- 1School of Economics and Management, Nanjing University of Science and Technology, Nanjing, China

- 2School of Management Science and Engineering, Nanjing University of Information Science and Technology, Nanjing, China

- 3School of Business, Jiangsu Open University, Nanjing, China

- 4School of Marxism, Nanjing University of Information Science and Technology, Nanjing, China

- 5School of Foreign Languages, Nanjing University of Finance and Economics, Nanjing, China

Under the initiative of sustainable development, green financial mechanisms have become an important object to study environmental protection and reduce energy consumption and environmental pollution. This paper explores the mechanism of green finance’s effect on China’s industrial structure through panel regression and mediating effect models using panel data from 30 Chinese provinces and cities from 2009 to 2019. The findings show that 1) the level of green finance is high in both eastern and central regions, but the industrial structure in the eastern region is the most balanced and reasonable. From the results, the consistency between the industrial structure and the level of green finance development is stronger in eastern China. 2) The study of the mechanism of green finance’s role through the intermediary effect model shows that there is an overall mechanism of green finance influencing the upgrading of industrial structure through the financial sector in China, but it is manifested as partial intermediation, and the direct role of green finance on the industrial structure is more obvious. 3) In the analysis of regional heterogeneity, the intermediary role of the financial industry does not exist in the eastern and western regions, while the central region shows a masking effect. In response to these results and to promote the transformation and upgrading of industrial structure, the recommendation of this paper is to focus on the important role of financial institutions in developing green finance to adjust industrial structure, especially in the central region, where both green finance and industrial structure are at an intermediate level. Each region should adjust its industrial structure according to the time and place and promote upgrading the industrial structure.

1 Introduction

Underdeveloped technology in high-tech industries and inefficient production within traditional industries can increase energy consumption and exacerbate the environmental crisis. There are ways to alleviate this dilemma, for example, by stimulating technological innovation (Zhang et al., 2022) or regional environmental regulation through industrial relocation or restructuring. A balanced industrial structure means more sustainable production and economic development. The focus of sustainable development is on environmental friendliness and rational allocation of resources, the core of which is energy saving and emission reduction. Inaction in energy-intensive industries can lead to increased environmental pollution and depletion of non-renewable resources. It can significantly reduce the happiness and wellbeing of people’s lives, as the quality of the environment can significantly affect people’s moods (Lu and Sohail, 2022). Reforming traditional industries, which comprise a large part of China’s economy and are vulnerable to pollution and negative externalities, is crucial to promoting high-quality and sustainable growth in the Chinese economy.

Green finance is a mechanism to finance green projects, promote technological progress, and facilitate green and sustainable economic development (Wang and Wang, 2021). Green finance contributes to quality economic development comprehensively through its positive impact on three aspects: ecology and environment, economic efficiency, and economic structure (Yang et al., 2021). Achieving the goals of environmental governance necessitates the introduction of financial resources into productive enterprises (Zhang et al., 2021). The more polluted the environment, the more effective the green finance policy (Huang and Zhang, 2021). Scholars (Eloot et al., 2013; Gabriel and de Santana Ribeiro, 2019; Sengupta et al., 2019) have expressed their views on improving China’s industrial structure. Sachs et al. (2019) argues that the financial sector can drive the development of infrastructure projects, including energy projects emphasising the importance of technological upgrading for the development of green finance. Höhne et al., 2012 emphasises environmental factors and sustainability (Liu et al., 2021) point out that green finance is an extension of the current supply-side structural reform of China’s financial sector in the context of digitalisation (Kaya and Yokobori, 1997; Höhne et al., 2012) suggest that excessive fossil energy consumption may lead to China having a higher ecological barrier, while (You, 2011) finds through empirical studies that renewable energy consumption contributes to natural, economic and social sustainability.

In addition, most scholars exploring the possibilities of sustainable development will set out to explore the regulation of the environment through policy regulations and fiscal instruments, which will play an important role in upgrading industrial structures. Beyond this, focusing on regional heterogeneity is key to addressing practical issues. This paper uses mediating effects to explore the mechanisms of influence in exploring the impact of green finance on upgrading industrial structures. Financial technologies promote the positive environmental impact of green finance, but the green role they play is unclear, and this paper aims to reveal the mechanisms of green finance development and analyse its regional differences.

This paper explores the factors that depend on the structural upgrading of the manufacturing industry and the effective path options to achieve its sustainable development from the perspective of green finance in China, providing a reference for current research and proposing policy recommendations that are conducive to sustainable development in light of the current situation. However, the selection of indicators is limited by the fact that the collection of relevant data cannot be perfectly coordinated because of the huge regional differences in China.

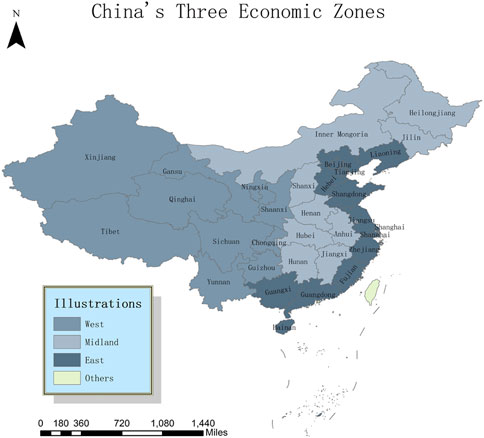

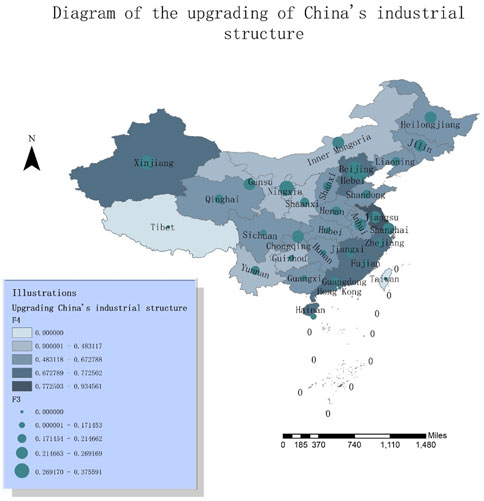

This study uses panel data from 2009 to 2019 for 30 provinces and cities in China, divided into three regions: the eastern, central, and western regions. According to the division of China’s three major economic zones, the eastern region includes 12 provinces (cities), and they are Beijing, Tianjin, Hebei, Liaoning, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan; The central region includes 9 provinces (cities and autonomous regions), namely Anhui, Henan, Shanxi, Hubei, Hunan, Jiangxi, Inner Mongolia, Jilin, and Heilongjiang; the western region includes 9 provinces (cities and autonomous regions), namely Chongqing, Yunnan, Sichuan, Guizhou, Xinjiang, Qinghai, Ningxia, Gansu, and Shaanxi. Data from Hong Kong, Macao, Taiwan, and Tibet are difficult to obtain or missing for the time being. The indicator system is constructed based on the data from these regions to explore the development of green finance and industrial structure in China and each region in Figures 1, 2.

2 Literature review

2.1 Industrial structure

The theory of industrial structure has a long history, with the concept of industrial structure first introduced by William Petty. He argued that the fundamental reason for the different levels of national income and economic development of countries was their different industrial structures. Clark (1940) supplemented this theory with a theory of industrial structure evolution based on the theory of the relationship between national income and labour mobility. Thus, the distribution of the employed population was divided into three categories of the structure according to the different periods of economic development in economics while discussing how they changed. During this period, Kuznets (1930) explored the evolution of the structure of the distribution of national income and labour between industries and their causes. Hoffmann (1958) proposed stages in the evolution of the industrial structure based on early development experience. Input-output economics by Leontief (1986) and Tinbergen (Leontief, 1986) explored the instruments of structural adjustment in the theory of national economic policy, which complemented the theory of industrial structure. They enriched the issue of industrial structure in the course of economic development in the 1950s. Lewis (1954), the founder of regional economics, proposed a dualism of economic structure that distinguished between two industrial categories within a country - traditional and modern industries - and focused on the effects of labour supply and demand and labour costs on upgrading industrial structure. Hirschman and Lindblom (1962), the theory of industrial linkage effects states that the activities of one industry affect related industries, causing their economic activities to be affected. Higgins (1977) proposed a sustainable industrial structure growth model. In contrast to the European and American studies of industrial structure, Ozawa (1979) proposed the dynamic comparative cost theory, which argues that the comparative costs of products are transformable. The overall trend of industrial structure is to move from a closed to an open structure. These are the early industrial structure and its development history. At this stage, energy and environmental protection are the hotspots of most scholars’ research, combining emission reduction, natural resources, and environmental policies (Chang, 2015; Hang et al., 2019), advocating a diversified and balanced industrial structure (Davis and Weinstein, 2008), and focusing on the role of energy use efficiency on industrial structure upgrading (Du and Li, 2019; Yu and Wang, 2021; Feng and Wu, 2022).

2.2 Green finance

Green finance is derived from the concept of sustainable development. It can be traced back to the environmental perspective in the utility value theory, where environmental value recognises the resource effectiveness of the environment. Sustainable development and environmental protection are discussed in externality and property rights theories. Scholars in green finance advocate the use of financial instruments to realise the utility of resources and environmental protection. Green finance is an innovative financial model that aims to protect the environment and achieve sustainable use of resources. According to Sachs (2015), green financial instruments can help achieve a green environment. Gielen et al. (2015) state that energy efficiency is a central issue in the fight against environmental pollution. Green finance can help to improve energy efficiency by implementing a knowledge transition in energy efficiency through improved green energy projects and capital absorption. Green finance offers a viable option for bridging the investment gap in green buildings. Taghizadeh-Hesary and Yoshino identify (Taghizadeh-Hesary and Yoshino, 2020)green finance instruments as an important and valuable solution to attract private partners for green projects under capital pressure. Debrah et al. (2022) claim that colour finance offers a viable option for bridging the green building investment gap. Rasoulinezhad and Taghizadeh-Hesary (2022) examine the role of green finance in improving energy efficiency and renewable energy development and show that green bonds are a suitable method for advancing green energy projects and reducing CO2. Madaleno et al. (2022) argues for the need to develop a comprehensive policy to enhance environmental responsibility and green finance by financing green technologies to achieve successful energy transition and sustainable development goals. Ullah et al. (2021) investigated the multifaceted role of green innovation in Green Intellectual Capital (GIC) for business sustainability in Pakistan’s manufacturing sector. Jin et al. (2022) examined the impact of government support on production and green investment in manufacturing firms with financing needs; Sachs et al. (2019) define this as expanding investments that provide environmental benefits. It is noted that the financial industry needs to understand the SDGs embrace the concept of true long-term investment and mobilise institutionally mobilised capital to support investment opportunities, ensuring a sustainable future for all. Most scholars have also focused on the potential of green finance to achieve sustainable development (Wang, 2009; Kumar et al., 2022).

2.3 Industrial structure and green finance

Porter and Van der Linde (1995) argue that pollution caused by business activities results from inefficient production processes and that any investment in improving production processes is considered green finance. The endogenous problem is at the heart of the technological development of the industrial structure and the improvement of production efficiency within the company through the optimisation of technology, organizational structures, etc. Green finance, on the other hand, is a means of improving the industrial structure through support for resource-saving and environmentally friendly enterprises and the monitoring of polluting enterprises.

Gu et al. (2021) c conducted an empirical study to explore the efficiency and policy effects of green finance on China’s industrial transformation and upgrading by building VAR and super-efficient DEA models with relevant data. Still, there is a lack of research on regional heterogeneity, which is complemented by this paper. Gao et al. (2022) explored the impact of green finance on industrial rationality. Of interest is their application of the Thiel index and entropy methods to measure industrial rationality and the green finance development index, which provide inspiration for this paper. Hang et al. (2019) highlighted the importance of manufacturing in the Chinese economy, arguing that decoupling it from CO2 emissions largely determines the achievement of China’s transition to a green economy. This is needed to improve the industrial structure of China’s carbon development status. This paper therefore also focuses on data relating to manufacturing companies. Ding (2019) and Ning (2019) pointed out that there is a significant correlation between the green financial system and the development of high energy-consuming industries. Among them, the former argued that green finance is closely related to industrial structure and empirically investigated the relationship between the two by establishing a grey correlation analysis model based on data from 2008 to 2017. The latter analyses the correlation between the development of the six energy-consuming industries by applying grey correlation analysis and selecting the main indicators of the green financial system. Therefore, this paper focuses on the selection of data for high energy-consuming and high-polluting enterprises and treats the data of the eight high-polluting enterprises as an aspect of the negative indicators accordingly.

Green adjustment and industrial structure upgrading are the main tasks of China’s current efforts to promote high-quality economic development. As such, there are more scholars from China in this area of research. In the relevant literature, the view that green finance promotes the upgrading of industrial structures is generally accepted by scholars. Huaiyu et al. (2022) constructed a spatial interaction model using panel data from 2010 to 2017 for 14 cities and states in Hunan Province, China, to measure industrial structure development and green finance. It was found that green finance can contribute to rationalising the industrial structure using technological innovation and green consumption. Wang and Zhu (2018) pointed out that the proposal of green finance helps alleviate a series of environmental problems and limits the expansion of high-energy-consuming and high-polluting industries, and promotes the adjustment of industrial structure. An empirical analysis of the relationship between green financial development and the structure of the tertiary industry in Guizhou Province was conducted using grey relational analysis. In the relevant literature, scholars generally accept the view that green finance promotes the upgrading of individual industrial structures. The exploration of the relationship between the two is a major feature of academic research in this area, with the shortcoming being that there is less analysis of regional heterogeneity.

2.4 Sustainable development

Rachel Carson’s 1962 book Silent spring is credited with creating public awareness of the widespread environmental degradation directly or indirectly attributed to industrial enterprises. The concept of sustainable development began to take shape in the 1980s when the World Commission on Environment and Development’s (WCED) 1987 report, Our Common Future, defined sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their needs.” Tomislav (Tomislav, 2018) summarises previous perspectives on sustainability as a concept based on development, needs, and future generations, ensuring the long-term use of resources and the possibility of guaranteeing the necessary quality of life for future generations.

Much of the early conceptions of sustainability focused on the firm’s sustainability, per capita utility, and wellbeing (Pearce et al., 1994) (Pezzey, 1989) and (Elkington, 1997) have raised the issue of the potential for technology and policy to influence the sustainability of firms in the context of enterprise development. Holmberg and Sandbrook (2019) focus on the international context and argue that sustainable development should move from conceptualization to operationalization. Torgerson (1995) argues that the public debate on the environment has largely evolved into a “primarily sustainability debate.”

Hall and Vredenburg (2003) introduced the concept of sustainable development innovation (SDI) in exploring corporate sustainability, considering the additional constraints of social and environmental pressures having a wider range of stakeholders. Silvestre and Ţîrcă (2019) argues that innovation is sustainable and is widely accepted by academics, industry professionals, and government representatives; Lee (2020) describes the different focus of different indicators internationally in terms of sustainability requirements, such as the introduction of the Genuine Progress Indicator (GPI) into economic performance indicators, Costa Rica’s Sustainable Development Indicators System (Sistema de Indicadores soarrollo Sostenable), Boston’s Composite Indicators of Sustainable Development, etc. Hörisch (2021) discusses the relationship between the COVID-19 pandemic and sustainable development, particularly the UN Sustainable Development Goals (SDGs). The author highlight how Sustainability Accounting, Management, and Policy (SAMP) research can help build a more sustainable post-COVID-19 era. Zakari et al. (2022), on the other hand, find that SAMP is also positive, showing that SAMP improves energy efficiency. Höhne et al. (2012) argues that green finance is a financial investment integrated into sustainable development projects and environmental asset policies to promote more sustainable economic development. Sachs et al. (2019) define it as the expansion of investments that provide environmental benefits. Liu et al. (2021) point out that green finance is an extension of the supply-side structural reform in China’s financial sector in a digital context. The study of green finance for industrial structure upgrading is a theoretical complement to the sustainable development of industrial enterprises and financial sustainability.

2.5 Externality

Sidgwick (1901) recognized the existence of externalities in his book Principles of Political Economy in the sense that “the individual’s right to wealth is not in all cases the equivalent of his contribution to society.” Marshall (2009), in Principles of Economics, introduced the concept of “external economies.” Pigou and Aslanbeigui (2017) further developed the theory of externalities by introducing “internal diseconomies” and “external diseconomies” in The Economics of Welfare, which eventually led to the theory of externalities. Pigou’s theory of externalities assumes that profits cannot be maximized through free competition at some point in the financial market. Government economic policy is needed to address this phenomenon to facilitate the proper functioning of the economy. The most commonly used methods include tax policy in fiscal policy. Based on the neoclassical economists’ approach to social welfare to explore externalities, neo-institutionalist economists such as (Coase, 2013)transformed the problem of externalities into a problem of property rights, arguing that effective property rights can eliminate externalities on this basis. He proposed private contracts and negotiated solutions. Coase firmly defends free markets, and according to his theory of invariance, the level of property rights in the presence of externalities is independent of the distribution of property rights. His efficiency theory argues that if externalities can be traded in the market, then equilibrium should be efficient. Still, this is often a non-cooperative game with fundamentally incomplete information in the real world. As a result, externalities are mostly inefficiently traded in markets. Demsetz (1974), following the other side of Coase’s emphasis, researched property rights, which are thought to function so that they can internalize externalities. Modern economics focuses on a combination of theory and empirical evidence to deal with real problems. Van den Bergh (2010) argues against the excessive pursuit of GDP and instead calls for a focus on human wellbeing. More emphatically, the concept of environmental externalities does not mean entering the realm of neoclassical economics, and a price tax on CO2 is likely to achieve climate sustainability. Spash (2021) argues that the theory of pollution externalities proves to be a blend of elite ethics and free-market ideology, stating that pollution can be corrected in the price system.

3 Theoretical Mechanism and research design

3.1 Theoretical mechanism

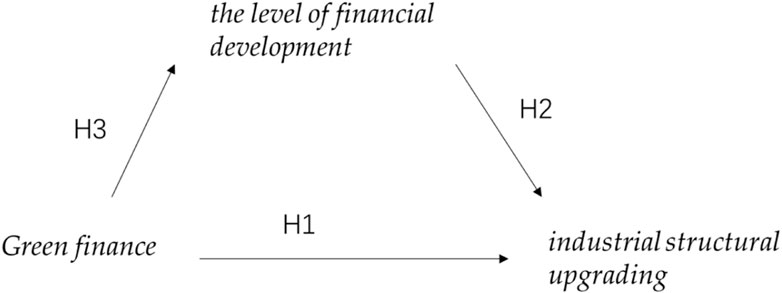

Porter & Van der Linde’s theory of production processes and green finance argues that any investment to improve pollution in production processes should be considered green finance and that environmental regulation promotes innovation and technological upgrading. Based on this, Hypothesis 1 is proposed.

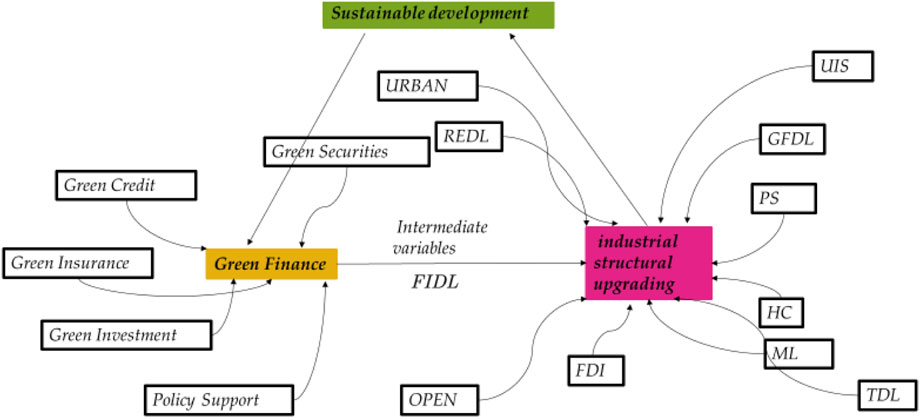

Hypothesis 1. (H1). Green finance can promote industrial structure upgrading.Sachs et al. (2019) state that the task of the financial sector is to ensure and understand the goals of sustainability and ensure that long-term investments are made to ensure a sustainable future for all people. He points out the mobilizing task and the importance of the financial sector in the sustainable development process. The financial sector’s support for energy investments also determines whether the goals of green finance can be achieved. Gielen et al. (2015) state that green finance can be achieved by improving green energy projects and absorbing capital. Based on these two discussions on the relationship between technological upgrading and the financial sector, Hypothesis 2 is formulated.

Hypothesis 2. (H2). The impact between the level of financial development and the upgrading of industrial structure is positive.According to modern empirical studies by economists on the relationship between green finance and industrial structure, for example (Gu et al., 2021), it is believed that with the help of green finance, the allocation of financial resources can be optimized, and the industrial structure can be optimized and upgraded. Ning (2019) points out a significant correlation between the green financial system and the development of high energy-consuming industries. As the hypothesis that the level of development of the financial industry impacts the industrial structure is mentioned in Hypothesis 2, the mechanism of the role of the financial industry in the relationship between green finance and industrial structure upgrading is explored. Hypothesis 3 is proposed.

Hypothesis 3. (H3). Green finance positively influences industrial structural upgrading through the level of financial sector development.Based on the current academic research on the theory of green finance for industrial structure in China, the lack of research on regional heterogeneity in China is a deficiency in the current research. Based on this, Hypothesis 4 is established.

Hypothesis 4. (H4). There is regional heterogeneity in different regions of the country, and the results of the above studies may vary due to regional differences.

3.2 Model construction

First, to test Hypothesis 1, fixed effects regression equations for output structure and green finance were developed to explore the relationship between the two. Model 1) was developed considering the control variables, and model 2) did not consider the control variables.

To test Hypothesis 2 and explore the relationship between industrial structure and the level of development of the financial sector, models 3) and 4), without and with control variables, were developed, respectively.

A mediating effects model was developed to test Hypothesis 3. Models 5) and 6) were developed.

Where

3.3 Index section

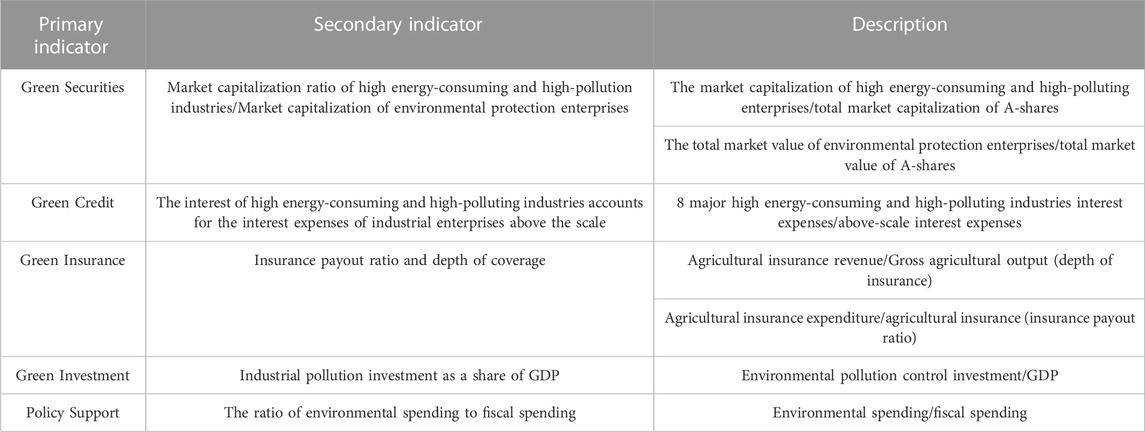

3.3.1 The explained variable; green finance development level

The level of green financial development can be evaluated based on the development status of the green financial market in each region. The ratio of the market capitalization of high energy-consuming and high-polluting enterprises to the total market capitalization of A-shares, expressed in the data, is a negative indicator of the development status of green finance. The stronger the development capacity of local high energy-consuming and high-polluting enterprises, the more it may affect the quality of the local environment. The market value share of the environmental industry is a positive indicator. The ratio of interest expenditure of high energy-consuming and high-polluting enterprises to the interest expenditure data of industrial enterprises above the scale is used as a negative indicator because the interest expenditure of high energy-consuming and high-polluting enterprises reflects the strength of their financing ability if their interest expenditure is high. It means that the enterprises have strong liquidity and better financing ability. In contrast, the strong financing ability of high energy-consuming and high-polluting enterprises with better development may bring about local environmental pollution, so this indicator is negative. Agriculture is an industry affected by the natural environment, so the scale of agricultural insurance and the payout rate can reflect the development of green insurance approximately. The data were obtained from Wind at the abase, China Industry Statistical Yearbook, China Insurance Yearbook, and the official website of the National Bureau of Statistics. The entropy value of panel data was used to calculate the composite index.

The indicators were first standardized. Positive indicators.

The positive and negative indicators in the standardization process indicate that the larger the indicator, the better the rating; the smaller the indicator, the worse the rating, respectively. Where

The second step carries out the normalization process.

The fourth step is to calculate the redundancy.

The fifth step is to calculate the final indicator weights.

The sixth step is to calculate the weighting of the final score for the indicator, which represents the normalized value and the weighting.

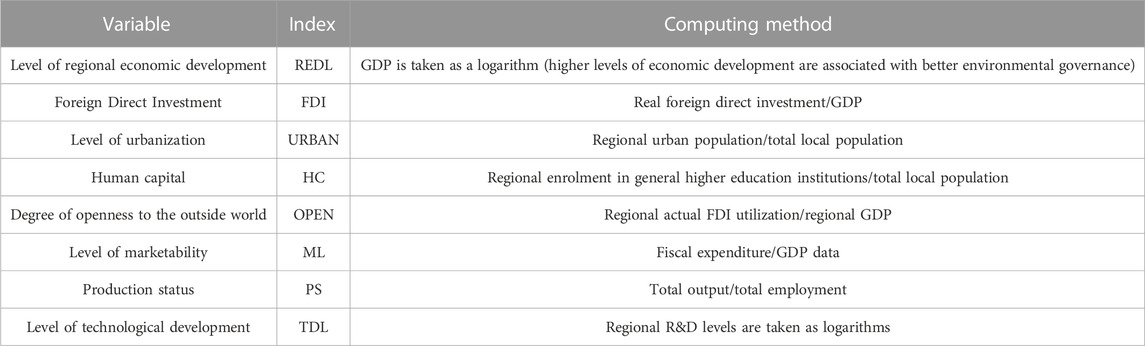

See Table 1 for the specific arrangement of the indicators.

3.3.2 The explained variable; industrial structure upgrade (

Two dimensions are used to express the rationalization of industrial structure (RIS) and the advanced industrial structure (AIS). This paper uses the modified Theil formula of Gan Chunhui (2011) to calculate the rationalization of industrial structure (RIS).

Where L and Y denote employment and output, respectively,

3.3.3 Intermediate variables; financial industry development level (

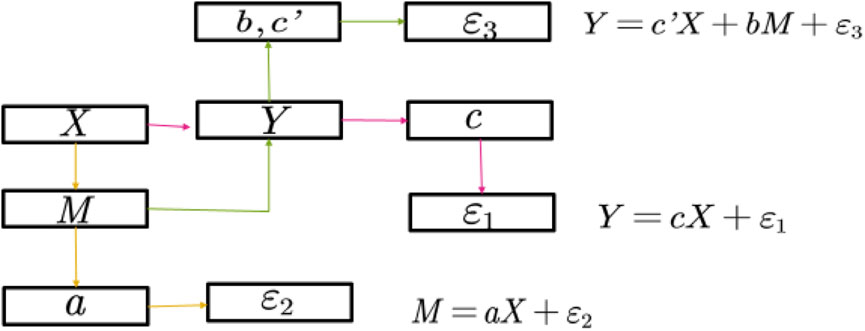

In the field of economics, mediating effects are also a new way of dealing with panel data.

Explore the independent variable X through which M plays a role in the process while making an effect on the dependent variable Y. Then call M a mediating variable of X and Y.

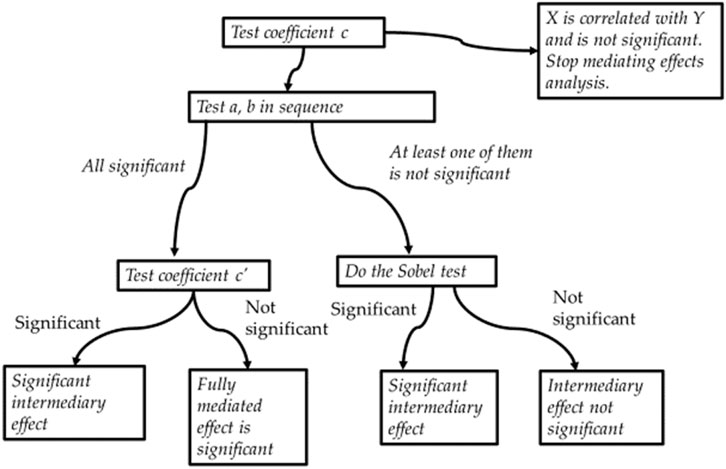

As shown in Figure 3, mediating effects are usually modelled in three ways. Model 1 produces coefficient

There are three measures of the intermediate effects model: the causal stepwise regression test, the multiplicative coefficient method, and the modified causal stepwise regression method. The causal stepwise regression test was proposed by Baron and Kenny (1986), and the test is a three-step process.

Step 1. Analyse the regression of X on Y and test the significance of the regression coefficient c.

Step 2. Analyse the regression of X on M and test the significance of the coefficient a.

Step 3. Intervene in the mediating variables and test the significance of b and c'.The principle of the mediating effect test is shown in Figure 4.However, as time passed, Baron and Kenny’s stepwise method was found to be flawed, and the more widely accepted method was the product test. Hayes and Preacher (2014) suggested using the Bootstrap method for the significance of the relative mediating effect, which is judged by the Bootstrap confidence interval that is derived. If the confidence interval does not contain 0, the relative mediating effect is significant.In order to make the results more reliable, this paper uses the bootstrap method for testing after taking a stepwise regression approach.Financial development was selected as the mediating variable based on the above discussion. Notated as

The entropy method introduced above was then used to measure the composite index of industrial structure upgrading. Data were extracted from the provincial statistical yearbooks and the official website of the National Bureau of Statistics.

3.3.4 Control variables

Economic growth is importantly linked to natural resources and their use, and the decoupling of economic growth from natural resource use is also an important issue of concern (Giljum et al., 2005). The level of economic growth is naturally an important indicator of resource utilisation, and this paper uses the natural logarithm of GDP as an indicator of regional economic development level (REDL). When most scholars study industrial structure, they mainly focus on the impact brought by foreign direct investment (FDI) and import/export because environmental regulations can have a great impact on the location of factories (Cole et al., 2017). Therefore this paper uses the ratio of FDI to regional GDP as an indicator of FDI. Openness (OPEN) is in turn closely related to the level of FDI (Grossman and Helpman, 1991), so the indicator of actual FDI utilized in the region is divided by GDP. the level of urbanization (URBAN) is one of the important factors for industrial transformation and is therefore used as one of the control variables. Sarkodie et al. (2020). showed that fossil fuel energy consumption and human capital are favourable catalysts for climate change; Chankrajang and Muttarak (2017) also noted that people with higher education would be more likely to take knowledge-based environmental action; Salim et al. (2017) identified a significant negative human capital-energy consumption relationship in China, suggesting that a 1% increase in human capital could reduce energy consumption by 0.18%–0.45%. They attribute this to the strong post-graduation human capital accumulation in the east. Based on these studies of the relationship between human capital and energy consumption, the number of students enrolled in general colleges and universities in the selected region was divided by the total local population. The level of marketization (ML) refers to the share of the government’s fiscal expenditure budget in GDP, and fiscal policy reflects, to some extent, the environmental basis for the region’s transformation and upgrading. Production Status (PS), total output/total employment, reflects the production status of each province and city. The real FDI and import/export of each region are converted into RMB at the average exchange rate of the current year in USD. Data are obtained from provincial statistical yearbooks, Wind database and the official website of the National Bureau of Statistics. See Table 2 for the specific calculation method.

Figure 5 shows the mechanism of operation.

4 Result from analysis

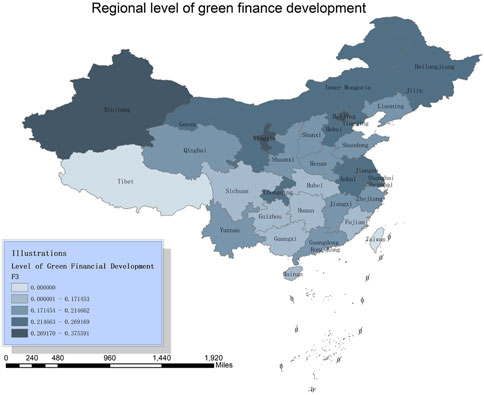

4.1 Regional level of green finance development

The results of the composite index measurement show that the western region’s level of green financial development is generally higher than other regions and higher than the national average. The eastern region is almost in line with the national average, while the central region is developing slowly. All three regions have shown an overall upward trend in the development of green finance in recent years, and the pace of development has been faster. The map drawn by the comprehensive green finance index measured by the entropy method is shown in Figure 6.

4.2 Level of upgrading of industrial structure

A map based on the Theil entropy calculation of Advanced Industrial Structure (AIS) and Rationalised Industrial Structure (RIS) and the composite index of the two obtained by the entropy method of panel data is shown in Figures 7, 8, with the size of the circles indicating the level of regional green finance. The Rationalisation of Industrial Structure (RIS) index shows a strong regional clustering. The more economically developed eastern region has a generally reasonable industrial structure, followed by the central region and the western region to a lesser extent. This trend of diminishing from east to west can also be seen in the colour change. It shows that the Yangtze River Delta, Beijing-Tianjin-Tang, and Pearl River Delta regions have a stronger consistency between green financial development and industrial structure. These regions have a higher level of urbanization, with developed industrial bases, high-tech industrial parks, and mature service industries. As such, both financial sustainability and industrial structure upgrading have reached a high level.

4.3 Robustness tests and baseline regression results

Based on the econometric model constructed above, the positive impact of green finance on the industrial structure was examined by first logging and tailing the data. It was followed by determining the use of a fixed-effects regression model through Hasman’s test, as well as establishing a correlation coefficient matrix and multiple cointegration test to determine the reliability of the fixed-effects regression results. Please see Table 3 for the results of the descriptive statistics. The results of the descriptive statistics showed that there was little variation within data groups between each indicator and the data was relatively smooth. The median and mean of each data group are close to each other, and the distribution of data is concentrated, with a low degree of dispersion. It may follow a normal or approximately normal distribution. The maximum value for the level of industrial structure development is 0.751, the minimum value is 0.155, and the standard deviation is 0.107. The maximum value for the level of green financial development is 0.169, the minimum value is 0.039, and the standard deviation is 0.025. The standard deviation of each variable is not large, indicating that the remaining data do not fluctuate much and no extreme values appear.

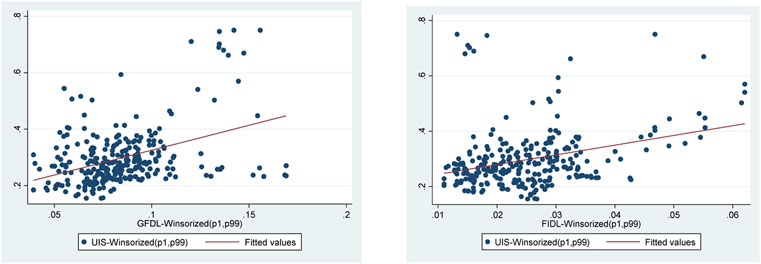

China’s regional industrial structure will improve as green economic development increases. Intuitively, it is assumed that the level of regional green finance and financial development will positively impact the optimization of the industrial structure. This suggests that the level of green finance and financial development in each province and city is positively correlated with the level of industrial structure development. The more emphasis placed on green financial development, the more reasonable the industrial structure of that province and city. The level of financial development is also positively correlated with the industrial structure, the higher the level of financial development, the more reasonable it is. This result is consistent with the preliminary hypothesis of this study.

As to whether the development status of green finance in each region will impact the role of green finance in the process of industrial structure optimization, the extent of the impact is not yet obvious.

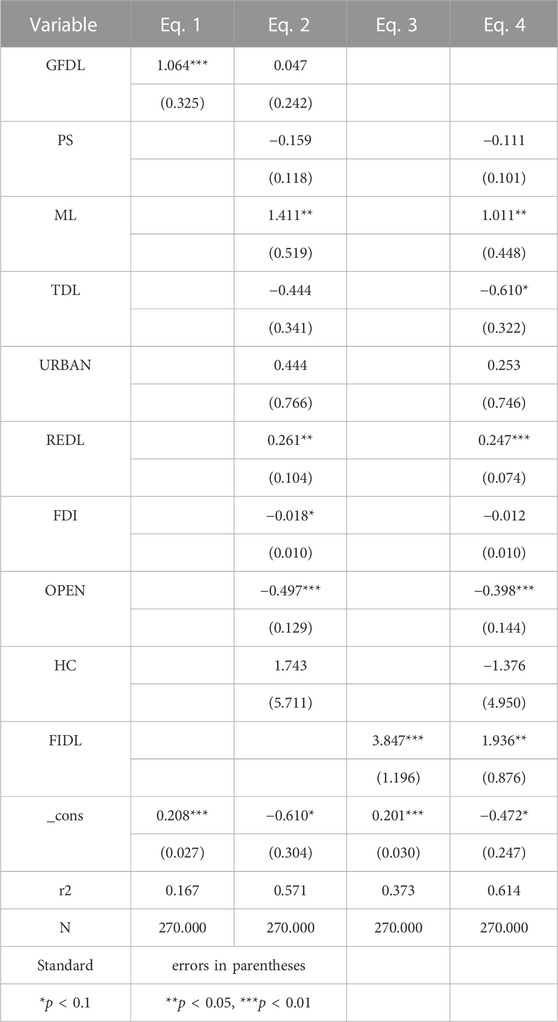

To test Hypothesis 1, Hypothesis 2, fixed effects regressions were conducted with and without the control variables. The results are shown in Table 4. The regression results without the inclusion of control variables show that both green finance and financial sector development positively impact industrial structure. The gradual inclusion of control variables remains significant, and the coefficients are also positive. This indicates that the level of green financial development (GFDL) in model 1) can promote the upgrading of industrial structure (UIS), and the overall regression results are as expected. In model 2), after adding the control variables and then in the regression equation with green finance as the explanatory variable, the production capacity (PS) has an inverse effect on the industrial structure, indicating that the output value does not indicate the level of industrial structure. The level of marketization (ML), on the other hand, is a positive indicator, and this indicator is highly significant, indicating that the degree of regional marketization can have a positive impact on the upgrading of the industrial structure. The coefficient of technological development level (TDL) is negative. It seems that the amount of R&D expenditure in a region does not positively influence the upgrading of industrial structure at present. Higher levels of urbanization (URBAN) and economic development (REDL), and human capital (HC) are more likely to contribute significantly to the upgrading of regional industrial structures. In contrast, this study found no significant positive relationship between openness to the outside world (OPEN) and foreign direct investment (FDI).

The results of the equation of model 4) with the addition of control variables show that in the model with financial sector development as the explanatory variable, productive capacity (PS), technological development level (TDL), openness (OPEN), foreign direct investment (FDI), and human capital (HC) do not have a positive impact on the upgrading of the industrial structure. The main positive influences are the level of marketization (ML), the level of urbanization (URBAN), and the level of economic development (REDL).

4.4 Intermediary effects regression model

Hypothesis 3 was tested by establishing a mediating effect regression model. This paper delves further into how the level of financial sector development as a mediating variable affects the achievement of green finance objectives by constructing models 5) and 6). Because of the obvious differences in economic development and urbanisation levels between regions, they are divided into eastern, central, and western regions according to the method of dividing China into three major economic zones.

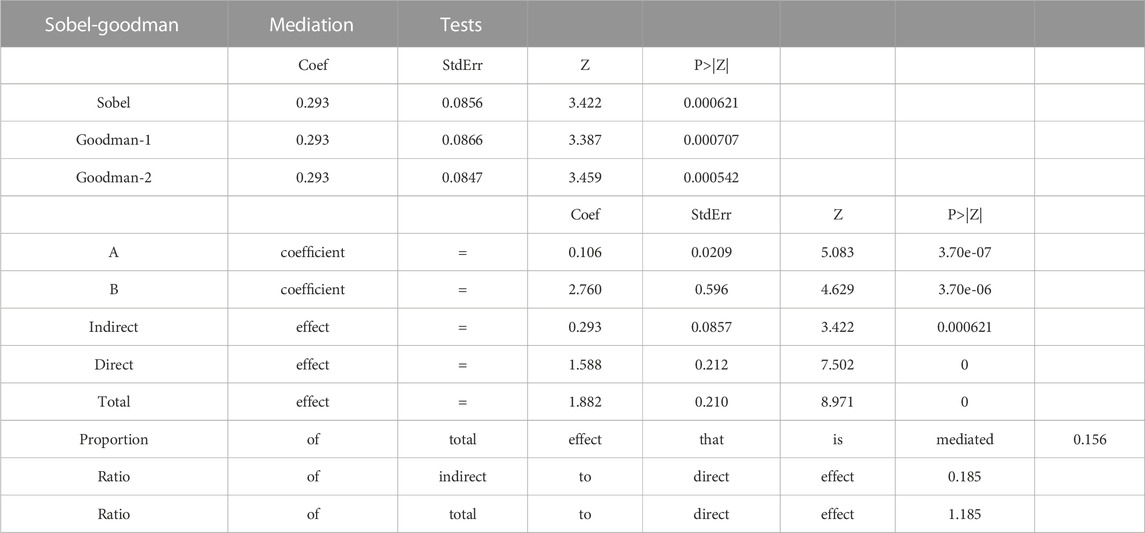

The most appropriate model is determined by gradually adding control variables. According to the analysis above, most scholars consider technological factors, economic development level, foreign direct investment, human capital, and market-oriented factors (fiscal expenditure budget) when studying industrial structure upgrading. The paper also finds that these factors give the best and most realistic results when used as control variables for the level of development of the financial sector when selecting the appropriate control variables. After running stepwise regressions, the coefficients were highly significant at all three stages. To increase the robustness of the model, the Sobel test and Bootstrap method were carried out to check the robustness, respectively.

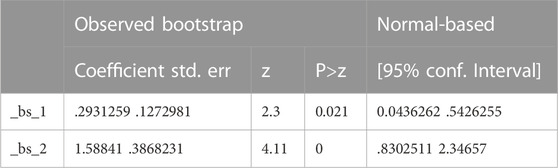

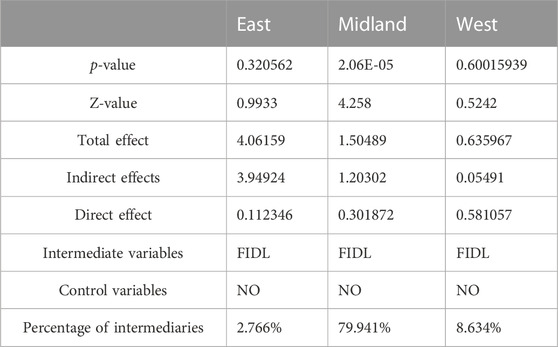

The results of the Sobel-Goodman test showed a direct effect of 1.588, an indirect effect of 0.293, and a total effect of 1.882, with a mediation effect of 15.6% of the total effect. This indicates that partial mediation occurred. The results are shown in Table 5.

The results of the Bootstrap test were also as expected, with both the z-value and the 95% confidence interval passing the significance test that a mediating effect was present. The results are shown in Table 6.

4.5 Regional heterogeneity analysis

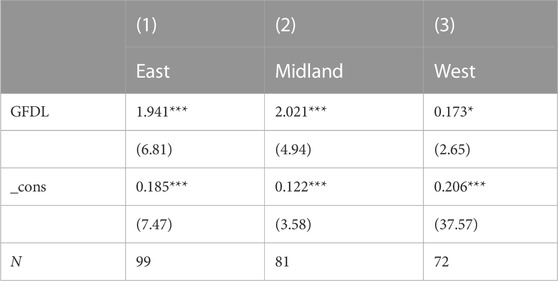

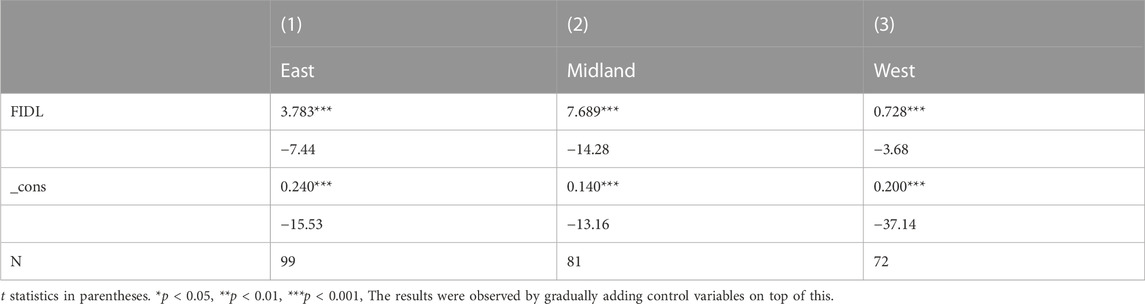

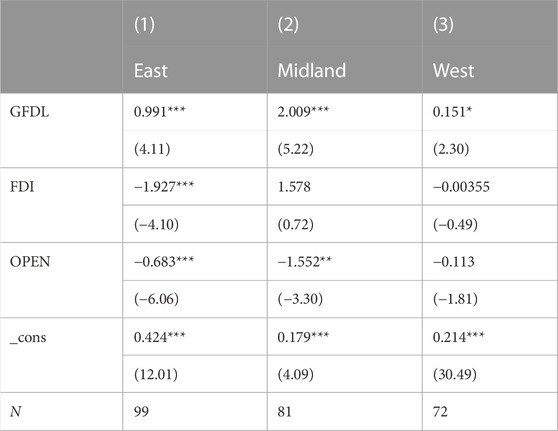

Having explored the mechanisms of the impact of green finance and financial sector development on the industrial structure in general, we next delve into a regional heterogeneity analysis. The best results are still sought by gradually adding control variables. The first regression is a fixed effects regression without any control variables. The results show that the impact of green finance on the industrial structure is significant and positive in the eastern, central, and western regions. The impact of the financial sector on the industrial structure is also significant and positive. These prove the validity of Hypothesis 1, 2. The results can be seen in Tables 7, 8.

TABLE 7. Regression results based on Hypothesis 1 sub-region without the inclusion of control variables.

TABLE 8. Regression results based on Hypothesis 2 sub-region without the inclusion of control variables.

First, as shown in Table 9, the addition of the control variables foreign direct investment (FDI) and (OPEN) did not have much effect on the original hypothesis. The impact of green finance on the industrial structure is positive in the eastern, central, and western regions. The impact of foreign direct investment (FDI) on the industrial structure is shown to be negative in both eastern and western regions. It does not positively affect industrial structure upgrading, a situation that suggests that the presence of multinational companies may have a negative effect on regional industrial technology upgrading. In contrast, the share of such FDI in the three industries significantly affects the balance of the three industries in each region and may not be conducive to regional equalisation of the industrial structure. Because the actual situation differs from region to region, the central region may have a greater need for imports, exports, and foreign investment to promote an advanced regional industrial structure.

TABLE 9. Regression results based on the inclusion of control variables for Hypothesis 1 sub-region.

As shown in Table 10, with financial sector development as the independent variable and the rest gradually added as control variables, none of the results is altered except for the significant positive effect of the level of urbanisation (URBAN). Such results illustrate that the level of financial development is, to a large extent, a direct contributor to the upgrading of the industrial structure.

TABLE 10. Regression results based on the inclusion of control variables for Hypothesis 2 sub-region.

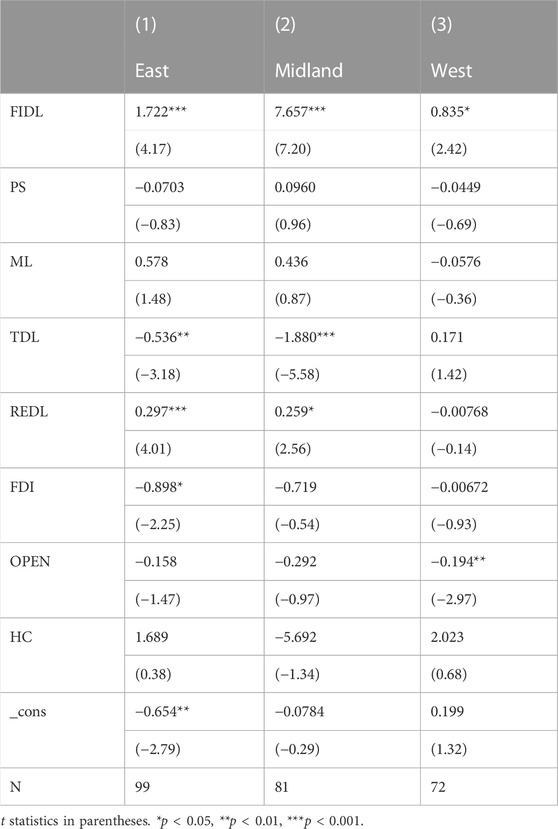

Having explored the conditions under which Hypothesis 1 and 2 are valid by sub-region, we move on to Hypothesis 3. We explore Hypothesis 3 in the sub-regional situation and examine the relationship between green finance and the level of financial sector development and the mechanism by which it acts to upgrade the industrial structure.

We follow Hypothesis 3 and examine the financial sector development as a mediating variable.

Again, the results when no control variables are included are shown in Table 11. The significant mediating role of the level of financial sector development in the central region indicates that green finance is influencing the upgrading of the industrial structure through the level of financial development. The region needs to further develop its economy to promote the green transformation of the industrial structure and form a virtuous cycle. The eastern and western regions, on the other hand, show that there is no mediating role for the financial sector, and the gradual addition of control variables remains fruitless. The results show that financial sector intermediation is not present in the eastern and western regions, and combined with the results of the above studies, as shown in Tables 7, 8, the direct impact of green finance on upgrading industrial institutions may be greater.

TABLE 11. Overall results for the three regions with financial sector development as a mediating variable.

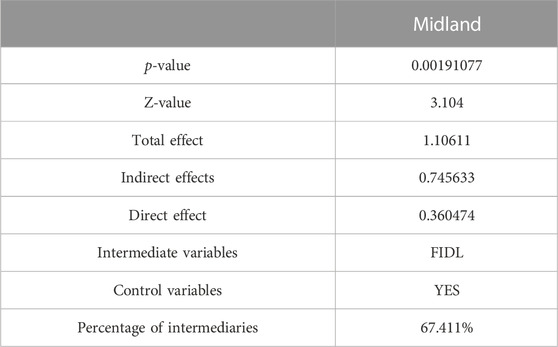

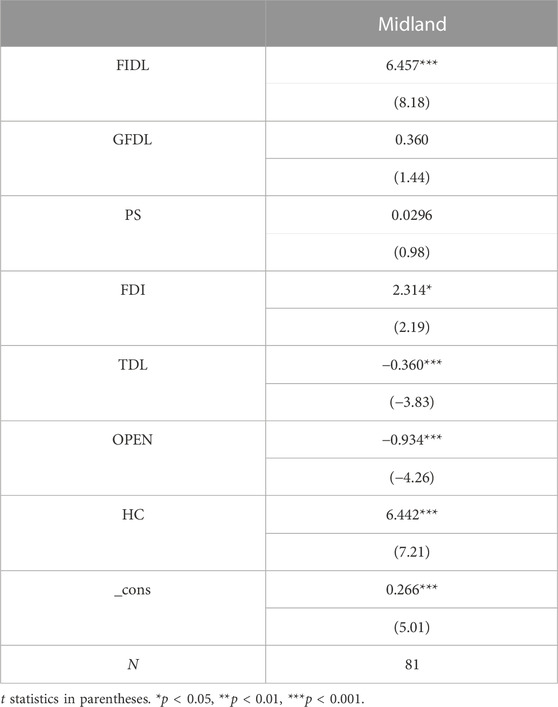

The study was repeated with the addition of control variables, and the results are shown in Table 12. For the central region, production status (PS), regional economic development level (REDL), foreign direct investment (FDI), technological development level (TDL), openness to the outside world (OPEN), and human capital (HC) were selected as control variables, and the results were optimal at this point. In the stepwise regression process, it was found that the values of the coefficients of the explanatory variables were not significant in the third stage. In this case, based on the principle of mediating variables, it is possible that there is a masking effect, i.e., after the inclusion of the control variables, green finance can only have an effect on the industrial structure through the development of the financial sector. In the central region, the level of industrial structure affected by green finance is still largely determined by the level of development of the financial sector, and in this mechanism of action in the central region, green finance mainly acts on industrial structure through the financial sector and enhances the positive relationship between green finance and industrial structure. As shown in Table 13, such results are still prevalent even with the inclusion of control variables.

TABLE 13. Regression results for Central Region with financial sector development as a mediating variable.

5 Conclusion and countermeasures

5.1 Research conclusions

This study first explores the regional linkages between green finance and industrial structure development in various regions of China through the measurement of comprehensive indicators.

The results of the study are as follows.

1. The findings show that green finance and financial sector development positively impact industrial structure upgrading at a national level, confirming the validity of Hypothesis 1, 2, 3. In order to investigate Hypothesis 4, the study was repeated by region, with very different results.

2. After the gradual inclusion of control variables, the regions showed significant regional differences. The absence of intermediation in the eastern and western regions predicts a strong direct influence. In contrast, the western region follows the mechanism of action of the mediating variable of financial sector development, confirming the validity of Hypothesis 3.

3. Economic development may come at the cost of damage to the environment (Wang et al., 2019; Lu and Sohail, 2022), but regions with higher levels of economic development can make efficient use of resources through more sophisticated technology and better promote industrial upgrading. The western part of China is rich in resources and spreads many heavy industries, so the industrial structure has not reached a reasonable level but has improved somewhat thanks to environmental regulations in the last 2 years.

4. The fixed effects regression model answers Hypothesis 1, 2, namely that green finance and the level of financial development have a significant positive impact on industrial structure. This result still holds after adding a large number of mediating variables. The results still hold after the inclusion of a large number of mediating variables, indicating that both have a significant positive effect on upgrading the industrial structure.

5. To explain Hypothesis 3, the specific mechanism of action of green finance is explored in depth for the intermediary effect analysis. The previous research results show that the financial industry significantly affects the level of regional green finance development. The development of finance was studied as a mediating variable, and the findings suggest that the mediating role of the financial sector is important at the national level, which is consistent with the Hypothesis 3 at the beginning of this paper. However, due to the large regional differences in China, regionally, this mechanism is more pronounced in the central region. Feng and Wu (2022) argue that financial development moderates the link between the rationalisation of industrial structure and the scale of carbon emissions and per capita carbon emissions in southern China, highlighting the formation of regional heterogeneity and the need to tailor policies to local conditions. From existing literature, R&D investment is positively correlated with natural resource use efficiency, so financial development positively impacts natural resource use efficiency. Capital can be reallocated through financial intermediation and financial markets, and limited resources can be invested in areas with higher productivity and output growth rates to drive the optimisation and upgrading of traditional industries (Xu and Tan, 2020). Thus, the results of this paper suggest that green finance plays an important role in the financial sector in promoting the upgrading of the industrial structure in the central region, which has a more balanced resource, financial development, and a sound industrial structure. Such a conclusion is in line with reality.

5.2 Countermeasures and suggestions

The recommendations based on this phenomenon are as follows.

a. Unlike other environmental regulations, China’s Green Credit Guidelines internalise a company’s environmental risk as a lending channel; companies with high environmental credit risk face high barriers to accessing loans (Li et al., 2022). There are significant differences in the actual situation of each region itself. The eastern economic belt, with its faster economic development, should continue to build a green financial system based on green credit and investment to support the development of environmentally friendly enterprises. In the central and western regions, where industrialisation is more advanced, green credit should be restricted to polluting enterprises. Provinces and municipalities should implement specific policies in line with the requirements of the “double carbon” policy.

b. The western regions have a greater demand for green financial development, but there are shortcomings in industrial restructuring. These regions should insist on developing technology-intensive enterprises while receiving labour-intensive industries from the east. Boosting the upgrading of industrial structure and playing a greater role in the new round of western development and the double cycle pattern.

c. Tourism is a natural low-carbon economy, and central regions such as those in the Yellow River basin can develop special tourism to promote the development of local cultural industries. Resource provinces such as Shanxi should adjust their energy structure and improve energy efficiency, and green financing can be developed to promote the reform of related industries. In the west, green agriculture can be developed to improve technological input in agriculture and reduce environmental pollution, as in Inner Mongolia. The manufacturing industry is the pillar industry of the coastal and eastern regions and can continue to develop while taking advantage of its resources, increasing investment in talent, and promoting innovation. Although the development of the economy has brought about the development of finance and services, the status of the manufacturing industry must not be reduced so as not to cause more financial bubbles and industrial hollowing out, which will affect exports and affect development.

d. Increase policy support, employment and tertiary sector development under the epidemic is not optimistic. The secondary sector is also affected, affecting the supply chain; reforms in logistics and transport should be promoted (Fan et al., 2022). Digital trade and teleworking should be supported, technological innovation should be increased, and the emergence of new professions should be encouraged and regulated.

e. Economic and industrial structure development are mutually reinforcing, and efforts should be made to explore economic development opportunities in each region. Thus, promote the renewal of human resource development mechanisms, encourage innovation, support technological change, improve energy use efficiency and achieve structural adjustment.

f. At a micro level, if environmental regulation is to be achieved to promote sustainable development, as suggested by Ren, Z. and R.Y. Hussain (Ren and Hussain, 2022), it is possible to promote green behaviour and green production by encouraging Green Human Resource Management (GHRM) within manufacturing companies.

In short, we should continue to promote and reform technology, policy, and talent training, focusing on less economically developed regions. Local governments should also strive to explore opportunities for economic development, promote regional economic development, adjust the energy structure and restructure the industrial structure.

5.3 Theoretical implication

It complements the theoretical research on green finance as an important stage in the evolution of the concept of sustainable development. The practice of green finance in China is relatively late and has been relatively popular in the Chinese academic community in recent years, focusing mainly on qualitative research on policies and quantitative research stages on green industries, green technology innovation, and the effects of green policies (Qi and Qi, 2020). This paper complements the limited research on the relationship between green finance and industrial structure and focuses on regional heterogeneity.

5.4 Practical implications

The economic development goals for the 14th Five-Year Plan period focus more on the people’s aspirations for a better life, emphasing innovation, technological development, and the integration of the service and manufacturing sectors. It is an important way to narrow the income gap and promote social equity in the post-epidemic era. In the context of global economic development, technological upgrading and the development of green production and low-carbon economies are common measures taken by countries along the Belt and Road to reduce global climate risks and economic losses. Policies to optimise the ecological environment are of great importance for global climate improvement and human development.

5.5 Limitations and future research

This paper has not explored in-depth the mediating role played by other variables in the absence of a significant mediating role of the financial sector and the mechanisms of this role. As such, research on this aspect can be explored in-depth in future studies. Due to data availability, more data were not included in the reference. Although environmental factors were taken into account in selecting indicators for green finance, environmental regulation did not interact with the overall study. It should be included in future studies as well as in green total factor productivity, which may lead to more accurate results.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author contributions

Conceptualization, DT, HK, and YX; methodology, YX; software, YX and RZ; validation, YX and VB; formal analysis, HK, RZ, YX, and DT; investigation, YX; resources, YX, GW, and DT; data curation, YX, RZ and D T; writing—original draft preparation, YX; writing—review and editing, HK, RZ, DT, YX, GW, BZ and VB; visualization, DT, BZ, and VB; supervision, HK, GW, DT, and BZ; project administration, DT. All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Chang, N. (2015). Changing industrial structure to reduce carbon dioxide emissions: A Chinese application. J. Clean. Prod. 103, 40–48. doi:10.1016/j.jclepro.2014.03.003

Chankrajang, T., and Muttarak, R. (2017). Green returns to education: Does schooling contribute to pro-environmental behaviours? Evidence from Thailand. Ecol. Econ. 131, 434–448. doi:10.1016/j.ecolecon.2016.09.015

Cole, M. A., Elliott, R. J., and Zhang, L. (2017). Foreign direct investment and the environment. Annu. Rev. Environ. Resour. 42 (1), 465–487. doi:10.1146/annurev-environ-102016-060916

Davis, D. R., and Weinstein, D. E. (2008). A search for multiple equilibria in urban industrial structure. J. Regional Sci. 48 (1), 29–65. doi:10.1111/j.1467-9787.2008.00545.x

Debrah, C., Chan, A. P. C., and Darko, A. (2022). Green finance gap in green buildings: A scoping review and future research needs. Build. Environ. 207, 108443. doi:10.1016/j.buildenv.2021.108443

Demsetz, H. (1974). “Toward a theory of property rights,” in Classic papers in natural resource economics (Berlin, Germany: Springer), 163–177. doi:10.1057/9780230523210_9

Ding, J. (2019). “The relations study on green finance and upgrading of industrial structure in China-based on grey correlation analysis model [C],” in Proceedings of the 2019 3rd International Conference on Education, Culture and Social Development (ICECSD 2019), 12 August 2019 (Germany: Atlantis Press). doi:10.2991/icecsd-19.2019.54

Du, K., and Li, J. (2019). Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 131, 240–250. doi:10.1016/j.enpol.2019.04.033

Eloot, K., Huang, A., and Lehnich, M. (2013). A new era for manufacturing in China. McKinsey Q. 1 (6), 1–14.

Fan, M., Wu, Z., Qalati, S. A., He, D., and Hussain, R. Y. (2022). Impact of green logistics performance on China’s export trade to regional comprehensive economic partnership countries. Front. Environ. Sci. 10, 544. doi:10.3389/fenvs.2022.879590

Feng, Y., and Wu, H. (2022). How does industrial structure transformation affect carbon emissions in China: The moderating effect of financial development. Environ. Sci. Pollut. Res. 29 (9), 13466–13477. doi:10.1007/s11356-021-16689-y

Gabriel, L. F., and de Santana Ribeiro, L. C. (2019). Economic growth and manufacturing: An analysis using Panel VAR and intersectoral linkages. Struct. Change Econ. Dyn. 49, 43–61. doi:10.1016/j.strueco.2019.03.008

Gan Chunhui, Z.R., The impact of industrial structural change on economic growth and volatility in China. United States: Economic Research, 2011.

Gao, L., Tian, Q., and Meng, F. (2022). The impact of green finance on industrial reasonability in China: Empirical research based on the spatial panel durbin model. Environ. Sci. Pollut. Res. Int. 2022, 1–17. doi:10.1007/s11356-022-18732-y

Gielen, D., Saygin, D., Wagner, N. W., Petrichenko, K., and Tsakiris, A. (2015). Synergies between renewable energy and energy efficiency-A working paper based on remap 2030. Berlin, Germany: Springer.

Giljum, S., Hak, T., Hinterberger, F., and Kovanda, J. (2005). Environmental governance in the European union: Strategies and instruments for absolute decoupling. Int. J. Sustain. Dev. 8 (1/2), 31. doi:10.1504/ijsd.2005.007373

Grossman, G. M., and Helpman, E. (1991). Trade, knowledge spillovers, and growth. Eur. Econ. Rev. 35 (2-3), 517–526. doi:10.1016/0014-2921(91)90153-a

Gu, B., Chen, F., and Zhang, K. (2021). The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: Analysis from the perspective of government regulation and public environmental demands. Environ. Sci. Pollut. Res. Int. 28 (34), 47474–47491. doi:10.1007/s11356-021-13944-0

Hall, J., and Vredenburg, H. (2003). The challenge of innovating for sustainable development. MIT Sloan Manag. Rev. 45 (1), 61.

Hang, Y., Wang, Q., Zhou, D., and Zhang, L. (2019). Factors influencing the progress in decoupling economic growth from carbon dioxide emissions in China’s manufacturing industry. Resour. Conservation Recycl. 146, 77–88. doi:10.1016/j.resconrec.2019.03.034

Hayes, A. F., and Preacher, K. J. (2014). Statistical mediation analysis with a multicategorical independent variable. Br. J. Math. Stat. Psychol. 67 (3), 451–470. doi:10.1111/bmsp.12028

Higgins, R. C. (1977). How much growth can a firm afford? Financial management. Netherlands: Wiley, 7–16. doi:10.2307/3665251

Hirschman, A. O., and Lindblom, C. E. (1962). Economic development, research and development, policy making: Some converging views. Behav. Sci. 7 (2), 211–222. doi:10.1002/bs.3830070206

Hoffmann, W. G. (1958). The growth of industrial economies. United States: Manchester University Press.

Höhne, N., Khosla, S., Fekete, J., and Gilbert, A. (2012). Mapping of green finance. Available at: http://www.idfc.org/Downloads/Publications/01_green_finance_mappings/IDFC_Green_FinanceMapping_Report_2012_14-06-12.pdf.

Holmberg, J., and Sandbrook, R. (2019). “Sustainable development: What is to be done?,” in Policies for a small planet (Washington: Routledge), 19–38. doi:10.4324/9780429200465

Hörisch, J. (2021). The relation of COVID-19 to the UN sustainable development goals: Implications for sustainability accounting, management and policy research. Sustain. Account. Manag. Policy J. 12, 877–888. doi:10.1108/SAMPJ-08-2020-0277

Huaiyu, Y., Jianghao, L., and Naiqi, Y. (2022). Has green finance promoted industrial structure optimization? Environ. Sci. Pollut. Res. Int. 2022, 24514. doi:10.1007/s11356-022-24514-3

Huang, H., and Zhang, J. (2021). Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 13 (7), 3754. doi:10.3390/su13073754

Jin, W., Ding, W., and Yang, J. (2022). Impact of financial incentives on green manufacturing: Loan guarantee vs. interest subsidy. Eur. J. Operational Res. 300 (3), 1067–1080. doi:10.1016/j.ejor.2021.09.011

Kaya, Y., and Yokobori, K. (1997). Environment, energy, and economy: Strategies for sustainability. United States: United Nations University Press Tokyo. doi:10.13140/RG.2.2.19997.61923

Kumar, S., Sharma, D., Rao, S., Lim, W. M., and Mangla, S. K. (2022). Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Ann. Operations Res. 21, 1–44. doi:10.1007/s10479-021-04410-8

Kuznets, S. S. (1930). Secular movement in production and prices: Their nature and their bearing upon cyclical fluctuations. Boston: Houghton Mifflin and company.

Lee, J. W. (2020). Green finance and sustainable development goals: The case of China. J. Asian Finance, Econ. Bus. 7 (7), 577–586. doi:10.13106/jafeb.2020.vol7.no7.577

Lewis, W. A. (1954). Economic development with unlimited supplies of labour. Berlin, Germany: Springer.

Li, S., Liu, Q., Lu, L., and Zheng, K. (2022). Green policy and corporate social responsibility: Empirical analysis of the Green Credit Guidelines in China. J. Asian Econ. 82, 101531. doi:10.1016/j.asieco.2022.101531

Liu, Y., Lei, J., and Zhang, Y. (2021). A study on the sustainable relationship among the green finance, environment regulation and green-total-factor productivity in China. Sustainability 13 (21), 11926. doi:10.3390/su132111926

Lu, F., and Sohail, M. (2022). Exploring the effects of natural capital depletion and natural disasters on happiness and human wellbeing: A study in China. Front. Psychol. 13, 870623. doi:10.3389/fpsyg.2022.870623

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Marshall, A. (2009). Principles of economics: Unabridged eighth edition. United States: Cosimo, Inc.

Ning, J. (2019). “Analysis of the impact of green finance on high energy consumption industry,” in IOP Conference Series: Earth and Environmental Science, 16 July 2019 (Austria: IOP Publishing).

Ozawa, T. (1979). International investment and industrial structure: New theoretical implications from the Japanese experience. Oxf. Econ. Pap. 31 (1), 72–92. doi:10.1093/oxfordjournals.oep.a041438

Pearce, D. W., Atkinson, G. D., and Dubourg, W. R. (1994). The economics of sustainable development. Annu. Rev. energy Environ. 19 (1), 457–474. doi:10.1146/annurev.eg.19.110194.002325

Pezzey, J. (1989). Economic analysis of sustainable growth and sustainable development. Washington, DC: World Bank Environment Dept.

Pigou, A. C., and Aslanbeigui, N. (2017). The economics of welfare. Washington: Routledge. doi:10.4324/9781351304368

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qi, R., and Qi, L. (2020). Can synergy effect exist between green finance and industrial structure upgrade in China? Open J. Soc. Sci. 8 (08), 215–226. doi:10.4236/jss.2020.88019

Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Effic. 15 (2), 14–12. doi:10.1007/s12053-022-10021-4

Ren, Z., and Hussain, R. Y. (2022). A mediated-moderated model for green human resource management: An employee perspective. Front. Environ. Sci. 10, 1538. doi:10.3389/fenvs.2022.973692

Sachs, J. D. (2015). “The age of sustainable development,” in The age of sustainable development (Columbia: Columbia University Press). doi:10.7312/sach17314

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). Importance of green finance for achieving sustainable development goals and energy security. Handb. green finance Energy Secur. Sustain. Dev. 10, 3–12. doi:10.1007/978-981-13-0227-5_13

Salim, R., Yao, Y., and Chen, G. S. (2017). Does human capital matter for energy consumption in China? Energy Econ. 67, 49–59. doi:10.1016/j.eneco.2017.05.016

Sarkodie, S. A., Adams, S., Owusu, P. A., Leirvik, T., and Ozturk, I. (2020). Mitigating degradation and emissions in China: The role of environmental sustainability, human capital and renewable energy. Sci. Total Environ. 719, 137530. doi:10.1016/j.scitotenv.2020.137530

Sengupta, P. P., Sinha, M., and Dutta, U. P. (2019). Economic and environmental performances in manufacturing industries: A comparative study. Periodicals Eng. Nat. Sci. 7 (1), 99–108. doi:10.21533/pen.v7i1.416

Silvestre, B. S., and Ţîrcă, D. M. (2019). Innovations for sustainable development: Moving toward a sustainable future. J. Clean. Prod. 208, 325–332. doi:10.1016/j.jclepro.2018.09.244

Spash, C. L. (2021). The history of pollution ‘externalities’ in economic thought. Vienna: Vienna University of Economics and Business.

Taghizadeh-Hesary, F., and Yoshino, N. (2020). Sustainable solutions for green financing and investment in renewable energy projects. Energies 13 (4), 788. doi:10.3390/en13040788

Tomislav, K. (2018). The concept of sustainable development: From its beginning to the contemporary issues. Zagreb Int. Rev. Econ. Bus. 21 (1), 67–94. doi:10.2478/zireb-2018-0005

Torgerson, D. (1995). “The uncertain quest for sustainability: Public discourse and the politics of environmentalism,” in Greening environmental policy (Berlin, Germany: Springer), 3–20. doi:10.1007/978-1-137-08357-9_1

Ullah, H., Wang, Z., Mohsin, M., Jiang, W., and Abbas, H. (2021). Multidimensional perspective of green financial innovation between green intellectual capital on sustainable business: The case of Pakistan. Environ. Sci. Pollut. Res. 2021, 5552–5568. doi:10.1007/s11356-021-15919-7

Van den Bergh, J. C. (2010). Externality or sustainability economics? Ecol. Econ. 69 (11), 2047–2052. doi:10.1016/j.ecolecon.2010.02.009

Wang, H., and Zhu, J. (2018). “Research on green finance promoting the optimization of industrial structure—an empirical analysis based on Guizhou province,” in 2018 3rd International Conference on Politics, Economics and Law (ICPEL 2018), 12 August 2018 (Germany: Atlantis Press). doi:10.4324/9781849776264

Wang, K., Wu, M., Sun, Y., Shi, X., Sun, A., and Zhang, P. (2019). Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour. Policy 60, 203–214. doi:10.1016/j.resourpol.2019.01.001

Wang, M. (2009). Manufacturing FDI and economic growth: Evidence from asian economies. Appl. Econ. 41 (8), 991–1002. doi:10.1080/00036840601019059

Wang, X., and Wang, Q. (2021). Research on the impact of green finance on the upgrading of China's regional industrial structure from the perspective of sustainable development. Resour. Policy 74, 102436. doi:10.1016/j.resourpol.2021.102436

Xu, L., and Tan, J. (2020). Financial development, industrial structure and natural resource utilization efficiency in China. Resour. Policy 66, 101642. doi:10.1016/j.resourpol.2020.101642

Yang, Y., Su, X., and Yao, S. (2021). Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resour. Policy 74, 102445. doi:10.1016/j.resourpol.2021.102445

You, J. (2011). China's energy consumption and sustainable development: Comparative evidence from GDP and genuine savings. Renew. Sustain. Energy Rev. 15 (6), 2984–2989. doi:10.1016/j.rser.2011.03.026

Yu, X., and Wang, P. (2021). Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Sci. Total Environ. 753, 142004. doi:10.1016/j.scitotenv.2020.142004

Zakari, A., Khan, I., Tan, D., Alvarado, R., and Dagar, V. (2022). Energy efficiency and sustainable development goals (SDGs). Energy 239, 122365. doi:10.1016/j.energy.2021.122365

Zhang, S., Wu, Z., Wang, Y., and Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 296, 113159. doi:10.1016/j.jenvman.2021.113159

Keywords: Green finance (GF), industrial structure, entropy method, intermediation effect, upgrading

Citation: Kong H, Xu Y, Zhang R, Tang D, Boamah V, Wu G and Zhou B (2023) Research on the upgrading of China’s regional industrial structure based on the perspective of green finance. Front. Environ. Sci. 11:972559. doi: 10.3389/fenvs.2023.972559

Received: 18 June 2022; Accepted: 24 January 2023;

Published: 13 February 2023.

Edited by:

Zeeshan Fareed, Huzhou University, ChinaReviewed by:

Ilyas Ahmad, University of Education Lahore, PakistanYunfeng Shang, Zhejiang Yuexiu University of Foreign Languages, China

Copyright © 2023 Kong, Xu, Zhang, Tang, Boamah, Wu and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ruizhe Zhang, emhhbmdyekBqc291LmVkdS5jbg==; Decai Tang, dGFuZ2RlY2FpQG51aXN0LmVkdS5jbg==; Valentina Boamah, MjAyMTUyNDIwMDVAbnVpc3QuZWR1LmNu

Haojia Kong1

Haojia Kong1 Decai Tang

Decai Tang Valentina Boamah

Valentina Boamah Guangliang Wu

Guangliang Wu