94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

POLICY AND PRACTICE REVIEWS article

Front. Environ. Sci., 26 July 2024

Sec. Environmental Policy and Governance

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1387138

This article is part of the Research TopicGreen Finance & Carbon Neutrality: Strategies and Policies for a Sustainable FutureView all 35 articles

Limiting global warming to close to 1.5°C by 2100 requires deep and rapid greenhouse gas emission reductions and carbon dioxide removals (CDR) on a massive scale, presenting a remarkable scaling challenge. This paper focuses on the financing of bioenergy with carbon capture and storage (BECCS) in Sweden. BECCS is one of the most prominent CDR methods in 1.5°C-compatible global emission scenarios and has been assigned a specific role in Swedish policy for net-zero. A Swedish state support system for BECCS based on results-based payments is planned. Furthermore, demand for CDR-based carbon credits is on the rise on the voluntary carbon markets (VCM) for use towards voluntary mitigation targets. Risks involved with the current Swedish policies are analysed, specifically for the co-financing of BECCS by the planned state support and revenues from the VCM. We find that with the current policies, state support systems will subsidise carbon credit prices on the VCM. We argue that such subsidisation can lower decarbonisation efforts by lowering the internal carbon price set by actors, thus undermining environmental integrity. It is concluded that proportional attribution should be applied, i.e., attributing mitigation outcomes to the state support and VCM revenue in proportion to their financial contribution to the CDR achieved. The attribution analysis should be accompanied by adjustments in national greenhouse gas accounting so that mitigation outcomes that are issued as carbon credits and used for offsetting are not double claimed (i.e., not used by both a nation and a non-state actor on the VCM towards their respective mitigation targets). If proportional attribution and adjustments in national GHG accounting are not implemented, the credibility and environmental integrity of offsetting claims made by carbon credit users are eroded. We recommend that action is taken to operationalise and implement proportional attribution to allow for co-financing of BECCS projects while maintaining environmental integrity. Wider implications for our recommendations beyond the case of Swedish BECCS are also analysed.

The IPCC AR6 WGIII report analyses scenarios which limit global warming to 1.5°C by 2100, emphasising the need for rapid and deep greenhouse gas (GHG) reductions and achieving global net-zero CO2 emissions by mid-century (IPCC, 2022). These scenarios rely on substantial carbon dioxide removal (CDR) for three purposes, namely i) to reduce net emissions from current levels faster, ii) to counterbalance residual emissions in order to enable net-zero emissions, and iii) for achieving global net-negative emissions in order to achieve the 1.5°C goal by 2100, even with a temporary overshoot. The annual rates of carbon removal projected for the end of the century approach half of the prevailing global CO2 emissions, which underscores the imperative nature and substantial significance of CDR in achieving the 1.5°C target stipulated in the Paris Agreement (IPCC, 2022).

Current financing for CDR is not enough, as evident by the so-called CDR gap, illustrating the difference between actual and necessary CDR deployment to reach the temperature target of the Paris Agreement (Smith et al., 2023). Previous studies have raised the question “who shall pay for CDR?” (Honegger et al., 2021; Zetterberg et al., 2021; Hickey et al., 2023; Honegger, 2023). To date, private voluntary funding has been the main source of funding for CDR (Honegger, 2023). However, the majority of currently operational mechanisms in carbon markets mainly support lower-cost conventional CDR methods that build on so-called nature-based solutions (Hickey et al., 2023), while novel (non-nature-based) CDR methods with more durable carbon storage have received less financing. In the most recent years, government financing schemes are being prepared and deployed to promote deployment of novel CDR methods, for example, in Denmark, Norway, Sweden, the United Kingdom, and the US (DESNZ, 2023; Grupert and Talati, 2023; Hickey et al., 2023; Möllersten et al., 2023). Without a significant growth in financing, CDR will fail to scale sufficiently. Therefore, an “all hands on deck” approach features in policy discussions, where both public and private finance can contribute to upscaling CDR (Honegger et al., 2021; Honegger, 2023; Möllersten and Zetterberg, 2023).

While governments must take the main responsibility for the timely funding and scaling of CDR within compliance frameworks, private funding through the voluntary carbon markets (VCM) can make important contributions in terms of creating early market demand signals and trigger investment (Allen et al., 2020; Bernasconi, 2021; Honegger, 2023; Puro.earth, 2023). Non-state actors such as corporations are increasingly engaging in voluntary climate target setting (Net Zero Tracker, 2024; SBTi, 2024), including the use of carbon credits as part of voluntary targets (Blaufelder et al., 2020). Moreover, there is a demand-shift on the VCM towards carbon credits representing durable CDR (Donofrio and Procton, 2023; Michaelowa et al., 2023). The demand for such carbon credits can be expected to grow, since an increasing number of standard-setters and scholars are demanding offsetting based on permanent CDR specifically in the context of net-zero claims (Allen et al., 2020; SBTi, 2021; Fankhauser et al., 2022; ISO, 2022; Race to Zero, 2022; United Nations, 2022). The demand-shift and a projected growth of the VCM (TSVCM, 2021; Chyka, 2023) combined, make the VCM a future potentially significant contributor to CDR financing and CDR gap closure. Initial VCM transactions involving bioenergy with carbon capture and storage (BECCS) include Microsoft entering into off-take agreements for carbon credits with Danish Ørsted and Swedish Stockholm Exergi (Romm, 2023; Beccs Stockholm, 2024).

This paper explores challenges associated with the interaction between public results-based finance and VCM finance for BECCS, one of the most prominent CDR methods in IPCC scenarios compatible with attaining the Paris Agreement long-term target. Sweden has been selected for the study. The Swedish government is preparing the introduction of results-based state support for CDR from BECCS (Government of Sweden, 2023). At the same time, a large number of private actors are pursuing preparations to actively participate as sellers of BECCS carbon credits on the VCM (Fridahl and Lundberg, 2021; Beccs Stockholm, 2023). Historically, the VCM have primarily sourced carbon credits in jurisdictions without formal national GHG mitigation obligations and typically only the carbon credit buyers have had an interest in claiming the underlying mitigation outcome (Hermwille and Kreibich, 2016). The co-financing of projects that combine government support with VCM finance for the same mitigation outcome, in a setting with national GHG mitigation targets, is a relatively new and untested situation. However, such situations are becoming increasingly common since the Paris Agreement entered into force (Ahonen et al., 2022). In the Swedish context, a policy discussion has surfaced which centres around the Swedish state’s and carbon credit buyers’ respective rights to claim the mitigation outcomes from co-financed BECCS projects. A main area of contention in the discussion is whether the double claiming of mitigation outcomes towards existing national and corporate mitigation targets should be eligible (Möllersten and Zetterberg, 2023). “Double claiming” refers to a situation where the same emission reduction or carbon removal (i.e., the same mitigation outcome) is claimed by two different entities or for two different purposes, for example, for two different targets (Schneider and La Hoz Theuer, 2019). In this case, the double claiming would occur between the Swedish state claiming the mitigation outcome towards the Swedish national target and a carbon credit buyer claiming the mitigation outcome towards its voluntary climate target. Environmental integrity risks associated with the policy choice of whether or not to allow double claiming have already been analysed in the literature (Kreibich and Hermwille, 2021; Ahonen et al., 2022; Ahonen et al., 2023). In the context of co-financing and double claiming of mitigation outcomes, based on a literature review, we identify an environmental integrity risk that has previously not been addressed in the literature and propose how the risk may be avoided.

In section 2, we outline the evolution of the VCM from the Kyoto era until now in order to provide a background on the rationale for the use of carbon credits for offsetting and the current Swedish policy debate. In section 3, we introduce the case study of Sweden, specifically the BECCS potential and recent developments of the Swedish policy context related to government BECCS support and the VCM. In section 4, we analyse environmental integrity risks associated with the current Swedish policies and suggest alternative pathways. In section 5, actionable recommendations are presented based on the Swedish case-study.

Carbon credit markets, established under the Kyoto Protocol through baseline and credit mechanisms, were introduced to enhance flexibility and cost-efficiency of compliance for developed countries with quantified GHG mitigation commitments (Ahonen et al., 2022). Two project-based mechanisms, namely the Clean Development Mechanism (CDM) and the Joint Implementation (JI), facilitated international transfer of mitigation outcomes. This meant that a “buyer country” could contribute to financing mitigation projects in another “host country” through the purchase of carbon credits, and that the buyer country could count the mitigation outcome towards its own Kyoto mitigation commitment, thus achieving part of its goal outside national boundaries (Michaelowa et al., 2019). The atmosphere sees no national boundaries, meaning that the same climate benefit could be achieved anywhere where there is mitigation potential. It would thus be economically rational to use international transfer mechanisms if mitigation outside the buyer country’s national borders was more cost-efficient. The CDM was a mechanism where host countries were developing countries without quantified GHG mitigation commitments, and the JI was a mechanism in which both the buyer country and the host country had quantified mitigation commitments (Michaelowa et al., 2019).

Both the CDM and the JI emphasised the importance of maintaining environmental integrity during international transfer of mitigation outcomes in the sense that meeting a Kyoto mitigation commitment through an international transfer would not result in a global increase of emissions compared to if the commitment was met without the international transfer (Schneider, 2009). Phrased differently, if the global net GHG emissions to the atmosphere would be lower if a buyer country reached its commitment within national borders and thus without any international transfer, the environmental integrity of the mechanisms could be questioned. Key provisions for ensuring environmental integrity included establishing conservative baselines, demonstrating additionality and preventing double counting (Schneider et al., 2015; Michaelowa et al., 2019). If the mitigation project would not have happened without the opportunity for revenue from the sale of carbon credits, the project was deemed additional. Additionality was thus important to ensure that carbon finance would not be wasted on projects that would have been realised either way. To avoid double claiming, a form of double counting, the CDM and the JI necessitated different approaches. Double claiming effectively undermines the environmental integrity of international transfer mechanisms, since the global net GHG emissions would have been lower if both countries had achieved their targets inside national boundaries, i.e., without international transfers. For the JI, where both the buyer country and the host country had mitigation commitments, double claiming was avoided through the surrender of assigned amount units (AAUs), which meant that only the buyer country would count the mitigation towards its commitment (Ahonen et al., 2022). Under the CDM, which was also the most successful mechanism in terms of total international transfers, double claiming was a non-issue, since only the buying country had a GHG mitigation commitment, while the host country did not have any quantified target to count the mitigation towards.

Private carbon crediting standards emerged in parallel with the Kyoto mechanisms to cater to demand for credits from the VCM (Ahonen et al., 2022). Despite lacking international oversight, the emerging VCM broadly embraced the principles for safeguarding environmental integrity observed in compliance markets, including additionality and avoidance of double counting (Kreibich and Hermwille, 2021). This meant that, effectively, while international carbon trading on compliance markets was a zero-sum game, the legitimacy of offsetting claims on the VCM required that the use of carbon credits should contribute to increased global mitigation ambition. This is evident if one considers the following key circumstances: firstly, the voluntary use of carbon credits for offsetting purposes would not be counted towards the mitigation commitment of the offsetting actor’s home country; secondly, the mitigation outcome underlying the carbon credits were additional and, in addition, associated with surrender of AAUs if carbon credits from JI projects were used for the offsetting. In other words, the home country of the offsetting company would not have to do less to comply with its Kyoto commitment and at the same time additional mitigation outcomes would be achieved elsewhere, thus raising global ambition beyond the collective ambition level of national mitigation commitments. Notably, the Voluntary Carbon Standard (VCS), the largest private carbon crediting standard during the time of the Kyoto Protocol, followed the JI principle for projects realised in developed countries, requiring an official document from the host country certifying that an amount of AAUs equivalent to the number of credits to be issued had been cancelled (Kreibich and Hermwille, 2021).

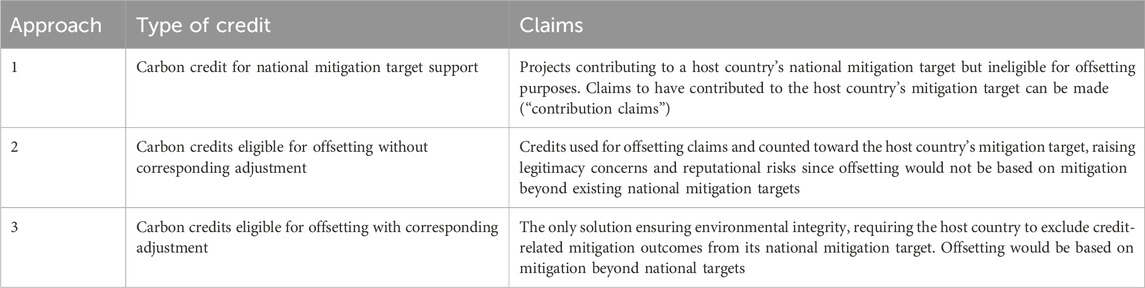

Since the Paris Agreement in 2015, all signatory countries have set climate targets, meaning that mitigation projects in any host country, which is a signatory to the Agreement, could be included in a national mitigation target. Although all countries have mitigation targets, some have opted to adopt targets that are not economy-wide. Therefore, additional mitigation outcomes in a sector outside a national emission target would still constitute a global ambition increase and thus respect the logic on which voluntary use of carbon credits for offsetting purposes was based under the Kyoto era. The same can be said about mitigation outcomes from activities that have not been incorporated in the framework for national GHG inventories, and are thus not visible in national GHG reporting and accounting, meaning that countries cannot report the mitigation towards their target. If, however, the additional mitigation outcome, underlying carbon credits used for voluntary offsetting purposes, belong in a sector that is covered by a national mitigation target, there would be no global ambition increase since the host country could do less to achieve its targets, unless the carbon credit is associated with a “corresponding adjustment” - the Paris equivalent of AAU surrender. Kreibich and Hermwille (2021) have proposed three alternative approaches for the use of carbon credits that are relevant to the case of co-financing of mitigation through results-based state support and carbon credit revenue from the VCM in the context of economy-wide targets, and thus applicable to Sweden, listed in Table 1.

Table 1. Approaches for the use of carbon credits in case of co-financing CDR, adapted from Kreibich and Hermwille (2021).

The categorisation of carbon credit use cases presented in Table 1 provides a conceptual background for understanding the current Swedish policy discussion which is elaborated in section 3.2 Swedish policy for state support for BECCS and its relation to the VCM concerning the interaction between results-based state support for BECCS and the emerging VCM for carbon credits based on CDR. The central issue revolves around whether and why mitigation outcomes should go beyond existing national mitigation targets, i.e., constitute a global ambition increase, when carbon credits based on the same mitigation outcome serve as the foundation for actors’ offsetting claims. Compared to what has been common practice on the VCM, it would constitute a reduction in ambition to transition from requiring offsetting claims only in accordance with approach 3) to also allowing offsetting in line with approach 2) in the above list in Table 1, which is a poignant fact considering the number of stakeholders arguing for allowing approach 2) (see for example, Stockholm Exergi, 2022; Swedenergy, 2022; Stenström et al., 2024). Although this background is required for understanding the current Swedish discussion, stakeholder efforts to increase acceptance for approach 2) is not the main focus of this paper, nor is the truthfulness of claims which has been discussed already in literature (Ahonen et al., 2022; Ahonen et al., 2023; Möllersten and Zetterberg, 2023), but rather previously unidentified effects on voluntary decarbonisation efforts from the current policies regarding co-financing of Swedish BECCS projects.

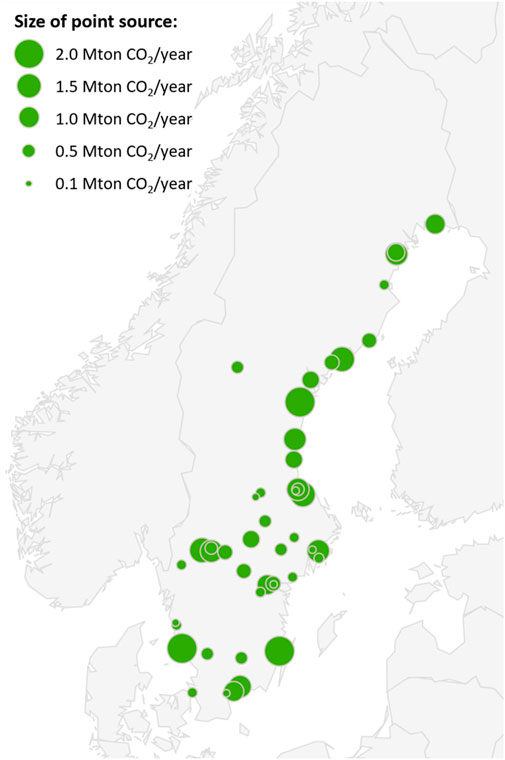

Sweden has a significant potential to capture biogenic CO2 from point source emissions, mainly from the pulp and paper industry and heat and power production (Rodriguez et al., 2021). Based on data from Swedish Environmental Protection Agency (2023), Figure 1 illustrates biogenic point source emissions in Sweden larger than 0.1 Mton CO2 annually. Point sources with a higher share than 10% fossil emissions have been excluded, meaning that waste incineration plants are not included. The rationale for only including point sources with over 90% biogenic emissions is because it is uncertain whether there will be a demand from the VCM for carbon credits from waste incineration plants, or other plants with a relatively high share of fossil emissions. The sum of biogenic emissions from the point sources included in Figure 1 is about 28 Mton CO2 annually. Assuming a 90% carbon capture rate, the biogenic capture potential from these sources amount to about 25 Mton CO2 per year. If instead all point sources above 0.1 Mton CO2 are included, regardless of the biogenic share, the biogenic emissions annually amount to 33 Mton CO2, implying a total biogenic capture potential of 30 Mton CO2 per year.

Figure 1. Biogenic point source emissions in Sweden. Biogenic point sources larger than 0.1 Mton CO2 have been included. Point sources with more than 10% fossil emissions have been excluded. Emissions data from 2022 was used. The sum of all illustrated biogenic point source emissions amount to about 28 Mton CO2. Assuming a capture rate of 90%, the biogenic capture potential from these point sources amount to about 25 Mton CO2 annually.

There is theoretical potential for geological storage of CO2 in Sweden (SGU, 2016), but a combination of lack of experience, regulatory hindrances, such as the HELCOM convention which prohibits geological storage of CO2 in the Baltic Sea, and long lead-times implies that captured CO2 needs to be exported for storage at least in the short-term (SGU, 2016; Fridahl et al., 2020; Möllersten et al., 2023). In close proximity, Norway is pioneering initiatives providing CO2 storage as a service below the North Sea. Furthermore, Denmark is making preparations for CO2 storage on- and off-shore and is increasingly recognized as a prospective geological CO2 storage service provider. Additionally, Iceland is in the preparatory stages to offer services based on in situ CO2 mineralisation, involving its dissolution in water and subsequent injection into basaltic subsurface layers (Möllersten et al., 2023). There are, thus, multiple potential storage places in neighbouring countries where CO2 from Swedish point sources potentially could be sequestered.

The Swedish government is planning for a state support system based on reverse auctions to enable implementation of BECCS (Möllersten and Zetterberg, 2023; Government of Sweden, 2023). In the reverse auctions, the state is the buyer of CDR from BECCS and actors with BECCS potential make bids. The lowest bid per ton of stored CO2 wins, and is granted state support for 15 years to capture and geologically store biogenic carbon dioxide (Government of Sweden, 2023). Thus far, 36 billion Swedish SEK have been allocated towards the support system. The intention is to use the resulting CDR towards national mitigation targets for counterbalancing residual emissions, ultimately to attain net-zero GHG emissions by 2045 at the latest.

The Swedish BECCS support system is being developed against the backdrop of a policy discussion that has already been mentioned briefly in previous sections. Several Swedish companies in the district heating sector who could potentially deploy BECCS have promoted, both individually and jointly through their business organisation Swedenergy, an approach which allows that BECCS mitigation outcomes could be awarded results-based payments from the Swedish state and be counted towards the Swedish national mitigation target, while the same mitigation outcomes would make the basis for issuance of carbon removal credits that could be sold on the VCM to be used by purchasing entities towards offsetting claims. Others, for example, the Swedish Energy Agency and scholars, have argued that such double claims would not be aligned with environmental integrity principles (Möllersten and Zetterberg, 2023). In 2023, a commission of inquiry recommended that the Swedish government should enable the additional private financing of BECCS by abstaining from claiming privately financed CDR from BECCS towards Swedish mitigation targets (Hassler, 2023). Moreover, in the EU beyond Sweden, seven EU member states made a joint statement in December 2023 which conveys the message that the credibility of offsetting claims requires that “The carbon credits represent mitigation outcomes that are not counted by the host country (as part of their national climate targets).” (Government of the Netherlands, 2023).

In December 2023, the Swedish government proposed in its strategic climate action plan that actors receiving state support for BECCS should be allowed to sell carbon removal credits on the VCM (Government of Sweden, 2023). It is stated that Sweden will claim the resulting CDR towards Swedish mitigation targets, contrary to the recommendation by Hassler (2023). It is further suggested that buyers of carbon removal credits should be able to claim the mitigation outcome that they represent towards their own voluntary climate targets. Therefore, it is suggested that the buyers of negative emissions shall make clear in their climate reporting that the negative emission is contributing to Sweden’s possibility to reach its climate targets (Government of Sweden, 2023).

Currently, the most common voluntary climate targets include carbon neutrality and net-zero emissions, typically relying on the voluntary use of carbon credits for offsetting in addition to the mitigation of GHG in the target-setting actors’ value chains (Blaufelder et al., 2020). Since the type of voluntary target eligible to claim the negative emission is not specified by the Swedish government, it cannot be ruled out that the Swedish government finds it appropriate for the carbon removal credits to be used for offsetting purposes. It is, therefore, justified to assume that the Swedish government is willing to support the potential use of carbon removal credits in accordance with approach 2 in Table 1, resulting in double claiming since both a state and an actor purchasing carbon credits on the VCM use the same mitigation outcome towards their respective mitigation targets.

Since BECCS is in its infancy and expected to be expensive with cost range estimates between 100 and 200 USD/ton CO2 towards mid-century (Fuss et al., 2018), sharing the cost with the VCM seems judicious in order to avoid high public expenditures. Even with the lower end cost estimation, the budget of the Swedish support system would yield CDR of 2.4 Mton CO2 annually which is significantly lower than the expected level of residual emissions in 2045 of 10.7 Mton CO2 when Sweden is to reach net-zero emissions (Government of Sweden, 2023). Co-financing without double claiming could be achieved with contribution claims where the carbon credit buyer does not make an offsetting claim but rather communicates that the funding contributes to achieve the Swedish climate targets (i.e., approach 1 in Table 1). However, the demand for carbon credits eligible only for contribution claims is currently unknown. Meanwhile, the demand for offsetting claims is expected to stay strong. Therefore, it seems from the current policies that the Swedish government is hoping that the VCM might help close the financing gap, by accepting double claims (approach 2 in Table 1).

The inclination of the Swedish government to rely on the VCM as a means to help finance CDR necessary to attain the Swedish net-zero target and accept double claiming comes with profound and widespread ramifications. Notably, allowing double claiming of co-financed CDR effectively means that the Swedish state is subsidising the carbon credit price on the VCM (Möllersten and Zetterberg, 2023). This is because the buyer of carbon credits can claim 100% of the mitigation outcome, while financing less than 100% (since part is financed by the state). In section 4.1 Internal carbon price, we will discuss possible implications of subsidised carbon removal credits on voluntary decarbonisation efforts. In section 4.2 Attribution, we suggest an alternative pathway for allowing co-financing of BECCS projects without double claiming, thus enabling the environmental integrity level of approach 3) mentioned in Table 1 to be attained. In section 4.3 Corresponding adjustment, we identify a policy gap that needs to be addressed for the solution suggested in section 4.2 Attribution to become practicable. In section 4.4 Alternative pathways until corresponding adjustments are enabled we suggest how to bridge the policy gap until it is filled, in order to use attribution as a solution.

Putting a price on GHG emissions, commonly known as “carbon pricing”, to internalise the damage of GHG emissions features in many climate policies. In Sweden, a tax on fossil CO2 emissions was introduced in 1991. In 2023, the Swedish CO2 tax was 122 EUR/ton CO2. Since 1990, partly due to the CO2 tax, Swedish emissions have decreased by 33% (Government Offices of Sweden, 2024). Another way of putting a price on GHG emissions is through a cap-and-trade system, such as the European Union (EU) emission trading system (ETS). Since 2005, the EU ETS has contributed to decreasing emissions from power and industry plants by 37% (European Commission, 2024). The permit price in the EU ETS is 71 EUR/ton CO2e at the time of writing (2024-06–12), and has varied between 50 to almost 105 EUR/ton CO2e during the last 2 years (Trading Economics, 2024).

Carbon pricing increasingly features voluntarily among actors as well (Bartlett et al., 2021). When a carbon price is set voluntarily, it is called an internal carbon price (ICP). Previous studies have shown multiple motivations for setting an ICP, for example, to mitigate risks associated with high carbon intensity in anticipation of national policies, to reach voluntary climate targets, to incentivise efficiency improvements or other changes that reduce operating costs, or to respond to outside pressure for carbon management (Harpankar, 2019; Bento and Gianfrate, 2020; Gorbach et al., 2022; Trinks et al., 2022). Previous studies have also shown that actors with an ICP decarbonize faster and deeper in comparison with their counterparts that do not have an ICP (Benedicto, 2022; Zhu et al., 2022; Qin et al., 2023).

The most common type of ICP is a so-called “shadow price” which informs investments and deters high-carbon investments, thus reducing emissions in the long-run compared to business as usual. However, shadow prices provide little short-term incentive to reduce emissions (Harpankar, 2019; Gorbach et al., 2022). Conversely, an “internal carbon fee” is a type of ICP which is associated with actual payments for ongoing emissions. An internal carbon fee provides a short-term incentive to decrease emissions as well as a longer-term incentive (Harpankar, 2019; Gorbach et al., 2022; Höglund, 2022).

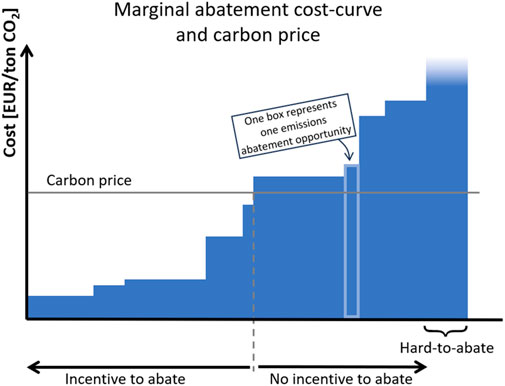

As part of setting voluntary science-based targets (see, e.g., SBTi (2021)), Schallert et al. (2020) recommend implementing an internal carbon fee to channel finance for mitigation within and/or outside of the value chain. If the ICP is higher than the company’s marginal abatement cost, emission reductions should be made across its value chain. Otherwise, the finance generated from the ICP should finance mitigation outside of the company’s value chain (Schallert et al., 2020). The higher the ICP, the higher the incentive to reduce emissions within the value chain (Qin et al., 2023), as illustrated in Figure 2, leading to lower remaining emissions within an actor’s value chain, and more carbon finance generated per unit of remaining emission.

Figure 2. Marginal abatement cost-curve and carbon price. The higher the carbon price, the higher incentive to reduce emissions. Note that some actors might have emissions that are hard- or impossible-to-abate, meaning that even an extremely high carbon price would not reduce those emissions due to technical limitations.

The ICP can be set in multiple ways. One way is to set a total financial commitment for emissions abatement during a period and divide the total number with the company’s remaining emissions during the same period, thus revealing the implied ICP (Schallert et al., 2020). Another way is to base the ICP on external factors, such as the social cost of carbon, policy carbon prices such as taxes or trading systems, the price of carbon credits on the VCM, or the cost of permanent carbon removals (Harpankar, 2019; Höglund, 2022; Modi et al., 2023). The social cost of carbon reflects the societal cost of GHG emissions and has recently been estimated by Rennert et al. (2022) to 185 USD/ton CO2 (in 2020 USD). The US Environmental Protection Agency estimates the social cost of carbon to be between 120 and 340 USD/ton CO2 (in 2020 USD), depending on the discount rate (EPA, 2023). Carbon taxes and trading system permits differ between regions. The Swedish carbon tax and EU ETS permit price have already been mentioned in the beginning of this section. The carbon credit price on the VCM was on average 7.37 USD/ton CO2 in 2022, but there is a large price range (Donofrio and Procton, 2023). The cost of permanent carbon removal depends on the CDR method. As an example, the cost of BECCS is, as already mentioned, estimated to 100–200 USD/ton CO2 towards mid-century (Fuss et al., 2018). Currently, the quoted market price for BECCS carbon credits is 300 EUR/ton CO2 (Smith et al., 2024).

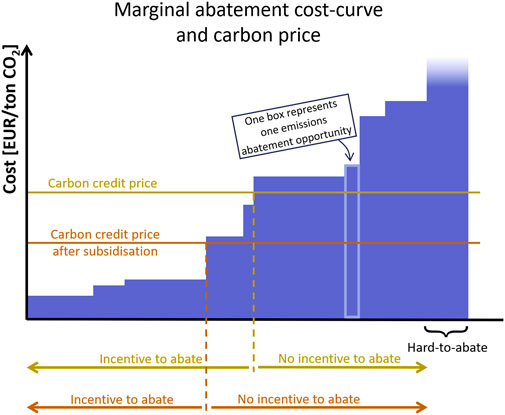

Combining co-financing through state support and carbon revenue from the VCM with double claiming means that the state is, in effect, subsidising the VCM, making the carbon credit prices lower than they would have been if actors on the VCM only could claim the share they paid for. As mentioned, there are multiple ways to set an ICP, but it is particularly likely that the carbon credit price of permanent removals will influence voluntary ICPs since influential standard-setters for voluntary targets require compensation for residual emissions by permanent removals specifically (SBTi, 2021; ISO, 2022). If the subsidised price of BECCS credits influences and lowers the ICP set by actors, this has far-reaching consequences since: i) the decarbonisation rate might be lower since the incentive to abate is reduced, and ii) the resulting residual emission level might be higher if a lower cost of purchasing permanent removals reduces what is perceived as a prohibitive cost of abatement. The potential effect of the subsidised BECCS credit price is illustrated in Figure 3.

Figure 3. Marginal abatement cost-curve and carbon credit price. The higher the carbon credit price, the higher incentive to reduce emissions. Note that some actors might have emissions that are hard- or impossible-to-abate, meaning that even an extremely high carbon price would not reduce those emissions due to technical limitations.

There is limited experience in blending public climate finance instruments with international carbon market mechanisms. Previous analyses (Fuessler et al., 2019; Spalding-Fecher et al., 2021) have explored “attribution”, i.e., the allocation of mitigation outcomes, resulting from a program supported by both international climate finance and compliance carbon markets (Article 6), to each of those financing sources. “International climate finance” refers to international public resources that cover the additional costs of low carbon and climate resilient investments, beyond what commercial financing could support in a business as usual scenario, and for which there are no transfers of certified mitigation outcomes. However, the concept can be extended to encompass any concessional financing from any source, that should receive some “credit” for its contribution to the total cost of abatement, as well as to the VCM. “Proportional attribution” means attributing emission reductions to financers in proportion to their financial contribution to the abatement costs of the mitigation activity. Attribution methods use “grant value equivalent” which considers the timing of the finance and potentially also other parameters such as risk absorbed by financiers. For example, a loan that provides upfront financing has a different value to the project proponents than carbon revenue received after implementation, which is addressed through discounting all cash flows to present value. Attribution analysis should focus mainly on financing streams that support implementation and investment, rather than the smaller funding for activities such as technical assistance and capacity building (Spalding-Fecher et al., 2021). As noted by Spalding-Fecher et al. (2021), without proportional attribution, there is a risk that climate finance will essentially subsidise the price of carbon credits (i.e., the price of the credits will be lower than the unit abatement cost of the mitigation intervention), undermining market efficiency and resulting in higher global emissions, thus violating the principle of environmental integrity. In the context of the present case study of Swedish BECCS, the simplest form of attribution would involve attributing the tonnes of CDR in direct proportion to the revenues from results-based payments from the Swedish state and revenue from selling carbon removal credits on the VCM. A more elaborate approach to attribution would entail consideration of grants received and any concessionary loans, and so on.

To operationalise attribution in the case of Swedish BECCS, the preferred option would be the enabling of corresponding adjustments on EU level because the EU has a joint nationally determined contribution (NDC). A corresponding adjustment in the context of Article 6 of the Paris Agreement refers to the requirement for parties involved in the authorisation and international transfer of Internationally Transferred Mitigation Outcomes (ITMO) to ensure that the collective ambition of their NDCs is not undermined. Applying a corresponding adjustment means that the host country where the mitigation project occurs does not count the mitigation towards its targets so that the buyer of ITMOs can claim the associated mitigation outcome uniquely towards its target, e.g., another country towards its national mitigation target or an actor towards a voluntary mitigation target, such as a corporate net-zero target. It is currently not possible to make a corresponding adjustment on the EU level and it is unknown when it will be possible, and especially when (if ever) it will be possible for individual member states to make a corresponding adjustment at EU level based on individual overachievements (Ahonen et al., 2023).

Since the EU is yet to enable corresponding adjustments, we use this section to elaborate on other ways to adjust for exported BECCS outcomes in order to avoid double claiming of mitigation outcomes. The EU currently divides its emission accounting into three different sectors, namely, the EU Emissions Trading System (EU ETS), the Effort Sharing Regulation (ESR), and the Land Use, Land Use Change and Forestry (LULUCF) sector. It is currently unknown in which sector, EU ETS, ESR, LULUCF or a new sector, CDR from BECCS would be accounted for in the EU (Fridahl et al., 2023). In a communication to the European Commission, the Swedish government has expressed its wish to be able to use CDR from BECCS to compensate for emissions in the ESR sector (DN, 2023). To achieve the joint EU NDC, each member state is allocated some expected contribution in the ESR sector. This allocation is expressed in a certain number of annual emissions allocations (AEAs), which corresponds to a certain amount of emissions. Flexibility mechanisms allow for a member state that overachieves its target to sell the overachievement to another member state. Sweden has previously overachieved the target for the ESR sector, meaning that Sweden has had surplus AEAs. Interestingly, Sweden has historically, however, not proceeded to sell surplus AEAs but has instead cancelled them. This essentially increases the emission reduction requirement on the EU level, since it limits underachieving member states’ opportunity to buy excess AEAs from overachievers. France and the UK have also cancelled AEAs (European Commission, 2020).

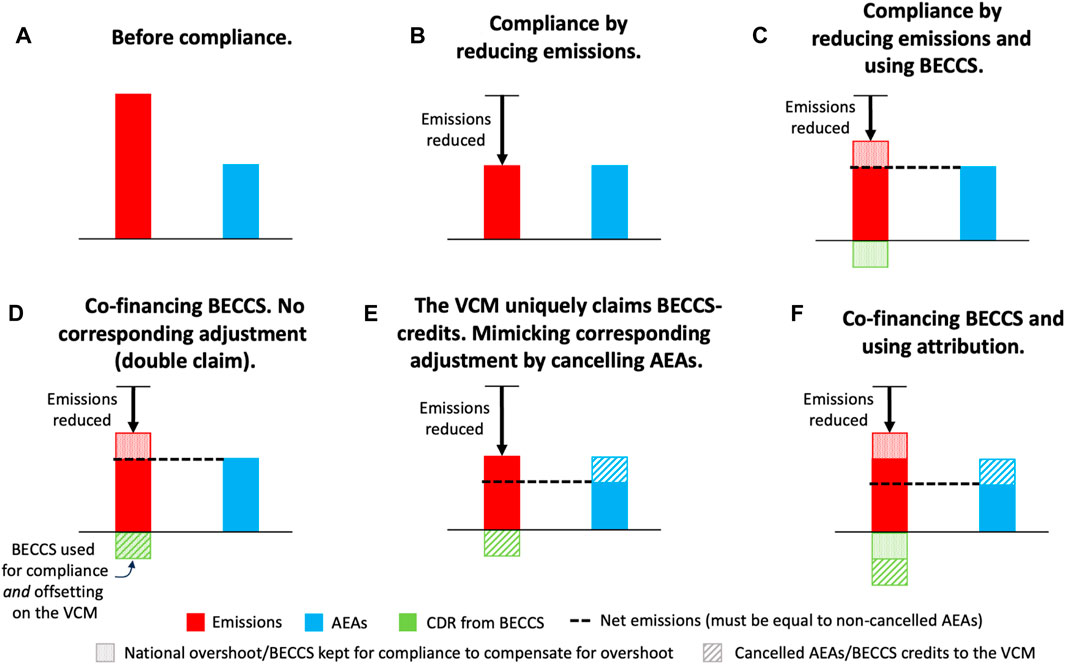

If CDR from BECCS were to be accounted for in the ESR sector, the cancellation of AEAs would offer a way for member states to mimic a corresponding adjustment without interfering with EU overall emissions accounting. Figure 4 illustrates how this could be done. Panel a) shows current emissions (in red) and the ESR emissions target for the member state, expressed as AEAs (in blue). Red bars can be interpreted as debts for the member state, while blue bars can be interpreted as assets. For compliance, emissions must be balanced by AEAs. In other words, red bars must be equal to the blue bars, or lower, which would constitute an overachievement. This can be achieved by reducing emissions to a level equivalent to the allocated AEAs, as shown in Panel b). If the amount of emission reductions is insufficient to reach the AEA level, CDR could be used to compensate for the overshoot, see Panel c), in which case net-emissions (taken as emissions minus CDR, represented by the dotted line) equals the AEAs (represented by the blue bar). We have dotted the emissions overshoot and the needed CDR to compensate for the overshoot in order to reach compliance, to emphasise that those are of equal size and correspond to each other. Panel d) shows the situation where an amount of BECCS credits are sold to a non-state actor on the VCM, without corresponding adjustment, for offsetting purposes. The procedure in panel d) thus results in a double claim, since the credits are used by the purchasing actor for offsetting emissions while also contributing to compliance in the host country. Double claiming could be avoided if the member state cancels AEAs corresponding to the sold BECCS credits, see Panel e). Note that in e), where all BECCS mitigation outcomes are sold to the VCM, the BECCS outcome does not suffice for the host country to compensate for the overshoot after the cancellation of AEAs. We have striped the cancelled AEAs and the BECCS credits to show that those are of equal size and correspond to each other. If a BECCS-producer has produced a certain amount of CDR, from which half of the outcome is attributed to carbon credit revenues from the VCM and half to the revenue from the state support, transferring half of the outcome is possible if the state cancels AEAs corresponding to half of the produced BECCS outcome, see Panel f). As illustrated in e) and f), the host country does not have to do less to comply with its mitigation target as a result of the international transfer, meaning that environmental integrity is maintained. Note that in Panels c), d), and f), emission reductions are displaced to a certain level by carbon removal occurring concurrently. This represents so-called “mitigation deterrence” (more specifically “contemporaneous substitution” as defined by Bednar et al., 2023). Mitigation deterrence is an undesirable effect that may be induced if the option is introduced to use CDR from BECCS to comply with ESR targets. Mitigation deterrence is a real risk that would need to be addressed. The focus here, however, is to discuss on a principal level how double claims could be avoided. See Supplementary Material for a more comprehensive discussion about the mitigation deterrence risk.

Figure 4. If CDR from BECCS is accounted for in the ESR, cancellation of AEAs can be a workaround until corresponding adjustments are enabled for EU member states. Panel (A) shows current emissions and the ESR emissions target for the member state, expressed as AEAs. In Panel (B), emissions are reduced to a level equivalent to the allocated AEAs. In Panel (C), a combination of emission reductions and CDR is used for compliance (net emissions equals allocated AEAs). Note that the emissions overshoot and the CDR to compensate for the overshoot is dotted, to emphasise that those are of equal size and correspond to each other. In Panel (D), an amount of BECCS credits are sold to an actor on the VCM, without corresponding adjustment, for offsetting purposes, resulting in a double claim. In Panel (E), double claiming is avoided since the member state cancels AEAs corresponding to the sold BECCS credits. Note that the cancelled AEAs and the BECCS credits are striped to show that those are of equal size and correspond to each other. In Panel (F), half of the mitigation outcome is attributed to the VCM and half to the state, and AEAs are cancelled accordingly. As illustrated in (E) and (F), the host country does not have to do less to comply with its mitigation target as a result of the international transfer, meaning that environmental integrity is maintained.

The reasoning above is valid in the case where BECCS are placed in the ESR sector. But it may well be the case that BECCS are placed in the EU ETS, motivated by the fact that the facilities lie in the energy sector. Still, mimicking corresponding adjustment may be possible by individual member states by cancelling EU ETS allowances. In the EU ETS, each member state is allocated a certain number of EU ETS allowances, called EUAs, that are auctioned to industry. This allows for the member state to do a mimic corresponding adjustment by cancelling EUAs (rather than auctioning them) corresponding to exported BECCS credits.

The present case study is an example of the interaction between public results-based finance and VCM finance for BECCS. According to the analysis presented in this paper, allowing double claiming of mitigation outcomes has disadvantages. Double claiming casts doubt upon the legitimacy of offsetting claims made by actors using carbon credits. Historically, offsetting claims based on the voluntary use of carbon credits have been based on the premise that offsetting entities can report lower GHG emissions than their actual carbon footprint because their use of the carbon credits have caused GHG emissions to be reduced elsewhere only due to the incentives created by the carbon credits used. When double claiming is allowed, the same mitigation outcome can be counted towards an existing national mitigation target and the mitigation target of a company that uses carbon credits for offsetting. In this situation, the most tangible impact of the offsetting entity’s use of carbon credits may be to help the host country of the mitigation activity from which the carbon credits were issued to save expenditures for meeting its already pledged mitigation ambition. The latter situation is arguably a less convincing case for the offsetting entity to report lower GHG emissions than their actual carbon footprint (Kreibich and Hermwille, 2021; Ahonen et al., 2023). Another problem is that, as this paper has shown, without proportional attribution in case of co-financed projects, public funding effectively subsidises the carbon credit price faced by the carbon market. This might lead to lowering the ICP set voluntarily by actors, which in turn can lead to decreased decarbonisation efforts and result in a higher residual emission level. This latter effect has, to the authors’ knowledge, not previously been discussed in the literature that covers the interaction between public funding and VCM revenue in mobilising capital for mitigation activities.

Based on the case study it is recommended that:

The double claiming of mitigation outcomes towards existing national mitigation targets and voluntary offsetting targets should be disallowed through the introduction of regulation at relevant levels, e.g., national legislation and by international standard setting bodies.

Proportional attribution should be applied in situations where results-based payments for mitigation outcomes used towards national mitigation targets are combined with VCM finance. Spalding-Fecher et al. (2021) proposed that an important role of crediting standards could be to develop principles for proportional attribution, to be implemented in the certification of carbon credits. The significance of that recommendation is confirmed by the present study.

Corresponding adjustments should, if possible, be carried out on the basis of the outcome of attribution analysis, to avoid the disadvantages attached to double claims identified through this study.

As this paper has described, EU member states currently lack the ability to perform corresponding adjustments. It is recommended that governments work towards enabling corresponding adjustments by exploring what changes and updates to legislation would be required on the national level in EU member states, and on EU level.

There may be alternatives to corresponding adjustments that can avoid the identified disadvantages attached to double claiming, as this paper has exemplified. EU member states that wish to facilitate the contribution of the VCM to GHG mitigation in their jurisdictions with high-integrity outcomes are recommended to explore alternative pathways to corresponding adjustments until corresponding adjustments are enabled.

The present case study has considered co-financing of BECCS by state support and VCM revenue. The vast capital required to close the CDR financing gap, and for low-carbon investments in general, to enable meeting the Paris Agreement temperature target creates a situation where combining multiple streams of financial support is likely to become more common by necessity. We have demonstrated how double claiming of mitigation outcomes can cause problems related to the environmental integrity of the voluntary use of carbon credits towards offsetting claims. Our recommendations might have positive or negative impacts on the BECCS deployment. Proponents of allowing double claiming of co-financed BECCS (and thus the subsidisation of BECCS credits) could argue that BECCS credits would be too expensive to be interesting for actors on the VCM if they must bear the entire cost themselves, and that this would decrease the interest in buying BECCS credits, thus resulting in less BECCS (Möllersten and Zetterberg, 2023). Conversely, we see a possibility for higher BECCS deployment if governments take full responsibility to achieve their set-out climate targets, without counting on contributions from the VCM to co-finance BECCS, since waiting for the VCM to step in to incentivise BECCS could lead to postponing national policies promoting BECCS. In other words, there may be a risk of postponing policy due to (over-)reliance on the VCM in the case of expecting co-financing, which could lead to less BECCS deployment. Furthermore, in a scenario without double claiming, VCM support towards BECCS would lead to BECCS deployment in addition to that deployed due to national policies, thus raising ambition beyond existing national mitigation targets. Another argument as to why our recommended attributions-approach and avoiding double claiming might result in more BECCS is that the VCM rely on trust among market actors, the public, and other stakeholders, and accusations of lacking environmental integrity, e.g., greenwashing accusations, reduce the appetite among actors to participate in the markets. Recent legislative developments in the EU even include the prohibition of offsetting claims in business-to-consumer situations, largely motivated as a way to protect consumers from misleading claims and to prevent greenwashing (European Parliament, 2024). Safeguarding environmental integrity will therefore arguably be important to build confidence in the VCM to enable the utilisation of its potential to mobilise investment.

Although the present case study concerns the interaction between public results-based finance and VCM finance for BECCS, the relevance of the results extend beyond the context of the case study. The integrity problem associated with offsetting claims when double claiming occurs is relevant regardless of the mitigation technology or method involved (e.g., Kreibich and Hermwille, 2021; Ahonen et al., 2022). Problems related to the subsidisation of the price of carbon credits are not limited to BECCS project activities. They are, moreover, also relevant for situations that involve compliance carbon markets rather than the VCM (Spalding-Fecher et al., 2021) and, plausibly, situations in which the mitigation outcome is not counted towards national mitigation targets.

One caveat of this study that should be mentioned is that it has shown on a principal level that there are mechanisms by which the subsidisation of carbon credits may reduce non-state actors’ voluntary decarbonisation efforts. However, the importance of the identified mechanisms remains to be further evaluated including quantitatively assessing their impact. Nonetheless, the combination of actors setting mitigation targets voluntarily, to be met in part by offsetting, especially as net-zero targets, and the increasing call by scholars and standard-setters influencing such actors and targets to offset emissions by using CDR credits in the context of net-zero targets, makes CDR carbon credit prices particularly likely to have an impact on voluntary GHG mitigation strategies.

We suggest the application of attribution, accompanied by corresponding adjustments or equivalent procedures. Since corresponding adjustments are yet to be enabled on the EU-level, we also suggest possible workarounds which would equate to a corresponding adjustment in the meantime. It is currently unknown when, or even if, member states will be able to operationalise corresponding adjustments since they have to be made on EU-level due to the joint nature of the EU NDC. The first Swedish BECCS projects, which will likely be co-financed by the planned state reverse auctions and VCM revenue, can be expected to be implemented roughly by 2027 if auctions are held in 2024 as planned. By then, developments might have occurred that enable corresponding adjustments, but there are large uncertainties. Notably, a pilot project by the Swedish and Swiss governments to investigate the operationalisation of Article 6.2 of the Paris Agreement for CDR was announced in November 2023 (Swedish Energy Agency, 2023). The project might contribute to bringing clarity concerning how Sweden could make corresponding adjustments for BECCS outcomes. Furthermore, EU-level developments can be expected for corresponding adjustments since the EU ETS is being linked to the Swiss emission trading system (Dutch Emissions Authority, 2024), which means that corresponding adjustments might be needed between Switzerland and the EU. However, enabling corresponding adjustments between the EU and Switzerland for this specific case might not enable corresponding adjustments for other cases, such as the case for individual member state overachievement sold to the VCM.

This analysis has shown that proportional attribution can make important contributions to prevent undesired outcomes when projects are co-financed through public and VCM finance. Spalding-Fecher et al. (2021) have shown, considering the combined concessionary international climate finance and finance from compliance carbon markets (Article 6), that unless proportional attribution is implemented, there is a risk that efficiency of markets is undermined, and that global emissions will end up higher, thus violating the principle of environmental integrity. Due to the limited experience in blending public and carbon credit market finance (compliance as well as VCM), and of proportional attribution in particular, more work is required to raise awareness and readiness among key actors in public and carbon credit markets, agree on principles for attribution, and develop support tools, etc., to enable the application of attribution principles in scaled-up mitigation cooperation (Spalding-Fecher et al., 2021). Extensive future research is also needed to fully understand the environmental integrity implications of blending public and carbon credit market finance.

MD: Conceptualization, Investigation, Methodology, Visualization, Writing–original draft. KM: Conceptualization, Funding acquisition, Investigation, Methodology, Project administration, Supervision, Writing–original draft. LZ: Investigation, Visualization, Writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This article has been funded by the Swedish Energy Agency, a Swedish Government Agency, through research grants P2021-00016 and P2022-01125. This article has been funded by the Swedish Energy Agency, a Swedish Government Agency, through research grants P2021-00016 and P2022-01125 and the Swedish Foundation for Strategic Environmental Research through the Mistra Carbon Exit program.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1387138/full#supplementary-material

Ahonen, H., Berninger, K., Kessler, J., Möllersten, K., Spalding-Fecher, R., and Tynkynen, O. (2022a). Harnessing voluntary carbon markets for climate ambition. Copenhagen, Denmark: Nordic Council of Ministers.

Ahonen, H.-M., Inclan, C., Kessler, J., and Singh, A. (2023). Raising climate ambition with carbon credits. Perspect. Clim. Group GmbH. Available at: https://www.energimyndigheten.se/49e25f/globalassets/klimat--miljo/internationella-klimatinsatser/raising-climate-ambition-with-carbon-credits.pdf.

Ahonen, H.-M., Kessler, J., Michaelowa, A., Espelage, A., and Hoch, S. (2022b). Governance of fragmented compliance and voluntary carbon markets under the Paris Agreement. Polit. Gov. 10 (1). doi:10.17645/pag.v10i1.4759

Allen, M., Axelsson, K., Caldecott, B., Hale, T., Hepburn, C., Hickey, C., et al. (2020). The Oxford principles for net zero aligned carbon offsettin. Oxford, United Kingdom: University of Oxford.

Bartlett, N., Coleman, T., and Schmidt, S. (2021). Putting a price on carbon - the state of internal carbon pricing by corporates globally. Available at: https://cdn.cdp.net/cdp-production/cms/reports/documents/000/005/651/original/CDP_Global_Carbon_Price_report_2021.pdf?1618938446.CDPWorldwide.

Beccs Stockholm (2023). Stockholm Exergi launches unique negative emissions offering – strong customer interest immediately. Available at: https://beccs.se/news/stockholm-exergi-launches-unique-negative-emissions-offering-strong-customer-interest-immediately/(Accessed February 12, 2024).

Beccs Stockholm (2024). Stockholm Exergi announces permanent carbon removal agreement with Microsoft, world’s largest to date. Available at: https://beccs.se/news/stockholm-exergi-announces-permanent-carbon-removal-agreement-with-microsoft-worlds-largest-to-date/(Accessed June 12, 2024).

Bednar, J., Höglund, R., Möllersten, K., Obersteiner, M., and Tamme, E. (2023). The role of carbon dioxide removal incontributing to the long-term goal ofthe Paris Agreement. IVL Report C807. Available at: http://ivl.diva-portal.org/smash/get/diva2:1825937/FULLTEXT01.pdf.

Benedicto, S. C. L. (2022). Internal Carbon Pricing: a lever for corporate decarbonization or checking the box on climate disclosure? (Doctoral dissertation).

Bento, N., and Gianfrate, G. (2020). Determinants of internal carbon pricing. Energy Policy 143, 111499. doi:10.1016/j.enpol.2020.111499

Bernasconi, L. (2021). A natural approach to net zero. Settling Clim. Accounts Navigating Road Net Zero, 121–144. doi:10.1007/978-3-030-83650-4_7

Blaufelder, C., Katz, J., Levy, C., Pinner, D., and Weterings, J. (2020). How the voluntary carbon market can help address climate change. McKinsey & Company. (2024). Price index [Accessed February 12, 2024].

Chyka, K. (2023). Carbon offset market could reach $1 trillion with right rules. Available at: https://about.bnef.com/blog/carbon-offset-market-could-reach-1-trillion-with-right-rules/(Accessed January 29, 2024).

DESNZ (2023). Engineered greenhouse gas removals. London, United Kingdom: Department for Energy Security and Net-Zero. Available at: https://assets.publishing.service.gov.uk/media/64955096831311000c296222/engineered-ggrs-government-response.pdf. Crown copyright 2023.

DN (2023). Regeringen vill använda kontroversiell teknik för att nå EU:s klimatkrav. Available at: https://www.dn.se/sverige/regeringen-vill-anvanda-kontroversiell-teknik-for-att-na-eus-klimatkrav/(Accessed January 26, 2024).

Donofrio, S., and Procton, A. (2023). State of the voluntary carbon markets 2023 - paying for quality. Available at: https://3298623.fs1.hubspotusercontent-na1.net/hubfs/3298623/SOVCM_2023/2023-EcoMarketplace_SOVCM-Nov28_FINALrev-1.pdf. Ecosystem Marketplace.

Dutch Emissions Authority (2024). Link to the Swiss ETS registry. Available at: https://www.emissionsauthority.nl/topics/eu-ets-registry-2021-2030/link-to-the-swiss-ets-registry (Accessed February 12, 2024).

EPA (2023). EPA report on the social cost of greenhouse gases: estimates incorporating recent scientific advances. Washington, DC: U.S. Environmental Protection Agency. Available at: https://www.epa.gov/system/files/documents/2023-12/epa_scghg_2023_report_final.pdf.

European Commission (2020). Report from the commission to the european parliament, the council, the European economic and social committee and the committee of the regions - kick-starting the journey towards a climate-neutral Europe by 2050 EU Climate Action Progress Report 2020. Available at: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2020:0777:FIN:EN:PDF.

European Commission (2024). What is the EU ETS? Available at: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/what-eu-ets_en (Accessed February 1, 2024).

European Parliament (2024). P9_TA(2024)0018 Empowering consumers for the green transition. European Parliament legislative resolution of 17 January 2024 on the proposal for a directive of the European Parliament and of the Council on amending Directives 2005/29/EC and 2011/83/EU as regards empowering consumers for the green transition through better protection against unfair practices and better information (COM(2022)0143 – C9-0128/2022 – 2022/0092(COD)). Available at: https://www.europarl.europa.eu/doceo/document/TA-9-2024-0018_EN.pdf (Accessed February 13, 2024).

Fankhauser, S., Smith, S. M., Allen, M., Axelsson, K., Hale, T., Hepburn, C., et al. (2022). The meaning of net zero and how to get it right. Nat. Clim. Change 12 (1), 15–21. doi:10.1038/s41558-021-01245-w

Fridahl, M., Bellamy, R., Hansson, A., and Haikola, S. (2020). Mapping multi-level policy incentives for bioenergy with carbon capture and storage in Sweden. Front. Clim. 2, 604787. doi:10.3389/fclim.2020.604787

Fridahl, M., and Lundberg, L. (2021). “Actor preferences in the design of a support scheme for bioenergy with carbon capture and storage (BECCS). (Aktörspreferenser i design av ett Stödsystem för bio-CCS),” in Swedish.

Fridahl, M., Schenuit, F., Lundberg, L., Möllersten, K., Böttcher, M., Rickels, W., et al. (2023). Novel carbon dioxide removals techniques must be integrated into the European Union’s climate policies. Commun. Earth Environ. 4 (1), 459. doi:10.1038/s43247-023-01121-9

Fuessler, J., Kansy, T., and Spalding-Fecher, R. (2019). Blending climate finance and carbon market mechanisms: options for the attribution of mitigation outcomes. Washington, DC: World Bank. Available at: https://cpf.wbcarbonfinance.org/sites/cpf_new/files/Documents/Blending_climate_finance_and_carbon_market_mechanisms_FINAL%28Clean%29_March.2019.pdf.CPF/TCAFDiscussionPaper.

Fuss, S., Lamb, W. F., Callaghan, M. W., Hilaire, J., Creutzig, F., Amann, T., et al. (2018). Negative emissions—Part 2: costs, potentials and side effects. Environ. Res. Lett. 13 (6), 063002. doi:10.1088/1748-9326/aabf9f

Gorbach, O. G., Kost, C., and Pickett, C. (2022). Review of internal carbon pricing and the development of a decision process for the identification of promising Internal Pricing Methods for an Organisation. Renew. Sustain. Energy Rev. 154, 111745. doi:10.1016/j.rser.2021.111745

Government Offices of Sweden (2024). Sweden’s carbon tax. Available at: https://www.government.se/government-policy/swedens-carbon-tax/swedens-carbon-tax/(Accessed February 1, 2024).

Government of Sweden (2023). “Swedish Government’s Strategic Climate Plan (Regeringens skrivelse 2023/24:59 Regeringens klimathandlingsplan – hela vägen till nettonoll),” in Swedish. Available at: https://www.regeringen.se/contentassets/990c26a040184c46acc66f89af34437f/232405900webb.pdf.

Government of the Netherlands (2023). Joint statement on voluntary carbon market: the claims side. Netherlands, Germany, France, Spain, Finland, Belgium, and Austria. Available at: https://www.government.nl/documents/publications/2023/12/10/joint-statement-on-voluntary-carbon-market (Accessed February 13, 2024).

Grupert, E., and Talati, S. (2023). The distortionary effects of unconstrained for-profit carbon dioxide removal and the need for early governance intervention. Carbon Manag. 15 (1). Article 2292111. doi:10.1080/17583004.2023.2292111

Harpankar, K. (2019). Internal carbon pricing: rationale, promise and limitations. Carbon Manag. 10 (2), 219–225. doi:10.1080/17583004.2019.1577178

Hassler, J. (2023). The Swedish climate strategy - 46 proposals for the climate transformation in the light of Fit for 55. Stockholm, Sweden: The Government Offices of Sweden. Available at: https://www.regeringen.se/contentassets/0b09ab52d60b4f8f8212acc1b71fbbb8/sveriges-klimatstrategi---46-forslag-for-klimatomstallning-i-ljuset-av-fit-for-55.pdf [Accessed February 13, 2024]. In Swedish.

Hermwille, L., and Kreibich, N. (2016). Identity crisis? - Voluntary carbon crediting and the Paris Agreement. Report No.02/2016. Wupperthal: Wupperthal Institute for Climate, Environment and Energy.

Hickey, C., Fankhauser, S., Smith, S., and Allen, M. (2023). A review of commercialisation mechanisms for carbon dioxide removal. Front. Clim. 4, 1101525. doi:10.3389/fclim.2022.1101525

Höglund, R. (2022). Guidance for setting an internal carbon fee. Available at: https://assets.ctfassets.net/8dzj5s79jaus/23ccBFadsLlZWbA6tJEawe/8ebf3573a5486f9ec4084d7e57e04b41/White_paper_Guidance_for_setting_an_internal_carbon_fee__.pdf.Milkywire.

Honegger, M. (2023). Toward the effective and fair funding of CO2 removal technologies. Nat. Commun. 14 (1), 534. doi:10.1038/s41467-023-36199-4

Honegger, M., Poralla, M., Michaelowa, A., and Ahonen, H. M. (2021). Who is paying for carbon dioxide removal? Designing policy instruments for mobilizing negative emissions technologies. Front. Clim. 3, 672996. doi:10.3389/fclim.2021.672996

IPCC (2022). Climate change 2022: mitigation of climate change. Available at: https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_FullReport.pdf.

ISO (2022). Net zero guidelines. Available at: https://www.iso.org/obp/ui/en/#iso:std:iso:iwa:42:ed-1:v1:en.

Kreibich, N., and Hermwille, L. (2021). Caught in between: credibility and feasibility of the voluntary carbon market post-2020. Clim. Policy 21 (7), 939–957. doi:10.1080/14693062.2021.1948384

Michaelowa, A., Honegger, M., Poralla, M., Winkler, M., Dalfiume, S., and Nayak, A. (2023). International carbon markets for carbon dioxide removal. PLOS Clim. 2 (5), e0000118. doi:10.1371/journal.pclm.0000118

Michaelowa, A., Shishlov, I., and Brescia, D. (2019). Evolution of international carbon markets: lessons for the Paris Agreement. WIREs Clim. Change 10, e613. doi:10.1002/wcc.613

Modi, A., Oberauer, A., Vir Singh, U., Ong, C., Burchardt, J., and Sheth, H. (2023). To inspire action on net zero, set a price for carbon. Available at: https://www.bcg.com/publications/2023/benefits-of-carbon-pricing-to-inspire-net-zero (Accessed January 31, 2024).

Möllersten, K., Marklew, S., and Ahonen, H.-M. (2023). Regulatory frameworks for BECCS in the Nordic countries. Copenhagen: Nordic Council of Ministers.

Möllersten, K., and Zetterberg, L. (2023). Bringing BECCS credits to voluntary carbon markets. Sustain. Finance Lab. Available at: https://www.sustainablefinancelab.se/wp-content/uploads/sites/14/2023/08/Bringing-BECCS-credits-to-voluntary-carbon-markets_web.pdf.

Swedish Environmental Protection Agency (2023). Utsläpp i siffror. Available at: https://utslappisiffror.naturvardsverket.se/sv/Sok/(Accessed November 1, 2023).

Net Zero Tracker (2024). Net zero numbers. Available at: https://zerotracker.net/(Accessed January 29, 2024).

Puro.earth (2023). Open letter requesting separate carbon removal targets to net zero asset owners alliance (NZAOA). Available at: https://puro.earth/articles/open-letter-requesting-separate-carbon-removal-targets-to-ne-796 (Accessed January 29, 2024).

Qin, L., Wang, Z., and Pan, A. (2023). How the implementation of internal carbon pricing impacts on carbon reduction: facilitating or hindering. Environ. Sci. Pollut. Res., 1–27. doi:10.1007/s11356-023-30997-5

Race to Zero (2022). Interpretation guide - Race to zero expert peer review group. Race to Zero. Available at: https://climatechampions.unfccc.int/wp-content/uploads/2022/09/EPRG-interpretation-guide.pdf.

Rennert, K., Errickson, F., Prest, B. C., Rennels, L., Newell, R. G., Pizer, W., et al. (2022). Comprehensive evidence implies a higher social cost of CO2. Nature 610 (7933), 687–692. doi:10.1038/s41586-022-05224-9

Rodriguez, E., Lefvert, A., Fridahl, M., Grönkvist, S., Haikola, S., and Hansson, A. (2021). Tensions in the energy transition: Swedish and Finnish company perspectives on bioenergy with carbon capture and storage. J. Clean. Prod. 280, 124527. doi:10.1016/j.jclepro.2020.124527

Romm, J. (2023). Are carbon offsets unscalable, unjust, and unfixable—and a threat to the Paris climate agreement? Penn center for science, sustainability, and the media. University of Pennsylvania. Available at: https://web.sas.upenn.edu/pcssm/news/carbon-offsets-are-unscalable-unjust-unfixable-joe-romm/.

SBTi (2021). SBTi corporate net-zero standard version 1.0. Available at: https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf.

SBTi (2024). Companies taking action. Available at: https://sciencebasedtargets.org/companies-taking-action (Accessed January 29, 2024).

Schallert, B., Stevenson, M., Weber, C., Farsan, A., Nielsen, J., Ponce de León, P., et al. (2020). Beyond science-based targets: a blueprint for corporate action on climate and nature. Available at: https://wwfint.awsassets.panda.org/downloads/beyond_science_based_targets___a_blueprint_for_corporate_action_on_climate_and_nature.pdf.

Schneider, L. (2009). Assessing the additionality of CDM projects: practical experiences and lessons learned. Clim. Policy, 242–254. doi:10.1080/14693062.2018.1521332

Schneider, L., Kollmuss, A., and Lazarus, M. (2015). Addressing the risk of double counting emission reductions under the UNFCCC. Clim. Change 131, 473–486. doi:10.1007/s10584-015-1398-y

Schneider, L., and La Hoz Theuer, S (2019). Environmental integrity of international carbon market mechanisms under the Paris Agreement. Clim. Policy 19 (3), 386–400. doi:10.1080/14693062.2018.1521332

SGU (2016). Koldioxidlagring i Sverige – sammanställning och resultat från NORDICCS. Available at: http://resource.sgu.se/produkter/sgurapp/s1620-rapport.pdf.

Smith, S., Arcusa, S., Bellamy, R., and Cowie, A. (2024). The state of carbon dioxide removal. 2nd Edition. doi:10.17605/OSF.IO/F85QJ

Smith, S. M., Geden, O., Nemet, G., Gidden, M., Lamb, W. F., Powis, C., et al. (2023). The State of carbon dioxide removal - 1st edition. The state of carbon dioxide removal. doi:10.17605/OSF.IO/W3B4Z

Spalding-Fecher, R., Kohli, A., Fallasch, F., Brown, P., Fuessler, J., Broekhoff, D., et al. (2021). Attribution: a practical guide to navigating the blending of climate finance and carbon markets. Eskilstuna, Swed. Swed. Energy Agency.

Stenström, O., Khatiwada, D., Levihn, F., Usher, W., and Rydén, M. (2024). A robust investment decision to deploy bioenergy carbon capture and storage - exploring the case of Stockholm Exergi. Front. Energy Res. 11, 1250537. doi:10.3389/fenrg.2023.1250537

Stockholm Exergi (2022). Contribution by Stockholm Exergi in response to UNFCCC’s Call for input 2022 - activities involving removals under the Article 6.4 Mechanism of the Paris Agreement. Available at: https://unfccc.int/sites/default/files/resource/SB002-call-for-input-Stockholm-Exergi.pdf (Accessed February 12, 2024).

Swedenergy (2022). Energiföretagen föreslår regelverk för effektiv handel med negativa utsläpp. Available at: https://www.energiforetagen.se/fragor-vi-driver/positioner/energiforetagen-foreslar-regelverk-for-effektiv-handel-med-negativa-utslapp/- (Accessed February 12, 2024).

Swedish Energy Agency (2023). Sweden and Switzerland pave the way for international trade with carbon removals. Available at: https://www.energimyndigheten.se/en/news/2023/sweden-and-switzerland-pave-the-way-for-international-trade-with-carbon-removals/(Accessed February 13, 2024).

Trading Economics (2024). EU carbon permits price. Available at: https://tradingeconomics.com/commodity/carbon (Accessed February 1, 2024).

Trinks, A., Mulder, M., and Scholtens, B. (2022). External carbon costs and internal carbon pricing. Renew. Sustain. Energy Rev. 168, 112780. doi:10.1016/j.rser.2022.112780

TSVCM (2021). Taskforce on scaling voluntary carbon markets - final report. Available at: https://www.iif.com/Portals/1/Files/TSVCM_Report.pdf.

United Nations (2022). Integrity matters: net zero commitments by businesses, financial institutions, cities and regions. Available at: https://www.un.org/sites/un2.un.org/files/high-level_expert_group_n7b.pdf.

Zetterberg, L., Johnsson, F., and Möllersten, K. (2021). Incentivizing BECCS – a Swedish case study. Front. Clim. 3. Article 685227. doi:10.3389/fclim.2021.685227

Keywords: BECCS, voluntary carbon markets, internal carbon price, co-financing, attribution, corresponding adjustment

Citation: Dufour M, Möllersten K and Zetterberg L (2024) How to maintain environmental integrity when using state support and the VCM to co-finance BECCS projects - a Swedish case study. Front. Environ. Sci. 12:1387138. doi: 10.3389/fenvs.2024.1387138

Received: 16 February 2024; Accepted: 04 July 2024;

Published: 26 July 2024.

Edited by:

Tian Tang, Florida State University, United StatesReviewed by:

Malte Winkler, Perspectives Climate Research gGmbH, GermanyCopyright © 2024 Dufour, Möllersten and Zetterberg. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Malin Dufour, bXNhdmVsaW5Aa3RoLnNl; Kenneth Möllersten, a2VubmV0aC5tb2xsZXJzdGVuQGl2bC5zZQ==

†These authors have contributed equally to this work and share first authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.