- School of Economics, Qingdao University, Qingdao, China

Environmental pollution has long been a global concern, and the development of fintech has led to radical changes in the financial industry, while finance plays a very important role in environmental governance. We use the number of fintech companies to create a city fintech index, and with the data of 827 listed companies in heavily polluting industries from 2011 to 2020, we study the impact of fintech development on enterprise environmental investment. We find that fintech can significantly increase the environmental investment of heavily polluting enterprises, while increasing the size of enterprise green bonds and improving the green cognition of executives are two important influence mechanisms. Heterogeneity analysis found that the impact of fintech on Southern enterprises and state-owned enterprises is more significant. Further analysis shows that fintech can significantly reduce the carbon emissions of heavily polluting enterprises and increase the number of green invention patents. The results of the study provide a useful reference for the government to promote the implementation of fintech policies and explore new ways to modernize pollution management.

1 Introduction

Facing increasingly serious global problems such as global warming, environmental pollution, and wasted resources, more and more countries have started to pay attention to greening economic growth (Wang et al., 2020; Liu et al., 2022). However, the development of low-carbon technologies and green industries requires financial support, and it has become a consensus to innovate financial forms and realize the coordinated development of economic greening (He et al., 2019). Currently, the rapid development of fintech (Haddad and Hornuf, 2019) has changed the operation mode of traditional financial institutions (Sangwan et al., 2020). The innovation of financial service model has supported the development of green enterprises (Huang and Ma, 2024). Fintech can ensure the availability of credit, solve information asymmetry and promote the green development of enterprises (Yu et al., 2020). Meanwhile, the development of fintech accelerates the procurement and deployment of special funds for environmental projects (Deng et al., 2019). Fintech supports the green transformation of enterprises and provides impetus for their ecological protection and sustainable development (Wu et al., 2024). Therefore, it is of great practical significance to study the impact and mechanism of fintech on enterprise environmental investment, both for the transformation and development of enterprises and for government decision-making.

Based on the above analysis, we created a city fintech index using the number of fintech companies and measured the environmental investment of enterprises using text mining. We investigated the impact of fintech on the environmental investment of heavily polluting enterprises, and explored the impact mechanism in terms of green bonds and executives’ green cognitions. Considering the regional differences, we divided the enterprises into south and north according to their location. Meanwhile, considering the differences in enterprises’ property rights, we divided the enterprises into state-owned and non-state-owned. Finally, we test the impact of fintech on carbon emissions and green invention patents of heavily polluting enterprises, which further proves the usefulness of fintech for enterprise environmental investment.

The contributions of this paper include the following three aspects. First, we explore the mechanisms through which fintech influences enterprise Environmental investment from two perspectives: green bonds and executive green cognitions, thus better explaining the channels through which fintech works. Second, we conducted a heterogeneity analysis according to the location of enterprises and the nature of property rights, and found that there were differences in the impact of fintech, which provided a basis for the government to formulate differentiation policies. Third, we found that fintech can significantly reduce carbon emissions of heavily polluting enterprises and increase the number of green invention patents. These research conclusions have important reference significance for the development of fintech and the design of green transformation mechanism of heavily polluting enterprises.

2 Literature review

Increasing investment in environmental protection by heavily polluting enterprises can help solve the world’s current environmental pollution problems (Zhong et al., 2022; Yu et al., 2023). Therefore, governments have encouraged enterprises to increase their investment expenditures in environmental protection by implementing centralized environmental monitoring policies (Wang et al., 2022b) and carbon emission trading policies (Yang, 2023), as well as strengthening local environmental regulation (Zhang et al., 2022) and increasing environmental subsidies to local governments (Peng et al., 2023). However, most enterprises face certain financing constraints, coupled with the long-term and low economic returns of environmental investment, enterprises are reluctant to use their limited funds in the field of environmental protection (Wei et al., 2020). Therefore, financing is crucial for the green development of enterprises.

At present, the literature on the relationship between fintech and enterprise green development mainly focuses on the following aspects. First, fintech can significantly increase the number of green patent applications by enterprises, which in turn promotes enterprise green innovation (Xue et al., 2022; Tan et al., 2023; Ding et al., 2022; Tian et al., 2023). Second, environmental, social, and governance (ESG) rating systems have emerged globally as a comprehensive evaluation standard for green and sustainable corporate development (Feng and Yuan, 2023), and some scholars (Du et al., 2022; Wang et al., 2022a), using data from Chinese enterprises, have found that fintech development significantly improves corporate ESG performance. Again, optimizing resource allocation and improving investment efficiency is also an important way to achieve sustainable national economic development (Lv and Xiong, 2022), and some scholars (Huang, 2022; Lv and Xiong, 2022; Sun and Zhang, 2023) have found that fintech can significantly improve the investment efficiency of listed companies.

The impact of fintech on enterprises’ Environmental investment has been studied in the literature. Digital finance can promote green investment by stimulating capital flows within firms and intensifying market competition (Ding et al., 2023), and the development of fintech helps reduce sulfur dioxide emissions (Muganyi et al., 2021). However, some scholars have come to the opposite conclusion, arguing that digital finance increases financial investment by firms, thereby crowding out green investment (Jiang et al., 2022).

There is already relevant literature that proves that fintech can promote environmental investment in heavily polluting enterprises, but the existing literature still has the following three shortcomings. First, the impact of fintech on enterprise environmental investment is uncertain, some scholars believe that it is a positive impact, while some hold the opposite view. Second, the role of fintech on enterprise environmental investment mechanism is not perfect, while the degree of impact on different types of enterprises is uncertain whether there is a difference. Third, the effect of fintech on enterprise environmental investment needs further verification. Therefore, this paper thoroughly explores the mechanism of the influence of fintech on the environmental investment of heavy polluting enterprises, and at the same time explores whether there is a difference in the influence of different enterprises, and further analyzes whether it really reduces the carbon emissions of heavily polluting enterprises.

3 Research hypotheses

Fintech has transformed and innovated the traditional financial services or business, which in turn has an important impact on the investment and financing behavior of enterprises (Fazzari et al., 1988). Firstly, financial institutions use big data, cloud computing and other technologies to alleviate information asymmetry (Dong and Yu, 2023; Li et al., 2024), and promote more capital flowing into the green economy. Second, fintech can promote enterprise investment in emission reduction and promote green transformation from the end of the governance link (Guo et al., 2023). Financial institutions are more willing to provide services to enterprises that actively invest in environmental protection and take social responsibility, and financial development can help guide the flow of capital to enterprises with strong environmental awareness (Heiskanen, 2017). Finally, while reducing the cost of financing, fintech also makes the environmental information of enterprises transparent, and to enhance enterprise social responsibility, managers will pay more attention to the green development of enterprises. Therefore, we propose the first hypothesis.

H1. Fintech will promote Environmental investment in heavily polluting enterprises.

Fintech policy promotes the standardization of resource elements in the financial market by innovating the form of financial business, and promotes the development of green credit, green bonds and other financial forms, which improves the quality of financing in the capital market (Forslid et al., 2018). Digital finance is based on the support of big data, cloud computing, distributed computing and other technologies, which can effectively crack the credit insufficiency dilemma of enterprises, solve the trust problem between the two sides of the transaction, and then promote the alleviation of financing constraints (Chiu and Koeppl, 2019; Chen et al., 2023). Currently, the Chinese government requires financial institutions to increase support for green industries, and the flow of funds from financial institutions will change the investment and financing behavior of enterprises (Sharfman and Fernando, 2008). Therefore, the development of fintech can promote the environmental investment of heavily polluting enterprises by increasing the funds for green projects of enterprises. Based on the above analysis, we propose the following hypothesis.

H2. Fintech will increase the size of green bonds for heavily polluting enterprises, which in turn will increase environmental investment.

Currently, financial institutions and investors have begun to pay attention to enterprise environmental development issues. It has been found that institutional investors are increasingly concerned about enterprise environmental governance (Krueger et al., 2020; Ilhan et al., 2023), and they are demanding that enterprises increase their commitment to social and environmental issues (Larcker et al., 2022). And the development of fintech has made enterprise environmental information transparent, forcing a shift in enterprise executives’ cognitions, and social responsibility has become an important part of enterprise strategy (Hao and He, 2022). If the rich data brought by fintech can attract the attention of executives, enterprises are likely to respond to this attention and thus increase their environmental investment (Ding et al., 2024). Therefore, the development of fintech can promote the environmental investment of heavy polluters by increasing the green awareness of enterprise executives. Based on the above analysis, we propose the following hypothesis.

H3. Fintech will increase the green cognitions of executives of heavily polluting enterprises, which in turn will increase environmental investment.

4 Variable selection and modeling

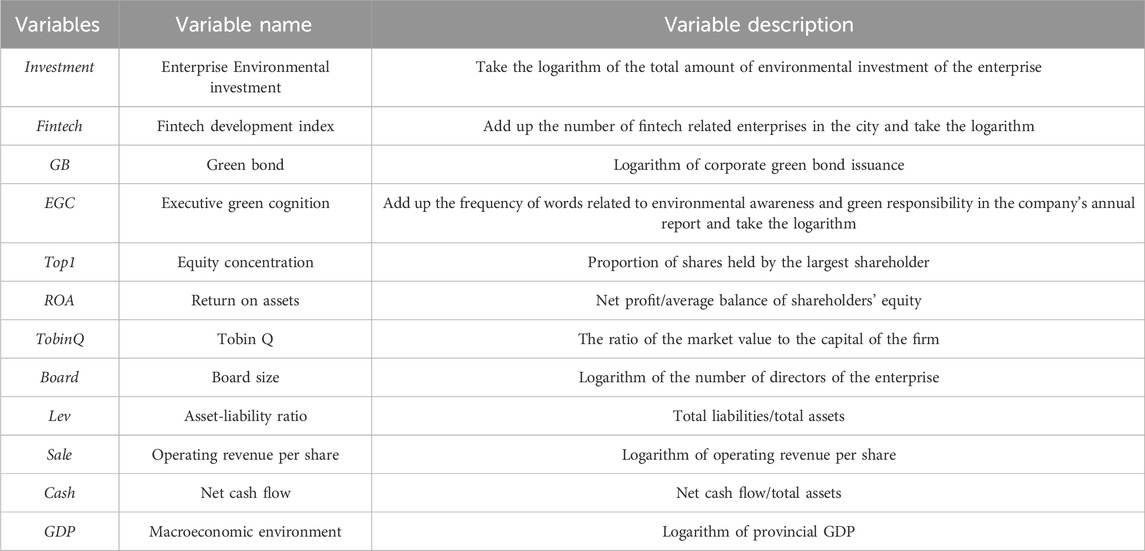

4.1 Definition of variables

4.1.1 Enterprise environmental investment (investment)

The dependent variable in this article is enterprise environmental investment (Investment). We obtained relevant environmental investment data by screening keywords related to environmental investment in the construction in progress and management expenses of the financial statements of listed companies (Lu, 2021). We take the logarithm of the total amount of environmental investment of the enterprise as an indicator to measure their environmental investment.

4.1.2 Fintech development index (fintech)

The independent variable of this paper is fintech development index (Fintech). We search the “Tian yan cha” website for keywords such as “Fintech”, “Cloud Computing”, “Big Data”, “Blockchain”, “Artificial Intelligence”, “Internet of Things”, and so on. We keep the samples with the above keywords in the company name or business scope (Liu et al., 2023). Finally, sum the number of all fintech enterprises in the same city and take the logarithm.

4.1.3 Control variables

We use the existing literature (Guo and Wei, 2022; Li et al., 2023) for reference to select control variables: proportion of shares held by the largest shareholder (Top1), return on assets (Roa), Tobin’s Q (Tobin), number of enterprise boards (Board), asset-liability ratio (Lev), operating revenue per share (Sale), net cash flow from operating activities (Cash), and macroeconomic environment (GDP). We also control for time and individual fixed effects.

4.1.4 Mechanism variables

The influence mechanisms in this paper include two: green bonds (GB) and executive green cognition (EGC). We manually organize the bonds issued by heavy polluters between 2011 and 2020, and determine whether they are green bonds by searching for keywords related to environmental protection in the use of funds. We summed up the amount of green bonds issued in the same year to finally get the data of enterprise green bonds. Using text mining, we collect word frequencies related to environmental awareness and environmental responsibility in the annual reports of listed companies, and use the total number of word frequencies in the same year to measure the green cognition of executives. Table 1 shows the description of the variables.

4.2 Data sources

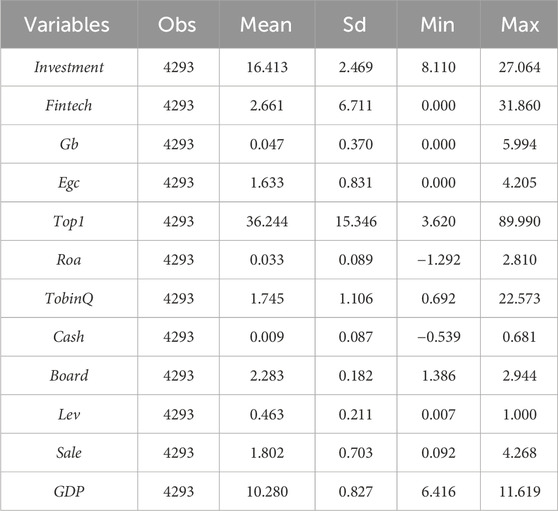

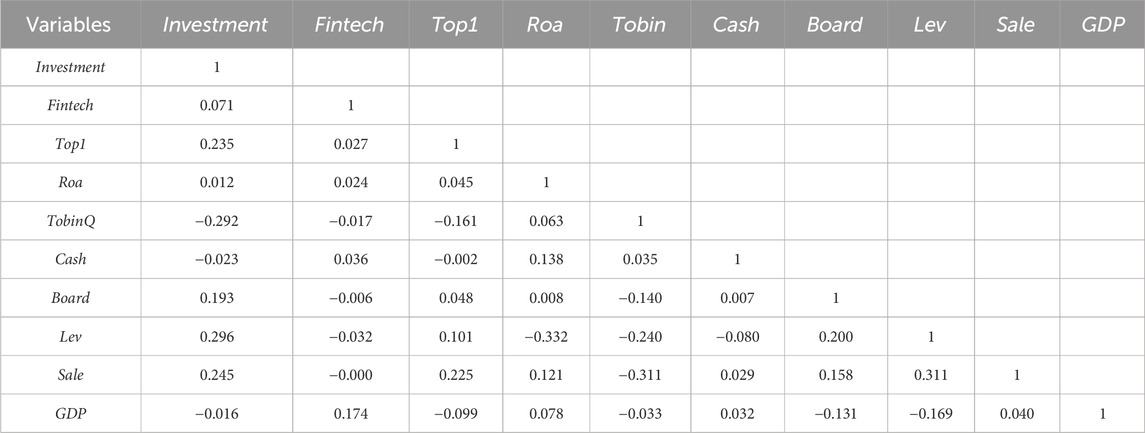

We use data from A-share listed companies from 2011 to 2020, and based on the “Classification and Management List of Environmental Protection Verification Industries for Listed Companies” released by the Chinese government in 2008, 14 industries such as thermal power, steel, and cement are classified as heavily polluting industries, which are matched with the revised “Industry Classification Guidelines for Listed Companies” in 2012. At the same time, we process the sample as follows: we exclude companies with abnormal financial conditions and companies with serious data missing, and finally get unbalanced panel data of 827 highly polluting enterprises. The city fintech index is based on the number of keyword searches on the “Tian yan cha” website, and the company data in this article comes from the Wind database. The descriptive statistics characteristics of each variable are shown in Table 2, including mean, standard error, minimum, median, maximum. We report the Pearson correlation matrix among the main variables in Table 3.

4.3 Modeling

We use individual and time fixed effects models, modeled as follows:

The explained variable

Combined with the previous mechanism analysis, we will explore the mechanism of its role from the perspective of green bonds and executives’ green cognitions, and the empirical model is as follows:

The explained variables

5 Empirical analysis

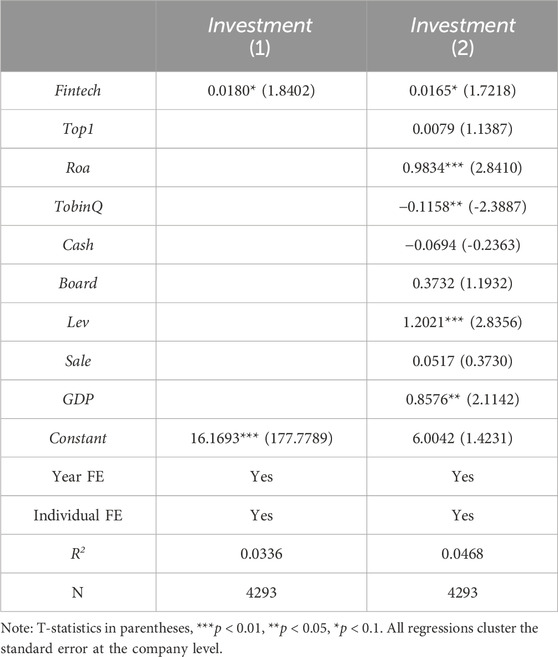

5.1 Baseline regression

Table 4 presents the impact of fintech on enterprise environmental investment, 1) and 2) are the results of regression alone and with the addition of control variables, respectively, and we find that fintech has a significant positive impact on enterprise environmental investment. We believe that with the help of big data, cloud computing, and other fintech, we can reduce the borrowing cost of financial institutions and alleviate the problem of information asymmetry, so that more funds can flow into the environmental management program of enterprises. Financial institutions are more willing to serve enterprises that actively make environmental investment and assume social responsibility, and financial development helps to guide the flow of capital to enterprises with strong environmental awareness. While reducing the cost of financing, fintech also makes the environmental information of enterprises transparent, and in order to enhance enterprise social responsibility, managers will pay more attention to the green development of enterprises. Therefore, the development of FinTech can significantly increase the environmental investment of heavily polluting enterprises, and hypothesis H1 is correct.

5.2 Robust test

5.2.1 Endogenous issues

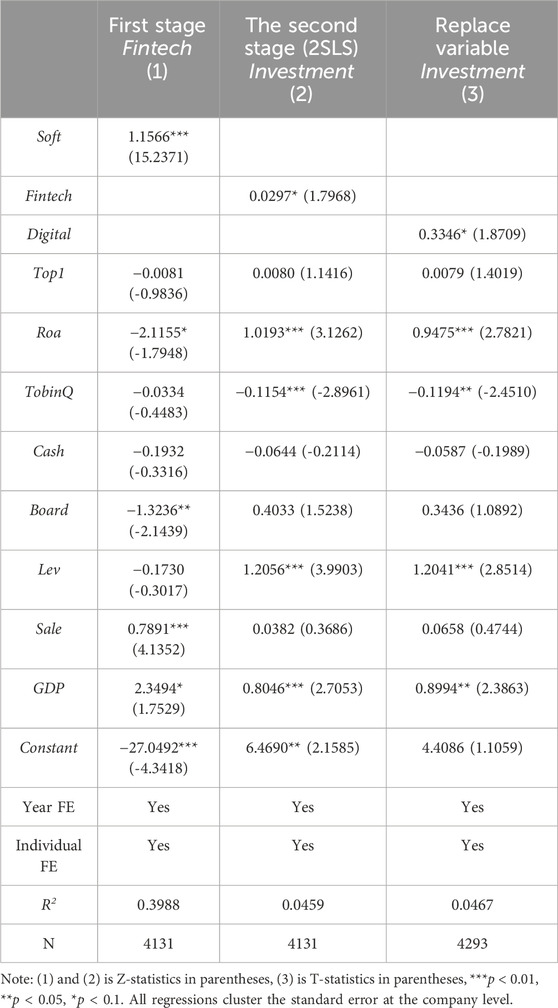

Considering that the model may have endogeneity problems such as omitted variables, we selected the number of urban computer services and software professionals as instrumental variables for endogeneity testing. We use 2SLS for regression, and the results of the endogeneity test are shown in Table 5 1) and 2). In the first stage, Cragg-Donald Wald F-statistic is 1153.804, there is no weak instrumental variable problem, so our selected instrumental variables are reasonable. The second stage regression results show that the effects of fintech on environmental investment in heavy polluters are still all significantly positive, indicating that the baseline regression is robust when tested after the introduction of instrumental variables.

5.2.2 Replacing independent variable

At present, there are many methods to measure fintech indicators. In order to avoid the error of results caused by the difference of indicators, we use other methods to measure the level of urban fintech. We try to use the digital level in Peking University’s digital inclusive finance index to represent the city’s fintech. Regression (3) in Table 5 is the empirical result. We found that the regression coefficient is still significantly positive, and the regression result is consistent with the original result.

5.3 Mechanism analysis

5.3.1 Green bond channels

The development of fintech can alleviate the problem of information asymmetry between borrowers and lenders, and change the difficulty of enterprises to obtain financing from financial institutions. Under China’s current policy, it is difficult for high-pollution and high-energy consumption projects to obtain loans from financial institutions, while green environmental protection projects are more likely to receive financial support. Therefore, the development of fintech will reduce the financing constraints of high-polluting enterprises for environmental protection projects, allowing enterprises to issue more green bonds, which in turn will promote enterprises’ environmental investment. To test this mechanism, we replace the explanatory variable with the amount of enterprise green bond issuance, and regression (1) in Table 6 shows the empirical results of the impact of fintech on enterprise green bonds. The coefficient of fintech is significantly positive, which indicates that the development of fintech can increase the green bond issuance of heavily polluting enterprises, which ultimately leads to an increase in environmental investment expenditures, and hypothesis H2 is correct.

5.3.2 Executive green cognition channels

With the gradual increase in environmental awareness, investors and financial institutions have begun to pay attention to enterprise environmental management. The development of fintech makes the environmental information of enterprises transparent, forcing enterprise managers to change their cognition, and more and more enterprises are beginning to incorporate green factors into their development strategies. The executives of enterprises should also have green cognition and integrate the concept of environmental protection into the development of enterprises. Through the application of big data, artificial intelligence and other fintech, financial institutions can more accurately provide financing services for green projects and publicize enterprise environmental data. These can attract the attention of executives, and in response to this attention, improve the environmental investment of enterprises. Thus, fintech promotes enterprise environmental investment by increasing executives’ green cognition and, in turn, their environmental investment. Regression (2) shows the empirical results of the impact of fintech on executives’ green cognition. The coefficients of fintech are all significantly positive and hypothesis H3 is correct.

5.4 Heterogeneity analysis

5.4.1 Impact on enterprises in different regions

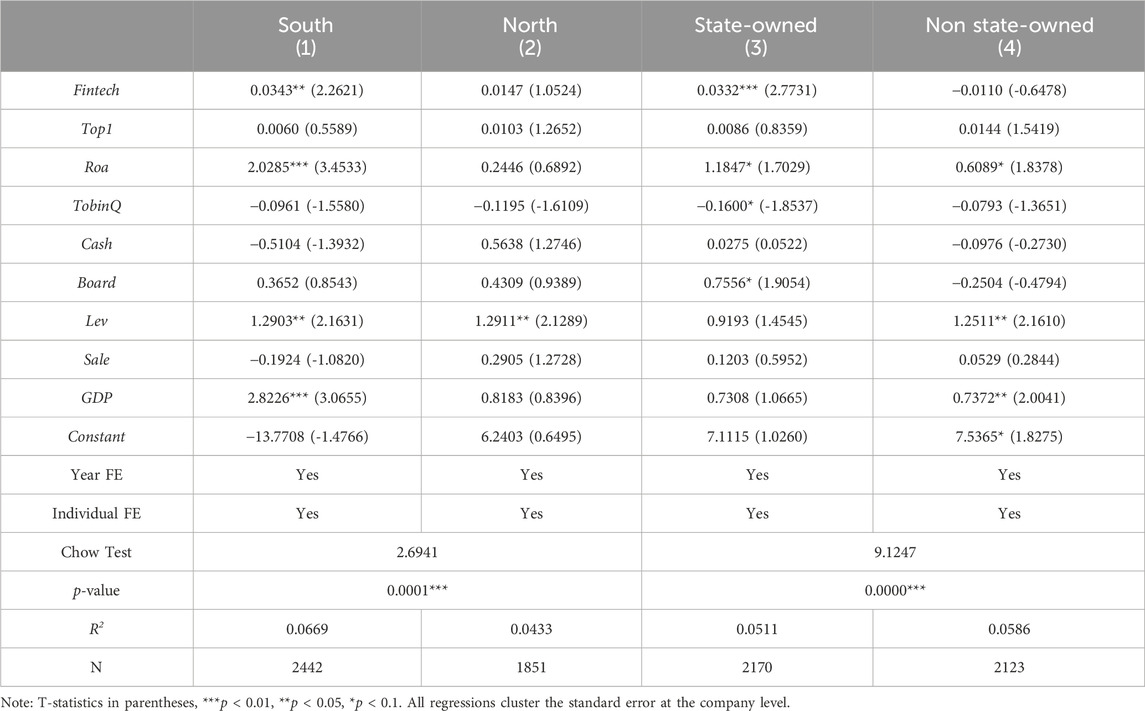

We divide the sample into South and North according to the location of the enterprises and run the regressions separately. We divide the sample into southern enterprises and Northern Enterprises according to the location of enterprises, and conduct regression respectively. Regression (1) and (2) in Table 7 are empirical results. We find that fintech can significantly improve the environmental investment of enterprises in the south, but the impact on enterprises in the north is not significant. We also conduct a test of difference between groups, and the Chow test is 2.6941, indicating that fintech has a greater impact on the environmental investment of heavily polluting enterprises in the South. We believe that, on the one hand, the level of development of fintech in the South is higher than that in the North, and fintech is more widely used in the financial field. On the other hand, the South is more economically developed than the North, and the financial sector is better developed, which can provide more funds for enterprises to invest in environmental protection. Therefore, fintech has a greater impact on the environmental investment of heavily polluting enterprises in the South.

5.4.2 Impact on different property right enterprises

We divide the sample into two groups of state-owned and non-state-owned enterprises according to the nature of their property rights, and regressions (3) and (4) in Table 7 show the empirical results for the two samples, state-owned and non-state-owned, respectively. We find that fintech does not have a significant effect on non-state-owned enterprises, but it can significantly increase the environmental investment of state-owned heavy polluters. We also conduct a between-groups difference test, and the Chow test is 9.1247, indicating that fintech has a greater impact on the environmental investment expenditures of state-owned heavy polluters. The possible explanation is that state-owned enterprises tend to receive support from local governments, and financial institutions are more willing to provide loans to state-owned enterprises. Therefore, state-owned enterprises are more likely to receive financial support with the help of fintech, and the development of fintech has a significant impact on them. On the other hand, non-state-owned enterprises have a lack of access to funds, and the development of fintech is also difficult to solve the problem of financing difficulties of non-state-owned enterprises, so the impact of fintech on the environmental investment of non-state-owned enterprises is not significant.

5.5 Further studies

5.5.1 Impact on enterprise carbon emissions

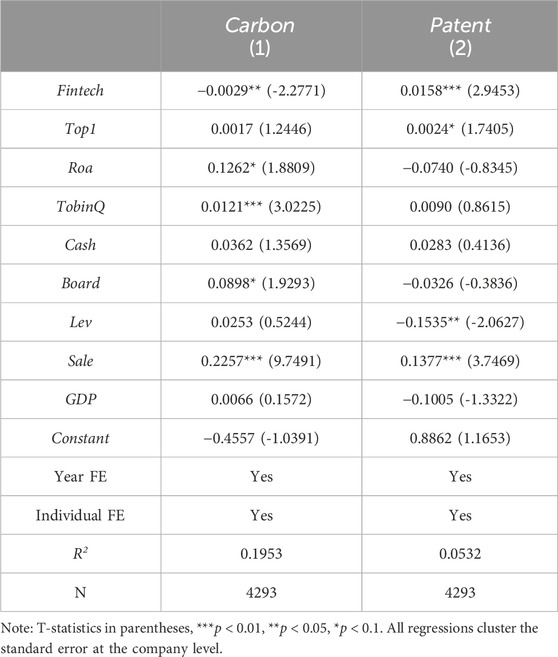

First, we examine the impact of fintech on the carbon emissions of heavy polluters, as measured by enterprise carbon emissions. This data is manually collected from the social responsibility reports, sustainability reports, and environmental reports disclosed by companies. We replace the explained variable with carbon emissions (Carbon) for the regression, and (1) in Table 8 shows the regression results, which shows that fintech is significantly negatively correlated with enterprise carbon emissions, indicating that the development of fintech inhibits the carbon emissions of heavy polluting enterprises. In order to improve their competitiveness, enterprises may increase the research and development of green technology to reduce the emission of pollutants. Meanwhile, they increase R&D investment to transform from low-end products with high pollution and energy consumption to high-end products that are energy-saving and environmentally friendly. Heavily polluting enterprises can use fintech to obtain financial support to develop new energy technologies, increase energy recycling rates, and improve exhaust gas treatment capacity, thereby promoting the greening of production structures.

5.5.2 Impact on enterprise green innovation

Secondly, we explore the impact of fintech on green invention patent applications of heavily polluting enterprises. Generally speaking, the more green invention patents an enterprise has, the stronger its green innovation ability is (Soltmann et al., 2015). Since design patents cannot be used to represent substantive innovation (Zhang et al., 2019), the number of green patent applications (patents) is measured by the number of green invention patents of heavily polluting enterprises. We change the explanatory variable into the number of green invention patent applications for regression. The empirical results in Table 8 (2) show that the development of fintech can significantly increase the number of green patent applications of heavy polluting enterprises, which shows that the fintech skills promote heavy polluting enterprises to carry out green innovation. We believe that fintech can change the green cognition of executives, provide more funds for green projects of heavily polluting enterprises, and make enterprises dare to carry out green innovation.

6 Conclusion

Using panel data of 827 Chinese listed companies from 2011 to 2020, we construct a city fintech index using the number of local fintech companies to empirically study the impact of fintech on the environmental investment expenditures of heavy polluters. It is found that the development of fintech significantly increases the environmental investment expenditure of heavy polluters. Furthermore, it is found that fintech increases environmental investment by increasing the issuance of green bonds and the green cognition of managers of heavy polluters. Analyzing from regional heterogeneity, the impact of fintech on southern enterprises is greater than that in the north. Analyzing from property rights heterogeneity, fintech significantly increases environmental investment in state-owned enterprises and is insignificant for non-state-owned enterprises. Furthermore, we find that fintech significantly reduces the carbon emissions of heavy polluting enterprises and significantly increases the number of green invention patent applications of enterprises, which indicates the significant impact of fintech on the green development of heavy polluting enterprises.

The conclusions of this paper have important policy implications for promoting the development of fintech, as well as promoting the green transformation and upgrading of heavily polluting enterprises. First, the application of technologies such as big data, cloud computing, artificial intelligence, and blockchain in the financial sector should be accelerated. The conclusion of this paper has shown that the development of fintech can significantly improve the environmental investment of heavily polluting enterprises, confirming the important role of fintech in the green development of the economy. Second, based on the analysis of the influence mechanism, we believe that financial institutions should take advantage of fintech to combine the real needs of the green transformation of heavy polluting enterprises, and promote the flow of funds to the environmental protection projects of heavy polluting enterprises by increasing the amount of green bond issuance, improving the green cognition of executives and other functions. Thirdly, enterprises should realize that the past rough development mode is no longer adapted to the needs of current economic development, and only by gradually eliminating the backward production capacity, increasing the innovation of green technology, and finally realizing the transformation and upgrading of enterprises, can we improve the competitiveness of enterprises in the market and their development prospects.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

XZ: Formal Analysis, Methodology, Software, Writing–original draft. YZ: Data curation, Validation, Writing–original draft. XL: Formal Analysis, Supervision, Validation, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This project was co-sponsored by the National Social Science Foundation of China (20CSH064).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Chen, W., Wu, W., and Zhang, T. H. (2023). Fintech development, firm digitalization, and bank loan pricing. J. Behav. Exp. Finance 39, 100838. doi:10.1016/j.jbef.2023.100838

Chiu, J., and Koeppl, T. V. (2019). Blockchain-based settlement for asset trading. Rev. Financial Stud. 32, 1716–1753. doi:10.1093/rfs/hhy122

Deng, X., Huang, Z., and Cheng, X. (2019). FinTech and sustainable development: evidence from China based on P2P data. Sustainability 11, 6434. doi:10.3390/su11226434

Ding, J. X., Li, L. X., and Zhao, J. S. (2024). How does fintech prompt corporations toward ESG sustainable development? Evidence from China. Energy Econ. 131, 107387. doi:10.1016/j.eneco.2024.107387

Ding, N., Gu, L., and Peng, Y. F. (2022). Fintech, financial constraints and innovation: evidence from China. J. Corp. Finance 73, 102194. doi:10.1016/j.jcorpfin.2022.102194

Ding, Q., Huang, J., and Chen, J. (2023). Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 117, 106476. doi:10.1016/j.eneco.2022.106476

Dong, X., and Yu, M. Z. (2023). Does FinTech development facilitate firms' innovation? Evidence from China. Int. Rev. Financial Analysis 89, 102805. doi:10.1016/j.irfa.2023.102805

Du, P., Huang, S., Hong, Y., and Wu, W. (2022). Can FinTech improve corporate environmental, social, and governance performance? a study based on the dual path of internal financing constraints and external fiscal incentives. Front. Environ. Sci. 10, 1061454. doi:10.3389/fenvs.2022.1061454

Fazzari, S. M., Hubbard, R. G., Blinder, A. S., Poterba, J. M., and Petersen, B. C. (1988). Financing constraints and corporate investment. Brookings Pap. Econ. Activity 1, 141–206. doi:10.2307/2534426

Feng, J. Y., and Yuan, Y. (2023). Green investors and corporate ESG performance: evidence from China. Finance Res. Lett. 60, 104892. doi:10.1016/j.frl.2023.104892

Forslid, R., Okubo, T., and Ulltveit-Moe, K. H. (2018). Why are firms that export cleaner? International trade, abatement and environmental emissions. J. Environ. Econ. Manag. 91, 166–183. doi:10.1016/j.jeem.2018.07.006

Guo, L. L., Tang, L., Cheng, X., and Li, H. J. (2023). Exploring the role of FinTech development in reducing firm pollution discharges: evidence from Chinese industrial firms. J. Clean. Prod. 425, 138833. doi:10.1016/j.jclepro.2023.138833

Guo, Q. H., and Wei, Y. D. (2022). Confucianism and corporate environmental protection investment: evidence from heavily polluting listed companies in China. Manag. Decis. Econ., 1–20. doi:10.1002/mde.3930

Haddad, C., and Hornuf, L. (2019). The emergence of the global fintech market: economic and technological determinants. Small Bus. Econ. 53, 81–105. doi:10.1007/s11187-018-9991-x

Hao, J., and He, F. (2022). Corporate social responsibility (CSR) performance and green innovation: evidence from China. China Finance Res. Lett. 48, 102889. doi:10.1016/j.frl.2022.102889

He, L., Zhang, L., Zhong, Z., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/j.jclepro.2018.10.119

Heiskanen, A. (2017). The technology of trust: how the internet of Things and blockchain could usher in a new era of construction productivity. Constr. Res. Innovation 8, 66–70. doi:10.1080/20450249.2017.1337349

Huang, J. C., and Ma, L. (2024). Substantive green innovation or symbolic green innovation: the impact of fintech on corporate green innovation. Finance Res. Lett. 63, 105265. doi:10.1016/j.frl.2024.105265

Huang, S. (2022). Does FinTech improve the investment efficiency of enterprises? Evidence from China’s small and medium-sized enterprises. Econ. Analysis Policy 74, 571–586. doi:10.1016/j.eap.2022.03.014

Ilhan, E., Krueger, P., Sautner, Z., and Starks, L. T. (2023). Climate risk disclosure and institutional investors. Rev. Financ. Stud. 36, 2617–2650. doi:10.1093/rfs/hhad002

Jiang, Y., Guo, C., and Wu, Y. (2022). Does digital finance improve the green investment of Chinese listed heavily polluting companies? The perspective of corporate financialization. Environ. Sci. Pollut. Res. 29, 71047–71063. doi:10.1007/s11356-022-20803-z

Krueger, P., Sautner, Z., and Starks, L. T. (2020). The importance of climate risks for institutional investors. Rev. Financ. Stud. 33, 1067–1111. doi:10.1093/rfs/hhz137

Larcker, D. F., Tayan, B., and Watts, E. M. (2022). Seven myths of ESG. Eur. Financ. Manag. 28, 869–882. doi:10.1111/eufm.12378

Li, W. P., Li, Y. T., Jiang, D. Q., and Zhang, X. Z. (2024). Bridging the information gap: how digitalization shapes stock price informativeness. J. Financial Stab. 71, 101217. doi:10.1016/j.jfs.2024.101217

Li, X., Guo, F., and Wang, J. Q. (2023). A Path towards enterprise environmental performance improvement: how does CEO green experience matter? Bus. Strategy Environ. 33, 820–838. doi:10.1002/bse.3524

Liu, H., Jiang, J., Xue, R., Meng, X. F., and Hu, S. Y. (2022). Corporate environmental governance scheme and investment efficiency over the course of COVID-19. Finance Res. Lett. 47, 102726. doi:10.1016/j.frl.2022.102726

Liu, J. T., Zhang, Y., and Jia, K. (2023). Fintech development and green innovation: evidence from China. Energy Policy 183, 113827. doi:10.1016/j.enpol.2023.113827

Lu, J. (2021). Can the green merger and acquisition strategy improve the environmental protection investment of listed company?. Environ. Impact Assess. Rev. 86, 106470. doi:10.1016/j.eiar.2020.106470

Lv, P., and Xiong, H. (2022). Can FinTech improve corporate investment efficiency? Evidence from China. Res. Int. Bus. Finance 60, 101571. doi:10.1016/j.ribaf.2021.101571

Muganyi, T., Yan, L. N., and Sun, H. P. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Peng, F., Zhou, S., Peng, L., and Mao, D. (2023). The effect of economic incentives on corporate environmental investment: evidence from Chinese manufacturing listed firms. Econ. Syst. 47, 101124. doi:10.1016/j.ecosys.2023.101124

Sangwan, V., Harshita, P., and Singh, S. (2020). Financial technology: a review of extant literature. Stud. Econ. Finance 37, 71–88. doi:10.1108/sef-07-2019-0270

Sharfman, M., and Fernando, C. S. (2008). Environmental risk management and the cost of capital. Strategic Manag. J. 29, 569–592. doi:10.1002/smj.678

Soltmann, C., Stucki, T., and Woerter, M. (2015). The impact of environmentally friendly innovations on value added. Environ. Resour. Econ. 62, 457–479. doi:10.1007/s10640-014-9824-6

Sun, R., and Zhang, B. (2023). Can fintech make corporate investments more efficient? A study on financing constraints and agency conflicts. Econ. Research-Ekonomska Istraživanja 36, 2185795. doi:10.1080/1331677x.2023.2185795

Tan, Z., Wang, H., and Hong, Y. (2023). Does bank FinTech improve corporate innovation? Finance Res. Lett. 55, 103830. doi:10.1016/j.frl.2023.103830

Tian, H., Siddik, A. B., Pertheban, T. R., and Rahman, M. N. (2023). Does fintech innovation and green transformational leadership improve green innovation and corporate environmental performance? A hybrid SEM–ANN approach. J. Innovation Knowl. 8, 100396. doi:10.1016/j.jik.2023.100396

Wang, D., Peng, K., Tang, K., and Wu, Y. (2022b). Does FinTech development enhance corporate ESG performance? Evidence from an emerging market. Sustainability 14, 16597. doi:10.3390/su142416597

Wang, F., Feng, L., Li, J., and Wang, L. (2020). Environmental regulation, tenure length of officials, and green innovation of enterprises. Int. J. Environ. Res. Public Health 17, 2284. doi:10.3390/ijerph17072284

Wang, J., Dong, H., and Xiao, R. (2022a). Central environmental inspection and corporate environmental investment: evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 29, 56419–56429. doi:10.1007/s11356-022-19538-8

Wei, F., and Zhou, L. (2020). Multiple large shareholders and corporate environmental protection investment: evidence from the Chinese listed companies. China J. Account. Res. 13, 387–404. doi:10.1016/j.cjar.2020.09.001

Wu, F., Hu, Y., and Shen, M. (2024). The color of FinTech: FinTech and corporate green transformation in China. Int. Rev. Financial Analysis 94, 103254. doi:10.1016/j.irfa.2024.103254

Xue, Q., Bai, C., and Xiao, W. (2022). Fintech and corporate green technology innovation: impacts and mechanisms. Manag. Decis. Econ. 43, 3898–3914. doi:10.1002/mde.3636

Yang, S. (2023). Carbon emission trading policy and firm's environmental investment. Finance Res. Lett. 54, 103695. doi:10.1016/j.frl.2023.103695

Yu, D., Hu, K., and Hao, Y. (2023). The effect of local government environmental concern on corporate environmental investment: evidence from China. Sustainability 15, 11604. doi:10.3390/su151511604

Yu, L. L., Zhao, D. Y., Xue, Z. H., and Gao, Y. (2020). Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 62, 101323. doi:10.1016/j.techsoc.2020.101323

Zhang, D., Rong, Z., and Ji, Q. (2019). Green innovation and firm performance: evidence from listed companies in China. Resour. Conservation Recycl. 144, 48–55. doi:10.1016/j.resconrec.2019.01.023

Zhang, P., Wu, F., Guo, Y., and Ma, J. (2022). Does enforcement matter in promoting corporate environmental investment: evidence from Chinese private firms. J. Clean. Prod. 337, 130432. doi:10.1016/j.jclepro.2022.130432

Keywords: fintech, environmental investment, heavily polluting enterprises, executive green cognition, green bond

Citation: Zhang X, Zhao Y and Liu X (2024) Can fintech promote environmental investment in heavily polluting enterprises? evidence from China. Front. Environ. Sci. 12:1373685. doi: 10.3389/fenvs.2024.1373685

Received: 20 January 2024; Accepted: 19 June 2024;

Published: 11 July 2024.

Edited by:

Mingming Jiang, Shandong University, ChinaCopyright © 2024 Zhang, Zhao and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoyu Liu, bGl1eGlhb3l1emJAMTI2LmNvbQ==

Xiao Zhang

Xiao Zhang Yu Zhao

Yu Zhao Xiaoyu Liu

Xiaoyu Liu