- College of Finance, Nanjing Agricultural University, Nanjing, China

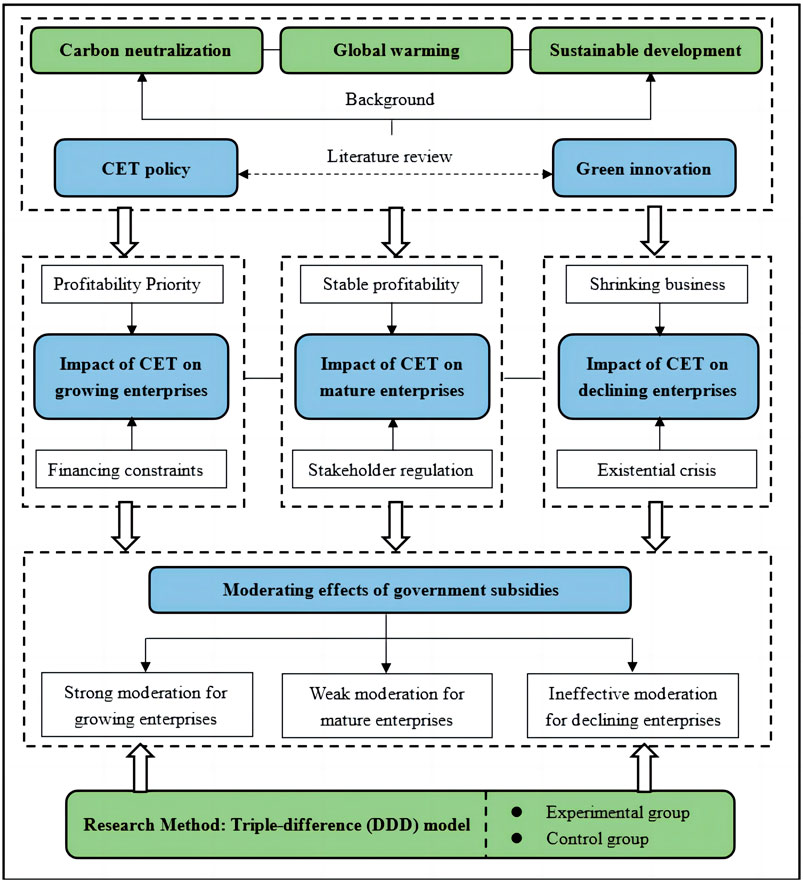

Enterprises with diverse life cycles possess distinct survival and operational laws. Hence, it is crucial to comprehend whether all these enterprises can proficiently engage in green innovation under the guidance of carbon emissions trading (CET). This study leverages the quasi-natural experiment of CET policy, employing panel data encompassing A-share listed companies in Shanghai and Shenzhen spanning from 2008 to 2020. Through the application of the triple difference model, the research examines the influence of CET policy on the green innovation endeavors of enterprises characterized by various life cycles. The research outcomes reveal the following: 1) CET policy significantly impacts the green innovation of mature enterprises, and contributes to the enrichment of the quality of their green innovation endeavors. 2) Due to limitations pertaining to financing constraints and business expansion, CET policy fails to foster green innovation within the growth and decline phases of enterprises. 3) Government subsidies can overturn the unfavorable position of growth-stage enterprises in carbon emissions trading and propel them towards heightened green innovation. However, government subsidies do not yield a substantial moderating effect on the green innovation endeavors of maturity-stage enterprises. Simultaneously, even if declining-phase enterprises are subjected to government subsidies, these subsidies do not reverse their innovation disadvantage in carbon emissions rights trading. In addition, we also found that in areas with heightened public awareness of environmental protection and state-owned enterprises, the positive regulatory effect of government subsidies is more significant. The findings derived from this study bestow invaluable insights for decision-makers striving to optimize the implementation of the CET policy and effectively allocate government subsidies.

1 Introduction

China’s exponential economic expansion in the last 40 years has given rise to increasingly dire environmental contamination predicaments. The correlation between the environment and economic prosperity has consequently become crucial for the pursuit of sustainable development (Zhong and Peng, 2022). Given that enterprises serve as major contributors to environmental degradation, it becomes imperative for governments to implement environmental regulatory policies aimed at curbing their emission levels (Tariq et al., 2017). The carbon emissions trading system (CET), which fosters the advancement of a low-carbon economy through green financial approaches, is regarded as a mechanism capable of internalizing environmental costs. Moreover, the CET can more equitably restrict the indiscriminate emissions of high-carbon-emitting enterprises driven solely by profit-seeking motives. Inspired by the European Union’s carbon emissions trading system, China has introduced and continually emphasized the CET policy, endorsed and promoted by the government (Gao et al., 2020). Consequently, the CET policy has transformed into a pivotal tool for emission reduction in China, it has also evolved into an instrumental driver for efficaciously managing carbon emissions.

According to key data, the collective volume of the seven trading markets in China, namely, Shanghai, Beijing, Shenzhen, Guangdong, Tianjin, Hubei, and Chongqing, is projected to reach 381 million tons in 2022, representing a noteworthy increase of 9.80% compared to 2021. Additionally, the combined turnover is expected to be 9.387 billion RMB, reflecting a significant surge of 17.48% from the previous year. An essential consideration lies in the expanding coverage of the Carbon Emissions Trading (CET) policy, leading to a diverse range of enterprises impacted by this policy with distinct life cycle stages encompassing growth, maturity, and decline. The production, operation, and innovation needs of these enterprises vary, resulting in potential heterogeneous effects of the CET policy. Notably, through green innovation, enterprises can effectively transform their production modes and factor structures (Medeiros et al., 2014). This serves as a crucial avenue for enterprises to gain a competitive edge in carbon emissions trading, as it is a testament to their ability to adapt and respond to the evolving landscape. Thus, this paper aims to explore whether enterprises in all life cycle stages can readily adapt to CET policy from the perspective of green innovation. Such an investigation holds immense practical significance in evaluating the effectiveness of CET policy and informing future enhancements.

In China, the CET policy is regarded as a market-oriented tool, yet it remains under the control of government authority, as pointed out by Yang et al. (2016). In terms of regulating the decision-making process of micro-firms, subsidies play a significant role and can potentially influence green innovation within firms operating under different life cycles, as supported by the CET policy. Theoretically, research has shown that government subsidies may assist firms in breaking through financial barriers and overcoming the negative effects of the CET policy’s financial constraints (Liu J et al., 2020; Li et al., 2021). This assistance enables firms to engage in carbon quota trading and fosters their willingness to pursue green innovation. Moreover, the subsidies alleviate the pressure faced by firms in reducing emissions and positively contribute to the regulation of green innovation. However, a key question remains: do government subsidies have a positive moderating effect on the green innovation of enterprises operating under different life cycles and affected by the CET policy? The current body of literature has yet to adequately address this issue from a life cycle perspective.

This study aims to investigate the response of enterprises with diverse life cycles to the CET policy, specifically focusing on their inclination towards green innovation. Through the implementation of a triple difference model, this study examines whether these enterprises actively respond or negatively avoid the policy. Furthermore, this study explores the influence of government subsidies on promoting green innovation among enterprises with varying life cycles. Substantively, this paper makes the following key contributions: Firstly, it pioneers the comprehensive integration of life cycle theory and environmental regulation theory, allowing for a differentiated understanding of the survival strategies and operational characteristics of enterprises at different stages. This analysis provides insights into the adaptability of enterprises, at various stages, to the environmental regulatory pressures imposed by carbon emissions trading, thus enhancing the existing literature on this topic. Secondly, this study introduces the moderating role of government subsidies in the context of CET policy, helping to guide the allocation of subsidies in the market. By aiding policy implementers in making scientifically and reasonably informed decisions, this research facilitates the promotion of green innovation within the carbon allowance trading realm.

The remainder of this article is organized as follows: Section 2 introduces relevant literature. Section 3 presents the main hypotheses. Section 4 details the research design, including model construction and variable definitions. Section 5 provides empirical results and robustness tests, analyzing the impact of CET policy on green innovation among enterprises at different stages of the corporate life-cycle, and examining the moderating role of government subsidies. Section 6 offers discussion, conclusions and policy recommendations.

2 Literature review

There is a plethora of literature regarding the CET policy and corporate sustainable development. About the trading mechanism of CET policy, enterprises with high carbon emissions need to buy carbon quota, while enterprises with low carbon emissions can sell carbon quota to make profits (Braun, 2009; Jaehn and Letmathe, 2009). With the advantages of flexible trading mechanisms, cost-effectiveness and technological incentives (Duan and Hu, 2014; Jiang et al., 2016), scholars believe that CET policy can achieve short-term emission reduction for companies (Shimizu, 2020), enhancing corporate core competitiveness, and achieve long-term emission reduction (Porter and Linde, 1995; Caparros et al., 2013). Liu and Li (2022) find that Chinese CET policy promotes corporate green innovation, which is more pronounced among large firms, non-state firms and firms with higher external concerns. Liu et al. (2022) argue that the CET policy promotes green innovation in firms and the quality of green innovation rather than quantity. Wei et al. (2022) use the ABM model to identify the impact of CET policy on corporate green innovation using a virtual decision and transaction mechanism, and obtain a similar conclusion. However, some scholars disagree with such views, which might be due to the oversupply of carbon emission quota reducing the market trading price. For firms whose cost of obtaining quota is lower than the cost of green technology innovation, they are more inclined to buy carbon emission quota with R&D funds (Tang et al., 2015), squeezing out R&D inputs and thus reducing green innovation output. Also, the top-level institutional design aspects of carbon markets and carbon quota allocation are still inadequate (Zhang and Zhang, 2020), which can also hinder corporate green innovation.

Through the aforementioned review of literature, it has been determined that prior research has primarily focused on the ramifications of CET policy on the ecological advancement of businesses, particularly in the realms of emissions reduction, pollution control, and technological innovation (Zhang et al., 2019; Wang et al., 2023). Although there exist select studies that touch upon the correlation between CET policy and corporate green innovation, no consensus has been reached on whether the policy stimulate or hinder such innovation (Zhang et al., 2022; Xiao et al., 2023). Consequently, it is our belief that further investigation in this area is warranted. Furthermore, notable gaps exist in the examination of how firms’ life cycle stages, CET policy, and innovation-related activities intertwine. These life cycle stages imbue firms with distinct characteristics in terms of their production and operations, organizational attributes, propensity for research and development, resources and capabilities, as well as relationships with investors and managers (Abdallah et al., 2012; Luo et al., 2021; He et al., 2022). It is reasonable to expect that the impacts of CET policy on firms’ green innovations will also fluctuate accordingly. Thus, a more comprehensive comprehension of the connection between CET policy and firms’ green innovation may be achieved through a life cycle perspective. Moreover, the existing literature primarily evaluates firms’ performance in CET policy, often neglecting the role of government subsidies and overlooking the influence of local governments in shaping CET policy. In fact, government subsidies serve as a crucial tool for micro-enterprise regulation and can greatly influence the relationship between CET policy and the green innovation of businesses.

3 Research hypothesis

3.1 Resource-based theory

The resource-based theory posits that an organization’s viability hinges on its ability to obtain critical resources from the external environment. And the degree of an organization’s dependence on external resources depends on two factors: the importance of the resource to the organization and its scarcity and non-substitutability. As organizations increasingly lean on external resources, the external environment limits their autonomy and exert control over them. Moreover, the external environment is characterized by volatility and unpredictability. Therefore, organizations must adopt strategic measures to reduce their dependence on external environments and increase their control over external resources (Qiu et al., 2016). Obtaining critical external resources is also imperative for organizations to maintain their competitive advantage (Barney, 1991).

Carbon emissions trading stands as a distinctive instrument within the low-carbon economy, leveraging financial resources to bolster corporate environmental governance. Carbon emissions trading offers financial resources that are scarce and liquid (Sheng et al., 2020), enabling companies to recognize that continued environmental governance can yield this scarce resource, and thus participate in green governance activities. In other words, companies must improve their production methods towards more environmentally-friendly ones, provide green equipment updates, engage in green innovative activities (Christophe and Tina, 2018), in order to be in a favorable position in carbon quota trading. Furthermore, obtaining financial resources support through carbon trading means that companies are more likely to possess resource advantages in production and manufacturing. Undoubtedly, this can help expand a company’s market share, enhance its green competitive advantage, and achieve broad market development prospects.

3.2 Corporate life-cycle theory

The corporate life-cycle theory suggests that enterprises continuously progress through evolution and transformation (Abdallah et al., 2012). Life-cycle can generally be divided into stages such as growth, maturity, and decline. The decision-making processes and management mechanisms employed by business managers differ across these life-cycle stages, resulting in dynamic patterns of growth (He et al., 2022). Moreover, organizations exhibit differentiated organizational structures, resource endowments, corporate governance, and innovation intentions at different stages of growth. Consequently, enterprises in different life-cycles possess diverse financial resources and innovative elements, which subsequently impact their financing and innovation activities (Wei et al., 2022). In essence, green innovation in organizations serves a dual purpose of economic benefits and environmental impact. Engaging in green innovation activities can be seen as a proactive response to carbon trading. Based on the theory of corporate life-cycle, this study explores the green innovation performance of enterprises in different life-cycle stages under the influence of CET policy, aiming to elucidate how these enterprises address the challenges associated with carbon trading.

3.3 Research hypothesis

According to life-cycle theory, growing enterprises often experience limited internal reserves and scale, necessitating external funding to bridge significant capital gaps (Habib and Hasan, 2019). Nevertheless, due to elevated investment risks and uncertain short-term returns, investors frequently hesitate to support these companies’ growth ambitions, resulting in profound financing constraints. Furthermore, as growing firms prioritize profit maximization and swift expansion, managers may place greater emphasis on ventures with considerable returns on investment (Miller and Friesen, 1984), neglecting environmental initiatives (Yang et al., 2021). The CET policy encourages firms to exchange surplus emission rights for additional emission reduction benefits when overall emissions remain below the imposed limit through carbon pricing. Alternatively, companies must acquire additional emission rights or reduce production. Based on resource-based theory, organizations frequently strive to achieve stage-specific objectives aimed at expanding their market size and augmenting their market influence, driven by constraints imposed by limited resource capacity. Considering their substantial capital requirements and financing limitations, growing firms are more inclined to adopt the most cost-efficient approach to comply with the CET policy in the short term (Yang and Luo, 2020). Enterprises may undertake the following actions: Firstly, growing firms will reallocate resources, prioritizing end-of-pipe pollution control measures to achieve rapid emission reduction, thus alleviating the burden of continuous carbon quota purchases. However, such an approach tends to neglect the development of green technologies, discouraging corporate innovation (Tavassoli, 2015). Secondly, enterprises will allocate funds towards purchasing carbon allowances, reducing the uncertainties associated with carbon trading. In turn, diminishing resources allocated to corporate research and development, as well as impeding the output of green innovation. Based on these observations, we can formulate the following assumptions:

H1:. The impact of CET policy on green innovation in growing firms has not yet been seen.

Drawing on the life-cycle theory, mature enterprises possess ample cash flow and consistent profits, enabling them to facilitate R&D and enhance green innovation outputs. Simultaneously, these mature firms, equipped with well-established and standardized management procedures (Lian et al., 2022), cultivate an environment conducive to the pursuit of green innovation. Notably, these enterprises possess a defined trajectory for growth and possess core values that facilitate adaptation to the evolving demands of the era (Cucculelli and Peruzzi, 2020). They comprehensively consider the requirements of stakeholders, particularly external ones such as investors, consumers, and suppliers, who demonstrate a keen interest in sustainability initiatives. Enhanced by their capabilities and resources, mature firms display a heightened responsiveness towards green innovation, thus showcasing greater incentive to take action. Under the guidance of CET policy, these enterprises stand to generate additional carbon quotas and accrue enhanced benefits through their commitment to green innovation (Dutta, 2018), thereby creating a growing disparity between themselves and their competitors. Consequently, mature firms exhibit a willingness to engage in green innovation and bolster its output (Utterback and Abernathy, 1975; Cohen and Klepper, 1996; Fritsch and Meschede, 2001). Meanwhile, mature enterprises also aspire to establish credibility in the carbon market and reap reputational benefits. They actively explore sustainable paths and strive toward an intensified and refined green production model through green innovation. This enables them to uphold their competitiveness and market position. Therefore, we posit hypothesis H2:

H2:. CET policy can promote green innovation in mature firms.

According to the life-cycle theory, deteriorating enterprises exhibit reduced competitiveness and a lack of new revenue growth. Firms in this phase tend to experience negative trends in product sales, market share, and profits (McGahan and Silverman, 2001), resulting in a decline in cash flow and a deteriorating financial position (Potter and Watts, 2011). Unfavorable corporate conditions directly diminish shareholders’ and creditors’ confidence, manifested in shrinking businesses and reduced debt. From the perspective of acquiring resources, on one hand, declining firms tend to perform poorly under CET policy as their main focus is on finding survival strategies (Cao and Chen, 2012). Management prioritizes enhancing corporate production efficiency and cost reduction during this period, where short-term performance becomes paramount. The primary objective is to conceal issues with their poor management and increase their market value. Consequently, management may allocate fewer resources to environmental projects. On the other hand, declining companies are more disadvantaged in carbon trading due to factors such as low product profitability, rigid systems and procedures, and decreased market share. Consequently, such companies encounter impediments in swiftly advancing their capabilities to devise and implement efficient green technologies. Therefore, this paper posits the following assumptions:

H3:. CET policy is ineffective in promoting green innovation in declining firms.

The research framework of this paper is shown in Figure 1.

4 Research design

4.1 Data and sample

This paper takes the listed enterprises in Shanghai and Shenzhen A-shares from 2008 to 2020 as the initial research sample. It is imperative to acknowledge that the comprehensive nature of our dataset may lead to occasional gaps in annual data for specific companies. Therefore, our data set is considered unbalanced panel, yet this does not diminish the feasibility and credibility of our conclusions. Similarly, in the literature on CET policy, the use of unbalanced panels has been acknowledged (Qi et al., 2023). We make the following selection on the initial samples: 1) Excluding data of financial and insurance enterprises and enterprises with ST/ST*/PT in the current period. 2) Excluding enterprises with restructuring, mergers and acquisitions, and cross-listing. 3) Excluding enterprises with missing and incomplete data. This paper finally obtains 23322 valid samples. Corporate financial data is from the CSMAR database, and corporate green innovation data is from published annual company statements and CNRDS database. We use 1% winsorize for all continuous variables.

The determination of the start time of the CET policy is worth exploring. Relevant studies have indicated that when the Chinese government first issued a notice on the pilot work of carbon trading in 2011, market participants may have already responded to carbon trading. Therefore, some scholars consider either 2011 or 2012 as the starting time of the policy (Zhang et al., 2020; Zhao et al., 2023). The CET policy was instituted at an earlier juncture; nonetheless, the actual formation and regular functioning of the carbon market transpired subsequently. As a consequence, the successful execution of the CET policy necessitates the comprehensive establishment of the seven carbon markets. In this regard, this paper follows the research by Zhao et al. (2023) and sets the implementation year of the CET policy as 2014.

4.2 Model selection

A triple-difference model is a Frontier approach for assessing policy effects, which differs from the design of the double-difference model in that it can better solve the pollution attribute problem of the industry (Cai et al., 2016). This study considers the pilot industries in the pilot areas as the “treatment group”, the non-pilot industries in the pilot areas as “control group I”, and the industries in the non-pilot areas as “control group II”. The common double-difference model sets all firms in the pilot region as the “treatment group” and the non-pilot region as the “control group”, which is less refined and comprehensive than the triple-difference model. At the same time, the triple-difference model can eliminate the existing industry-region differences between the “treatment” and “control” groups, obtaining more robust test results. The triple-difference model is constructed below.

The subscripts i, j, k and t denote firm, region, industry and year, respectively. Y is the green innovation.

4.3 Variables and data descriptions

1) Dependent variable

In our study, the dependent variable is corporate green innovation. Drawing on Chen et al. (2021), we matched two sets of data: the “Green List of International Patent Classification” released by WIPO in 2010, the patent classification number information of enterprise invention and utility models in the CNRDS database. After the matching, we summarized the data into listed companies to obtain the annual number of green innovation applications for each enterprise. The aggregated number of green innovation patent applications is used as the green innovation index (GI). The approach taken in this article may overlook the use of R&D expenses as a measure of innovation, primarily due to the accurate depiction of innovation levels through patent data (Hu et al., 2020). Previous literature has also predominantly utilized patent data rather than R&D expenditure data to measure innovation indicators (Jiang et al., 2020; Liu and Sun, 2021).

2) Independent variable

The core explanatory variable of this paper represents the carbon emission right pilot policy variable, composed of the interaction of three virtual variables. When enterprise i is located in the carbon trading right pilot province, such as Shenzhen, Beijing, Shanghai, Tianjin, Hubei, Chongqing, and Guangdong, the variable

3) Adjustment variable

Corporate life cycle. A common method for delineating the life cycle of a firm is the cash flow portfolio approach constructed by Dickinson (2011). Compared with the univariate analysis and the comprehensive index analysis, it can successfully prevent the interference of the industry’s intrinsic variations and flaws such overly subjective solid analysis. As shown in Table 1, the cash flow model divides the corporate life cycle into three stages, namely, the growing period, mature period, and declining period, and reflects the operating risk, profitability, and growth rate of various life cycles through the positive and negative combination of the net cash flows of operation, investment and financing.

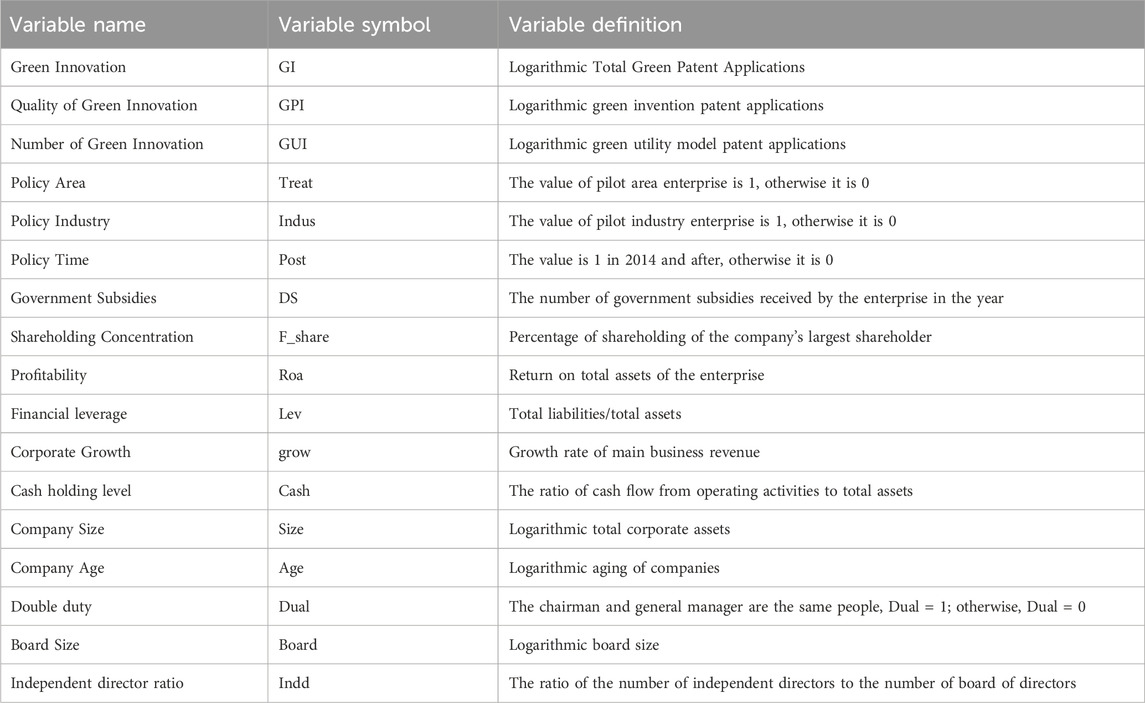

We have adopted the approaches of previous literature (Chen et al., 2021; Lian et al., 2022; Ni et al., 2022), selecting indicators that have an impact on corporate green innovation as control variables. In contemplation of a firm’s attributes, it is observed that as the dimensions and expansion of a company escalate, there is a corresponding augmentation in its propensity to allocate greater resources towards endeavors in innovation. A protracted corporate history signifies heightened resilience to risk and a more harmonious alignment with the distinctive high-risk, high-reward attributes inherent in innovative pursuits (Barasa et al., 2017). Consequently, the impact of organizational longevity on technological innovation merits careful consideration and should not be underestimated. From a financial perspective, indicators such as asset return rate, financial leverage, and cash holdings at satisfactory levels indicate stronger operational and profitability capabilities, which positively impact the execution of innovation activities (Rong et al., 2017). Furthermore, from the perspective of corporate governance, metrics such as ownership concentration, dual appointment, board size, and independent director proportion can reflect the effectiveness of a company’s governance (Zuo and Lin, 2022). These metrics reveal whether management has made decisions to carry out innovation activities and control R&D investments, thus they can exert an influence on a company’s innovation. The classification, definitions and descriptions of all variables are given in Table 2.

4) Control variables

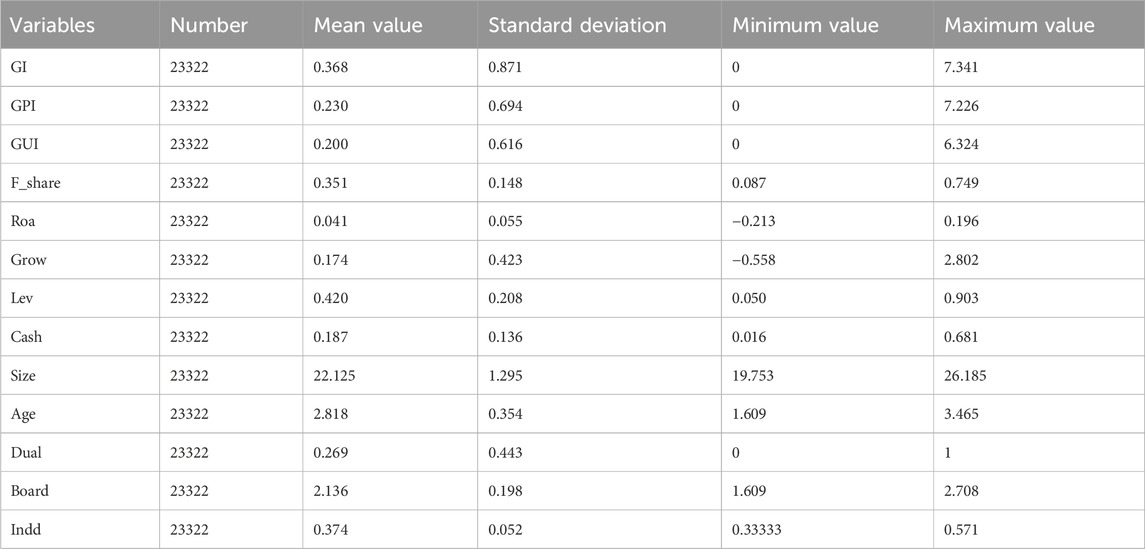

4.4 Description of variables

Table 3 summarizes descriptive statistics for variables. The mean value of corporate green innovation (GI) is 0.368. The maximum value is 7.341, and the minimum value is 0, indicating a large gap between different companies’ green innovation. About 36.8% of the companies in the sample have a certain amount of green innovation. The mean value of the quality of green innovation (GPI) is 0.230, and the mean value of green innovation quantity (GUI) is 0.200, which shows that the quality of green innovation is slightly more prominent.

5 Empirical results and discussions

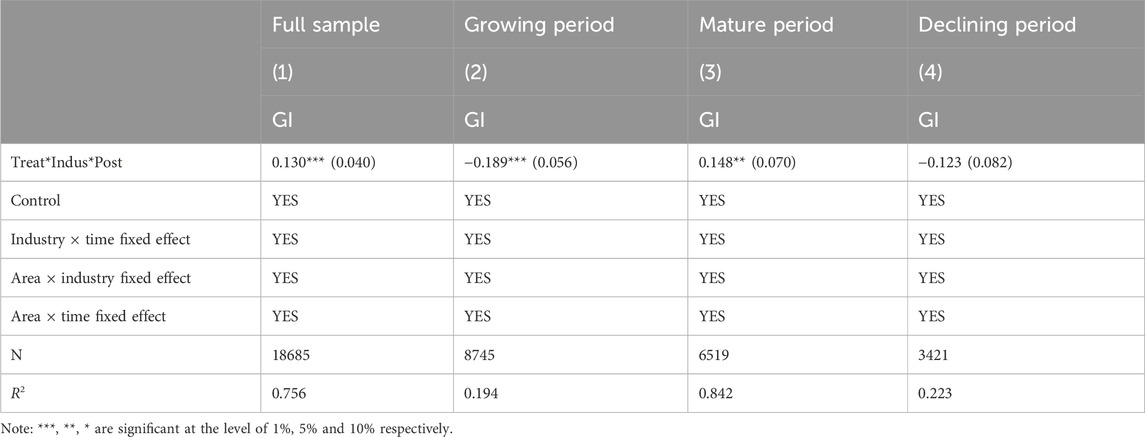

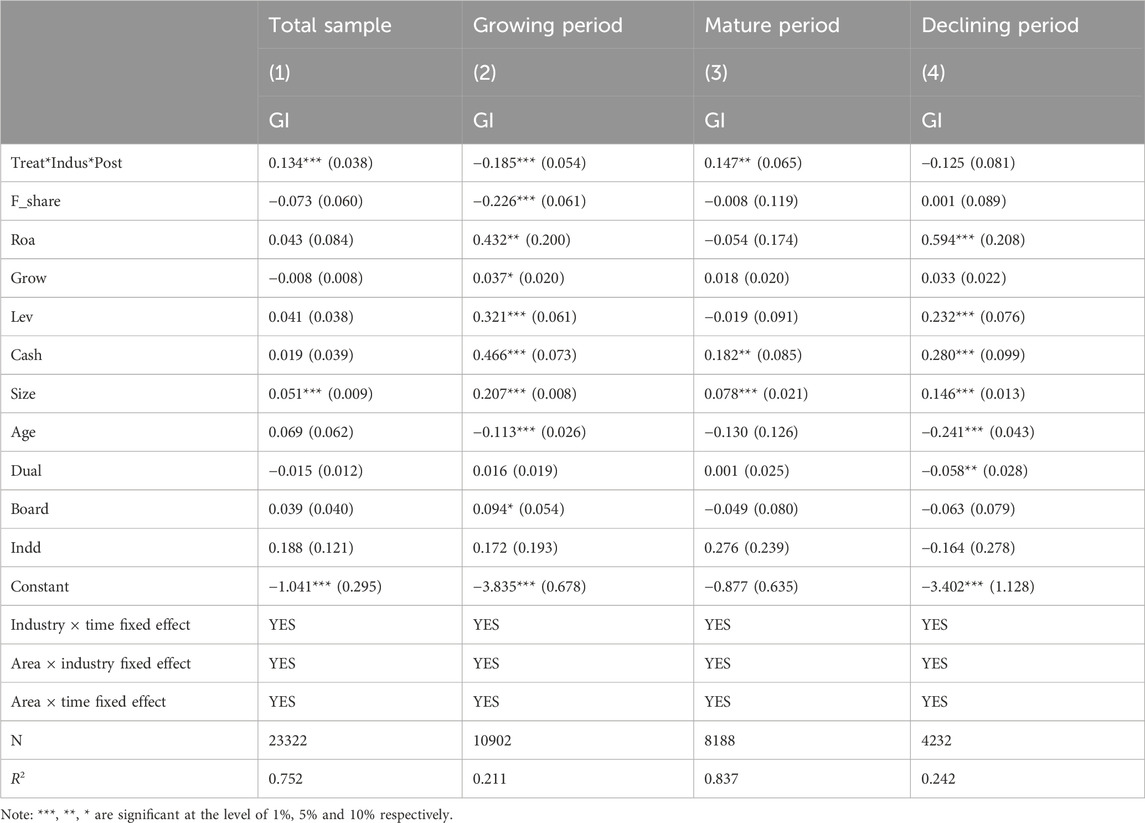

5.1 Benchmark regression

The results of the benchmark regression are shown in Table 4. In the total sample, CET policy has a significant positive effect on corporate green innovation. Columns (2)–(4) show the effects of CET policy on the green innovation of firms in the growing, mature and declining periods, where all control for joint fixed effects. In column (2), the regression coefficient of CET policy is −0.185 and is significant at the 1% level, indicating that CET policy inhibits green innovation in growing firms, verifying H1. In column (3), the regression coefficient of CET policy is 0.147 and is significant at the 5% level, indicating that CET policy significantly promotes green innovation in mature firms, which verifies H2. In column (4), the regression coefficient of CET policy does not pass the significance test, indicating that CET policy does not impact the green innovation in declining firms, which verifies H3. In conclusion, the findings indicate that the influence of CET policy differs depending on the stage of a firm’s life cycle, favoring green innovation in mature firms but not significantly boosting it in growing or declining firms. This result implies that the conclusions obtained from studying the innovation effects of CET policy without distinguishing the characteristics of life-cycle firms are not comprehensive and accurate. Policy recommendations from a life-cycle perspective consideration can support the precise implementation of CET policy.

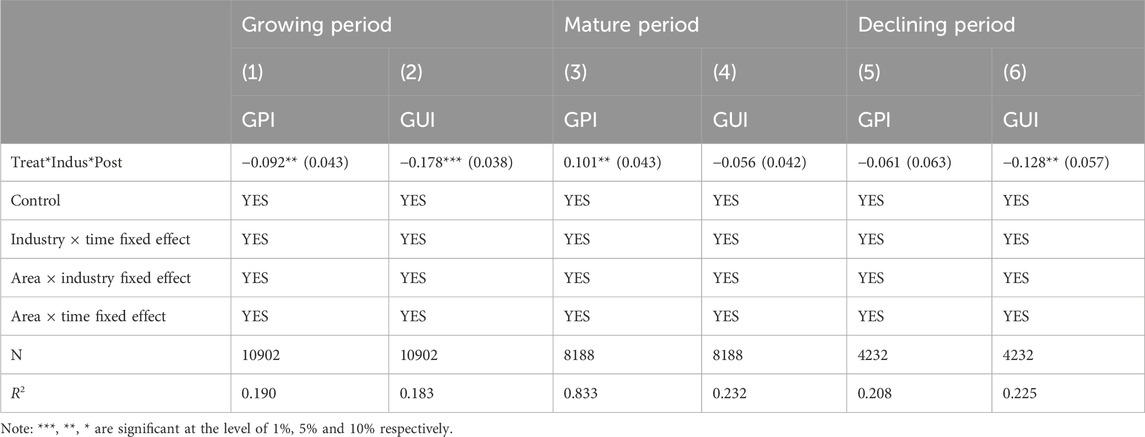

TABLE 4. Test results of the impact of CET policy on corporate green innovation with different life cycles.

5.2 Parallel trend test

The assumption of parallel trends holds to verify the consistency of the triple-difference estimates, to promise that the treatment and control groups maintain the same trend before the event, ensuring that the exogenous event is the only driver of the difference between them. Although the triple-difference model can solve the problem that the parallel trend hypothesis is not valid, the parallel trend test is conducted in this paper for rigor and accuracy. Drawing on the idea of Feng et al. (2024), the model focuses on whether the sample and corresponding variables are consistent with parallel trends before implementing the CET policy. The baseline regression has some new interaction terms that include dummy variables for each year prior to the implementation of the pilot over the period of 2009–2013. Post2009 is a dummy variable that indicates whether the time is 2009, and the rest of the dummy variables are similarly built. From the regression results in Table 5, in the full sample as well as in each life cycle sample, the regression coefficients of the CET test variables are almost insignificant in the estimated models. It indicates that the firms in the treatment and control groups have the same trend when the CET policy was not yet implemented.

5.3 Robustness test

5.3.1 Replacement of control group sample test

In the baseline regression, the CET policy for the treatment group equals to 1 in the Shenzhen, Shanghai, Beijing, Guangdong, Hubei, Tianjin and Chongqing provinces, and 0 otherwise, which is the setting method generally used by the current academic. Considering the well economic development of pilot cities and the geographical location feature, the samples from Jiangsu, Shandong, Zhejiang, Sichuan, Hunan, Hebei, Anhui and Henan provinces are chosen to appear as the control group to narrow the economic gap between the treatment and control groups. From the regression results in Table 6, the direction and significance of the regression coefficients of CET policy are robust in each model.

5.3.2 The problem of time lag in innovation

The corporate green innovation index is tested by moving it forward by one period due to the R&D uncertainty. The regression results in columns (1)–(4) of Table 7 show that the direction and significance of the regression coefficients of CET policy are relatively robust.

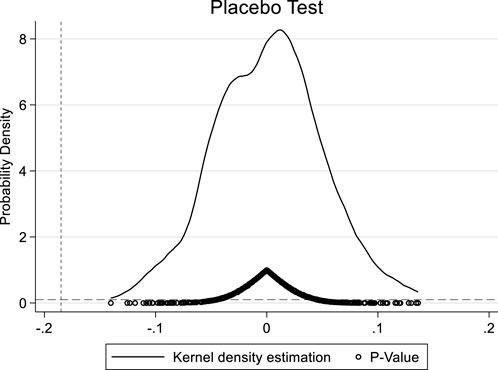

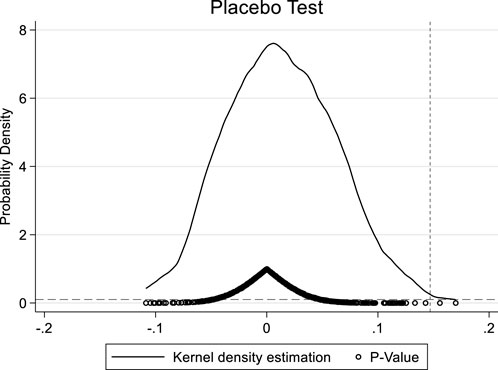

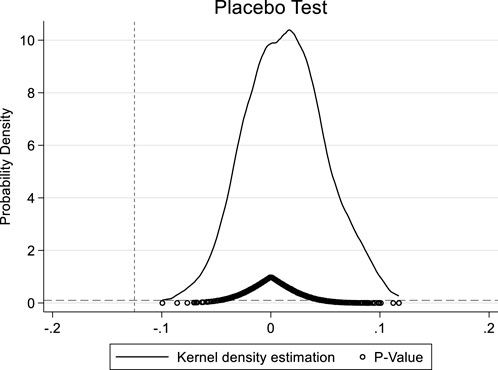

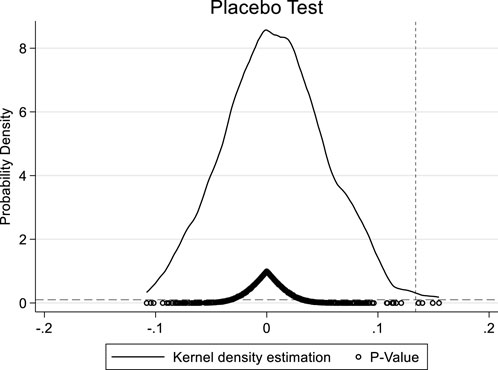

5.3.3 Placebo test

To exclude potential effects of unobservable factors on the triple-difference model, the placebo test is conducted by randomly selecting the treatment group in this paper. Specifically keeping the policy time constant, the same number of firms as those supported by the CET policy are randomly selected from the sample as a random treatment group, and the above random simulation is chosen to be repeated 1000 times. According to the kernel density distributions present in Figure 2, Figure 3, Figure 4, Figure 5, it can be found that the coefficients based on random sample estimation are concentrated around the value of 0. Numerically, they are all much lower than the truly estimated coefficients and insignificant, which means that the green innovation of firms is influenced by the CET policy and is not due to random and unobservable factors. The placebo test confirms the conclusions are robust.

5.4 Analysis to distinguish the categories of green innovation

To further test whether the impact of CET policy is heterogeneous for different categories of green innovation across life-cycle firms, the overall green innovations are divided into qualitative green innovations and quantitative green innovations. Qualitative green innovations are based on significant changes in the leading technologies for resource conservation, energy consumption reduction and pollution prevention, generating unique features and benefits superior to existing green products and markets. From the R&D and manufacturing perspective, quality-based green innovations reduce emissions and fight pollution from the design and development source with more advanced technical concepts, advanced performance, and greater product quality. In contrast, quantitative green innovations are primarily concerned with the selling of green goods and services in response to specific market demands in order to better serve both present and potential clients. Changes in the technological trajectory of quantitative green innovation typically have a tiny impact on the underlying technology. It primarily focuses on customer feedback to develop its products, technologies and services.

The results in Table 8 show that the regression coefficient of CET policy is significantly positive only in the model of qualitative green innovation of mature firms, indicating that CET policy significantly promotes qualitative green innovation of mature firms while having no significant effect on quantitative green innovation. The CET policy does not support green innovation for firms in either growing or declining firms. The finding further confirms the higher quality of green innovation sought by mature firms currently supported by CET policy. It is reasonable to explain that, in comparison to quantitative green innovation, qualitative green innovation could better meet the requirements of carbon quota trading and financial performance gain, enabling firms to gain more economic benefits from CET policy.

6 Further research

6.1 Moderating role of government subsidies

The flexible carbon quota trading mechanism within the CET policy enables the comprehensive utilization of both regulatory and market approaches to internalize the environmental costs incurred by enterprises, thereby attaining emission reduction targets. The profitability or loss of trading enterprises is determined by the market carbon quota and their own carbon emissions. Government subsidies, characterized as gratuitous transfer payments offered by the government to microeconomic entities, can be accounted for as current or future income to enhance the financial performance of enterprises (Lee et al., 2014). The provision of government subsidies aids enterprises with a willingness for green innovation yet facing disadvantages in carbon quota trading, enabling them to surpass financial barriers and counteract the adverse effects of the CET policy’s financial constraints (Pan et al., 2022). Conversely, for enterprises that could have benefited from carbon quota trading, the allocation of government subsidies is expected to reinforce their resilience to risks and enhance their performance under the CET policy (Dong et al., 2019; Flora and Vargiolu, 2020). Therefore, for firms supported by CET policy, government subsidies has the potential to influence their initial decisions regarding green innovation.

In order to test the moderating role of government subsidies, the value of government subsidies (DS) is introduced on the basis of model (1) and the model form is constructed as follows:

Where

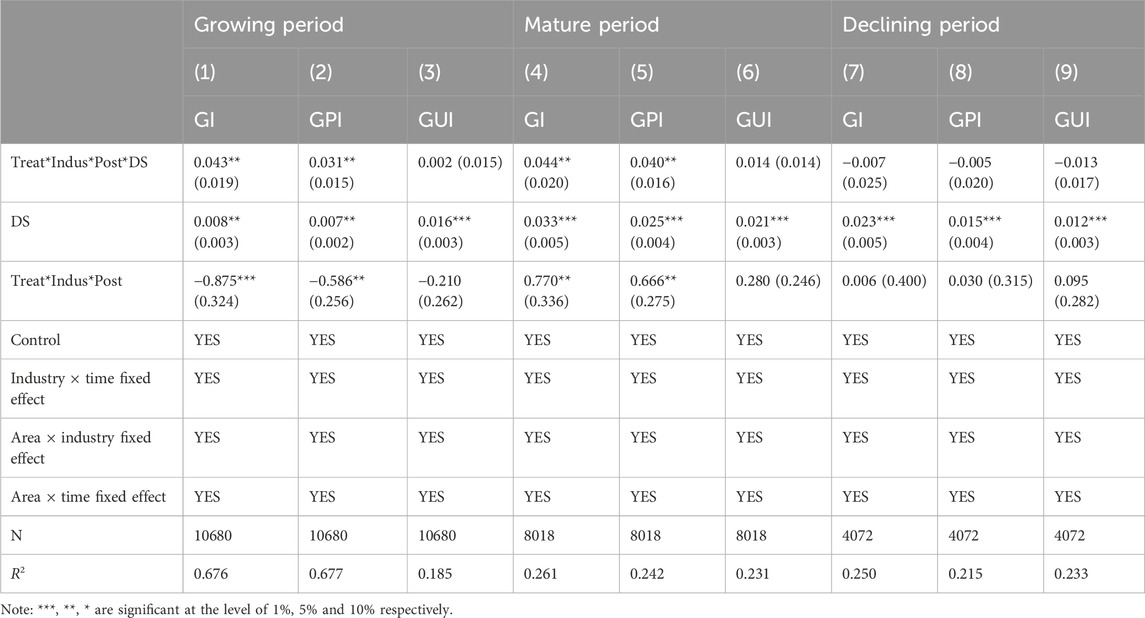

The outcomes of the regression in column (1) of Table 9 reveal that the coefficient of DS is significantly positive, indicating that government subsidies are conducive to improving corporate green innovation output. Treat*Indus*Post*DS exhibits a significantly positive result. This indicates that government subsidies have the ability to positively modify the negative impact of CET policy on the green innovation of firms in the growth period. Specifically, with the introduction of government subsidies, the CET policy transform from impeding green innovation in growth period firms to fostering such innovation. Upon comparing the direction and significance of the regression coefficients of the interaction terms in columns (2)–(3), we observe that the provision of government subsidies has a favorable effect on this shift from inhibition to promotion, particularly in relation to quality-based green innovation.

Why is it possible for government subsidies to mitigate the bias against low-carbon innovation in growth-stage firms under CET policy? According to the life-cycle theory, growth-stage firms face significant survival pressure while simultaneously striving to expand their production scale and mature. Hence, they possess heightened incentives for innovation (Acs and Audretsch, 1987). However, the volatility of carbon prices introduces uncertainty into firms’ returns, leading growth-stage firms to underperform in terms of green innovations. By providing subsidies, the government can alleviate the additional costs incurred by firms in carbon quota trading, thereby granting them more financial resources to invest in green innovations. These investments may encompass green R&D projects, procurement of environmentally friendly equipment, and the recruitment of specialized technical personnel (Shao and Chen, 2022). Additionally, receiving government subsidies serves as a positive signal to external stakeholders (Yan and Li, 2018), encouraging their participation and alleviating financial constraints. Furthermore, government subsidies function as a means to address externalities (Bi et al., 2016), ultimately reducing the risks and uncertainties associated with enterprise green innovation (Bai et al., 2019), thus encouraging growth-stage firms to engage in green innovation activities.

The regression outcomes in columns (4)–(5) of Table 9 reveal that the coefficient for Treat*Indus*Post*DS is statistically significant and positive. This demonstrates that the inclusion of government subsidies can effectively enhance the impact of CET policy on fostering green innovation among mature enterprises. Nevertheless, when considering the outcomes in Table 4 it becomes evident that even in the absence of government subsidies, CET policy still significantly stimulates green innovation in mature enterprises. This suggests that the added value of government subsidies is comparatively smaller.

We have also formulated an explanation for this phenomenon. In contrast to companies in the growth stage, mature firms possess consistent profitability and robust resilience against risks. Additionally, they are more likely to obtain supplementary advantages by fine-tuning the balance between transaction costs and compensation for innovation within the context of CET policy (Ma and Li, 2021). Therefore, such firms do not exhibit a strong demand for government subsidies (Richardson, 2006; Shahzad et al., 2022). The firms are already in a state of equilibrium concerning their own contributions and anticipations regarding green innovation. Consequently, the infusion of government subsidies does not demonstrate a substantial positive impact when firms’ technological and financial streams are still stabilizing in the mature stage. In other words, even without government-imposed subsidies, mature firms will voluntarily allocate funds towards R&D for green innovation (Malerba and Orsenigo, 1997). It is more probable that the injection of government subsidies will merely play a modest facilitating role and will not significantly alter the R&D investment decisions of mature firms.

In the context of declining enterprises, Treat*Indus*Post*DS does not hold statistical significance in Columns (7)–(9), indicating that government subsidies do not effectively regulate green innovation within such firms. For businesses experiencing recession, they face heightened survival pressures and limited financial resources, which, coupled with reduced awareness towards innovation and other factors, places them at a disadvantage under the CET policy. Consequently, as a first step in obtaining subsidies, these enterprises should focus on reinforcing their own “stop-loss” infrastructure, utilizing the subsidies to acquire trading quotas, thus preventing market elimination and laying a stronger foundation for conduct business. The likelihood of utilizing subsidies for green research and development (R&D) remains low, as the subsidies primarily reinforce fundamental business operations to evade market elimination. Furthermore, the inclusion of subsidies also contributes to the inertia associated with innovation in declining firms (Shao and Wang, 2023), further diminishing their motivation to innovate. Hence, the injection of government subsidies does not effectively enhance green innovation in declining firms.

6.2 Heterogeneity analysis

First, we consider the heterogeneous influence of regional public environmental awareness. From the perspective of demand, the higher the public awareness of environmental protection, the greater the demand for green products. Consumers are more aware of the environmental advantages of products, interested in green production and willing to pay more for environmentally friendly products (Thongplew et al., 2017), which can offer firms cost compensation on green innovation (Sueyoshi and Wang, 2014). From a regulatory point, the public with high environmental awareness can effectively monitor firms for malicious emissions and require firms to participate jointly in the process of environmental remediation, which could promote green innovation. Conversely, in regions with low public awareness of environmental protection, the ability and desire of firms to benefit from environmental management is reduced, which have a negative impact on green innovation (Liu et al., 2012) and slump the influence of CET policy in the area.

Second, we examine the diverse impact of nature property rights. As SOEs are required to undertake more national policy-oriented tasks and have close ties with the government (Wang and Xu, 2015), they have certain financing facilities and may face lower financing constraints under the CET policy. To elevate the caliber of green innovation, there exists a heightened likelihood that SOEs will engage in comprehensive environmental conservation efforts, enhance green product offerings to align with established standards, and undertake various governance measures. Furthermore, SOEs bear the responsibility for fulfilling national and societal environmental objectives, thereby displaying a proclivity towards embracing environmentally sustainable and innovative approaches to address the imperative national demand for environmental protection within the context of the CET policy.

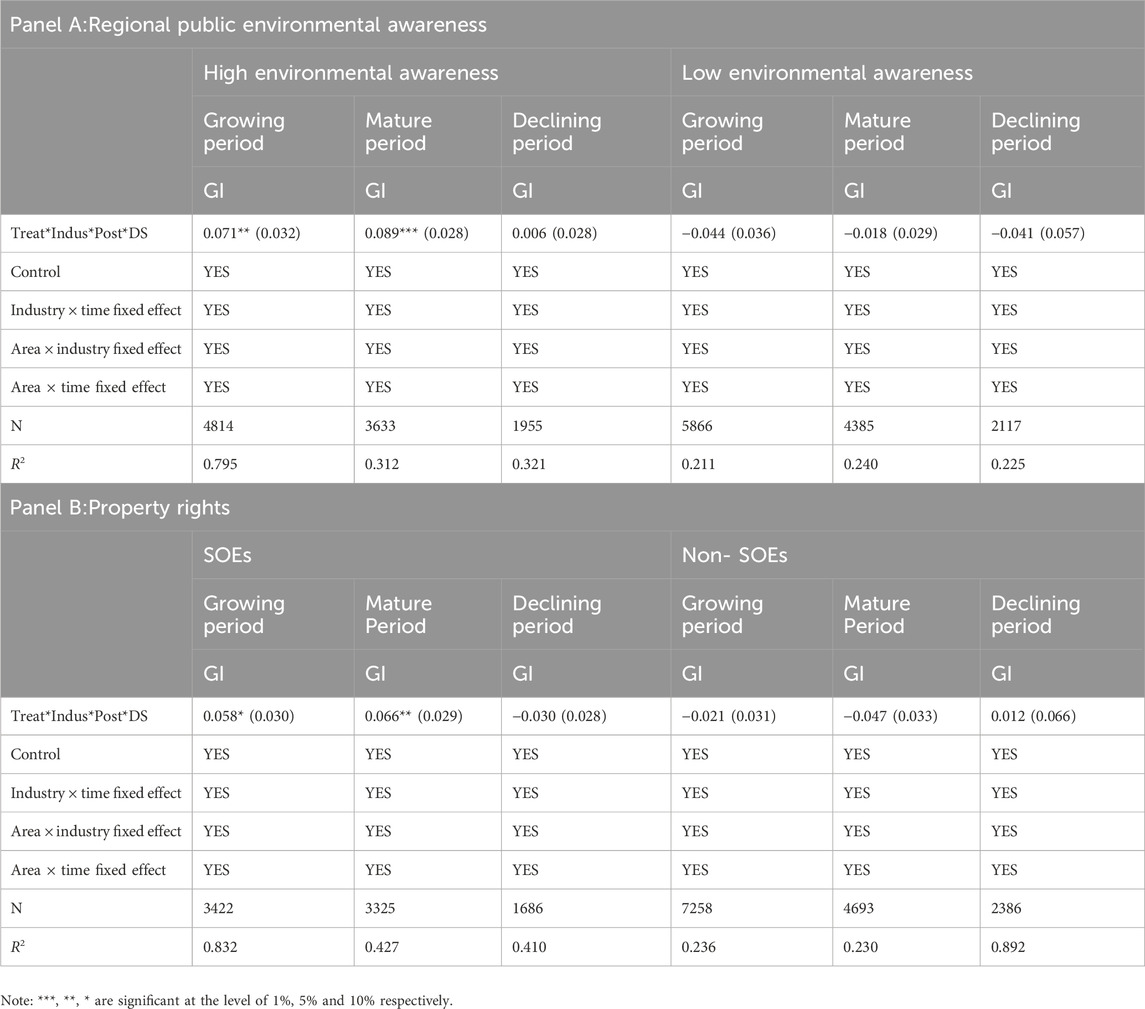

In Panel A of Table 10, the samples were divided into two groups based on the median of the “Public Environmental Protection Livelihood Index” published by the China Environmental Culture Promotion Association. The study found that in areas with higher public environmental awareness, the interaction effect of CET policy and government subsidies (Treat*Indus*Post*DS) positively promotes green innovation in both growth and mature companies. However, this positive effect is not observed in areas with lower public environmental awareness. This indicates that in areas with higher public environmental awareness, the effects of both CET policy and government subsidies are enhanced. Public supervision enables companies to effectively utilize government subsidies to carry out green innovation and strive for profits in carbon quota trading. In Panel B of Table 10, we found that in SOEs, the moderating effect of government subsidies can promote green innovation in both growth and mature companies. However, this promoting effect is not evident in non-SOEs. This suggests that compared to non-SOEs, SOEs truly benefit from the moderating effect of government subsidies. The reason is that when receiving government subsidies, SOEs are more likely to use them for technological innovation, demonstrating a positive response to CET policy.

7 Discussion

Firstly, although some scholars employing panel data from various provinces in China to examine the impact of CET policy on economic transformation and technological innovation (Shi et al., 2022; Song et al., 2023; Wu et al., 2023), an oversight remains regarding the pivotal role of micro-level economic activities in shaping macro development. Enterprises, as primary innovators, serve as foundational drivers within this context. This paper investigates the influence of CET policy on green innovation in heavily-polluting enterprises, thus enriching the literature on carbon emissions trading systems from micro viewpoint. Moreover, existing literature has also examined the effects of CET policy in different geographic or industrial contexts, whereas the findings of this study present significant research significance in comparison to these works. From an industrial perspective, Zhao et al. (2023) studied the impact of CET policy on green innovation in the electricity industry and found that the pilot programs in Beijing and Guangdong had a substantial promoting effect on this sector. Wang et al. (2023) found that CET facilitated technological innovation in industries such as chemical, non-ferrous metals, electricity, and aerospace, but had no influence on industries such as petrochemicals, construction, and steel. Liu et al. (2023) revealed that CET policy had an impact on the stock value of industrial enterprises. From a spatial geographical perspective, Qi et al. (2023) argued that CET policy exhibited certain spatial spillover effects and could cross-regional influence carbon emissions of enterprises. The aforementioned studies have explored the impact of CET policy on enterprise innovation with industry and regional heterogeneity based on industrial and geographical backgrounds. However, these studies have not yet identified the life-cycle heterogeneity of CET policy. Building upon the foundation of these studies, this paper delves into whether differences in enterprise life-cycle lead to variations in the effects of CET policy.

Secondly, there are still divergent views on the existence of a “Porter effect” in carbon emissions trading (Zhang et al., 2022; Xiao et al., 2023). This study has found that companies in different life-cycles have varying responses to carbon trading, which may be the primary reason for the divergent viewpoints. It is possible that these scholars lacked consideration for company life-cycle when exploring the innovative effects of carbon emissions trading. Moreover, this study indicates that carbon emissions trading can significantly promote green innovation in mature-stage enterprises, thus confirming the viewpoint proposed by Wang et al. (2023) that carbon emissions trading effectively stimulates technological innovation in enterprises. Generally speaking, this study has not only utilized China’s carbon emissions trading mechanisms to examine whether emerging economies are subject to the “Porter effect,” but has also verified the effectiveness of the “Porter effect” in various life-cycle stages.

Thirdly, existing studies have mainly focused on the impact of the CET policy on carbon emissions and technological innovation (Zhang et al., 2019; Chen et al., 2020; Zeng et al., 2020). However, these studies primarily emphasize the direct effects and channels of CET policy. They fail to examine the role of government subsidies in this context, which hinders the provision of recommendations on how government intervention can promote the development of carbon trading and corporate innovation. This article examines the moderating role of government subsidies between the CET policy and green innovation in different stages of the corporate life-cycle, expanding the literature on how government involvement influences carbon trading and enterprise innovation. It provides valuable insights for evaluating the implementation effectiveness of the CET policy.

Finally, the research findings reveal the “double-edged sword” effect of carbon emissions trading system, providing reference for the optimization and improvement of CET policy. We believe that enterprises in different life cycle should adopt distinct approaches to carbon trading, and the promotion of green innovation by CET policy is not always tangible. Mature enterprises are more likely to rely on carbon trading for green innovation, but growing and declining enterprises may not profit from the carbon market, especially the growing ones that require government subsidies to benefit from the carbon market. Therefore, compared with previous studies on CET policy (Huang et al., 2021), this paper offers a deeper interpretation of the innovative effect of carbon emissions trading, deepening our understanding of CET policy.

8 Conclusion

Based on the dataset of Chinese A-share listed companies in Shanghai and Shenzhen from 2008 to 2020, this paper constructs a triple difference model using a quasi-natural experiment to investigate the influence of the CET policy on the green innovation of firms at different stages of their life-cycle. Additionally, it explores the moderating role of government subsidies in this process. The findings of this study reveal that the CET policy stimulates the green creativity of mature enterprises. However, its impact on the green innovation of firms in the growth and decline phases is not statistically significant. These results imply that while the CET policy can foster firms’ green innovation, its effects are most apparent during the maturity stage of a firm’s life-cycle. Furthermore, further examination reveals that government subsidies can alleviate the disadvantageous position faced by growing firms in carbon emissions trading, thereby motivating them to intensify their green innovation endeavors. Nonetheless, for mature firms, government subsidies do not demonstrate a notable moderating effect on their green innovation. Moreover, even if government subsidies are allocated to declining enterprises, they are unable to reverse the innovation disadvantage of such firms in carbon emissions trading.

The policy implications of this paper are as follows: As the CET policy undergoes gradual advancement, it becomes imperative for the government to systematically refine and optimize it. This involves ensuring alignment with the distinctive development stages of enterprises, fostering an environment conducive to corporate green innovation.

Firstly, in terms of environmental regulation, the government should establish a scientifically reasonable allocation and carbon pricing system, leveraging the advantages of market-based environmental regulatory tools. Building upon this foundation, the government should supervise and guide enterprises in complying with the operational rules of the carbon trading market, affording businesses more time to adapt to the impacts of the carbon trading system, instead of imposing a one-size-fits-all approach. It is crucial to consider the actual production and operational conditions of regulated enterprises. In this process, special consideration should be given to growing enterprises by relaxing regulatory constraints to alleviate their carbon trading disadvantages, providing them with plentiful growth opportunities. Simultaneously, the government should actively encourage mature enterprises to respond to the CET policy, incentivizing increased investment in green innovation, thus enabling them to make significant contributions in emissions reduction and pollution control realms.

Furthermore, in terms of corporate behavior, businesses under the influence of the CET policy should also pay attention to their life cycle stages and carry out corresponding green innovation work. For example, during the growth phase, companies can address the funding shortage issue encountered in the CET policy through utilizing government subsidies and other expenditure methods. This will gradually foster a green development mindset and focus on the research and development of green innovation. Mature companies, with relatively abundant cash flows, should actively respond to the CET policy and carry out green innovation activities in a stable and orderly manner, thus achieving high-quality green innovation. As for companies in the decline phase, it is crucial to distribute government subsidies in an orderly manner to ensure steady progress with the CET policy. Guiding declining companies to explore the potential profitability of carbon quota trading is needed, which could gradually push firms to adopt green production technologies effectively tackle the challenges posed by carbon quota trading.

Finally, the government is supposed to develop differentiated CET policies and green innovation pathways based on different regions and company characteristics, as this is the key to achieving enhanced green innovation performance. The government should enhance public awareness of environmental protection, driving corporate green innovation through public regulation and demand for green products, thus creating a favorable regional environment for the implementation of CET policy. Additionally, the government should implement relevant measures such as direct subsidies to enhance the enthusiasm of both growing and mature SOEs in carrying out green innovation activities. Furthermore, the market mechanisms of CET policy should be fully utilized to address the financing difficulties faced by non-SOEs in the process of green innovation. In terms of carbon quota allocation, certain relaxations should be granted to non-SOEs, relieving the innovation sustainability challenges caused by insufficient funds during the growth and maturity stages.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

XG: Conceptualization, Methodology, Software, Writing–original draft. RZ: Writing–review and editing. YZ: Formal Analysis, Supervision, Writing–review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Postgraduate Scientific Research Innovation Project of Jiangsu Province (KYCX23_0832).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abadie, A., Diamond, A., and Hainmueller, J. (2010). Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. Publ. Am. Stat. Assoc. 105 (490), 493–505. doi:10.1198/jasa.2009.ap08746

Abdallah, T., Farhat, A., Diabat, A., and Kennedy, S. (2012). Green supply chains with carbon trading and environmental sourcing: formulation and life cycle assessment. Appl. Math. Model. 36, 4271–4285. doi:10.1016/j.apm.2011.11.056

Acs, Z. J., and Audretsch, D. B. (1987). Innovation, market structure, and firm size. Rev. Econ. Stat. 69 (4), 567–574. doi:10.2307/1935950

Bai, Y., Song, S., Jiao, J., and Yang, R. (2019). The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J. Clean. Prod. 233, 819–829. doi:10.1016/j.jclepro.2019.06.107

Barasa, L., Knoben, J., Vermeulen, P. A., Kimuyu, P., and Kinyanjui, B. (2017). Institutions, resources and innovation in East Africa: a firm level approach. Res. Policy 46 (1), 280–291. doi:10.1016/j.respol.2016.11.008

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Bi, K., Huang, P., and Wang, X. (2016). Innovation performance and influencing factors of low-carbon technological innovation under the global value chain: a case of Chinese manufacturing industry. Technol. Forecast. Soc. Chang. 111, 275–284. doi:10.1016/j.techfore.2016.07.024

Braun, M. (2009). The evolution of emissions trading in the European Union – the role of policy networks, knowledge and policy entrepreneurs. Acc. Organ. Soc. 34 (3), 469–487. doi:10.1016/j.aos.2008.06.002

Cai, X., Lu, Y., Wu, M., and Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Cao, Y., and Chen, X. (2012). An agent-based simulation model of enterprises financial distress for the enterprise of different life cycle stage. Simul. Model. Pract. Theory 20, 70–88. doi:10.1016/j.simpat.2011.08.008

Caparros, A., Pereau, J. C., and Tazdait, T. (2013). Emission trading and international competition: the impact of labor market rigidity on technology adoption and output. Energy Policy 55, 36–43. doi:10.1016/j.enpol.2012.09.017

Chen, S., Shi, A., and Wang, X. (2020). Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: the mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 264, 121700. doi:10.1016/j.jclepro.2020.121700

Chen, Z. F., Zhang, X., and Chen, F. L. (2021). Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change. 168, 120744. doi:10.1016/j.techfore.2021.120744

Christophe, B., and Tina, R. (2018). Collaborative environmental governance and transaction costs in partnerships: evidence from a social network approach to water management in France. J. Environ. Plan. Manag. 61 (1), 105–123. doi:10.1080/09640568.2017.1290589

Cohen, W. M., and Klepper, S. (1996). Firm size and the nature of innovation within industries: the case of process and product R&D. Rev. Econ. Stat. 78 (2), 232–243. doi:10.2307/2109925

Cucculelli, M., and Peruzzi, V. (2020). Innovation over the industry life-cycle. Does ownership matter? Res. Policy. 49, 103878. doi:10.1016/j.respol.2019.103878

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. Acc. Rev. 86 (6), 1969–1994. doi:10.2308/accr-10130

Dong, F., Dai, Y., Zhang, S., Zhang, X., and Long, R. (2019). Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 653, 565–577. doi:10.1016/j.scitotenv.2018.10.395

Duan, H., and Hu, Q. (2014). Local officials’ concerns of climate change issues in China: a case from Jiangsu. J. Clean. Prod. 64, 545–551. doi:10.1016/j.jclepro.2013.08.036

Dutta, A. (2018). Modeling and forecasting the volatility of carbon emission market: the role of outliers, time-varying jumps and oil price risk. J. Clean. Prod. 172, 2773–2781. doi:10.1016/j.jclepro.2017.11.135

Feng, X., Zhao, Y., and Yan, R. (2024). Does carbon emission trading policy has emission reduction effect?—An empirical study based on quasi-natural experiment method. J. Environ. Manage. 351, 119791. doi:10.1016/j.jenvman.2023.119791

Flora, M., and Vargiolu, T. (2020). Price dynamics in the European Union Emissions Trading System and evaluation of its ability to boost emission-related investment decisions. Eur. J. Oper. Res. 280, 383–394. doi:10.1016/j.ejor.2019.07.026

Fritsch, M., and Meschede, M. (2001). Product innovation, process innovation, and size. Rev. Ind. Organ. 19, 335–350. doi:10.1023/a:1011856020135

Fu, L., and Li, X. (2014). Analysis of the signal transmission effect of government subsidies in the process of corporate innovation–based on panel data of listed companies in strategic emerging industries. Syst. Eng. 32, 50–58.

Gao, Y., Li, M., Xue, J., and Liu, Y. (2020). Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 90, 104872. doi:10.1016/j.eneco.2020.104872

Garthwaite, C., Gross, T., and Notowidigdo, M. J. (2014). Public health insurance, labor supply, and employment lock. Q. J. Econ. 129 (2), 653–696. doi:10.1093/qje/qju005

Habib, A., and Hasan, M. M. (2019). Corporate life cycle research in accounting, finance and corporate governance: A survey, and directions for future research. Int. Rev. Financ. Anal. 61, 188–201. doi:10.1016/j.irfa.2018.12.004

He, Q., Chen, H., Lin, Z., Dai, X., Huang, Y., and Cai, W. (2022). A cost-based life-cycle pricing model for offshore wind power plants within China’s carbon trading scheme. Energy Rep. 8, 147–155. doi:10.1016/j.egyr.2022.08.101

Hu, J. F., Pan, X. X., and Huang, Q. H. (2020). Quantity or quality? The impacts of environmental regulation on firms’ innovation-Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Change. 158, 120122. doi:10.1016/j.techfore.2020.120122

Huang, H., Zhai, S., and Chen, J. (2016). Corporate life cycle, financing methods and financing constraints: based on the moderating effect research of investor sentiment. J. Financial Res. 7, 96–112. (in Chinese).

Huang, J., Shen, J., Miao, L., and Zhang, W. (2021). The effects of emission trading scheme on industrial output and air pollution emissions under city heterogeneity in China. J. Clean. Prod. 315, 128260. doi:10.1016/j.jclepro.2021.128260

Jaehn, F., and Letmathe, P. (2009). The emissions trading paradox. Eur. J. Oper. Res. 202 (1), 248–254. doi:10.1016/j.ejor.2009.05.007

Jiang, J., Xie, D., Ye, B., Shen, B., and Chen, Z. (2016). Research on China’s cap-and-trade carbon emission trading scheme: overview and outlook. Appl. Energy 178, 902–917. doi:10.1016/j.apenergy.2016.06.100

Jiang, Z. Y., Wang, Z. J., and Zeng, Y. Q. (2020). Can voluntary environmental regulation promote corporate technological innovation? Bus. Strat. Environ. 29, 390–406. doi:10.1002/bse.2372

Lee, E., Walker, M., and Zeng, C. (2014). Do Chinese government subsidies affect firm value? Acc. Org. Soc. 39 (3), 149–169. doi:10.1016/j.aos.2014.02.002

Li, Z., Pan, Y., Yang, W., Ma, J., and Zhou, M. (2021). Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 101, 105426. doi:10.1016/j.eneco.2021.105426

Lian, G., Xu, A., and Zhu, Y. (2022). Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J. Innov. Knowl. 7, 100203. doi:10.1016/j.jik.2022.100203

Liu, J., Mao, W., and Qiao, X. (2023). Dynamic and asymmetric effects between carbon emission trading, financial uncertainties, and Chinese industry stocks: evidence from quantile-on-quantile and causality-in-quantiles analysis. N. Am. Econ. Financ. 65, 101883. doi:10.1016/j.najef.2023.101883

Liu, J., Zhao, M., and Wang, Y. (2020). Impacts of government subsidies and environmental regulations on green process innovation: a nonlinear approach. Technol. Soc. 63, 101417. doi:10.1016/j.techsoc.2020.101417

Liu, M., and Li, Y. (2022). Environmental regulation and green innovation: evidence from China’s carbon emissions trading policy. Financ. Res. Lett. 48, 103051. doi:10.1016/j.frl.2022.103051

Liu, M., Shan, Y., and Li, Y. (2022). Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 171, 113290. doi:10.1016/j.enpol.2022.113290

Liu, Z., Anderson, T. D., and Cruz, J. M. (2012). Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 218 (3), 602–613. doi:10.1016/j.ejor.2011.11.027

Liu, Z. L., and Sun, H. B. (2021). Assessing the impact of emissions trading scheme on low-carbon technological innovation: evidence from China. Environ. Impact Asses. 89, 106589. doi:10.1016/j.eiar.2021.106589

Liu S, S., Lin, Z., and Leng, Z. (2020). Whether tax incentives stimulate corporate innovation: evidence based on corporate life cycle theory. Econ. Res. J. 55 (6), 105–121. (in Chinese).

Luo, W., Zhang, Y., Gao, Y., Liu, Y., Shi, C., and Wang, Y. (2021). Life cycle carbon cost of buildings under carbon trading and carbon tax system in China. Sust. Cities Soc. 66, 102509. doi:10.1016/j.scs.2020.102509

Ma, H., and Li, L. (2021). Could environmental regulation promote the technological innovation of China’s emerging marine enterprises? Based on the moderating effect of government grants. Environ. Res. 202, 111682. doi:10.1016/j.envres.2021.111682

Malerba, F., and Orsenigo, L. (1997). Technological regimes and sectoral patterns of innovative activities. Ind. Corp. Chang. 6 (1), 83–118. doi:10.1093/icc/6.1.83

McGahan, A. M., and Silverman, B. S. (2001). How does innovative activity change as industries mature? Int. J. Ind. Organ. 19 (7), 1141–1160. doi:10.1016/s0167-7187(01)00067-4

Medeiros, J. F. D., Ribeiro, J. L. D., and Cortimiglia, M. N. (2014). Success factors for environmentally sustainable product innovation: a systematic literature review. J. Clean. Prod. 65, 76–86. doi:10.1016/j.jclepro.2013.08.035

Miller, D., and Friesen, P. H. (1984). A longitudinal study of the corporate life cycle. Manage. Sci. 30 (10), 1161–1183. doi:10.1287/mnsc.30.10.1161

Ni, X., Jin, Q., and Huang, K. (2022). Environmental regulation and the cost of debt: evidence from the carbon emission trading system pilot in China. Financ. Res. Lett. 49, 103134. doi:10.1016/j.frl.2022.103134

Pan, X., Pu, C., Yuan, S., and Xu, H. (2022). Effect of Chinese pilots carbon emission trading scheme on enterprises’ total factor productivity: the moderating role of government participation and carbon trading market efficiency. J. Environ. Manage. 316, 115228. doi:10.1016/j.jenvman.2022.115228

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi:10.1257/jep.9.4.97

Potter, A., and Watts, H. D. (2011). Evolutionary agglomeration theory: increasing returns, diminishing returns, and the industry life cycle. J. Econ. Geogr. 11 (3), 417–455. doi:10.1093/jeg/lbq004

Qi, Y., Yuan, M., and Bai, T. (2023). Where will corporate capital flow to? Revisiting the impact of China’s pilot carbon emission trading system on investment. J. Environ. Manage. 336, 117671. doi:10.1016/j.jenvman.2023.117671

Qiu, Y., Shaukat, A., and Tharyan, R. (2016). Environmental and social disclosures: link with corporate financial performance. Brit. Acc. Rev. 48 (1), 102–116. doi:10.1016/j.bar.2014.10.007

Richardson, S. (2006). Over-investment of free cash flow. Rev. Acc. Stud. 11 (2–3), 159–189. doi:10.1007/s11142-006-9012-1

Rong, Z., Wu, X. K., and Boeing, P. (2017). The effect of institutional ownership on firm innovation: evidence from Chinese listed firms. Res. Policy 46 (9), 1533–1551. doi:10.1016/j.respol.2017.05.013

Shahzad, F., Ahmad, M., Fareed, Z., and Wang, Z. (2022). Innovation decisions through firm life cycle: a new evidence from emerging markets. Int. Rev. Econ. Financ. 78, 51–67. doi:10.1016/j.iref.2021.11.009

Shao, Y., and Chen, Z. (2022). Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Acc. Org. Soc. 74, 716–727. doi:10.1016/j.eap.2022.03.020

Shao, K., and Wang, X. (2023). Do government subsidies promote enterprise innovation?—Evidence from Chinese listed companies. J. Innov. Knowl. 8, 100436. doi:10.1016/j.jik.2023.100436

Sheng, C., Wang, G., Geng, Y., and Chen, L. (2020). The correlation analysis of futures pricing mechanism in China’s carbon financial market. Sustainability 12 (18), 7317. doi:10.3390/su12187317

Shi, B., Li, N., Gao, Q., and Li, G. (2022). Market incentives, carbon quota allocation and carbon emission reduction: evidence from China’s carbon trading pilot policy. J. Environ. Manage. 319, 115650. doi:10.1016/j.jenvman.2022.115650

Shimizu, M. (2020). The relationship between pollution abatement costs and environmental regulation: evidence from the Chinese industrial sector. Rev. Dev. Econ. 24, 668–690. doi:10.1111/rode.12655

Song, M., Zheng, H., and Shen, Z. (2023). Whether the carbon emissions trading system improves energy efficiency – empirical testing based on China’s provincial panel data. Energy 275, 127465. doi:10.1016/j.energy.2023.127465

Sueyoshi, T., and Wang, D. (2014). Radial and non-radial approaches for environmental assessment by data envelopment analysis: corporate sustainability and effective investment for technology innovation. Energy Econ. 45, 537–551. doi:10.1016/j.eneco.2014.07.024

Tang, L., Wu, J., Yu, L., and Bao, Q. (2015). Carbon emissions trading scheme exploration in China: a multi-agent-based model. Energy Policy 81 (6), 152–169. doi:10.1016/j.enpol.2015.02.032

Tariq, A., Badir, Y. F., Tariq, W., and Bhutta, U. S. (2017). Drivers and consequences of green product and process innovation: a systematic review, conceptual framework, and future outlook. Technol. Soc. 51, 8–23. doi:10.1016/j.techsoc.2017.06.002

Tavassoli, S. (2015). Innovation determinants over industry life cycle. Technol. Forecast. Soc. Chang. 91, 18–32. doi:10.1016/j.techfore.2013.12.027

Thongplew, N., Spaargaren, G., and van Koppen, C. S. A. K. (2017). Companies in search of the green consumer: sustainable consumption and production strategies of companies and intermediary organizations in Thailand. NJAS-Wagen. J. Life Sci. 83, 12–21. doi:10.1016/j.njas.2017.10.004

Utterback, J. M., and Abernathy, W. J. (1975). A dynamic model of process and product innovation. Omega 3 (6), 639–656. doi:10.1016/0305-0483(75)90068-7

Wang, C., Wang, L., Wang, W., Xiong, Y., and Du, C. (2023). Does carbon emission trading policy promote the corporate technological innovation? Empirical evidence from China’s high-carbon industries. J. Clean. Prod. 411, 137286. doi:10.1016/j.jclepro.2023.137286

Wang, X., and Chen, J. (2020). Province managing county reform and regional air pollution: empirical evidence from satellite inversion data. J. Financial Res. 11, 76–93. (in Chinese).

Wang, X., and Wang, Y. (2021). Research on the green innovation promoted by green credit policies. J. Manag. World 37 (6), 173–188. (in Chinese).

Wei, Y., Zhu, R., and Tan, L. (2022). Emission trading scheme, technological innovation, and competitiveness: evidence from China’s thermal power enterprises. J. Environ. Manage. 320, 115874. doi:10.1016/j.jenvman.2022.115874

Wu, R., Tan, Z., and Lin, B. (2023). Does carbon emission trading scheme really improve the CO2 emission efficiency? Evidence from China’s iron and steel industry. Energy 277, 127743. doi:10.1016/j.energy.2023.127743

Xiao, Y., Huang, H., Qian, X., and Chen, L. (2023). Can carbon emission trading pilot facilitate green development performance? Evidence from a quasi-natural experiment in China. J. Clean. Prod. 400, 136755. doi:10.1016/j.jclepro.2023.136755

Yan, Z., and Li, Y. (2018). Signaling through government subsidy: Certification or endorsement. Financ. Res. Lett. 25, 90–95. doi:10.1016/j.frl.2017.10.007

Yang, L., Li, F., and Zhang, X. (2016). Chinese companies’ awareness and perceptions of the Emissions Trading Scheme (ETS): evidence from a national survey in China. Energy Policy 98, 254–265. doi:10.1016/j.enpol.2016.08.039

Yang, L., Qin, H., Xia, W., Gan, Q., Li, L., Su, J., et al. (2021). Resource slack, environmental management maturity and enterprise environmental protection investment: an enterprise life cycle adjustment perspective. J. Clean. Prod. 309, 127339. doi:10.1016/j.jclepro.2021.127339

Yu, D., and Wang, J. (2022). Research on the impact of government subsidies on enterprise innovation in different life cycles. J. Finance Econ. 48 (1), 19–33. (in Chinese).

Zeng, S., Jia, J., Su, B., Jiang, C., and Zeng, G. (2020). The volatility spillover effect of the European Union (EU) carbon financial market. J. Clean. Prod. 282, 124394. doi:10.1016/j.jclepro.2020.124394

Zhang, H., Duan, M., and Deng, Z. (2019). Have China’s pilot emissions trading schemes promoted carbon emission reductions? -the evidence from industrial sub-sectors at the provincial level. J. Clean. Prod. 234, 912–924. doi:10.1016/j.jclepro.2019.06.247

Zhang, H., and Zhang, B. (2020). The unintended impact of carbon trading of China’s power sector. Energy Policy 147 (12), 111876. doi:10.1016/j.enpol.2020.111876

Zhang, Q., Zhang, S., Chen, R., and Li, J. (2023). Does carbon emission trading mitigate firm’s default risk? Evidence from China. J. Clean. Prod. 398, 136627. doi:10.1016/j.jclepro.2023.136627

Zhang, W., Li, G., and Guo, F. (2022). Does carbon emissions trading promote green technology innovation in China? Appl. Energy. 315, 119012. doi:10.1016/j.apenergy.2022.119012

Zhang, Y. J., Shi, W., and Jiang, L. (2020). Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? Bus. Strateg. Environ. 29 (3), 872–885. doi:10.1002/bse.2404

Zhao, X., Lu, W., Wang, W., and Hu, S. (2023). The impact of carbon emission trading on green innovation of China’s power industry. Environ. Impact Assess. Rev. 99, 107040. doi:10.1016/j.eiar.2023.107040

Zhong, Z., and Peng, B. (2022). Can environmental regulation promote green innovation in heavily polluting enterprises? Empirical evidence from a quasi-natural experiment in China. Sustain. Prod. Consump. 30, 815–828. doi:10.1016/j.spc.2022.01.017

Keywords: carbon emission trading policy, corporate green innovation, government subsidies, life cycle, moderating effects, triple-difference (DDD) model

Citation: Guo X and Zhang Y (2024) How do companies with different life cycles respond to carbon trading?—Analysis of the moderating role of government subsidies. Front. Environ. Sci. 12:1320039. doi: 10.3389/fenvs.2024.1320039

Received: 11 October 2023; Accepted: 04 January 2024;

Published: 18 January 2024.

Edited by:

Wojciech Przychodzen, ESIC Business and Marketing School, SpainReviewed by:

Fernando Gómez-Bezares, University of Deusto, SpainSa'D Shannak, Hamad bin Khalifa University, Qatar

Copyright © 2024 Guo and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yue Zhang, bW9vbm56aGFuZ0AxNjMuY29t

Xiaoxu Guo

Xiaoxu Guo Yue Zhang

Yue Zhang