- College of Economics and Management, Shanghai Ocean University, Shanghai, China

Sustainability accounting is crucial for corporate transparency and responsibility, but its relationship with firm characteristics in Shanghai, China’s financial center, remains poorly understood. This study uses a descriptive-analytical methodology to examine the impact of firm size, industry type, and profitability on sustainability accounting practices. A systematic literature review and meta-analysis of 43 studies provide insights into the extent and drivers of sustainability reporting. The findings reveal a positive association between firm size (r = 0.389) and profitability (r = 0.327) with sustainability reporting. Larger, more profitable firms, including state-owned enterprises, exhibit extensive sustainability accounting practices. However, the effect of industry type is inconclusive (r = 0.061), indicating a contingent relationship dependent on firm-specific contexts. The study suggests implementing regulations mandating minimum sustainability disclosure for large and profitable enterprises. Capacity-building initiatives for small private firms and the adoption of integrated reporting policies can enhance transparency. These outcomes contribute contemporary insights into corporate sustainability accounting in China’s evolving landscape. The implications extend to policy development and collaborative efforts to expand sustainability measurement and disclosure in Shanghai. Tailoring regulatory initiatives to firm profiles, such as size and profitability, enhances sustainability accounting practices. Targeted capacity-building programs, assurance mandates, and integrated reporting regulations improve the quality and usefulness of sustainability accounting information. Collaboration with the investor community is crucial for mainstreaming sustainability measurement and disclosure. This study deepens the understanding of sustainability accounting practices in Shanghai, an emerging economy financial hub. It provides insights for policy development, emphasizing firm and sector-specific factors driving sustainability accounting. Policymakers can promote transparency and responsibility by considering firms’ unique characteristics, fostering a more sustainable business environment.

1 Introduction

In the modern world, it is impossible to initiate or sustain any economic activity without adequate and comprehensive information on the subject, emphasizing the critical role of information in economic decision making. The ability to access more information is a key factor for success in today’s society (Tu et al., 2020; Jian et al., 2021; Shang and Luo, 2021; Luo et al., 2022; Yin and Song, 2023). Information becomes valuable when it results in changes in investors’ beliefs and actions, and its effectiveness can be gauged by the degree of price fluctuations following its release (Gao et al., 2020; Gao et al., 2021; Luo et al., 2023; Qiu et al., 2023; Wang and Tao, 2023). The worth of accounting information is influenced by various characteristics, according to the viewpoints of information producers and potential users (Desai, 2022; Dura and Suharsono, 2022; Jiang et al., 2022). These factors encompass information dependability, the reach of its distribution, its relevance to specific economic entities or general application, its content and volume (e.g., whether it pertains to current status or the strategies and actions of other entities or groups, and considers the interests and preferences of stakeholders, production resources, or market characteristics such as price and quality), and its significance in decision making (Kafiliveyjuyeh and İlhan, 2017; Ryoo et al., 2023). Hirshleifer (Hirshleifer, 1973) identifies these features as examples of what affects the importance of information in economic decision making.

The competitiveness of a company within its industry can be negatively affected by the lack of valuable information for decision making. This can result in reduced growth in different markets within the industry (Zhai and Wang, 2016; Gonzalez and Pena-Vinces, 2022). According to Zhai and Wang (Zhai and Wang, 2016), companies that possess higher quality accounting information tend to exhibit lower levels of over-investment. Enhancing the quality of accounting information can therefore enhance a company’s competitiveness within the industry, allowing it to seize opportunities for expansion as the industry grows. Previous studies have found that, when considering the presence of an under-investment variable, there is no significant association between accruals quality and investment efficiency. However, when both over and under-investment variables are present, there is a positive and significant relationship between earnings stability and investment efficiency (Gonzalez and Pena-Vinces, 2022; Hsiao et al., 2022; Pasko et al., 2022).

Sustainability accounting refers to the process of measuring, disclosing, and being accountable for an organization’s environmental, social, and governance performance, as defined by Archel et al. (Archel et al., 2009). It involves compiling and reporting verifiable data on the organization’s impacts and dependencies on society and the environment. Sustainability accounting encompasses different types of non-financial reporting, such as environmental, social, and integrated reporting, which provides stakeholders with insights into environmental and social externalities that are not captured by traditional financial accounting, according to Schaltegger et al. (Schaltegger et al., 2006). The increasing popularity of sustainability accounting reflects the growing societal demands for corporate transparency and accountability regarding environmental and social concerns.

Firm size is a crucial factor in the adoption of sustainability accounting practices (Darnall et al., 2010). Larger firms have greater visibility, resources, and capabilities to implement environmental and social accounting systems. They face more significant stakeholder pressures and scrutiny as compared to small and medium enterprises (SMEs). According to institutional theory, large companies are compelled to employ sustainability accounting as a legitimization tactic due to heightened public exposure, as stated by Chen et al. (Chen and Roberts, 2010). Large enterprises are also better equipped to absorb the administrative costs of sustainability reporting. However, research findings have been mixed, with some studies observing a positive association between company size and sustainability disclosure and others finding no definitive relationship.

Industry type is another factor that determines sustainability accounting practices, as highlighted by Reid and Toffel (Reid and Toffel, 2009). Environmentally sensitive industries, such as oil and gas, chemicals, and mining, face greater stakeholder demands for environmental transparency. Institutional theory suggests that environmentally visible firms use sustainability accounting to achieve social legitimacy (Cho and Patten, 2007). Companies in consumer-facing industries rely heavily on their social reputation and use sustainability reporting to safeguard their brand image, as noted by Khan et al. (Khan et al., 2016). However, empirical evidence on the effects of industry remains inconclusive. While certain studies have found positive associations between high-impact, high-profile industries and sustainability disclosure, others have found negligible or no industry influence.

Profitability is a crucial resource-based determinant of sustainability accounting (Artiach et al., 2010). More profitable firms have the necessary financial resources to implement comprehensive environmental and social accounting systems. Stakeholder and legitimacy perspectives suggest that profitable companies aim to legitimize their existence and superiority through extensive sustainability disclosures, according to Reverte (Reverte, 2009). However, other studies argue that less profitable firms may use sustainability reporting to improve their reputation and image among stakeholders, as noted by Uyar et al. (Uyar et al., 2013). Empirical evidence has produced contradictory results, with some studies demonstrating positive, negative, and no associations between profitability and the extent of sustainability reporting.

In the past decade, sustainability accounting practices in China have expanded. As noted by Yu (Yu, 2023), larger, more profitable Chinese firms tend to have broader sustainability disclosure, potentially due to greater visibility, resources, capabilities, and institutional pressures. State-owned enterprises also exhibit more extensive reporting, as the government promotes environmental and social responsibility among national champions, according to Noronha et al. (Noronha et al., 2013). However, limited large-sample empirical research has been conducted on Chinese sustainability accounting, particularly across different company characteristics and in Shanghai, which is China’s leading financial center (Dhar et al., 2022; Suileek and Alshurafat, 2022).

The emergence of sustainability accounting can be understood through different theoretical perspectives. According to stakeholder theory, organizations adopt environmental and social accounting practices to fulfill the information needs of various stakeholders, such as local communities, NGOs, investors (Deegan, 2002). Institutional theory suggests that companies use sustainability reporting as a legitimization strategy in response to social and institutional pressures (Chen and Roberts, 2010). Resource-based perspectives suggest that organizational characteristics influence the ability to implement sustainability accounting. For example, larger firms have more financial resources to absorb reporting costs (Artiach et al., 2010). Sustainability accounting includes various types of non-financial reporting, such as standalone corporate social responsibility reports, integrated reports, and dedicated disclosures in annual reports. Analyzing the content of corporate reports provides insights into the depth and quality of sustainability accounting information, as noted by Noronha et al. (Noronha et al., 2013). Statistical analysis of firm-level variables (e.g., size, profitability, ownership) associated with the extent of sustainability disclosure enables identification of organizational characteristics and theoretical interpretations of why certain companies report more than others (Dong et al., 2022; Ezejiofo et al., 2022; Zahid et al., 2023).

Environmental accounting involves measuring environmental performance using non-financial indicators such as pollution levels and resource usage, and integrating environmental costs, liabilities, and impacts into financial reporting, as defined by Christ and Burritt (Christ and Burritt, 2013). This approach enhances organizational environmental accountability. Social accounting, on the other hand, encompasses reporting on labor practices, human rights, community impacts, and other social matters (Archel et al., 2009). Integrated reporting combines financial, environmental, social, and governance information to provide a holistic overview of the organization, according to Eccles and Krzus (Eccles and Krzus, 2010). Sustainability accounting offers stakeholders a more comprehensive perspective on the organization’s risks, opportunities, performance, and strategic direction.

Company size is usually measured using indicators such as total assets, sales revenues, market capitalization, or number of employees (Reverte, 2009; Yu, 2023). Larger firms have more resources to implement sustainability initiatives and face greater public visibility and pressure to legitimize their activities through reporting (Darnall et al., 2010). Industry type reflects the main business activities of firms. Environmentally sensitive and consumer-facing industries face higher stakeholder demands for sustainability transparency, as highlighted by Cho and Patten (Cho and Patten, 2007). Profitability reflects bottom-line organizational performance. More profitable firms have the capability to absorb the costs of sustainability accounting and aim to legitimize their success through reporting (Reverte, 2009).

Previous academic studies have investigated the impact of various firm characteristics, such as size, industry, and profitability, on sustainability accounting practices across different global contexts. For example, Artiach et al. (Artiach et al., 2010) found that larger, more profitable Australian firms had higher levels of sustainability disclosure, which was interpreted through resource-based and legitimacy perspectives. Eccles et al. (Eccles et al., 2014) noted that high sustainability companies in the United States outperformed low sustainability firms in stock market and accounting performance, controlling for size, sector, and country factors. Reverte (Reverte, 2009) determined that larger, more visible, and profitable Portuguese firms displayed increased sustainability reporting to achieve legitimacy.

In the Chinese context, Noronha et al. (Noronha et al., 2013) found that larger state-owned enterprises with foreign partners exhibited greater environmental and social disclosure, highlighting the role of institutional factors. Yu (Yu, 2023) analyzed the Chinese context and discovered that larger, more profitable firms had more extensive sustainability reporting, attributing this to visibility, capability, and legitimacy drivers. In the context of Chinese energy companies, Huafang et al. (Huafang and Jianguo, 2007) identified a positive association between state ownership and firm size with carbon emission disclosures as a dimension of environmental transparency. While these studies provide initial evidence on company-level determinants, they require further extension to characterize sustainability accounting practices, including across different Chinese stock exchanges (Ikpor et al., 2022; Ma et al., 2022; Qian et al., 2022).

While prior studies have made significant contributions to our comprehension of the determinants of sustainability accounting adoption at the company level, further investigation is necessary to elucidate the specific relationships between firm attributes and sustainability accounting adoption, particularly within different Chinese stock exchanges. Notably, the dearth of large-sample empirical research focused on the Shanghai Stock Exchange underscores the need for additional inquiry. Consequently, the primary objective of this study is to examine the association between company size, industry type, and profitability with the extent of sustainability accounting practices among firms listed on the Shanghai Stock Exchange. By undertaking this investigation, our aim is to synthesize existing literature to discern patterns of sustainability reporting across various firm characteristics and provide contemporary empirical insights into a market where sustainability disclosure practices are still undergoing evolution.

Through conducting a comprehensive review and employing quantitative integration of the emerging scholarship on sustainability accounting determinants in Shanghai, this study makes a novel and systematic contribution to this burgeoning research domain. The findings derived from this research endeavor will furnish valuable information for regulators, investors, executives, and standard-setters in the formulation of targeted policies, the integration of sustainability factors into valuations, and the implementation of comprehensive accounting practices. Specifically, our research underscores the significance of firm and sector-specific factors that can augment the quality and utility of sustainability accounting information through the implementation of bespoke capacity-building programs, assurance mandates, integrated reporting regulations, and collaborative initiatives with investors. Consequently, this study contributes to the collaborative endeavors aimed at expanding sustainability measurement and disclosure practices in Shanghai’s swiftly evolving sustainability landscape.

2 Fundamentals and definitions

2.1 Sustainability accounting

Within the realm of accounting, sustainability accounting encompasses various forms of non-financial reporting that are both integrated and differentiated. These forms include environmental accounting, social accounting, and integrated reporting (Frias-Aceituno et al., 2013). The primary objective of sustainability accounting is to offer a comprehensive and scientifically grounded perspective on an organization’s long-term risks, dependencies, impacts, costs, and value creation across ESG dimensions. These dimensions are not adequately captured by traditional financial accounting and reporting systems (Unerman and Zappettini, 2014; Qian et al., 2015).

Businesses in the present era are increasingly recognizing the significance of sustainability in maintaining their long-term viability and addressing societal, environmental, and stakeholder concerns. For example, Sukma and Leelasantitham propose that community water supply enterprises should integrate sustainability principles, including corporate governance, environmental preservation, and stakeholder engagement, into their operational strategies (Sukma and Leelasantitham, 2022a). They emphasize the importance of establishing a community sustainability ecosystem model that involves the participation of various stakeholders to foster the sustainability of local businesses, such as community water suppliers (Sukma and Leelasantitham, 2022b). The rise and widespread adoption of sustainability accounting worldwide reflect the increasing societal demands and expectations for corporate transparency, accountability, and stewardship concerning ESG risks, externalities, and impacts (KPMG, 2020). Several factors drive this trend, such as evolving stakeholder concerns, institutional pressures, peer benchmarking, activist campaigns, responsible investment trends, and the recognized business benefits in terms of brand, risk management, competitiveness, and financial performance (Schaltegger et al., 2019). Consequently, sustainability accounting has transitioned from an optional corporate social responsibility initiative to an essential business function that is necessary for managing and disclosing complete value creation.

Environmental accounting involves identifying, measuring, analyzing, and disclosing an organization’s interactions with and impacts on the natural environment quantitatively and in monetary terms (Christ and Burritt, 2013). This includes measuring environmental performance through indicators such as greenhouse gas emissions, water usage, waste generation, biodiversity impacts, and pollution levels across facilities, supply chains, and products (Qian and Burritt, 2008). Monetary environmental management accounting aims to track, allocate, analyze, and report environmental costs, liabilities, and savings such as waste treatment, compliance costs, fines, taxes, permits, procurement of eco-friendly inputs, and operational eco-efficiencies (Jasch and Stasiškienė, 2005). Environmental accounting provides actionable data to inform corporate environmental management, goal-setting, and strategy evaluation. It also demonstrates accountability to stakeholders and aids comprehensive performance analysis (Burritt et al., 2011).

Social accounting involves identifying, monitoring, measuring, and reporting an organization’s impacts on social dimensions, including labor relations, human rights, diversity and inclusion, community relations, consumer welfare, public health, and societal wellbeing (Archel et al., 2009; Unerman, 2010). Its objective is to expand corporate accountability and transparency beyond shareholders to a broader group of stakeholders affected by or concerned with the organization’s social performance, risks, and externalities. Social accounting provides insights into issues such as workplace equity, employee health and safety, supply chain labor standards, product responsibility and quality, and community development impacts (Munilla and Miles, 2005). It signals an organization’s commitment to responsible management of social risks, relationships, and impacts (Maon et al., 2009). The fundamental premise is that financial information alone provides an incomplete and potentially distorted picture for understanding modern organizational value creation, which significantly depends on ESG factors (Moroney et al., 2012; Unerman and Zappettini, 2014). Therefore, integrated reporting aims to provide a comprehensive corporate reporting system for well-informed decision-making by investors and other stakeholders (Eccles and Krzus, 2010).

Several conceptual frameworks highlight the intended benefits of sustainability accounting. One of its benefits is enhancing strategy setting, risk management, and decision-making by integrating ESG considerations into information systems (Schaltegger and Burritt, 2018). Tracking non-financial key performance indicators facilitates internal management and performance improvement over time. Comprehensive and reliable ESG data enables investors and stakeholders to better evaluate risks, intangible assets, competitive positioning, and future performance (Qian et al., 2015). Addressing information gaps and stakeholder demands strengthens corporate legitimacy and reputational advantage (Cho et al., 2012). Therefore, sustainability accounting aims to generate shared value for corporations and stakeholders by bridging externalities and dependencies associated with ESG impacts (Baumgartner, 2014).

However, sustainability accounting also faces limitations and critiques. Measurement challenges include subjectivity, lack of consistent valuation methodologies for intangibles, data reliability issues, and the costs of information systems (Landau et al., 2020). The materiality and decision-usefulness of sustainability reporting have been questioned by those focused narrowly on financial returns (Unerman and Zappettini, 2014). There are also concerns regarding selective disclosures, unverified claims, and ‘greenwashing’ in the absence of assurance standards (Boiral, 2013). Despite these issues, international evidence indicates increasing adoption and continuous improvement in sustainability accounting (KPMG, 2020), reflecting growing corporate and mainstream investor recognition of its decision-making value.

In the Chinese context, the development of sustainability accounting has accelerated over the past decade, reflecting rising regulatory, investor, and societal pressures for ESG transparency and corporate social responsibility (Noronha et al., 2013; Alduais et al., 2022). Relatively more extensive sustainability accounting practices have been demonstrated by larger state-owned and private firms in high-impact sectors (Yu, 2023). However, adoption remains limited, especially among small and medium enterprises, where awareness, technical capacity, and data reliability are key constraints (Zaman et al., 2022). The depth, quality, and comparability of disclosed sustainability information require enhancement through capacity building, standardization, assurance, and integrated digital accounting systems (Huafang and Jianguo, 2007; Qian et al., 2015). Therefore, there is a need and opportunity to further expand and strengthen sustainability accounting practices among Chinese corporations, particularly in financial hubs like Shanghai, where public visibility and stakeholder scrutiny are high.

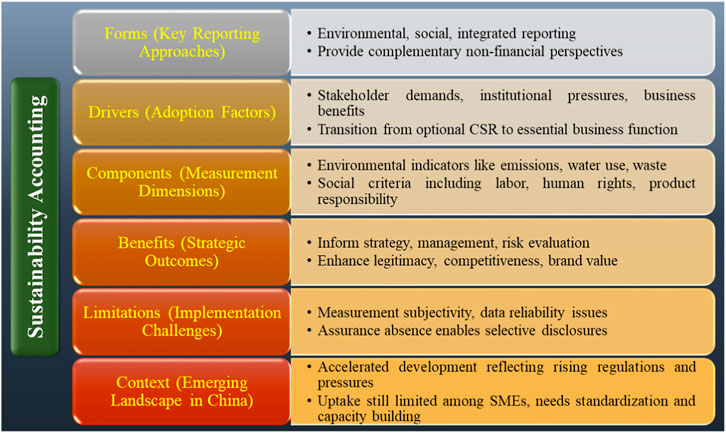

In the context of China, prevalent sustainability accounting practices encompass the publication of standalone corporate social responsibility reports, the disclosure of specific environmental and social key performance indicators (KPIs) in annual reports, and the provision of narrative descriptions pertaining to policies, programs, and impacts. However, it is important to note that the depth and quality of measurement, disclosure, and integration with financial accounting are relatively constrained, particularly among smaller companies that face limitations in terms of awareness, resources, and technical capacity. There is increased adoption of and continuous improvements in sustainability accounting globally, reflecting its recognized business benefits and rising stakeholder expectations. However, the extent and quality of sustainability accounting continue to vary across countries, industries, and firms based on multiple contextual drivers. In China’s rapidly emerging sustainability landscape, greater policy support, institutional capacity building, and collaborative initiatives can help enhance the scope and utility of corporate sustainability accounting. Figure 1 shows a comprehensive framework that integrates the central role of sustainability accounting and its essential components, drivers of adoption, strategic outcomes, limitations, and the evolving implementation landscape. At its core, sustainability accounting facilitates the integration of ESG (Environmental, Social, and Governance) measurement, management, and disclosure systems. The framework depicts the connections between this central role and complementary forms of non-financial reporting, factors that influence adoption, components involved in measurement, advantages for strategy and legitimacy, criticisms and challenges, and the evolving context specific to China. Through the examination of these interrelationships, a holistic understanding of the fundamental characteristics, incentives, practices, and discussions surrounding corporate sustainability accounting can be attained.

FIGURE 1. Framework of core features, forms, drivers, outcomes, limitations and contextual landscape of corporate sustainability accounting practices.

2.2 Firm attributes

Firm attributes refer to the specific characteristics or qualities that describe and distinguish a company as an economic entity, business organization, and corporate actor (Co and ase, 1995). These attributes represent the relatively inherent and stable features that fundamentally shape a company’s strategic operations, resource base, organizational capabilities, output mix, competitive positioning, and overall profile within its institutional and industry environment (Porter, 1981). Key firm attributes that are frequently analyzed in corporate research include size, industry classification, profitability, ownership structure, business strategy orientation, risk profile, corporate governance mechanisms, and organizational culture (Grant, 1991). These firm attributes significantly influence the sustainability accounting practices adopted by companies, which constitute the focus of this study.

Company size is a well-established and significant factor affecting the adoption of sustainability accounting. It is usually measured using indicators such as total assets, annual revenues, market capitalization, and number of employees (Artiach et al., 2010). Larger firms have greater visibility in the public domain and possess more extensive financial, human, technological, and organizational resources and capabilities that facilitate the development and implementation of sustainability measurement, data collection, reporting, and assurance systems (Chen and Roberts, 2010). They face more significant pressures and scrutiny from regulators, investors, consumers, and civil society organizations to be transparent and accountable for their environmental, social, and governance impacts, compared to small and medium enterprises (Darnall et al., 2010).

Institutional theory posits that large companies are motivated to proactively employ sustainability accounting as a strategic legitimization tactic due to heightened external exposure and dependencies on external stakeholders (Campbell, 2007). Larger firms can also more easily absorb the significant compliance costs and investments required in specialized staff, training, information systems, and assurance to develop comprehensive sustainability accounting processes due to their resource advantages (Simnett et al., 2009). Small firms face greater resource constraints and tend to have more limited sustainability accounting. Therefore, company size is considered one of the most significant organizational determinants of the breadth and depth of corporate sustainability accounting and reporting.

Industry type refers to the core business activities, outputs, technologies, value chain architecture, and sector context in which a firm operates. A company’s industry profile shapes the level of environmental and social impacts associated with its operations, the stakeholder expectations and material ESG issues connected to its products and services, and the vulnerabilities and externalities created across its supply chain (Cho and Patten, 2007). For instance, extractive and heavy industries such as oil and gas, chemicals, mining, cement, and steel inherently have far greater emissions, pollution, health, and safety impacts compared to service sectors such as consulting or software.

Industries that are environmentally sensitive consequently face substantially higher pressure from stakeholders such as local communities, activists, and responsible investors to measure, manage, mitigate, and transparently disclose their environmental risks, liabilities, dependencies, and externalities (Patten, 1991). In contrast, consumer-facing industries whose reputation and brand image depend heavily on public trust invest more efforts in social accounting practices related to product responsibility, labor conditions, and community impacts (Khan et al., 2016). Therefore, a firm’s industry profile, which influences its underlying ESG impacts and stakeholder pressures, is a driver of sustainability reporting focus and practices.

Profitability represents a firm’s bottom-line financial performance results, commonly measured using metrics like net income, return on assets (ROA), return on equity (ROE), or profit margin ratios (Orlitzky et al., 2003). Mainstream economic perspectives suggest that more profitable firms possess greater slack resources and financial capacity required to absorb the costs of implementing comprehensive sustainability measurement, accounting, audit, and reporting systems (Artiach et al., 2010).

Stakeholder and legitimacy theories propose that highly profitable companies proactively report on ESG activities as a legitimization tactic to validate their financial outcomes to external parties, presenting themselves as responsible corporate citizens (Reverte, 2009). However, other critical perspectives argue that less profitable firms with weaker financials may also resort to sustainability accounting to strategically enhance their reputation, brand image, and perceived social legitimacy if they are unable to excel in economic performance (Uyar et al., 2013). Hence, empirical evidence demonstrates mixed associations between profitability and the extent of corporate sustainability accounting and reporting across contexts. Profitability interacts with other firm drivers in shaping ESG disclosure.

Ownership structure is a significant but often understudied firm attribute affecting sustainability accounting adoption. It refers to the distribution of equity ownership among different entity classes that wield control rights over corporate decisions (Anderson and Reeb, 2003). The main ownership types include family or founder ownership, dispersed shareholding, government or state ownership, institutional ownership by investment entities like mutual funds, foreign ownership, and managerial ownership (Jiang and Kim, 2015). State-owned enterprises often demonstrate more extensive sustainability accounting practices due to active governmental promotion of environmental, social, and governance responsibility among national corporate champions as a development priority (Yu, 2023).

Socially responsible investment by institutional investors has risen substantially, and this class of owners increasingly expects significant disclosures from their portfolio firms on sustainability issues to enable monitoring of ESG performance (Solomon et al., 2011). Foreign partners may also mandate sustainability accounting and reporting from local joint ventures as an emerging market entry strategy (Marano et al., 2017). Therefore, a corporation’s ownership structure partially shapes the orientation and extent of its sustainability measurement and reporting.

There are close interrelationships between several of the key firm attributes driving sustainability accounting practices. Larger companies tend to have more dispersed public shareholding, greater presence of institutional investors, and reduced family or founder control compared to smaller, privately held businesses with more concentrated ownership (Anderson and Reeb, 2003). State ownership predominates among large, strategically important enterprises in several major emerging economies (Inoue et al., 2013). Highly globalized and scrutinized multinational corporations face greater public visibility and pressures for sustainability transparency compared to domestic firms focused only on local markets (Huafang and Jianguo, 2007). Thus, firm attributes such as size, ownership structure, internationalization, and industry profile often overlap and combine to collectively influence sustainability accounting practices.

In summary, firm attributes refer to the relatively stable inherent features that characterize and fundamentally shape the strategic operations, capabilities, resources, outputs, impacts, dependencies, and public profile of a company as an economic organization. Specific attributes such as size, industry, profitability, and ownership have been theoretically and empirically linked to the implementation of sustainability accounting practices in corporations around the world, to varying extents based on their associations with financial resource availability, stakeholder demands, institutional factors, legitimacy motivations, and other drivers.

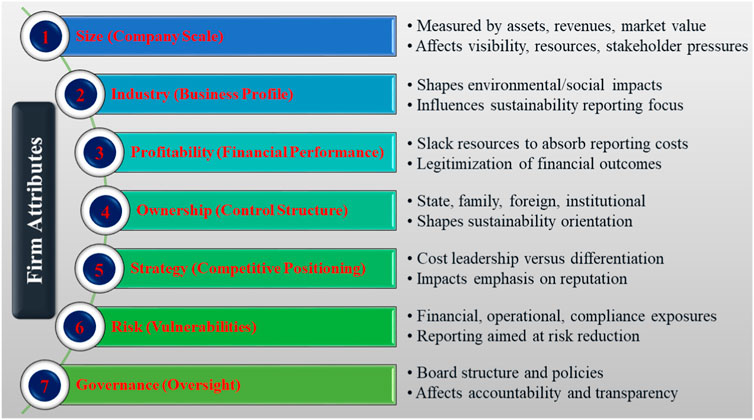

The Chinese government has implemented a range of guidelines, policies, and reporting requirements with the objective of improving corporate transparency and accountability regarding environmental and social concerns. Notably, the Ministry of Environmental Protection and the Shanghai Stock Exchange Social Responsibility Instructions have issued guidelines on corporate environmental reporting that necessitate specific disclosures. State-owned enterprises, in particular, encounter significant pressures to implement government sustainability initiatives and exhibit leadership in this domain. Figure 2 presents a framework illustrating the significant influence of firm attributes on the strategic operations, resources, capabilities, impacts, and public profile of companies. The central role of firm characteristics is depicted, highlighting their connections to various attributes such as size, industry, profitability, ownership, strategy, risk, and governance mechanisms. These interrelationships play a fundamental role in shaping the adoption of sustainability accounting practices.

FIGURE 2. Framework of major firm attributes including size, industry, profitability, ownership, strategy, risk, and governance that impact corporate sustainability accounting.

2.3 Environmental and social accounting

Environmental accounting and social accounting are two key dimensions within the broader framework of sustainability accounting. Although distinct, they are interconnected and complementary approaches that aim to expand organizational measurement, management, and disclosure regarding environmental and social performance, risks, impacts, and dependencies (Schaltegger and Burritt, 2018). Environmental accounting specifically involves identifying, measuring, analyzing, and reporting on an organization’s interactions with and impacts on the natural environment across quantitative and monetary parameters (Qian and Burritt, 2008). Key areas of focus include greenhouse gas emissions, energy consumption, water usage, waste generation, air/water pollution, biodiversity impacts, deforestation, and carbon sequestration across the company’s direct operations, supply chain, and product life cycle stages (Jasch and Stasiškienė, 2005). Environmental accounting quantifies environmental performance through non-financial indicators and integrates relevant costs, liabilities, dependencies, and savings into traditional financial accounts to enable holistic decision-making (Schaltegger and Zvezdov, 2015).

While environmental and social accounting have different areas of focus, they share the overarching goals of quantifying and disclosing sustainability performance to inform strategy, management, and stakeholder decision-making (Gond et al., 2012). They contribute unique as well as complementary perspectives to the evolving sustainability accounting landscape. Comparing and contrasting key features provides insights into their respective roles:

Scope: Environmental accounting focuses on the organization’s interactions with the natural environment, while social accounting examines impacts on people, communities, and society (Gray, 2002).

Metrics: Environmental accounting emphasizes quantitative and monetary indicators like emissions, resource usage, compliance costs, and fines. Social accounting highlights qualitative and narrative disclosures related to social policies, impacts, and relationships (Girard and Sobczak, 2012).

Areas: Environmental aspects include energy, water, waste, pollution, and biodiversity. Social dimensions encompass labor relations, human rights, diversity, product responsibility, and community impacts (Schaltegger and Burritt, 2018).

Valuation: Environmental accounting values environmental costs, liabilities, and dependencies in financial terms. Social accounting often involves qualitative and descriptive evaluations of social criteria (Schaltegger and Zvezdov, 2015).

Stakeholders: Key audiences for environmental accounting include regulators, communities, and environmental interest groups. Social accounting caters more to employees, customers, supply chain partners, and society (O'Dwyer, 2005).

Assurance: Environmental performance indicators can be verified through scientific measurement and audits. Assurance for social disclosures is more challenging due to qualitative narratives and self-reported information (Manetti and Becatti, 2009).

Frameworks: Environmental accounting aligns with reporting standards like GRI, CDP, SASB that contain quantitative eco-efficiency indicators. Social accounting follows guidance from standards-setters, but with flexibility for qualitative and descriptive disclosures (Mi et al., 2013).

Maturity: Environmental accounting systems tend to be more established and standardized relative to the evolving arena of social accounting (Gond et al., 2012).

Regulation: Environmental accounting and reporting are mandatory in several countries and jurisdictions. Social accounting remains predominantly voluntary at present (Schaltegger and Zvezdov, 2015).

Therefore, while environmental and social accounting have distinct characteristics, they offer complementary non-financial perspectives that enrich sustainability accounting. Companies utilize both forms of reporting to provide a well-rounded disclosure to stakeholders while focusing particular effort where their sustainability impacts are most material (Sun, 2012). Many leading firms produce integrated sustainability reports that consolidate quantitative environmental performance indicators with narrative, descriptive, and visual accounts of their social policies, programs, and impacts.

Academic scholars have debated the comparative merits and limitations of environmental and social accounting along several dimensions (Cho et al., 2010):

Measurability: Environmental data is argued to be more robust and verifiable, while social impacts are difficult to quantify consistently (Hughes et al., 2001). However, this view has been countered by highlighting the subjectivity in environmental valuations and limitations of key indicators (Milne, 1996).

Materiality: Environmental externalities are presented as more financially material in sectors like oil and gas. However, social risks related to labor, ethics, and product responsibility also bear financial implications (Cho and Patten, 2007).

Stakeholder utility: Certain studies argue environmental accounting provides more value to mainstream investor decision-making relative to social data. But interests in ESG factors are converging among shareholders and stakeholders (Deegan, 2002).

Comparability: Standardized metrics are assumed to enable better benchmarking of environmental performance. But social accounting comparability can improve through reporting norms and guidance (Lock and Seele, 2016).

Assurance: Independent verification is considered more credible for quantitative environmental data versus narrative social disclosures. However, techniques for social assurance are evolving (Boiral, 2013).

Costs: Comprehensive environmental accounting is regarded as more resource-intensive compared to social disclosure. But integrated digital systems can reduce reporting costs across dimensions (Vesty et al., 2018).

Therefore, while debates persist in some areas, academic and corporate practice increasingly reflect integration and convergence between environmental and social accounting (Mi et al., 2013). Certain limitations of both forms of non-financial reporting are continually being addressed through advancements in data accuracy, materiality analysis, stakeholder engagement, standardization, assurance techniques, and integrated digital systems. The evolution from environmental management accounting to social and sustainability accounting also highlights the expansion in managerial objectives over recent decades - from eco-efficiency, risk mitigation, and cost reduction towards strategy setting, product and community impact management, stakeholder relationships, disclosure, and integrated reporting (Schaltegger and Burritt, 2001). Modern sustainability accounting requires an integrated governance approach that leverages environmental and social disclosures to inform business decisions, manage externalities, and create long-term value for diverse stakeholders across the triple bottom line.

In summary, environmental accounting focuses on measuring and disclosing sustainability performance related to interactions between business and the natural environment. Social accounting examines and reports on business impacts on social systems, including labor, human rights, communities, and consumers. While distinct in scope, metrics, and focus, environmental and social accounting provide complementary non-financial perspectives within the expanding ambit of sustainability measurement, management, and reporting. They support integrated decision-making, strategy formulation, and stakeholder accountability when leveraged together by organizations to provide a comprehensive sustainability disclosure. The ongoing evolution of both forms of accounting towards robust, material, and decision-useful information is critical for advancing responsible business practices that balance economic growth with environmental stewardship and social wellbeing.

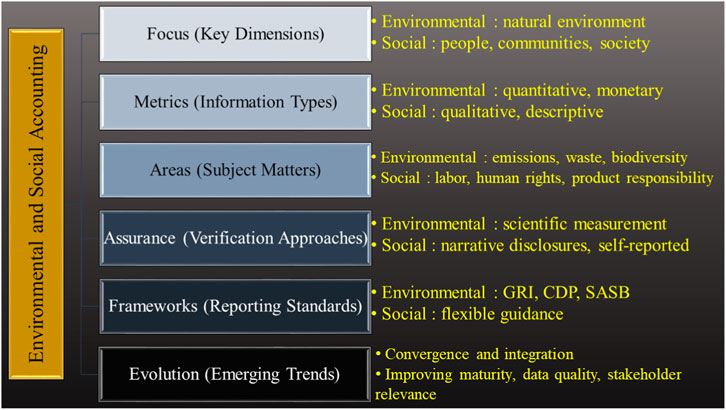

In summary, the extant body of research suggests that larger, more profitable, and state-owned firms in China display a wider adoption of sustainability accounting. This can be attributed to factors such as visibility, resources, capabilities, and institutional drivers. However, the impact of industry on sustainability accounting practices remains inconclusive. Although there has been progress, significant gaps persist in terms of the depth, integration, reliability, and comparability of sustainability accounting practices, particularly among smaller private companies. Figure 3 illustrates a framework that compares and contrasts the essential characteristics of environmental accounting and social accounting as two complementary approaches within the broader scope of sustainability accounting. The framework examines their distinct focus, metrics, subject areas, assurance methods, and reporting frameworks. Furthermore, it highlights the ongoing trend of convergence that encompasses both environmental and social accounting practices.

FIGURE 3. Comparative framework of environmental and social accounting approaches, metrics, focus areas, assurance methods and standards within sustainability accounting.

3 Research methodology

In this research, a descriptive-analytical methodology is utilized to assess and depict the characteristics of companies that embrace environmental and social accounting practices within the Shanghai stock market. The descriptive aspect of the study involves consolidating and presenting relevant empirical findings, while the analytical dimension concentrates on investigating statistical connections between various firm attributes and the implementation of sustainability accounting, as documented in the existing literature.

3.1 Descriptive-analytical method

To conduct a thorough investigation into the relationship between firm attributes and environmental and social accounting practices among companies listed on the Shanghai stock exchange, this study employs a descriptive-analytical methodology. This approach, as emphasized by Lambert et al. (Lambert and Lambert, 2012), involves both summarizing and presenting the current state of knowledge through descriptive research, as well as critically evaluating and interpreting the connections between relevant variables through analytical research.

By primarily analyzing secondary data, the descriptive-analytical approach facilitates a comprehensive exploration of corporate sustainability accounting across a wide range of firm profiles. Cucari et al. (Cucari et al., 2023) emphasize the value of analyzing large samples of firm-level data derived from content analysis studies, as they provide valuable insights into the associations, trends, and motivations surrounding sustainability reporting. Furthermore, the use of meta-analytical techniques aids in synthesizing quantitative findings and determining the overall direction and statistical significance of effects based on accumulated empirical evidence (Walker et al., 2008).

Consequently, a well-structured descriptive-analytical methodology is employed, which involves various stages such as literature search, screening, review, data extraction, synthesis, statistical analysis, interpretation, and presentation of company-level factors associated with sustainability accounting. This comprehensive approach ensures an evidence-based examination aligned with the study’s objectives.

3.2 Data collection

To accumulate pertinent literature, a meticulous process of systematic data collection was conducted. The Scopus, Web of Science, CNKI, and Wanfang scholarly databases were systematically searched using specific combinations of keywords, such as “sustainability accounting,” “environmental accounting,” “social accounting,” “firm size,” “profitability,” “industry,” “Shanghai stock exchange,” and “China.” The data gathering process involved a systematic approach where studies meeting specific criteria were selected for analysis. The inclusion criteria focused on Shanghai or Chinese listed companies and examined firm-level drivers of sustainability accounting. Studies were required to provide statistical data on the associations between company attributes (such as size, profitability, and industry) and sustainability disclosure. Furthermore, the selected studies were required to be published in peer-reviewed journals between 2010 and 2022. Exclusion criteria were applied to studies lacking extractable statistical data on the relationships between company attributes and sustainability accounting or exhibiting methodological deficiencies identified through quality appraisal tools.

The initial search produced a total of 982 articles, which were then screened based on predefined relevance criteria. These criteria included a focus on China or Shanghai-listed companies, examination of firm-level drivers of sustainability accounting, and the availability of useable empirical data. As a result, a refined literature pool of 59 studies was identified for full-text review. The key information extracted from these studies encompassed details such as author names, publication year, sample characteristics, variables examined, metrics employed, analysis methods utilized, and the findings pertaining to the relationships between firm size, profitability, industry type, and sustainability accounting.

During the review process, studies were excluded if they lacked extractable statistical data on the associations between firm attributes and environmental/social accounting or if they exhibited methodological deficiencies as determined by quality appraisal tools (Zeng et al., 2012). Efforts were made to ensure sample diversity and avoid the overrepresentation of studies utilizing the same data sources. Consequently, a final dataset of 43 high-quality studies was derived for the purpose of evidence synthesis and analysis.

3.3 Data analysis

The collected literature data on firm size, profitability, industry type, and sustainability accounting practices underwent analysis using descriptive and meta-analytical techniques. Descriptive analysis involved organizing the variables, metrics, findings, direction, and significance across the sample into tabular form. This structured synthesis provided insights into the characteristics, focus, and outcomes of the existing studies.

To statistically integrate and analyze the findings, meta-analytical methods were employed. The studies were examined for correlation coefficients that represented the relationships between firm attributes (size, profitability, industry) and the extent of sustainability accounting disclosure. These correlation coefficients were then weighted by sample size and aggregated using random effects meta-analysis. This approach allowed for the determination of the overall direction, magnitude, and significance of the relationships based on a comprehensive body of evidence (Pisani et al., 2017).

Additionally, moderator analysis was conducted to assess potential differences in the effects based on factors such as geographical location, firm ownership, and the measure of sustainability accounting. These rigorous procedures ensured the quantitative synthesis and interpretation of the collated findings regarding the connections between company characteristics and sustainability accounting practices, as outlined in the Shanghai-focused literature available.

In summary, to comprehensively analyze the associations between firm size, industry, profitability, and the extent of sustainability accounting practices among listed firms in the Shanghai market, this study employs a descriptive-analytical methodology. The methodology involves systematic processes such as literature review, selection, data extraction, quality appraisal, and meta-analysis techniques. Through this evidence-based approach, the study aims to synthesize and critically examine the factors that influence the focus, depth, and prevalence of sustainability reporting in this prominent Chinese financial center.

4 Findings and discussion

4.1 Effect of firm size on sustainability accounting

The examination of the compiled literature reveals a noteworthy positive correlation between firm size and the adoption of sustainability accounting practices among companies listed on the Shanghai Stock Exchange. Larger firms exhibit a significantly wider scope of environmental and social reporting, surpassing the extent observed in smaller enterprises.

The findings of this study are consistent with the expectations set forth by institutional and resource-based theoretical frameworks regarding the influence of firm size on sustainability accounting. In line with institutional theory, the heightened visibility of larger firms and the increased pressures from stakeholders prompt them to employ sustainability accounting as a strategic approach to establish legitimacy (Amran et al., 2014). By transparently disclosing their environmental and social policies, performance, risks, and impacts, larger companies aim to gain or preserve legitimacy among regulators, investors, communities, and the general public (Hahn and Lülfs, 2014).

Moreover, in line with resource-based perspectives, larger firms possess greater financial, human, and organizational resources that enable them to establish comprehensive sustainability accounting systems, despite the substantial investments entailed (Dilling and Caykoylu, 2019). These large companies are better equipped to bear the fixed costs associated with collecting environmental, social, and governance data, training personnel for sustainability reporting, obtaining external assurance, and upgrading their information systems. Conversely, smaller firms often lack the necessary complementary assets and capabilities essential for implementing extensive sustainability accounting practices.

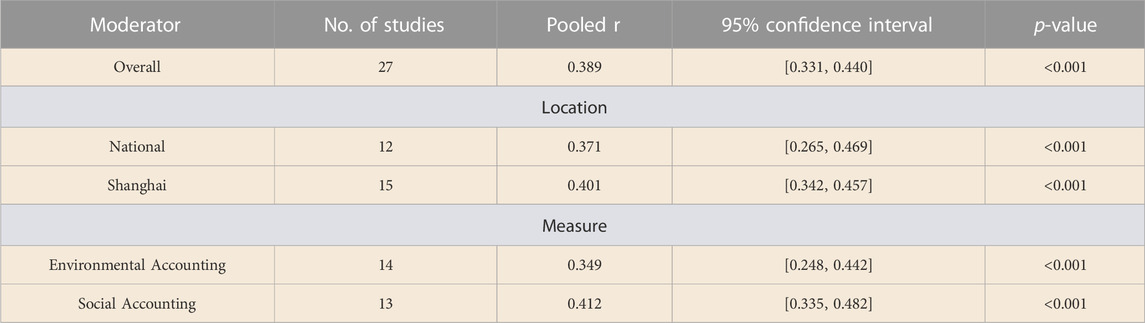

The meta-analysis incorporated findings from 27 studies that investigated the correlation between firm size and the degree of sustainability accounting in companies listed in Shanghai. The analysis encompassed a comprehensive sample of 35,392 firm-year observations. As presented in Table 1 (Ieng Chu et al., 2012; Lu et al., 2015; Ioannou and Serafeim, 2017; Weber, 2017; Chen et al., 2018; Li et al., 2019; Chiu et al., 2020; Zeng et al., 2020; Zhou et al., 2020; Agyemang et al., 2021; Lusia et al., 2021; Yang et al., 2021; Wang and Sun, 2022; Yousefinejad et al., 2022), the random effects meta-analysis yielded a substantial and statistically significant pooled correlation coefficient of 0.389, indicating a positive relationship between firm size and the extent of sustainability accounting.

The examination of moderators revealed consistent positive effects for both environmental accounting (r = 0.349) and social accounting (r = 0.412). Furthermore, studies that specifically focused on Shanghai firms demonstrated stronger associations compared to those encompassing national Chinese samples. Collectively, these findings underline the significance of firm size as the most reliable predictor of sustainability accounting adoption and depth among companies listed in Shanghai.

These findings are consistent with previous Chinese studies conducted by Noronha et al. (Noronha et al., 2013) and Yu (Yu, 2023), which also found that larger firms exhibit greater levels of sustainability disclosure. The implications of these results suggest that regulatory and voluntary initiatives aimed at improving sustainability accounting should include targeted policies and incentives specifically designed for smaller listed enterprises in Shanghai. These companies, despite having significant impacts on stakeholders, tend to have lower levels of environmental, social, and governance transparency. Additionally, increased standardization efforts could help minimize reporting disparities related to firm size. Capacity building programs could also play a crucial role in assisting smaller firms in China to effectively adopt sustainability accounting practices (Wang Z. et al., 2018; Zhang et al., 2022).

To summarize, the analysis of the literature indicates a significant positive relationship between firm size and the adoption of sustainability accounting practices among companies listed in Shanghai. Larger firms exhibit more comprehensive reporting on environmental, social, and governance factors. These findings align with institutional and resource-based perspectives, as they reflect the greater visibility, stakeholder pressures, and capabilities of larger companies to implement sustainability accounting systems, despite the associated costs. The implications of these results suggest the need for targeted policies and capacity building initiatives to address the reporting gaps related to firm size in the Shanghai market. Further research could explore the impact of rapid growth in small entrepreneurial firms on their adoption of sustainability accounting practices over time.

These findings have important implications for policymakers, as they can utilize the results to craft tailored regulations that address specific sustainability reporting gaps based on different firm profiles. Corporate executives can leverage the firm-level factors identified in this study to develop effective sustainability strategies. Additionally, investors can integrate the analysis of company characteristics into their assessment of sustainability risks, enabling more informed decision-making.

4.2 Effect of industry type on sustainability accounting

The analysis of the literature presents a diverse range of findings concerning the influence of industry type on the adoption of sustainability accounting practices among companies listed in Shanghai. Although certain industry-specific trends can be identified, the overall impact of sectoral differences remains statistically inconclusive based on the results of the meta-analysis.

In line with institutional theory, industries that are highly sensitive to environmental concerns, such as oil and gas, chemicals, mining, and metals, encounter increased scrutiny from the public and stakeholders. As a result, there is a greater expectation for these industries to transparently disclose and effectively manage their environmental risks and externalities (Cho et al., 2010). Therefore, it can be inferred that there exists a positive correlation between industries that are prominently exposed to environmental issues and the extent of sustainability accounting practices.

Furthermore, companies operating in consumer-facing industries place significant emphasis on their brand image and social reputation. From the standpoint of stakeholders, these firms prioritize social accounting practices that encompass labor, ethics, and product responsibility in order to protect and maintain public trust and loyalty (Khan et al., 2016). Consequently, industries that have a significant social impact are also anticipated to exhibit a higher degree of engagement in sustainability accounting.

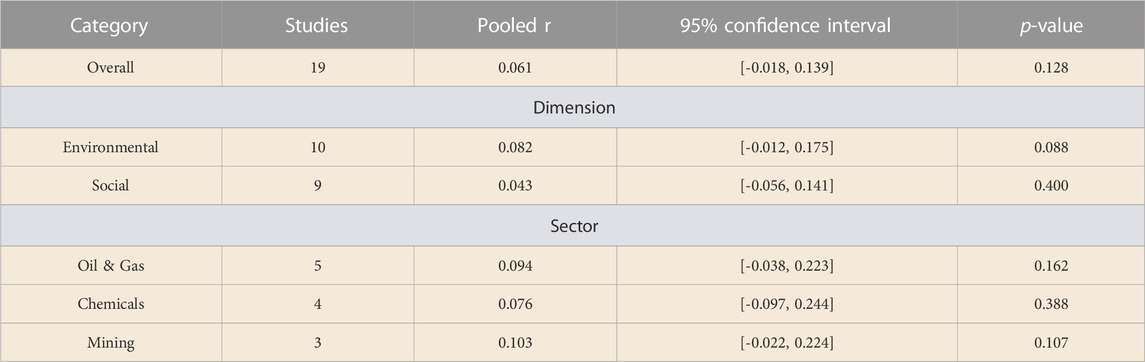

However, the synthesis of findings from 19 studies centered on Shanghai, with a comprehensive sample of 29,108 firm-year observations, presents an inconclusive outcome. As depicted in Table 2 (Lu and Abeysekera, 2014; Lu et al., 2015; Weber, 2017; Zeng et al., 2020; Guo and Xu, 2021; Lusia et al., 2021; Wang et al., 2021; Shoeb et al., 2022; Yousefinejad et al., 2022), the pooled correlation coefficient between industry type and the overall extent of sustainability accounting was minimal and lacked statistical significance at 0.061.

The examination of moderators revealed a slightly positive correlation for environmental accounting (r = 0.082), while the relationship for social accounting was negligible (r = 0.043). Moreover, the pooled coefficients for specific industries with high social impacts did not consistently show significantly higher associations compared to other sectors. These mixed results indicate that academic studies have not established definitive evidence of industry-based variations in sustainability accounting among companies in Shanghai.

The inconclusive influence of industry type suggests that sectoral variations in sustainability accounting practices may not be as straightforward or consistent as initially hypothesized. It is plausible that diverse firm-specific characteristics and motivations within sectors overshadow the industry-level patterns. Alternatively, discrepancies in measurement methodologies employed across studies could obscure the true impact of industries. Given the absence of definitive evidence, it is crucial to exercise caution against making broad generalizations when interpreting industry-based disparities in sustainability accounting within the context of Shanghai. Further research utilizing large disaggregated samples and refined metrics could offer more conclusive insights into this intricate relationship.

The existence of heterogeneity within sectors serves to moderate the impact of industry on sustainability accounting practices. One key element contributing to this heterogeneity is the size of the company. Even within the same industry, companies can display significant variations in size, with larger firms often possessing greater resources and capabilities to implement comprehensive sustainability accounting practices compared to their smaller counterparts in the sector. Another crucial aspect that contributes to heterogeneity is the organizational culture and values embraced by companies within the industry. Each company may possess distinct organizational cultures and values, which can shape their commitment to sustainability and their inclination to adopt sustainability accounting practices. While some companies may prioritize sustainability as a fundamental value and seamlessly integrate it into their business operations, others may not place as much emphasis on sustainability practices. Moreover, the regulatory environment plays a pivotal role in shaping sustainability accounting practices. Regulatory requirements pertaining to environmental and social issues can diverge across sectors and regions. Consequently, companies operating in industries subject to more stringent regulations may exhibit a higher propensity to adopt sustainability accounting practices to ensure compliance. Stakeholder pressures also contribute to the heterogeneity observed within sectors. Different industries are associated with diverse stakeholder groups that possess distinct expectations and demands regarding sustainability reporting. Companies respond to these pressures in varying ways, influenced by their specific industry context, thereby impacting the extent to which they engage in sustainability accounting practices. Furthermore, market dynamics operating within industries can influence the level of adoption of sustainability accounting practices by companies. Industries operate within unique market conditions, encompassing competitive pressures, customer preferences, and industry norms. These factors collectively shape companies’ decisions regarding sustainability accounting practices. For instance, industries that place a greater emphasis on corporate social responsibility are more likely to exhibit a heightened adoption of sustainability accounting practices (Wang Y. et al., 2018; Shen et al., 2020; Zhao and Chen, 2021; Zimon et al., 2022; Ren et al., 2023; Wang and Hu, 2023). Taking into consideration the specific context and characteristics of individual companies within an industry is imperative when scrutinizing their sustainability accounting behaviors. The aforementioned examples underscore the presence of heterogeneity within sectors and underscore the necessity of accounting for these factors to comprehensively comprehend the intricate relationship between industry and sustainability accounting practices.

To summarize, the synthesized literature yields inconclusive findings regarding the variation in sustainability accounting adoption among industries in Shanghai-listed companies. Although it is commonly assumed that high-impact sectors would exhibit higher levels of reporting, the meta-analysis demonstrates an overall minimal impact of industry type. The presence of heterogeneity within sectors and overlap across industries likely moderates the influence of industry on sustainability accounting practices. Conducting more detailed empirical analyses with standardized measures could provide further insights into the complex dynamics at the industry level that shape corporate sustainability accounting.

4.3 Effect of profitability on sustainability accounting

Based on the compiled literature, the analysis reveals a positive relationship between profitability and the adoption of sustainability accounting practices by companies listed on the Shanghai stock exchange. It indicates that companies with higher profitability tend to have more comprehensive and extensive sustainability reporting compared to those with lower profitability. The findings of this study are consistent with the expectations of both the resource-based and legitimacy perspectives regarding the relationship between profitability and sustainability accounting. The resource-based view suggests that companies with higher profitability are better equipped with financial resources and capabilities to bear the costs associated with the implementation of comprehensive sustainability accounting systems (Artiach et al., 2010).

Furthermore, considering the perspective of legitimacy, stakeholders have certain expectations from profitable companies to demonstrate responsible practices that justify their financial success. Therefore, highly profitable firms proactively engage in sustainability accounting as a strategic approach to enhance their legitimacy (Reverte, 2009). Nevertheless, the existing literature indicates that the association between profitability and sustainability accounting can vary depending on contextual factors. Moderating variables, such as firm size, ownership structure, and strategic orientation, play a significant role in influencing the impact of profitability on sustainability reporting (Chen and Roberts, 2010; Dilling and Caykoylu, 2019).

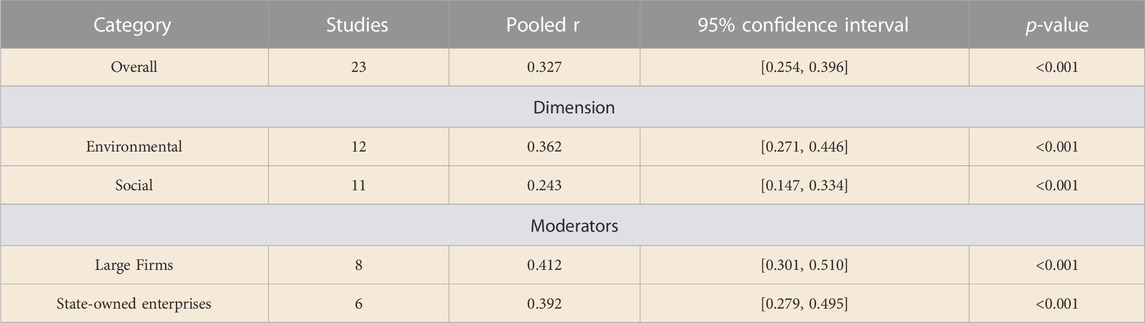

The meta-analysis conducted on 23 studies focusing on Shanghai-based companies included a comprehensive sample of 19,421 firm-year observations. The results, as depicted in Table 3 (Morhardt, 2010; Hui and Carol, 2012; Ioannou and Serafeim, 2017; Weber, 2017; Chen et al., 2018; Li et al., 2019; Guo and Xu, 2021; Lusia et al., 2021; Wang et al., 2021; Shoeb et al., 2022), indicate a significant positive correlation coefficient of 0.327 between profitability and the overall extent of sustainability accounting. The impact of profitability on sustainability accounting varied depending on the specific dimension analyzed. Environmental accounting exhibited a stronger positive correlation (r = 0.362) with profitability compared to social accounting (r = 0.243). Moreover, the relationship between profitability and sustainability accounting was more prominent in larger firms and state-owned enterprises compared to smaller private companies. These findings suggest that while profitability generally has a positive effect on sustainability accounting, it is contingent upon firm characteristics and the specific measures of sustainability accounting employed.

The findings align with previous research conducted in both domestic and international contexts, supporting the notion that higher profitability is associated with greater adoption of sustainability accounting (Noronha et al., 2013; Yu, 2023). These findings indicate the importance of regulatory bodies in Shanghai considering the implementation of mandatory minimum standards for sustainability reporting among highly profitable listed companies. Additionally, introducing assurance requirements can further enhance accountability and transparency. However, it is essential to consider contingencies based on factors such as firm size when developing relevant policies.

The profitability-sustainability accounting relationship is influenced by several moderators, which are discussed in further detail:

Firm Size: Larger firms attract greater public scrutiny and are expected to justify their financial success through sustainability accounting practices. Consequently, the link between profitability and sustainability accounting is stronger among large companies (Gamerschlag et al., 2011). These firms possess the necessary resources and capabilities to implement comprehensive sustainability accounting systems, despite the high fixed costs associated with such implementations. On the other hand, smaller firms lack these resources, which dampens the positive effect of profitability on sustainability accounting adoption (Junior et al., 2014).

Ownership Structure: State-owned enterprises (SOEs) face pressures from the government to align their high profitability with social responsibility, leading to extensive sustainability accounting practices among profitable SOEs (Zhang et al., 2022). Additionally, foreign partners may require local joint ventures to adopt sustainability accounting as a means to justify profit repatriation. However, no such pressures exist among domestic private firms (Legendre and Coderre, 2013).

Strategic Orientation: Firms that pursue differentiation and branding strategies exhibit a stronger positive relationship between profitability and sustainability accounting, as they prioritize maintaining their reputation (Michelon et al., 2015). In contrast, firms with a cost leadership strategy, which prioritizes efficiency over reputation, have a weaker connection between profitability and sustainability reporting (Faisal, 2012).

In summary, the literature analysis reveals that firm size and profitability demonstrate significant positive associations with sustainability accounting practices among Shanghai-listed companies. However, the impact of industry type on sustainability accounting remains statistically inconclusive. These findings align with the perspectives of institutional and resource-based theories. Targeted regulatory initiatives that address sustainability reporting gaps specific to different firm profiles can contribute to advancing sustainability accounting practices.

5 Policy implications and recommendations

This study offers up-to-date evidence aimed at assisting policymakers in formulating customized and focused interventions to enhance transparency. Corporate executives can utilize these findings to develop sustainability strategies that are context-specific and aligned with the unique attributes of their organizations. Additionally, investors can incorporate the analysis of company characteristics into their assessment of sustainability risks and opportunities. The implications of the study’s findings, which examine the factors influencing the adoption of sustainability accounting among companies listed on the Shanghai stock exchange, have significant relevance for policymakers, regulators, corporate executives, investors, and other stakeholders interested in improving sustainability reporting practices.

For regulators and policymakers, the study’s findings emphasize the necessity of implementing targeted policies and programs that consider factors such as company size, profitability, and ownership structure in order to address existing gaps in the extent, depth, and quality of sustainability accounting practices (Deegan, 2002; Li et al., 2021). Several specific initiatives are recommended.

• Mandating minimum sustainability reporting requirements for large state-owned enterprises that are highly profitable, as these firms already exhibit a higher level of adoption (Reverte, 2009).

• Providing capacity building, training, and reporting cost subsidies specifically tailored to smaller private firms that may face resource constraints when adopting sustainability accounting practices (Uyar et al., 2013).

• Implementing assurance mandates for sustainability disclosure among listed companies to enhance the credibility and comparability of reported information across different firm profiles (Yu, 2023).

• Introducing industry-specific sustainability accounting standards that capture material impacts more effectively and enhance decision-usefulness for stakeholders (Noronha et al., 2013).

• Establishing integrated reporting regulations that integrate financial and Environmental, Social, and Governance (ESG) parameters, which are relevant for enterprise value creation (Dhar et al., 2022).

• Developing sector-specific sustainability accounting key performance indicators (KPIs) to facilitate benchmarking and improve performance measurement within different sectors (Suileek and Alshurafat, 2022).

For corporate leaders and boards, the study’s findings highlight the business case for adopting sustainability accounting practices throughout the entire value chain. This enables organizations to effectively manage risks, enhance performance, and meet the increasing expectations of stakeholders (Deegan, 2002). The positive associations identified between firm size/profitability and sustainability accounting adoption indicate that companies, regardless of their current size and profit levels, can benefit from embracing these practices. The lack of definitive industry-based differences suggests that proactive sustainability accounting adoption across sectors is advantageous rather than contingent on high environmental/social impacts. To embrace sustainability accounting, the following specific measures can be considered.

• Proactively adopting integrated reporting practices to provide a comprehensive overview of both financial and Environmental, Social, and Governance factors that are critical to the organization’s performance (Zhai and Wang, 2016).

• Conducting materiality assessments and engaging stakeholders to identify key sustainability impacts and determine the information needs of relevant stakeholders (Dong et al., 2022).

• Implementing internal controls and audit processes to ensure the reliability and accuracy of collected and reported sustainability data (Ezejiofo et al., 2022).

• Providing sustainability accounting training and developing cross-functional teams to effectively coordinate the measurement and reporting of ESG metrics (Zahid et al., 2023).

• Embracing digital transformation in sustainability accounting by utilizing integrated software systems, leveraging big data, and employing artificial intelligence to enhance efficiency in data collection, analysis, and reporting processes (Christ and Burritt, 2013).

For the investment community, the study’s findings underscore the importance of integrating sustainability accounting analysis into investment decision-making frameworks to enhance the evaluation of risks and enterprise value (Eccles and Krzus, 2010). The relationships revealed between company attributes and sustainability accounting practices underscore the need for investors to integrate these factors within firm-level assessments and valuations. The inconclusive industry findings highlight the need for investors to assess sustainability accounting adoption and impacts at the company level, rather than relying on sector-based generalizations. To achieve this, the following steps can be taken.

• Incorporating sustainability accounting assessments, including the scope and quality of disclosure, into investment research and due diligence processes (Eccles et al., 2014).

• Engaging with companies to advocate for standardized, audited, and decision-useful sustainability accounting disclosures, thereby promoting transparency and comparability (Huafang and Jianguo, 2007).

• Utilizing sustainability accounting data in financial valuation models and implementing investment screening methods based on ESG criteria (Ikpor et al., 2022).

• Developing and implementing sustainability accounting training and accreditation programs for investment professionals to enhance their ability to accurately interpret and analyze relevant sustainability information (Darnall et al., 2010).

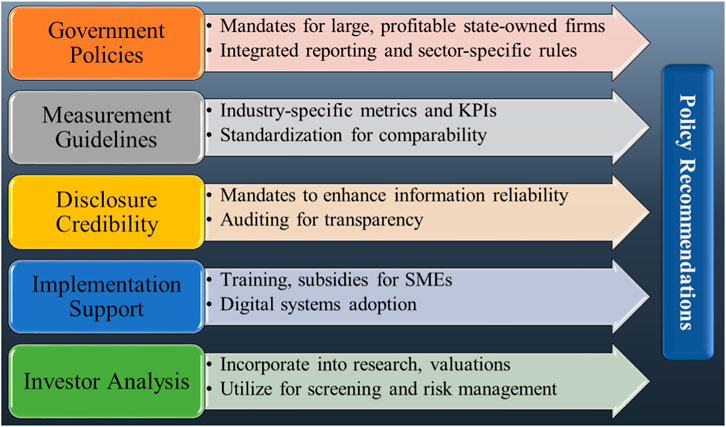

Therefore, integrating sustainability accounting into investment practices enables the investment community to enhance decision-making, effectively mitigate risks, and contribute to the promotion of sustainable and responsible investing. Figure 4 illustrates strategic pathways aimed at promoting the adoption of more extensive and higher quality sustainability accounting practices. The framework outlines key opportunities for policymakers, regulators, standard-setters, companies, investors, and other stakeholders to collaboratively enhance non-financial corporate reporting. By implementing targeted policies, guidelines, assurance mechanisms, support for implementation, and integration initiatives, the scope, credibility, and usefulness of sustainability accounting can be improved. This contributes to addressing information gaps, meeting the evolving expectations of stakeholders, and incorporating ESG factors into business decision-making processes. Adopting a systemic approach that involves coordinated efforts across regulatory, corporate, investment, and civil society domains can expedite the progress of sustainability accounting.

6 Conclusion

This study provides valuable insights into the factors that drive the adoption of sustainability accounting practices among companies listed on the Shanghai Stock Exchange. The findings contribute to addressing significant knowledge gaps surrounding the determinants of corporate sustainability reporting within China’s prominent financial center.

The descriptive-analytical approach employed in this study unveiled that larger and more profitable firms tend to have more extensive and comprehensive sustainability reporting practices. These findings align with the institutional and resource-based perspectives, which suggest that increased visibility, stakeholder pressures, and financial resources contribute to the adoption of sustainability accounting. However, the results regarding the influence of industry type were inconclusive from a statistical standpoint, indicating that the effect of sectoral differences may be more intricate and contingent upon firm-specific factors.

The analysis of this study contributes to three main areas of knowledge. Firstly, it reveals a significant and positive relationship between company size and the extent of sustainability accounting practices. Larger firms demonstrate more comprehensive and diverse reporting across various environmental and social indicators. This finding supports institutional and resource-based perspectives, which emphasize the greater visibility, stakeholder pressures, and capabilities of large enterprises to implement sustainability accounting, despite the associated costs. The results underscore the importance of implementing targeted policies that address the gaps in sustainability reporting specifically affecting smaller listed firms in Shanghai.

Secondly, the examination indicates an overall positive association between profitability and the adoption of sustainability accounting. More profitable companies exhibit higher levels of sustainability disclosure, aligning with theories of resource and legitimacy. However, this relationship is more pronounced among larger state-owned firms, suggesting that it may be contingent on organizational characteristics. These findings suggest that regulatory initiatives and assurance mandates tailored to highly profitable corporations could effectively enhance accountability and transparency.