- 1Dong Fureng Institute of Economics and Social Development, Wuhan University, Wuhan, China

- 2Business School, Central University of Finance and Economics, Beijing, China

- 3Nanjing Branch of Internal Audit Bureau, Industrial and Commercial Bank of China, Nanjing, China

- 4School of Management and Economics, Beijing Institute of Technology, Beijing, China

- 5School of Statistics and Mathematics, Central University of Finance and Economics, Beijing, China

One of the best ways for nations to achieve sustainable economic development in the modern era is by accelerating energy transformation and enhancing energy efficiency. Sustainable finance plays a crucial role in bridging economic development and environmental protection. We calculate sustainable finance indexes at the provincial level and at the city level in China, and find that sustainable financial development can promote energy efficiency. These findings remain robust even after employing a series of robustness tests and implementing an instrumental variable approach to address potential endogeneity concerns. Investigations of the underlying mechanism reveal that sustainable finance primarily promote the energy efficiency by promoting technological innovation and optimizing the industrial structure. Moreover, sustainable finance has a particularly significant impact on energy efficiency in cities with non-low-carbon pilot and cities with strict environmental regulations. We further test whether green finance has a threshold effect on energy efficiency. This paper suggests leveraging the positive role of sustainable finance in the energy efficiency of firms, especially by encouraging firms to invest technologies to accelerate their energy efficiency. Furthermore, this paper aim to offer insightful recommendations for accurately formulating and applying sustainable finance development strategies.

1 Introduction

Green funds are pivotal in financing resource utilization while promoting environmental quality and resource efficiency by directing funds toward environmentally responsible businesses and regions. The advancement of sustainable finance can facilitate the development of a green, low-carbon economy, foster energy transition, and enhance energy efficiency (Coase, 1992; Dean and Brown, 1995). A substantial body of research by both domestic and international scholars is currently devoted to exploring the impacts of sustainable finance. This innovative financial system product, sustainable finance, amalgamates sustainability and environmental protection and is deeply ingrained throughout economic activities. It forms the bedrock of financial business development, transcending its role as a financial instrument for environmental concerns. Sustainable finance, instead, is intricately intertwined with national or regional economic growth and environmental conservation (Perry, 2010), effectively melding financial resources with corporate entities.

China’s carbon peaking goals have been divided into smaller goals and assigned to provinces, cities, and counties, just like other policies. However, certain underdeveloped regions of China are finding it challenging to keep up with the rate of carbon peaking because of their colossal geography and unequal regional growth. Additionally, power shortages occasionally happen due to problems related to climate change and the shift to cleaner energy (Wang et al., 2022; Guo et al., 2023). In this situation, one efficient strategy to reduce carbon emissions is increasing energy transformation and efficiency. As sustainable finance has continued to advance, academics have investigated the connection between sustainable financing and energy efficiency. Sustainable finance can force businesses that have yet to undergo a green transformation to do so to promote the greening of the industry as a whole and improve energy efficiency. It can also encourage the development of emerging green industries by providing financial support (Huo et al., 2022). Scholars from home and abroad have researched sustainable finance and its effects. However, Considering the Gap in the literature, most of it uses provincial panel data or prefecture- or city-level studies on specific provinces. There needs to be more literature on how sustainable financing affects local governments at the municipal and county levels. The intermediate channel of energy efficiency for sustainable finance in emerging market countries like China is also worth studying. So we want to explore: can sustainable financial development at the city level in China improve the energy efficiency of enterprises? What are the intermediate channels through which sustainable finance affects corporate energy efficiency?

Moreover, constrained by data limitations, municipal and county-level research often resorts to employing single indicators, such as green credit, as proxies for assessing sustainable finance development levels. Consequently, a comprehensive analysis of the precise impact and underlying mechanisms of sustainable finance development on municipal-level energy efficiency remains challenging. To address this challenge, it is imperative to explore the heterogeneity that exists among various categories of cities, given the significant economic disparities between Chinese provinces and variations among cities within each province. Hence, the provision of tailored, region-specific policy recommendations to local governments is of paramount importance (Ghisetti and Rennings, 2014).

Through the review of existing literature, it is found that the research on green finance has a long history. Most scholars believe that the development of green finance considers environmental protection and economic benefits, guides financial resources to invest in environmentally friendly fields and enterprises, improves ecological quality, reduces energy consumption, and improves energy efficiency. The research on green finance mainly involves three aspects: banks, enterprises, and regions. At the bank level, it focuses on the impact of green finance on bank risk-bearing ability and operation effect; at the enterprise level, it mainly studies the impact of green finance policy on enterprise technological innovation and performance. At the regional level, in addition to the impact of green finance on the high-quality development of the local economy, technological innovation, and energy consumption, we also focus on establishing an appropriate index system to evaluate the development level of green finance.

The two following elements are where this paper innovates. First, it creates a thorough evaluation index of the level of urban sustainable finance development. When examining the problems associated with sustainable finance at the municipal level, the existing literature frequently employs single-dimensional indicators to refer to the development level of sustainable finance due to the difficulty in gathering data. The quality of a city’s sustainable financial structure is assessed in this article using numerous metrics, including credit, investment, insurance, securities, and carbon emissions, to create a more thorough and multidimensional evaluation index. Therefore, it can more accurately reveal the contribution of financial development at the city level to the optimization of energy structure, which might serve as a guide for the precise implementation of sustainable finance policies at the city level. Secondly, this paper investigates whether implementing other environmental policies will affect the impact of sustainable finance development on optimizing the energy structure, quantifies the synergistic effect between different policies, and serves as a guide for formulating complementary policies. It takes the low-carbon pilot and environmental regulation policies as entry points. The research will further verify from the perspective of China’s city database that the development of sustainable financial impact for energy use will further the development of sustainable finance and the use of energy bring specific policy significance, especially under the background of global carbon emissions pressure, assessment of all kinds of environmental regulation policy and financial policy will also contribute to the practice of energy transformation.

In the context of global climate risk frequency, China’s low-carbon transformation requires enterprises to improve energy efficiency and then reduce carbon emissions; this paper wants to discuss whether the sustainable financial development level at the urban level in China can optimize the energy use of enterprises and improve the energy use efficiency of enterprises. This paper aims to study the impact of sustainable finance development on energy efficiency, further enrich the role and impact of sustainable finance, and verify the effectiveness of sustainable finance development. The empirical findings demonstrate that sustainable finance will support advancing energy efficiency through technological innovation and optimizing industrial structure. The degree of environmental regulation and the implementation of low-carbon pilot policies moderate this process. Sustainable finance has a more significant impact on energy efficiency in non-low-carbon pilot cities with strict environmental regulations. Additionally, due to the variation in technology levels, the effect of sustainable finance on energy efficiency will also experience structural fractures. The improvement effect of sustainable finance on energy efficiency increases with the technology level.

The rest of this essay is structured as follows: The current research status and development trend of sustainable finance and energy efficiency are roughly clarified in Chapter 2 by methodically reviewing and summarizing the relevant literature, qualitatively analyzing the relationship and influence mechanism between the two, and proposing several hypotheses based on them; The third chapter provides a thorough introduction to data collecting, index creation, and model creation; The hypothesis is empirically analyzed in chapter 4, which also conducts the mediation effect test and the moderating effect test based on the fundamental model. The analysis and proof of the previous results and policy proposals form the basis of the fifth chapter.

2 Literature review and research hypotheses

To direct the distribution of social resources and support the growth and expansion of the environmental protection and energy conservation industries, sustainable finance employs a variety of financial tools and regulations. As a result, it can simultaneously consider the economy’s healthy and sustainable growth and the achievement of low-carbon and energy-saving targets (Liu et al., 2021). Starting with the supply side, financial institutions encourage the development of green financial products, accelerate the growth of green, energy-saving, and environmental protection industries, and allocate funds to various enterprises in various ways (Chiu and Lee, 2020). Financial institutions, on the one hand, increase the return on investment of businesses by offering green financing options like green credit to green businesses, employing discounted interest rates, and using other strategies to successfully pull the investment of green businesses (Sadorsky, 2010); On the other hand, financial institutions endogenize the negative externalities of their environmental costs for businesses with high emissions and low production capacity, increasing the costs and financing challenges of businesses with high water, energy, and pollution levels. This prevents the growth of high energy-consuming industries and boosts energy efficiency (Sadorsky, 2010; Bak et al., 2013). Second, from the demand side, sustainable finance strengthens residents’ environmental responsibility and awareness by raising awareness of environmental protection and low-carbon consumption, constructing an environmental protection and low-carbon consumption system, encouraging residents’ green consumption, and encouraging residents’ green investment, which forces the conversion and upgrading of inefficient energy-consumption industries to environmentally friendly industries and thereby increases energy efficiency (Frederick, 2012; Chen et al., 2014; Shao, 2020).

Based on the above influence mechanism, Hypothesis 1 is proposed in this study.

Hypothesis 1:. The development of sustainable finance has a catalytic effect on the improvement of energy efficiency.

Since 2010, low-carbon pilot programs have been implemented in 87 cities across China, and the influence of these initiatives on energy efficiency remains a topic of ongoing debate. Some studies suggest that these programs have bolstered local governments’ commitment to incentivizing the transition from high-carbon to low-carbon enterprises through the strategic utilization of policy instruments and market-driven approaches (Cheng et al., 2019). Conversely, other research indicates that the overall impact of low-carbon pilot initiatives on energy efficiency is unpredictable, contingent upon the varying magnitudes of both positive and negative effects. While some environmental costs can potentially be mitigated through innovative compensation mechanisms, the precise level of such compensation remains uncertain (Porter and Linde, 1995). Building on this analysis, this paper posits Hypothesis 2.

Hypothesis 2:. Low-carbon pilot policies have a moderating role in sustainable finance, affecting energy efficiency.

Environmental regulation is a state-led social regulation with essential requirements that might directly impact the area’s industrial structure, such as through taxation. Technological advancement and industrial structure both affect how environmental legislation affects energy efficiency. Ecological regulation can assist businesses in developing a favorable innovation environment while staying within realistic bounds from the technical innovation perspective. Partially or entirely counterbalance the economic pressure brought on by environmental laws. In contrast, overly strict and unjustified ecological regulations will have a detrimental effect on businesses and impede the development of green technology. The improvement in consumer knowledge of environmental protection from the standpoint of industrial structure encourages the optimization and upgrading of regional consumption patterns and further pushes businesses to implement technological change on the consumer side. The study shown above can be compared to the analysis of the cost internalization theory. However, it is still being determined how the costs associated with environmental regulation and technology compensation balance each other out (Coase, 1992). Based on the above analysis, Hypothesis 3 is proposed.

Hypothesis 3:. The intensity of environmental regulation has a moderating role in sustainable finance, affecting energy efficiency.

3 Methodology and data

3.1 Model specification

According to the theoretical analysis presented above, the amount of green finance impacts the advancement of energy structure and efficiency. The intermediate channel of influence is mainly through technological innovation and industrial structure upgrading. To test the effect of environmentally friendly financial development on energy efficiency through regulating variables, green finance is added to the basic model as the primary explanatory variable, and the level of industrial structure optimization and technological innovation are added as significant explanatory variables (Model 1).

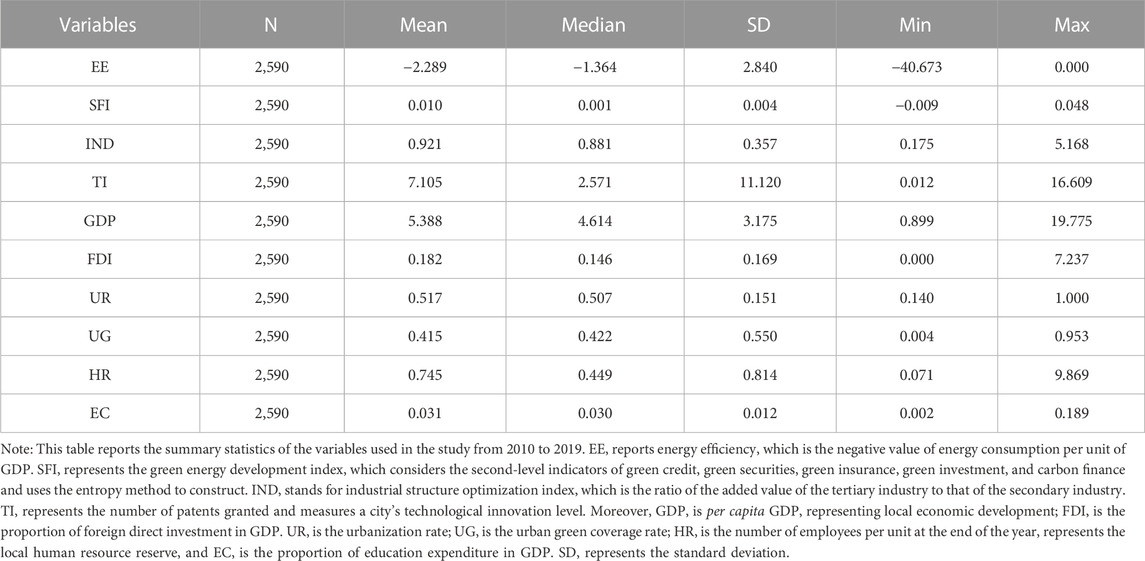

In Model (1), EEit represents energy efficiency. The negative value of energy consumption per unit of GDP is adopted to facilitate interpretation. SFIit represents the Comprehensive index of green finance development level, which considers the second-level indicators of green credit, green securities, green insurance, green investment, and carbon finance and uses the entropy method to construct. INDit stands for industrial structure optimization index, which is the ratio of the added value of the tertiary industry to that of the secondary industry. TIit represents the number of patents granted and measures a city’s technological innovation level. Model (1) estimates mainly used a fixed effects model with multiple linear regression, where we controlled for urban fixed effect and year fixed effect while controlling for robust standard error at the regional level of the city.

Moreover, control variables of the level of urban economic development, urban construction, amount of foreign investment, and human resources are also introduced to avoid variable omission. Among them, GDPit represents per capita GDP, representing the level of local economic development; FDIit is the proportion of foreign direct investment in GDP; URit is the urbanization rate, which is equal to the proportion of the urban population in the total population; UGit is the urban green coverage rate; HRit is the number of employed at year-end, which represents the local human resource reserve, ECit represents the proportion of education expenditure in GDP. Based on the above research contents and assumptions, variables to be collected or constructed in this paper include explained variables -- energy efficiency; core explanatory variable -- green finance development index; control variable -- industrial structure, technological innovation, urbanization rate, opening-up degree, human resources, etc. See Table 1 for the specific definitions.

3.1.1 Dependent variable: Energy efficiency

Energy consumption efficiency can be measured using either a single factor or a combination of factors. Regarding single-factor energy efficiency, there are primarily two approaches: 1) Taking industrial enterprises as research objects, using the total energy consumption of coal, oil, and electricity to measure energy use efficiency (Karen et al., 2004; Zhang et al., 2020). The research scene with industrial companies or industrial industries as the research object, however, is more suited for this strategy; 2) When energy is a factor of production, energy efficiency is stated as the average total energy consumption per unit of GDP to quantify the benefit output capacity (Perez-Lombard et al., 2014); If multi-factor energy efficiency is mentioned, there are three primary approaches: 1) Calculating total factor energy efficiency using the DEA method, taking into account all energy variables and other input elements in actual production; 2) According to the CRS hypothesis, total factor energy efficiency was constructed using energy, physical capital, and human capital as input variables, GDP as the expected result, and industrial wastewater, industrial waste gas, and carbon emissions as the unanticipated output (Pang et al., 2015). 3) Measure energy efficiency by the ratio of energy input and service output (Perez-Lombard et al., 2014).

When deciding which of the two types of energy use efficiency measurements, some academics contend that single-factor energy efficiency places more emphasis on the financial gains made during the energy utilization process than multi-factor energy efficiency does on the technical properties of energy output. Based on the abovementioned justifications, this study employs the inverse of GDP per unit of energy usage as an energy efficiency index. The energy efficiency unit is also consistently converted to 10,000 tons of regular coal (Luis and Velazquez, 2013).

3.1.2 Core independent variables: sustainable finance index

In the existing literature (Bi et al., 2014; Akomea-Frimpong et al., 2022), there are mainly two ways to measure the level of development of the environmentally friendly financial system: 1) The single-dimensional variable sustainable credit is used to measure it (Xu and Li, 2020); 2) Conduct a sustainable credit, sustainable securities, sustainable insurance, sustainable investment, and sustainable carbon finance development index system (Xie and Hu, 2021; Zhang et al., 2022). The second approach, the entropy value method, is used in this paper to create a relatively complete sustainable finance development index.

Referring to previous studies, sustainable credit equals the balance of sustainable urban loans, but it is not easy to collect data on sustainable urban loans. The stock refers to the practice of Tian et al. (2022) using the balance of loans of urban financial institutions to estimate the balance of sustainable credit, that is, first calculate the proportion of the balance of loans of urban financial institutions in the balance of loans of national financial institutions, and then multiply the proportion by the balance of sustainable federal loans (Caroline, 2021). To get the estimated value of the sustainable loan balance of the city (Tian et al., 2022).

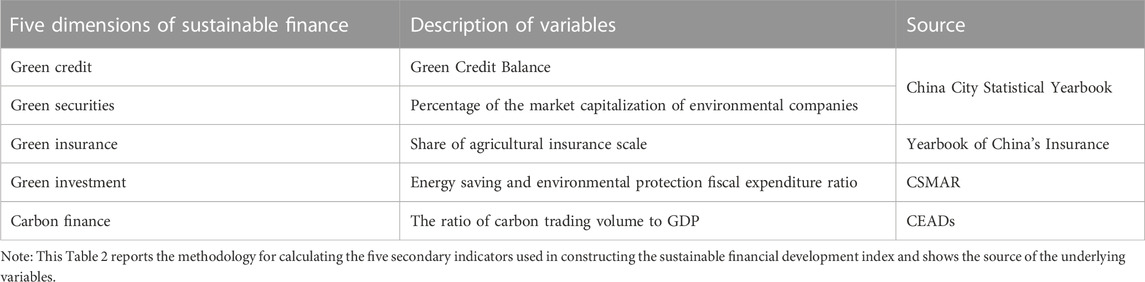

In addition, sustainable securities are equal to the proportion of the A-stock market value of local environmental protection enterprises in the total A-share market value of local enterprises. Sustainable insurance is equal to the proportion of local agricultural insurance income in total insurance income, green investment is equal to the government’s fiscal expenditure on energy conservation and environmental protection divided by GDP, and carbon finance is the ratio of carbon dioxide emissions to GDP. The specific index system is shown in Table 2.

Regarding the sustainable financial development index, we consider green credit, green bonds, green securities, etc. These indicators will play different roles, so we use the entropy method to evaluate different points. Weight can represent green credit, green bonds, green securities, and green insurance represent differentiation, respectively. Among them, the entropy weight method is an objective empowerment method based on the principle that the less the degree of variation of the index, the less the information reflected, and the lower the corresponding weight should be. When the entropy method is used to weigh each index, the first step is to standardize the data, so there is no need to worry about different units of different indicators. The entropy method determines the weights as follows.

① Data standardization: the maximum and minimum standardization method is usually used

② Calculate the information entropy of each index:

In model (2),

③ Determine the weight of each index:

The entropy value of each index is calculated through step 2:

3.1.3 Control variables

We selected the following variables according to Huo et al. (2022) and other authoritative papers on energy efficiency. Industrial structure and technological innovation are key factors affecting energy efficiency. In addition, the urban economic development level, human resource reserve, and urban construction level may also impact energy efficiency. Other possible control variables must be introduced to prevent missing variables from distorting analysis results. 1) industrial structure, the change of industrial structure is the critical intermediate variable of green finance affecting energy consumption, which is expressed by the ratio of the added value of the tertiary industry to that of the secondary industry; 2) technological innovation level, represented by the number of patents granted by the city in the current year; 3) the level of economic development is expressed by the per capita GDP of the city in that year; 4) the degree of opening-up, expressed by the ratio of foreign direct investment to GDP; 5) the level of urban construction, involving two indicators of urbanization rate and urban green coverage rate, wherein the urbanization rate is equal to the proportion of the urban population in total population; and 6) the human resource reserve of a city, which also involves two indicators -- the number of employees and the proportion of education expenditure in GDP.

3.2 Data source and pre-processing

3.2.1 Data acquisition

The main difficulty of this paper is to obtain prefecture-level data and construct the index system. Data acquisition, GDP, fiscal expenditure, foreign direct investment, urbanization rate, and the number of patents authorized can all be collected and downloaded from the CEI DATA or CSMAR database. It is not easy to obtain sustainable credit data to construct the sustainable finance development index. The mainstream way is to measure central banks’ sustainable loan balance ratio. However, it is not easy to obtain the sustainable loan data of central banks at the prefecture-level city level. Therefore, through reading the literature, it is decided to use the ratio of the loan balance of city financial institutions to the total loan of national financial institutions to estimate. Furthermore, the loan balance of each significant bank financial institution can be obtained from the China City Statistical Yearbook. Secondly, it is also complicated to get agricultural insurance data. Most of the existing agricultural insurance data are at the provincial or county level, but data must be at the prefecture-level city level. Therefore, the county data is matched and added to the prefecture-level agricultural insurance data.

The total energy consumption at the city level refers to the practice of Wang et al. (2022). In the China City Statistical Yearbook, the energy consumption of natural gas and liquefied petroleum, the electricity consumption of the whole society, and urban heating (steam heating, thermal power plant heating) are checked and sorted out. The total energy consumption is obtained through the conversion coefficient of standard coal.

3.2.2 Missing value processing

Most of the above variables have a certain amount of missing value, and the missing value of each variable is between 5% and 18%. Methods such as provincial data substitution and trend value of adjacent data are used for interpolation. For example, agricultural insurance data covers 800 grain-producing counties in the country also see “China Insurance Yearbook” added the successfully matched prefecture-level city data, but China has a total of about 1,600 county-level administrative regions, in addition to unmatched prefecture-level cities, there are still about 20 prefecture-level city agricultural insurance data missing, so the use of the province of the prefecture-level city agricultural insurance data to fill the missing value, the total amount of agricultural insurance income of the province divided by the number of prefecture-level cities to get the average value as the final value of the missing value.

In addition, if there are missing data such as fiscal expenditure, urbanization rate, and the number of patent grants, all the data are arranged in the order of prefecture-level cities and statistical year so that the observation objects with adjacent missing values are prefecture-level cities belonging to the same province, and the statistical year is also arranged by time. Then, the trend value of adjacent values is used to fill in, which can achieve better results.

3.2.3 Data matching and descriptive statistics

Since there are differences in the identification of prefecture-level city names in different data tables, such as “Beijing City” instead of “Beijing” in the urbanization rate table, or “Kashgar City” will also be identified as “Kashgar region,” there may be problems in the matching process. The solutions are as follows: Firstly, each prefecture-level city is coded according to the code of the Chinese administrative division to form the standard coding table of prefecture-level city, province, and prefecture-level city. Secondly, Python is used to fuzzy match the names and codes of prefecture-level cities in each form, and the city names are converted into administrative district codes, thus realizing the unique identification of city names. Finally, the modeling data is obtained using the prefecture-level city code for data matching. In the final data obtained, the modeling data can be obtained by standardizing the final data.

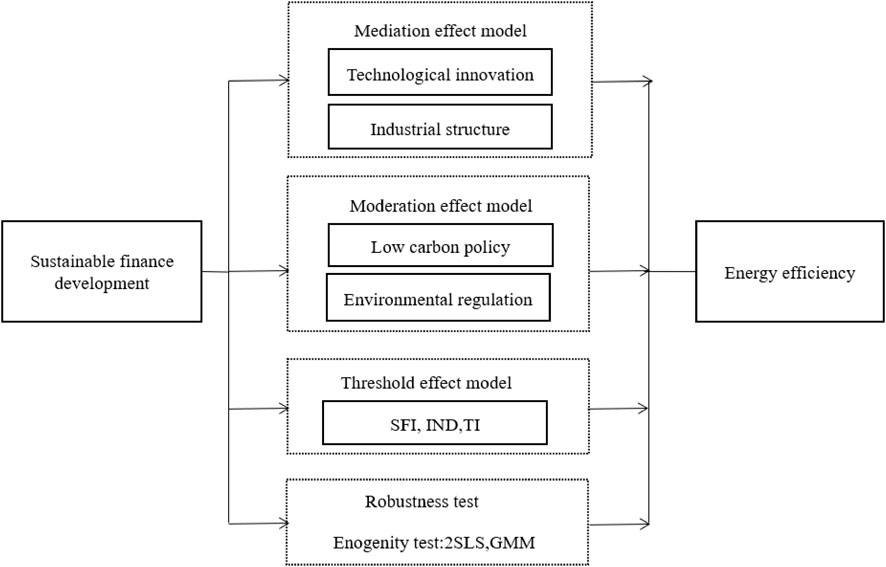

Then, this research will follow the following conceptual framework (see Figure 1), highlighting the methodological approach. We used the econometric software Stata 17.0 in our study. Indeed, the Stata commands used in this study included reg, xtreg, ivreg2, ivregress, xtabond, xtdpdsys, xthreg, and vif. These commands were used to realize the preliminary tests and the model estimations. We also used the econometric software Python3.0 in our study. Indeed, the Python 3.0 commands used in this study included pandas, numpy, and math. These commands were used to realize the preliminary tests and the model estimations”.

The description and statistics of the original data are shown in Table 3. According to the descriptive statistics results, key variables such as energy efficiency, sustainable finance, industrial structure, and technological innovation have a certain degree of variability, which meets the requirements of the study. The mean of EE is-2.289, the standard deviation is 2.840, the mean of GFI is 0.010, the standard deviation is 0.004, the maximum GDP growth rate is 19.775, indicating that the urban GDP growth rate can reach 19.775%, the lowest is 0.899%, the average is 5.388%, and the standard deviation is 3.175, indicating the GDP growth rate of different cities, which is consistent with the actual difference of different cities. UR represents the urbanization rate, of which the average urbanization rate is 51.7%, indicating that with the continuous promotion of urbanization, the urbanization rate of more than half of Chinese cities exceeds 50%, the maximum value is 100%, the minimum value is 14%, and the standard deviation is 0.151. EC refers to the proportion of education expenditure in GDP, of which the maximum value is 18.9%, the minimum value is 0.2%, and the average value is 3.1%.

3.2.4 VIF test

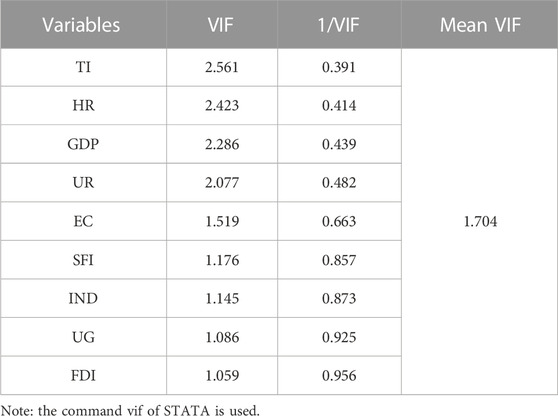

It is essential to test and measure multicollinearity between variables in the model; therefore, the variance inflation factor (VIF) test was calculated. Table 4 shows the model’s VIF-test result. The mean VIF of 1.704 represents low multicollinearity among the model variables, as the rule of thumb suggests a mean VIF value of 6 or lower to proceed with the model estimation.

4 Empirical results and analysis

4.1 The influence of sustainable finance on energy efficiency

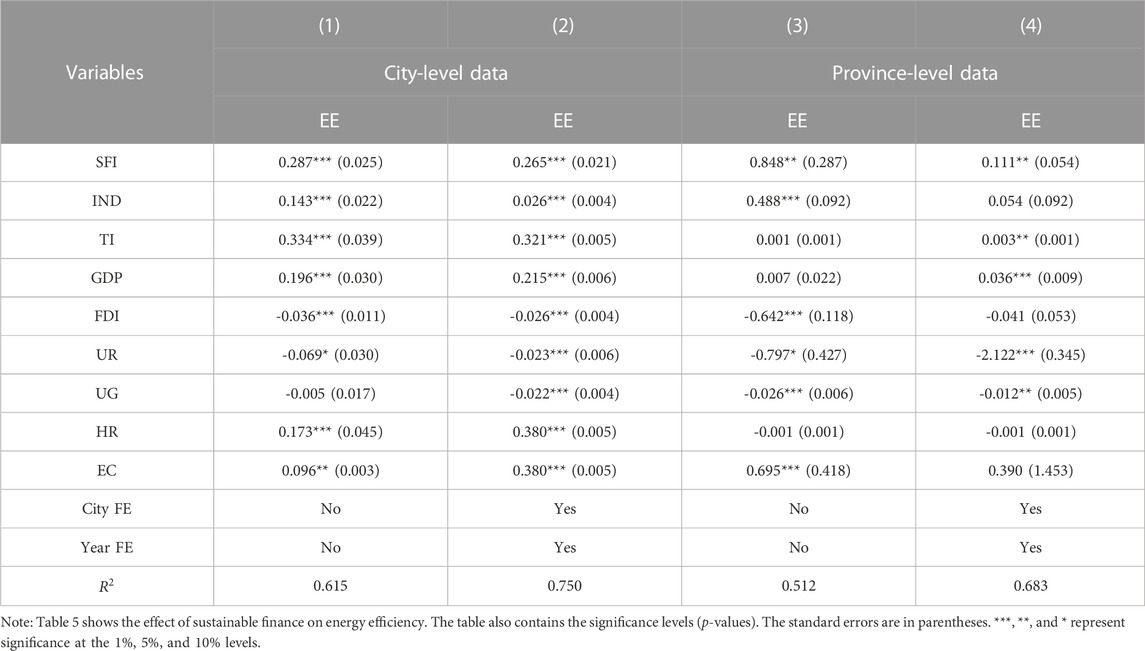

The data utilized in the modeling is stable because, according to the findings of the LLC panel unit root test performed on panel data, all variables pass the test. The regression results are then established using a conventional panel regression model and are displayed in Table 5. It can be seen that the regression coefficient of sustainable finance is positive (the coefficient is 0.111) and significant at the level of 1%, regardless of whether fixed effects are controlled or not, whether provincial data or city-level data, indicating that an increase in sustainable finance level can significantly improve energy utilization efficiency. Specifically, Column (1) (2) is the city level of sustainable finance index, from column (1) of Table 5, when the control year and urban fixed effect, the coefficient of sustainable finance is 0.111, standard error is 0.054, t value is 2.05, significant at 5% level, from the column (2) of Table 5, when the coefficient of sustainable finance is 0.848, standard error is 0.287, t value is 2.95, significant at 1% level. Column (3) (4) measures the sustainable finance index at the provincial level, as can be seen from column (3) of Table 5, when the control year and urban fixed effect coefficient is 0.265, the standard error is 0.021, t value is 12.62, significant at 1% level, from the column (4) of Table 5, when not control year and urban fixed effect, the coefficient of sustainable finance is 0.287, the standard error is 0.025, t value is 11.48, significant at 1% level. Since the socialist construction period, China has focused on developing heavy industry to establish an advanced industrial system. Against this backdrop, financial institutions have also concentrated resources into high energy- and pollution-intensive industries and imported foreign capital has naturally been pushed into these industries under the stimulus of policy advantages, making environmental pollution and excess capacity increasingly problematic. Even if The Times has recently made sustainable development a trend, many regions and sectors still need help with the transition. Sustainable finance is the solution to this issue. Financial institutions offer favorable loan products to businesses that conserve energy to increase their social capital, diversify their funding sources, and lower their financing costs (Muganyi et al., 2021; Revell and Goldsmith, 2021).

Furthermore, employing an interest rate decrease and an extension of payback terms assists them in reviving their operating capital and enhancing their return on investment. On the other hand, the state and the government spare no effort to implant the concept of sustainable consumption and sustainable investment in the general people. These efforts have successfully boosted the development vigor of the sustainable sector. Most individual investors and consumers also need to understand the broad contours of sustainable development and progressively create a sustainable consumption structure. Creating and growing a sustainable financial system may ease China’s resource and environmental problems. They are shifting substantial financial resources to the sustainable sector, encouraging the improvement and modernization of the industrial structure as a whole, and enhancing the effectiveness of energy utilization.

Most individual investors and buyers also know the necessity of comprehending the broad principles of sustainable development and gradually developing a sustainable consumption structure. Developing and expanding a sustainable financial system will help China’s resource and environmental issues. We are directing significant financial resources toward the sustainable sector, promoting the modernization and advancement of the industrial structure, and increasing energy efficiency. After the new development pattern was proposed, our country issued a series of policies to promote sustainable development plans, among which fostering technological innovation and industrial structure optimization and upgrading are the two most important means to start from the supply side. China’s manufacturing industry has long been dominated by low-end manufacturing, which has become a long-term challenge to crack the “curse” of energy waste. Establish a “win-win” scenario for economic growth and environmental protection.

The estimated coefficient of economic development among the remaining control variables is significantly positive at the significant level of 1%, indicating that China’s economic development can generally improve energy efficiency. This is because development goals and forms have been appropriately and positively adjusted throughout China’s development. Technology-intensive development has the potential to increase production effectiveness as well as product competitiveness. Additionally, it can implement the development philosophy that “clear waters and green mountains are invaluable assets” and encourage energy saving and emission reduction. According to Table 5, opening up to the outside world performed substantially worse than expected. This shows that foreign investment has not increased our nation’s energy efficiency, which is still directly tied to the direction of foreign investment. Our overall technical level and economic development are far behind those of industrialized countries at the time of our WTO admission. We can only trade quantity for quality as a result. Generally speaking, foreign investment is concentrated in energy-intensive and low-end industrial sectors, and these investments still need to improve technical sophistication and energy efficiency. In addition, the predicted coefficient of urbanization level is markedly negative. Urban people use more resources for food, clothing, housing, and transportation as the rate of urbanization rises, which is reflected in the decline in energy efficiency. The significant positive correlations between human capital and education spending show that the development of human resources helps increase energy efficiency.

4.2 Robustness tests and endogeneity issues

4.2.1 Robustness tests by replacing the dependent variable and using provincial data

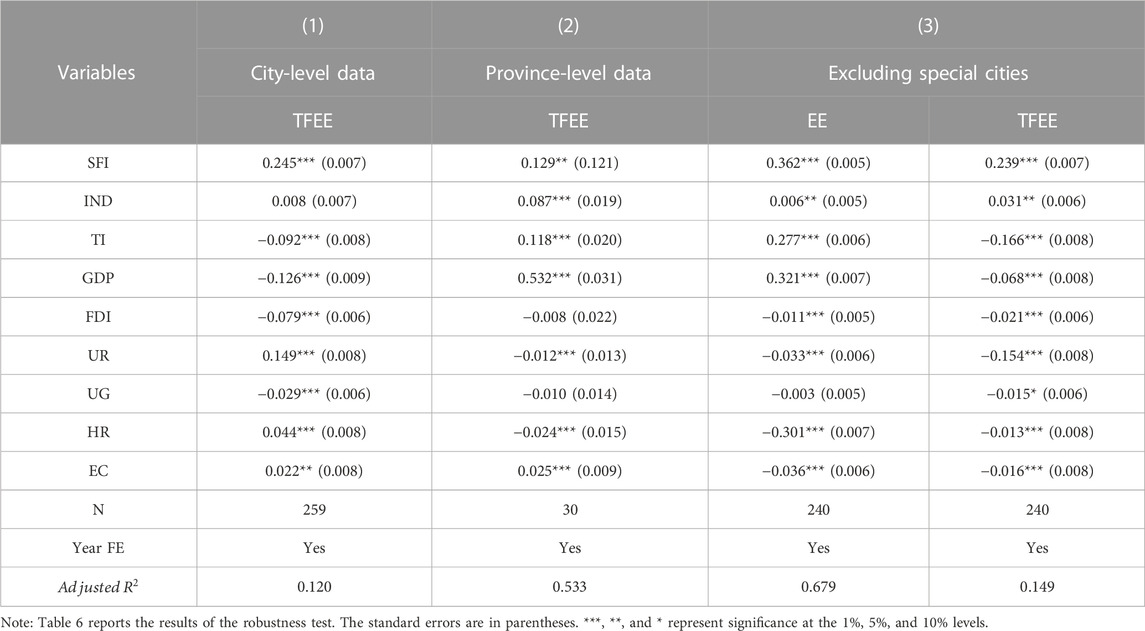

Changes to the dependent variable, adjustments to the sample size, and removal of the particular sample were all taken into account while assessing the robustness of the previous regression model. The results of the robustness tests are shown in Table 6.

At the local and municipal levels, total factor energy efficiency (TFEE) is regressed as a proxy variable for energy consumption per unit of GDP (EE). TFEE is calculated by using urban GDP as the desired output, industrial wastewater, industrial waste gas, and carbon emissions as non-desired outputs, and input factors as energy consumption and the average number of employees, using DEA analysis. The regression results show that the core explanatory variable (GFI) is still significantly positive. The main explanatory variables, such as environmental regulation, industrial structure, and technological innovation, are also significant. The sign does not change, indicating that the findings remain robust and the conclusions are valid after replacing the same type of dependent variables.

After that, the regression analysis was conducted by replacing the provincial-level data, and the results of the analysis showed that the effect of the level of sustainable finance development on energy efficiency was significant regardless of whether the dependent variable was all-factor energy efficiency (TFEE) or single-factor energy efficiency (EE).

In the previous analysis, the extraordinary city sample was not treated. Since China consists of four municipalities directly under the central government and 15 sub-provincial cities, the financial industry and economic strength of these cities are more different from other cities, and the regression was conducted again after excluding these nineteen cities to make the results more robust and accurate. From the regression results, the main explanatory variables, such as the level of sustainable financial development, environmental regulation, industrial structure, and science and technology innovation, are still significant. The direction of the sign does not change, indicating that the effects of each explanatory variable on energy efficiency are consistent with the benchmark regression after excluding the unique city samples, which also indicates that the conclusions drawn from the study are robust.

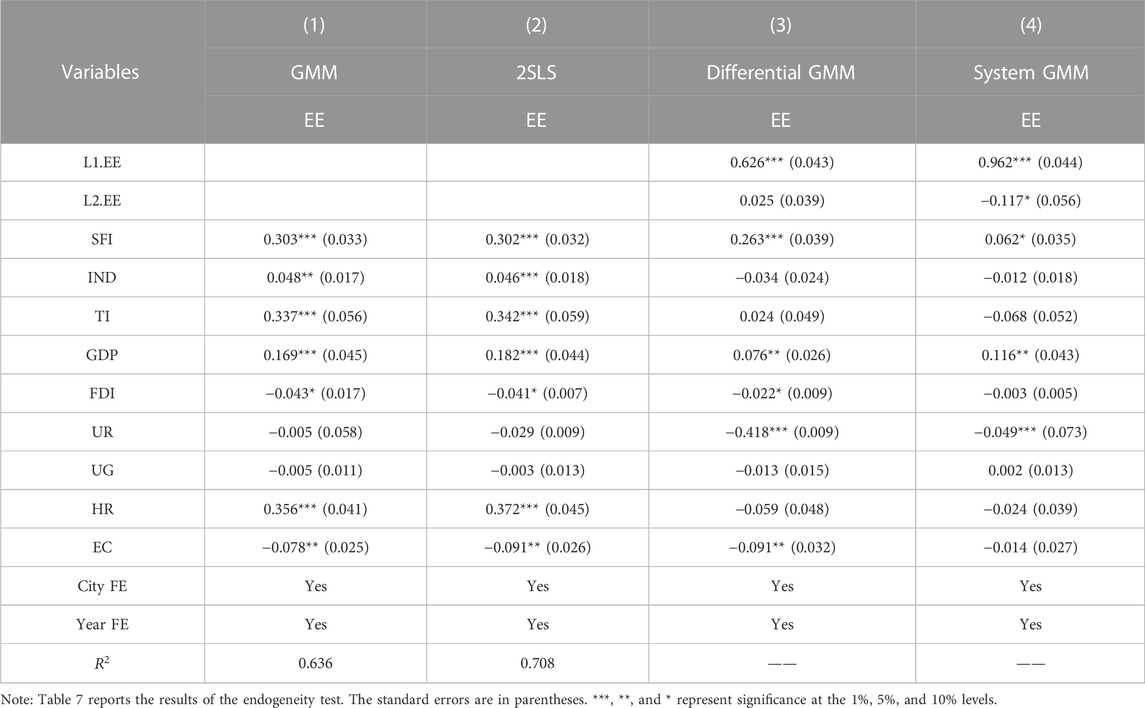

4.2.2 Endogeneity problem by 2SLS and GMM

There are many influencing factors for energy efficiency. Although the above model has included all kinds of mainstream control variables in previous studies as much as possible, it still cannot fit all potential influencing factors, so there may be endogeneity. On the other hand, there may be reverse causality between sustainable finance development level and energy efficiency improvement, which may produce endogeneity problems. Therefore, this paper tests and mitigates the endogeneity problems through two steps.

In the first step, instrumental variables are introduced to conduct the correlation and Sargan tests. The instrumental variable for the sustainable finance development index is understood to be the trailing phase of the index. The instrumental variable passes the correlation test and Sargan test, and it is believed that the lagging phase of the sustainable finance development index meets the correlation and exogenous demand of the instrumental variable. Then, GMM and 2SLS are used for regression analysis, and the regression results are shown in columns (1) and (2) in Table 7. It can be seen that the regression results of generalized moment estimation and two-stage least squares are significant, and the estimated value of the coefficient is very close to the benchmark panel regression model of city-level data, which further verifies the reliability of the instrumental variables. The dynamic panel model was additionally constructed; the explanatory variable included the lagged item of the explained variable (EE) to regress, and the endogeneity problem of the model was observed. This paper used differential GMM and system GMM to re-estimate the basic regression model. The model is as follows:

4.3 Analysis of the mechanism of sustainable finance on energy efficiency

The stepwise test regression coefficient approach is first used to determine whether the growth of sustainable financing will increase energy efficiency through the effects of industrial structure optimization and technological innovation. The Sobel method will be used if the test findings are not statistically significant. To analyze whether green finance will affect energy efficiency through industrial structure and technological innovation, this paper uses the causal gradual regression method to analyze the mediation effect. The causal stepwise regression method, proposed by Baron and Kenny (1986), has three steps: First, analyze the regression of X to Y to test the significance of the regression coefficient; second, analyze the regression of X to M to test the significance of the regression coefficient; third, analyze the regression of X to Y after adding the mediation variable M to test the significance of the regression coefficient of X and M. The results show that industrial structure and technological innovation both play an intermediary role in promoting energy efficiency through the development level of green finance.

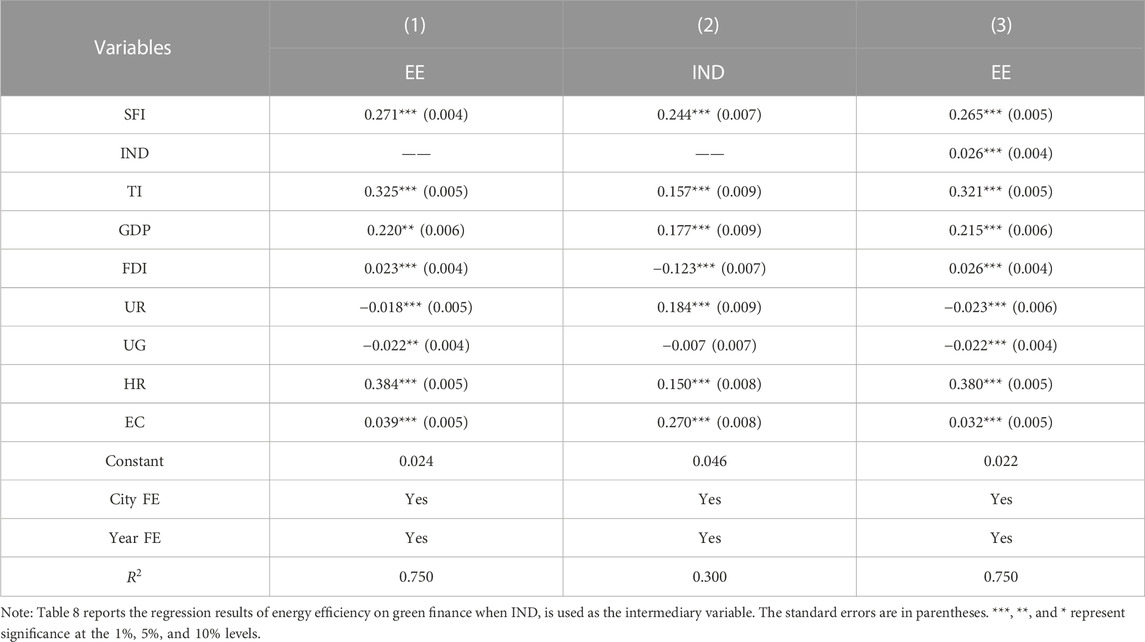

4.3.1 Model analysis of industrial structure as a mediating variable

A stepwise regression test is conducted on industrial structure as an intermediary variable to investigate if an industrial structure is a significant factor in the relationship between sustainable finance and energy efficiency. When no industrial structure is included in the model, as shown in Column 1 of Table 8, the regression coefficient of sustainable finance development is 0.271, which, at a significance level of 1%, could significantly boost energy efficiency—indicating that, on average, energy efficiency increases by 0.271 units for every unit increase in the development level of sustainable financing. Technological advancement, economic growth, opening to the outside world, human resources, and education spending are among the other control factors that are significantly positive. At the same time, the urbanization rate and urban greening are significantly unfavorable. The regression findings are displayed in Column 2, with sustainable financing as the primary explanatory variable and industrial structure as the explained variable. The regression coefficient is 0.244, and the results demonstrate a substantial relationship between the level of sustainable finance development and the enhancement of industrial structure. It demonstrates that, on average, every unit of sustainable finance expands the industrial structure by 0.244 units, and other control variables, among which scientific and technological innovation, economic development, urbanization rate, human resources, and education expenditure are positive prominence are significant besides urban greening but not urban greening.

In contrast, opening to the outside world is negatively significant. The regression findings are displayed in Column 3, with industrial structure as the intermediary variable and energy efficiency as the explanatory variable. The findings demonstrate that the improvement effect of industrial structure on energy efficiency is equally significant and favorable, as is the improvement effect of sustainable finance development level. Combining the regression results with the industrial structure, the level of sustainable financial development in China facilitates the transfer of energy efficiency improvement.

4.3.2 Model analysis of technological innovation as a mediating variable

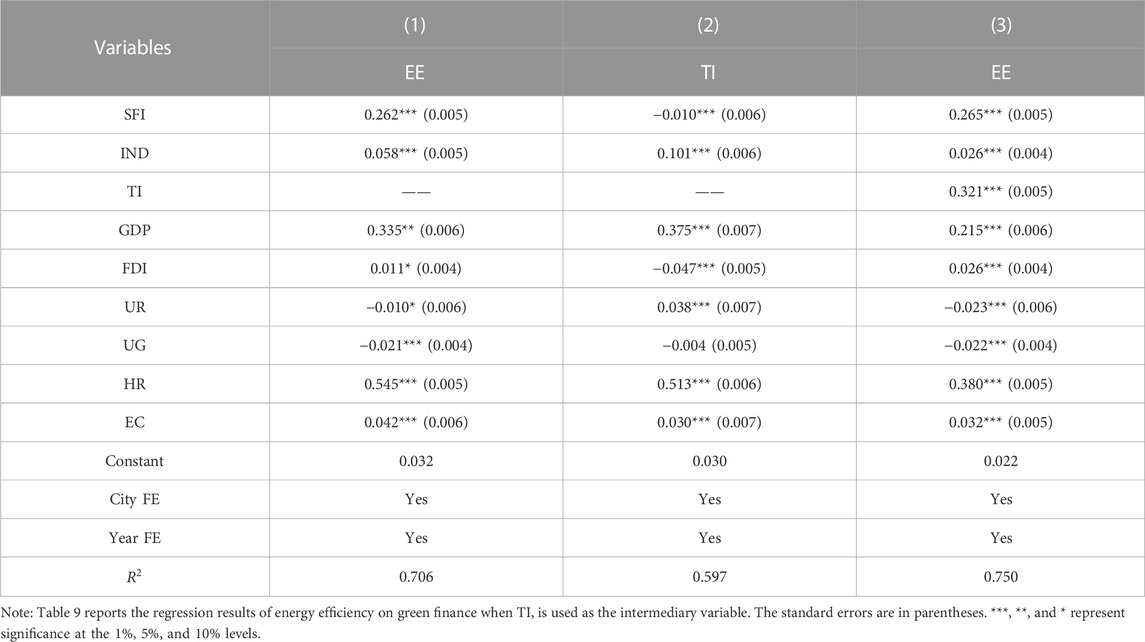

Then, using technological innovation as an intermediary variable, do a stepwise regression test to determine whether technological innovation contributes significantly to increasing energy efficiency by the degree of sustainable finance development. When energy efficiency is the explained variable and technological innovation is not included in the model, Table 9 Column (1) displays the regression findings using sustainable financing as the primary explanatory variable. As can be seen, the development level of sustainable finance is positively significant at the 1% significance level. The regression coefficient, or total effect of the influence, is 0.262, meaning that for every unit increase in the development level of sustainable finance, the energy efficiency increases by 0.262 units on average. While urbanization rate and urban greening exhibit negative importance, other control factors like industrial structure, economic development, opening to the outside world, human resources, and education spending all show positive significance. The regression findings are displayed in Column 2, with technological innovation as the explained variable and sustainable financing as the main explanatory factor. The regression coefficient is 0.010, indicating that sustainable finance significantly improves technological innovation. The improvement effect of sustainable finance on energy efficiency is still significantly positive in Column 3 after the intermediary variable technology innovation is added, and the improvement effect of technology innovation on energy efficiency is also positive. The value of the regression coefficient also slightly rises. It can be deduced from the above regression results that technological innovation is a critical intermediary in the energy efficiency improvement process supported by China’s degree of growth in sustainable financing.

4.4 Heterogeneity analysis

From a national perspective, sustainable finance’s direct and indirect effects on energy efficiency are examined above. Second, the effects of explanatory factors in various locations may change due to variations in financial development level, economic development level, resource endowment, and policy intensity in various cities. It is intended to analyze the heterogeneity of the following two systems concerning prior practices.

First, the samples were split into low-carbon pilot cities and non-low-carbon pilot cities for regression to examine how sustainable finance differed between the two types of cities in its effect on energy efficiency (Zhou et al., 2020). Currently, China has implemented 87 pilot low-carbon cities in three batches between the years 2010 and 2017.

Second, considering the moderating effect of environmental regulation level1 on the energy efficiency of sustainable finance development level, the median environmental regulation level of the sample data was taken as the cut-off point, and the sample cities were divided into two categories: high and low environmental regulation level, considering the difference of influence of sustainable finance development level on energy efficiency under different environmental regulation levels.

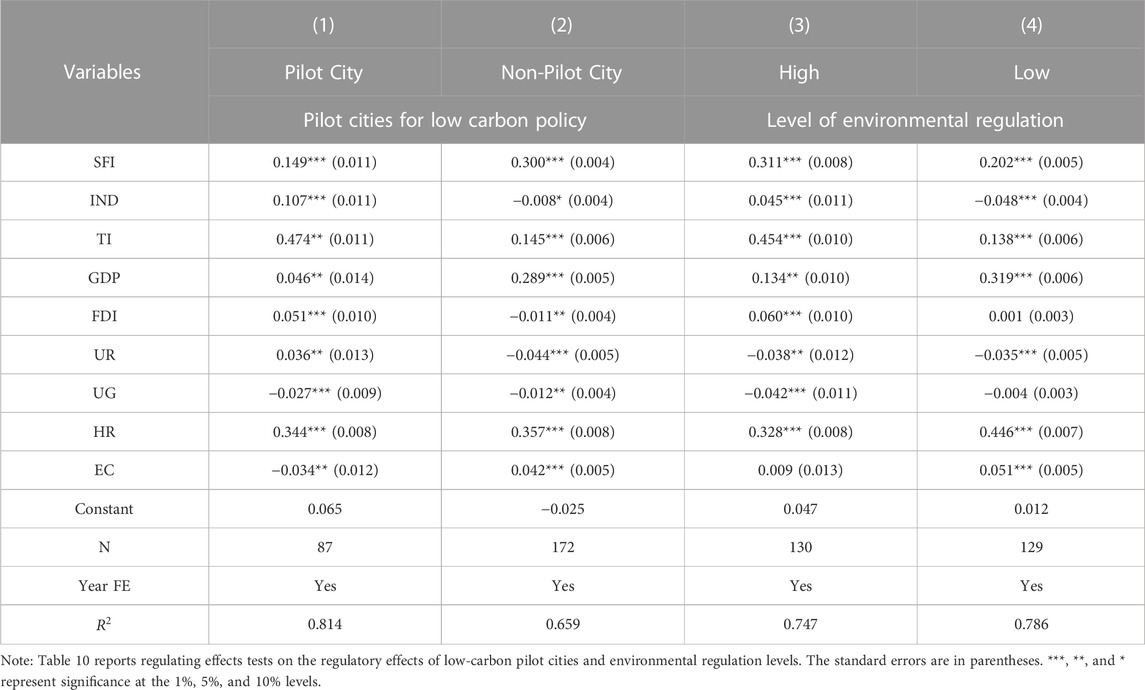

Columns 1 and 2 of Table 10 display the findings of the heterogeneity analysis about implementing the low-carbon pilot program. The regression coefficient of sustainable finance development level is positively significant in both low-carbon pilot cities and non-low-carbon pilot cities, indicating that sustainable finance development level significantly impacts the improvement of energy efficiency in both low-carbon pilot cities and non-low-carbon pilot cities. This finding is significant at the 1% level of significance. However, in low-carbon pilot city settings, the absolute value of the regression coefficient of sustainable finance development level is more significant. Non-low-carbon pilot cities are mostly resource-based and industrial cities with large energy consumption bases, so implementing sustainable finance policies here can reap more significant marginal effects.

Columns 3 and 4 of Table 10 display the outcomes of the environmental regulatory level heterogeneity study. At the 1% significance level, the regression coefficient of the sustainable finance development level is positive and significant from the perspective of the environmental regulation level, regardless of whether the urban environmental regulation level is high or low. This shows that the sustainable finance development level significantly impacts the improvement of energy efficiency irrespective of the environmental regulation level. Cities with high environmental regulation levels have a regression coefficient of 0.311, higher than cities with low environmental regulation levels. In other words, cities with high environmental regulation levels are more likely to see improvements in their energy efficiency due to the amount of sustainable finance development. This is due to three critical factors. Local governments first develop environmental regulation programs. Through administrative means, local governments raise the budgetary outlay for environmental governance operations, support ecological progress, and boost energy efficiency. Second, the market mechanism also contributes to ecological regulating measures. The tax penalty increases the hidden cost of environmental pollution for businesses on three waste emissions, which forces businesses to create environmentally friendly products with low energy consumption and buy equipment with low energy consumption and low pollution. Third, environmental regulation policies can also enhance the public’s attention to environmental protection. The public is more inclined to sustainable consumption and sustainable investment, and such demand-side transformation can also promote the continuous improvement of green technology level at the supply side, thus improving energy efficiency.

4.5 Further study: Threshold effect analysis

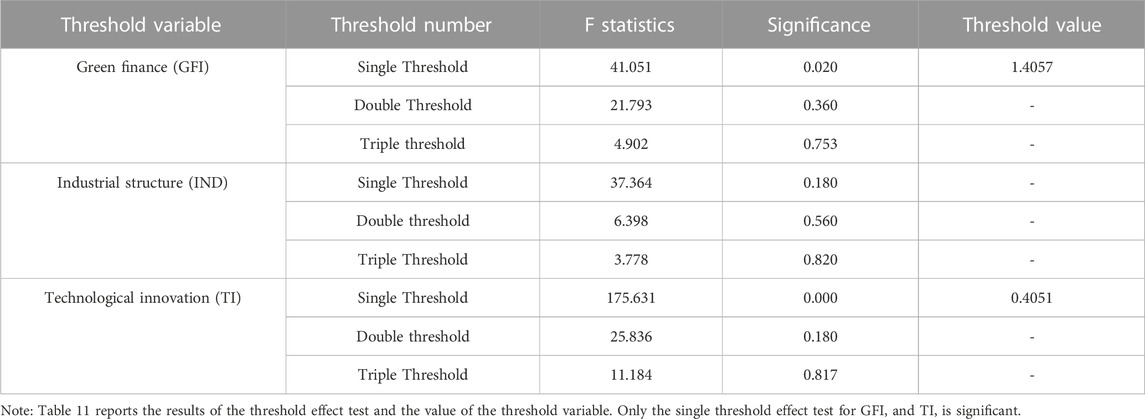

It is apparent from the theoretical analysis above that there needs to be more certainty regarding the impact of industrial structure and technical innovation on energy efficiency. In the regression model with energy efficiency as the explained variable, the relationship between sustainable finance, technological innovation, industrial structure, and energy efficiency may not be linear because of the coexistence of negative and positive effects. The so-called threshold effect refers to the possibility that the estimated coefficients of these key explanatory variables differ significantly. To further investigate the impact of sustainable finance on energy consumption under various levels of technological innovation and industrial structures, a panel threshold regression model needs to be built to assess the threshold effect. With sustainable finance, technological innovation, and industrial structure as the threshold variables, model 3, model 4, and model 5 were established, respectively.

Model 3 to Model 5 are all single-threshold models. As shown in the threshold effect test above, the double-threshold and three-threshold tests are insignificant; the multi-threshold model will not be discussed again. In the above model, δ1 is the threshold value when the threshold variable is greater than the δ1 = 1; otherwise, 0.

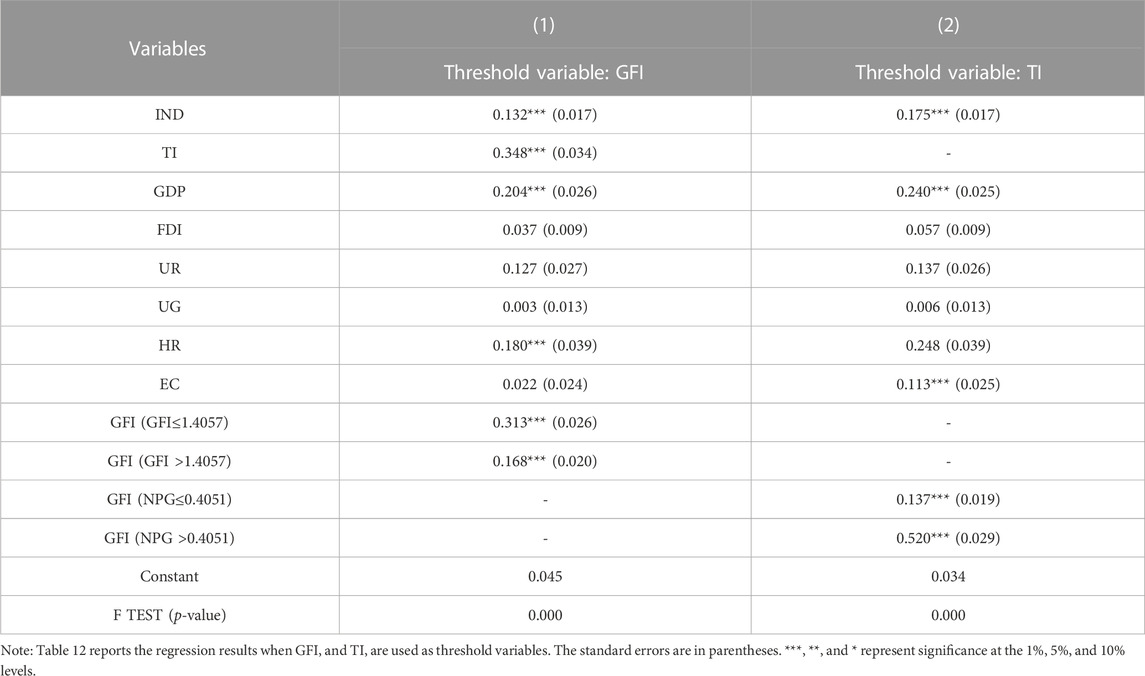

Following benchmark model regression analysis, sustainable financial development can significantly increase energy efficiency by utilizing industrial structure and technological innovation as intermediary variables. Additionally, as the degree of technical innovation and the configuration of the industrial structure can serve as proxies for the features of the entire social market economy, they can be used as threshold factors and incorporated into models of sustainable financing that influence energy consumption efficiency. The test results for single, double, and triple thresholds are displayed in Table 11. As can be seen, under a 5% significance level, technological innovation and sustainable finance passed the single threshold test but failed the double and triple threshold tests. In contrast, industrial structure failed the single threshold test, indicating no threshold effect on the influence of industrial structure. Technological innovation has a threshold value of 0.4456, and sustainable finance has a threshold value of 1.4057, with sustainable finance acting as the dependent variable of the threshold variable.

The panel threshold model is set up for the two threshold variables, and Table 12 displays the regression analysis results. Both sustainable finance and technological innovation pass the F test and have a significant individual fixed impact as the threshold variables. The result in Table 12 demonstrates that the regression coefficient of GFI is significantly positive at the significance level of 1%, regardless of whether the development level of sustainable finance is high or low. However, the regression coefficient of GFI is noticeably positive when the amount of sustainable finance development is low (GFI = 1.4057). When sustainable finance’s development level is higher (GFI >1.4057), the estimated coefficient of sustainable finance is 0.168. The estimated coefficient of sustainable finance is now 0.313. Sustainable finance has a structurally altered impact on energy efficiency. In general, the advancement of sustainable financing helps to increase energy efficiency. The effect of increasing energy efficiency, however, diminished as sustainable finance’s level of development rose. When technological innovation (TI) is the threshold variable, and sustainable finance is the threshold-dependent variable, the threshold effect is depicted in Column 2 of Table 12. The findings indicate that the estimated coefficient of sustainable finance is 0.137 when the level of technological innovation is low (TI = 0.4051) and 0.137 when the level of technological innovation is high (TI > 0.4051). The predicted coefficient of sustainable finance is 0.520, which suggests that as technology advances, the impact of sustainable finance on energy efficiency would alter structurally. The impact of sustainable finance on improving energy efficiency increases with the technological level. When technical innovation is low, energy-intensive sectors are unfriendly to the environment predominate, and total energy efficiency is low. Since implementing a sustainable finance strategy forces enterprises to develop innovative green technologies, they have a financial problem. The efficiency improvement effect is small because they can increase production to compensate for the lost revenue by preserving the environment. Sustainable finance policies can increase energy efficiency more successfully as technology advances and the industry structure shifts from poor energy efficiency to sustainable energy saving.

5 Discussion

5.1 Analyzed results

The key feature of our sustainable Financial Development index is green sustainability and comprehensiveness. Green sustainability is characterized by green finance. Highlight the primary connotation of green finance. Green finance is the product of the organic integration of financial industry and sustainable development. Its connotation involves green financial systems, green financial markets, green financial instruments, green financial institutions, green financial supervision, and many other aspects. But in essence, all aspects of green finance are designed to readjust the financing behavior of the financial industry and promote sustainable development. Therefore, when constructing the measurement index system, we always focus on the connotation of green finance, focus on the financial field which is conducive to promoting the sustainable development of the economy, society, and environment, and eliminate the influencing factors with little correlation, to ensure the accuracy of the evaluation results.

Therefore, from the city level, a comprehensive index of green finance development is constructed to study the influence and mechanism of green finance development on energy efficiency. It should not only investigate the direct impact of green finance development on energy efficiency but also introduce two adjustment variables of technological innovation and industrial structure to analyze its indirect effects. Specifically, first of all involving the green finance and energy efficiency of existing literature system combing and summary, roughly clarify the current academia of both research status and development trend, qualitative analysis of the relationship between the two and the influence mechanism, and puts forward several assumptions, finally based on China’s 2010–2019 city panel data, respectively using ordinary panel model, two stages of least squares, GMM model, panel threshold model for empirical test of research hypothesis, thus clear the influence of green finance on energy efficiency promotion mechanism.

5.2 Comparisons of sustainable business utilities between a proposed model and prior works

First, we want to discuss the comparisons of sustainable business utilities (energy and water supply) between a proposed model and prior works. One of the important features of sustainable finance is sustainability. Sukma and Leelasantitham (2022a) investigate the necessary components for presenting and establishing a community sustainability ecosystem model that supports local business sustainability with participation by highlighting essential variables that foster sustainable business prospects. Sukma and Leelasantitham (2022b) propose a novel Sustainable Business Framework for Community Water Supply Companies suitable for local community businesses. In the sustainable community ecosystem and sustainable business utilities, this paper focuses on discussing the impact of sustainable finance while conducting research from the energy perspective, which enriches the sustainable related research.

Second, in the past, for the measurement of sustainable finance, more literature has analyzed the level of sustainable financial development at the national and provincial level (Karen et al., 2004; Zhang et al., 2020), Different provinces, and even between different cities in the province of economic development difference is also very obvious, but the current study on green finance and energy efficiency or from the national or provincial data, also few established covering multiple dimensions of other green financial development index, the precision of green financial policy implementation has certain limits. At the city level, we build a comprehensive index from the total dimension.

Third, In the past, there was little consideration of the impact of macro-environmental policies. From the perspective of macro-environmental regulation policies, this paper studies the effect of sustainable finance on energy efficiency under different environmental policies. It examines the heterogeneous impact of low-carbon urban policies and environmental regulations on energy efficiency. Considering the financial development level of different cities in China, economic development level, resource endowment, and policy strength are different, so the effect of different variables may vary; reference predecessors from the perspective of the following two adjustment effect tests: first, the sample is divided into low carbon pilot cities and low carbon pilot cities regression respectively, to explore the influence of green finance on energy efficiency in the difference between the two types of cities. Second, considering the environmental regulation level may affect energy efficiency in the development level of green finance, with the median environmental regulation level of sample data as the cut-off point, the sample city is divided into two categories of high and low ecological regulation levels, to observe whether there is any difference in the effect.

6 Conclusion and policy implications

Based on the panel data of 259 cities in China from 2010 to 2019, this paper finds that green finance significantly improves energy efficiency. Industrial structure optimization, technological innovation, and other factors play an intermediary role. In addition, the development level of green finance plays a more significant role in promoting the energy efficiency of cities with high levels of environmental regulation and non-low-carbon pilot cities. In the high-environment regulatory level city samples and low-environment regulatory levels, the regression coefficients of GFI are 0.311 and 0.202, respectively. In low-carbon pilot cities samples and non-low-carbon pilot cities, the regression coefficients of GFI are 0.149 and 0.300. Finally, the impact of green finance on energy efficiency has structural mutations in energy efficiency. When the level of green finance is lower, the estimation coefficient of green finance is 0.313. When the level of green finance is higher, the estimation coefficient of green finance is 0.168.

According to the empirical results of this paper, the following policy implications are put forward for formulating relevant policies. First, implementing green finance policies can significantly improve energy efficiency. The government should focus on improving the level of green finance in all regions, actively guide enterprises to participate in green financial innovation by enhancing the institutional framework, providing policy guarantees and increasing capital investment, and support the development of various green financial products to realize the vision of energy conservation and emission reduction jointly.

Second, by strengthening the coordination of green finance policies, science and technology policies and measures, and industrial development policies and measures, a complete policy and measure framework should be established to achieve the joint development of all parties and achieve a “win-win” situation. When making policies, the government should fully consider the interaction between various policies, pay attention to regional development and the implementation of multiple policies, and introduce appropriate policies at different stages of development to better play the policy effect of green finance and promote sustainable economic development.

7 Limitations of the study

The paper also has some shortcomings: First, in terms of sample data collection, China city-level data collection is complex; the relevant departments did not disclose the city level of green insurance data and can only use agricultural insurance data as an alternative, although has certain rationality, to a certain extent, will cause specific deviation to the research results; Second, the existing literature suggests that energy consumption may have specific space effect, adjacent areas between the green financial policy, the environmental regulation policy will influence each other, so the green finance and energy efficiency may also exist space spillover effect, so explore whether the role of space spillover effect in the process will be one of the perspectives of the following research.

Data availability statement

Data will be made available on request.

Author contributions

XL: Conceptualization. ML: Conceptualization, Writing–original draft, Writing–review and editing. XW: Writing–original draft, Data curation, Validation, Visualization, Methodology. YZ: Formal Analysis, Writing–original draft, Methodology, Resources. ZS: Project administration, Funding acquisition.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The authors would like to thank the financial support from the Fundamental Research Funds for the Central Universities (2023CX13024), the National Natural Science Foundation of China (No. 71871022, 72173145, 72134002), the National Social Science Foundation of China (No. 21&ZD156 23BJL131), the Fok Ying Tung Education Foundation (161076), the Joint Development Program of Beijing Municipal Commission of Education, and the National Program for Support of Top-notch Young Professionals. The third phase of the science and education integration of graduate students academic new star incubation program in Central University of Finance and Economics. Central University of Finance and Economics Business School doctoral students key topic selection support plan. Research on the index system and policy suggestions of high quality development of financial industry in Xicheng District of Beijing (The name of the person in charge is ZS). All authors have equal contributions in this paper. We thank Prof. Ke Wang for suggestions revising this article.

Conflict of interest

Author XW was employed by company Nanjing Branch of Internal Audit Bureau, Industrial and Commercial Bank of China.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The measurement indicator of the level of environmental regulation is the comprehensive index of environmental regulation index constructed by the entropy value method, based on industrial wastewater emissions, industrial SO2 emissions, and industrial smoke and dust emissions.

References

Akomea-Frimpong, I., Adeabah, D., Ofosu, D., and Tenakwah, E. J. (2022). A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Finance Invest. 12 (4), 1241–1264. doi:10.1080/20430795.2020.1870202

Bak, C., Lee, G., and Seo, C. S. (2013). The effects of green technology patents on the financial performance of specialized green enterprises. J. Korea Technol. Innovation Soc. 16 (3), 724–753.

Berrone, P., Fosfuri, A., and Gelabert, L. (2017). Does greenwashing pay off? Understanding the relationship between environmental actions and environmental legitimacy. J. Bus. Ethics 144, 363–379. doi:10.1007/s10551-015-2816-9

Bi, W. S., Zhou, P., and Liang, L. (2014). Does environmental regulation affect energy efficiency in China’s thermal power generation? Empirical evidence from a slacks-based DEA model. Energy Policy 66, 537–546. doi:10.1016/j.enpol.2013.10.056

Caroline, F. (2021). Corporate green bonds. J. Financial Econ. 142 (2), 499–516. doi:10.1016/j.jfineco.2021.01.010

Chen, R., Long, Y., Niu, W. J., Feng, Q., and Yang, R. R. (2014). How does individual low-carbon consumption behavior occur? An analysis based on attitude process. Appl. Energy 116 (C), 376–386. doi:10.1016/j.apenergy.2013.11.027

Cheng, J., Yi, H., Dai, S., and Xiong, Y. (2019). Can low-carbon city construction facilitate green growth? Evidence from China's Pilot low-carbon City Initiative. J. Clean. Prod. 231, 1158–1170. doi:10.1016/j.jclepro.2019.05.327

Chiu, Y. B., and Lee, C. C. (2020). Effects of financial development on energy consumption: the role of country risks. Energy Econ. 90, 104833. doi:10.1016/j.eneco.2020.104833

Clement, P. S. (2021). Green and good? The investment performance of U.S. environmental mutual funds. J. Bus. Ethics 103 (2), 275–287.

Coase, R. H. (1992). The problem of social cost. The Journal of Law and Economics, Vol. III, 1960, pp. 1–44. J. Law Econ. 9 (1), 79–81. doi:10.1002/sres.3850090105

Dean, T. D., and Brown, R. L. (1995). Pollution regulation as a barrier to new firm entry: initial evidence and implications for future research. Acad. Manag. J. 38 (1), 288–303. doi:10.5465/256737

Frederick, C. W., and Withagen, C. (2012). Is there a green paradox? J. Environ. Econ. Manag. 64 (3), 342–363. doi:10.1016/j.jeem.2012.08.002

Ghisetti, C., and Rennings, K. (2014). Environmental innovations and profitability: how does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 75, 106–117. doi:10.1016/j.jclepro.2014.03.097

Guo, D., Li, Q., Liu, P., Shi, X., and Yu, J. (2023). Power shortage and firm performance: evidence from a Chinese city power shortage index. Energy Econ. 119 (C), 106593. doi:10.1016/j.eneco.2023.106593

Huo, D., Zhang, X., Meng, S., Wu, G., Li, J., and Di, R. (2022). Green finance and energy efficiency: dynamic study of the spatial externality of institutional support in a digital economy by using hidden Markov chain. Energy Econ. 116, 106431. doi:10.1016/j.eneco.2022.106431

Liu, X., Ji, Q., and Yu, J. (2021). Sustainable development goals and firm carbon emissions: evidence from a quasi-natural experiment in China. Energy Econ. 103 (C), 105627. doi:10.1016/j.eneco.2021.105627

Luis, J. O., and Velazquez, D. (2013). Revisiting energy efficiency fundamentals. Energy Effic. 6 (2), 239–254. doi:10.1007/s12053-012-9180-8

Muganyi, T., Yan, L., and Sun, H. P. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Pang, R., Deng, Z., and Hu, J. (2015). Clean energy use and total-factor efficiencies: an international comparison. Renew. Sustain. Energy Rev. 52, 1158–1171. doi:10.1016/j.rser.2015.08.002

Perry, S. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy 38, 2528–2535. doi:10.1016/j.enpol.2009.12.048

Porter, V., and Linde, D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Revell, J. R., and Goldsmith, R. W. (1970). Financial structure and development. Econ. J. 80 (318), 365–367. doi:10.2307/2230134

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy 38 (5), 2528–2535. doi:10.1016/j.enpol.2009.12.048

Shao, R., Zhong, Y., and Ren, X. D. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J. Clean. Prod. 277, 122844. doi:10.1016/j.jclepro.2020.122844

Sukma, N., and Leelasantitham, A. (2022a). A community sustainability ecosystem modeling for water supply business in Thailand. Front. Environ. Sci. 10, 940955. doi:10.3389/fenvs.2022.940955

Sukma, N., and Leelasantitham, A. (2022b). From conceptual model to conceptual framework: a sustainable business framework for community water supply businesses. Front. Environ. Sci. 10, 2213. doi:10.3389/fenvs.2022.1013153

Tian, W., Huang, Y., Pen, J. C., and Fu, S. K. (2022). Transmission mechanism and spatial effect of green finance enabling carbon neutrality. West. Forum 32 (5), 44–62.

Wang, Z., Wang, X., Xian, Y. J., Shi, X. P., Yu, J., FengHubacek, K. S. K., et al. (2022). Optimizing the rolling out plan of China’s carbon market. Iscience 26 (1), 105823. doi:10.1016/j.isci.2022.105823

Xie, S., and Hu, H. (2021). Financial leverage and urban green economic growth--based on 285 prefecture-level cities and above in China. Explor. Econ. Issues 11, 150–163.

Xu, X., and Li, J. (2020). Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 264, 121574. doi:10.1016/j.jclepro.2020.121574

Zhang, D., Li, J., and Ji, Q. (2020). Does better access to credit help reduce energy intensity in China? Evidence from manufacturing firms. Energy Policy 145, 111710. doi:10.1016/j.enpol.2020.111710

Zhang, D., Mohsin, M., and Taghizadeh-Hesary, F. (2022). Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ. 113, 106183. doi:10.1016/j.eneco.2022.106183

Keywords: sustainable finance, energy efficiency, environmental regulation, industrial structure, technological innovation

Citation: Liu X, Lan M, Wang X, Zhang Y and Su Z (2023) The impact of sustainable finance development on energy efficiency in emerging economies. Front. Environ. Sci. 11:1273784. doi: 10.3389/fenvs.2023.1273784

Received: 07 August 2023; Accepted: 30 October 2023;

Published: 06 December 2023.

Edited by:

Adisorn Leelasantitham, Mahidol University, ThailandReviewed by:

Narongsak Sukma, Mahidol University, ThailandMatheus Koengkan, University of Aveiro, Portugal

Copyright © 2023 Liu, Lan, Wang, Zhang and Su. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Minghui Lan, bWluZ2h1aWxhbkBlbWFpbC5jdWZlLmVkdS5jbg==; Yongji Zhang, eWp6aGFuZ0BiaXQuZWR1LmNu

Xing Liu1

Xing Liu1 Minghui Lan

Minghui Lan Yongji Zhang

Yongji Zhang