- 1School of Economics and Management, China University of Mining and Technology, Xuzhou, China

- 2Business School, Suqian University, Suqian, China

- 3School of Rural Revitalization, Fujian Agriculture and Forestry University, Fuzhou, China

This article uses the entropy weight method to calculate China’s economic high-quality development index and carbon finance development index from 2000 to 2020. Additionally, it conducts empirical examinations to scrutinize impacts of carbon finance regarding quality-focused development of China’s economy through dynamic spatial models. The findings reveal that the advancement of carbon finance substantively promotes the quality-focused economy advancement through enhancing the overall factor productivity, thereby establishing a mediating effect. Concurrently, the allocation of resources in green fiscal expenditure assumes a moderating effect, subsequently amplifying the promoting effect of carbon finance regarding quality-focused economy advancement. Consequently, it is recommended that a robust financial milieu be established, energy efficiency be enhanced, scientific and technological progress be bolstered, total factor productivity be further augmented, and the expenditure on green conservation be escalated. These measures will effectively stimulate the quality-focused development of China’s economy.

1 Introduction

Currently, Chinese economy has shifted from a stage of swift expansion to one focusing on quality. The nation finds itself in a crucial period where economy advancement models are being reformed, internal economic structures are being optimized, and the driving forces of progress are being altered. The pressing issue at hand is how to enhance the quality of economy advancement across all regions. The emergence of the low-carbon economy presents a potential solution to this quandary. Carbon finance, also known as carbon material trading, pertains to investment and financing endeavors within the low-carbon economy that have stemmed from the Kyoto Protocol. These activities encompass direct investments and financing, carbon trading, bank loans, and other financial operations that contribute to the restriction of pollutant emissions as well as the advancement among related technologies and projects. The rise of “carbon finance” can be attributed to shifts in international climate policies and the establishment of two significant global conventions—the United Nations Framework Convention on Climate Change and the Kyoto Protocol. Developing the low-carbon economy propels the growth of Chinese carbon finance, which possesses a strong foundation for its expansion. By 2030, China’s reduction in carbon dioxide emissions is projected to reach 2–3 billion tons, surpassing the cumulative emissions reduction achieved by European countries. Environmental quality degradation and the emergence of an energy crisis have made it evident that the previous extensive mode of economic growth, reliant on “high investment, high energy waste, and great contamination,” is no longer sustainable. Nevertheless, advancing Chinese carbon finance remains challenging concerning its depth and breadth. In the global context of climate change, determining how to attain quality-focused economy advancement is a significant proposition in the Chinese context. It is imperative for scholars to conduct in-depth research to address these questions: Is the development of carbon finance truly conducive to promoting quality-focused economy advancement? What mechanisms underlie the role of carbon finance in fostering quality-focused economy advancement?.

Drawing on the current research progress in carbon finance and the pursuit of superior economic advancement, this research primarily examines three focal areas. Firstly, it employs the entropy weight technique to gauge the index of first-rate economic advancement and the index of carbon finance development. Secondly, through empirical methods, it explores carbon finance impacts on facilitating superior economy progress. Thirdly, it thoroughly dissects how carbon finance impacts quality-focused economy advancement while examining the mediating effect using total factor productivity and the moderating effect using green fiscal expenditure.

The primary contributions of this study can be summarized as follows: Firstly, by synthesizing the existing literature, this study constructs an evaluative framework for the development of carbon finance. Utilizing the entropy weight approach, it quantifies the degree of advancement in carbon finance, presenting novel perspectives to investigate its developmental aspects. Moreover, it explores innovative approaches for fostering quality-focused economic growth through the utilization of carbon finance, thus expanding the breadth of research outcomes pertaining to superior economic advancement. Secondly, this paper establishes a diverse range of models for assessing the effect regarding carbon finance upon quality-focused economy advancement, ensuring the robustness of the research findings. Additionally, the study employs path analysis and mechanism examination to elucidate the precise pathways and mechanisms by which carbon finance influences superior economic progress. Thirdly, this manuscript offers pertinent countermeasures and recommendations, possessing significant practical implications for fostering quality-focused economy advancement and embarking on a sustainable low-carbon trajectory within China.

The present paper is organized in the following manner: Firstly, the introduction section serves to present the research backdrop and the consequential importance of this study, outlining the key issues to be addressed and the potential contributions to be made. Subsequently, the second segment comprises an extensive literature review. The third section establishes the theoretical framework. The fourth section delineates the procedure of variable selection and model formulation. The ensuing fifth part encompasses empirical investigations. Finally, the sixth section offers a succinct summary along with policy recommendations.

2 Literature review

2.1 Carbon finance

The emergence of carbon finance is closely relevant to the environmental finance advancement at the end of last century. It can be said that carbon finance is a branch of low-carbon environmental finance. The concept of environmental finance was first proposed by Jose Salazar in 1998. He defines environmental finance as the innovation of the financial industry to the changes in the environmental industry. Since then, numerous academics studied the connection between finance and the environmental industry. However, there is no unified definition of carbon finance. In a broad sense, Sonia Labatt and Rodney R. Waite (2007) Labatt and Rodney (2002) believe that carbon finance is the financial method and means to solve climate problems in a society with limited carbon emissions through market-oriented means. Mrijer and Damania (2006) believes that carbon finance is an innovative mechanism design. In a narrow sense, the World Bank defines carbon finance as a series of institutional arrangements such as trading and allocation aimed at reducing greenhouse gas emissions.

Foreign carbon finance markets started earlier, and the research on carbon finance is relatively mature. According to the relevant literature, the research on carbon finance abroad mainly focuses on carbon trading price, carbon finance index measurement, carbon finance market risk measurement and other aspects.

In terms of carbon trading prices, Alberola and Chevallier. (2009) finds that oil and natural gas prices were the main driving factors of carbon trading price fluctuations. Kijima (2009) Alberola et al. (2008) finds that the carbon transaction price changes in the European carbon market are complicated, and the carbon price sometimes increases suddenly, which aggravates the investment risk.

Chevaliers (2012) Kijima et al. (2009) introduces the constant conditional correlation (CCC) and dynamic conditional correlation MGARCH (DCC-MGARCH) models to analyze day-to-day information from April 2005 to December 2008, and finds that the carbon price return rate has fluctuation aggregation, and there are robust autoregressive conditional heteroscedasticity (ARCH) and GARCH effects.

In terms of the measurement of carbon finance index, Mohsin and Taghizadeh-Hesary (2021) Chevallier. (2012) calculate the low carbon finance development index with a similar DEA comprehensive indicator method, believing that it will help attract foreign direct investment and private investment in the low carbon energy industry through the analysis of the index.

In terms of risk measurement of carbon financial market, Sultan (2009) Mohsin et al. (2021) applies GARCH-X model to study the optimal hedging ratio of carbon market and finds that complex hedging transactions in the market are the main factors of risk in carbon financial market. William Blyth (2011) (Blyth and Bunn, 2011) uses regression analysis and Monte Carlo simulation to estimate risks concerning the market as well as policy of EU ETS underlying diverse carbon trading prices, while examines the conversion between the two risks through comparative analysis. Li et al. (2013) uses Copula-GARCH-EVT model to measure the VAR of carbon futures and finds that this model was more effective than other models under distribution conditions.

Jiao et al. (2018) proposes an economy-state-dependent (SD) method to evaluate the value at risk (VaR) of the carbon market, encompassing the information of macroeconomic principles in the VaR model and forecast of carbon revenue. The empirical results of EU’s carbon financial market shows that the SD method outperforms the conventional non-SD method in the out-of-sample VaR forecast, especially when the carbon market experienced large-scale economic-driven structural damage.

2.2 Quality-focused economy advancement

The notion of superior economy advancement was initially introduced in the report of the 19th National Congress of the Communist Party of China in 2017. It underscored the transition of Chinese economy from a stage of swift expansion to quality-focused mode. Foreign academics have primarily directed their research efforts towards scrutinizing the caliber of economic expansion in this regard.

Vinod Thomas (2001) (Thomas, 2001) argues that in addition to the accumulation of material capital in the traditional sense impacting the quality-focused economic growth, the role of human capital input and natural capital input in economy advancement should also be considered. Martinez and Mlachila (2013) define quality-focused growth as strong, stable and sustainable growth when studying the quality and speed of economic growth. Mlachila et al. (2017) regards quality-focused growth as high-growth, sustainable and pro-social growth.

Regarding measuring quality-focused economy advancement, academics such as Solow (1956), Jorgensen and Griliches (1967) and Saleem et al. (2019) adopt the single index measurement method to construct the economic model with total factor productivity as the power source of economic growth. However, it is obvious that a sole indicator is inadequate to calculate the degree of quality-focused economy advancement. Some scholars use the multi-indicator measurement method. Gelb et al. (1993) and Cubas et al. (2016) take total factor productivity as an evaluation standard in measuring the quality of economy advancement. Agbola (2014) focuses on foreign direct investment and human capital, Ghosh (2017) focuses on banking globalization and ICT, Zeira (2009) studies education and other factors. Bai et al. (2012) find that China’s economic growth has significant spatial spillover effect by creating an entropy calculation program and using spatial econometric model and Moran index. Monastiriotis (2013) discusses the quality of economy advancement in Central and Eastern European countries by nonparametric method, and shows the unbalanced dynamic evolution trend of per capita income by using Moran index and spatial econometric model. Papalia and Bertarelli (2013) find the convergence characteristic of the economic growth rate of various developed countries through the procedure of determining entropy. Other researchers measure the quality of economy advancement by constructing indicators. As an illustration, Qi (2016) establishes a quality measurement system of economic growth from four aspects: scale, economic performance, organizational structure and coordination. In addition, Niebel (2018) and other scholars use various econometric models to discuss the specific effect of economy advancement drivers on the quantity of economy growth, and include education level, labor quality, degree of globalization, modern communication technology, and degree of political stability as evaluation indicators.

2.3 Carbon finance and quality-focused economy advancement

There exists a paucity of literature concerning the correlation betwixt carbon finance and the advancement of quality-focused economy advancement. A few erudite minds have indeed embarked upon investigations pertaining to the nexus linking carbon emissions and the economy growth.

Grossman and Krueger (1995) postulated the hypothesis of the environmental Kuznets Curve (EKC), which posits an inverse U-shaped association between carbon dioxide emissions and income levels. Tahvonen and Salo (2001) examined alterations in renewable and non-renewable energy consumption across various developmental stages. They concluded that a similar inverted U-shaped pattern existed between carbon dioxide emissions and economic income levels, irrespective of the impact of environmental policies. Empirical analysis of Chinese data also confirms this inverted U-shaped relationship. Ji (2015) employed fixed effects panel regression models and random effects panel regression models, utilizing data from 28 provinces in China spanning from 1996 to 2010. The findings revealed an inverted U-shaped curve relationship between carbon emissions and economic growth, wherein energy consumption intensity and foreign direct investment exhibited positive correlations with carbon emissions.

Moreover, certain academics postulate the existence of an “inverted N-shaped” correlation amid economic expansion and carbon emissions. This result is mainly attributed to Professor Roman (2016) (Luo, 2016), who constructs the equation based on the accounting formula of GDP of expenditure method, and uses the approximate uncorrelated regression rule to jointly estimate the data from 1994 to 2014. On this basis, he estimates the value from 2015 to 2025, and discusses the change form and inflection point of China’s carbon emission EKC curve. The results show that the current EKC curve of carbon dioxide presents an “inverted N-type,” that is, with the growth of time, the economic level is also increasing, while the carbon emissions present a trend of first decreasing, then increasing and then decreasing. Munir et al. (2019) (Ahmad et al., 2019) empirically test the influencing mechanism among energy consumption, financial development and economic growth, and find that energy consumption and financial development significantly influenced economic growth.

Dou and Cui (2017) point out in his paper that China is facing climate change, environmental protection and energy security, and proposed that China must create a low-carbon society to solve these problems. Dmitriy Li, Jeong Hwan Bae and Meenakshi Rishi (2021) (Li et al., 2022) analyze the correlations among energy, carbon emissions and economic growth in the sub-Saharan region and point out that all types of energy assistance will contribute to economic growth in the long run. Khan et al. (2022) examine the correlation between economic expansion and carbon emissions, employing income data from nations worldwide. They ascertain that the utilization of sustainable energy sources can likewise influence a nation’s economic advancement by diminishing carbon emissions and enhancing environmental standards.

In conclusion, the extant body of literature has addressed the essence, quantification, and determinants of superior economic advancement, as well as providing insights into the functioning of the carbon emissions rights trading market, the valuation of carbon emissions rights and their financial derivatives, and the perils associated with the carbon financial market. Nevertheless, there exists a dearth of research findings concerning the relations among carbon finance and quality-focused economy advancement, and deficiencies persist in understanding the pathways, variances, and mechanisms through which carbon finance influences superior economic progress. This study appraises the degree of superior economic advancement and carbon finance maturation, delves into the causal paths by which carbon finance affects quality-focused economy advancement, examines the regional and temporal attributes of carbon finance’s impact on superior economic progress, and scrutinizes the mechanisms underlying carbon finance’s influence on quality-focused economy advancement. In doing so, it bridges the gaps in the current scholarship and compensates for its deficiencies.

3 Theoretical analysis

3.1 The meaning and characteristics of carbon finance

Carbon finance is an investment activity of financial products and related derivatives under the background of world climate change, with the carbon market as the carrier, supported by laws and regulations, and with carbon emission rights as the target. Carbon finance serves as a catalyst for directing the aggregate financial resources of the entirety of society toward facilitating the progression of a low-carbon, environmentally sustainable economy. Its overarching objective is to curtail the emission of greenhouse gases, fortify environmental governance, and ultimately advance the superior development of diverse sectors and industries within the national economy.

China’s carbon finance emphasizes the phased task of serving “carbon neutrality and carbon peaking”. Carbon finance is, not only a product of the financialization of the carbon market, but also an inherent requirement of social progress for the zero-carbon development of the financial industry.

3.2 Carbon finance can improve total factor productivity and drive quality-focused economy advancement

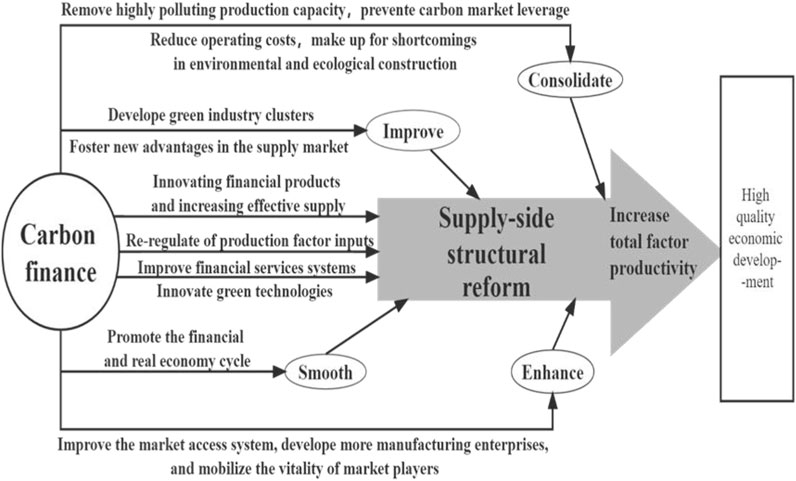

Carbon finance exerts a substantial impetus on the supply-side structural reform, fostering it through two discernible dimensions. This facilitation proves beneficial in enhancing China’s aggregate factor productivity and, consequently, propelling superior economic advancement within the nation.

Conversely, the development of carbon finance has always adhered to the main line of supply-side structural reform. First, the progress in carbon finance drives the continuous innovation of carbon finance derivatives, guides green, low-carbon and clean production in the carbon market, improves the level of the relevant manufacturing industry chain, and increases quality-focused physical and financial products that meet the needs of the people. Second, carbon finance promotes the reoptimization of the allocation of labor, land, capital and other elements in social reproduction, adjusts the unreasonable resource diversion structure, and guides the economic structure to transform toward a green and sustainable direction. Third, carbon finance is a good thing for the entire economy. It puts forward low-carbon, energy-saving, and green development requirements for many manufacturing industries and even the financial industry itself. It provides capital and an institutional basis for innovative technologies by expanding and improving the financial services system.

Whereas, the progress in carbon finance indicates the execution of the “eight-character policy”. First, the achievements of “three eliminations, one reduction and one supplement” were consolidated. Carbon finance is, not only conducive to removing high-polluting production capacity and potential financial leverage in the carbon market, but also reduces the production and operation costs of enterprises through technological upgrades. In addition, carbon finance guides the construction of environmental infrastructure to compensate for the shortcomings of China’s environmental protection and ecological construction. Second, it enhances the vitality of enterprises and individuals. Developing carbon finance improves the access mechanism of the carbon market, attracting quality-focused enterprises, promoting the subjective initiative of entrepreneurs, stimulating the vitality of carbon market entities, and promoting the healthy development of manufacturing enterprises. Third, the focus is on developing green industrial clusters through social investment, improving the level of the industrial chain, and enhancing the competitive advantage of China’s new format supply market. Fourth, national economic cycle must run smoothly. Developing carbon finance is closely related to social life and production, which greatly reduces the possibility of deviating from the real to the virtual, promotes the benign interaction between the real manufacturing economy and finance, and consolidates the foundation for stable financial growth (Figure 1). According, the following assumptions are proposed:

Hypothesis 1:. Developing carbon finance promotes quality-focused economy advancement in China by enhancing total factor productivity.

3.3 Green fiscal expenditure is able to enhance the development effect of carbon finance and consolidate the basis of quality-focused economy advancement

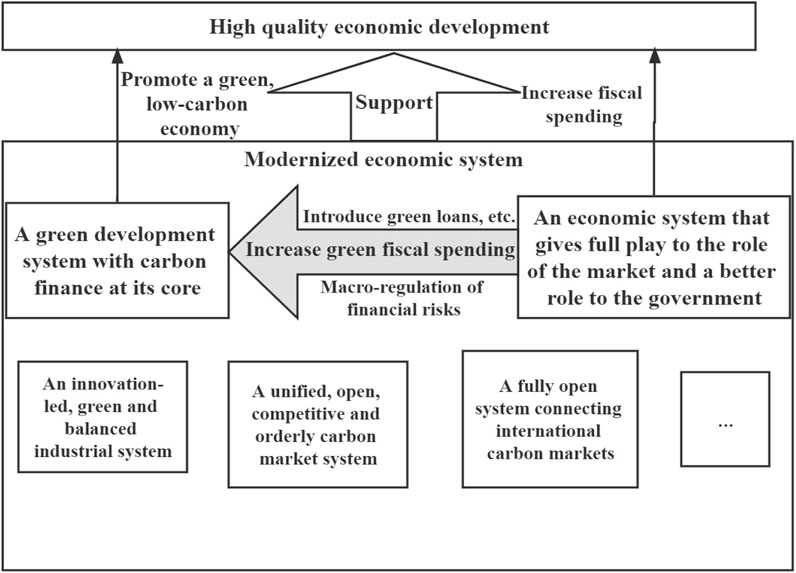

The modern economic system is composed of the interrelation and internal connection of all links, levels and fields of social and economic activities, and it is very complex.

General Secretary Xi Jinping reiterated about developing a modern economy system is a major task that is systematic, overall and long-term. Therefore, this part selectively prioritizes assessing the supporting function of the green development system and economic system with carbon finance as the core to quality-focused economy advancement and the internal mechanism of the government’s strengthening of carbon finance development through fiscal means.

The establishment of a resource-conserving and ecologically sustainable green development system constitutes an integral facet of a contemporary economic framework, in addition to being a fundamental component of China’s economy’s quality-focused advancement.

Carbon finance may become the core driving force for promoting the construction of a green development system, promoting low-carbon economic growth through interest rates, and thus contributing to quality-focused economy advancement. However, the economic market will inevitably have defects. To avoid market failure and smooth the economic cycle, the government’s macro-control is particularly important. In addition to increasing fiscal investment directly contributing to quality-focused economy advancement, the Chinese government can also promote the development of carbon finance by increasing green fiscal expenditure, thereby supporting quality-focused economy advancement. Green fiscal funds have good traction, and the development of green loans through preferential interest rates and other means contributes healthy and sustainable growth of carbon finance. The injection of green fiscal expenditures is conducive to optimizing the capital structure of carbon finance, and with the support of laws, regulations and macro policies, the financial risks in the carbon market are effectively alleviated. Therefore, green fiscal expenditure can promote the growth of carbon finance, which in turn promotes quality-focused economy advancement (Figure 2). Thus, the following assumptions are put forth:

Hypothesis 2:. As an external adjustment variable, green fiscal expenditure can effectively enhance the impact of carbon finance on quality-focused economy advancement.

4 Variables and models

4.1 Variables

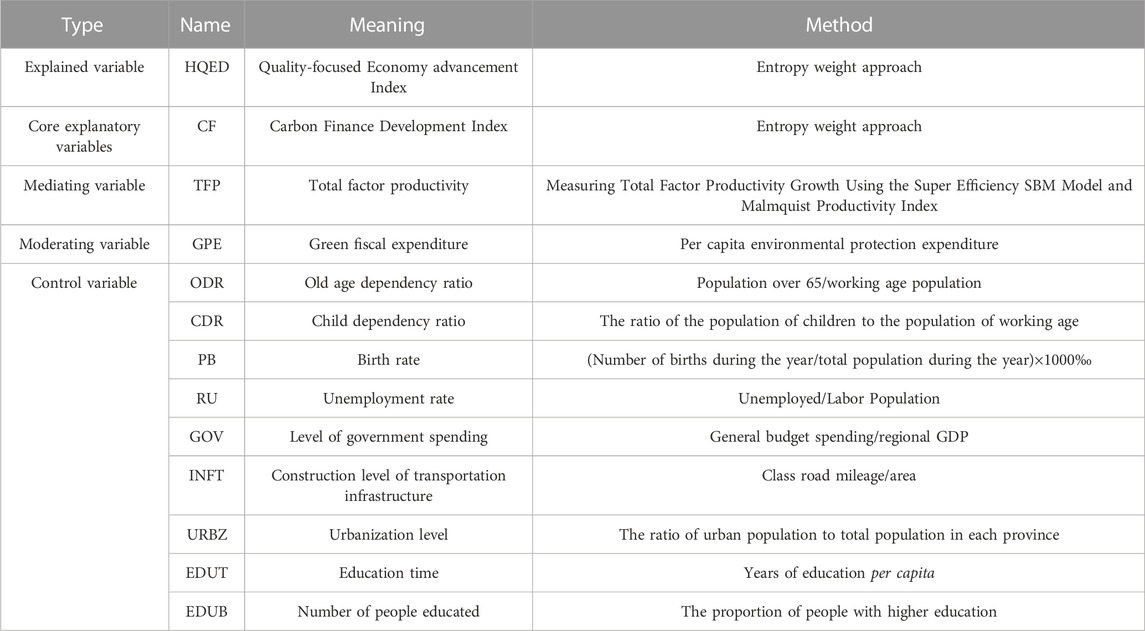

According to the empirical arrangement, Table 1 presents the variables involved in this paper:

4.2 Introduction to variables

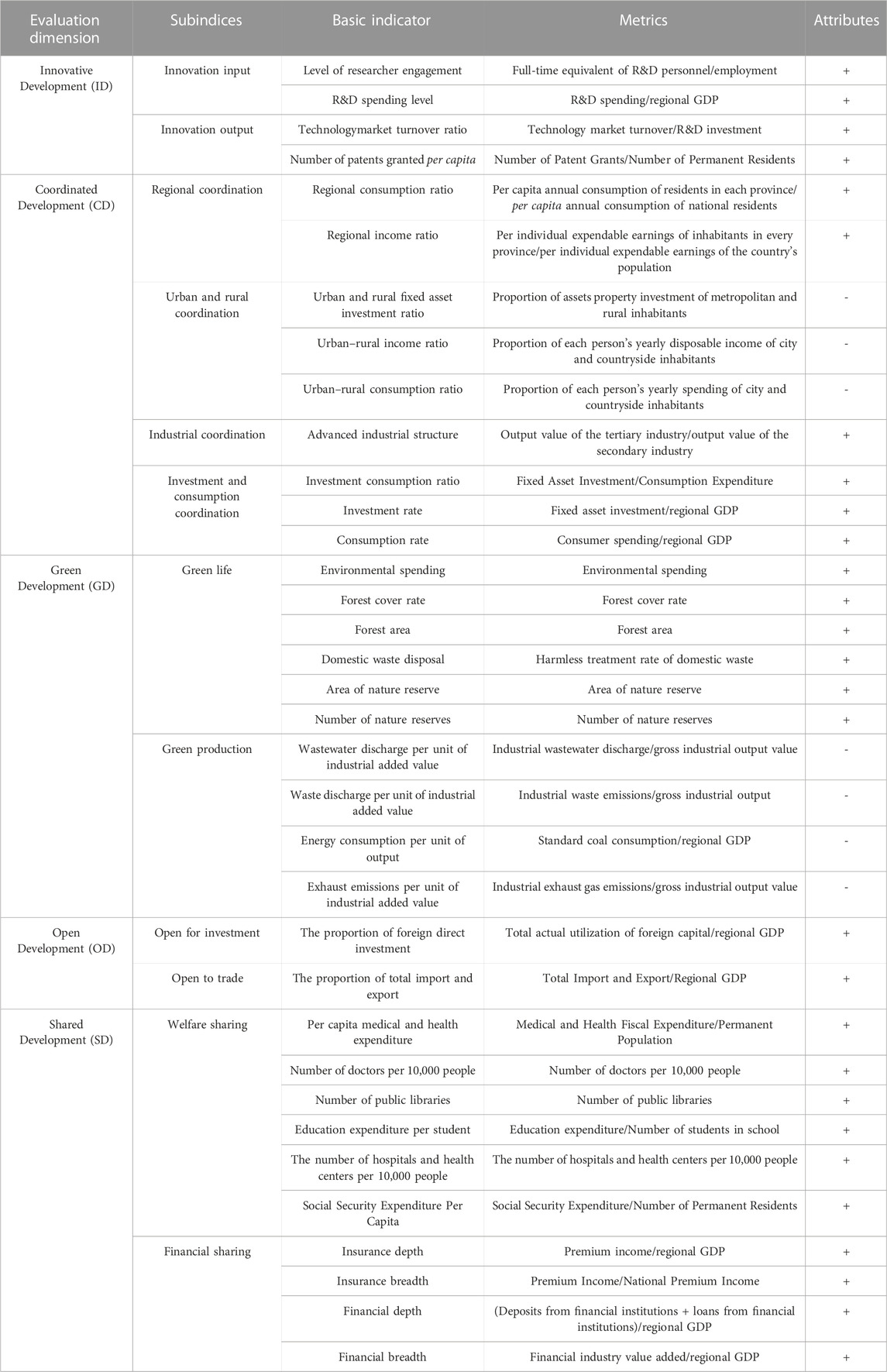

4.2.1 Explained variable

The variable under consideration pertains to the index measuring superior economic advancement, prominently encompassing five core facets: innovation, coordination, environmental sustainability, international engagement, and equitable distribution. As delineated in Table 2, this investigation has meticulously chosen 35 essential indicators from the abovementioned dimensions to construct an evaluative framework for quality-focused economy advancement.

4.2.2 Core explanatory variables

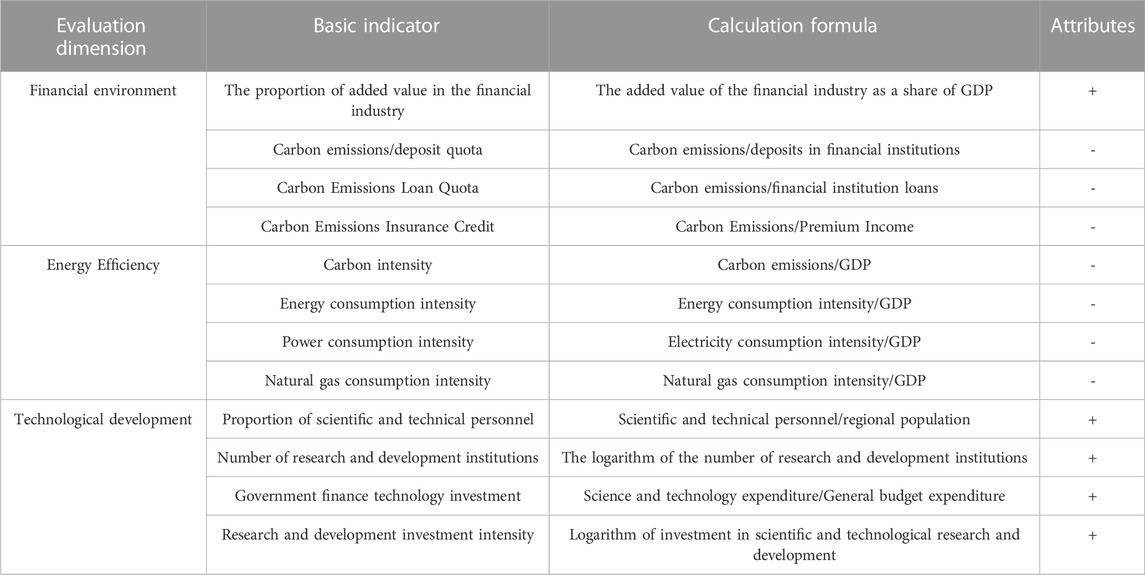

Carbon finance index is the core explanatory variable. According to the theoretical part, this paper selects 12 secondary indicators from three aspects, financial environment, energy efficiency, and technological development, to construct a carbon finance evaluation index system, as shown in Table 3.

4.2.3 Mediating variable

Total factor productivity (TFP). On the one hand, carbon finance can directly influence the quality-focused development of the economy, in addition, it can indirectly improve the level of quality-focused economy advancement by improving total factor productivity. Therefore, total factor productivity is the mediating variable in this paper. The research draws on the method of Pastor et al. (2005), under the framework of data envelopment analysis of global reference, and comprehensively considers the super efficiency SBM model of undesired output and the Malmquist productivity index to measure the growth of urban total factor productivity and calculate the total factor productivity of each Chinese region.

4.2.4 Adjustment variables

Green Fiscal Expenditure (GPE). In terms of promoting quality-focused economy advancement, carbon finance is a market-oriented means, but the role of national macro-control cannot be ignored. This paper believes that green fiscal expenditure, as a means of national macro-control, can effectively avoid market failure. The extent of quality-focused economy advancement can be further improved through the joint action of the financial market and national finance.

4.2.5 Control variables

This paper selects the control of population dependency ratio (old age dependency ratio, child dependency ratio), population birth rate, unemployment rate, government expenditure, transportation facility construction level, urbanization level, education level (per capita education time, the proportion of higher education population), etc. The specific construction method of each variable is shown in Table 1.

The dependency ratio of the population encompasses the ratio of elderly dependents (ODR) and child dependents (CDR). The process of population aging will impede the accumulation of human capital, which hampers the favorable progress of China’s economy in terms of quality-focused development.

The birth rate (PB)), being the prime force behind economic activities and labor supply, typically exhibits a positive correlation with superior economic advancement.

Typically, a decrease in the unemployment rate signifies the sound development of the overall economy, thereby establishing an inverse correlation between the unemployment rate and quality-focused economy advancement.

The level of governmental expenditure (GOV) has the potential to augment societal demand, influence the investment direction of social capital, and facilitate economic progress. It is widely accepted that the level of government spending is directly proportional to the superior development of the economy.

Infrastructure development in the transportation sector (INFT), being an essential prerequisite for economic advancement, is generally considered to be proportionate to quality-focused economy advancement.

The rate of urbanization (URBZ) fosters economic growth, as it is commonly believed that the urbanization rate is directly related to quality-focused economy advancement.

The educational level can be assessed by metrics such as per capita years of education (EDUT) and the proportion of individuals with higher education (EDUB). The greater the average education years per capita and the higher the proportion of individuals with higher education, the higher the level of education, which in turn promotes quality-focused economy advancement.

4.3 Entropy weight approach

The entropy weight approach represents an objective technique for assigning weights. During its application, the entropy weight of each index is computed through information entropy, taking into consideration the degree of dispersion exhibited by the data pertaining to each index. Subsequently, the entropy weight is adjusted in accordance with the characteristics of each index, thus yielding a comparatively more objective weightage for the indicators. The step-by-step calculation procedure is outlined as follows:

First, the evaluation object is determined, the evaluation index system is established, and the level matrix is constructed;

Second, the evaluation matrix is standardized to obtain the matrix.

J is a positive indicator

J is a negative indicator

The third step is to calculate the entropy value of each indicator.

where

The fourth step is to calculate the entropy weight of the jth index.

The fifth step is to calculate the comprehensive weight of the index and modify the weight obtained by the entropy weight approach.

4.4 Mediating effect model and moderating effect model

In the preceding examination, it is posited that carbon finance directly influences on the advancement of superior economy advancement and exerts an indirect influence on such progress through its effects on total factor productivity (TFP), which is, therefore, an intermediary variable. To verify whether there is a mediation effect, this paper establishes the following mediation effect model on the basis of Model (8):

This paper believes that green fiscal expenditure can strengthen the role of carbon finance in quality-focused economy advancement, and it is essential to confirm the governing impact of green fiscal expenditure on quality-focused economy advancement from an empirical perspective. This paper establishes the following regulatory effect model:

5 Empirical analysis

5.1 Selection and processing of data

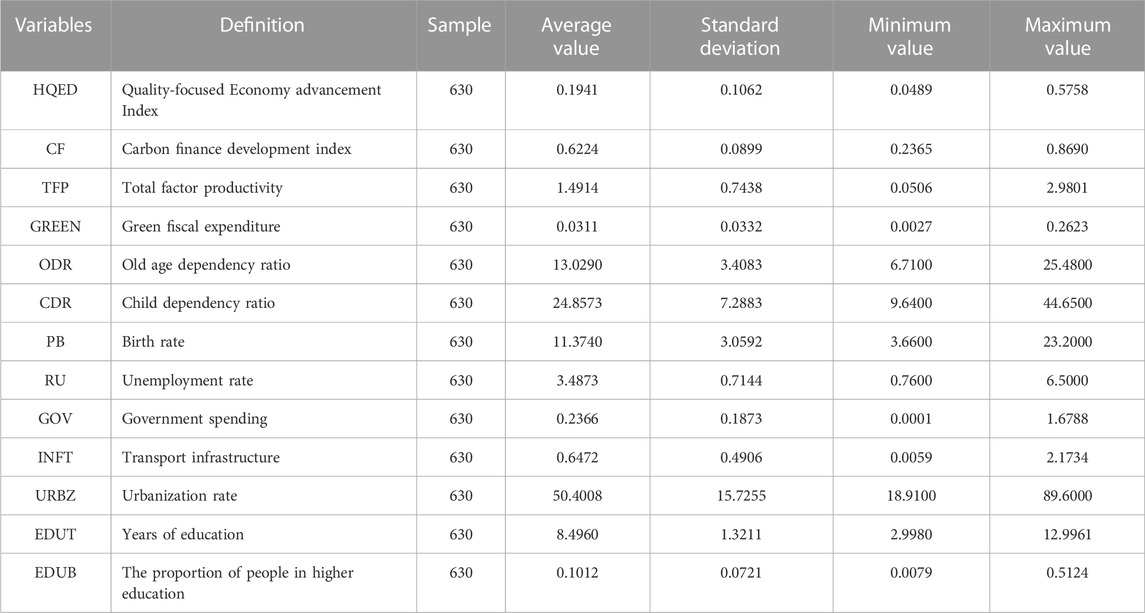

The study adopts the panel dataset encompassing 31 provinces, autonomous regions, and centrally-administered municipalities in China, spanning the period from 2000 to 2020, as its research subject. The data utilized in this research are derived from authoritative sources such as the “China Statistical Yearbook,” “EPS Database,” and the “China Science and Technology Statistical Yearbook,” among others. Any instances of missing data were rectified through trend-based imputation. Table 4 presents the descriptive statistics associated with the aforementioned dataset.

5.2 Quality-focused economy advancement index

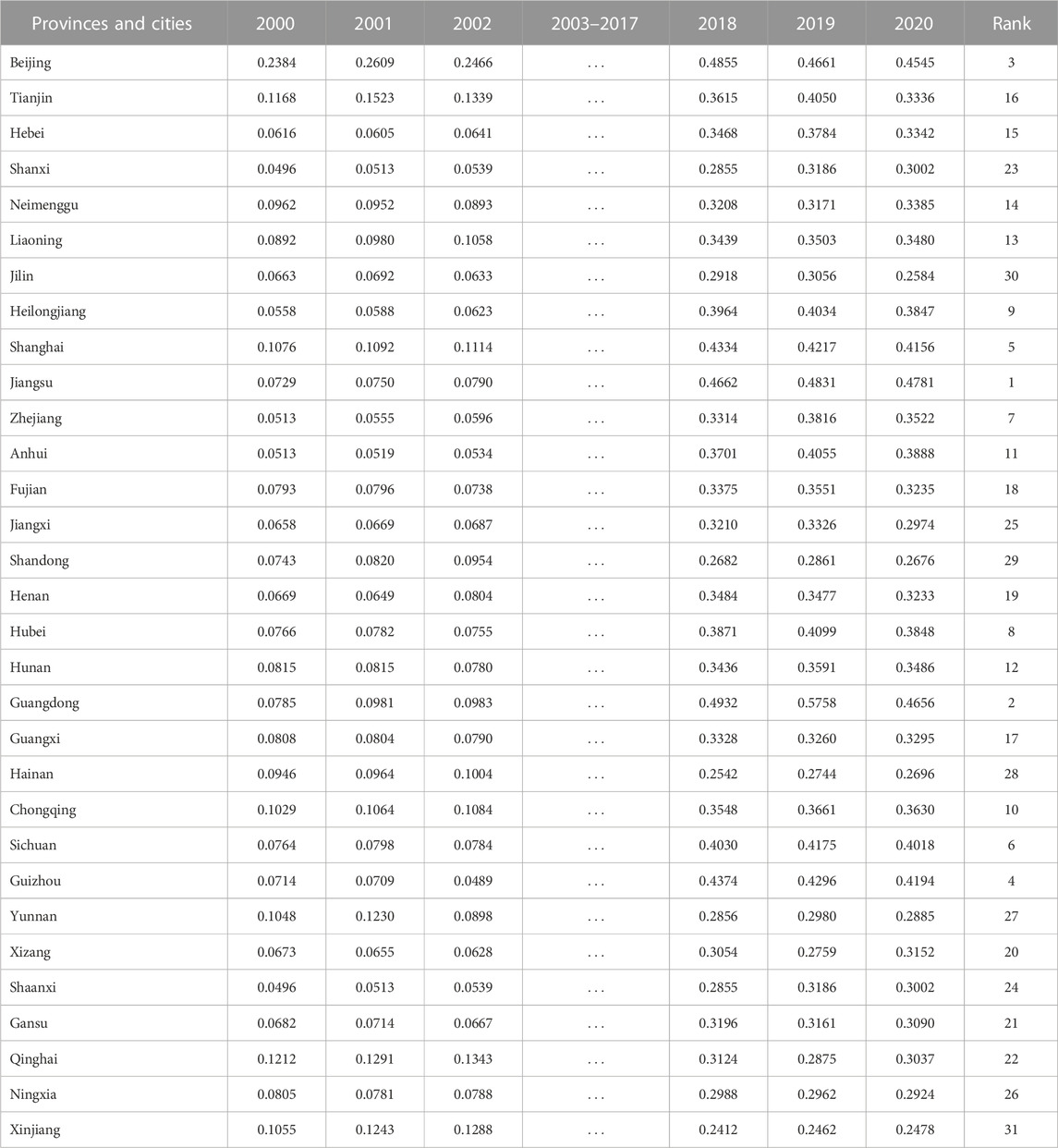

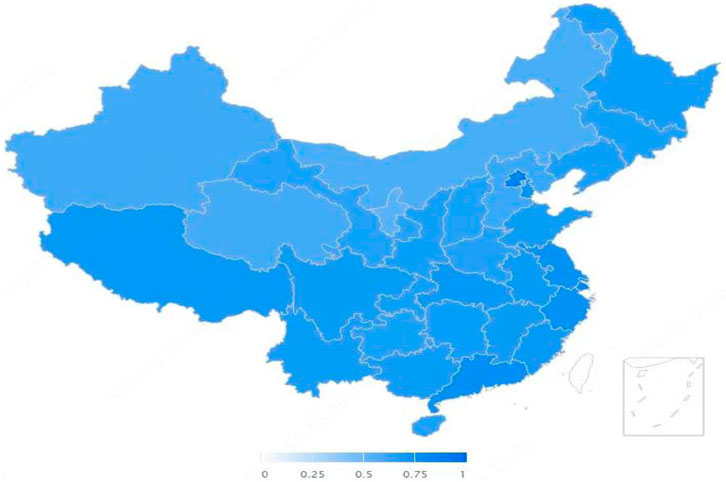

It can be seen from Table 5, Figure 3 and Figure 4 that there are large development gaps in various aspects of China’s 31 regions:In terms of quality-focused economy advancement, there is a clear gap between the quality-focused economy advancement of the provinces. The Quality-focused.

Economy advancement Index of Jiangsu Province, which ranked first, in 2020 was 0.4781, and the last-ranked Xinjiang quality-focused economy advancement index was only 0.2478. At the same time, there is also a certain gap between the quality-focused economy advancement indices of different regions in different years. There was a substantial increase from 2000 to 2020. According to the ranking of the 2020 quality-focused economy advancement index, Jiangsu Province, Guangdong Province and Beijing are the top three, which are closely related to the economy advancement of these three provinces. The Xinjiang region ranks last, and Qinghai, Ningxia and other western regions are also relatively low in the ranking of quality-focused economy advancement. On the whole, the quality-focused economy advancement index is positively correlated with the economy advancement level of each region.

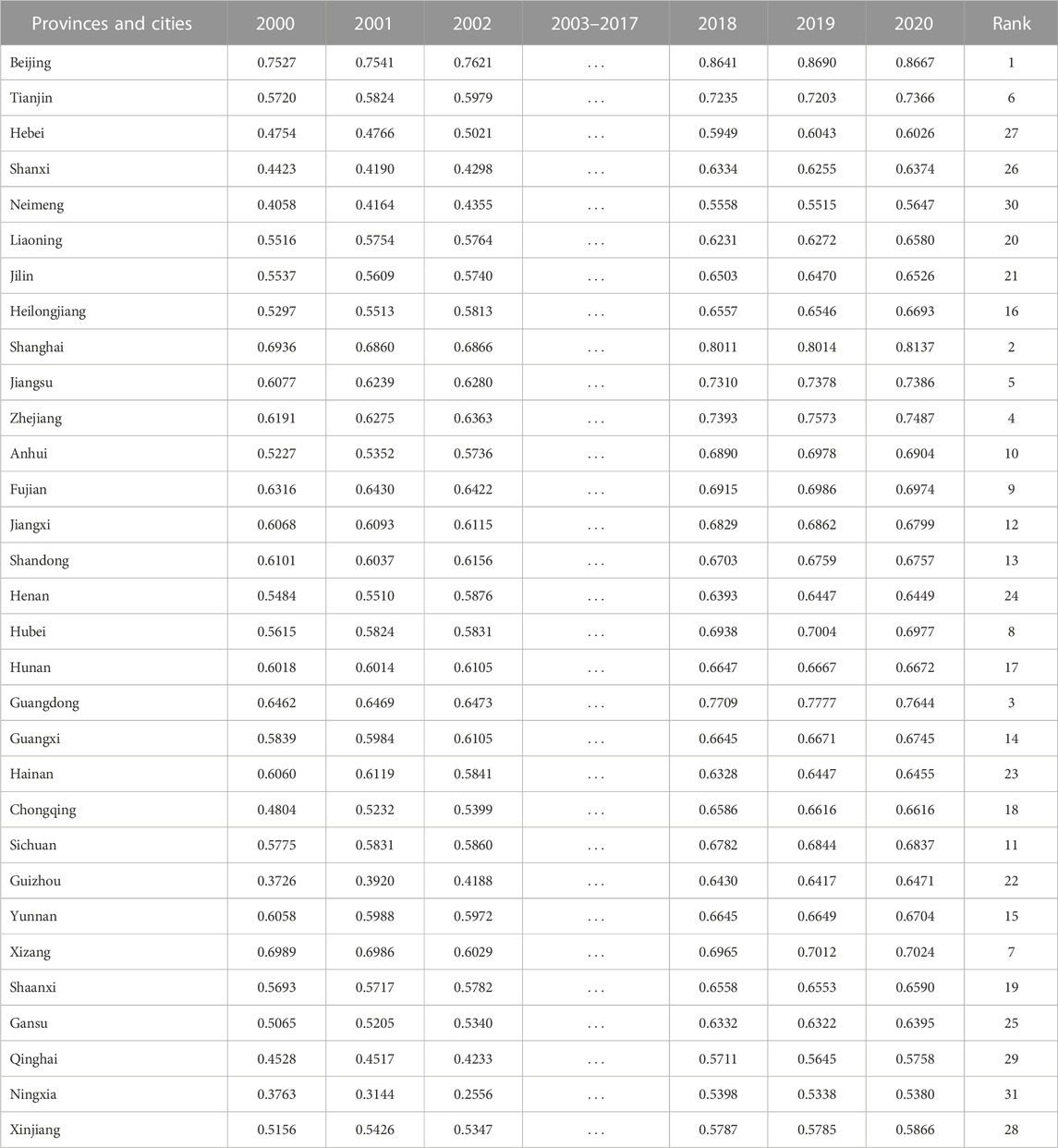

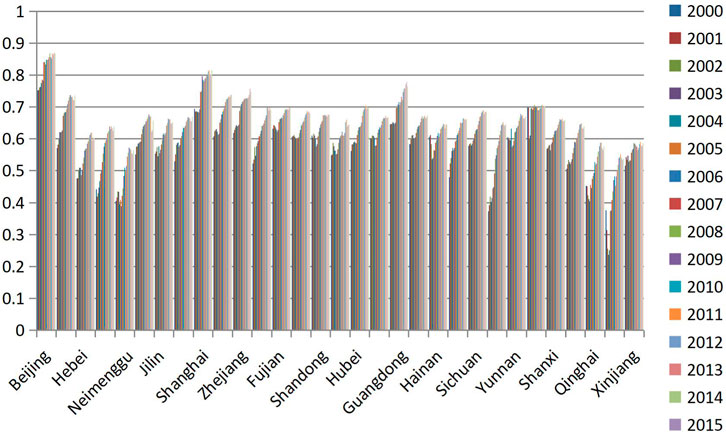

5.3 Carbon finance development index

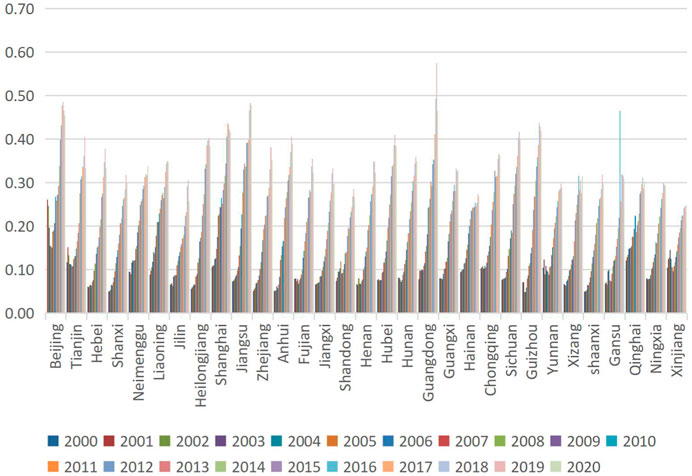

From Table 6, Figure 5 and Figure 6, it can be seen that the carbon finance development index has the following characteristics:

First, the development level of carbon finance in different regions varies greatly. Beijing, Shanghai, Guangdong, Zhejiang, Jiangsu, Tianjin and other regions firmly occupy the first level, which is closely related to the early pilot projects1 for the regions. The development level of carbon finance in most provinces is relatively stable and has been within the same level for a long time. The development level of carbon finance in Inner Mongolia, Xinjiang, Ningxia, Qinghai and Hebei is relatively low. Among them, Xinjiang, Inner Mongolia and Ningxia are in the western part of the motherland. Due to the lack of talent and natural resources, weak educational resources, imperfect policies and systems, and lack of infrastructure, the scientific allocation of resources in the regional market is restricted. Shanxi Province is a resource-based city with many types of energy, large reserves, and large output of energy mining. Nevertheless, the industrial structure remains singular, and the progression of carbon finance encounters constraints. Evidently, the advancement of the financial sector within these regions exerts a restricted influence on the consolidation of industrial structure, the promotion of low carbonization, and the development of the regional economy, consequently yielding a persistent lag in the evolution of carbon finance.

Second, the overall development level of carbon finance in the pilot areas shows three distinct development echelons. The first echelon is Beijing, Shanghai, Guangdong and Tianjin, the second echelon is Hubei and Fujian, and the third echelon is Chongqing. The disparities among tiers become more conspicuous, exhibiting resemblances to the economic and financial progression stages across diverse regions. In terms of carbon emission allowances trading and carbon emission mitigation investment and financing, the comprehensive level of development concerning carbon emission mitigation investment and financing in the pilot regions surpasses that of carbon emission allowances trading. This observation can be attributed to the anterior development of China’s conventional financial market. The development level of carbon emission trading in the pilot areas shows the same echelon characteristics as the development level of carbon finance, and each pilot area has its own characteristics. Guangdong has a small number of emission-controlled enterprises and stable carbon trading prices; Shanghai has a large carbon trading scale and low trading costs; Hubei has a large carbon trading scale; and Chongqing’s carbon emissions trading remains in early stage of development. The development level of carbon emission reduction investment and financing in the pilot areas is relatively stable, and the differences between regions are small.

Third, the development of carbon finance has obvious effects on policy. The degree of advancement in carbon finance is comparatively elevated in the eastern region, while it remains relatively deficient in Hebei and Liaoning. As for the central region, the level of carbon finance development is generally at the intermediate level, and the development level of carbon finance in the western region is at a relatively backward level. This is closely related to the role played by regional governments and the NDRC in promoting the development of carbon finance. The energy consumption level in the early stage is the pressure to promote the development of carbon finance, and it is also a huge driving force. Coastal areas have a higher degree of carbon finance development due to possible development concepts, as well as technological and talent advantages.

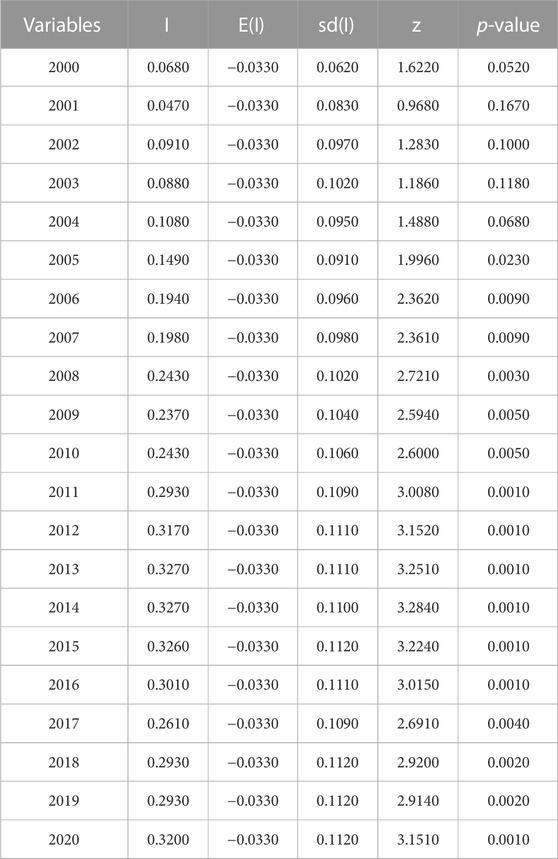

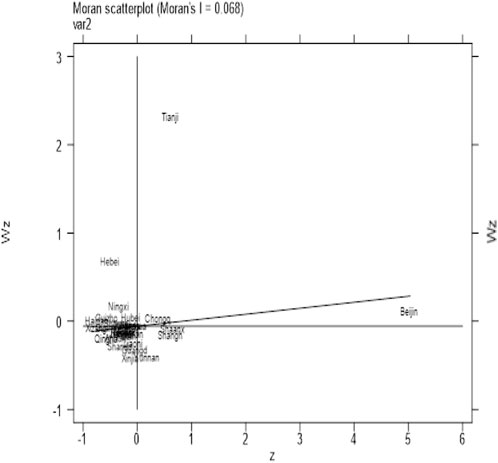

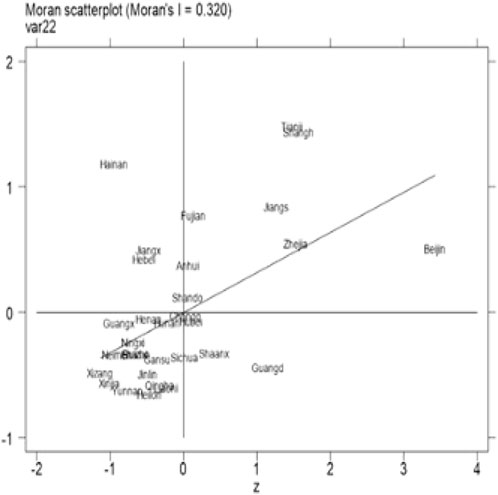

5.4 Spatial autocorrelation test

When conducting spatial measurement regression, it becomes imperative to ascertain the presence of spatial spillover effects among variables, i.e., the existence of spatial autocorrelation. The assessment of spatial autocorrelation typically employs the Moran index. A positive value of the Moran index signifies the presence of positive spatial correlation among neighboring regions, while a negative value indicates negative spatial correlation. As indicated in Table 7, the Moran index exhibited predominantly positive values between 2000 and 2020, with only 2001 and 2003 failing the significance test. This outcome suggests a noteworthy spatial autocorrelation between the levels of quality-focused economy advancement across provinces and cities in China. Accordingly, the correlation between the two is possible to be studied via spatial measurement.

From Figures 7 and 8, it is discernible that a pronounced positive correlation existed among the quality-focused economy advancement of diverse Chinese regions in 2000; the spatial correlation in China in 2020 was still positive and significantly enhanced.

5.5 Analysis results impacting carbon finance development concerning quality-focused economy advancement

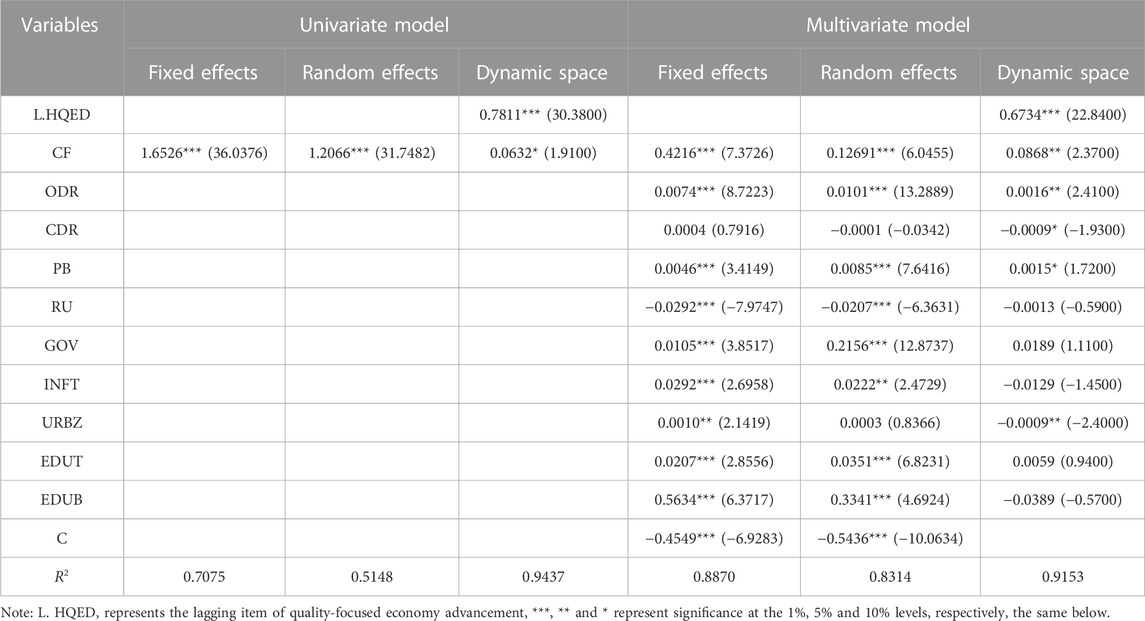

According to Table 8, whether it pertains to univariate regression or multivariate regression analyses, carbon finance exhibits a favorable impact on the advancement of superior economic growth. To illustrate, employing the dynamic spatial Durbin model as an exemplification within the context of multivariate regression, one can observe the following outcomes. Initially, the regression coefficient of the lagged first-order term of quality-focused economy advancement with respect to the present quality-focused economy stands at 0.6734, demonstrating statistical significance at the 1% level of significance. This outcome underscores the presence of an endogenous influence on quality-focused economy advancement, which necessitates acknowledgement throughout the empirical investigation. Furthermore, the regression coefficient of carbon finance on quality-focused economy advancement registers at 0.0868, indicating statistical significance at the 5% level. This finding substantiates the positive impact of carbon finance on superior economic advancement. This empirical result is consistent with Hypothesis 1 in this paper.

TABLE 8. Main regression analysis of carbon finance development on quality-focused economy advancement.

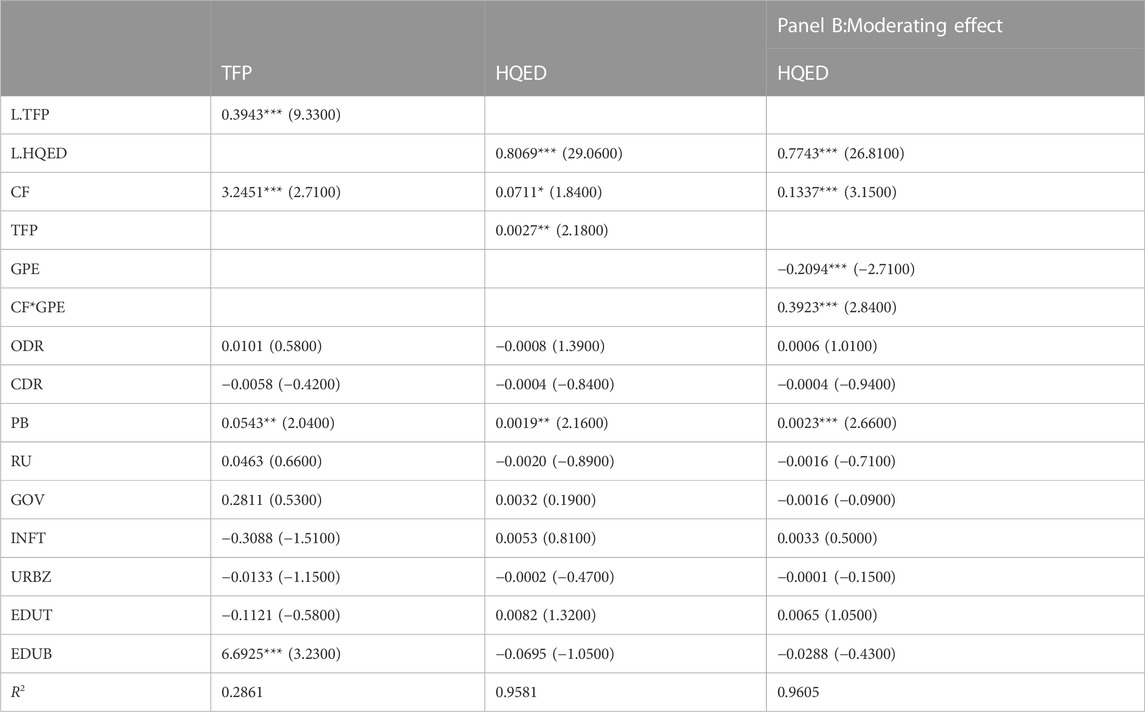

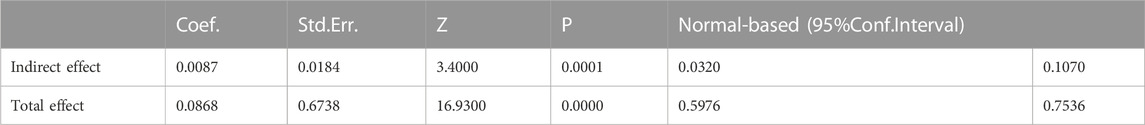

5.6 Mechanism analysis

Panel A in Table 9 reveals noteworthy insights. Firstly, the regression analysis on the relationship between carbon finance and total factor productivity indicates a substantial and statistically significant regression coefficient of 3.2451 at the 1% significance level. This finding highlights the positive impact of carbon finance on total factor productivity. Secondly, examining the influence of carbon finance and total factor productivity on quality-focused economy advancement, the regression coefficient for carbon finance stands at 0.0711, significant at the 10% level. Similarly, the regression coefficient for total factor productivity is 0.0027, significant at the 5% level. These results underscore the significance of both variables in relation to quality-focused economy advancement. Notably, total factor productivity exhibits a mediating role, accounting for approximately 10% (0.0087/0.0878) of the overall effect. Thirdly, the bootstrap test results in Table 10 confirm the significance of the Sobel test, and the BCa confidence interval does not contain 0. Therefore, the conclusion of the mediation test is robust.

From the results of Panel B in Table 10, it is evident that the pre-CF*GPE coefficient is 0.3903, and the corresponding Z statistic is significant. Green fiscal expenditure positively moderates the development of carbon finance and quality-focused economy advancement.

6 Summary and policy recommendations

This article uses the entropy weight method to calculate the Economic High Quality Development Index and the Carbon Finance Development Index. There is a significant gap between the high-quality economic development of each province. The first ranked Jiangsu Province’s 2020 Economic High Quality Development Index was 0.4781, while the last ranked Xinjiang Economic High Quality Development Index was only 0.2478. At the same time, there is also a certain gap in the high-quality economic development index between different regions in different years, with a significant increase from 2000 to 2020. There are significant differences in the development level of carbon finance among different regions, and the overall development level of carbon finance in the pilot areas shows obvious three development echelons. The development of carbon finance has obvious policy effects. This article also empirically tests the effect of carbon finance on the high-quality development of China’s economy by establishing univariate and multivariate fixed effects models, random effects models, and spatial Durbin models. The development of carbon finance has a significant promoting effect on the high-quality development of the economy. At the same time, this paper also carried out mechanism analysis. The development of carbon finance can affect Total factor productivity and then affect high-quality economic development. There is a Mesomeric effect. At the same time, there is a regulatory effect of green fiscal expenditure on carbon finance to promote high-quality economic development.

Drawing upon the empirical evidence, this scholarly manuscript presents the subsequent policy prescriptions:

First, a good financial environment should promote developing the carbon finance. When calculating the developmental degree of carbon finance, the indicators at the financial environment level are very important factors. To better promote the development of carbon finance, it is possible to increase the proportion of the added value of the financial industry, increase the deposit, loan and insurance premium income of financial institutions, and create a good financial environment. Promoting the influx of “green” funds to energy-saving technology development industries helps protect the environment. A large number of outstanding technology-based enterprises have been encouraged to become increasingly stronger with the capital market has become a new force in promoting quality-focused development. Creating a good financial environment for the development of carbon finance to promote quality-focused economy advancement.

Second, energy efficiency could be improved, along with the optimal development of carbon finance. Carbon emissions intensity, energy consumption intensity, electricity consumption intensity and natural gas consumption intensity are all negative indicators in the calculation of carbon finance development levels. To better improve the development level of carbon finance, it is necessary to reduce carbon emissions and improve the utilization efficiency of energy, electricity and natural gas consumption. Making full use of the energy big data center involves the collection and online analysis of energy consumption data of all categories, such as electricity, gas, and water, dynamically warning the energy consumption trend, serving the energy consumption diagnosis and energy efficiency benchmarking of enterprises, and supporting the government in energy consumption management through digital means. The whole society can actively participate energy efficiency through the transformation from the previous relatively extensive method to the refined, flexible and market-oriented method.

Third, investment in science and technology should be strengthened to drive the development of carbon finance. In the calculation of the carbon finance development level, investment in science and technology development is a positive indicator. The proportion of R&D personnel, the number of R&D institutions, financial technology investment and R&D investment intensity should all be increased, the development level of carbon finance improved, and quality-focused economy advancement promoted. Accelerating the deployment of international cutting-edge technology research in the low-carbon field, the application of advanced common pollution reduction and carbon reduction technologies, enhance China’s technological advantages and reserves in the field of green, low-carbon and environmental protection, and strengthen technology integration and coupling innovation, especially disruptive technological innovation and application. Building green manufacturing R&D, promotion and application bases and innovation platforms accelerates the application and industrialization of innovations and the digital transformation of existing industries. This involves strengthening the dominant position of innovative enterprises, promoting the industrialization and large-scale application of advanced and applicable technologies, and continuing to enhance the resilience and flexibility of the industrial chain. New sustainabile technologies are continually being developed, such as carbon sinks, carbon capture, utilization and storage, as well as non-CO2 greenhouse gas emission reduction technologies.

Fourth, enhancing total factor productivity and facilitating the attainment of superior economic advancement come into focus. From the preceding analysis, it becomes apparent that total factor productivity exerts a mediating influence on the promotion of quality-focused economy advancement. Augmenting total factor productivity presents an avenue for bolstering superior economic advancement. It is pertinent to note that total factor productivity is not contingent upon specific product technologies but rather the systemic attributes, the extent of marketization within the economy, and the capacity for optimizing resource allocation. At present, China’s economy has transitioned from a phase of rapid growth to a phase of quality-focused development, necessitating an innovation-driven mode of economic progress. Hence, it becomes imperative to construct a novel developmental catalyst grounded in innovation, thereby shifting China’s economic growth trajectory towards one that relies more heavily on the enhancement of total factor productivity. The digital transformation of the industry can be sped up, system and mechanism innovation implemented, and technological innovation vigorously promoted to improve total factor productivity. Industrial digital transformation is the most direct and effective means to improve total factor productivity.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, LJ and YR; methodology, YW; validation, HN; data curation, AT; writing—original draft preparation, LJ and YR; writing—review and editing, HN. All authors contributed to the article and approved the submitted version.

Funding

This paper was supported by a phased achievement of the General Project of Philosophy and Social Sciences in Jiangsu Province’s Universities—Research on the Coupling Development of High Quality Economic Development and Comprehensive Rural Revitalization from the Perspective of “Two Strives for One Front” (2022SJYB2405). This paper was supported by the Fundamental Research Funds for the Central Universities (2022ZDPYSK02), National Nature Science of China (71871120). This paper was supported by the Jiangsu Blue Project.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1In October 2011, pilot carbon emission trading had been conducted at seven provincial and municipal levels regions including Beijing, Shanghai, etc. Fujian Province initiatedthe carbon trading market on 22 December, 2016. It marks the 8th carbon trading pilot program in the country.

References

Agbola, F. (2014). Modelling the impact of foreign direct investment and human capital on economic growth:empirical evidence from the Philippines. J. Asia Pac. Econ. 19 (2), 278–289. doi:10.1080/13547860.2014.880282

Ahmad, M., Zhao, Z.-Y., Irfan, M., and Mukeshimana, M. C. (2019). Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: A heterogeneous dynamic panel data analysis of China. Environ. Sci. Pollut. Res. 26 (26), 14148–14170. doi:10.1007/s11356-019-04673-6

Alberola, E., Chevallier, J., and Chéze, B. (2008). Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy 36, 787–797. doi:10.1016/j.enpol.2007.10.029

Alberola, E., and Chevallier, J. (2009). European carbon prices and banking restrictions: Evidence from phase I (2005–2007). Energy J. 30, 51–80. doi:10.5547/issn0195-6574-ej-vol30-no3-3

Bai, C. E., Ma, H., and Pan, W. (2012). Spatial spillover and regional economic growth in China. China Econ. Rev. 23 (4), 982–990. doi:10.1016/j.chieco.2012.04.016

Blyth, W., and Bunn, D. (2011). Coevolution of policy, market and technical price risks in the EU ETS. Energy Policy 39 (39), 4578–4593. doi:10.1016/j.enpol.2011.04.061

Chevallier, J. (2012). Time-varying correlations in oil, gas and CO2prices: An application using BEKK, CCC and DCC-MGARCH models. Appl. Econ. 44 (32), 4257–4274. doi:10.1080/00036846.2011.589809

Cubas, G., Ravikumar, B., and Ventura, G. (2016). Talent, labor quality, and economic development. Rev. Econ. Dyn. 21 (21), 160–181. doi:10.1016/j.red.2015.06.004

Dou, X., and Cui, H. (2017). Low-carbon society creation and socio-economic structural transition in China. Environ. Dev. Sustain 19 (19), 1577–1599. doi:10.1007/s10668-016-9834-3

Gelb, A., Jefferson, G., and Singh, I. (1993). Can communist economies transform incrementally? The experience of China[J]. NBER Macroecon. Annu. 8 (8), 87–133. doi:10.1086/654211

Ghosh, A. (2017). How does banking sector globalization affect eco-nomic growth?[J]. Int. Rev. Economics&Fi-nance 48, 83–97. doi:10.1016/j.iref.2016.11.011

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment[J]. Q. J. Econ. 110 (2), 355–377.

Ji, D. (2015). Empirical study on the relationship between economic growth and carbon dioxide emissions in China. J. Shanghai Univ. Commer. 16 (5), 56–61.

Jiao, L., Liao, Y., and Zhou, Q. (2018). Predicting carbon market risk using information from macroeconomic fundamentals. Energy Econ. 73 (73), 212–227. doi:10.1016/j.eneco.2018.05.008

Jorgensen, D. W., and Griliches, Z. (1967). The explanation of productivity change[J]. Rev. Econ. Stud. 34 (3), 56–62. doi:10.2307/2296675

Khan, I., Han, L., Khan, H., and Khan, H. (2022). Renewable energy consumption and local environmental effects for economic growth and carbon emission: Evidence from global income countries. Environ. Sci. Pollut. Res. 29 (29), 13071–13088. doi:10.1007/s11356-021-16651-y

Kijima, M., Maeda, A., Nishide, K., and Nishide, k. (2009). Equilibrium pricing of contingent claims in tradable permit markets. J. Futur. Mark. 30 (1), 1–31. doi:10.1002/fut.20430

Li, T., Zhang, Z. G., and Zhao, L. T. (2013). Estimating the portfolio risk with copula-GARCH-EVT method: Empirical study of carbon market. Adv. Mater. Res. 791-793, 2175–2178. doi:10.4028/www.scientific.net/amr.791-793.2175

Li, D., Bae, J. H., and Rishi, M. (2022). Sustainable development and SDG-7 in sub-saharan africa: Balancing energy access, economic growth, and carbon emissions[J]. Eur. J. Dev. Res. 35 (3), 1–19. doi:10.1057/s41287-021-00502-0

Luo, M. (2016). Study on the relationship between China's economic growth and carbon dioxide emissions [J]. Foreign Trade Econ. Coop. (12), 117–121+124.

Martinez, M., and Mlachila, M. (2013). The quality of the recent high-growth episode in Sub-Saharan Africa [R]. IMF Work. Pap. (53), 3–12.

Mlachila, M., Tapsoba, R., and Tapsoba, S. (2017). A quality of growth index for developing countries:A Proposal. Soc. Indic. Res. 134, 676–710. doi:10.1007/s11205-016-1439-6

Mohsin, M., Taghizadeh-Hesary, F., Panthamit, N., Anwar, S., Abbas, Q., and Vinh Vo, X. (2021). Developing low carbon finance index: Evidence from developed and developing economies. Finance Res. Lett. 2021 (11), 1–5. doi:10.1016/j.frl.2020.101520

Monastiriotis, V. (2013). Regional growth in central and eastern europe:convergence, divergence and non-linear dynamics. Berlin Heidelberg: Springer, 77–94.

Mrijer, S., and Damania, R. (2006). Carbon finance and the forest sector in NortheastIndia. Washington D.C: World Bank.

Niebel, T. (2018). ICT and economic growth – comparing developing, emerging and developed countries. World Dev. 104 (04), 197–211. doi:10.1016/j.worlddev.2017.11.024

Papalia, R. B., and Bertarelli, S. (2013). Nonlinearities in economic growth and club convergence[J]. Empir. Econ. 44 (3), 1171–1201. doi:10.1007/s00181-012-0568-2

Qi, J. (2016). Fiscal expenditure incentives, spatial correlation and quality of economic growth: Evidence from a Chinese province: Evidence from a Chinese province. Int. J. Bus. Manag. 11 (7), 191–201. doi:10.5539/ijbm.v11n7p191

Saleem, H., Shahzad, M., Khan, M. B., and Khilji, B. A. (2019). Innovation,total factor productivity and economic growth inPakistan:a policy perspective. J. Econ. Struct. 8 (1), 1–18. doi:10.1186/s40008-019-0134-6

Solow, R. M. (1956). A contribution to the theory of economic growth. Q. J. Econ. 70 (1), 65–94. doi:10.2307/1884513

Tahvonen, O., and Salo, S. (2001). Economic growth and transitions between renewable and nonrenewable energy resources. Eur. Econ. Rev. 45 (8), 1379–1398. doi:10.1016/s0014-2921(00)00062-3

Keywords: quality-focused economy advancement, carbon finance, spatial dubin model, mediating effect, regulating effect

Citation: Jiang L, Niu H, Ru Y, Tong A and Wang Y (2023) Analysis on the mediating effect and regulating impact of carbon finance on quality-focused economy advancement. Front. Environ. Sci. 11:1235382. doi: 10.3389/fenvs.2023.1235382

Received: 06 June 2023; Accepted: 05 July 2023;

Published: 13 July 2023.

Edited by:

Wang Pei, Nanjing Agricultural University, ChinaCopyright © 2023 Jiang, Niu, Ru, Tong and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Huawei Niu, bml1aHVhd2VpQGN1bXQuZWR1LmNu Yufan Ru, dmFtMTAwODFAMTYzLmNvbQ==; Aihua Tong, dG9uZ2FpaHVhMTJAMTYzLmNvbQ==; Yifeng Wang, d3lmODcwNDAzQDE2My5jb20=

Lili Jiang

Lili Jiang Huawei Niu

Huawei Niu Yufan Ru3*

Yufan Ru3* Aihua Tong

Aihua Tong Yifeng Wang

Yifeng Wang