- 1School of Finance and Economics, Jiangsu University, Zhenjiang, China

- 2College of Economics and Management, Nanjing University of Aeronautics and Astronautics, Nanjing, China

- 3Division of State-Owned Enterprise Reform and Innovation, Institute of Industrial Economics, Jiangsu University, Zhenjiang, China

- 4Department of Accounting, Banking and Finance, Business School, Ghana Communication Technology University, Accra North, Ghana

- 5Jiangsu Xinhan Yi Information Management Co., LTD, Zhenjiang, China

- 6Department of Economics, School of Business, Ghana Communication Technology University, Accra North, Ghana

One of the crucial issues confronting China is high carbon dioxide (CO2) emissions. Despite the numerous measures outlined to promote the country’s carbon neutrality target, CO2 emissions in the nation continue to increase. This means that more policy options are needed to help improve environmental sustainability (ES) in the nation. Hence, examining the relationship between financial development (FD), foreign direct investment, industrialization, and environmental sustainability in China to provide proper recommendations to drive the carbon neutrality agenda of the nation is deemed fitting. In attaining this goal, time-series data from the period 1990 to 2018 is employed. According to the results, foreign direct investment deteriorates environmental sustainability by promoting more CO2 emissions. This validates the pollution haven hypothesis (PHH). In addition, industrialization and financial development are not friendly to the nation’s environmental quality. Furthermore, economic growth and urbanization escalate environmental pollution in the nation. In addition, the interactions between financial development and foreign direct investment and between financial development and industrialization deteriorate the environment in China. Moreover, foreign direct investment and financial development have an inverted U-shaped association with environmental degradation, but industrialization and environmental pollution are not nonlinearly related. The study advocated for the implementation of measures that could help advance the carbon-neutrality targets of the nation.

1 Introduction

The Sustainable Development Goals (SDGs), which focus on environmental sustainability (ES), have drawn attention from around the world (Nadeem, 2023). The inclusion of environmental sustainability in the SDGs signifies the recognition by the international community of the relationship between environmental concerns and social and economic advancements (Nadeem, 2023). Environmental sustainability highlights the necessity of pursuing an integrated and well-balanced strategy to guarantee a sustainable future for present and future generations (Nadeem, 2023). However, atmospheric environmental pollution caused by excessive carbon dioxide emissions (Wang et al., 2022; Ali et al., 2023a; b) has been the main obstacle to nations’ drive toward environmental sustainability.

The emission of carbon into the environment affects social production and human health and thus influences policy choices, the mode of current economic development, future economic development, and the global distribution of economic interest patterns (Wang et al., 2022). Carbon emissions have escalated and continue to escalate the world’s temperature to higher levels. This development influenced countries to commit to the Paris Agreement (2015) with the aim of limiting global temperature increases to preferably 1.5°C. To accomplish this goal, countries aimed to attain a global peak in greenhouse gas emissions as early as possible to achieve a climate-neutral world in the mid-century.

One of the signatories to the Paris Agreement (2015) that is still battling with climate issues is China. The Rhodium Group’s research indicates that in 2019, China was responsible for 27% of global greenhouse gas emissions. This figure exceeded greenhouse gases emitted by all developed nations combined. The US became second with 11% of emissions, while India became third with 6.6% of emissions. According to the report, China’s emissions were more than three times those of the last 3 decades. According to the report, China has the largest population in the world and lower per-person emissions than the US, but its emissions have tripled in the past 20 years. The nationally determined contributions (NDCs), a key component of the Paris Agreement (2015) , represent each nation’s pledge to reduce its national emissions and prepare for the effects of climate change. However, according to the Climate Action Tracker, China’s NDCs are incredibly inadequate and cannot contribute to bringing the temperature below 2°C.

At the 2021 climate summit in the US, the Chinese president reaffirmed his country’s commitment to lowering global emissions, reiterating that China’s position is based on the need for sustainable development and the sense of duty to create a community with a shared future for humanity. Meanwhile, China is heavily dependent on coal power, which is emission-intensive. According to the Rhodium Group’s report, the nation already operates 1,058 coal plants, representing more than half of the global capacity. China reaffirmed its commitment to cutting carbon emissions on 22 September 2020, during the general debate of the 75th session of the UN General Assembly. It declared that it would aim to reach carbon neutrality by 2060 and aim for a peak in carbon emissions by 2030. This indicates the nation’s commitment to tackling the problem of carbon emissions (Cui et al., 2024).

Emissions in China are influenced by many macroeconomic factors, of which foreign direct investment, industrialization, and financial development (FD) are no exception. Based on the data from the nation’s commerce ministry, foreign direct investment increased by 31.7% to $59.09 billion in the first quarter of 2022. The main sources of the above increments were South Korea, the US, and Germany, contributing 52.8%, 27.1%, and 21.4%, respectively. Since the reform and opening in 1978, China’s actual use of foreign direct investment has increased from $40.7 billion to $131 billion, which is twice the amount of foreign investment in less than 2 decades.

The gradual expansion in foreign direct investment has not only promoted vitality in the country’s economy but has also deteriorated the ecosystem of the nation. As reported by Hou et al. (2021), carbon emissions in China increased from 1,182,904,870t in 1997 to 3,723,989,462t in 2018, representing more than thrice the emissions in almost 20 years. This figure far exceeded the foreign direct investment inflows the nation received over the same period. The inflows of foreign direct investment into China impact its environmental sustainability in two diverse ways. For instance, if foreign direct investment inflows into the country are related to the utilization of dirty energies, the rate of emissions could escalate, leading to increased environmental pollution. This aligns with the pollution haven hypothesis (PHH), which stipulates that jurisdictions with lax regulations on their ecosystems serve as hosts to polluting establishments emanating from jurisdictions with tight environmental regulations (Levinson and Taylor, 2008; Danish and Ahmad, 2021; Singhania and Saini, 2021). Kouton et al. (2022), Ali et al. (2022), Amin et al. (2022), and Dada et al. (2022), among others, validated the haven hypothesis.

Contrastingly, some foreign direct investment inflows may bring capital, advanced technologies, professional knowledge, and research and development initiatives that could enhance environmental sustainability via emission mitigation. This assertion is in line with the pollution halo hypothesis (PHA), which stipulates that investing in wealthy nations helps host countries reduce emissions because their production structures rely on green technology as opposed to that of the host countries (Polloni-Silva et al., 2021; Mert and Caglar, 2020; Zakia et al., 2021). Haq et al. (2022), Rahaman et al. (2022), Udemba and Yalçıntaş (2021), and Pradhan et al. (2022) supported the halo hypothesis.

Moreover, China has witnessed significant economic growth in recent times. However, this economic progress has been accompanied by significant environmental damage (Liu and Bae, 2018), largely due to polluting industrial activities undertaken in the nation. Currently, China is at the pinnacle of industrialization and requires massive energy inputs to propel its economic undertakings. However, a greater portion of the energy used to drive those activities comes from carbon-intensive sources, leading to environmental deterioration. Thus, despite the economic gains China has made from its rapid industrialization, there has been severe environmental damage emanating from that sector, which cannot be overlooked if the nation is to accomplish its sustainable development goals.

In addition, the literature is inconclusive on the relationship between financial development and environmental sustainability. Based on the available literature, financial development has both beneficial and detrimental influences on environmental sustainability. Development in the financial sector worsens environmental sustainability by providing low-cost credit facilities to households to acquire polluting products that end up harming the environment (Ju et al., 2023). Financial sector growth also helps industries access funds to widen their operations, leading to more energy utilization and, therefore, more environmental pollution (Menegaki et al., 2021). Contrastingly, financial development helps stimulate technological innovations, energy efficiency, green energy production, and environmentally friendly initiatives that improve environmental quality. Amin et al. (2022) reported that financial development reduced CO2 emissions in China. According to the study, financial institutions that focus on green growth by promoting eco-friendly initiatives could help mitigate pollution in the country. Zhang’s (2011) study, on the other hand, confirmed financial development as a driver of carbon emissions in China.

In summary, foreign direct investment, industrialization, and financial development significantly stimulate economic progress in China. However, the series has the potential to escalate the nation’s environmental pollution due to its connection with high CO2 emissions. The emissions from these factors contribute significantly to greenhouse effects, which not only endanger the lives and health of individuals but also undermine the nation’s environment. However, to the best of our knowledge, no study has investigated the contributions of financial development, foreign direct investment, and industrialization to the carbon neutrality target of China, taking into consideration direct, indirect, and nonlinear effects. To attain this goal, we investigate the connection between foreign direct investment, industrialization, financial development, and environmental sustainability as measured by CO2 emissions. Based on the identified research gap, the following research questions are posed: Do foreign direct investment, industrialization, and financial development significantly influence environmental sustainability in China? If so, what is the nature of the identified effect? Do foreign direct investment, industrialization, and financial development have a nonlinear relationship with environmental sustainability in China? If so, what is the nature of the relationship between the variables? Does financial development significantly moderate the relationship between foreign direct investment, industrialization, and environmental sustainability in China? If so, what is the nature of the identified impact? By finding answers to these questions, we seek to shed light on how industrialization, financial development, and foreign direct investment influence both climate change mitigation and sustainable development.

This study is motivated by the increasing rate of CO2 emissions and their consequences for human health and the environment. According to the IEA, China has emitted the largest CO2 emissions in the world since 2007. The World Energy Statistics Yearbook 2019 (BP, 2019) reported China as the number one in global CO2 emissions, accounting for 27.8 percent. In 2018, the nation’s CO2 emissions totaled 10 billion tons, which was more than the combined emissions of the US and the EU, which accounted for 5.4 billion tons and 3.5 billion tons, respectively. The increasing rate of emissions highlights the nation’s deteriorating environmental circumstances, signifying the need for in-depth research to develop practical solutions to raise environmental standards in the nation. Therefore, examining the environmental effects of foreign direct investment, industrialization, and financial development to offer policy options to propel the carbon neutrality ambition of the nation is worthwhile.

Our exploration makes the following contributions to the existing literature. First, previously conducted studies on the relationship between foreign direct investment, industrialization, financial development, and environmental sustainability in China solely focused on the direct impacts of these factors on the nation’s environmental sustainability, failing to address the interactive effects of financial development on the relationship between foreign direct investment, industrialization, and environmental sustainability. This study closes this gap by investigating how financial development moderates the association between foreign direct investment, industrialization, and environmental sustainability in the nation. Second, prior environmental studies in the nation investigated only the linear connections between industrialization, financial development, foreign direct investment, and environmental sustainability, neglecting the nonlinear relationship between the variables of interest. By analyzing the nonlinear relationships between industrialization, financial development, foreign direct investment, and environmental sustainability, our study is viewed as innovative compared to others.

Third, by employing the fully modified ordinary least squares (FMOLS), dynamic ordinary least squares (DOLS), and canonical cointegrating regression (CCR) techniques to explore the elasticities of the predictors, we seek to take into consideration heteroscedasticity, serial correlation, and endogeneity in the model under investigation. The reason for adopting this strategy is that failure to recognize these factors may lead to biased regression estimates, and if that happens, it may be impossible to determine the true relationship between the response variable and predictors. Hence, we view it as appropriate to use estimators that can handle the aforementioned issues. Last, most of the research studies on China, including those conducted by Mahadevan and Sun (2020), Zhang et al. (2022), and Huang et al. (2019), have focused on the predictors’ role in explaining the response variable, neglecting the causal relationships between the variables of concern. To make better policy decisions, we apply the Engle and Granger (1987) test to ascertain the causal paths between the variables.

This research offers decision-makers a more thorough and nuanced grasp of the intricate connections between foreign direct investment, financial development, industrialization, and environmental sustainability, which can help them create more viable policies that will both encourage sustainable growth and lower emissions. We also expect the findings of this study to enrich the existing literature and broaden the readers’ understanding of the association between the variables of concern. Moreover, the study’s discoveries will assist policymakers in developing efficient frameworks for monitoring and regulating carbon emissions in the country. This will help in the attainment of SDG 13, “Climate Action.” The study will also help authorities increase policy options that will help promote health and wellbeing among the citizenry (SDG 3); accessibility to modern and sustainable energy (SDG 7); sustainable economic growth (SDG 8); inclusive and sustainable industrialization (SDG 9); sustainable cities and societies (SDG 11); responsible consumption and production (SDG 12); and healthy land, forests, and biodiversity (SDG 15).

The literature review is provided in Section 2, while the methodology used to conduct the study is presented in Section 3. In Section 4, the results and their discussions are presented, while the conclusions and policy recommendations are described in Section 5. Section 6 presents the limitations and suggestions for future research.

2 Literature review

2.1 Nexus between foreign direct investment and environmental sustainability

Several studies have explored the relationship between foreign direct investment and environmental sustainability. However, the findings are contradictory. For example, Liu et al. (2024) investigated the influence of Chinese foreign direct investment on 46 Belt and Road countries from 2005 to 2018. From the Driscoll–Kraay econometric estimates, the pollution halo and haven hypotheses were confirmed for nations in Panels A and B, respectively. These findings are vital; however, they should be interpreted with caution because the study was limited to only Chinese foreign direct investment. If investments from other foreign sources were taken into consideration, the outcome might be different. Wang et al. (2024) studied the effect of foreign direct investment on carbon emission reduction performance in China. Based on the estimates, improvements in the quality of foreign direct investment positively impacted regional energy-carbon emission performance in the country. In addition, the optimization of industrial structure, advancement in green innovations, and development in clean energy positively influenced the relationship between foreign direct investment and the nation’s energy-carbon emission performance. This study was confined to only China. The results cannot be generalized to all economies because if the analysis had been expanded to cover more nations, the outcome might vary.

Famanta et al. (2024) investigated the relationship between green foreign direct investment and environmental quality in 34 less-developed countries from 2003 to 2021. From the results, green foreign direct investment enhanced environmental quality as measured by the load capacity factor. The study was limited to only green foreign direct investment. This implies that if other foreign direct investments were to be incorporated into the analysis, the outcome might be different. Hence, the interpretation of the results warrants some caution. Baskurt et al. (2022) studied various income groups by employing the pooled mean group (PMG) and the PARDL techniques. It was revealed that foreign direct investment had a positive connection with the ecological footprint (EF), validating the PHH hypothesis. However, the discoveries were sensitive to the differences in the income groups of the countries. Huang et al. (2019) studied G20 economies from 1996 to 2018. Based on the estimates, foreign direct investment increased environmental pollution in the countries.

Dormean et al. (2022) analyzed the linkage between foreign direct investment and environmental sustainability in European Union member countries. From the results, a sound business environment that catered to environmental sustainability had the chance of attracting more foreign direct investment inflows, particularly for developed nations. Sattar et al. (2022) reported that China’s outward direct investment deteriorated environmental sustainability by 9.9%. Ali et al. (2022) conducted a study on Brazil, Russia, India, China, and South Africa (BRICS) economies and found that foreign direct investment is harmful to environmental sustainability. Haq et al. (2022) studied the predictors of carbon emissions in Pakistan and discovered foreign direct investment to support the nation’s environmental sustainability. Rahaman et al. (2022) studied the foreign direct investment and environmental sustainability linkage in Bangladesh from 1990 to 2019. From the discoveries of the study, foreign direct investment improved environmental sustainability in the short run but deteriorated environmental sustainability over the long run.

Abdo et al. (2022) employed the spatial econometric approach to study 51 Belt and Road Initiative (BRI) economies from 1992 to 2012. Based on the estimates, foreign direct investment had a positive direct and spillover effect on greenhouse gas emissions. Ali et al. (2023c) found that foreign direct investment improved environmental sustainability in G20 nations. Tanveer et al. (2022) studied Pakistan from 1975 to 2014. The discoveries from the study affirmed foreign direct investment as beneficial to the nation’s environmental sustainability. From 1971 to 2015, Kouton et al. (2022) researched Côte d'Ivoire and found a positive affiliation between foreign direct investment and environmental deterioration. Shah et al. (2022) investigated low-income countries from 2000 to 2020. Based on the estimates, foreign direct investment degraded the nation’s environmental sustainability. Pradhan et al. (2022) investigated the foreign direct investment and environmental sustainability nexus in BRICS from 1992 to 2014. Based on the findings, foreign direct investment improved the nation’s environmental sustainability. Soto (2024) proposed the utilization of more foreign direct investment to help reduce the dependency on polluting fuels. Amin et al. (2022) discovered that foreign direct investment damaged the ecosystem of China. Khan (2023) investigated the effects of foreign direct investment on economic growth, a key determinant of environmental sustainability. Based on the results, foreign direct investment promoted economic development in the United Kingdom (UK) after Brexit. Dada et al. (2022) adopted the ARDL technique to study Nigeria and found foreign direct investment to contribute to environmental pollution in the country. Arogundade et al. (2022) analyzed the spatial effect of foreign direct investment on environmental sustainability in Africa. The discoveries revealed a substantial spatial spillover of foreign direct investment in enhancing environmental sustainability in the region.

2.2 Nexus between industrialization and environmental sustainability

The association between industrialization and environmental sustainability has also been explored expansively. However, the discoveries are inconclusive. For example, Aquilas et al. (2024) investigated the relationship between industrialization and environmental sustainability in 46 African economies from 2000 to 2022. From the generalized least squares and the robust panel fixed effects regression estimates of the study, industrialization, proxied by values added in manufacturing, worsened environmental quality in the nations. However, the interaction between renewable energy and industrialization improved the nations’ environmental quality. The findings are very vital; however, they cannot be generalized to all economies in Africa because the study was confined to only 46 nations. If other countries were to be factored into the analysis, the outcome might be different.

Mehmood et al. (2024) analyzed the role of green industrial transformation in mitigating carbon emissions in Pakistan. According to the results, industrial greening reduced carbon emissions in the country. Although the outcome of the study is very essential, care should be taken in its interpretation because the analysis was conducted only in Pakistan. The inclusion of other nations in the study could result in different discoveries. Nkemgha et al. (2024) examined the connection between industrialization and environmental quality in 24 sub-Saharan African countries. According to the system generalized method of moment (GMM) estimates from the study, industry value added and manufacturing value added adversely affected environmental quality in the nation. The study employed only the GMM methodology for the parameter estimates. This implies that care should be taken in interpreting the results because if other econometric methods were to be employed, the outcome could be different.

Elfaki et al. (2022) investigated the industrialization and environmental sustainability nexus in ASEAN + 3 economies. According to the estimates, industrialization promoted environmental sustainability in economies. In addition, causation from environmental pollution to industrialization was discovered. Dagar et al. (2022) studied OECD economies from 1995 to 2019. From the GMM estimates of the study, industrialization degraded the ecosystems of the nations. Khan and Imran (2023) conducted a study on Europe and Central Asia. From the results, industrialization worsened environmental sustainability by promoting more pollutant emissions. Imran et al. (2023) revealed that cement production industries degraded environmental sustainability by promoting pollutant emissions.

Kahouli et al. (2022) conducted research on Saudi Arabia and disclosed a bilateral relation between industrialization and pollutant emissions. Appiah et al. (2019) employed the ARDL approach to study Uganda and found industrialization detrimental to the nation’s ecosystem. This discovery aligns with that of Ahmed et al. (2022) for 55 Asia–Pacific economies. Azam and Raza (2022) investigated 125 economies and affirmed that industrialization is detrimental to environmental sustainability in the full sample of developed countries but found it insignificant in developing economies. In Liu et al.’s (2022) study on 21 European economies, financial development (FD) was found to be detrimental to ES. In Tanzania, Byaro et al. (2022) discovered industrialization to be damaging to environmental sustainability in the short term but immaterial over the long term. Lee et al. (2022) studied 99 economies and discovered industrialization to be harmful to ecological quality in almost all the quantiles.

Sikder et al. (2022) investigated the determinants of environmental sustainability in 23 developing economies and reported that industrialization deteriorated environmental sustainability by 0.54%. As reported by Li and Ma (2024), China’s construction industry played a key role in achieving the ‘double carbon’ goal of the nation. Ahmad et al. (2022) studied the predictors of environmental sustainability in 31 Chinese provinces from 1995 to 2017. The pooled mean group (PMG) model, supported by the fully modified ordinary least squares (FMOLS) estimator, was used to compute the elasticity coefficients of the regressors. According to the results, industrialization improved environmental sustainability in both the short and long periods. Ali et al. (2023d) found that industrialization worsened environmental sustainability in European Union economies.

Mentel et al. (2022) studied the association between industrialization and environmental sustainability in 44 sub-Saharan African countries over the period 2000–2015. Employing the system GMM technique, industrialization improved environmental sustainability in the first model but was insignificant in the other two models. Usman and Balsalobre-Lorente (2022) investigated the association between industrialization and environmental sustainability in newly industrialized economies. The study confirmed industrialization as damaging to the environment of the economies.

2.3 Nexus between financial development and environmental sustainability

Numerous investigations have been conducted into the connection between financial development and environmental sustainability. The discoveries are, however, contradictory. For instance, Nguyen et al. (2024) investigated the relationship between financial development and environmental sustainability in developing countries from 1990 to 2020. Based on the GMM regression technique, more-developed financial systems enhanced environmental sustainability in the nations. This finding is vital, but it cannot be generalized to all economies because the study was limited to only some selected developing nations. If the analysis had been expanded to include other economies, the outcome might have been different. Nathaniel et al. (2024) employed the dynamic ARDL (DARDL) simulation technique to examine the association between financial development and environmental sustainability in Bangladesh. According to the results, development in the financial sector enhanced environmental sustainability by mitigating the country’s ecological footprint. In addition, causality from financial development to ecological footprint was observed. The study adopted the DARDL technique to estimate the coefficients of the predictors. Interpretation of the findings warrants some caution because if other econometric techniques were to be considered, the outcome might be different.

Prempeh (2024) studied the financial development–environmental sustainability connection in 10 ECOWAS countries from 1990 to 2019. According to the Driscoll–Kraay and panel quantile regression techniques, financial development improved environmental quality in the economies. Although this finding is very essential, it cannot be generalized to all economies because the study was confined to only 10 nations in the ECOWAS region. If other countries were to be considered for the analysis, the outcome might be different. Nurgazina et al. (2022) studied the relationship between financial development and environmental sustainability in China and found an immaterial association between them. In four South Asian economies, Pata et al. (2022) confirmed financial development as detrimental to environmental sustainability. Geyikci et al. (2022) affirmed financial development as an agent of environmental pollution in 13 developing nations. Elfaki et al. (2022) researched eight ASEAN + 3 economies and confirmed financial development as a promoter of environmental sustainability. In addition, financial development and environmental pollution were not causally related.

Appiah et al. (2024) reported that environmental pollution via natural resource overexploitation has repercussions on the financial development of OECD economies. Ofori et al. (2023) discovered mixed effects of financial development on environmental sustainability in BRICS, MINT, and G7 economies. Zhang et al. (2022) found that financial development promoted environmental deterioration in developing economies. Nazir (2023) indicated that the development of the financial sector helped promote the utilization of environmentally friendly energy in Pakistan. Wang et al. (2022) researched on N-11 economies and discovered that the interaction between financial development and renewable energy mitigated carbon emissions. Moreover, the bidirectional causality between financial development and environmental pollution was disclosed. Saqib (2022) investigated 63 emerging economies and revealed a negative connection between financial development and environmental pollution. In addition, a two-way causality between financial development and environmental degradation was observed. In Latif et al.’s (2023) investigation of RCEP economies, financial development was found to be damaging to environmental sustainability. In addition, feedback causality between the variables was observed.

In BRICS economies, Ojekemi et al. (2022) disclosed a trivial relationship between financial development and environmental sustainability. In addition, there was no causality between the variables in the countries. Radmehr et al. (2022) researched 62 economies over the period 1995–2016. From the results, financial development had a major influence on environmental sustainability by promoting sustainable economic development. Opuala et al.’s (2022) exploration of West Africa reported financial development to be harmful to environmental sustainability. Weili et al. (2022) reported that financial development deteriorated environmental sustainability in the Belt and Road economies. Shah et al. (2022) documented financial development as damaging to environmental sustainability. This aligns with the study of Usman et al. (2022). Finally, Ehigiamusoe et al. (2022) discovered a tenuous U-shaped connection between financial development and carbon emissions but not with the ecological footprint.

2.4 Research gap

From the literature reviews, the nexuses between financial development, foreign direct investment, industrialization, and environmental sustainability have yielded varied conclusions. Although some studies confirmed financial development, foreign direct investment, and industrialization to be detrimental to environmental sustainability, others affirmed them as friendly to the environment. These conflicting results might be due to the differences in variable selection, methodology, geographical locations, and timeframe, implying that the argument on the relationship between the variables is far from over and warrants further studies like ours. Moreover, a thorough scrutiny of the literature has confirmed that prior explorations on the connection between financial development, foreign direct investment, industrialization, and environmental sustainability only examined the direct effects without examining how financial development influences environmental sustainability through foreign direct investment and industrialization.

Moreover, prior studies only explored the linear relationships between foreign direct investment, financial development, industrialization, and environmental sustainability without examining whether these relationships are nonlinearly related to a sustainable environment or not. This study fills the gaps above by first examining the direct effects of foreign direct investment, financial development, and industrialization on environmental sustainability. The study also examines the moderating effects of financial development on the relationship between foreign direct investment, industrialization, and environmental sustainability. Finally, the nonlinear relationship between financial development, foreign direct investment, industrialization, and environmental sustainability is explored. To accomplish these objectives, the following hypotheses are developed for testing:

H1. Foreign direct investment, industrialization, and financial development harm environmental sustainability in the nation.

H2. The interaction between financial development and foreign direct investment deteriorates environmental sustainability in the country.

H3. The interaction between financial development and industrialization harms ecological safety in the nation.

H4. Foreign direct investment, industrialization, and financial development have a non-linear association with environmental sustainability in the country.

3 Materials and methods

3.1 Data source

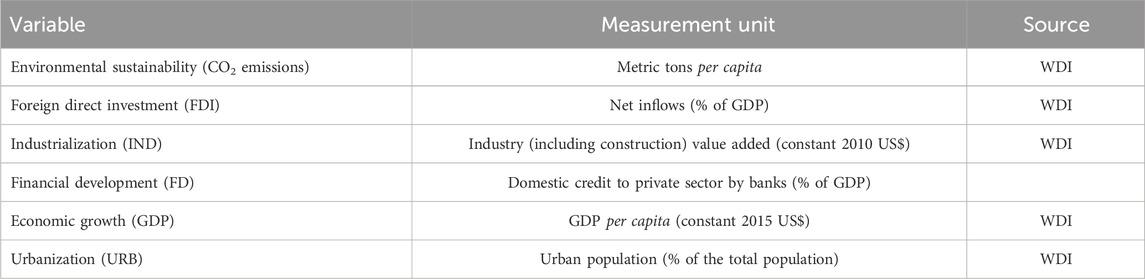

Time-series data on China from 1990 to 2018 are used for the study. The study data are dependent on the availability of data on the variables of concern. In the study, environmental sustainability is the response variable that proxies CO2 emissions, while foreign direct investment, industrialization, and financial development are the main predictors. To cater to the consequences of model misspecifications, the study controls for urbanization and economic growth. CO2 emissions are measured in metric tons per capita, while foreign direct investment is measured by net inflows as a percentage of GDP. In addition, industrialization is measured by industry (including construction) value added (constant 2010 US$), while financial development is measured by domestic credit to the private sector by banks (% of GDP). Finally, economic growth is measured by GDP per capita (constant 2015 US$), while urbanization is measured by urban population (% of the total population). The SDGs formed the basis for the choice of the analyzed series. Further details on the variables are displayed in Table 1.

3.2 Model specification and theoretical underpinning

Several studies have been conducted on the association between macroeconomic factors and environmental quality by academicians from different geographical environments. These studies are pertinent because they offer policy options to help economies attain the carbon neutrality target. Despite the countless investigations on the predictors of environmental quality, limited studies have examined the contributions of foreign direct investment, industrialization, and financial development to meeting China’s carbon neutrality target. This study is, therefore, undertaken to help patch that void. To achieve this goal, the following baseline model is formulated for estimation:

where CO2 emissions are the criterion variable representing ES, while foreign direct investment (FDI), industrialization (IND), and financial development (FD) are the main determinants of concern. In addition, economic growth (GDP) and urbanization (URB) are used as control variables, while β1, β2, β3, β4, and β5 are the coefficients of the predictors. In addition, t represents the study period, while the error and constant terms are denoted by

Moreover, several studies have proven that financial development has a major influence on industrialization and foreign direct investment. If this assumption holds, then the interaction between financial development and these variables can have a major effect on environmental sustainability. To test whether this assumption holds for China, the interactive terms between financial development and foreign direct investment (FD*FDI) and between financial development and industrialization (FD*IND) are incorporated into the baseline model, resulting in the following specification.

where

The focus is on the sign and materiality of the parameters (for instance,

To examine whether foreign direct investment, industrialization, and financial development are nonlinearly related to CO2 emissions, the baseline framework is augmented with the square terms of foreign direct investment (FDI2), industrialization (IND2), and financial development (FD2), resulting in the following model:

where

Setting Eqs 3a–3c to zero, the turning points of the variables are obtained as

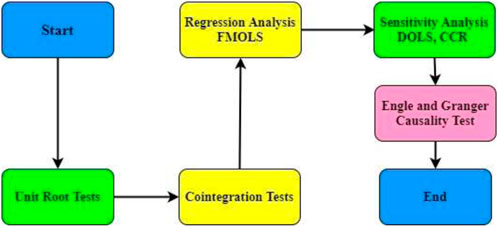

3.3 Econometric strategy

A four-step analytical process is used in conducting this research. First, the augmented Dickey–Fuller (ADF), Phillips–Perron (PP), Kwiatkowski–Phillips–Schmidt–Shin (KPSS), and Elliot Rothenberg and Stock (ERS) unit root tests were performed to study the integration order of the variables. Next, the Hatemi-J (2008) cointegration test was performed to examine whether the series share a long-term cointegration association or not. The above approach is superior to other conventional approaches in that it considers structural breaks in datasets.

After confirming cointegration among the variables, the parameters of the regressors are first explored via the FMOLS technique of Phillips and Moon (1988). To test the sensitivity (robustness) of the FMOLS results, the DOLS and CCR estimates are computed at the next stage. The FMOLS and DOLS techniques are engaged because of their resilience to small sample bias, heteroscedasticity, and serial correlation (Funk and Strauss, 2000; Kiefer and Vogelsang, 2005; Sulaiman and Abddul-Rahim, 2018). As reported by Sulaiman and Abddul-Rahim (2018), the above estimators can still be used even if series are not of the same integration order. Endogeneity is a serious issue in regression analysis, and the DOLS approach is vigorous toward it. According to Montalvo (1995), the CCR technique exhibits less bias and is therefore better than other econometric methods like the OLS and FMOLS. Following Pedroni (2001), the ensuing FMOLS specification is developed for estimation.

In the above model,

where the leads and lags are i, m, n, o, and p, which are used to account for serial correlation and endogeneity. The above techniques differ from Zaman’s (2023) cross-panel data approach, which fits the case where the regressand of a single nation relies concurrently on regressors from a wide variety of other countries. The adopted techniques for our analysis also vary from the approach of Zaman (2023b). Because regression does not unearth causalities between variables, the test of Engle and Granger (1987) is employed to unravel the causalities between the variables. This method is adopted due to its robustness to time-series datasets. The models of the test are specified as

where

4 Results and discussion

4.1 Descriptive and correlational analysis

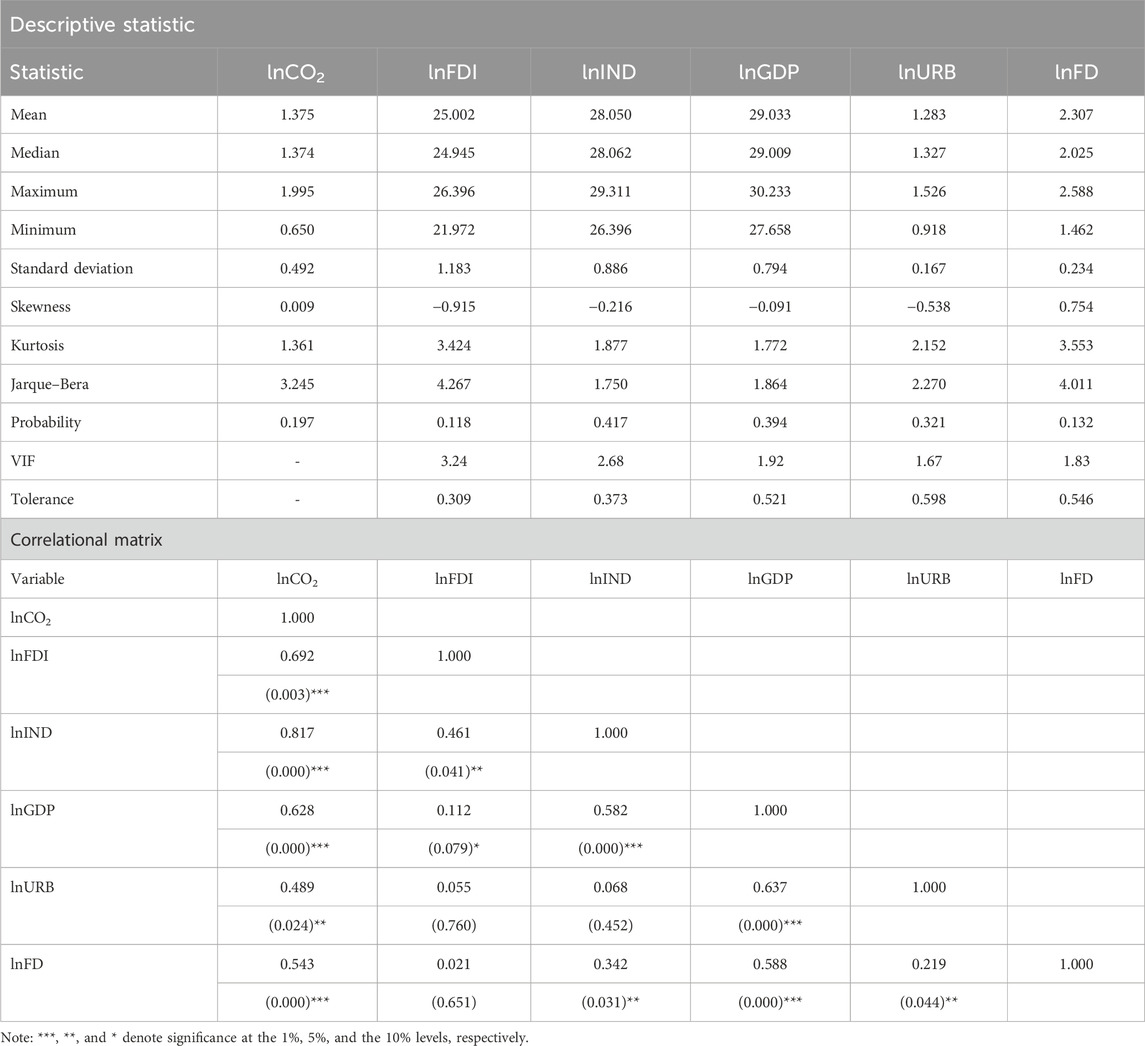

The summary statistics on the series are provided in Table 2. Based on the information shown in Table 2, economic growth has the greatest average value, while urbanization has the smallest. In addition, foreign direct investment possesses the highest volatility, with a deviation of 1.183, while urbanization is the least volatile, with a deviation of 0.167. Moreover, the distributions of foreign direct investment, industrialization, urbanization, and economic growth are skewed negatively, while the distributions of financial development and CO2 emissions are skewed positively. In addition, foreign direct investment and financial development have leptokurtic-shaped distributions, while industrialization, urbanization, economic growth, and CO2 emissions have platykurtic distributions. In addition, the Jarque–Bera test confirms all the series to be normally distributed. On the correlations between the series, all the regressors have a positive relationship with CO2 emissions. This means that the regressors and the regressand increase and decrease at the same time. Finally, the tolerance and variance inflation factor tests report no collinearity among the determinants. This implies that the series can be used to predict carbon emissions in the country.

4.2 Unit root and cointegration analysis

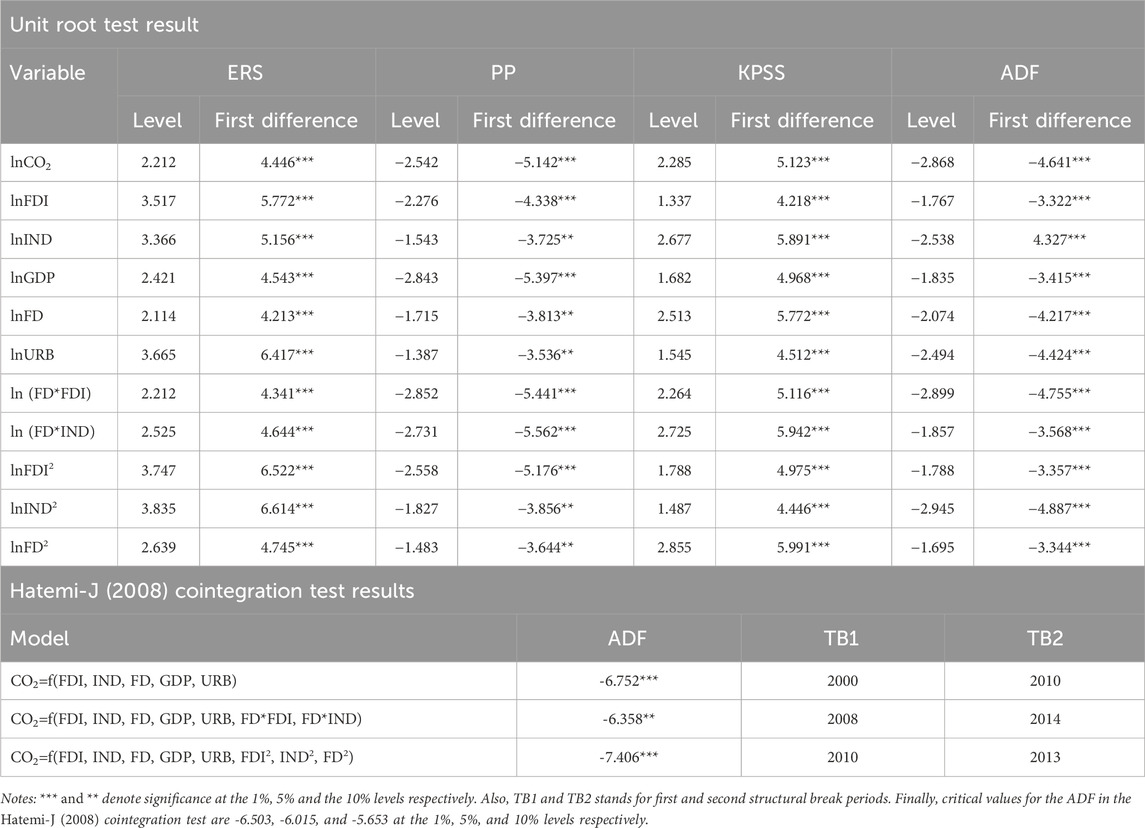

The unit root characteristics of series are essential in econometric analysis because their negligence could result in valid or spurious regression coefficients. Therefore, first, the variables’ stationarity attributes are studied via the tests displayed in Table 3. Based on the estimates, the variables possess an I (1) integration order. Second, the Hatemi-J (2008) test displayed in Table 3 is conducted to examine the cointegration attributes of the variables. According to the estimates, the variables possess a long-term cointegration association. After establishing that the series possess a cointegration relationship, the researchers proceed to explore the parameters of the determinants.

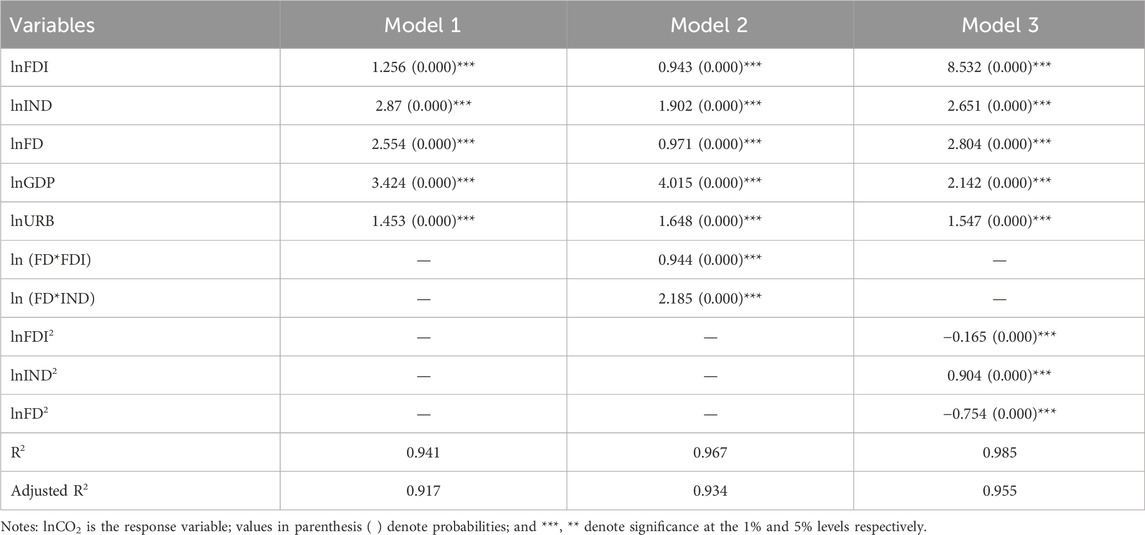

4.3 Regression analysis

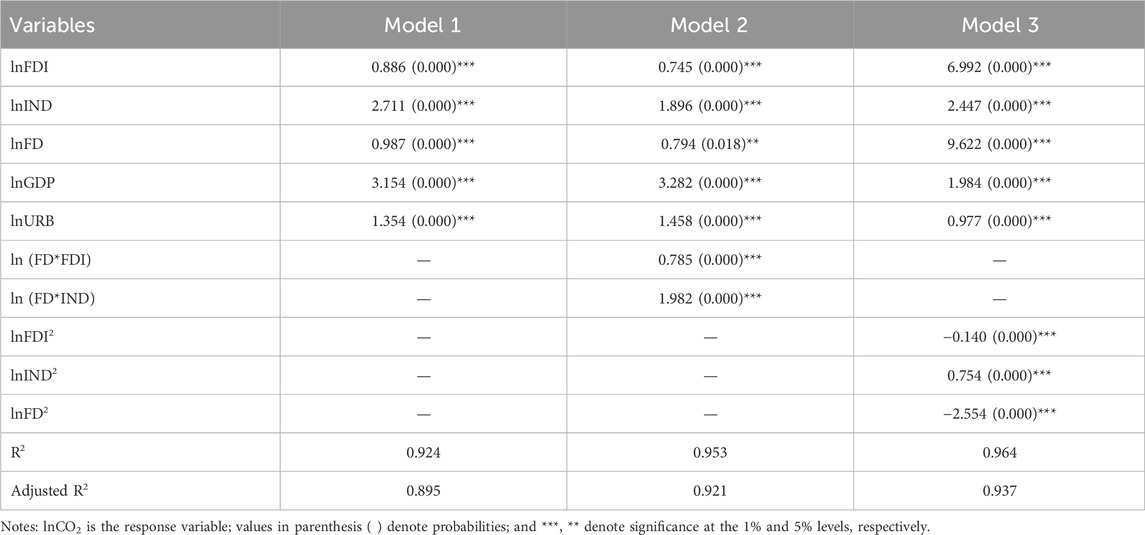

It is very important to report and discuss the findings of this study to make various recommendations that can aid China in achieving its SDGs. After affirming the variables to be cointegrated, the FMOLS approach is first engaged to explore the parameters of the predictors. As shown in Table 4, foreign direct investment worsens environmental sustainability in all three models. Precisely, a percentage increase in foreign direct investment increases the country’s emissions by 0.886%, 0.745%, and 0.992%, respectively. In addition, industrialization is a positive determinant of environmental pollution in the nation. All factors held constant, a percentage increase in industrialization increases CO2 emissions by 2.711%, 1.896%, and 2.447%, respectively. Likewise, financial development positively predicts pollutant emissions in China. All factors held constant, a 1% increase in financial development escalates emissions by 0.987%, 0.794%, and 2.622%, respectively. In addition, economic growth is detrimental to China’s environmental safety. Precisely, a percentage increase in economic growth increases emissions by 3.154%, 3.282%, and 1.984%, respectively. Moreover, urbanization promotes carbon emissions by 1.354%, 1.458%, and 0.977%, respectively.

In model 2, the interactions between financial development and foreign direct investment and between industrialization and financial development positively predict CO2 emissions. In addition, in model 3, the coefficients of the square terms of foreign direct investment and financial development are negatively related to environmental pollution; however, the coefficients of foreign direct investment and financial development are positive. This means that foreign direct investment and financial development have an inverted U-shaped relationship with environmental pollution. However, the coefficients of both industrialization and its square terms are positive, suggesting a monotonically increasing relationship between the variables and environmental pollution. Finally, the R-squared values of 0.895, 0.921, and 0.937 signify that the predictors account for 89.5%, 92.1%, and 93.7% of variations in the country’s carbon emissions, respectively.

4.4 Discussion of the results

Based on the discoveries displayed in Table 4, foreign direct investment is detrimental to the nation’s environmental quality. This outcome suggests that foreign investments in China are not green. Thus, the nation attracts polluting investments due to its possible lax environmental standards. The majority of foreign industries that operate in China use energy from dirty sources to drive their operations, resulting in more emissions. For the country to attain its SDGs, it must improve its environmental sustainability by mitigating the rate of pollution in the environment. This goal could be achieved if the nation enacts laws to direct foreign entities to embrace green energy sources in their undertakings. Moreover, China should improve the quality of its institutions to help promote the sustainable development agenda of the nation. In addition, foreign investments that come along with innovations that could improve environmental quality and boost productivity should be embraced by the nation. Furthermore, foreign investments, which could stimulate investments in the energy sector, resulting in alternative energy sources like photovoltaic cells and wind turbines (Keeley and Ikeda, 2017), should be welcomed. According to Yi et al. (2017), cited in Polloni-Silva (2021), such foreign investments have substantially mitigated pollution in China. The finding supports the PHH. According to this assumption, environmental regulations in rich countries are stricter than those in developing countries, making comparative advantage patterns distorted. As a result, polluting firms relocate their operations from developed to developing nations, making them “pollution havens.” This discovery supports the studies of Liu et al. (2024), Huang et al. (2022), and Ali et al. (2022) but contrasts those of Wang et al. (2024), Famanta et al. (2024), Rahaman et al. (2022), and Udemba et al. (2022).

Similarly, industrialization damages environmental quality by promoting more CO2 emissions in China. This finding is justifiable because the implementation of policies like the Belt and Road Initiative has led to an increase in industrial activities in the nation, consequently degrading the nation’s environment due to the increase in the consumption of more polluting energies. It is a known fact that industrial processes affect vital actions in economies (Dagar et al., 2022). Therefore, as industrial activities increase, there will be a gradual increase in the consumption of energy resources that can pollute the environment (Xiao, 2017). Particularly in developing economies like China, rapid increases in industrial operations have not only fueled tremendous economic expansion but have also increased the consumption of energy, resulting in more carbon emissions (Dagar et al., 2022). The production and distribution of products via various means of transportation also form part of the industrial process. These activities involve the use of polluting energies that can also degrade the environment (Udemba et al., 2022). Moreover, as emerging countries transition from agrarian to industrial economies, pollution-intensive industrial production increases, contributing significantly to environmental pollution (Patnaik, 2018). It will be beneficial to the country if industrial activities are driven by energy from renewable sources. Policymakers can encourage the growth of renewable energy in the industrial sector by providing low-interest loans and tax cuts for the purchase and installation of renewable energy generators. In addition, implementing regulations that promote renewable energy technologies across industries will be worthwhile. This ambition could be accomplished if the government subsidizes green energy, lowers the tax rates for businesses that embrace green energy technologies, and provides low-interest loans and incentives to entities (Mentel et al., 2022). The damaging environmental effects of industrialization confirmed by this study align with those of Aquilas et al. (2024), Nkemgha et al. (2024), Elfaki et al. (2022), and Udeagha and Ngepah (2022) but vary from those of Mehmood et al. (2024) and Ahmed et al. (2022).

Likewise, financial development worsens environmental pollution in the country. A probable reason for this finding is that financial development stimulates economic expansion, which in turn increases energy consumption and carbon emissions (Shahbaz et al., 2013). Well-developed financial systems help industries obtain financial support, enabling them to increase their production and consequently emit more emissions. According to Xu et al. (2021), financial development boosts consumer credit and encourages them to spend funds on home appliances, automobiles, and other commodities that are harmful to the environment. The finding supports the scale effect of financial development, which posits that development in the financial sector helps industries access funding to expand their operations, resulting in the consumption of more polluting energies, thereby degrading the environment. However, the technique’s effect on financial development contrasts with the study’s findings. According to this assumption, well-developed financial frameworks stimulate investments in eco-friendly technologies, consequently enhancing environmental safety. Nguyen et al. (2024), Nathaniel et al. (2024), Prempeh (2024), Saqib (2022), and Ojekemi et al. (2022) confirmed that financial development enhances environmental quality in different economies, contrasting the outcome of this study. However, the investigations of Ngoc and Tram (2024) and Abid et al. (2022) supported the outcome of this exploration.

In addition, economic growth deteriorates environmental quality in China. This finding is not surprising because, in an attempt to increase economic development, environmental degradation increases as the scale and composition effects prioritize economic progress over environmental sustainability (Prempeh, 2024). China predominantly relies on industrialization and infrastructure to increase its economy, heavily depending on energy sources that are harmful to the environment. This is not surprising because every economy begins with industrial developments to achieve its growth targets. However, the large-scale demand for energy to propel such developments could lead to environmental degradation through higher emissions. In addition, weak environmental controls allow external economic agents like investors and producers to penetrate the system, taking advantage of the laxity in regulations and policies to engage in economic activities that harm environmental sustainability. Most of these activities are linked to the use of fossil fuels, which result in high carbon emissions and, subsequently, poor environmental quality. The detrimental impact of economic growth on environmental quality aligns with the findings of the studies of Teklie and Yağmur (2024), Koilakou et al. (2024), Wang et al. (2022), and Azam and Raza (2022) but contrasts with those of Dogan and Aslan (2017) and Salahuddin et al. (2016).

This research further discloses that urbanization aggravates environmental quality in China. This finding is justifiable because urbanization creates the market forces necessary to propel economic growth, which increase energy consumption and carbon emissions. Changes in urban population have an impact on economic activities and energy utilization. Activities that drive economic advancement are concentrated in urban areas. These activities consume a lot of energy and, therefore, contribute to more environmental damage. According to Sardorsky (2014) and Kwakwa and Adu (2018), urban population variations affect the rate of economic activities, impacting pollution. If urban inhabitants participate in activities that worsen the environment’s bio-productive types of land usage while ignoring environmental protection, the simultaneous growth in urbanization and, therefore, energy utilization might aggravate environmental pollution (Ehigiamusoe et al., 2022; Kwakwa and Alhassan (2018). However, increased urbanization may influence residents to live more sustainably by encouraging them to use urban infrastructure more effectively (Zhang and Lin, 2012). This could help mitigate pollution in the environment. The detrimental effect of urbanization on the nation’s environment supports the studies of Kusiyah et al. (2024), Singh et al. (2024), Murshed et al. (2022), and Adebayo et al. (2022) but contradicts those of Rehman et al. (2022) and Hasmi et al. (2021).

In model 2, the interactions between financial development and foreign direct investment and between financial development and industrialization positively predict CO2 emissions. This suggests that the interactive terms promote environmental pollution throughout the nation. In other words, financial development worsens the harmful environmental effects of foreign direct investment and industrialization in China. This finding contrasts with the studies of Gyamfi et al. (2022) and Haq et al. (2022). In addition, in model 3, foreign direct investment and financial development have an inverted U-shaped relationship with environmental pollution. This suggests that, at the initial stages, the increase in financial development and foreign direct investment worsens environmental quality, but after attaining a certain threshold level, further increases in the series enhance environmental safety. This finding contradicts the studies of Baskurt et al. (2022) and Ahmed et al. (2022). However, industrialization has a monotonically increasing relationship with pollutant emissions. This suggests that, in both the initial and latter periods, industrialization harms environmental quality in the nation. The studies of Mehmood et al. (2024), Aquilas et al. (2024), and Nkemgha et al. (2024) contrast this discovery. The elastic effects of the regressors on the regressands are displayed in Figure 1.

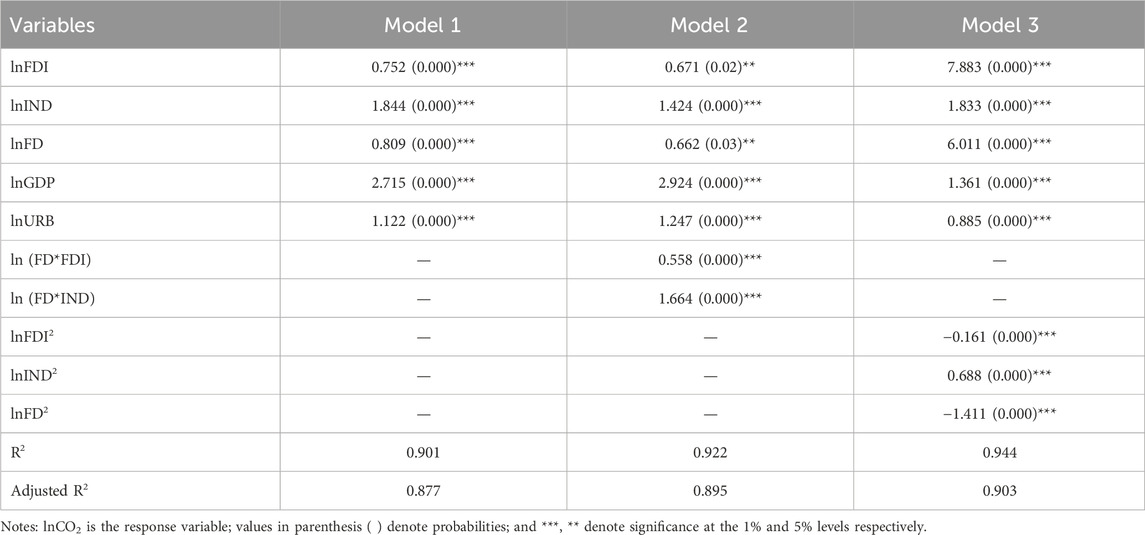

4.5 Sensitivity analysis

We conduct a sensitivity analysis by employing the DOLS and CCR approaches to confirm whether the results are consistent across methodologies. Based on the results shown in Tables 5, 6, foreign direct investment, industrialization, and financial development exacerbate carbon emissions in China. In addition, urbanization and economic growth promote environmental pollution in the country. Besides, the interactive terms between financial development and foreign direct investment and between financial development and industrialization harm the nation’s environmental sustainability. Moreover, foreign direct investment and financial development have an inverted U-shaped association with environmental pollution, but industrialization has no nonlinear association with pollutant emissions in the country. Although the parameter estimates under FMOLS, DOLS, and CCR vary in weight, they are the same in terms of sign. The consistency of the results under the three methodologies implies that the results are robust.

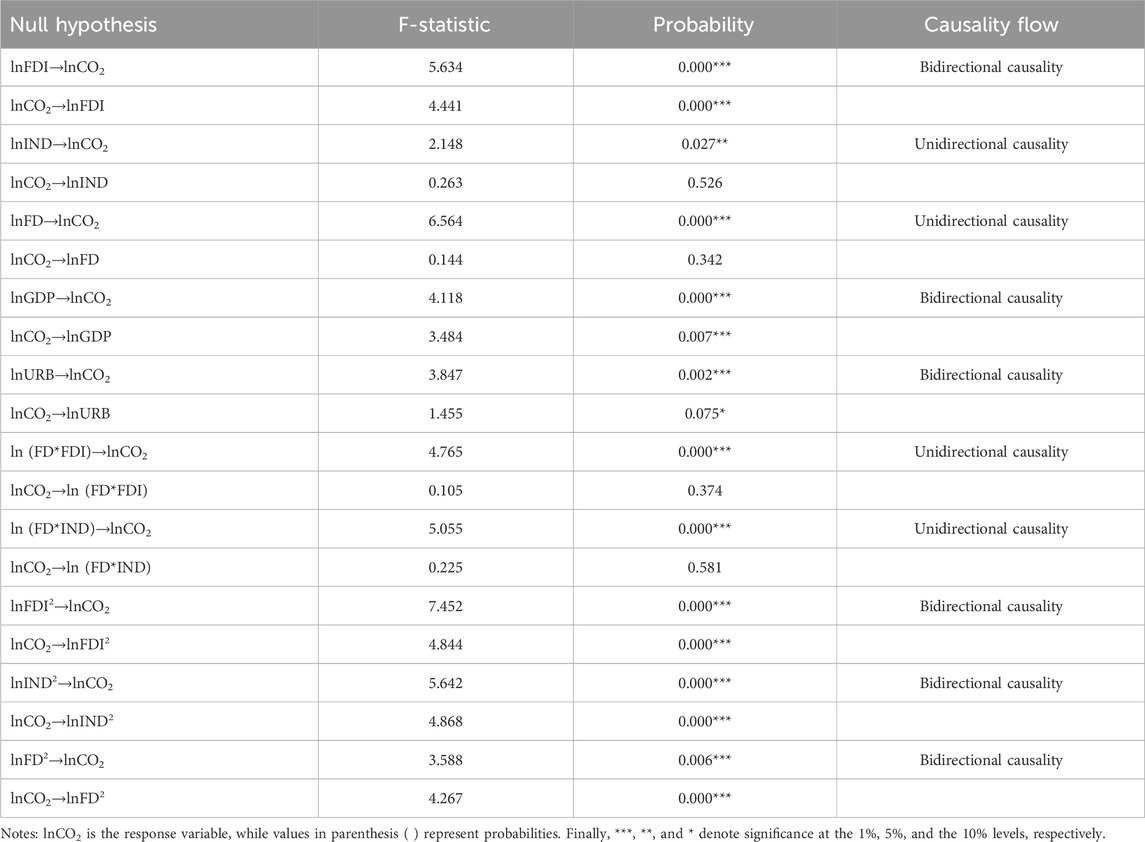

4.6 Causality analysis

The causal paths between the variables are provided in Table 7. Based on the estimates, there is feedback causality between foreign direct investment and CO2 emissions. This indicates that the two variables are dependent on each other. This finding contrasts with that of the study by Udemba et al. (2022). In addition, a causal relationship between industrialization and CO2 emissions is observed, meaning that CO2 is dependent on industrial activities in the country. The findings of Appiah et al. (2022) and Khan and Imran. (2023) conflict with this outcome. Moreover, a unidirectional causality between financial development and CO2 emissions is discovered, indicating that financial development increases pollution in the country but not vice versa. Bui (2020) supported this discovery. Furthermore, there is a two-way causality between economic growth and CO2 emissions, suggesting that the two series predict each other. Sahoo and Sethi (2021) supported this finding for developing economies, while Osobajo et al. (2020) did so for 70 countries. However, Adebayo et al. (2021) contradicted this revelation for South Korea, and Osadume and University (2021) did so for West African countries. In addition, bidirectional causality between urbanization and CO2 emissions is discovered, indicating that urban concentration has a detrimental impact on environmental sustainability through high CO2 emissions. The findings of Sufyanullah et al. (2022) and Nihayah et al. (2022) varied from this disclosure, while those of Wu et al. (2021) and Salman et al. (2022) supported the findings of the study. In addition, the interactions between financial development and foreign direct investment and between financial development and industrialization contribute to pollution in the country. Finally, the square terms of foreign direct investment, industrialization, and financial development are bidirectionally related to CO2 emissions, indicating that these variables and environmental quality are dependent on each other.

5 Conclusion and policy recommendations

5.1 Conclusion

The purpose of this study is to examine the relationship between foreign direct investment, industrialization, financial development, and environmental sustainability in China to offer policy options to help the nation attain its carbon neutrality agenda. To achieve this aim, data spanning the period 1990–2018 are utilized. Based on the findings, the variables possess a first-differenced integration order and are cointegrated in the long run. The FMOLS technique is employed to examine the parameters of the determinants, and according to the results, foreign direct investment deteriorates environmental sustainability in China by promoting more CO2 emissions. This finding validates the pollution haven hypothesis for the country.

In addition, industrialization and financial development are not friendly to the nation’s environment. Besides, economic growth and urbanization promote pollution in the nation. Moreover, the interactions between financial development and foreign direct investment and between financial development and industrialization worsen the nation’s environmental sustainability. Furthermore, foreign direct investment and financial development have an inverted U-shaped relationship with environmental pollution, but industrialization has no nonlinear association with pollutant emissions in the country.

Sensitivity analysis via the DOLS and CCR estimators upholds the above discoveries. On the causalities between the variables, feedback causalities between foreign direct investment and CO2 emissions, economic growth and CO2 emissions, and urbanization and CO2 emissions are disclosed. Furthermore, unidirectional causalities between industrialization and financial development and CO2 emissions are unfolded. In addition, the interactions between financial development and foreign direct investment and between financial development and industrialization cause pollution in the country. Finally, the square terms of foreign direct investment, industrialization, and financial development have a bidirectional relationship with CO2 emissions.

5.2 Policy implications

The findings of the study have implications for stakeholders and policymakers addressing environmental concerns like climate change and global warming and provide empirical evidence for how foreign direct investment, financial development, and industrialization influence environmental sustainability in China. As evidenced by the results, foreign direct investment harms the environmental quality of the country. Hence, the government of China should encourage eco-friendly foreign investments in the country. In addition, foreign investments that promote energy efficiency, human capital development, technological innovations, renewable energy production, and research and development initiatives that could advance environmental sustainability in the nation should be encouraged.

Furthermore, the nation should impose dumping levies on industries that import polluting items into the nation. This will encourage them to deal with items that could promote the country’s environmental quality. Additionally, authorities should not trade-off environmental quality over polluting foreign direct investment inflows. This will curtail damaging inflows into the nation. In addition, institutions or bodies that enact environmental regulations should be motivated to be more effective. If they are motivated, the country could benefit from proper laws that could prevent it from being used as dumping grounds for polluting goods.

It can also be deduced from the findings that industrialization harms environmental quality in China. Therefore, industries whose operations are not beneficial to the ecosystem of the nation should be shut down. However, industries that have the environment at heart should be allowed to operate. In addition, the government has the power to increase taxes on industries that harm the environment while lowering taxes for those whose operations are eco-friendly. This will entice the dirty industries to switch to eco-friendly operations. Additionally, the country should consider industrial restructuring as one of its key emission mitigation strategies. The argument made by Zhou and Li (2020) that the implementation of industrial restrictive plans is beneficial to the economic advancement and emission reduction objectives of economies supports the above point. It is further important for the authorities to develop policies that could encourage energy efficiency at the industrial level and change the industrial structure of the nation from carbon-intensive to non-carbon-intensive, which is eco-friendly.

Moreover, the country’s green energy generation capacity should be increased to help abate the negative consequences of industrialization. This objective could be attained if the country invests more in technologies, expertise, equipment, and infrastructure linked to the production of green energies. It is further deduced from the findings that financial development damages environmental quality in the country. Therefore, it would benefit the country if financial resources were properly allocated to energy initiatives and sources that are environmentally friendly. The government should also formulate strict rules to compel banks to provide funding for projects that are not eco-friendly. In addition, financial organizations that engage in activities that harm the environment should be heavily taxed. This would force them to adopt eco-friendly practices.

Moreover, economic growth harms environmental quality in China. Therefore, authorities should ensure that economic activities undertaken in the nation are friendly to the environment. Since economic advancement activities are mostly driven by establishments, the adoption of clean energies by these establishments could play a major role in the emission mitigation agenda of the nation. The entities should not only adopt clean energies but should also embrace green and energy-efficient technologies in their operations. Following Udemba and Yalçintaş (2021), subsidies, such as tax cuts and price controls, should be considered for sectors that specialize in the manufacturing and assembly of renewable energy sources. This will help boost production and, subsequently, economic growth.

In addition, urbanization deteriorates environmental quality in China. Therefore, authorities should enact regulations to promote sustainable urbanization in the country. In addition, the condition of people living in rural areas of the country should be improved. This will decrease the movement of people to cities where they perceive that they could get better standards of living. Additionally, if communities in the country offer residents the fundamental infrastructural amenities that could influence people to migrate to urban centers, the level of urbanization in the nation will witness a massive reduction. The above point aligns with the findings of Majeed and Tauqir (2020), who reported that the harmful effects of urbanization on an economy could be lessened if balanced development in both urban and rural areas is carried out.

Finally, since the interactions between financial development and foreign direct investment and between financial development and industrialization increase pollutant emissions in China, policies or strategies that can help improve financial development, foreign direct investment, and industrialization without harming environmental sustainability should be formulated and implemented. Generally, the requirements outlined in the Paris Agreement (2015) and other agreements should be strictly followed. This would make the country environmentally sustainable. In addition, increasing monitoring of the environment, enforcing strict environmental regulations, and increasing public awareness on the benefits of environmental quality could help reduce pollution in China. Finally, the development and implementation of green policies across the country should involve active participation from all stakeholders.

6 Limitations and suggestions for future research

The limitations of this study cannot be underrated. Data constraints confined the study to the period 1990–2018. Specifically, most of the variables did not have data before 1990 or after 2018. Therefore, using 1990 as the base period and 2018 as the end period, the period 1990–2018 was appropriate for the analysis. We therefore suggest that when more data become available, similar studies should be conducted to authenticate the study’s outcomes. Methodologically, the study was confined to the FMOLS, DOLS, and CCR econometric techniques. Care should be taken in interpreting the results because the adoption of other econometric methods could have yielded varied outcomes. For comparative purposes, we recommend the application of other econometric methods for analyzing the nexus amidst the series in future explorations. Finally, the analysis was confined only to China. Therefore, the results cannot be generalized to all economies around the globe. To validate the robustness of the results, future studies should be expanded to cover more nations in different locations.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found at: https://databank.worldbank.org/source/world-development-indicators.

Author contributions

JY: conceptualization, methodology, writing–original draft. KL: conceptualization and writing–original draft. MM: conceptualization, writing–original draft, and writing–review and editing. LZ: methodology and writing–original draft. YZ: data curation and writing–review and editing. DG: data curation, conceptualization, and writing–review and editing. JN: methodology and writing–review and editing. FS: methodology, supervision, and writing–review and editing. EK: formal analysis and writing–original draft. SC: data curation, formal analysis, and writing–original draft. LY: methodology and writing–review and editing.

Funding

The authors declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

Author KL was employed by Division of State-Owned Enterprise Reform and Innovation and DG was employed by Jiangsu Xinhan Yi Information Management Co., LTD.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

FDI, foreign direct investment; IND, industrialization; GDP, gross domestic product; URB, urbanization; ES, environmental sustainability; FD, financial development; EQ, environmental quality; CO2 emissions, carbon dioxide emissions; ARDL, autoregressive distributed lag; GMM, generalized method of moments; ADF, augmented Dickey–Fuller; PP, Phillips–Perron; WDI, world development indicators; FMOLS, fully modified ordinary least squares; DOLS, dynamic ordinary least squares; SDGs, Sustainable Development Goals; OECD, Organization for Economic Co-operation and Development; SD, standard deviation; VIF, variance inflation factor; GHGs, greenhouse gases; EF, ecological foot print; ASEAN, Association of South East Asian Nations; EU, European Union; PMG, pooled mean group; OLS, ordinary least squares; US, United States; AIC, Akaike information criterion; KPSS, Kwiatkowski–Phillips–Schmidt–Shin; MG, mean group; SSA, sub-Saharan Africa; G20, Group of 20; PHA, pollution halo hypothesis; BRICS, Brazil, Russia, India, China, South Africa; PHH, pollution haven hypothesis; CCR, canonical cointegrating regression; NDCs, nationally determined contributions; ERS, Elliot, Rothenberg, and Stock; ECOWAS, Economic Community of West African States.

References

Abdo, A. B., Li, B., Qahtan, A. S. A., Abdulsalam, A., Aloqab, A., and Obadi, W. (2022). The influence of FDI on GHG emissions in BRI countries using spatial econometric analysis strategy: the significance of biomass energy consumption. Environ. Sci. Pollut. Res. 29, 54571–54595. doi:10.1007/s11356-022-19384-8

Adebayo, T. S., Agyekum, E. B., Kamel, S., Zawbaa, H. M., and Altuntaş, M. (2022). Drivers of environmental degradation in Turkey: designing an SDG framework through advanced quantile approaches. Energy Rep. 8, 2008–2021. doi:10.1016/j.egyr.2022.01.020

Adebayo, T. S., Awosusi, A. A., Kirikkaleli, D., Akinsola, G. D., and Mwamba, M. N. (2021). Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ. Sci. Pollut. Res. 28, 38969–38984. doi:10.1007/s11356-021-13498-1

Ahmad, F., Draz, M. U., Chandio, A. A., Ahmad, M., Su, L., Shahzad, F., et al. (2022). Natural resources and environmental quality: exploring the regional variations among Chinese provinces with a novel approach. Resour. Policy 77, 102745. doi:10.1016/j.resourpol.2022.102745

Ahmed, U., Ilhan, O., Naqvi, SMMA, Ullah, S., and Javed, M. I. (2022). Revealing the nexus between nuclear energy and ecological footprint in STIRPAT model of advanced economies: fresh evidence from novel CS-ARDL model. Prog. Nucl. Energy 148, 104220. doi:10.1016/j.pnucene.2022.104220

Al-Arkawaz, S. A. Z. (2018). Measuring the influences and impacts of signalized intersection delay reduction on the fuel consumption, operation cost and exhaust emissions. Civ. Eng. J. 3, 552–571. doi:10.28991/cej-0309115

Ali, E. B., Gyamfi, B. A., Kwakwa, P. A., and Agbozo, E. (2023a). Transitioning to low carbon economy among OECD countries: do renewable energy, globalization and higher economic growth matter? Energy and Environ. 0 (0), 0958305X2311777. doi:10.1177/0958305X231177746

Ali, E. B., Radmehr, R., Shayanmehr, S., Gyamfi, B. A., and Anufriev, V. P. (2023d). The role of technology innovation, R&D, and quality governance in pollution mitigation for EU economies: fresh evidence from method of moment quantile regression. Int. J. Sustain. Dev. World Ecol. 30 (3), 244–261. doi:10.1080/13504509.2022.2134939

Ali, E. B., Shayanmehr, S., Radmehr, R., Amfo, B., Awuni, J. A., Gyamfi, B. A., et al. (2023b). Exploring the impact of economic growth on environmental pollution in South American countries: how does renewable energy and globalization matter? Environ. Sci. Pollut. Res. 30 (2023), 15505–15522. doi:10.1007/s11356-022-23177-4

Ali, E. B., Shayanmehr, S., Radmehr, R., Bayitse, R., and Agbozo, E. (2023c). Investigating environmental quality among G20 nations: the impacts of environmental goods and low-carbon technologies in mitigating environmental degradation. Geosci. Front. 15 (1), 101695. doi:10.1016/j.gsf.2023.101695

Ali, N., Phoungthong, K., Techato, K., Ali, W., Abbas, S., Dhanraj, J. A., et al. (2022). FDI, green innovation and environmental quality nexus: new insights from BRICS economies. Sustainability 14, 2181. doi:10.3390/su14042181

Amin, A., Ameer, W., Yousaf, H., and Akbar, M. (2022). Financial development, institutional quality, and the influence of various environmental factors on carbon dioxide emissions: exploring the nexus in China. Front. Environ. Sci. 9, 838714. doi:10.3389/fenvs.2021.838714

Appiah, K., Du, J., Yeboah, M., and Appiah, R. (2019). Causal relationship between industrialization, energy intensity, economic growth and carbon dioxide emissions: recent evidence from Uganda. Int. J. Energy Econ. Pol. 9 (2), 237–245.

Appiah, K., Worae, T. A., Yeboah, B., and Yeboah, M. (2022). The causal nexus between trade openness and environmental pollution in selected emerging economies. Ecol. Ind. 138, 108872. doi:10.1016/j.ecolind.2022.108872

Appiah, M., Li, M., Taden, J., Ashraf, S., Tiwari, A. K., and Laari, P. B. (2024). Enhancing natural resource rents through industrialization, technological innovation, and foreign capital in the OECD countries: does financial development matter? Resour. Policy 89, 104520. doi:10.1016/j.resourpol.2023.104520

Aquilas, N. A., Ngangnchi, F. H., and Mbella, M. E. (2024). Industrialization and environmental sustainability in Africa: the moderating effects of renewable and non-renewable energy consumption. Heliyon 10 (4), e25681. doi:10.1016/j.heliyon.2024.e25681

Arogundade, S., Mduduzi, B., and Hassan, A. S. (2022). Spatial impact of foreign direct investment on ecological footprint in Africa. Environ. Sci. Pollut. Res. 29, 51589–51608. doi:10.1007/s11356-022-18831-w

Aye, G. C., and Edoja, P. E. (2017). Effect of economic growth on CO2 emission in developing countries: evidence from a dynamic panel threshold model. Cogent Econ. Fin. 5, 1379239. doi:10.1080/23322039.2017.1379239

Bakhsh, S., Yin, H., and Shabir, M. (2021). Foreign investment and CO2 emissions: do technological innovation and institutional quality matter? Evidence from system GMM approach. Environ. Sci. Pollut. Res. 28, 19424–19438. doi:10.1007/s11356-020-12237-2

Baskurt, B. B., Celik, S., and Aktan, B. (2022). Do foreign direct investments influence environmental degradation? Evidence from a panel autoregressive distributed lag model approach to low-lower-middle-upper-middle-and high-income countries. Environ. Sci. Pollut. Res. 29, 31311–31329. doi:10.1007/s11356-021-17822-7

Bui, D. T. (2020). Transmission channels between financial development and CO2 emissions: a global perspective. Heliyon 6 (11), e05509. doi:10.1016/j.heliyon.2020.e05509

Byaro, M., Mafwolo, G., and Mayaya, H. (2022). Keeping an eye on environmental quality in Tanzania as trade, industrialization, income, and urbanization continue to grow. Environ. Sci. Pollut. Res. 29, 59002–59012. doi:10.1007/s11356-022-19705-x

Ceretta, P. S., and Vieira, M. A. (2021). CO2 emissions: a dynamic structural analysis. Rev. Adm. UFSM St. Maria 14, 949–966. doi:10.5902/1983465963884

Chaouachi, M., and Balsalobre-Lorente, D. (2022). Environmental strategies for achieving a new foreign direct investment golden decade in Algeria. Environ. Sci. Pollut. Res. 29, 37660–37675. doi:10.1007/s11356-021-18149-z

Cohen, G., Jalles, J. T., Loungani, P., Marto, R., and Wang, G. (2019). Decoupling of emissions and GDP: evidence from aggregate and provincial Chinese data. Energy Econ. 77, 1–118. doi:10.5089/9781484351000.001

Corporate Finance Institute (2022). Foreign direct investment (FDI): an international business investment. Available at: https://corporatefinanceinstitute.com/resources/knowledge/economics/foreign-direct-investment-fdi/(Accessed July 26, 2022).

Cui, Y., Zhong, C., Cao, J., Guo, M., and Zhang, M. (2024). Spatial effect of carbon neutrality target on high-quality economic development-Channel analysis based on total factor productivity. Plos one 19 (1), e0295426. doi:10.1371/journal.pone.0295426

Dada, J. T., Adeiza, A., Noor, A. I., and Marina, A. (2022). Investigating the link between economic growth, financial development, urbanization, natural resources, human capital, trade openness and ecological footprint: evidence from Nigeria. J. Bioecon 24, 153–179. doi:10.1007/s10818-021-09323-x

Dagar, V., Khan, M. K., Alvarado, R., Rehman, A., Irfan, M., Adekoya, O. B., et al. (2022). RETRACTED ARTICLE: impact of renewable energy consumption, financial development and natural resources on environmental degradation in OECD countries with dynamic panel data. Environ. Sci. Pollut. Res. 29, 18202–18212. doi:10.1007/s11356-021-16861-4

Danish, K. S. U.-D., and Ahmad, A. (2021). Testing the pollution haven hypothesis on the pathway of sustainable development: accounting the role of nuclear energy consumption. Nucl. Eng. Tech. 53 (8), 2746–2752. doi:10.1016/j.net.2021.02.008

Data Bank (2022). Metadata glossary. Available at: https://databank.worldbank.org/metadataglossary/jobs/series/BX.KLT.DINV.WD.GD.ZS (Accessed July 26, 2022).

Dickey, D. A., and Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74 (366a), 427–431. doi:10.2307/2286348

Dogan, E., and Aslan, A. (2017). Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew. Sustain Energy Rev. 77, 239–245. doi:10.1016/j.rser.2017.03.111

Dornean, A., Chiriac, I., and Rusu, V. D. (2022). Linking FDI and sustainable environment in EU countries. Sustainability 14, 196. doi:10.3390/su14010196

Ehigiamusoe, K. U., Lean, H. H., Babalola, S. J., and Poon, W. C. (2022). The roles of financial development and urbanization in degrading environment in Africa: unravelling non-linear and moderating impacts. Energy Rep. 8, 1665–1677. doi:10.1016/j.egyr.2021.12.048