94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 14 September 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1257912

This article is part of the Research TopicDeterminants of Sustainable Development from a Global PerspectiveView all 5 articles

Although China has implemented numerous environmental governance polices to realize green development, no significant changes have been achieved in reality. To understand the underlying reasons, we relate green development to the debt-driven model by the local government. Using the total debt data of prefecture-level cities in China from 2007 to 2013, we analyze the effects of debt expansion through a two-way fixed effect model. Results imply that the expansion of local government debt will inhibit green total factor productivity, but there are differences between long-term and short-term debts. Further analysis shows that local government debt will affect capital misallocation and also finds that an increase in local government debt will increase urban carbon emissions. This study recommends that the Chinese government should further decrease debt size and improve investment effectiveness to achieve high-quality development.

The report of the 20th National Congress of the Communist Party of China indicated that “We must firmly establish and practice the idea that green mountains and green hills are Jinshan Yinshan, and plan development from the height of harmonious coexistence between man and nature.” To achieve high-quality development, the inevitable choices for China include accelerating the green transformation of development, promoting green development, promoting the harmonious coexistence between man and nature, and building a “green China.” Since the reform and opening up, China has turned in remarkable economic performance, but it has been followed by severe environmental problems. In 2013, the failure to meet standards (i.e., AQI, PM10, and PM2.5) caused economic losses of about 7.9 trillion RMB yuan, accounting for about 13.46% of the GDP. In 2018, the economic losses decreased to 3120 billion RMB yuan, accounting for 3.48% of the GDP. Although the economic losses caused by environmental pollution are decreasing annually, the negative effects are still significant.

To completely change the status of environmental pollution, the Chinese government has implemented numerous anti-pollution policies, but the outcome of governance has failed to achieve the expected goals. Numerous studies have shown that the effects of environmental supervision depend on local governments, which have selectivity in facing different incentives (e.g., financial and promotion incentives) (Kahn et al., 2015; He et al., 2020).The officials’promotion depends on the economic performance (Li and Zhou, 2005). That is, local governments choose avoiding regulations to meet growth targets (Cai et al., 2016). The preference for economic growth by local governments will affect the effectiveness of environmental governance, especially the choice of development strategies. in particular, local governments mainly choose the investment-driven growth model, which is highly reliant on debt expansion. The investment structure and scale caused by credit expansion will inevitably affect the quality of economic growth. The Chinese government is also aware of this situation and no longer focuses exclusively on GDP and total factor productivity (TFP) but considers green GDP and green TFP (GTFP) when evaluating local governments. When considering economic growth and environmental protection, improving GTFP is an important starting point for building a “green China” in a holistic manner. Accordingly, green development is imperative with China’s macroeconomic status changing from high-speed growth to high-quality development. Therefore, our research attempts to investigate how the debt expansion of local governments affects GTFP. In particular, we aim to clarify the fundamental factors for which the effectiveness of environmental governance is lower.

In the absence of competition, the debt-driven investment model may not be conducive to improving GTFP. Ke et al. (2021) explained that China’s GTFP in recent years has shown a generally fluctuating upward trend, but the increase rate is small and speed is slow. Moreover, such a development shows a gradient distribution trend, in which coastal, border, and inland areas decrease in space and their GTFP gap has been gradually widened. The expansion of local government debt will lead to resource misallocation, resulting in the failure of production efficiency to reach optimal levels in a fully competitive market and affecting GTFP thereafter.

At present, the literature has discussed the positive effects of local debt expansion on GTFP. On this basis, this study analyzes the impact of local government debt on GTFP by using the full-scale data of local government debt in Chinese cities. Results indicate that the expansion of local government debt inhibits local GTFP, which is more pronounced in the central and western regions. This research also finds that long-term and short-term debts significantly reduce GTFP of cities, and the negative effect of the former is greater than the latter. We further clarify the inhibitory effects of local government debt through a robustness test. Lastly, we also show that the expansion of local government debt increases the carbon emissions of local governments and exacerbates the degree of capital misallocation, thereby reducing GTFP.

The contributions of this study are as follows. First, the current research aims to further enrich the discussion on the effectiveness of environmental governance. Current studies have mainly discussed the micro effects of a specific environmental policies, indicating that the selective enforcement of local governments leads to the low efficiency of environmental governance (Chen et al., 2018; Zhang et al., 2018; Greenstone et al., 2021; 2022; Karplus et al., 2021). The failure of certain governance policies is generally related to macro objectives, so our research mainly considers the environmental and economic effects of macro policies (e.g., debt expansion). This supplement is crucial to the current research. Second, we use different levels and more comprehensive data. Our research analyzes the impact of local government debt expansion on GTFP in Chinese cities. Given that the existing literature on local government debt research is markedly based on provincial data in China, this study uses the Wind database to calculate local debts in cities more accurately. Third, we provide additional research details. In particular, we divide local debt into long-term and short-term debts to analyze the impact of local debt balance expansion on GTFP. We likewise discuss the mechanism of local government debt expansion from the perspective of carbon emissions, which were not discussed in Mao and Failler (2022). Lastly, our measure of local debt is more comprehensive than that of Mao and Failler (2022), which only included the debt balance of each city’s financing platform company.

The remainder of this paper is organized as follows. Section 2 presents the literature review. Section 3 provides the institutional background, theoretical mechanism, and research hypotheses. Section 4 describes the model design and variable selection. Section 5 conducts basic empirical regression, robustness, and heterogeneity tests. Section 6 analyzes the intermediary effect. Lastly, Section 7 provides the conclusion and policy recommendations.

Extensive literature has considerably focused on the effectiveness of specific environmental policies (Greenstone et al., 2021; Karplus et al., 2021), disregarding the environmental effects of macro policies. Our research is related to the literature on the environmental effects of macro means, especially the effects of local government debt. The first is on the influence of local government debt. Li et al. (2022) explained that when the debt scale is less than the threshold, local government debt will inhibit environmental pollution; by contrast, if debt scale is greater than the threshold, then the local government debt will promote environmental pollution. Xiong and Shen (2019) indicated that excessive borrowing by local governments affects the availability of corporate credit funds, intensify the financing constraints faced by enterprises, and then squeezes out innovative activities. Lv et al. (2022) elaborated that the expansion of local government debt significantly reduces the efficiency of resource allocation in manufacturing industries, with high correlation with infrastructure. On the one hand, the demand for and investments in infrastructure products brought by the expansion of local government debt flowed more to state-owned enterprises with low productivity in the industry. On the other hand, the unreasonable allocation of resources reduced the probability of high-productivity enterprises entering and low-productivity enterprises exiting the market. Furthermore, the effect was more significant in cities with high dependence on state-owned enterprises and where officials have immense pressure on the promotion.

The second is on the influencing factors of GTFP. Liu et al. (2018) indicated that industrial structure upgrading and energy efficiency have significant roles in promoting the growth of regional GTFP, but the growth brought by the former is more obvious than that of the latter. Dong and Xia (2022) found that foreign direct investment has a significant inhibitory effect on China’s GTFP growth, and this effect is characterized by “weak in the east and strong in the west” geographically. Yin and Chang (2022) determined that China’s carbon emission trading policy can promote regional industrial structure upgrading and scientific and technological innovation to enhance regional GTFP.

The third is the effects of local government debt on TFP. Mao and Failler (2022) explained that local government debt inhibits GTFP by reducing the level of green innovation, but the development of the financial market helps alleviate this inhibition. Zhu and Kou (2019) indicated that large-scale borrowing by local governments can ease fiscal pressure in the short term, but the expansion of long-term debt scale will bring significant negative effects on TFP. Ji and Zhong (2022) found that the expansion of local government debt will lead to a decline in regional capital allocation and thereafter inhibit TFP growth.

In summary, existing studies have seldom discussed the impact of local debt on GTFP in Chinese cities, which are mostly concentrated on Chinese provinces. The mechanism of the local debt impact should be further discussed. Moreover, discussions on the impact of heterogeneous debt are lacking. Consequently, this study focuses on the impact of local government debt on GTFP and the intermediary mechanism behind it. Our purpose is to solve two problems: 1) analyze the impact of local government debt on GTFP in prefecture-level cities and 2) discuss the green productivity effect of local government debt expansion from the perspective of resource allocation (i.e., whether the change of local government debt scale will cause resource misallocation and then affect GTFP).

Local government debt has a long history. Globally, the history of municipal bonds can be traced back to the Renaissance. Historically, the Chinese government has rarely borrowed money. In 1905, Yuan Shikai issued 4.8 million local bonds for the purpose of training the new army, which was the first local bond in Chinese history. After the People’s Republic of China was founded, fiscal revenue and expenditure, material scheduling, and cash management were highly unified nationwide to maintain political stability and the development of economic and social undertakings. The two main forms of local government debt are 1) local borrowing and 2) “economic construction bonds” issued by local governments in some areas. However, the current autonomy of local governments has resulted in the relatively small local debt scale in various places. The Budget Law promulgated in 1994 proposes that “local governments shall not issue local bonds except as otherwise provided by laws and the State Council.” Given this background, local governments solve the problem of funding sources for the needs of economic development, and various localities borrow money by setting up local financing platforms and bank loans. Consequently, local government debt gradually expands. When the subprime mortgage crisis broke out in 2008, the Chinese government issued a “4 trillion” stimulus policy to cope with the impact of the financial crisis. The central government also issued 200 billion RMB yuan of local debt in 2009 and 2010, which broke the central government’s 16-year ban on borrowing from local governments. To date, the scale of local government debt in China has expanded rapidly. To develop the local economy, local governments borrowed on a large scale for economic construction. The debt balance is shown in Figure 1.

Figure 1 shows that the balance of local government debt reached 15.3 trillion in 2016, and then rapidly increased annually, reaching 30.47 trillion in 2021 and 37.65 trillion in 2022. In 2014, the increase in local government debt balance mainly came from platform companies, government departments, and institutions. The debt was mainly invested in municipal construction and people’s livelihood, of which the total funds for municipal construction, transportation, and land storage accounted for about 54%. The expansion of local government debt further promotes the investment-driven development model of local governments. The investment-driven growth model aims to promote GDP expansion owing to the publicity of investment subjects and investment directions. The blind GDP expansion may disregard environmental protection, leading to the lower utilization of clean and frontier technology, which has a negative impact on GTFP.

Confined by the limited resources and increasingly severe environmental problems, the importance of a green economy and sustainable development is evident, and resources have increasingly become rigid constraints that restrict high-quality development. GTFP, which includes the unexpected output into the assessment scope, is more comprehensive than TFP, which only considers the expected output. Given that this study aims to focus on the impact of local government debt on GTFP, this section begins with the mechanism of local government debt on productivity. In general, local governments usually raise funds in two ways. On the one hand, local governments can borrow to alleviate the shortage of funds and compensate for the financial gap in their public investment. On the other hand, the stimulation of officials’ promotion incentives results in local governments borrowing money to pursue economic construction and vanity projects. A principal–agent relationship exists between the central and local governments under the promotion incentives. Given the difficulty of the central government to accurately grasp various local measures, officials can easily borrow money on a large scale to pursue economic activities, such as urban construction and planning, to highlight their performance during their tenure. The long duration of such projects, even if local governments have difficulty in repaying loans in later periods, will not affect incumbent officials, so the short-term behavior shifts the responsibility to the succeeding officials (Zhang and Jiang, 2017). From the perspective of the proportion of local government debt to GDP, when its value exceeds the threshold, the aggravation of the debt burden increases the financial pressure on local governments. To expand fiscal revenue, local governments may choose “bottom-by-bottom competition” and relax environmental supervision, which will lead to an increase in pollution emissions of enterprises (Guo and Xue, 2021).

From the perspective of the industrial proportion to GDP, the secondary industry is undoubtedly the supporting industry, which will boost the growth of the regional economy and make local officials win the promotion competition (Li and Zhou, 2005). However, heavy industry in the secondary industry and other industries with high pollution, high emissions, high energy consumption and low efficiency will cause immense damage to the environment. In addition, the income of land lease is the main source of local governments to repay debts, but the resulting large-scale industrial land development will lead to an increase in pollution emissions, intensify environmental pollution, and is not conducive to local green development (Zheng et al., 2014). From the aforementioned impact of local government debt on environmental pollution, the expansion of local government debt will have an impact on the local environment and a negative impact on the GTFP growth. Hence, we propose Hypothesis 1 on the basis of the preceding analysis.

Hypothesis 1. The expansion of local government debt will inhibit the growth of GTFP.

Resource misallocation will reduce TFP (Hsieh and Klenow, 2009) and will also affect GTFP. Compared with the effective allocation of resources, resource mismatch means that the imperfect market makes the market price of labor, capital, and other factors deviate from their opportunity cost, leading to the non-optimal allocation of resources. In the market, the price of resources is distorted owing to market failure or government intervention, which limits the free flow of resources. The allocation ratio of resources among various departments deviates from the allocation ratio of resources under a perfectly competitive market, resulting in resource mismatch. Existing research has shown that the expansion of local government debt will affect the allocation efficiency of the capital market, leading to the inability of capital elements to flow freely between regions, which results in capital mismatch (Bai et al., 2016). Local government borrowing inspired by the promotion of officials will affect the allocation of labor resources (Zhou et al., 2013), resulting in labor mismatch. If resources are misallocated to enterprises or industries with high pollution and energy consumption (i.e., industries with low GTFP), then GTFP of enterprises and industries will be affected. Thus, Hypothesis 2 is formulated on the basis of the preceding analysis.

Hypothesis 2. The expansion of local government debt will inhibit GTFP by affecting capital mismatch or labor mismatch.

where

GTFP. To verify the relationship between local government debt and GTFP, this study uses the method of Tone and Tsutsui (2010) to estimate the economic output efficiency (i.e., GTFP) using the EBM model with unexpected output. EBM, as a hybrid distance model, overcomes the main defects of radial and non-radial measures. Moreover, this model avoids overestimating GTFP by combining the advantages of radial measures of CCR and non-radial measures (e.g., SBM) into a composite framework and by considering unexpected output. This study takes the number of local employees, capital stock, and energy consumption as input indicators. In addition, local industrial soot, industrial wastewater, and sulfur dioxide emissions are taken as unexpected outputs, while local GDP is taken as expected output to calculate local GTFP. The specific method is as follows. Suppose there are n decision-making units (DMU) and m inputs

where z, r, and p represent the zth input, rth expected output, and pth unexpected output, respectively; j and t represent the city and year respectively;

where

Local government debt. Before measuring the scale of local government debt, we introduce the way local governments in China of issue bonds. Given that local governments cannot borrow directly from banks and issue bonds on their own, local government financing platforms are set up to instruct them to borrow from banks or issue bonds by transferring assets (usually land) to them. This study measures the scale of local government debt as the amount of debt issued by such local government financing platforms. We use the Wind database as basis to divide the debt of the local government financing platforms into long-term and short-term debts by collecting the balance sheet of the local government financing platforms and combining the data of the China Banking Regulatory Commission. This method can effectively exclude the information that the central government issues bonds for local governments and avoid double counting of city data. This research uses per capita local government debt to measure the scale of local government debt. In particular, we use the ratio of local government debt balance and city population to measure the scale of local government debt. Local government debt balance refers to the debt balance of financing platform companies at the prefecture-level city, and its calculation formula is as follows:

Given the influencing factors of GTFP, any factors that can affect TFP will affect GTFP. Combined with research topics and based on the related findings of GTFP research (Krugman, 1991; Tang et al., 2014), gross economic product, industrial structure, the openness, population, innovation investment, and infrastructure constructions will affect the regional TFP. After screening, this research mainly selects the following controlled variables. The first variable is gross economic product (lnPGDP), which is expressed by log per capita GDP. The second variable is industrial structure, which is expressed by the proportion of the output value of secondary and tertiary industries to the local GDP. The third variable is the degree of economic openness (FDI), which is expressed by the proportion of foreign direct investment in the local GDP. The fourth variable is population size (lnpop), which is expressed by the log population. The fifth variable is the level of innovation investment (tec), which is expressed by the proportion of local science and technology expenditure to fiscal expenditure. The sixth variable is infrastructure level (construct), which is expressed by the road area per capita.

To verify the mechanism of GTFP change caused by local government debt expansion through resource allocation efficiency, this study measures resource allocation efficiency using the resource mismatch index. An increase in the degree of resource mismatch indicates that capital allocation efficiency decreases. The specific methods are as follows:

where

The sample interval of empirical regression is from 2007 to 2013, and the sample is prefecture-level cities. If there is no other explanation, then the local data used in this research come from statistical data, such as those from the China Urban Statistical Yearbook, China Population and Employment Statistical Yearbook, China Regional Economic Statistical Yearbook, and China Energy To ensure the comparability of samples, this study excludes Beijing, Tianjin, Shanghai, and Chongqing, which are four municipalities directly under the central government.

Some prefecture-level cities were excluded because they lack local government debt data during our study period. Eventually, 257 prefecture-level cities were included. Considering that outliers of samples will have an impact on this study, data are reduced by 1% at most and 1% at least.

To intuitively describe the relationship between local government debt and GTFP, we take the data of the two in 2013 as samples and make a scatter plot to depict their relationship, as shown in Figure 2.

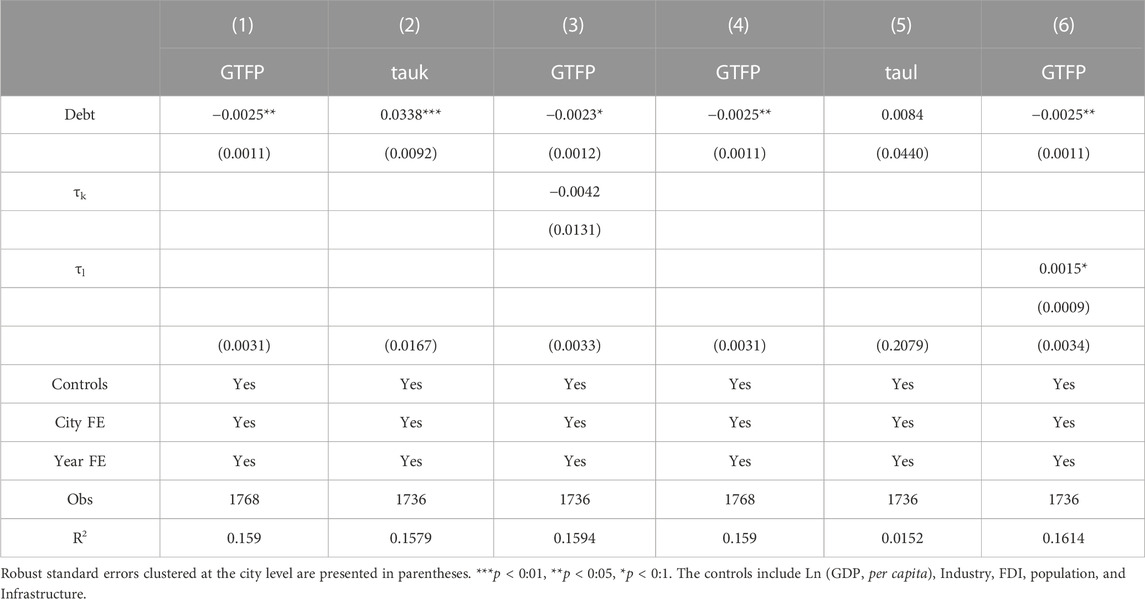

As shown in Figure 2, the horizontal and vertical axes are local government debt per capita and GTFP, respectively. Note that there is a certain negative correlation between them. That is, GTFP shows a downward trend with the expansion of local government debt. To further investigate the impact of local government debt on GTFP, basic regression is carried out according to model (1). The results are shown in Table 1 Table 2.

Table 2 shows the test results of model (1), in which (1) is the two-way fixed effect regression between local government debt per capita and GTFP growth rate, and (2) to (7) are the two-way fixed effect regression results of gradually adding control variables. The regression results show that in all the estimated results based on model (1), the regression coefficients between local government debt per capita (debt) and GTFP are negatively correlated. Moreover, they are at least significant at the 5% statistical level. The regression coefficient in column (7) is −0.0025, which shows that GTFP decreases by 0.25% for every 1% increase in local government debt per capita. That is, the expansion of local government debt will inhibit the growth of GTFP in this region. Hence, Hypothesis 1 is verified. To test whether there is a nonlinear relationship between local government debt and GTFP, we also conduct a threshold model test. The threshold regression results show no nonlinear relationship between them. That is, their relationship is linear and there is no jump feature in the sample period selected in this study (2007–2013).

(1) Regional heterogeneity. For a long time, unbalanced regional economic growth there has always been a problem in China. The differences in economic growth stages and heterogeneity of growth objectives will bring different influences on debt-driven investment models. Therefore, this study attempts to explore whether this influence will have heterogeneity at the regional level. Accordingly, the samples are divided into eastern, central, and western regions, and the regression of model (1) is carried out. The results are shown in columns (1), (2), and (3) of Table 3. The regression of the east is not significant, while the regressions of the central and western regions are significant at the 1% and 10% statistical levels, respectively, with regression coefficients of −0.0027 and −0.0043, respectively. This result indicates that GTFP in the central and western regions will decrease by 0.27% and 0.43% for every 1% increase in local government debt. The result is also similar to other studies, such as Mao and Failler (2022). The possible reason is that under an unbalanced regional economic growth pattern, in promoting urbanization and industrialization, the central and western regions have undertaken pollution-intensive industries transferred from the eastern region to promote economic growth. This situation accelerates environmental pollution in the central and western regions simultaneous to economic growth.

(2) Debt heterogeneity. The length of debt reflects different policy objectives. Short-term debt aims more to solve current growth or fiscal pressure, whereas long-term debt reflects long-term investment objectives. Considering the short-term growth target, the investment behavior brought by short-term debt expansion will cause greater distortion of resource allocation and a more negative impact on GTFP. To verify the influence of debt duration on GTFP, this study divides local government debt into short-term and long-term debts, and regression model (1) is carried out as well. The results are shown in columns (4) and (5) of Table 3, both of which are significant at the 5% statistical level and the regression coefficients are −0.0103 and −0.0028, respectively. This result indicates that the local GTFP will decrease by 1.03% and 0.28% for every 1% increase in local government short-term and long-term debts. From the perspective of declining ratio, it is consistent with expectations, and short-term local government debt brings GTFP.

When local governments borrow money for economic construction, they will consume substantial energy, most of which is coal consumption, which is not conducive to the realization of China’s “double carbon” goal. To verify the impact of local government debt on carbon emissions, this study regresses the carbon emissions on debt, and the data of carbon emissions is from the China Carbon Accounting Database (CAEDs). The results are shown in column (6) of Table 3, which is significant and positive at the 10% statistical level. This result indicates that local government borrowing for economic construction will lead to a large amount of carbon emissions, which is similar to the results of prior studies (Zheng et al., 2014; Guo and Xue, 2021).

Using the method of Pastor and Lovell. (2005) for reference, under the framework of global reference data envelopment analysis, the GTFP growth of cities is measured by considering the super-efficiency SBM model and Malmquist productivity index (SBM-GML). The GDP boundary of each prefecture-level city is obtained using the stochastic frontier regression method. Meanwhile, production efficiency is calculated by dividing the actual GDP by the GDP boundary value, and it is regressed thereafter as the explained variable (GTFP2). The results are shown in column (1) of Table 4. The regression coefficient of the core explanatory variable is still significantly negative at the 10% statistical level.

Considering the relationship between the size of local government debt and GTFP, the total size of local government debt (debt2) is used as an independent variable for regression. According to the regression results shown in column (2) of Table 4, the inhibitory effect of local government debt on GTFP is still significant at the 5% statistical level.

Considering that the scale of local government debt will not have an impact on GTFP in the succeeding year, the explanatory variables are treated with a one-stage lag (L.debt). As shown in column (3) of Table 4, the regression coefficient of local government debt is significantly negative at the 10% statistical level.

Owing to the financial crisis in 2008, the central government launched a “4 trillion” economic stimulus plan that year. Since then, numerous financing platform companies have been established immediately in various areas. To eliminate the impact of this policy shock on the benchmark regression results, this study uses samples from 2009 to 2013 for regression. The specific results are shown in Table 4. The inhibitory effect of local government debt on GTFP is still significant and negative.

The two reasons for endogeneity are omitted variables and mutual causality. For the problem of omitted variables, we add fixed effects and the corresponding control variables in regression to relatively reduce the influence of omitted variables. For mutual causality, if GTFP of the previous period decreases, then the local government will expand the borrowing scale of the current period. that is, there is a negative correlation between them and that the regression coefficient is underestimated. To further consider the influence of endogeneity, this study refers to Rao et al. (2022) and takes the medical and family planning expenditure per capita in urban public finance expenditure as the instrumental variable of local government debt. Moreover, we adopt the instrumental variable method to test. The results show that the coefficient of local government debt is still significantly negative. That is, the regression results are not affected by endogeneity, and the results are still valid.

The previous theoretical analysis determined the intermediary variable of this resource mismatch index and measured the mismatch of resource caused by the expansion of local government debt through the capital mismatch and labor mismatch indexes, leading to the decline of GTFP. To test the possibility of this mechanism, this research calculates the resource mismatch index of each prefecture-level city, which indicates the efficiency of resource allocation. When the resource mismatch index rises, it will cause the efficiency of resource allocation to decline. Combined with the current research topic, we construct a recursive model composed of Eqs 6, 7, 8 by using the mediating effect test method proposed by Baron and Kenny (1986) for reference:

where

TABLE 5. Analysis of the intermediary effect of local government debt on green total factor productivity.

Undoubtedly, local governments play an important role in the development of the local economy, but we cannot disregard the damage caused by development to the environment. Under the background of high-quality economic development, building a “green China” and improving GTFP are important topics at present. The current research studies the influence of local government debt on GTFP in prefecture-level cities, and draws the following conclusions through theoretical analysis and empirical tests. First, the expansion of local government debt inhibited GTFP. In addition, the inhibition showed evident regional differences, and the negatives effects were more pronounced in the central and western regions. Second, the expansion of local government debt increases the scale of carbon emissions, which is not conducive to the realization of the “double carbon” goal. We find that the short-term local government debt has a greater negative effect on GTFP than long-term local government debt. Lastly, capital misallocation caused by debt expansion further reduces GTFP, and labor misallocation has no effects.

To reduce the negative impact of the expansion of local government debt balance, this study proposes the following policy suggestions based on the obtained findings. First, the central government should improve the bond issuance system and curb the excessive expansion of government debt. On the one hand, there is a necessity to improve the issuing systems of local government debt, establish local government bond supervision, or increase green local bonds to replace ordinary bonds. On the other hand, there is a need to strictly implement the quota management system of local government bond issuance to curb the negative effects of excessive local government debt expansion. Second, local governments could optimize the investment direction of debt funds and promote the rational allocation of capital markets. On the one hand, stimulated by the promotion of officials, local governments will borrow money to invest in the secondary industry with high short-term economic performance. However, this decision will also bring environmental pollution problems to local governments. Therefore, funds should be flowed to green industries that consider economic performance and environmental friendliness to simultaneously improve TFP and protect the environment. On the other hand, local government debt will cause a regional capital mismatch, thereby reducing GTFP. Therefore, local governments should introduce relevant policies to promote the rational allocation of capital markets and focus on improving GTFP.

Our study confirms the negative environmental effects of government behavior from a macro perspective and explores the intrinsic mechanisms. However, there are still some limitations in the current study, such as endogeneity. Hence, we still need to find some policy shocks to better identify the causal effects of government debts. Furthermore, we do not observe the environmental impact of government debt on firms. Accordingly, exploring how the macro behavior of the government affects the environmental performance of micro individuals is a future research direction.

The data analyzed in this study is subject to the following licenses/restrictions: They are not free for visit. Requests to access these datasets should be directed to https://data.cnki.net/.

GD: Writing–review and editing. CZ: Writing–original draft. DW: Writing–original draft, Writing–review and editing. WZ: Writing–review and editing.

Funding was received from the National Natural Science Foundation of China (No. 71773103) and the Hubei Provincial Department of Education (No. 21Q157).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Andersen, P., and Petersen, N. C. (1993). A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 39 (10), 1261–1264. doi:10.1287/mnsc.39.10.1261

Bai, C. E., Hsieh, C. T., and Song, Z. M. (2016). The long shadow of a fiscal expansion. Natl. Bureau Econ. Res.

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Cai, H., Yuyu, C., and Qing, G. (2016). Polluting thy neighbor: unintended consequences of China׳ s pollution reduction mandates. J. Environ. Econ. Manag. 76 (1), 86–104. doi:10.1016/j.jeem.2015.01.002

Chen, J., Pei, L., and Yi, L. (2018). Career concerns and multitasking local bureaucrats:Evidence of a target-based performance evaluation system in China. J. Dev. Econ. 133, 84–101. doi:10.1016/j.jdeveco.2018.02.001

Dong, Y., and Xia, W. (2022). Foreign direct investment and green total factor productivity in China: an empirical study based on systematic GMM and threshold model. Shanghai Econ. Res. (08), 94–106. (in Chinese).

Greenstone, M., Guojun, H., Ruixue, J., and Tong, L. (2022). Can technology solve the principal-agent problem? Evidence from China’s war on air pollution. Am. Econ. Rev. Insights 4 (1), 54–70. doi:10.1257/aeri.20200373

Greenstone, M., Guojun, H., Shanjun, L., and Eric, Y. Z. (2021). China’s war on pollution: evidence from the first 5 years. Rev. Environ. Econ. Policy 15 (2), 281–299. doi:10.1086/715550

Guo, Y., and Xue, J. (2021). Research on nonlinear environmental effects of local government debt. Stat. Res. 38 (12), 105–117. (in Chinese).

He, G., Shaoda, W., and Bing, Z. (2020). Watering down environmental regulation in China. Q. J. Econ. 135 (4), 2135–2185. doi:10.1093/qje/qjaa024

Hsieh, C. T., and Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. Q. J. Econ. 124 (4), 1403–1448. doi:10.1162/qjec.2009.124.4.1403

Ji, Y., and Zhong, S. (2022). Research on the influence of local government debt on total factor productivity. Fiscal Res. (04), 87–99. (in Chinese).

Kahn, M. E., Pei, L., and Zhao, D. (2015). Water pollution progress at borders: the role of changes in China's political promotion incentives. Am. Econ. J. Econ. policy 7 (4), 223–242. doi:10.1257/pol.20130367

Karplus, V. J., Junjie, Z., and Jinhua, Z. (2021). Navigating and evaluating the labyrinth of environmental regulation in China. Rev. Environ. Econ. Policy 15 (2), 300–322. doi:10.1086/715582

Ke, W., Fu, J., Cai, Q., and Cao, J. (2021). Regional differences and dynamic evolution of green total factor productivity. Tech. Econ. Manag. Res. (05), 112–116. (in Chinese).

Krugman, P. (1991). Increasing returns and economic geography. J. political Econ. 99 (3), 483–499. doi:10.1086/261763

Li, F., Huang, J., and Du, M. (2022). Spatial and nonlinear effects of local government debt on environmental pollution: evidence from China. Front. Environ. Sci. 10, 1031691. doi:10.3389/fenvs.2022.1031691

Li, H. B., and Zhou, L. A. (2005). Political turnover and economic performance: the incentive role of personnel control in China. J. Public Econ. 89, 1743–1762. doi:10.1016/j.jpubeco.2004.06.009

Liu, Y., Tian, Y., and Luo, Y. (2018). Industrial structure upgrading, energy efficiency and green total factor productivity. Theor. Pract. Finance Econ. 39 (01), 118–126. (in Chinese).

Lv, X. N., Fu, W., and Zhou, R. (2022). Local government debt, industry association and resource allocation efficiency. Finance Trade Econ. 43 (12), 49–64. (in Chinese).

Mao, K., and Failler, P. (2022). Local government debt and green total factor production-empirical evidence from Chinese cities. Int. J. Environ. Res. Public Health 19 (19), 425.

Pastor, J. T., and Lovell, C. A. K. (2005). A global Malmquist productivity index. Econ. Lett. 88 (2), 266–271. doi:10.1016/j.econlet.2005.02.013

Rao, P., Tang, S., and Li, X. (2022). Crowding out effect of local government debt: evidence based on leverage manipulation of enterprises. China Ind. Econ. (01), 151–169. (in Chinese).

Tang, W., Fu, Y., and Wang, Z. (2014). Technological innovation, technology introduction and transformation of economic growth mode. Econ. Res. (7), 31–43. (in Chinese).

Tone, K., and Tsutsui, M. (2010). An epsilon-based measure of efficiency in DEA-a third pole of technical efficiency. Eur. J. Operational Res. 207 (3), 1554–1563. doi:10.1016/j.ejor.2010.07.014

Xiong, H., and Shen, K. (2019). Research on the crowding-out effect of local government debt on innovation. Econ. Sci. (04), 5–17. (in Chinese).

Yin, Y., and Chang, X. (2022). Does China's carbon emission trading policy promote the promotion of regional green total factor productivity? Finance Econ. (03), 60–70. (in Chinese).

Zhang, B., Xiaolan, C., and Huanxiu, G. (2018). Does central supervision enhance local environmental enforcement? Quasi-Experimental evidence from China. J. Public Econ. 164, 70–90. doi:10.1016/j.jpubeco.2018.05.009

Zhang, Z., Jiang, F., Liu, Y., Zhang, L. X., Guo, H., Deng, Y. L., et al. (2017). Alleviation of ischaemia-reperfusion injury by endogenous estrogen involves maintaining Bcl-2 expression via the ERα signalling pathway. J. Shanxi Univ. Finance Econ. 39 (06), 15–23. (in Chinese). doi:10.1016/j.brainres.2017.02.004

Zheng, H., Wang, X., and Cao, S. (2014). The land finance model jeopardizes China's sustainable development. Habitat Int. 44, 130–136. doi:10.1016/j.habitatint.2014.05.008

Zhou, L., Zhao, Y., and Li, L. (2013). Resource mismatch and political cycle. Financial Res. (03), 15–29. (in Chinese).

Zhu, J., Kou, F., Jin, C., Meng, Z., and Yang, N. (2019). The influence of local government debt on total factor productivity in China--Also on the power source of local government debt expansion: from the strong or the weak. J. Hebei Univ. (Philosophy Soc. Sci. Ed. 44 (06), 80–92. (in Chinese). doi:10.3390/microorganisms7030080

Keywords: local government debt, green total factor productivity, resource misallocation, carbon emissions, EBM model

Citation: Deng G, Zhou C, Wang D and Zhou W (2023) Local government debt, resource misallocation, and green total factor productivity in China. Front. Environ. Sci. 11:1257912. doi: 10.3389/fenvs.2023.1257912

Received: 13 July 2023; Accepted: 29 August 2023;

Published: 14 September 2023.

Edited by:

Yilmaz Bayar, Bandirma Onyedi Eylül University, TürkiyeReviewed by:

Maham Furqan, Oregon State University, United StatesCopyright © 2023 Deng, Zhou, Wang and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dingxing Wang, d2FuZzMyMDMyNzhAMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.