95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 09 February 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1290338

Low-carbon transition, as the backbone of corporate innovation drive, has an important strategic position globally. In order to avoid heterogeneous intercepts related to explanatory variables or interfering with each other, this paper empirically examines the impact of regional carbon emissions on corporate technological innovation and its mechanism based on the data of listed companies in China from 2009 to 2020, using a fixed-effects model. It is found that 1) the reduction of regional carbon emissions is favourable to corporate technological innovation; 2) in terms of the impact mechanism, the reduction of regional carbon emissions promotes corporate technological innovation by enhancing R&D investment and reducing financing constraints. 3) Based on the study of heterogeneity, it is found that: from the perspective of spatial distribution, regional carbon emissions show the phenomenon of “high on both sides and low in the middle”; state-owned enterprises refer to wholly state-owned enterprises, wholly state-owned companies and state-owned capital holding companies in which the State Council and the local people’s governments respectively perform the responsibilities of funders on behalf of the state. In terms of the nature of equity, compared with state-owned enterprises, regional carbon emissions have a greater impact on the technological innovation of non-state-owned enterprises. 4) Further analysis reveals that the low-carbon city pilot policy is conducive to regional carbon emission reduction. Through the comparison before and after the implementation of low carbon policy, this paper reliably verifies that the introduction of urban carpet policy is conducive to regional carbon emissions, and explores the issue of enterprise technological innovation from the perspective of low carbon transformation, providing theoretical support for the carbon emission reduction efforts and the improvement of the technological innovation capacity of different enterprises. At the same time, it fully affirmed the important role of regional carbon emissions, continued to deepen the process of green transformation of enterprises, and boosted the high-quality development of low-carbon enterprises.

Since the reform and opening up of China, the theme of China’s environmental governance has been constantly changing, from energy conservation and emission reduction to low-carbon development, and gradually evolving into the “dual-carbon” era. In 1972, China participated in the Human Environment Conference for the first time, which started the enlightenment journey of environmental protection. Until 1979, China introduced the first environmental protection law, environmental protection began to develop rapidly. Today, China’s environmental regulations are relatively mature, and in recent years, the country’s major cities have actively responded to the goals of the “dual-carbon” strategy, focusing on building a clean, low-carbon, safe and efficient energy system, production and lifestyle, and promoting the development of low-carbon transformation. 2020 United Nations General Assembly put forward the country will be achieved by 2030 to achieve the carbon peak, 2060 to achieve the carbon peak. In 2020, the United Nations General Assembly put forward the goal that China will achieve carbon peak by 2030 and carbon neutrality by 2060, pointing out the direction for China to accelerate low-carbon transformation and make greater contributions to the global response to climate change. 2021, the 14th Five-Year Plan further depicted a new blueprint and a new path for carbon peak and carbon neutrality in the industrial sector, which provided a strong guarantee for accelerating the construction of a green development system for the industrial sector. The report of the 20th Party Congress points out that we should actively and steadily promote “carbon peak and carbon neutrality”. Undoubtedly, enterprises, as the backbone of the industrial sector, play a crucial role in realising their own green transformation and development in order to achieve the “dual-carbon target” (Wang et al., 2023). However, due to the lack of innovative technologies, the differences in resource endowment between regions, the nature of property rights and other practical constraints, the contradiction between regional carbon emission reduction and technological innovation of enterprises continues to intensify, and how enterprises can seize the opportunity to break through the key core technologies and gradually realise the green transformation has become a hot issue in China’s development nowadays.

In order to cope with the environmental challenges, several easily confused concepts have emerged. Sustainable development focuses on long-term benefits and environmental protection, while the green economy is centred on a low-carbon economy, which refers to resource efficiency and environmental protection. Therefore, in order to support the development of the green economy, green finance and green transactions have been derived. Green finance promotes the sustainable development of green industry through the guidance and mobilisation of funds. Green trading, on the other hand, is the process of trading goods and services in the field of low-carbon economy, which also aims to promote environmental protection and sustainable development.

With the continuous development of environmental protection, the degree of attention in the academic research field has gradually increased. Existing research on the impact of carbon emissions on enterprises is mostly based on the impact of carbon emissions trading rights on technological innovation in the micro perspective (Wang et al., 2023). However, there is a relative lack of research on the impact of regional carbon emissions on corporate technological innovation in the macro context. At the same time, this study argues that regional carbon emissions will support the enhancement of technological innovation ability of enterprises by improving R&D investment and reducing financing constraints. As a result, the mechanism behind how regional carbon emissions affect technological innovation is not clear. In addition, it remains to be demonstrated whether different resource endowment differences and the nature of property rights have different effects on the technological innovation capacity of enterprises in different regions. Relatedly, it is also worth exploring whether the low-carbon policies introduced by the government are reliable or not, and whether they can reduce carbon emissions between regions.

In summary, this study adopts a quantitative research approach, mainly based on the fixed effect model, to verify the effect of regional carbon emissions on the technological innovation of enterprises. It further verifies the role mechanisms of R&D investment and financing constraints in regional carbon emissions and enterprise technological innovation. Subsequently, it explores the differences of regional carbon emissions on the technological innovation of enterprises with different equity nature in different regions. Finally, to verify the reliability of low carbon policies introduced in China on carbon emission reduction in different regions. This study aims to open the black box of the mechanism of regional carbon emissions on enterprise technological innovation, to provide decision support for the government to introduce more powerful policies as well as for the green transformation of enterprises, which has important theoretical significance and practical application value.

Based on this, the possible marginal contribution of this paper lies in exploring the impact of carbon emissions on enterprise technological innovation from a macro perspective. Further, by linking regional carbon emission with enterprise innovation capacity, and feeding back the enhancement of enterprise technological innovation capacity to the two driving paths, this paper analyses how R&D investment and financing constraints can realise the driving effect, and explores the way to break the green transformation of enterprises under the vision of “dual-carbon”, and tries to deconstruct the mechanism of “dual-transformation” and “dual-transformation”. This paper also analyses how R&D investment and financing constraints can achieve the driving effect, explores the way to break through the green transformation of enterprises under the vision of “dual carbon”, and tries to deconstruct the mechanism of “dual transformation”. At the same time, this paper also carries out group regression based on the relevant factors that may affect the driving effect in different regions and the nature of different shareholdings, etc., to capture the heterogeneous effect of regional carbon emission-driven enterprise green innovation. It explores the incentivising effect of low-carbon city pilot policies and regional carbon emissions on corporate technological innovation, with a view to providing useful policy references for the promotion of corporate green transformation under the vision of “dual-carbon”.

The research on carbon emission reduction is currently of interest to many scholars, both domestically and globally. The concept of “carbon emission intensity” came into being because western developed countries criticized China for its lack of quantifiable indicators. Most of the techniques used by researchers to measure carbon concentration can be summed up in the following two steps. The first ratio is the major business income to real total carbon emissions ratio (Wang et al., 2022). In particular, emissions from burning and escape, emissions from industrial processes, emissions from trash, and emissions from shifting land use make up the actual total carbon emissions. The second one expresses the ratio of overall carbon emissions to the increased value of secondary production using a natural logarithmic expression (Shao et al., 2019). This approach is frequently used to compare the carbon emissions of various industries. For instance, Yi et al. (2022) looked at how the digital economy affects reducing carbon emissions, while Shao et al. (2019) looked at how economic agglomeration affects reducing emissions and saving energy.

Some scholars pay attention to the connection between innovation and carbon emission intensity. Zhang et al. (2022c) and He et al. (2020) analyse the spatiotemporal evolution characteristics of China’s industrial carbon emission performance and they pinpoint the mechanism by which technological innovation influences industrial carbon emission performance. The trends in carbon emissions vary significantly across different industries, and it is found that Chinese industrial firms’ carbon emission performance shows a rising tendency over time. According to the panel data from 2010 to 2019, industrial carbon emissions were predicted. Guo et al. (2022) believe that power industry and manufacturing industry have their own special action paths on carbon emissions. This article creates a city-level digital economy development index based on 223 Chinese cities and conducts an empirical examination of the effects of this development. The research shows that the degree of influence varies in different regions with different levels of technological innovation, and the research also pays attention to the influence of government policies on technological innovation of enterprises. All of them believe that green innovation will help to reduce urban carbon emissions. Environmental regulation, according to Li et al. (2020) and Xiao et al. (2012), affects regional carbon emissions differently in areas with varying levels of technological innovation. Research that is relevant also looks at how relevant government policies impact corporate technology innovation. Zhang et al. (2022a) stated that although the policy did not significantly improve the reduction of carbon emissions for high energy-consuming businesses, it did so for the pilot enterprises in the entire sample. Song et al. (2021) believes that carbon emission pricing is closely related to green innovation activities of enterprises, and adopting benchmark technology has a greater incentive effect than historical methods. Wei and Ren. (2021) found that carbon emission trading significantly boosted companies’ incentives to experiment with green technology. According to Wan and Wang (2022), by modifying the product conversion rate, the carbon emission pricing policy can enhance the innovation quality of urban export firms.

The majority of international research focuses on how technological advancement and carbon emissions are related, as well as the factors that affect innovation, energy usage, and carbon emissions. Ganda. (2019) found that from 2000 to 2014, innovation and investment influenced each other in the economic blocks of the OECD. The results of solving the carbon emission problem show that there is a significant negative correlation on the basis of considering various internal problems. Daniel and Wendler. (2020) used the generalized matrix approach to find that while general innovation activities did not reduce carbon emissions, environmental innovation did. Different from other scientists, Khattak et al. (2022) found the asymmetric circular relationship between green and sustainable technologies and carbon emissions from the perspective of innovation cycle. According to Shah et al. (2022), there was a substantial inverse relationship between the global energy innovation index and carbon dioxide. Umme et al. (2022) utilized the DH causality test to show that while financial development raised carbon emissions, green technological innovation and the use of renewable energy decreased such emissions. Two further studies should be mentioned. First of all, Konadu et al. (2022) investigated how gender diversity on the board of directors affects the company’s capacity to cut carbon emissions and discovered that this is because of environmental innovation. Secondly, Obobisa et al. (2022) studied the long-term effects of economic development, institutional quality, renewable energy production and technological progress on carbon emissions in 25 African countries. Commercial technological innovation and carbon emissions are closely related. The majority of studies concentrate on how technological development affects carbon emissions in cities. Green technology and new energy sources contribute to the reduction of carbon emissions, giving businesses a solid theoretical foundation on which to strengthen their commitment to CSR. The cost of carbon emissions and technological innovation varies from industry to industry, although the influence mechanism of regional carbon emissions and technological innovation of enterprises has not been clearly established in relevant literature. For instance, the financial and insurance industries experience less technological innovation than do businesses engaged in manufacturing, which creates problems like the difficulty of regulating carbon emissions in the banking and insurance industries and the high costs associated with businesses’ low-carbon transformation. This shows a link between regional carbon emissions and commercial technical advancement. Thus, this paper makes the following suggestion:

Hypothesis 1. When other conditions are certain, regional carbon emission intensity will have a negative impact on corporate technological innovation.

Carbon emissions related to R&D investment. The research conclusion of Wang et al. (2020); Wang et al. (2020) is an example that environmental policy and technical efficiency jointly determine the direction of environmental technology progress. According to Li and Li. (2022), FDI influences manufacturing companies’ carbon emissions due to a bias toward technical advancement and technology spill over. For the manufacturing sector, the capital-intensive manufacturing sector, and the labour-intensive manufacturing sector over the sample period, R&D input exhibits a positive connection with carbon emissions. Another conclusion that deviates from accepted wisdom is that a rise in R&D in the labour-intensive industrial sector leads to higher carbon emissions. In contrast, He et al. (2021) investigated how investments in R&D in various stages of business and across various categories of sectors affected carbon emissions. The findings demonstrate that R&D spending helps advance carbon emission reduction at all levels. Lin and Xu. (2020) believe that frequent changes in economic phenomena cause nonlinear relations among economic variables. This is not the most previous research hypothesis, but the result based on nonparametric regression model used to analyze data. This paper examines whether investment will have a nonlinear impact on carbon intensity in different regions. The Soviet Union is studying the changes in carbon emissions brought about by direct investment in the whole region. Whether or whether the samples are classified, they discover that China’s direct investment has reduced surrounding nations’ carbon emissions (Su et al., 2022). Hailemariam et al. (2022) investigated the impact of public and private R&D spending on environmental quality. The study demonstrates that R&D expenditures in renewable technologies have a significant positive impact on environmental quality by removing a few pollutants, including carbon dioxide and methane. The report mentioned above is a useful resource for examining how R&D spending and carbon emissions are related. However, it is undeniable that businesses must deal with issues related to low-carbon management, technology, and other sectors as a result of the need for low-carbon life. Further research is needed to determine the path of regional carbon emissions, enterprise technological innovation and R&D expenditure. Thus, we propose the following hypothesis:

Hypothesis 2. When other conditions are certain, regional carbon emission intensity has a positive impact on R&D investment, which can have a positive effect on enterprise technological innovation.

The scientific literature on the relationship between carbon and financial constraints is very extensive, mainly focusing on two types of research. The first is that a company’s carbon emissions are not just restricted to itself; over time, the firm’s competitive environment will also be impacted by the carbon emission intensity of upstream and downstream companies. As a result, this contributes to the issue that areas with high carbon emission intensity are more likely to have severe financial restrictions. For example, Muhammad and Khan. (2019) believe that stricter environmental rules can make high-tech industries develop at full speed and attract foreign direct investment from developed countries to Asian countries. The second kind of research is based on the notion of pollution paradise, as seen in Lv and Yu. (2020) efforts to raise the SO2 Sewage Charge Collection Standard as a Policy Shock and the empirical data demonstrating how SO2 Financing Constraints are greatly loosened in high-emission companies. Liu and Liu. (2022) looked at whether carbon emission trading has strengthened China’s appeal to fiscal restraints in this setting. From a micro perspective, When Zhang et al. (2022b) looked at the relationship between carbon emissions and the effectiveness of business investments, they found that carbon emission trading might significantly boost corporate investment effectiveness. The main manifestation of this beneficial effect is the decline in corporate underinvestment, with less of an impact on corporate overinvestment. Chen and Chen. (2021) used industrial businesses between 2011 and 2017 as their samples to study the moderating influence of green invention patents. They looked at how media pressure and financial restrictions affected business carbon emissions using the fixed effect model. The results show that press pressure on corporations dramatically lowers their carbon emissions, and that this pressure can promote corporate carbon emission reduction by alleviating financial restrictions. Foreign direct investment considerably increased economic growth while simultaneously having a large positive impact on environmental quality by reducing the amount of pollutants, according to Qamri et al. (2022). Wang et al. (2022) looked at the impact of green bond issue on innovation and green technologies. They concluded that by issuing green bonds, businesses can reduce financial constraints while advancing green technology and green innovation. Enterprise technology innovation is a research and development activity with high risks, a protracted project cycle, costs, and uncertainty. Due to knowledge asymmetry, many financial institutions have little faith in businesses, which prevents potentially successful corporate funding. In conclusion, the degree of information sharing between financial institutions and businesses affects the binding nature of institutions’ lending. It is obvious that, despite giving businesses more benefits when allocating resources, these institutions have consistently encouraged businesses to innovate. The internal virtuous loop of businesses will be broken, and the internal drive for low-carbon transformation will vanish if financial limitations are established. Following this research and analysis, the following hypothesis is proposed:

Hypothesis 3. When other conditions are certain, regional carbon emission intensity has a positive effect on financing constraints, and thus can have a positive effect on corporate technological innovation.

Accordingly, the conceptual model for regional carbon emissions, corporate technological innovation, financing constraints and R&D investment is shown in Figure 1 below.

Due to the relatively strong economic linkages between different industries in China, at the same time, the environmental regulatory policies introduced in different years differ. Therefore, as confirmed by the study of Ma and Hu. (2012), the pressure to reach peak carbon in China can have different effects on firms’ technological innovation between regions. It is inferred that both the effect of industry and year differences on the experimental results and the dependence characteristics that may be exhibited should be excluded. In this paper, a fixed effects model is used in order to eliminate the influence of different characteristics between individuals on the experimental results, thus obtaining more accurate results. In view of this, a more general fixed effects model was constructed as follows:

where: lnpatit is the number of patents granted by enterprise i in period t. CEIit is the regional carbon emission intensity of the city where enterprise i is located in period t. Colit is the control variable of enterprise i in period t. φi is the estimated coefficient. γi stands for individual fixed effects. δt represents the time fixed effect. μi is the intercept term. εit is the random disturbance term.

The Bootstrap method does not require any assumptions to be made about the distribution of the data and is, therefore, suitable for all types of data and also allows for obtaining standard errors and confidence intervals for the estimated parameters as well as constructing prediction intervals. The proposed bootstrap mediating effect model by Preacher et al. (2007) is applied in the empirical investigation of this study. The model looks like this:

The CEIit is the independent variable in (3). lnpatit is the dependent variable. The mediating factor is called Mit. The control variable is Colit. ϵit and εit are the terms for random disturbance. The mediating effect (ME), if ϵit and εit are assumed to be independent of one another, is:

Since the DID model can control for time and treatment fixed effects and can more accurately estimate the results of the intervention, the interference of other factors is eliminated. Therefore, this paper will use the double-difference approach to study the impact of low-carbon pilot city policies on corporate technological innovation. This paper uses Xu and Liu. (2022a) methodology to assess how low-carbon city pilot policies affect business technological innovation. The specific formula is as follows:

where: i stands for the company, and t for the year. DIDit is the policy, while lnpat reflects the innovation performance of enterprise i in year t. Firm fixed effect, temporal fixed effect, and random disturbance term, respectively, are denoted by the letters i, t, and it. Controls also stand in for additional control variables employed in the research.

Based on the research of Lederman and Saenz. (2015) and Zhang et al. (2016), this paper suggests that the number of licensed patents of enterprises should be taken as the explanatory variable, to choose CO2 intensity (CEI) as the core form for the National Development and Reform Commission and the Development Commission. The explanation and calculation are as follows.

(1) Explained variable: Patents (lnpat). As the attribute classification of the number of patents is clearer, it can better reflect the activity level of technological innovation. Therefore, the natural logarithm of the number of patents granted by a firm plus one is generally chosen for the measurement of technological innovation.

(2) Explanatory variable: carbon emission intensity (CEI). Compared with other explanatory variables, the concept of carbon emission intensity (CEI) is relatively new. Therefore, considering the ability of data collection, the research focuses on the total carbon emissions in this region. Referring to previous surveys, the proportion of regional total carbon emissions and the company’s core business income are taken as interpretation variables.

(3) Control variables: Enterprise SIZE (SIZE), profitability (ROA), asset-liability ratio (LEV), liquidity ratio (CR), GDP growth rate (GDP), ratio of secondary industry to GDP (I2), ratio of tertiary industry to GDP (I3), ratio of primary industry to GDP (I1), ratio of tangible assets (TAN), ratio of operating cash flow (FC), proportion of current assets (LI-Q), the largest equity concentration index (TLEC), and the top three equity concentration index (TTEC). According to the prior literature, it is discovered that these factors will affect regional carbon emissions and enterprise technological innovation.

(4) Mediating variables: For the variable of research and development investment (R&D), this paper adopts the approach of Cheng and Zou. (2020), which is measured by the ratio of the amount of R&D investment to the operating income of the enterprise, which better reflects the importance and level of the enterprise’s commitment to R&D; and financing constraints (FIC) is borrowed from the approach of Hadlock and Pierce. (2010), which uses the SA index to measure the financing constraints (FIC), and this kind of index does not contain the variables of the financial leverage rate of cash flow, which mitigates the interference of the endogenous financing variables to some extent. The final variable list is shown in

In this paper, the data of Chinese listed companies and the carbon emission data of the cities where the companies are located from 2009 to 2020 are selected as the research data by checking the statistical data on different government official websites. Regional carbon emission data were obtained from the China Carbon Accounting Database (CEADs) and The Statistical Yearbook of Chinese Cities, while CNRDS (Research Data Service Platform) provides information about the number of patent applications and licenses for enterprise technological innovation. Both the regional carbon emission data for 2021 and the data for regional carbon emissions before 2009 are not yet publicly available. Therefore, this paper takes the regional carbon emission data in 2009 and 2020 as the starting and ending points for data analysis. Table 1.

The original data sample is 23,729. This paper treats the original data uniformly because of its numerous issues. First, the enterprise samples of ST and *ST, which are the specifically treated stock enterprises and the stock enterprises to be delisted, are omitted from the database. Second, it is discovered that the banking and insurance sectors are realistically less involved in corporate technological innovation. Businesses with industry codes J66-J69 are removed after examination of the industry code reveals that they are all involved in the finance and insurance sectors. The sample businesses with missing data, for example, patents, are then purged. In addition, we use the winsor2 program in Stata to conduct bilateral winsorize to prevent huge errors in the results. Finally, a total of 20,887 samples were valid for further analysis.

The descriptive statistics are made on the collected samples, as shown in Table 2.

The minimum value of carbon emission intensity is 3.2400e-10, the maximum value is 6.2700e-07, and the average value is 7.0300e-08, indicating that there are great differences in carbon emission intensity in different regions. The average value of enterprise’s technological innovation is 2.7024, which means that the number of patent licenses granted by listed companies is generally small every year.

To test whether there is a correlation between each of the variables, this study conducts Pearson analysis and Spearman test on each variable, results are shown in Table 3 (only part of the results are shown here. The full correlation matrix please refer to Supplementary Material).

The data show that corporate technological innovation is highly correlated with regional carbon emissions, total assets, asset-liability ratio, profitability, and other variables. The correlation coefficients show a negative association between regional carbon emission intensity and enterprise technological innovation (−0.25 and −0.35 in Table 3). It indicates that the reduction of carbon emissions will enhance the enterprise technological innovation, which is consistent to hypothesis 1. However, the mechanism between technological innovation and regional carbon emissions needs to be further discussed.

This paper makes individual effect test, time effect test and Hausmann test to show whether the panel data of listed companies have a fixed influence from 2009 to 2020. The results support fixed effect model. Therefore, the results of Formula (1) with fixed effect were shown in Table 4.

Table 4 shows that the CEI coefficient of the fixed effect model 1) is −391863.8000 which is statistically significant at 1% level. Indicating the low level of carbon emission intensity, the higher level of enterprise technological innovation. Thus, H1 was confirmed. It means that, 1% decrease of regional carbon emission, will bring an increase of 391,863 enterprise innovations in the region.

The industrial distribution of listed companies is concentrated in heavy industries (energy mining, processing, fossil fuel refining) and light industries (textile and clothing manufacturing) after eliminating the insurance and financial sectors. Although these industries have high investment value, compared to other industries, they have obvious particularities, such as large energy consumption, serious pollution discharge, and great influence by the market, climate, and other factors. The new energy industry, for instance, has gradually eliminated outdated businesses with slow technological advancement, backward industries, serious pollution, poor benefits, and backward industries with high carbon emission intensity. Therefore, enterprises inevitably need to carry out technological innovation and energy structure adjustment so that they can survive. The results show that the implementation of carbon emission policy will accelerate the speed enterprises’ technological innovation.

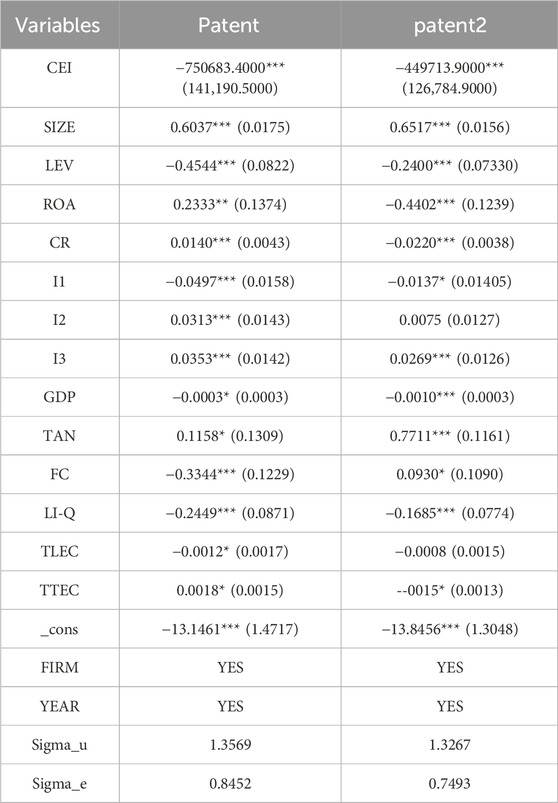

This study using the number of patents granted by enterprises every year to indicate technological innovation. In order to increase the robustness of the results, this paper takes the number of patent applied each year (patent) and the sum of the licensed number of invention patents, practical patents, design patents (patent2) as new explanatory variables. Both new variable add 1 before taking natural logarithm. Regression results with fixed effect models are shown in Table 5.

TABLE 5. Robustness test: The explained variable is replaced by patent and patent2 respectively. Standard errors are in parentheses.

The results show that local carbon emissions continue to damage enterprise technological innovation, and both regression coefficients increase, indicating the influence of regional carbon emissions on the number of patents granted by the enterprises was under-estimated.

Patents are crucial to China’s development of the green economy. The trend of patent development should be changed with high quality, so as to alleviate the pressure of regional carbon emission. In a word, under the background of green industry development, patents are playing an increasingly important role.

The correlation between the remaining factors and the explanatory variable regional carbon emission intensity (CEI) is the primary cause of the endogenous issue. We further apply instrumental variable to perform endogeneity test.

The average carbon emission intensity (M-CEI) of the cities outside the province where the firm is located is used as the carbon emission intensity (CEI) instrumental variable to address these issues. Two reasons may support the use of M-CEI as a tool variable. First, the remaining error u has nothing to do with the province’s average carbon emission intensity of other cities or cities where businesses are located; second, the province’s average carbon emission intensity (CEI) of other cities has a strong correlation with the city where the business is located. Regarding correlation, there are not many differences among the same province’s natural resources, economic growth, energy structure, etc. The average carbon emissions of cities in the same province, excluding the city where the firm is located, are thus appropriate to use as an instrumental variable of CEI. The results are shown in Table 6.

Further, to further mitigate the effect of other factors on the results, a one-period lag of carbon emission intensity is used as a new instrumental variable to address the reciprocal causal relationship that exists between the explanatory and explanatory variables. Based on this, this study will use the instrumental variables (M-CEI, L-CEI) for least squares regression and the empirical results are shown in Table 6 below.

The regression coefficients of −907879.9000 and −417407.1000 are somewhat higher in absolute value than the baseline regression (−322441.6000) and the fixed effects regression (−391863.8000). This all indicates that there is a potential endogeneity of the impact of regional carbon emissions on corporate technological innovation, and that this potential endogeneity reduces the impact of regional carbon emissions on corporate technological innovation. As the software stata17 used found that P > F equals to 0.0000, it indicates that there is a “strong instrumental variable” relationship between the instrumental variables (M-CEI, L-CEI) and firm technological innovation (lnpat), thus ruling out the possible “weak instrumental variable” relationship is ruled out. The data in this paper are stratified, with the explanatory variables at the province level and the explanatory variables at the firm level, which can mitigate the reverse causality problem to some extent. Therefore, we can conclude that the regional carbon emissions have a significant detrimental effect on corporate technological innovation. Thus, H1 was further supported.

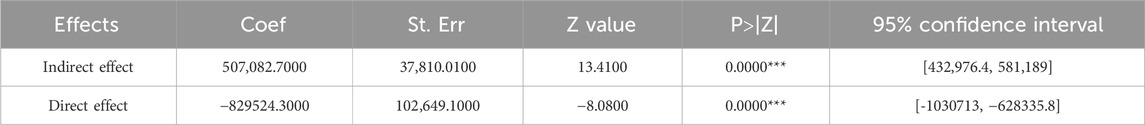

Literature show that there is a strong link among R&D investment, local carbon emissions, and business technological innovation (Mao and Wang, 2022). In their study from 2003 to 2018, Xu and Liu. (2022) discovered that China’s import and export trade had a nonlinear threshold effect on the primary industry’s carbon emissions. With the continued growth of R&D spending, the gradual emergence of the technology effect, and the continued optimization of the industrial production structure, this effect will even become more prominent in the future. Previous studies have found that an increase in R&D investment can reduce regional carbon emissions. However, how do regional carbon emissions affect corporate technological innovation through R&D investment? This question is worth exploring. This paper uses regional carbon emission intensity, the R&D investment of enterprises, and the number of patents licensed to the enterprises to test the possible mediating effect of R&D investment. We apply bootstrap intermediary effect test to analyse Eqs 2–4 in the model with 5,000 samples extraction. The results are shown in Table 7.

TABLE 7. Testing of regional carbon emissions, R&D investment, and enterprise technological innovation mechanism.

The indirect effect’s 95% confidence interval is [432,976.4, 581,189], which excludes the value 0 (See Table 7). Thus, the mediating effect of R&D investment was approved. Furthermore, the direct effect’s 95% confidence interval 0. Thus, a partial mediating effect of R&D investment in relationship between regional carbon emissions and corporate technological innovation was confirmed. Thus, H2 was supported.

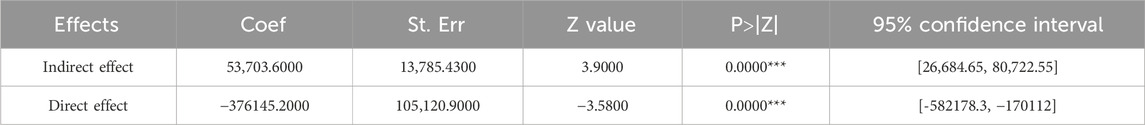

Given the current development trends, green finance has become one of the development directions of enterprises in China. Zhao et al. (2021) put forward the low-carbon policy issued by the government, which can improve the technological innovation level and capital allocation efficiency of enterprises and promote the development of enterprises by alleviating financing constraints. Zhang et al. (2022d) found that the government’s policy mainly promotes enterprises’ green technology innovation by strengthening environmental supervision at the city level and easing financing constraints. Li et al. (2021) found that there is a strong correlation between regional carbon emissions and corporate financing constraints. Financing constraint has become a major problem in technological transformation of enterprises. Therefore, this study will further investigate the mediating effect of financing constrains on the relationship between regional carbon emissions and technological innovation. Again, we apply bootstrap intermediary effect test with 5,000 samples extraction. The results are shown in Table 8.

TABLE 8. Testing of regional carbon emissions, financing constraints and corporate technological innovation mechanism.

The indirect effect’s 95% confidence interval is [26,684.65, 80,722.55], which excludes the value 0 (See Table 8). Thus, the mediating effect of financial constraints was valid. Furthermore, the direct effect’s 95% confidence interval has a range of [-582178.3, 170,112], it also excludes 0. Thus, a partial mediating effect of financial constraints in relationship between regional carbon emissions and corporate technological innovation was found. Thus, H3 was supported.

Previous research and surveys have shown that variations in energy structure, consumption levels, and economic development levels will have an impact on regional carbon pressure (Li et al., 2022b). Therefore, we further analysed the impact of carbon emissions in different regions on technological innovation of enterprises.

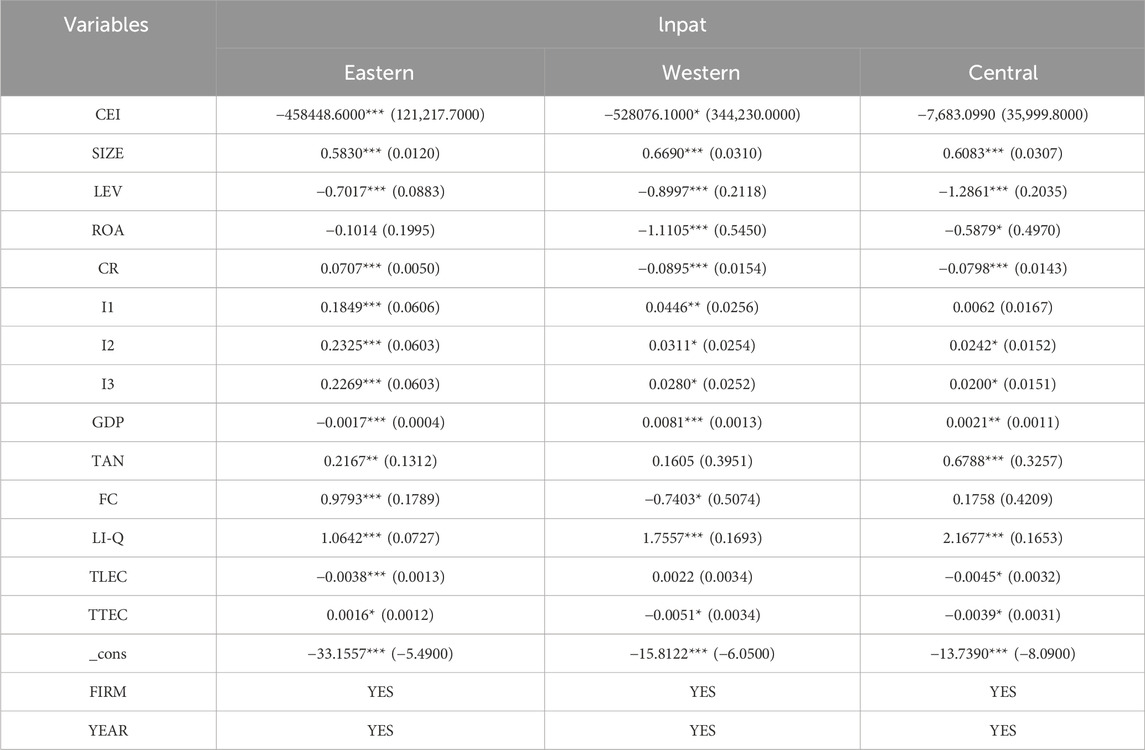

To explore this issue, this study collected regional carbon emission data from 29 provinces and cities which are divided into three groups: eastern, western, and central regions. After processing the data, the eastern region with 11 provinces has 15,977 samples, the central region with 9 provinces has 2,817 samples, and the western region with 9 provinces has 2093 samples. The empirical results of difference regions are shown in Table 9.

TABLE 9. Influence of carbon emissions in different regions of China on technological innovation of enterprises. Standard errors are in parentheses.

The results show that the regional carbon emissions have the highest significant level (1%) on enterprise technological innovation in the eastern region. In fact, the eastern region has a more developed national economy due to its superior geographic location. The most blatant impact of carbon emissions on business technological innovation in the eastern coastal regions may be the results of the following two reasons. First, the eastern region has a sophisticated economy. Its economic hinterland is broad, and its regional economic development is rapid. The economy of the eastern region is generally strong, which is incomparable to other regions. The economic environment has obvious advantages. In addition, the eastern region has a strong advantage in high-tech sectors and a high level of industrial agglomeration. Second, the major economically well-developed cities, such as Shanghai, Beijing, Guangzhou, Shenzhen, and others, the tertiary industry with finance, insurance, information consulting, and real estate develops rapidly (Peng, 2007). The speed of industrial structure upgrading in the eastern coastal region is much faster than that in the central and western regions. As a result, corporate technological innovation is most severely impacted by carbon emissions in the eastern region.

In contrast, regional carbon emission in western area has a weak impact on technological innovation of enterprises (significant at 10%). The western region is located in the westernmost part of China. Compared with the other two regions, the western region is rich in resources, such as mineral resources, land resources, hydropower resources and tourism resources. China has implemented the well-known Western development strategy, creating a structure with energy processing and refining industries, high-tech industries, equipment manufacturing, deep processing of agricultural and sideline products, tourism, and other industries as the main industries. This has allowed China to fully utilize the resources in the western region and convert resource advantages into industrial advantages. As we all know, low-energy processing and refining technology will not only cause a large impact on the surrounding environment but also cause a low utilization rate of resources. Despite the region’s wealth in natural resources, the number of high-tech businesses is relatively small. This may be the main factor limiting the technological innovation of enterprises.

Surprisingly, there is no correlation between regional carbon emissions and enterprise technological innovation in the central region. China’s central region is situated along the middle area of Yangtze River. The development strategy of central region is focusing on bases to produce food, energy, raw materials, modern equipment, and comprehensive transportation hubs. This means that the industrial structure of the central region limits the development of its high-tech industries. Enterprises in the central region lack innovation motivation, so the relevant “environmental regulation” policies issued by the government have little influence on enterprises in the central region. This explains why the technological innovation of enterprises in the central region is not affected by carbon emissions. In addition, the slow economic development in the central region also limits its low-carbon transformation.

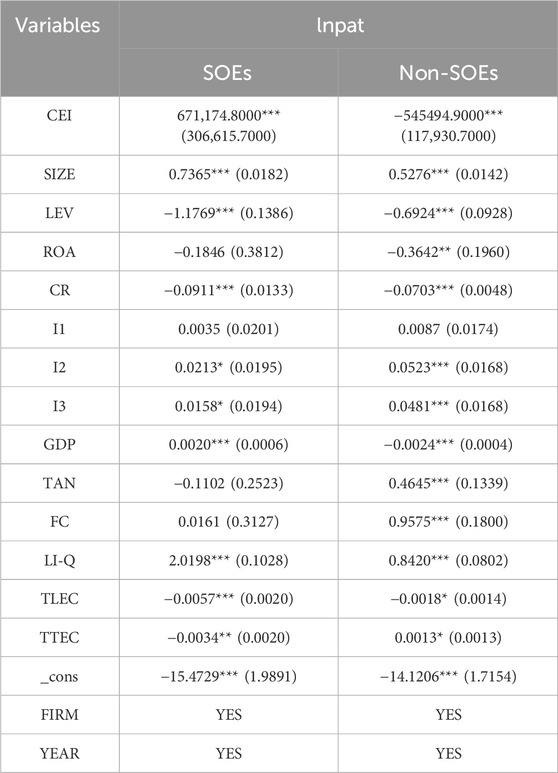

Xu and Liu. (2022a) found that the nature of enterprise ownership usually has different impacts on its innovation investment and performance. Therefore, we keep looking into how regional carbon emissions affect corporate technological innovation with various ownership types. The SOEs and non-SOEs are divided into two categories in this article. There are 6,414 samples for SOEs and 14,473 samples are non-SOEs. The results are shown in Table 10.

TABLE 10. Influence of regional carbon emissions on technological innovation of enterprises with different ownership. Standard errors are in parentheses.

As shown at Table 10, regional carbon emission has a significant positive impact on technological innovation of enterprises, which is contrary to the result of fixed effect analysis. This indicates that the improvement of technological innovation of SOEs is not caused by environmental regulation pressure within the region. Considering the nature of state-owned enterprises, they represent the country, do not take profit maximization as the business goal, and have the obligation to undertake social responsibility. Therefore, SOEs themselves have intrinsic motivation to technological innovation no matter carbon emissions policy.

It can be seen from the analysis results of non-SOEs samples that regional carbon emission has a significant negative impact on enterprise technological innovation, which is consistent with the result of fixed effect analysis of the overall sample. For non-SOEs, economic benefits are their main business objectives, so enterprises often lack the consciousness to undertake corporate social responsibility independently. Therefore, only when the disclosure of carbon emissions is subject to external influences, such as the laws and constraints of carbon emission policies and environmental regulations issued by the state or the government, they will take action to respond.

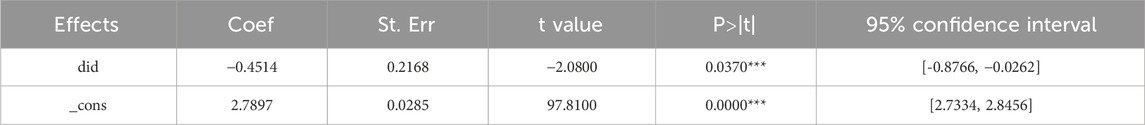

China has issued a call to promote green development and build a community with a shared future for mankind. The roadmap of “carbon peak and carbon neutrality” has also been made clear. Therefore, it is an inevitable choice to build a clean, low-carbon, and efficient energy system, to develop green and low-carbon industries and products. In 2010, the National Development and Reform Commission launched pilot projects for low-carbon provinces, regions, and cities, with the aim of building low-carbon production and consumption as well as resource-saving and environment-friendly cities. There are total 8 municipalities (including Beijing, Shanghai, etc.) and 34 regions and cities were included. After 10 years of the pilot development, it is reasonable to ask a question, does the pilot policy reduce the carbon emission and improve technological innovation in pilot areas? In view of this, we take 2,312 listed companies in Suzhou (one of the pilot cities) to further analyze the impact of low-carbon city pilot policies on carbon emissions and technological innovation of enterprises. According to Eq. 5, the DID model was applied. If the city where the listed company is located is Suzhou, the DID variable corresponding to the company is 1; If the listed company is in a city other than Suzhou, the corresponding DID variable is 0. The results of the DID test are shown in Table 11.

TABLE 11. Impact of carbon emissions on enterprise technological innovation in Jiangsu Province under the low-carbon city pilot policy.

Table 11 shows that the DID coefficient is negative, and p-value is significant at 1% level, indicating that low-carbon city pilot policy has a driving effect on technological innovation of listed companies in Suzhou. With the increasing efforts of low-carbon pilot city policy, the technological innovation of enterprises will continue to improve, which again confirm H1.

First, China has successfully supported the low-carbon transformation and progressively increased awareness of corporate social responsibility since the implementation for the last decade. Currently, the government’s environmental supervision policy and low-carbon pilot cities are implemented simultaneously. Regional carbon emissions and enterprise assistance are inextricably linked. Businesses should be environmentally conscious and take action to meet their obligations to protect the environment and promote green development. Businesses need to address the demands of the government and the public through environmental protection investment and green innovation to achieve legitimacy and a competitive edge when faced with the pressure of environmental governance from local governments.

Second, it is showed that the innovative transformation of businesses in China will be significantly impacted by regional carbon emissions. R&D spending has a partial mediating effect on the relationship between local carbon emissions and business technological innovation. Lowering regional carbon emission intensity will boost business direct investment, and further influence business technological innovation. Financing constraints play a partial intermediary role between regional carbon emissions and corporate technological innovation.

Thirdly, the impact of carbon emissions on enterprises’ technological innovation varies depending on the geography, even for businesses with different ownership. Carbon emission intensity has a significant negative impact on enterprise technological innovation in the eastern region, the negative impact become weak in western region, and there is no significant impact in central region. Through the research in this paper, it can be found that the corresponding conclusions can also be applied to Mumbai in the Indian region. Mumbai is located in the central and western part of India, is a more developed city in India but its lack of resources due to the shortcomings of environmental protection and social security, and the eastern part of China has similar problems; therefore, the government can promote technological innovation of enterprises through the above methods. Interestingly, the impact of carbon emission on technological innovation of SOEs is favourable when seen from the perspective of different ownership. The regional carbon intensity has a significant detrimental effect on the technological innovation of non-SOEs.

Fourth, the low carbon pilot city policy reduces the carbon emission and enhances the technological innovation of enterprise. Taking a pilot city, Suzhou City in Jiangsu Province, as an example, the intensity of carbon emissions in Suzhou decreased dramatically after the pilot city policy, meanwhile, the capacity for technological innovation of the related listed enterprises increased. This demonstrates that low carbon related policies like pilot city project, may support regional carbon emission reduction, enhance capacity for innovation, and achieve coordinated growth across urban and rural areas.

Compared with the results of existing studies, the insights presented in this paper have some commonalities and some differences: from a common point of view, the low-carbon pilot policy implemented in China is conducive to regional carbon emission reduction and pushes enterprises to accelerate the pace of innovation (Zhang et al., 2017). The increase in R&D investment is conducive to technological innovation (Xue and Xu, 2017). From the point of view of the differences, most of the existing studies have examined the impact of technological innovation on regional carbon emissions and passed the significance test, but this paper goes against the grain, because most of the other studies are based on the impact of carbon trading rights on technological innovation, while this paper would like to put the study in a macro perspective, to explore the invisible pressure of environmental regulations and the performance of peer companies around the enterprise technological innovation, so that this paper concludes that the impact of carbon trading rights on regional carbon emissions is more important than that of carbon trading rights on technological innovation. Therefore, this paper concludes that regional carbon emissions have a negative effect on corporate technological innovation. This is mainly due to the Chinese government’s promotion of dual-carbon targets for cities and the policies it has put in place. There are also some shortcomings in this paper: the research object is mainly manufacturing industry, and the scope of research can be expanded in the future.

Therefore, this paper can make up for the shortcomings of the current research in the field of dual-carbon, expand the content of the impact of carbon emissions on corporate technological innovation in different dimensions, and promote the solution of related problems. From the perspective of China’s reality, the introduction of dual-carbon policy, manufacturing enterprises are in urgent need of green transformation, optimising the industrial structure, and the improvement of enterprise technological capabilities will help the green development of manufacturing enterprises to practice. In the future, government policies and peer-to-peer green pressure will further force the green transformation of manufacturing enterprises.

At present, there is a “misunderstanding” within enterprises, and entrepreneurs believe that the pursuit of profit maximization is the foundation of enterprise establishment, which ignores their awareness of corporate social responsibility. However, they do not know that while pursuing interests, enterprises can also meet their requirements by assuming their social responsibilities. Under a free-market economy environment, the businesses’ sense of social responsibility must go beyond simple survival and growth to include a deeper analysis of their innovation, technology, and business models in order to help them better meet societal needs and foster their long-term, healthy development. At the same time, the strengthening of the implementation of social responsibility can also force all sectors of society to work together, breakthrough innovations to resist public health events, so as to join hands to build a community of human destiny. To this end, enterprises should continuously strengthen their understanding of the “carbon peak and carbon neutrality”, “Scientific carbon target Initiative”, “ESG”, etc., promote the harmonious development of enterprises and the ecological environment, and create a better future in which humans and nature coexist in harmony. Therefore, enterprises need to actively publicize the knowledge related to “low-carbon and environmental protection” within the enterprise, improve the awareness of employees to protect the environment, form an excellent cultural atmosphere within the enterprise, and promote the enterprise to strengthen technological innovation and development (Project Synthesis Report Writing Team, 2020).

The investment and financing constraints of most enterprises require information circulation. This requires the establishment of a platform to promote mutual understanding of enterprises, a timely grasp of external information, and promote win‒win cooperation between enterprises. Using finance constraints as an example, knowledge asymmetry between the funding parties plays a major role in the establishment of financing restrictions. If the financing institutions do not know the internal situation of the enterprise and believe that the financing risk is high, the financing will not be able to continue. Financial limitations will have a significant negative effect on businesses, such as inadequate funding for R&D and unsuccessful technical advancement. Therefore, enterprises should actively use market means to enhance their information communication channels, realize information sharing and technical assistance, enhance market competitiveness, and jointly mitigate market risks. Firms must utilize contemporary information technology to its fullest extent and embrace innovative information disclosure techniques in order to remove knowledge asymmetry between enterprises, even with improved information communication channels (Chen and Chen, 2021).

The foundation for businesses to follow the path of sustainable development in the future and the secret to the success of firms is “green talent.” The premise for the normal operation of regional carbon emission reduction is that enterprises have special carbon accounting talents. First, enterprises should focus on cultivating green and low-carbon talents who understand the production process, marketing strategy, and industrial structure of enterprises to make sufficient preparations for enterprises to take the road of sustainable development. Second, enterprises should formulate talent training plans and projects jointly with colleges and universities and jointly participate in talent training to combine students’ professional ability with their post-professional ability. Third, to better fulfill their role in corporate social responsibility, businesses should set up a corresponding employee incentive system, encourage all employees to innovate, and enhance the level of green innovation of enterprises.

Publicly available datasets were analyzed in this study. This data can be found here: https://www.ceads.net.cn/data/province/.

HL: Conceptualization, Funding acquisition, Methodology, Supervision, Writing–review and editing. ZX: Data curation, Formal Analysis, Investigation, Methodology, Software, Validation, Visualization, Writing–original draft. YL: Data curation, Formal Analysis, Writing–original draft. GX: Funding acquisition, Investigation, Supervision, Visualization, Writing–review and editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by National Natural Science Foundation of China (grant number 72273016, 71773046, 72103026); Provincial Social Science Federation Consulting Base Project (Grant Number: 23SSL145); Postgraduate Research & Practice Innovation Program of Jiangsu Province (grant number KYCX 22_2983).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1290338/full#supplementary-material

Chen, X. B., and Chen, X. T. (2021). Media pressure, financial constraints and carbon emissions of industrial enterprises: the moderating effect of green invention patents. Sci. Technol. Prog. Policy 38 (12), 69–78. doi:10.6049/kjjbydc.2020060332

Cheng, L. W., and Zou, S. (2020). Research on the impact of venture capital late entry on enterprise innovation performance: selection effect or value-added effect? Manag. Rev. 32 (01), 80–90. doi:10.14120/j.cnki.cn11-5057/f.2020.01.011

Daniel, T., and Wendler, T. (2020). The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 244 (C), 118787. doi:10.1016/j.jclepro.2019.118787

Ganda, F. (2019). The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J. Clean. Prod. 217, 469–483. doi:10.1016/j.jclepro.2019.01.235

Guo, F., Yang, S., and Ren, Y. (2022). Digital economy, green technology innovation and carbon emissions: empirical evidence from the Chinese city level. J. Shaanxi Normal Univ. 51 (03), 45–60. doi:10.15983/j.cnki.sxss.2022.0507

Hadlock, C., and Pierce, J. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. Financial Finance 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hailemariam, A., Ivanovski, K., and Dzhumashev, R. (2022). Does R&D investment in renewable energy technologies reduce greenhouse gas emissions? Appl. Energy 327 (1), 120056. doi:10.1016/j.apenergy.2022.120056

He, W., Li, W., and Deng, M. (2020). Human capital, green science and technology innovation and total factor carbon emission efficiency in the Yangtze River Economic Belt. Sci. Technol. Prog. Policy 39 (09), 23–32.

He, Y., Fu, F., and Liao, N. (2021). Analysis on the impact of industrial R&D investment on carbon emissions based on STIRPAT model. Sci. Technol. Manag. Res. 41 (17), 206–212. doi:10.3969/j.issn.1000-7695.2021.17.026

Khattak, S., Ahmad, M., Haq, Z., Gao, S., and Jiang, H. (2022). On the goals of sustainable production and the conditions of environmental sustainability: does cyclical innovation in green and sustainable technologies determine carbon dioxide emissions in G-7 economies. Sustain. Prod. Consum. 29, 406–420. doi:10.1016/j.spc.2021.10.022

Konadu, R., Ahinful, G., Boakye, D., and Elbardan, H. (2022). Board gender diversity, environmental innovation and corporate carbon emissions. Technol. Forecast. Soc. Change 174, 121279. doi:10.1016/j.techfore.2021.121279

Lederman, D., and Saenz, L. (2005). Innovation and development around the world. Policy Research Working Paper.

Li, B., Wang, M., and An, S. (2021a). Research on financing strategy of financial constrained supply chain under low carbon efforts. J. Industrial Eng. Eng. Manag. 35 (02), 211–220. doi:10.13587/j.cnki.jieem.2021.02.019

Li, J., Li, X., and Hao, L. (2021b). Impact of dual environmental regulation on carbon emission intensity under the constraint of technological innovation. China Popul. Resour. Environ. 31 (09), 34–44. doi:10.12062/cpre.20210816

Li, X., and Li, H. (2022). Do foreign capital introduction and technological progress bias affect manufacturing carbon emissions? Empirical test of panel data model from 27 manufacturing industries in China. China Soft Sci. 01, 159–170.

Li, Z., Yin, S., Jiang, Y., and Lv, Y. (2020). Analysis of allometric relationship and formation mechanism between economic growth and carbon emissions in the Yangtze River Delta. J. Nat. Resour. 37 (06), 1507–1523. doi:10.31497/zrzyxb.20220610

Lin, B., and Xu, B. (2020). R&D investment, carbon intensity and regional carbon dioxide emissions. J. Xiamen Univ. 04, 70–84. doi:10.3969/j.issn.0438-0460.2020.04.007

Liu, C., and Liu, J. (2022). Does carbon emission trading improve China's attractiveness to FDI? Mod. Econ. Res. 03, 26–35. doi:10.13891/j.cnki.mer.2022.03.012

Lv, Z., and Yu, X. (2020). Can the increase of pollutant discharge charging standard affect the location choice of FDI? A quasi-natural experiment based on the adjustment policy of SO2 emission charge standard. China Popul. Resour. Environ. 30 (09), 62–74. doi:10.12062/cpre.20200330

Ma, W., and Hu, Y. (2012). Regional carbon peak pressure and enterprise green technology innovation: a study based on carbon emission growth rate. J. Account. Econ. Res. 36 (04), 53–73. doi:10.16314/j.cnki.31-2074/f.2022.04.001

Mao, J., and Wang, L. (2022). Constraints on energy conservation and carbon reduction, R&D investment and industrial green total factor productivity growth: an empirical analysis of urban agglomeration in the Yellow River Basin under the background of "dual carbon. J. Northwest Normal Univ. 59 (02), 75–85. doi:10.16783/j.cnki.nwnus.2022.02.008

Muhammad, B., and Khan, S. (2019). Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Rep. 5, 1305–1315. doi:10.1016/j.egyr.2019.09.004

Obobisa, E., Chen, H., and Mensah, I. (2022). The impact of green technological innovation and institutional quality on CO2 emissions in African countries. Technol. Forecast. Soc. Change 180, 121670. doi:10.1016/j.techfore.2022.121670

Peng, L. (2007). Industrial structure characteristics and regional transfer trend in eastern, Central and western regions. Econ. Rev. 11, 29–31. doi:10.16528/j.cnki.22-1054/f.2007.11.010

Preacher, K., Rucker, D., and Hayes, A. (2007). Addressing moderated mediation hypotheses: theory, methods, and prescriptions. Multivar. Behav. Res. 42 (01), 185–227. doi:10.1080/00273170701341316

Project Synthesis Report Writing Team (2020). Synthesis report on China's long-term low-carbon development strategy and transition path. China Population-Resources Environ. 30 (11), 1–25. doi:10.12062/cpre.20201025

Qamri, G., Sheng, B., Adeel-Farooq, R., and Alam, G. (2022). The criticality of FDI in Environmental Degradation through financial development and economic growth: implications for promoting the green sector. Resour. Policy 78, 102765. doi:10.1016/j.resourpol.2022.102765

Shah, M., Foglia, M., Shahzad, U., and Fareed, Z. (2022). Green innovation, resource price and carbon emissions during the COVID-19 times: new findings from wavelet local multiple correlation analysis. Technol. Forecast. Soc. Change 184, 121957. doi:10.1016/j.techfore.2022.121957

Shao, S., Zhang, K., and Dou, J. (2019). Energy saving and emission reduction effect of economic agglomeration: theory and China's experience. Manag. World 35 (01), 36–60+226. doi:10.19744/j.cnki.11-1235/f.2019.0005

Song, D., Zhu, W., and Wang, B. (2021). The empirical study of carbon trading pilot covered enterprises in China: carbon emission trading, quota allocation method and corporate green innovation. China Popul. Resour. Environ. 31 (01), 37–47. doi:10.12677/ORF.2023.136622

Su, X., Li, Y., Fang, K., and Long, Y. (2022). Does China's direct investment in "Belt and Road Initiative" countries reduces their carbon dioxide emissions? J. Clean. Prod. 339 (10), 130543. doi:10.1016/j.jclepro.2022.130543

Umme, H., Cao, X., and Ahsan, A. (2022). Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 193, 1082–1093. doi:10.1016/j.renene.2022.05.084

Wan, X., and Wang, J. (2022). Carbon emission trading policy, product conversion and green product innovation: experience and enlightenment from Chinese export enterprises. J. Int. Trade 04, 91–106. doi:10.13510/j.cnki.jit.2022.04.003

Wang, C., Wang, L., Wang, W., Xiong, Y., and Du, C. (2023a). Does carbon emission trading policy promote the corporate technological innovation? Empirical evidence from China's high-carbon industries. J. Clean. Prod. 411 (20), 137286. doi:10.1016/j.jclepro.2023.137286

Wang, H., Liu, J., and Zhang, L. (2020a). Carbon emissions and asset pricing: evidence from China's listed companies. Acta Econ. Sin. 9 (02), 28–75. doi:10.16513/j.cnki.cje.2022.02.003

Wang, H., Qi, S., Zhou, C., Zhou, J., and Huang, X. (2022). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331 (10), 129834. doi:10.1016/j.jclepro.2021.129834

Wang, L., Wang, H., and Dong, Z. (2020b). Policy conditions of compatibility between economic growth and environmental quality: a test of policy bias effect from the perspective of environmental technology progress. Manag. World 36 (03), 39–60. doi:10.19744/j.cnki.11-1235/f.2020.0033

Wang, Y., Zhao, Z., Zhang, S., and Su, Y. (2023b). Research on the impact of digital inclusive finance on regional carbon emissions: based on the sustainable green innovation of small and medium-sized enterprises. J. Clean. Prod. 428, 139513. doi:10.1016/j.jclepro.2023.139513

Wei, L., and Ren, L. (2021). Whether carbon emission trading can promote corporate green technology innovation: from the perspective of carbon price. Lanzhou Acad. J. 07, 91–110.

Xiao, Z., Tan, R., Shi, J., and Wang, F. (2012). Research on the impact of environmental regulation on regional green innovation efficiency: a quasi-natural experiment based on the "carbon emission rights" pilot. Eng. Manag. Sci. Technol. Front. 41 (02), 63–69.

Xu, B., and Liu, X. (2022a). Research on the carbon emission effect of import and export trade on the primary industry: a threshold test based on China's provincial R&D input data. Econ. Issues 02, 27–33. doi:10.16011/j.cnki.jjwt.2022.02.004

Xu, Y., and Liu, Y. (2022b). Digital infrastructure construction and enterprise technology innovation: empirical evidence based on "Broadband China" demonstration city policy. J. Nanjing Univ. Finance Econ. 04, 77–87.

Xue, C., and Xu, Y. (2017). Influence factor analysis of enterprise IT innovation capacity based on system dynamics. Procedia Eng. 174, 232–239. doi:10.1016/j.proeng.2017.01.125

Yi, M., Liu, Y., Sheng, M., and Wen, L. (2022). Effects of digital economy on carbon emission reduction: new evidence from China. Energy Policy 171, 113271. doi:10.1016/j.enpol.2022.113271

Zhang, J., Gao, D., and Xia, Y. (2016). Whether patents can promote China's economic growth: an explanation from the perspective of China's patent funding policy. China Ind. Econ. 01, 83–98. doi:10.19581/j.cnki.ciejournal.2016.01.006

Zhang, Y., Peng, Y., Ma, Z., and Shen, B. (2017). Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100, 18–28. doi:10.1016/j.enpol.2016.10.005

Zhang, J., Wang, K., and Zhang, Y. (2022a). The emission reduction effect of carbon emission trading mechanism: based on the mediating effect of low-carbon technology innovation. J. Soft Sci. 36 (05), 102–108. doi:10.13956/j.ss.1001-8409.2022.05.15

Zhang, T., Wu, M., and Zhou, L. (2022b). Does carbon emission trading promote corporate investment efficiency? Quasi-experiment based on carbon emission trading pilot. Zhejiang Soc. Sci. 01, 39–47+157. doi:10.14167/j.zjss.2022.01.004

Zhang, Y., Wang, J., and Cheng, Y. (2022c). Spatial-temporal characteristics of industrial carbon emission performance and the influence mechanism of technological innovation in China. Resour. Sci. 44 (07), 1435–1448. doi:10.18402/resci.2022.07.10

Zhang, Z., Sun, Z., and Lu, H. (2022d). Has the low-carbon city pilot achieved the "incremental quality improvement" of enterprise green technology innovation? J. Yunnan Univ. Finance Econ. 38 (04), 85–98. doi:10.16537/j.cnkijynufe.000777

Keywords: low-carbon transition, carbon emission intensity, enterprise technology innovation, carbon neutrality and carbon peak, China

Citation: Lu H, Xie Z, Liu Y and Xu G (2024) Study on the impact of regional carbon emissions on enterprise technological innovation under the background of low-carbon transformation in China. Front. Environ. Sci. 12:1290338. doi: 10.3389/fenvs.2024.1290338

Received: 24 October 2023; Accepted: 25 January 2024;

Published: 09 February 2024.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Love Kumar, University of Florida, United StatesCopyright © 2024 Lu, Xie, Liu and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hualiang Lu, MTQxNjI2MTYyMUBxcS5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.