- 1College of Public Policy, Hamad Bin Khalifa University, Doha, Qatar

- 2Department of Islamic Finance and Economics, College of Islamic Studies, Hamad Bin Khalifa University, Doha, Qatar

The ongoing war between Russia and Ukraine has led to considerable human suffering and raised concerns regarding the potential implications for the global economy. Türkiye, as a neighboring country and a major player in the region, maintains close ties with Ukraine and Russia and heavily relies on agricultural imports from both countries making it susceptible to market shocks caused by the war. In this research paper, we examine the economic impact of war-induced soaring food prices on the Turkish economy using a Computable General Equilibrium (CGE) model, which is a widely used tool for simulating the effects of shocks and policy changes on a country’s economy. We considered two utility functions with varying elasticity parameters to explore both micro-level and macro-level impacts of the price shock, encompassing household demand, industrial production, price and trade dynamics, income, investment, and welfare implications. The findings reveal significant effects on agricultural imports of crops (wheat, maize, barley, rice, and cereal grains), fruit and vegetables, and oil products, leading to an increase in both import and domestic prices, resulting in food inflation in the country. Additionally, the findings show that while the trade balance for the agricultural sector improved, the services, manufacturing, and forestry sectors have experienced an increased trade deficit. Furthermore, the war has caused a decline in foreign direct investment flowing into the country. Finally, the war-led price shock resulted in an estimated income loss of 0.2 or 0.8 percent of real GDP depending on the utility function, and a significant welfare loss. Based on these findings, several policy recommendations were discussed. The findings of the study highlight the importance of considering the interplay between food prices and micro and macroeconomic indicators.

1 Introduction

The ongoing war between Russia and Ukraine has resulted in significant human suffering and raised concerns about its potential impact on the global economy. Beyond the direct consequences for the two countries involved, the war has significant economic implications for the region and the world. This is particularly true in agricultural markets, as Russia and Ukraine are major players in both the region and globally. Türkiye, as a neighboring country and major player in the region, has close ties with both countries. Hence, the war between Ukraine and Russia has significant implications for the Turkish economy. Particularly, trade disruptions pose a significant concern, due to the country’s heavy reliance on agricultural imports from Russia and Ukraine. Any disruption in the supply chains could lead to food price inflation and potential shortages within the Turkish market. Additionally, the ongoing war carries implications for global energy markets. If the war disrupts energy supplies from Russia or triggers an increase in global energy prices, Türkiye, as an energy importer, will inevitably face heightened energy costs, which, in turn, will impact manufacturing and transportation and the entire agricultural production process. Furthermore, the geopolitical risks due to the war can have adverse effects on investor sentiment, resulting in decreased foreign direct investment flowing to Türkiye. Moreover, the tourism sector, which significantly contributes to the Turkish economy, may also suffer. In essence, the consequences of the war extend far beyond trade and energy, affecting various aspects of the Turkish economy. Assessing the impact fully is beyond the scope of one paper. However, in this paper, we assessed the economic impact of the war-led soaring food prices on the key economic indicators in Türkiye using a computable general equilibrium model, which, as explained in the next subsection, allows us to capture the complex interrelationships between different sectors and agents in the economy. This study aims to contribute to evidence-informed policy-making by providing a holistic picture of the quantitative effects of the impact on micro and macroeconomic indicators.

1.1 Theoretical background: computable general equilibrium model

The computable general equilibrium (CGE) model is a widely used economic modeling tool that researchers use to analyze the complex interrelationships and interactions within an economy. It functions like a map of the economy, showing how different sectors and actors are connected. CGE model provides a framework for studying the impact of various policy changes, shocks, and external factors such as a crisis or war on the economy as a whole. For example, one could use the model to see what would happen if the government cut taxes or if there was a natural disaster. The model could also be used to assess the distributional effects of policy changes, meaning how they would affect different groups of people in the economy. The CGE model is based on general equilibrium theory, which posits that all markets in an economy are interrelated and that changes in one market can affect the equilibrium outcomes in other markets. For example, if the government imposes a tariff on imported goods, this will raise the price of those goods for consumers. In turn, this could lead to a decrease in demand for those goods, which could then lead to job losses in the affected industries.

The CGE model is a powerful tool for understanding the structure and dynamics of an economy. It combines microeconomic foundations, empirical data, and a system of equations to analyze the complex interactions and interdependencies within the economy. By capturing the behavior of economic agents, their decision-making processes, and the linkages between different sectors, the CGE model provides insights into the potential impacts of policy changes and shocks, supporting evidence-based policy analysis and decision-making.

The structure of this paper is as follows: The next section provides an overview of the existing literature regarding the effects of war. Section 3 outlines the methodology and data employed in the analysis. Section 4 presents the findings, followed by the discussion section, which includes policy recommendations. Finally, Section 6 provides the concluding remarks.

2 Literature review

The Russia-Ukraine war, which began in February 2022, disrupted the agricultural supply chain, leading to global concerns over food insecurity and inflation. The war’s adverse impact is estimated to be catastrophic, pushing an additional 27.2 million people into poverty and 22.3 million more into hunger (Arndt et al., 2022). Many countries depend on Russia and Ukraine for their agricultural needs, with nearly 50 countries relying on them for at least 30 percent of their wheat imports. Among these countries, 26 source over 50 percent of their wheat imports from these two nations (FAO, 2022). The GDP losses in the agricultural sectors of developing countries, caused by the war-induced rise in fuel and fertilizer prices, are expected to surpass the national GDP losses (Arndt et al., 2022). The war situation and economic blockade have worsened food prices and posed a threat to global food security (FAO, 2022). Lin et al. (2023) examined the impact of the Russia-Ukraine war on food prices using a computable general equilibrium framework. They found that the war resulted in a 60 percent reduction in trade, a 50 percent increase in wheat prices, and a 30 percent decrease in purchasing power. Countries like Türkiye, which heavily rely on wheat imports from Russia and Ukraine, are particularly affected. The analysis indicated that import-dependent countries experience the highest increase in wheat prices due to the war’s global impact. They also found that the trade blockade resulting from the Russia-Ukraine war caused a price increase of 10–30 percent and a decline in welfare of 15–25 percent in these countries. Hassen and Bilali (2022) reviewed the literature on the consequences of the Russia-Ukraine war and concluded that it has severe economic implications for global food security and resilient food systems through direct and indirect channels. The consequences are further exacerbated by worldwide spillovers through commodity markets, financial markets, and trading channels. For instance, Boungou and Yatié (2022) provide empirical evidence of the war’s negative effects on stock market returns, using monthly data from the first 2 months of the war for 97 countries. Domestic food prices and their relationship with external and internal macroeconomic indicators have been examined by researchers in literature (Kara, 2017; İslam and Wong, 2017; Campos, 2020; Ertuğrul and Seven, 2021; Kirikkaleli and Darbaz, 2021; Li and Li, 2021; Letta et al., 2022). Raleigh et al. (2015) empirically assess the relationship between food prices, war, and climate, using data on violent war events in 113 markets of 24 African states. They found positive feedback regarding food prices and political violence.

World trade data shows that exports of main agricultural items including wheat, maize, barley, and sunflower oil significantly declined in early 2022 because of the Russian invasion of Ukraine, disrupting the food supply chain. The global effects of the disruption in the supply chain resulting from war are substantial (World Bank, 2022). Although the main sectors affected by sudden war include grain and wheat, it can have far-reaching effects disturbing trade channels for other commodities. For example, studies show significant synchronization of international commodity prices which are facing war-led supply chain disruption (Lasaroux, 2009). A recent study by Ihle et al. (2022) examined the effect of Russia Ukraine war on commodity prices for which the two countries are the main exporters and assessed the spillover effect to other commodity groups. Their analysis showed that the war significantly affected exports in 2022, disrupting the supply chain and provided empirical evidence of spillover to commodity groups other than the main exports of Russia and Ukraine. Arndt et al. (2022) empirically examine the impacts of war-led rising world prices for food, fertilizers, fuel agriculture sector, poverty, and food insecurity in 19 developing countries. The impact varies across the countries, but general findings include the following: On average, in the overall sample, the increase in fuel price is the largest contributor to GDP losses followed by fertilizer. Their analysis shows that the importers face the largest GDP losses, and that the price increase in fuel and fertilizer causes an increase in production cost in the agriculture sector, and productivity loss, indirectly contributing to domestic inflation in the agriculture sector. The effect of food price increase on GDP losses is found to be negligible.

Türkiye is a major importer of agricultural products from both Russia and Ukraine. According to the latest data from the World Integrated Trade Solution, Türkiye imported USD 17.8 million worth of agricultural products from the Russian Federation and USD 2.6 million from Ukraine in 2016. Imports from the Russian Federation accounted for 8.12 percent of Turkiye’s total imports in 2016, a share that increased to 14.9 percent in 2023, making it vulnerable to disruptions in the supply chains caused by the ongoing war. Such shocks contribute to food inflation affecting other micro and macroeconomic indicators within the country.

The World Bank lays out the inefficiencies in the Turkish agriculture market and identifies a mix of drivers of food price inflation in Türkiye over the long run. The demand and supply-side factors include the depreciation of the Turkish lira, inflationary expectations, an increase in aggregate demand, variations in consumer preferences, and low productivity (World Bank, 2020). The report notes that keeping other factors constant, food price volatility affects both the demand and supply sides of the economy. On the demand side, it affects household purchasing power, and on the supply side, it has a negative impact on producers’ decisions to invest in enhancing productivity. Inflation volatility in Türkiye has shown an upward trend during the last decade (Ertugrul and Seven, 2021; World Bank, 2022).

The recent war has led to an increase in global food prices due to energy price hikes and trade restrictions, indirectly affecting food prices in Türkiye. Moreover, the surge in food prices resulting from the war can also be attributed to the high import costs of agricultural inputs, as Russia holds dominance in the global fertilizer market. Ertugrul and Seven (2021) identified that the exchange rate significantly contributed to the food price differential between Türkiye and the rest of the world between 2003 and 2019. Their analysis also shows convergence with an increase in oil prices in international markets. Demirkılıç et al. (2022) suggest that the impact of exchange rates on domestic prices in Türkiye is significant. On the other hand, Ozturk (2017) and Ozturk (2020) argue that price shocks from world to local market depends on the extent to which local market integrated with international markets.

While multiple factors contribute to food price inflation in Türkiye, the Russia-Ukraine war has exacerbated the situation. It is probable that global shocks play more significant role in domestic food inflation compared to domestic shocks. For instance, a study by Nguyen et al. (2017) found a substantial decrease in the contribution of domestic supply shocks to inflation. Conversely, the global oil and food price shocks contributed more prominently due to increased economic integration in recent years.

This paper aims to contribute to the existing literature on the impact of the Russia-Ukraine war by quantifying the effects of the war-led food price hike on the Turkish economy within a CGE framework.

3 Methodology

We used a CGE model for the analysis of this paper, as it is a useful method to capture the complex interdependencies between different sectors of the economy and the effects of policy responses. The analysis is based on the global CGE model database developed by Global Trade Analysis Project (GTAP)1. The CGE model represents the economy as a system of equations with market clearing constraints, equilibrium price and quantity. Then, a model experiment in GTAP disturbs this equilibrium to reveal the behavior of different economic agents and elements in response to the shock. The standard CGE model is a static model, and there are wide ranges of dynamic CGE models. CGE models are well documented and used by many researchers, with different variations and purposes. The early application of these models in literature started from the study of taxation (Shoven and Whalley, 1984), trade, and development policies (Bandara, 1991). Over time, it has been used for studying the impact of trade liberalization (Robinson and Thierfelder, 2002; McDonald and Walmsley, 2008; Ozturk, 2020; Ozturk and Radouaı, 2020; Chow et al., 2022), and non-tariff measures (Fugazza and Maur, 2008). The classical CGE models were mostly used in international trade research, however, in the contemporary world their growing diversity of application solves economic problems in different disciplines including climate change (Xie et al., 2020) and food security (Anderson and Strutt, 2012; Baquedano et al., 2022). In the context of Russia-Ukraine war, most recent application of CGE is that of Lin et al. (2023). GTAP, founded by Hertel (1997), provides core data for CGE models along with many in-built CGE models. Burfisher (2021) explains the GTAP database as comprised of input-output tables, taxes and tariff data, bilateral trade flows, and the data comprising Social Accounting Matrices (SAMS). The database also provides elasticity parameters for CGE models, which allow modelers to study the responsiveness of economic agents to variations in relative price and income. GTAP database distinguishes commodities based on the origin, destination, and agents in the importing country (intermediate demand, final demand by households, governments, and Investments). This allows the modeler to examine the varying import intensities by agents within the region. Domestic agents pay import duties as well as sale taxes. On the domestic supply side, the product is either sold in the domestic market or exported. The producers use inputs in GTAP which include intermediate inputs and primary factors of production, i.e., Land, labor, and capital, and pay production taxes. The primary factors of production are assumed to be fixed in static CGE. The income of regional households comes from factor sale and tax instruments, i.e., Import-export duties, sale tax, production tax and tax on factors of production (McDonald and Walmsley, 2008; Burfisher, 2021).

A static CGE model outlines a comparison of pre and post-shock scenarios. We introduced a 50 percent price shock to the price of agricultural products imported to Türkiye and examine the impact of the shock on the economy. We made no modification to the model, used its standard closure and medium-term behavioral parameters, following Jensen and Anderson (2017). In the first scenario, we run the experiment using standard elasticities in the model, including the cross-price elasticities within the agricultural sector. In scenario 2, we run the experiment by altering the elasticities.

The model is calibrated using GTAP version 10, which partitions the global economy into 141 countries and 20 aggregate regions, encompassing 65 products and services, 21 agricultural commodities, 24 manufacturing products, and 20 services. However, we have tailored the model to align with our research question by focusing on specific aggregated data related to relevant sectors and countries. Since our specific interest lies in the agriculture commodity group, we have aggregated the manufacturing products and services into single sectors each, while maintaining detailed aggregation for the agriculture sector products. Consequently, our model consists of ten sectors, including eight agriculture sectors, one manufacturing sector, and one services sector. Since we are interested to study the effect of price shock in rest of the world on the Turkish economy, we keep Türkiye as one region and aggregate the rest of 140 countries into one region: the rest of the world. Hence our model has two regions and 10 sectors. All details are provided in Supplementary Table SA1.

4 Results

4.1 Descriptive statistics

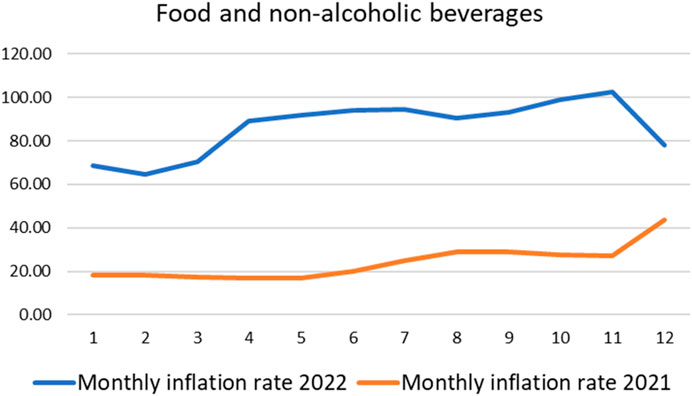

International food prices witnessed a remarkable surge in 2022, surpassing the levels observed during the 2008 financial crisis and marking the highest increase in the past two decades. According to Food and Agriculture Organization (FAO), the food price index reached 143.7 in 2022, surpassing the levels recorded during the 2008 financial crisis (117.5) and even exceeding the highest index of the previous decade (131 in 2011). These statistics shed light on the significant upward trajectory of food prices, with a noticeable surge experienced during the Covid-19 period. The food price index soared from 98.1 in 2020 to 125.7 in 2021, ultimately peaking in 2022 at 143. Among the various food categories, the oil price index claimed the highest position, standing at 187.8, followed by the cereal price index at 154.7.2 Similarly, Türkiye faced an upward trend in food prices throughout 2022, the food inflation rate reaching 85 percent by the end of 2022. The monthly data for food and non-alcoholic beverages shows that prior to 2022, although food inflation had a mostly upward trend, the inflation rate was less than 50 percent compared to 68 percent recorded in January 2022, and reaching 102 percent in November 2022, with a persistent upward trend in between (Figure 1).

FIGURE 1. Monthly inflation rate in Türkiye for Food and non-alcoholic beverages. Source: Authors’ calculation based on IMF data.

As discussed above, the significant increase in food prices in 2022 in Türkiye can be primarily attributed to the Russia-Ukraine war, although it is important to acknowledge that multiple factors contribute to food price inflation in the country.

4.2 Simulation results

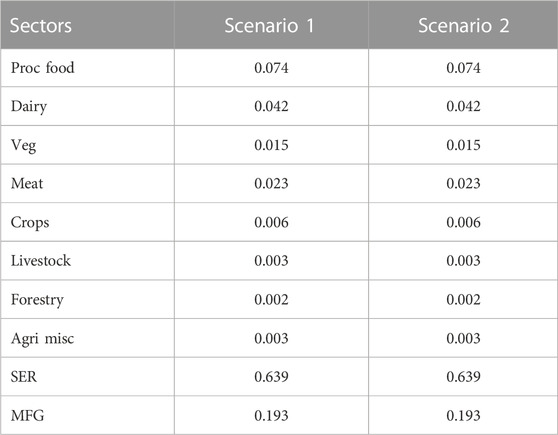

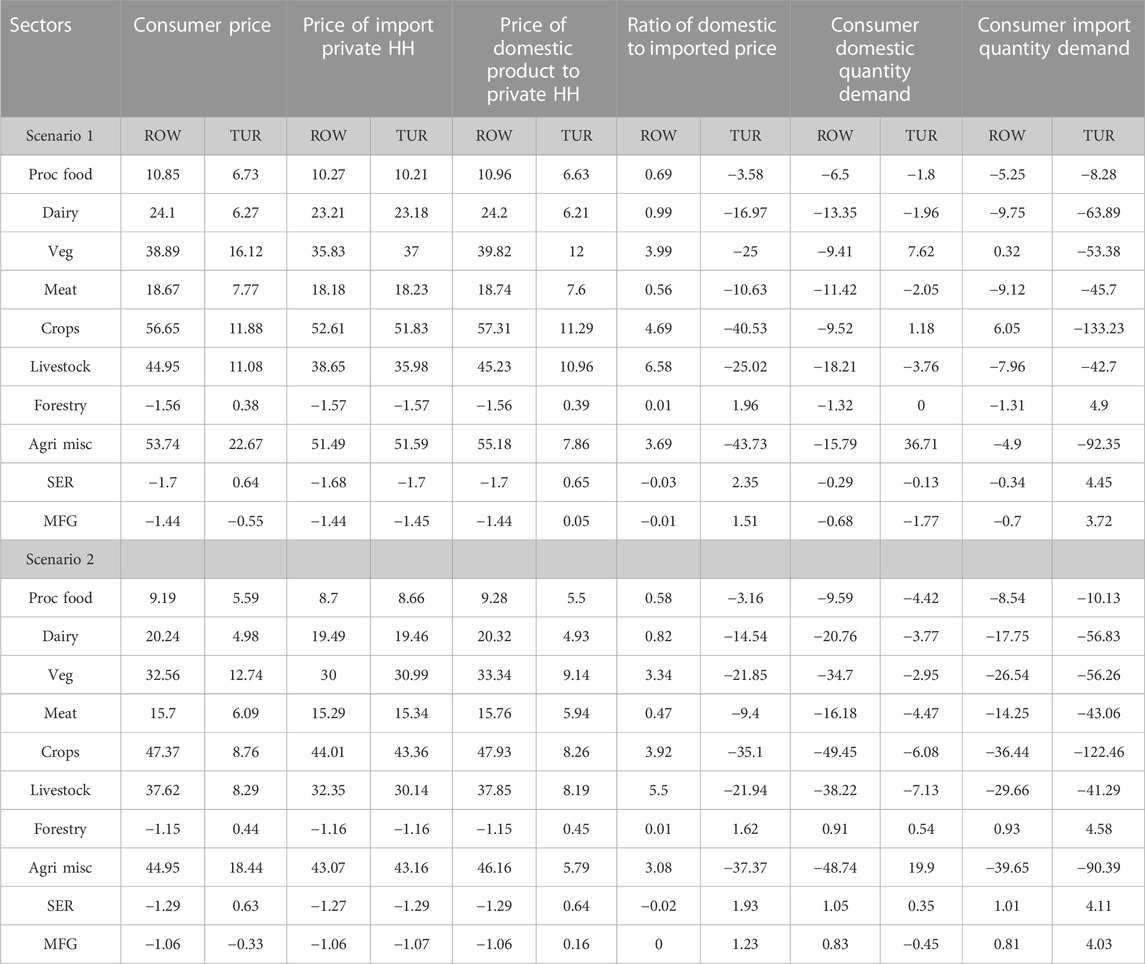

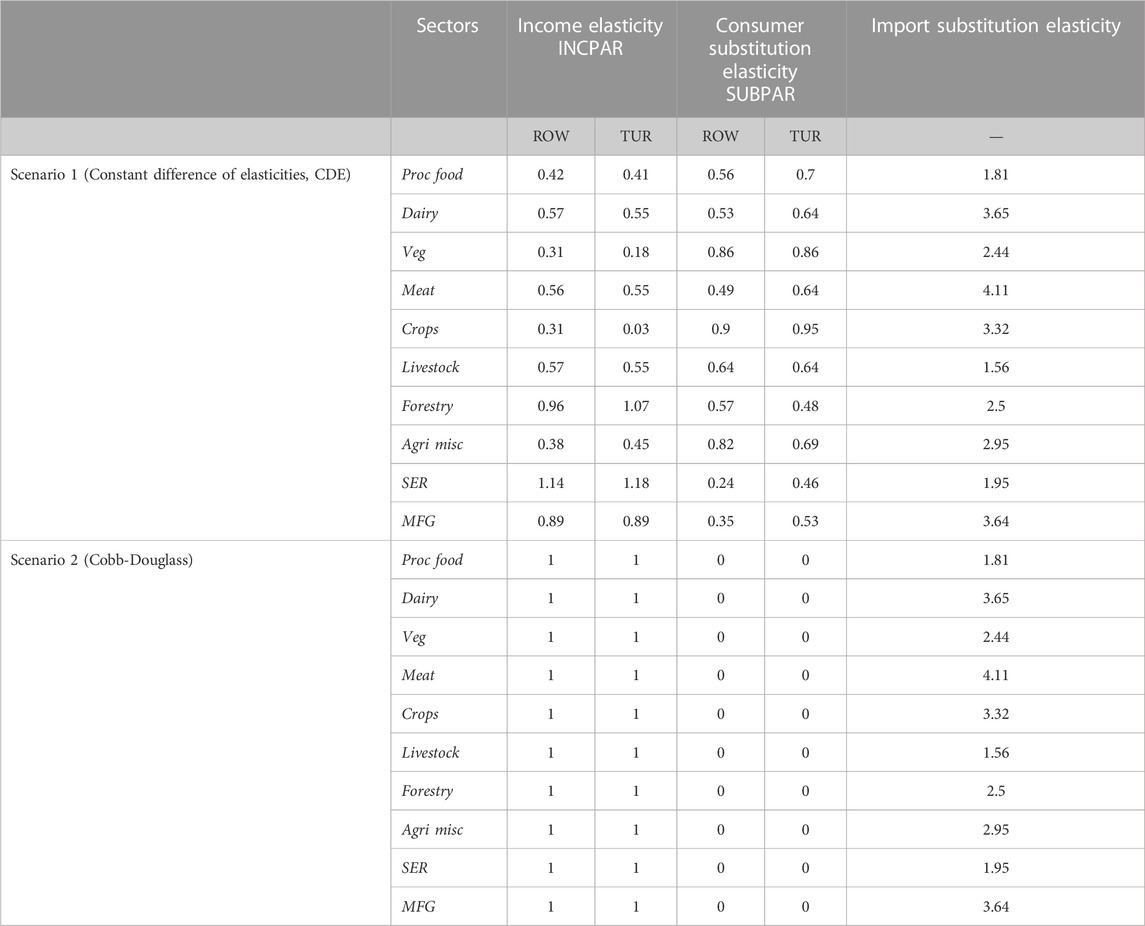

In this model, we simulated a 50 percent increase (in line with the current spike) in the world price of agricultural products imported to Türkiye. We ran the same model experiment twice with two different utility functions mentioned in Table 1. In the first experiment, scenario 1, we used the Constant Difference of Elasticity, CDE, demand system with the consumer income, INCPAR, and substitution, SUBPAR, and import elasticity parameters. In Scenario 2, we modified the consumer’s utility function by changing the INCPAR and SUBPAR parameters to replicate those of a Cobb-Douglass utility function. We compare the results of both scenarios in the following Tables 1–6.

TABLE 1. Elasticity parameters in two scenarios of a 50 percent increase in world agricultural price.

Table 1 also provides the import substitution elasticity for all sectors studied. Constant Difference of Elasticities, CDE, demand system assumes to have non-homothetic income elasticity meaning that, holding prices constant, as income increases consumers can purchase proportionately more luxury goods and spend a smaller share of their budget on necessities. As shown in Table 1, CDE income parameter values range from 0.31 to 0.96 for agricultural commodities, suggesting that all agricultural goods are necessity goods. Furthermore, manufacturing sectors are necessity goods with 0.89 income elasticity while services are luxury goods as the income parameter is greater than one, 1.14. On the other hand, the Cobb-Douglas (CD, hereafter) utility function assumes to have homothetic income elasticity implying that as income increases, holding prices constant, the quantity demanded of all goods in the table increases by the same proportion as income. For example, if income increases by 10%, the quantity demanded of all goods also increases by 10%. Concerning import substitution elasticity, the Armington assumption regarding the consumer behavior implies that consumer goods are differentiated by country of origin, and consumers are willingness to substitute between imports and domestic varieties, governed by an import substitution elasticity. The higher import substitution elasticity, the greater is the response of consumer to the import price. Given the import substitution elasticities reported in Table 1, consumers are more responsive to changes in the import price of meat, dairy, crop, and agriculture miscellaneous sectors.

In terms of budget shares, the household budget shares are similar in both scenarios (Table 2). The figure shows that 64 percent of the households’ budget is spent on services, 19 percent is spent on manufacturing goods, and 17 percent on agricultural products. The CDE assumes flexible budget shares subject to price and income changes, whereas CD assumes fixed budget shares in response to price and income changes, hence, the budget shares of each commodity in the consumer basket remain constant when income alone changes. Both CDE and Cobb-Douglass utility functions assume negative own-price elasticities, meaning that, with income constant, as price increases, demand should fall. The CGE model results in Table 3 are consistent with this as the consumer demand quantity falls in both scenarios. The same change is observed in consumer import demand quantity (last column) in both scenarios. For example, following the shock, import demand decreases by 8.28 percent for processed food, 64 percent for dairy, 53 percent for vegetables, and 46 percent for meat (scenario 1). The highest drop is observed in crop import demand with 133 percent, followed by 64 percent in dairy, 53 percent in vegetables, 45 percent in meat, and 42 percent in livestock. As for the price effects, the shock causes a significant rise in prices in both scenarios as shown in the first three columns of Table 3. The average price increase in imported agricultural products is about 30 percent, the highest pick is observed in crop prices with a 52 percent increase followed by vegetables with 37 percent and livestock with 36 percent. On the other hand, prices of services and manufacturing sectors are not affected significantly.

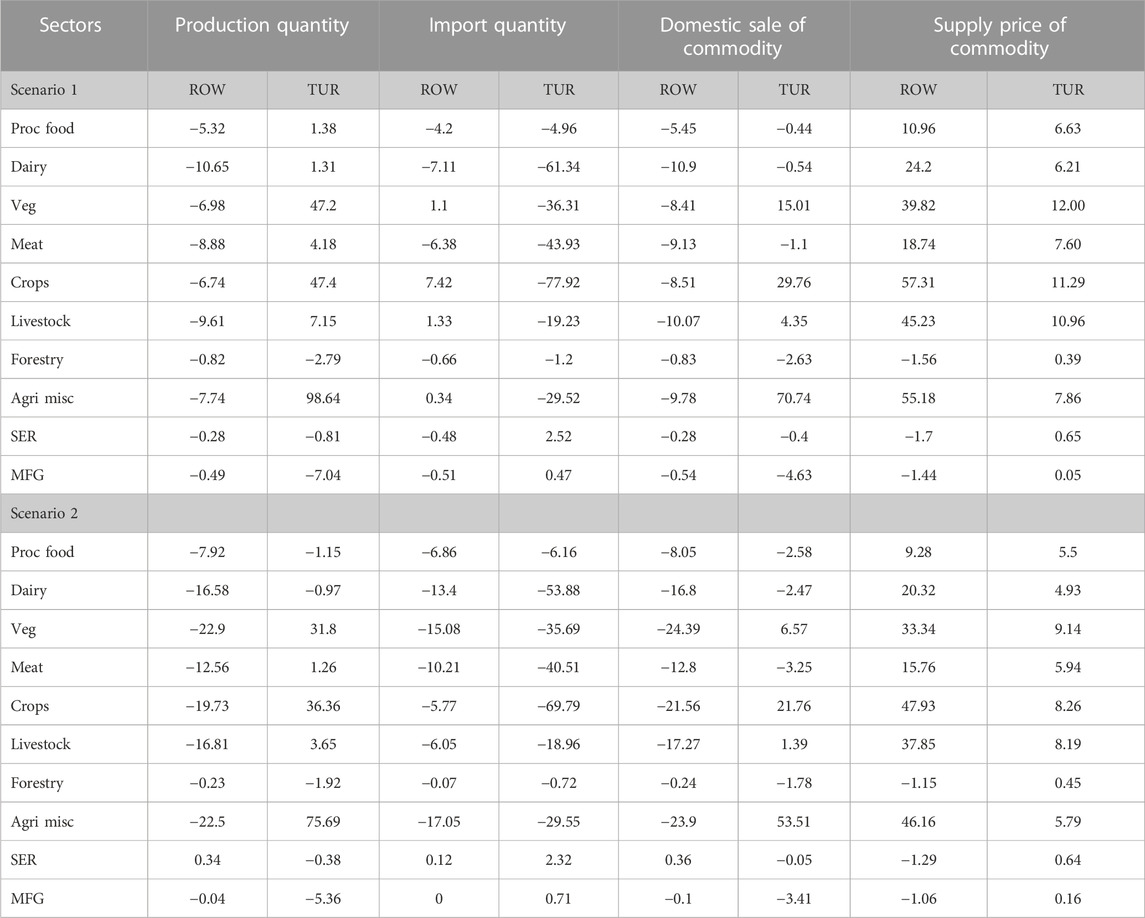

Looking at the supply side on Table 4, the shock diverted the demand from imports to local products causing an increase in the supply of domestic commodities. For example, domestic production of miscellaneous categories has increased by 99 percent while crop production increased by 47 percent followed by dairy with 47 percent. These changes pushed production prices upwards. As shown in the last column, due to the isolated shock, supply prices have increased by 12 percent for vegetables, 11.29 for meat followed by 11 percent for crops. On the other hand, a sharp drop is observed in import quantities showing the substitute feature of import and domestic to some extent. The isolated impact of the shock on services and manufacturing services is not substantial.

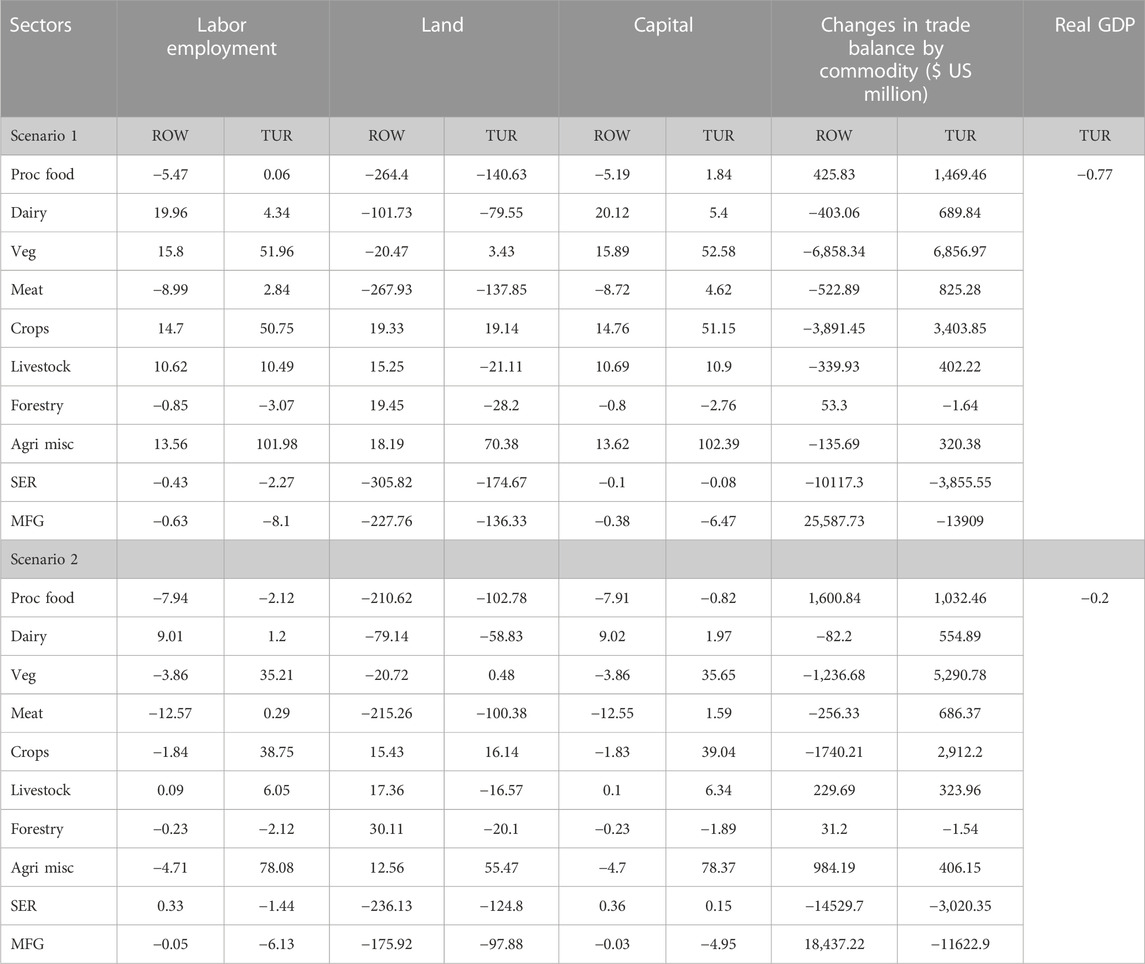

The increase in domestic production has also increase the use of production factors in Türkiye. As shown in Table 5, labor employment increases following the changes in domestic production. The increase in labor demand is highest in agriculture miscellaneous category followed by crops and vegetable. The employment of land has increased for crops, miscellaneous, and vegetables production. Similarly, more capital is employed in agriculture sector for almost all product groups.

TABLE 5. Effects of a 50 percent increase in the world agricultural prices on macroeconomic indicators.

The food price surge resulted in a change in industry structure in Türkiye, as the output of the manufacturing sector and services sector falls with booming agriculture sector, causing increase in both production and employment. Both scenarios describe a substantial decline in imports and increased consumer demand for the domestic variety of agricultural products, resulting in an increase in agricultural output. Real GDP declines as the agricultural output will exert a pull on the productive resources used in the manufacturing and services sector, resulting in a decline in output.

The trade balance in Türkiye is positive for agricultural products which is expected due to significant drop in imports of agriculture. The largest improvement in the trade balance is observed for the vegetable sector ($6856 US million), followed by the crops ($3403 US million) and meat ($825 US million) sectors. On the other hand, the trade deficit in the manufacturing and services sector increased.

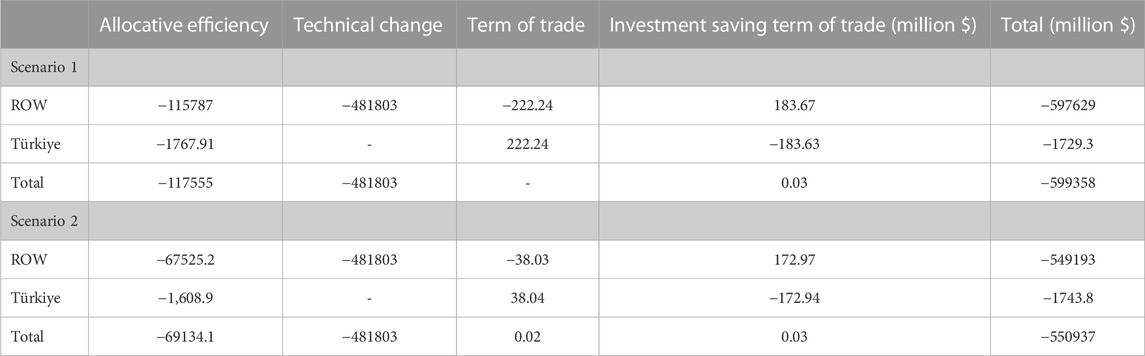

Using GTAP model’s welfare decomposition utility, we quantified the equivalent variation in welfare incurred due to impacts of a 50 percent increase in world food prices.3The overall welfare effect is negative in both regions as given in Table 6. There is a welfare loss of $1729 million ($1.7 billion) in Türkiye, which is the sum of the decline in resource allocation (1st column) stemming from the excess burden due to price surge and decline in investment (3rd column). The investment saving terms of trade measure the change in the price of domestically produced capital investment goods relative to the price of saving in the global bank. As shown in Table 6, the investment saving term of trade declines by $184 million and $172 million in scenario 1 and scenario 2, respectively. As terms-of-trade changes cancel each other out at the global level, welfare impact measures include changes in allocative efficiency only. With a total efficiency loss of $551 billion in the world due to the agricultural price hike.

5 Discussion

The results presented in the previous section can be classified into two categories: micro-level impacts and macro-level impacts of the war-induced price shock. Micro-scale impacts encompass price and trade dynamics, and industry structure while macro-level impacts are related to income loss, trade balance, investment, and welfare implications. We discuss these impacts respectively.

Regarding the trade effects, although the price shock does not decrease the imports of the services, manufacturing, and forestry sectors, it has a significant impact on the imports of agricultural products. Notably, the sharpest decline is observed in the import of the crop category, which includes paddy rice, wheat, cereal grains, sugar cane, and other crops. This drop in crop import coincides with an increase in demand for domestic crops as consumers substitute the imported quantity with domestic variety. A similar trend is observed in the vegetables category which includes fruits, nuts, vegetable oils, and fats, and the agricultural miscellaneous category which includes oil seeds, plant-based fibers, wool, and silkworm cocoons. These results suggest that there has been a demand shift from international markets to domestic markets. The highest substitution is observed in the products that have higher import substitution elasticities given the Armington assumption of import substitution. On the other hand, the demand for meat and livestock, both domestic and imports, has decreased indicating that some consumers have reduced or stopped purchasing meat products possibly due to the decline in purchasing power of the households in Türkiye. On the production side, as expected, the rise in demand for domestic production has led to a significant expansion in domestic production. Particularly, the production of vegetables, meat, livestock, and crop categories increased significantly. Regarding price effects, as anticipated, the shock has increased both import prices and domestic prices. Specifically, the isolated shock has caused an average of approximately 12 percent increase in agricultural domestic prices and an average increase of 33 percent in import prices. Domestic production prices have also experienced a 9 percent average spike. These price increases due to isolated shock coupled with other factors have brought the food inflation up to 65 percent (shown in Figure 1) raising concerns about the food security of vulnerable households.

On the macro-economic front, due to the increase in domestic production, the use of land, labor, and capital has increased. The sharp fall in agricultural imports improved the trade balance for agricultural categories while increasing the trade deficit for the services, manufacturing, and forestry sectors. Overall income loss due to war-led price shock is estimated to be from 0.2 to 0.8 percent of the real GDP depending on the utility function assumption. The estimated total welfare loss due to the war-driven high prices is estimated to be $1.7 billion for Türkiye. The results also show that the war has caused a decline in the FDI flowing to the country.

Based on these findings, several policy recommendations can be made. First, efforts should be made to support and further develop domestic agriculture to meet the increased demand and reduce dependence on imports, which can be achieved through targeted investment, subsidies, and agricultural reforms aimed at increasing productivity and competitiveness. Second, measures should be implemented to address the rising food inflation and ensure food security for vulnerable households. These measures could include targeted social safety nets, price stabilization mechanisms, and support for local food production and distribution networks. Third, steps should be taken to mitigate the negative impact on the trade balance caused by the decline in agricultural imports. This could involve diversifying the economy, promoting exports in other sectors, and seeking new trading partners to reduce dependence on specific markets. Finally, efforts should be made to attract and retain foreign direct investment in Türkiye. This could be achieved through policy measures to improve the business environment, enhance investor confidence, and highlight the potential opportunities in non-agricultural sectors.

6 Conclusion

In this study, we assessed the economic impact of war-induced soaring food prices on the Turkish economy, using computable general equilibrium model developed by GTAP. Our simulation results underscore the multifaceted consequences of the war and soaring food prices on the Turkish economy. Trade disruptions resulting from the war pose risks to the agricultural sector of Türkiye due to its heavy reliance on agricultural imports from Russia and Ukraine. Additionally, disruptions in the supply chains led to food price inflation in the country. Furthermore, the war carries implications for global energy markets. Türkiye is an energy importer and any increase in energy costs due to the war would increase manufacturing, transportation, and agricultural production costs in the country. These combined effects influence various aspects of the Turkish economy causing food inflation, investment reduction, and income and welfare losses. The findings highlight the need for proactive measures to address trade disruptions, mitigate food price inflation, manage energy costs, and attract foreign direct investment. By implementing appropriate policies, Türkiye can navigate the challenges posed by the ongoing war. There are some limitations of this study. First, CGE models are based on a series of assumptions to make the model computationally manageable. While these assumptions help in simplifying the complex real-world economy, they can also oversimplify certain aspects and lead to potential inaccuracies. Second, CGE models are typically static, meaning they do not capture dynamic changes over time adequately. As a result, they might not fully capture the long-term implications of policy changes or structural shifts in the economy. Third, to simplify the model, CGE models often group sectors together, which can lead to a loss of detail and accuracy. This aggregation might not accurately represent certain industries or sectors with unique characteristics. Finally, While our study focused on the economic impact of the war, it is important to acknowledge that capturing all the consequences of the war go beyond the scope of this paper. Future research could look into additional dimensions, such as social and political implications, to provide a comprehensive understanding of the overall impact.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.gtap.agecon.purdue.edu/databases/.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Acknowledgments

Open Access Funding provided by Qatar National Library.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1233233/full#supplementary-material

Footnotes

1https://www.gtap.agecon.purdue.edu/products/rungtap/default.asp

2The FAO Food Price Index (FFPI) measures the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices (meat, dairy, cereal, oil, and sugar) weighted by the average export shares of each of the groups over 2014–2016. The FAO data can be assessed at: https://www.fao.org/worldfoodsituation/foodpricesindex/en/.

3The welfare effect measures monetary value of the effects of price changes on real consumption and savings of trading partners. The welfare decomposition allows contribution of welfare by commodity, factor, and tax type and to account for terms-of-trade effects. The equivalent variation welfare explains the amount of additional income that would have been required to purchase a basket that yields the new utility level. GTAP model gives equivalent variation welfare effects on behalf of the regional household. It includes the combined changes in the utility of household and government from their purchases, and in addition includes domestic savings.

References

Aguiar, A., Chepeliev, M., Corong, E. L., McDougall, R., and Van Der Mensbrugghe, D. (2019). The GTAP data base: Version 10. J. Glob. Econ. Analysis 4 (1), 1–27. . doi:10.21642/jgea.040101af

Anderson, K., and Strutt, A. (2012). Asia S growth, the changing geography of world trade, and food security: Projections to 2030.

Arndt, C., Diao, X., Dorosh, P. A., Pauw, K., and Thurlow, J. (2022). Russia-Ukraine war and the global crisis: Impacts on poverty and food security in developing countries (No. 20). Washington: International Food Policy Research Institute IFPRI.

Bandara, J. S. (1991). Computable general equilibrium models for development policy analysis in LDCs. J. Econ. Surv. 5 (1), 3–69. doi:10.1111/j.1467-6419.1991.tb00126.x

Baquedano, F., Jelliffe, J., Beckman, J., Ivanic, M., Zereyesus, Y., and Johnson, M. (2022). Food security implications for low-and middle-income countries under agricultural input reduction: The case of the European Union's farm to fork and biodiversity strategies. Appl. Econ. Perspect. Policy 44 (4), 1942–1954. doi:10.1002/aepp.13236

Ben Hassen, T., and El Bilali, H. (2022). Impacts of the Russia-Ukraine war on global food security: Towards more sustainable and resilient food systems? Foods 11 (15), 2301. doi:10.3390/foods11152301

Boungou, W., and Yatié, A. (2022). The impact of the Ukraine–Russia war on world stock market returns. Econ. Lett. 215, 110516. doi:10.1016/j.econlet.2022.110516

Burfisher, M. E. (2021). Introduction to computable general equilibrium models. Cambridge: Cambridge University Press.

Castro Campos, B. (2020). Are there asymmetric relations between real interest rates and agricultural commodity prices? Testing for threshold effects of US real interest rates and adjusted wheat, corn, and soybean prices. Empir. Econ. 59 (1), 371–394. doi:10.1007/s00181-019-01636-1

Chow, P., Ozturk, O., and Thompson, H. (2022). Short-run adjustments in taiwan to free trade in a multisector specific factors model. Int. Trade J., 1–13. doi:10.1080/08853908.2022.2090463

Demirkılıç, S., Özertan, G., and Tekgüç, H. (2022). The evolution of unprocessed food inflation in Turkey: An exploratory study on select products. New Perspect. Turkiye 67, 57–82. doi:10.1017/npt.2022.9

Ertuğrul, H. M., and Seven, Ü. (2021). Dynamic spillover analysis of international and Turkish food prices. Int. J. Finance Econ. 28, 1918–1928. doi:10.1002/ijfe.2517

FAO (2022). Impact of the Ukraine-Russia war on global food security and related matters under the mandate of the food and agriculture organization of the united nation (FAO) CL 170/6. Rome, Italy: Food and Agriculture Organization.

Fugazza, M., and Maur, J. C. (2008). Non-tariff barriers in CGE models: How useful for policy? J. policy Model. 30 (3), 475–490. doi:10.1016/j.jpolmod.2007.10.001

Hertel, T. W. (1997). Global trade analysis: Modeling and applications. Cambridge, United Kingdom: Cambridge University Press.

Ihle, R., Bar-Nahum, Z., Nivievskyi, O., and Rubin, O. D. (2022). Russia’s invasion of Ukraine increased the synchronisation of global commodity prices. Aust. J. Agric. Resour. Econ. 66 (4), 775–796. doi:10.1111/1467-8489.12496

Islam, M. S., and Wong, A. T. (2017). Climate change and food in/security: A critical nexus. Environments 4 (2), 38. doi:10.3390/environments4020038

Jensen, H. G., and Anderson, K. (2017). Grain price spikes and beggar-thy-neighbor policy responses: A global economywide analysis. World Bank Econ. Rev. 31, lhv047. doi:10.1093/wber/lhv047

Kara, E. (2017). Does US monetary policy respond to oil and food prices? J. Int. Money Finance 72, 118–126. doi:10.1016/j.jimonfin.2016.12.004

Kartal, M. T., and Depren, Ö. (2023). Asymmetric relationship between global and national factors and domestic food prices: Evidence from Turkey with novel nonlinear approaches. Financ. Innov. 9 (1), 11. doi:10.1186/s40854-022-00407-9

Kirikkaleli, D., and Darbaz, I. (2021). The causal linkage between energy price and food price. Energies 14 (14), 4182. doi:10.3390/en14144182

Lescaroux, F. (2009). On the excess co-movement of commodity prices—a note about the role of fundamental factors in short-run dynamics. Energy Policy 37 (10), 3906–3913. doi:10.1016/j.enpol.2009.05.013

Letta, M., Montalbano, P., and Pierre, G. (2022). Weather shocks, traders' expectations, and food prices. Am. J. Agric. Econ. 104 (3), 1100–1119. doi:10.1111/ajae.12258

Li, Y., and Li, J. (2021). How does China’s economic policy uncertainty affect the sustainability of its net grain imports? Sustainability 13 (12), 6899. doi:10.3390/su13126899

Lin, F., Li, X., Jia, N., Feng, F., Huang, H., Huang, J., et al. (2023). The impact of Russia-Ukraine conflict on global food security. Glob. Food Secur. 36, 100661. doi:10.1016/j.gfs.2022.100661

McDonald, S., and Walmsley, T. (2008). Bilateral free trade agreements and customs unions: The impact of the EU Republic of South Africa free trade agreement on Botswana. World Econ. 31 (8), 993–1029. doi:10.1111/j.1467-9701.2008.01112.x

Nguyen, A. D., Dridi, J., Unsal, F. D., and Williams, O. H. (2017). On the drivers of inflation in Sub-Saharan Africa. Int. Econ. 151, 71–84. doi:10.5089/9781513583013.001

Ozcan, O., Ergun, A., and Sena, G. (2023). An empirical examination of trade policy and food security in MENA countries: Evidence from quantile regressions. Glob. Bus. Econ. Rev. Inderscience. doi:10.1504/GBER.2024.10056913

Ozturk, O. (2017). Effects of price transmission and exchange rate elasticities of three developing countries on the world cotton trade. Appl. Econ. Finance 5 (1), 91. doi:10.11114/aef.v5i1.2894

Ozturk, O. (2020). Market integration and spatial price transmission in grain markets of Turkey. Appl. Econ. 52 (18), 1936–1948. doi:10.1080/00036846.2020.1726862

Ozturk, O., and Radouaı, N. (2020). “Does trade openness contribute to economic growth and development of Morocco?,” in Economics business and organization research (Turkiye: Dergipark). Available at: https://dergipark.org.tr/en/pub/ebor/issue/58610/850557.

Raleigh, C., Choi, H. J., and Kniveton, D. (2015). The devil is in the details: An investigation of the relationships between conflict, food price and climate across Africa. Glob. Environ. Change 32, 187–199. doi:10.1016/j.gloenvcha.2015.03.005

Robinson, S., and Thierfelder, K. (2002). Trade liberalisation and regional integration: The search for large numbers. Aust. J. Agric. Resour. Econ. 46 (4), 585–604. doi:10.1111/1467-8489.t01-1-00057

Shoven, J. B., and Whalley, J. (1984). Applied general-equilibrium models of taxation and international trade: An introduction and survey. J. Econ. literature 22 (3), 1007–1051.

World Bank Group (2022). Commodity markets outlook: The impact of the war in Ukraine on commodity markets. Washington: World Bank Group.

Keywords: Russia-Ukraine war, soaring food prices, computable general equilibrium, CGE, Turkish economy

Citation: Ozturk O and Faizi B (2023) The Russia-Ukraine war, soaring food prices, and the Turkish economy: insights from computable general equilibrium. Front. Environ. Sci. 11:1233233. doi: 10.3389/fenvs.2023.1233233

Received: 01 June 2023; Accepted: 31 July 2023;

Published: 09 August 2023.

Edited by:

Muhammad Abdul Kamal, Abdul Wali Khan University Mardan, PakistanCopyright © 2023 Ozturk and Faizi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ozcan Ozturk, b296dHVya0BoYmt1LmVkdS5xYQ==

Ozcan Ozturk

Ozcan Ozturk Bushra Faizi

Bushra Faizi