95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 14 July 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1225509

China’s listed companies have serious Principal-agent problem of the second kind. Large shareholders have violated the rights and interests of minority shareholders in an endless stream of cases. However, the voice of encouraging minority shareholders to actively participate in enterprise decision-making is growing day-by-day. However, there is no consensus on whether the enthusiasm of minority shareholders in decision-making can have a positive impact on enterprises. Therefore, this article takes China’s A-share listed companies from 2016 to 2020 as the research sample, and from the perspective of green innovation, discusses whether the minority shareholders’ active participation in enterprise decision-making can improve the level of green innovation of enterprises. The study found that the minority shareholders’ active participation in enterprise decision-making can improve the level of green innovation. Moreover, the minority shareholders’ “hand voting” improves the green innovation level of enterprises by influencing the media attention; A higher level of legal environment is conducive to strengthening the role of minority shareholders’ participation in the shareholders’ meeting in green innovation. Based on the property right nature, regional and industrial level, further research found that the minority share-holders’ role in improving green innovation capacity is more significant in non-state-owned enterprises, eastern regions and heavy pollution industries. The research results show that minority shareholders, as an important force to monitor the senior executives’ behavior and enhance corporate value, actively participate in corporate decision-making, can not only improve corporate governance, but also benefit the sustainable development of enterprises.

Since the reform and opening up, China’s economy has developed rapidly, while problems such as outdated green development concepts and weak innovation capabilities have hindered the high-quality development of China’s economy. Green development strategy has become the only way for enterprises to rapidly change their own value growth mode and high-quality development. The report of the 19th National Congress of the Communist Party of China put forward the socialist ecological civilization concept that “Lucid waters and lush mountains are invaluable assets”, which provides direction for sustainable economic development. China has gradually realized the significance of the concept of green development, and how to achieve a balance between economic growth and environmental protection and achieve the concept that “Lucid waters and lush mountains are invaluable assets” has become one of the most important goals at present. Accelerating green technology innovation is the Critical path method for China to achieve the goal of carbon peaking, carbon neutrality, and sustainable economic and social development. Only by closely combining innovation as a key driving force with green development and vigorously implementing green innovation can we break the dilemma of either the economy or the environment and achieve China’s goals. The win-win situation of characteristic socialist economic construction and ecological civilization construction. Therefore, how to motivate enterprises to improve green innovation performance and green governance awareness has gradually aroused widespread discussion in the academic community. As a systematic project, green innovation cannot be separated from the creation of good environmental resources or the active participation of various stakeholders. As the beneficiaries of Surplus value of enterprises, minority shareholders are the core stakeholders in corporate governance. Many scholars have conducted comprehensive discussions on green innovation in enterprises from multiple perspectives, but the impact of active participation of minority shareholders in decision-making on green innovation has not yet received sufficient attention. Therefore, exploring the impact of the participation of minority shareholders in decision-making on green innovation in enterprises has important theoretical and practical significance.

At the beginning of 2018, incidents of major shareholders of listed companies harming the interests of other shareholders emerged one after another: LeTV suffered a pre loss of 11.6 billion yuan, Baoqianli continuously fell below the limit for more than 20 times … setting another “record” in the Chinese capital market. Numerous surprising events have proven that conventional governance mechanisms such as independent directors have limited effectiveness, so are there other effective governance methods? Many minority shareholders believe that compared to major shareholders, their own shareholding ratio is relatively low, making it difficult to have an impact on corporate decision-making, and participating in corporate decision-making requires a certain cost. Therefore, their enthusiasm for directly participating in corporate decision-making is not high, often adopting the method of “free riding” or “feet-voting”. However, in recent years, the voices advocating for active participation of minority shareholders in corporate decision-making and encouraging them to shift from “feet-voting” to “hand-voting” have become increasingly strong. For example, the capital market regulatory authorities have taken multiple measures to increase the enthusiasm of minority shareholders to directly participate in corporate decision-making. The relevant regulations introduced in 2004 and 2013 not only played a decisive role in the construction and development of online voting platforms for shareholders’ meetings of listed companies, greatly reducing the cost of minority shareholders participating in corporate decision-making, but also improving their discourse power. In addition, many cases in the industry also demonstrate that the active exercise of voting rights by minority shareholders can have a significant impact on corporate decision-making. The minority shareholders of Busen Group jointly rejected the proposal to re-elect the board of directors and supervisors of the major shareholders. The minority shareholders of ST Biochemical actively facilitated the bid acquisition opposed by the major shareholders; The proposal to terminate the restructuring of Fengshen Shares was rejected by minority shareholders. However, whether direct participation of minority shareholders in corporate decision-making can have a positive impact on the enterprise has not been fully explored, and some existing studies are also inconsistent, failing to reach widely accepted conclusions.

Opportunistic behavior such as major shareholder hollowing out is a short-sighted behavior that not only damages the interests of minority shareholders, but also seriously affects the long-term development of enterprises. Green innovation, because of its dual contributions to economic performance and environmental protection, is a key factor in promoting the transformation and upgrading of enterprises and fostering a green economic system. It requires not only new ideas and new perspectives that are different from the conventional ones, but also long-term and continuous capital and personnel input from enterprises. It has high requirements for enterprises’ resource acquisition ability, Assumption of risk ability and governance level. The opportunistic behavior of major shareholders can empty corporate resources, damage corporate value, lead to the disorder of the green innovation system, and have a negative impact on corporate green innovation (Wang and Wang, 2020). With the increasingly mature capital market in China, the awareness of the rights and interests of minority shareholders is gradually increasing. For the purpose of expressing their demands and safeguarding their own interests, minority shareholders actively participate in corporate decision-making by attending shareholder meetings and other means. Moreover, the rapid development of online voting platforms has provided convenience for minority shareholders to express their wishes. Therefore, the active participation of minority shareholders in corporate decision-making may weaken the speculative behavior of major shareholders, protect their legitimate rights and interests, and have a significant impact on green innovation of enterprises.

Based on this, this paper takes China’s A-share listed companies from 2016 to 2020 as an empirical research sample, uses the number of shares attending the shareholders’ meeting of listed companies and the matching capital structure data to construct indicators to measure the minority shareholders’ participation in the shareholders’ meeting, to measure the degree of minority shareholders’ participation in decision-making, and empirically analyzes the actual impact of minority shareholders’ participation in decision-making on enterprise green innovation and the internal mechanism. In addition, the introduction of life cycle variables reveals the dynamic governance effects of minority shareholders in different life stages of enterprises. The theoretical model is shown in Figure 1. The study found: First, the degree of minority shareholders’ participation in decision-making is significantly and positively correlated with green innovation of enterprises, and this relationship is more significant in non-state-owned enterprises, eastern regions and heavy pollution industries. Second, the degree of minority shareholders’ enthusiasm to participate in the shareholders’ meeting affects the level of green innovation through the intermediary variable of media attention. At the same time, as an effective regulatory variable, the interaction between the legal environment and the degree of minority shareholders’ enthusiasm to participate in the shareholders’ meeting can significantly promote the performance of green innovation of enterprises. Third, the minority shareholders’ governance effect dynamically evolves with the change of enterprise life cycle. Specifically, the minority shareholders’ participation in decision-making has a significant role in promoting green innovation in the growth and transformation period, but it is not significant for mature enterprises. This shows that the minority shareholders’ active participation in the “hand-voting” at the shareholders’ meeting can not only protect their own rights and interests to a certain extent, give play to the effectiveness of effective corporate governance, but also benefit the high-quality and sustainable development of enterprises.

Compared to previous research, the contribution of this article lies in: firstly, from a research perspective, extending the governance effect of minority shareholders to the field of green innovation, and revealing the differentiated impact of minority shareholders under different enterprise natures, providing incremental article contributions for related research on minority shareholders. In the context of high-quality development, the academic community has begun to explore the impact of macroeconomic policy factors such as economic policy uncertainty, environmental regulation (Cheng and Lu, 2022; Liu and Hong, 2022), and digital finance (Gu and Gao, 2022) on green innovation in enterprises. However, there is little literature that extends the governance effect of minority shareholders to the field of green innovation. This article is based on the impact of active participation of minority shareholders in decision-making on green innovation in enterprises, in order to enrich the research on the driving factors of green innovation in enterprises from a microstructure perspective. Secondly, from the perspective of research content, analyzing the decision-making antecedents of green innovation in enterprises from the perspective of the interaction between minority shareholders and corporate governance enriches and supplements relevant research on principal-agent theory, resource dependence theory, and symbiosis theory. Analyze the dynamic governance characteristics of minority shareholders from the process of enterprise growth, maturity, and transformation evolution, and provide a new theoretical explanation for them. In the face of the evolution of the enterprise’s life cycle, the enterprise’s value creation ability has significantly changed, resulting in a certain dynamic governance effect of s minority shareholders on enterprise green innovation, which provides Empirical evidence for the development of enterprise green innovation. Thirdly, from the perspective of research data, the online voting data of shareholders in China after 2009 has not been publicly available, and the conclusions of existing relevant studies (Kong et al., 2012; Li et al., 2012; Li and Kong, 2013) may not be fully applicable to the new network environment represented by the mobile internet. This article uses the number of shares attending the shareholders’ meeting of a listed company and matching capital structure data to construct indicators to measure the participation of minority shareholders in the shareholders’ meeting, in order to measure the degree of active participation of minority shareholders in decision-making, better ensure the continuity of data and indicators, and to some extent make up for the objective shortcomings of the latest online voting data that are not available.

Green innovation is the driving force for sustainable development of enterprises, and is also the inevitable requirement for economic stability and development. Green innovation mainly refers to green technology innovation. At present, researchers mainly discuss the driving factors of green innovation capability of enterprises from the perspective of macroeconomic policy and micro corporate governance.

Macroeconomic policies mainly come from government policies, media and investor’s concerns. At the government policy level, Cui et al. (2018) found that the implementation of the green low-carbon emission trading pilot policy promoted the efficiency of resource utilization in the production process, thus urging enterprises to carry out green innovation. Qi et al. (2018) also confirmed that the implementation of the environmental rights trading policy and the energy quota trading mechanism have incentive effects on green innovation of enterprises, and the above effects are more significant in non-state enterprises. Kong et al. (2013) used Jiangsu Province as an example to reveal the adaptability between water pollution utilization and industrial structure through quantitative analysis, which indirectly confirms that enterprises promote green innovation while managing the environment, thereby promoting the sustainability of industrial development. Yuan et al. (2022) found through constructing an economic ecological model that the green development of the Yangtze River Economic Belt helps to support low-carbon technological innovation, promote enterprise transformation and upgrading, and play a crucial role in leveraging resource endowment advantages and building a regional collaborative development mechanism. However, the policy role of environmental regulation is not always positive. Lu et al. (2021) found that the implementation of green credit policy could not bring innovation compensation effect to enterprises, but could accelerate the exit risk of high-polluting enterprises and realize the reallocation of resources among enterprises. From the perspective of external media supervision, Zhao and Zhang (2020) found that high media attention can significantly improve the investment level of green innovation of enterprises, while Zhang et al. (2021) believed that negative environmental reports can further force heavily polluting enterprises to carry out green innovation. The above research is mainly conducted from the perspective of the external environment of enterprises, and mostly confirms the effectiveness of green technology innovation in energy conservation, emission reduction, and environmental protection.

Micro-company governance originates from the nature of property rights, governance structure, characteristics of the board of directors, and senior executives’ characteristics. First of all, from the perspective of the nature of property rights, Ma et al. (2020) confirmed that family enterprises have a stronger tendency to green innovation than non-family enterprises. Based on the dimension of governance structure, Huang (2021) believes that the embedded governance of the party organization can strengthen the awareness of corporate social responsibility and enhance the level of substantive green innovation. Ren et al. (2021) believes that the senior executives’ characteristics will significantly affect the willingness of enterprises to green innovation. Specifically, the sense of hometown identity makes the emotional connection between senior executives and the local environment closer, which helps stimulate the environmental protection senior executives’ awareness to their hometown, thus improving the level of green innovation of enterprises. Calel and Dechezlepretre (2016) believes that the professional technology and overseas network resources of executives with overseas backgrounds are conducive to the improvement of green innovation level of enterprises. Yin and Shuang (2022) also confirmed that CEOs with academic experience have a stronger sense of social responsibility and long-term value orientation, which can suppress short-sighted behavior in green innovation activities and enhance the willingness of enterprises to green innovation. In addition, research has found that the pledge of controlling shareholder equity and the increase in the degree of separation between ownership and control of major shareholders can inhibit the green transformation of listed companies, and is more significant in enterprises with lower value or greater financing constraints (Zhang et al., 2022).

The above research focuses on exploring the impact of informal institutions such as government policies and external supervision on the green innovation capability of enterprises. From the perspective of influencing the green innovation mechanism, the improvement of enterprises’ green innovation capability is mainly based on passive green innovation under various internal pressures. Regarding how to stimulate enterprises’ willingness to innovate independently, enhance enterprises’ green innovation capability from the root, and achieve the ultimate goal of enterprises, There is still a lack of such mature research. In summary, this article attempts to explore the internal mechanism of enhancing the green innovation capability of enterprises from the perspective of introducing minority shareholders to actively participate in decision-making and enhancing the endogenous innovation motivation of enterprises, taking heterogeneous shareholders as the entry point.

For major shareholders, there are two ways to achieve effective corporate governance: one is to limit the opportunistic motivation of managers by submitting proposals and changing managers; The second is to send some negative information to the market through selling stocks. As a minority shareholder, due to its dispersed equity and low shareholding ratio, it is easy to “free ride” behavior, which makes it difficult to protect its own interests through the above two governance methods. Therefore, the protection of the interests of minority shareholders has become the focus of widespread attention from all walks of life (Zheng et al., 2016). “Exit” and “voice” mechanism are two main means for minority shareholders to participate in decision-making. “Exit”, also known as “voting with feet”, means that minority shareholders sell the company’s shares and invest in other companies. However, this way requires minority shareholders to hold enough shares to create a “credible threat” to the company’s management, so as to play the role of corporate governance. “Voice” means that minority shareholders participate in voting at the shareholders’ meeting to express their wishes by means of network media, that is, “vote-with-hand” (Othman et al., 2019). The existing literature has paid more attention to the impact of the “voice” mechanism of “hand voting” of minority shareholders, but the conclusions are still inconsistent.

Many literature studies believe that the minority shareholders active participation in decision-making can help reduce Principal–agent problem and enhance enterprise value, including the improvement of short-term performance and long-term performance (Azizan and Ameer, 2012; González and Calluzzo, 2019). The data on dissenting votes from the board of directors indicates that minority shareholders can supervise and balance major shareholders through the appointment of directors, which is more effective than independent directors. The participation of minority shareholder directors can effectively improve the company’s future accounting performance, while independent directors exhibit a strong risk aversion tendency (Zhu et al., 2015). Kong et al. (2012), Li et al. (2012), Li and Kong (2013) respectively examined the factors that affect the participation rate of minority shareholders in online voting from the perspectives of investor protection, corporate governance level, and information transparency. They found that the lower the level of corporate governance, the worse the information transparency, and the higher the market sentiment, the higher the enthusiasm of minority shareholders to participate in online voting, and this positive behavior effectively improves the company’s future performance and enhances shareholder wealth. In addition, focusing on the sustainable development of the company, Li et al. (2018) found that the high Voter turnout of minority shareholders would significantly increase the R&D investment and patent applications of enterprises. Zheng et al. (2007) research also proved that the active participation of minority shareholders in decision-making has won more reasonable consideration for themselves, effectively reduced the tunneling behavior of large shareholders, played a good governance role, and ultimately improved the long-term performance of enterprises.

Some studies also questioned the effect of minority shareholders’ participation in corporate governance. Harris (2010) and Yao et al. (2019) found through empirical research that the protection of minority shareholders may have certain side effects. Minority shareholders will use their increased power to engage in more opportunistic behavior and reduce activities that are conducive to the long-term development of enterprises, such as innovation. Bainbridge (2006) found that due to severe information asymmetry between minority shareholders and controlling shareholders, their direct participation in company decision-making can actually reduce company value due to judgment bias. Research on typical cases has found that the participation of minority shareholders in decision-making may cause confusion in the enterprise and its operations. These studies have all stated that granting more power to minority shareholders has a limited impact on improving corporate governance, and improving governance mechanisms may be more important (Listokin, 2010).

In summary, in addition to institutional change and technological innovation that can effectively reduce the exercise cost of active participation of minority shareholders in corporate governance, minority shareholders will pay more attention to the decision-making of listed companies that are closely related to their interests. It is worth noting that previous studies directly exploring the participation of s minority shareholders in decision-making have been relatively rare. A few existing literature either focuses on the introduction of a certain regulation or conducts theoretical analysis, which has limitations. There are also certain shortcomings in measuring the enthusiasm of minority shareholders in decision-making. This article explores the impact of minority shareholders’ participation in decision-making based on voting data from shareholder meetings, which effectively compensates for the shortcomings of previous research. Green innovation benefits the long-term stability of dividend distribution for minority shareholders, is related to the long-term development of enterprises, is also the source of core competitiveness of enterprises, and even directly relates to the success or failure of China’s economic transformation. Therefore, taking green innovation as the starting point, exploring the impact of the participation of minority shareholders in decision-making on corporate behavior, in order to provide suggestions for China’s support for the “dual carbon” goal from the perspective of micro decision-making behavior and innovation effects of enterprises, not only has important theoretical significance, but also fits the current practical background.

In recent years, in order to facilitate the exercise of the minority shareholders’ rights, in December 2004, China’s A-share market established the online voting system for shareholders’ meetings, and further guided listed companies to provide a comprehensive online voting platform for shareholders’ meetings in 2014, and began to implement the independent vote counting mechanism for minority shareholders on major matters of shareholders’ meetings, actively promote and improve the voting system for minority shareholders, and strive to promote the transformation of minority shareholders’ “feet-voting” to “hand-voting”. With the vigorous development of the economic market, China’s sense of personal ownership has gradually strengthened, and gradually began to pay attention to its own interests and the development prospects of the enterprise. At the same time, the introduction of these measures has also enhanced the minority shareholders’ interest in the development of the enterprise, and gradually participated in the decision-making team of the enterprise. The establishment of an innovative economy with sustainable development is the top priority of the national economic work at this stage. The country is taking various measures to actively promote green innovation of enterprises. Can encouraging minority shareholders to actively participate in governance play a certain role? Based on the above background, this paper will mainly discuss the impact of minority shareholders’ active participation in decision-making on green innovation of enterprises.

Innovation is an important way for an enterprise to achieve its sustainable development (Porter, 1992), and green innovation is also related to the sustainable development of enterprises and economic society. Green innovation involves multiple links of R&D and production. The green innovation practice of enterprises requires not only resource investment, talent team and technical support, but also strategic foresight and stakeholders’ long-term orientation. The minority shareholders, as the beneficiaries of the enterprise’s residual value, are the most core stakeholders in corporate governance. The improvement of enterprises’ green innovation ability can also well explain the actual effect of minority shareholders’ governance.

Green innovation brings about environmental externalities reduction and energy conservation and emission reduction, but these benefits cannot be converted into economic benefits in the short term, and green innovation requires a large amount of early investment, and its maintenance cost is also very expensive. In the case of limited resources, the major shareholders who firmly hold the decision-making power of the enterprise are more inclined to pursue “private interests” and give up “public interests”. Projects with short investment return period and high income (Lu and Li, 2021), their pursuit of private interests will empty the enterprise resources and hinder the enterprise’s green innovation activities (Wang and Wang, 2020), As a result, minority shareholders can only “vote with their feet” to passively express their dissatisfaction (Pan and Han, 2016; Chen et al., 2021). Therefore, many studies have found that in the capital market (such as China) where the legal protection of investors is weak and the equity is relatively concentrated, the major shareholders can seize the control right for private interests by virtue of their control over the company rather than focus on improving the company’s green innovation level (Chemmanurt and Tian, 2018). Unlike large shareholders, green innovation is an important way to achieve the compatibility of incentives between minority shareholders and enterprises. The minority shareholders’ interests focus on the long-term stability of dividend distribution, while the dual value effect of green innovation reduces the pressure of government regulation and environmental regulation faced by enterprises, effectively drives the sustainable development and environmental performance of enterprises, and conforms to the interests of minority shareholders (Wang and Wang, 2020). In addition, green innovation involves many links of production and research and development, and requires complex and diversified knowledge, background, technology and experience. The non-professional guidance of major shareholders may cause enterprises’ green innovation to deviate from the existing track, and even cause managers’ dissatisfaction and confrontation (Zhou and Song, 2016). However, minority shareholders have a large number of people with different backgrounds and possess a large number of information resources and social capital, which can provide a new perspective and diversified knowledge for green innovation of enterprises (Li et al., 2018) and help enterprises find more valuable technological innovation opportunities.

Compared with traditional innovation, green innovation needs to invest more capital. Green innovation has the characteristics of large investment, long cycle and high risk. It needs continuous capital investment. Under the role of checks and balances of minority shareholders, the strategic resources occupied by large shareholders for a long time are released, which alleviates the problem of enterprise financing constraints and capital gap, thus prompting the company to allocate funds to innovative activities to improve competitive advantage, it has met a large amount of capital requirements necessary for green innovation activities. In addition, minority shareholders are more sensitive to the supervision and governance role of local governments. Under the current high-quality development, minority shareholders are more inclined to improve green innovation performance through reasonable resource allocation, submit satisfactory “green answers” to the government, thus avoiding government supervision and regulation caused by excessive environmental externalities, and ultimately improving the environmental legitimacy of enterprise operation and the robustness of dividend distribution. It should also be noted that due to the different backgrounds of minority shareholders, the large number of people, and the possession of multiple channels of information and a large amount of social capital (Li et al., 2018), social capital, as a relational resource embedded in social networks, will be accompanied by richer information flow and stronger information processing capabilities (Guo and Zhou, 2019; Huang, 2021). They can not only use their own social resources to meet the knowledge and technology needs generated by green innovation in multiple links, but also provide new perspectives and diversified knowledge for enterprises’ green innovation, effectively make up for the lack of one-sided narrow vision of major shareholders, reduce the non-professional intervention of major shareholders in green innovation, and help enterprises find more valuable technological innovation opportunities, It ensures the freedom of managers’ innovative decision-making (Belloc, 2013). According to the provisions of the Company Law, listed enterprises can submit issues and proposals to the shareholders’ meeting when the proportion of individual or group shares holding more than 3% of the shares, effectively restrain the behavior of major shareholders to pursue private interests and encroach on the green innovation resources of enterprises, and make green innovation decisions that are more conducive to the long-term development of enterprises. The promulgation and implementation of policies such as the Several Provisions on Strengthening the Protection of the Rights and Interests of Social Public Shareholders and the Opinions on Further Strengthening the Protection of the Legal Rights and Interests of Minority Investors in the Capital Market have greatly reduced the cost of minority shareholders’ participation in management decisions, and improved the voice of minority shareholders in the process of formulating green innovation strategies, in order to curb the tunneling behavior of large shareholders, strengthen the willingness of green innovation It provides a good institutional guarantee for the continuous growth of enterprises and the improvement of business legitimacy.

According to the symbiosis theory (Yang and Liu, 2009), minority shareholders are also an important part of enterprise equity holders. They should not be indifferent to enterprise decision-making because of the small number of shares they hold. They need to work together with major shareholders for the long-term development of the enterprise. The minority shareholders’ active participation in decision-making can, to a certain extent, alleviate the speculative activities of major shareholders in order to seek private interests, it has effectively alleviated the problem of major shareholders in enterprises. When the minority shareholder’s enthusiasms to participate in the decision-making is not high, the large shareholders now become the decision-makers of the enterprise. For the purpose of seeking personal interests, the large shareholders will prefer to invest in a large number of rapidly profitable assets. In this way, the innovation funds for the long-term development of the enterprise will be reduced, and the enterprise will inevitably appear “tunneling” behavior; When the minority shareholders are more active in decision-making, the information communication with the large shareholders is more convenient, the information asymmetry is weakened, and the large shareholders are subject to the supervision and restriction of the minority shareholders, thus avoiding the short-sighted behavior of the management, and the personal interests of the minority shareholders are also protected. In this case, putting the long-term development of the enterprise first is its common goal, and the large shareholders will pay more attention to the long-term sustainable development of the enterprise in decision-making, Improve the management’s enthusiasm for green innovation. Therefore, this paper puts forward the following research assumptions:

Hypothesis 1. The minority shareholders’ active participation in decision-making can significantly promote green innovation of enterprises.

Compared with traditional media, social media can play a more effective role in public opinion supervision (Yang et al., 2017). Both the amount of information and the speed of information dissemination are incomparable with traditional media (Zhu et al., 2020). With the gradual development of Internet technology, the rise of new information media such as social media has provided conditions for individual investors to “speak out”. The exchange of views among minority shareholders on social media helps to form an alliance of interests to gain more voice, which will have a profound impact on the capital market. As an emerging subject of corporate governance, minority shareholders participate in decision-making and express their will through the network media, prevent the adoption of resolutions that are not conducive to the long-term and stable development of the company by exercising their voting rights, inhibit the management’s pursuit and manipulation of short-term performance, and enhance the enterprise’s green innovation desire. As a kind of supervision mechanism outside the law, the media plays an important role in corporate governance. In the environment of information openness and network transparency, minority shareholders are on the side of information weakness, while social media provides a platform for minority shareholders to “speak out”, expands the voice of minority shareholders, makes minority shareholders gradually grasp the true endowment and operating conditions of the enterprise, strengthens the attention of capital market participants to the speech of minority shareholders, and then restricts the opportunistic behavior of large shareholders in investment activities, Put pressure on its green environmental protection activities to achieve green innovation. With the worsening of China’s environmental problems (such as water pollution, haze weather, etc.), the attention of domestic and foreign media to China’s environmental events has risen to a new height, and the environmental pressure faced by enterprises is also increasing. In order to gain favorable media public opinion guidance and establish a good corporate image, green innovation has become an important way for more and more enterprises to publicize and achieve sustainable development. In the field of institutional economics, public opinion is an informal system. For enterprises with negative environmental news, external investors will boycott and public opinion will condemn them. If they violate the law, they will be punished by the regulatory authority. Under the pressure of all parties, enterprises pay more attention to green environmental protection, implement green innovation development strategy, and shape their own green enterprise image. Therefore, minority shareholders, as the core stakeholders, actively participate in decision-making and governance when external investors send signals of interest in green ecological and environmental protection, supervise enterprises through media attention, exert pressure on their green environmental protection activities, and urge enterprises to actively take action to achieve green innovation through technical means. Therefore, this paper puts forward the following research assumptions.

Hypothesis 2. Minority shareholders actively participate in decision-making and promote green innovation through media attention, that is, media attention plays an intermediary role between minority shareholders’ participation in governance and green innovation.

The enterprise life cycle theory points out that the development of enterprises follows the dynamic growth law of growth, maturity and decline (Miller and Friesen, 1984). In this process, the resource reserve, growth potential and agency conflict of enterprises will change dynamically with the life cycle (Wang and Wang, 2020). This will lead to dynamic changes in the governance will of minority shareholders along with the enterprise life cycle.

In the growth stage, on the one hand, due to a large amount of capital demand, limited resource reserves, asymmetric information and lack of historical observation performance, enterprises cannot obtain resource support in the capital market and face severe financing constraints, thus shaping the legitimacy of operation and obtaining government recognition become the necessary options for enterprises. To carry out green innovation can not only obtain government recognition, but also obtain financial subsidies from local governments to solve the problem of insufficient funds. Therefore, minority shareholders of growing enterprises tend to reach an agreement with the management to capture government resources through green innovation and alleviate the plight of insufficient financing of enterprises. On the other hand, growing enterprises have not yet established a firm foothold in the market. At this stage, enterprises need to seize market share and improve their core competitiveness. Green innovation has a good driving and promoting effect on the growth and competitiveness of enterprises. Green innovation is the best choice for growing enterprises. Moreover, minority shareholders value the long-term stability of corporate dividend distribution, and green innovation with development potential can meet the income expectations of minority shareholders. Therefore, when the enterprise is in the growth period, minority shareholders will actively promote the enterprise to carry out green innovation in order to obtain good profits.

Enterprises in the mature stage have reached an unprecedented level of profitability and market size, formed a rich resource base, and relatively smooth financing channels. Diversified profit models and perfect management systems can improve the financing constraints from the external capital market. In addition, mature enterprises have developed mature technology and supporting R&D teams through early market exploration and experience accumulation. At this time, enterprises have a strong desire to carry out green innovation in order to obtain greater market share and profit space, and minority shareholders do not need to supervise the green innovation of enterprises. In addition, mature enterprises have high market value and perfect corporate governance. Even if minority shareholders do not participate in corporate governance, they can obtain considerable benefits, so they will relax the supervision and governance of mature enterprises.

When the enterprise enters the transformation period, its growth ability and profitability level drop rapidly, and the enterprise urgently needs to find new profit growth points to smooth through the recession. In order to protect their own interests from loss, minority shareholders will force enterprises to actively transform and use green innovation to achieve “bottoming rebound”. In addition, during the recession, the problems of corporate management seeking private interests and principal-agent problems are extremely prominent. Minority shareholders have strong motives for wealth protection, which can prevent the management from using green innovation to seek private interests. Based on the above analysis, this paper proposes the following assumptions.

Hypothesis 3. The minority shareholders’ active participation in decision-making has a significant role in promoting green innovation in the growth and transformation period, but it is not significant for mature enterprises.

As an external regulatory mechanism, the market environment is more to promote the rational allocation of resources and cannot play a mandatory role in the decision-making behavior of enterprises; The rule of law environment is to regulate the market subject through laws and regulations, which is the key to ensure the orderly development of the market economy. For China, although the capital market has entered a period of leapfrog development, the external governance mechanism and internal management system are not perfect, and the behavior of the top management of the enterprise to use the equity advantage to damage the minority shareholders still exists, which needs to be solved by perfect laws and regulations. First of all, in areas with a perfect legal environment, local government behavior is more standardized, with a higher degree of protection for investors and a strong constraint on enterprise owners, which to a certain extent inhibits the tunneling behavior of major shareholders on listed companies, can promote the investment of enterprises in material and human resources, make the reasonable allocation of enterprise resources, and benefit the development of green innovation activities of enterprises, Moreover, the existing research found that the function of traditional media governance often needs the protection of legal system (Li and Zheng, 2018) that is, a good legal environment will promote the improvement effect of minority shareholders’ voice in social media on green innovation. Secondly, green technology innovation is guided by the laws of ecological economy, saving energy consumption, eliminating or reducing environmental pollution, and has dual externalities of value and environment. Compared with traditional innovation, it requires more capital investment, faces higher risks, and has a more lagging impact on the company’s performance. In the case of limited resources, the pursuit of private interests by the major shareholders who firmly control the decision-making power of the enterprise will drain the enterprise’s resources, Therefore, it is often faced with greater financing constraints and difficult to obtain high-quality financing support. Existing research has confirmed that a good law-based environment can improve the protection of creditors, help the steady development of the credit market, and improve the ability of enterprises to obtain credit financing (Wan, 2013). As an effective alternative to credit financing, commercial credit is another common way for enterprises to ease financing constraints and promote green innovation activities. Therefore, this paper believes that the rule of law environment, as a means of environmental regulation, can significantly enhance the effect of minority shareholders’ participation in governance on green innovation. Based on the above analysis, this paper proposes the following assumptions.

Hypothesis 4. Regions with good legal environment will strengthen the role of minority shareholders’ active participation in decision-making in promoting green innovation of enterprises.

This paper takes China’s A-share listed companies from 2016 to 2020 as the research object. The reason for choosing 2016 as the starting point of the sample is that the five development concepts of innovation, coordination, green, openness and sharing were first proposed at the Fifth Plenary Session of the 18th CPC Central Committee on 26 October 2015. Since then, the concept of green innovation has been gradually strengthened, and 2020 is the latest data year available in this paper. On the basis of the initial sample, the following processing is carried out:1) eliminate the financial industry sample; 2) Exclude the samples of listed companies that were ST (ST *) in the current year; 3) Remove the samples with missing values for the main variables. Finally, 7,908 company-annual observations were obtained. In order to eliminate the impact of extreme values on the empirical results, the continuous variables are subject to the tail reduction treatment of up and down 1% and 99% quantiles. Green innovation data comes from China Research Data Service Platform (CNRDS), and other data comes from CSMAR database.

Green innovation of enterprises. At present, the measurement of green innovation at the enterprise level mainly includes three methods: scale design, green patent grant and green patent application. The design of the scale is rich in dimensions, but there is a certain degree of subjectivity. The grant of patents is vulnerable to bureaucratic factors and has more uncertainty and instability (Zhou et al., 2012). The patent technology can affect the performance of enterprises in the application process, which is more timely and stable than the grant amount. After comparison, this paper refers to the research of Wang and Wang (2020) and Qi et al. (2018), and measures the green innovation of enterprises by the number of green patent applications.

The core explanatory variable of this paper is used to measure the minority shareholders’ participation in the general meeting. The existing research mainly uses two ways to measure the minority shareholder’s enthusiasms to participate in the “hand voting” of the shareholders’ meeting: first, use non-public data such as the online voting data of Shenzhen Stock Exchange for direct measurement (Kong et al., 2013; Li and Kong, 2013); The second is to use other relevant indicators to construct indirect measurement variables (Hu et al., 2018).

This paper uses the number of shares attending the shareholders’ meeting and the matching data of the capital structure of listed companies to construct the participation index of minority shareholders (Wang, 2020; Xu and Wu, 2020). Academics and practitioners usually define major shareholders holding 5% or more as major shareholders of listed companies. Therefore, this paper defines the difference between the total number of shares attending the shareholders’ meeting and the total number of shares of shareholders holding more than 5% as the number of shares of minority shareholders attending the shareholders’ meeting. Then, divide the number of minority shareholders’ shares by the total share capital of the company in the latest quarter to obtain the proportion of minority shareholders’ shares participating in the shareholders’ meeting, and then construct the variable Attend to measure the absolute degree of minority shareholders’ participation in the shareholders’ meeting. At the same time, in order to eliminate the impact of the possibility of major shareholders not attending the shareholders’ meeting on the absolute degree of minority shareholders’ participation in the shareholders’ meeting, this paper also constructs the relative degree indicator of minority shareholders’ participation in the shareholders’ meeting. Its calculation formula is Attend/(1-Attend).

The specific formula is as follows:

Attend= (total number of shares attending the general meeting of shareholders - number of shares held by shareholders holding more than 5%)/total share capital of the previous quarter.

Attend_r = Attend/(1-Attend).

Media attention. Because traditional newspapers and financial news have strong authority (Wu et al., 2019), while online news has strong timeliness (Wu and Zheng, 2021). Therefore, in the benchmark regression, this paper uses the natural logarithm of the sum of the number of newspaper financial news and online news reports plus 1 to measure media attention.

Enterprise life cycle. As for the measurement of life cycle, previous studies mostly used single indicators such as operating cash flow to divide the life cycle. Although the life cycle can lead to changes in cash flow, this method ignores the multi-dimensional changes that occur during the dynamic evolution of enterprises, and is prone to measurement errors. This paper draws on Wang Xu’s multiple indicator system and uses the comprehensive scoring method to divide the life cycle (Wang and Wang, 2020). First of all, select the important indicators representing the growth, maturity and transformation period of the enterprise, and take the sales growth rate, retained earnings rate and net financing growth rate as the life cycle indicator variables. Secondly, taking the third quantile as the dividing standard, the upper third quantile of the retained earnings rate is assigned 0, the middle third quantile is assigned 1, the lower third quantile is assigned 2, and the other two indicators are given the same score; Finally, the samples with a comprehensive score of 0–2 for the three indicators are growth samples, three to four samples are mature samples, and five to six samples are metamorphosis samples.

Law. Referring to the practice of Zhou et al. (2019), this paper uses the “development of market intermediary organizations and legal system environment score” of each province and city in the Fan Gang marketization index to measure the legal environment of the location of listed companies.

Referring to the Vexisting research on the impact of factors related to green innovation (Jin et al., 2022; Wei and Ma, 2022), this paper controls the following variables: Lev, TobinQ, Size, Roa, Balance, Indep, dual, Board, Inst. In addition, this paper also controls the industry and annual variables. All variable descriptions are shown in Table 1.

This paper uses a two-way fixed effect model to study the impact of minority shareholders’ active participation in decision-making on green innovation of enterprises. The reason for adopting this method is that there is heterogeneity in the subdivided industries of each enterprise, and the amount of information in the panel data is large. If the relevant factors are not controlled, the experimental results will be biased and the objectivity of the results will be reduced. Therefore, the two-way fixed effect model of controlling “industry year” is selected. The set measurement model is as follows:

Where, i represents the enterprise, t represents the period, and Green represents the green innovation of the enterprise, α0 is a constant item, Attend and Attend_r is the absolute and relative minority shareholders’ participation, and Control is a series of control variables. As the control variable affecting green innovation of enterprises, ɛ is a random error item. At the same time, it controls the impact of year and industry.

In order to further clarify the impact mechanism of minority shareholders’ active participation in decision-making on green innovation of enterprises, the intermediary effect model of Wen et al. (2005) is further used for analysis. The regression equation is as follows:

Formula (2) tests the direct effect of the core explanatory variable on the explained variable, Formula (3) tests the direct effect of the core explanatory variable on the intermediate variable, and Formula (4) tests the direct effect of the core explanatory variable and the intermediate variable on the explained variable.

In order to explore the regulatory role of the rule of law environment, this paper further constructs a model, as follows:

Table 2 lists the descriptive statistics of variables in this paper. It can be seen from the table that in the whole sample, the mean value of the explained variable Green is 0.470, which is similar to the conclusion of Wang (2020), and its maximum and minimum values differ greatly, indicating that the green innovation performance of different enterprises varies greatly. The average of the absolute proportion of minority shareholders attending the general meeting of shareholders is 5.7%, indicating that the proportion of minority shareholders attending the general meeting of shareholders in China’s listed companies is relatively low on the whole. However, the maximum value of Attend is 30.7%, which indicates that minority shareholders of some listed companies have relatively high enthusiasm to attend the shareholders’ meeting. The relative proportion of minority shareholders attending the shareholders’ meeting. The average value of r is 6.5%, and the maximum value is 44.3%. The distribution characteristics are basically similar to that of Attend. The descriptive statistics of other corporate characteristics and internal governance variables are detailed in Table 2.

Table 3 shows the correlation coefficient matrix between the main variables in this paper. It can be seen from the table that the absolute proportion and relative proportion of green innovation and minority shareholders attending the shareholders’ meeting has a significant positive linear correlation at the level of 1%, which preliminarily indicates that green innovation is positively correlated with the degree of minority shareholders’ participation in the shareholders’ meeting.

This paper first uses the above econometric model to test the impact of the absolute and relative proportion of minority shareholders participating in the shareholders’ meeting on the green innovation of enterprises. Columns (1) and (3) only control the fixed effect of the year and industry, while columns (2) and (4) further add the regression results of the control variables at the enterprise level. The results show that in the regression results in columns (2) and (4), after controlling the relevant variables, the absolute proportion and relative proportion of minority shareholders participating in the shareholders’ meeting attend_r. The coefficient is significantly positive at the level of 1%, indicating that the minority shareholders’ active participation in decision-making is significantly positively correlated with green innovation of enterprises. Among them, the Attend coefficient is 0.568, indicating that when other conditions remain unchanged, when the absolute proportion of minority shareholders participating in the shareholders’ meeting increases by 1 unit, the number of green innovation patents of enterprises increases by 0.568. Attend_r coefficient is 0.445, and the growth rate is basically similar to that of Attend. The above results show that the level of green innovation of enterprises will increase with the minority shareholder’s enthusiasms to participate in the shareholders’ meeting, thus verifying the research hypothesis of this paper.

The possible reason is that the focus of the interests of minority shareholders lies in the long-term stability of dividend distribution, and the dual value effect of green innovation can effectively meet the interests and demands of minority shareholders. When minority shareholders actively participate in corporate decision-making, they can not only utilize their rich professional knowledge and stronger information processing capabilities to effectively compensate for the narrow perspective of major shareholders, integrate and analyze information, clarify the long-term value brought by green innovation, and help enterprises discover more valuable innovation opportunities; Moreover, they can utilize their respective social resources to meet the knowledge and technological needs generated by green innovation in multiple stages of production and research and development, providing enterprises with more sufficient innovation resources such as funds and manpower, and providing a new perspective and diversified knowledge and experience for green innovation. In addition, minority shareholders are more sensitive to the supervision and governance role of local governments. Under the current high-quality development, in order to improve the environmental legitimacy of enterprise operation and the stability of dividend distribution, the minority shareholders with interests as the focus actively participate in enterprise decision-making more tend to improve green innovation performance through reasonable resource allocation, and submit satisfactory “green answers” to the government, thus avoiding government supervision and regulation caused by excessive environmental externalities. The regression analysis between minority shareholders “hand-voting” and green innovation of enterprises is shown in Table 4.

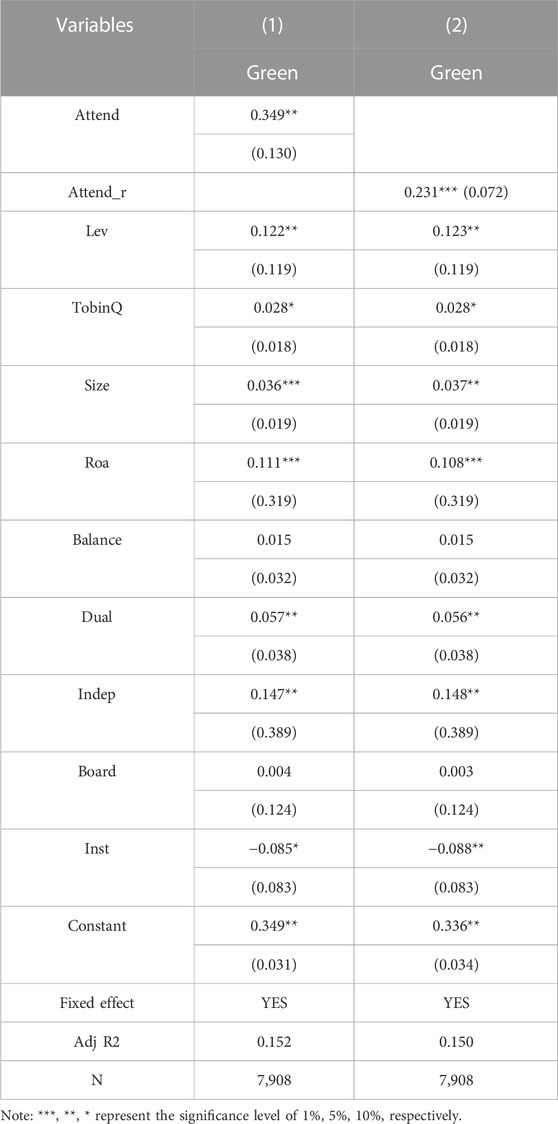

Table 5 reports the intermediary effect results of media attention. In columns 1) and 4) of Table 5, the coefficient of minority shareholders’ active participation in the shareholders’ meeting is significantly positive at the level of 5%, indicating that the greater the degree of minority shareholders’ participation in the shareholders’ meeting, the higher the media attention. The coefficient of media attention in columns 3) and 5) of Table 5 is significantly positive at the 5% level, while the coefficient of minority shareholders’ participation in the shareholders’ meeting is still significantly positive, indicating that the minority shareholders’ active participation in decision-making and governance can improve media attention and have a positive impact on green innovation of enterprises. Therefore, media attention plays a part of intermediary effect in the impact of minority shareholders’ active participation in decision-making on green innovation of enterprises. The research hypothesis has been verified.

Table 6 reports the results of the dynamic governance effect of minority shareholders on green innovation in each life cycle stage. In the growth period, the ratio of minority shareholders participating in the shareholders’ meeting and the coefficient of green innovation are 0.067 and 0.871, which are significantly positive at the level of 1%, indicating that the governance effect of minority shareholders’ active participation in the growth period has been effectively played. The reason is that the main task of this stage is to develop competitive products and technologies and quickly seize market share. At this time, minority shareholders are optimistic about the development prospects of growing enterprises and will actively urge enterprises to carry out green innovation to improve their competitive advantages. In the mature period, the proportion of minority shareholders participating in the shareholders’ meeting and the coefficient of green innovation are 0.297 and 0.223, which fail to pass the significance test, indicating that minority shareholders have no significant impact on the green innovation of mature enterprises. The reason is that the profitability of mature enterprises has increased, and they have a strong resource base and strong financing ability. Minority shareholders can obtain considerable benefits without investing too much energy. During the transformation period, the coefficients between the proportion of minority shareholders participating in the shareholders’ meeting and green innovation are 0.247 and 0.179, which are significantly positive at the level of 5%. The empirical results show that minority shareholders will participate in and supervise green innovation decision-making during the enterprise transformation period. During the transformation period, the market share of enterprises has shrunk sharply, and their profitability has declined sharply, and they are in a tight situation. At this time, the unique value contribution of green innovation has become the “innovation grip” to promote the transformation and transformation of enterprises. In order to protect the interests from loss, minority shareholders will actively urge enterprises to carry out green innovation, in order to turn losses into profits and get rid of existing difficulties. Therefore, it is assumed that hypothesis is demonstrated.

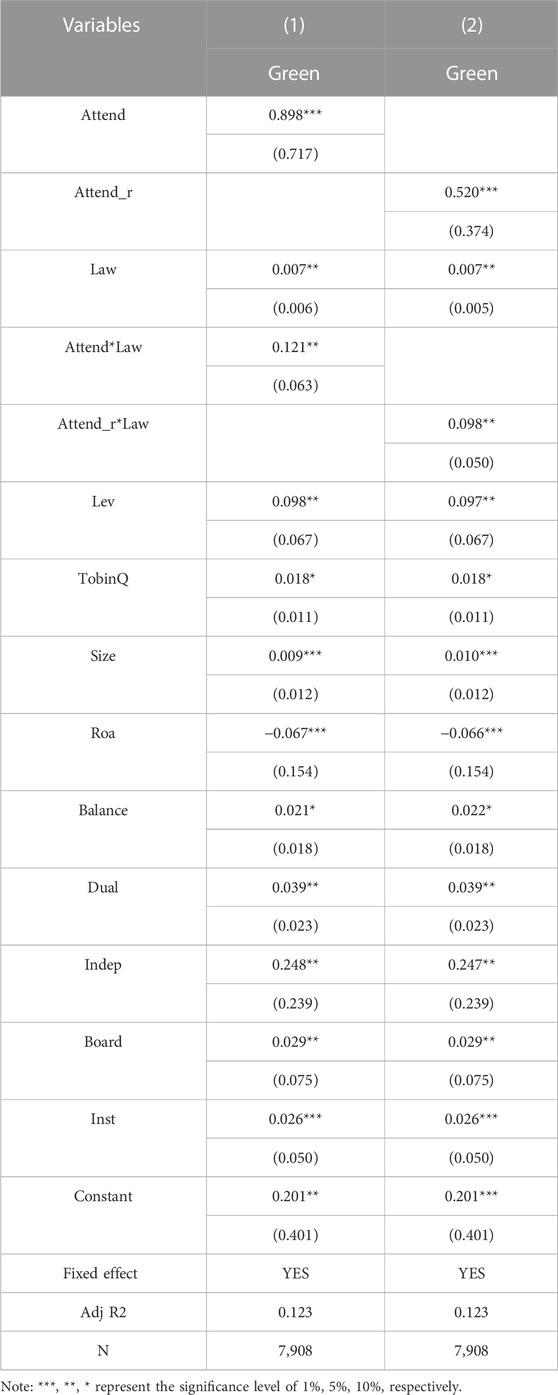

Table 7 reports the regression results of the regulatory role of the rule of law environment. It can be seen from Table 7 that the coefficient of interaction between the minority shareholders’ active participation in governance and the rule of law environment is 0.121 and 0.098 respectively, which is significantly positive at the level of 5%, indicating that the rule of law environment can play a significant positive regulatory effect. It can be seen that the stronger the legal environment in the region, the more significant the role of minority shareholders’ active participation in governance in promoting green innovation of enterprises, and the hypothesis is verified.

TABLE 7. Minority shareholders’ “hand-voting”, legal environment and green innovation of enterprises.

First of all, considering that the explanatory variables constructed in this paper to measure the degree of minority shareholders’ participation in the shareholders’ meeting may be affected by the definition of major shareholders, this paper uses the number of shares held by the top three major shareholders to replace the number of shares held by shareholders holding 5% or more, and reconstructs the absolute proportion and relative proportion indicators of minority shareholders participating in the shareholders’ meeting. Secondly, in order to eliminate the impact of the shareholding ratio of minority shareholders on the accuracy of measuring the minority shareholders’ participation, this paper defines the difference between the total share capital of the company in the latest quarter and the total number of shares held by shareholders holding more than 5% as the number of shares held by minority shareholders. Then, divide the number of shares of minority shareholders attending the shareholders’ meeting by the number of shares held by minority shareholders to obtain the proportion of shares of minority shareholders participating in the shareholders’ meeting, and construct the variable Vote to measure the absolute degree of minority shareholders participating in the shareholders’ meeting. At the same time, Vote, an indicator to measure the relative degree of minority shareholders’ participation in the shareholders’ meeting, is also constructed Vote_r. The calculation formula is Vote/(1-Vote). As shown in Table 8, the results of the new measurement method used to test the research assumptions in this paper are basically consistent with the previous article.

TABLE 8. Replace the measurement method of participation in the general meeting of minority shareholders.

Considering that the innovation activities of enterprises have a long cycle, the green innovation level of a lag period (t+1 period) is used as the explained variable for regression, and the results are shown in Table 9. The results show that the regression coefficient of the absolute and relative proportion of minority shareholders participating in the shareholders’ meeting is significantly positive at least at the 1% statistical level, indicating that the minority shareholder’s enthusiasms participating in decision-making lags behind the long-term green innovation level of enterprises and passes the robustness test.

In view of the characteristics of zero accumulation and positive continuous distribution of the number of green patent applications of the explained variable enterprises, in order to make the research results more robust, this paper uses Tobit model to test the regression results, and the results are shown in Table 10. The results show that the absolute proportion (Attend) and relative proportion (Attend_r) coefficients of minority shareholders participating in the shareholders’ meeting are significantly positively correlated with the number of green patent applications (Green) of enterprises, indicating that the minority shareholders’ active participation in decision-making still has a promoting effect on green innovation of enterprises. The test results are basically consistent with the previous regression results, indicating that the research results are robust.

In order to further ensure the objectivity and rigor of the research method, this article excluded the sample of dual listed companies and re-selected observation values for testing. Just because some listed companies in China have a dual listing phenomenon of simultaneously issuing A-shares and B-shares, H-shares and S-shares. Considering that dual listed companies not only face different regulatory requirements in overseas markets, but also have significant differences in their shareholder structure compared to domestic non dual listed A-share companies due to the presence of foreign investors. In order to exclude the impact of different shareholder composition on minority Activist shareholder ‘activism, this paper conducts a new test by removing the sample of dual listed companies. The test results are shown in Table 11. Except for slight changes in the significance of individual variable coefficients, the results are basically consistent with the original conclusion.

In order to ensure the reliability of the research results, this study conducted an endogenous test through Instrumental variables estimation regression. There may be a reverse causal endogeneity problem between the enthusiasm of minority shareholders to participate in decision-making and green innovation in enterprises. The possible alternative explanation is that enterprises with higher levels of green innovation perform better and are more likely to attract the attention of minority shareholders, resulting in higher enthusiasm for participating in decision-making. This paper selects two Instrumental variables estimation, namely, “Attend_mean1” and “Attend_mean2”, and uses a two-stage model to solve possible endogenous problems. The test results are shown in Table 12. The p-value of Sargan test is 0.497, which is greater than 0.100, indicating that there is no problem of over recognition; The p-value of Cragg Donald test is 0.000, indicating that the Instrumental variables estimation has passed the weak Instrumental variables estimation test and the Instrumental variables estimation is valid. After controlling for endogeneity, the coefficient of Attend remains significantly positive at the 1% level, indicating that after overcoming endogeneity, the previous conclusion is still valid.

Table 13 shows the regression results of the heterogeneity of property rights. As shown in columns 1) and 2), the coefficient of minority shareholders’ active participation in the shareholders’ meeting is not significant in the regression results of state-owned enterprises. However, in the regression results of non-state-owned enterprises, the coefficients of minority shareholders participating in the shareholders’ meeting are significantly positive at the 5% significance level, and in the regression results of non-state-owned enterprises, the coefficients of minority shareholders participating in the shareholders’ meeting are 0.578 and 0.424, which are significantly greater than the coefficients of minority shareholders participating in the shareholders’ meeting of state-owned enterprises, indicating that the minority shareholders’ active participation in decision-making has a more obvious role in promoting green innovation of non-state-owned enterprises.

The possible reason is that in the context of China’s current system, state-owned enterprises have obvious advantages in green innovation endowment. They are not only favored by various policies and resources, but also favored by government subsidies. Their financing channels are relatively smooth, so the marginal role of minority shareholders’ active participation in decision-making is small. Moreover, due to the “owner vacancy” problem in state-owned enterprises, the second type of proxy problem is not serious, so the role of minority shareholders in voting is weak. For non-state-owned enterprises, the minority shareholders’ active participation in decision-making can improve their financing channels, effectively alleviate the budget constraints of non-state-owned enterprises, and is more conducive to their green innovation activities. In addition, under the market-based environmental regulations such as the emission trading mechanism, non-state-owned enterprises can make profits by selling emission rights, so they have a stronger willingness to green innovation. However, state-owned enterprises are not sensitive to the market because they bear more political tasks (Qi et al., 2018). Therefore, the green innovation effect of minority shareholders’ participation in decision-making on state-owned enterprises is weaker than that of non-state-owned enterprises.

In 2008, the national environmental protection department issued the Catalogue of Classified Management of Environmental Protection Verification Industries of Listed Companies (HBH [2008] No. 373), which subdivided the heavy pollution industries into 14, and further subdivided them into 16 in 2010. The industry code of the Guideline on Industry Classification of Listed Companies revised by the China Securities Regulatory Commission in 2012 is used here to classify the heavy pollution industry standards in 2008 and 2010.

Table 14 shows the regression results of industry heterogeneity. In the regression results of enterprises in heavy pollution industry and non-heavy pollution industry, the coefficients of minority shareholders participating in the shareholders’ meeting are significantly positive, indicating that the minority shareholders’ active participation in decision-making can significantly promote the green innovation of enterprises in heavy pollution industry and non-heavy pollution industry. Among them, in the regression results of non-heavy pollution enterprises, the absolute proportion and relative proportion coefficients of minority shareholders participating in the shareholders’ meeting are 0.497 and 0.389, and the significance level is 5%; In the regression results of heavily polluted enterprises, the absolute and relative proportion coefficients of minority shareholders participating in the shareholders’ meeting are 0.706 and 0.557, which are higher than those of non-heavily polluted enterprises, and the significance level is 1%. It can be seen that the minority shareholder’s enthusiasms to participate in decision-making plays a more significant role in promoting green innovation of enterprises in heavy pollution industries.

The possible reason is that compared with non-heavy pollution enterprises, heavy pollution enterprises face greater pressure of green transformation, and are more motivated to achieve their own green development through the supervision and governance role of minority shareholders. First, green innovation will bring competitive advantages. Although the early stage of green technology innovation requires a large amount of capital and human investment, as a kind of technology innovation, it will play a role in saving energy, reducing costs, improving quality, and ultimately enable enterprises to gain competitive advantages in the market (Wang and Chen, 2018). In addition, heavily polluting enterprises are facing greater pressure of environmental regulation. With the continuous improvement of environmental standards and industry access threshold, enterprises with heavy pollution and high energy consumption will face the risk of elimination if they do not carry out green transformation and upgrading in time (Li et al., 2013). Environmental regulations have increased the cost burden of enterprises in heavy pollution industries and may crowd out green innovation resources (Palmer et al., 1995), while the rich social capital of minority shareholders has provided a new financing channel for the financial pressure of green innovation of enterprises in heavy pollution industries. Therefore, the green innovation effect of minority shareholders’ active participation in decision-making on heavily polluting enterprises is greater than that of non-heavily polluting enterprises.

Table 15 shows the regression results of regional heterogeneity. According to the classification of the National Bureau of Statistics, enterprises in the eastern region and enterprises in non-eastern regions are grouped and tested. The results show that the absolute proportion and relative proportion coefficient of minority shareholders participating in the shareholders’ meeting in the regression results of eastern and non-eastern regions are significantly positive, and the significance level is 5%, indicating that the minority shareholders’ active participation in decision-making can significantly promote the green innovation of enterprises in the eastern region and the central and western regions. Among them, the regression results of enterprises in the eastern region show that the coefficients of minority shareholders participating in the shareholders’ meeting are 0.710 and 0.558; In the regression results of enterprises in the central and western regions, the coefficients of minority shareholders participating in the shareholders’ meeting are 0.503 and 0.388, which are lower than those of enterprises in the eastern regions. It can be seen that the minority shareholder’s enthusiasms to participate in decision-making plays a more significant role in promoting green innovation of enterprises in the eastern region.

The possible reason is that the function of traditional media governance often needs to be guaranteed by the legal system (Li and Zheng, 2018). Compared with the central and western regions, the eastern region has a relatively developed economy, a relatively complete legal and regulatory system, and a high degree of informatization. A good legal environment will promote the governance effect of minority shareholders’ voice in social media. In addition, as the bridgehead of the national economic development and reform experiment, the eastern coastal region has a good financial environment. The development level of both the traditional financial market and the digital financial market is ahead of the central and western regions. Minority shareholders with rich social capital can use the developed and perfect traditional financial market to broaden the financing channels of enterprises, focusing on green innovation that can effectively drive the sustainable development and environmental performance of enterprises. Therefore, the green innovation effect of minority shareholders’ active participation in decision-making on enterprises in the eastern region is greater than that of enterprises in the central and western regions.