaged and poor groups. The initial form of inclusive finance was microfinance. After years of development, it now encompasses financial products and services such as credit, management, payment, insurance, and savings.

Recognizing the imperative for change, China has vigorously pursued its digital economy development strategy in recent years. Innovations in digital technologies, such as big data and cloud computing, have democratized access to financial resources, particularly in rural areas where resources and environments are more difficult, and facilitated a more equitable allocation of assets across critical sectors (Aziz and Naima, 2021).

In 2020, China achieved overall poverty alleviation with digital financial inclusion playing an essential role in this achievement. According to the “China Inclusive Finance Indicators Analysis Report (2020)” published by the Financial Consumer Rights Protection Bureau of the People’s Bank of China and the “2020 Financial Institutions Loan Allocation Statistical Report” published by the People’s Bank of China, at the end of 2020, the balance of inclusive small and micro loans was 15.1 trillion yuan, a year-on-year increase of 30.3%. Among them, the balance of farmers’ production and operation loans was 5.99 trillion yuan, a year-on-year increase of 11.5%. In addition, as of the end of 2020, the balance of loans to registered poor people was 142.7 billion yuan. Considering the situation that they have escaped poverty but have not yet escaped the policy, the balance of loans to registered poor people and those who have been lifted out of poverty was 788.1 billion yuan. Digital inclusive finance aligns with this trend, providing farmers with access to sustainable finance, easing their financing constraints and meeting basic needs. This contributes to more resilient and sustainable opportunities for farmers to benefit from development in the digital era.

Simultaneously, China’s agricultural sector has undergone significant strides in environmentally friendly and green development, aligning with broader societal shifts towards sustainability. Green agriculture, characterized by eco-friendly approaches and technological innovations, has gained momentum, enhancing production efficiency and product quality (Nourzad, 2002; Adnan et al., 2019; Liu Y. et al., 2021a).

While some existing theoretical studies have explored the possibility of digital financial inclusion in agricultural green development, such as through agricultural technology innovation and agricultural socialization services (Wang Lei, 2023), few scholars have measured the level of agricultural green development using a com-prehensive evaluation system and have cut through the pathway of digital financial inclusion as a driving force of agricultural green development from both macro and micro perspectives, and dig deep what kind of differences in spatial patterns this role has. In light of this gap, we attempt to explore the complex effects of digital financial inclusion driving agricultural green development in China based on a complete framework.

Specifically, the possible marginal contribution of this paper lies in three aspects. 1) Research Methodology. This paper draws on the “Measures for Monitoring and Evaluation of the Level of Agricultural Green Development (for Trial Implementation)” (2023) newly issued by the General Office of the Ministry of Agriculture and Rural Affairs of the People’s Republic of China and existing literature to introduce agricultural scientific and technological development and agricultural output greening (Huang, 2021; Wang Lei, 2023). We develop a set of agricultural green development evaluation systems containing four first-level indicators and 18 second-level indicators, providing a more comprehensive measurement of agricultural green development, which is able to discuss its spatial and temporal evolutionary characteristics and its influence relation-ship with digital financial inclusion at a more subtle scale compared to the study by Jian (2023). 2) Research Perspective. Existing studies have only approached the subject from a single perspective of macro or micro (Jian, 2023; Wang Lei, 2023), while this paper explores the fundamental question of how digital financial inclusion mainly affects agricultural green development under the two perspectives of macro and micro. It comprehensively evaluates the effect of digital financial inclusion. 3) Research Content. This paper utilizes the spatial Durbin model to discover the spatial spillover effect of digital financial inclusion on agricultural green development. This broadens the scope of previous research and can more accurately measure the differential role characteristics of the two between regions.

2 Theoretical analysis and research hypothesis

2.1 Possible mechanisms of digital financial inclusion in influencing agricultural green development

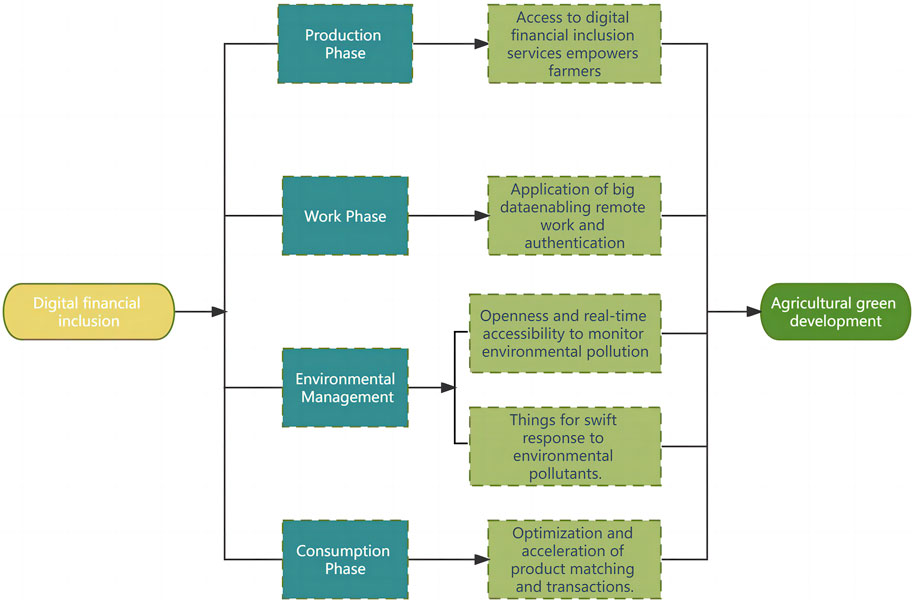

2.1.1 Direct effect

China’s information field continually witnesses the emergence of new technologies and forms (Han et al., 2024). Leveraging the Internet as a conduit, the integration and development of digital financial inclusion have interconnected financial services across the entire spectrum of production, distribution, exchange, and consumption (Guo et al., 2024). This integration furnishes innovative ideas for financially supporting agriculture and serves as a pivotal force in elevating the level of agricultural green development (Bondarenko et al., 2024).

Regarding production, farmers accessing digital financial inclusion services through online platforms conveniently and swiftly acquire information on the production, transportation, and sale of green agricultural products (Yu et al., 2020). This facilitates timely comprehension of the substantial market demand for green and healthy food, inherently motivating farmers to engage in green agricultural production (Panday et al., 2024).

In terms of work, digital financial inclusion employs big data to assess the credit status of farmers and small enterprises, thereby mitigating financing constraints resulting from information asymmetry or collateral shortages during the transition to environmentally friendly agricultural practices (Mhlanga, 2024). Moreover, it fosters the development of online businesses, enabling home-based work and remote authentication (Oanh, 2024). This reduces commuting, minimizes infrastructure, lowers energy consumption, and curtails auto-mobile emissions.

In the realm of environmental management, the advantages of digital financial inclusion, such as openness and real-time accessibility, address previous information asymmetry drawbacks (Hu et al., 2023). Leveraging technologies like big data, cloud computing, and the Internet of Things, environmental pollution in agricultural enterprises can be dynamically monitored and shared with governmental decision-makers, enterprises, and the public. This real-time monitoring enables swift responses to environmental pollutants, enhancing agricultural green development (Ataei Kachouei et al., 2023).

Concerning consumption, the evolution of digital financial inclusion optimizes and expedites product matching and transactions. The application of digital technology optimizes the cross-border allocation of limited resources (Pratama et al., 2023; Liu et al., 2024). The essence of digital financial inclusion, represented by the Internet, facilitates information exchange. The expanded scale and diversity of agricultural products generate a wealth of information, introducing complexity to the economic system and presenting new matching challenges. Emerging technologies like the Internet, cloud computing, and big data offer avenues for optimizing economic market matching problems (Chen et al., 2014).

The framework diagram of the direct mechanism is shown in Figure 1.

2.1.2 Indirect effect

Digital financial inclusion plays a pivotal role in influencing agricultural green development by optimizing industrial structure upgrading and fostering entrepreneurial activity among farmers, which can be corresponded to “Structural” effects and “Active” effects.

From a macro perspective, digital financial inclusion has “Structural” effects. China’s significant advancements in digital financial inclusion have triggered spurts in industrial structural evolution. Agricultural development’s fundamental components have transitioned from land and labor to modern facets like science, technology, and human capital (Hong, 2023). Lever-aging digital financial services such as the Internet and the Internet of Things, traditional industries realign factor resources, integrating and developing them with the information technology industry. This optimization process enhances production workflows, consistently augmenting production efficiency, and establishing an effective and environmentally friendly production mode. Through industrial association, integration, and innovation, traditional industries with high energy consumption, emissions, and pollution gradually phase out, fostering the upgrading of the industrial structure. Simultaneously, digital financial inclusion’s financial support for rural industrial integration propels the comprehensive advancement of rural industries. Its digital attributes yield “digital dividends,” amplifying the agricultural output’s quality (Xu and Wang, 2023). This results in improved environmental quality, thereby augmenting economic growth and enhancing agricultural green development levels.

From a micro perspective, digital financial inclusion has “Active” effects. Digital financial inclusion significantly contributes to entrepreneurial activities (Xie et al., 2018). Its development offers a seamless information exchange platform, catering to the information needs of entrepreneurial farmers. Whether facilitating pre-entrepreneurial decision-making or aiding information exchange during entrepreneurial processes, it significantly promotes entrepreneurship (Zhou and Fan, 2018). On this basis, entrepreneurial activities in turn positively impact agricultural green development.

Specifically, for agri-entrepreneurial farmers, they often utilize entrepreneurial capital to expand agricultural production scales, initiate small agribusinesses, join agricultural cooperatives, etc. Grounded in the principles of the “rational economic man” and profit maximization, these entrepreneurial choices tend to favor activities with low energy consumption, minimal pollution, and government support, directly promoting agricultural green development (Li et al., 2020). For non-agricultural entrepreneurial farmers, digital financial inclusion empowers them with entrepreneurial capital. This prompts some farmers to diversify into non-agricultural entrepreneurship, reducing traditional agricultural production’s frequency and associated pollution emissions. Additionally, it steers farmers towards industries closely linked to agriculture, reducing entrepreneurial risks while rationally adjusting industrial structures to minimize pollution and agricultural production risks. This strategic restructuring phase gradually replaces high-pollution, high-energy-consumption industries with low-pollution, energy-efficient green sectors, indirectly fostering agricultural green development.

In summation, digital financial inclusion emerges as a substantial driving force propelling agricultural green development in the contemporary era. Thus, we propose the following research hypotheses.

Hypothesis 1. “Byte-Sized Finance” (Digital financial inclusion) can directly contribute to “Bushel-Sized Benefits” (agricultural green development) on its own merits.

Hypothesis 2. “Byte-Sized Finance” generates “Bushel-Sized Benefits” by promoting the upgrading of industrial structure and enhancing the entrepreneurial activity of farmers. That is, with “Structural” effect and “Active” effect.

2.2 Spatial spillover effects of digital financial inclusion on agricultural green development

An essential aspect of digital financial inclusion lies in its ability to compress spatial and temporal distances through efficient information transfer, expanding interregional linkages in agricultural activities. Early attention to spatial spillovers resulting from informatization was observed in the empirical examination of a panel dataset comprising 48 states in the U.S.A. by Yilmaz et al. (2002). Keller (2002) furthered this perspective, exploring the spillover distance associated with knowledge and technology diffusion. In the Chinese context, studies by Su et al. (2021) and Fang et al. (2022) corroborate the idea that the Internet, particularly digital financial inclusion, exhibits spatial spillovers.

Moreover, agricultural activities demonstrate significant spatial relevance, with the Internet showcasing spatial spillover effects on regional agricultural development across various domains such as agricultural economic informatization (Xurui, 2022), agricultural mechanization (Sun et al., 2022), and agricultural green total factor productivity (Hu et al., 2022). Therefore, it follows logically that the influence of digital financial inclusion via the Internet on agricultural green development should similarly display spatial spillover effects. Consequently, we advance the following research hypothesis.

Hypothesis 3. “Byte-Sized Finance” (Digital financial inclusion) can act on agricultural green development in neighboring regions through spatial spillover effects, generating“ Bushel-Sized Benefits”.

3 Materials and methods

3.1 Model construction

Based on the above theoretical analysis, the following benchmark model is constructed to examine the direct impact of digital financial inclusion on agricultural green development:

Here:

Besides the direct impact Equation 1 captures, to explore potential indirect effects of digital financial inclusion on agricultural green development through alternative pathways, we conducted empirical analysis using mediation effect test methodology proposed by Zhonglin et al. (2004) and tested the results based on the Bootstrap method (with 1,000 resampled iterations) referring to Wu et al. (2021). This allowed us to examine the influence of digital financial inclusion on agricultural green development and its operational mechanisms within the context of our research inquiry. The specific model was structured as follows.

Here:

Finally, serving as a standard framework for spatial econometric modeling, spatial correlation arising from different sources is well captured by spatial Durbin models (Elhorst, 2014). Spatial correlation can originate from both the explained variables themselves, as well as from the explanatory variables and error terms. It can be adapted into common spatial lag and spatial error models by adjusting coefficient settings, thus enhancing its applicability (Beer and Riedl, 2012). Therefore, this paper considers introducing the spatial interaction term, for explanatory variable and control variables in Equation 1 respectively. This expansion transforms it into a spatial panel Durbin model, allowing for a more in-depth discussion of the spatial spillover effect of digital financial inclusion on agricultural green development.

Specifically, the natural logarithmic value (Log-L), likelihood ratio test (LR test), and Wald test are employed to determine whether the Spatial Durbin Model (SDM) needs to be downgraded. The Hausman test results reject the null hypothesis at the 1% significance level, indicating that the SDM with fixed effects is superior to the model with random effects. Collectively, these tests determined that the SDM model with spatiotemporal double fixed effects is the optimal choice.

Here:

3.2 Variable measurement and description

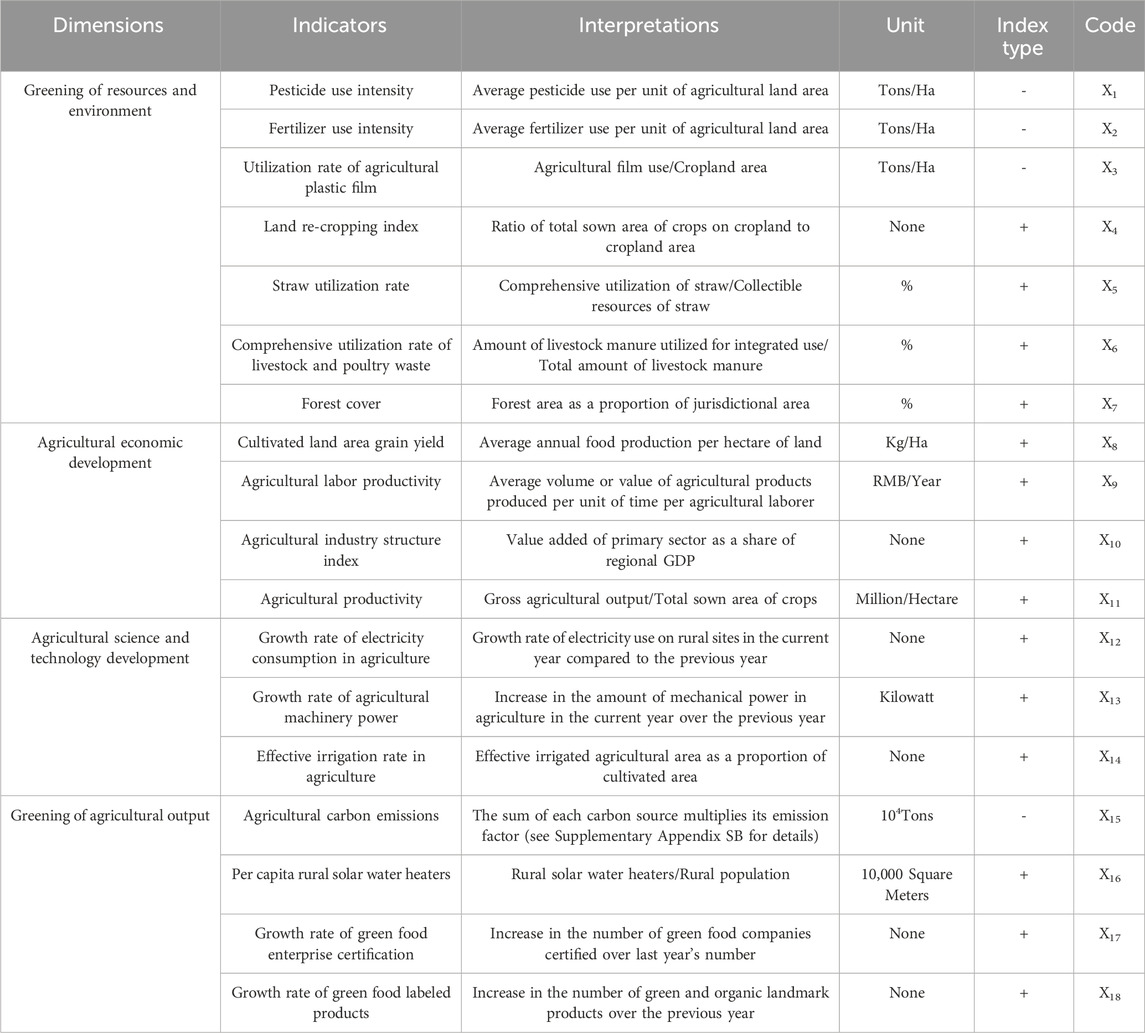

3.2.1 Agricultural green development (green)

While the significance of agricultural green production in agricultural green development is widely acknowledged in the academic realm, the prevailing evaluation index system predominantly emphasizes resource environment and agricultural production. However, due to measurement volatility and the limited dimensions, relying solely on these criteria fails to suffice for comprehensive research requirements in assessing agricultural green development. Consequently, an increasing number of scholars are resorting to multidimensional indicator systems to measure the level of agricultural green development.

Green agriculture aims at achieving four-fold integration and coordinated development involving agricultural economic growth, advancements in agricultural science and technology, ecological resource sustainability, and environmentally friendly agricultural output. Specifically, the system designed in this paper draws on Huang S (2021), Wang Lei (2023) and the most recent report by the General Office of China’s Ministry of Agriculture and Rural Affairs on “Monitoring and Evaluation Measures for the Level of Agricultural Green Development (for Trial Implementation)” released in October 2023. It encompasses the attributes, objectives, pathways, and out-comes of agricultural green development.

To align more closely with the realistic context of synergistic governance of pollution and carbon emission reduction in China, we also include agricultural carbon emissions and agricultural non-point source pollution as some of the secondary indicators of the level of agricultural green development, thus obtaining the situations of clean and low-carbon transformation of agricultural production1. Consequently, we establish an Indicator System for agricultural green development, consisting of four primary and eighteen secondary indicators. These indicators are distributed across categories: greening of resources and the environment includes seven secondary indicators, agricultural economic development comprises four secondary indicators, agricultural science and technology development involves three secondary indicators, and greening of agricultural output encompasses four secondary indicators. Refer to Table 1 for a detailed breakdown.

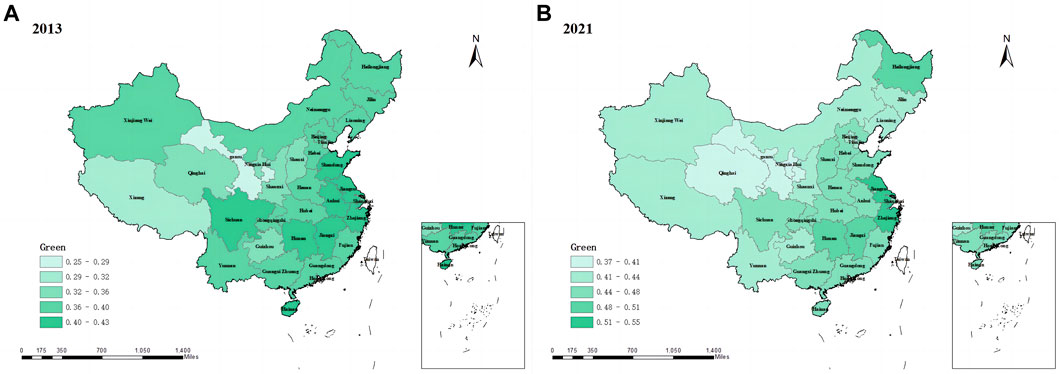

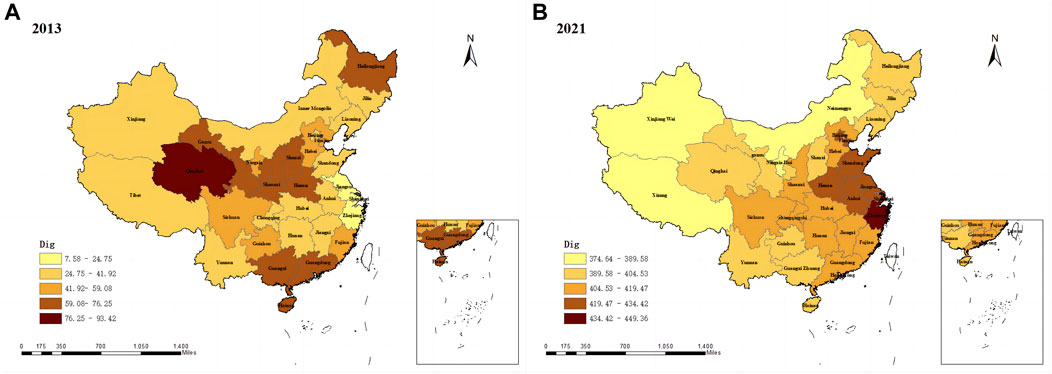

To assess the level of agricultural green development in the 31 provinces (excluding Hong Kong, Macao, and Taiwan) from 2013 to 2021, we employed the entropy method, resulting in the Agricultural Green Development Index (AGDI). Figure 2 depicts the spatial distribution of agricultural green development levels in various provinces in 2013 and 2021.

Figure 2. Agricultural green development level by provinces in 2013 and 2021, listed as: (A) 2013; (B) 2021.

3.2.2 Digital financial inclusion (dig)

Digital financial inclusion represents a modern financial model that amalgamates traditional business practices with digital technology, encompassing diverse sectors like insurance, securities, payments, and credit. In this study, we opt to gauge China’s Digital Financial Inclusion Index (DFII), a collaborative effort between the Digital Finance Research Center of Peking University and Ant Financial Group (Guo et al., 2020). Widely adopted, this index serves as a benchmark for assessing the level of digital financial inclusion development across various regions in China. It comprises three dimensions: breadth of coverage, depth of use, and digitization, incorporating a total of 33 refined indicators. Figure 3 depicts the spatial distribution of the Digital financial inclusion levels in 2013 and 2021 by province.

Figure 3. Digital financial inclusion level by provinces in 2013 and 2021, listed as: (A) 2013; (B) 2021.

Other variable definitions are in the Supplementary Appendix SA.

3.3 Data source

This study examines 279 balanced panel observations from 31 provinces in China (excluding Hong Kong, Macao, and Taiwan) spanning from 2013 to 2021. The data regarding the evaluation system for agricultural green financial development were sourced from the China Environmental Statistics Yearbook, China Rural Statistics Yearbook, China Statistics Yearbook, Green Food Statistics Yearbook, and the statistical yearbooks of provinces (municipalities) from previous years. Additionally, the data for the digital financial inclusion index were obtained from the Digital Financial Inclusion Index compiled by the Digital Finance Center of Peking University. Other variables were collected from various sources such as the China Statistical Yearbook, China Statistical Yearbook of Industrial Economy, China Agricultural Machinery Industry Year-book, and China Tertiary Industry Statistics Yearbook. Some of the missing data were processed using interpolation.

4 Results

The empirical test results are structured into four steps.

Step 1. Examine whether digital financial inclusion directly impacts agricultural green development (Hypothesis 1).

Step 2. Test whether digital financial inclusion indirectly affects agricultural green development through the upgrading of industrial structure and the entrepreneurial activity of farmers. This step aims to analyze the “Structural” and “Active” effects of digital financial inclusion (Hypothesis 2).

Step 3. Explore the spatial spillover effect of digital financial inclusion on agricultural green development in neighboring provinces (Hypothesis 3).

Step 4. Test the robustness of results and analyze for any heterogeneity.

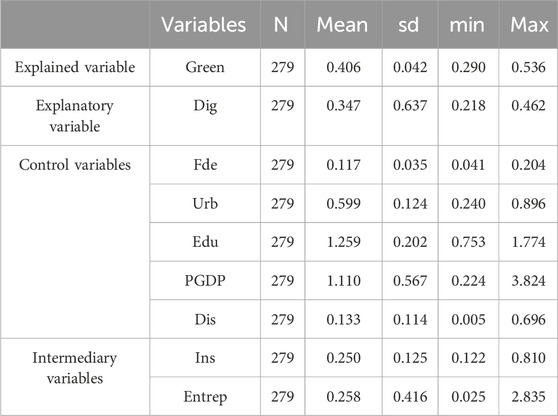

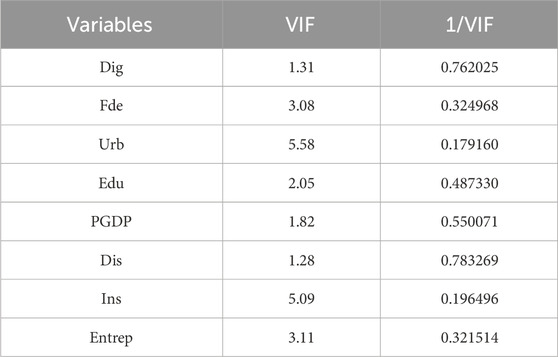

Descriptive statistics for the variables are presented in Table 2. To ensure accurate estimation results and minimize issues related to multicollinearity, we utilized the variance inflation factor method to assess the model (refer to Table 3). The results in Table 3 indicate that the variance inflation factor of each variable is below 10, alleviating concerns regarding multicollinearity. Additionally, based on the Hausman test and F-test, the double fixed effects model was selected for further analysis.

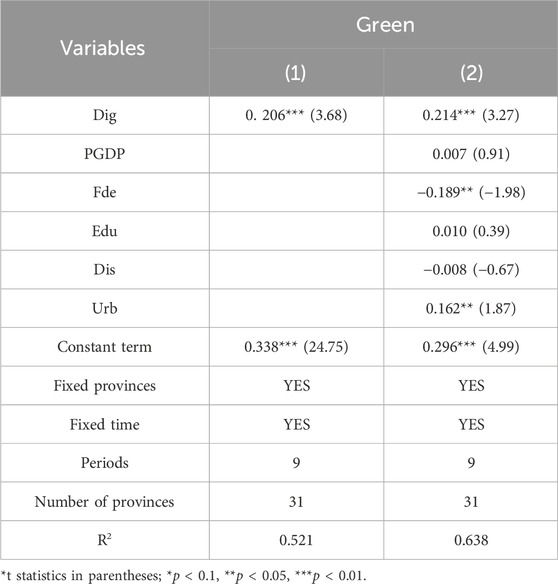

4.1 Benchmark regression result

Table 4 presents the linear estimation outcomes illustrating the influence of digital financial inclusion on agricultural green development. The estimated coefficients of the key explanatory variable, the digital financial inclusion index (Dig), exhibit significantly positive values in both Model (1) and Model (2). These findings affirm that digital financial inclusion fosters favorable conditions for green agricultural development, even when considering the control variables. That is, “Byte-Sized Finance” does produce “Bushel-Sized Benefits.” Consequently, it supports the validation of Hypothesis 1.

4.2 Test of possible mechanisms

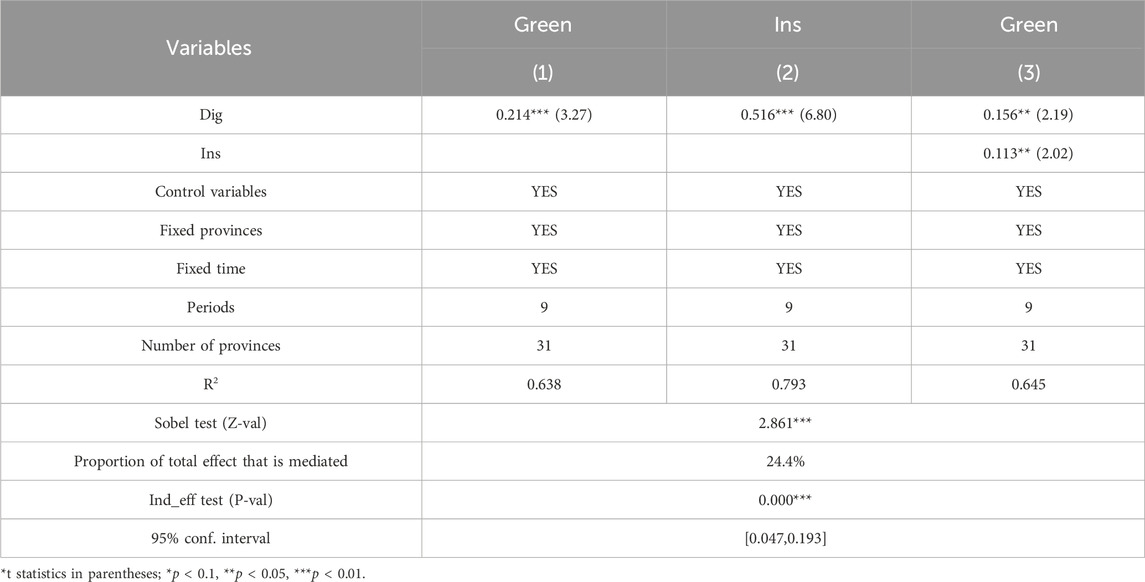

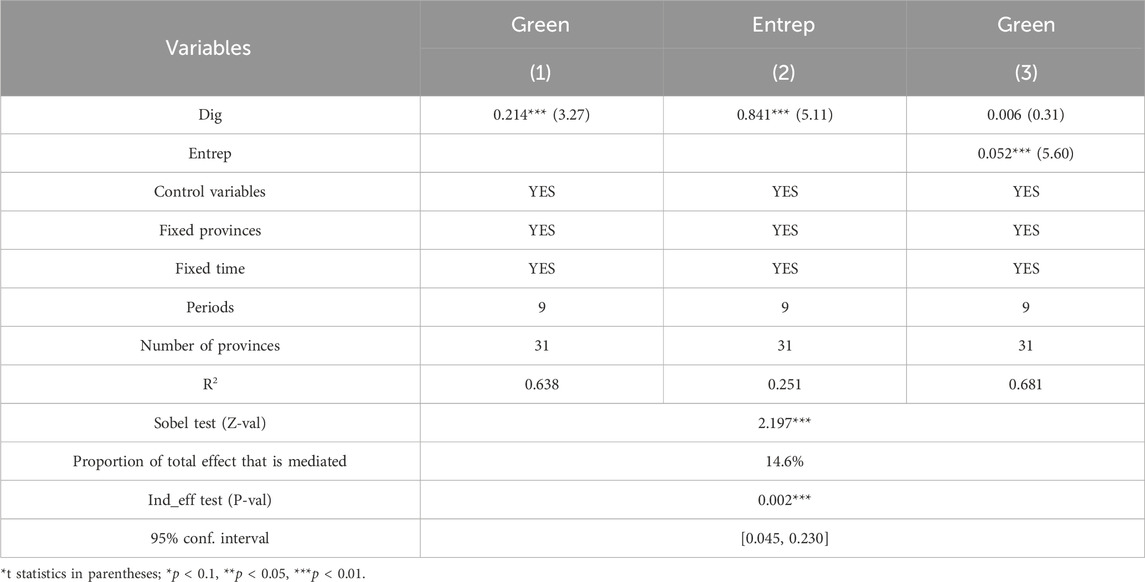

The previous section presented a theoretical analysis of the transmission mechanism through which digital financial inclusion impacts green agricultural development, focusing on industrial structure upgrading at the macro level and the farmers’ entrepreneurial motivation at the micro level. To empirically validate the existence of these transmission paths, this study utilizes the mediation effect model based on Equations 1–3, with regression results presented in Tables 5, 6.

From a macro perspective: Model (1) in Table 5 confirms the positive impact of digital financial inclusion on agricultural green development, while Model (2) verifies whether digital financial inclusion optimizes industrial structure upgrading. In both models, the regression coefficients of digital financial inclusion are positive and significant at the 1% level. Model (3) demonstrates that the influence of industrial structure (intermediary variable M) on the agricultural green development level is significantly positive. However, the estimated coefficient of digital financial inclusion is smaller than the 0.214 estimated in the benchmark regression model [Model (1)] and passes the 5% significance test. This suggests that industrial structure functions as an intermediary. The Sobel test confirms the hypothesis of a mediation effect. The intermediary effect size of industrial structure upgrading accounts for 24.40% of the total effect. This suggests that, from a macro perspective, digital financial inclusion optimizes the structure of the industry and thus contributes to agricultural green development. It has “Structural” effect.

From a micro perspective: Model (2) in Table 6 indicates a significantly positive impact of digital financial inclusion on the entrepreneurial activity of agricultural households at the 1% level. Subsequently, by reintroducing the intermediary variables of entrepreneurial activity into the regression equation for the impact of digital financial inclusion on agricultural green development, Model (3) shows a decreased and non-significant coefficient for the impact of digital financial inclusion compared to Model (1). This suggests that entrepreneurial activity also mediates the enhancement of digital financial inclusion in promoting agricultural green development. The Sobel test reveals the mediating effect of the entrepreneurial activity of farmers accounts for 14.60% of the total effect. This signifies that digital financial inclusion can boost agricultural green development by increasing farmers’ entrepreneurial activity, thus significantly exhibiting the “active” effect of digital financial inclusion. This suggests that, at the micro level, digital inclusive finance can contribute to the agricultural green development by increasing farmers’ entrepreneurial motivation. It has “Active” effect.

On this basis, we further tested the findings of the mediating effects of the two paths using the Bootstrap method (with 1,000 resampled iterations). The test results confirm that ‘Byte-Sized Finance’ generates “Bushel-Sized Benefits” by promoting the upgrading of the industrial structure and enhancing the entrepreneurial activity of farmers, through the “Structural” effect and the “Active” effect. Consequently, this supports the validation of Hypothesis 2.

4.3 Spatial spillover analysis

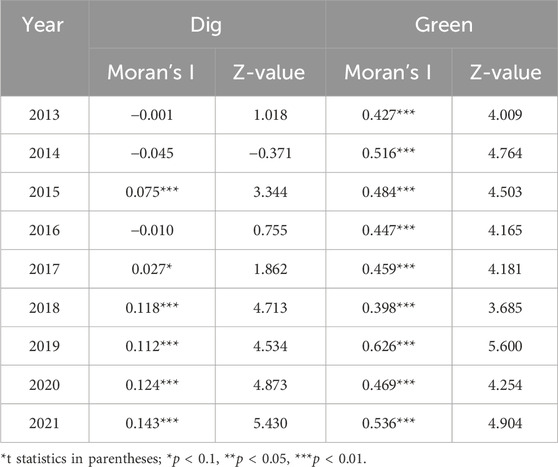

Before conducting spatial econometric analysis, it is crucial to examine the existence of a spatial effect on the variables under study, specifically the spatial autocorrelation of the digital financial inclusion development index and the agricultural green development index. In this paper, Moran’s I index method is employed to compute the spatial effect for each year using the first-order inverse distance weight matrix, as presented in Table 7.

The results in Table 7 demonstrate that for the years 2013–2021, most Moran’s I indices associated with the digital financial inclusion development index and agricultural green development index under the first-order inverse distance weight reach the 1% significance level. This signifies significant spatial autocorrelation in digital financial inclusion and agricultural green development across China’s provinces from 2013 to 2021. These findings suggest a clustering phenomenon in the spatial distribution of both indices.

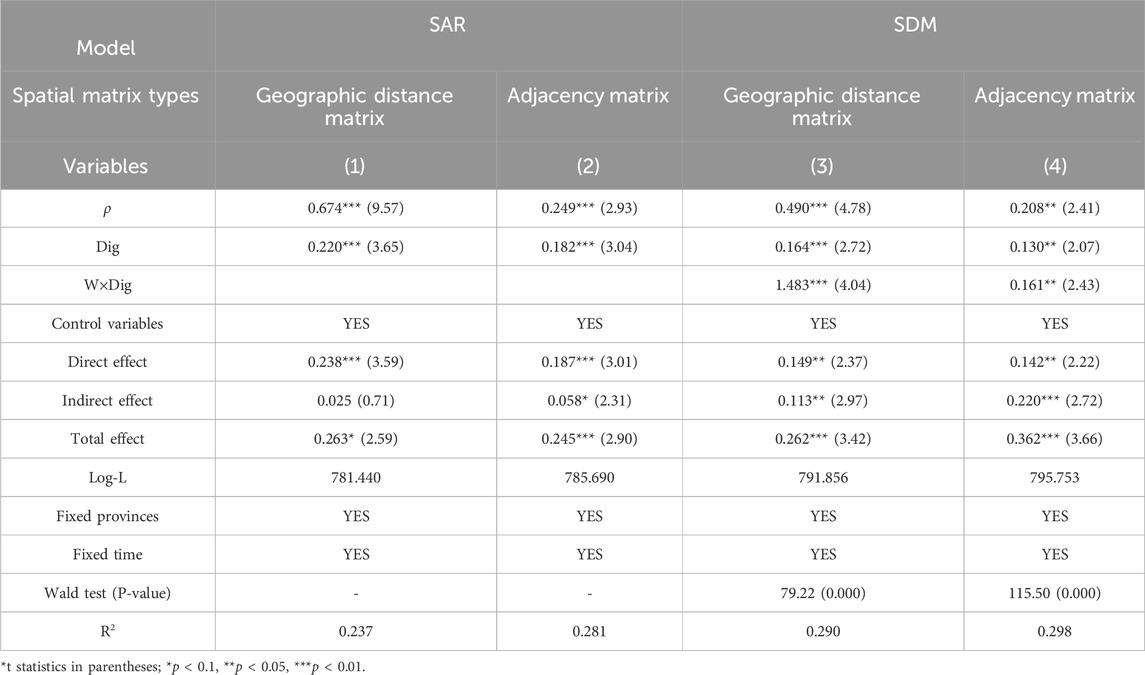

Based on Equation 4, Table 8 presents the outcomes derived from spatial regression models analyzing the impact of digital financial inclusion on agricultural green development using two distinct spatial weight matrices. To gauge the robustness of the estimations of SDM model, this paper also showcases the estimation results of the spatial lag model (SAR) incorporating spatiotemporal double fixed effects. The findings in Table 8 reveal notable time lag effects and spatial spillover im-pacts on agricultural green development. Models (2) and (4) indicate significantly positive spatial autoregressive coefficients for agricultural green development, alongside significantly positive estimated coefficients for the spatial lag term of digital financial inclusion. These results imply that the level of digital financial inclusion in neighboring provinces exerts a positive effect on local agricultural green development.

Table 8. Results of the spatial model of digital financial inclusion affecting agricultural green development.

This effect may be attributed to interregional economic competition and mutual emulation, where the digital financial inclusion and agricultural green development models in neighboring provinces demonstrate a robust effect on the local area. Moreover, the growing integration between regions fosters closer links in digital financial inclusion, facilitating the formation of both backward-forward and upstream-downstream linkages among industries with high correlations. Such connections support technology spillovers and knowledge dissemination, contributing to the favorability of neighboring regions’ digital financial inclusion to local agricultural green development.

However, it's important to note that the values of spatial autoregressive coefficients cannot directly determine the marginal impact of digital financial inclusion on agricultural green development. Simple point regression results may lead to misestimation while assessing spatial spillover effects between regions. Hence, a comprehensive analysis using partial differential interpretation to explain variable changes, including direct and indirect effects, is necessary to ascertain the impact of the independent variable in one region on the dependent variable in both the same region and other regions.

Upon examining Table 8, the results indicate a significant indirect effect of digital financial inclusion on agricultural green development. “Byte-Sized Finance” can act on agricultural green development in neighboring regions through spatial spillover effects, generating“ Bushel-Sized Benefits”. Consequently, it supports the validation of Hypothesis 3.

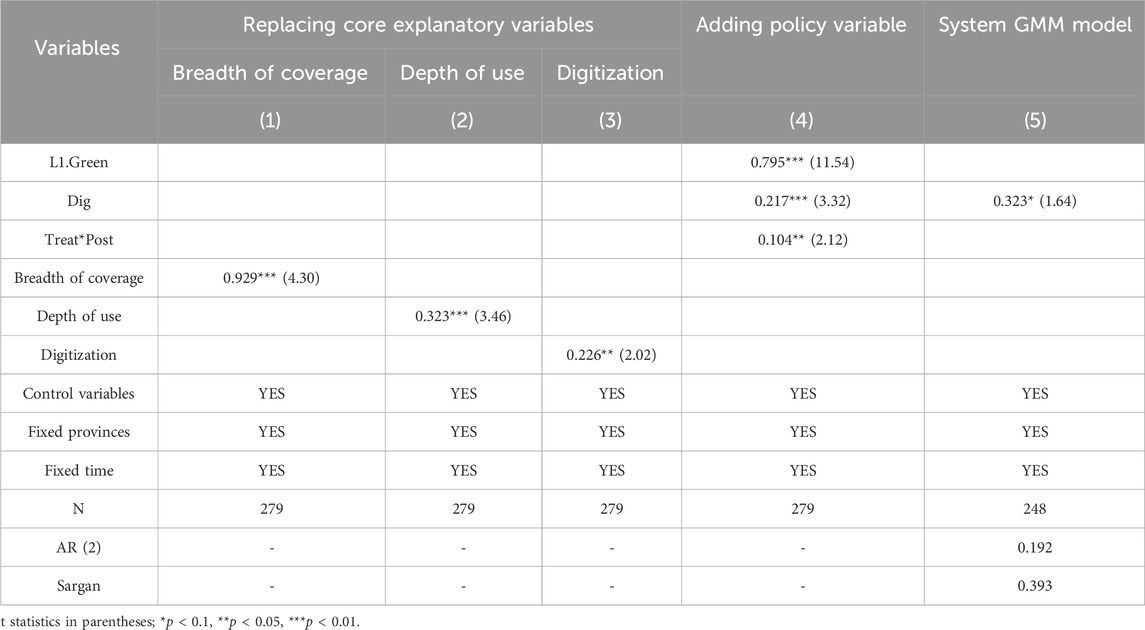

4.4 Robustness test

To determine the reliability of digital financial inclusion in bolstering agricultural green development, the article conducts rigorous tests, and the outcomes are presented in Table 9. Initially, the core explanatory variables are replaced. In models (1), (2), and (3), the measures of breadth of coverage, depth of use, and digitization all exhibit significant positive impacts at the 1% level. This indicates that altering the measures of the core explanatory variables doesn't significantly alter the estimation results, and the promotion effects, in descending order, are observed as breadth of coverage, depth of use, and digitization. Overall, the estimation results regarding the impact of different dimensions of digital financial inclusion on agricultural green development are largely consistent with the earlier findings regarding the influence of digital financial inclusion on green agricultural development.

Subsequently, highly correlated policy variable is added as another control variable, and enter the model in the form of dummy variables. The General Office of the CPC Central Committee and the General Office of the State Council issued the Opinions on the Establishment of Unified and Standardized National Ecological Civilization Pilot Zones on 22 August 2016. Taking into account the existing ecological civilization reform practice foundation, regional variability and development stage of each region, the first batch of Fujian, Jiangxi and Guizhou provinces, which have a better ecological foundation and stronger carrying capacity of resources and environment, were selected as the pilot zones. In model (4), the estimated coefficients and signs of digital financial inclusion exhibit no significant changes after incorporating the policy, confirming the robustness of the conclusions.

Thirdly, alternative models (system GMM) were used to further enhance the robustness of the article’s conclusions. To verify the validity of the Gaussian mixed model estimation results, this study employs two tests, including the second-order serial autocorrelation test and the over-identification constraint test, to validate the model estimation results and the validity of instrumental variables. As shown in model (5), the Arellano-Bond test for AR (2) in first differences is 0.192 (greater than 0.05), which verifies the hypothesis that there is no second-order serial autocorrelation in the model. Additionally, the value of the Sargan test is greater than 0.05, which confirms that there is no over-identification of the instrumental variables, indicating that the model setting is reasonable and effective. The estimation results in model (5) also demonstrate a positive effect of digital financial inclusion on agricultural green development. These outcomes collectively affirm that digital financial inclusion indeed exerts a noteworthy promotional effect on agricultural green development.

4.5 Endogenous discussion

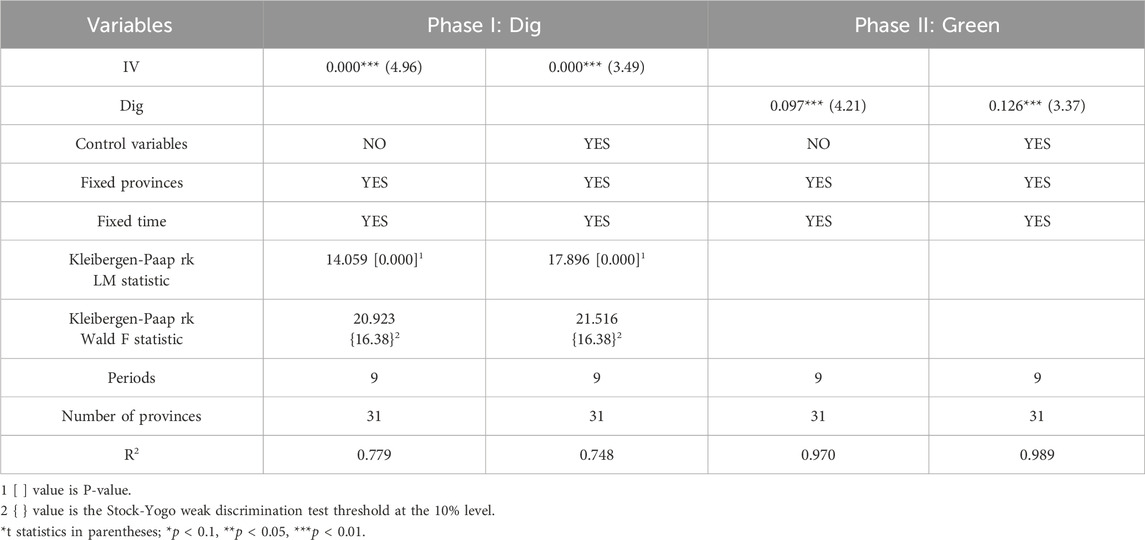

The main method to address the endogeneity problem caused by omitted variables and reverse causation is the selection of appropriate instrumental variables for the core explanatory variables. Following the methodology of Huang et al. (2019), the historical data of post and telecommunications of each province in 1984 is utilized as an instrumental variable for the digital financial inclusion development index. This selection is based on the premise that the vehicle for the development of digital financial inclusion is the information network, of which the Internet is a representative, and Internet access technology began with telephone dial-up access (PSTN), followed closely by fiber-optic broadband access technology. Such that places with historically high ownership of telephones are also likely to have high Internet penetration. Moreover, traditional telecommunication tools such as landline telephones are unlikely to exert an impact on present-day agricultural green development, which meets the requirement of exclusivity. Therefore, using the number of telephones owned by provinces (excluding Chongqing) in 1984 as an instrumental variable satisfies the criteria of exogeneity and relevance. The data on telephone ownership by provinces in 1984 is derived from the Compendium of Fifty Years of Statistical Resources of New China.

However, as the instrumental variable comprises cross-sectional data, it cannot be directly employed in the econometric analysis of panel data. To address this issue, we introduce time series data and create an interaction term with the cross-sectional data to construct the panel instrumental variable, following Nunn and Qian (2014)’s approach. Specifically, the number of Internet users in the country in the previous year (time-series data) is separately constructed from the number of telephone sets owned in each province in 1984 (cross-sectional data) as an instrumental variable (IV) for the provincial digital financial inclusion index in that year. Subsequently, a two-stage least squares (2SLS) regression is conducted.

The outcomes depicted in Table 10 demonstrate that even after considering endogeneity, the effect of digital financial inclusion on enhancing agricultural green development remains significant at the 1% level. Additionally, regarding the original hypothesis of “insufficient identification of instrumental variables,” the p-value of the LM statistic of Kleibergen-Paap rk is significant, rejecting the original hypothesis. Furthermore, in the test of weak identification of instrumental variables, the Wald F statistic of Kleibergen-Paap rk is greater than that of the Stock-Yogo weak identification test, signifying significance at the 10% level. The critical value of the Stock-Yogo weak identification test at the 10% level is 16.38. Overall, these tests validate the selection of the cross term between the historical number of telephones in each province and the number of Internet users in the country in the previous year as an instrumental variable for historical postal and telecommunications data.

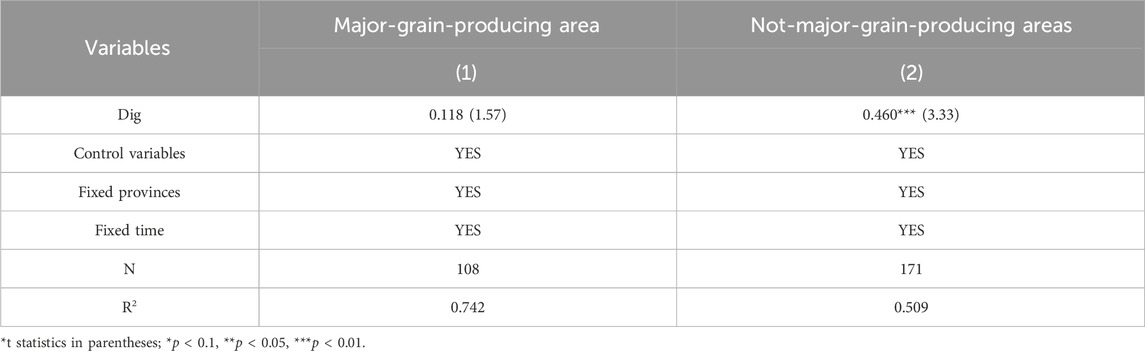

4.6 Heterogeneity analysis

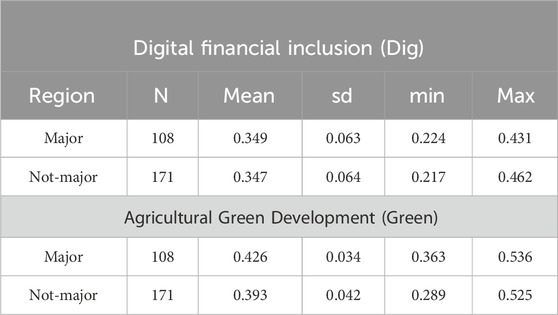

Regional heterogeneity in the distribution of agricultural green development exists due to varying resource endowments and developmental stages. This is typically observed when dividing up food-producing areas. In order to guarantee food security, China has established 13 main grain-producing regions: Liaoning, Hebei, Shandong, Jilin, Inner Mongolia, Jiangxi, Hunan, Sichuan, Henan, Hubei, Jiangsu, Anhui, and Heilongjiang. An overall sample regression might obscure regional characteristics. Therefore, before testing for categorical regression, the descriptive statistics of the differences in the levels of agricultural green development and digital financial inclusion between different regions are explained.

From Table 11, it can be seen that the major-grain-producing region is significantly ahead of the not-major-grain-producing in agricultural green development, reflecting the “first-mover advantage” of resource endowment. This result sets the foundation for testing the regional heterogeneity in the impact of digital financial inclusion on the level of green development in agriculture. Consequently, the sample is divided into major-grain-producing regions and not-major-grain-producing regions for regression in the heterogeneity analysis. The estimation results are presented in Table 12.

Table 11. Differences of digital financial inclusion and agriculture green development across regions.

The results in models (1) and (2) show that the effect of digital financial inclusion on the promotion of not-major-grain-producing regions is significant at the 1% statistical level, while its positive effect on agricultural green development in major-grain-producing regions is not significant. The possible reasons for this are that the major-grain-producing areas are the primary source of food supply in China, and the frequent agricultural production activities, high intensity of agricultural inputs such as chemical fertilizers and pesticides, and serious pollution problems present greater obstacles to the promotion of agricultural green development by digital inclusive finance. This heterogeneous result also suggests that the role of digital inclusive finance in mitigating pollution and fostering green agriculture should be tailored to the specific conditions of major-grain-producing region. Furthermore, agricultural green transformation policies should be strategically focused on these primary food-producing areas to fully exploit the potential of digital inclusive finance in advancing the comprehensive and sustainable development of agriculture in these key regions.

5 Discussion

This paper has a high correlation with the existing research. For example, some theoretical studies delve into the role of digital financial inclusion in affecting green total factor productivity (Liu et al., 2023; Shen et al., 2023), agroecological efficiency (Ma and Li, 2021), farm income (Li et al., 2022), farmers’ adoption of green production technologies (Carter et al., 2016; Zhou et al., 2022), carbon emission reduction (Wang et al., 2022a; Lee et al., 2022), and the convergence theme of green finance contributing to sustainable agricultural development (Mo et al., 2023). Some other theoretical studies have underscored the multidimensional impact of digital financial inclusion on agricultural green development, such as agricultural technological innovation and agricultural socialization services (Wang Lei, 2023).

However, significant gaps remain. What are the characteristics of this effect, and how can we capitalize on these effects for coordinated regional development? While these studies have provided valuable insights, they have often focused on either macro or micro perspectives, overlooking the holistic impact of digital financial inclusion across different levels.

Our study addresses this gap by providing a comprehensive analysis that integrates both macro and micro perspectives. At the micro-level, research suggests that digital financial inclusion fosters entrepreneurship among farmers (Liu Z. et al., 2021b; Ji et al., 2021). At the macro-level, studies propose that digital financial inclusion facilitates the upgrading of industrial structures (Ren et al., 2023; Zhang et al., 2023). By confirming these pathways of digital inclusive finance and further affirming its role in agricultural green development through these pathways, our findings address the question of how “Byte-Sized Finance” can yield “Bushel-Sized Benefits” in China’s agricultural green development. It offers fresh evidence for the discussion of the “Structural” and “Active” impacts of digital inclusive finance on agricultural green development.

Furthermore, both digital financial inclusion and agricultural green development demonstrate the potential for spatial spillovers (Keller, 2002; Yilmaz et al., 2002; Su et al., 2021; Hu et al., 2022; Xurui, 2022). We confirm this through empirical analysis and provide policy suggestions on leveraging these effects to promote coordinated regional development in the agricultural sector, adding practical significance to our study.

This study still has some limitations. It is hoped that future research will further our study from the following aspects:

(1) Scale of Analysis. This study uses Chinese provincial-level regions as case areas due to data availability. Future research can conduct empirical studies at more granular levels to test whether the findings are equally applicable in smaller administrative units within China, such as the city or county level.

(2) Focus on Digital Finance. This study concentrates on the impact of digital financial inclusion on agricultural green development. Future research could expand this focus to assess the broader financial dividends from the integration of economy and technology on agricultural sustainability. Investigating the potential impacts of digital financial inclusion on other environmentally related areas of sustainable development would also be valuable.

(3) Geographical Applicability. This study focuses on the spatial spillover effects of digital financial inclusion within China. Further research should explore the applicability of these results to other developing countries and explore the potential spatial spillover effects of digital financial inclusion on agricultural green development.

6 Conclusion and policy implications

In this paper, “Byte-Sized Finance” refers to digital financial inclusion, which encompasses the use of digital technologies to provide financial services to individuals and businesses that are underserved by traditional financial institutions. The primary goal is to make financial services more accessible, affordable, and convenient, especially for rural and remote areas. “ Bushel-Sized Benefits” refers to the significant benefits and improvements in agricultural green development and sustainability resulting from the application of digital financial services. Given the substantial impact of digital financial inclusion on agricultural green development in China, this study empirically examines the complex impacts of digital financial inclusion as driver of agricultural green development. The main conclusions are as follows:

(1) “Byte-Sized Finance” and “Bushel-Sized Benefits”: Digital financial inclusion, referred to as “Byte-Sized Finance,” can contribute to significant agricultural benefits, termed “Bushel-Sized Benefits.” Digital financial inclusion significantly propels agricultural green development in China, emerging as a pivotal determinant in shaping agricultural sustainability in the contemporary era. The conclusions remain robust even after employing instrumental variables and conducting robustness tests, with digital financial inclusion demonstrates greater effectiveness in not-major-grain-producing areas.

(2) Mechanisms of Impact: “Byte-Sized Finance” generates “Bushel-Sized Benefits” through “Structural” effect and “Active” effect. It facilitates industrial structural upgrading and stimulates entrepreneurial activity among farmers, thus empowering agricultural green development.

(3) Spatial Spillover Effects: Digital financial inclusion can positively impact agricultural green development in neighboring regions through spatial spillover effects. Our empirical findings corroborate the presence of a spatial spillover effect of digital financial inclusion on provincial agricultural green development. This underscores the pivotal role of digital financial inclusion in fostering an interconnected and harmonized paradigm of green agriculture across regional boundaries. Such synergistic dynamics are instrumental in enhancing the standards, efficiency, and sustainability of Chinese agriculture.

Given the above conclusion, our study offers several policy implications. Firstly, boost investments in internet finance. Recognizing digital financial inclusion as a potent catalyst for agricultural sustainability necessitates a significant increase in investments in Internet finance. This can be achieved through the establishment of special demonstration zones that showcase the benefits of digital financial services in agriculture. Additionally, enhancing collaborative efforts among stakeholders—including government agencies, financial institutions, and tech companies—is essential. Conducting regular performance evaluations will further solidify the dividends gained from comprehensive financial service reforms. These steps are crucial in advancing agricultural green development by ensuring that digital financial inclusion reaches its full potential.

Secondly, implement tailored strategies for regional integration. While the positive impact of digital financial inclusion on agricultural green development is evident across China, deeper integration is required in the major-grain-producing areas. It is imperative to implement dynamic and tailored digital financial inclusion strategies that address the unique challenges and needs of these regions. Providing “hardware” technical support, such as improving digital infrastructure and offering targeted financial products, can effectively address regional disparities in resource endowments and heterogeneity in development characteristics. This approach ensures that all regions benefit equally from digital financial inclusion, thereby promoting balanced and sustainable agricultural growth.

Lastly, harness spatial spillover effects. Acknowledging the spatial spillover effects of digital financial inclusion activities implies the need to fully harness spatial contributions to agricultural green development. This can be achieved by enhancing coordination in constructing new infra-structure across different regions and aligning decision-making strategies from the CPC Central Committee and the State Council to foster inclusive finance. These approaches highlights the interconnectedness of regional agricultural systems and ensures that advancements in one area benefit neighboring regions as well.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

LZ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing. YQ: Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Visualization, Writing–original draft, Writing–review and editing. XD: Conceptualization, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by National Social Science Fund of China (Grant No. 22CJY046), the Open Fund of Sichuan Province Cyclic Economy Research Center (Grant No. XHJJ-2303) and National Statistical Science Research Project, China (Grant No. 2023LY014).

Acknowledgments

We gratefully acknowledge financial support from National Social Science Fund of China (Grant No. 22CJY046), the Open Fund of Sichuan Province Cyclic Economy Research Center (Grant No. XHJJ-2303), and National Statistical Science Research Project, China (Grant No. 2023LY014). The authors also extend great gratitude to the reviewers and editors for their helpful re-view and critical comments. Additionally, all authors are very grateful to National Social Science Foundation of China (Grant No. 18ZDA091, Professor Jingyi Wang at Peking University) for providing the data.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1411866/full#supplementary-material

Footnotes

1Thank the reviewers for the precious comments and suggestions.

References

Adnan, N., Nordin, S. M., and Rasli, A. M. (2019). A possible resolution of Malaysian sunset industry by green fertilizer technology: factors affecting the adoption among paddy farmers. Environ. Sci. Pollut. Res. 26, 27198–27224. doi:10.1007/s11356-019-05650-9

Akhter, S., and Daly, K. J. (2009). Finance and poverty: evidence from fixed effect vector decomposition. Emerg. Mark. Rev. 10, 191–206. doi:10.1016/j.ememar.2009.02.005

Alharbi, R. K., Yahya, S., and Ramadani, V. (2022). Financial literacy, access to finance, SMEs performance and Islamic religiosity: evidence from Saudi Arabia. Int. J. Entrepreneursh. Small Bus. 46, 259–285. doi:10.1504/ijesb.2022.124456

Altunbaş, Y., and Thornton, J. (2020). Finance and income inequality revisited. Finance Res. Lett. 37, 101355. doi:10.1016/j.frl.2019.101355

Ataei Kachouei, M., Kaushik, A., and Ali, M. A. (2023). Internet of things-enabled food and plant sensors to empower sustainability. Adv. Intell. Syst. 5, 2300321. doi:10.1002/aisy.202300321

Aziz, A., and Naima, U. (2021). Rethinking digital financial inclusion: evidence from Bangladesh. Technol. Soc. 64, 101509. doi:10.1016/j.techsoc.2020.101509

Demirgüç-Kunt, A., Beck, T. H. L., and Honohan, P. (2008). Finance for all? policies and pitfalls in expanding access. A World Bank policy research report, World Bank, Washington, D.C.: Tilburg University.

Beer, C., and Riedl, A. (2012). Modelling spatial externalities in panel data: the Spatial Durbin model revisited. Pap. Regional Sci. 91, 299–319. doi:10.1111/j.1435-5957.2011.00394.x

Bondarenko, V., Sidorenko, V., Hryshchenko, A., Vyshnivska, B., Nahorna, O., Barylovych, O., et al. (2024). Development of marketing at agricultural and processing enterprises. Int. Sci. Group.

Carter, M. R., Cheng, L., and Sarris, A. (2016). Where and how index insurance can boost the adoption of improved agricultural technologies. J. Dev. Econ. 118, 59–71. doi:10.1016/j.jdeveco.2015.08.008

Chen, M., Mao, S., Zhang, Y., and Leung, V. C. (2014). Big data: related technologies, challenges and future prospects. Vol. 100. Heidelberg: Springer.

deHaan, E., de Kok, T., Matsumoto, D., and Rodriguez-Vazquez, E. (2023). How resilient are firms’ financial reporting processes? Manag. Sci. 69, 2536–2545. doi:10.1287/mnsc.2023.4670

Fang, Z., Razzaq, A., Mohsin, M., and Irfan, M. (2022). Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol. Soc. 68, 101844. doi:10.1016/j.techsoc.2021.101844

Guo, D., Li, L., and Pang, G. (2024). How does digital inclusive finance affect county's common prosperity: theoretical and empirical evidence from China. Econ. Anal. Policy 82, 340–358. doi:10.1016/j.eap.2024.03.016

Guo, F., Wang, J., Wang, F., Kong, T., Zhang, X., and Cheng, Z. (2020). Measuring the development of digital inclusive finance in China: index compilation and spatial characteristics. China Econ. Q. 19, 1401–1418. doi:10.13821/j.cnki.ceq.2020.03.12

Han, W., Li, X., Zhu, W., Lu, R., and Zu, X. (2024). Knowledge digitization and high-tech firm performance: a moderated mediation model incorporating business model innovation and entrepreneurial orientation. Technol. Soc. 77, 102536. doi:10.1016/j.techsoc.2024.102536

Hong, Y. Y. Y. (2023). The network effect of China's industrial technology progress from the perspective of technology spillovers in dual circulation: measurement of TFP growth and propagation based on global production networks. J. Manag. World 39, 1–8. doi:10.19744/j.cnki.11-1235/f.2023.0068

Hu, D., Fang, X., and DiGiovanni, Y. M. (2023). Technological progress, financial constrains, and digital financial inclusion. Small Bus. Econ. 61, 1693–1721. doi:10.1007/s11187-023-00745-7

Hu, J., Zhang, X., and Wang, T. (2022). Spatial spillover effects of resource misallocation on the green total factor productivity in Chinese agriculture. Int. J. Environ. Res. Public Health 19, 15718. doi:10.3390/ijerph192315718

Huang, Q., Yu, Y., and Zhang, S. (2019). Internet development and productivity growth in manufacturing industry: internal mechanism and China experiences. China Ind. Econ. 8, 5–23. doi:10.19581/j.cnki.ciejournal.2019.08.001

Huang, S. F. S. (2021). Index design and level measurement of agricultural green development. Ecol. Econ. 37, 125–131.

Ji, X., Wang, K., Xu, H., and Li, M. (2021). Has digital financial inclusion narrowed the urban-rural income gap: the role of entrepreneurship in China. Sustainability 13, 8292. doi:10.3390/su13158292

Jian, Y. (2023). Study on the coupling relationship between digital inclusive finance and agricultural green development in the yellow river basin. Price Theory and Pract. doi:10.19851/j.cnki.CN11-1010/F.2023.06.403

Keller, W. (2002). Trade and the transmission of technology. J. Econ. Growth 7, 5–24. doi:10.1023/a:1013461025733

Khanal, A. R., and Omobitan, O. (2020). Rural finance, capital constrained small farms, and financial performance: findings from a primary survey. J. Agric. Appl. Econ. 52, 288–307. doi:10.1017/aae.2019.45

Koku, P. S. (2015). Financial exclusion of the poor: a literature review. Int. J. Bank Mark. 33, 654–668. doi:10.1108/ijbm-09-2014-0134

Lee, C.-C., Wang, F., and Lou, R. (2022). Digital financial inclusion and carbon neutrality: evidence from non-linear analysis. Resour. Policy 79, 102974. doi:10.1016/j.resourpol.2022.102974

Leyshon, A., French, S., and Signoretta, P. (2008). Financial exclusion and the geography of bank and building society branch closure in Britain. Trans. Inst. Br. Geogr. 33, 447–465. doi:10.1111/j.1475-5661.2008.00323.x

Leyshon, A., and Thrift, N. (1993). The restructuring of the UK financial services industry in the 1990s: a reversal of fortune? J. Rural Stud. 9, 223–241. doi:10.1016/0743-0167(93)90068-u

Leyshon, A., and Thrift, N. (1994). Access to financial services and financial infrastructure withdrawal: problems and policies. Area 26, 268–275.

Leyshon, A., and Thrift, N. (1995). Geographies of financial exclusion: financial abandonment in Britain and the United States. Trans. Inst. Br. Geogr. 20, 312–341. doi:10.2307/622654

Li, M., Wang, J., Zhao, P., Chen, K., and Wu, L. (2020). Factors affecting the willingness of agricultural green production from the perspective of farmers' perceptions. Sci. Total Environ. 738, 140289. doi:10.1016/j.scitotenv.2020.140289

Li, Y., Wang, M., Liao, G., and Wang, J. (2022). Spatial spillover effect and threshold effect of digital financial inclusion on farmers’ income growth—based on provincial data of China. Sustainability 14, 1838. doi:10.3390/su14031838

Liu, D., Li, Y., You, J., Balezentis, T., and Shen, Z. (2023). Digital inclusive finance and green total factor productivity growth in rural areas. J. Clean. Prod. 418, 138159. doi:10.1016/j.jclepro.2023.138159

Liu, K., Liu, X., and Wu, Z. (2024). Nexus between corporate digital transformation and green technological innovation performance: the mediating role of optimizing resource allocation. Sustainability 16, 1318. doi:10.3390/su16031318

Liu, Y., Ji, D., Zhang, L., An, J., and Sun, W. (2021a). Rural financial development impacts on agricultural technology innovation: evidence from China. Int. J. Environ. Res. Public Health 18, 1110. doi:10.3390/ijerph18031110

Liu, Z., Zhang, Y., and Li, H. (2021b). Digital inclusive finance, multidimensional education, and farmers’ entrepreneurial behavior. Math. Problems Eng. 2021, 1–13. doi:10.1155/2021/6541437

Ma, J., and Li, Z. (2021). Does digital financial inclusion affect agricultural eco-efficiency? A case study on China. Agronomy 11, 1949. doi:10.3390/agronomy11101949

Mhlanga, D. (2024). The role of big data in financial technology toward financial inclusion. Front. big Data 7, 1184444. doi:10.3389/fdata.2024.1184444

Mo, Y., Sun, D., and Zhang, Y. (2023). Green finance assists agricultural sustainable development: evidence from China. Sustainability 15, 2056. doi:10.3390/su15032056

Morrison, P. S., and O’Brien, R. (2001). Bank branch closures in New Zealand: the application of a spatial interaction model. Appl. Geogr. 21, 301–330. doi:10.1016/s0143-6228(01)00014-5

Ndlovu, G., and Toerien, F. (2020). The distributional impact of access to finance on poverty: evidence from selected countries in Sub-Saharan Africa. Res. Int. Bus. Finance 52, 101190. doi:10.1016/j.ribaf.2020.101190

Nourzad, F. (2002). Financial development and productive efficiency: a panel study of developed and developing countries. J. Econ. Finance 26, 138–148. doi:10.1007/bf02755981

Nunn, N., and Qian, N. (2014). US food aid and civil conflict. Am. Econ. Rev. 104, 1630–1666. doi:10.1257/aer.104.6.1630

Oanh, T. T. K. (2024). Digital financial inclusion in the context of financial development: environmental destruction or the driving force for technological advancement. Borsa Istanb. Rev. 24, 292–303. doi:10.1016/j.bir.2024.01.003

Panday, D., Bhusal, N., Das, S., and Ghalehgolabbehbahani, A. (2024). Rooted in nature: the rise, challenges, and potential of organic farming and fertilizers in agroecosystems. Sustainability 16, 1530. doi:10.3390/su16041530

Pratama, I. N., Dachyar, M., and Pratama, N. R. (2023). Optimization of resource allocation and task allocation with Project management information systems in information technology companies. TEM J. 12, 1814–1824. doi:10.18421/tem123-65

Ren, X., Zeng, G., and Gozgor, G. (2023). How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 330, 117125. doi:10.1016/j.jenvman.2022.117125

Scholtens, B., and Dam, L. (2007). Banking on the equator. Are banks that adopted the equator principles different from non-adopters? World Dev. 35, 1307–1328. doi:10.1016/j.worlddev.2006.10.013

Shahbaz, M., Solarin, S. A., Mahmood, H., and Arouri, M. (2013). Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 35, 145–152. doi:10.1016/j.econmod.2013.06.037

Shen, Y., Guo, X., and Zhang, X. (2023). Digital financial inclusion, land transfer, and agricultural green total factor productivity. Sustainability 15, 6436. doi:10.3390/su15086436

Su, Y., Li, Z., and Yang, C. (2021). Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: an empirical study based on spatial simultaneous equations. Int. J. Environ. Res. Public Health 18, 8535. doi:10.3390/ijerph18168535

Sun, X., Yu, T., and Yu, F. (2022). The impact of digital finance on agricultural mechanization: evidence from 1869 counties in China. Chin. Rural. Econ. 2, 76–93.

Wang, X., Wang, X., Ren, X., and Wen, F. (2022a). Can digital financial inclusion affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric approach. Energy Econ. 109, 105966. doi:10.1016/j.eneco.2022.105966

Wang, X., Wang, Y., and Zhao, Y. (2022b). Financial permeation and rural poverty reduction Nexus: further insights from counties in China. China Econ. Rev. 76, 101863. doi:10.1016/j.chieco.2022.101863

Wang Lei, M.J.-M. (2023). Mechanism and effect of digital financial inclusion affecting green development of agriculture. J. South China Agric. Univ. Soc. Sci. Ed. 6.

Wu, F., Hu, H., Lin, H., and Ren, X. (2021). Enterprise digital transformation and capital market performance: empirical evidence from stock liquidity. Manag. World 37, 130–144. doi:10.19744/j.cnki.11-1235/f.2021.0097

Xie, X., Shen, Y., Zhang, H., and Guo, F. (2018). Can digital finance promote entrepreneurship? Evidence from China. China Econ. Q. 17, 1557–1580. doi:10.13821/j.cnki.ceq.2018.03.12

Xu, S., and Wang, J. (2023). The impact of digital financial inclusion on the level of agricultural output. Sustainability 15, 4138. doi:10.3390/su15054138

Xurui, Z. (2022). Path Analysis of agricultural economy information construction under the perspective of urban-rural integration strategy in the “internet plus” era. Mob. Inf. Syst. 2022, 1–8. doi:10.1155/2022/1577211

Yilmaz, S., Haynes, K. E., and Dinc, M. (2002). Geographic and network neighbors: spillover effects of telecommunications infrastructure. J. Regional Sci. 42, 339–360. doi:10.1111/1467-9787.00262

You, W., Zhang, Y., and Lee, C.-C. (2022). The dynamic impact of economic growth and economic complexity on CO2 emissions: an advanced panel data estimation. Econ. Anal. Policy 73, 112–128. doi:10.1016/j.eap.2021.11.004

Yu, L., Zhao, D., Xue, Z., and Gao, Y. (2020). Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 62, 101323. doi:10.1016/j.techsoc.2020.101323

Zhang, R., Wu, K., Cao, Y., and Sun, H. (2023). Digital inclusive finance and consumption-based embodied carbon emissions: a dual perspective of consumption and industry upgrading. J. Environ. Manag. 325, 116632. doi:10.1016/j.jenvman.2022.116632

Zhonglin, W., Lei, Z., Jietai, H., and Hongyun, L. (2004). Mediation effect test procedure and its application. J. Psychol. 5, 614–620.

Zhou, G., and Fan, G. (2018). Internet usage and household entrepreneurship: evidence from CFPS. Econ. Rev. 5, 134–147. doi:10.19361/j.er.2018.05.10

Keywords: digital financial inclusion, agricultural green development, spatial spillovers, sustainable development, green agriculture

Citation: Zhang L, Qi Y and Deng X (2024) Byte-Sized Finance, Bushel-Sized Benefits: unraveling digital financial inclusion impact on China’s agricultural green development. Front. Environ. Sci. 12:1411866. doi: 10.3389/fenvs.2024.1411866

Received: 03 April 2024; Accepted: 30 July 2024;

Published: 08 August 2024.

Edited by:

Wei Zhang, China University of Geosciences Wuhan, ChinaReviewed by:

Cunyi Yang, Sun Yat-sen University, ChinaYang Shen, Huaqiao University, China

Yang Wang, Yunnan Normal University, China

Copyright © 2024 Zhang, Qi and Deng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Deng, ZGVuZ3hpbkBzaWNhdS5lZHUuY24=

Ludan Zhang

Ludan Zhang Yanbin Qi

Yanbin Qi Xin Deng

Xin Deng