94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 17 June 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1384332

This article is part of the Research TopicCarbon Neutrality and High-quality DevelopmentView all 5 articles

With the continuous promotion of digitalization and the global trend toward a low-carbon economy, the issue of whether enterprises can enhance their carbon performance with the assistance of digital technology has aroused widespread attention from both academia and industry. In order to explore whether digital technology can improve the carbon performance of manufacturing enterprises, this study, based on resource orchestration theory and signaling theory, utilizes data from China’s A-share manufacturing enterprises from 2012 to 2021 to empirically investigate the relationship between digital technology and the carbon performance of manufacturing firms. It also explores the mediating conduction path and boundary influencing factors between them. Its findings demonstrate that: digital technology is capable of improving carbon performance; green innovation (including green technology and green collaboration) has partially mediating effects; there is a catalytic role for environmental information disclosure in utilizing digital technology to enhance carbon performance. Building on this, we find that the impacts of digital technology, green innovation, and environmental information disclosure on carbon performance vary due to differences in the nature of industries and the strategic aggressiveness of enterprises. Specifically, the role of digital technology on carbon performance seems somewhat more pronounced among firms in the high-tech industry and those employing defensive and analytical strategies. Additionally, the effects generated by green innovation and environmental information are more pronounced in the high-tech industry and among enterprises that adopt analytical strategies. This study reveals the inherent mechanism of digital technology in enhancing the carbon performance of manufacturing enterprises, which provides empirical evidence for the development of digital technology and the improvement of carbon performance in manufacturing enterprises, thus helping promote low-carbon economic transformation.

Since the Industrial Revolution, excessive production and consumption have led to the serious depletion and destruction of resources along with a rapid increase in carbon emissions. This escalation has intensified the global climate crisis. Consequently, reducing carbon emissions and promoting sustainable development have become prominent topics of global discussion (Dogan et al., 2022). The concept of a “low-carbon economy” (Samargandi and Sohag, 2022), which emphasizes both environmental protection and economic growth, has gradually emerged and garnered significant attention. Scholars from various countries have thus studied the issue of carbon emissions from various perspectives. For example, they have explored industry sectors such as transportation and power, where, for example, technological advancements have facilitated energy substitution in the transportation sector of Bangladesh, leading to a reduction in carbon emissions (Raza, 2023). Liu H. et al. (2024) observed that energy structure and consumption affect carbon dioxide emissions in the power industry, and that carbon reduction technology plays a significant inhibitory role. From a macro perspective, scholars have identified the optimization of energy regeneration (Xiao et al., 2024), implementing green technology (Ren et al., 2024), promoting renewable energy policies (Jiang and Raza, 2023), increasing energy intensity (Raza and Li, 2023), and improving the energy structure as crucial measures to reduce regional carbon emissions. Energy-efficient technologies, in turn, are crucial to increasing energy intensity (Jiang and Raza, 2022). Additionally, capital flows play a significant role globally (Ma, 2023). For instance, Raza pointed out that capital growth can lower carbon emissions, reduce energy waste, and contribute to energy technology advancement, thus helping to control carbon emissions (Raza and Tang, 2022). Wang highlighted that the level of green finance (Wang et al., 2024), financial technology (Chen W. J. et al., 2024), and economic development (Ji et al., 2024) all contribute to reducing regional carbon emissions and ensuring sustainable development. However, some scholars have also pointed out that foreign investment has a negative impact on curbing carbon emissions (Ma and Zhu, 2024).

The manufacturing sector, as a fundamental industry for economic construction and development, thus plays a crucial role in global economic growth. However, the crude development paradigm of “high input, high emission, and high consumption” in the manufacturing has made it the primary source of carbon emissions. As indicated by statistics, carbon emissions from the manufacturing sector, including energy consumption and direct emissions from production processes, account for about 30% of global carbon emissions. This makes it a significant contributor to global carbon emissions. Therefore, promoting carbon emission reduction in the manufacturing sector is crucial for addressing global climate issues. In addition, as one of the world’s largest carbon emitters and the world’s largest manufacturing country, China not only contributes to the stabilization of the global economy but also affects the quality of global ecological environment. Therefore, promoting the green and low-carbon transformation of China’s manufacturing industry is a key goal in achieving “carbon peak” and “carbon neutrality,” thereby contributing to global carbon reduction efforts.

However, exploring how to effectively promote green development and foster the symbiosis of environmental and economic benefits for manufacturing enterprises from a micro perspective is a crucial issue that requires attention from both academia and industry. In addition, since carbon performance directly determines overall carbon emission levels (Gao et al., 2021), it can reflect not only information about an enterprise’s emission reductions but also the economic inflow generated by carbon emissions during the operation of the enterprise (Wang M. L. et al., 2023). Therefore, it is of great theoretical and practical significance to find effective ways to improve the carbon performance of manufacturing enterprises and assist them to develop sustainably. This will help promote the realization of China’s “double carbon” goal and further alleviate the global carbon emission problem while ensuring the stable development of the social economy.

In the meantime, the emergence of digital technology, exemplified by cloud computing and big data, has created opportunities for manufacturing enterprises to undergo low-carbon transformation. However, existing research reveals no unified conclusion from industry and academia regarding the linkage between carbon performance and digital technology. According to the Global E-Sustainability Promotion Institute (GESI), digital technology has the hidden ability to decouple carbon emissions from economic growth, thereby driving improvements in corporate carbon performance. Some argue that enterprises can leverage big data, blockchain, and other digital technologies to integrate innovations into energy-saving and emission-reduction processes, ultimately enhancing the reduction of corporate emissions (Chen Q. L. et al., 2024; Liu Y. J. et al., 2024). Some have argued that advances in digital technology result, to a certain extent, in the additional consumption of resources, leading to increased greenhouse gas emissions (Lange et al., 2020). The construction of digital industry facilities can lead to high energy consumption (Bianchini et al., 2023), thus resulting in increased carbon emissions (Lange et al., 2020). Some studies also find the presence of a non-linear relationship, initially suppressed and then revealed (Zheng et al., 2023; Zhan and Pu, 2024).

Others have investigated the mechanisms through which digital technology impacts carbon emissions, among which are industrial structure (Zeng and Yang, 2023) and improvements in energy efficiency and green technology innovation capacity (Liu H. et al., 2024). Most research affirms the ability of green innovation to solve corporate environmental problems (Hojnik and Ruzzier, 2016b; Song and Yu, 2018; Dong et al., 2023), indicating that it can indirectly contribute to carbon performance by improving economic efficiency through the optimization of factors such as allocation (Deng et al., 2019) and cost reduction (Peng et al., 2020). However, others have pointed out that the rebound effect of green innovation can lead to an increase in net carbon emissions (Li et al., 2020) due to factors such as the potential hindrance of cost pressure during the investment process (Habiba et al., 2022). In addition, the existing literature mainly focuses on independent innovation. As collaborative innovation becomes increasingly important for enterprise innovation, the academic community has proposed the concept of green collaborative innovation, which indicates that it can integrate multi-disciplinary perspectives and resources to help solve environmental problems, leading to a new green innovation method that balances economic growth and environmental sustainability. Therefore, this paper considers the autonomy and collaborative behaviors of green innovation (Lian et al., 2023). However, some scholars have pointed out that the green market environment, synergistic capacity and benefits, and synergistic costs and risks will affect the enthusiasm and innovation stability of green collaborative innovation (Yang and Zou, 2023), thus affecting its effect. Taken together, this paper selects green innovation as a mediating variable, specifically as green technology innovation and green collaborative innovation, to explore whether both autonomous and collaborative green innovation play a role in the relationship between digital technology and carbon performance.

This paper proposes that when analyzing how digital technology affects carbon performance, the boundary environment of enterprises must be considered. Based on signaling theory, enterprises are non-independent individuals in the market environment, and their strategic behaviors will be affected by internal and external influences. Environmental disclosure is the primary means of corporate communication regarding the environmental status to external stakeholders (Zhang C. et al., 2024), influences corporate risk (Lee et al., 2024), investments (Pan et al., 2023), share prices (Yang et al., 2023), and the selection of green innovation strategies (Lu and Li, 2023). These factors, in turn, impact the allocation of resources aimed at improving carbon performance. Therefore, this paper chooses the factor of environmental information disclosure to explore its digital technology and carbon performance moderating role. Based on the literature study, the following questions are therefore worth considering.

Question 1. What is the correlation between firms’ carbon performance and digital technology?

Question 2. Can green innovation serve as a mediating mechanism between digital technology and firms’ carbon performance? Are the environmental impacts of green technology innovation and green collaborative innovation the same?

Question 3. Does environmental information disclosure play a moderating role between digital technology and firms’ carbon performance?

To address these issues, this paper will first empirically analyze these questions based on resource orchestration and signaling theory. Second, it will utilize data from China’s A-share listed manufacturing enterprises from 2012 to 2021, and, to ensure its quality and reliability, this paper will employ a fixed-effects model for linear regression on the panel data and use an instrumental variable approach in the robustness test to address endogeneity. It will further explore and test the mechanism paths and boundary-influencing factors between the two, as well as analyze heterogeneity according to the nature of the industries in which the firms are situated and the different strategic aggressiveness.

The following contributions are made by this research. 1) This paper focuses on China’s manufacturing enterprises, exploring the effect of digital technology on carbon performance through micro-level research. 2) Previous studies have mainly focused on autonomous green innovation, but this paper considers the increasingly important function of collaborative innovation in today’s enterprises, dividing green innovation into two categories: green technology innovation and green collaborative innovation. It explores their roles in the process of digital technology affecting carbon performance from the perspectives of autonomous and collaborative behavior, thus expanding research on the path mechanism of carbon performance. 3) This study identifies the mechanism of the moderating impact of environmental information disclosure, enriching research on the boundary factors of digital technology that affect carbon performance. 4) Most heterogeneity studies focus on regions and the nature of enterprise property rights. In its further analysis, this paper identifies that the heterogeneity of the study exists across samples with different industry natures and varying degrees of strategic aggressiveness. This provides a basis for differentiated promotion of the “dual carbon” goal in China’s manufacturing industry.

Digital technology offers new opportunities for enhancing the carbon performance of enterprises. Borrowing from the theory of resource orchestration, digital technology at the enterprise level can effectively utilize vast data resources. It uses data as the basic element to optimize production and manufacturing (Xie et al., 2024) so that it can strip and reuse the enterprise’s idle resources in time and build a more reasonable and better resource combination within the enterprise, thus controlling carbon emissions (Wen et al., 2022). Generally, lower carbon emissions indicate a better carbon performance of an enterprise (Wang S. Y. et al., 2023). From a regional perspective, digital technology can better integrate into the design, manufacturing, and operations of various industries and processes (Weigel and Manfired, 2019; Zhong et al., 2022) than traditional manufacturing enterprises. Digital technology can empower enterprises to optimize the industrial structure while maintaining economic benefits and reduce the mismatch of resources, thus reducing carbon emissions (Stanko and Rindfleisch, 2023). According to signaling theory, in market competition, as the rapid accumulation of data by manufacturing enterprises increases dramatically, digital technology, as a basic and strategic resource for obtaining development information (Song et al., 2019), can significantly improve the search scope, transmission speed, and transparency of information (Yoo et al., 2012). To a certain extent, it enhances the acuity and flexibility of enterprises to perceive green information and technology. Digital technology reduces marginal cost through the sharing of data, which provides the conditions for the enterprises to utilize efficient energy-saving activities in terms of time and space (Hui et al., 2024). As a result, enterprises can indirectly reduce carbon emissions and enhance carbon performance by improving the allocation efficiency of innovation resources to reduce energy consumption and increase inputs. Consequently, we have formulated the following research hypothesis:

Hypothesis 1. Digital technology can improve enterprise carbon performance.

Driven by the “double carbon” goal, green innovation has become a ready tool for businesses to solve environmental problems (Luo et al., 2023). Green innovation encompasses a range of innovative activities, including technology, products, and management and service-related systems (Hojnik and Ruzzier, 2016a). Research has highlighted the significance of green technology innovation, including process improvement and material research and development, in facilitating enterprises to achieve a mutually beneficial outcome with both environmental and economic advantages. Nikzad and Sedigh (2017) and Xie Xuemei et al. have identified green innovation behaviors that transcend organizational boundaries in their analysis of the green transformation process of enterprises. They have defined this phenomenon as “green collaborative innovation”, wherein multiple entities are able to complement and optimize green technologies and knowledge across various fields (Xie and Han, 2022). Using to the research literature, green innovation can be categorized into two types from the perspective of research and development (R&D): green technology innovation, representing enterprises’ independent R&D capability and green collaborative innovation, representing enterprise R&D cooperation.

Based on resource orchestration theory, the capability to integrate resources can assist enterprises in creating higher value (Zhu and Li, 2023), which also gives them competitive advantage (Matinaro et al., 2019). Digital technology can liberate information by assimilating technology, knowledge, and information resources (Yuan and Pan, 2023) for strategic green layout. It can empower the enterprise’s innovation, providing new and efficient technologies for businesses to implement green innovation activities. Green technology innovation is thus enhanced so that enterprises can use the green power of resources by focusing on cleaner production and end-of-pipe technologies. They can realize the substitution of green energy and other methods (Han et al., 2024) to reduce negative consequences for the environment (Zhang et al., 2019) and accelerate the improvement of carbon performance. According to signaling theory, digital technology facilitates the creation of a cooperation network for enterprises, which can help them overcome geographical and resource limitations, expand the scope of green innovation by enhancing information exchange among different enterprises (Tang et al., 2023), and provide internal and external resources for green innovation on a broader spatial and temporal scale (Li et al., 2023). Digital technology also enables the collection of technological knowledge across multiple fields, allowing green innovation to achieve a synergistic innovation effect of “1 + 1>2″, improve the overall efficiency of green innovation for enterprises and stakeholders, and indirectly remove barriers to enhancing the carbon performance of enterprises and the industry as a whole. These research hypotheses are therefore proposed:

Hypothesis 2. Green innovation plays a mediating role between digital technology and corporate carbon performance.

Hypothesis 2a. Green technology innovation plays a mediating role between digital technology and corporate carbon performance.

Hypothesis 2b. Green collaborative innovation plays a mediating role between digital technology and corporate carbon performance.

Enterprises are not independent entities in the market environment; their strategic behavior is influenced by multiple factors from within and outside. Environmental information disclosure, as the primary means for an enterprise to demonstrate its environmental situation and level of environmental governance to the outside world, will impact its green strategy implementation (Zhang J. et al., 2024) and industrial structural adjustment, whether of high or low quality (Liu et al., 2021). According to signaling theory, disclosing environmental information can reduce information asymmetry and opacity, enabling other parties to better understand a company’s environmental pollution data (Ye et al., 2023); it also serves as a monitoring mechanism (Cheng et al., 2017). Faced with scrutiny from external parties, companies are motivated to engage in various carbon reduction initiatives, prompting them to leverage digital technology to improve quality and efficiency in the dissemination of environmental information (Zhang Y. J. et al., 2024). This, in turn, enhances corporate reputation and garners public support (Zhang et al., 2023). It also attracts external investment (Pan et al., 2023) and integrates corporate information internally, enabling companies to break away from traditional path dependency and empowering them to upgrade their strategies, thus reducing short-sighted corporate management and focusing on more long-term sustainable strategic goals, and so improving carbon performance. Accordingly, the research proposes this hypothesis:

Hypothesis 3. The influence of digital technology on company carbon performance can be amplified through environmental information disclosure.

Figure 1 depicts the paper’s theoretical model.

This study utilizes panel data from China’s A-share listed manufacturing enterprises from 2012 to 2021 as the research sample. The data measuring digital technology and carbon performance come from the CSMAR database, while the data on green innovation are obtained from the CNRDS. Additionally, the data on environmental disclosure are collected from listed companies’ annual reports and China Provincial Databases, and data on other firm-level variables are organized from the CSMAR, CNRDS, and RESSET databases. The study processed the relevant data for the aim of ensuring the availability of the data as follows: 1) excluding ST, *ST, PT, and terminated-listed firms during the study period; 2) excluding insolvent and missing-data samples; 3) all continuous variables are subjected to standard shrinkage between 1% and 99%. Balanced panel data consisting of 16,876 observations were thus obtained.

Given that businesses are unlikely to voluntarily disclose their carbon emissions, this paper indirectly estimates enterprise carbon emissions by using the industry’s carbon emissions as a reference (Ding et al., 2023). It calculates the data by dividing the ratio of the enterprise’s operating income per million yuan to its carbon emissions by 100, using revenue per unit of carbon emissions as a proxy for the enterprise’s carbon performance (CPER) (Gao et al., 2024). The specific calculations are reflected in Eqs 1, 2 below:

The annual reports of enterprises can reflect their strategic directions; therefore, most research uses text analysis to measure the degree of the digitization of enterprises by analyzing the number of words related to numbers in their annual reports (Wen et al., 2022). In comparison with other methods, the text analysis method can comprehensively reflect the degree of digital technology adoption by microenterprises. Therefore, this paper draws on Qi et al. (2024) to organize specific keywords related to digital technology and categorize them into two dimensions based on the previous analysis. One dimension is the application of digital technology, which focuses on its implementation. The other dimension is the research and development of digital technologies such as AI, blockchain, cloud computing, and big data (Yu and Tang, 2023). The keywords are summarized in Table 1. Expressions with negative words such as “no” before the keywords are eliminated. This paper then summarizes and extracts the annual reports of all A-share listed enterprises using Python software. It calculates the frequency of keywords in the annual reports as a measure of digital technology (LDIGTA). Then, based on the keyword phrases in Table 1, the word frequencies are summed up and subjected to logarithmic processing. A higher value indicates a higher level of an enterprise’s digital technology.

Numerous studies have used the number of green patent applications by enterprises as an indicator of the level of green innovation and innovation within enterprises (Zhang and Zhao, 2023; Di et al., 2024). Green application patents usually cover green invention and utility patents. More innovative green invention patents are a better indicator of the quality of green innovation than green utility patents. Therefore, for green technology innovation (LGreTeIn), we calculate the number of green invention patents filed independently by listed companies plus one to take the logarithm. Then we measure green collaborative innovation (LGreCoIn) by the number of jointly filed green invention patents plus one taking the logarithm.

This paper refers to the research of Kong et al. (2021), which classifies the disclosure of environmental information according to whether it is monetized, and divides monetized and non-monetized information into five dimensions according to scoring criteria: environmental responsibility, performance and governance, management, regulations and certifications, and disclosure channels (scores are assigned to each dimension—Guo et al. (2023)), and sums up and logarithmically processes the data as a measure of the environmental information disclosure index (EDI).

Drawing on existing research and the characteristics of listed manufacturing enterprises, the following control variables are selected: 1) revenue growth rate (Growth); 2) listed years (ListAge); 3) management shareholding ratio (M share); 4) Tobin’s Q (Tobin Q); 5) research and development intensity (RDEX); 6) shareholding checks and balances (Balance1); 7) accounts receivable ratio (REC); 8) solvency (GEAr). The variable definitions of the main research variables are presented in Table 2.

This paper builds the benchmarking model to validate the effect of digital technology on carbon performance:

where

The following mediation effect model is constructed on the basis of Eq. 3 for further empirical testing:

Here,

To deeply explore the effect of the interaction between environmental information disclosure and digital technology disclosure of manufacturing firms on carbon performance, this study adds a centered interaction term

where

In this paper, the VIF test was performed prior to the benchmark regression; all the VIF values were less than 2, indicating no significant multicollinearity between variables. The Hausman test and F-test were then conducted. Synthesizing the test results, we chose the fixed effects model for estimation. The descriptive statistics of major variables in Table 1 are presented in Table 3.

In this section, the results of models (3)–(6) for the two-way fixed-effects model are derived, along with all regressions with clustered standard errors at the firm level; they are compared with earlier findings. Next, robustness tests are then conducted to mitigate endogeneity issues. Finally, heterogeneity in firm nature and strategic aggressiveness is explored.

Table 4 presents the baseline regression analysis of the influence of digital technology on carbon performance. Column 1 reports the influence of digital technology on firms’ carbon performance while controlling only for individuals and time; the coefficient of the direct effect of digital technology on firms’ carbon performance is 0.604. Column 2 incorporates control variables. These results suggest that the influence of digital technology on corporate carbon performance is consistently positive whether or not control variables are included, which aligns with the findings of Wen et al. (2022), Chen et al. (2024a), and Liu H. et al. (2024). It also verifies Hypothesis 1, indicating that manufacturing industry enterprises can leverage digital technology to enhance enterprise carbon performance.

Furthermore, according to the regression analysis of control variables, it can be seen that a firm’s years on the market, Tobin’s Q, a firm’s solvency, equity checks and balances, and R&D intensity can all positively contribute to a firm’s carbon performance, with coefficients of 0.898, 0.240, 3.386, 1.154, and 0.337, respectively. This may be because the longer a company is listed, the greater its potential for growth, the higher its overall value, and the greater its investment in R&D. This indicates that the company is more capable of promoting the decoupling of its economy and carbon emissions and that it can actively invest more resources in carbon reduction activities, resulting in better carbon performance. Conversely, the growth rate of a firm’s operating income and proportion of accounts receivable negatively affect its carbon performance, with coefficients of −0.505 and −4.409, suggesting that a higher level of investment and production operation will lead to poorer carbon performance. In terms of shareholding structure, management shareholding is detrimental to a company’s carbon performance, while equity stability can enhance it. A high management shareholding ratio indicates that they have significant and unrestricted control over the company’s governance. This increases the likelihood of the management being more short-sighted and making decisions in favor of their own interests, thereby potentially neglecting the long-term interests and sustainability of the enterprise (Wang Z. R. et al., 2023). Hence, shareholding checks and balances are beneficial for an enterprise in aligning its strategic vision with a more sustainable path of development, ultimately enhancing its overall carbon performance.

Robustness tests were conducted, with the results presented in Table 5 to ensure the credibility of the model estimation results.

The first was an endogenous test. Considering the existence of a certain reverse causality between digital technology and enterprise carbon performance, which leads to the endogeneity problem, this paper adopts the instrumental variable method to deal with the problem. Considering that the level of digital technology in the industry in which the enterprise operates and the density of mobile base stations are closely related to the digital technology application by enterprises, and at the same time, it is also difficult to produce a direct logistical correlation of the carbon performance of the enterprise, so this paper chose the average level of digital technology industry (ADAI) (Li and Shen, 2021) and the density of mobile base stations (MBSD) as the instrumental variables. The results are shown in columns 1 and 2 of Table 5, in which the weak instrumental variable and over-identification tests verify their relevance and exogeneity, respectively, and the regression results show that after overcoming the endogeneity problem, the positive impact of digital technology on corporate carbon performance is still significant, and the results are still robust.

There are, at the same time, more factors that affect carbon performance. The control variables selected in this paper are limited, so the problem of omitted variables may arise; this paper thus introduces the size of the firm (SIZE) and the level of economic development of the province in which the firm is located (REDL) as new control variables. The results are shown in column 3 of Table 5, where the coefficient before the numerical technical indicators is 0.527 and positively significant, so the results are robust.

We second replaced the dependent variables. Given that the current state of digital technology in manufacturing companies is likely to affect future carbon performance, this study substituted the dependent variables for future period data and re-ran the regression. The results are displayed in Column 4; the coefficient before the numerical technical indicator is 0.423 and positively significant, which is not different from the previous result.

Third, we replaced the independent variables. By comparing the two dimensions of the digital technology division—the digital technology application dimension and the digital technology R&D dimension—we selected the word frequency that represented the more specific digital technology application index (LDigAPP) as a replacement variable. The regression was then re-run. Column 5 shows the results, and so the coefficient for the digital technology (LDigApp) indicator is 0.346, showing a positive relationship at the 5% level. This finding is consistent with the conclusions of the previous benchmark regressions.

Fourthly, non-heavy-polluting enterprises were excluded from the sample subregression. In manufacturing enterprises with significant emissions, high energy-consuming and heavily polluting enterprises account for a larger proportion of carbon emissions. Therefore, this paper categorizes the heavily polluting enterprises based on Pan et al. (2019) and examines whether digital technology will continue to enhance carbon performance in these enterprises after excluding the non-heavy polluting samples. Column 6 demonstrates that the coefficient of the effect of digital technology on carbon performance still behaves positively. Although it is slightly reduced in comparison, it is enough to show the credibility of the carbon reduction effect of digital technology on firms.

Lastly, we replaced the clustering robust standard error at the industry and city levels. From the results displayed in Columns 7 and 8, respectively, the coefficients of digital technology indicators do not change significantly in significance and sign after regrouping the standard errors at the industry and city levels. Although the coefficients clustered at the industry level for digital technology are slightly lower in magnitude and significance, digital technology still demonstrates a significant positive push on firms’ carbon performance.

This paper used Eqs 4 and 5 to examine whether digital technology can impact corporate carbon performance through green innovation. The analysis was performed with stepwise regression as the main method, and a Bootstrap test was used to perform 1,000 sample regressions to further assist validation. Table 6 presents the mediation test results of green technology innovation and green collaborative innovation.

Columns 1 and 5 reveal the results of digital technology on green technological and green collaborative innovation. From the results, it is evident that the coefficients of digital technology are 0.021 and 0.007, respectively, and both are significant, suggesting that digital technology is capable of enhancing the level of green technological and collaborative innovation within companies, confirming Li et al. (2023) and Han et al. (2024). Furthermore, core explanatory variables were added in columns 2 and 6. The coefficients of digital technology and green technology innovation in column 2, digital technology and green collaborative innovation in column 6 are all significantly positive, with values of 0.528, 0.525, 0.533, and 0.770 respectively. The coefficients of digital technology are smaller than the main effect regression coefficients without intermediaries. In addition, the confidence interval adjusted for bias in the Bootstrap test does not contain zero and shows a positive sign. Based on a variety of results, we comprehensively judge that there is a mediation effect. This means that digital technology can enhance carbon performance by ramping up independent green technology innovation and green collaborative innovation on behalf of R&D cooperation. Thus, Hypotheses 2a and 2b are both verified.

In order to further verify the existence of green innovation mechanisms, this study comprehensively considered green invention patents and green utility patents. It utilized the total amount of green patents independently applied by the company (LGreTe), the total amount of green patents jointly filed (LGreCo) plus one to take the natural logarithm as a replacement variable to re-measure the level of green technological and green innovation for regression. Results are shown in Columns 3, 4, 7, 8, respectively. Depending on the outcome, the coefficients and significance of the indicators of digital technology, green technology innovation, and green collaborative innovation do not produce significant changes.

Taken together, the results indicate that digital technology is capable of improving the carbon performance of firms by enhancing green innovation; thus Hypothesis 2 is confirmed. This is consistent with Dong et al. (2023) and Zhang et al. (2019) on the ability of green innovation to solve environmental problems in enterprises.

Environmental disclosure is taken as a moderating variable to test whether the influence of digital technology on carbon performance is swayed by environmental disclosure in this paper, and Eq. 6 is utilized to test the moderating effect. Column 2 of Table 7 shows the coefficient of the interaction term between environmental disclosure and digital technology as 0.426, indicating that environmental disclosure positively moderates the process of carbon performance enhancement by digital technology. Thus, the greater the quality of environmental disclosure by an enterprise, the more energy and resources enterprises will go into the behavior of carbon emission reduction in the face of supervision from outside subjects. This prompts the enterprise to take the initiative to seek ways to improve resource allocation methods, leading to the improvement of enterprise carbon performance. Hence, Hypothesis 3 is verified.

The impacts of digital technology, green innovation, and environmental information disclosure on carbon performance vary across firms with different strategic aggressiveness due to their different nature and implementation strategies. Therefore, this paper conducted subgroup regressions on a sample of companies in various types of industry and with different levels of strategic aggressiveness.

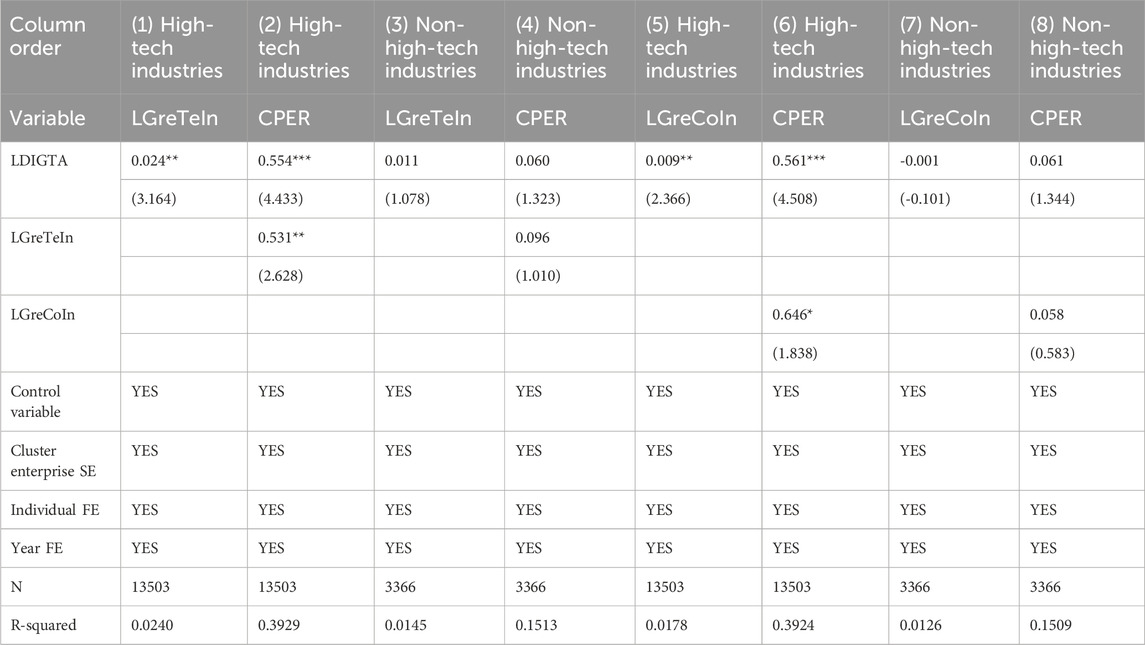

Considering that manufacturing enterprises of different industry types will vary in their implementation of digital technology, the activities of green innovation, the disclosure of environmental information due to differences in their own conditions, and such variations will affect an enterprise’s ability to reduce carbon emissions and increase efficiency. This paper categorizes the enterprise samples into high-tech and non-high-tech industries, based on their nature.

The industry heterogeneity analysis of the influence of digital technology on carbon performance is presented in Table 8. In Column (1), we can see that within the sample of high-tech industry firms, digital technology significantly boosts corporate carbon performance. Column 2 displays the regression result for non-high-tech industry enterprises, indicating a coefficient of 0.061 for the digital technology indicator; however, the result is not statistically significant. Thus, by comparing the two, high-tech industry enterprises are shown to have a greater potential for carbon reduction. This suggests that high-tech industry firms possess more human capital and advanced technology and equipment. They are also more likely to capitalize on opportunities in today’s wave of digitization and utilize a variety of digital technologies to enhance their carbon performance level.

Table 9 presents the industry heterogeneity analysis of the two mediating mechanisms. It is apparent that digital technology can enhance the carbon performance of high-tech industry enterprises through two pathways: green technology and green collaborative innovation. However, the mediating effects of these do not exist in non-high-tech industry enterprises, because there is a superior level of technology and pollution control in high-tech industry firms, coupled with government encouragement of the promotion and development of high-tech technology, they have more resources and policy support, and therefore digital technology can facilitate the two channels of green innovation, leading to higher levels of companies’ carbon performance.

Table 9. Industry heterogeneity testing of green technology innovation and green collaborative innovation mechanisms.

Table 10 presents the findings of an industry heterogeneity analysis of environmental information disclosure. This indicates that environmental disclosure can positively influence carbon performance driven by digital technology, regardless of whether they are in high-tech industries, although the moderating effect is better in high-tech industries. This is because high-tech companies themselves are a focus of the public and the government, and their level of environmental disclosure can convey the positive information of the enterprise to the outside world and become a favorable tool for the enterprise to enhance its competitiveness. This prompts the enterprise to take the initiative to use digital technology and other means to enhance its carbon performance. In contrast, non-high-tech manufacturing enterprises are constrained by resource availability, policy conditions, and digitalization construction, which limit their ability to fully leverage environmental information disclosure to regulate digital technology and promote carbon performance.

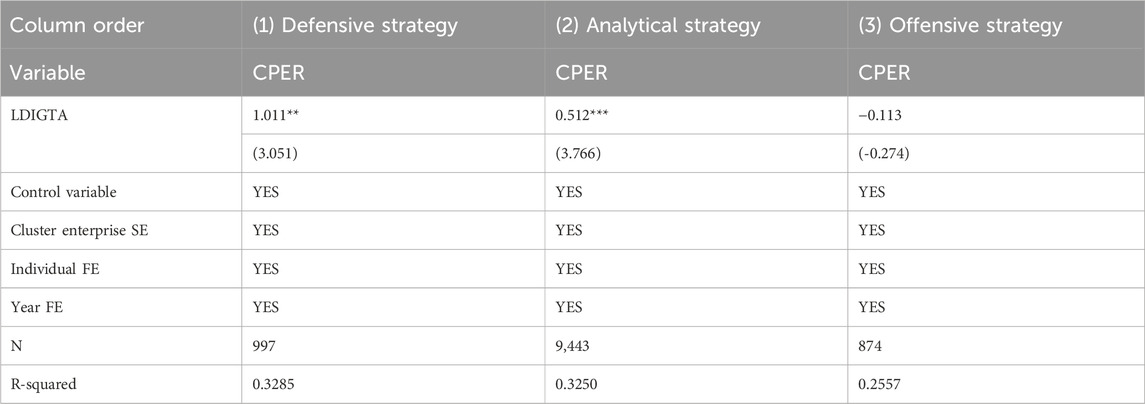

An enterprise’s development strategy is an important motivator for the construction and development of digital technology in manufacturing enterprises. Its development objectives and business directions are affected by different degrees of strategic aggressiveness (Weinzimmer et al., 2023). Enterprises with low degrees of strategic aggressiveness tend to choose a more prudent development strategy to ensure the maintenance of the existing business performance. Enterprises with a high degree of strategic aggressiveness tend to pursue the maximization of benefits, which will inevitably have different impacts on how companies build digital technology, green innovation, and environmental disclosure, which in turn affects their carbon performance. For the purpose of verifying this, this study passed through the steps of sorting, assigning, and summing up the six dimensions of innovation tendency, market expansion tendency, growth, production efficiency, organizational structure, and capital density. These are divided into three groups—defensive, analytical, and offensive strategies—based on their total scores, with the degree of aggressiveness increasing in turn (Wang J. X. et al., 2023).

The results of the heterogeneity test for the strategic aggressiveness of the impact of digital technology on firms’ carbon performance are shown in Table 11. These demonstrate that digital technology can help companies with defensive and analytical strategies improve their carbon performance. However, it has a negative but not significant impact on the carbon-performance-implementing offensive strategies, with a coefficient of −0.113. This is because offensive enterprises are more inclined to open up new markets and strive for higher economic benefits, therefore increasing the utilization and flow rate of resources; this in turn increases carbon emissions and is not conducive to the carbon performance of enterprises.

Table 11. Heterogeneity test of strategic incentive progress of the impact of digital technology on carbon performance.

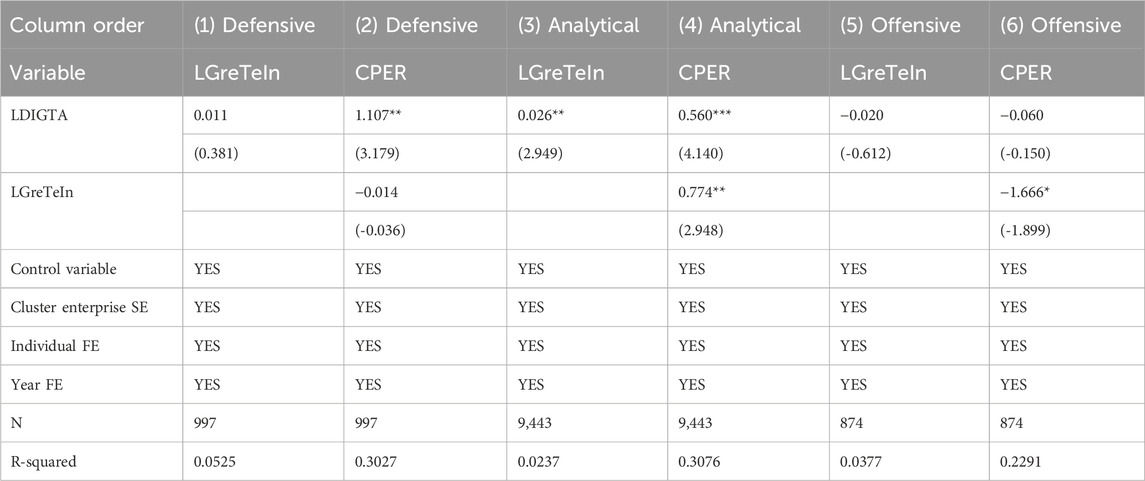

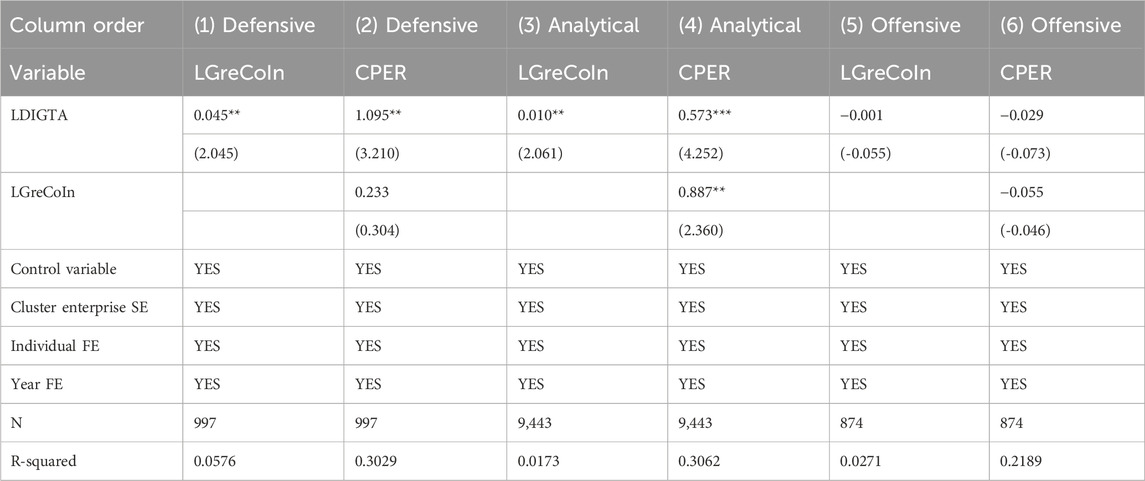

Tables 12 and 13 show the analysis of the heterogeneity of the strategic aggressiveness of the two mediating mechanisms. The results suggest that the two mediating paths—green technology innovation and green collaborative innovation—can only work in enterprises that implement analytical strategies, but they do not exist in enterprises that implement both defensive strategies and offensive strategies. This is because enterprises focus more on short-term economic benefits when implementing defensive strategies and will neglect their environmental performance in order to avoid risks and reduce resource inputs. On the other hand, enterprises that implement offensive strategies may increase resource demand in pursuit of higher economic benefits, which is also not conducive to improving carbon performance.

Table 12. Heterogeneity test of the strategic incentive progress of the green technology innovation mechanism.

Table 13. Heterogeneity test of the strategic stimulation progress of the green collaborative innovation mechanism.

Table 14 shows the findings of strategic aggressiveness heterogeneity analysis on the moderating impact of environmental disclosure. This indicates that in companies that implement analytical strategies, environmental disclosure can positively influence the adoption of digital technology to enhance corporate carbon performance. However, environmental disclosure did not have such a moderating effect in firms with defensive and offensive strategies. This suggests that higher-quality environmental disclosure in companies that implement analytical strategies is more beneficial for leveraging digital technology to enhance corporate carbon performance.

Based on the realistic scenarios now driving the digitalization and green low-carbon transformation of firms, this study empirically explored data from China’s A-share listed manufacturing enterprises for 2012–2021 by adopting a fixed-effects model through resource coordination and signaling theories. Specific studies include the impact of digitalization technology on the carbon performance of manufacturing companies, the dual intermediary mechanism of green technological and green collaborative innovation, and the moderating role of environmental information disclosure. From these empirical results, the conclusions and contributions follow thus.

(1) Digital technology can help companies improve their carbon performance, and the results remain valid after various robustness tests. In other words, digital technology can help businesses maximize the value of data, optimize resource utilization processes, and promote sustainable enterprise development.

(2) Digital technology can promote the enhancement of enterprise carbon performance through the two intermediary mechanisms of green technology innovation and green collaborative innovation. Enterprises can break the information shackles by utilizing digital technology to obtain green core competitiveness and promote their own and cross-principal green innovation activities, which then helps them enhance their carbon performance.

(3) Environmental information disclosure shows a positive moderating impact in the process of promoting enterprise carbon performance by digital technology. Environmental disclosure can decrease the asymmetry and opacity of information externally, so that in the face of public supervision and government regulation, it can focus on long-term sustainable development, take the initiative to launch the construction of digital technology, and enhance firms’ carbon performance.

(4) Differences in the nature of industries and the aggressiveness of enterprises’ implementation strategies lead to heterogeneity in the impacts of digital technology, green innovation, and environmental information disclosure on carbon performance. Specifically, when considering industry heterogeneity, the effectiveness of digital technologies to improve carbon performance, green innovation, and environmental disclosure are more significant for high-tech industry enterprises. Additionally, when considering the heterogeneity of enterprise strategic aggressiveness, digital technology shows a better ability to improve carbon performance in companies with defensive and analytical strategies than companies with offensive strategies, while the character of green innovation as a mediator and environmental disclosure as a moderator is more significant among firms with analytical strategies.

The following useful insights are obtained by this study based on the empirical results.

First, manufacturing companies should concentrate on the carbon reduction potential of digital technologies, build their digital talent pipeline and infrastructure, and apply it to more enterprise development areas. They should also establish a green innovation system around digital technology and proactively ramp up the quality of environmental information disclosure, which supports improving their carbon performance. Manufacturing businesses should also base their decisions on their current state, the characteristics of their sector, and the application of a plan to create a carbon performance improvement plan. To support the complete implementation of carbon reduction goals, non-high-tech industrial firms should expedite the creation of digital technology and green innovation investment. Businesses that adopt more aggressive or conservative strategies should also adopt digitalization and greening practices appropriate to their own elemental structure and strategic goals. They should also avoid placing undue emphasis on short-term financial gains and high performance in exchange for environmental harm and instead ensure their own sustainable development.

Second, the manufacturing industry should fully consider the characteristics of the industry and the law of development, the development of differentiated digitalization and green transformation programs, and the scientific promotion of digital technology infrastructure. They should do so focusing on enterprise-independent green technology research and development, the construction of a multi-body green R&D cooperative platform, and rely on the platform of synergistic innovation results to promote the whole manufacturing industry, the whole chain of digitalization, and green transformation.

Third, local governments should increase support for the digital technology construction and green innovation activities of manufacturing enterprises. Government should consider factors such as type of industry and degree of a company’s development to establish precise and differentiated support policies to expedite the promotion of digital and green transformation in traditional manufacturing enterprises. It should also more intensively supervise enterprises’ environmental information disclosure and formulate corresponding warning and punishment rules. Moreover, government can improve innovation incentive policies, provide incentives for enterprise innovation behavior—such as subsidies, tax incentives, or technical support—and actively promote inter-enterprise innovation cooperation to guide the construction of digital technology and green innovation for manufacturing enterprises and even the whole industry, thereby promoting the transformation of China’s manufacturing industry into a low-carbon economy, facilitating the implementation of China’s “dual-carbon” target program, and thus contribute to the mitigation of environmental problems caused by global carbon emissions.

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

JL: writing–review and editing. LJ: writing–review and editing and writing–original draft. SZ: writing–review and editing. YZ: writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work is funded by the National Social Science Foundation of China (22BJY227).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Bianchini, S., Damioli, G., and Ghisetti, C. (2023). The environmental effects of the “twin” green and digital transition in European regions. Environ. Resour. Econ. 84 (4), 877–918. doi:10.1007/s10640-022-00741-7

Chen, Q. L., Gong, Z. Y., Wu, J. F., and Wang, T. C. (2024a). Does digital transformation affect carbon performance through talent? The moderating role of employee structure. J. Clean. Prod. 435, 140581. doi:10.1016/j.jclepro.2024.140581

Chen, W. J., Wang, J., and Ye, Y. F. (2024b). Financial technology as a heterogeneous driver of carbon emission reduction in China: evidence from a novel sparse quantile regression. J. Innovation Knowl. 9 (2), 100476. doi:10.1016/j.jik.2024.100476

Cheng, Z. H., Wang, F., Keung, C., and Bai, Y. (2017). Will corporate political connection influence the environmental information disclosure level? Based on the panel data of A-shares from listed companies in Shanghai stock market. J. Bus. Ethics 143, 209–221. doi:10.1007/s10551-015-2776-0

Deng, Y. L., You, D. M., and Wang, J. J. (2019). Optimal strategy for enterprises’ green technology innovation from the perspective of political competition. J. Clean. Prod. 235, 930–942. doi:10.1016/j.jclepro.2019.06.248

Di, K. X., Xu, R. H., Liu, Z. K., and Liu, R. K. (2024). How do enterprises green collaborative innovation network locations affect their green total factor productivity? Empirical analysis based on social network analysis. J. Clean. Prod. 438, 140766. doi:10.1016/j.jclepro.2024.140766

Ding, X., Ren, Y. J., Tan, W. H., and Wu, H. M. (2023). Does carbon emission of firms matter for Bank loans decision? Evidence from China. Int. Rev. Financial Analysis 86, 102556. doi:10.1016/j.irfa.2023.102556

Dogan, E., Chishti, M. Z., Karimi Alavijeh, N., and Tzeremes, P. (2022). The roles of technology and kyoto protocol in energy transition towards COP26 targets: evidence from the novel GMM-PVAR approach for G-7 countries. Technol. Forecast. Soc. Change 181, 121756. doi:10.1016/j.techfore.2022.121756

Dong, S. M., Ren, G. X., Xue, Y. T., and Liu, K. (2023). How does green innovation affect air pollution? An analysis of 282 Chinese cities. Atmos. Pollut. Res. 14 (9), 101863. doi:10.1016/j.apr.2023.101863

Gao, P., Yue, S. J., and Chen, H. T. (2021). Carbon emission efficiency of China’s industry sectors: from the perspective of embodied carbon emissions. J. Clean. Prod. 283, 124655. doi:10.1016/j.jclepro.2020.124655

Gao, W., Wen, S. B., Li, H., and Lyu, X. (2024). Executives carbon cognition and corporate carbon performance: the mediating role of corporate low-carbon actions and the moderating role of firm size. Heliyon 10 (1), e23959. doi:10.1016/j.heliyon.2023.e23959

Guo, C., Jiang, Y. L., Yu, F., and Wu, Y. Y. (2023). Does environmental information disclosure promote or prohibit financialization of non-financial firms? Evidence from China. Q. Rev. Econ. Finance 92, 200–214. doi:10.1016/j.qref.2023.10.005

Habiba, U., Xinbang, C., and Anwar, A. (2022). Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 193, 1082–1093. doi:10.1016/j.renene.2022.05.084

Han, L., Xiao, Z. J., and Yu, Y. Z. (2024). Environmental judicature and enterprises’ green technology innovation: a revisit of the porter hypothesis. J. Asian Econ. 91, 101693. doi:10.1016/j.asieco.2023.101693

Hojnik, J., and Ruzzier, M. (2016a). What drives eco-innovation? A review of an emerging literature. Environ. Innovation Soc. Transitions 19, 31–41. doi:10.1016/j.eist.2015.09.006

Hojnik, J., and Ruzzier, M. (2016b). The driving forces of process eco-innovation and its impact on performance: insights from Slovenia. J. Clean. Prod. 133, 812–825. doi:10.1016/j.jclepro.2016.06.002

Hui, L. L., Xie, H. B., and Chen, X. F. (2024). Digital technology, the industrial internet, and cost stickiness. China J. Account. Res. 17, 100339. doi:10.1016/j.cjar.2023.100339

Ji, M., Li, J. R., and Zhang, M. D. (2024). What drives the agricultural carbon emissions for low-carbon transition? Evidence from China. Environ. Impact Assess. Rev. 105, 107440. doi:10.1016/j.eiar.2024.107440

Jiang, B. H., and Raza, M. Y. (2023). Research on China’s renewable energy policies under the dual carbon goals: a political discourse analysis. Energy Strategy Rev. 48, 101118. doi:10.1016/j.esr.2023.101118

Jiang, X. H., and Raza, M. Y. (2022). Delving into Pakistan’s industrial economy and carbon mitigation: an effort toward sustainable development goals. Energy Strategy Rev. 41, 100839. doi:10.1016/j.esr.2022.100839

Kong, D. M., Wei, Y. X., and Ji, M. M. (2021). The impact of environmental protection fee-to-tax policy on the green information disclosure of enterprises. Secur. Mark. Her., 2–14. (In Chinese).

Lange, S., Johanna, P., and Tilman, S. (2020). Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 176, 106760. doi:10.1016/j.ecolecon.2020.106760

Lee, G., Bae, M., Sohn, J., Han, C., and Cho, J. (2024). Does voluntary environmental information disclosure prevent stock price crash risk? – Comparative analysis of chaebol and non-chaebol in korea. Energy Econ. 131, 107394. doi:10.1016/j.eneco.2024.107394

Li, D., and Shen, W. (2021). Can corporate digitalization promote green innovation? The moderating roles of internal control and institutional ownership. Sustainability 13983, 13983. doi:10.3390/su132413983

Li, K. J., Dong, D. D., and Han, Y. F. (2020). The analysis on the environmental performance of green innovation. An examination based on spatial spillover effect and rebound effect. China Soft Sci. (7), 112–121.

Li, M., Dong, H., Yu, H. C., Sun, X. Q., and Zhao, H. J. (2023). Evolutionary game and simulation of collaborative green innovation in supply chain under digital enablement. Sustainability 15 (4), 3125. doi:10.3390/su15043125

Lian, J., Huang, X. S., and Wu, X. (2023). How green bonds promote firms green collaborative innovation? Corp. Soc. Responsib. Environ. Manag. 31, 2109–2126. doi:10.1002/csr.2688

Liu, H., Liu, Q., He, R., Li, F., and Lu, L. (2024a). Decomposition analysis and decoupling effects of factors driving carbon emissions produced by electricity generation. Energy Rep. 11, 2692–2703. doi:10.1016/j.egyr.2024.02.020

Liu, S. H., Liu, C. J., and Yang, M. (2021). The effects of national environmental information disclosure program on the upgradation of regional industrial structure: evidence from 286 prefecture-level cities in China. Struct. Change Econ. Dyn. 58, 552–561. doi:10.1016/j.strueco.2021.07.006

Liu, Y. J., Zhang, X. W., and Shen, Y. (2024b). Technology-driven carbon reduction: analyzing the impact of digital technology on China’s carbon emission and its mechanism. Technol. Forecast. Soc. Change 200, 123124. doi:10.1016/j.techfore.2023.123124

Lu, Z. Q., and Li, H. Y. (2023). Does environmental information disclosure affect green innovation? Econ. Analysis Policy 80, 47–59. doi:10.1016/j.eap.2023.07.011

Luo, G. Y., Guo, J. T., Yang, F. Y., and Wang, C. Y. (2023). Environmental regulation, green innovation and high-quality development of enterprise: evidence from China. J. Clean. Prod. 418, 138112. doi:10.1016/j.jclepro.2023.138112

Ma, D., and Zhu, Y. J. (2024). The impact of economic uncertainty on carbon emission: evidence from China. Renew. Sustain. Energy Rev. 191, 114230. doi:10.1016/j.rser.2023.114230

Ma, Yu. (2024). A study on the estimation of the desirable range of cross-border capital flows in emerging economies. Beijing: China Social Sciences Press.

Matinaro, V., Liu, Y., Tzong-Ru, L., and Poesche, J. (2019). Extracting key factors for sustainable development of enterprises: case study of SMEs in taiwan. J. Clean. Prod. 209, 1152–1169. doi:10.1016/j.jclepro.2018.10.280

Nikzad, R., and Sedigh, G. (2017). Greenhouse gas emissions and green technologies in Canada. Environ. Dev. 24, 99–108. doi:10.1016/j.envdev.2017.01.001

Pan, A., Qin, Y. Y., Li, H., Zhang, W. N., and Shi, X. P. (2023). Can environmental information disclosure attract FDI? Evidence from PITI project. J. Clean. Prod. 403, 136861. doi:10.1016/j.jclepro.2023.136861

Pan, A. L., Liu, X., Qiu, J. L., and Shen, Y. (2019). Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Ind. Econ. 02, 174–192. (In Chinese). doi:10.19581/j.cnki.ciejournal.20190131.005

Peng, B. H., Zheng, C. Y., Wei, G., and Elahi, E. (2020). The cultivation mechanism of green technology innovation in manufacturing industry: from the perspective of ecological niche. J. Clean. Prod. 252, 119711. doi:10.1016/j.jclepro.2019.119711

Qi, Y. D., Han, M. M., and Zhang, C. (2024). The synergistic effects of digital technology application and ESG performance on corporate performance. Finance Res. Lett. 61 (March), 105007. doi:10.1016/j.frl.2024.105007

Raza, M. Y. (2023). Fuels substitution possibilities, environment and the technological progress in bangladeshs transport sector. Heliyon 9 (2), e13300. doi:10.1016/j.heliyon.2023.e13300

Raza, M. Y., and Li, D. S. (2023). Analysis of energy-related CO2 emissions in Pakistan: carbon source and carbon damage decomposition analysis. Environ. Sci. Pollut. Res. 30 (49), 107598–107610. doi:10.1007/s11356-023-29824-8

Raza, M. Y., and Tang, S. L. (2022). Inter-fuel substitution, technical change, and carbon mitigation potential in Pakistan: perspectives of environmental analysis. Energies 15 (22), 8758. doi:10.3390/en15228758

Ren, X. H., Xiao, Y., Xiao, S. T., Jin, Y., and Taghizadeh-Hesary, F. (2024). The effect of climate vulnerability on global carbon emissions: evidence from a spatial convergence perspective. Resour. Policy 90, 104817. doi:10.1016/j.resourpol.2024.104817

Samargandi, N., and Sohag, K. (2022). The interaction of finance and innovation for low carbon economy: evidence from Saudi arabia. Energy Strategy Rev. 41, 100847. doi:10.1016/j.esr.2022.100847

Song, M., Ron, F., and Yusen, K. (2019). Technological challenges of green innovation and sustainable resource management with large scale data. Technol. Forecast. Soc. Change 144, 361–368. doi:10.1016/j.techfore.2018.07.055

Song, W. H., and Yu, H. Y. (2018). Green innovation strategy and green innovation: the roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 25 (2), 135–150. doi:10.1002/csr.1445

Stanko, M. A., and Rindfleisch, A. (2023). Digital manufacturing and innovation. J. Prod. Innovation Manag. 40 (4), 407–432. doi:10.1111/jpim.12686

Tang, M. G., Liu, Y. L., Hu, F. X., and Wu, B. J. (2023). Effect of digital transformation on enterprises’ green innovation: empirical evidence from listed companies in China. Energy Econ. 128, 107135. doi:10.1016/j.eneco.2023.107135

Wang, C. Q., Liu, P. Z., Ibrahim, H., and Yuan, R. X. (2024). The temporal and spatial evolution of green finance and carbon emissions in the pearl river delta region: an analysis of impact pathways. J. Clean. Prod. 446, 141428. doi:10.1016/j.jclepro.2024.141428

Wang, J. X., Ma, M. D., Dong, T. Y., and Zhang, Z. Y. (2023d). Do esg ratings promote corporate green innovation? A quasi-natural experiment based on SynTao green finance’s esg ratings. Int. Rev. Financial Analysis 87, 102623. doi:10.1016/j.irfa.2023.102623

Wang, M. L., Yan, H. F., and Song, Y. Y. (2023a). Research on the influence of firm digitization on strategic aggressiveness. Chin. J. Manag. 20 (05), 667–675. (In Chinese). doi:10.3969/j.issn.1672-884x.2023.05.004

Wang, S. Y., Zhang, R. W., Yang, Y. J., Chen, J. S., and Yang, S. (2023b). Has enterprise digital transformation facilitated the carbon performance in industry 4.0 era? Evidence from Chinese industrial enterprises. Comput. Industrial Eng. 184, 109576. doi:10.1016/j.cie.2023.109576

Wang, Z. R., Fu, H. Q., and Ren, X. H. (2023c). Political connections and corporate carbon emission: new evidence from Chinese industrial firms. Technol. Forecast. Soc. Change 188, 122326. doi:10.1016/j.techfore.2023.122326

Weigel, P., and Manfred, F. (2019). Review and categorization of digital applications in the energy sector. Appl. Sci. 9 (24), 5350. doi:10.3390/app9245350

Weinzimmer, L., Esken, C. A., Michel, E. J., McDowell, W. C., and Mahto, R. V. (2023). The differential impact of strategic aggressiveness on firm performance: the role of firm size. J. Bus. Res. 158, 113623. doi:10.1016/j.jbusres.2022.113623

Wen, H. W., Zhong, Q. M., and Lee, C. C. (2022). Digitalization, competition strategy and corporate innovation: evidence from Chinese manufacturing listed companies. Int. Rev. Financial Analysis 82, 102166. doi:10.1016/j.irfa.2022.102166

Xiao, J. F., Chen, S. Y., Han, J. W., Tan, Z. X., Mu, S. Y., and Wang, J. Y. (2024). The carbon emission reduction effect of renewable resource utilization: from the perspective of green innovation. Atmos. Pollut. Res. 15 (6), 102121. doi:10.1016/j.apr.2024.102121

Xie, W. H., Zheng, D. W., Li, Z. S., Wang, Y. J., and Wang, L. G. (2024). Digital technology and manufacturing industrial change: evidence from the Chinese manufacturing industry. Comput. Industrial Eng. 187, 109825. doi:10.1016/j.cie.2023.109825

Xie, X. M., and Han, Y. H. (2022). How can local manufacturing enterprises achieve luxuriant transformation in green innovation? A multi-case study based on attention-based view. J. Manag. World 38 (03), 76–106. (In Chinese). doi:10.19744/j.cnki.11-1235/f.2022.0043

Yang, X. H., and Zou, H. (2023). ‘Technology innovation consortium research on the game of cooperative innovation evolution of green’. Shenyang University of Technology. CNKI, Shenyang, China, (In Chinese).doi:10.27322/d.cnki.gsgyu.2023.000077

Yang, Y. L., Zhang, J. T., and Li, Y. (2023). The effects of environmental information disclosure on stock price synchronicity in China. Heliyon 9 (5), e16271. doi:10.1016/j.heliyon.2023.e16271

Ye, Y. H., Yang, X., and Shi, L. (2023). Environmental information disclosure and corporate performance: evidence from Chinese listed companies. Heliyon 9 (12), e22400. doi:10.1016/j.heliyon.2023.e22400

Yoo, Y., Boland, R. J., Lyytinen, K., and Majchrzak, A. (2012). Organizing for innovation in the digitized world. Organ. Sci. 23 (5), 1398–1408. doi:10.1287/orsc.1120.0771

Yu, C. J., and Tang, W. (2023). Can digital transformation of industrial enterprises contribute to carbon emission reduction: evidence based on Chinese A-share listed industrial enterprises. Macroeconomics 07, 97–110+127. (In Chinese). doi:10.16304/j.cnki.11-3952/f.2023.07.006

Yuan, S., and Pan, X. F. (2023). Inherent mechanism of digital technology application empowered corporate green innovation: based on resource allocation perspective. J. Environ. Manag. 345, 118841. doi:10.1016/j.jenvman.2023.118841

Zeng, J. T., and Yang, M. R. (2023). Digital technology and carbon emissions: evidence from China. J. Clean. Prod. 430, 139765. doi:10.1016/j.jclepro.2023.139765

Zhan, K. Y., and Pu, Z. N. (2024). Does digital technology promote carbon emission reduction in the service industry: economic logic and empirical evidence from China. Heliyon 10 (4), e25686. doi:10.1016/j.heliyon.2024.e25686

Zhang, C., Zhou, B., Wang, Q. W., and Jian, Y. D. (2024a). The consequences of environmental big data information disclosure on hard-to-abate Chinese enterprises’ green innovation. J. Innovation Knowl. 9 (2), 100474. doi:10.1016/j.jik.2024.100474

Zhang, D. Y., Du, P. C., and Chen, Y. W. (2019). Can designed financial systems drive out highly polluting firms? An evaluation of an experimental economic policy. Finance Res. Lett. 31. doi:10.1016/j.frl.2019.08.032

Zhang, J., Zhang, L., and Zhang, M. C. (2024b). Media pressure, internal control, and corporate environmental information disclosure. Finance Res. Lett. 63, 105369. doi:10.1016/j.frl.2024.105369

Zhang, W. Q., and Zhao, J. L. (2023). Digital transformation, environmental disclosure, and environmental performance: an examination based on listed companies in heavy-pollution industries in China. Int. Rev. Econ. Finance 87, 505–518. doi:10.1016/j.iref.2023.06.001

Zhang, W. W., Zhang, S. J., Chen, F., Wang, Y., and Zhang, Y. C. (2023). Does Chinese companies' OFDI enhance their own green technology innovation? Finance Res. Lett. 56, 104113. doi:10.1016/j.frl.2023.104113

Zhang, Y. J., Wang, H. W., Ruan, S. Z., Cheng, J. H., and Song, Y. (2024c). Effects of environmental information disclosure on the green development of mining industry: evidence from Chinese provincial mining sub-sectors. Resour. Policy 89, 104669. doi:10.1016/j.resourpol.2024.104669

Zheng, R. J., Wu, G., Cheng, Y., Liu, H. M., Wang, Y. P., and Wang, X. Y. (2023). How does digitalization drive carbon emissions? The inverted U-shaped effect in China. Environ. Impact Assess. Rev. 102, 107203. doi:10.1016/j.eiar.2023.107203

Zhong, M. R., Cao, M. Y., and Zou, H. (2022). The carbon reduction effect of ICT: a perspective of factor substitution. Technol. Forecast. Soc. Change 181, 121754. doi:10.1016/j.techfore.2022.121754

Keywords: carbon performance, digital technology, green innovation, green collaborative innovation, green technology innovation, environmental information disclosure

Citation: Li J, Ji L, Zhang S and Zhu Y (2024) Digital technology, green innovation, and the carbon performance of manufacturing enterprises. Front. Environ. Sci. 12:1384332. doi: 10.3389/fenvs.2024.1384332

Received: 09 February 2024; Accepted: 13 May 2024;

Published: 17 June 2024.

Edited by:

Yigang Wei, Beihang University, ChinaReviewed by:

Muhammad Yousaf Raza, Shandong Technology and Business University, ChinaCopyright © 2024 Li, Ji, Zhang and Zhu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Luyue Ji, amx5MjAwNjEzQDE2My5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.