95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 12 April 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1362450

This article is part of the Research Topic Green Finance & Carbon Neutrality: Strategies and Policies for a Sustainable Future View all 36 articles

Under the background of “dual carbon,” the power industry, as a pillar industry of the national economy, is ushering in changes. Based on the data of listed companies in the electric power production and supply industry from 2010 to 2020, this paper takes the operating income corresponding to each unit of carbon emission as the substitute variable of carbon performance (CP). After dimensionality reduction of 12 financial indicators through factor analysis, this paper establishes a comprehensive indicator of financial performance (FP), and establishes panel data to explore the relationship between CP and FP of electric power enterprises. To mitigate the endogeneity problem, 2SLS regression was performed using instrumental variables. The results show that CP has a positive and sustainable impact on the FP, which indicates that power enterprises need to pay attention to the long-term management of carbon emission reduction, so that the improvement of FP of enterprises can achieve sustainable development, which is in line with the expectations of Porter’s hypothesis and stakeholder theory. In addition, firm size plays a negative moderating role in the relationship between CP and FP. The research results provide a path and basis for encouraging power enterprises to improve CP and help China achieve the goal of “dual carbon” as soon as possible.

• Relationship between Carbon and financial performance of electric power was explored.

• High carbon emission enterprises was identified and targeted.

• The size of enterprises is introduced as the adjusting variable.

• The measurement of financial performance indicators was improved.

With the increasing global warming and environmental problems, climate change caused by carbon emissions has become an inevitable issue for economic growth and social development of various countries. The role of energy consumption is highly relevant to environmental protection and climate change. High levels of carbon monoxide emissions have become a serious global problem (Bekun et al., 2019). Globally, China is the second largest economy (Cheong, 2019) and the largest emitter of greenhouse gases (Koondhar et al., 2021). China’s power industry is still thermal power generation as the main way of power generation, the annual carbon emissions of the power industry up to 3 billion tons, accounting for about 39% of the national carbon emissions, it can be seen that the power industry is reliant on China’s carbon emissions. In addition, the first compliance cycle and online trading of the national unified carbon market in 2021 will include the power generation industry as the first batch of participants. As the main body of carbon emissions, whether enterprises can shift to low-carbon development mode or not is crucial to the realization of China’s “dual carbon” goal. During the 14th Five-Year Plan period, the construction of ecological civilization in our country has turned to a strategic direction with energy saving and emission reduction as the focus, committed to carbon emission reduction and actively promoting global sustainable development (Peng et al., 2023). In accordance with the Paris Climate Change Agreement, China has rationally planned a “30–60 Target” of “Carbon Peak to Carbon Neutral.” In the context of the “Dual Carbon” Goals, green finance of our country has been further developed and promoted (Fan et al., 2023).

With the continuous implementation of China’s environmental protection policies, the rapid development of carbon emission trading and carbon trading market has a significant impact on the FP of enterprises at the micro level (Liu et al., 2021). In the process of implementing carbon reduction strategy to improve CP, enterprises will invest a lot of human, material and financial resources through the purchase of low-carbon equipment, research and development of carbon reduction technology, and introduction of carbon management talents, which will lead to the increase of enterprise operating costs. The impact of environmental performance on corporate performance, such as short-term costs or long-term benefits, has always been the focus of research (Eva Horváthová, 2012). Therefore, what impact the increased cost of implementing carbon emission reduction will have on the financial situation and enterprise development is an area that enterprises need to ponder over. Under the background of “dual carbon,” Power industry of China puts forward higher requirements for energy conservation and emission reduction. Whether the economic benefits brought by the improvement of CP can make up for the new cost of carbon emission reduction will have a direct impact on the business strategy and business activities of power enterprises. Achieving the dual objectives of low carbon emission reduction and FP has become a common business issue (Yoo et al., 2020).

The power sector is a pillar of our economy, and reducing power-related carbon emissions is critical to achieving China’s emission reduction targets, yet the relationship between carbon performance and financial performance in this sector is rarely discussed. Therefore, this paper takes thermal power enterprises as the research object. In order to evaluate enterprise FP more comprehensively and fully consider the characteristics of power enterprises represented by thermal power, 12 financial indicators are selected to construct FP evaluation system through structure factor analysis to fully reflect the FP level of enterprises, and panel data is established to explore the relationship between CP and FP of power enterprises. Exploring the relationship between CP and FP in the power industry is helpful for power enterprises to implement carbon emission reduction strategy and realize the goal of “dual carbon,” and fill the research gap in related fields. At the same time, this paper introduces firm size to explore the relationship between the three. Although scholars have reached a consensus on the relationship between firm size and FP, the direction of the regulating effect of CP and FP curves cannot be determined theoretically, and further testing of large sample data is needed. Therefore, this paper further studies the regulating effect of firm size. It can not only provide empirical support for the research on the relationship between carbon performance and financial performance, but also provide certain reference value for power enterprises of different sizes in the process of implementing carbon emission reduction and pursuing profit maximization.

Under the dual policy goals of carbon peaking (CEP) and industrial green transformation (IGT), China usually adopts top-down policy implementation and needs to build a better industrial green development plan (Zhou et al., 2022). A better understanding of the relationship between “dual carbon” and economic growth is conducive to industrial development and green development. From the perspective of mutual funds, Ji puts forward that China’s green funds outperform other countries, and proposes that China can further achieve carbon neutrality while ensuring corporate performance and economic growth by introducing new carbon-friendly investment tools, promoting trading mechanisms, providing financial benefits, and reducing market friction (Ji et al., 2021). Starting from the Emissions Trading System (ETS), Zhang believes that in order to minimize carbon emissions, the government should improve the efficiency of supervision and formulate appropriate incentive strategies for excess emission reduction and punishment strategies for insufficient emission reduction. Reasonable free carbon quota ratio, lower technology emission reduction cost and higher carbon price can stimulate the enthusiasm of governments and enterprises to reduce emissions (Zhang et al., 2023). Hou, from the perspective of spatial characteristics and green finance, believes that the development of green finance will promote carbon neutral performance with regional consistency, and China needs to strengthen the green sustainable financial system, promote regional green finance, and improve the carbon neutral performance of green finance (Hou et al., 2023). From the perspective of the dual performance (DP) of environmental performance and corporate performance, Ding found that the incentive effect of green subsidies could make corporate performance reach the inflection point in advance and realize the synergistic growth of DP. The evolutionary game between the government and enterprises leads to the fluctuation of DP rising first, then decreasing, and finally rising. In addition, DP can develop cooperatively under collaborative governance to achieve the consistency of carbon decision-making behavior (Ding et al., 2022).

CP is also known as low CP, carbon reduction performance or carbon emission efficiency. The premise of measuring CP level is to obtain the corresponding carbon emission data. One is to use the carbon emission index disclosed in the mandatory report or voluntary report to measure the CP level of enterprises. For example, Ragini et al. (2019) studied the CP of American companies based on the carbon information in the CDP report. However, not all enterprises or regions are willing to participate in CDP projects, and China’s carbon information disclosure system is not yet perfect, so there are not many enterprises that disclose carbon emission information, and the disclosure standards are different, resulting in the inability to directly obtain standardized and unified corporate carbon emission data. Therefore, most scholars use the main business income of enterprises and operating costs to estimate the proportion of carbon emissions of enterprises from the carbon emissions of industries to measure the level of CP (Busch and Lewandowski, 2016; Yan et al., 2022).

Most scholars in the existing literature focus on the relationship between environmental performance and FP. However, with the deepening of research and the rise of the concepts of “carbon neutrality” and “carbon peaking,” scholars have also begun to detail the relationship between CP, a branch of environmental performance, and FP. There are four views on the relationship between CP and FP.

Some scholars believe that CP is positively correlated with FP. Meng found that CP can significantly improve the FP of enterprises, and FP has a promotion effect on CP, and there is no lag effect (Meng et al., 2023). Timo Busch’s meta-analysis results show that carbon emissions are inversely proportional to FP, indicating that good CP is usually positively correlated with excellent FP (Busch and Lewandowski, 2016). Manrique studied the impact of corporate environmental performance on corporate FP during the global financial crisis according to the economic development level of the country where the enterprise is located. They found that good environmental protection behaviors had a significant and positive impact on corporate FP in both developed and developing countries (Sergio and Martí-Ballester, 2017). Yan takes energy enterprises listed in China’s A-shares as samples and finds that good CP and technological innovation in the energy industry have A positive impact on the FP of enterprises (Yan et al., 2022).

Some scholars believe that CP is negatively correlated with FP. Liu conducted an empirical study on the correlation between the environmental performance and financial performance of 16 heavily polluting industries in China, and found that the heavily polluting industries were negatively correlated with FP, and the improvement of environmental performance could not bring the overall improvement of FP (Liu et al., 2022). Liu investigated the impact of environmental responsibility performance on China’s financial performance by constructing the evaluation index of corporate environmental responsibility. He found that corporate environmental responsibility has heterogeneity on FP, and in the central region of China, environmental responsibility is negatively correlated with FP (Liu et al., 2020). Tang conducted an empirical test with 293 Chinese heavily polluting enterprises as samples, and found that enterprises paying attention to environmental protection expenditure will bring good CP, but will have a significant negative impact on the current corporate FP (Tang et al., 2023).

Some scholars believe that the relationship between them is U-shaped. Ogunrinde integrates a process dimension based on an environmental management score with an outcome dimension represented by firms’ carbon emissions intensity). By studying the relationship between corporate environmental performance and corporate financial performance, he found that there is a U-shaped relationship between the outcome dimension of corporate environmental performance in high-carbon intensive industries and FP, while the opposite is true for low-carbon intensive industries (Ogunrinde et al., 2020). Based on the provincial panel data of China’s manufacturing industry from 2008 to 2019, Peng measured the relationship between carbon intensity and green transformation ability in 30 provinces, and found that as more capital flows into pollution-dominated but profitable projects, carbon emission and financial performance show a U-shaped relationship (Peng and Guo, 2022). Starting from the core factors of enterprise profitability, Yang et al. found that there was a U-shaped relationship between carbon constraint and the profitability of large thermal power enterprises through theoretical analysis and empirical results. In the early stage, Yang et al. believed that the profitability of enterprises declined due to high research and development costs. Once this input becomes a heterogeneous resource that is difficult to replace, profitability will increase with the reduction of carbon emissions (Yang and Zhang, 2017).

Some scholars believe that there is no direct correlation between the two. Sun used general Bayesian networks to analyze the correlation between corporate environmental management activities, financial performance and financial characteristics, and found that there was no direct relationship between financial performance and corporate environmental management activities (Sun et al., 2018). Based on data from a database of industrial enterprises in China, Zhang determined the impact of companies’ meeting energy efficiency targets on their FP. The results show that energy conservation has no significant impact on the FP of high-energy-consuming industries (Zhang et al., 2022). Dai analyzed the influence of carbon emission constraint on the performance of thermal power enterprises from both static and dynamic perspectives, and found that the influence of carbon emission constraint on enterprise performance is not absolute, and many factors such as technological innovation, management and operation will affect enterprise performance (Dai and Wang, 2020).

Domestic and foreign scholars have made rich achievements in studying the relationship between environmental performance and financial performance. They believe that there is a positive correlation between CP and FP in the literature, most of which take enterprises in developing countries as examples, and the selected enterprises are basically from the whole industry or the energy industry. The literature that considers the negative correlation between cp and fp is more focused on emerging countries or industries with serious pollution. For literatures with U-shaped or insignificant correlation, it may be affected by sample selection, such as industry and regional heterogeneity; It is also affected by the internal factors of the enterprise, such as the technological innovation of the enterprise, the mode of operation and so on.

However, the research on the relationship between carbon performance and financial performance is relatively scarce. By combing and comparing the literature, the following shortcomings are drawn: 1) The academic community has not reached a unified conclusion on the relationship between the two. There are heterogeneous and complex interactions between the two structures in general. Selection of different research periods, research perspectives and indicators may lead to different research conclusions (Hoppe and Guenther, 2014; Markus et al., 2018). Most scholars disagree on whether the relationship between carbon performance and financial performance is positive or negative. A few scholars propose that the relationship between the two is inversely “U” shaped correlation and non-correlation. 2) The selection of carbon performance evaluation methods and indicators is highly subjective. There is no unified standard for measuring carbon performance in academic circles. Some scholars choose a single variable to measure carbon performance by absolute or relative value, while others choose multiple environmental indicators and financial indicators to jointly build a carbon performance evaluation system.

To sum up, many literatures only discuss the single influence of CP on FP, ignoring other factors that affect the relationship between the two. In particular, few studies introduce the relationship between the two as a moderating variable, few literatures comprehensively examine the mechanism of action of the three, and few studies explore the relationship between CP and FP with domestic micro-enterprises as research objects. Starting from the shortcomings of the research on the relationship between the two, this paper selects the power industry as the research object, adopts a more comprehensive performance evaluation index and considers the regulating effect of enterprise scale on the relationship between the two. Therefore, the research on the relationship between carbon performance and financial performance is more comprehensive and targeted.

Although under the influence of environmental regulations, high-carbon enterprises inevitably need to increase the corresponding cost to meet the requirements of environmental policies. However, Porter’s hypothesis holds that appropriate environmental regulations can improve the FP of enterprises and ultimately offset the costs of carbon reduction measures. For example, enterprises can reduce unnecessary energy consumption and improve their CP by introducing low-carbon environmental protection equipment and researching and developing low-carbon technologies (Gao and Zhou, 2015), which can not only relieve the pressure of legality and avoid environmental penalties, but also get the government’s policy support in terms of tax incentives and environmental protection subsidies, so as to make up for the incremental cost of investment to a certain extent.

Secondly, stakeholder theory holds that enterprises need to achieve a balance between economic interests and various stakeholders when implementing strategic decisions. With the improvement of low-carbon awareness in all sectors of society, especially after the “dual carbon” goal was proposed, carbon information has gradually become a non-financial indicator concerned by stakeholders because it is closely related to the sustainable development of enterprises. Stakeholders need to be involved in carbon reduction activities to achieve carbon peaking and carbon neutrality. Wang pointed out that five stakeholders affecting carbon emission reduction intensity are listed in descending order as follows: manufacturing enterprises, government, energy supply industry, research and development organizations, and financial institutions (Wang et al., 2022). The pressure on enterprises to reduce carbon emissions is also increasing under the influence of low-carbon requirements from stakeholders such as governments and financial institutions. Companies need to take reasonable carbon reduction measures and actions to meet stakeholder requirements. If an enterprise’s carbon emission reduction measures are ineffective and its CP level is low, it will send a negative signal to stakeholders and thus make the enterprise face public opinion or substantial pressure from stakeholders. By implementing carbon emission reduction strategies and actively improving CP, enterprises can build their green reputation, which reflects their competitive advantages. This green reputation not only helps reduce business risks, but also helps enterprises obtain more favorable business conditions in negotiations with various stakeholders. Meanwhile, the improvement of CP also provides opportunities for enterprises to expand market share and obtain new resources. This will further increase the profits of enterprises (Baah et al., 2019). In addition, carbon disclosure is a form of enterprise’s positive concern for the environment, which is positively responded by the market and is the basis for investors to evaluate the sustainability of the company. Therefore, carbon disclosure has a positive and significant impact on enterprise value. Enterprises with good CP are more motivated to disclose carbon information to external stakeholders, so as to reduce the degree of information asymmetry and reduce the cost of capital, and then integrate carbon information into stock price and improve FP (Hardiyansah et al., 2021). Based on the above analysis, this paper proposes the following hypotheses:

H1:. CP has a positive impact on FP.

To achieve the goal of “dual carbon” is a long-term task. As the main body of carbon emissions, enterprises need to promote the green upgrading of existing facilities, accelerate the research and development and application of advanced and applicable technologies, strengthen innovation capacity, and carry out green and low-carbon transformation. The dividend brought by improving CP may make enterprises increase their investment in carbon emission reduction. However, based on the principle of diminishing marginal benefit, increasing the input of production factors will increase the output, but after the input exceeds a certain degree, the output will decrease, and the low sales ability will result to the loss of enterprise interests. For example, in the automotive industry, there is a strong and persistent negative correlation between carbon emissions and FP, which is associated with lower return on sales and lower capital efficiency for high-emission companies (Palea and Cristina, 2022). Therefore, after the investment in carbon emission reduction improves the CP to a certain extent, the phenomenon of diminishing marginal benefits may appear, thus damaging the financial interests of enterprises and hitting the enthusiasm of enterprises to achieve the “dual carbon” goal. Based on the above analysis, this paper proposes the following hypotheses:

H2:. The positive effect of CP on FP is not sustainable.

In the study of the relationship between CP and FP, enterprise size is mostly used as the control variable in variable design. While increased capital expenditures by companies to improve their CP will increase their operating costs to some extent, the impact of these additional costs may not be the same for companies of different sizes. Under normal circumstances, smaller enterprises have lower access to resources and information than larger enterprises, resulting in greater operational risks and external pressure. Improving CP through environmental governance can alleviate agency problems to a certain extent and improve corporate image to gain market recognition or attract external investment, thus improving profitability. Large scale enterprises are in a leading position in the industry, and their rich financing channels and resources make them less motivated to improve environmental governance to improve profitability. The size of the enterprise also has a certain impact on the management structure and the formulation of the enterprise strategy. Larger enterprises emit more pollutants and have more stakeholders, so they are subject to higher supervision by the government and society. In the process of operation, they not only need to consider profit, but also need to bear more environmental and social responsibilities, which may also lead to inefficient investment. According to Deng Xiang’s research, environmental regulation is negatively correlated with the FP of enterprises, and the sensitivity of state-owned enterprises to environmental regulation is higher than that of non-state-owned enterprises (Deng and Li, 2020). Therefore, the following hypothesis is proposed:

H3:. Firm size plays a negative moderating role in the relationship between CP and FP.

This paper selects the data of thermal power enterprises listed on Shanghai and Shenzhen A-shares from 2011 to 2020. The reason is that thermal power generation is still the main power generation mode in China’s power industry and thermal power generation is an important source of carbon emissions in the power industry. Therefore, thermal power enterprises will be more representative and comparable when studying the relationship between CP and FP of power enterprises. Up to now, the China Energy Statistical Yearbook has not updated the industry energy consumption data after 2020, so the observation period is until 2020. According to the 2012 edition of the industry classification of the CSRC, select such enterprises and screen them, the process is as follows: 1) Eliminate listed enterprises, ST, *ST, and main business changes after 2011; 2) Eliminate listed enterprises with abnormal data, missing data, and delisting. A total of 29 sample enterprises and 290 sample data were obtained. The financial data are mainly from the CSMAR database, and other data are mainly from the China Energy Statistical Yearbook. In order to reduce the Influence of outliers, this paper carries out 1%–99% indent processing for all continuous variables, and mainly uses Spss26.0 and Stata16.0 software for data processing.

The direct purpose of enterprises to improve their CP level is to reduce carbon emissions. Using carbon emissions to measure CP level not only conforms to the definition of performance but also reflects the carbon emission reduction results of enterprises. Therefore, this paper intends to draw on the method proposed by Zhao, divide the main business income of an enterprise by the carbon emission of an enterprise, and take the logarithm as the CP index of an enterprise (Zhao et al., 2021). However, because Chin’s carbon information disclosure system is not yet perfect, there are not many enterprises that disclose carbon emission information, and the disclosure standards of different enterprises are not uniform, and the carbon emission data of Chinese enterprises can not be directly obtained, so the carbon emission of enterprises is estimated by the carbon emission of the industry with the help of business costs.

Specific calculation steps: (1) Multiply the various energy consumption of the power industry published in the China Energy Statistical Yearbook with the corresponding reference coefficient and carbon emission coefficient to obtain the carbon emission of the industry. (As shown in Table 1) ② Enterprise carbon emission = enterprise main business cost/(industry main cost)× industry carbon emission. ③ Corporate CP cp = Ln(corporate main business income/corporate carbon emissions).

Scholars usually choose a single indicator to measure FP, such as ROA or TobinQ value (Zhao et al., 2021; Fortune, 2018; Meng et al., 2023), but this paper believes that only a single indicator to measure the FP of enterprises cannot fully reflect the financial situation of enterprises. In order to evaluate the FP of enterprises more comprehensively and fully consider the characteristics of power enterprises represented by thermal power, this paper intends to select 12 financial indicators to build a FP evaluation system through structure factor analysis, so as to fully reflect the FP level of enterprises (Table 2).

The difference of enterprise scale will affect the resource acquisition ability and accumulation ability of enterprises. Large-scale enterprises have relatively rich capital accumulation and strong anti-risk ability. And its importance to the market economy is higher, more concerned by the state and society. Therefore, large-scale enterprises will pay more attention to corporate image and social responsibility, increase their investment in environmental protection, and have high enthusiasm in implementing carbon emission reduction strategies. Therefore, the difference of enterprise scale has a certain impact on CP and FP. In this paper, the firm size is expressed using the natural logarithm of total assets at the end of the period.

This paper mainly explores the relationship between CP and FP. The research object focuses on the internal power enterprises, and the difference of external environmental impact is relatively small. By referring to the research of relevant scholars, the size of enterprises, listing years, financial leverage and ownership concentration are selected as control variables. The relevant variables and their definitions are shown in Table 3.

In order to test the relationship between CP and FP, the following model is constructed to verify hypothesis 1 (Eq. 1):

In order to test whether CP is sustainable to FP, the following model is constructed to verify hypothesis 2 (Eq. 2):

Where n = 1,2,... . If n = 1, it represents the impact of CP in the current period on FP in the lagging period.

In order to test the moderating effect of firm size on the relationship between CP and FP, the cross-multiplication term of CP and firm size is introduced(inter = cPit*SIZEit). Construct the following model to verify hypothesis 3 (Eq. 3):

This paper uses Stata16.0 software to conduct descriptive statistics on the sample data. The descriptive statistical results of all variables are shown in Table 4. The maximum value of FP (FP) is 1.592 and the minimum value is −1.950, indicating that there is a large gap in the FP of thermal power sample enterprises. The maximum value of CP (CP) is 7.401, and the minimum value is 6.159. There is still a gap between some enterprises and the average value of the industry, and the carbon emission reduction efforts of enterprises are different. Some enterprises have low carbon emission reduction awareness and insufficient carbon emission control efforts, and there is still a large room for improvement.

The maximum value of enterprise S″ze i′ 26.81, the minimum value is 20.99, the mean value is 24.20, and the standard deviation is 0.243, indicating that the overall scale of the sample enterprises is large, and the size difference among enterprises is small, mainly because the fixed assets of electric power enterprises account for a high proportion of total assets. In this paper, the natural logarithm of total assets is adopted to measure enterprise size. The mean value of financial leverage (LEV) is 0.635, the standard deviation is 0.147, and the maximum is 0.937. The overall leverage level of the industry remains at a reasonable level, but the leverage of individual enterprises is too high and needs to be adjusted in a timely manner. For listing years (Age), this variable is measured by taking the natural logarithm of the difference between the reporting year and the listing year. The maximum value is 3.296 and the average value is 2.787, indicating that the overall development of the sample enterprises is relatively mature. The maximum value of ownership concentration (OC) is 0.834 and the average value is 0.437, indicating that the overall ownership of listed thermal power companies is relatively concentrated. The maximum value of the independence of the Board of directors (IDR) is 0.356 on average, 0.6 on maximum, and 0.231 on minimum, indicating that there are still enterprises that fail to meet the Company La’s requirement that the number of independent directors shall not be less than one third of the board members.

As shown in Figure 1, the average value of CP has remained stable and increased from 2011 to 2020. Especially after the pilot carbon trading policy in 2013, power enterprise’ awareness of carbon emission control has been strengthened year by year, and CP level has also maintained a good development trend.

In order to understand the correlation between variables and their significance level, correlation analysis was carried out on each variable, as shown in Table 5. It can be seen from the table that the correlation coefficient between the FP (FP) of the explained variable and the CP (CP) of the explained variable is 0.263 and positively correlated at the significance level of 1%. It indicates that the improvement of CP (CP) will contribute to the improvement of FP (FP). A preliminary proof is provided for hypothesis 1.

In this paper, VIF test was conducted on whether there was multicollinearity between variables. The results were shown in Table 6. The maximum value of variance inflation factor was 1.40, and the variance inflation factor of each variable was much lower than 10, indicating that there was no multicollinearity between variables and regression analysis could be conducted.

Before the regression analysis, F-test and Hausmann test are required to select a model suitable for the study of the relationship between CP and FP of thermal power enterprise’ balance panel data from 2011 to 2020. In the F-test comparing the mixed model and the fixed effect model, the p-value is 0, indicating that the null hypothesis is rejected, that is, the fixed effect model is superior to the mixed model. In the Hausmann test comparing the fixed effects and random effects models, the p-value is 0, that is, the fixed effects model should be chosen over the random effects model. Based on the above test results, the fixed effect model is more suitable for the study of this paper.

In order to verify that H1: CP has a positive impact on FP, regression analysis is performed on model (1), and the results are shown in Table 7. The R2 is 0.424 and the adjusted R2 is 0.395, indicating that the model has a good overall fitting effect. CP (CP) and FP (FP) are significantly positive at the 1% level. It shows that the improvement of CP level will contribute to the improvement of FP. H1 is verified. It shows that power enterprises attach a high degree of importance to carbon emission reduction, and their investment in carbon emission reduction wins the favor of stakeholders, enhances the flexibility of enterprises, and makes it easier to translate carbon emission reduction achievements into FP. Therefore, CP has a positive impact on FP. In order to verify H2: the positive impact of CP on FP is not sustainable. Regression analysis was performed on model (2), and the results were shown in Table 8. On the basis of model (1), regression analysis was conducted on the CP of the current period and the FP of the period lagging phase 1 and phase 2 to test whether the positive impact of CP on FP was sustained. The results showed that the regression coefficient of CP of the current period on the FP of the period lagging phase 1 and phase 2 was positive, and both passed the significance level test of 1%. The result of regression analysis is contrary to H2, that is, the positive impact of CP on FP is persistent. It shows that the investment in carbon emission reduction of power enterprises makes CP have a positive effect on FP when CP is increased to a certain extent, but this effect shows a diminishing marginal effect. Therefore, it is necessary to attach importance to the long-term management of carbon emission reduction, and enterprises need to allocate resources reasonably according to their own conditions, so as to achieve sustainable development of FP improvement of enterprises.

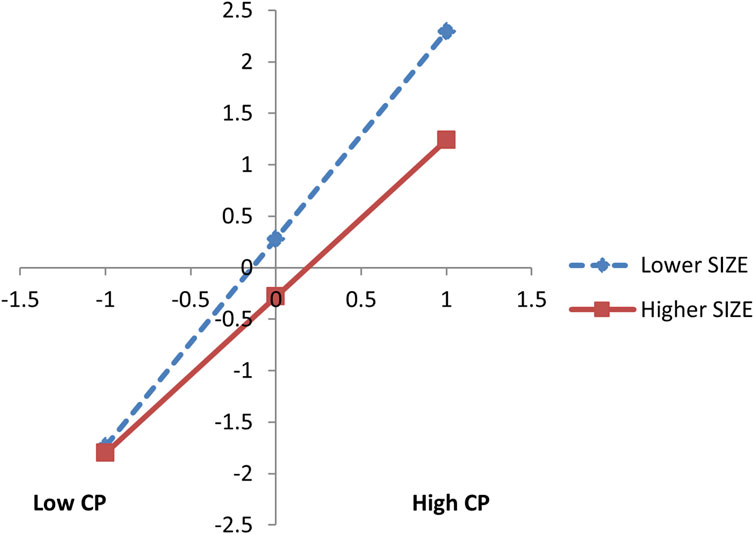

In order to test the regulating effect of firm size on the relationship between CP and FP, the interaction term (inter) between CP and firm size was introduced for regression analysis. The results are shown in Table 9. First, it can be seen from the main effect analysis of model (1) that the regression coefficient of CP on FP is 1.753, which passes the significance level test of 1%. In other words, CP has a significant positive impact on FP. Based on this, the adjustment effect analysis of enterprise size is conducted. According to model (2), it can be seen that the regression coefficient of the interaction term (inter) between enterprise size and CP on FP is −0.248 and passes the significance test of 5%, so enterprise size belongs to the interference adjustment effect, which proves hypothesis 3 is valid. That is, enterprise size negatively regulates the positive impact of CP and FP.

In addition, the adjusted R2 in model 1 is 0.395, and the adjusted R2 in model 2 is 0.405, which increases somewhat, further indicating that the introduction of adjustment variables is reasonable.

In order to more clearly show the adjustment effect of enterprise size, Excel table is used to draw the adjustment effect of enterprise size, as shown in Figure 2.

Figure 2. Influence of firm size on the relationship between carbon-based performance and financial performance.

Considering that there may be mutual influence between CP and FP, in order to solve the potential endogenous problem, the method proposed by Yan Huahong was used to study the lag of explanatory variable (CP) one stage as the instrumental variable, and 2SLS regression was carried out (Yan et al., 2019). The results are shown in Table 10. The instrumental variable passed the under-recognition test and the weak instrumental variable test. In addition, it can be seen from the results of the first stage that L.cp and cp are significantly positively correlated at the level of 1%, which indicates the rationality of the instrumental variables selected in this paper. As can be seen from the regression results of the second stage, IV-2SLS is basically consistent with the previous regression results, and the promoting effect of CP on FP is significantly positive, which indicates that the endogenous problem is controlled.

In order to verify the accuracy of the above model and the results of regression analysis, this paper intends to test the robustness of the model, replace the original FP indicator FP with ROE and keep other variables unchanged, and conduct a regression analysis on the hypothesis again. The results are shown in Table 11. The regression coefficient between carbon performance (CP) and financial performance (ROE) is 0.242. The T statistic value is 9.21, which further proves that there is a significant positive correlation between CP and FP through the significance level test of 1%. At the same time, the replaced FP indicators are delayed to test whether there is continuity between CP and FP in the current period. Through re-regression analysis, CP can still effectively improve the FP of the lag phase 1 and lag phase 2. The regression coefficient between the current CP and the ROE one period behind is 0.202, and the T-value is 6.8, passing the 1% significance level. The regression coefficient between CP in the current period and ROE in the second lagging period is 0.161, and the T-value is 4.78, which also passes the significance test at the 1% level, further proving that the positive impact of CP on FP is sustained.

The robustness test of hypothesis 3 is conducted, and the results are shown in Table 12. The regression coefficient of the interaction term (inter) between CP and firm size is −0.057 and passes the significance test of 1%, which further proves the validity of hypothesis 3.

The academic community has not yet formed a unified view on the relationship between CP and FP. Traditional economists believe that environmental regulations will lead to the company that causes environmental pollution to bear the corresponding environmental costs, which will lead to the increase of enterprise operating costs and further affect the FP of enterprises. However, scholars based on Porte’s hypothesis and stakeholder theory believe that appropriate environmental regulations can stimulate enterprises to carry out ecological innovation, and the economic benefits obtained through innovation can offset the new environmental costs, thus forming competitive advantages in the market and obtaining good economic benefits. A large number of studies by Sun Zhao Yong and Yan also show that improving corporate social responsibility capability is an effective way to promote FP, and good CP is usually positively correlated with excellent FP(Sun and Park, 2023; Yan et al., 2019).

Carbon emissions from Chin’s power sector account for about one-seventh of global carbon dioxide emissions and half of Chin’s carbon dioxide emissions (Jiang et al., 2018). Reducing power-related carbon emissions is critical to achieving Chin’s emission reduction targets (Wei et al., 2017). The governmen’s strict environmental regulations put forward higher “low-carbo” requirements for high-carbon emission enterprises such as electric power enterprises, but by implementing “carbon emission reductio,” electric power enterprises can improve the utilization rate of resources, avoid environmental penalties, and enjoy government subsidies and tax incentives. In addition, due to the particularity of the industry, electric power enterprises involve more stakeholders, and the pressure caused by stakeholders in the process of reducing carbon emissions becomes the driving force for enterprises to make environmental commitments, improve CP, and achieve the goal of “dual carbo” (Silva et al., 2013). While fulfilling their social responsibilities and improving CP, electric power enterprises can also improve CP. By integrating green resources and improving the green attributes of products, the company can optimize its own image to win the favor of more stakeholders, increase the loyalty and satisfaction of customers with green preferences to products, expand the market share, improve the relationship with government regulators, improve the value of enterprises, and play a positive role in FP. Therefore, enterprise managers need to pay attention to the long-term management of carbon emission reduction, so as to improve the FP of enterprises for sustainable development. The combination of carbon reduction strategy and business strategy to achieve a win-win situation of environmental and economic benefits.

Chin’s inter-provincial trade leads to the increase of power-related carbon emissions and the flow of carbon emissions (Wei et al., 2020). The electric power industry, as the first industry incorporated into the carbon emission rights trading system in China, internalizes the external cost of carbon emissions of electric power enterprises under the influence of carbon emission rights trading policy. Those who exceed the limit buy carbon credits through carbon trading or pay environmental penalties. Yuan believed that the adoption of emission reduction technology could effectively reduce the impact of carbon constraints on output, reduce emissions and purchase carbon emission rights, and realize environmental and economic dividends (Yuan et al., 2022). Enterprises reduce carbon emissions through technological innovation, such as purchasing or updating production equipment. By selling the excess carbon emission rights in the secondary market, they can make up for the environmental costs incurred by purchasing or updating equipment. It can be seen that Porte’s hypothesis and stakeholder theory have been confirmed in the research on the relationship between CP and FP of electric power enterprises in China.

In addition, this paper adds and validates a new important factor in exploring the relationship between the two–- firm size. Although environmental investment in order to improve environmental performance will increase the operating costs of enterprises to some extent, the impact of such cost increase on companies of different sizes is different. Although scholars have reached a consensus on the relationship between enterprise size and FP, when it comes to the directionality issue, However, there are two different views: diseconomies of scale or diminishing returns to scale and increasing economies of scale or returns to scale.

However, the existence of economies of scale has forced scholars to reflect on the positive relationship between enterprise scale and efficiency, that is, the possibility of increasing returns to scale. Gun JeaYu and Andries believe that enterprise scale has a significant moderating effect on the relationship between FP and environmental performance (Gun et al., 2016; Andries and Stephan, 2019). However, the larger the enterprise scale, the more stakeholders will be involved in its production and operation, and the more environmental and social responsibilities must be considered in the process of business decision-making, which may lead to more resources being invested in projects that cannot bring economic benefits to the enterprise in the short term. The problem of inefficient investment leads to a decline in resource utilization and offsets the positive impact of CP on FP to a certain extent. Zhang took 11909 micro-industrial enterprises in Anhui Province, China as research objects, and found that the enterprises that improved performance were mainly low-energy enterprises and small enterprises. In contrast, most of the enterprises with declining performance are high energy-consuming enterprises and large enterprises (Zhang et al., 2018).

It can be seen that although the existence of the regulating effect of enterprise size on the relationship between CP and FP curve is theoretically established, the direction of this regulating effect cannot be determined theoretically, and further large-scale sample data testing is needed. Therefore, this paper further studies the regulating effect of enterprise size.

This paper takes 29 A-share listed power enterprises as samples, selects 2011–2020 as the research interval, explores the relationship between carbon performance and financial performance of power enterprises under the background of “dual carbon,” and draws the following conclusions:

(1) Carbon performance has a positive impact on financial performance. The regression results show that the regression coefficient of carbon performance and financial performance is positive and passes the significance test of 1%, and passes the robustness test. Enterprises achieve carbon emission reduction through carbon management to improve the level of carbon performance is conducive to improving financial performance. A high level of carbon performance is a manifestation of an enterprise’s active commitment to social responsibility and adherence to the path of green and low-carbon development, which can send positive signals to the market and enhance the green image of an enterprise. At the same time, although the improvement of carbon performance will bring about a surge in costs in the short term, it is conducive to reducing production costs in the long run.

(2) The positive impact of carbon performance on financial performance is sustained. The regression analysis of carbon performance in the current period and financial performance by lagging one and two periods shows that carbon performance in the current period has continuity to financial performance. Enterprises rationally arrange resources and management plans and incorporate carbon emission reduction strategies into their long-term strategic development plans. By reducing carbon pollution and green production to change the extensive economic development mode, enterprises can improve their reputation, shape their good image, attract the participation of potential investors, increase inestimable intangible benefits, and improve their performance.

(3) Firm size plays a negative moderating role in the relationship between carbon performance and financial performance. The larger the scale of the enterprise, the more stakeholders involved in its production and operation, the more environmental and social responsibilities must be considered in the process of business decision-making, and more resources may be invested in projects that cannot bring economic benefits to the enterprise in the short term. The problem of inefficient investment leads to the decrease of resource utilization and offsets the positive impact of carbon performance on financial performance to a certain extent.

“Carbon information disclosure” is a way to obtain the “carbon performance” of enterprises. Since CP has a positive effect on FP, and this effect is persistent, the disclosure system of carbon information needs to be improved. Carbon information is also a component of accounting information. The Accounting Standards for Business Enterprises can clearly specify the time, way and the content of carbon information disclosure, establish responsibility investigation and punishment system, promote enterprises to disclose carbon information more fully, and formulate unified and standardized statistical accounting methods for carbon emissions. Clear accounting caliber, emission factors and other information makes carbon information disclosure more standardized and standardized. It is also necessary to integrate carbon information supervision resources and build a carbon audit supervision system that combines government audit supervision, enterprise internal control audit and third-party independent audit represented by professional service institutions. Establish and improve the mechanism for carbon information to be compatible with the full coverage of the audit, and require enterprises subject to carbon emission control to disclose the audited carbon information together with their annual financial report or ESG report.

Since enterprise size plays a negative regulating role in the relationship between CP and FP, small and medium-sized enterprises need to pay more financial costs than large enterprises while ensuring good carbon performance. The government should improve the incentive system for carbon emission reduction. For example, for enterprises that actively adjust the energy structure and achieve good carbon emission reduction results, tax relief can be granted according to corresponding standards. On this basis, more tax incentives or publicity can be given to small and medium-sized enterprises that actively respond to the policy and have good carbon emission reduction effects. To realize the positive transformation between CP and FP under the premise of guaranteeing the interests of small and medium-sized enterprises.

Guided by industry associations, technical and operational management exchanges and cooperation among power enterprises will be strengthened by organizing industry summits and other forms. For a series of “dual carbon” policies, do a good job of collecting difficulties and suggestions from power enterprises, especially pay attention to the difficulties put forward by small and medium-sized enterprises, carry out forward-looking research in combination with the actual situation of the industry and give feedback to the government regulatory authorities. The association awards power enterprises with outstanding carbon emission reduction and financial performance, and acts as an intermediary to promote exchanges and learning among enterprises, ensuring that small and medium-sized enterprises can get exchanges and research opportunities.

Power enterprises need to base on the “dual carbo” era background, in the medium and the long term development strategy of carbon reduction, pay attention to the development trend of carbon emissions and the impact of “dual carbo” on the development of enterprises. Enterprises should clarify low-carbon development goals, including reducing carbon emissions, improving energy efficiency, and adopting renewable energy. These goals should be measurable, attainable and sustainable to ensure the effectiveness of long-term planning. We can learn from the development strategies of large energy groups in Europe and the United States, set up a “carbon strategy management departmen” to establish a sound management system for carbon emission reduction, promote carbon budget management, let all departments participate in the formulation and modification of carbon budget, combine emission reduction targets with business plans in light of the actual situation of production and operation of enterprises, and change the previous passive work mode of energy conservation and environmental protection. The implementation of carbon cost management, the carbon emission reduction cost of each production link into the cost accounting, the manager proposed the corresponding refined cost management plan, and implemented in the whole process of production. For traditional thermal power enterprises, it is more necessary to strengthen cost control, stabilize coal supply prices, strengthen coal power cooperation, and promote the fine management of clean energy costs.

As the electric power industry is the breakthrough of Chin’s carbon emission rights trading market, in order to achieve the “dual carbo” goal, its annual available carbon quota will actually show a decreasing trend, and the part that exceeds the carbon quota needs to purchase the quota to achieve carbon emission compliance. Therefore, in the future, electric power enterprises can avoid the increase of carbon price and actively participate in carbon market trading. On the one hand, participating in carbon trading helps to convey the awareness of green responsibility to the outside world through the carbon market to enhance the corporate image; on the other hand, the active use of carbon financial instruments not only helps to reduce the cost of carbon emission reduction, but also helps to hedge the risk caused by the fluctuation of carbon trading. It is also conducive to easing the financing dilemma of enterprises so as to carry out the low-carbon transformation of energy structure more effectively.

Since low-carbon strategy requires long-term management with diminishing marginal effect, such management needs to allocate resources reasonably according to the conditions of enterprises themselves. The strategy of an enterprise should be adaptable and adjustable. The whole strategic arrangement should be the participation of the whole enterprise to form a good feedback mechanism. Enterprises should establish a monitoring and evaluation mechanism to regularly monitor and evaluate the implementation of low-carbon development plans. These mechanisms should be able to detect problems in a timely manner and take appropriate measures to ensure that enterprises can adjust their carbon strategies in a timely manner to ensure the high utilization and high returns of resource investment. At the same time, through training and education, employees can enhance their low-carbon awareness and responsibility, so that employees can better feel and participate in the low-carbon strategy of the enterprise, and the low-carbon development strategy can be implemented and supervised for a longer time.

The Action Plan for Accelerating Green and Low-carbon Innovative Development of Electric Power Equipment released by the Ministry of Industry and Information Technology in 2022 also points out that China’s energy production will shift from relying mainly on resources to relying more on equipment. The core of the program is to require enterprises to rely on technological innovation to enhance the green ability of electric power equipment. Power enterprises, especially thermal power enterprises, should pay more attention to the development of clean and low-carbon power generation equipment, improve energy storage technology, low-cost carbon capture and storage technology, and strengthen technical exchanges and cooperation between enterprises, promote the recycling of resources through technological innovation to meet the challenges of carbon emissions times, and achieve green and low-carbon development.

The datasets presented in this article are not readily available because Company data is private. Requests to access the datasets should be directed to NDk4MDM1ODUyQHFxLmNvbQ==.

JH: Writing–original draft. ZH: Data curation, Methodology, Writing–original draft. XF: Formal Analysis, Investigation, Writing–review and editing. HZ: Supervision, Validation, Writing–review and editing. MS: Conceptualization, Writing–review and editing, Writing–original draft. YZ: Validation, Writing–review and editing. CZ: Validation, Writing–review and editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Fundamental Research Funds for the Central Universities (2662022ZHYJ004) and the National Natural Science Foundation of China (41101494).

Thanks to financial support from the Fundamental Research Funds for the Central Universities and the National Natural Science Foundation of China.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Andries, P., and Stephan, U. (2019). Environmental innovation and firm performance: how firm size and motives matter. Sustainability 11 (13), 3585. doi:10.3390/su11133585

Baah, C., Jin, Z., and Tang, L. (2019). Organizational and regulatory stakeholder pressures friends or foes to green logistics practices and financial performance: investigating corporate reputation as a missing link. J. Clean. Prod. 247, 119125. doi:10.1016/j.jclepro.2019.119125

Bekun, F. V., Alola, A. A., and Sarkodie, S. A. (2018). Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci. Total Environ. 657 (MAR.20), 1023–1029. doi:10.1016/j.scitotenv.2018.12.104

Busch, T., and Lewandowski, S. (2016). Corporate carbon and FINANCIAL PERFORMANCE: a meta-analysis. Acad. Manag. Annu. Meet. Proc. 2016 (1), 745–759. doi:10.1111/jiec.12591

Cheong, T. E. (2019). Singapore–China economic collaboration 2.0. Singap. Econ. Rev. 66, 207–217. doi:10.1142/S0217590819410017

Dai, L., and Wang, M. (2020). Study on the influence of carbon emission constraints on the performance of thermal power enterprises. Environ. Sci. Pollut. Res. Int. 27 (24), 30875–30884. doi:10.1007/s11356-020-09604-4

Deng, X., and Li, L. (2020). Promoting or inhibiting? the impact of environmental regulation on corporate financial performance—an empirical analysis based on China. Int. J. Environ. Res. Public Health 17 (11), 3828. doi:10.3390/ijerph17113828

Ding, Y., Hu, Y., and Liu, J. (2022). Equilibrium analysis of carbon decision behavior for the evolutionary game between the government and enterprises. Front. Energy Res. 10, 990219. doi:10.3389/fenrg.2022.990219

Fan, F., Wang, Y., and Liu, Q. (2023). China's carbon emissions from the electricity sector: spatial characteristics and interregional transfer. Integr. Environ. Assess. Manag. 18, 258–273. doi:10.1002/ieam.4464

Fortune, G. (2018). The effect of carbon performance on corporate financial performance in a growing economy. Soc. Responsib. J. 14, 0212. doi:10.1108/SRJ-12-2016-0212

Gao, J., and Zhou, W. (2015). Coordinating supply chains to reduce carbon emissions that of a retailer and a supplier. Environ. Eng. Manag. J. 14 (8), 1857–1863. doi:10.30638/eemj.2015.198

Gun, J.Yu, Kwon, K.-M., Lee, J., Jung, H., and Giuseppe, I. (2016). Exploration and exploitation as antecedents of environmental performance: the moderating effect of technological dynamism and firm size. Sustainability 8 (3), 200. doi:10.3390/su8030200

Hardiyansah, M., Agustini, A. T., and Purnamawati, I. (2021). The effect of carbon emission disclosure on firm value: environmental performance and industrial type. Korea Distribution Sci. Assoc. (1). doi:10.13106/JAFEB.2021.VOL8.NO1.123

Hoppe, H., and Guenther, E. (2014). Merging limited perspectives a synopsis of measurement approaches and theories of the relationship between corporate environmental and financial performance. J. Industrial Ecol. 18 (5), 689–707. doi:10.1111/jiec.12125

Horváthová, E. (2012). The impact of environmental performance on firm performance: short-term costs and long-term benefits? Ecol. Econ. 84 (none), 91–97. doi:10.1016/j.ecolecon.2012.10.001

Hou, H., Qu, P., and Zhang, M. (2023). Does green finance boost carbon–neutral performance? Evidence from China. Environ. Sci. Pollut. Res. 30, 108212–108229. doi:10.1007/s11356-023-29921-8

Ji, X., Zhang, Y., Mirza, N., Umar, M., and Rizvi, S. K. A. (2021). The impact of carbon neutrality on the investment performance: evidence from the equity mutual funds in BRICS. J. Environ. Manag. 297, 113228. doi:10.1016/j.jenvman.2021.113228

Jiang, X. T., Su, M., and Li, R. (2018). Decomposition analysis in electricity sector output from carbon emissions in China. Sustainability 10 (9), 3251. doi:10.3390/su10093251

Koondhar, M., Tan, Z., Alam, G., Khan, Z., Wang, L., and Kong, R. (2021). Bioenergy consumption, carbon emissions, and agricultural bioeconomic growth: a systematic approach to carbon neutrality in China. J. Environ. Manag. 296, 113242. doi:10.1016/j.jenvman.2021.113242

Liu, M., Zhou, C., Lu, F., and Hu, X. (2021). Impact of the implementation of carbon emission trading on corporate financial performance: evidence from listed companies in China. PLOS ONE 16, e0253460. doi:10.1371/journal.pone.0253460

Liu, Y., Xi, B., and Wang, G. G. (2020). The impact of corporate environmental responsibility on financial performance-based on Chinese listed companies. Environ. Sci. Pollut. Res. 28 (7), 7840–7853. doi:10.1007/s11356-020-11069-4

Liu, Z., Zhu, J., and Sun, Y. (2022). Research on the correlation betweenEnvironmental performance and FinancialPerformance in China’s heavy PollutionIndustries based on Raga-PP model. Pol. J. Environ. Stud. 31 (4), 3195–3205. doi:10.15244/pjoes/146558

Markus, H., Geyer-Klingeberg, J., Rathgeber, A., and Stöckl, S. (2018). Economic development matters: a meta-regression analysis on the relation between environmental management and financial performance. J. Industrial Ecol. 22 (4), 720–744. doi:10.1111/jiec.12573

Meng, X., Gou, D., and Lei, C. (2023). The relationship between carbon performance and financial performance: evidence from China. Environ. Sci. Pollut. Res. 30, 38269–38281. doi:10.1007/s11356-022-24974-7

Ogunrinde, O., Shittu, E., and Dhanda, K. K. (2020). Distilling the interplay between corporate environmental management, financial, and emissions performance: evidence from u.s. firms. IEEE Trans. Eng. Manag. 69 (99), 3407–3435. doi:10.1109/TEM.2020.3040158

Palea, V., and Cristina, S. (2022). The financial impact of carbon risk and mitigation strategies: insights from the automotive industry. J. Clean. Prod. 344, 131001. doi:10.1016/j.jclepro.2022.131001

Peng, B., Chen, S., Elahi, E., and Wan, A. (2023). Can corporate environmental responsibility improve environmental performance? an inter-temporal analysis of hinesee chemical companies. Environ. Sci. Pollut. Res., 1–12. doi:10.1007/s11356-020-11636-9

Peng, C., Guo, X., and Long, H. (2022). Carbon intensity and green transition in the Chinese manufacturing industry. Energies 15 (16), 6012. doi:10.3390/en15166012

Ragini, R. D., Luo, Le, and Tang, Q. (2019). Corporate voluntary carbon disclosure strategy and carbon performance in the USA. Account. Res. J. 32 (3), 417–435. doi:10.1108/ARJ-02-2017-0031

Sergio, M., and Martí-Ballester, C.-P. (2017). Analyzing the effect of corporate environmental performance on corporate financial performance in developed and developing countries. Sustainability 9 (11), 1957. doi:10.3390/su9111957

Silva, M. E. D., Oliveira, A. P. G. D., and Gomez, C. R. P. (2013). Can collaboration between firms and stakeholders stimulate sustainable consumption? discussing roles in the brazilian electricity sector. J. Clean. Prod. 47 (5), 236–244. doi:10.1016/j.jclepro.2012.10.027

Sun, E. J., and Park, S. J. (2018). The effect of environmental management activities on financial performance. Korean Bus. Educ. Rev. 33 (5), 547–573. doi:10.23839/kabe.2018.33.5.547

Sun, Z.-Y., Li, M.-J., and Li, D. (2023). CARBON PERFORMANCE and corporate FINANCIAL PERFORMANCE: the moderating role of consumer awareness of corporate social responsibility. Manag. Decis. Econ. 44 (DOl), 663–670. doi:10.1002/MDE.3706

Tang, Y., Yue, S., Ma, W., and Zhang, L. (2023). How do environmental protection expenditure and green technology innovation affect synergistically the financial performance of heavy polluting enterprises? evidence from China. Environ. Sci. Pollut. Res. 29, 89597–89613. doi:10.1007/s11356-022-21908-1

Wang, Y., Wang, J., and Dong, Z. (2022). Interactions and co-governance policies of stakeholders in the carbon emission reduction. Sustainability 14, 5891. doi:10.3390/su14105891

Wei, W., Hao, S., Yao, M., Chen, W., Zhang, P., Wang, Z., et al. (2020). Unbalanced economic benefits and the electricity-related carbon emissions embodied in China's interprovincial trade. J. Environ. Manag. 263, 110390. doi:10.1016/j.jenvman.2020.110390

Wei, W., Wang, X., Zhu, H., Li, J., Li, J., Zou, Z., et al. (2017). Carbon emissions of urban power grid in jing-jin-ji region: characteristics and influential factors. J. Clean. Prod. 168, 428–440. doi:10.1016/j.jclepro.2017.09.015

Yan, H. H., Jiang, J., and Wu, Q. F. (2019). The impact of carbon performance on financial performance based on property property analysis. Math. statistics Manag. (01), 94–104.

Yan, J., Hui, Z., Mu, J., Zhang, Y., and Rahman, A. (2022). The synergistic effect of CARBON PERFORMANCE and technological innovation on corporate financial performance. Front. Psychol. 13, 1060042. doi:10.3389/fpsyg.2022.1060042

Yang, S., and Zhang, X. (2017). Study on the u-shaped relationship of carbon constraint on the large thermal power plants' profitability. Nat. Hazards 89 (4), 1421–1435. doi:10.1007/s11069-017-3028-7

Yoo, S., Eom, J., and Han, I. (2020). Too costly to disregard: the cost competitiveness of environmental operating practices. Sustainability 12, 5971. doi:10.3390/su12155971

Yuan, Y., Zhang, Y., Wang, L., and Wang, Li (2022). Coping decisions of production enterprises under low-carbon economy. Sustainability 14 (15), 9593. doi:10.3390/su14159593

Zhang, L., Long, R., Chen, H., and Huang, X. (2018). Performance changes analysis of industrial enterprises under energy constraints. Resour. Conservation Recycl. 136, 248–256. doi:10.1016/j.resconrec.2018.04.032

Zhang, X., Guo, X., and Zhang, X. (2023). Collaborative strategy within China's emission trading scheme: evidence from a tripartite evolutionary game model. J. Clean. Prod. 382, 135255. doi:10.1016/j.jclepro.2022.135255

Zhang, Y., Zhao, X., and Fu, B. (2022). Impact of energy saving on the financial performance of industrial enterprises in China: an empirical analysis based on propensity score matching. J. Environ. Manag. 317, 115377. doi:10.1016/j.jenvman.2022.115377

Zhao, Y., Qiao, Y., Zhou, Li, and Zhao, J. (2021). How emission reduction measures improve the financial performance of high-energy enterprises: the mediating role of carbon performance. Syst. Eng. (06), 14–24. https://kns.cnki.net/kcms/detail/43.1115.N.20210617.0845.002.html.

Keywords: dual carbon, carbon performance, financial performance, electric power enterprises, relationship

Citation: He J, Huang Z, Fan X, Zhang H, Song M, Zhao Y and Zhang C (2024) Research on the relationship between carbon performance and financial performance of electric power enterprises under the background of “dual carbon”. Front. Environ. Sci. 12:1362450. doi: 10.3389/fenvs.2024.1362450

Received: 28 December 2023; Accepted: 18 March 2024;

Published: 12 April 2024.

Edited by:

Wei Zhang, China University of Geosciences Wuhan, ChinaReviewed by:

Mohammad Haseeb, Wuhan University, ChinaCopyright © 2024 He, Huang, Fan, Zhang, Song, Zhao and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hui Zhang, emhhbmdoNzNAaG90bWFpbC5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.