- 1School of Energy and Environmental Engineering, University of Science & Technology Beijing, Beijing, China.

- 2Advancing Systems Analysis (ASA) Program International Institute for Applied Systems Analysis, Laxenburg, Austria

- 3Institute of Blue and Green Development, Weihai Institute of Interdisciplinary Research, Shandong University, Weihai, China

- 4Changsha Social Laboratory of Artificial Intelligence, School of Science, Hunan University of Technology and Business, Changsha, China

- 5Nanjing Institute of Environmental Sciences, Ministry of Ecology and Environment of the People’s Republic of China, Nanjing, China

The rapid growth of the Chinese economy has significantly escalated energy consumption and carbon emissions. The imperative to achieve synergies in energy conservation and carbon reduction has never been more pressing. Digital development presents promising avenues for addressing these challenges, making it crucial to investigate its impact on energy intensity (EI) and carbon emission performance (CEP). This study integrates the super efficiency epsilon-based measure (SE-EBM), mediation effect, and threshold effect models to assess the influence of digital development on EI and CEP using data from 267 cities across China from 2011 to 2019. Our findings demonstrate a notable 23.1% reduction in EI and an 18.5% improvement in CEP attributable to digital development. Moreover, our analysis underscores the pivotal role of technological innovation as a transformative conduit. Importantly, we identify significant threshold effects linked to economic development stages. This study not only enriches our understanding of pathways to energy conservation and carbon reduction but also provides compelling evidence supporting policies aimed at fostering and accelerating digital development initiatives.

1 Introduction

The rapid expansion of digitalization has profoundly impacted China’s production and daily life. According to Pan et al. (2022), the development of the digital economy contributes to promoting the transition towards green production and lifestyles. From 2012 to 2022, China achieved an annual energy consumption growth rate of 6.2%, leading to a cumulative 26.4% decrease in energy intensity (EI), equivalent to a reduction of approximately 1.41 billion tons of standard coal and nearly three billion tons of carbon emissions (CAC, 2022). The integration of the digital economy with traditional industries has enhanced resource utilization efficiency, promoting low-carbon production and sustainability (Ghobakhloo, 2020; Ding et al., 2022). Therefore, digital development significantly contributes to achieving green and low-carbon objectives.

Numerous studies have investigated the energy and environmental impacts of the digital economy (Haseeb et al., 2019; Lange et al., 2020; Zhang et al., 2022; Ma et al., 2022; Guo et al., 2023). However, our study identifies two potential gaps compared to existing research: Firstly, previous studies predominantly focus on energy consumption impacts, neglecting EI. For example, these studies examine digital development’s influence on energy consumption (Salahuddin and Alam, 2016; Lange et al., 2020; Ren et al., 2021; Zheng and Wang, 2021), energy transition (Shahbaz et al., 2022), energy security (Lee et al., 2022; Li et al., 2024), and energy sustainability (Wang et al., 2022b). Secondly, existing research predominantly assesses carbon emissions and environmental pollution impacts, neglecting carbon emission performance (CEP). For example, studies explore digital development’s effects on carbon emissions (Paschou et al., 2020; Ahmed and Le, 2021; Xu et al., 2021; Zhang et al., 2022; Dong et al., 2022; Dwivedi et al., 2022), environmental quality (Raza and Tang, 2022; Xu et al., 2022), and air pollution (Wu et al., 2023). Moreover, there is limited research focusing on developing countries, particularly China, which faces significant challenges related to carbon emissions and energy consumption (Jiang and Raza, 2023). Therefore, our study aims to fill these gaps in the existing literature, contributing to carbon neutrality goals and promoting digital development in developing countries.

This study offers several significant contributions to the literature. Firstly, while previous studies separately examine energy and carbon emissions (Husaini and Lean, 2022; Khan et al., 2022), our study provides a comprehensive assessment under a unified framework. Secondly, while many studies traditionally use energy consumption and carbon emissions as indicators (Salahuddin et al., 2016; Lange et al., 2020), we introduce metrics for EI and CEP, essential for understanding energy efficiency and emission reduction efforts. Thirdly, whereas existing research often relies on simple linear models (He et al., 2021; Zhang and Liu, 2022), we employ advanced linear models alongside mediation and threshold effect models. These models enable a comprehensive evaluation of the indirect and threshold effects of digital development on EI and CEP. By integrating theoretical insights with empirical analysis, our study provides a nuanced understanding of how digital development influences energy conservation and emission reduction strategies.

This study integrated the super efficiency epsilon-based measure (SE-EBM), mediation effect, and threshold effect models to assess the impact of digital development on EI and CEP using data from 267 cities in China from 2011 to 2019. CEP was calculated using the SE-EBM model, evaluating the linear, nonlinear, and threshold effects of digital development on EI and CEP using fixed effects, mediation effects, and threshold effects models. Furthermore, four robustness analysis methods were employed to test the stability of empirical results.

The logical structure of this study is as follows: Section 2 reviews the literature, Section 3 describes the methodology and data sources, Section 4 presents empirical results, and Section 5 provides conclusions and policy implications.

2 Literature review

2.1 Impact of digital development on energy consumption

Many existing studies have examined the impact of digital development on energy consumption reduction (Schulte et al., 2016; Cao et al., 2021). Cao et al. (2021) used digital finance as an indicator and found significant energy consumption reductions associated with digital development. Scholars have also highlighted digital development’s role in enhancing energy sustainability (Wang et al., 2022b; Husaini and Lean, 2022) and promoting the adoption of new energy sources (Li et al., 2021; Hong Nham et al., 2023) or clean energy (Wang et al., 2023). Shahbaz et al. (2022) reported a notable increase in renewable energy usage by 0.021% due to digital development, contributing to green and sustainable development (Chen, 2022).

However, some researchers argue that the growth of the internet has led to increased energy consumption (Ren et al., 2021). Despite this, most studies emphasize the positive impact of digital development on reducing energy consumption and improving sustainability. EI serves as a crucial metric for assessing green and high-quality development, although digital development may adversely affect EI. Unfortunately, research specifically investigating the role of digital development in EI remains limited.

2.2 Impact of digital development on carbon emissions

Numerous studies have demonstrated the positive effect of digital development on reducing carbon emissions (Wang et al., 2022a; Li and Wang, 2022). Wang et al. (2022a) reported that a 1% increase in digital development correlates with a 0.886% decrease in carbon emissions. Digital development has been shown to facilitate significant reductions in carbon emissions through optimized energy mixes aimed at achieving carbon neutrality (Guo et al., 2022). Additionally, studies indicate that digital development plays a critical role in promoting low-carbon sustainable development, particularly in economically advanced eastern regions (Zhang et al., 2022; Lee and Wang, 2022). Some scholars have underscored the role of digital finance in advancing environmental sustainability (Ozturk and Ullah, 2022).

Conversely, others argue that digital development exacerbates carbon emissions, particularly in China (Zhou et al., 2019; Zhang et al., 2022; Li et al., 2018). Zhou et al. (2022) suggested that digital development has contributed to a 6% increase in China’s total carbon emissions. Despite these findings, most scholars maintain that digital development ultimately benefits carbon emissions reduction. Existing research has predominantly focused on assessing CEP and its impacts on carbon emissions, overlooking research from the perspective of CEP. CEP is crucial for understanding the relationship between carbon emissions and economic growth, thereby serving as a pivotal indicator for green development. Based on existing research, we propose that digital development presents new opportunities for enhancing CEP, although research specifically evaluating this remains scarce.

2.3 Energy-saving and emission reduction effects of digital development

Achieving synergies in energy conservation and carbon reduction is crucial for sustainable development, aligning with China’s goals of peak carbon emissions by 2030 and carbon neutrality by 2060 (SCPRC, 2021; Chen et al., 2018). The Chinese government emphasizes coordinated efforts in energy conservation and carbon reduction through initiatives like the “Notice on the Action Plan for Peak Carbon Emissions by 2030”. These efforts aim to increase the share of non-fossil energy consumption to approximately 20% by 2025, reduce energy consumption per unit of GDP by 13.5% from 2020 levels, and lower carbon dioxide emissions per unit of GDP by 18% from 2020 levels.

Existing literature, as reviewed in Section 2.1, Section 2.2, predominantly focuses on separate analyses of energy consumption and carbon emissions, overlooking synergistic effects within a unified framework. Moreover, existing studies often neglect EI and CEP, which are closely tied to economic growth.

To address these gaps, our study evaluates the synergistic effects of digital development on EI and CEP under a unified framework. Based on the literature review, we hypothesize that digital development synergistically reduces EI and enhances CEP. Our hypotheses are as follows.

Hypothesis 1. Digital development has a significant synergistic effect on reducing EI and enhancing CEP.

2.4 Mechanism analysis

While existing research confirms the positive role of digital development in reducing energy consumption and carbon emissions (Chen et al., 2016; Wurlod and Noailly, 2018; Ajayi and Reiner, 2020; Chakraborty and Mazzanti, 2020), it often lacks theoretical explanations for underlying mechanisms. Digital development facilitates technological innovation and drives investments in technology (Vavilina et al., 2020; Zhou et al., 2020). For instance, Zhou et al. (2020) found that digital development promotes technological innovation, demonstrating robust empirical results using patent counts as indicators.

Technological innovation and scientific inputs are critical pathways through which digital development influences EI and CEP. Scholars have shown that digital development drives technological innovation (Apostolov and Coco, 2021; Li et al., 2017; Radicic and Petkovic, 2023) and that technological innovation positively impacts EI and CEP (Ma et al., 2021; Wahab, 2021; Wang and Liu, 2022). Thus, technological innovation serves as an intermediary variable in the relationship between digital development, EI, and CEP.

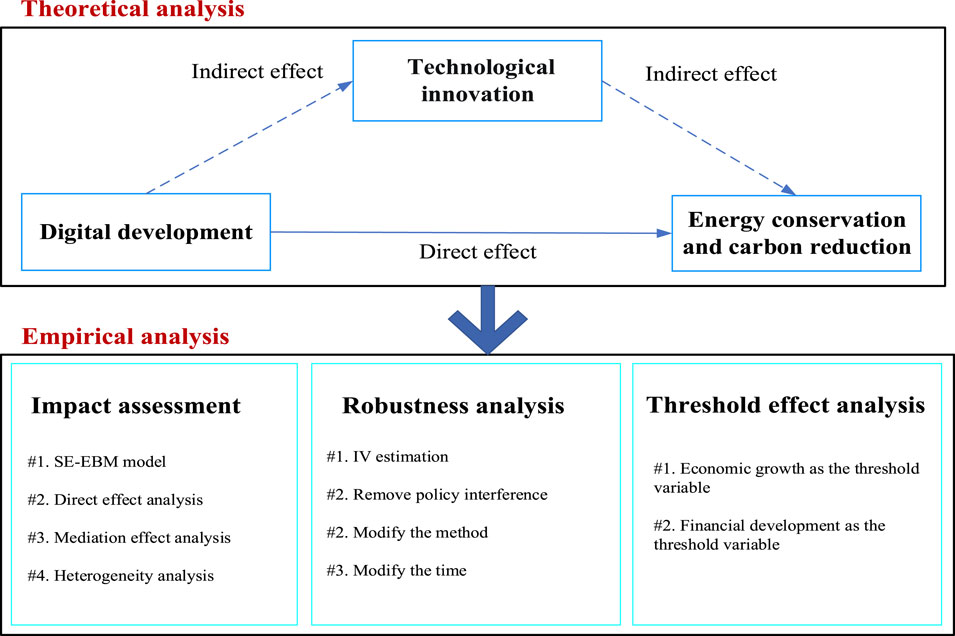

China’s economic growth has been accompanied by regional disparities in energy and environmental outcomes (Zhang et al., 2022; Shahbaz et al., 2022). Financial development plays a crucial role in achieving carbon neutrality and promoting new energy development. Regional disparities, economic growth, and financial development heterogeneity may influence the impact of digital development on EI and CEP. Figure 1 illustrates our research framework.

Hypothesis 2. Digital development reduces EI and improves CEP through technological innovation.

Hypothesis 3. The impact of digital development on EI and CEP varies across different regions in China.

Hypothesis 4. The relationship between digital development and EI and CEP exhibits threshold effects related to economic growth and financial development.

3 Method and data

3.1 Method

The methodological approach in this study was carefully chosen to ensure robust analysis. We selected the fixed effects model to assess how digital development impacts EI and CEP, focusing on linear effect analysis while controlling for potential individual effects. Subsequently, we employed the panel threshold model to explore nonlinear effects, investigating the thresholds of digital development on EI and CEP. Additionally, we used the mediation effect model to examine the mechanisms through which digital development influences EI and CEP, facilitating path analysis. Hence, our methodology not only adheres to the logical framework of the study but also ensures the applicability and comprehensiveness of the methods.

3.1.1 Baseline model

In our baseline model, digital development serves as the independent variable, while EI and CEP are the dependent variables. This model aims to elucidate how digital development enhances EI and CEP. Referring to the model of Chen et al. (2018), we set the following model:

where yit represents the values of EI and CEP for city i at time t, DD denotes the digital development variable, and

3.1.2 Panel threshold model

The impact of digital development on EI and CEP is influenced by various factors, leading to a nonlinear relationship between them. To explore this, we propose employing a threshold model to investigate how digital development affects EI and CEP under different conditions. Given significant regional disparities in economic growth and financial development (Zhang et al., 2022; Shahbaz et al., 2022), these variables are considered potential thresholds that may reveal distinct effects on EI and CEP.

By incorporating these threshold variables, we aim to capture the nonlinear dynamics of the relationship and precisely identify the thresholds at which digital economic development impacts EI and CEP (Zhou and Li, 2022). Referring to the model of Zhou and Li (2022), We include the identified threshold variables to elucidate the nonlinear effects of digital development on EI and CEP:

where c and h stand for the threshold variable and value, respectively. The study considered economic growth and financial development as threshold variables, with an indicative function (I) applied. A value of one was assigned when correct; otherwise, a value of 0 was assigned. The remaining parameters are identical to Model (1).

3.1.3 Mediation effect model

In this section, we design the channels through which technological investment and innovation impact innovation by constructing a mechanistic analytical model to ensure the accuracy and comprehensiveness of the model (Lee et al., 2022). Referring to the model of Lee et al. (2022), we set the following model:

where m denotes the intermediate variable encompassing two forms: scientific input (SI) and technological innovation (TI). The coefficient

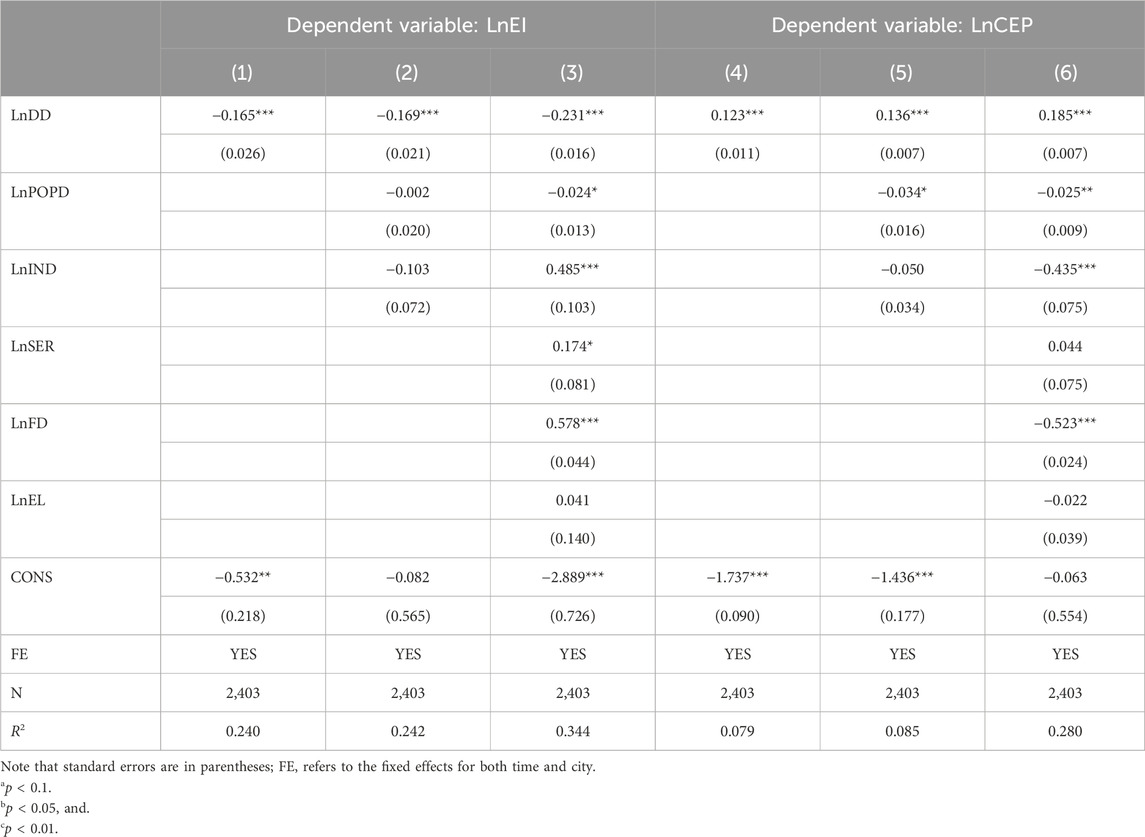

3.2 Variables

3.2.1 Dependent variable

(i) EI. The EI variable serves as a crucial strategy for achieving carbon neutrality and fostering sustainable economic development. Numerous scholars have investigated the influence of EI on carbon emissions (Shahbaz et al., 2015; Huang et al., 2020). A commonly employed indicator for energy conservation was the EI, which assesses the proportion of energy consumption to GDP. As a pivotal metric for shaping energy policies, EI plays a significant role in advancing green development (Bashir et al., 2021). In this study, we applied the proportional method to compute the share of energy to GDP, which serves as an indicator of EI based on existing research (Zhou et al., 2022).

(ii) CEP. The CEP is a crucial metric for evaluating the efficacy of green development. In this study, the SE-EBM model, as referenced in prior works (Tone and Tsutsui, 2010; Akbari et al., 2020; Jalo et al., 2021; Zhou and Li, 2024), was employed to compute the CEP index. The detailed calculation process of the SE-EBM model is provided in Appendix A.

The model’s input indicators encompassed labor, capital, and energy consumption, while its output indicators encompassed economic development and environmental pollution. Labour was quantified using the urban working population, and capital was measured by summing current and fixed capital at year-end. Energy consumption included liquefied petroleum gas, natural gas, electricity, and heating and was converted to standard coal values based on prior research (Ru et al., 2015) (unit: 10,000 tons of standard coal). The GDP measures economic output (unit: 100 million yuan), while sulfur dioxide emissions assess environmental outcomes (unit: 10,000 tons) (Bi et al., 2014; Shan et al., 2020; Zhou and Li, 2020; Zhou et al., 2023).

3.2.2 Independent variables

The independent variable in this study was digital development, constituting a comprehensive index derived from various elements. According to previous studies (Bukht and Heeks, 2017; Li and Wang, 2022; Yi et al., 2022; Zhu and Chen, 2022; Wu et al., 2023), digital development encompasses five key dimensions: (1) telecom business revenue (measured in ten thousand yuan), (2) computer employment (measured by the number of people employed), (3) internet broadband households (measured in ten thousand households), (4) mobile phone users (measured in 10,000 persons), and (5) the inclusive finance index (measured without units).

To simplify and consolidate these dimensions into a single index, the principal component analysis (PCA) method was employed—a widely adopted approach for constructing composite indicators (Interlenghi et al., 2017; Pan et al., 2022). Consequently, the study employed the PCA method to construct the digital development index.

3.2.3 Control variables

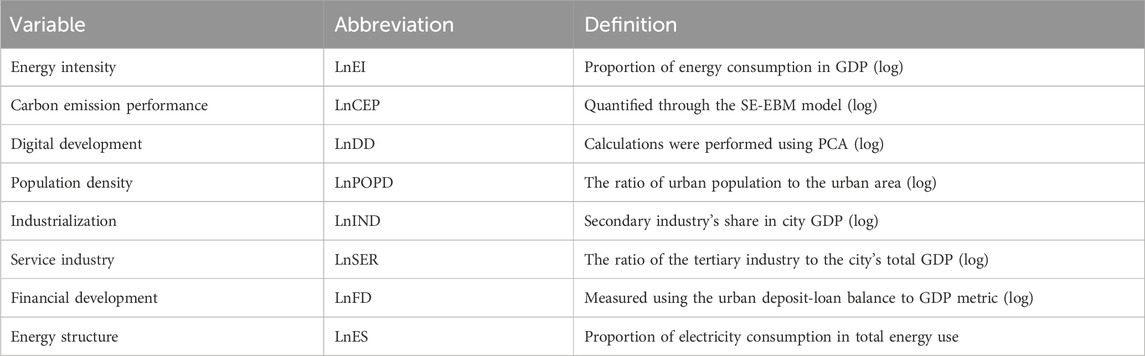

To mitigate the potential interference of extraneous factors on EI and CEP, we controlled for five relevant variables in this study: (1) population density, which was measured as the ratio of total urban registered population to urban area at year-end (Danish et al., 2020); (2) industrialization, which was measured by the proportion of the GDP of the secondary industry to the total GDP in each year (Li et al., 2022); (3) service industry development, which was calculated as the proportion of tertiary industry added value in GDP (Li et al., 2022); (4) financial development, which was measured as the ratio of urban deposit and loan balance to the urban total GDP (Qu et al., 2020); and (5) energy structure, which was measured as the ratio of electricity consumption to the total energy consumption (Zhou and Li, 2022). We present the definitions and sources of the variables used in Table 1.

3.3 Data sources

This study employed panel data encompassing 267 Chinese cities from 2011 to 2019. The data sources included the China Urban Statistical Yearbook (CUS, 2021), National Bureau of Statistics (NBS, 2021), China Energy Administration (CEA, 2021), and China Environmental Statistical Yearbook (CES, 2021). The control and dependent variables originated from CUS and NBS, while the independent variable was derived from CUS. The environmental pollution data were sourced from the CES. Table 2 summarizes the statistical analysis of the key variables. The dataset encompassed 267 cities over 9 years, totaling 2,403 observations.

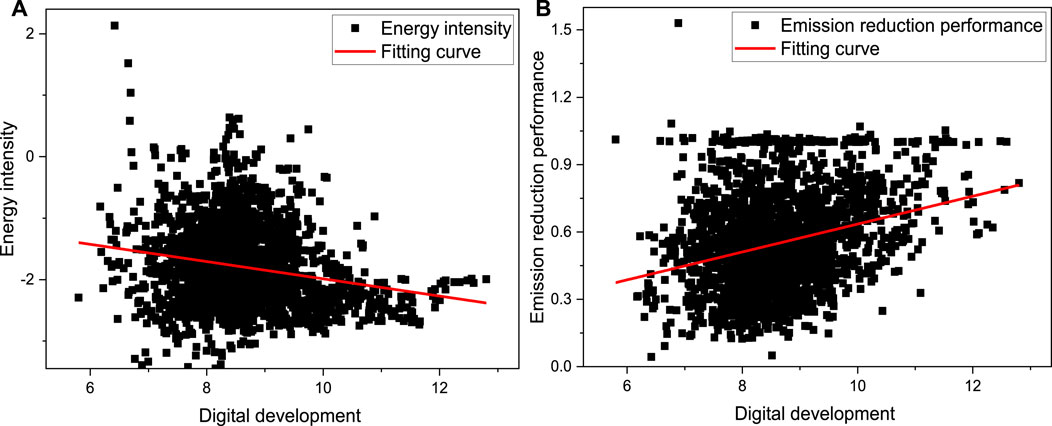

Figure 2 depicts the scatter correlation between digital development, EI, and CEP. The results show a negative correlation between digital development and EI and a positive correlation with CEP. This implies that digital development has the potential to reduce EI and improve CEP. To enhance the empirical analysis results, these variables underwent a logarithmic transformation.

Figure 2. Scatter correlation between digital development, energy intensity, and carbon emission performance.

4 Results and discussion

4.1 Impact assessment analysis

4.1.1 Direct effect analysis

To address potential serial correlation and heteroscedasticity, we utilized a robust standard error estimation equation clustered by city and a benchmark regression model.

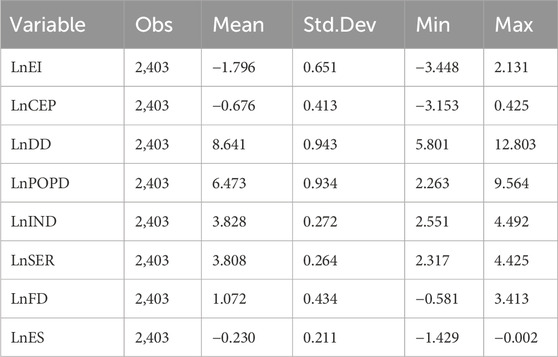

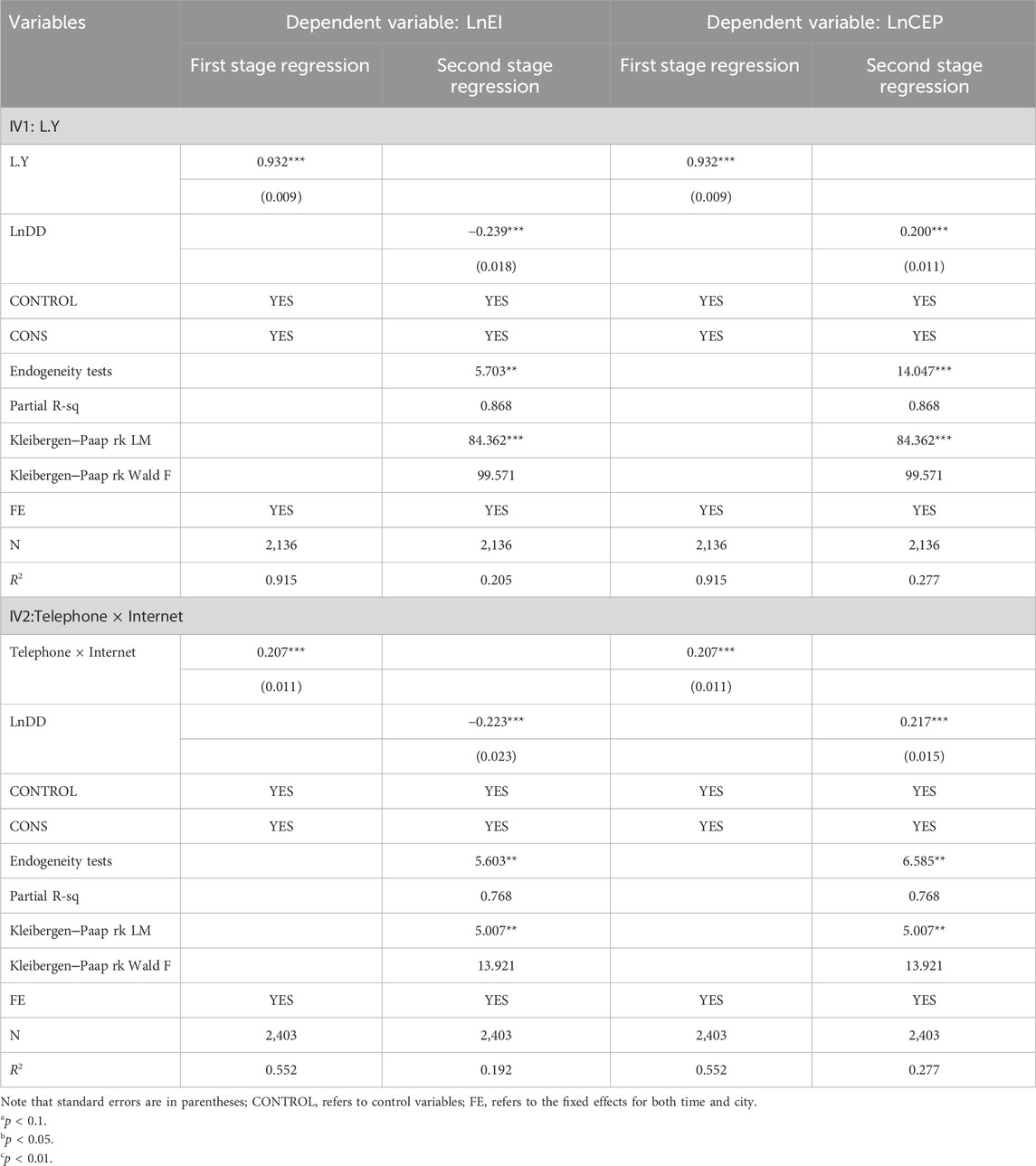

Table 3 summarizes the results of the direct effect analysis. Columns (1) to (3) show the impact of digital development on EI, while columns (4) to (6) detail its influence on CEP. The LnDD regression coefficients in columns (1) to (3) were all negative, statistically significant at the 1% level, and amounted to −0.165, −0.169, and −0.231, respectively. This indicated a significant reduction in EI of 0.231 units due to digital development, aligning with previous studies (Husaini and Lean, 2022; Shahbaz et al., 2022), which found a 2.1% increase in renewable energy attributed to digital advancements.

Columns (4) to (6) reveal positive LnDD regression coefficients of 0.123, 0.136, and 0.185, respectively, which are statistically significant at the 1% level. This suggested that digital development could enhance CEP.

The control variables also yielded significant results. The positive and statistically significant coefficients of LnIND and LnFD suggested that industrialization and finance fostered EI. However, our findings did not support the role of population density in CEP improvement, contrary to the conclusions of other scholars (Morikawa, 2012). Additionally, population density, industrialization, and financial development negatively impacted CEP, consistent with existing research (Morikawa, 2012). Therefore, Hypothesis 1 was confirmed.

4.1.2 Mediation effect analysis

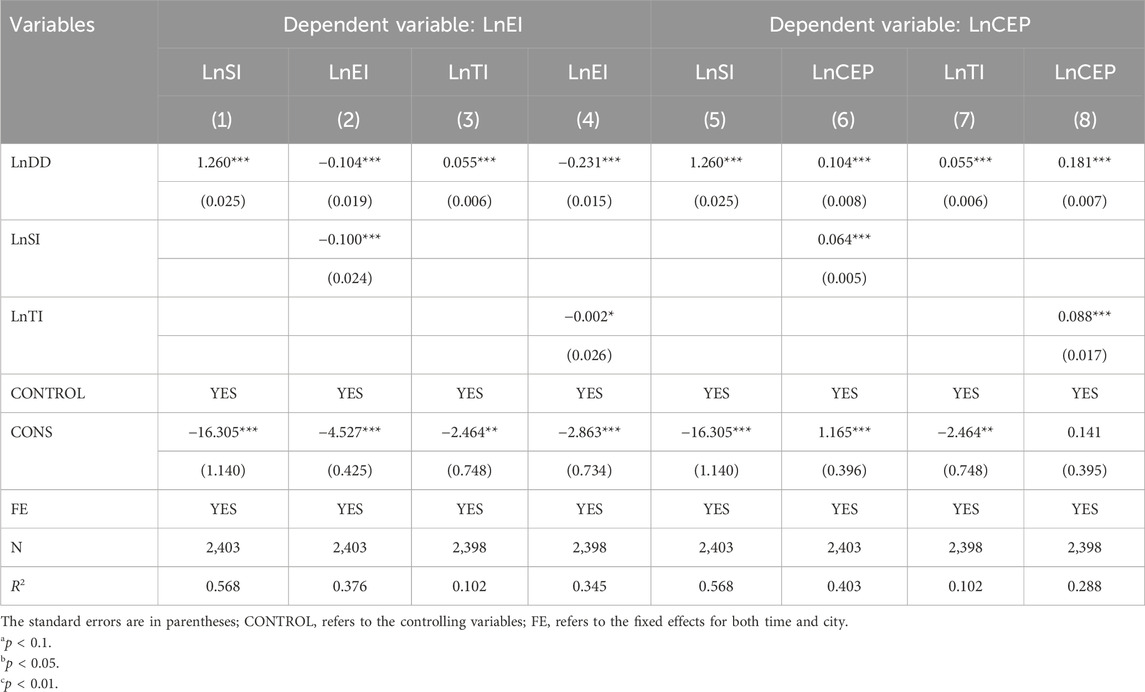

In this section, we employed an intermediary effect model, incorporating scientific input and technological innovation as mediating variables. Our study yielded substantial and noteworthy results, which are briefly summarized in Table 4.

When the dependent variable is EI, we find a statistically significant positive correlation between EI and technological input, with a coefficient value of 1.260, indicating that digital development significantly enhances SI. The second column shows regression coefficients of −0.104 and −0.100 for digital development and technological input, respectively, both of which are significant, indicating that digital development and SI significantly reduce EI, with SI exerting a significant mediating effect. In columns three and four, TI is also positively influenced by digital development, with scholars revealing the mediating effect of TI on EI (Voigt et al., 2014; Wurlod and Noailly, 2018).

When the dependent variable is CEP, our findings regarding the impact of digital development align with the results for EI. Specifically, columns (5) through (8) reveal a significant positive impact on CEP, with SI and TI also showing significant positive effects, confirming the mediating role of CEP (He et al., 2021; Zhang and Liu, 2022). These findings suggest that digital development, through increased scientific input and technological innovation, can significantly reduce EI and enhance CEP. Thus, this conclusion validates Hypothesis 2 that digital development influences EI and CEP through SI and TI.

4.1.3 Heterogeneity analysis

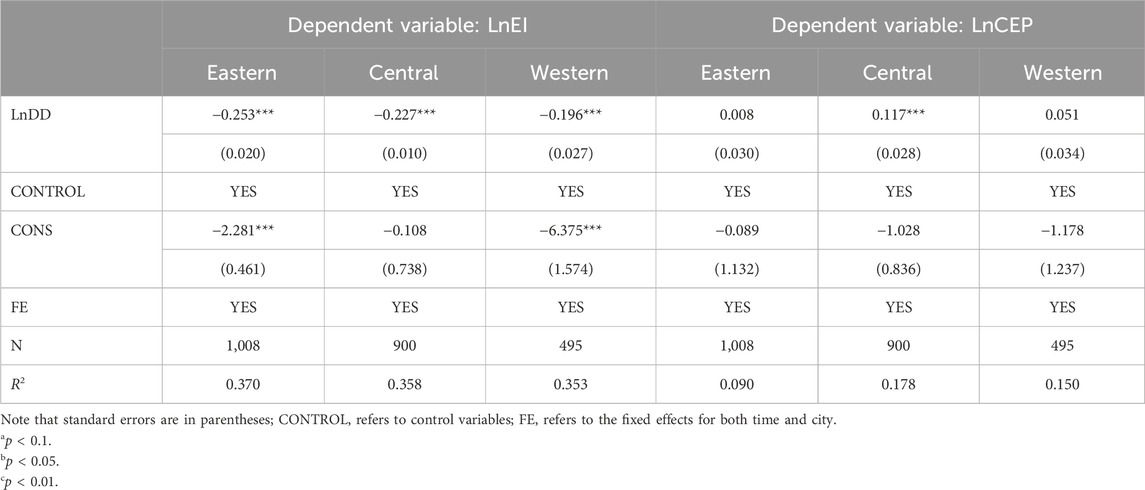

Table 5 shows that the regression coefficients of LnDD across regions were all significantly negatively correlated with EI at the 1% level, with coefficient values of −0.253, −0.227, and −0.196, respectively. This implies that digital development significantly reduces EI in all regions, with the strongest impact observed in the eastern region and the weakest in the western region. When the dependent variable was CEP, the coefficient of LnDD was significantly positively correlated only with the central region, with a coefficient value of 0.117, while the eastern and western regions showed positive effects but were not significant. This indicated that digital development significantly increased CEP only in the central region. This result was consistent with previous research (Guang et al., 2019). These findings suggest significant heterogeneity effects of digital development on EI and CEP. The reason for the above phenomenon may lie in the differences in efficiency improvement between regional development and pollution emissions. Variations in resource endowment and technological levels across different cities contribute to the heterogeneity of digital development. Despite the advanced technology and economic strength in the eastern region, it still faces significant challenges in terms of energy conservation and emission reduction. With its lower technological level, the western region exerts less influence on CEP than does the central region. These findings support Hypothesis 3.

The establishment of China’s two control zones (TCZ), including acid rain control zones and sulfur dioxide pollution control zones, primarily aims to manage and regulate environmental protection (Zhou et al., 2023). Consequently, these policies create significant heterogeneity in urban energy conservation and emissions reduction efforts. Analyzing the heterogeneous effects of TCZ policies on energy conservation and emissions reduction across different cities is essential for understanding their outcomes in diverse environmental contexts. Therefore, it is imperative for this study to conduct an analysis of TCZ heterogeneity.

Table 6 summarizes the urban heterogeneity results. When EI serves as the dependent variable, cities within TCZ exhibit regression coefficients of DD with absolute values (0.300) greater than those in Non-TCZ areas (0.088), indicating substantial energy-saving benefits of DD within TCZ. Similarly, when CEP is the dependent variable, cities within TCZ (0.210) show regression coefficients of DD greater than those in Non-TCZ areas (0.110), highlighting significant emission reduction benefits of DD within TCZ. These findings underscore the significant heterogeneous effects of digital economic development between TCZ and Non-TCZ areas.

4.2 Robustness analysis

This study employed four methods for robustness analysis. (1) The instrumental variable (IV) method was used to address endogeneity issues. This method introduced exogenous IVs that were correlated with the independent variable but unrelated to the error term, thereby improving the accuracy and reliability of the regression results. (2) The method of excluding other policy interferences aimed to eliminate the interference of other policies, enabling a more accurate assessment of the impact of the factors under consideration on the results and ensuring the reliability and robustness of the research conclusions. (3) The substitution method was utilized to mitigate endpoint issues, enhancing the model’s goodness of fit and explanatory power. (4) The method of altering the research period was employed to control for time-related concerns, ensuring the accuracy and robustness of causal relationships.

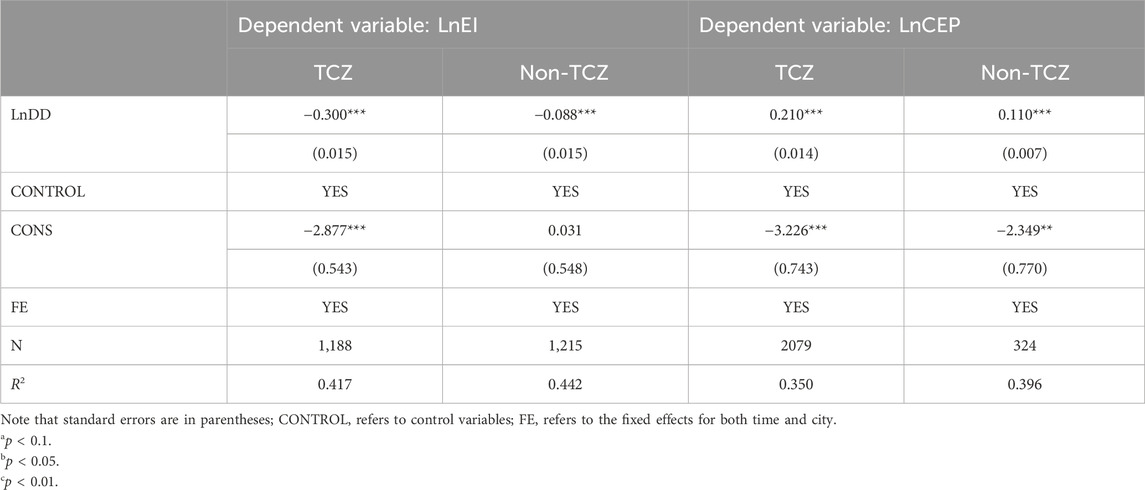

4.2.1 Instrumental variable approach

To address potential endogeneity issues in examining the reduction in EI and improvement in CEP, this study adopted the widely used IV method in energy and environmental economics (Barrera-Santana et al., 2022; Xue et al., 2022). The lagged terms of EI and CEP were chosen as IV1 due to their correlation with the independent variable. Furthermore, city telecommunications data from 1984 served as IV2 (Nunn and Qian, 2014), reflecting the influence of telecommunication infrastructure on internet technologies, including technology advancement and usage patterns. A time-varying variable was utilized, and a panel instrument variable was formulated using the interaction of internet and telephone counts, designated “Telephone◊Internet.” Additionally, we acknowledged the waning influence of traditional telecommunication tools, such as landline telephones, on economic growth as their usage decreased.

The regression coefficients of IV1 and IV2 were positive and substantial in both models, verifying the appropriateness of IV selection, as shown in Table 7. This study addressed endogeneity concerns, and the second-stage regression analysis revealed that the regression coefficient of LnDD was significant at the 1% level. These findings aligned with the direct effects analysis and exceeded the baseline regression results, supporting the view that endogeneity underestimated the impact.

Endogeneity tests confirmed the endogeneity of digital development. The LM statistic significantly rejected the null hypothesis of insufficient IV identification. Moreover, the Wald F-statistic exceeded the threshold of the Stock-Yogo weak identification test, indicating the adequacy of the IV choice.

When CEP was the dependent variable, the regression coefficient of LnDD was significant at the 1% level, suggesting that digital development improved CEP. After addressing the endogeneity problem, the coefficient of LnDD increased, indicating that endogeneity caused the lower baseline results.

4.2.2 Remove policy interference

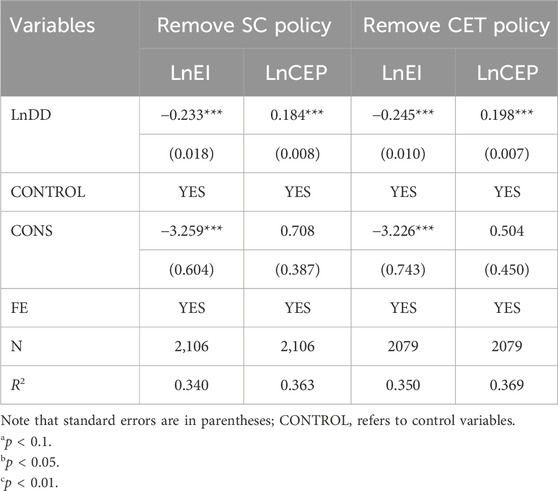

During the study period, the Chinese government implemented several policies to promote energy consumption and reduce emissions. However, as these policies could impact EI and CEP, we excluded two policies, namely, the smart city pilot policy (SC) (Mathiesen et al., 2015) and the carbon emissions trading policy (CET) (Chen et al., 2020), to obtain more accurate estimates.

Table 8 presents the estimated results, excluding the impact of these policies. Even after excluding the SC policy, we found that the regression coefficients of LnDD remained significantly above the 1% level, at −0.233 and 0.184, respectively. This suggested that the results of our study were robust even after excluding the SC policy. Furthermore, after excluding the CET policy, the regression coefficients of LnDD were −0.245 and 0.198, which were significant at the 1% level. This indicated that the results remained similar to the benchmark results even after excluding the CET policy. However, the impact of digital development was found to be more significant after excluding the CET policy, suggesting that CET policies did have an effect on the role of digital development in EI and CEP.

4.2.3 Method modification

In this section, we investigated alternative estimation methods to analyse the conclusions. While the ordinary least squares method excelled under classical assumptions, the generalized method of moments (GMM) remained valid even without exact distribution information of random perturbations (Hashmi and Alam, 2019; Zakari et al., 2022). It was also robust to heteroskedasticity and autocorrelation, violating classical assumptions. Many scholars have applied GMM in environmental science and economics (Omri and Afi, 2020; Ozturk and Ullah, 2022). Therefore, we employed this method to assess the robustness of the impact of digital development on EI and CEP.

Table 9 summarizes the GMM regression results. Our model tests confirmed the validity of all the assumptions, with significant AR (1) and insignificant AR (2), aligning with the nature of GMM. Additionally, the Sargan and Hansen tests met the necessary conditions. The regression coefficients of LnDD were −0.068 and 0.097, both of which are significant at the 1% level. This indicated that digital development significantly reduced EI and enhanced CEP, which is consistent with the results obtained from the direct effect analysis. We were confident in the reliability of our conclusions.

4.2.4 Modifying the time

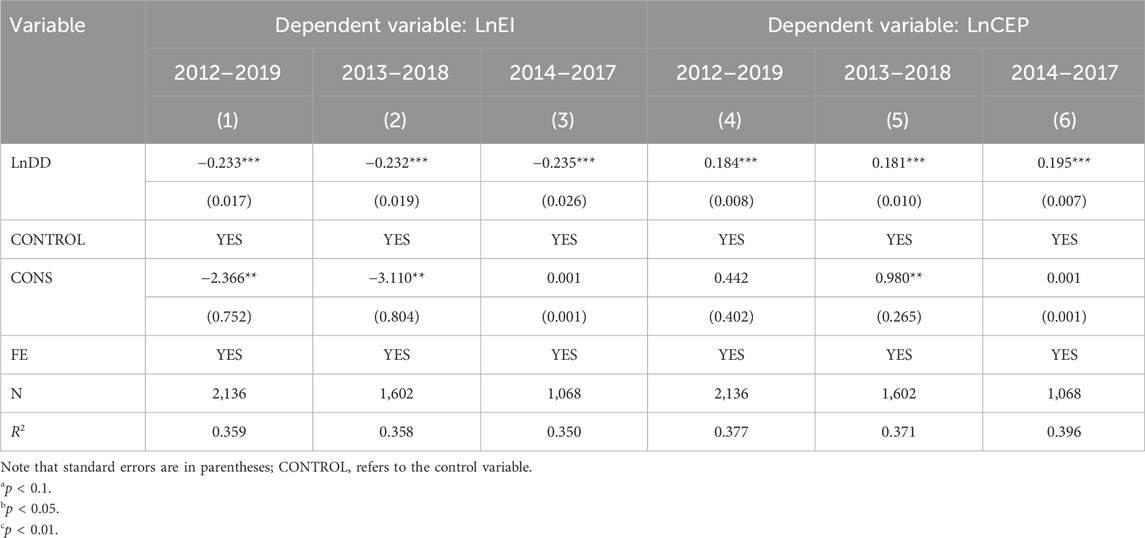

To address potential biased estimation results arising from different study periods (Vieira et al., 2018), we proposed setting distinct study spans. Specifically, we assessed the periods of 2012–2019, 2013–2018, and 2014–2017 to mitigate temporal interference. Table 10 illustrates that the influence of digital development on EI remained consistent across various study periods, as evidenced by the consistently negative and significant coefficients of LnDD in columns (1)–(3).

In terms of CEP, the regression coefficients of LnDD were consistently positive and significant at the 1% level in columns (4)–(6), indicating a consistent impact across different study periods. However, it was observed that these coefficients increased with the duration of the study period, suggesting that the sample period did indeed influence the effect of digital development.

4.3 Threshold effect analysis

4.3.1 Economic growth as the threshold variable

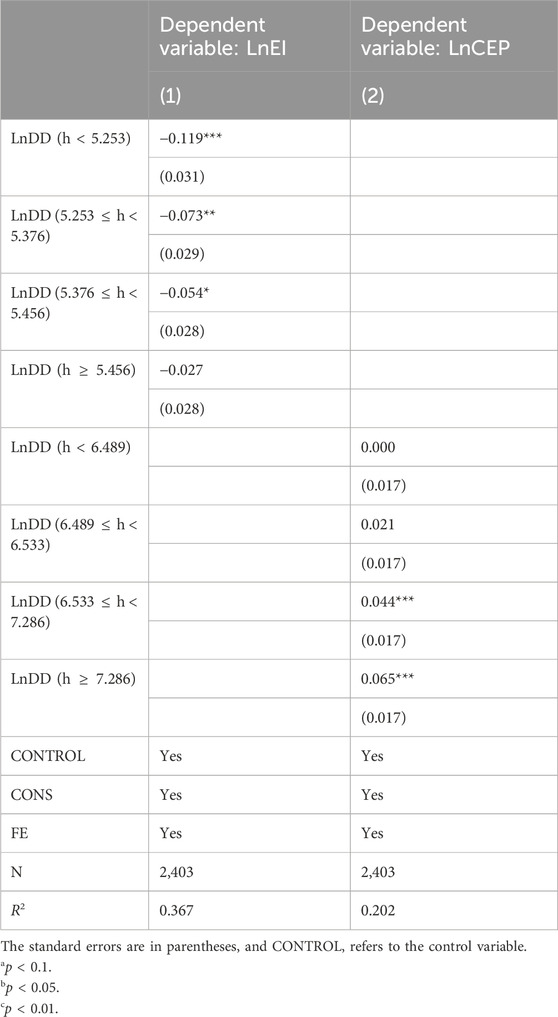

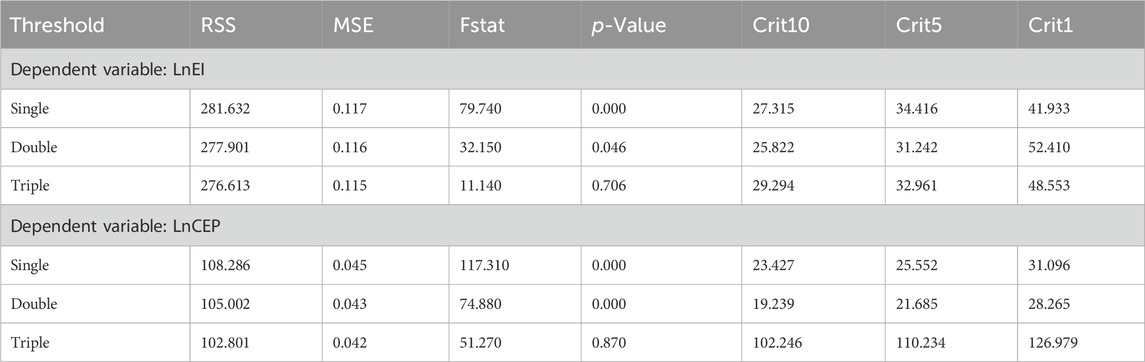

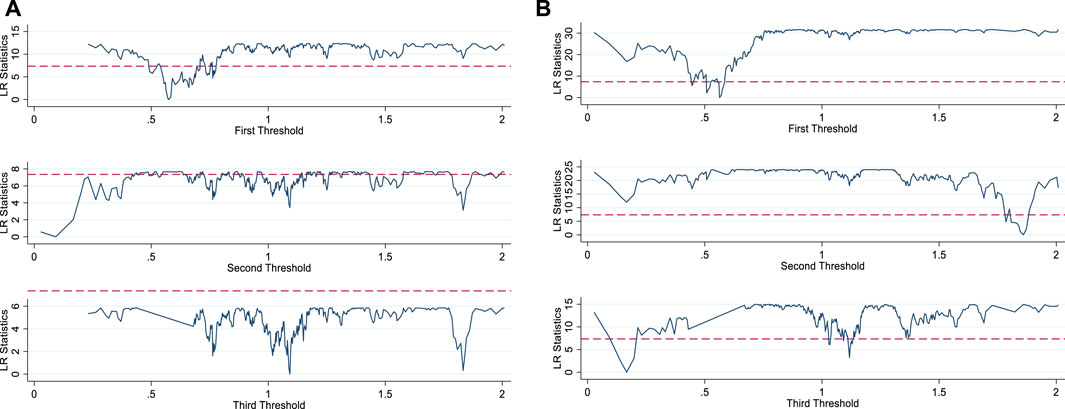

This study employed a panel threshold model to explore the nonlinear impact of different levels of regional economic growth on EI and CEP (Ibrahim &Vo, 2021; Zhou and Li, 2022). As depicted in Table B1, economic growth had a significant impact on EI at the single and double thresholds but not at the triple threshold, indicating a double threshold effect. Similarly, economic growth was deemed insignificant at three thresholds when CEP served as the dependent variable, suggesting a triple threshold effect for the threshold variable.

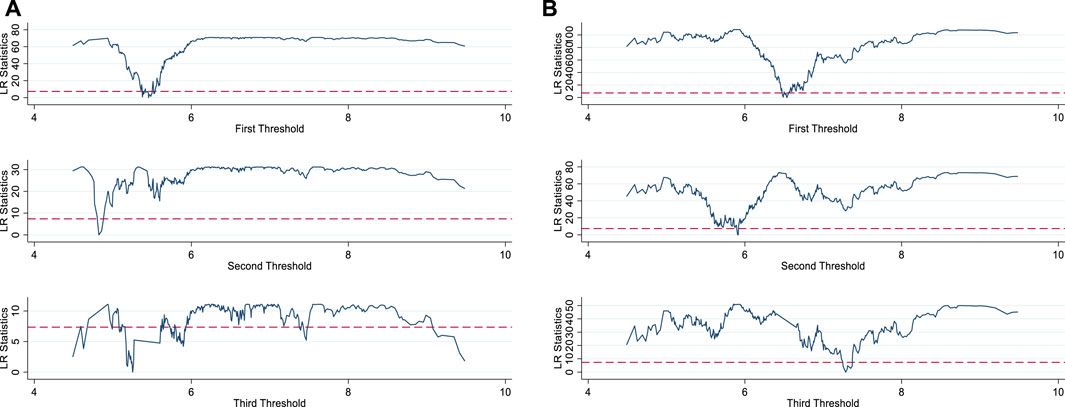

Table 11 indicates that the impact of digital development on EI and CEP varies across different thresholds of economic growth. When EI is the dependent variable, as the economic growth threshold increases, the regression coefficient of LnDD shows a linear decreasing trend, ranging from −0.119 to −0.027. Additionally, the significance of the coefficients decreases, suggesting that as economic growth accelerates, the effect of digital development on EI gradually weakens, confirming Hypothesis 4. However, when CEP is the dependent variable, the regression coefficient of LnDD exhibits a linear increasing trend, rising with the increase in the threshold but becoming significant only after surpassing the second threshold. This finding implies that the stronger economic growth is, the stronger the effect of digitalization on CEP. As depicted in Figure 3, these findings underscore the importance of incorporating digital development in the pursuit of sustainable development.

Figure 3. Threshold parameter of threshold variables. Note: (A) and (B) refer to the dependent variables energy intensity and carbon emission performance, respectively; the solid blue line refers to the LR; and the red dotted line indicates the 95% confidence interval.

In summary, the threshold values derived from the threshold testing in this study possess not only statistical significance but also profound economic implications. They reveal distinct influence pathways and intensities of digital transformation on EI and CEP across various stages of economic growth. These discoveries not only deepen our understanding of the relationship between digital transformation and sustainable development but also offer valuable guidance for policymakers, emphasizing the need to consider the current stage of economic growth and the specific effects of digital transformation when formulating and implementing relevant policies.

4.3.2 Financial development as a threshold variable

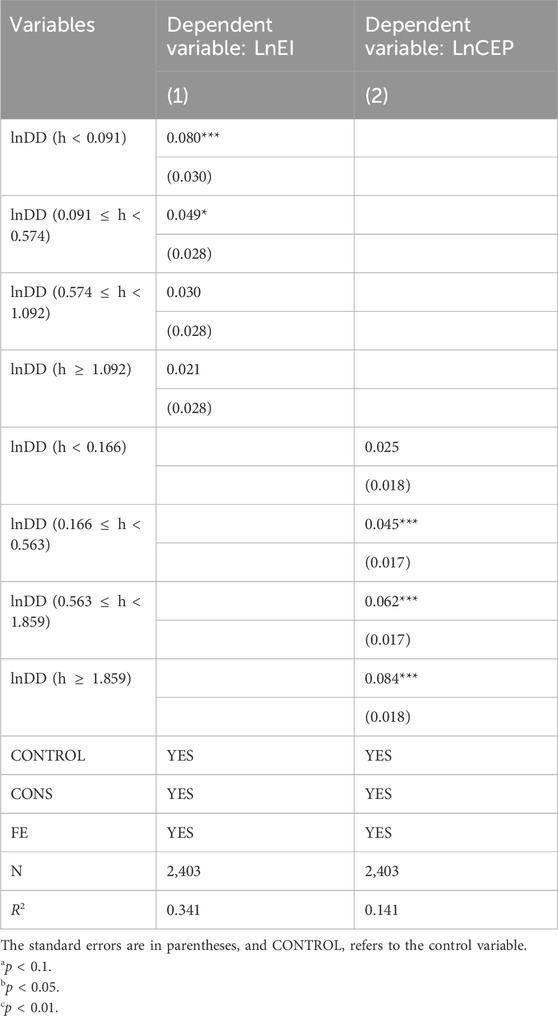

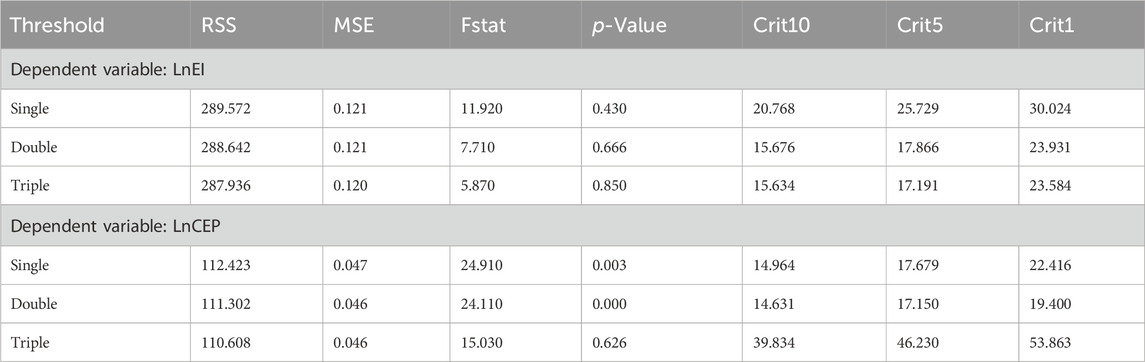

Regional financial levels may influence energy use and emission reduction (Habiba et al., 2022; Razzaq et al., 2022), with a focus on the threshold effect of financial development. According to Table B2, financial development was not a significant factor at the single, double, or triple thresholds when EI was the dependent variable. However, when CEP was the dependent variable, financial development was substantial at the single and double thresholds but not at the triple threshold, suggesting a triple threshold effect.

Table 12 reveals that as the threshold of financial development increases, the regression coefficient of LnDD gradually decreases, indicating that with better financial development, the effect of digitalization on EI gradually diminishes. The most significant impact is observed when financial development is below the first threshold. For CEP, the influence of digital development increases with increasing financial development, becoming significant after surpassing the first threshold, indicating the presence of a threshold effect of financial development on CEP. We provide a visual representation of these changes in Figure 4. These findings illustrate the significant threshold effects of financial development on the impact of digitalization on EI and CEP.

Figure 4. Threshold parameter of threshold variables. Note: (A) and (B) refer to the dependent variables energy intensity and carbon emission performance, respectively; the solid blue line refers to the LR; and the red dotted line indicates the 95% confidence interval).

Employing financial development as a threshold variable in examining the impact of digital economy on EI and CEP carries significant economic implications and values. It serves to uncover the intrinsic link between the digital economy and financial development, thereby facilitating the green transformation and high-quality development of the economy. This approach sheds light on the diverse pathways and effects of digital economy development on EI and CEP across varying levels of financial development. Regions with advanced financial systems tend to allocate capital more efficiently towards innovative, digital, and low-carbon projects, thereby accelerating the optimization of energy structures and reducing carbon emissions. Additionally, it fosters the green transition of energy structures, diminishes CEP, and mitigates financial and market risks incurred during enterprises' digital transformation journey. Ultimately, this ensures the sustained positive influence of the digital economy on both EI and CEP.

5 Conclusions and implications

5.1 Conclusions

Enhancing energy efficiency and reducing carbon emissions are crucial for achieving China’s carbon neutrality goals and sustainable development objectives. This study focuses on Chinese cities and empirically evaluates the synergistic effects of digital development on EI and CEP. The research yielded several significant findings, summarized below:

The findings indicate a substantial 23.1% reduction in EI and an 18.5% increase in CEP attributed to digital development. To strengthen the robustness of our conclusions, we conducted four additional tests, all of which consistently reaffirmed our findings. Furthermore, our study identifies that digital development influences EI and CEP by fostering technological innovation. Notably, we observed a threshold effect on EI and CEP concerning economic and financial development.

5.2 Implications

Drawing from our findings, we propose the following policy recommendations.

(1) Enhance Digital Industry Policies: Strengthen policies related to the digital industry to maximize the positive impact of digital development on energy conservation and carbon reduction in China. Encourage businesses to invest in digital technologies, particularly in sectors such as smart manufacturing, IoT, and big data analytics. Promote the adoption of digital energy efficiency monitoring systems for real-time energy usage analysis.

(2) Promote Investment in Digital Technology Innovation: Foster investment in digital technology innovation, especially within the energy sector. Establish dedicated funds to support innovative applications of digital technology, AI, and big data in energy management. Facilitate collaboration between businesses and research institutions to drive research and application of digital technologies in energy efficiency.

(3) Tailor Policies to Regional Differences: Formulate differentiated policy measures based on regional disparities. Promote the application of digital technology in energy-intensive sectors in regions experiencing significant impacts of digital development. Strengthen digital infrastructure in regions with lesser impacts to enhance digitization. Consider economic and financial disparities in policymaking by providing financial incentives for digital technology adoption in less developed areas and guiding advanced energy management system implementation in more developed regions.

However, this study has notable limitations. Alternative methodologies for measuring EI and CEP indicators may exist. Additionally, our analysis focused on two impact mechanisms, potentially overlooking other underlying pathways. Future research should address these limitations by incorporating additional indicators, datasets, and mechanistic pathways to comprehensively understand the complex relationships among digital development, energy, and the environment.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

SW: Funding acquisition, Methodology, Resources, Visualization, Writing–original draft. HZ: Formal Analysis, Funding acquisition, Investigation, Supervision, Writing–review and editing. GY: Funding acquisition, Software, Supervision, Writing–original draft. AZ: Conceptualization, Formal Analysis, Funding acquisition, Methodology, Software, Writing–original draft. JL: Writing–review and editing, Formal analysis, Funding acquisition, Resources.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China (72103022, 72091511, and 72174111), the Beijing Outstanding Scientist Program (BJJWZYJH01201910027031), the Education Department and Natural Science Foundation of Hunan Province (24A0453, 23A0477, and 2023JJ30196). the Shandong Natural Science Foundation of China (ZR2021MG013), the Taishan Scholars Programme of Shandong Province (Young Taishan Scholars), the Youth Foundation in the Jiangsu Province of China (No. BK20220205), and the Project Funded by the China Postdoctoral Science Foundation (2020TQ0048, 2021M700460, and 2022M710421).

Acknowledgments

The authors are grateful to the reviewers for their comments and suggestions, which contributed to the further improvement of this paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmed, Z., and Le, H. P. (2021). Linking Information Communication Technology, trade globalization index, and CO(2)emissions: evidence from advanced panel techniques. Environ. Sci. Pollut. Res. 28, 8770–8781. doi:10.1007/s11356-020-11205-0

Ajayi, V., and Reiner, D. (2020). European industrial energy intensity: innovation, environmental regulation, and price effects. Energy J. 41, 105–128. doi:10.5547/01956574.41.4.vaja

Akbari, N., Jones, D., and Treloar, R. (2020). A cross-European efficiency assessment of offshore wind farms: a DEA approach. Renew. Energy 151, 1186–1195. doi:10.1016/j.renene.2019.11.130

Andersen, P., and Petersen, N. C. (1993). A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 39, 1261–1264. doi:10.1287/mnsc.39.10.1261

An, Q., Meng, F., Xiong, B., Wang, Z., and Chen, X. (2020). Assessing the relative efficiency of Chinese high-tech industries: a dynamic network data envelopment analysis approach. Ann. Oper. Res 290, 707–729. doi:10.1007/s10479-018-2883-2

Apostolov, M., and Coco, N. (2021). Digitalization-based innovation - a case study framework. Int. J. Innov. Technol. MANAGE 18. doi:10.1142/s021987702050025x

Barrera-Santana, J., Marrero, G. A., and Ramos-Real, F. J. (2022). Income, energy and the role of energy efficiency governance. Energy Econ. 108, 105882. doi:10.1016/j.eneco.2022.105882

Bashir, M. F., Ma, B., Shahbaz, M., Shahzad, U., and Vo, X. V. (2021). Unveiling the heterogeneous impacts of environmental taxes on energy consumption and energy intensity: empirical evidence from OECD countries. Energy 226, 120366. doi:10.1016/j.energy.2021.120366

Bi, G.-B., Song, W., Zhou, P., and Liang, L. (2014). Does environmental regulation affect energy efficiency in China’s thermal power generation? Empirical evidence from a slacks-based DEA model. Energy Policy 66, 537–546. doi:10.1016/j.enpol.2013.10.056

Bukht, R., and Heeks, R. (2017). Defining, conceptualising and measuring the digital economy. SSRN Electron. J. doi:10.2139/ssrn.3431732

CAC (2022). China internet development report 2022, 2022. Xinhua News Agency, Xinhua News Agency. Available at: https://xinhuanet.com/.

Cao, S. P., Nie, L., Sun, H. P., Sun, W. F., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: evidence from China's regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

CEA (2021). China energy administration. Available at: https://www.nea.gov.cn/.

CES (2021). Environmental statistical Yearbook, 2021. China Statistics Press, National Bureau of Statistics. Available at: https://www.stats.gov.cn/.

Chakraborty, S. K., and Mazzanti, M. (2020). Energy intensity and green energy innovation: checking heterogeneous country effects in the OECD. Struct. Change Econ. Dynam 52, 328–343. doi:10.1016/j.strueco.2019.12.002

Chen, X. H., Yi, N., Zhang, L., and Li, D. Y. (2018). Does institutional pressure foster corporate green innovation? Evidence from China's top 100 companies. J. Clean Prod. 188, 304–311. doi:10.1016/j.jclepro.2018.03.257

Chen, P. (2022). Is the digital economy driving clean energy development? -New evidence from 276 cities in China. J. Clean. Prod. 372, 133783. doi:10.1016/j.jclepro.2022.133783

Chen, S., Shi, A., and Wang, X. (2020). Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: the mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 264, 121700. doi:10.1016/j.jclepro.2020.121700

Chen, Y. C., Han, B. T., and Liu, W. M. (2016). Green technology innovation and energy intensity in China. Nat. Hazards 84, S317–S332. doi:10.1007/s11069-016-2158-7

CUS (2021). China urban statistical Yearbook. Available at: https://www.stats.gov.cn/zs/tjwh/tjkw/tjzl/202302/t20230220_1913734.html.

Danish, , Ulucak, R., and Khan, S. U. D. (2020). Relationship between energy intensity andCO(2)emissions: does economic policy matter? Sustain. Dev. 28, 1457–1464. doi:10.1002/sd.2098

Ding, C. H., Liu, C., Zheng, C. Y., and Li, F. (2022). Digital economy, technological innovation and high-quality economic development: based on spatial effect and mediation effect. Sustainability 14, 216. doi:10.3390/su14010216

Dong, F., Hu, M. Y., Gao, Y. J., Liu, Y. J., Zhu, J., and Pan, Y. L. (2022). How does digital economy affect carbon emissions? Evidence from global 60 countries. ScTEn 852, 158401. doi:10.1016/j.scitotenv.2022.158401

Du, K. R., and Lin, B. Q. (2017). International comparison of total-factor energy productivity growth: a parametric Malmquist index approach. Energy 118, 481–488. doi:10.1016/j.energy.2016.10.052

Dwivedi, Y. K., Hughes, L., Kar, A. K., Baabdullah, A. M., Grover, P., Abbas, R., et al. (2022). Climate change and COP26: are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. Int. J. Of Inf. Manag. 63, 102456. doi:10.1016/j.ijinfomgt.2021.102456

Ghobakhloo, M. (2020). Industry 4.0, digitization, and opportunities for sustainability. J. Clean. Prod. 252, 119869. doi:10.1016/j.jclepro.2019.119869

Guang, F. T., He, Y., Le, W., and Sharp, B. (2019). Energy intensity and its differences across China’s regions: combining econometric and decomposition analysis. Energy 180, 989–1000. doi:10.1016/j.energy.2019.05.150

Guo, Q. B., Wang, Y., and Dong, X. B. (2022). Effects of smart city construction on energy saving and CO2 emission reduction: evidence from China. ApEn 313, 118879. doi:10.1016/j.apenergy.2022.118879

Guo, Q. R., Wu, Z., Jahanger, A., Ding, C. C., Guo, B. C., and Awan, A. (2023). The spatial impact of digital economy on energy intensity in China in the context of double carbon to achieve the sustainable development goals. Environ. Sci. Pollut. Res. 30, 35528–35544. doi:10.1007/s11356-022-24814-8

Habiba, U., Xinbang, C., and Anwar, A. (2022). Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 193, 1082–1093. doi:10.1016/j.renene.2022.05.084

Haseeb, A., Xia, E. J., Saud, S., Ahmad, A., and Khurshid, H. (2019). Does information and communication technologies improve environmental quality in the era of globalization? An empirical analysis. Environ. Sci. Pollut. Res. 26, 8594–8608. doi:10.1007/s11356-019-04296-x

Hashmi, R., and Alam, K. (2019). Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: a panel investigation. J. Clean. Prod. 231, 1100–1109. doi:10.1016/j.jclepro.2019.05.325

He, A. P., Xue, Q. H., Zhao, R. J., and Wang, D. P. (2021). Renewable energy technological innovation, market forces, and carbon emission efficiency. ScTEn 796, 148908. doi:10.1016/j.scitotenv.2021.148908

Hong Nham, N. T., Mai Hoa, T. T., and Ha, L. T. (2023). Influences of digitalization on sustaining marine minerals: a path toward sustainable blue economy. Ocean. Coast. Manage. 239, 106589. doi:10.1016/j.ocecoaman.2023.106589

Huang, J., Lai, Y., Wang, Y., and Hao, Y. (2020). Energy-saving research and development activities and energy intensity in China: a regional comparison perspective. Energy 213, 118758. doi:10.1016/j.energy.2020.118758

Husaini, D. H., and Lean, H. H. (2022). Digitalization and energy sustainability in ASEAN. Resour. Conservation Recycl. 184, 106377. doi:10.1016/j.resconrec.2022.106377

Ibrahim, M., and Vo, X. V. (2021). Exploring the relationships among innovation, financial sector development and environmental pollution in selected industrialized countries. J. Environ. Manage. 284, 112057. doi:10.1016/j.jenvman.2021.112057

Interlenghi, S. F., de Almeida Bruno, P., Araujo, O. Q. F., and de Medeiros, J. L. (2017). Social and environmental impacts of replacing transesterification agent in soybean biodiesel production: multi-criteria and principal component analyses. J. Clean. Prod. 168, 149–162. doi:10.1016/j.jclepro.2017.08.222

Jalo, N., Johansson, I., Kanchiralla, F. M., and Thollander, P. (2021). Do energy efficiency networks help reduce barriers to energy efficiency? -A case study of a regional Swedish policy program for industrial SMEs. Renew. Sustain. Energy Rev. 151, 111579. doi:10.1016/j.rser.2021.111579

Jiang, B., and Raza, M. Y. (2023). Research on China's renewable energy policies under the dual carbon goals: a political discourse analysis. Energy Strateg. Rev. 48, 101118. doi:10.1016/j.esr.2023.101118

Khan, K., Su, C. W., Rehman, A. U., and Ullah, R. (2022). Is technological innovation a driver of renewable energy? Technol. Soc. 70, 102044. doi:10.1016/j.techsoc.2022.102044

Lange, S., Pohl, J., and Santarius, T. (2020). Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 176, 106760. doi:10.1016/j.ecolecon.2020.106760

Lee, C. C., He, Z. W., and Xiao, F. (2022b). How does information and communication technology affect renewable energy technology innovation? International evidence. Renew. Energy 200, 546–557. doi:10.1016/j.renene.2022.10.015

Lee, C. C., and Wang, F. H. (2022). How does digital inclusive finance affect carbon intensity? Econ. Anal. Pol. 75, 174–190. doi:10.1016/j.eap.2022.05.010

Lee, C.-C., Yuan, Z., and Wang, Q. (2022a). How does information and communication technology affect energy security? International evidence. Energy Econ. 109, 105969. doi:10.1016/j.eneco.2022.105969

Li, D. Y., Zeng, M., Cao, C. C., Chen, X. H., Ren, S. G., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J Clean Prod. 141. doi:10.1016/j.jclepro.2016.08.123

Li, D. Y., Zhao, Y. N., Zhang, L., Chen, X. H., and Cao, C. C. (2018). Impact of quality management on green innovation. J Clean Prod. 170. doi:10.1016/j.jclepro.2017.09.158

Li, J., and Lin, B. (2017). Ecological total-factor energy efficiency of China's heavy and light industries: which performs better? Renew. Sustain. Energy Rev. 72, 83–94. doi:10.1016/j.rser.2017.01.044

Li, L., Raza, M. Y., and Cucculelli, M. (2024). Electricity generation and CO2 emissions in China using index decomposition and decoupling approach. Energy Strateg. Rev. 51, 101304. doi:10.1016/j.esr.2024.101304

Li, M., Pan, X., and Yuan, S. (2022). Do the national industrial relocation demonstration zones have higher regional energy efficiency? ApEn 306, 117914. doi:10.1016/j.apenergy.2021.117914

Li, Y., Yang, X. D., Ran, Q. Y., Wu, H. T., Irfan, M., and Ahmad, M. (2021). Energy structure, digital economy, and carbon emissions: evidence from China. Environ. Sci. Pollut. Res. 28, 64606–64629. doi:10.1007/s11356-021-15304-4

Li, Z. G., and Wang, J. (2022). The dynamic impact of digital economy on carbon emission reduction: evidence city-level empirical data in China. J. Clean. Prod. 351, 131570. doi:10.1016/j.jclepro.2022.131570

Lin, B., and Long, H. (2015). A stochastic frontier analysis of energy efficiency of China’s chemical industry. J. Clean. Prod. 87, 235–244. doi:10.1016/j.jclepro.2014.08.104

Ma, Q., Murshed, M., and Khan, Z. (2021). The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 155, 112345. doi:10.1016/j.enpol.2021.112345

Ma, Q., Tariq, M., Mahmood, H., and Khan, Z. (2022). The nexus between digital economy and carbon dioxide emissions in China: the moderating role of investments in research and development. Technol. Soc. 68, 101910. doi:10.1016/j.techsoc.2022.101910

Mathiesen, B. V., Lund, H., Connolly, D., Wenzel, H., Østergaard, P. A., Möller, B., et al. (2015). Smart Energy Systems for coherent 100% renewable energy and transport solutions. ApEn 145, 139–154. doi:10.1016/j.apenergy.2015.01.075

Morikawa, M. (2012). Population density and efficiency in energy consumption: an empirical analysis of service establishments. Energy Econ. 34, 1617–1622. doi:10.1016/j.eneco.2012.01.004

NBS (2021). National Bureau of statistics statistical Yearbook 2021. National Bureau of Statistics. Available at: https://data.stats.gov.cn/easyquery.htm?cn=E0103.

Nunn, N., and Qian, N. (2014). US food aid and civil conflict. Amer. Econ. Rev. 104, 1630–1666. doi:10.1257/aer.104.6.1630

Omri, A., and Afi, H. (2020). How can entrepreneurship and educational capital lead to environmental sustainability? Struct. Change Econ. Dynam. 54, 1–10. doi:10.1016/j.strueco.2020.03.007

Ozturk, I., and Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour. Conservation And Recycl. 185, 106489. doi:10.1016/j.resconrec.2022.106489

Pan, W., Xie, T., Wang, Z., and Ma, L. (2022). Digital economy: an innovation driver for total factor productivity. J. Bus. Res. 139, 303–311. doi:10.1016/j.jbusres.2021.09.061

Paschou, T., Rapaccini, M., Adrodegari, F., and Saccani, N. (2020). Digital servitization in manufacturing: a systematic literature review and research agenda. Ind. Mark. Manag. 89, 278–292. doi:10.1016/j.indmarman.2020.02.012

Qu, C. Y., Shao, J., and Shi, Z. K. (2020). Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 146, 111810. doi:10.1016/j.enpol.2020.111810

Radicic, D., and Petkovic, S. (2023). Impact of digitalization on technological innovations in small and medium-sized enterprises (SMEs). Technol. Forecast. Soc. Change 191, 122474. doi:10.1016/j.techfore.2023.122474

Raza, M. Y., and Tang, S. (2022). Inter-fuel substitution, technical change, and carbon mitigation potential in Pakistan: perspectives of environmental analysis. Energies 15, 8758. doi:10.3390/en15228758

Razzaq, A., Sharif, A., Ozturk, I., and Skare, M. (2022). Inclusive infrastructure development, green innovation, and sustainable resource management: evidence from China’s trade-adjusted material footprints. Resour. Pol. 79, 103076. doi:10.1016/j.resourpol.2022.103076

Ren, S. Y., Hao, Y., Xu, L., Wu, H. T., and Ba, N. (2021). Digitalization and energy: how does internet development affect China's energy consumption? Energy Econ. 98, 105220. doi:10.1016/j.eneco.2021.105220

Ru, M. Y., Tao, S., Smith, K., Shen, G. F., Shen, H. Z., Huang, Y., et al. (2015). Direct energy consumption associated emissions by rural-to-urban migrants in Beijing. Environ. Sci. Technol. 49, 13708–13715. doi:10.1021/acs.est.5b03374

Salahuddin, M., and Alam, K. (2016). Information and Communication Technology, electricity consumption and economic growth in OECD countries: a panel data analysis. Int. J. Electr. Power and Energy Syst. 76, 185–193. doi:10.1016/j.ijepes.2015.11.005

Salahuddin, M., Alam, K., and Ozturk, I. (2016). The effects of Internet usage and economic growth on CO2 emissions in OECD countries: a panel investigation. Renew. Sustain. Energy Rev. 62, 1226–1235. doi:10.1016/j.rser.2016.04.018

Schulte, P., Welsch, H., and Rexhäuser, S. (2016). ICT and the demand for energy: evidence from OECD Countries. Environ. Resour. Econ. 63, 119–146. doi:10.1007/s10640-014-9844-2

SCPRC (2021). Notice on the action plan for peak carbon emissions by 2030. Available at: https://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm?eqid=99e472f30000977100000006647ab153.

Shahbaz, M., Solarin, S. A., Sbia, R., and Bibi, S. (2015). Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol. Indic. 50, 215–224. doi:10.1016/j.ecolind.2014.11.007

Shahbaz, M., Wang, J., Dong, K., and Zhao, J. (2022). The impact of digital economy on energy transition across the globe: the mediating role of government governance. Renew. Sustain. Energy Rev. 166, 112620. doi:10.1016/j.rser.2022.112620

Shan, Y. L., Huang, Q., Guan, D. B., and Hubacek, K. (2020). China CO2 emission accounts 2016-2017. Sci. Data 7, 54. doi:10.1038/s41597-020-0393-y

Sueyoshi, T., Yuan, Y., and Goto, M. (2017). A literature study for DEA applied to energy and environment. Energy Econ. 62, 104–124. doi:10.1016/j.eneco.2016.11.006

Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Operational Res. 130, 498–509. doi:10.1016/S0377-2217(99)00407-5

Tone, K., and Tsutsui, M. (2010). An epsilon-based measure of efficiency in DEA – a third pole of technical efficiency. Eur. J. Operational Res. 207, 1554–1563. doi:10.1016/j.ejor.2010.07.014

Vavilina, A. V., Gladysheva, I. V., and Tkachenko, I. N. (2020) “Digital economic infrastructure as A necessary condition for technological development,” in 35th international-business-information-management-association conference (IBIMA). Seville, SPAIN, 4817–4826.

Vieira, N. D. B., Nogueira, L. A. H., and Haddad, J. (2018). An assessment of CO2 emissions avoided by energy-efficiency programs: a general methodology and a case study in Brazil. Energy 142, 702–715. doi:10.1016/j.energy.2017.10.072

Voigt, S., De Cian, E., Schymura, M., and Verdolini, E. (2014). Energy intensity developments in 40 major economies: structural change or technology improvement? Energy Econ. 41, 47–62. doi:10.1016/j.eneco.2013.10.015

Wahab, S. (2021). Does technological innovation limit trade-adjusted carbon emissions? Environ. Sci. Pollut. Res. 28, 38043–38053. doi:10.1007/s11356-021-13345-3

Wang, B., Wang, J., Dong, K., and Dong, X. (2023). Is the digital economy conducive to the development of renewable energy in Asia? Energy Policy 173, 113381. doi:10.1016/j.enpol.2022.113381

Wang, J., Dong, K., Dong, X., and Taghizadeh-Hesary, F. (2022a). Assessing the digital economy and its carbon-mitigation effects: the case of China. Energy Econ. 113, 106198. doi:10.1016/j.eneco.2022.106198

Wang, J., Ma, X., Zhang, J., and Zhao, X. (2022b). Impacts of digital technology on energy sustainability: China case study. ApEn 323, 119329. doi:10.1016/j.apenergy.2022.119329

Wang, L. L., Chen, L. Y., and Li, Y. S. (2022c). Digital economy and urban low-carbon sustainable development: the role of innovation factor mobility in China. Environ. Sci. Pollut. Res. 29, 48539–48557. doi:10.1007/s11356-022-19182-2

Wu, H., Hao, Y., Ren, S., Yang, X., and Xie, G. (2021). Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 153, 112247. doi:10.1016/j.enpol.2021.112247

Wu, L., Wan, X. W., Jahanger, A., Li, M. Y., Murshed, M., and Balsalobre-Lorente, D. (2023). Does the digital economy reduce air pollution in China? A perspective from industrial agglomeration. Energy Rep. 9, 3625–3641. doi:10.1016/j.egyr.2023.02.031

Wurlod, J. D., and Noailly, J. (2018). The impact of green innovation on energy intensity: an empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 71, 47–61. doi:10.1016/j.eneco.2017.12.012

Xu, L., Fan, M. T., Yang, L. L., and Shao, S. (2021). Heterogeneous green innovations and carbon emission performance: evidence at China's city level. Energy Econ. 99, 105269. doi:10.1016/j.eneco.2021.105269

Xu, S., Yang, C. Y., Huang, Z. H., and Failler, P. (2022). Interaction between digital economy and environmental pollution: new evidence from a spatial perspective. Int. J. Env. Res. Public Health 19, 5074. doi:10.3390/ijerph19095074

Xue, Y., Tang, C., Wu, H. T., Liu, J. M., and Hao, Y. (2022). The emerging driving force of energy consumption in China: does digital economy development matter? Energy Policy 165, 112997. doi:10.1016/j.enpol.2022.112997

Yi, M., Liu, Y. F., Sheng, M. S., and Wen, L. (2022). Effects of digital economy on carbon emission reduction: new evidence from China. Energy Policy 171, 113271. doi:10.1016/j.enpol.2022.113271

Yu, Y., and Zhang, N. (2019). Does smart city policy improve energy efficiency? Evidence from a quasi-natural experiment in China. J. Clean. Prod. 229, 501–512. doi:10.1016/j.jclepro.2019.04.316

Zakari, A., Khan, I., Tan, D. J., Alvarado, R., and Dagar, V. (2022). Energy efficiency and sustainable development goals (SDGs). Energy 239, 122365. doi:10.1016/j.energy.2021.122365

Zhang, J. N., Lyu, Y. W., Li, Y. T., and Geng, Y. (2022a). Digital economy: an innovation driving factor for low-carbon development. Environ. Impact Assess. Rev. 96, 106821. doi:10.1016/j.eiar.2022.106821

Zhang, L., Mu, R. Y., Zhan, Y. F., Yu, J. H., Liu, L. Y., Yu, Y. S., et al. (2022b). Digital economy, energy efficiency, and carbon emissions: evidence from provincial panel data in China. ScTEn 852, 158403. doi:10.1016/j.scitotenv.2022.158403

Zhang, M. L., and Liu, Y. (2022). Influence of digital finance and green technology innovation on China's carbon emission efficiency: empirical analysis based on spatial metrology. ScTEn 838, 156463. doi:10.1016/j.scitotenv.2022.156463

Zhang, W., Liu, X. M., Wang, D., and Zhou, J. P. (2022c). Digital economy and carbon emission performance: evidence at China's city level. Energy Policy 165, 112927. doi:10.1016/j.enpol.2022.112927

Zheng, J. J., and Wang, X. W. (2021). Can mobile information communication technologies (ICTs) promote the development of renewables? evidence from seven countries. Energy Policy 149, 112041. doi:10.1016/j.enpol.2020.112041

Zhou, A., and Li, J. (2020). Impact of income inequality and environmental regulation on environmental quality: evidence from China. J. Clean. Prod. 274, 123008. doi:10.1016/j.jclepro.2020.123008

Zhou, A., and Li, J. (2021). Investigate the impact of market reforms on the improvement of manufacturing energy efficiency under China’s provincial-level data. Energy 228, 120562. doi:10.1016/j.energy.2021.120562

Zhou, A., and Li, J. (2022). How do trade liberalization and human capital affect renewable energy consumption? Evidence from the panel threshold model. Renew. Energy 184, 332–342. doi:10.1016/j.renene.2021.11.096

Zhou, A., and Li, J. (2024). Impact of policy combinations on carbon emission performance: evidence from China. Clean Technol. Environ. Policy. doi:10.1007/s10098-024-02773-7

Zhou, A., Wang, S., and Chen, B. (2023). Impact of new energy demonstration city policy on energy efficiency: evidence from China. J. Clean. Prod. 422, 138560. doi:10.1016/j.jclepro.2023.138560

Zhou, A., Xin, L., and Li, J. (2022a). Assessing the impact of the carbon market on the improvement of China's energy and carbon emission performance. Energy 124789, 124789. doi:10.1016/j.energy.2022.124789

Zhou, X. Y., Zhou, D. Q., Wang, Q. W., and Su, B. (2019). How information and communication technology drives carbon emissions: a sector-level analysis for China. Energy Econ. 81, 380–392. doi:10.1016/j.eneco.2019.04.014

Zhou, X. Y., Zhou, D. Q., Zhao, Z. Y., and Wang, Q. W. (2022b). A framework to analyze carbon impacts of digital economy: the case of China. Sustain. Prod. And Consum. 31, 357–369. doi:10.1016/j.spc.2022.03.002

Zhou, Z. F., Nie, L., Ji, H. Y., and Chen, X. H. (2020). Does a firm’s low-carbon awareness promote low-carbon behaviors? Empirical evidence from China. J Clean Prod. 244. doi:10.1016/j.jclepro.2019.118903

Zhu, W. J., and Chen, J. J. (2022). The spatial analysis of digital economy and urban development: a case study in Hangzhou, China. Cities 123, 103563. doi:10.1016/j.cities.2022.103563

Appendix A Measurement of emission reduction performance

Several approaches have been developed to assess CEP, encompassing both parametric and nonparametric methods. Parametric techniques, such as the proportional method (Shahbaz et al., 2015) and stochastic Frontier analysis (SFA) (Lin and Long, 2015; Du and Lin, 2017), hinge on stringent production function assumptions and single-factor analysis, respectively. Nonparametric methods, notably data envelopment analysis (DEA) (Tone, 2001; Li and Lin, 2017; Sueyoshi et al., 2017; An et al., 2020; Yu and Zhang, 2019; Wu et al., 2021; Zhou A. et al., 2022), have seen widespread use, with a particular emphasis on the Charnes, Cooper, and Rhodes (CCR) model. Nevertheless, these methodologies have limitations, such as unrealistic assumptions for parametric approaches and the dependence on a single distance function for nonparametric methods.

To address these challenges, we adopted the SE-EBM model introduced by Tone and Tsutsui (2010), which incorporates both radial and nonradial distance functions. This approach allowed us to surmount the constraints associated with existing methodologies, providing a more holistic assessment of CEP. The initial model was formulated as the following equation:

In this equation,

The parameter

Appendix B

Keywords: digital development, super efficiency epsilon-based measure model, energy intensity, carbon emission performance, mediation effect model, carbon neutrality

Citation: Wang S, Zhong H, Yang G, Zhou A and Liu J (2024) Has digital development achieved a synergistic effect of reducing energy intensity and improving carbon emission performance? evidence from China. Front. Environ. Sci. 12:1397753. doi: 10.3389/fenvs.2024.1397753

Received: 08 March 2024; Accepted: 15 July 2024;

Published: 24 December 2024.

Edited by:

Chuanwang Sun, Xiamen University, ChinaReviewed by:

Jinping Sun, Peking University, ChinaXiongying Li, Guangdong University of Finance and Economics, China

Muhammad Yousaf Raza, Shandong Technology and Business University, China

Yufeng Chen, Zhejiang Normal University, China

Copyright © 2024 Wang, Zhong, Yang, Zhou and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Anhua Zhou, emhvdWFuaHVhQGh1dGIuZWR1LmNu; Jing Liu, bGl1amluZ0BuaWVzLm9yZw==

Saige Wang1,2

Saige Wang1,2 Honglin Zhong

Honglin Zhong Anhua Zhou

Anhua Zhou