94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 07 November 2023

Sec. Environmental Policy and Governance

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1302089

This article is part of the Research Topic Greenhouse Gas Emission (GHG) Reduction and Economic Structural Transformation View all 18 articles

The accuracy of carbon emission data is essential for various disciplines to maintain reasonable expectations and certainty regarding the carbon emission rights trading market. However, the management of carbon emission data quality faces many challenges, especially due to the harmful behavior of enterprises that falsify such data, which seriously disrupts the order and credibility of the carbon market. Currently, few studies focus on the behavior and mechanism of corporate carbon emission data fraud, which requires an in-depth stakeholder analysis to obtain theoretical and empirical support for the formulation of effective regulatory policies. To investigate the influence of government regulation and media monitoring on addressing enterprise carbon emission data falsification, as well as to analyze the game behaviors and equilibrium outcomes among the government, media, and enterprises under different policy combinations and market environments, this study develops an evolutionary game model incorporating the government, media, and enterprises as three key stakeholders. Furthermore, numerical simulations are conducted for empirical validation. The key findings of this research highlight the significant impact of government regulation and media monitoring on deterring enterprise carbon emission data falsification, thus effectively reducing falsification motives and behaviors and enhancing the quality of carbon emission data. Additionally, the game between the government, media, and enterprises reveals the existence of multiple evolutionary stable strategies. Of these, the optimal strategy is the comprehensive implementation of all three elements: government regulation, media monitoring, and corporate integrity disclosure. This paper comprehensively examines the influence of government regulation and media monitoring on enterprise carbon emission data falsification and addresses the gaps in existing research. Moreover, it provides theoretical guidance and policy recommendations for establishing a high-quality carbon market.

With the alarming rise in global carbon dioxide emissions and greenhouse gases, climate change has emerged as a paramount global concern, posing a threat to ecosystems (Solomon et al., 2009; Frona et al., 2021). To address this urgent issue, countries worldwide actively promote energy conservation and emission reduction through a global agreement, emphasizing the objectives of attaining carbon peaking and neutrality (Huang and Zhai, 2021; Wei et al., 2022). Carbon emissions trading serves as a crucial and efficient strategy to realize these goals. It operates as a market-based mechanism that facilitates the exchange of carbon dioxide emission rights as tradable commodities. By fostering market competition and responding to price signals, enterprises with lower costs of emission reduction are incentivized to surpass their reduction targets. They can subsequently trade their surplus quotas or emission reduction credits to enterprises faced with higher emission reduction costs. This trading process facilitates the achievement of emission reduction targets for enterprises encountering greater challenges while effectively reducing compliance costs associated with target attainment (Liu et al., 2015; Wang et al., 2019).

The accuracy of carbon emission data forms the foundation for diverse stakeholders to establish reasonable expectations and achieve a level of certainty within the carbon emissions trading market (Giannarakis et al., 2018). The provision of authentic and comprehensive carbon information plays a vital role in governing the carbon trading market, improving market transparency, and facilitating high-quality carbon emission reduction efforts (Matisoff et al., 2013; Liesen et al., 2015). Developed nations like the United Kingdom, the United States, and Australia have mandated enterprises to disclose carbon information. In December 2017, the China Securities Regulatory Commission (CSRC) explicitly stipulated that listed companies must include key environmental information in their annual or semi-annual reports (Zhang and Liu, 2020). However, managing the quality of carbon emission data encounters several challenges, including the absence of standardized disclosure criteria, incentive and constraint mechanisms, and third-party auditing systems (Chen et al., 2022; Zhu et al., 2023). In an attempt to evade the expenses associated with purchasing carbon emission allowances, some enterprises resort to fraudulent practices such as tampering and falsifying inspection reports, producing deceptive coal samples, and misrepresenting findings and conclusions (Table 1). These deceitful activities severely disrupt the integrity and credibility of the carbon market (Long et al., 2022).

Previous studies have examined corporate carbon emission information disclosure using various analytical approaches, including regression analysis (Karim et al., 2021), game theory (Song et al., 2021), and institutional analysis (Ding et al., 2023). These investigations primarily focus on aspects such as the motives behind corporate carbon emission information disclosure (Li et al., 2019), factors influencing disclosure behavior (Motoshita et al., 2015), and the effectiveness of governance measures (He et al., 2023), among others. Some studies adopt a stakeholder perspective, examining multiple actors involved in corporate carbon emission information disclosure, including the government, enterprises, media, and the public (Zhang and Liu, 2020). Many studies highlight the crucial role of government regulations in constraining corporate disclosure behavior, such as the design of incentive-compatible systems and the improvement of laws and regulations (Liu and Li, 2019; Yan et al., 2020). Additionally, some studies emphasize the significance of media oversight, which is believed to enhance transparency, objectivity, public trust, and support for corporate emission reduction actions (Luo et al., 2019; Shao and He, 2022). However, the current research lacks an investigation into the governance of corporate carbon emission information falsification from a government regulation and media monitoring standpoint. The deceptive practice of falsifying corporate carbon emission information is not uncommon. Considering this practical challenge, it is imperative to delve into how governmental and media decision-making behaviors influence enterprise carbon emission information practices. Moreover, it is crucial to optimize the system to effectively address issues related to carbon emission information falsification, ultimately contributing to the establishment of a high-quality carbon market in China.

Evolutionary game theory is a theoretical framework based on biological evolution principles and game theory methods, which is used to analyze the strategy choices and behavior changes of groups in complex environments (Yang et al., 2022; Sun et al., 2023). Evolutionary game theory assumes that groups’ behavior depends not only on their interests, but also on the influence of other groups, and that through constant interaction and learning, groups will gradually form a stable behavior pattern or equilibrium state. Evolutionary game theory can reveal the strategy choices and behavior motives of groups in the carbon emission data falsification problem, and analyze the impact of different factors on group behavior. It can also simulate the behavior changes of groups in different scenarios, examine the impact of different parameters on the equilibrium state, and predict the possible behavior trends and outcomes in the future. Existing studies based on evolutionary game theory have focused on various issues such as carbon emission policies (Song et al., 2021), environmental governance (Sun et al., 2022), and supply chain management (Mahmoudi and Rasti-Barzoki, 2018), which provide good inspiration for this study.

The governance of enterprise carbon emission data falsification plays a pivotal role in fostering the growth of a robust carbon market in China. This research paper focuses on examining the impact of government regulation and media monitoring on the governance of such deceptive practices, and aims to address the following key research questions: How does the occurrence of carbon emission data falsification by enterprises vary when accounting for government regulation and media monitoring? What is the stability status of the evolutionary equilibrium within the three-party game framework? How can the system design be optimized to enhance the accuracy and reliability of carbon emission data?

To answer these questions, an evolutionary game model is constructed, incorporating the government, media, and enterprises. Optimal strategies and equilibrium outcomes for each party are analyzed under various parameter conditions, and numerical simulation methods are used to empirically test the model. The paper makes two main contributions to the literature: (Frona et al., 2021): The paper proposes a novel evolutionary game model that captures the interactions and incentives of enterprises, government, and media in the context of carbon emission data falsification. The paper extends the existing literature by considering both government regulation and media monitoring as key factors that influence the game behavior and equilibrium outcomes of enterprises. (Solomon et al., 2009). The paper provides empirical evidence on how different policy and market conditions affect the stability of the evolutionary equilibrium in the three-party game. The paper offers practical implications for designing optimal governance strategies to combat enterprise carbon emission data falsification in China.

Extensive research has been conducted on the role of businesses in the context of global climate change. It is widely acknowledged that businesses bear the primary responsibility for global climate change (Bebbington et al., 2008) and are also vulnerable to associated risks (Labatt and White, 2011; Zhou and Li, 2019). However, climate change also presents potential business opportunities, particularly in greenhouse gas (GHG) emission reduction projects. Companies can capitalize on these opportunities by developing more efficient alternative energy sources, reducing reliance on oil, and participating in carbon credit trading within energy markets (Southworth, 2009; Martin and Walters, 2013). Nonetheless, it should be noted that such opportunities may also give rise to the risk of climate change fraud (Haque and Islam, 2015). Evidence of media coverage of climate change fraud is growing, with reports of widespread fraudulent activities observed in the European Union’s emissions trading system and the production and sale of carbon credits from carbon reduction projects (Lohmann, 2009). Companies voluntarily reporting their carbon emissions face an even higher risk of data misreporting and associated fraudulent activities due to the absence of standardized reporting standards (Haque and Islam, 2015). To ensure transparency and understand the financial implications of using emissions credits and related contracts, companies should provide comprehensive disclosure of emissions data and accounting policies (Lindquist and Goldberg, 2010). However, some companies dishonestly manipulate their reported emissions due to financial pressures. They engage in under-reporting actual emissions to deflate carbon credits, thus inflating revenues and asset values (Lindquist and Goldberg, 2010; Haque and Islam, 2015). Alternatively, they may raise the baseline for carbon emissions to earn additional credits and emit less than the preset baseline. This allows them to retain unused credits or profit from their sale at a later time.

The government plays a pivotal role as the primary authority responsible for determining the content, format, and requirements of carbon disclosure in environmental regulation (Wang et al., 2020). It combines auditing with supervision and management to enhance relevant policies and regulations, eliminate misinformation, and preserve factual information. However, relying solely on the apparent transparency of information is insufficient to combat fraudulent or deceptive practices (Haque and Islam, 2015). Regulators must have access to a system capable of verifying self-reported data and possess sufficient authority to penalize those who attempt to falsify information (Drew and Drew, 2010). The responsibilities of carbon trading regulators across different countries encompass auditing, ensuring compliance with emission reporting standards, and enforcing legislation. A specific and comprehensive legislative framework for greenhouse gas (GHG) and energy audits is essential (Perdan and Azapagic, 2011; Zhou and Li, 2019). Some argue that while regulators provide detailed information on audit methodologies, it remains unclear how companies subject to liability are selected and the extent of scrutiny applied to their emissions reporting (Yang, 2017). In addition to government-level regulation, the involvement of third parties, such as the media, is necessary in the design of the system. Media participation can effectively promote transparency and fairness in corporate carbon emissions, while the government should incentivize moderate media involvement in monitoring efforts (Yuan et al., 2022).

The media serves as the primary disseminator of information, and its experiences, attitudes, and expectations significantly influence the screening and distribution of carbon disclosure (Li et al., 2021), which can either amplify or diminish the impact of disclosing carbon-related information (White, 1950). Regarding media influence, scholars have identified a positive linear moderating effect of media evaluation on corporate value. As a crucial external monitoring mechanism for corporate carbon disclosure, the media can incentivize companies to engage in more positive environmental management practices (Aerts and Cormier, 2009), stimulate corporate research and development (R&D) innovation, and enhance overall corporate efficiency (Joe et al., 2009). Furthermore, increased media attention towards a company leads to an improvement in the level of corporate information disclosure (Bloomfield and Wilks, 2000) and a reduction in information asymmetry (Bushee et al., 2010). As a result, external investors and the media place higher trust and recognition in the firm, consequently enhancing its value (Liao, 2020). However, Ma et al. (Ma et al., 2023) argued that media evaluation does not follow a linear moderating pattern in the relationship between carbon disclosure and firm value; rather, it follows an “inverted U-shape.” Lyon and Montgomery (Lyon and Montgomery, 2013) discovered that media evaluation places firms under intensified social pressure, leading them to disclose less information regarding their carbon emissions and make suboptimal decisions, ultimately harming firm performance and value.

In conclusion, previous studies have examined the motivations, influencing factors, consequences, and mitigation strategies associated with enterprise carbon emission data falsification, yielding valuable insights. However, there is a dearth of research on the institutional framework for enterprise carbon emission data falsification, specifically regarding institutional design. Given that government regulation and media monitoring are vital institutional arrangements, this paper aims to investigate the impacts and effects of government regulation and media monitoring on enterprise carbon emission data falsification using an evolutionary game model. By uncovering the underlying logic and mechanism behind enterprise carbon emission data falsification, this study offers valuable insights for government authorities and society as a whole.

To enhance the supervision and management of carbon emission data quality and ensure the efficient and ethical functioning of the carbon market, collaborative governance actions are necessary (Deegan and Blomquist, 2006). On 14 March 2022, the Ministry of Ecology and Environment of China publicly exposed four cases of carbon emission data falsification by four enterprises. They were accused of tampering with and forging detection reports, making fake coal samples, instructing enterprises to avoid using default values, neglecting their verification duties, and issuing false verification conclusions. The Ministry of Ecology and Environment swiftly investigated and dealt with the illegal and irregular behaviors of data falsification, concealment, and fabrication, and strengthened the supervision and management of technical service institutions. Afterwards, the media widely followed up and reported on the behavior and event of carbon emission data fraud, generating a broad social impact and encouraging these enterprises to reduce data falsification through reputation mechanisms and social supervision. With the participation of multiple forces such as the government and the media, similar situations can be better prevented and deterred. This case inspires the model design.

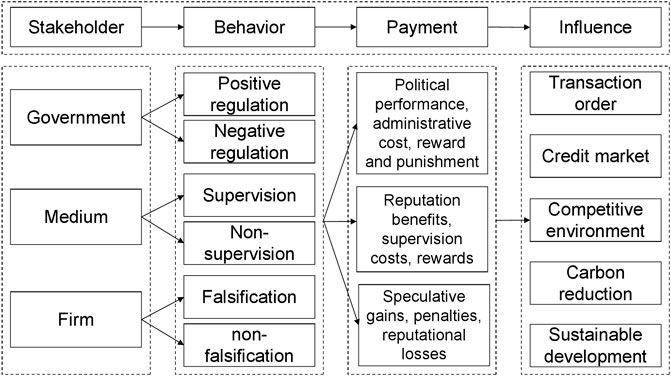

The government assumes a regulatory role in overseeing both the disclosure of carbon emissions and the operational conduct of enterprises, thus curtailing the dissemination of false or unlawful carbon emission information (Wang et al., 2020). Additionally, the media plays a selective role in reporting on corporate activities, thereby determining the final information conveyed to the public. This selective reporting can either magnify or diminish the influence of carbon-emitting behaviors on corporate value (Yuan et al., 2022). Enterprises, as the subjects of voluntary and mandatory carbon emission disclosure, possess the ability to selectively disclose carbon emission information, often focusing on pro-environmental management details while altering the manner and tone of disclosure (Zhang and Liu, 2020). Figure 1 depicts the mechanism illustrating the impact of relevant government regulation and media oversight on the accurate disclosure of enterprise carbon emission data.

FIGURE 1. Mechanisms of government regulation and media monitoring on the governance of corporate carbon emission information modelling behaviour.

Based on the aforementioned analysis, this paper constructs a three-dimensional dynamic game system (Figure 2) to depict the evolutionary game system governing enterprise carbon emission data falsification, considering the influence of government regulation and media monitoring. This comprehensive model encompasses three key subjects: the government, the media, and the enterprises, each equipped with multiple strategic options. The decisions made by each subject mutually impact one another, as the regulatory strategies adopted by the government and the monitoring actions taken by the media influence the behavior of enterprises, subsequently prompting reactions from both the government and the media. Due to limited rationality, each subject cannot thoroughly evaluate all potential outcomes and strategies. Instead, decisions are made based on restricted information and knowledge. Adopting an evolutionary game framework proves appropriate for studying this dynamic game process, as it allows for the examination of interactions between subjects and the evolutionary progression of strategic choices. By utilizing evolutionary game theory, this research aims to analyze which strategies yield superior outcomes in long-term competitive scenarios and explore concepts such as evolutionary stable strategies and equilibrium points.

Based on the above analysis, model assumptions were made (Table 2).

Assumption 1: The government has the option to implement proactive regulation or passive regulation, with a probability of choosing proactive regulation denoted as x, and the probability of choosing passive regulation denoted as 1-x. The media can choose to supervise or not supervise, with a probability of choosing supervision denoted as y, and the probability of not supervising denoted as 1-year. Similarly, businesses can choose to falsify carbon emission data or not, with the probability of falsification denoted as z, and the probability of not engaging in falsification denoted as 1-z.

Assumption 2: It is the fundamental responsibility of the government, as a responsible entity, to actively engage in environmental governance. By doing so, the government can achieve political performance, denoted as Ug. However, this regulatory process incurs administrative costs, represented by Cg. Enterprises resort to deceptive practices, such as manipulating test reports, falsifying coal samples, and distorting report conclusions, to falsify carbon emission data. Such behavior tends to remain concealed, and the government can only detect instances of carbon emission data falsification with a certain probability during active regulation, denoted as a. Again, stricter active supervision by the government tends to enhance this probability. Should the enterprise’s falsification come to light, the government will impose penalties for the falsification of carbon emission data, referred to as P.

Assumption 3: The media’s commitment to fair and unbiased reporting can enhance public trust and support, thereby bolstering its reputation and influence. Consequently, when the media actively engages in exposing enterprise carbon emission data falsification, it stands to gain certain reputation benefits, denoted as Um. However, due to the inherent limitations and opacity surrounding corporate carbon emissions, conducting investigations and monitoring can be exceptionally challenging for the media, resulting in additional costs, referred to as Cm. To encourage the media’s involvement in monitoring efforts, the government may provide incentives, denoted as A, when the media successfully uncovers instances of carbon emission data falsification by businesses. The probability of the media’s monitoring efforts detecting such falsification is represented by b, with a higher likelihood observed during more rigorous monitoring activities.

Assumption 4: In some cases, enterprises may engage in falsifying or concealing carbon emission data to reduce emission-related costs, evading penalties for excessive emissions, or obtaining preferential treatment from the government through misrepresentation or concealment of data. This paper uniformly refers to the benefits or cost reductions resulting from such actions as “carbon emission data falsification benefits,” denoted as Rf. These benefits can be obtained when the government does not regulate or the media does not monitor their activities. However, once detected by the government, the enterprise faces penalties, denoted as P, while exposure by the media leads to reputation losses, denoted as Le. These two factors constitute the key elements that potentially deter future instances of carbon emission data falsification. Furthermore, the degree of industry self-regulation significantly influences their behavior, denoted as d. Higher levels of degree self-regulation often coincide with greater market competition and increased standardization of carbon emission data disclosure, which in turn diminishes the potential benefits derived from carbon emission data falsification.

Based on Table 3, the anticipated profits for various government strategies can be calculated. Specifically, the expected profit when the government selects a positive regulation approach is denoted as E11 and can be expressed as E11 = (1 - y) ((-Cg + Ug) (1 - z) + (-Cg + a P + Ug) z) +y ((-Cg + Ug) (1 - z) + (-A b - Cg + (a - a b + b) P + Ug) z). On the other hand, the expected profit when the government opts for negative regulation is referred to as E12 and is determined as E12 = 0. Consequently, the average expected profit for the government denoted as E1, is calculated as E1 = x E11 + (1-x) E12.

The replication dynamic equation of government can be obtained as Eq. 1.

Similarly, the equation for the replication dynamics equation of the media can be obtained as Eq. 2 and the replication dynamics equation of the enterprise as Eq. 3.

By combining Eqs 1–3, a concise two-dimensional dynamical system (I) can be derived, which corresponds to Eq. 4.

When the replicator dynamics equations equal zero, it indicates that the speed and direction of strategic adjustments by the three participating entities in the governance evolutionary game system for falsification of enterprise carbon emission data no longer change. As a result, the system reaches a relatively stable equilibrium state. Thus, by letting F(x) = F(y) = F(z) = 0 in Eq. 4, the equilibrium solutions of the governance evolutionary game system for falsification of enterprise carbon emission data are: (0, 0, 0), (0, 0, 1), (0, 1, 0), (1, 0, 0), (1, 1, 0), (1, 0, 1), (0, 1, 1), (1, 1, 1), and (x*, y*, z*). Based on relevant research (Friedman, 1991), it is established that a mixed strategy equilibrium in asymmetric game dynamics cannot be considered as an evolutionary stable equilibrium. Consequently, the asymptotic evolutionary stability of (x*, y*, z*) should not be addressed, and the focus should solely be on the remaining eight pure strategies.

Based on the principles of Lyapunov theory (Friedman, 1991), a Jacobian matrix is deemed asymptotically stable if all its eigenvalues (λ) are less than zero. Conversely, it is classified as unstable when all eigenvalues are greater than zero. Additionally, when the Jacobian matrix exhibits both positive and negative eigenvalues (λ), signifying a saddle point, the equilibrium point is considered unstable. By taking partial derivatives of F(x), F(y), and F(z) with respect to x, y, and z, respectively, the Jacobian matrix can be obtained, as expressed in Eq. 5.

By substituting the eight equilibrium points into the Jacobian matrix mentioned above, the corresponding eigenvalues for each of these points can be calculated. The resulting eigenvalues are presented in Table 4.

Based on the aforementioned discriminating criterion (Friedman, 1991), it becomes evident that E1 (0, 0, 0) cannot be considered a stable equilibrium strategy. Conversely, E2 (0, 0, 1), E3 (0, 1, 0), E4 (1, 0, 0), E5 (1, 1, 0), E6 (1, 0, 1), E7 (0, 1, 1), and E8 (1, 1, 1) demonstrate stability as equilibrium strategies, provided they meet specific conditions. In the subsequent analysis, these seven stable equilibrium scenarios will be analyzed individually.

Scenario 1: E2 (0, 0, 1) represents the stable equilibrium strategy when -Cg + a P + Ug < 0, -Cm + Um < 0, and -Rf (1 - d) < 0. In instances where the expense of government regulations exceeds the sum of political achievements and penalty income, the cost of media monitoring is greater than the advantages of media reputation, and the benefits of manipulating enterprise carbon emission data are higher, an equilibrium strategy characterized by negative government regulations, absence of media oversight, and falsification of enterprise carbon emission data forms. Consequently, enterprises possess strong incentives to falsify carbon emissions data because the benefits outweigh the risks of being caught in the absence of regulation. Due to high costs, there is little incentive for both the government and the media to regulate or expose enterprises’ carbon emission information. This situation typically arises in regions or countries with less developed carbon markets, high carbon credit prices, and inadequate regulation of carbon emission data credibility, representing a case of haphazard development. Prompt and effective government regulation and media monitoring are crucial at this stage to restrict enterprise misconduct regarding falsification.

Scenario 2: E3 (0, 1, 0) represents the stable equilibrium strategy when -Cg + Ug < 0, Cm - Um < 0, and -b Le + Rf (1 - d) < 0. This equilibrium strategy entails negative government regulation, media monitoring, and non-falsification of enterprises’ carbon emission data. Such a situation may occur in developing countries or regions where the government prioritizes economic growth over environmental protection, the media exposes instances of carbon emission data falsification to attract public attention, and enterprises refrain from falsifying data due to the fear of penalties and reputation damage. Although the carbon emission data remains untampered, inadequate government supervision may result in excessive emissions or insufficient incentives for emissions reduction among enterprises. To enhance the effectiveness and credibility of carbon emissions reduction, the government should amplify the gap between regulatory costs and political performance, impose stricter penalties for excessive emissions, foster and support the monitoring role of the media, and widen the disparity between the advantages and disadvantages of media oversight.

Scenario 3: E4 (1, 0, 0) represents a stable equilibrium strategy when Cg - Ug < 0, -Cm + Um < 0, and -a P - (−1+a) Rf (1-d) < 0. This equilibrium strategy involves positive government regulation, the absence of media monitoring, and non-falsification of enterprise carbon emission data. Due to robust government regulation, the cost of falsifying carbon emission data is prohibitively high, prompting enterprises to uphold the values of veracity, completeness, and accuracy of their carbon emission data. They abide by relevant laws and regulations and fulfill their social responsibilities dutifully. This scenario is typical of countries or regions with more developed carbon markets and more refined regulations governing the quality of carbon emission data. It exemplifies an instance of effective regulation wherein the cost of enterprise carbon emission data falsification outweighs its benefits, resulting in honest and transparent reporting by enterprises.

Scenario 4: E5 (1, 1, 0) represents a stable equilibrium strategy when Cg - Ug < 0, Cm - Um < 0, and -b Le–a P + a b P–b P - (−1+a-a b + b) Rf (1-d) < 0. This equilibrium strategy entails active government regulation, media monitoring, and non-falsification of enterprise carbon emission data. This scenario arises when the cost of government regulation is lower than the political performance, the cost of media monitoring outweighs its benefit, and the benefit of falsifying enterprise carbon emission data is lower than the associated costs. It occurs in situations where the government prioritizes environmental concerns, the media diligently focuses on enterprise carbon emission information, and businesses are acutely aware of the risks associated with falsifying carbon emission data. For instance, in countries or regions with well-established carbon market systems and regulatory mechanisms, the government can facilitate accurate disclosure of carbon emission information by imposing strict laws, regulations, and effective incentives. The media, driven by social responsibility and external incentives, can exercise oversight over enterprise conduct, fostering a favorable market atmosphere for the transparent disclosure of enterprise carbon emission data.

Scenario 5: E6 (1, 0, 1) represents a stable equilibrium strategy when Cg–a P - Ug < 0, A b - Cm + Um < 0, and a P + (−1+a) Rf (1-d) < 0. This equilibrium strategy emerges when the cost of government regulation is lower than the combined effects of political performance and penalty revenues, the cost of media monitoring outweighs its benefits, and the potential benefits of falsifying enterprise carbon emissions data exceed its associated costs. Under this strategy, positive regulation is established, the media does not engage in monitoring, and enterprises falsify their carbon emissions data. Consequently, the boundaries of carbon emissions data monitoring and regulation in the carbon market become blurred, resulting in widespread data bias and diminished data quality, rendering regulation ineffective. To prevent the carbon market from becoming a hub of counterfeiting, it becomes imperative to regulate the behavior of consulting, verification, and testing services. This entails ensuring that technical services adhere to principles of truthfulness, compliance, and fairness in both process and outcomes. Simultaneously, it is necessary to enhance the political performance and punitive measures associated with government regulation, increase the reputational benefits and social responsibility surrounding media monitoring, and reduce incentives for companies to falsify carbon emission data.

Scenario 6: E7 (0, 1, 1) represents a stable equilibrium strategy when -A b - Cg + a P - (a b - b) P + Ug < 0, Cm - Um < 0, and b Le – Rf (1-d) < 0. This equilibrium strategy arises when the cost of government regulation exceeds political performance, the cost of media monitoring is outweighed by its benefits, and the benefits of falsifying enterprise carbon emission data surpass the associated costs. Such a scenario may be observed in countries or regions grappling with significant environmental pollution and climate change challenges, characterized by inadequate governance and insufficient environmental responsibility. These entities may exhibit a lack of initiative in strengthening laws, regulations, and punishments to curb enterprise disclosure of carbon emission information. However, driven by social responsibility, the media may expose instances of enterprise carbon emission data falsification to enhance public awareness and engagement in environmental protection. Enterprises, motivated by profit maximization or a lack of emission reduction incentives, may resort to falsification, instead prioritizing emissions reduction or profit maximization. To combat enterprise carbon emission data falsification, governments should intensify incentives for emissions reduction among enterprises, widen the gap between the benefits and costs of emission reduction, and bolster support and coordination for media monitoring to enhance its quality and effectiveness.

Scenario 7: E8 (1, 1, 1) represents the stable equilibrium strategy when A b + Cg–a P + (a b - b) P - Ug < 0, -A b + Cm - Um < 0, and b Le + a P–a b P + b P + (−1 + a – a b + b) Rf (1-d) < 0. This equilibrium strategy arises when the cost of government regulation is lower than the political performance, the cost of media monitoring is outweighed by its benefits, and the benefits of falsifying enterprise carbon emission data surpass the associated costs. Such a scenario may occur in countries or regions confronted with severe environmental pollution and climate change pressures. In response, the government may enhance laws, regulations, and penalties to curb the disclosure of enterprise carbon emission information, while the media may expose instances of enterprise carbon emission data falsification to raise public awareness and promote environmental participation. However, in some cases, despite more active government regulation and media monitoring, there remains the possibility of enterprise carbon emission data falsification, a practice that undermines the credibility and effectiveness of the carbon market.

To assess the efficacy of evolutionary game analysis and derive practical managerial insights, this study employs Python for simulation and analysis, emphasizing crucial indicators. The investigation focuses on four cases of falsification in carbon emission reports publicized by China’s Ministry of Ecology and Environment. By collecting and analyzing policy documents, academic articles, media reports, and other relevant literature, it aims to explore the basic characteristics and governance effectiveness involving the government, corporations, and media in these cases. The findings reveal that tampering and falsifying inspection reports, producing fake coal samples, and exploiting findings in reports are prominent issues. The government faces considerable challenges in regulating the falsification of carbon emission data by enterprises and can only monitor non-compliance to a certain extent. In contrast, media investigations play a significant role in promoting compliance with the disclosure of enterprise carbon emissions data, complementing government regulation and also affecting enterprise reputation. Both government regulation and media monitoring form a dual strategy to regulate the falsification of enterprise carbon emission data.

According to prior studies (Sun et al., 2023), the parameters in the evolutionary game model play a crucial role in capturing the underlying structural relationships. It is essential for the simulation model to accurately depict the intrinsic patterns of change (Sterman, 2001; Wu et al., 2010). On one hand, it is important to maintain consistency between the model and the real world, which requires empirical evidence and supporting data. On the other hand, in situations where actual data is lacking or the complexity of the real world makes it difficult to extract relevant information, many similar studies resort to using idealized parameters to establish theoretical models (Yang et al., 2022; Liu et al., 2023). To enhance the model’s explanatory capacity and provide a more accurate representation of real-world scenarios, it is imperative to incorporate empirical data into these parameters. In line with this objective, the researchers have determined the essential parameters through survey data, expert interviews, and analysis of policy documents as follows: Ug = 4, Cg = 3, p = 1, a = 0.6, Rf = 6, d = 0.6, Um = 3, Cm = 2, A = 2, b = 0.6, and Le = 1. Furthermore, considering the current incomplete development of the carbon market in China and the uncertainties regarding the enthusiasm of the government, media, and enterprises, it is generally assumed that the government will actively regulate, and the proportions of media supervision and corporate data falsification (x, y, and z) are all set at 0.5.

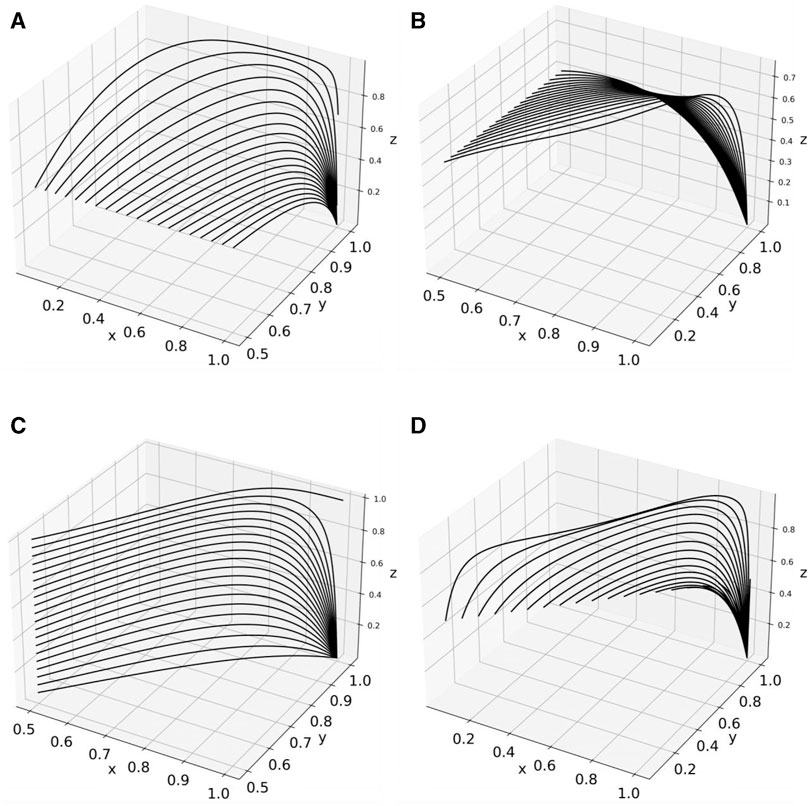

Firstly, the researchers analyze the impact of changes in initial strategies on both individual entities and all entities involved in the game. The results, depicted in Figure 3A, suggest that when the initial likelihood of active government regulation is low, it may fail to induce complete compliance with data integrity regulations among all enterprises in the final equilibrium state. This indicates that the government’s less proactive intervention in the initial stages exerts limited influence on the management of enterprise carbon emissions data falsification. As depicted in Figure 3B, regardless of the initial probability of media supervision, enterprises ultimately fully comply with data compliance requirements and refrain from fabricating data. Therefore, enterprises face sufficient pressure, irrespective of the intensity of media supervision, to ensure adherence to data authenticity requirements. In Figures 3C, a higher initial probability of data falsification by enterprises may lead to persistent non-compliant behavior in the final equilibrium state. Figure 3D demonstrates Government regulation and media monitoring exhibit a complementary effect. When both mechanisms are present simultaneously, they create a stronger binding force and incentive for promoting enterprise transparency in disclosing carbon emissions data.

FIGURE 3. Impact of initial probability change on enterprise carbon emissions data falsification behaviour. (A) Impact of x0 on the evolutionary game. (B) Impact of y0 on the evolutionary game. (C) Impact of z0 on the evolutionary game. (D) Impact of x0,y0 and zo on the evolutionary game.

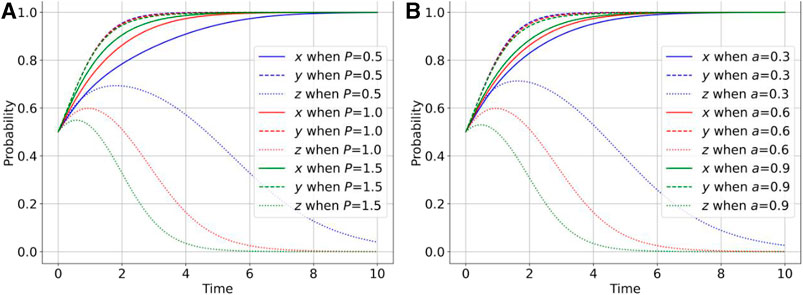

As depicted in Figure 4A, a stronger penalty for enterprises engaging in carbon emission data falsification under government regulation exhibits a higher degree of binding on their fraudulent behavior. This highlights the role of legal sanctions imposed by government regulation, which amplify the costs and losses associated with enterprise violations, thereby deterring counterfeiting practices. This finding aligns with previous research (Liu and Li, 2019; Yan et al., 2020), they demonstrated that government regulation addressing spatial heterogeneity in the quality of enterprise carbon disclosure effectively enhances the level of carbon disclosure. Additionally, Figure 4B demonstrates that a higher probability of detecting enterprises’ falsification of carbon emission data under government regulation leads to a more pronounced impact on enterprises’ fraudulent behavior. This underscores the enforcement capability exhibited by government regulation, which increases the likelihood of enterprises being investigated and penalized, subsequently diminishing their inclination to engage in falsification. This finding is consistent with the proposition put forth by Long et al. (Long et al., 2022), advocating for strengthened legal liability and penalty mechanisms to combat carbon emission data falsification by verification agencies.

FIGURE 4. Impact of government regulation on enterprise carbon emissions data falsification behaviour. (A) Impact of P on the player behavior. (B) Impact of a on the player behavior.

Illustrated in Figure 5A, an increased level of reputation losses resulting from enterprise carbon emissions data falsification during media monitoring engenders a stronger restraining effect on enterprise fraudulent behavior. This underscores the influence of social norms as wielded by media monitoring, impacting enterprises’ reputation capital and market competitiveness, thereby incentivizing them to enhance the quality of their carbon emission data. This finding aligns with previous research conducted by Aerts and Cormier (Aerts and Cormier, 2009), who observed that media evaluations catalyze promotion favorable environmental management practices among enterprises. Furthermore, Figure 5B demonstrates that a heightened probability of detecting the falsification of enterprises’ carbon emission data during media monitoring amplifies the impact on enterprises’ fraudulent behavior. This highlights the investigative power exhibited by media monitoring, which increases the risk of enterprises being exposed and penalized, consequently deterring their inclination to engage in falsification.

FIGURE 5. Impact of media monitoring on enterprise carbon data falsification behaviour. (A) Impact of Le on the player behavior. (B) Impact of b the player behavior.

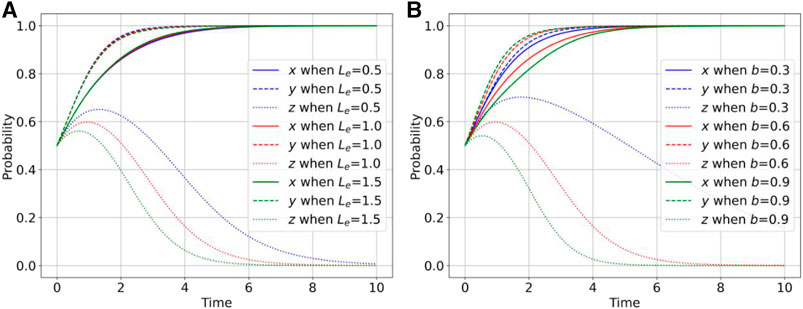

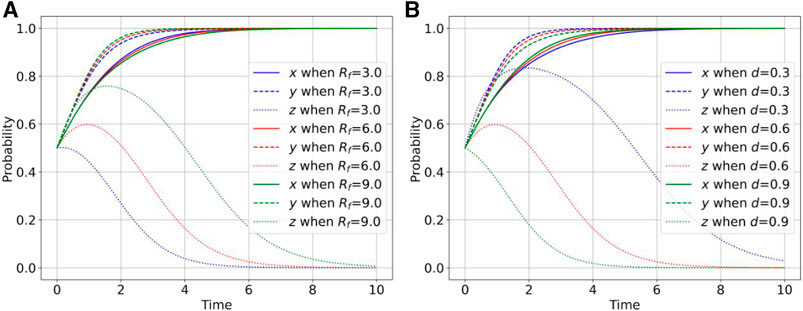

As depicted in Figure 6A, a greater speculative gain resulting from enterprises’ falsification of carbon emission data corresponds to a heightened motivation for such fraudulent practices. This sheds light on the issues of moral hazard and adverse selection within the realm of carbon emission data disclosure, where enterprises exploit information asymmetry to attain undeserved advantages through misrepresentation and underreporting. This finding aligns with prior research conducted by Haque and Islam (Haque and Islam, 2015), who identified carbon emission data falsification as a form of accounting fraud driven by motives such as evading government regulation, cost reduction, or revenue augmentation. Additionally, Figure 6B demonstrates that an increased level of self-regulation within the carbon emissions trading and carbon accounting industry exerts a stronger influence on enterprises’ inclination to engage in falsification. This underscores the normative role played by industry self-regulation, contributing to enhanced quality and credibility of carbon emissions data disclosure while mitigating information asymmetry and market failure.

FIGURE 6. Impact of speculative gains from enterprises falsifying carbon emissions data on their behaviour. (A) Impact of Rf on the player behavior. (B) Impact of d the player behavior.

As mentioned earlier, in March 2022, the Ministry of Ecology and Environment (MEE) in China issued notifications regarding instances of data falsification in carbon emission reporting. These cases involved organizations such as China Carbon Energy Investment (CCEI), resulting in significant public concern. The underlying cause of these issues stems from a lack of awareness and understanding of laws and regulations among certain carbon market technical service institutions. Additionally, some consulting and testing organizations prioritize their interests over compliance, engaging in risky behavior and aiding enterprises in manipulating carbon emission data through fraudulent means. This irresponsible conduct greatly disrupts the normal functioning of the carbon market. Furthermore, deficiencies in quality control systems and chaotic project management within certain technical service organizations make it challenging to ensure compliance and guarantee the authenticity of data. In an attempt to minimize expenses, some verification agencies outsource their verification services, leading to practices such as “signing on behalf of enterprises”, “hanging names”, and other irregularities. Consequently, some verification agencies merely rely on readily available data and information provided by enterprises without conducting thorough evaluations to verify the accuracy, completeness, and authenticity of the documents and data.

Multi-stakeholder participation played a significant role in the governance process of this particular case. Media reports not only exposed instances of intentional data falsification but also highlighted additional issues within emission control enterprises, such as data inaccuracy and flexible interpretation of regulations. These revelations captured the attention of both the government and the market, exerting pressure on carbon emission data falsification enterprises to rectify their practices. Subsequently, government departments conducted thorough investigations, identifying non-compliant behaviors in the initial reports of certain enterprises and consequently strengthening their supervision. By implementing mechanisms such as joint investigations and case transfers in collaboration with relevant departments, they collectively enhanced the daily oversight of technical service providers while increasing information disclosure and credit supervision. These measures effectively facilitated the correction of non-compliant behaviors by the enterprises involved. It is worth noting that government regulation and media monitoring play pivotal roles in uncovering and penalizing instances of carbon emissions data falsification. Moreover, they contribute to the enhancement of data quality and ensure enterprises adhere to established norms.

The aforementioned case underscores the crucial role of co-regulation between the government and media, as evidenced by the findings of this evolutionary game research. This study examines the influential role of government regulation and media monitoring in shaping enterprise behavior in terms of disclosing carbon emissions. These findings align with previous research on government regulation (Liu and Li, 2019; Yan et al., 2020) and media monitoring (Luo et al., 2019; Shao and He, 2022) concerning enterprise carbon information disclosure. Through a literature review, the researchers found that previous research has primarily focused on the impact of carbon information disclosure on firm value, environmental performance, and social responsibility. However, there has been limited attention given to the mechanisms of data falsification in carbon information disclosure and its influencing factors. However, this paper contributes to the existing body of knowledge by examining the impact of government regulation and media monitoring on the governance of enterprise carbon emission data falsification from a stakeholder perspective, addressing this research gap. By employing evolutionary game theory, this study explores the dynamic interactive process among the government, media, and enterprises. It uncovers the internal mechanisms behind behavioral changes within each party, providing valuable insights for enhancing China’s carbon emission information disclosure system, as well as improving the efficiency and credibility of the carbon market. Thus, it offers pertinent recommendations for China to bolster its carbon emission information disclosure system and enhance the overall efficiency and credibility of the carbon market.

The main findings and theoretical contributions of this study provide several valuable management insights. Firstly, the government should oversee the process by developing assessment and supervision mechanisms, implementing monitoring and support management strategies, and introducing preferential policies and incentives for enterprises to increase their carbon emission reduction inputs. Additionally, the government should audit the carbon emissions disclosed by listed companies. Secondly, both the government and media should collaborate in establishing an assessment, monitoring, and management mechanism for enterprise carbon emissions disclosure. This can be achieved by utilizing mainstream and social media platforms to enhance understanding and interpretation of environmental laws, regulations, standards, and major policy documents. Furthermore, advanced cases should be publicized while negative cases should be timely exposed, thereby encouraging enterprises to fulfil their carbon emission disclosure obligations. Lastly, financing policies should embed more reputational mechanisms to prompt private enterprises to pay attention to carbon emission disclosure, encourage financial institutions to innovate green financial products, and develop green credit to address the challenges of financing difficulty and high cost.

The objective of this paper is to investigate the influence of government regulation and media monitoring on the governance of enterprise carbon emission data falsification. Additionally, it aims to analyze the game behaviors and equilibrium outcomes among the government, media, and enterprises under various policy combinations and market environments. The ultimate goal is to offer theoretical guidance and policy recommendations for the establishment of a robust carbon market in China. Applying the principles of evolutionary game theory, this study builds a dynamic game model that incorporates the interactions between the government, media, and enterprises. Empirical testing of the model is conducted using numerical simulation techniques.

The main findings of this paper are summarized as follows:

1) Government regulation and media monitoring exert a significant influence on the falsification of enterprise carbon emission data. They effectively deter enterprises from engaging in falsification and enhance the overall quality of carbon emission data.

2) Government regulation and media monitoring exhibit a complementary effect. When both mechanisms are present simultaneously, they create a stronger binding force and incentive for promoting enterprise transparency in disclosing carbon emissions data.

3) The game between the government, media, and enterprises reveals the existence of multiple evolutionary stable strategies. Among these strategies, the optimal equilibrium is achieved when all three elements are present: government regulation, media monitoring, and enterprise transparency in disclosure. This equilibrium state maximizes social welfare and aligns with the interests of all parties involved.

This study has shown a certain degree of validity, but also has some limitations. Its validity lies in building a dynamic game model with strong logic and operability, which accurately reflects the real-world situation. However, one of the limitations of this study is that it does not fully consider the multiple reactions and strategic choices of enterprises, such as the flexible measures that enterprises may take to evade regulation and media monitoring. Moreover, this paper focuses on the research point and considers the three parties of government, media and enterprises, resulting in a lack of research on other stakeholders, such as carbon emission data verification agencies, social organizations, etc. In view of these limitations, future research can be expanded and improved from the following aspects:

1) Explore the behavior and strategy of enterprises in depth. This paper assumes that enterprises have only two choices when facing government and media monitoring: honesty or fraud. However, in reality, enterprises may adopt more means to evade or cope with monitoring, such as using technical means to manipulate or conceal the real carbon emission data, and seeking cooperation and collusion with government agencies and media. Future research can consider introducing more enterprise behavior and strategy variables, as well as analyzing their impact on the dynamic game results and social welfare.

2) Include a wider range of stakeholders. This paper mainly focuses on the role and function of government and media monitoring, and lacks analysis of the impact and participation of other actors such as non-governmental organizations and the general public. However, in the process of governing carbon emission data fraud, these actors may also play an important role, such as providing third-party verification services, initiating social movements, raising public awareness, etc. Future research can consider incorporating these actors into the dynamic game model, as well as analyzing their impact on the monitoring effect and social welfare.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

YW: Writing–original draft, Writing–review and editing. YS: Writing–review and editing. YM: Writing–review and editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the National Social Science Funds of China, grant number 22&ZD192, and the Guangdong Provincial Philosophy and Social Science Planning Project, grant number GD23XGL067.

We thank the journal editor and reviewers.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Aerts, W., and Cormier, D. (2009). Media legitimacy and corporate environmental communication. Account. Organ. Soc. 34 (1), 1–27. doi:10.1016/j.aos.2008.02.005

Bebbington, J., Larrinaga, C., and Moneva, J. M. (2008). Corporate social reporting and reputation risk management. Auditing Account. J. 21 (3), 337–361. doi:10.1108/09513570810863932

Bloomfield, R. J., and Wilks, T. J. (2000). Disclosure effects in the laboratory: liquidity, depth, and the cost of capital. Account. Rev. 75 (1), 13–41. doi:10.2308/accr.2000.75.1.13

Bushee, B. J., Core, J. E., Guay, W., and Hamm, S. J. (2010). The role of the business press as an information intermediary. J. Account. Res. 48 (1), 1–19. doi:10.1111/j.1475-679x.2009.00357.x

Chen, G. D., Zou, X. B., Lu, R., Chen, J. J., and Ma, S. Z. (2022). Domestic and international statistical methods and quality control status for carbon emission from fossil-fired power plants. Therm. Power Gener. 51 (10), 54–60. doi:10.19666/j.rlfd.202205075

Deegan, C., and Blomquist, C. (2006). Stakeholder influence on corporate reporting: an exploration of the interaction between WWF-Australia and the Australian minerals industry. Account. Organ. Soc. 31 (4-5), 343–372. doi:10.1016/j.aos.2005.04.001

Ding, D., Liu, B., and Chang, M. (2023). Carbon emissions and TCFD aligned climate-related information disclosures. J. Bus. Ethics 182 (4), 967–1001. doi:10.1007/s10551-022-05292-x

Drew, J. M., and Drew, M. E. Establishing additionality: fraud vulnerabilities in the clean development mechanism. Account. Res. J. (2010) 23(3):243-253. doi:10.1108/10309611011092574

Frona, D., Szenderak, J., and Harangi-Rakos, M. (2021). Economic effects of climate change on global agricultural production. Nat. Conservation-Bulgaria 44 (44), 117–139. doi:10.3897/natureconservation.44.64296

Giannarakis, G., Zafeiriou, E., Arabatzis, G., and Partalidou, X. (2018). Determinants of corporate climate change disclosure for European firms. Corp. Soc. Responsib. Environ. Manag. 25 (3), 281–294. doi:10.1002/csr.1461

He, S., Xu, L. L., and Shi, D. Q. (2023). How does environmental information disclosure affect carbon emissions? Evidence from China. Environ. Sci. Pollut. Res. 30, 93998–94014. doi:10.1007/s11356-023-28883-1

Huang, M. T., and Zhai, P. M. (2021). Achieving Paris Agreement temperature goals requires carbon neutrality by middle century with far-reaching transitions in the whole society. Adv. Clim. Change Res. 12 (2), 281–286. doi:10.1016/j.accre.2021.03.004

Joe, J. R., Louis, H., and Robinson, D. (2009). Managers' and investors' responses to media exposure of board ineffectiveness. J. Financial Quantitative Analysis 44 (3), 579–605. doi:10.1017/s0022109009990044

Karim, A. E., Albitar, K., and Elmarzouky, M. (2021). A novel measure of corporate carbon emission disclosure, the effect of capital expenditures and corporate governance. J. Environ. Manag. 290, 112581. doi:10.1016/j.jenvman.2021.112581

Labatt, S., and White, R. R. (2011). Carbon finance: the financial implications of climate change. John Wiley and Sons. 1118161157.

Li, H. Y., Fu, S. Y., Chen, Z., Shi, J., Yang, Z. Y., and Li, Z. H. (2019). The motivations of Chinese firms in response to the Carbon Disclosure Project. Environ. Sci. Pollut. Res. 26 (27), 27792–27807. doi:10.1007/s11356-019-05975-5

Li, L., Liu, Q. Q., Tang, D. L., and Xiong, J. C. (2021). Media reporting, carbon information disclosure, and the cost of equity financing: evidence from China. Environ. Sci. Pollut. Res. 37 (03), 52–60. doi:10.19520/j.cnki.issn1674-3288.2021.03.008

Liao, Z. J. (2020). Is environmental innovation conducive to corporate financing? The moderating role of advertising expenditures. Bus. Strategy Environ. 29 (3), 954–961. doi:10.1002/bse.2409

Liesen, A., Hoepner, A. G., Patten, D. M., and Figge, F. (2015). Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Account. Auditing Account. J. 28 (7), 1047–1074. doi:10.1108/aaaj-12-2013-1547

Lindquist, S. C., and Goldberg, S. R. (2010). Cap-and-trade: accounting fraud and other problems. J. Corp. Account. Finance 21 (4), 61–64. doi:10.1002/jcaf.20595

Liu, L. W., Chen, C. X., Zhao, Y. F., and Zhao, E. D. (2015). China's carbon-emissions trading: overview, challenges and future. Renew. Sustain. Energy Rev. 49, 254–266. doi:10.1016/j.rser.2015.04.076

Liu, Q. Q., and Li, L. (2019). Spatial heterogeneity of government regulation, spatial distance and enterprise carbon information disclosure: an analysis based on the heavy pollution industry in China. Int. J. Environ. Res. Public Health 16 (23), 4777. doi:10.3390/ijerph16234777

Liu, Y., Cui, M. Y., and Gao, X. B. (2023). Building up scrap steel bases for perfecting scrap steel industry chain in China: an evolutionary game perspective. Energy 278, 127742. doi:10.1016/j.energy.2023.127742

Lohmann, L. (2009). Regulation as corruption in the carbon offset markets. Upsetting offset political Econ. carbon Mark., 175–191.

Long, D., Fan, D. T., Slater, H., Tian, D. Y., Xie, R. L., and Yang, P. J. (2022). Carbon emission data quality issues and improvement suggestions. Environ. Prot. 50 (12), 54–56. doi:10.14026/j.cnki.0253-9705.2022.12.016

Luo, W. B., Guo, X. X., Zhong, S. H., and Wang, J. Z. (2019). Environmental information disclosure quality, media attention and debt financing costs: evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 231, 268–277. doi:10.1016/j.jclepro.2019.05.237

Lyon, T. P., and Montgomery, A. W. (2013). Tweetjacked: the impact of social media on corporate greenwash. J. Bus. ethics 118, 10167–10757. doi:10.5465/ambpp.2013.10167abstract

Ma, D. D., Lv, B. F., Liu, Y., Liu, S. Q., and Li, X. T. (2023). Brand premium and carbon information disclosure strategy: evidence from China listed companies. Sustainability 15 (6), 5240. doi:10.3390/su15065240

Mahmoudi, R., and Rasti-Barzoki, M. (2018). Sustainable supply chains under government intervention with a real-world case study: an evolutionary game theoretic approach. Comput. Industrial Eng. 116, 130–143. doi:10.1016/j.cie.2017.12.028

Martin, P., and Walters, R. (2013). Fraud risk and the visibility of carbon. Int. J. Crime Justice Soc. Democr. 2 (2), 27–42. doi:10.5204/ijcjsd.v2i2.95

Matisoff, D. C., Noonan, D. S., and O'Brien, J. J. (2013). Convergence in environmental reporting: assessing the carbon disclosure project. Bus. Strategy Environ. 22 (5), 285–305. doi:10.1002/bse.1741

Motoshita, M., Sakagami, M., Kudoh, Y., Tahara, K., and Inaba, A. (2015). Potential impacts of information disclosure designed to motivate Japanese consumers to reduce carbon dioxide emissions on choice of shopping method for daily foods and drinks. J. Clean. Prod. 101, 205–214. doi:10.1016/j.jclepro.2015.04.005

Perdan, S., and Azapagic, A. (2011). Carbon trading: current schemes and future developments. Energy Policy 39 (10), 6040–6054. doi:10.1016/j.enpol.2011.07.003

Shao, J., and He, Z. W. (2022). How does social media drive corporate carbon disclosure? Evidence from China. Front. Ecol. Evol. 10, 10. doi:10.3389/fevo.2022.971077

Solomon, S., Plattner, G. K., Knutti, R., and Friedlingstein, P. (2009). Irreversible climate change due to carbon dioxide emissions. Proc. Natl. Acad. Sci. U. S. A. 106 (6), 1704–1709. doi:10.1073/pnas.0812721106

Song, X. N., Shen, M., Lu, Y. J., Shen, L. Y., and Zhang, H. Y. (2021). How to effectively guide carbon reduction behavior of building owners under emission trading scheme? An evolutionary game-based study. Environ. Impact Assess. Rev. 90, 106624. doi:10.1016/j.eiar.2021.106624

Southworth, K. (2009). Corporate voluntary action: a valuable but incomplete solution to climate change and energy security challenges. Policy Soc. 27 (4), 329–350. doi:10.1016/j.polsoc.2009.01.008

Sterman, J. D. System dynamics modeling: tools for learning in a complex world. Calif. Manag. Rev. (2001) 43(4):8-25. doi:10.2307/41166098

Sun, Y., Du, H. Y., Liu, B. Y., Kanchanaroek, Y., Zhang, J. F., and Zhang, P. (2022). Evolutionary game analysis for grassland degradation management, considering the livelihood differentiation of herders. Land 11 (10), 1776. doi:10.3390/land11101776

Sun, Y., Liu, B. Y., Sun, Z. R., and Yang, R. J. (2023). Inter-regional cooperation in the transfers of energy-intensive industry: an evolutionary game approach. Energy 282, 128313. doi:10.1016/j.energy.2023.128313

Wang, H., Chen, Z. P., Wu, X. Y., and Niea, X. (2019). Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis? -Empirical analysis based on the PSM-DID method. Energy Policy 129, 930–938. doi:10.1016/j.enpol.2019.03.007

Wang, H. Y., Huang, D. J., Dong, D. C., and Huang, Y. (2020). The evolution of the role and working strategy of technology journal editors in the era of new media - from the perspective of "gatekeepers" theory. Media Sci. Technol. China (09), 30–32. doi:10.19483/j.cnki.11-4653/n.2020.09.004

Wei, Y. M., Chen, K. Y., Kang, J. N., Chen, W. M., Zhang, X. Y., and Wang, X. Y. (2022). Policy and management of carbon peaking and carbon neutrality: a literature review. Engineering 14, 52–63. doi:10.1016/j.eng.2021.12.018

White, D. M. (1950). The “gate keeper”: a case study in the selection of news. Journal. Q. 27 (4), 383–390. doi:10.1177/107769905002700403

Wu, D. D., Xie, K. F., Hua, L., Shi, Z., and Olson, D. L. (2010). Modeling technological innovation risks of an entrepreneurial team using system dynamics: an agent-based perspective. Technol. Forecast. Soc. Change 77 (6), 857–869. doi:10.1016/j.techfore.2010.01.015

Yan, H. H., Li, X. Y., Huang, Y., and Li, Y. H. (2020). The impact of the consistency of carbon performance and carbon information disclosure on enterprise value. Finance Res. Lett. 37, 101680. doi:10.1016/j.frl.2020.101680

Yang, B. W. (2017). Construction of the framework of carbon audit and verification system in the view of environment responsibility. J. Nanjing Audit Univ. 14 (06), 75–84.

Yang, W. X., Yang, Y. P., and Chen, H. M. (2022). How to stimulate Chinese energy companies to comply with emission regulations? Evidence from four-party evolutionary game analysis. Energy 258, 124867. doi:10.1016/j.energy.2022.124867

Yuan, L., Chen, Y. Y., He, W. J., Kong, Y., Wu, X., Degefu, D. M., et al. (2022). The influence of carbon emission disclosure on enterprise value under ownership heterogeneity: evidence from the heavily polluting corporations. Environ. Sci. Pollut. Res. 29 (46), 69753–69770. doi:10.1007/s11356-022-20705-0

Zhang, Y. J., and Liu, J. Y. (2020). Overview of research on carbon information disclosure. Front. Eng. Manag. 7 (1), 47–62. doi:10.1007/s42524-019-0089-1

Zhou, K. L., and Li, Y. W. (2019). Carbon finance and carbon market in China: progress and challenges. J. Clean. Prod. 214, 536–549. doi:10.1016/j.jclepro.2018.12.298

Keywords: carbon emission data falsification, government regulation, media monitoring, evolutionary game, numerical simulation

Citation: Wang Y, Sun Y and Miao Y (2023) Management of enterprise carbon emissions data falsification considering government regulation and media monitoring. Front. Environ. Sci. 11:1302089. doi: 10.3389/fenvs.2023.1302089

Received: 26 September 2023; Accepted: 19 October 2023;

Published: 07 November 2023.

Edited by:

Zhangqi Zhong, Guangdong University of Foreign Studies, ChinaReviewed by:

Kaiwei Zh, Tsinghua University, ChinaCopyright © 2023 Wang, Sun and Miao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yong Sun, c3VueW9uZ0Bnemh1LmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.