95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 10 July 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1349036

This article is part of the Research Topic Green Finance & Carbon Neutrality: Strategies and Policies for a Sustainable Future View all 36 articles

Based on measuring the green transformation of heavily polluting enterprises based on the sub-dimensions of green strategy and green action, we empirically analyze whether and how bank digitization affects the green transformation of enterprises by using the data of China’s A-share heavily polluting enterprises from 2010 to 2021. The findings show that 1) bank digitization has a significant positive effect on firms’ green transformation; 2) bank digitization promotes firms’ green transformation by alleviating firms’ financing constraints and improving firms’ ESG performance; 3) governmental environmental regulations and media attention positively moderates the relationship between bank digitization and firms’ green transformation; and 4) bank digitization is more likely to promote the green transformation of firms that are highly digitized, non-state-owned firms, and enterprises in the eastern region; 5) the sub-dimension test shows that bank digitization has significant differences on different dimensions of green transformation. The above analysis shows that bank digitization should be deeply integrated with the green transformation of enterprises, and the former should be deeply embedded in supervising, forcing and empowering enterprises to upgrade environmental protection technology and sewage treatment, and the regulator should formulate a more detailed environmental protection disclosure program to realize the consistency “words” and “deeds” of the green transformation of enterprises.

Since the Industrial Revolution, economic growth has led to serious environmental problems (Lee and Lee, 2022; Lin and Ma, 2022), and how to cope with environmental problems and make a green transition has become a difficult problem to solve all over the world (Zhao et al., 2022). As the world’s largest carbon emitter and energy consumer and the second largest economy, China plays an important role in alleviating the contradiction between economic development and resources and the environment (Zhai and An, 2020). In the face of the urgency of environmental governance, and to guarantee the sustainable development of the economy and the ecological environment, China is pursuing a green transformation while ensuring economic growth (Zhao et al., 2022). Promoting the greening and decarbonization of economic and social development is a key part of achieving high-quality economic development, and an issue that the Chinese government and enterprises need to focus on (Wang L. et al., 2022). Thus, the green transformation of enterprises, especially heavily polluting enterprises, is a necessary part of high-quality development and should be embedded in the greening and decarbonization process of social development. Enterprises are an important engine of economic development and are the main actors in pollution prevention and ecological civilization (Shrivastava, 1995; Liu et al., 2022).

Finance, as the bloodline of the real economy, is undergoing systemic digital transformation, taking on the important responsibility of green transformation of enterprises and promoting high-quality economic development (Cao et al., 2022; Liu et al., 2022; Ma et al., 2023). The digital economy has demonstrated its strong resilience and potential in the face of environmental problems (Hao et al., 2023), promoting changes in production and governance and effectively driving high-quality green development (Zhang and Liu, 2022; Wu et al., 2023). In the digital context, the phenomenon of financial disintermediation has become more serious, competition in the financial services industry has intensified, and financial institutions have to undergo digital transformation to adapt to the overall environment (Gomber et al., 2018; Lin and Ma, 2022). In this regard, the Chinese government is fully aware of the importance of fintech development and actively promotes the digital transformation of financial institutions. China’s financial industry has always been significantly bank-led (Allen et al., 2005; Zheng et al., 2023), and the digital transformation of banks is the main body of the digital transformation of financial institutions. 2023 The People’s Bank of China (PBC) even released the “Specification for Digitalisation Models of Inclusive Financial Services in the Banking Sector” in July 2023, which regulates the digitalization models of the banking sector and accelerates the digital transformation process of the banking sector. Transformation process. Some scholars believe that banks reduce operating costs, simplify business processes, improve service efficiency, alleviate financing constraints of enterprises, and correct resource mismatch through digital technology (Gomber et al., 2018; Lin and Ma, 2022; Tan et al., 2023). However, some scholars believe that the digitalization of China’s banking industry is currently at the stage of simple application of digital technology, and the existing business model is not yet able to portray customer profiles well enough to accurately assess customer credit and risk levels (Feng et al., 2022; Murinde et al., 2022), and cannot effectively provide credit support for the green transformation of enterprises. At the same time, various types of banks are differentiated in the process of digital transformation (Xie and Wang, 2023), and the stability of diversified banks deteriorates with digital transformation (Khattak et al., 2023), as well as the impact on the cost of credit for different types of enterprises (Lyu et al., 2023). B bank digital transformation presents both opportunities and challenges for banks. So, can banking and digitalization facilitate the green transformation of heavy polluters? What is the mechanism by which bank digital transformation promotes the green transformation of heavy polluters? This is a typical empirical question.

Taking an overview, past studies have mostly explored how to promote corporate green transformation from the perspectives of government subsidies (Wu and Hu, 2020), environmental regulation (Wang L. et al., 2022), and corporate governance (Galbreath, 2019). Although some scholars have noted that digital financial development is expected to achieve green economic growth (Hao et al., 2023), they have more often explored the impact of digital finance on the green innovation dimension of enterprises (Feng et al., 2022; Liu et al., 2022), and have not comprehensively measured the impact of digital financial development on the overall green transformation of enterprises. In addition, few existing studies have brought the study of digital finance on corporate green transformation down to the level of banks’ digital transformation, and more often cover banks’ digitization within digital finance as a whole (Lin and Ma, 2022; Ma et al., 2023). Relative to previous studies, this paper expands the research on the consequences of banks’ digital transformation, extends the impact of banks’ digital transformation to the green transformation of heavily polluting enterprises, provides new evidence for the positive externality effect of banks’ digital transformation, and provides theoretical and empirical support for accelerating banks’ digital transformation based on the novel perspective of the green transformation of heavily polluting enterprises.

The green transformation of enterprises has strong externalities, a long cycle, and a large demand for funds (Cao et al., 2021; Lv et al., 2023), and enterprises’ inputs are unable to satisfy the funding gap of green transformation, so external financing has become an important channel for obtaining funds for the green transformation of enterprises (Liu et al., 2022; Guo et al., 2023). Traditional financial institutions are poorly inclusive and tend to favor low-risk and short-term projects, making it difficult to provide stable financial support for corporate green transformation (Feng et al., 2022). Digital finance relying on digital technology is efficient and convenient (Gomber et al., 2018; Tan et al., 2023), providing important support for corporate green transformation. Bank digitalization is the mutual integration of digital technology and traditional banks (Guo et al., 2020; Zhu and Jin, 2023). To crack the resource, environment, and climate problems faced by the development of human society, digital technology is deeply rooted in green attributes from its birth. The green attributes of digital technology and the nature and mission of financial services for the high-quality development of the real economy are embedded in the green transformation of enterprises in the development of digital finance (Ozturk and Ullah, 2022). It has been shown that digital finance promotes the improvement of corporate green innovation and the reduction of environmental pollution through the optimization of credit allocation and regulation (Gomber et al., 2018; Liu et al., 2022; Lin and Ma, 2022). Chinese finance is characterized by significant bank dominance (Allen et al., 2005; Zheng et al., 2023). The digital transformation of banks will further break down the information barriers between banks and enterprises (Rodrigues et al., 2022), The quantity, quality, depth, breadth, and speed of information of banks and enterprises will be significantly improved, and the pricing bias, supervision bias, and risk control bias of bank credit will be further reduced, the abuse of power by bank management will be restrained, and the screening and supervision of green projects will become more scientific and precise, which in turn can empower enterprises to green transformation (Gomber et al., 2018; Murinde et al., 2022; Li M. et al., 2023).

Based on the above analyses, this paper proposes the following hypotheses:

H1:. Digital transformation of banks empowers green transformation of enterprises.

The origin of banks’ digital transformation lies in serving the real economy, the symbiosis and co-creation of value between banks and the real economy (Berger et al., 2020), and the existence of the value of bank franchises that make banks’ concessions to enterprises possible. 1) In recent years, China’s demographic dividend has continued to decline and labor costs have been rising (Zhou et al., 2023). The digital transformation of banks promotes the shift of banking services from offline to online, and a large number of repetitive tasks originally performed by humans are mostly replaced by machines, with business processes automated and unmanned, which reduces the labor demand of banks, lowers labor costs (Berg et al., 2022), and brings about a scale effect. 2) Enterprises have been digitally transformed to improve their performance (Peng and Tao, 2022), Based on the digitization of business operations, banks use new technologies such as big data and artificial intelligence for pre-credit review and post-credit supervision, to enhance the screening capacity of banks’ information screening ability and the screening capacity of enterprises’ green behaviors, and to carry out real-time tracking of the use of enterprises’ funds, to reduce the risk management costs of banks’ green credits (Gomber et al., 2018; Guo et al., 2023), effectively driving down bank costs and improving operational efficiency. 3) In the context of the digital transformation of banks, the network characteristic of traffic is king is increasingly prominent, and concessions to enterprises are an important means of increasing customer stickiness, improving customer experience, cultivating customer habits, and exploring new customer needs.

Based on the above analysis, this paper proposes the following hypothesis:

H2:. Banks’ digital transformation promotes banks’ concessions to enterprises, eases enterprises’ financing constraints, reduces enterprises’ green transformation risks, and thus leads to enterprises’ green transformation.

In the digital era, the degree of enterprise digitization is increasing year by year (Peng and Tao, 2022), along with the deepening of the online presence of enterprises’ green business data, social responsibility, and corporate governance information (Wang and Esperança, 2023), and the “digital footprint” and “digital portrait” of the enterprise’s sustainable operations can be quickly and accurately captured by banks. The “digital footprints” and “digital portraits” of enterprises’ sustainable operations can be quickly and accurately captured by banks. The information asymmetry between banks and enterprises before lending is significantly reduced, and the subjectivity in traditional credit approval is significantly alleviated (Berg et al., 2022). As the degree of transparency and standardization of bank-enterprise information increases, banks are also better able to monitor the flow of loans and alleviate post-loan information asymmetry between banks and enterprises (Gomber et al., 2018; Li M. et al., 2023). More importantly, ESG ratings of firms by professional organizations connect firms to the market, improve firms’ external information (Fang et al., 2023), and further reduce the information asymmetry between firms and banks. With the improvement of the efficiency and quality of information communication between banks and enterprises, banks can capture corporate ESG performance faster and more accurately, and the demand for corporate ESG performance increases (Zhang, 2023). Corporate ESG data effectively plays the role of market incentives and external monitoring mechanisms (Fang et al., 2023), which will continue to tighten credit approval for polluting projects with low ESG ratings and contrary to national policies, forcing enterprises to transform green production and reduce corporate pollution.

Based on the above analysis, this paper proposes the following hypothesis:

H3:. Banks’ digital transformation improves firms’ ESG performance and forces firms to undergo green transformation.

Government environmental regulation is a formal system that constrains firms’ environmental pollution behavior, forcing firms to increase their green investment and make a green transition (Wang L. et al., 2022). Enterprises subject to looser environmental regulations do not take the initiative to go green based on concerns about production costs, and strict government environmental regulations increase enterprise costs, reduce enterprise revenues, and incentivize enterprises to go green (Cai et al., 2020). Government environmental regulation incorporates corporate environmental governance into the economic and social rating system for high-quality development, using the government’s “hand” to support sustainable development (Wang L. et al., 2022). In the era of the digital economy, the increase in the intensity of government environmental regulation can help enterprises improve factor allocation efficiency (Cao et al., 2021) and effectively use the funds provided by banks’ digital transformation; at the same time, the greater the intensity of government environmental regulation, the greater the impact of ESG ratings on banks’ credit decision-making (Zhang, 2023), which can effectively promote banks’ digitalization to improve the performance of enterprises’ ESG, and thus promote enterprises’ green transformation. Improvement, thus promoting the green transformation of enterprises.

Based on the above analyses, this paper proposes the following hypothesis:

H4:. The increase in the intensity of government environmental regulation will strengthen the role of banks’ digital transformation in facilitating the green transformation of enterprises.

Media attention pairs are informal institutions that complement government environmental regulation (Jie and Jiahui, 2023). Media attention is the main external supervisor and information intermediary, on the one hand, the media increases the transparency of corporate information through tracking and reporting on enterprises, and increases the difficulty and cost of corporate environmental violations (Li Z. et al., 2023); on the other hand, with the continuous improvement of the public’s awareness of environmental protection, the media reports have become an important channel for the public to understand the information on corporate environmental governance and condemn corporate pollution, increasing the possibility of government regulatory intervention, and the related negative reports affect the value and reputation of enterprises (Zhu and Jin, 2023). Likelihood of government regulatory intervention and related negative reports affecting firms’ value and reputation (Zou et al., 2015; Wang F. et al., 2022), further increasing public and bank scrutiny of environmental governance issues and supervising firms’ management to adopt green strategies (Wang F. et al., 2022). Therefore, the higher the media attention, the greater the contribution of bank digitalization to corporate green innovation should be.

Based on the above analyses, this paper proposes the following hypothesis:

H5:. Increased media attention reinforces the role of banks’ digital transformation in promoting green innovation in companies.

This paper selects Chinese A-share listed heavy polluting enterprises as the research sample. For the selection of heavy polluting enterprises, this paper firstly relies on the Guidelines on Environmental Information Disclosure for Listed Companies (Draft for Public Comments) issued by the Ministry of Ecology and Environment (former Ministry of Environmental Protection) in 2010 to categorise 16 types of industries, such as thermal power, iron and steel, cement, etc., as heavy polluting industries, and then combines with the Guidelines on the Classification of Listed Companies by Industry (2012) of the Securities and Exchange Commission to select 20 industries initially, including non-metallic mineral mining and processing, wine, beverage and refined tea manufacturing, etc. and other 20 industries. Finally, with reference to the selection of heavy pollution industries by He et al. (2022), 13 industries including coal mining and washing industry, oil and gas extraction industry are screened out, which include: B06, B07, B08, B09, C17, C19, C22, C28, C29, C30, C31, C32, D44. The digital financial data of the Digital Finance Research Centre of Peking University used in this article Research Centre’s commercial bank digital transformation data timeframe is 2010–2021, so this paper selects A-share heavy polluters from 2010 to 2021 as the research object.

The sample data are processed as follows: 1) ST and *ST enterprises are excluded; 2) samples with missing data are excluded. A total of 212 enterprises were obtained for 12 years of observations, and finally 2,372 sample observations were obtained. The financial data and news report data in this paper come from CSMAR database, green patent data from CNRDS database, enterprise annual reports from Juchao Information Network, and ESG performance data from CSI ESG Rating.

The explanatory variable in this paper is corporate green transformation, which is obtained by crawling the annual reports of enterprises using Python software. Firstly, referring to Li and Wang (2021) and Wu and Li (2022), the search direction of enterprise green transformation is divided into “enterprise green strategic transformation” and “enterprise green action transformation,” in which the strategic transformation is further divided into two dimensions (strategy The strategic transformation is divided into two dimensions (strategy, planning), and the action transformation is divided into three dimensions (environmental technology upgrading and transformation, sewage treatment, monitoring and prevention). Secondly, based on the Guiding Opinions of the State Council on Accelerating the Establishment of a Sound Green, Low-Carbon and Circular Economic System and the China Green Transformation and Sustainable Development Report, the key words of each dimension were identified; then Python software was used to read the annual reports of enterprises, and the total number of word frequencies of key words appeared in the annual reports of the enterprises was counted, and logarithmic processing was carried out to measure the degree of green transformation of the enterprises. The larger the value of enterprise green transformation, the stronger the degree of enterprise green transformation.

The explanatory variable of this paper is the bank digital transformation index, which indicates the degree of commercial banks’ digital transformation of corporate lending. 1) The degree of commercial banks’ digital transformation is measured by the Peking University Commercial Bank Digital Transformation Index, which breaks down banks’ digital transformation into three sub-dimensions: strategic digitalization, business digitalization, and management digitalization; and 2) the level of corporate lending from banks is measured by referring to the study of He et al. (2023) in conjunction with the ratio of the total amount of bank loans obtained by each enterprise to the total assets each year. The weighted average level of commercial banks’ digital transformation of corporate loans is then calculated based on the level of corporate loans.

In this paper, the SA index is used to measure the financing constraints faced by firms, and the SA index is constructed using two relatively exogenous variables, namely, firm assets, and age. The SA index is calculated as follows:

where Asset is the natural logarithm of the firm’s total assets and Age is the firm’s year of establishment. a negative SA index and its larger absolute value indicate that the firm is subject to a more severe degree of financing constraints.

Currently, the ESG rating systems for Chinese companies mainly include CSI, BDRC, Bloomberg, etc. Among them, the CSI ESG rating system refers to the international mainstream ESG evaluation framework, integrates Chinese characteristics, and covers more companies. Among them, the CSI ESG rating system refers to the international mainstream ESG evaluation framework, integrates Chinese characteristics, and covers more enterprises, so this paper uses the CSI ESG rating data as a measure of corporate ESG performance, according to the CSI ESG ratings from high to low assignment of value, the highest score of 9 points, the higher the score indicates that the better the performance of corporate ESG.

Referring to the studies of Zhang and Chen (2021) and Pei et al. (2019), this paper firstly selects 27 environmental vocabularies by considering the three aspects of environmental protection goals, environmental protection objects, and environmental protection measures; secondly, it downloads the working report of each prefectural and municipal government, reads the working report of each prefectural and municipal government by using the Python software, subdivides the word frequency of the text of each prefectural and municipal government’s working report, and tallies the environmental Finally, the ratio of the word frequency of environmental words to the word frequency of the full text of the municipal government work reports was used to measure the intensity of environmental regulation by the municipal government at each prefecture level. The larger the value, the stronger the government’s environmental regulation. The intensity of government environmental regulation for each enterprise is matched according to the city to which the enterprise belongs.

With the arrival of the digital era, traditional paper media received the influence of new media, the living space is constantly compressed, and more and more traditional paper media due to the deterioration of economic efficiency choose to suspend publication. In comparison, online media has the advantages of stronger timeliness, longer retention time, more openness, and lower cost. Considering this, the influence of online media is greater than that of traditional paper media in the context of the digital economy, so this paper measures the media attention received by companies based on the online news coverage of listed companies in CNRDS. At the same time, existing studies have found that negative media coverage receives more public attention and exerts more pressure on heavily polluting companies than positive coverage. This is mainly because negative media coverage will lead to damage to the firm’s reputation and make investors question the competence of the firm’s management. Therefore, negative media reports are an important monitoring channel for the green transformation of heavily polluting enterprises. Therefore, this paper measures the media attention received by firms based on the total number of negative online media reports of listed firms in the CNRDS.

In order to avoid the possibility of biased econometric tests due to omitted variables, this paper refers to the studies of Liu et al. (2022) and Li et al. (2022) and selects the following control variables: return on total assets (ROA), financial leverage (Lev), two rights (Dev), proportion of sole directors (Inde), firm size (Size), top ten shareholders’ shareholding (Top10), and firm age (AGE). In order to minimize the endogeneity problem, the paper further controls for two macro-level variables: provincial GDP growth rate (GDPg) and provincial consumer price index (CPI).

Table 1 is a description of the main variables in this paper.

Table 2 reports the results of descriptive statistics for the main variables. As can be seen from Table 2, the mean value of Green Transformation of Enterprises (GTS) is 5.09, the minimum value is 0, and the maximum value is 13.24, which indicates that there is a difference in the degree of green transformation among enterprises. The two sub-dimensions of enterprise green transformation, green strategy transformation (Strategy) and green action transformation (Action) have a minimum value of 0 and a maximum value of 6.11 and 9.01, respectively, indicating that there is a gap between them. The mean value of the Total Digital Transformation Index (TDI) for banks is 13.17, with a minimum value of 0 and a maximum value of 61.05, indicating a large gap in the digital transformation of bank-to-business lending among firms. Among the sub-dimensions of banks’ digital transformation, the Management Dimension (MDI) has the largest mean value, which is much higher than Strategic digitalization (SDI) and Business digitalization (BDI).

In model (2) i denotes the enterprise and t denotes the year. Where GTS is the degree of green transformation of the enterprise, and specifically the enterprise green transformation is divided into the following two dimensions: Strategy denotes the enterprise green strategy transformation, and Action denotes the enterprise green action transformation. DI is the bank digital transformation index, and specifically, the bank digital transformation index includes the following four dimensions: SDI denotes the bank strategic digital index, BDI denotes the Bank Business Digitalization Index, MDI denotes the Bank Management Digitalization Index, and TDI denotes Total Bank Digitalization Index. Control is a vector composed of control variables.

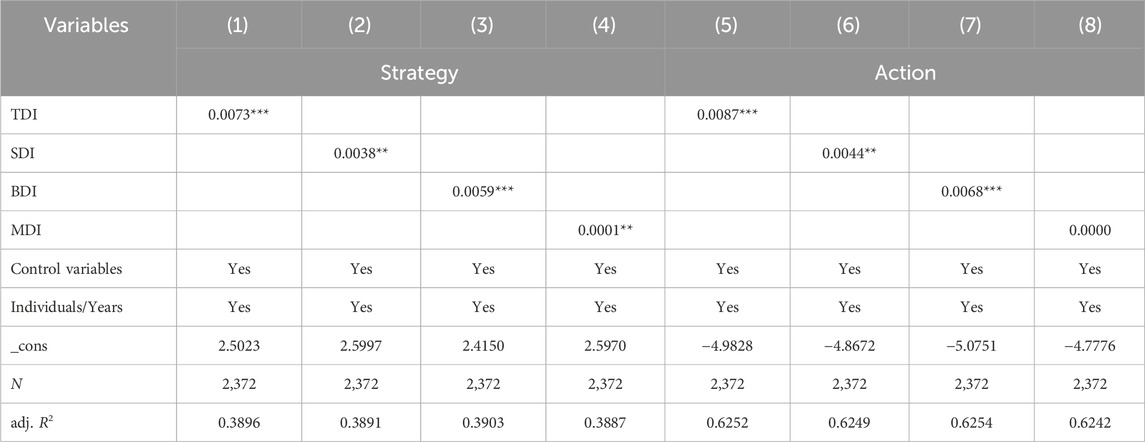

Table 3 shows the results of the baseline regression on the impact of banks’ digitalization on firms’ green transformation. From columns (1)–columns (4) of Table 3, which are fixed effects controlling only for individuals and time, it can be seen that the regression coefficients of bank’s overall digitalization, strategic digitalization, and business digitalization on enterprise green transformation are all significantly positive at the 1% level, and the regression coefficients of bank’s management digitalization on enterprise green transformation are significantly positive at the 5% level. It indicates that banks’ digital transformation promotes the greening of enterprises, and H1 of this paper holds. This effect mainly stems from business digitalization in that banks integrate digital technology into the business level of the financial services they provide, followed by strategic digitalization that reflects the level of attention to digital technology at the overall strategic level of the bank. This result implies that the current progress of banks’ digital transformation relies mainly on the application of digital technologies in financial products and services and the strategic level focus on digital technologies. As can be seen from columns (5)–columns (8) of Table 3, the conclusion remains unchanged with the inclusion of control variables. It can be seen that compared to the traditional banking model, banks have taken advantage of digital technology through digital transformation to give better support to enterprises in their green transformation and to facilitate their green transformation.

Table 4 further divides enterprise green transformation into green strategy transformation and green action transformation. Table 4 shows that the total index of bank digital transformation, strategy, and business dimensions significantly contribute to the green strategy and green action transformation of enterprises, while the digitalization of bank management significantly contributes to the green strategy transformation of enterprises, while it has no significant impact on the green action transformation of enterprises. Compared with the green strategy transformation of enterprises, it is more likely to promote enterprises to take green actions, truly practice corporate environmental and social responsibility, and realize green transformation, which validates the research of Wu and Li (2022).

Table 4. Impact of banks’ digital transformation on different dimensions of corporate green transformation.

Therefore, this paper further takes the two instrumental variables of the spherical distance from the enterprise’s registered place to HCM City and the number of subscribers with Internet broadband access per year in each province to mitigate the endogeneity problem.

First, the spherical distance (Dis) from the enterprise’s registration place to Hangzhou City is selected as an instrumental variable. In recent years, Hangzhou has become the most rapidly developing area of fintech in China, and the level of development is perennially at the leading level of the country (Guo et al., 2020), which is representative of the fact that the closer the distance between the city and Hangzhou, the higher the degree of digital transformation of the bank. However, the instrumental variables we selected do not vary over time, while bank digital transformation varies over time, so the spherical distance from the firm’s place of incorporation to Hangzhou interacts with the indices of bank digital transformation dimensions to form the instrumental variable IV1 with time-varying effects (Dis*TDI, Dis*SDI, Dis*BDI, Dis*MDI).

Second, the number of users with Internet broadband access per year in each province is taken as the instrumental variable IV.2 Digital development cannot be separated from the construction of Internet infrastructure, and in regions with a higher level of Internet development, the obstacles for banks to carry out digital transformation are relatively fewer, the cost is relatively lower, and the transformation process is quicker, and it does not directly affect the green transformation of the enterprise, so the number of users with Internet broadband access is in line with the instrumental variable Exogeneity requirement.

Table 5 shows the test results for instrumental variables 1 and 2, and the test results are not substantially changed from the baseline regression results in Table 3, and there is no weak instrumental variable problem. It indicates that after controlling for possible endogeneity issues, the positive impact of bank digital transformation on corporate green transformation is still significant and the findings of this paper are robust.

Enterprises are the important main body of pollution prevention and the construction of ecological civilization, and innovation is the first power to lead the development of green innovation to achieve sustainable development of enterprises as the core pursuit, in reducing the consumption of natural resources at the same time can also enhance the competitiveness of the green development of enterprises. Enterprises carrying out green innovation can increase the supply of high-quality products in line with ecological and environmental standards in the production process, and improve their own product quality, revenue, and influence while bringing positive externalities to the entire economy and society. Therefore, referring to the measurement of green innovation by Li et al. (2022) and Liu et al. (2022), the findings in Table 3 are robustly tested using the number of green patent applications by enterprises.

The regression results of column (1)–column (4) in Table 6 show that there is a significant positive relationship between banks’ digital transformation and firms’ green technological innovation and that banks’ promotion of firms’ green innovation is more pronounced in the business digitization dimension, which is in line with the results of the previous test.

Table 6. Robustness test results for changing explanatory variables and excluding major public event shocks.

The rapid spread of the New Crown epidemic in 2020 was classified as a major public emergency, a major and sudden public event with great urgency and uncertainty, which posed a huge challenge to the Chinese and global economy, but at the same time, it catalyzed the rapid development of the digital economy in China (Berg et al., 2022). In the face of the demand for “contactless” services, the digital transformation of banks has been pressed on the fast-forward button, resulting in an extreme impact. Therefore, this paper excludes the sample data of 2020 and 2021, and the sample interval of the robustness test is 2010–2019. The regression results of Columns (5)–Columns (8) in Table 6 show that the digital transformation of banks significantly contributes to the green transformation of enterprises after the exclusion of the impact of the Xinguancun epidemic, which is consistent with the results of the previous test.

Foreign banks are founded by foreign sole proprietorships, which are closely linked to their headquarters and other regional operations, and are more influenced by their home countries. Moreover, the operation mode and disclosure quality of foreign banks are different from those of Chinese banks (Liu and Shen, 2022). Therefore, this paper excludes the sample of foreign banks and is based on the digital transformation of local Chinese banks.

The regression results in Table 7 show that after excluding foreign banks, the total index of banks’ digital transformation and its three sub-dimensions have a significantly positive impact on corporate green transformation at the 1% level, and the test results are basically consistent with the baseline regression results in Table 3, and the test results of this paper are robust.

The digital transformation of banks under the development of digital technology has pushed banks to make concessions to enterprises, which has brought about a breakthrough in alleviating the problem of enterprise financing (Gomber et al., 2018; Li et al., 2022), and has helped to improve the match between credit resources in terms of “quantity” and resource allocation in terms of “quality”, thus realizing the role of the financial sector in promoting the green transformation of enterprises. “Quality” of credit resources and resource allocation, thereby realizing the financial sector’s role in promoting the green transformation of enterprises. Currently, the mainstream measurement of financing constraints includes the SA index, KZ index and WW index, of which the SA index is more exogenous than the KZ index, and WW index, therefore, this paper refers to the research of Ju et al. (2013) to take SA index as a measure of corporate financing constraints.

Table 8 shows the test results of the transmission mechanism of financing constraints in banks’ digital transformation and enterprises’ green transformation. The mechanism test in this paper refers to the method of median grouping regression, which calculates the median of enterprises’ financing constraint samples, and according to the median of the samples, the enterprises are divided into two groups of enterprises with low financing constraints and high financing constraints. Columns (1)–(4) show that all dimensions of bank digital transformation can significantly promote the green transformation of enterprises with low financing constraints at the 1% level, and columns (5)–(8) show that none of the dimensions of bank digital transformation effectively promotes the green transformation of enterprises with high financing constraints. This implies that as the process of bank digital transformation accelerates, in general, it will reduce the financing threshold, release the dividend of financial services, and effectively alleviate the problem of enterprise financing constraints, thus achieving the effect of promoting the green transformation of enterprises, which verifies H2. This is consistent with the findings of Guo et al. (2023), Tan et al. (2023).

The ESG concept requires companies to develop themselves without compromising the sustainable development of the economy and society, and the ESG rating system complements formal environmental regulation by demonstrating to the external market the performance of companies in terms of environmental and social responsibility and corporate governance through professional rating agencies. Therefore, Corporate ESG performance is an important way to urge corporate green transformation. In this paper, according to the median of corporate ESG performance samples, enterprises are divided into two groups good ESG performance and poor ESG performance for mechanism testing.

Table 9 presents the results of testing the transmission mechanism of firms’ ESG performance in banks’ digital transformation and firms’ green transformation. Columns (1)–Column (4) show that none of the bank digital transformation dimensions contribute effectively to the green transformation of firms with poor ESG performance. Columns (5)–Column (8) show the results of regressions of bank digitalization dimensions on green transformation of firms with good ESG performance. Columns (5) and (7) show that total bank digitalization index and business digitalization significantly contribute to the green transformation of ESG-performing firms at the 5% level, column (6) shows that bank strategic digitalization significantly contributes to the green transformation of ESG-performing firms at the 1% level, and column (8) shows that bank management digitalization fails to significantly contribute to the green transformation of ESG-performing firms. In general bank digitalization effectively promotes the green transformation of ESG-performing firms, validating H3. This implies that ESG ratings improve the external information environment of firms, connect firms to the market, and help ESG-performing firms to obtain more support from banks and other sources, which provides intrinsic motivation for firms’ green transformation, validating the findings of Zhang (2023), Wang and Esperança (2023) studies.

Tables 8, 9, while validating the results of Feng et al. (2022) study on fintech-enabled corporate green development, also provide new ideas on how the financial industry can empower corporate green transformation in the era of digital economy.

Government environmental regulation is an important policy instrument to stimulate enterprises to carry out green transformation, and when the intensity of government environmental regulation is high in a certain region, it will increase the cost of heavily polluting enterprises and stimulate enterprises to carry out green transformation. To examine the moderating effect of environmental regulation on the relationship between bank digitization and enterprises’ green transformation, this paper introduces the intensity of government environmental regulation (ER) that enterprises are subject to and its interaction term with the dimensions of bank digitization to construct a moderating effect test model, and to ensure the robustness of the results, the explanatory variables (TDI, SDI, BDI, MDI) and the moderating variables of government environmental regulation (ER) are decentralized by processing, and then construct the interaction terms.

The results in Table 10 show that the interaction terms of environmental regulation with total bank digitization index (ERTDI_C), with bank strategy digitization (ERSDI_C), and with bank business digitization (ERBDI_C) are all significantly positive, while the interaction term of government environmental regulation with bank management digitization (ERMDI_C) is not significantly positive, but in general it can show that the government environmental regulation has a positive moderating effect on the relationship between bank digitization and corporate green transformation. Regulation has a positive moderating effect on the relationship between bank digitization and corporate green transformation, which validates H4. The reason is that government environmental regulation is an important institutional tool formulated by the government to protect the environment, and serves to constrain corporate pollutant emissions and other behaviors that are detrimental to environmental protection (Cai et al., 2020; Cao et al., 2021). Government environmental regulations regulate and supervise the rational use of bank loans by enterprises, penalize enterprises that pollute more and are unwilling to change their original production methods, increase the costs of the enterprises concerned, and motivate enterprises to raise their awareness of environmental management and carry out green transformation.

With the intensification of environmental and sustainable development issues, the media’s attention to corporate environmental issues has increased, and given the media’s role as a watchdog and information intermediary, it has an important impact on corporate green transformation. To examine the moderating effect of media attention on the relationship between bank digitization and corporate green transformation, this paper introduces the media attention received by corporations (LNMEDIA) and its interaction term with the dimensions of bank digitization to form a moderating effect test model, and to ensure the robustness of the results, the explanatory variables (TDI, SDI, BDI, MDI) and the moderating variable media attention (LNMEDIA) are pair-centered and then the interaction terms are constructed.

The results in Table 11 show that the interaction terms between media attention and each dimension of bank digitization are all significantly positive at the 1% level, indicating that media attention has a positive moderating effect on the relationship between bank digitization and corporate green transformation, validating H5. The reason is that media attention is an important complement to government regulation, and media coverage can improve corporate information transparency, increase public attention to corporate green transformation, and increase the likelihood of government regulatory intervention, increasing the difficulty and cost of polluting production activities by firms, thus regulating their environmental behavior (Wang F. et al., 2022; Jie and Jiahui, 2023). Enterprises accelerate their green transformation to protect their reputation and obtain bank credit support.

A certain degree of enterprise digitization is a prerequisite for banks to capture the “digital footprint” of enterprises, effectively alleviate the information asymmetry between banks and enterprises, and then promote the green transformation of enterprises. Therefore, based on the CSMAR database data on the degree of digital transformation of enterprises, this paper divides enterprises into two groups with low and high degrees of digitalization according to the median degree of digital transformation of enterprises and examines whether the different degrees of digital transformation of enterprises cause the heterogeneous impact of bank digitalization on green transformation of enterprises.

The results of columns (1)–column (4) of Table 12 show that in the case of low enterprise digitization, the total digitization index and business digitization of banks promote enterprise green transformation at the level of 10 percent and 5 percent, respectively, whereas strategic digitization and managerial digitization of banks fail to contribute significantly to the green transformation of enterprises. The results in columns (5)–(8) show that in the case of high enterprise digitization, banks’ total digitization index, strategic digitization, and business digitization all contribute significantly to the green transformation of enterprises, and the coefficients are larger than those in the group with low enterprise digitization, indicating that banks’ digitization is more capable of facilitating the green transformation of enterprises with high digitization.

Traditional finance is more inclined to allocate funds to state-owned enterprises, which creates an attribute mismatch problem and slows down the process of the financial system supporting the high-quality development of enterprises. In the previous paper, it has been verified that the digital transformation of banks can promote the green transformation of enterprises, but whether it can correct the mismatch problem and improve the ability of finance to support the green development of enterprises still needs to be further explored. Therefore, this paper divides enterprises into state-owned and non-state-owned parts according to the nature of their property rights.

The regression results in columns (1)–(4) of Table 13 show that all dimensions of bank digitization significantly contribute to corporate green transformation at the 1% level. The regression results in columns (5)–(8) show that for SOEs, the total bank digitization index, business digitization significantly contributes to corporate green transformation only at the 5% level, while bank strategic digitization contributes to corporate green transformation only at the 10% level. The overall results suggest that non-state-owned enterprises better reflect the green-driven effect of bank digitization. This suggests that compared to the traditional financial model, the policy and capital advantages of SOEs are weakened to a certain extent with the digital transformation of banks, making the attribute mismatch problem less severe.

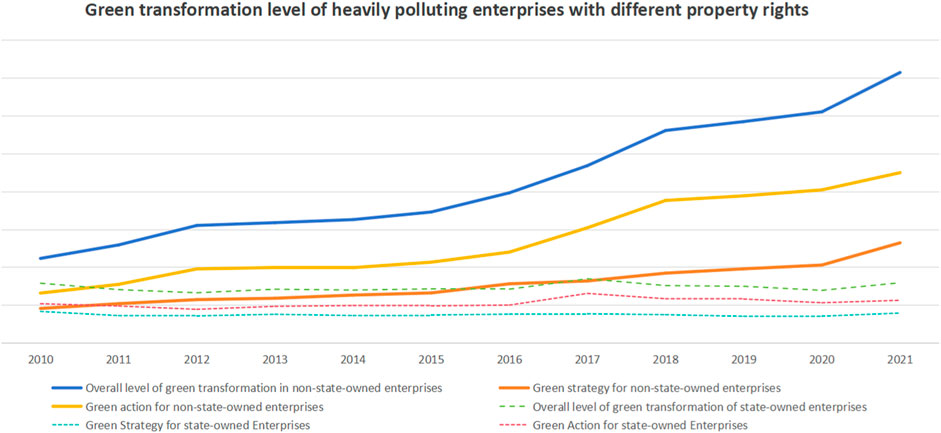

Figure 1 shows the level of green transformation of heavily polluting enterprises with different property rights. From Figure 1, we can also see that the level of green transformation of non-state-owned heavy-polluting enterprises is much higher than that of state-owned enterprises and shows a stable upward trend. The regression results in Table 13 are supported by the fact that state-owned enterprises themselves have abundant funds, implicit guarantees, weak awareness of change, and low sensitivity to transformation. Non-state-owned enterprises, to improve their competitiveness, need to timely capture future development directions, discover market green development signals, and carry out green transformation.

Figure 1. Green transformation level of heavily polluting enterprises with different property rights.

Under the promotion of a series of policy initiatives in China, the overall economic development of China has been greatly improved, but there are still problems of inadequacy and incoherence. Compared with the eastern region, the central and western regions are limited by factors such as regional mismatch of production factors and low efficiency of digital technology absorption, resulting in a low level of regional development of the digital economy, and the aggregation of financial resources to economically developed regions, which limits the development of enterprises in less developed regions.

Therefore, this paper divides enterprises by region into two parts, the eastern coastal region, and the central and western inland region, according to where they belong to for the heterogeneity test. The regression results in Table 14 show that in general, the facilitating effect of bank digitization on the green transformation of enterprises in the eastern region is higher than that in the central and western regions both in terms of significance and coefficients, which validates the study of Li et al. (2022). It indicates that although the development of the digital economy also provides convenient digital financial services for the central and western regions, the development of bank digitalization in the central and western regions is still slower than that in the eastern region, and the facilitating effect on the green transformation of enterprises is smaller than that in the eastern region. However, it also shows that there is relatively more room for banks’ digital transformation in the western region, and government departments should increase the construction of digital infrastructure in the central and western regions to provide a reference for how banks’ digitalization can help the high-quality development of the regional economy.

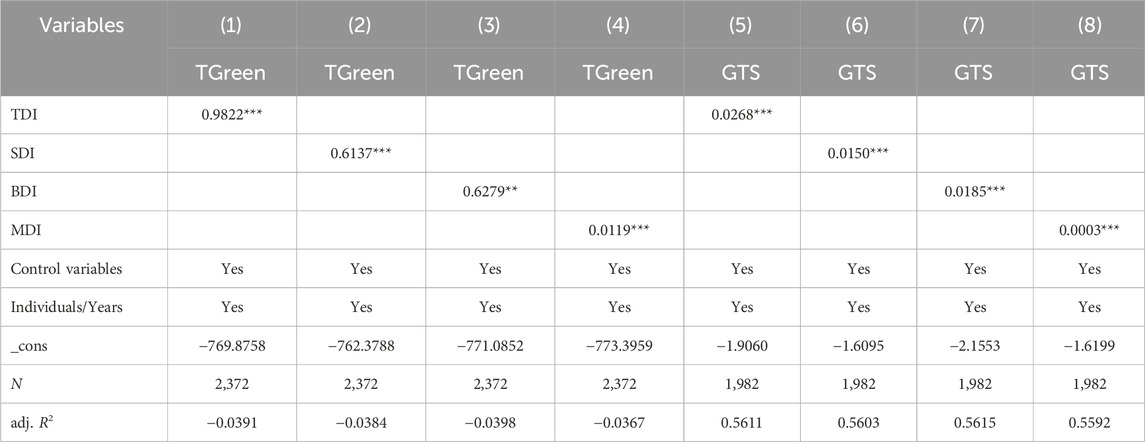

In order to further explore the sub-dimensional impact of bank digitization on corporate green transformation, this paper further subdivided green strategic transformation into two dimensions: strategic concept and assessment planning, and green actions into three dimensions: environmental technology, emission control, and monitoring and prevention.

Table 15 shows the regression results based on each sub-dimension of corporate green transformation5. The results in column (1) show that all dimensions of bank digitization significantly increase the importance of green transformation by corporate management and promote the establishment of green strategic concepts by corporations. The results in column (2) show that none of the bank digitization dimensions significantly contribute to the implementation of assessment planning for green transformation in enterprises. Column (3) results show that banking digitization significantly promotes firms’ environmental technology upgrading at a 10% level. Column (4) results show that all dimensions of banking digitization significantly promote firms to undertake emissions management. The results in column (5) show that all dimensions of banking digitalization significantly promote firms for monitoring and prevention at a 1% level. The results of further analyses validate the findings of Li and Wang (2021), and Duan et al. (2023) that there is a discrepancy between what enterprises say and what they do in the process of green transformation. It shows that the digital transformation of the bank is more to enhance the importance of enterprise management on green and promote enterprises to monitor and prevent environmental aspects, but the enterprises have not yet formed a systematic and effective green transformation planning. At the same time, heavily polluting enterprises have limited financial resources and lack the funds to carry out high-cost equipment renewal, process modification, and sewage treatment.

Based on the annual data of Chinese A-share heavily polluting listed companies from 2010 to 2021, this paper empirically analyses whether the digital transformation of banks affects the green transformation of enterprises and its possible internal mechanisms, and the findings are as follows:

Digital transformation of banks facilitates the green transformation of firms. This finding remains robust after eliminating endogeneity issues and a series of robustness tests. It is also found that the strategic digitalization and operational digitalization dimensions of banks have a more pronounced effect on driving corporate green transformation than their managerial digitalization, and are mainly reflected in the transformation of corporate green actions.

Bank digital transformation facilitates corporate green transformation through two channels: mitigating corporate finance constraints and improving corporate ESG performance, both of which are effective on the bank strategy and business digitalization sub-dimensions, while only the mitigating finance constraints channel is effective on the bank management digitalization dimension.

The facilitating effect of bank digital transformation on firms’ green transformation is heterogeneous. Banks’ digital transformation has a facilitating effect on enterprises with different degrees of digitization, but the green-driving effect is more obvious for enterprises with a high degree of digitization. The facilitating effect of bank digital transformation on the green transformation of non-state-owned enterprises is higher than that of state-owned enterprises, indicating that bank digital transformation corrects the attribute mismatch problem to a certain extent. The facilitating effect of bank digital transformation on the green transformation of enterprises in the eastern coastal region is greater than that in the inland central and western regions, suggesting that the digital transformation of banks in the central and western regions needs to be accelerated.

Based on the above findings, this paper makes the following policy recommendations:

Commercial banks should take the initiative to embrace digitalization and accelerate the promotion of digital transformation and upgrading. The construction of Digital China has become an important engine for promoting Chinese-style modernization in the digital era, and the banking industry, as an important force for promoting economic and social progress, is bound to accelerate the promotion of digital transformation. Therefore, banks should increase investment in financial technology, attract scientific and technological talents, and promote the intelligence of each service link. Through digital means to empower the green transformation of enterprises and improve the allocation efficiency of credit resources.

Enterprises should strengthen ESG concepts, enhance ESG practices, and focus on the implementation of green actions. In the past, China’s ESG information disclosure requirements for enterprises were low, with voluntary disclosure as the main focus, resulting in many enterprises coping with ESG information disclosure, more abbreviated descriptions of corporate ESG information, poor reliability, and overall low quality of information, which is not conducive to the use of digital technology by banks to capture the ESG performance of the enterprise, and may lead to difficulties in obtaining corporate credit. This requires enterprises to strengthen their own ESG information disclosure, which also coincides with the current construction of China’s ESG information disclosure. At the same time, enterprises should also put green transformation into action, enhance their competitiveness in green development, and contribute to the high-quality development of the economy.

The Ministry of Ecology and Environment and other departments should promote the construction of an ESG evaluation system with Chinese characteristics, and promote data sharing of ESG information between commercial banks and enterprises. Although the Ministry of Ecology and Environment has set up a special agency for ESG, and the State-owned Assets Supervision and Administration Commission (SASAC) is constantly regulating the disclosure of ESG information of listed companies held by central enterprises, China’s ESG information system is completely adapted from foreign frameworks without fully taking into account China’s national conditions. Relevant departments in China should grasp the relationship between domestic and international standards, refer to ISSB’s global ESG reporting standards, and construct a scientific and standardized ESG indicator system with Chinese characteristics. The results of this paper found that the digital transformation of banks can promote the green transformation of enterprises by improving their ESG performance. In practice, banks are unable to obtain timely and accurate corporate ESG information before lending, which causes delays in credit approval. Ecological and environmental departments should strengthen coordination with banks and take the lead in realizing the sharing of information resources among commercial banks, enterprises, and ecological and environmental departments.

The government should improve the construction of infrastructure related to digital technology to create favorable conditions for the digital transformation of banks. Weak digital infrastructure will hinder the process of banks’ digital transformation. Therefore, the government should consider increasing funding to improve the construction of digital infrastructure such as broadband networks, and subsidizing the introduction of talent to strengthen the robustness of digital infrastructure. In particular, it should accelerate the improvement of digital infrastructure in the central and western regions to create conditions for them to catch up with the digital transformation of banks in other regions.

In exploring the impact of bank digitalization on corporate green transformation based on the sub-dimensions of corporate green transformation, this paper finds that there is an symmetry in this impact. Overall bank digitalization promotes corporate green transformation, with differences in corporate green transformation under the sub-dimensions. Bank digitalization significantly promotes enterprises’ green transformation in terms of strategic concepts and monitoring and prevention, but not in terms of enterprises’ green assessment planning, environmental technology upgrading and upgrading, and sewage treatment, and the specific reasons for this problem need to be further explored.

It should be noted that the study in this paper has some limitations. First, the study in this paper only focuses on Chinese heavy polluters, and future studies should include global samples, and other types of enterprises in China to guarantee the applicability of the results. Second, bank digitalization is an all-around and systematic change, and with the development of digital technology, the index of bank digital transformation needs to be refined. Finally, there are still unexplored avenues between bank digitalization and the green transformation of heavily polluting enterprises. There are rich avenues for bank digitization to influence the green transformation of firms, and the role of enterprise risk between bank digitization and the green transformation of firms can be further explored in the future.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

KJ: Conceptualization, Funding acquisition, Project administration, Resources, Supervision, Validation, Writing–review and editing. YuZ: Data curation, Formal Analysis, Investigation, Methodology, Software, Visualization, Writing–original draft. YaH: Supervision, Formal Analysis, , Writing–review and editing.

The authors declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the 2023 Liaoning Provincial Science Public Welfare Research Fund (Soft Science Research Program) Project (Class B) (2023JH4/10600041) and the Key Research Topics For Decision-making Consultation And New Think Tanks In Liaoning Province in 2023 (23-A008).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1349036/full#supplementary-material

Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. J. financial Econ. 77 (1), 57–116. doi:10.1016/j.jfineco.2004.06.010

Berg, T., Fuster, A., and Puri, M. (2022). Fintech lending. Annu. Rev. Financial Econ. 14, 187–207. doi:10.1146/annurev-financial-101521-112042

Berger, A. N., Molyneux, P., and Wilson, J. O. (2020). Banks and the real economy: an assessment of the research. J. Corp. Finance 62, 101513. doi:10.1016/j.jcorpfin.2019.101513

Cai, X., Zhu, B., Zhang, H., Li, L., and Xie, M. (2020). Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci. Total Environ. 746, 140810. doi:10.1016/j.scitotenv.2020.140810

Cao, J., Law, S. H., Samad, A. R. B. A., Mohamad, W. N. B. W., Wang, J., and Yang, X. (2022). Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J. Clean. Prod. 365, 132865. doi:10.1016/j.jclepro.2022.132865

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: evidence from China's regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Duan, R., Duan, Y., and Liu, Y. (2023). Can corporate digitalisation promote "less talk and more action" on environmental responsibility. Contemp. finance Econ. 2023, 1–12. doi:10.13676/j.cnki.cn36-1030/f.20230719.003

Fang, M., Nie, H., and Shen, X. (2023). Can enterprise digitization improve ESG performance? Econ. Model. 118, 106101. doi:10.1016/j.econmod.2022.106101

Feng, S., Chong, Y., Li, G., and Zhang, S. (2022). Digital finance and innovation inequality: evidence from green technological innovation in China. Environ. Sci. Pollut. Res. 29 (58), 87884–87900. doi:10.1007/s11356-022-21826-2

Galbreath, J. (2019). Drivers of green innovations: the impact of export intensity, women leaders, and absorptive capacity. J. Bus. Ethics 158, 47–61. doi:10.1007/s10551-017-3715-z

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. W. (2018). On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 35 (1), 220–265. doi:10.1080/07421222.2018.1440766

Guo, F., Wang, J., Wang, F., Kong, T., Zhang, X. U. N., and Cheng, Z. J. E. Q. (2020). Measuring the development of digital inclusive finance in China: index compilation and spatial characteristics. China Econ. Q. 19 (4), 1401–1418. doi:10.13821/j.cnki.ceq.2020.03.12

Guo, J., Fang, H., Liu, X., Wang, C., and Wang, Y. (2023). FinTech and financing constraints of enterprises: evidence from China. J. Int. Financial Mark. Institutions Money 82, 101713. doi:10.1016/j.intfin.2022.101713

Hao, X., Li, Y., Ren, S., Wu, H., and Hao, Y. (2023). The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J. Environ. Manag. 325, 116504. doi:10.1016/j.jenvman.2022.116504

He, L., Zhong, T., and Gan, S. (2022). Green finance and corporate environmental responsibility: evidence from heavily polluting listed enterprises in China. Environ. Sci. Pollut. Res. 29 (49), 74081–74096. doi:10.1007/s11356-022-21065-5

He, Y., Yang, L., and Wen, W. (2023). Can the participation of non-state shareholders in governance improve the "market rationality" of state-owned enterprises' financing behaviours--evidence from the dynamic adjustment of capital structure. Nankai Manag. Rev. 26 (01), 118–135.

Jie, G., and Jiahui, L. (2023). Media attention, green technology innovation and industrial enterprises’ sustainable development: the moderating effect of environmental regulation. Econ. Analysis Policy 79, 873–889. doi:10.1016/j.eap.2023.07.003

Ju, X., Lu, D., and Yu, Y. (2013). Financing constraints, working capital management and corporate innovation sustainability. Econ. Res. 48 (01), 4–16.

Khattak, M. A., Ali, M., Azmi, W., and Rizvi, S. A. R. (2023). Digital transformation, diversification and stability: what do we know about banks? Econ. Analysis Policy 78, 122–132. doi:10.1016/j.eap.2023.03.004

Lee, C. C., and Lee, C. C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Li, M., Hu, J., Liu, P., and Chen, J. (2023a). How can digital finance boost enterprises’ high-quality development? evidence from China. Environ. Sci. Pollut. Res. 30 (38), 88876–88890. doi:10.1007/s11356-023-28519-4

Li, X., Shao, X., Chang, T., and Albu, L. L. (2022). Does digital finance promote the green innovation of China's listed companies? Energy Econ. 114, 106254. doi:10.1016/j.eneco.2022.106254

Li, Z., Huang, Z., and Su, Y. (2023b). New media environment, environmental regulation and corporate green technology innovation: evidence from China. Energy Econ. 119, 106545. doi:10.1016/j.eneco.2023.106545

Li, Z., and Wang, W. (2021). Whether the environmental responsibility performance of "many words and few actions" can affect the acquisition of bank credit? —— a text analysis based on "words" and "lines". J. Financial Res. 12, 116–132.

Lin, B., and Ma, R. (2022). How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 320, 115833. doi:10.1016/j.jenvman.2022.115833

Liu, J., Jiang, Y., Gan, S., He, L., and Zhang, Q. (2022). Can digital finance promote corporate green innovation? Environ. Sci. Pollut. Res. 29 (24), 35828–35840. doi:10.1007/s11356-022-18667-4

Liu, M., and Shen, R. (2022). How does settlement and sale of foreign exchange affect the level of bank risk taking? -Based on the perspective of bank balance sheets. Financial Res. 2022 (05), 57–75.

Lv, C., Fan, J., and Lee, C. C. (2023). Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 397, 136573. doi:10.1016/j.jclepro.2023.136573

Lyu, Y., Ji, Z., Zhang, X., and Zhan, Z. (2023). Can fintech alleviate the financing constraints of enterprises? evidence from the Chinese Securities market. Sustainability 15 (5), 3876. doi:10.3390/su15053876

Ma, F., Fahad, S., Yan, S., and Zhang, Y. (2023). Digital transformation and corporate environmental green innovation nexus: an approach towards green innovation improvement. Sustainability 15 (7), 6258. doi:10.3390/su15076258

Murinde, V., Rizopoulos, E., and Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: opportunities and risks. Int. Rev. Financial Analysis 81, 102103. doi:10.1016/j.irfa.2022.102103

Ozturk, I., and Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour. Conservation Recycl. 185, 106489. doi:10.1016/j.resconrec.2022.106489

Pei, Y., Zhu, Y., Liu, S., Wang, X., and Cao, J. (2019). Environmental regulation and carbon emission: the mediation effect of technical efficiency. J. Clean. Prod. 236, 117599. doi:10.1016/j.jclepro.2019.07.074

Peng, Y., and Tao, C. (2022). Can digital transformation promote enterprise performance? from the perspective of public policy and innovation. J. Innovation Knowl. 7 (3), 100198. doi:10.1016/j.jik.2022.100198

Rodrigues, A. R. D., Ferreira, F. A. F., Teixeira, F. J., and Zopounidis, C. (2022). Artificial intelligence, digital transformation and cybersecurity in the banking sector: a multi-stakeholder cognition-driven framework. Res. Int. Bus. Finance 60, 101616. doi:10.1016/j.ribaf.2022.101616

Shrivastava, P. (1995). The role of corporations in achieving ecological sustainability. Acad. Manag. Rev. 20 (4), 936–960. doi:10.2307/258961

Tan, Z., Wang, H., and Hong, Y. (2023). Does bank FinTech improve corporate innovation? Finance Res. Lett. 55, 103830. doi:10.1016/j.frl.2023.103830

Wang, F., Sun, Z., and Feng, H. (2022b). Can media attention promote green innovation of Chinese enterprises? Regulatory effect of environmental regulation and green finance. Sustainability 14 (17), 11091. doi:10.3390/su141711091

Wang, L., Long, Y., and Li, C. (2022a). Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 322, 116127. doi:10.1016/j.jenvman.2022.116127

Wang, S., and Esperança, J. P. (2023). Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 419, 137980. doi:10.1016/j.jclepro.2023.137980

Wu, F., and Li, W. (2022). Tax incentive and enterprise green transformation —— empirical evidence based on the text identification of the annual reports of listed enterprises. Public Finance Res. 2022 (04), 100–118. doi:10.19477/j.cnki.11-1077/f

Wu, H., and Hu, S. (2020). The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean. Prod. 274, 122682. doi:10.1016/j.jclepro.2020.122682

Wu, J., Zhao, R., and Sun, J. (2023). What role does digital finance play in low-carbon development? Evidence from five major urban agglomerations in China. J. Environ. Manag. 341, 118060. doi:10.1016/j.jenvman.2023.118060

Xie, X., and Wang, S. (2023). Digital transformation of commercial banks in China: measurement, progress and impact. China Econ. Q. Int. 3 (1), 35–45. doi:10.1016/j.ceqi.2023.03.002

Zhai, X., and An, Y. (2020). Analyzing influencing factors of green transformation in China’s manufacturing industry under environmental regulation: a structural equation model. J. Clean. Prod. 251, 119760. doi:10.1016/j.jclepro.2019.119760

Zhang, D. (2023). Can digital finance empowerment reduce extreme ESG hypocrisy resistance to improve green innovation? Energy Econ. 125, 106756. doi:10.1016/j.eneco.2023.106756

Zhang, J., and Chen, S. (2021). Financial development, environmental regulation and economic green transformation. Financial Res. 47 (11), 78–93. doi:10.16538/j.cnki.jfe.20210918.301

Zhang, M., and Liu, Y. (2022). Influence of digital finance and green technology innovation on China's carbon emission efficiency: empirical analysis based on spatial metrology. Sci. Total Environ. 838, 156463. doi:10.1016/j.scitotenv.2022.156463

Zhao, X., Ma, X., Chen, B., Shang, Y., and Song, M. (2022). Challenges toward carbon neutrality in China: strategies and countermeasures. Resour. Conservation Recycl. 176, 105959. doi:10.1016/j.resconrec.2021.105959

Zheng, C., Wang, Z. A., Pan, S., Chen, X., and Jia, S. (2023). Does financial structure still matter for technological innovation when financial technology and financial regulation develop? Technol. Forecast. Soc. Change 194, 122747. doi:10.1016/j.techfore.2023.122747

Zhou, J., Deng, J., Li, L., and Wang, S. (2023). The demographic dividend or the education dividend? Evidence from China’s economic growth. Sustainability 15 (9), 7309. doi:10.3390/su15097309

Zhu, Y., and Jin, S. (2023). COVID-19, digital transformation of banks, and operational capabilities of commercial banks. Sustainability 15 (11), 8783. doi:10.3390/su15118783

Keywords: digital transformation, green transformation, heavy polluters, financing constraints, ESG performance

Citation: Jia K, Zhang Y and Zheng Y (2024) Has bank digitization facilitated green transformation of enterprises?. Front. Environ. Sci. 12:1349036. doi: 10.3389/fenvs.2024.1349036

Received: 06 December 2023; Accepted: 26 April 2024;

Published: 10 July 2024.

Edited by:

Mobeen Ur. Rehman, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST), United Arab EmiratesReviewed by:

Muhammad Ishfaq Ahmad, The University of Lahore, PakistanCopyright © 2024 Jia, Zhang and Zheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanting Zheng, emhlbmd5YW50aW5nQHRoLmJ0YnUuZWR1LmNu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.