94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 05 June 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1342557

This article is part of the Research TopicLow-Carbon Economy and Sustainable Development: Driving Force, Synergistic Mechanism, and Implementation PathView all 21 articles

Wentao Li*

Wentao Li* Yujie Wang

Yujie WangAlong with the intensification of global ecological problems, corporate environmental, social, and governance (ESG) issues have attracted extensive attention from the investment community, and solving these issues is crucial for sustainable development. However, little is known about the research on equity structure reform on corporate ESG performance, especially state-owned capital on private firms' ESG performance. To this end, we utilize the panel data of 1,589 privately listed firms in China from 2013 to 2021 to explore the impact of state-owned capital on the ESG performance of private firms. The findings suggest that state-owned capital significantly improves the ESG performance of private firms. In addition, the results of mechanism analysis indicate that state-owned capital stimulates ESG performance through the dual path of improving the mitigation of external financial constraint problems and internal control environment problems. We also find that firms' external environmental shocks enhance the extent to which state capital injection into private firms enhances ESG performance, and these external environmental shocks include the strength of environmental regulation in the region, whether the firms' attribute is that of heavily polluting industries, and the strength of external media attention. In summary, our findings support the conjecture that state capital injection into private firms will be followed by enhanced ESG performance, and the external environment is a factor that influences this process. Our study may provide lessons for the sustainable development of private firms and dig deeper into the internal root causes and external shock factors.

Under the macro-policy requirement where green development has become a universal pattern in China, how enterprises realize high-quality, high-efficiency, and sustainable development has become the wind vane for cultivating core competitiveness (Kassim et al., 2020). ESG comprehensive governance is a development concept that integrates environmental, social, and corporate governance. It puts them in the same comprehensive framework, which elaborates on the unity of product competition, environmental responsibility, and the pursuit of corporate social value (Trahan and Jantz, 2023). With the change in economic model and increase of industrialization, the contradiction between positive environmental externalities, social wellbeing, and reasonable internal governance requirements and the problems of environmental pollution and financial corruption of listed companies is increasing and ESG practices suitable for the current economic development environment have attracted the attention of academia and industry (Khan et al., 2021). In this context, studying the impact of state-owned capital, a special equity, on corporate ESG is an important issue to promote the sustainable development of national economy. State-owned capital is capital held or controlled by the state, and the specific economic objective is usually to satisfy society's public interest and realize the value-added state-owned capital (Maw, 2002). On the one hand, it is expensive to meet the disclosure requirements in order to obtain a composite ESG-score, which is contrary to the goal of value-added state capital; on the other hand, the theory of external stakeholders states that firms must maximize the value of all stakeholders (customers, debtors, employees, shareholders, and the community in which the firm is located), which coincides with the political goal of social stability of state capital. Therefore, without changing the ownership nature of private enterprises, studying the positive and negative impacts of state capital injection into private enterprises on ESG is of excellent research significance for sustainable development of private enterprises and also provides a reference for national high-quality development, which is also the primary concern of this study.

In a broader sense, ESG is viewed as an extension of corporate social responsibility (CSR), reflecting the degree of green transformation and the environmental profile of a company (Debbarma and Choi, 2022) and is gradually being integrated into the long-term strategy of corporate development (Tarmuji et al., 2016). Current research focuses on corporate ESG performance and economic consequences. Some researchers and scholars have found that ESG-scores can alleviate corporate financing constraints, improve internal cash flow (Koller et al., 2019), enhance stock liquidity (Lööf et al., 2022), promote corporate green innovation research and development, and enhance total factor productivity (Deng et al., 2023). Of course, on the one hand, the economic consequences of ESG performance are not all positive, and investors pay a price for making ESG investments, which is not conducive to enhancing firms' performance (Auer and Schuhmacher, 2016). On the other hand, for the issue of influencing factors that promote corporate ESG and urge environmental social responsibility, many scholars have explored the perspectives of micro-corporate governance, meso-industry competition, macro-environmental regulation, etc., and their experimental results show that corporate litigation risk (Freund et al., 2023), socially responsible investment demand (Michelon et al., 2020; Pawliczek et al., 2021), and regional environmental regulation (de Villiers and Alexander, 2014) are all factors that drive corporate ESG performance.

With China's economic transformation, the equity structure of enterprises has gradually changed. Equity mixed reform refers to the existence of different types and interests of equity in the equity structure of an enterprise, where the private capital's shareholding in state-owned enterprises and state-owned capital's shareholding in private enterprises belong to the scope of the reform. Equity reform aims to promote in-depth cooperation between state-owned and private enterprises, to realize the sharing of external resources, the complementary advantages of internal governance, and the coordinated development of enterprise core competitiveness enhancement and performance (Chernykh, 2011; Guriev et al., 2011). Research directly related to this paper argues that state-owned capital balances the multiple business objectives of economic performance and political responsibility fulfillment and that increased investment by state-owned capital in the environment, society, and governance enhances ESG performance of SOEs, which is partly responsible for the economic inefficiency and lack of competitiveness of China's SOEs (Dewenter and Malatesta, 2001); by contrast, private capital injected into state-owned firms is afterward, as a minority shareholder, more likely to collude with SOE executives in pursuit of short-term financial performance (Cheng et al., 2020), and as shareholding increases, private capital considers the long-term development of the firm, mitigating the potential externalities of management shortsightedness. Therefore, as the amount of private capital injected into SOEs increases, the ESG performance of SOEs becomes “U” shaped (Tian et al., 2023). Such studies provide rich insights into the limits of ESG effects of state-owned capital and sustainable development of private firms and confirm that capital structure changes firms' ESG performance.

It is important to note that scholars have explored the enterprise state ownership system (Özcan and Beyond, 2020) and ESG performance consequences (Tian et al., 2023) of private capital injection into SOEs. However, they still have to examine the ESG impact of state capital injection on private firms without changing the ownership of the private firms based on this specific perspective. The business objectives of private enterprises tend to maximize performance, resulting in insufficient motivation to fulfill environmental and social responsibilities, and many private enterprises tend to introduce state-owned equity when they face a difficult transition process. After the introduction of state-owned capital in private enterprises, on the one hand, ESG disclosure and transparency also represent a source of cost for the enterprise, leading to a decline in the profit of state-owned shareholders; this is contrary to the goal of preserving and increasing the value of state-owned capital. On the other hand, ESG activities can create a sustainable business model value for stakeholders, enhance social wellbeing, and improve stakeholder trust and corporate social reputation. This fits to maximize the public value of state-owned capital. The two conflicting views above lead to specific research questions: how does state capital injection into private firms affect corporate ESG performance? What macro- and micro-external factors serve as external heterogeneities of corporate ESG performance? How can private firms improve corporate governance and enhance positive environmental externalities with the help of state capital? In order to clarify these questions, it is necessary to conduct an empirical study based on the conclusions of the relevant literature, combined with the background of the current state capital injection.

This study explores the role of state capital equity participation in promoting the ESG performance of private enterprises and its internal mechanism based on a complete framework. Specifically, this study collects data from domestic private listed companies from 2013 to 2021. It manually organizes 9,941 samples of information related to private firms with state-owned capital stakes, which are obtained from the authoritative Shanghai Huazheng and CSMAR databases. Based on the trend of reforming the equity structure of Chinese enterprises, we empirically demonstrate and reveal the impacts and internal mechanisms of state capital equity, the checks and balances between state capital and private capital on ESG performance of private enterprises and analyze the impacts of heterogeneity in the external environment of enterprises. The conclusion shows that 1) when state-owned capital takes shares in private firms, there is a significant increase in ESG performance of firms and the performance in the three dimensions of environment, social responsibility, and governance. Influenced by political objectives, state-owned capital is more obvious for the enhancement of corporate social responsibility and governance dimensions; 2) given that Chinese firms are at the initial stage of sustainable financial investment, we found that state-owned capital provides sustainable financial investment for firms by alleviating financing constraints and enhancing corporate identity. This is a specific channel through which state-owned capital enhances the ESG performance of private firms; 3) state-owned capital enters private firms as an emerging economy to optimize the original shareholding structure, improve internal control mechanisms, and reduce internal fraud. This is another channel for state-owned capital to enhance the ESG performance of private enterprises; 4) based on the external correlator theory, the degree of improvement of external environmental shocks should be considered on ESG performance, especially under strict environmental regulation and greater media attention.

Compared with the completed studies, the marginal contribution of this study is mainly reflected in the following. First, this study proves that state-owned equity will positively enhance the ESG performance of private firms from the perspectives of macroeconomic trends and structural changes. The synergy between the two will help to enhance the firms' ability to resist financial risks. Unlike the completed research, this paper emphasizes the role of state-owned capital for sustainable development of private enterprises and ownership mixing of private enterprises rather than the mixing of state-owned enterprises. This enriches the research on economic consequences of mixed-ownership reform from the opposite perspective. Second, this paper investigates the internal mechanism of the impact of state-owned equity on ESG of private enterprises. This study finds that state-owned capital partly enhances ESG performance through channels such as alleviating private enterprises' operating capital constraints and improving internal control, which extends the theoretical basis of the factors influencing corporate ESG governance. Third, this paper explores the role of private firms' external factors in enhancing state capital's equity participation and private firms' ESG governance from the perspectives of micro-external media attention, meso-industry nature, and macro-environmental regulation. The exogenous factors of corporate governance, corporate ESG governance, and equity structure are placed in the same framework to analyze the moderating role of exogenous factors in as much detail as possible and to fill the gaps in related research. Fourth, the results of this study have certain practical significance, and under the current goal of focusing on the construction of ecological civilization and high-quality synergistic development of the economy, this paper provides policy insights for private enterprises in developing countries to assume environmental and social responsibilities.

The rest of this article is structured as follows: Section 2 is a literature review with research and hypotheses, in which the motives, specific paths, and possible hypotheses of state-owned capital to stimulate private firms' ESG are described. Section 3 describes the data and methodology and designs of the regression model. Section 4 provides the results of the empirical study and conducts rigorous endogeneity and robustness tests. Section 5 verifies the mediating role of internal control and financing constraints. In Section 6, the impact of the external environment is considered as much as possible to investigate the heterogeneous impact of external environmental shocks. Section 7 provides the economic consequences of synergies between state-owned equity and corporate ESG. Section 8 is the conclusion and policy implications section of this study, while Section 9 is the limitation section of the study.

At the beginning of the 21st century, after China proposed that “the market should play a decisive role in the allocation of resources,” the proposal to develop a mixed-ownership economy attracted extensive discussion in both academic and practical circles (Bortolotti et al., 2002). Based on the theory of property rights (Hart, 1995), the theory of government intervention (Shleifer and Vishny, 1997), and so on, scholars mainly focus on the study of the economic consequences of the introduction of non-state capital in state-owned enterprises (Megginson et al., 1994), and the results of this research provide a reasonable basis for equity ownership reform to explore the direction of policy optimization. However, all the studies focus on introducing private capital into state-owned enterprises. However, few focus on the economic consequences of entering state-owned capital into private enterprises.

So how exactly does state capital affect private firms? The few existing literature works have made valuable explorations of the external financing problem of private enterprises from the perspectives of financial structure (Beck et al., 2008), finance company function (Stein, 1997), political affiliation, and credit discrimination (Cull et al., 2015), and other perspectives on the external financing of private firms have been valuable explorations; in addition, in terms of internal business risks, state capital plays the role of supervising private firms by suppressing irregularities (Firth et al., 2009; An et al., 2018), increasing the possibility of scrutiny, and mitigating internal governance problems in order to reduce the business risks of firms.

One-sidedly, research on the economic consequences of state-owned capital for private enterprises has focused more on the factors that can ease the external financing constraints of enterprises and factors that can improve the internal governance of companies that lack a thorough analysis of how to promote the improvement of the environment and social wellbeing of private enterprises. However, without an answer to the question of “whether it could have an impact,” the study of “what factors” will only be one-sided.

The concept of ESG, which originated from ethical and responsible investing, is a comprehensive indicator that measures the rights and interests of internal and external stakeholders of an enterprise and requires enterprises to strive to balance the relationship between internal governance, the environment, and the society in the course of business. Currently, more research is focused on the impact of the ESG system on corporate development in a different areas of management. Regarding environmental and social responsibilities, scholars have studied corporate social responsibility and reputation (Moser and Martin, 2012; Qiu et al., 2016), intrinsic social capital (Lins et al., 2017), and institutional ownership mechanisms (Dimson et al., 2015). Regarding corporate governance, scholars have thoroughly investigated the perspectives of governance efficiency, information disclosure, and investor returns.

Research on firms' motivations to improve ESG performance can be conducted from macro-, micro-, and intra-firm perspectives: at the macro-national level, institutional theory states that firms are influenced by a wide range of social frameworks and economic factors and that higher levels of national political and cultural institutions improve firms' ESG ratings (Crespi and Migliavacca, 2020); at the domestic regional level, the intensity of environmental regulation and monitoring will also push firms to enhance environmental protection motivation (Chakravarthy et al., 2014), which affects firms' willingness to take on environmental social responsibility (de Villiers and Alexander, 2014); at the micro-level, the party organization internalizes the government's social goals in the corporate organization, which prompts firms to take on more environmental and social responsibilities (Chang and Wong, 2004), and ensures that ESG decision-making is effectively implemented from the root cause; at the firm perspective, good ESG performance reduces the negative externalities of corporate business activities (Cho and Patten, 2007), which is manifested in reducing financing costs (El Ghoul et al., 2011; Goss and Roberts, 2011; Tan et al., 2020), improving innovation output (Ryou et al., 2022), improving corporate information transparency (DesJardine et al., 2021), reducing the risk of regulatory penalties (Baloria et al., 2019), and creating a favorable business environment, which in turn enhances firms' value (Al-Tuwaijri et al., 2004; Dhaliwal et al., 2011; Matsumura et al., 2014) and becomes an incentive to attract firms to improve their governance performance. In addition, the realization of ESG disclosure in developing countries is costly. However, the potential rewards of ESG disclosure seem to outweigh the accounting costs (Fandella et al., 2023). This finding elaborates on ESG disclosure motives from an ex post perspective and overcomes the sample selection bias problem in the empirical evidence.

In summary, the research on the motivation of ESG focuses on analyzing external macro- and micro-factors, resulting in a lack of theory on the impact of equity differences on environmental and social responsibilities and governance of private enterprises; based on this, this study analyzes in depth whether state capital equity participation can play a role in the radiation of political goals and on whether and how it can push enterprises to undertake broader environmental and social responsibilities, to enrich the sustainable development of private enterprises and help realize the goal of green development.

In the modern corporate governance system, the risk of information asymmetry arising from the separation of enterprise ownership and management and the possibility that managers may make business decisions that hurt the enterprise out of their pursuit of personal interests have led to the first type of principal–agent conflict. In the process of the company's operations, the controlling shareholders often regard the company as their own “tunnel” through the abuse of decision-making, transfer of resources, or improper transactions to obtain private interests, to the detriment of the interests of small- and medium-sized shareholders, leading to the second type of principal–agent conflict (Ness and Mirza, 1991); these two types of principal–agent conflict in the private sector are more common. The principal–agent conflict is closely related to the innovation of corporate governance structure, and companies can improve the effectiveness and efficiency of the principal–agent relationship through the innovation of their governance structure (Singh and Davidson, 2003). The process of injecting state-owned capital into private enterprises is actually the dynamic optimization process of the governance structure of heterogeneous capital through the equity game, which realizes the mutual integration and incentive compatibility in equity structure, completes the transformation from external stakeholders to internal stakeholders, and then promotes the innovation of governance structure of private enterprises.

Based on the embedding theory, the government–enterprise relationship in contemporary China is an implicit contractual relationship in which the government uses resource allocation to incentivize enterprises to realize specific economic and non-economic goals. The specific economic objectives of state-owned capital are usually to satisfy social public interests, support scientific and technological innovation, and safeguard national security and social stability; at the same time, as the bearer of state property, value preservation of state-owned capital is an important task for the protection of the security of state property. Value-added state-owned capital is essential for accumulating national wealth (Maw, 2002). The dual diversification mechanism of business objectives and the capital value preservation and appreciation requirement make state-owned capital face more political pressure (Jin et al., 2008). With the injection of state-owned capital into private enterprises, the ultimate control of the enterprise is not transferred; the pursuit of value maximization is still the controlling shareholder's pursuit of business objectives, which coincides with the goal of value preservation and appreciation of state-owned capital (Friedman, 2007); therefore, through the optimization of equity governance structure to enhance the level of corporate governance, it has become a common demand of the state-owned capital and private enterprises. As a representative of internal stakeholders, especially small- and medium-sized shareholders, on the one hand, state-owned capital, as a political factor input, requires private enterprises to establish a sound internal control mechanism, which includes risk management, internal auditing, and compliance monitoring, in order to ensure sound operation and risk prevention and control capabilities. This will help reduce internal fraud and prevent major shareholders from obtaining personal benefits through abusive decision-making, transfer of resources, or improper transactions. On the other hand, state-owned capital can actively promote the organization of small- and medium-sized shareholders or appoint representatives of small- and medium-sized shareholders to the board of directors, optimize the structure of directors, promote the establishment of a sound information disclosure system by enterprises, provide comprehensive and accurate financial and operational information, strengthen the voice of small- and medium-sized shareholders in the board of directors' strategy formulation and operational decision-making process, and ensure that outside investors have a comprehensive understanding of the company's operations and decision-making process (Yang et al., 2023). According to the inference, the state-owned capital, as a stakeholder in the development of the enterprise, can improve the level of corporate governance by optimizing the shareholding structure of the company and perfecting the internal control system and alleviate agency problems of “shareholders–creditors,” “major shareholders–minor shareholders” and “major shareholders–minor shareholders.” Small shareholders” and “shareholder–creditor” agency problems thus improve the management performance of private enterprises (Joh, 2003) and realize the common management objectives of both parties.

H1. State-owned capital stakes in private firms enhance corporate ESG governance performance.

H2a. State-owned capital stakes in private firms enhance corporate ESG performance by improving internal controls.

In the enterprise external environment—social responsibility, enterprises face the reality of green research and development, energy saving and environmental protection transformation, and other capital investment; however, such an investment cycle is long, with low returns, high opportunity cost, and poor economic efficiency (Meng and Wang, 2020); when enterprises face a macroeconomic downturn, individual production costs rise to enterprises operating in financial distress, it will reduce the willingness of the independent inputs. Enterprises facing macroeconomic downturns and rising individual production costs will be less willing to invest independently. When external supervision or regulation is intense, the willingness of enterprises to undertake environmental and social responsibilities will be further strengthened. Reducing environmental pollution and realizing green ecological goals are part of the non-economic goals of state-owned capital. Therefore, to realize the transformation of corporate environmental profitability, the relevant state departments must be guided by macro policies and capital market reforms.

This study concludes that the guiding effect of state-owned capital on private enterprises' assumption of environmental and social responsibilities is mainly reflected in the two aspects of enhancing the willingness to undertake and alleviating the resource dilemma. In terms of willingness to undertake, the entry of state-owned capital not only is a recognition of the strength of private enterprises but also represents the supervision and guidance of enterprises at the state level. Within the company, state-owned capital enters the corners where government supervision fails through equity to enhance the identity of private enterprises. State-owned capital, as a stakeholder in the development of the enterprise, can enhance the enterprise's awareness of environmental protection and promote the innovation and practice of environmental protection technology through the cooperation and joint efforts of the enterprise and private enterprises. This kind of supervision and guidance can push enterprises to undertake environmental and social responsibilities more actively and realize the goal of sustainable development. Externally, the participation of state-owned capital in private enterprises will send a positive signal, and such participation will help enterprises build an excellent social reputation and enhance their visibility (Zou and Ma, 2023). The partnership between enterprises and state-owned capital will attract the attention of environmental organizations and the public (Guo and Lu, 2021). It will provide a means of supervision through the news media, environmental letters and visits, and legal assistance to ensure that enterprises fulfill their environmental responsibilities and move toward green and sustainable development. Under such supervision, enterprises have to take necessary measures to fulfill their environmental responsibilities and safeguard the interests of the society and the rights and interests of the public. In alleviating enterprises' resource dilemma, when enterprises undertake environmental and social responsibilities for supply chain transformation and face considerable financing constraints, they will face the dilemma of market industry competition, high investment, and low returns on environmental and social responsibilities, which would limit the development of enterprises. According to the signaling theory, state-owned equity participation conveys the signal that private enterprises have a certain degree of strength, advocates the active fulfillment of social responsibility, enhances the social status of private enterprises, attracts more customers and investors, helps enterprises to obtain more resources to support them, and increases the cash flow of the company, which significantly reduces the cost of debt financing for private enterprises and increases the scale of debt financing (Al-Tuwaijri et al., 2004; Rahaman et al., 2020), thus providing more favorable production conditions for enterprises to meet the financial requirements of production and business activities and environmental and social responsibilities. Based on the above analysis, the research hypothesis is proposed.

H2b. State-owned capital stakes in private firms enhance corporate ESG performance by alleviating external financing constraints.

This study selects privately listed Chinese A-share companies for 2013–2021. In order to avoid the interference of outliers, the data are screened as follows: 1) Excluding the samples of ST, *ST, and delisted companies; 2) excluding the financial companies; 3) excluding the companies with missing values of the main variables during the sample period; 4) in order to eliminate the influence of extreme values, the variables are subjected to winsorizing at the upper and lower 1% quartiles. After the collation, 1,623 listed companies totaled 9,941 samples.

There are four sources of data in this study. The ESG evaluation data come from the Shanghai Huaxin Evaluation System, which adopts a combination of quarterly periodic evaluation and dynamic tracking for data adjustment, with strong timeliness, and the index can cover all the A-share listed companies with strong representativeness. The ESG data robustness test data come from hexun.com, which also adopts a professional evaluation system and is China's most widely recognized ESG testing website. One of the more recognized ESG rating agencies in China. The calculation of the regional marketization index in the macro control variables is based on the yearbooks of provinces and statistical bulletins of prefectural cities. At the same time, the data on state-owned capital participation and the rest of the data are from companies' annual reports in the CSMAR database.

There is no uniform academic definition of ESG at the international level. However, many institutions and organizations share a common focus on corporate ESG practices and are committed to a consistent framework despite different systems.

In this study, we consider the authority of China's ESG rating agencies and choose the Huazheng rating system to characterize the ESG (ESG-score) performance of private companies. Specifically, the first-level indicators of Huazheng's ESG information assessment system contain three dimensions: environmental (E-score), social (S-score), and corporate governance (G-score), with each dimension rated as C-AAA totaling nine grades, and the composite scores of the three dimensions are used as proxies for the company's comprehensive ESG performance. The assignment method is used to assign a value of 1–9 to C-AAA, and in order to avoid the problem of ESG-score data being too large, the logarithmic approach of plus 1 is used for measurement. In order to exclude the sample selection problem brought about by the database selection problem, company ratings from hexun.com are used in the robustness test section.

This study manually organizes the types and nature of shareholders of the top 10 companies, with 2,885 listed in China. The identified shareholders include the state, state-owned legal persons, domestic natural persons, foreign legal persons, and others. The amount of shareholders' participation in the top 10 affiliated shareholders was combined. If the state or state-owned legal person retains less than 50% ownership, it is considered a private enterprise (Özcan and Beyond, 2020).

The nature of the shareholders in the top 10 legal persons of the enterprise, which are state or state-owned legal persons, will have a practical decision-making impact on the enterprises that have taken shares. In this study, the value of the samples with the presence of state-owned shareholders in the top 10 shareholders of the private enterprises (State1) will be taken to be 1. The value of the samples will be taken to be 0 if otherwise.

Furthermore, based on the Company Law of the People's Republic of China, shareholders who individually or collectively hold more than 10% of the company's shares can request to convene an extraordinary shareholders' meeting within 2 months, or they can convene and preside over the shareholders' meeting on their own. Therefore, this study hypothesizes that private firms can participate in corporate management and decision-making more when their state-owned capital injection exceeds 10% of the total holding (Liu et al., 2023). The sample of private firms whose top 10 shareholders' state-owned capital holdings (State2) are more than 10% of the total holdings will take the value of 1. Otherwise, it will take the value of 0. The State2 sample is built on top of the State1 sample, which is more stringent than the State1.

In addition, this study also uses the ratio of state-owned shareholders to non-state-owned shareholders in the top 10 shareholders (State3) to measure the relative strength of state-owned capital and private capital, and the larger the indicator, the higher the degree of checks and balances of a different nature of shareholdings in the mixed-system reform.

From a cross-sectional perspective, this study manually reviews and matches 200,000 pieces of information from the CSMAR database, which include information on equity background and management adjuncts, then cross-matches the information with the types of equity held by the top 10 shareholders. The study also added missing information by cross-checking with the official annual reports of listed companies. By doing so, this study determines the reliability and completeness of the research data. In addition, this study uses the presence of state-owned shareholders in the top 10 shareholders and whether the shareholdings of such shareholders exceed 10%—two dummy variables that will enhance the robustness of the test results.

At the macro-level, the methodology of Xin and Xin (2017) and Song et al. (2024) was adopted, using the provincial marketization index as a control variable, which included the combined relationship between government and market relationships, the development of the non-public economy, the degree of development of product markets, the degree of development of factor markets, and the development of market intermediary organizations and the legal institutional environment. The index is derived from the Marketization Index of Chinese Provinces—the National Economic Research Institute (NERI) report compiled by Wang et al. (2017), which provides the most authoritative information currently available to Chinese scholars to assess the degree of marketization and has been widely used to investigate the external impacts of firms in different situations; in addition, concerning previous studies (Tian et al., 2023; Zhang and Zhao, 2023) at the firm level, this study incorporates firm size (Size), the number of years since listing (Age), the gearing ratio (Lev), the net profit margin of assets (Roa), growth, the proportion of fixed assets (Fixed), the value of Tobinq (TobinQ), the proportion of independent directors (Indep), and whether it is audited by the Big Four (Big4) accounting firms, which are considered to be potentially influential. The specific measurements are shown in Table 1.

In order to test the impact of state-owned capital investment on the environmental, social responsibility, and corporate governance performance of private enterprises, this paper sets model (1) as follows:

where ESGi,t denotes the ESG composite score (ESG-score) and sub-scores (E-score, S-score, and G-score) for observation i in period t; α0 is a constant term; Statei,t (State1 and State2) denotes the true decision-making power and the degree of checks and balances of the state-owned capital in the private firms in period t; Controlsi,t denotes a series of control variables as mentioned above; ∑Industry denotes the industry fixed effect; and ∑Year denotes the year fixed effect εi,t denotes the error variance term.

The results of the descriptive statistics and correlation analysis of the variables after shrinkage treatment are shown in Table 2. The results show that the mean value of ESG-score is 1.561 (corresponding to a sample standard deviation of 0.265), corresponding to an average score value of BB, which shows that the overall ESG performance of private enterprises is still good and also indicates that there is a large difference between different companies. The mean value of State2 is 0.038, with a standard deviation of 0.089, which preliminarily indicates that there are various forms of state-owned capital participation, but the basic forms of participation are small- and medium-sized shareholders.

As shown in Table 3, the correlation analysis shows that the ESG total score and sub-scores are significantly and positively correlated with State1 at the 1% level and State2 at the 5% level, which initially confirms that the research hypothesis H1 is correct. This study also used the variance inflation factor (VIF) method to test further that the variance inflation coefficients of each explanatory variable were below 1.60, and the baseline regression model did not have serious multicollinearity.

In order to thoroughly test the hypotheses, this study carries out the estimation of model (1) using a three-dimensional fixed-effects panel regression. Table 4 reports the test results of state-owned capital participation on ESG performance of private firms; specifically, columns (1)–(4) use the presence of state-owned shareholders in the top 10 shareholders (State1) as the core explanatory variable to test the ESG performance of private firms and the system's three-dimensional environmental (E-score), social (S-score), and corporate governance (G-score); columns (5)–(8) use the three-dimensional fixed-effects panel regression to estimate model (1) score and corporate governance (G-score); columns (5)–(8) use the top 10 shareholders with more than 10% of state-owned capital (State2) as the core explanatory variable, the rest of the explanatory variables and control variables are consistent; columns (9)–(12) use the checks and balances between state-owned capital and private capital (State3) as the core explanatory variable; columns (9)–(12) use the checks and balances between state-owned capital and private capital (State3) as the core explanatory variable, the rest of the explanatory variables and control variables are consistent. The test results show that the estimated coefficients of E-score, S-score, G-score, and ESG-score are all significantly positive at the 10% level or lower, indicating that the actual participation of state-owned capital in the management of private firms and the checks and balances between state-owned capital and private capital enhance the enterprises' commitment to the environment and social responsibility and improve the level of corporate governance. Meanwhile, in multiple benchmark regression results, the significance of the control variables and the direction of the estimated coefficients are basically the same, which initially indicate that the regression results are robust, the results are relatively reliable, and hypothesis H1 is confirmed. On the one hand, state-owned capital enhances the willingness of private enterprises to undertake environmental responsibility and social empowerment and stimulates enterprises to make sustainable investments and actions; on the other hand, state-owned capital ensures the sound operation and risk prevention and control ability of enterprises, which help to reduce internal fraud and improve ESG performance.

According to Table 4—columns (1)–(3), (5)–(7), and (9)–(11) of the regression results—the three sub-dimensions of environmental, social, and governance of state-owned enterprises are analyzed in depth. In the above nine columns, the coefficients of the independent variables are significantly positive at the 10% level or below, except for State3. Thus, state capital participation and checks and balances provide comprehensive rather than partial incentives to private firms. If we focus on the sub-dimension coefficients, the effect of state capital participation on corporate social responsibility and governance shows the most significant performance, probably because the ring political objective of state capital imposes more political and regulatory pressures, and the participation of state shareholders leads to more targeted ESG-enhancing strategies, and a greater tendency to take socially sensitive actions in response to the concerns of the government and investors. At the same time, state-owned shareholders ensure sound business operations and risk prevention and control capabilities, which will help reduce internal fraud and prevent large shareholders from enhancing internal corporate governance through abusive decision-making. As a result, we find more nuanced evidence in support of hypothesis H1.

ESG is a sustainable “substantive innovation,” and our study affirms the positive significance of equity heterogeneity on ESG performance, which positively affects firms' empirical innovations. The introduction of state capital as a form of equity heterogeneity improves firms' ESG good practices, promotes sustainable development, and realizes the integration of firms' environmental, social, and economic effects.

This study focuses on the following types of endogeneity issues to improve the findings' robustness.

This study focuses on explaining the role of the introduction of state capital in promoting the ESG performance of private firms, and the results of the test above indicate that the two have a positive correlation, but not enough to solve the reverse causality problem, i.e., private firms attract the attention and recognition of state capital and carry out the act of injecting capital because of their environmental and social responsibilities; another possible explanation is that good internal firms can better protect the interests of internal shareholders and attract the injection of state capital in order to realize the goal of value preservation and appreciation. In order to preliminarily rule out the reverse causality problem, this part swaps the core explanatory variable (State1) with the explanatory variable (ESG-score) and carries out a regression of the core explanatory variable (State1) for multiple future periods. The results of the test, as shown in Table 5, indicate that there is a relationship between the ESG performance of private firms and state capital injection in the future period, but the relationship disappears completely in the second period and beyond. The test of lagging the core explanatory variables for multiple periods can only preliminarily rule out the problem of reverse causality, but a more rigorous test is still required.

This section further conducts a reverse causality problem test using the two-stage least squares method, using the number of broadband port accesses (Inter) in the prefecture-level city where the private enterprise is registered to characterize the level of the number and as an instrumental variable. The rationale for its use lies in 1) correlation: the development of the digital level is often cross-industry and cross-discipline and requires synergistic cooperation among enterprises. State-owned capital's equity participation in private enterprises can promote public–private cooperation, realize industry synergies, and jointly open up markets in the field of digital economy. At the same time, private companies are often innovative and agile in digital transformation, making them attractive investment targets. 2) Homogeneity: there is no empirical evidence that the number of broadband port accesses in the region drives private firms environmental and social responsibility-taking and governance performance. A weak instrumental variables test shows that the Cragg–Donald Wald F-statistic is 13.5059, while the critical value of 15% for the weak instrumental variables test is 8.96, which rejects the original hypothesis of weak instrumental variables at the 15% level. Therefore, the number of broadband port accesses (Inter) satisfies the correlation and homogeneity requirements. The test results of the instrumental variable method are shown in Table 6, and the results of the two stages of the instrumental variable are significant at 1% and 5% levels, respectively, which indicates that the hypothesis does not have the problem of reverse causality among variables, and hypothesis H1 is still valid.

As the pillar industries in different provinces of China are fundamentally different, and there will be differences in industrial organizations, technological levels, resource endowments, etc., the environmental and social problems will also be different. Therefore, firms in different regions should formulate appropriate environmental social responsibility strategies and objectives based on local characteristics and environmental issues. This part further controls the province effect (Pro) in the model to eliminate the performance of geographical variable differences affecting the impact of state-owned capital equity on corporate ESG performance. The test results are shown in columns (1) and (2) of Table 7. After controlling for the province effect (Pro), the core explanatory variables state-owned capital actual management (State1) and state-owned capital–private capital checks and balances (State2) are still significant at the 1% level, which indicates that hypothesis H1 is still valid after controlling for the problem of omitted variables.

ESG may be affected by political pressure from domestic “dual carbon targets.” In 2020, China formally proposed at the 75th session of the UN General Assembly to achieve peak carbon by 2030 and carbon neutrality by 2060, and the political pressure from dual carbon targets may affect ESG. Therefore, this study constructs a DID model to address the endogeneity problem that may result from the pressure of this target. First, the time of the shock is defined. This part uses 2020, the year that the dual carbon target was proposed, as the exogenous time—with 2020 and the subsequent year post-defined as 1 and the previous year as 0. Second, State1 itself is the within-group variable, which is cross-multiplied by post to form the State1*post DID variable, and the rest of the control variables, as well as the industry year fixed effects, are consistent with the central regression part. The results of the DID regression test are shown in Table 7. The test results given in column (3) of the table show that the DID variable is significantly positive (at least significant at the 10% level), confirming the robustness of the H1 findings.

According to the descriptive statistics, only some private enterprises have state capital, and the state capital is small- and medium-sized equities, which fail to constitute the actual control of the enterprise, so there may be endogeneity problems caused by differences in sample selection. Based on this, the propensity score matching (PSM) is used to test endogeneity; first, based on the existence of state-owned capital in the top 10 shareholders of private enterprises, 1 or 0 assignment; second, the control variables consistent with the primary regression are selected, and the logit model is used to estimate the propensity scores of whether the state-owned capital of the enterprise is as the top 10 shareholders; third, the nearest-neighbor matching method is used to estimate the propensity scores of whether the state-owned capital is as the top 10 shareholders of the enterprise. Finally, the 1:1, 1:2, 1:3, 1:5 nearest-neighbor matching method is used to find the control group for whether the state-owned capital is in the top 10 shareholders, and the data obtained after matching are subjected to a regression test. The results are shown in Table 8; with the increase in the number of matches, both State1 and State2 are significant at a 1% level, confirming that H1 of this study is valid.

In order to avoid possible pseudo-regression and multicollinearity problems in the baseline regression model, this part further adopts the first-order difference model for the regression analysis; specifically, the each of the variables in model (1), and control variables are used to generate the new change variables by subtracting the previous terms from the latter terms. The test results are shown in Table 9.

The data of this study mainly come from the Huazheng data evaluation system, which is authoritative but partially different from other rating agencies. Therefore, this part is replaced by hexun.com ESG comprehensive evaluation database, which has the same professional evaluation system. The hexun.com also categorizes the ESG performance ratings of companies into C-AAA totaling nine grades, using the assignment method of assigning values from 1–9 to C-AAA and using the plus 1 logarithmic approach for measurement. The ESG performance rating of hexun.com (ESG-HX) is taken as the explanatory variable. The actual management of state-owned capital (State1) and the checks and balances between state-owned and private capital (State2) are the core explanatory variables. Regression tests are conducted using the same control variables and fixed effects as above. The results, as shown in Table 9, show that after replacing the corporate ESG performance rating database, the core explanatory variables are still significant at the 1% level, and the conclusion of hypothesis H1 is valid. In addition, this part also uses the cumulative shareholding of Chinese capital in the top 10 shareholders and State4 to test the relationship between the proportion of state-owned shareholdings and corporate ESG performance. The results, as shown in Table 10, are still significant at the 1% level after replacing the core explanatory variable measure, and the conclusion of hypothesis H1 is robust.

In addition, this part also uses the proportion of the sum of Chinese capital holdings of the top 10 shareholders of the firms (State4) to characterize the state-owned capital holdings and test the relationship between the proportion of state-owned capital holdings and the firms' ESG performance. The results, as shown in Table 9, are still significant at the 1% level after replacing the core explanatory variable measure, and the conclusion of hypothesis H1 is robust.

Reasonable internal control is the core factor that directly enhances the ESG performance of enterprises. Based on the objective of capital preservation and appreciation, state-owned capital requires private enterprises to establish sound internal control mechanisms and more robust accounting policies to ensure sound operation and risk prevention and control. At the same time, state-owned capital, as the small- and medium-sized shareholder and external regulator, appoints representatives of small- and medium-sized shareholders to the board of directors, optimizes the structure of the directors, reduces the short-selling behavior of significant shareholders, and suppresses the surplus management of private enterprises, which improves the environment for internal control of enterprises.

Based on the above analysis, this study chooses the internal control evaluation index (In_mana) as the channel test index, which is based on the degree of realization of the five objectives of internal control compliance, reporting, asset safety, operation, and strategy to design the primary index of internal control. At the same time, the internal control defects are used as the corrective variables, and finally, the internal control that comprehensively reflects the level of listed companies' internal control and the ability of risk control is formed. The larger the index, the better the company's internal control environment. In order to test the path hypothesis in H1, the testing procedure in this study applies a three-step approach to test the mediation mechanism, using the Stata “sgmediation” command to implement the Sobel test to test the mediation effect (MacKinnon, Lockwood, Hoffman, West and Sheets, 2002). Models (1)–(3) were set up to test hypothesis H2a.

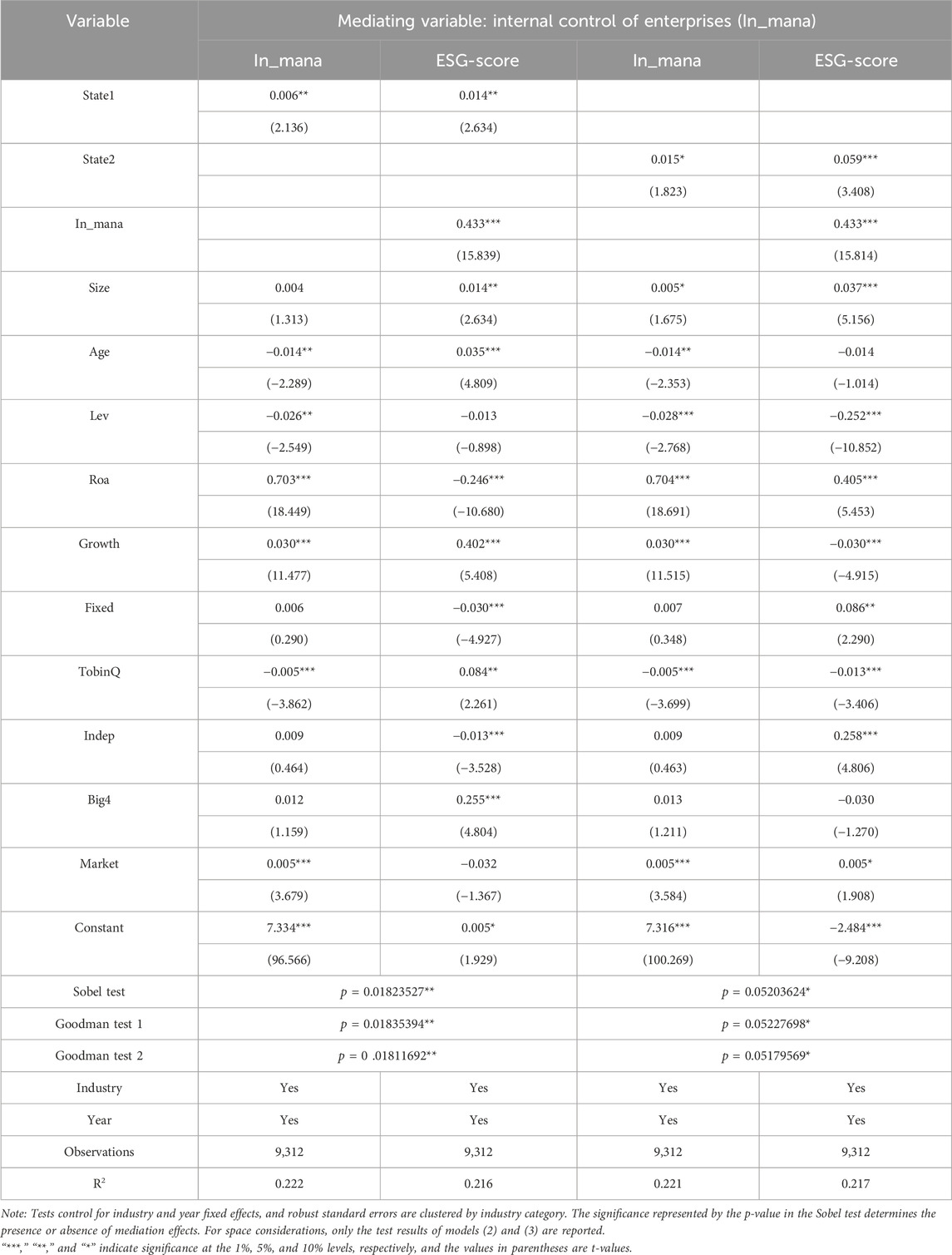

The test results of models (2) and (3) are shown in Table 11. The results show that the presence of state-owned shareholders (State1) in the top 10 is positively related to the internal control rating of enterprises at the 5% level, indicating that state capital participation helps private enterprises improve the internal control environment. The presence of state-owned major shareholders (State1) and the internal control rating index (In_mana) are positively related to corporate ESG at the 5% significant level, indicating that state capital participation exerts governance effects and improves the internal control environment of private firms, thus improving their ESG performance, and hypothesis H2a is confirmed.

Table 11. Mechanisms of state-owned equity influence on ESG performance: improving internal controls.

The multiple business objectives of state-owned capital dictate that it pays more attention to the synergistic development of the environment, society, and governance. State-owned capital advocates enterprises' fulfillment of environmental and social responsibilities to enhance their legitimacy. Existing studies have shown that private firms' introduction of state-owned capital and good political interactions with the government will enhance their legitimacy and help them meet the government's and stakeholders' expectations, thus gaining access to more critical state resources. At the same time, state capital endorses the behavior of private firms to enhance corporate reputation, reduce policy discrimination, attract more external investors, increase cash flow, and alleviate financing constraints.

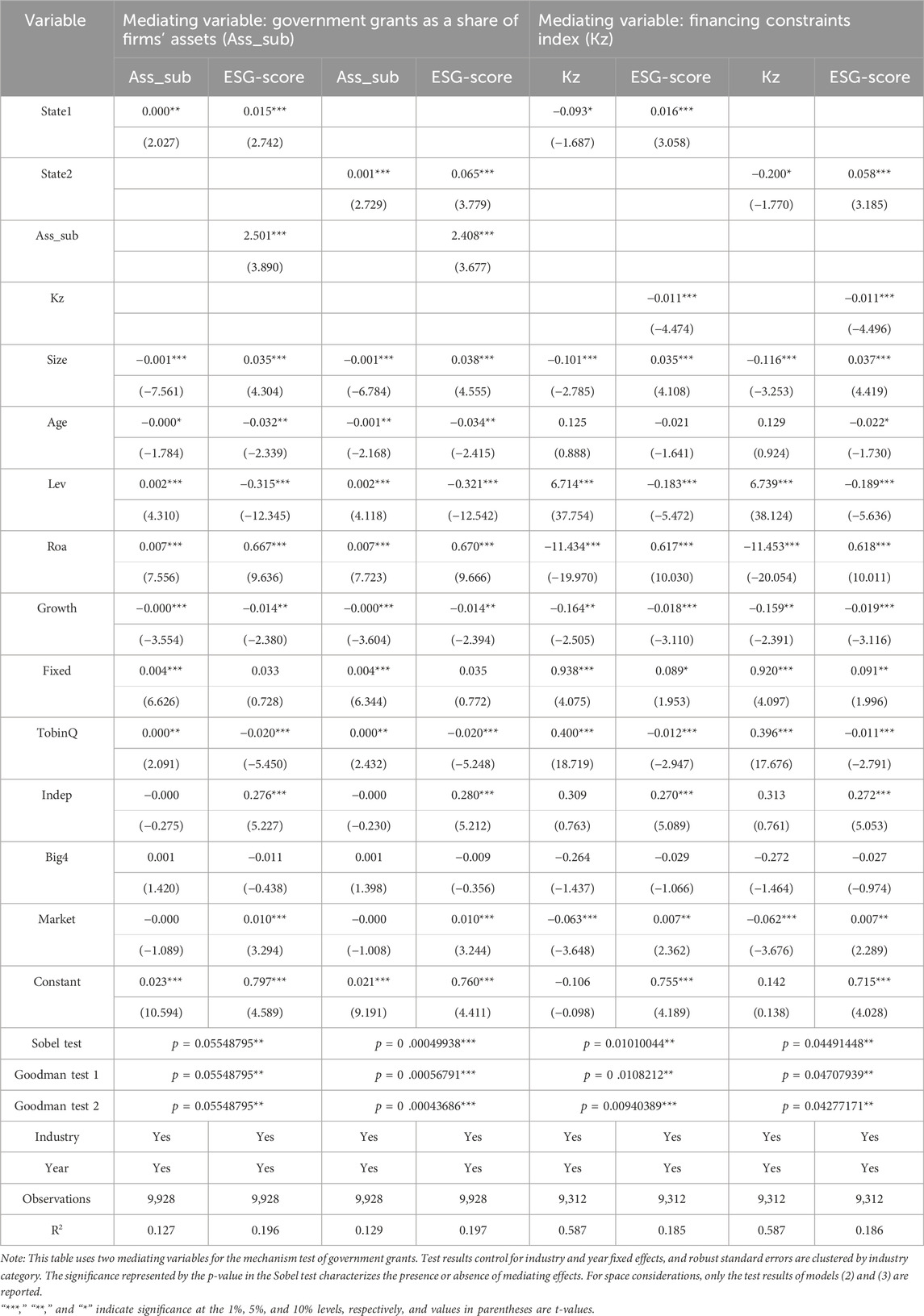

Based on the above analysis, this section examines the mechanism of state-owned capital participation in the ESG performance of private enterprises from two aspects: government subsidies and financing constraints. The level of government subsidies is characterized by the proportion of government subsidies to enterprise assets (Ass_sub); the external financing constraints of enterprises in the current year are characterized by the KZ index (Kz), and the larger the index is, the larger the external financing constraints of the enterprises are. In order to verify the path hypothesis in H1b, the test program of this study applies the three-step method to test the mediation mechanism, using the Stata “sgmediation” command to implement the Sobel test to test the mediation effect. Setting models (1), (4)–(7) to test the channel of state capital injection on the financial constraints of private enterprises, confirming hypothesis H2b.

The test results of models (4)–(7) are shown in Table 12, and the results show that state-owned capital stockholding indirectly enhances the ESG performance of firms by alleviating external financial constraints, and hypothesis H2b is valid.

Table 12. Mechanisms by which state equity participation affects ESG performance: easing financing constraints.

The regression results above show that state-owned capital injection into private enterprises will positively promote their ESG performance and is realized through improving the internal control environment and alleviating corporate capital constraints. However, at the same time, the factors affecting corporate governance and environmental responsibility include internal control, resource constraints, other factors, and external stakeholders such as the government, the media, and industry competition (Clarkson et al., 2004). External stakeholders put different requirements on corporate ESG performance based on their demands. Under different external environments, is there a difference in the role of state-owned capital injection in enhancing ESG performance? To address the above issues, this part attempts to carry out the study from the macro exhaustively, micro- and meso-industry perspectives outside the enterprise, explicitly selecting macro-regional environmental supervision, meso-industry environmental pollution attributes, and micro-enterprises receiving media attention to test for heterogeneity.

As an important role in macroeconomic regulation, regional policy plays an unignorable role in resource allocation. With the continuous promotion of ecological civilization construction, the government pays more and more attention to the ESG performance of listed companies, and the regional environmental regulation carried out by the government will impact the assumption of environmental responsibility by enterprises. Strict environmental regulation requires firms to pay more attention to environmental protection and minimize adverse environmental impacts to ensure that their operations comply with regulations and standards. Firms may have to invest more resources in environmental management and protection measures (Downar et al., 2021). In addition, environmental regulation mandates corporate transparency and reporting mechanisms to increase firms' environmental responsibility. Firms have to report their environmental data and performance promptly and accurately. This open and transparent requirement can drive firms to be more proactive in adopting environmentally friendly measures and improving their ESG performance (Qian and Schaltegger, 2017).

Regional environmental regulation aims to save energy and reduce regional environmental pollution, so this section uses carbon emissions to characterize the intensity of regional environmental regulation. This section uses carbon emissions to characterize the intensity of regional environmental regulation. Furthermore, based on the carbon dioxide emissions of the provinces (municipalities directly under the central government) where the enterprises are located, the provinces with carbon emissions higher than the median value are classified as high carbon emission regional groups, and vice versa, and the test based on the above groupings is shown in Table 13.

The reported results show that when the carbon emissions of the region where the enterprises are located are high, the comprehensive ESG performance (ESG-score) is significantly and positively correlated with the index of state capital participation (State1 and State2) at the 1% level, and the assessment index is significantly higher than that of the region where the carbon emissions are low. Meanwhile, in the cross-sectional analysis of State1 and State2 by introducing the cross-section term, the Chow test values were calculated to be 5.98 and 5.85, respectively, and the p-values were 0.000, which were significant at the 1% level, indicating that the differences between the two groups were significant. In regions with greater environmental regulatory intensity, state-owned equity is more likely to enhance the ESG governance performance of private firms significantly.

Corporate industrial activities significantly contribute to environmental pollution, and heavily polluting industries face environmental pressures from stakeholders such as the government, media, and residential community, which may motivate heavy-polluting industries to invest in ESG aspects. Specifically, due to the nature of industrial activities, heavy-polluting industries tend to have higher carbon emissions, face higher environmental penalties such as emission permits and differential electricity tariffs along with public opinion pressure from the residential community, and have investors who will demand higher returns to compensate for the potential risks (Schneider, 2011; Chakravarthy et al., 2014). In order to whitewash environmental performance and lower financing costs to attract capital, there is a greater likelihood of “greenwashing” behavior. By contrast, non-polluting firms with lower carbon emissions are less likely to engage in “greenwashing” due to regulatory or environmental performance pressures.

As China is in the nascent stage of sustainable financial investment, a more significant financial gap must exist for firms to shift from production based to environment based (Liu et al., 2023). At the same time, the study confirms that energy industrialization has a significant positive impact on carbon emissions in the short term, reducing environmental performance undertakings (Idowu et al., 2023). This is despite heavily polluting firms being more likely to commit to reducing environmental pollution, improving social responsibility, and obtaining more long-term and lasting benefits. However, non-heavily polluting industries still have inherent advantages in sustainable operations, such as external stakeholder cooperation and reduced production costs. Based on the above analysis, non-heavily polluting industries are likely to improve ESG performance with state-owned capital participation.

Based on the SEC industry classification, the sample is divided into heavy pollution industry groups and non-heavy pollution industry groups, and the test results of the grouping are shown in Table 14. The results show that the assessment index of non-heavily polluting industries is significantly higher than that of heavily polluting industries, and further introducing the cross-section analysis of State1 and State2 with cross-section terms, the Chow test values are calculated to be 15.05 and 15.95, respectively, and the p-values are both 0.000, which are significant at the 1% level, indicating that the difference between the two groups is significant. That is, non-heavily polluting industries can enhance ESG performance with state capital participation.

Media attention is an external watchdog that drives high ESG performance of privately listed firms. The news media, as a critical micro-information intermediary, directly forms information interaction with individual enterprises, helping investors make investment decisions by timely conveying to the market positive behaviors such as corporate environmental protection governance and social responsibility fulfillment, as well as negative behaviors such as environmental pollution and violation of laws and regulations (Reverte, 2009). Moreover, state-owned capital is more likely to receive media attention due to its property rights nature and policy objectives and, therefore, will devote more energy to environmental and social responsibilities fulfillment, thus promoting corporate ESG performance. Therefore, this study expects that when media attention is high, the promotion effect of state-owned capital on private firms' ESG performance will be more significant due to the pressure of external public opinion and the motivation of government reputation protection.

To verify the above expectation, this section measures the media attention of private firms by adding one to the total number of company names appearing in newspaper reports and dividing them into high- and low-media-attention groups based on the median. As shown in Table 15, the regression significance of the high-media-attention group is significantly higher than that of the low-media-attention group, which proves the conjecture that when private firms receive a higher level of media attention, the effect of state capital participation on ESG performance is more prominent.

In the above section, we intentionally used the introduction of state-owned capital as an event to investigate “whether” it can positively impact the ESG performance of private firms. Based on the above findings, this section further discusses the impact of the synergy between introducing state-owned capital and improving ESG performance on enterprises' financial market risk, to explore the experience of sustainable enterprise management.

Private enterprises play an irreplaceable role in innovation and safeguarding people's livelihoods, and preventing their financial risks is an important gateway to realizing sustainable business and social wellbeing. As state-owned capital is more aware of risk aversion and financial information quality requirements, it supplements enterprise liquidity in the short term. Therefore, in the face of challenges posed by the complex international situation, some private enterprises have introduced state-owned capital to cope with financial market risks. This part intends to analyze the impact of state-owned capital participation and ESG performance of private enterprises on the prevention of financial market risk of private enterprises from the perspective of stock price crash risk.

The phenomenon of stock price collapse refers to the full outbreak of “bad news” that has been concealed by an enterprise for a long time, and the stock price in the market suffers a shock and continues to fall, which may contagiously trigger a chain crash of other stocks. Information transparency is the main factor affecting the risk of stock price collapse. The above confirms that state-owned capital participation enhances the ESG performance of private companies, which focuses on the long-term value and sustainable development of the enterprise, and will proactively strengthen effective communication with the outside world, release more reliable financial information to stakeholders, and improve the transparency of the enterprise's information. On the one hand, a higher degree of information transparency increases the cost of hiding bad news from the management and suppresses the risk of stock price collapse. On the other hand, a higher degree of information transparency facilitates investors' understanding of the enterprise promptly, helps investors make rational and scientific investment decisions, and prevents the emergence of “herd behavior” and “stock price bubbles.” Therefore, this section predicts that state-owned capital participation can improve the ESG performance of private firms and enhance their information transparency to strengthen their financial prevention ability.

The validation section measures the risk of stock price collapse using two indicators: the negative stock return skewness coefficient (NCSKEW) and the ratio of upward and downward fluctuations in returns (DUVOL).

The validation results are shown in Table 16. This result shows that ESG performance can be used as a supplement to corporate disclosure and become one of the measures of disclosure quality, reducing the prevalent information barriers; on the other hand, the ESG framework, to a certain extent, provides the correct guidance for the direction of business management of enterprises and provides new evidence for the relationship between state-owned capital equity participation and financial prevention of private enterprises. This finding may bring the following insights: governmental organizations should actively promote the development of ESG systems and urge private enterprises to improve the ESG evaluation system. Meanwhile, private enterprises should strengthen ESG concepts in operation and management, reduce the hoarding of negative news, and realize sustainable operations in the financial market.

When global economic recovery is struggling, it is beneficial to national and even global economic recovery to explore action programs with sustainable value for emerging economies from a quantitative ESG system under a sustainable governance framework (Richmond et al., 2019). As emerging economies, private enterprises in which state-owned capital has taken a stake to reshape the shareholding structure of traditional enterprises and cultivate the strategic will for sustainable development. At the same time, state-owned capital has special political objectives relative to other shareholders and enhances internal control by mitigating agency problems; state-owned capital, as a supervisor, has an information cost advantage in loan acquisition and the guarantee of government endorsement, alleviating the difficulties of financing external funds for enterprises.

This paper uses the panel data of listed private firms in China from 2013 to 2021 to test the consequences of state-owned capital participation on private firms' environment, social responsibility assumption, and governance and the possible external correlates to the shock factors under the constant nature of firm ownership. The test results show that, first, state-owned capital injection enhances private firms' environmental and social responsibility-taking and internal governance performance. Moreover, state capital and ESG governance processes will synergize to prevent financial risks. This study demonstrates the relationship between state capital injection and ESG of private enterprises, which will make up for the gap of ESG influencing factors of private enterprises and provide a brand new direction for studying corporate sustainable development. Second, in terms of the channels through which state capital injection affects the ESG performance of private firms, state capital injection enhances the actual management rights of small- and medium-sized shareholders, a sound internal control system, and promotes the recognition of environmental wellbeing, which improves the internal control and governance structure of firms and eases the channel mechanism of the external financial constraints faced by firms, and positively enhances the ESG performance of private firms. Finally, in terms of heterogeneity, a breakdown of the sample shows that stricter regional environmental regulation will enhance the ESG performance of private firms through state capital equity participation; at the meso-industry level, state capital equity participation in non-heavily polluting industries has a stronger role in enhancing the ESG performance of private firms; and at the micro-individual level, the enhancement of ESG performance by state capital equity participation is more pronounced when private firms receive greater media attention.

Undeniably, injecting state capital while maintaining ownership of private firms is an equity reform attempt with unknown risks, which may trigger conflicts of interest between state and non-state shareholders (Lo et al., 2022). However, our study confirms that introducing state capital in private firms realizes ESG objectives and sustainability options and is carried out through multiple channels; at the same time, introducing state-owned shareholders will generate incentives for private firms' financial market performance. Our study provides new conclusions for equity reform by introducing state capital based on external correlator theory and trade-off theory.

Although the sample of this study focuses on China, China's large market economy provides corroboration for focusing on the issue of returns to state capital. Thus, this study is still of global value. On the one hand, using the United Nations ESG paradigm as an evaluation criterion, this study finds that private ownership reforms contribute to sustainable development. These findings inspire policymakers in developing countries to adopt the international paradigm of sustainable governance to promote further changes in shareholder structure and improve the operational efficiency of private enterprises. On the other hand, in the context of global economic integration, the findings also reveal hidden issues such as regional differences in environmental regulation, external media attention, and the “greenwashing” of heavily polluting enterprises.

Based on the findings of this study, recommendations are made at the policy level for state-owned shareholders in developing countries:

(1) If state-owned capital requires private enterprises to improve their ESG performance, it must consider the costs and expenses associated with the amount of sustainable development of the enterprise, take advantage of social reputation, and alleviate the pressure of external financing of the enterprise. Compared with developed countries, state-owned capital must provide adequate financial support for small- and medium-sized private enterprises, as sustainable finance in developing countries is in the nascent stage, and the development of sustainable investment could be faster.

(2) Segmentation of the sample shows that stricter regional environmental regulation will enhance state capital's equity participation in boosting the ESG performance of private firms. This inspires state capital to consider the strictness of regional environmental regulation when choosing investment targets by selecting private firms with potential and cooperating in strictly regulated regions. Such a cooperation model can be carried out within more developing countries and positively affect global environmental performance.

(3) At the meso-industry level, the role of state-owned equity in non-polluting industries to enhance the ESG performance of private firms is stronger. This, in turn, suggests to national and regional governments that there is a greater gap in sustainable development in heavily polluting industries and that they have to prioritize capital injections into heavily polluting industries to develop the environment. State-owned stakes in private companies in heavily polluting industries can gradually guide them to transform into green industries such as those with clean energy and circular economy, thus reducing their environmental impact at the source.

The injection of state capital into private enterprises has a positive impact and will provide lessons for sustainable economic development and environmental protection in developing countries. At the same time, it also requires the joint efforts of the government, enterprises, and all parties in society to ensure the effective implementation and continuous monitoring of the injection of state-owned capital into private enterprises to achieve the goals of optimizing resource allocation and promoting sustainable development.

After the hypotheses were formulated and tested several times, this study still has several possible areas for improvement.

First, financial distress is a common problem encountered in business operations. Due to financial constraints, companies may not be able to invest sufficient resources in environmental protection, human rights protection, and community investment and face problems such as inaccurate financial statements and an increase in non-compliance, which may diminish the company's environmental reputation, raise questions about public opinion, and ultimately have a negative impact on ESG performance. This study has not yet explored the issue of heterogeneity in corporate financial distress, which may result in a gap in related research. Second, the benchmark regression shows that the shareholding ratio of state-owned capital has a significant positive effect on firms' ESG performance. This implies that a stronger balance of state capital to private firms leads to better ESG performance. This paper has not yet investigated the possibility of the non-linear impact of this indicator on firms' ESG performance.

Based on the limitations of this paper, future research directions are first, future research will address the issue of corporate financial distress and explore whether the role of state capital equity in enhancing corporate ESG performance can be enhanced when firms face financial pressure. Addressing this issue will provide direction to the goal of state capital introduction. Second, future research should be devoted to identifying the possibility of the non-linear effect of state capital shareholding on corporate ESG performance. Addressing the above issues will provide a useful addition to studies related to utilizing state capital dividends to enhance environmental and social wellbeing and improve internal corporate governance.

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding authors.

WL: writing–original draft, conceptualization, data organization, formal analysis, methodology, software. YW: writing–review and editing, visualization.

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Al-Tuwaijri, S. A., Christensen, T. E., and Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Account. Organ. Soc. 29 (5-6), 447–471. doi:10.1016/s0361-3682(03)00032-1

An, W. W., Xu, Y. H., and Zhang, J. Q. (2018). Resource constraints, innovation capability and corporate financial fraud in entrepreneurial firms. Chin. Manag. Stud. 12 (1), 2–18. doi:10.1108/cms-02-2017-0024

Auer, B. R., and Schuhmacher, F. (2016). Do socially (ir)responsible investments pay? New evidence from international ESG data. Q. Rev. Econ. Finance 59, 51–62. doi:10.1016/j.qref.2015.07.002

Baloria, V. P., Klassen, K. J., and Wiedman, C. I. (2019). Shareholder activism and voluntary disclosure initiation: the case of political spending. Contemp. Account. Res. 36 (2), 904–933. doi:10.1111/1911-3846.12457

Beck, T., Demirgüç-Kunt, A., and Maksimovic, V. (2008). Financing patterns around the world: are small firms different? J. Financial Econ. 89 (3), 467–487. doi:10.1016/j.jfineco.2007.10.005