- 1Chinese International College, Dhurakij Pundit University, Bangkok, Thailand

- 2School of Economics, Lanzhou University, Lanzhou, China

- 3Stamford International University, Bangkok, Thailand

Enhancing corporate green innovation is a crucial pathway towards achieving a green economic transformation. Diverging from the literature focusing on government environmental regulations and hard regulatory approaches, this study investigates how market soft regulation intervenes in corporate green innovation. From the perspective of informal environmental governance, this paper employs a multi-period difference-in-differences empirical model to examine the impact of ESG ratings on corporate green innovation. The findings reveal that ESG ratings have a positive influence on corporate green innovation. Specifically, ESG ratings encourage firms to increase the number of green patents application and authorization, thereby stimulating investment and innovation activities in the realm of green innovation. These conclusions remain robust after undergoing various statistical tests. In the analysis of moderating effects, this paper discovers a negative inhibitory effect of financing constraints on the relationship between ESG ratings and corporate green innovation. Additionally, the study finds that ESG ratings exhibit a more pronounced promotion effect on green innovation among high-pollution and high-quality information disclosure firms. The research emphasizes the importance for enterprises to undertake proactive strategic adjustments and provides insights for optimizing existing green development policies.

1 Introduction

The increasingly severe ecological environmental issues, frequent natural disasters, and risks of extreme climate events have made green sustainable development a prominent theme in today’s era (Hu et al., 2023). In 2015, President Xi Jinping of China first proposed the concept of “innovation, coordination, green, openness, and sharing” as five key development principles, with a particular emphasis on the importance of environmental protection and innovation. Subsequently, China has also put forward goals for “green transformation” and “dual carbon,” making the “green development concept” a focal point across various industries in the country. This has led to a need for businesses to pay more attention to environmental protection and green development, providing a direction and requirements for their green transformation. Although the government has implemented comprehensive policies for green development, whether these policies effectively promote corporate green transformation often depends on the interaction between non-market strategies and market strategies within the companies themselves (Rong et al., 2023). Due to challenges such as high capital investment, high investment risks, long profit cycles, and the dual externality of green technological innovation activities, there is insufficient motivation for green innovation at the enterprise level (Wang and Wang, 2023). Therefore, stimulating corporate green investment and achieving green innovation have become key concerns for various sectors, particularly governmental regulatory departments.

With the escalating global climate change and environmental issues, green innovation has become a pivotal topic for businesses and investors. On this premise, the concept of Environmental, Social, and Governance (ESG) has emerged as a driving force behind the promotion of green innovation (Wu and Chen, 2022; Pan and Guo, 2023). In the face of increasingly pressing environmental challenges, capital plays a catalyst role in the establishment of the ESG framework. More and more funds are flowing into ESG-related fields, forming a long-term trend that compels companies to strengthen their ESG practices (Hu et al., 2023).

ESG investment has become mainstream in the European and American markets. According to the official website of the United Nations Principles for Responsible Investment (PRI), the number of signatories has increased from 734 in 2010 to 1,384 in 2015 and reached 5,022 as of June 2022. These signatories manage assets totaling over 50% of the global professional asset management scale. The United States, in particular, has witnessed rapid growth in ESG-related investments, with sustainable investment, pension funds, green bonds, and ESG rating and index organizations leading the global forefront. In China, the construction of the ESG framework is also gaining momentum under the guidance of policies and the implementation of relevant institutions. According to data from Wind, there are nearly 300 ESG investment funds in China’s secondary market, with a total scale of approximately 270 billion yuan. Among them, there are 30 thematic funds with ESG as their main investment strategy, managing assets exceeding 15 billion yuan. It is estimated that the scale of funds encompassing the broad concept of ESG exceeds 1.5 trillion yuan. Furthermore, the China Securities Regulatory Commission and exchanges have issued multiple rules and guidelines to standardize the disclosure of ESG information by listed companies. The increasingly sound regulatory policies have led to stricter ESG disclosure requirements in China. According to data from the China Listed Company Association, the proportion of listed companies disclosing ESG information reached 29.4% in 2021, further highlighting the importance of ESG information (Bai and Zhang, 2022).

Certain literature examines the environmental governance issues of green innovation and transformation from the perspective of top-down formal environmental regulatory tools such as regulations and supervision by governments or institutions (Shi et al., 2016; Shen and Zhou, 2017; Yang and Cheng, 2021; Du et al., 2022; He and Su, 2022; Li et al., 2023). However, due to inconsistencies between the goals of the central and local governments regarding economic development and green development, the implementation of formal environmental regulations faces the challenge of “government initiative, corporate passivity, and public inaction.” This leads to difficulties in effectively executing specific policies, either with inadequate enforcement or excessive and rigid enforcement, resulting in high costs and low efficiency, and failing to achieve the desired governance outcomes (Hu et al., 2023).

Organizational strategic theory suggests that businesses need to adapt to constantly changing external environments and make strategic adjustments to effectively integrate internal and external resources for sustainable development (Rajagopalan and Spreitzer, 1997; Pan and Guo, 2023). Informal environmental regulations, represented by public non-governmental organizations, play an increasingly important role in environmental governance, as they have a “bottom-up” effect and can better stimulate intrinsic motivations within companies, thus encouraging proactive green innovation (Zhao and Ni, 2022).

ESG investment plays a significant role in promoting green innovation and achieving sustainable economic development, with ESG ratings serving as a crucial basis for ESG investment. However, the extent to which ESG ratings, as external market governance mechanisms, drive companies to embark on proactive green transformations beyond government environmental regulations has been rarely explored in literature. Therefore, this study takes a perspective of informal environmental regulations to investigate the impact of ESG ratings on green innovation.

After careful consideration, this article adopts a perspective of informal environmental regulations and examines the exogenous impact of ESG ratings announced by Greenife on listed companies’ green innovation from 2009 to 2021 in the A-share market. Using a multi-period difference-in-differences model, it empirically investigates the effect of ESG ratings on green innovation from the perspectives of green patent applications and authorizations. The research findings of this study highlight the importance of ESG ratings for corporate green innovation, providing empirical evidence for relevant departments to further improve the ESG rating system.

2 Literature review and theoretical analysis

2.1 Literature review

Green innovation, as a key means to achieve sustainable development, has received widespread attention in recent years. Green innovation primarily refers to technological and managerial innovations oriented towards environmental friendliness. The objective of such innovations is to reduce negative impacts on the environment and enhance the efficiency of resource utilization. Existing literature suggests that macro and micro-level policies, as well as other formal environmental regulations, play a significant role in promoting green innovation and environmental protection (Xiong et al., 2020; Wang et al., 2022). For instance, in the Porter Hypothesis, scholars Porter and Linde (1995) postulated that the “innovation offset” resulting from sound environmental regulatory policies can compensate for the “compliance costs” borne by manufacturing enterprises. This, in turn, guides businesses to improve their technology, enhance resource efficiency, and thereby reduce environmental impacts. Qi et al. (2018) used the pollution trading pilot policy as a quasi-natural experiment, comparing the changes in green patent applications before and after the policy’s implementation. They found that environmental regulations indeed serve as a significant motivator for businesses in the pilot areas to pursue green technological innovations.

ESG Ratings, as a method for assessing a company’s performance in the areas of environment, social responsibility, and governance, encompass various domains, including environmental protection, employee rights, corporate governance, social responsibility, and sustainable operations (Kotsantonis and Serafeim, 2019). ESG Ratings serve as both a measure of a company’s sustainable development performance (Rajesh, 2020) and a vital informal tool for environmental regulation in the market. The methodologies for ESG Ratings are diverse, typically involving data collection, assessment, and ranking, often represented in the form of letters or numbers, such as A-grade or 100 points. ESG Ratings have significant impacts on both companies and investors (Wang et al., 2022). Companies with high ESG Ratings are usually favored by investors because they are perceived as having lower risks and long-term sustainability (Liu et al., 2023). For instance, research by Gao et al. (2021) found that strong ESG performance can enhance a company’s investment efficiency. Furthermore, some investment funds and asset management companies are adopting ESG standards to guide their investment decisions (Gillan and Starks, 2007). Strong ESG performance communicates a company’s efforts in environmental responsibility, social engagement, and corporate governance to society, reducing information asymmetry and providing resources for corporate innovation (Li et al., 2022). This, in turn, creates potential opportunities to promote corporate green innovation. Therefore, in contrast to previous studies, this research emphasizes examining the motivations for corporate green innovation from the perspective of ESG Ratings as informal environmental regulations. It not only explores a new perspective for promoting green innovation but also underscores the significance of market-based soft regulation, providing valuable insights for future research.

2.2 Impact analysis of ESG ratings on green innovation

ESG ratings are evaluative metrics designed to measure corporate performance across environmental, social, and governance (ESG) dimensions. These ratings promote sustainable business practices and have a positive influence on green innovation within firms.

The environmental factor is a significant aspect of ESG ratings. High environmental performance often propels firms towards green innovation, defined as the development of eco-friendly technologies, products, or services to reduce adverse environmental impacts. Enhanced environmental performance signifies that a company consistently applies pertinent environmental management techniques, improving pollution control and resource utilization efficacy. Firms proactively assuming environmental responsibilities are more likely to invest in environmental management and green technology innovation. Such endeavors not only provide intrinsic motivation for green technological advancements but also afford these firms a competitive edge in green innovation, facilitating a virtuous cycle (Hu, 2012). The study by Adams and Ferreira (2009) revealed a significant positive correlation between environmental factors and corporate innovation. ESG ratings’ environmental components, such as reduced energy consumption, emissions control, and efficient resource utilization, further incentivize companies to excel in green innovations.

Social factors, another crucial facet of ESG ratings, significantly influence green innovation. Grewal et al. (2004) demonstrated a positive correlation between a firm’s innovative capability in meeting societal demands and its market performance. The social criteria of ESG ratings, emphasizing employee rights, community development, and consumer rights, direct companies to align their green innovations with societal expectations. This alignment encourages the creation of environmentally friendly products and services that resonate with public aspirations.

ESG ratings necessitate companies to maintain optimal governance structures and transparency. A robust governance structure underpins and supports green innovation endeavors. Kolk and Perego (2010) observed a positive relationship between commendable corporate governance and environmental performance. The governance aspect of ESG ratings, emphasizing robust internal controls and transparent information disclosure mechanisms, aids companies in formulating and executing effective green innovation strategies, ensuring judicious resource allocation and seamless innovation progression. Moreover, ESG ratings mitigate information asymmetry between firms and stakeholders, minimizing external frictions and transaction costs. This reduction mitigates business operational risks, fostering a stable business environment conducive for green transitions (Hu et al., 2023). These external market governance mechanisms endow intrinsic motivations for green evolution, driving firms towards proactive green innovations.

In summary, ESG ratings significantly guide and encourage firms to innovate sustainably by considering environmental, social, and governance factors, promoting a more eco-friendly and socially responsible corporate landscape.

When approached from the lens of reputation theory, the proactive disclosure of a firm’s ESG responsibility performance, coupled with commendable results in third-party ratings, can convey a favorable reputation of the company being genuinely committed to responsibilities in areas like the environment, society, and corporate governance. Such a portrayal further solidifies the notion that the firm is actively embracing its duties in these domains.

A business that emphasizes safeguarding employee rights and assumes responsibilities in environmental conservation and other areas is likely to garner trust and loyalty from its employees, investors, and entities within its supply chain (DU et al., 2011). Such trust can be instrumental in giving the firm a competitive edge by ensuring it is attuned to market demands, allowing it to rapidly respond to any shifts in these demands and subsequently launch corresponding products.

In light of the above discussions, we put forth the following research hypothesis:

H1. ESG ratings have a positive impact on a company’s green innovation.

2.3 ESG ratings, financing constraints, and green innovation of companies

In the context of Chinese businesses, which frequently face varying degrees of financing constraints, it’s crucial to incorporate these constraints into the analysis of the relationship between ESG ratings and green innovation.

Financing constraints indicate challenges that companies face during financing, potentially leading to capital shortages and restrictions on investments. The availability of funds is a precondition for technological innovation. Technological innovation activities are characteristically more uncertain in returns, have longer cycles, and demand larger capital investments compared to other business investment activities. The asymmetry of information between investors and managers can expose firms to financing constraints, subsequently dampening their R&D investments (Zhang, 2021). Different kinds of innovative investments come with varied risks and rewards. Deciding on which R&D investment projects to undertake and their pacing represents significant financial challenges and critical strategic choices for businesses (Wang et al., 2022).

In the context of green innovation, significant capital injections are often needed. Firms with financing constraints might be inadequately poised to invest extensively in green innovation. Ju et al. (2013) noted that financing constraints have an adverse effect on a company’s innovative endeavors. Thus, these constraints might limit a company’s engagement and evolution in green innovation, potentially weakening the bolstering effect that ESG ratings could have on green innovation. Conversely, in firms with minimal financing constraints, the reduced financial pressure could pave the way for the efficient conversion of resources fostered by ESG ratings into outputs of green innovation.

In light of the above discussion, the paper proposes the following research hypothesis:

H2. Financing constraints negatively modulate the enhancing effect of ESG ratings on green innovation in businesses.

3 Data, variables, and estimation strategy

3.1 Sample selection and data source

The study utilizes financial data of Chinese A-share listed companies from 2009 to 2020 as the research sample, employing a multi-period difference-in-differences approach to investigate the impact of ESG ratings on corporate green innovation. Prior to conducting statistical analysis, the initial data is processed as follows: 1) excluding delisted and non-operational companies, as well as ST and *ST company samples; 2) excluding samples from the financial industry; 3) removing missing values; 4) to mitigate the influence of outliers, the “winsor2” command in Stata 17.0 is utilized to winsorize all continuous variables at the first and 99th percentiles, resulting in a final sample of 23,343 observations. The primary data sources for this article are the Wind, CSMAR, and CNRDS databases. Specifically, the ESG rating data is sourced from the Wind database, the corporate green innovation data is derived from the China Research Data Service Platform (CNRDS) database, and all other data is obtained from the CSMAR database.

3.2 Variable selection

3.2.1 Dependent variable

The dependent variable in this study is corporate green innovation. Generally, scholars commonly measure this using the application and authorization volume of green patents. To ensure robustness, this paper measures green innovation using both the application and authorization volume of corporate green patents. Specifically, drawing on the studies of Qi et al. (2018), Jia and Cui (2020), this study matches listed companies’ patents using the Green International Patent Classification (IPC) codes provided by the World Intellectual Property Organization (WIPO) to obtain the green patent application and authorization numbers of Chinese listed companies. Given the right-skewed nature of patent data, it is log-transformed after adding one.

3.2.2 Key independent variable

The core explanatory variable of this paper is the ESG rating. Based on the research of Hu et al. (2023); Tan and Zhu (2022), this study constructs a dummy variable using the “Shangdao Ronglu ESG” rating data as a benchmark. If the “Shangdao Ronglu” publishes the ESG rating data of company i in year t, it is considered the treatment group (ESG = 1). Otherwise, it's the control group (ESG = 0).

3.2.3 Moderating variable

The moderating variable in this paper is financing constraints. Referencing the research of Wang et al. (2022), the SA index is used as a measure of financing constraints. Specifically, SA = −0.737 × SI + 0.043 × SI^2 − 0.040 × A, where SI represents the natural logarithm of the company’s total assets, and A stands for the number of years the company has been listed. The absolute value of SA is taken; a larger absolute value indicates greater financing constraints.

3.2.4 Control variables

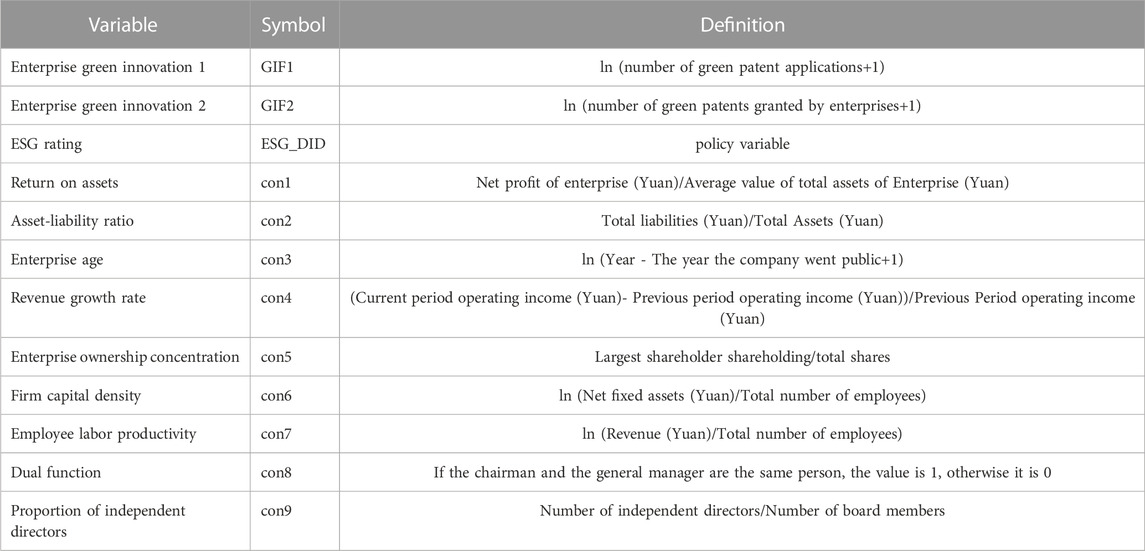

Based on existing literature, this paper selects firm-level factors such as Return on Assets (con1), Debt to Assets Ratio (con2), Firm Age (con3), Revenue Growth Rate (con4), Equity Concentration (con5), Capital Intensity (con6), Employee Labor Productivity (con7), CEO-Chairperson Duality (con8), and the Proportion of Independent Directors (con9) as control variables in the main regression model to exclude the influence of heterogeneous corporate characteristics on green innovation. The variables used for this study are presented in Table 1 below.

3.3 Estimation strategy

Drawing from previous studies and considering that firm-specific and annual factors may affect the regression results, this paper constructs a multi-period DID (Difference-in-Differences) model to examine the relationship between ESG ratings and corporate green innovation. Compared to some literature that directly uses ESG rating data for regression, this method can better alleviate endogeneity issues.

In Eq. 1, the subscript i represents the firm, c denotes the city, and t corresponds to the year. GIF represents corporate green innovation, indicated by GIF1 and GIF2 respectively. ESG_DID represents the double difference variable, while X represents the control variables.

To examine the moderating effect of financial constraints, the model (1) is augmented with an interaction term between ESG_DID and SA index (ESG_DID*SA). The dependent variable and control variables remain the same as previously mentioned. The specific model is as follows:

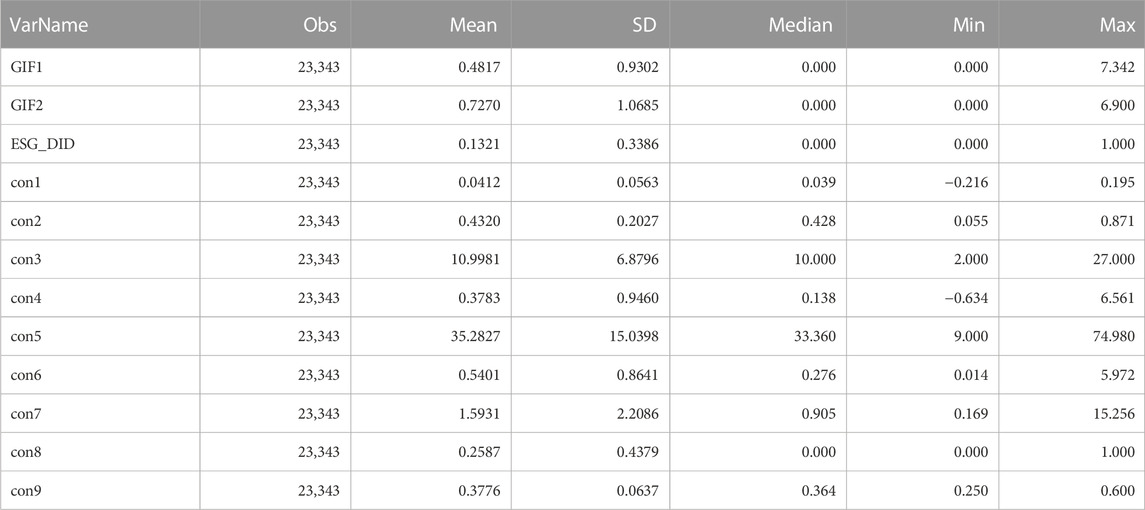

Table 2 shows descriptive statistics of the main variables.

4 Empirical results

4.1 Regression results

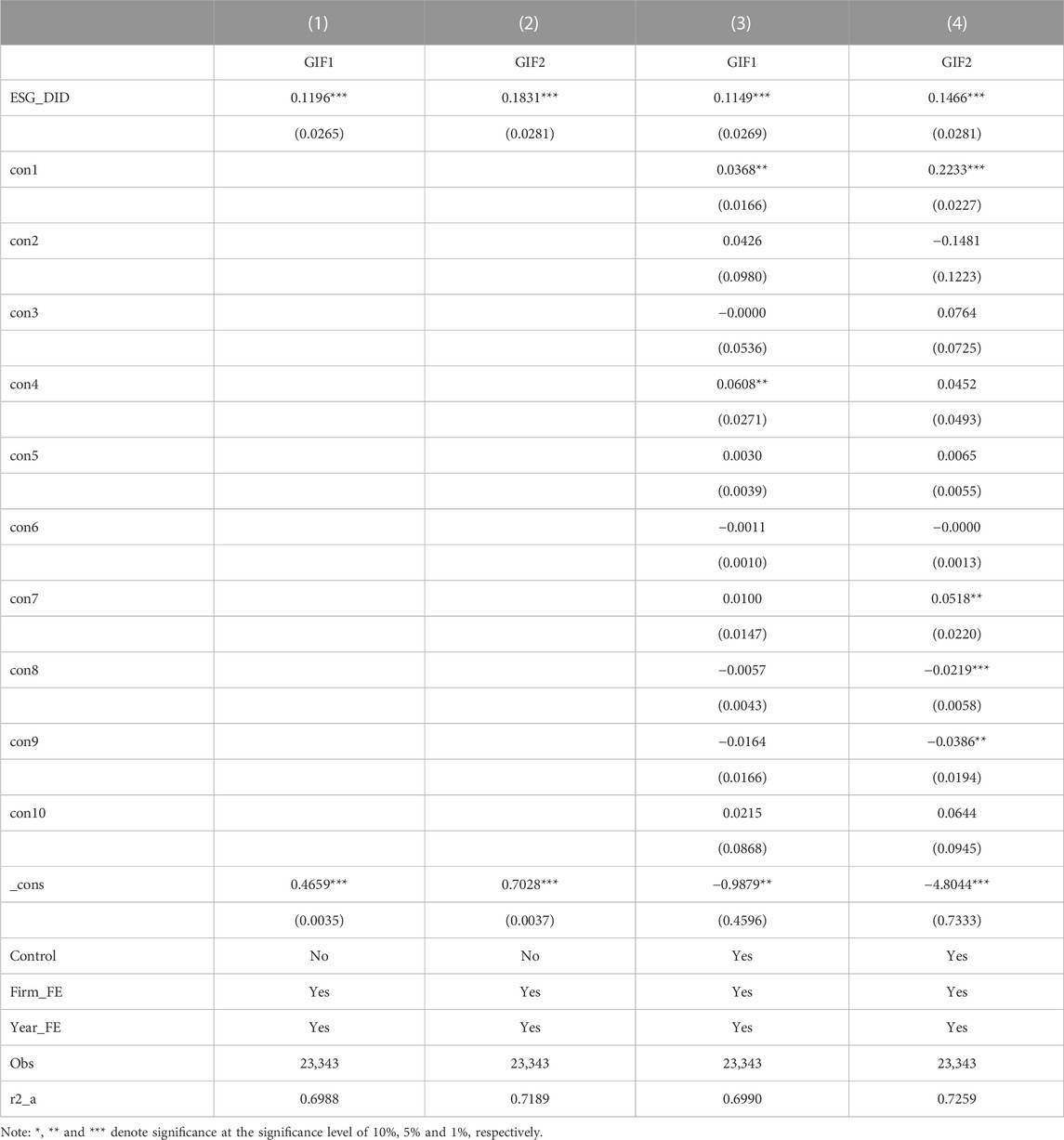

Table 3 presents the baseline regression results of the impact of ESG ratings on corporate green innovation. In the first column, without including control variables but controlling for firm fixed effects and time fixed effects, the coefficient of ESG_DID on the number of green patent applications is 0.1196, significant at the 1% level. In the second column, under the same control conditions, the coefficient of ESG_DID on the number of green patent grants is 0.1831, significant at the 1% level. In the third column, after introducing control variables, the coefficient of ESG_DID on the number of green patent applications is 0.1149, significant at the 1% level. In the fourth column, with control variables included, the coefficient of ESG_DID on the number of green patent grants is 0.1466, significant at the 1% level.

These results indicate a significant positive impact of ESG ratings on both the number of green patent applications and grants. This suggests that ESG ratings can promote corporate green innovation, providing support for research hypothesis H1.

Table 4 presents the regression results of the impact of ESG ratings on corporate green innovation, considering financial constraints as a moderating variable. In the first column, with the number of green patent applications as the dependent variable, the coefficient of the interaction term between ESG ratings and financial constraints is −0.2589, significant at the 1% level. In the second column, with the number of green patent grants as the dependent variable, the coefficient of the interaction term between ESG ratings and financial constraints is −0.3737, significant at the 1% level.

These results indicate that more severe financial constraints hinder the promoting effect of ESG ratings on corporate green innovation. This implies a negative moderating effect of financial constraints on the relationship between ESG ratings and corporate green innovation. This provides support for research hypothesis H2.

4.2 Robustness checks

4.2.1 Parallel trend test

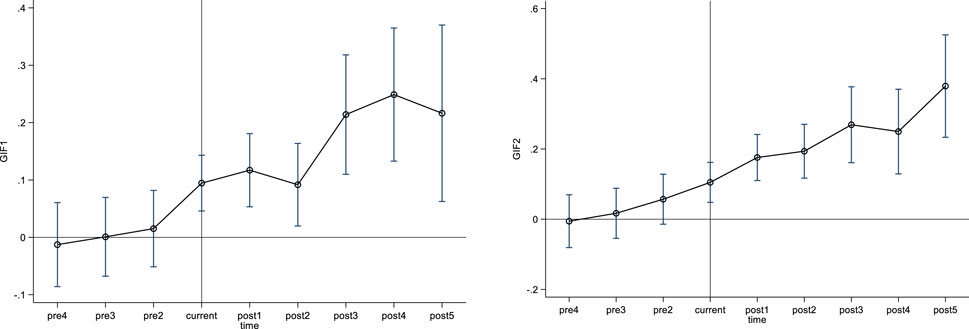

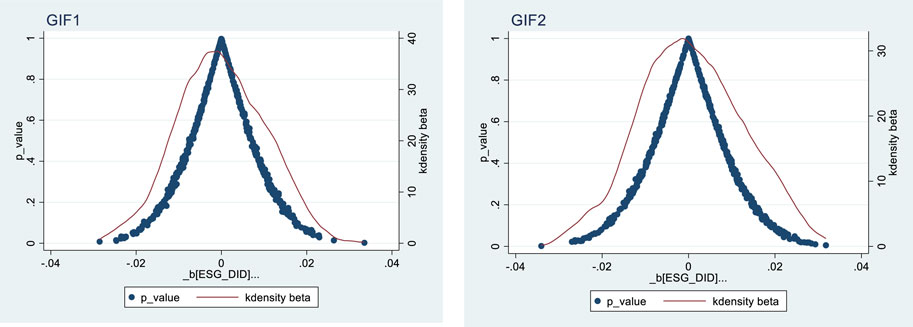

The effectiveness of the Difference-in-Differences (DiD) model relies on the absence of trend differences between the treatment and control groups before the policy shock. In other words, prior to the implementation of the ESG rating policy, the trends in green innovation for both the treatment and control groups should be consistent.

To test this, this study adopted the event-study method proposed by Jacobson et al. (1993) and constructed a staggered quasi-natural experiment. The results of the parallel trend test are shown in Figure 1. On the left side are groups where the number of green patent applications is the dependent variable, and on the right side are groups where the number of green patent grants is the dependent variable.

From Figure 1, it is evident that whether in the group with green patent applications or in the group with green patent grants, the coefficient estimates for the ESG rating as a quasi-natural experiment are mostly insignificant before its implementation. However, after the policy is implemented, the coefficient values largely pass the significance test. This suggests that the ESG rating drives corporate green innovation, and this driving effect is dynamically sustainable. This result confirms the parallel trend assumption.

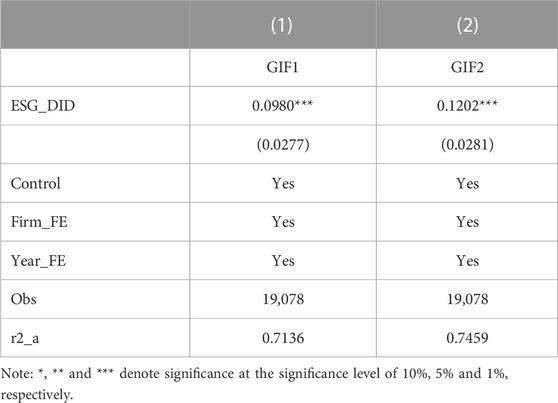

4.2.2 Placebo test

In the application of the Difference-in-Differences (DiD) method to evaluate the effects of policies, unobservable omitted variables, reverse causation, and other endogeneity issues can impact the estimated results. To alleviate concerns that unobservable factors and other endogeneity issues may affect the estimated results, drawing from Zhou et al. (2018); La Ferrara et al. (2012), this study conducted a placebo test by randomly creating fictitious policy pilots to further identify the incidental effects of ESG ratings. The study performed 500 random samples and then re-estimated the regression. Figure 2 depicts the kernel density distribution of the placebo test, and it can be observed that the estimated coefficients essentially follow a normal distribution with a mean of 0. The coefficient estimates in the baseline regression are inconsistent with the estimated parameters in the placebo test. Based on the results of the placebo test, it can be concluded that the enhancement in corporate green innovation levels after the implementation of the ESG rating “policy” is primarily due to the ESG rating. This suggests that the estimated results of the DiD model in this study are unlikely to be driven by unobservable factors, further validating the robustness of the conclusion from the baseline regression.

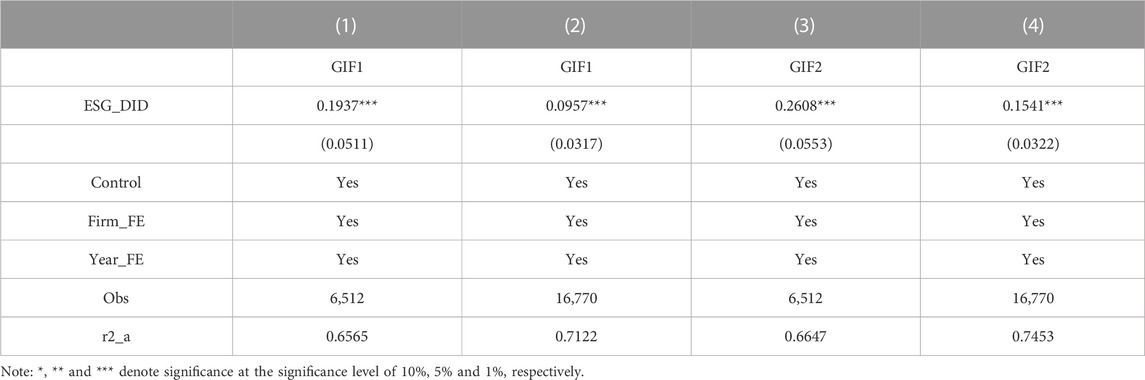

4.2.3 The control variable lags one phase

Taking into account the potential reverse causality between the selected variables and the establishment of the ESG ratings “policy,” this study further mitigates potential endogeneity issues by lagging all control variables by one period. The regression results are presented in Table 5. Column (1) displays the regression results with the number of green patent applications as the dependent variable, revealing a significant coefficient of 0.0980 for ESG_DID at the 1% level. Column (2) presents the regression results with the number of green patent grants as the dependent variable, showing a significant coefficient of 0.1202 for ESG_DID at the 1% level. These results once again validate the robustness of the conclusions drawn from the difference-in-differences model employed in this study.

4.3 Heterogeneity analysis

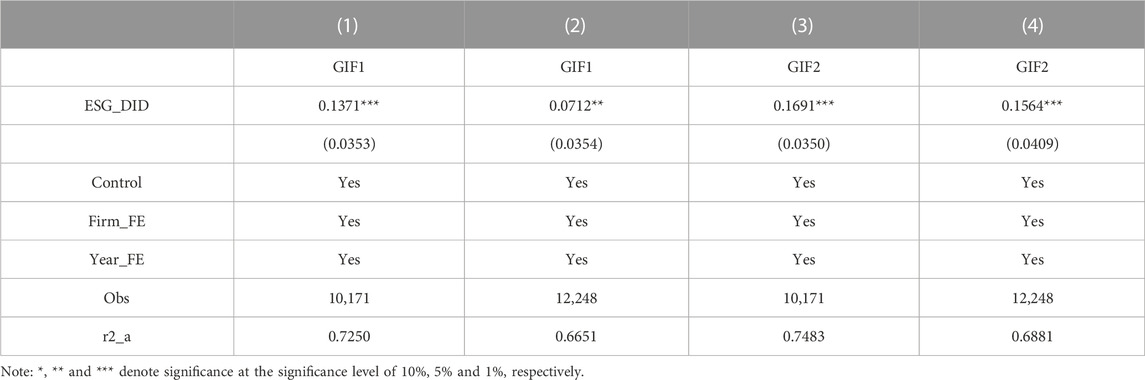

4.3.1 ESG rating, pollution level and corporate green innovation

Building a green and low-carbon cyclic development economic system, reducing energy resource consumption, promoting green economic transformation, optimizing and upgrading industries, and reducing pollutant emissions are critical research topics that deserve serious attention. Pollution control, especially for heavily polluted enterprises, industries, and regions, remains a challenging issue. The positive influence of ESG ratings on green innovation is more substantial for highly polluted enterprises, where there is significant room for green improvement, compared to less polluted ones. To validate this conjecture, this study employs a group regression for verification.

Specifically, referencing the definition of heavily polluted industries by Li and Xiao (2020), industries coded as B06, B07, B08, B09, B10, B11, B12, C17, C18, C19, C22, C25, C26, C27, C28, C29, C31, C32, and D44 are classified as heavily polluted. The regression results are presented in Table 6.

In the first column, using heavily polluted enterprises as a sample and the number of green patent applications as the dependent variable, the coefficient for ESG_DID is 0.1937, significant at the 1% level. The second column, with less polluted enterprises as the sample and again using the number of green patent applications as the dependent variable, shows a coefficient for ESG_DID of 0.0957, also significant at the 1% level. It is evident that the impact of ESG ratings on green innovation is more substantial for heavily polluted enterprises, corroborating the aforementioned conjecture.

The third column, using heavily polluted enterprises as the sample but now with the number of green patent grants as the dependent variable, yields a coefficient for ESG_DID of 0.2608, significant at the 1% level. The fourth column, which uses less polluted enterprises as the sample with the number of green patent grants as the dependent variable, has a coefficient for ESG_DID of 0.1541, significant at the 1% level. This outcome likewise indicates that ESG ratings play a more significant role in promoting green innovation among heavily polluted enterprises.

4.3.2 ESG rating, information disclosure and corporate green innovation

The dissemination of information serves as the primary conduit through which publicly listed entities convey corporate data to the external sphere, while also serving as a critical reference for commercial banks when extending credit facilities to these enterprises. Prudent and comprehensive information disclosure further contributes to diminishing the asymmetry prevalent within internal and external data spheres, thus leading to a decline in capital acquisition costs whilst augmenting the dependability of financing channels (Liu et al., 2023). Consequently, this fortifies the impact of Environmental, Social, and Governance (ESG) ratings on the green innovation initiatives undertaken by corporations. Moreover, an elevation in the quality of information disclosure complements subsequent enhancements in a company’s ESG ratings, thereby incentivizing heightened involvement in ecological advancements and fostering a superior level of sustainable performance. To corroborate this hypothesis, inspired by the work conducted by Hou, D. et al. (2021), this study underscores the utilization of the KV information disclosure quality index as a metric to quantify the extent of information divulged by businesses. It further performs a segmentation-based regression analysis. Specifically, entities surpassing industry bounds in terms of KV scores are designated high information disclosure quality companies, while those trailing behind industry-wide averages are classified as low information disclosure quality companies. The ensuing regression results, presented in Table 7, unveil column (1), whereby high information disclosure quality companies represent the sample and the count of green patent applications serves as the dependent variable. Within this arrangement, the coefficient attributable to ESG_DID is 0.1371, exuding statistical significance at the 1% level. Correspondingly, column (2) enlists low information disclosure quality companies as the sample, with the number of green patent applications serving as the dependent variable. In this specific scenario, the coefficient ascribed to ESG_DID is 0.0712, denoting statistical significance at the 1% level. Henceforth, these findings substantiate the superior efficacy of ESG ratings in cultivating green innovations within the realm of high information disclosure quality companies, consequently vindicating the aforementioned hypothesis. We proceed to column (3), featuring high information disclosure quality companies as the sample and the number of green patent grants embraced as the dependent variable. Herein, the coefficient aligned with ESG_DID is 0.1691, attaining statistical significance at the 1% level. Advancing to column (4), low information disclosure quality companies form the statistical cohort, with the count of green patent grants serving as the dependent variable. In this particular configuration, the coefficient associated with ESG_DID is 0.1564, once again reflecting significant statistical relevance at the 1% level. Ergo, this outcome further corroborates the heightened capacity of ESG ratings to enrich green innovations within corporations distinguished by a superior information disclosure quality.

5 Discussion

In this section, we will discuss the results found in the empirical analysis of this study. Firstly, the baseline research results indicate that ESG ratings have a positive impact on corporate green innovation. Companies with high ESG ratings are generally more motivated to take environmental measures and engage in green technological innovation to enhance their sustainability performance (Khan et al., 2016). Specifically, ESG ratings encourage companies to increase the number of green patents applied for and authorized, thereby promoting investments and innovative activities in green innovation. This finding supports the significant role of ESG ratings in driving corporate green transformation and sustainable development, which is also supported by existing literature (Xu et al., 2021; Tan and Zhu, 2022; Meng et al., 2023). Ioannou and Serafeim (2015) suggest that this positive promoting effect may be partly attributed to the support of investors and stakeholders for companies with high ESG ratings, encouraging these companies to allocate resources and efforts towards green innovation. This study concurs with this perspective but emphasizes that a more crucial factor is that ESG ratings, as a form of informal environmental regulation, have a “bottom-up” environmental governance effect. This governance effect prompts companies to make internal strategic adjustments from within the organization to adapt to the evolving external environment. As global green sustainable development becomes increasingly important, companies should fully recognize the impact of ESG ratings, actively fulfill their environmental, social, and corporate governance responsibilities, and work towards the goals of green sustainable development.

Furthermore, the study found that financial constraints have a negative inhibitory effect on the impact of ESG ratings on corporate green innovation. One study indicates that companies typically require more capital to support environmental projects and technological innovation. However, when constrained by financial limitations, they may not fully harness their potential for green innovation (Liang and Liu, 2022). Moreover, financial constraints may lead to a conflict between a company’s short-term financial interests and long-term sustainability in the ESG context. Companies may be more inclined to pursue short-term financing and profits, potentially neglecting long-term environmental and social responsibility goals. This could reduce the positive correlation between ESG ratings and green innovation (Goss and Roberts, 2011). Therefore, financial constraints limit investments and activities in green innovation, thereby weakening the promoting effect of ESG ratings on corporate green innovation. This finding underscores the importance of addressing corporate financial constraints, providing more financing opportunities and support to companies, and promoting the development of green innovation, consistent with previous findings (Wang et al., 2022; Wang et al., 2023).

Additionally, this study also found that ESG ratings have a more pronounced promoting effect on green innovation in high-pollution companies with high information disclosure quality. This suggests that ESG ratings play a crucial role in driving high-pollution companies to improve their environmental performance and enhance information disclosure quality. Concurrently, research by Busch and Friede (2018) suggests that companies with high information disclosure quality typically find it easier to attract sustainable investments, further enhancing their motivation for green innovation and, consequently, the role of ESG ratings in promoting green initiatives. Governments and regulatory authorities can strengthen their oversight and encouragement of these companies, thereby encouraging increased investment and efforts in green innovation.

This study contributes in three main aspects. First, from the perspective of green patent applications and authorizations, it validates the application value of ESG and enriches the research on the economic consequences of corporate ESG. Companies that focus on their own ESG performance not only contribute to environmental protection and governance but also promote long-term development. Second, it expands the literature in the field of corporate innovation. While the academic community has extensively studied the driving factors of innovation, few studies have explored the influence of innovation from a green and sustainable perspective. Unlike existing studies that focus on green innovation from the perspective of formal environmental regulations, this study emphasizes the contribution of ESG, an informal environmental regulation resulting from environmental governance pressure, and highlights the importance of companies proactively adjusting their strategies. This not only expands the research achievements in the field of innovation but also provides insights for optimizing and adjusting existing green development policies. Third, it deepens the research methods regarding ESG. In terms of empirical research, this study treats listed companies’ ESG ratings as an exogenous shock and constructs a quasi-natural experiment. By using the multi-period difference-in-differences method, it examines the impact of ESG ratings on corporate green innovation. Furthermore, it extends the research on the heterogeneity of companies fulfilling ESG responsibilities.

This paper provides an in-depth examination of the relationship between ESG and green innovation, yet there are certain limitations to consider. Firstly, the study chose Chinese A-share listed companies as the research sample, which might lead to potential limitations in the study’s conclusions. Companies from different regions and industries may exhibit variances in their ESG and green innovation performances. As such, one should exercise caution when generalizing these findings to other regions and industries. Secondly, ESG ratings can be conducted by various institutions, each possibly using different standards and methods. This could lead to discrepancies in the rating results for the same company across different agencies, impacting the accuracy and comparability of the research. Furthermore, the data period for this study spans from 2009 to 2021, which may not comprehensively reflect the relationship between ESG and green innovation. Given that ESG is a relatively new concept that has garnered increasing attention over recent years, its influence on corporate strategy and investment decisions may become more apparent in the future.

Future research is advised to expand the sample size and consider a broader time frame. This would allow for a more thorough analysis of the impact of ESG ratings on green innovation and would also better account for changes in the external environment.

6 Conclusion

6.1 Research conclusion

Amid the escalating global environmental degradation and the challenges brought about by climate change, green innovation in businesses has emerged as an urgent and pivotal concern. Under the leadership of President Xi Jinping, China’s endeavors and investments towards green development have positioned green innovation at the heart of both national and corporate strategies. Yet, relying solely on formal governmental regulations can’t wholly achieve the desired governance outcomes, highlighting the importance of informal environmental regulations like ESG ratings. This study, from the perspective of informal environmental regulation, examines the impact of ESG ratings under market-based soft regulation on corporate green innovation. Through the analysis of a multi-period difference-in-differences empirical model, this paper finds that ESG ratings have a positive and significant impact on promoting corporate green innovation. More specifically, companies with strong ESG performance are more likely to generate green innovation outcomes, such as green patent applications and authorizations, a point that is strongly validated from the perspective of green patents. This conclusion holds even after undergoing various robustness tests. Furthermore, the study demonstrates that more severe financial constraints inhibit the promoting effect of ESG ratings on corporate green innovation, indicating that financial constraints exhibit a negative inhibitory effect in the impact of ESG ratings on corporate green innovation. Finally, the study also discovers that ESG ratings have a more pronounced promoting effect on green innovation in high-pollution companies with high information disclosure quality.

6.2 Policy implication

Based on the findings of this study, we offer the following policy recommendations:

Promotion of ESG Ratings: Governments and regulatory bodies can further encourage and support companies to undergo ESG evaluations. This would act as an incentive for businesses to invest more heavily in green innovation. Initiatives such as rewards and favorable policies can be introduced to motivate companies to participate actively in ESG rating processes.

Addressing Financing Constraints: Given the negative moderating effects of financing constraints on the impact of ESG ratings, governments can adopt measures to alleviate financing pressures on companies. This can be achieved by providing dedicated funds for green innovation, reducing financing costs, among others. Such measures would facilitate companies to engage more in green innovation.

Focus on High-Pollution and High-Quality Disclosure Firms: Considering the pronounced promotional effects of ESG ratings on green innovation in high-pollution and high-quality information disclosure firms, governments can intensify regulations and guidance on these companies. This would drive them to bolster their efforts and investments in green innovation.

Enhancement of ESG Rating System: There is a need to further refine the ESG rating system to boost its accuracy and credibility. It's imperative that companies portray a genuine and comprehensive representation of their performances in environmental, social, and corporate governance domains. By providing more reliable ESG information, investors will be encouraged to channel more funds into ESG-related sectors.

Incorporating these recommendations can foster an environment that not only recognizes the value of ESG ratings but also promotes the advancement of green innovation, contributing significantly to sustainable development goals.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

CC: Conceptualization, Funding acquisition, Methodology, Resources, Writing–original draft. MF: Data curation, Software, Validation, Visualization, Writing–original draft. YF: Formal Analysis, Investigation, Methodology, Resources, Writing–original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The author would like to thank the reviewers and the editors.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adams, R., and Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. J. Financial Econ. 94 (2), 291–309. doi:10.1016/j.jfineco.2008.10.007

Bai, M., and Zhang, J. (2022). An exploration of the construction path of listed companies' ESG information disclosure system. Finance Account. Mon. (07), 90–99. doi:10.19641/j.cnki.42-1290/f.2022.07.012

Busch, T., and Friede, G. (2018). The robustness of the corporate social and financial performance relationship over time: a note on the role of long-run financial strength. Strategic Manag. J. 39 (6), 1813–1820.

Du, J., Jiang, M., and Yang, Y. (2022). Can local government regulation promote corporate green innovation? Account. Friend 16, 52–60.

Du, S., Bhattacharya, C. B., and Sen, S. (2011). Corporate social responsibility and competitive advantage:overcoming the trust barrier. Manag. Sci. 57 (9), 1528–1545. doi:10.1287/mnsc.1110.1403

Gao, J., Chu, D., and Lian, Y. (2021). Can ESG performance improve corporate investment efficiency? Secur. Mark. Her. 2021 (11), 24–34+72.

Gillan, S. L., and Starks, L. T. (2007). The evolution of shareholder activism in the United States. J. Appl. Corp. Finance 19 (1), 55–73. doi:10.1111/j.1745-6622.2007.00125.x

Goss, A., and Roberts, G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. J. Bank. Finance 35 (7), 1794–1810. doi:10.1016/j.jbankfin.2010.12.002

Grewal, R., Lilien, G. L., and Mallapragada, G. (2004). Location, location, location: how network embeddedness affects project success in open source systems. Manag. Sci. 50 (8), 1199–1212.

He, J., and Su, H. (2022). Digital transformation and green innovation of Chinese firms: the moderating role of regulatory pressure and international opportunities. Int. J. Environ. Res. Public Health 20, 13321. doi:10.3390/IJERPH192013321

Hou, D., Li, Z., He, H., and Zheng, J. (2021). Green innovation, information disclosure quality, and financing constraints of coal companies. Coal Technol. 09, 208–211. doi:10.13301/j.cnki.ct.2021.09.057

Hu, J., Yu, X., and Han, Y. (2023). Can ESG ratings promote corporate green transformation? - verification based on the multi-time point difference-in-differences method. Quantitative Econ. Tech. Econ. Res. 07, 90–111. doi:10.13653/j.cnki.jqte.20230517.002

Hu, Q. (2012). Study on the correlation between listed companies' environmental performance and financial performance. China Popul. Resour. Environ. 6, 23∼32.

Ioannou, I., and Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: analysts' perceptions and shifting institutional logics. Strategic Manag. J. 36 (7), 1053–1081. doi:10.1002/smj.2268

Jacobson, L. S., Lalonde, R. J., and Sullivan, D. (1993). Earnings losses of displaced workers. Am. Econ. Rev. 83 (4), 685–709.

Jia, Xu, and Cui, J. (2020). Low-carbon cities and corporate green technological innovation. China Ind. Econ. 12, 178–196. doi:10.19581/j.cnki.ciejournal.2020.12.008

Ju, X., Lo, D., and Yu, Y. (2013). Financing constraints, working capital management, and corporate innovation sustainability. Econ. Res. (01), 4–16.

Khan, M., Serafeim, G., and Yoon, A. (2016). Corporate sustainability: first evidence on materiality. Account. Rev. 91 (6), 1697–1724. doi:10.2308/accr-51383

Kolk, A., and Perego, P. (2010). Determinants of the adoption of sustainability assurance statements: an international investigation. Bus. Strategy Environ. 19 (3), 182–198. doi:10.1002/bse.643

Kotsantonis, S., and Serafeim, G. (2019). Four things No one will tell you about ESG data. J. Appl. Corp. Finance 31 (2), 50–58. doi:10.1111/jacf.12346

La Ferrara, E., Chong, A., and Duryea, S. (2012). Soap operas and fertility: evidence from Brazil. Am. Econ. J. Appl. Econ. 4 (4), 1∼31–31. doi:10.1257/app.4.4.1

Li, H. Y., Liu, Q. Y., Li, S. Y., and Fu, S. Y. (2022). Environmental, social, and governance information disclosure and corporate green innovation performance. Stat. Res. 12, 38–54. doi:10.19343/j.cnki.11-1302/c.2022.12.003

Li, J., Zhong, T., Ma, F., and Liu, H. (2023). Environmental vertical supervision and green technology innovation: strategic compliance or spontaneous innovation? Finance Account. Newsl. 12, 26–30+99. doi:10.16144/j.cnki.issn1002-8072.2023.12.022

Li, Q., and Xiao, Z. (2020). Heterogeneous environmental regulatory tools and corporate green innovation incentives—evidence from listed companies' green patents. Econ. Res. 55 (09), 192–208.

Liang, Y., and Liu, B. (2022). Social responsibility, financial constraints, and green technological innovation. Friends Account. 2022 (17), 61–68.

Liu, X., Li, W., and Hesar, N. (2023). Digital transformation and corporate green technological innovation - discussing the moderating role of environmental information disclosure. Ind. Technol. Econ. (08), 59–69.

Liu, X., Yang, Q., and Hu, J. (2023). ESG rating discrepancy and stock price synchronicity. China Soft Sci. 2023 (08), 108–120.

Meng, M. M., Tan, X. Y., Liu, S. R., and Lei, J. H. (2023). The impact of corporate ESG performance on green innovation. Technol. Econ. 07, 13–24.

Pan, Y., and Guo, M. (2023). Corporate ESG performance under air pollution pressure. Quantitative Econ. Tech. Econ. Res. 07, 112–132. doi:10.13653/j.cnki.jqte.20230517.003

Porter, M. E., and Linde, C. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qi, S. Z., Lin, S., and Cui, J. B. (2018). Can environmental equity trading markets induce green innovation? Evidence from green patent data of listed companies in China. Econ. Res. J. 53 (12), 129–143.

Rajagopalan, N., and Spreitzer, G. M. (1997). Toward A theory of strategic change: a multi-lens perspective and integrative framework. Acad. Manag. Rev. 22 (1), 48–79. doi:10.5465/amr.1997.9707180259

Rajesh, R. (2020). Exploring the sustainability performances of firms using environmental, social, and governance scores. J. Clean. Prod. 247, 119600. doi:10.1016/j.jclepro.2019.119600

Rong, R., Dong, Di, Hu, X., and Fang, T. (2023). Inhibition or promotion: corporate social responsibility and green innovation performance. Res. Manag. (06), 95–106. doi:10.19571/j.cnki.1000-2995.2023.06.010

Shen, H., and Zhou, Y. (2017). Environmental law enforcement supervision and corporate environmental performance: quasi-natural experimental evidence from environmental protection interviews. Nankai Manag. Rev. (06), 73–82.

Shi, Q., Guo, F., and Chen, S. (2016). Political blue sky" in smog control - evidence from China's local "two sessions. China Ind. Econ. 05, 40–56. doi:10.19581/j.cnki.ciejournal.2016.05.003

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 68, 101906. doi:10.1016/j.techsoc.2022.101906

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers' environmental awareness. Environ. Aware. Technol. Soc. 68, 101906. doi:10.1016/j.techsoc.2022.101906

Wang, L., Lian, Y., and Dong, J. (2022). Research on the impact mechanism of ESG performance on corporate value. Secur. Mark. Her. 2022 (05), 23–34.

Wang, T., Liu, X., and Wang, H. (2022). Green bonds, financing constraints, and green innovation. J. Clean. Prod. 381 (1), 135134. doi:10.1016/j.jclepro.2022.135134

Wang, W., Meng, Q. J., Chen, Y. H., Guo, S. T., Dang, K. T., Gao, C., et al. (2023). Spatial transcriptomics: recent developments and insights in respiratory research. Sci. Technol. Industry 10 (01), 38–45. doi:10.1186/s40779-023-00471-x

Wang, X., Fan, M., Fan, Y., Li, Y., and Tang, X. (2022). R&D investment, financing constraints and corporate financial performance: empirical evidence from China. Front. Environ. Sci. 10, 1056672. doi:10.3389/fenvs.2022.1056672

Wang, X., and Wang, Y. (2021). The promotion of green innovation by green credit policies. Manag. World 37 (06), 173–188+11.

Wang, Y., and Wang, Y. (2023). Corporate ESG performance, risk-taking, and green technological innovation. Account. Friend (10), 94–102.

Wu, C., and Chen, S. (2022). Green transformation and high-quality development under the ESG system with Chinese characteristics. New Finance (04), 8–16.

Xiong, G. Q., Shi, D. Q., and Li, M. N. (2020). The impact of low-carbon city pilots on corporate green technology innovation. Sci. Res. Manag. 41 (12), 93–102.

Xu, J., Liu, F., and Shang, Y. (2021). R&D investment, ESG performance and green innovation performance: evidence from China. Kybernetes 50 (3), 737–756. doi:10.1108/K-12-2019-0793

Yang, Y., and Cheng, X. (2021). The impact of environmental regulatory tools on corporate green innovation. China Soft Sci. (S1), 247–252.

Zhang, Y. (2021). Corporate ESG performance, financing constraints, and green technology innovation. Bus. Account. (11), 33–39.

Zhao, X., and Ni, J. (2022). Research on foreign informal environmental regulations and their environmental governance effects. Foreign Soc. Sci. (05), 128–139+198.

Keywords: ESG ratings, corporate green innovation, multi-period difference-in-differences model, financing constraints, information disclosure

Citation: Chen C, Fan M and Fan Y (2023) The impact of ESG ratings under market soft regulation on corporate green innovation: an empirical study from informal environmental governance. Front. Environ. Sci. 11:1278059. doi: 10.3389/fenvs.2023.1278059

Received: 15 August 2023; Accepted: 07 November 2023;

Published: 21 November 2023.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Yang Wang, Yunnan Normal University, ChinaMaham Furqan, Oregon State University, United States

Rana Yassir Hussain, University of Education Lahore, Pakistan

Copyright © 2023 Chen, Fan and Fan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Min Fan, MTE2MDUyOTg4MUBxcS5jb20=

Cheng Chen1

Cheng Chen1 Min Fan

Min Fan Yaojun Fan

Yaojun Fan