- 1School of Business Administration, Liaoning Technical University, Fuxin, Liaoning, China

- 2School of Business Administration, Liaoning Technical University, Huludao, Liaoning, China

- 3Faculty of Management Sciences, National University of Modern Language, Islamabad, Pakistan

- 4“Economic Security” Department, Tashkent State University of Economics, Tashkent, Uzbekistan

Green finance initiatives are encouraged in the world to attain green economic milestones. Therefore, it is the centered area of research for the plethora of researchers across the globe. Instead of this significant transition to green finance, the study analyzed the Chinese data to explore the relationship between Green Finance, Green Technology innovation, and Environmental Performance from 2003 to 2022 in the Chinese context. We preferred the CS-ARDL and panel Quantile regression models for exploring our hypothesis and to examine the relationship of these variables. Our results validated that both green finance and green technology innovation have positive effects in both the long-term and short-term on the environmental performance in numerous Chinese cities. The statistical results showed that Green Finance and Green technology innovation reduce the amount of CO2 emission. Hence our results confirmed that both Green Finance and green technology innovations are significantly contributing to the environmental quality of China as the selected cities considered for the study investigation are considerably more driven towards green initiatives. This research also discussed the potential for implementing policy interventions in the future to leverage the adoption of green technology and make a significant impact on the world’s environmental quality as China is the biggest emitter of CO2 emissions. The study places and puts forward valuable insights to the regulatory bodies that would likely help them in achieving sustainable milestones and would contribute to their long-term strategic landscape for the attainment of environmental objectives and heights.

1 Introduction

There has been a significant rise in global environmental crises over the past few decades. There is a growing concern among experts worldwide regarding issues such as climate change, biodiversity loss, deforestation, air and water pollution, ocean acidification, and resource depletion. These problems have the potential to cause significant harm to ecosystems, human health, and the planet as a whole. To mitigate the negative effects of these challenges on our environment, it has become imperative to maintain sustainable practices (Mirzaei and Shokouhyar, 2023). In this endeavor, it is important to note that China plays one of the most crucial roles to be had, due to its substantial role in global manufacturing and trade. As a result of China’s crucial role in the global economy, it is often referred to as “the world’s factory” (Yetgin and Yilmaz, 2022). As China’s economy continues to grow, the country is also facing the high environmental footprint that comes along with it, presenting a difficult task for sustainable development. There have been instances where China’s strict environmental standards have lagged behind the country’s fast economic development. Lax enforcement of environmental regulations brought substantial emphasis on economic expansion and has historically led to significant pollution and resource depletion. An important point for policy and research considerations in this context will be the impact of environmental regulations on the environment, and these regulations will need to be carefully analyzed (Peng et al., 2021). The goal of this study is to provide insight into how environmental regulations play a powerful role in the adoption of green technology in China. In this study, we highlight the mechanisms that enable sustenance amid the global industrial landscape as well as draw attention to this issue. China’s rapid economic growth and development has led to significant environmental challenges that are a cause for concern. The country’s rapid industrialization and urban development have led to major environmental challenges, such as air and water pollution, depletion of natural resources, and increased greenhouse gas emissions. The government of China has undertaken a journey toward transition to a more sustainable growth paradigm as a result of recognizing these challenges. Environmental regulations play a vital role in this transformation, as they set stricter standards for industries, encouraging them to adopt new technologies that are cleaner and more resource efficient as a result of these regulations (Li et al., 2022). These regulations need to serve not only as instruments for protecting the environment but as catalysts also for bringing about technological innovation and reorganizing the economy as well. As sustainable development goals are concerned, green technology plays an essential role in achieving the desired outcomes by minimizing environmental impact and increasing resource efficiency (Jahanger and Usman, 2023). Several factors play a role in industries adopting green technology, including economic viability, technological feasibility, regulatory pressures, and market demand, all of which are intertwined in a complex interaction of factors (Nyangchak, 2022). As China works to maintain a balance between growth and environmental protection, understanding how environmental regulations can influence the adoption of green technologies has become an increasingly important component of formulating policies that will provide long-term benefits (Doğan et al., 2023). This study examines how environmental regulations may influence the adoption of green technology within China’s industrial innovation landscape, specifically in terms of green technology adoption and environmental regulations’ influence on green technology adoption in China. Analyzing the mechanisms shaping technology adoption decisions in a rapidly developing economy enables a better understanding of sustainability. Our goal is to contribute to a more nuanced understanding of how regulations influence technology adoption (Lashitew et al., 2019). This study aims to achieve specific objectives. This study is focused on analyzing the environmental regulations in China about the sustainability standards set by international organizations and trying to determine whether or not they align with these sustainability standards. The purpose of this study is to find out how environmental regulations influence other industries in terms of green technology adoption. Identifying the relationship between green technology adoption and key environmental performance indicators, i.e (measure air pollution, water pollution, and carbon emissions. Providing a glimpse at China’s progress in transitioning to greener technologies, as well as enhancing conservation initiatives, the report demonstrates China’s commitment to balancing rapid economic development and environmental protection) (Serrano-García et al., 2023). The purpose of the study is to provide policymakers, industries, and stakeholders with actionable insights into the ways in which regulatory frameworks can be optimized in order to increase the adoption of green technologies. It provides policymakers, industries, and stakeholders with actionable insights into how regulatory frameworks can be optimized.

Aiming for an in-depth examination of the situation, this research will use quantitative analysis. The quantitative analysis involves a review of industry-level data on environmental regulations, technological adoption trends, and environmental performance indicators at the industry level (Cui et al., 2022). This study seeks to offer both academic knowledge and practical policy considerations by conducting an in-depth analysis of the impact of environmental regulations on the adoption of green technology in China. The findings of the study are to be interpreted as a result of the process of enhancing our understanding of how regulatory frameworks influence sustainability development in an industry as a result of the information obtained from this study. There is a need for policymakers to strike a balance between economic growth and environmental preservation to ensure that growth does not compromise the environment. Furthermore, it has been demonstrated that the insights gained from this research can provide industries with valuable perspectives on how to navigate the challenges and opportunities associated with green technology adoption within regulatory frameworks to facilitate its adoption. China has seen tremendous industrial expansion and is a major player in the global economic landscape, but it has also experienced serious environmental challenges. Scene. Consequently, the process of elucidating the mechanisms that are responsible for the persistence of sustainability inside the nation is of utmost importance as a precondition for its achievement. Many factors have a significant influence, including government regulations, incentives, and technical breakthroughs. Policies that encourage the use of renewable energy, the reduction of emissions, and the management of waste have the potential to profoundly impact industrial operations (Zeeshan et al., 2021a). Investigating these links can assist in determining whether there are complications or opportunities for firms to implement environmentally friendly technologies. To provide insights that can contribute to a more harmonious existence between economic growth and environmental wellbeing, the purpose of this study is to investigate the relationship between rules that control the environment and green technologies. This will assist in informing strategies that contribute to the combination of economic growth and environmental wellbeing. As a result of the convergence of green finance and green technology innovation, it is believed that environmental performance will eventually balance out green financing in developing countries. The concept of green technology innovation should be recognized as one that will increase energy efficiency and increase the use of renewable energy resources, both of which will be beneficial to the environment (López and Palacios, 2014; López-Menéndez et al., 2014). Moreover, the increased innovation in green technology indicates a positive outcome for eco-innovation as a whole, as well as a way to generate a greater amount of clean energy. Thus, green financing can contribute to the development of clean energy research and development and the production of renewable energy. Furthermore, Haller and Murphy (2012), documented that investing in green technology leads to the growth of international financial support for green technology, resulting in better environmental performance combined with more green technology innovation. Accordingly, green innovation is vital for the sustainable development of a green economy and the sustainability of the environment (Chen et al., 2023).

Green finance can lead to more sustainable green technologies by relating environmental performance to green finance (Zhang, 2022). By improving environmental performance, individuals may build habitats that require less air pollutants, which may lead to more green technology innovation from policymakers (Yang et al., 2021). Second, Carrión-Flores and Innes (2010) documented the process of increasing green technologies is usually a long-term process, it is natural that the results of improved environmental performance will continue to grow year after year. Furthermore, government support for green technology may spur more R&D into renewable energy and clean energy production, resulting in less pollution (Ahmed et al., 2022). As a result of these findings, green technology innovation is influenced by the environment and green finance.

This paper is stimulating due to its potential to make significant contributions in various areas. Our investigation examined the one-way cause-and-effect connection between advancements in eco-friendly technology and the overall environmental impact over an extended period. In contrast to previous studies that focused solely on the impact of sustainable finance on environmental performance, this research takes a different approach. Through an analysis of balanced panel data from 2002 to 2016 across 57 countries, the study explored the connections between environmental performance, green finance, and green technology innovation. While Westerlund and Edgerton (2007) explore the integration of potential CSD into the cointegration test. We proceeded with further analysis, in which we analyzed the long-term implications of environmental performance and green finance as they relate to green technologies innovation on both a panel-level and on a sub-sample-level basis in emerging economies and non-emerging economies respectively, as well as in many sub-samples established as indicators of environmental performance. Thirdly, it is important to note that the impact of green finance and environmental performance on the development of sustainable technologies may vary according to the level of environmental performance, green finance, and sustainable management innovation in a country, which is determined by the combination of these factors. Additionally, we constructed six sub-samples (High-GI, High-GF, Low-GF, High-EPI, and Low-EPI). The purpose of this research is to determine whether there are any differences in the relationship between three variables: green finance, environmental management innovation, and environmental performance, when it comes to the underlying causes of each variable. Furthermore, previous studies on green technology innovation have often focused on companies from a single country to analyze this phenomenon. Yu et al. (2022) highlighted the collection of data from 57 countries, providing a broader perspective on the outcomes and implications of economic development. Our study findings suggest that over time, there is a balanced connection between environmental performance, green finance, and green innovation. As a result, policymakers must consider all three factors together, as any alteration in one factor can potentially affect the other two.

1.1 Theory literature and hypotheses

The best support for this study we found the theories that are related to the Green Economy and Ecological Modernization. Technology innovation and systemic changes in economic practices promote economic growth while protecting the environment. In this way, environmental performance can also be brought into consideration in the context of green finance and is therefore aligned with this notion. By adopting green technologies and focusing on environmental factors, sustainable development can be achieved. This study is also supported by the Green Economy theory which prioritizes ecological stability and resource conversion Daly (1970) which is based on the notion that natural assets continue to meet the resources and environmental services that are essential to our health and wellbeing while promoting economic growth and development. Due to this notion, researchers emphasize the importance of green finance and its role in transforming economies into greener trends. Likewise, the TBL theory by Høgevold et al. (2019) and Sholeh et al. (2020) explains that apart from economic focus, businesses should also prefer to focus on social and environmental factors to ascertain sustainability. The theory of green finance also suggests that green initiatives would be very impactful to achieve environmental sustainability (Wang et al., 2022a). Our paper variables relationship is based on the notion of the above theories.

2 Literature review

China is widely recognized as “World’s Factory” a global manufacturing powerhouse due to its significant role in the manufacturing industry. In this study, we explore how the adoption of green technologies intersects with the regulatory framework of environmental protection. Green technologies and environmentally friendly technologies are integrated into China’s industrial landscape. Using the causal relationship between regulation and technology adoption, this study examines how environmental regulations influence China’s transition to sustainable practices. Chinese environmental policy is analyzed comprehensively from various sources, with a comprehensive synthesis of existing research, challenges and opportunities in adopting green technologies presented, as well as long-term implications. China is a major global manufacturing hub with many sustainability challenges. This research examines some of those factors through systematic literature reviews.

2.1 Green finance and green technology innovation

A green finance activity is a financial activity that seeks to improve the environment through the organized use of financial resources. Although green finance plays a critical role in mitigating the effects of climate change, it remains underinvested despite its importance. A green finance program includes a variety of environmental objectives, such as reducing emissions from industry, reducing CO2 emissions, preserving biodiversity, and improving water sanitation. As part of this program, green finance can also be used to finance social initiatives (Akram et al., 2020). The importance of Green Finance and Green Technology Innovation in advancing sustainable development can be illustrated by the recent research conducted on the intersection of these two fields. With the increasing use of green finance as a tool for transitioning towards a low-carbon economy, it has gained momentum as a catalyst for promoting investments, loans, and financial instruments that promote environmentally friendly initiatives (Tamasiga et al., 2022). Simultaneously, various studies have consistently demonstrated the close connection between successful Green Finance and groundbreaking Green Technologies. These technologies play a vital role in mitigating the impacts of climate change (Lazaro et al., 2023). The findings of the study emphasize the significant relationship between both of these domains, which exist in a mutually beneficial relationship. The Green Finance sector channels funds toward the exploration, advancement, and application of eco-friendly technologies to foster environmental wellbeing (Wang and Wang, 2021). Green Finance has gained more credibility from investors due to the scalability and profitability of these technologies, making it more appealing to new investors. This dynamic synergy has the potential to generate long-term ecological benefits, foster economic growth, and address climate change on a global scale (Moreno et al., 2023). Early studies in this field examined the effects of green financing policies on GTI in enterprise sectors, along with the various factors that drive green technology innovation within these sectors (Jiakui et al., 2023). The Chinese government has implemented several environmental policies due to its status as one of the world’s largest polluters and the world’s largest developing country. The policy aims to assist businesses in decreasing their energy consumption and emission levels by implementing environmentally-friendly innovations (Hao and Chen, 2023). Multiple executive orders were unable to bring about the “innovation offsets” anticipated by Porter because of this coercion; in fact, rather than promoting enterprise innovation, they stifled it (Gray and Shadbegian, 2003; Zhong and Peng, 2022). Corporate green innovation has been shown to be insufficiently impacted by many market-based policies (Ghisetti and Pontoni, 2015). There are fundamental differences between ordinary innovation projects and green innovation projects, and the latter have higher risks and a lower success rate as compared to the former, so they require a longer R&D process and increased costs, and external financial backing is necessary (Tseng et al., 2013). China has implemented various sustainable financing initiatives, including green bonds and green credits, to support its environmental policies and foster sustainable economic growth. This became more comprehensive and influential due to China’s implementation of the GFPP (Green Finance Pilot Policy) in 2017. As part of the government’s efforts to promote green finance reform, a pilot zone for green finance reform and innovation has been chosen in eight cities across four provinces (Zhang et al., 2023). These cities were motivated to enhance and revolutionize their existing green finance tools by establishing a robust green technological innovation system. According to this theory, GFPP has the potential to impact a company’s external financing and green innovation choices by allocating financial resources to environmentally friendly firms that meet certain environmental criteria (Aizawa and Yang, 2010; Huang et al., 2022). Does the Green Business Partnership Program (GFPP) effectively promote corporate green innovations and have a significant impact on the green economy? There is still much to discover about these subjects, as they remain largely unexplored. Global warming has always been associated with ecological disasters and resource depletion since the 1960s Zheng et al. (2022), land problems Yang et al., 2022 reserve lessening (Abbas and Dogan, 2022). Globalization, the depletion of resources, pollution of the environment, and food crises are all factors that are bringing an increasing number of challenges to the world (Zhang et al., 2022a).

H1. Green finance and Green Technology Innovation have a positive relationship.

The hypothesis above describes that investments in green finance positively influence the development and adoption of green technologies, suggesting a synergetic relationship between green technology and green finance. According to this hypothesis, financial mechanisms will play a vital role in enabling technological innovation, which is necessary for sustainable environmental practices to be achieved.

2.2 Green finance, and environmental performance

Green finance has been researched for a long time as a means of improving a company’s environmental performance, and prior research indicates that there is a favorable correlation between these two variables. In essence, an organization’s level of financial responsibility is directly tied to its environmental impact. However, Zhang et al., 2022b, documented the concept of green finance, which involves providing financial support to projects that promote environmental sustainability, such as clean energy and technology. Based on existing literature, it has been found that the environmental impact of companies can be improved through the implementation of green finance, leading to better performance (Guang-Wen and Siddik, 2022; Zeeshan et al., 2022a). Moreover, Shi et al., 2022 documented that green finance had a positive impact on the performance of enterprises in regards to green operations. Indriastuti and Chariri (2021) highlighted that green investments lead to better financial performance as well as a sustainable business model. According to the findings of this study conducted by Alola et al., 2021 it was found and concluded that to attain environmental sustainability at a high-income level, there may be a need to compromise on investment risk. Extensive research has shown that green finance has a notable impact on improving environmental outcomes within a firm. Thus, it is anticipated that green finance will have a crucial role in enhancing the sustainability capabilities of banking institutions in the midst of this epidemic due to its positive environmental impact.

Additionally, Hsu et al., 2021 examine the correlation between green finance and environmental performance in China. It is interesting to see the insights that emerge from studying how Chinese firms respond to environmental concerns through Green Finance mechanisms. The study revealed a strong link between the adoption of green finance practices and the enhancement of environmental performance among companies. This finding was based on an extensive dataset that spanned from 2014 to 2018. Based on the results of this study, it is evident that companies involved in Green Finance activities, such as issuing green bonds or accessing green funds, have a significantly higher success rate in achieving their environmental goals compared to companies that do not participate in such activities (Zeeshan et al., 2021b; Baldi and Pandimiglio, 2022). In addition to exploring the relationship between green finance and environmental performance, the study also investigates the impact of institutional factors, such as government regulations and policy support. Given the substantial investment China has made in advancing green finance over the last 20 years, these findings have a noteworthy influence on the governance of its industrial sector, ensuring it remains environmentally sustainable and economically competitive. The growing awareness of global climate change and environmental issues has led governments to adopt a variety of policies aimed at promoting the adoption of green technologies, including green brands and environmentally friendly technology, across different industries. Likewise, Weinhofer and Hoffmann (2010) documented that, there is green finance, such as green bonds, to minimize the impact on the environment (Zeeshan et al., 2022b; Li et al., 2023). Green finance, however, is just a representation of the government’s attitude toward protecting the environment, whereas environmental innovation refers to their attitude towards resolving environmental degradation, as well as innovation in generating renewable energy and improving the efficiency of the utilization of energy (Liang et al., 2021; Wang et al., 2022b). There have been only a few studies that have explored the potential connections between green finance and environmental performance. However, no empirical tests have been conducted to determine if green finance can influence environmental performance. Developing sustainable products and processes based on the current performance of green finance and the development of environmental quality can provide valuable insights for governments to understand the relationship between green finance and environmental performance. By promoting green technology innovation, the government has the potential to enhance economic development and environmental performance. It is crucial for global development to prioritize environmentally friendly, green, and sustainable practices. Therefore, this study aims to understand the impact of green finance and green technology innovation on environmental performance, both in the short and long term.

H2. There is a significant association between Green Finance and the Environmental Performance

In this hypothesis, we examine the impact of green finance on environmental performance from a quantitative perspective. Based on the results, it is suggested that a major factor associated with sustainable policies and outcomes is financial investments in environmental sustainability. The purpose of this hypothesis is to explore how financial initiatives may influence environmental quality by directly impacting the overall quality of the environment.

2.3 Green Technology Innovation and Environmental Performance

The footprints regarding the relationship of these variables exist in the body of knowledge. Singh et al. (2020), and data was collected from 669 manufacturing firms in the United Arab Emirates. Their findings indicate that a firm’s green innovation processes a crucial role in determining its environmental performance. Another study on 244 Malaysian large manufacturing companies was conducted and found that there is a strong connection between green innovation and both human resource management and green intellectual capital to improve the environment (Kraus et al., 2020). Moreover, Rehman et al., 2021a highlighted the results of 244 large manufacturing companies and found that green innovation was related to environmental performance. However, Yan and Zhang (2021) highlighted an analysis of green practices and environmental management in energy-intensive units showed a positive impact on the environment through a stochastic Frontier model that was developed between 2011 and 2017. Furthermore, Zameer et al. (2021) and Xie et al. (2022) documented an efficient and effective way to monitor, develop, and implement green practices that can contribute to the improvement of the environment. Their research suggests that by closely monitoring, developing, and implementing green practices, significant improvements can be made to the overall environmental conditions. However, (Luo, 2020), found that the use of green technology innovation to improve environmental performance is significantly correlated with the use of green technology innovation. However, this study analyzes the positive impact of technology innovation on environmental performance in the energy sector, using data from 136 companies over 10 years (2009–2019). The connection between green innovation, government subsidies, and environmental performance has become more evident in recent years, although there are still some controversial findings. Several studies have explored the correlation between different types of government subsidies and environmental performance s (Zeeshan et al., 2021a; Xie et al., 2022). However, previous studies have not been able to distinguish between different categories of government subsidies, including those aimed at environmental protection. The potential impact of green technology innovation within both of them has not yet been fully demonstrated in the current situation (Sharif et al., 2022). Environmental protection subsidies aim to guarantee the preservation of the environment and the regulation of pollution. To assess the impact of China’s environmental subsidy policy, it is crucial to directly analyze the influence of these subsidies on the performance of heavy-polluting industrial sectors, specifically those involved in the production of heavy pollutants. This analysis will help determine the effectiveness of these subsidies in safeguarding the environment (Pei and Pei, 2022).

H3. Green Technology Innovation is Postulated to Improve Environmental Performance

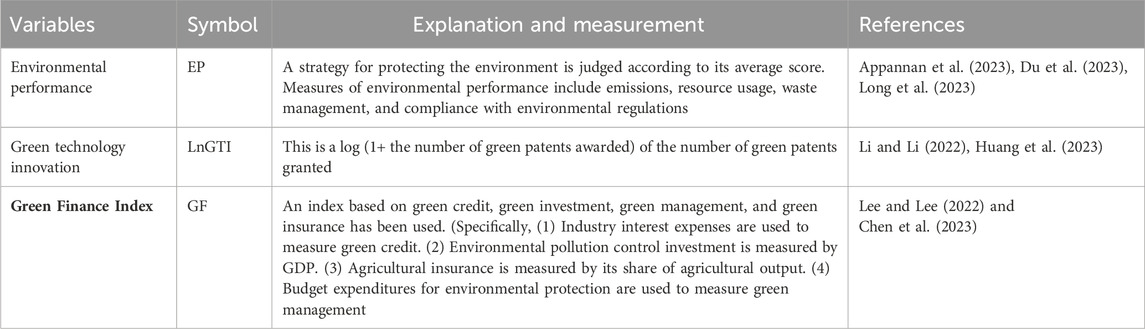

The hypothesis above suggests that advancements in green technologies directly contribute to the improvement of environmental performance, which illustrates that innovative solutions are essential to dealing with the challenges associated with the environment. Using green technologies for research and development will lead to more efficient resource use and reduced environmental degradation. Table 1 denote the variable definition and measurement of the study the same table pattern used by many researcher like (Zeeshan, Rehman, Ullah, Hussain, and Afridi, 2022)

3 Empirical methodology

3.1 Data, variables, models, and estimation techniques

After thoroughly examining the available literature and analyzing the data presented in this paper, we were able to carry out a comprehensive study on the effects of green finance, green technology innovation, and environmental performance in 280 Chinese cities having 16 types of heavy-polluting industries by using the data source which is available on: Ministry of Ecology and Environment, China City Statistical Yearbook and from CNRDS (http://www.cnrds.com) database which has been reported in this paper for the period 2003–2022. We selected those firms for which the green finance and GTI data are available in the Chinese database. The most relevant econometric techniques of this study are as follows Eq. 1:

Where EP depicts environmental performance Shao et al. (2023),

Furthermore, a cross-sectionally augmented IPS test (CIPS) is performed to assess the stationarity of the variables. Stationarity is a vital aspect to consider before applying a suitable model to a study. As a result, CIPS was also used. Eq. 3 CIPS are as follows:

Therefore, the CIPS establishes equation (5), wherever, CADF depicts the cross-sectional ADF test.

In previous studies, the Westerlund and Edgerton (2008) cointegration test was used to assess cointegration and determine whether it applies to the relevant model. This step is crucial for employing the appropriate model. In addition, when taking into account the distinctive characteristics of the durable CSD approach and making assumptions about structural breaks, it emerges as a highly efficient method for examining cointegration. Additionally, we explore how the structure varies during periods of regime shifts and non-regime shifts. Below is the equation for the test Eq. 6:

It is also important to note that the previous literature applied the CS-ARDL technique to check the correlations between the constructs under study. There are several assumptions associated with this model, such as endogeneity, CSD, and slope heterogeneity. Furthermore, it can be noted that ARDL is an approach broadly used for panel data analysis, but it does not address the problem of CSD errors. It is therefore appropriate to deal with CSD issues in the best possible way using CS-ARDL. This is a novel approach developed by Chudik and Pesaran (2015) that also has some strict assumptions, which are related to these methods. An example of how the approach equation can be represented is shown below Eq. 7:

Thus previous research also proposed the cross-sectional ARDL employing the understudy concept and stated as follows equation no Eq. 8:

3.2 Panel quantile regression (PQR)

The study additionally used panel quantile regression, a method introduced by Koenker (2004) to understand the different heterogeneity of the dataset. Quantile regression has become a crucial instrument in environmental research in recent years. There are four strong reasons why quantile panels should be modeled based on a regression approach. By employing traditional regression analysis, researchers calculate regression coefficients based on average effects of covariates, rather than estimating coefficients using average effects. For more accurate regression coefficients, it is advisable to utilize this method as it accounts for the significant variations between predicted and observed variables. It has been noticed that the conditional mean does not consistently produce the same outcomes. PQR, on the other hand, does not rely on any assumptions about the distribution, including the absence of a normal distribution (Ouyang et al., 2022). In terms of the distinct heterogeneity of the panel data, there is no distinction between CM and PQR methods, which also incorporate the distributional heterogeneity of the panel data (Akram et al., 2020). When studying PQR, it is important to measure the independent variables alongside the dependent variables to gain a thorough understanding of them. This approach sets itself apart from CM methods by not relying on distributional assumptions. In addition, it avoids making any normality assumptions, unlike the CM method. In comparison to CM, PQR also addresses outliers and produces reliable results. Due to the utilization of various quantiles in PQR, there exists a distinct relationship between the predicted and observed variables. Each cross-section is also explored for unobserved heterogeneity by measuring various parameters within the quantiles (Amin et al., 2020). Considering the coefficient at the extreme is also useful for policy purposes. Besides its econometric advantage, the PQR provides a multidimensional analysis of how GF and GTI are estimated at different stages of EP, offering a comprehensive analysis of these variables.

According to Eq. 9, Akram et al. (2021) the Panel Quantile Regression model can be summarized as follows:

Here

In the case of Panel Quantile Regression, a traditional linear regression model cannot be used to estimate the model. Likewise, Koenker (2004) documented that with the elimination of an unknown part of the estimation process, it is possible to minimize the estimation process by offering a penalty term. Compared to other approaches, this method has two distinct advantages over the others. Additionally, it minimizes variance caused by distinct coefficient estimation by decreasing the estimated parameters efficiently (Akram et al., 2020). It has been estimated that the Eq. 11 in this way:

4 Results and findings

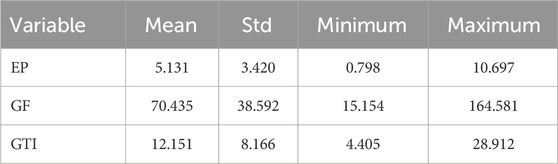

The findings regarding the descriptive statistics indicate that the Environmental Performance variable has a mean value of 5.131. This variable serves as a measure of the effectiveness of environmental protection strategies in safeguarding the environment. On the other hand, the average value of the Green Finance variable was found to be 70.435. This variable is a composite index that takes into account factors such as Lev, Share, Share and Size. Lastly, the mean value of Green Technology Innovation was determined to be 12.151. This variable is quantified using the logarithm of one plus the number of green patents granted. These results are summarized in Table 2.

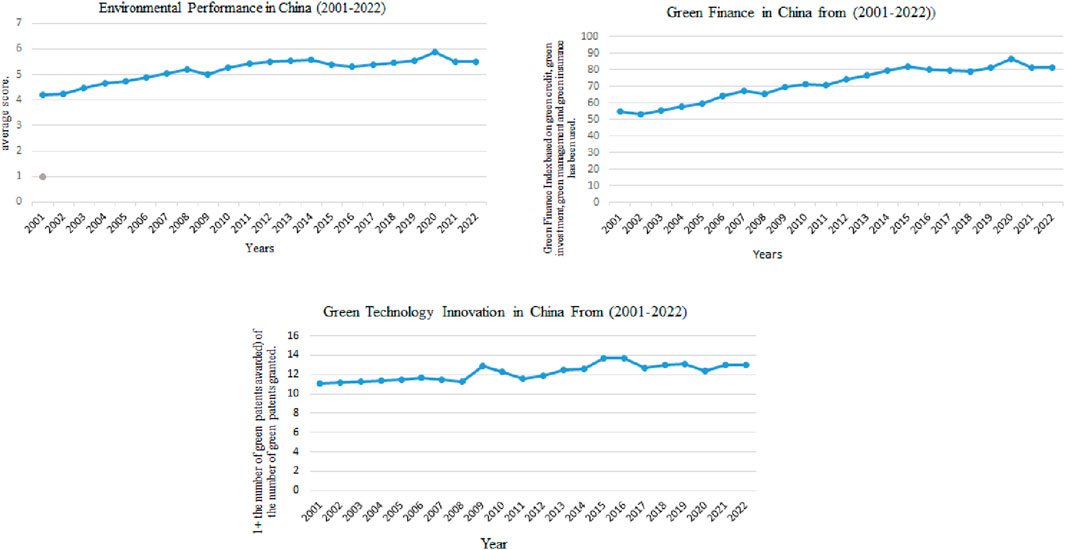

This research employed descriptive statistics to examine the distribution of variables across different years. Specifically, the analysis focused on determining the levels of the variables for each year and calculating their respective mean values. Descriptive statistics were employed to estimate the level of each variable by year, thereby providing an analysis of the data for the temporal dimension. The data unveiled indicates that the year 2020 exhibited the most noteworthy degree of environmental performance and green finance. In contrast to previous years, the year 2016 witnessed a notable surge in the rate of innovation within the realm of green technology. The breakdown of these values is presented in Table 3.

It is suggested by the provided tables that the research could assess the relationships and trends between these variables, in addition to the potential underlying factors that may influence their behavior. There is a lot of information that may be useful in making informed decisions, formulating policies, or gaining a much broader understanding of broader economic or social dynamics, depending on the variability, trends, and potential interactions between these variables. A deeper analysis of the relationships between these variables could be revealed through further analysis, such as a regression or correlation analysis. In addition, the results of this study may explain trends and variations observed over time.

Figure 1 show the descriptive and statistical graph of the data (Slough, McTigue, Kim, and Jennings, 2010). The correlation of the variables has been examined in Table 4 to confirm whether there are strong or weak relationships between them. Based on the results of Table 5, it appears that the correlation between Green Finance and Green Technology Innovation and CO2 emission is negative which means that both GF and GTI reduce CO2 emission and enhance the level of environmental quality.

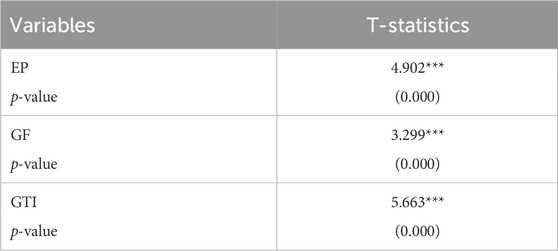

Also in Table 5, the cross-sectional dependence test values show statistically significant values which confirm that there is cross-sectional dependence in the data.

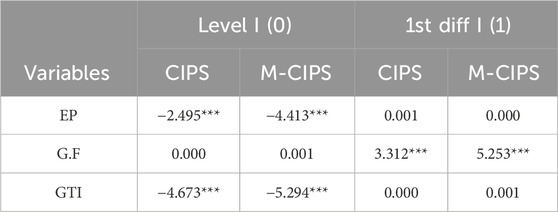

Table 6 Cross-sectionally the stationarity of variables, we conducted a cross-sectionally augmented IPS (CIPS) unit root test to analyze the stationarity of variables in Table 6. During the estimation process, we found that the “EP and GTI are stationary at the first difference, whereas the GF are stationary at the level.

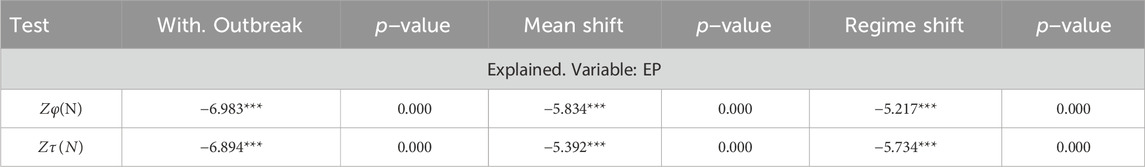

Based on the footprints regarding stationarity, we proceeded with applying cointegration techniques to find out if there exist any long-run relationships between the variables. The data in Table 7 Cointegration test showed that all probability values are statistically significant which declared the cointegration among variables.

4.1 CS-ARDL

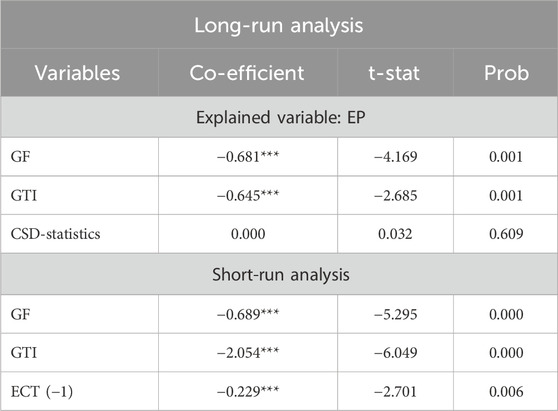

To know the impact of Green Finance and Green Technology Innovation on Environmental Performance we conducted a CS-ARDL estimator as a main frame econometric technique and the results in this regard are displayed in Table 8 which provides an overview of these values. This technique shows both short-term and long-term relationships between EP, GF, and GTI, the research done using CS-ARDL analysis suggests that there is a statistically strong association between (GF& CO2 and GTI and CO2) these variables in the long run and the short term. GF and GTI are associated with increases in EP, as both show an inverse relationship with CO2 a proxy for Environmental Performance. In addition, a significant error correction term appears that indicates that any deviation from the long-run equilibrium tends to be corrected by the system when it performs a short-run analysis.

4.2 Panel quantile regression (PQR)

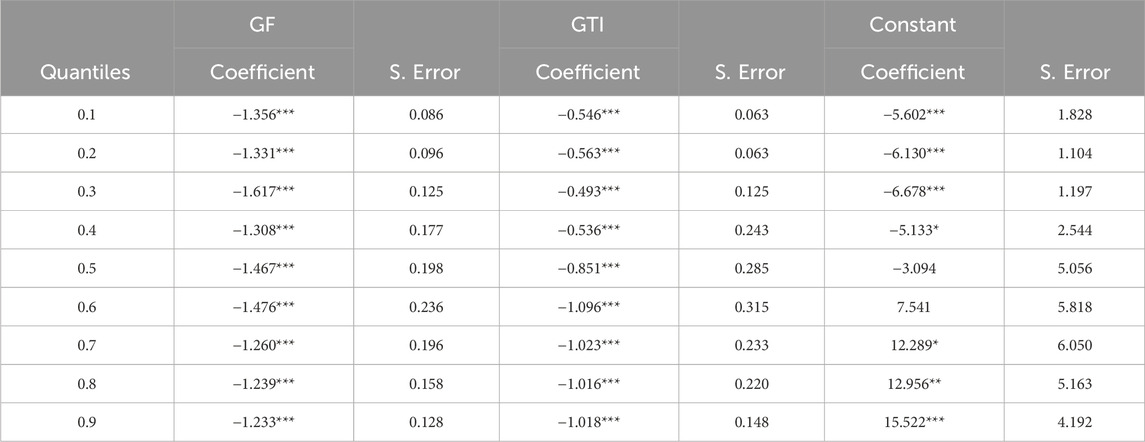

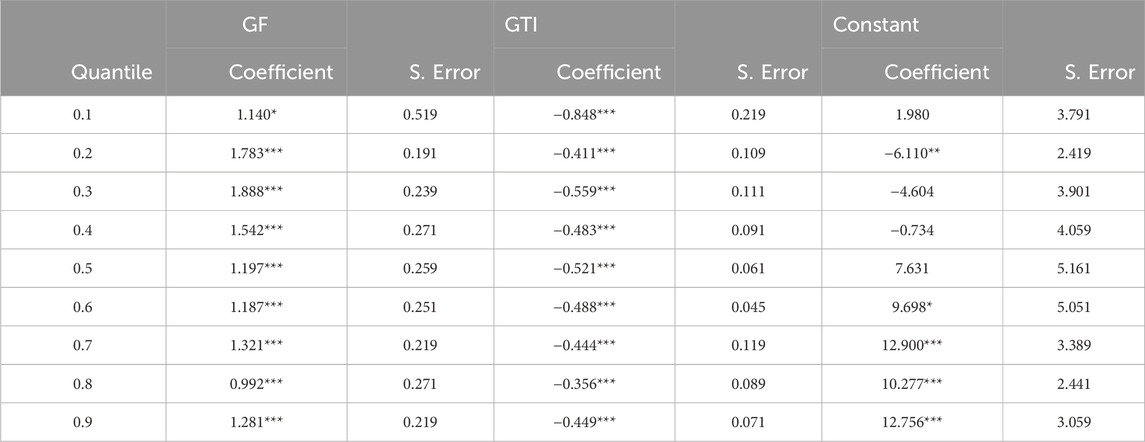

Table 9 PQR results explain how GF and GTI, affect the EP. For a comprehensive analysis of the impact of GF on EP, the study used numerous quintiles for a comprehensive analysis. Moreover, since PQR models an entire conditional distribution, it allows for an exploration of the effects of I.V. on the D.V. simply because the quintiles show a diverse set of effects in an individual conditional distribution. A PQR analysis also examines hidden heterogeneity across all cross-sections and assesses the slope coefficients for different quantiles corresponding to the various cross-sections (Amin et al., 2020). Additionally, decision-makers should keep in mind the value of the coefficient at the level of the distribution.

Table 10 has been placed as a second choice or robustness check estimator. The results in the quintiles show the effect of green finance and green technology innovation on CO2 emission (EP). The quintiles for green finance are negative and statistically significant which determines that with green finance initiatives in cities in China, the amount of CO2 emission is reduced which contributes to the environmental quality of China. All quintiles regarding GF are statistically significant. Likewise, the results in numerous quintiles for green technology innovation on CO2 emission (EP). The quintiles for green finance are negative and statistically significant and also show statistically significant coefficients with negative signs which confirm the negative impact of GTI on CO2 emission, implying that an increase in green technology innovation on CO2 emission (EP). The quintiles for green finance are negative and statistically significant leading to an improvement in Environmental Performance.

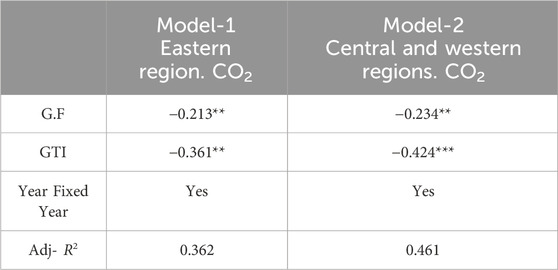

Tabel 11 the heterogeneity was assessed based on dividing the firms in the Eastern region and Central and Western regions firms. Our results displayed that terms of both green finance and green technology innovation are some how same in both panels, i.e., eastern region, Central and western regions or cities as both green finance and green technology innovation reduce CO2 emission which indicates that both regions in regards to its cities contribute to the regional environmental quality. Hence it is assumed and obtained that there are favoring results for both green finance and green technology innovation in both regional penal documents that heterogeneity does not exist in our data. The results are some how same in both panels for the Eastern region and Central and Western regions, which documented that there is no such bigger issue of heterogeneity in the data of these firms. Hence, our results would have no spurious coefficients.

5 Discussion based on the results

The findings of the study revealed that green financial performance has a negative impact on CO2 emission which means that GF enhances environmental quality. While exploring the paradox of these kinds of variables, Ji and Zhang (2019) also validated the efforts of firms to enhance their growth through green initiatives, as these initiatives bolster the environmental performance of the country by mitigating the adverse impact of CO2 emission. The study supports the implementation of green instruments like green bonds and green loans, which serve to enhance and advance environmental sustainability efforts. Likewise, Falcone and Sica (2019), also validated that financial institutions can play a significant role in bolstering the financial capacity of small and medium-size businesses by offering green finance facilities. This, in turn, enables these businesses to effectively tackle challenges related to carbon dioxide emissions and mitigate the adverse effects of environmental degradation on the economy. Furthermore, the research conducted by JinRu and Qamruzzaman (2022) revealed that green finance has the potential to bolster environmental performance within an economy. According to the results obtained from the research conducted, it has been demonstrated that the performance of green technologies is possitively correlated with the performance of the environment due to its negative impact on CO2 emission meaning that green practices and renewable energy reduce CO2 emissions (Rehman et al., 2021b). In addition, Chege and Wang (2020) pointed out that green technology innovation has a positive impact on environmental performance. Zhang et al., 2022a also argued that green technology innovations can be vital to enhancing environmental quality. Likewise, Pofoura et al. (2021) argued that green business practices help in reducing CO2 emissions. Through the use of efficient technologies, energy transition, eco-friendly raw materials, and green human resources management, an organization with green technology innovation can overcome the problems associated with environmental degradation. Furthermore, Raihan (2023) also highlighted that in countries where industrialization is growing, rapid technological modernization contributes to increasing energy efficiency that improve the sustainability of the environment.

6 Conclusion

Due to intense efforts for the attainment of environmental milestones, countries like China also emphasize achieving environmental heights. This ambition has made China enhance greener practices. Hence we explored the impact of green finance and green technology on environmental performance, using green finance instruments in the form of indexes, i.e., green credit, green securities, green investments, and green loans, on the different firms in different cities’ environmental performance. Our findings proved that green financial instruments are very effective in achieving environmental milestones in different cities, hence one of our hypotheses is achieved which means the accomplishment of one of our study objectives. This notion proved that green initiatives in Chinese cities turn the environmental quality table in favor of environmental regulatory bodies. Our results also validated the importance of green technology in bolstering the Chinese environmental performance at both central and western cities firms as well as industry levels that resultantly help in the quality environment, hence our second hypothesis and corresponding objective is achieved regarding the relationship between Green Technology Innovation and Environmental Performance. Thus our study proved that green finance and green technologies are considerably important due to their impactful contribution to the environmental performance of numerous cities resultantly improve the Chinese environmental quality. This notion proved to achieve the objectives of our study.

Based on the findings, it is advised that the financial institutions in China located in different cities should extend the services and volume of green services to the industrial units as well as households to assist the bodies involved in the concerned tasks of achieving city-level environmental quality. Chinese city-level administration should draw certain parameters for the industries and reward system to enhance the arsenals of greener practices. Moreover, due to the significant impact of green technologies in Chinese cities, the government should focus on investment in green technologies to obtain green output efficiency and green environmental milestones as these would directly impact the eco-friendly economic milestones of China. The environmental regulatory bodies should reward banks for providing green loans and consistently put their robust share in the Chinese green strategic framework. Firms should be encouraged and help out in the transition to green technology to enhance green total factor productivity. Certain limitations were witnessed in the data span for green finance parameters and greener technology as green finance is a very new emerging trend in the developing world.

Studies in the future should explore separate panels of at least the top ten cities of China to identify the magnitude of difference in terms of these variables’ relationship and also make separate industry-level panels in these cities to conduct a robust and comprehensive study. Moreover, polluted and non-polluted firms should also be assessed in similar future studies.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

LJ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Supervision, Software, Visualization, Project administration, Writing–original draft. MZ: Conceptualization, Formal Analysis, Investigation, Resources, Supervision, Writing–original draft, Methodology, Validation, Writing–review and editing, Visualization. AR: Conceptualization, Methodology, Data-curation, Formal-analysis, Funding-acquisition, Validation, Investigation, Software, Visualization, Writing–review and editing. KU: Conceptualization, Supervision, Methodology, Formal-analysis, Validation, Investigation, Funding-acquisition, Supervision, Software, Resources, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., and Dogan, E. (2022). The impacts of organizational green culture and corporate social responsibility on employees’ responsible behaviour towards the society. Environ. Sci. Pollut. Res. 29 (40), 60024–60034. doi:10.1007/s11356-022-20072-w

Ahmed, Z., Ahmad, M., Murshed, M., Shah, M. I., Mahmood, H., and Abbas, S. (2022). How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res. 112, 105–115. doi:10.1016/j.gr.2022.09.014

Aizawa, M., and Yang, C. (2010). Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J. Environ. Dev. 19 (2), 119–144. doi:10.1177/1070496510371192

Akram, R., Majeed, M. T., Fareed, Z., Khalid, F., and Ye, C. (2020). Asymmetric effects of energy efficiency and renewable energy on carbon emissions of BRICS economies: evidence from nonlinear panel autoregressive distributed lag model. Environ. Sci. Pollut. Res. 27 (15), 18254–18268. doi:10.1007/s11356-020-08353-8

Alola, A. A., Ozturk, I., and Bekun, F. V. J. E. P. (2021). Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa? A myth or reality. Energy Policy 158, 112520. doi:10.1016/j.enpol.2021.112520

Amin, A., Dogan, E., and Khan, Z. (2020). The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci. Total Environ. 740, 140127. doi:10.1016/j.scitotenv.2020.140127

Appannan, J. S., Mohd Said, R., Ong, T. S., and Senik, R. (2023). Promoting sustainable development through strategies, environmental management accounting and environmental performance. Bus. Strategy Environ. 32 (4), 1914–1930. doi:10.1002/bse.3227

Baldi, F., and Pandimiglio, A. (2022). The role of ESG scoring and greenwashing risk in explaining the yields of green bonds: a conceptual framework and an econometric analysis. Glob. Finance J. 52, 100711. doi:10.1016/j.gfj.2022.100711

Carrión-Flores, C. E., and Innes, R. (2010). Environmental innovation and environmental performance. J. Environ. Econ. Manag. 59 (1), 27–42. doi:10.1016/j.jeem.2009.05.003

Chege, S. M., and Wang, D. (2020). The influence of technology innovation on SME performance through environmental sustainability practices in Kenya. Technol. Soc. 60, 101210. doi:10.1016/j.techsoc.2019.101210

Chen, R., Ramzan, M., Hafeez, M., and Ullah, S. (2023). Green innovation-green growth nexus in BRICS: does financial globalization matter? J. Innovation Knowl. 8 (1), 100286. doi:10.1016/j.jik.2022.100286

Chudik, A., and Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econ. 188 (2), 393–420. doi:10.1016/j.jeconom.2015.03.007

Cui, Y., Yang, L., Shi, L., Liu, G., and Wang, Y. (2022). Cleaner production indicator system of petroleum refining industry: from life cycle perspective. J. Clean. Prod. 355, 131392. doi:10.1016/j.jclepro.2022.131392

Daly, H. E. (1970). The population question in northeast Brazil: its economic and ideological dimensions. Econ. Dev. Cult. Change 18 (4), 536–574. doi:10.1086/450452

Doğan, B., Shahbaz, M., Bashir, M. F., Abbas, S., and Ghosh, S. (2023). Formulating energy security strategies for a sustainable environment: evidence from the newly industrialized economies. Renew. Sustain. Energy Rev. 184, 113551. doi:10.1016/j.rser.2023.113551

Du, C., Zhang, Q., and Huang, D. (2023). Environmental protection subsidies, green technology innovation and environmental performance: evidence from China’s heavy-polluting listed firms. Plos one 18 (2), e0278629. doi:10.1371/journal.pone.0278629

Falcone, P. M., and Sica, E. (2019). Assessing the opportunities and challenges of green finance in Italy: an analysis of the biomass production sector. Sustainability 11 (2), 517. doi:10.3390/su11020517

Ghisetti, C., and Pontoni, F. (2015). Investigating policy and R&D effects on environmental innovation: a meta-analysis. Ecol. Econ. 118, 57–66. doi:10.1016/j.ecolecon.2015.07.009

Gray, W. B., and Shadbegian, R. J. (2003). Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 46 (3), 384–402. doi:10.1016/s0095-0696(03)00031-7

Guang-Wen, Z., and Siddik, A. B. (2022). Do corporate social responsibility practices and green finance dimensions determine environmental performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 10, 890096. doi:10.3389/fenvs.2022.890096

Haller, S. A., and Murphy, L. (2012). Corporate expenditure on environmental protection. Environ. Resour. Econ. 51, 277–296. doi:10.1007/s10640-011-9499-1

Hao, Y., and Chen, P. (2023). Do renewable energy consumption and green innovation help to curb CO2 emissions? Evidence from E7 countries. Environ. Sci. Pollut. Res. 30 (8), 21115–21131. doi:10.1007/s11356-022-23723-0

Høgevold, N. M., Svensson, G., Rodriguez, R., and Eriksson, D. (2019). Relative importance and priority of TBL elements on the corporate performance. Manag. Environ. Qual. Int. J. 30 (3), 609–623. doi:10.1108/meq-04-2018-0069

Hsu, C.-C., Quang-Thanh, N., Chien, F., Li, L., and Mohsin, M. (2021). Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 28 (40), 57386–57397. doi:10.1007/s11356-021-14499-w

Huang, J., An, L., Peng, W., and Guo, L. (2023). Identifying the role of green financial development played in carbon intensity: evidence from China. J. Clean. Prod. 408, 136943. doi:10.1016/j.jclepro.2023.136943

Huang, W., Chau, K. Y., Kit, I. Y., Nureen, N., Irfan, M., and Dilanchiev, A. (2022). Relating sustainable business development practices and information management in promoting digital green innovation: evidence from China. Front. Psychol. 13, 930138. doi:10.3389/fpsyg.2022.930138

Indriastuti, M., and Chariri, A. (2021). The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus. Manag. 8 (1), 1960120. doi:10.1080/23311975.2021.1960120

Jahanger, A., and Usman, M. (2023). Investigating the role of information and communication technologies, economic growth, and foreign direct investment in the mitigation of ecological damages for achieving sustainable development goals. Eval. Rev. 47 (4), 653–679. doi:10.1177/0193841x221135673

Ji, Q., and Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047

Jiakui, C., Abbas, J., Najam, H., Liu, J., and Abbas, J. (2023). Green technological innovation, green finance, and financial development and their role in green total factor productivity: empirical insights from China. J. Clean. Prod. 382, 135131. doi:10.1016/j.jclepro.2022.135131

JinRu, L., and Qamruzzaman, M. (2022). Nexus between environmental innovation, energy efficiency, and environmental sustainability in G7: what is the role of institutional quality? Front. Environ. Sci. 10, 860244. doi:10.3389/fenvs.2022.860244

Koenker, R. (2004). Quantile regression for longitudinal data. J. Multivar. analysis 91 (1), 74–89. doi:10.1016/j.jmva.2004.05.006

Kraus, S., Rehman, S. U., and García, F. J. S. (2020). Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 160, 120262. doi:10.1016/j.techfore.2020.120262

Lashitew, A. A., van Tulder, R., and Liasse, Y. (2019). Mobile phones for financial inclusion: what explains the diffusion of mobile money innovations? Res. policy 48 (5), 1201–1215. doi:10.1016/j.respol.2018.12.010

Lazaro, L., Grangeia, C., Santos, L., and Giatti, L. (2023). What is green finance, after all? Exploring definitions and their implications under the Brazilian biofuel policy (RenovaBio). J. Clim. Finance 2, 100009. doi:10.1016/j.jclimf.2023.100009

Lee, C.-C., and Lee, C.-C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Li, G., Xue, Q., and Qin, J. (2022). Environmental information disclosure and green technology innovation: empirical evidence from China. Technol. Forecast. Soc. Change 176, 121453. doi:10.1016/j.techfore.2021.121453

Li, L., and Li, W. (2022). The promoting effect of green technology innovations on sustainable supply chain development: evidence from China’s transport sector. Sustainability 14 (8), 4673. doi:10.3390/su14084673

Li, Y., Zhou, M., Sun, H., and Liu, J. (2023). Assessment of environmental tax and green bonds impacts on energy efficiency in the European Union. Econ. Change Restruct. 56 (2), 1063–1081. doi:10.1007/s10644-022-09465-6

Liang, H., Wang, F., Yang, L., Cheng, Z., Shuai, Y., and Tan, H. (2021). Progress in full spectrum solar energy utilization by spectral beam splitting hybrid PV/T system. Renew. Sustain. Energy Rev. 141, 110785. doi:10.1016/j.rser.2021.110785

Long, W., Luo, L., Sun, H., and Zhong, Q. (2023). Does going abroad lead to going green? Firm outward foreign direct investment and domestic environmental performance. Bus. Strategy Environ. 32 (1), 484–498. doi:10.1002/bse.3156

López, R., and Palacios, A. (2014). Why has Europe become environmentally cleaner? Decomposing the roles of fiscal, trade and environmental policies. Environ. Resour. Econ. 58, 91–108. doi:10.1007/s10640-013-9692-5

López-Menéndez, A. J., Pérez, R., and Moreno, B. (2014). Environmental costs and renewable energy: Re-visiting the environmental kuznets curve. J. Environ. Manag. 145, 368–373. doi:10.1016/j.jenvman.2014.07.017

Luo, E. (2020). Fiscal incentives, green technology innovation and corporate environmental performance. Commun. Financ. Acc. 20, 46–49. doi:10.1080/24725854.2021.1912440

Mirzaei, S., and Shokouhyar, S. (2023). Applying a thematic analysis in identifying the role of circular economy in sustainable supply chain practices. Environ. Dev. Sustain. 25 (5), 4691–4722. doi:10.1007/s10668-022-02217-6

Moreno, J., Van de Ven, D.-J., Sampedro, J., Gambhir, A., Woods, J., and Gonzalez-Eguino, M. (2023). Assessing synergies and trade-offs of diverging Paris-compliant mitigation strategies with long-term SDG objectives. Glob. Environ. Change 78, 102624. doi:10.1016/j.gloenvcha.2022.102624

Nyangchak, N. (2022). Emerging green industry toward net-zero economy: a systematic review. J. Clean. Prod. 378, 134622. doi:10.1016/j.jclepro.2022.134622

Ouyang, L., Zhu, S., Ye, K., Park, C., and Wang, M. (2022). Robust Bayesian hierarchical modeling and inference using scale mixtures of normal distributions. IISE Trans. 54 (7), 659–671. doi:10.1080/24725854.2021.1912440

Pei, W., and Pei, W. (2022). Empirical study on the impact of government environmental subsidies on environmental performance of heavily polluting enterprises based on the regulating effect of internal control. Int. J. Environ. Res. Public Health 20 (1), 98. doi:10.3390/ijerph20010098

Peng, H., Shen, N., Ying, H., and Wang, Q. (2021). Can environmental regulation directly promote green innovation behavior? based on situation of industrial agglomeration. J. Clean. Prod. 314, 128044. doi:10.1016/j.jclepro.2021.128044

Pofoura, A. K., Sun, H., Mensah, I. A., and Liu, F. (2021). How does eco-innovation affect CO2 emissions? Evidence from Sub-Saharan Africa. J. Environ. Assess. Policy Manag. 23 (03n04), 2250017. doi:10.1142/s146433322250017x

Raihan, A. (2023). Nexus between greenhouse gas emissions and its determinants: the role of renewable energy and technological innovations towards green development in South Korea. Innovation Green Dev. 2 (3), 100066. doi:10.1016/j.igd.2023.100066

Rehman, A., Ullah, I., Afridi, F.-e.-A., Ullah, Z., Zeeshan, M., Hussain, A., et al. (2021a). Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modelling. Environ. Dev. Sustain. 23, 13200–13220. doi:10.1007/s10668-020-01206-x

Rehman, S. U., Kraus, S., Shah, S. A., Khanin, D., and Mahto, R. V. (2021b). Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol. Forecast. Soc. Change 163, 120481. doi:10.1016/j.techfore.2020.120481

Shao, Y., and Chen, Z. (2022). Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Economic Analysis and Policy. 74, 716–727. doi:10.1016/j.eap.2022.03.020

Serrano-García, J., Llach, J., Bikfalvi, A., and Arbeláez-Toro, J. J. (2023). Performance effects of green production capability and technology in manufacturing firms. J. Environ. Manag. 330, 117099. doi:10.1016/j.jenvman.2022.117099

Sharif, A., Saqib, N., Dong, K., and Khan, S. A. R. (2022). Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustain. Dev. 30, 1934–1946. doi:10.1002/sd.2360

Shi, J., Yu, C., Li, Y., and Wang, T. (2022). Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol. Forecast. Soc. Change 179, 121678. doi:10.1016/j.techfore.2022.121678

Sholeh, M. B., Salija, K., and Nur, S. (2020). Task-Based Learning (TBL) in EFL classroom: from theory to practice. Int. J. Humanit. Innovation (IJHI) 3 (4), 139–144. doi:10.33750/ijhi.v3i4.97

Singh, S. K., Del Giudice, M., Chierici, R., and Graziano, D. (2020). Green innovation and environmental performance: the role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Change 150, 119762. doi:10.1016/j.techfore.2019.119762

Tamasiga, P., Onyeaka, H., and Ouassou, E. H. (2022). Unlocking the green economy in african countries: an integrated framework of FinTech as an enabler of the transition to sustainability. Energies 15 (22), 8658. doi:10.3390/en15228658

Tseng, M.-L., Tan, R. R., and Siriban-Manalang, A. B. (2013). Sustainable consumption and production for Asia: sustainability through green design and practice. J. Clean. Prod. 40, 1–5. doi:10.1016/j.jclepro.2012.07.015

Wang, K.-H., Zhao, Y.-X., Jiang, C.-F., and Li, Z.-Z. (2022a). Does green finance inspire sustainable development? Evidence from a global perspective. Econ. Analysis Policy 75, 412–426. doi:10.1016/j.eap.2022.06.002

Wang, S., Zhao, E., and Razzaq, H. K. (2022b). Dynamic role of renewable energy efficiency, natural resources, and climate technologies in realizing environmental sustainability: implications for China. Renew. energy 198, 1095–1104. doi:10.1016/j.renene.2022.08.083

Wang, X., and Wang, Q. (2021). Research on the impact of green finance on the upgrading of China's regional industrial structure from the perspective of sustainable development. Resour. Policy 74, 102436. doi:10.1016/j.resourpol.2021.102436

Weinhofer, G., and Hoffmann, V. H. (2010). Mitigating climate change–how do corporate strategies differ? Bus. Strategy Environ. 19 (2), 77–89. doi:10.1002/bse.618

Westerlund, J., and Edgerton, D. L. (2007). A panel bootstrap cointegration test. Econ. Lett. 97 (3), 185–190. doi:10.1016/j.econlet.2007.03.003

Xie, X., Han, Y., and Hoang, T. T. (2022). Can green process innovation improve both financial and environmental performance? The roles of TMT heterogeneity and ownership. Technol. Forecast. Soc. Change 184, 122018. doi:10.1016/j.techfore.2022.122018

Yang, T., Li, F., Du, M., Huang, M., and Li, Y. (2023). Impacts of alternative energy production innovation on reducing CO2 emissions: Evidence from China. Energy 268, 126684. doi:10.1016/j.energy.2023.126684

Yan, X., and Zhang, Y. (2021). The effects of green innovation and environmental management on the environmental performance and value of a firm: an empirical study of energy-intensive listed companies in China. Environ. Sci. Pollut. Res. 28, 35870–35879. doi:10.1007/s11356-021-12761-9

Yang, Q., Liu, G., Casazza, M., Dumontet, S., and Yang, Z. (2022). Ecosystem restoration programs challenges under climate and land use change. Sci. total Environ. 807, 150527. doi:10.1016/j.scitotenv.2021.150527

Yang, X., Wang, J., Cao, J., Ren, S., Ran, Q., and Wu, H. (2021). The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir. Econ. 63, 847–875. doi:10.1007/s00181-021-02151-y

Yu, B., Li, C., Mirza, N., and Umar, M. (2022). Forecasting credit ratings of decarbonized firms: comparative assessment of machine learning models. Technol. Forecast. Soc. Change 174, 121255. doi:10.1016/j.techfore.2021.121255

Zameer, H., Wang, Y., Vasbieva, D. G., and Abbas, Q. (2021). Exploring a pathway to carbon neutrality via reinforcing environmental performance through green process innovation, environmental orientation and green competitive advantage. J. Environ. Manag. 296, 113383. doi:10.1016/j.jenvman.2021.113383

Zeeshan, M., Han, J., Rehman, A., Ullah, I., and Afridi, F. E. A. (2021a). Exploring asymmetric nexus between CO2 emissions, environmental pollution, and household health expenditure in China. Risk Manag. Healthc. Policy 14, 527–539. doi:10.2147/rmhp.s281729

Zeeshan, M., Han, J., Rehman, A., Ullah, I., Afridi, F. E. A., and Fareed, Z. (2022). Comparative analysis of trade liberalization, CO2 emissions, energy consumption and economic growth in southeast asian and Latin American regions: a structural equation modeling approach. Front. Environ. Sci. 79, 854590. doi:10.3389/fenvs.2022.854590

Zeeshan, M., Han, J., Rehman, A., Ullah, I., and Alam Afridi, F. E. (2021b). Exploring determinants of financial system and environmental quality in high-income developed countries of the world: the demonstration of robust penal data estimation techniques. Environ. Sci. Pollut. Res. 28 (43), 61665–61680. doi:10.1007/s11356-021-15105-9

Zeeshan, M., Han, J., Rehman, A., Ullah, I., and Mubashir, M. (2022b). Exploring the role of information communication technology and renewable energy in environmental quality of south-east Asian emerging economies. Front. Environ. Sci. 10, 917468. doi:10.3389/fenvs.2022.917468

Zhang, H., Shao, Y., Han, X., and Chang, H.-L. (2022a). A road towards ecological development in China: the nexus between green investment, natural resources, green technology innovation, and economic growth. Resour. Policy 77, 102746. doi:10.1016/j.resourpol.2022.102746

Zhang, H., Wang, Y., Li, R., Si, H., and Liu, W. (2023). Can green finance promote urban green development? Evidence from green finance reform and innovation pilot zone in China. Environ. Sci. Pollut. Res. 30 (5), 12041–12058. doi:10.1007/s11356-022-22886-0

Zhang, L., Xu, M., Chen, H., Li, Y., and Chen, S. (2022b). Globalization, green economy and environmental challenges: state of the art review for practical implications. Front. Environ. Sci. 10, 870271. doi:10.3389/fenvs.2022.870271

Zhang, Y. (2022). How economic performance of OECD economies influences through green finance and renewable energy investment resources? Resour. Policy 79, 102925. doi:10.1016/j.resourpol.2022.102925

Zheng, Z., Ning, L., Dai, D., Chen, L., Wang, Y., Ma, Z., et al. (2022). Water budget variation, groundwater depletion, and water resource vulnerability in the Haihe River Basin during the new millennium. Phys. Chem. Earth, Parts A/B/C 126, 103141. doi:10.1016/j.pce.2022.103141

Keywords: sustainability, environmental regulation, green technology adoption, cross-sectional ARDL, China

Citation: Jinping L, Zeeshan M, Rehman A and Uktamov K (2024) A green revolution in the making: integrating environmental performance and green finance for China’s sustainable development. Front. Environ. Sci. 12:1388314. doi: 10.3389/fenvs.2024.1388314

Received: 19 February 2024; Accepted: 05 June 2024;

Published: 30 July 2024.

Edited by:

Tian Tang, Florida State University, United StatesReviewed by:

Zheming Yan, Xi’an Jiaotong University, ChinaYuanyuan Hao, Jiangsu University of Technology, China

Copyright © 2024 Jinping, Zeeshan, Rehman and Uktamov. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li Jinping, MTgzNDI5MTcwNjlAMTYzLmNvbQ==; Muhammad Zeeshan, c2hhbnplZWxudHUxOTIyQGdtYWlsLmNvbQ==

Li Jinping

Li Jinping Muhammad Zeeshan

Muhammad Zeeshan Alam Rehman3

Alam Rehman3