- 1School of Economics and Management, Beijing Forestry University, Beijing, China

- 2Research Academy for Rural Revitalization of Zhejiang Province, Zhejiang A&F University, Hangzhou, China

- 3Department of Forestry, Michigan State University, East Lansing, MI, United States

- 4College of Economics and Management, Northwest A&F University, Yangling, China

The question of funding necessary climate actions, including those in the forest sector, to drastically reduce greenhouse gas (GHG) emissions and global warming, is important to both national governments and international agencies. The objective of this paper is to address this question by reviewing and synthesizing the economic principles associated with reducing GHG emissions, the pricing mechanisms used to achieve that goal, and the diverse practices of climate finance. Included in the carbon pricing mechanisms and practices are carbon tax, compliance and voluntary emission trading, internal pricing, and funding via issuing bonds or mobilizing public budgetary resources. Then, it proceeds to describe the roles that public and private organizations can play and have played in supporting emission reduction and removal, which serves as a vital backdrop for examining current states and relative costs of forest sector initiatives. Overall, as reported by the World Bank, only about 23% of global GHG emissions are subject to any explicit price, and 75% of the emissions that are subject to a price are charged less than $10 per tCO2e. Market-based forest finance and international support for reducing emissions from deforestation and forest degradation have accounted for a small fraction of the total spent on climate mitigation and adaptation. Further, the more recent developments in carbon pricing and funding remain slow and disappointing. Without the right scale of green finance at the right time, however, it will be difficult to achieve the needed energy and economic transformation.

1 Introduction

As the global warming worsens, the need for humane society to take decisive actions to mitigate climate change (CC) has become more urgent (IPCC, 2022). Therefore, transforming the energy-use system to achieve low-carbon economic development has been a crucial thrust of international deliberation and policy (Stern, 2007; Nordhaus, 2021). Central to this deliberation and policy are the following two questions: Given the massive global investment anticipated to limit the catastrophic effects of CC by drastically reducing greenhouse gases (GHG) emissions, how can the necessary mitigation and adaptation (M&A) actions, including those in the forest sector, be funded, and how have they been financed?

The objective of this Policy and Practice Review is to address the above two questions by pursuing two interconnected analytic tasks carefully. Our first task is to exposit the fundamental economic principles of how to reduce GHG emissions and the mechanisms used to achieve that goal through various forms of carbon pricing. Our second task is to overview the developments in designing and implementing explicit carbon pricing mechanisms and the roles public and private sectors can play and have played beyond these pricing mechanisms, in financing emission reduction and removal (ER&R) and exploring alternative energy sources.

To appreciate the magnitude of the investment required to achieve global “net-zero” GHG emissions by 2050 in line with the Paris Agreement climate targets, a recent study by McKinsey & Co. (2022) suggests that an annual global investment of $9.2 trillion is needed over the next 30 years1. That amount of expenditure, an increase of $3.5 trillion per year from what is spent today (Tyson and Weiss, 2022), must be made to transform the energy, transportation, building, manufacturing, and other sectors of the economy, as well as to protect and enhance the capacities of carbon capture and storage through land-use and other practices (IPCC, 2022, Roe et al., 2019). Thus, it is important and worthwhile to investigate the essentials of carbon finance in general and funding for forest sector climate actions in particular.

Meanwhile, there has been scant attention devoted to this subject matter. For instance, in outlining alternative ways to introduce a carbon price, the Carbon Pricing Leadership Coalition (2017) noted that “GHG emissions can be priced explicitly through a carbon tax or a cap-and-trade system. Carbon pricing can also be implemented by embedding national prices in, among other things, financial instruments and incentives that foster low-carbon programs and projects.” Nonetheless, we still do not know how these alternative mechanisms of carbon pricing have been adopted and whether they have considered forest sector climate actions. Likewise, while the World Bank (World Bank, 2021; World Bank, 2023) has been tracking the State and Trend of Carbon Pricing, it has not covered the forest sector well. Since forests are a crucial component in the international efforts of mitigating CC (Griscom et al., 2017; IPCC, 2020), filling this knowledge gap is imperative.

Parrotta et al. (2022), in their comprehensive assessment of a decade implementation of the REDD + initiative2, examined its evolving international finance landscape. Other than lamenting on the slow and limited funding and portraying a not-so-promising outlook, however, the authors were unable to examine funding for forest sector climate solutions more broadly, let alone the specific principles and mechanisms of carbon finance. Following an overview of the policies and practices of implementing the Paris Agreement, including nationally determined contribution (NDC) and carbon accounting, Wang et al. (2021) expounded their implications to forest sector climate actions. But at the end of that article, they noted that “[S]pace limit does not permit us to get into C[carbon] finance, as well as pricing, which we will address in the future.”

Building on these, and many other, studies, we review and synthesize the policy evolution and practical developments of carbon finance and funding for forest sector climate solutions in this paper. We begin with an elaboration of the economic principles of how to reduce GHG emissions and the mechanisms used to achieve that goal through various forms of carbon pricing in Section 2. In Section 3, we summarize the recent developments in designing and implementing the carbon pricing mechanisms first, and then consider the roles that public and private sectors can play and have played, beyond explicit pricing, in financing ER&R. It is expected is that this broader and updated background will enable readers to form an adequate perspective that will help them approach forest sector climate actions more effectively. In Section 4, we delve into forest sector climate actions by examining the current states and relative costs of different initiatives, alternative means they are funded, and other relevant issues. Finally, we close with a summary of the explicit and implicit mechanisms of carbon pricing and a brief discussion of the potential opportunities for future inquiry and implementation. Whenever necessary, a box or table is included to showcase the advances of a particular mechanism of carbon pricing or to report the relevant statistics of its implementation.

In sum, the evidence reported by the World Bank (World Bank, 2021; World Bank, 2023) indicates that only about 23% of global GHG emissions are subject to any price at all, and 75% of emissions that are subject to a price are less than $10 per ton of carbon dioxide equivalent (tCO2e). In addition, REDD+ and market-based finance of forest projects and programs have accounted for a small fraction (∼3%) of the total spent on climate mitigation (Barbier et al., 2020), and the average trading price of forest carbon credits is ∼$7/tCO2 (Donofrio et al., 2023). Overall, while promising, the more recent developments of carbon pricing remain slow and disappointing, and the financial incentives for ER&R continue to be weak.

Before proceeding, a couple of points should be made clear. First, unlike a typical review of the academic literature, this is a Policy and Practice Review. The former tends to focus on the performances of different carbon pricing mechanisms in terms of effectiveness, efficiency, and equity (e.g., Clausing and Wolfram 2023; Yin 2024). In comparison, the latter provides “a comprehensive coverage and balanced overview of current and relevant topics related to policy, regulations, and guidelines”3. We have chosen to do the latter, instead of the former, largely because while both types of reviews are interesting and informative, it appears that the latter is currently more pertinent and more beneficial. Plus, it seems too soon to conduct a regular literature review given that the policies and practices have not been greatly advanced yet.

Second, while the references are available from a number of classical and contemporary sources, it is challenging to collate such a vast, dynamic repository of information. Moreover, it is crucial to place the literature in a proper context and shed crucial light on how to satisfactorily confront the challenges we face in CC M&A. We hope that our efforts of reviewing the policies and practices will contribute to a timely and coherent understanding of the multitude of CC financial complexities and a more effective execution of M&A actions defined by the NDCs and other international obligations, including those in the forest sector.

2 Principles and mechanisms of carbon pricing

In his book titled The Spirit of Green, Professor William Nordhaus (2021) has succinctly articulated the economic theory of GHG emission as a global-scale externality (or public good) and the mechanisms for CC mitigation through GHG ER&R. He began by observing that CC results from the impact of GHG emission that takes place outside the market; thus, GHG emission constitutes a global-scale externality, as the cost it entails spill outside of the market worldwide and are not directly reflected in prices. For activities associated with this type of externality, the costs, benefits, and prices are not properly aligned. So, “a well-managed society will ensure that major negative externalities are corrected through government laws that promote negotiations and liability for damage through powers such as regulations and taxes (p. 19).”

He further noted that “the common theme of all externalities is that “the price is wrong,” meaning that prices do not reflect social costs. In the context of CC, the social cost of Carbon (SCC) is the total economic cost incurred for each additional ton of CO2 (or equivalent) emitted to the atmosphere (Nordhaus, 2019). So, he argued that a central principle for dealing with CC as a grave externality is federalism, which “recognizes that legal, ethical, economic, and political obligations and processes operate at different levels, and the solutions will necessarily involve various institutions and decision processes depending on the level” (Nordhaus, 2021, p. 22). In fact, many eminent economists agree that the most effective policies are to “internalize” costs and benefits. Internalization requires that those who generate the negative externality pay the SCC. Put differently, only if the SCC is covered by the carbon price set by societies, which deploy various mechanisms to deal effectively with spillovers, can the externality be fully internalized. The mechanisms include “market incentives, governmental regulations and fiscal penalties, organizational activities through corporate responsibility, and personal ethics for important interpersonal interactions” (Nordhaus, 2021, p. 24).

Indeed, the Paris Agreement has urged national jurisdictions, businesses, and other organizations to gear up the adoption of policies that promote carbon pricing schemes and substantially boost M&A finance (World Bank, 2021). As an indispensable part of efficient ER&R, carbon pricing is intended to incentivize changes in investment, production, and consumption patterns and to promote technological innovation and deployment that will drive down future abatement costs. More specifically, scholars have argued that carbon pricing can serve multiple functions (Stern, 2007; Rogoff, 2021):

• It signals to consumers which products and services are more carbon intensive.

• It offers incentives for investors/innovators to develop new low-carbon technologies.

• It incentivizes producers to adopt low-carbon practices, processes, and technologies.

• It provides revenues for government and business to fund investments in CC M&A.

In practice, carbon pricing can take the form of cap and trade, taxation, corporate internal pricing, and voluntary market, even though external carbon tax and cap-and-trade are the two primary policy mechanisms (Carbon Pricing Leadership Coalition, 2017). The key elements to any external pricing mechanism are to ensure that the appropriate legal framework exists, public and private sectors are adequately prepared and receptive, and most importantly, the price is appropriately set to drive the desired behavior (Stern, 2007).

Before we turn to the different mechanisms of carbon pricing, it is worth noting that the Carbon Pricing Leadership Coalition (2017) indicated that to achieve the Paris Agreement climate goal—a global temperature rise of within 1.5°C, carbon emissions should be priced at least $40-80/tCO2e by 2020, ramping up to $50-100/tCO2e by 2030. A recent study, featuring a more pragmatic approach to price carbon in the US by targeting net-zero emissions by 2050, has shown a similar result: $34-64/tCO2e in 2025 and $77-124/tCO2e in 2030 (Kaufman et al., 2020).

3 Putting a price on carbon

Here, we deliberate the specific mechanisms of putting a price on carbon. In addition to carbon tax and emission cap and trade, we also cover voluntary market, corporate internal pricing, and other relevant developments.

3.1 Carbon tax

A carbon tax is a simple and straightforward way to introduce a price for GHG emissions, and each emitter is incentivized to cut emissions to reduce its own tax burden. A carbon tax offers several advantages. First, it puts the burden of GHG emissions on polluters and drives a sharp focus on reducing emissions as well as innovating new technologies (Rogoff, 2021). If it is built within the framework of existing tax code, it can be relatively easy to implement and administer. Also, a carbon tax generates revenue that can be used to improve energy efficiency, develop clean or novel technologies like carbon capture and storage, adapt to CC effects, and/or fund nature-based climate solutions (NbS) (Pettinger, 2020; Clausing and Wolfram, 2023).

To facilitate implementation, a carbon tax can be instituted as “revenue neutral,” whereby the full revenue stream is returned to businesses or households in the form of rebates or other tax cuts; similarly, public monetary transfers can be used to infuse cash into targeted constituencies that do not contribute much to GHG emissions but may experience economic hardship as a result of the carbon tax (Summer et al., 2009). While the cost of a carbon tax is predictable and can be targeted to specific areas, it does not guarantee achievement of a specific net emission reduction. Further, taxes are notoriously unpopular and politically polarizing. The mere notion of a carbon tax typically evokes stiff resistance from industry and consumers, who generally dislike the idea and may neither understand nor trust in the notion of revenue neutrality (Pettinger, 2020).

Even if public resistance can be overcome, political battles are inevitable as the allocation of tax revenues is decided amongst competing interests. Contentious debate is also likely to arise when considering on whom the carbon tax is to be levied—should it be placed on upstream sources of emissions (producers) or downstream users (consumers) along the supply chains? Taxing upstream users may be easier for government agencies, but taxing downstream users may provide a more direct signal to change behaviors (Sumner et al., 2009; Xu et al., 2023). Despite its challenges, many economists, politicians, and industry leaders often favor a carbon tax as the most efficient way to drive emission reductions. Several countries, including Sweden, Switzerland, Colombia, and Costa Rica (see Box 1) and other jurisdictions, like British Columbia, have successfully reduced emissions through a tax policy, while maintaining robust economic growth (World Bank, 2021). Unlike the case of Costa Rica summarized below, however, agricultural, forestry, and other land-based sectors in many countries have not directly benefitted from their carbon tax revenues, even though certain activities in these sectors may have been somehow exempted by the policy (Donofrio et al., 2021).

Box 1 Carbon tax in costa rica

Costa Rica introduced a 3.5% tax on fossil fuels in 1997. Today, proceeds from this carbon tax generate about $27 million per year that is administered by the country’s National Forest Fund (FONAFIFO). FONAFIFO supports the conservation of mature forests, reforestation with native species, and agroforestry projects that incorporate a mix of trees with crops or grasslands. In the two decades following the implementation of the tax, Costa Rica’s economy has grown an average of more than 4% per year, and the fund has disbursed $500 million to about 18,000 landowners for projects protecting at least one million hectares of mature forest and more than 71,000 ha of reforestation. Transparency and accountability are keys to the success of government agencies like FONAFIFO, along with its commitment to represent interests of indigenous people, such as the protection of 162,000 ha of territory occupied by the Cabécar and Bribri tribes (Barbier et al., 2020). As shown on its website (https://www.fonafifo.go.cr/es/), transparency pertains to open business transactions and publicly assessable information on services, assets, and expenses of FONAFIFO, and accountability means that it takes full responsibility for its actions.

3.2 Cap and trade

In contrast to a carbon tax, a cap-and-trade system, also known as an emissions trading scheme (ETS), uses market forces to drive emission reductions. While results are mixed, ETS has the distinct advantage of being more politically and socially acceptable than a carbon tax. Over 80 countries specifically mention carbon markets in their NDCs (Bayer and Aklin 2020).

In an ETS, a governmental body sets an overall limit, or cap, on carbon emissions for a given jurisdiction, and each emitter is granted permits (allowable quantities of emissions) that add up to the cap. Participants are allowed to trade emission credits or debits, provided the total emission cap is achieved for the entire community (Carbon Pricing Leadership Coalition, 2017). The key is to regulate a gradual reduction of the cap, so that polluters must make commensurate cuts in emissions; as the cap is lowered, scarcity results in an increase in the price of emission allowances. If allowances for an individual firm are unachievable or unaffordable, then that firm can pay another to help achieve its target (Naughten, 2011). This is done through purchasing carbon credits from others who operate below their permitted emissions. Participants can also offset emissions by funding projects that sequester and store carbon, such as forest sector NbS.

The basic premise of an ETS is that it does not matter if every individual polluter reduces emissions equitably, provided that total emissions for the entire jurisdiction fall within the defined cap. The desired way to achieve this objective is for firms to invest in innovation of new technologies or efficiency improvements to reduce their own emissions, and offsets serve as an enabler to help achieve this ultimate objective. In theory, market forces should result in lowest cost of emission reductions, with the idea that benefits will be enjoyed by consumers and society at large (Carbon Pricing Leadership Coalition, 2017).

While an ETS induces emissions to align with an overall cap, the price of carbon is difficult to predict as economic growth and other factors cause variability in the trading price. In addition, these schemes often fail to demonstrate measurable ER&R because industries stoke fear of economic calamity and sow doubt to successfully lobby governments to grant generous (even free) permits with limited regulation, oversight, and accountability (Canham, 2021). For example, China recently launched the world’s largest ETS, representing 12% of global emissions; but due to intense industry lobbying, the initial rollout omits a formal overall emissions cap, basically rendering it ineffective in driving emission reductions (Liu, 2021). Also, many ETSs have become exceedingly complicated, often involving speculation in sophisticated financial instruments, like forward derivatives and futures, that benefit an elite class of traders and result in limited impact on actual emissions (Naughten, 2011).

Many of these shortcomings can be overcome with an aggressive cap reduction strategy and strong safeguards and enforcement designed to create robust market forces to achieve sustainable ER&R (World Bank, 2021). Today, over 30 ETS programs exist around the world, including the European Union, New Zealand, and the state of California (see Box 2).

Box 2 Carbon cap-and-trade in California, United States

In response to the failure of a US national carbon pricing bill in 2003, California spearheaded its own ETS, Assembly Bill 32 (AB-32), in 2006. AB-32 was designed to reduce GHG emissions to baseline (1990) levels by 2020 (realized in 2016) and further reduce emissions by 40% and 80%, respectively, below baseline by 2030 and 2050. California also intends to generate 100% of its electricity carbon-free and achieve economy-wide carbon neutrality by 2045. Since 2015, 85% of the state’s GHG emissions have been governed by AB-32. The overall cap decreased by 3% per year between 2015 and 2020 and is designed to decrease another 5% per year by 2030. As a result, AB-32 contributed to a 5.3 percent GHG emission reduction in 2013–2017 and generated $5 billion of revenue, 35% of which was invested in low-income and environmentally disadvantaged communities (Center for Climate and Energy Solutions, 2022).

To incentivize GHG emission reductions and carbon sequestration, California Air Resources Board (CARB) issues offset credits to qualified projects pursuant to six Board-approved Compliance Offset Protocols (on livestock, ozone depletion substance, U.S. forests, urban forests, mine methane capture, and rice cultivation projects). These offsets are tradable credits that represent verified emissions reductions or removal enhancements from sources not subject to a compliance obligation in the cap-and-trade program. Compliance entities may use offset credits to meet up to 8% of their obligation for emissions through 2020; 4% of their obligation for emissions from 2021-2025; and 6% for emissions from 2026-2030. Forestry credits in the offset market surged to more than 83 MTCO2e during 2017–2019, valued at almost $1.2 billion (CARB, 2021). But two recent studies reported that carbon accumulated in offset projects to date has not been additional to what might have otherwise occurred (Badgley et al., 2022; Coffield et al., 2022). Other than the California ETS, however, few other compliance markets offer similar offsetting opportunities; meanwhile, the voluntary carbon markets have been actively pursuing forest-sector offsetting credits (Yin, 2024).

3.3 Voluntary markets

With growing pressure on companies to adopt “net-zero” emission goals as part of their corporate social responsibility (CSR), voluntary markets are becoming popular and evolving rapidly. Like compliance (ETS) markets, voluntary markets provide an alternative path for organizations to offset GHG emissions through the purchase and sale of carbon credits. But as the name implies, these are neither mandated nor regulated (World Bank, 2021). Nevertheless, voluntary markets are gaining momentum as large, reputable organizations like Microsoft and Amazon commit to net-zero targets, and American Carbon Registry and Gold Standard develop protocols for certifying ER&R projects (Donofrio et al., 2021; DeFries et al., 2022).

It is important to emphasize that effective corporate environmental, social, and governance (ESG) strategies strive for true emission reductions at the source. Unfortunately, in pursuit of “quick wins,” some companies may be tempted to purchase carbon offsets, including those predicated on REDD + projects, as a substitute for reducing their own emissions (Parrotta et al., 2022). While initially attractive, this approach is not sufficient to reduce GHG emissions in the spirit of the Paris Agreement. Offsets should only be used to complement investments that abate emissions (World Bank, 2021). Furthermore, socially responsible companies look to optimize their full value chains by selecting upstream partners with low GHG emissions and/or supporting supply partners to achieve emission reductions (Xu et al., 2023). When used properly, purchasing carbon credits offers a great opportunity for companies to realize net-zero emissions across their entire value chains, while providing a funding source for offsetting projects, such as NbS.

Another question is how to ensure the trustworthiness of the large intermediaries, who are involved in the project development, verification, and certification, and thus the credibility of the transactions over voluntary markets. As found by a recent investigative report of The Guardian, most of the REDD + projects in Peru have failed to deliver what were promised (Zadek, 2023). So, there is an acute need for adequate supervision and regulation by certifying the certifiers and verifying the verifiers, as part of the discussion over alternative approaches to governing climate solutions. It is also relevant to consider integrating voluntary markets and other carbon projects of the private sector into a national or subnational and programs (Wang et al., 2021), which is also referred to as nesting (Yin, 2024). Hopefully, these ideas will attract the public attention, and the offset credits generated by voluntary markets will be robust and reliable.

3.4 Other financing sources

There is increasing recognition that capital in global markets must be shifted toward low-carbon activities. Effective public policy can induce research and development of new technologies to reduce emissions and should foster investments in such areas as renewable energy, increased efficiency standards, public transportation, urban planning, and land management. One could argue that current global energy policy, in the form of subsidies to the fossil fuel industry, has the opposite effect by actually promoting GHG emissions. Data for 2020 indicate that of the $634 billion in global energy sector subsidies, about 70%, or nearly $450 billion went to fossil fuels (Taylor, 2020). Clearly, this disparity must be addressed where it exists, partly by phasing out the fossil fuel subsidies.

On the other hand, certain jurisdictions are reluctant or unable to impose costs of ER&R directly on firms and consumers, which can lead to either inaction or to imposition of costs in other forms. A prominent example is that the US federal government has recently enacted a burst of public spending on clean energy and innovation in 2021 and 2022, including funding for clean energy infrastructure and investments as well as a long list of clean energy tax credits (Clausing and Wolfram, 2023). It has been reported that the 2022 Inflation Reduction Act alone would spend more than $350 billion over 10 years on clean energy tax credits and subsidies (Congressional Budget Office, 2022).

Climate or “green” bonds involve the use of fixed-income instruments designed to finance debt for climate solutions (World Bank, 2014). The global green bond market has grown from about $13 billion in 2013 (World Bank, 2014) to over $646 billion in 2021 and is expected to surpass $1 trillion in 2022 (Jones, 2022). However, bonds have limitations. Investors are not always guaranteed that their money will be spent directly on a specific project of their desire. Budget constraints or scarcity of capital may force debtors to invest in alternative priorities. Despite these and other challenges, green bond investment continues to grow because it allows organizations to signal to investors their commitment to sustainability. Moreover, these bonds also offer investors an opportunity to diversify portfolios with an ESG agenda (Giugale, 2018). While not yet a significant source of capital for forest projects, global bond proceeds support projects such as renewable energy, transportation, building energy efficiency, land use, and the like (Jones, 2022).

The Carbon Pricing Leadership Coalition (2017) stated that “[C]arbon pricing can also be implemented by embedding notional prices in, among other things, financial instruments and incentives that foster low carbon programs and projects.” One way this is done is for companies to institute their own internal price on carbon. This can be accomplished with an internal carbon fee (monetary value on carbon emissions used to generate a dedicated investment stream for ER&R projects); a shadow price (internal hurdle rate designed to support investments and create an internal inducement to decarbonize); or an implicit price (spotlights the amount spent to comply with efficiency standards or reduce emissions to alleviate carbon footprint). Regardless, the aim is to place a monetary value on GHG emissions and factor the associated costs into existing operations and future investments. Many companies also advocate this approach to help build more resilient supply chains and support CSR objectives by responding to shareholder concerns. According to the Center for Climate and Energy Solutions (2022), over 1,200 companies have either instituted or plan to implement internal carbon pricing.

In addition to domestic public and private finance in developed countries, political leaders and academic experts have stressed the urgency of international finance to “assist developing countries in mitigating the effects of climate change without further exacerbating their already-unsustainable debt levels” (Rogoff, 2023). Some have even called for establishing a “global green bank” or “global carbon bank,” which Rogoff (2023) argues is a proposal “that rich countries must consider if they are serious about tackling climate change … and promoting prosperity … in the developing world.” More broadly, just like public-private partnership can help drive innovation and investment for a sustainable future (Tyson and Weisss, 2022), international cooperation and linkage will reduce distortions in trade and capital flows and aid the efficient ER&R by promoting consistency of actions across countries (Nordhaus, 2021).

In short, in pursuing jurisdictional approaches to governing climate solutions, there is a significant role for public policy and government action to foster investment and complement roles for the private sector, multilateral development banks, international financial institutions, and concessional finance of various forms (Songwe et al., 2022).

4 Forest sector solutions

World forests are huge carbon sinks, absorbing ∼15.6 billion tons of CO2 per year; because of deforestation and other disturbances, however, they emit about half of that quantity back into the atmosphere (Harris and Gibbs, 2021). Thus, deforestation and forest degradation remains a great source of CO2 emissions. Altogether, ∼23% of anthropogenic GHG emissions currently come from the destruction or poor management of the world’s forests, farms, and pasture lands (Donofrio et al., 2021). On the other hand, forest sector actions could offer over two-thirds of the cost-effective NbS necessary to hold warming to below 2.0°C and about half of the low-cost mitigation opportunities (Griscom et al., 2017).

The argument for using forest sector NbS to combat CC is compelling. Stern (2007) observed that reducing deforestation is the “single largest opportunity for cost-effective and immediate reductions of C[carbon] emissions.” It is estimated that about 14% of all emission reductions required to achieve net-zero GHG emissions by 2050 could be realized at a relatively low cost (∼$10/tCO2e) by eliminating deforestation (McKinsey and Co, 2022). Busch et al. (2019) further showed that carbon removals from tropical reforestation between 2020 and 2050 could be increased by 5.7 billion tons of CO2 at a carbon price of $20 per ton or by 15.1 billion tons at $50 per ton. Similar results were also reported by Austin et al. (2020). Ironically, forest ecosystem conservation only receives a small fraction (∼3%) of the total amount of funds spent on climate mitigation (Barbier et al., 2020).

4.1 Supporting REDD+

The Paris Agreement “recognizes the importance of adequate and predictable financial resources … for reducing emissions from deforestation and forest degradation,” while affirming the significance of non-carbon co-benefits, such as community livelihoods and biodiversity conservation (UNFCCC, 2020). Many developing countries rely on REDD + activities in their NDCs to achieve emission reduction targets (Duchelle et al., 2017). While effective policy should be shaped and enacted by the nations where deforestation occurs, many poor countries lack the economic resources to fund the effort (Parrotta et al., 2022). As a result, industrialized countries pledged at COP15 $100 billion a year by 2020 to help developing countries cut carbon emissions and deal with the effects of CC. To administer this fund, the Green Climate Fund (GCF) was established as the financial arm of the UNFCCC with a mandate to invest equally between M&A. Unfortunately, that pledge has not been delivered (Roberts et al., 2021). Despite a flurry of promises leading up to COP26 in Glasgow, only about $80 billion a year was committed in 2021, most in the form of public grants or loans. Also, only about 25% of the funding has been designated for adaptation projects, falling short of the GCF mandate (Timperley, 2021).

In an encouraging sign, over 100 world leaders at COP26 committed to end deforestation by 2030, including a total pledge of $19.2 billion in public and private funds (Parrotta et al., 2022). Notably, the 2021 pledge includes key players like Brazil, Russia, and China, who did not sign the 2014 declaration. In addition, the US also committed $9 billion to conserve and restore the world’s forests. These commitments are critical, and the relatively low cost and high impact of REDD + programs and projects are borne out by the data. During its initial 5-year pilot (2014–2018), for instance, eight REDD + projects (mostly in the Amazon) totaling more than 100 million tCO2e in emission reductions were funded for less than $500 million, or at a cost about $5/tCO2e (Green Climate Fund, 2022).

4.2 Market-based funding

Forest-based projects may also be funded through the sale of offsets in compliance or voluntary carbon markets. In either case, the trading of carbon credits creates two desired effects: First, market forces are leveraged to drive efficient emission reductions; second, essential investments in NbS are made. In market transactions, the process normally begins with a forest owner (land manager) who authors a program/project design document describing how the project will lead to ER&R, which may take the form of afforestation and reforestation (A&R) or improved forest management (IFM), in addition to REDD.

The project design document includes a comparison of a “business as usual” base case estimate of emissions if the project was not implemented, compared with predicted emissions resulting from the intervention (Balmford et al., 2023). It is then submitted for review under a protocol designed to verify ER&R before the project can be certified and offset credits issued. Various registries are engaged in certifying programs and projects in voluntary markets, whereas the CARB and the Regional Greenhouse Gas Initiative are examples of regulatory agencies that certify those in compliance markets (Elyse et al., 2018).

Critics point out that the process to develop offsets is slow and may overstate the impact of an intervention, especially in voluntary markets, due to one or more of the following factors: (1) the “additionality” or true net impact on emissions may be overestimated because of inaccurate BAU emissions that are derived from unrealistic scenarios (Canham, 2021; Coffield et al., 2022); (2) ER&R from protecting, rehabilitating, or reforesting one area can leak emissions to another area and result in forest degradation and deforestation or A&R that may not have occurred otherwise (DeFries et al., 2022); and (3) inadequate or inaccurate measurement, reporting and verification of forest inventory and thus carbon emission from a program or project may exaggerate its benefit (Naughten, 2011) Relatedly, in examining the uncertainties in establishing forest a BAU scenario, or forest reference level, and predicting future carbon stocks, Teo et al. (2023) highlighted the variability of local forest conditions and thus the difficulty of determining the carbon additionality. They argued for scaling up project implementation and assessment to a higher level of aggregation.

While there are active and promising trends in these markets, the overall market size and trading price remains relatively small. In 2021, the trade volume forest carbon credits peaked at 517 million tCO2e in the voluntary markets; but it dropped precipitously to less than one-10th of that amount in 2023 (Donofrio et al., 2023). This was largely attributed to the credits’ lack of credibility (Balmford et al., 2023; Zadek, 2023). Even though the average price of these credits rose to ∼$7.0/tCO2 in 2023, it was still disappointingly low.

4.3 Jurisdictional finance

To address the inefficiency and limited capability associated with the project-oriented approach and to accelerate the pace of forest sector M&A, governments, businesses, and other players (“donors”) have been increasingly engaged in carbon financing through jurisdictional approaches. In this case, the donor, who wishes to reduce emissions via REDD or to enhance removals via A&R or IFM, finances forest sector NbS across an entire jurisdiction, instead for a single project (Donofrio et al., 2021). The resulting payments are made to the jurisdictional authorities where the NbS are pursued.

As a core component of the CC M&A governance paradigm under the Paris Agreement (Wang et al., 2021), jurisdictional funding represents an important turning point in carbon financing because until recently, most forest results-based finance has involved market-based funding, while the designated public-sector funding has been funneled to REDD + readiness efforts (Donofrio et al., 2021). More importantly, countries have undertaken ecological restoration programs (ERPs) as part of their commitments to sustainable development. While many of these ERPs may not have been originally conceived for carbon sequestration or emission offsetting, they are now called upon to assume this additional responsibility (IPCC, 2022). With a general compatibility between carbon sequestration and storage and other ecosystem services, and the newly gained currency following the UN declaration of this decade as the Decade of Ecosystem Restoration (Cook-Patton et al., 2021), ERPs have become a “game changer” for funding ER&R. We summarize the Chinese experience in Box 3.

Box 3 China’s ecosystem restoration and conservation

The Chinese government invested about 700 billion yuan ($110 billion) by 2017 in several large ERPs, such as the Sloping Land Conversion Program, the Natural Forest Protection Program, the Three-Norths Shelterbelt Program, the Beijing-Tianjin-Hebei Desertification Combating Program, and the Wildlife Protection and Nature Reserve Program (NFGA, 2018). These programs have greatly improved the ecological conditions and the local people’s livelihoods (Yin, 2009). Also, the country has planned to spend about three trillion yuan ($470 billion) on nine large regional ecosystem restoration and conservation initiatives during 2021–2035, which are expected to further improve the ecological conditions and the local people’s livelihoods (NFGA, 2018). When these programs/initiatives were originally construed and planned, however, carbon sequestration and storage by forest and other terrestrial ecosystems was not explicitly considered. With the country’s updated NDC targets to peak GHG emissions this decade and reach carbon neutrality before 2060, nonetheless, they have attracted a great deal attention for removing carbon from the atmosphere to offset its emissions (Hou and Yin, 2022).

Jurisdictional funding has also opened new opportunities for “nesting” and “hybridizing” market-based, public, and other private alternatives; thus, it offers distinct advantages that are expected to accelerate funding of forest sector NbS (Seymour, 2020). For example, unlike project developers, governments have the authority to enforce policy and control land use change broadly, while the private sector can serve as a source of immediate results-based payments. Also, incentives for aggregating projects across a jurisdiction can mitigate the risks of non-additionality, non-permanence, and leakage, and the threats to indigenous rights (van der Gaast et al., 2017). Finally, this approach can reduce the transaction costs and uncertainties and risks associated with individual projects (Wang et al., 2021).

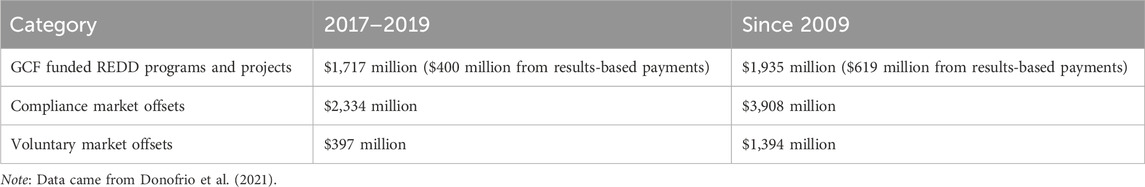

Table 1 shows that REDD and market-based forest finance is ramping up in recent years. As indicated by the 2017–2019 data, about 39% of money spent on forest projects were REDD + funded through the GCF, while 52% of global financing came through compliance markets, and only about 9% came from voluntary markets—too little to make a big difference. It should be added that this not-so-favorable situation has persisted over the last a few years. Additionally, forest carbon credits have access to compliance markets in only a few national and subnational jurisdictions, with a low range of allowed offsets—mostly <8% (Yin, 2014).

5 Summary and outlook

This paper sought to better understand the carbon pricing and financing mechanisms that are not just currently available but also required for achieving ER&R in line with the Paris Agreement climate targets. We began with an overview of the economic principles of ER&R and the mechanisms of carbon pricing and then elucidated the roles that the private and public sectors can play and have played in financing ER&R. Finally, we examined the current state of forest-based climate actions, alternative ways they are funded, and their efficiency and effectiveness.

To sum up, although carbon pricing alone may not be adequate to induce ER&R at a pace or on the scale required to meet the Paris Agreement climate targets, it is vital to create strong incentive to drive down GHG emissions (Stern, 2007; Nordhaus, 2021), which can take a variety of forms and must be complemented by well-designed policy (World Bank, 2021). The concrete mechanisms, such as carbon tax, compliance and voluntary emission trading, internal pricing, and financing via issuing bonds or mobilizing public budgetary resources, are summarized in Table 2.

Regardless, however, it is prudent to note that we are far from the envisioned extent and level of carbon price. The prevalence and magnitude of indirect carbon pricing policies still dwarf the impact of direct carbon pricing: fossil fuel excise taxes and subsidies are worth over $1 trillion each year; at the same time, ETSs and carbon taxes raised almost $100 billion in revenues in 2022, and the voluntary carbon market came up with a total annual value in the order of $2 billion (World Bank, 2023). Only about 23% of global GHG emissions are subject to any price at all, and 75% of emissions that are subject to a price are less than $10 per tCO2e (World Bank, 2021; Donofrio et al., 2023). Also, as of 1 April 2023, less than 5% of global GHG emissions were covered by a direct carbon price at or above the range recommended by 2030 (World Bank, 2023). The financial rewards and penalties continue to be weak in incentivizing polluters to abate their emissions (World Bank, 2023).

Going forward, not only are the various categories of financing expected to surge, but it is also believed that jurisdictional finance will emerge rapidly as public pressure to achieve carbon neutrality and ecosystem restoration mounts (Donofrio et al., 2021). The more seamlessly and comprehensively carbon pricing is introduced on a global scale and the more aggressively pricing is ratcheted up, the more effective it will be in limiting the devastating impacts of CC (Carbon Pricing Leadership Coalition, 2017). But care must be taken to ensure that the introduction of carbon pricing is done in a way that limits emissions and potential climate disruption while fostering economic growth and ecological sustainability (DeFries et al., 2022). The choice of instrument, the level of coverage, and the underpinning price can, and should be, tailored to meet the specific circumstances, priorities, and needs (World Bank, 2023).

Fortunately, there are many pricing mechanisms that have been successfully deployed to achieve these objectives, and novel approaches continue to emerge as different mechanisms are strengthened, nested, hybridized, and/or integrated. A combination of them is likely to be more efficient, effective, and even equitable (World Bank, 2021). Just like public-private partnership can help drive innovation and investment for a sustainable future (Tyson and Weisss, 2022), international cooperation and linkage will reduce distortions in trade and capital flows and aid efficient ER&R by promoting consistency of actions across countries (Nordhaus, 2021).

Finally, we highlighted the opportunities of forest sector climate solutions, including REDD+, as well as their significance and comparative advantage. As of now, however, forest sector M&A actions are inadequately linked up with or integrated into these pricing mechanisms. As more national and subnational jurisdictions look to set up domestic crediting mechanisms, the transparency and accountability in goal setting, trading, and reporting by nonstate actors must be guaranteed (UN High-Level Expert Group on Net Zero Emissions Commitments of Non-State Entities 2022b). Without sufficient credibility, the forest carbon markets, voluntary or compliant, can hardly work well.

Obviously, there are many other land-use practices than forest-based actions that can contribute to ER&R, including grassland, wetland, peatland conservation or restoration, climate-smart agriculture and agroforestry, soil conservation, and coastal restoration. These efforts should also be part of the ultimate NbS (Sato et al., 2019; IPCC, 2022). But for any land-use practices to be effective and sustainable, we must confront the risks of potential non-additionality, non-permanence, leakage, and high transaction costs and uncertainties resulting from individual projects (Badgley et al., 2022; Defries et al., 2022). Whenever feasible, some kind of pooling or aggregation via intermediary agencies or jurisdictional organizations should be pursued; accordingly, national and subnational program-based approaches are called for (Wang et al., 2021). As such, the effects of mitigating project-level risks and costs of these alternative funding and participating pathways, as well as their effectiveness, deserve closer attention (Kotchen et al., 2023).

Lastly, it should be reiterated that what we did in this paper is a Policy and Practice Review. Future work should thus consider reviewing the academic literature on the performances of different carbon pricing mechanisms when the time is appropriate and adequate empirical studies have been produced.

Author contributions

KZ: Formal Analysis, Investigation, Methodology, Validation, Writing–original draft, Writing–review and editing. DM: Conceptualization, Formal Analysis, Investigation, Validation, Writing–original draft, Writing–review and editing. RY: Formal Analysis, Investigation, Methodology, Validation, Writing–original draft, Writing–review and editing, Conceptualization, Supervision. HZ: Conceptualization, Formal Analysis, Investigation, Validation, Writing–original draft, Methodology, Supervision.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The authors are grateful for the comments and suggestions made by the reviewers and editors of this journal. They are also thankful for the feedback provided by their colleagues from the U.S., China, and other parts of the world. Runsheng appreciates the AgBioResearch of Michigan State University for financial support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1This is a preliminary, aggregate estimation. There exist other aggregate and disaggregate studies. See, for example, Kotchen et al. (2023) for a disaggregate estimation that highlights the different ideas and thus realizations about emissions reduction costs between the IPCC and leading economic models.

2REDD+ is a combination of “REDD” and “+.” The former means reducing greenhouse gas emissions from deforestation and forest degradation, and latter refers to conservation of forest carbon stocks, sustainable management of forests, and enhancement of forest carbon stocks (Parrotta et al., 2022).

3For more detail, visit https://www.frontiersin.org/journals/communications-and-networks/for-authors/article-types

References

Austin, K. G., Baker, J. S., Sohngen, B., Wade, C. M., Daigneault, A., Ohrel, S. B., et al. (2020). The economic costs of planting, preserving, and managing the world’s forests to mitigate climate change. Nat. Commun. 11 (1), 5946–5949. doi:10.1038/s41467-020-19578-z

Badgley, G., Freeman, J., Hamman, J. J., Haya, B., Trugman, A. T., Anderegg, W. R. L., et al. (2022). Systematic over-crediting in California's forest carbon offsets program. Glob. Change Biol. 28, 1433–1445. doi:10.1111/gcb.15943

Balmford, A., Brancalion, P. H. S., Coomes, D., Filewod, B., Groom, B., Guizar-Coutino, A., et al. (2023). Credit credibility threatens forests. Science 380 (6644), 466–467. doi:10.1126/science.adh3426

Barbier, E., Lozano, R., Manuel-Rodriguez, C., and Troeng, S. (2020). Adopt a carbon tax to protect tropical forests. Nature 578, 213–216. doi:10.1038/d41586-020-00324-w

Busch, J., Engelmann, J., Cook-Patton, S. C., Griscom, B. W., Kroeger, T., Possingham, H., et al. (2019). Potential for low-cost carbon dioxide removal through tropical reforestation. Nat. Clim. Change 9, 463–466. doi:10.1038/s41558-019-0485-x

California Air Resources Board (CARB) (2021). California’s compliance offset program. Available at: https://ww2.arb.ca.gov/sites/default/files/2021-10/nc-forest_offset_faq_20211027.pdf.

Canham, C. (2021). Rethinking forest carbon offsets. Millbrook, New York, USA: Cary Institute of Ecosystem Studies. Available at: https://www.caryinstitute.org/news-insights/feature/rethinking-forest-carbon-offsets.

Carbon Pricing Leadership Coalition (2017). Report of the high-level commission on carbon prices. Washington, D.C., United States: World Bank Group.

Center for Climate and Energy Solutions (2022). Center for climate and energy solutions, Available at: https://www.c2es.org/ (accessed in February, 2022).

Clausing, K., and Wolfram, C. (2023). Carbon border adjustments, climate clubs, and subsidy races when climate policies vary. J. Econ. Perspect. 37 (3), 137–162. doi:10.2139/ssrn.4469052

Coffield, S. R., Vo, C. D., Wang, J. A., Badgley, G., Goulden, M. L., Cullenward, D., et al. (2022). Using remote sensing to quantify the additional climate benefits of California forest carbon offset projects. Glob. Change Biol. 28, 6789–6806. Also available at:. doi:10.1111/gcb.16380

Congressional Budget Office (2022). Congressional Budget Office cost estimate. https://www.cbo.gov/system/files/2022-08/hr5376_IR_Act_8-3-22.pdf.

Cook-Patton, S. C., Shoch, D., and Ellis, P. W. (2021). Dynamic global monitoring needed to use restoration of forest cover as a climate solution. Nat. Clim. Change 11, 366–368. doi:10.1038/s41558-021-01022-9

DeFries, R., Ahuja, R., Friedman, J., Gordon, D. R., Hamburg, S. P., Kerr, S., et al. (2022). Land management can contribute to net zero. Science 376 (6598), 1163–1165. doi:10.1126/science.abo0613

Donofrio, S., Calderon, C., Weatherer, L., and Procton, A. (2023). Paying for quality: state of the voluntary carbon markets 2023. Washington, DC, USA: Forest Trends Association.

Donofrio, S., Maguire, P., Myers, K., Daley, C., and Lin, K. (2021). State of forest carbon finance 2021. Washington, DC, USA: Forest Trends Association.

Duchelle, A. E., de Sassi, C., Jagger, P., Cromberg, M., Larson, A. M., Sunderlin, W. D., et al. (2017). Balancing carrots and sticks in REDD+: implications for social safeguards. Ecol. Soc. 22 (3), 2. doi:10.5751/ES-09334-220302

Elyse, C., Kerr, A., Morton, S., Seal, A., Voehler, K., Yan, L., et al. (2018). Forest carbon credits: a guidebook to selling your credits on the carbon market. Boston, MA, United States: Boston University.

FAO (Food and Agriculture Organization of the United Nations) (2016). Forestry for a low-carbon future: integrating forests and wood products in climate change strategies. Rome, Italy: FAO.

Giugale, M. (2018). The pros and cons of green bonds. Washington, D.C., United States: The World Bank.

Graham, P. (2015). Forests at UNFCCC-COP21: brief. WWF For. Clim. Programme. Available at: https://wwfint.awsassets.panda.org/downloads/forest_basics_brief_cop21.pdf.

Green Climate Fund (2022). Green climate fund. Available at: https://www.greenclimate.fund/redd#projects (accessed in February, 2022).

Griscom, B. W., Adams, J., Ellis, P. W., Houghton, R. A., Lomax, G., Miteva, D. A., et al. (2017). Natural climate solutions. PNAS 114 (44), 11645–11650. doi:10.1073/pnas.1710465114

Harris, N., and Gibbs, D. (2021). Forests absorb twice as much carbon as they emit each year. Washington, D.C., United States: World Resources Institute. Available at: https://www.wri.org/insights/forests-absorb-twice-much-carbon-they-emit-each-year.

Hou, J. Y., and Yin, R. S. (2022). How significant a role can China’s forest sector play in decarbonizing its economy? Clim. Policy 23, 226–237. doi:10.1080/14693062.2022.2098229

IPCC (2020). Climate change and land: summary for policymakers. Available at: https://www.ipcc.ch/srccl/.

IPCC (2022). Climate change 2022: impacts, adaptation and vulnerability. Work. Group II Contribution Sixth Assess. Rep.,

Jones, L. (2022). $500 bn Green Issuance 2021: social and sustainable acceleration: annual green $1 tn in sight: market expansion forecasts for 2022 and 2025. Clim. Bonds Initiat.,

Kaufman, N., Barron, A. R., Krawczyk, W., Marsters, P., and McJeon, H. (2020). A near-term to net zero alternative to the social cost of carbon for setting carbon prices. Nat. Clim. Change 10, 1010–1014. doi:10.1038/s41558-020-0880-3

Kotchen, M. J., Rising, J. A., and Wagner, G. (2023). The costs of “costless” climate mitigation. Science 382 (6674), 1001–1003. doi:10.1126/science.adj2453

Liu, H. Q. (2021). In-depth Q&A: will China’s emissions trading scheme help tackle climate change? Carbon Brief., Available at: https://www.carbonbrief.org/in-depth-qa-will-chinas-emissions-trading-scheme-help-tackle-climate-change.

McKinsey & Co (2022). The net-zero transition: what it would cost, what it would bring. New York, USA: McKinsey Global Institute.

Naughten, A. (2011). Designed to fail? The concepts, practices and controversies behind carbon trading. Available at: https://www.fern.org/fileadmin/uploads/fern/Documents/FERN_designedtofail_internet_0.pdf.

NDRC (National Development and Reform Commission) (2022). A national strategic plan of ecosystem restoration and conservation over 2021-2035. Beijing, China: NDRC.

NFGA (National Forestry and Grassland Administration of China) (2018). China forestry yearbook. NFGA.Beijing, China

Nordhaus, W. (2019). Climate Change: the ultimate challenge for economics. Am. Econ. Rev. 109, 1991–2004. Available at:. doi:10.1257/aer.109.6.1991

OECD (Organisation for Economic Co-operation and Development) (2021). Carbon pricing in times of COVID-19: what has changed in G20 economies? Paris: OECD. Available at: https://www.oecd.org/tax/tax-policy/carbon-pricing-in-times-of-covid-19-what-has-changed-in-g20-economies.htm?_ga=2.133364810.515584805.1649599297-1674718103.1649599297.

Ostrom, E. (2010). Beyond markets and states: polycentric governance of complex economic systems. Am. Econ. Rev. 100, 641–672. doi:10.1257/aer.100.3.641

Parrotta, J., Mansourian, S., Wildburger, C., and Grima, N. (2022). Forests, climate, biodiversity and people: assessing a decade of REDD+. Vienna: IUFRO World Series.

Pettinger, T. (2020). Carbon tax – pros and cons. Econ. help. Available at: https://www.economicshelp.org/blog/2207/economics/carbon-tax-pros-and-cons/ (accessed on November 1, 2021).

Roberts, J. T., Weikmans, R., Robinson, S., Ciplet, D., Khan, M., and Falzon, D. (2021). Rebooting a failed promise of climate finance. Nat. Clim. Change 11, 180–182. doi:10.1038/s41558-021-00990-2

Roe, S., Streck, C., Obersteiner, M., Frank, S., Griscom, B., Drouet, L., et al. (2019). Contribution of the land sector to a 1.5°C world. Nat. Clim. Change 9, 817–828. doi:10.1038/s41558-019-0591-9

Rogoff, K. (2023). Rethinking climate finance for the developing world Project Syndicated. Prague: Project Syndicate.

Sato, I., Langer, P., and Stolle, F. (2019). Enhancing NDCs: opportunities in the forest and land-use sector. Washington, D.C., United States: World Resources Institute.

Seymour, F. (2020). INSIDER: 4 reasons why a jurisdictional approach for REDD+ crediting I superior to a project-based approach. Washington, D.C., United States: World Resources Institute.

Songwe, V., Stern, N., and Bhattacharya, A. (2022). Finance for climate action: scaling up investment for climate and development. London: Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science.

Stern, N. (2007). The economics of climate change: the stern review. Cambridge University Press. Available at: http://mudancasclimaticas.cptec.inpe.br/∼rmclima/pdfs/destaques/sternreview_report_complete.pdf.

Sumner, J., Bird, L., and Smith, H. (2009). Carbon taxes: a review of experience and policy design considerations. Technical Report NREL/TP-6A2-47312. National Renewable Energy Laboratory.

Taylor, M. (2020). Energy subsidies: evolution in the global energy transformation to 2050. Int. Renew. Energy Agency.

Teo, H. C., Tan, N. H. L., Zheng, Q., Lim, A. J. Y., Sreekar, R., Chen, X., et al. (2023). Uncertainties in deforestation emission baseline methodologies and implications for carbon markets. Nat. Commun. 14, 8277. doi:10.1038/s41467-023-44127-9

Timperley, J. (2021). The broken $100-billion promise of climate finance – and how to fix it. Nature 598, 400–402. doi:10.1038/d41586-021-02846-3

UNFCCC (United Nations Framework Convention on Climate Change Secretariat) (2020). Reference manual for the enhanced transparency framework under the Paris agreement. Bonn, Germany: UNFCCC.

United Nations’ High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities (2022a). Expert Group on the net zero emissions commitments of non-state entities. https://www.un.org/sites/un2.un.org/files/high-level_expert_group_n7b.pdf.

United Nations’ High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities (2022b). Integrity matters: net zero commitments by businesses, financial institutions, cities and regions: report from the united nations’ high-level. https://www.un.org/sites/un2.un.org/files/high-level_expert_group_n7b.pdf.

Van der Gaast, W., Sikkema, R., and Vohrer, M. 2018. The contribution of forest carbon credit projects to addressing the climate change challenge projects to addressing the climate change challenge. Clim. Policy 18, 42–48. doi:10.1080/14693062.2016.1242056

Wang, Y., Li, L., and Yin, R. S. (2021). A primer on forest carbon policy and economics under the Paris Agreement: Part I. For. Policy Econ. 132, 102595. doi:10.1016/j.forpol.2021.102595

World Bank (2014). Financial institutions taking action on climate change. Washington, D.C., United States: World Bank Group and United Nations Environmental Programme.

Xu, C., Tang, X., Song, J., and Wang, C. (2023). Research on low-carbon dual channel supply chain considering product substitution under government carbon tax and low-carbon subsidy. PLoS ONE 18 (6), e0287167. doi:10.1371/journal.pone.0287167

Yin, R. S. (2009). An integrated assessment of China’s ecological restoration programs. Dordrecht, The Netherlands: Springer.

Keywords: economic externality, climate finance, social cost of carbon, emission trading, carbon tax, jurisdictional funding

Citation: Zhou K, Midkiff D, Yin R and Zhang H (2024) Carbon finance and funding for forest sector climate solutions: a review and synthesis of the principles, policies, and practices. Front. Environ. Sci. 12:1309885. doi: 10.3389/fenvs.2024.1309885

Received: 08 October 2023; Accepted: 26 March 2024;

Published: 10 April 2024.

Edited by:

Chuanxu Wang, Shanghai Maritime University, ChinaReviewed by:

Danny Otto, Helmholtz Association of German Research Centres (HZ), GermanyXin Zhao, Pacific Northwest National Laboratory (DOE), United States

Kai Liu, Taiyuan University, China

Copyright © 2024 Zhou, Midkiff, Yin and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Runsheng Yin, eWluckBtc3UuZWR1; Han Zhang, aGFuemhhbmdAbndhZnUuZWR1LmNu

Kai Zhou1,2

Kai Zhou1,2 Runsheng Yin

Runsheng Yin Han Zhang

Han Zhang