95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 26 July 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1225084

This article is part of the Research Topic Ripple Effects of the Russia-Ukraine Conflict on the Global Climate Initiatives and Sustainable Development Goals View all 6 articles

As we mark one year since the start of the Russia-Ukraine war, countries and companies alike continue to adapt to this unprecedented disruption in the global economy and the subsequent uncertainty. One aspect that has not been thoroughly addressed from this conflict is its effect on companies’ ESG ratings and how the decision to remain or withdraw from Russia influences these ratings. To study this, a panel regression methodology on ESG data was applied on a significant number of companies before and after the start of the conflict. According to the results obtained, it would seem that insofar neither the overall ESG scores, nor the Social Scores are influenced by companies’ decisions to leave or to stay in Russia after 24-th of February 2022. We consider that these are not final outcomes and it will require further investigations and methodology improvements. The paper provides insights for ESG ratings providers, regulators and asset managers on the effects of companies’ decision to withdraw from/remain in an invading country on ESG ratings.

In the aftermath of the onset of the Russian Federation’s invasion of Ukraine on February 24-th, 2022, a considerable number of Western companies and corporations decided to discontinue their operations in Russia. This entailed divesting or selling their businesses, or alternatively, completely forsaking their production and distribution facilities in Russia. Such actions were undertaken as a form of protest against the invasion of a sovereign and widely recognized European country. Other corporations announced their intention to leave after a certain period needed to arrange an orderly retreat, yet some other companies decided to continue their business in Russia, seemingly unaffected by the unfolding events.

The impetus behind this study stemmed from the belief that the general public, financial markets, and investors would express disapproval of the Russian Federation’s aggressive war in Ukraine. As a result, it was posited that companies choosing to remain in Russia would face a reduction in their ESG ratings, widely considered a measure of non-financial performance that can ultimately affect a company’s profitability. To prove this assertion, a panel regression methodology on ESG data for a significant number of companies which operated in Russia before February 24-th 2022 was employed.

The Russian invasion of Ukraine has led to serious consequences on both the regional and global economies as it contributed to diminishing production capacities, supply chain disruptions and trade delays alike (Khudaykulova et al., 2022). The Western response was immediate in the form of sanctions addressing the wealthy Russian citizens, as well as its public and private bank system (Tank and Ospanova, 2022).

Following the international sanctions imposed to Russia by the West, over a thousand companies reacted by ending, either fully or partially, their operations inside the Russian territory. Some however decided to continue their businesses, but without any doubts, under extensive supervision by investors and the general public alike. The current study analyzes the extent to which the costs of such a decision transpose in ESG ratings, using four regression models, with the change in ESG scores as dependent variable and explanatory variables accounting for the size of companies, indebtedness, profitability and market-based measures. Given the limited interval from the beginning of the war and the lag in reflecting the change of investors’ perspectives and approach to companies still doing business in Russia the results showed no significant changes insofar in the ESG ratings of involved companies.

The ESG literature has grown in the previous years at a rapid pace, benefiting from multi-layered interdisciplinary contributions. Nevertheless, the main research pillar in this field consists in the symbiotic relationship between the ESG pillars and financial returns. While using panel data analysis with data covering European companies and a period of 9 years, Zahid et al. (2023) find strong empirical evidence to support a positive relationship between ESG and dividend payouts. Nonetheless, using a solid methodology, the authors highlight, in an objective manner, that increased engagement in ESG practices hampers the rate of dividend growth. A similar negative consequence of investment in ESG practices is found by Zahid et al. (2022). Using panel data estimation, with a sample size of over 600 Western European firms, their findings indicate a notable adverse impact of ESG on a company’s financial performance, as evidenced by a decrease in the dependent variable, return on assets. Another significant financial consequence of ESG investments is found by Zahid et al. (2023). Using a fixed effects regression on panel database of over 6,000 observations, the authors highlight that high ESG scoring companies have easier access to financing on the stock markets.

Moving away from the sphere of ESG scores and financial decisions, we find a scarce literature of ESG and war related implications. As previously mentioned, the war in Ukraine generated a strong wave amongst the companies operating in Russia which did not yet benefit of sufficient academic emphasis. As ESG scores capture a company’s environmental, social and governance performance, we consider that is of utmost importance to have a clear understanding of how these scores react in the presence of exogeneous shocks. Only a couple of prior contributions have been found towards this line of research. Basnet et al. (2022) study the decision of withdrawal as a consequence of their ESG levels before the war began. In this regard, through a multivariate regression analysis, the authors find that companies with low ESG scores did not change their business operations, whereas those with high scores ceased their activities in Russia and did not witness negative share market reactions. However, using a similar regression methodology, contrasting results are found by Ahmed et al. (2022) as firms with high scores on the social pillar were neither faster nor more probable to exit the Russian market than compared to the low scored ones. The lack of reaction from those companies is in itself an alarming indicator for the integrity of the ESG factors and an indication that the construction of the social pillar should further include propensity to war and associated crimes. Analyzing the abnormal stock market returns before and after the war began, Berninger et al. (2022) confirm higher stock market returns for those companies that decided to leave Russia compared to those that remained. Similar results are found by Sonnenfeld et al. (2022) which highlight that stock markets reward companies that leave, with investors placing high emphasis on this decision.

However, Tosun and Esraghi (2022) observe an increased trading volume for the remaining companies, which put in the context of an invasion, acts as an indicator for the selling pressure upon those companies. In addition, a lack of decisiveness and firm standpoint on whether to stay or leave is found more costly than the actual decision to continue operations in the Russian territory.

From the stock market perspective, the war crisis unveiled a highly interconnected commodity market between the G7 and BRICS countries with gas and oil being amongst the highest shock transmitters (Alam et al., 2022). Given the Russian geopolitical position in the European energy sector and not only, a change in investment decisions is immediately observed. Singh, Patel and Singh (2022) discover how the Russian-Ukraine war led to a shift in investors preference towards the highly rated ESG stocks in the energy and defense sectors. More specific, the Russian invasion of Ukraine has once again reignited interest in renewable energy growth and energy independence (Ahmed et al., 2022). However, an event study (Kick and Rottmann, 2022) around the first day of conflict concludes that high ESG scores did not offer additional investment protection, especially when referring to cumulative abnormal returns.

A war is undoubtedly a test for companies operating both in invaded and invading countries through direct implications that arise in the daily operations. However, such conflicts are found to impose moral tests and challenges even to businesses operating outside the warzone in the form of ethics and brand management (Lim, et al., 2022). The newly created tests and challenges appear to have a higher magnitude on companies that rank lower on the social responsibility scale, irrespective of their geographic positioning (Ligorio et al., 2022). On a more general note, irrespective of ESG scores and ethics, the performance of stock markets worldwide has been negatively affected by the war in Ukraine on the 24th of February, with diminishing effects in the following weeks (Boungou and Yatié, 2022) (Boubaker et al., 2022). Proximity to war and the lack of policy reaction were found to be determining factors for the companies that sustained the highest losses Sun and Zhang (2022). The proximity factor is furthermore confirmed by (Kumari et al., 2023) and as well as (Federle et al., 2022) which find that an additional distance of one thousand kilometers contributes towards an extra 1.1 percentage points in equity returns.

From a managerial perspective, one might ask whether shareholders profits outweighed social responsibility in the decision to stay or leave. A study (Pajuste and Toniolo, 2022) indicates that corporate leaders are inclined to prioritize stakeholders’ interest in front of reputational risks, which in turn, could impact shareholders wealth. Moreover, social media is found to significantly influence the pursuit of social objectives alongside financial gains, rather than solely focusing on profits. Moreover, company size is highly relevant to the previous remarks, as larger companies present higher accountability.

In view of providing a better understanding of corporate war attitudes and their impact on ESG scores, we provide an overview of other influential factors depicted in the literature. Firstly, company size is considered an essential determinant of ESG scores, as larger companies dispose of the necessary resources needed to provide ESG data towards rating agencies, thus improving their scores (Drempetic et al., 2020), (Baldini et al., 2018), (Gregory, 2022). Secondly, companies that operate in socially developed countries are found to benefit of higher ESG ratings (Crespi and Migliavacca, 2020) as the rule of law is highly valued by investors. In regards to this second factor, we expect companies which still continue their operations in Russia to suffer significant consequences as law and human rights are highly questioned in the invading country. Thirdly, the social visibility of companies, independent of company size, influences ESG reporting and performance (Abdul Rahman and Alsayegh, 2021). The social visibility of companies operating in Russia has significantly increased after the war begun and is sustained through public initiatives such as Leave Russia of KSE Institute or Yale’s School of Management list.

The rest of the paper is configured as follows. Section presents the methodology used to prove the initial hypothesis according to which the ESG ratings of the companies which continued their businesses in Russia would likely decline, Section 4 presents the results of the study, Section 5 discusses the results, whilst Section 6 concludes and presents future lines of research.

For this research article, ESG and financial data before and after the start of the war were gathered from Morningstar Sustainalytics, one of the largest ESG ratings and financial data provider, as well as data on companies’ involvement in Russia (as of 27 March 2023) made publicly available by Yale School of Management and Kyiv School of Economics.

The ESG data gathered consists of two variables of interest, namely the monthly ESG Score, which is the overall Environment, Social and Governance score, and monthly Social Score (S Score) of a company. The ESG Score measures the overall sustainability performance of a company, considering the Environmental, Social and Governance aspects. The Social Score of a company reflects its performance based on metrics regarding Human Rights, working conditions, impact on communities, etc. The timeframe chosen was February 2022–February 2023.

According to Morningstar Sustainalytics, the ESG Score and Social Score were measured on a scale from 0 to 100, where 0 represents a laggard performance and 100 a top performance for the researched company in the overall ESG pillars or Social pillar.

The financial data consists of four variables, namely Total Assets, Return on Assets, Debt-to-Equity ratio and Market-to-Book ratio.

Moreover, data related to firms’ activities in Russia, specifically the Share of revenue in Russia vs. Global (%, 2021), were gathered from Kyiv School of Economics’ project website “SelfSanctions/LeaveRussia”1.

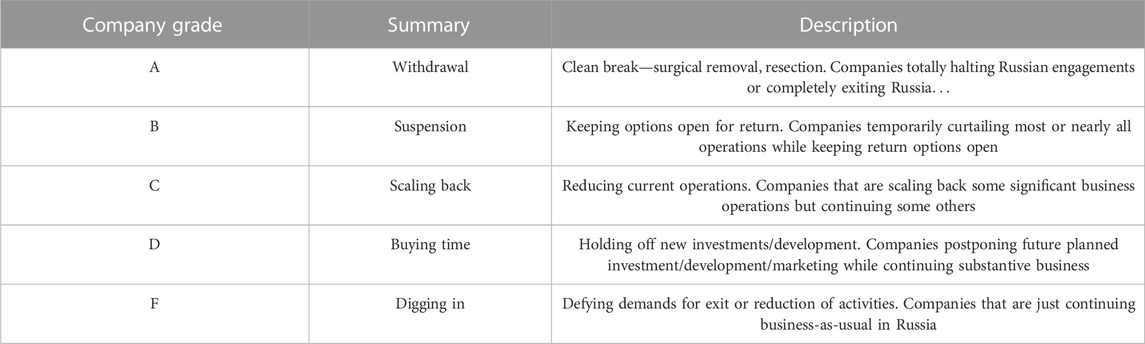

The dataset provided by the Yale School of Management consists of a compilation of companies categorized into five distinct groups using a grading scale akin to a traditional letter grading system (A–F). These classifications are determined by the degree to which the companies have successfully and comprehensively disengaged from their operations in Russia. The grading structure is summarized in Table 1 below.

TABLE 1. Yale School of Management’s company grading based on completeness of withdrawal from Russia.

After matching the Morningstar Sustainalytics data with the Yale SOM and KSE data, a final dataset of 559 companies was formed. The number of companies in the dataset grouped by region and country is found in Table 2, by industry in Table 3, while the number of companies grouped by the grade awarded by Yale SOM is found in Table 4.

As it can be observed in the tables above, the dataset contains companies from numerous countries/regions, though most of them are from the United States and Europe, and from a diverse number of industries, mostly from Industrials, Consumer Discretionary and Information Technology.

Judging by their completeness of withdrawal, most companies in the dataset have pursued a complete withdrawal from Russia or a suspension of nearly all operations, while 60 companies have continued business-as-usual in Russia.

To measure the impact of remaining in/withdrawing from the invading country on companies’ ESG performance, a panel regression analysis approach was employed.

For our use case, this approach helps answering to the following research questions:

1. Does continuing business-as-usual in an invading country influence a company’s overall ESG and Social rating?

2. Does withdrawal from an invading country influence a company’s overall ESG and Social rating?

These queries reflect the interest to examine the research topic from all possible perspectives and provide an exhaustive analysis given the availability of data at a significant point in time, roughly 1 year after the start of the conflict.

Thus, in addressing these questions, four models were estimated, two per each research question, aiming to capture the impact of companies’ withdrawal from/remaining in Russia on the two variables of interest, namely the ESG Score and Social Score, after controlling for financial, country-level and industry-level variables.

The main dependent variables are the changes in ESG Score (ΔESG) and Social Score (ΔS), respectively, after 3, 6, 9, and 12 months compared to the latest scores available for the companies before the outbreak of war (from 2nd of February 2022). The chosen intervals should allow enough time for the firm to process the implication of the war and for the ESG rating provider to update their scores to reflect this information.

In all the models, other factors such as firm’s size, financial performance, firm’s activity/operations in Russia, riskiness and market performance, were controlled for, using the variables of Total Assets, ROA, Share of revenue in Russia vs. Global, Debt-to-equity and Market-to-Book ratios. Additionally, country-level and industry-level factors were controlled using 2-digit variables.

Models 1a and 1b. In these models, the impact of continuing business-as-usual in Russia on companies’ ESG Score and Social Score, were on focus, controlling for firm, country and industry variables.

This is given by the following theoretical models:

where:

• The dependent variable is the change in ESG Score and S Score, respectively, for company i in period t compared to February 2022;

•

•

•

•

•

•

•

Models 2a and 2b. In these models, the impact of a complete withdrawal from Russia on companies’ ESG and Social Score, were on focus, controlling for firm, country and industry variables.

This is given by the following theoretical models:

where:

• The dependent variable is the change in ESG and Social Score, respectively, for company i in period t compared to February 2022;

•

•

•

•

•

•

•

The descriptive statistics are presented in Table 5 below.

As we can see in Table 6, none of the withdrawal-related coefficients are statistically significant, therefore, we can conclude that ESG performance, measured by the ESG Score and the Social Score of a company is not significantly affected by the company’s decision to remain in/withdraw from Russia.

Furthermore, among the control variables, the natural logarithm of total assets and the Market-to-Book value negatively affect the ESG and Social Scores, while ROA negatively affects only the Social Score at a 10% significance level.

The existing literature on the relationship between ESG and implications of war is limited. The present study provides the first empirical evidence on the effects of companies’ actions in an invading country on their ESG ratings.

According to the results obtained, it would seem that insofar neither the changes in ESG scores, nor the changes in Social Scores are influenced by companies’ decisions to leave or to stay in Russia after 24-th of February 2022. We consider that these are not final outcomes and this can be due to mainly three factors.

A first conceivable factor that may account for this phenomenon is the cautious stance taken by ESG score producers, who are awaiting a comprehensive assessment of economic and financial conditions faced by companies operating in a heavily sanctioned country. As time progresses, it is expected that these producers will incorporate the aspect of sustained business activities in an invading country within their evaluation frameworks. As Morningstar Sustainalytics use financially material ESG issues as the basis for ESG ratings (Garz, Volk, and Morrow, 2018), some of the ESG issues that could be up for review are Human Capital, Human Rights or Business Ethics. In the context of an updated evaluation of companies, based on their involvement in an invading country, the overall ESG and Social Scores could, in the future, be adjusted to better reflect this involvement. A subsequent analysis might reveal different results than this study.

The second factor, closely interconnected with the first, pertains to potential modifications required in the methodology employed for ESG scores. Adapting this methodology to encompass recent developments and contextual nuances is imperative for achieving a comprehensive and meaningful evaluation of a company or corporation’s overall operations and status. As Simon McMahon (2020) stated in his Harvard Business Review article, “Creating the ratings is challenging work. There are no uniform requirements for reporting ESG information, and many environmental and social impacts are hard to measure. So, the data inputs that we start with are fundamentally less structured, less complete, and of lower quality than financial data, which companies are required to present in standardized form and have audited by accountants.” Recently, the European Union has proposed new regulations for ESG ratings providers, in a first attempt to harmonize and standardize this market and provide more transparency regarding the methodologies used in calculating ESG ratings (European Commission, 2023). In the past years, ESG ratings providers have operated in an ever-changing environment, constantly developing new products in a bid to stay in front of competitors. It is safe to assume that these many changes in the industry have determined a limited approach and integration of the effects of the war in the ESG ratings, while the focus has been to constantly adapt to market conditions and regulation. Further regulatory proposals can enable ESG ratings providers to incorporate research data about companies’ involvement in an invading country in ESG scores.

The third factor could be that investors (existing and prospective ones) are still placing a great emphasis on the economic and financial situation of any given company and not yet prioritize the ethics of a company, especially under extraordinary circumstances such as starting a war and withdrawing from or continuing business-as-usual in an invading country.

From an investing and ESG research perspective, the materiality of the war as an ESG factor is yet to be determined. Even though some investors recognize ethical considerations as important, most of them are attracted to the idea of linking ESG integration with financial performance, therefore with materiality. Some studies suggest that integrating ESG ratings in investment decisions, at a minimum, does not affect performance (Khan, Serafeim, and Yoon, 2016), while others suggest a positive relationship (Friede, Busch, and Bassen, 2015). Therefore, a certain materiality is required when incorporating research in a company’s ESG rating.

This research aims to foster greater awareness among investors, scoring agencies, and regulatory bodies regarding the potential necessity of incorporating the social and political positioning of implicated companies into ESG scores. Beyond economic and financial performance, good governance, and environmental and social initiatives, it is important to consider the social and political ramifications of conducting business in heavily sanctioned countries or countries that contribute to significant humanitarian crises and global economic instability. By shedding light on this aspect, our study can contribute to a more comprehensive evaluation framework that encompasses the broader implications of corporate activities on a societal and geopolitical scale.

The Conclusion section is approached from three perspectives, respectively from theoretical implications, from managerial implications and ideas for future research, as follows.

In the context of an increasing regulatory framework for ESG ratings providers, current research provides empirical evidence that withdrawal from or remaining in an invading country does not affect ESG ratings. This can be of help to regulators and ESG ratings providers alike in an effort to address this situation from a research and methodology perspective.

The materiality of the war is still to be determined. Investors are still relying on financial information, even if they recently started to include ESG ratings into their business decisions and the awareness connected with this has increased considerably in the last 10 years.

From an ethical investor’s perspective, while difficult to quantify under the current ESG frameworks, conducting business in an invading country definitely has negative consequences on the company’s reputation and credibility.

Further studies are obviously necessary to have a middle term analysis of the ESG scores’ evolution for the companies which decided to have business as usual in Russia after the aggression war against Ukraine. We will also use other investigation methods such as propensity score matching and perhaps interviews with managers of the scoring agencies. We also recommend applying the methods used in this study on different datasets, preferably from multiple ESG ratings providers.

Publicly available datasets were analyzed in this study. Data can be found at: https://www.sustainalytics.com/esg-ratings; https://www.morningstar.com/products/direct; https://som.yale.edu/story/2022/over-1000-companies-have-curtailed-operations-russia-some-remain; https://kse.ua/selfsanctions-kse-institute/.

MD: Introduction, overall management, discussions, and conclusions. C-DV: Methodology, results, and data collecting. DD: Literature review, Methodology, and introduction. All authors contributed to the article and approved the submitted version.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1https://kse.ua/selfsanctions-kse-institute/

Abdul Rahman, R., and Alsayegh, M. F. (2021). Determinants of corporate environment, social and governance (ESG) reporting among Asian firms. J. Risk Financial Manag. 14 (4), 167. doi:10.3390/jrfm14040167

Ahmed, D., Demers, E., Hendrikse, J., Joos, P., and Lev, B. (2022a). Are ESG ratings informative about companies' socially responsible behaviors abroad? Evidence from the Russian invasion of Ukraine. Evid. Russ. Invasion Ukraine. doi:10.2139/ssrn.4151996

Ahmed, S., Hasan, M. M., and Kamal, M. R. (2022b). “Russia–Ukraine crisis: The effects on the European stock market,” in European financial management (Hoboken, NJ, USA: Wiley). doi:10.1111/eufm.12386

Alam, M. K., Tabash, M. I., Billah, M., Kumar, S., and Anagreh, S. (2022). The impacts of the Russia–Ukraine invasion on global markets and commodities: A dynamic connectedness among G7 and BRIC markets. J. Risk Financial Manag. 15 (8), 352. doi:10.3390/jrfm15080352

Baldini, M., Maso, L. D., Liberatore, G., Mazzi, F., and Terzani, S. (2018). Role of country-and firm-level determinants in environmental, social, and governance disclosure. J. Bus. Ethics 150, 79–98. doi:10.1007/s10551-016-3139-1

Basnet, A., Blomkvist, M., and Galariotis, E. (2022). The role of ESG in the decision to stay or leave the market of an invading country: The case of Russia. Econ. Lett. 216, 110636. doi:10.1016/j.econlet.2022.110636

Berninger, M., Kiesel, F., and Kolaric, S. (2022). Should I stay or should I go? Stock market reactions to companies' decisions in the wake of the Russia-Ukraine conflict. doi:10.2139/ssrn.4088159

Boubaker, S., Goodell, J. W., Pandey, D. K., and Kumari, V. (2022). Heterogeneous impacts of wars on global equity markets: Evidence from the invasion of Ukraine. Finance Res. Lett. 48, 102934. doi:10.1016/j.frl.2022.102934

Boungou, W., and Yatié, A. (2022). The impact of the Ukraine–Russia war on world stock market returns. Econ. Lett. 215, 110516. doi:10.1016/j.econlet.2022.110516

Crespi, F., and Migliavacca, M. (2020). The determinants of ESG rating in the financial industry: The same old story or a different tale? Sustainability 12 (16), 6398. doi:10.3390/su12166398

Drempetic, S., Klein, C., and Zwergel, B. (2020). The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 167, 333–360. doi:10.1007/s10551-019-04164-1

European Commission (2023). Proposal for a Regulation of the European parliament and of the Council on the Transparency and Integrity of Environmental, Social and Governance (ESG) rating activities.

Federle, J., Meier, A., Müller, G. J., and Sehn, V. (2022). Proximity to War: The stock market response to the Russian invasion of Ukraine. CEPR Discussion Paper No. DP17185 Available at:https://ssrn.com/abstract=4121360.

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. finance Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Garz, H., Volk, C., and Morrow, D. (2018). The ESG risk ratings. Moving up the innovation curve. Amsterdam: White Paper, 1.

Gregory, R. P. (2022). The influence of firm size on ESG score controlling for ratings agency and industrial sector. J. Sustain. Finance Invest., 1–14. doi:10.1080/20430795.2022.2069079

Khan, M., Serafeim, G., and Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Account. Rev. 91 (6), 1697–1724. doi:10.2308/accr-51383

Khudaykulova, M., Yuanqiong, H., and Khudaykulov, A. (2022). Economic consequences and implications of the Ukraine-Russia war. Int. J. Manag. Sci. Bus. Adm. 8 (4), 44–52. doi:10.18775/ijmsba.1849-5664-5419.2014.84.1005

Kick, A., and Rottmann, H. (2022). Sustainable stocks and the Russian war on Ukraine-an event study in Europe. doi:10.2139/ssrn.4137955

Kumari, V., Kumar, G., and Pandey, D. K. (2023). Are the European Union stock markets vulnerable to the Russia–Ukraine war? J. Behav. Exp. Finance 37, 100793. doi:10.1016/j.jbef.2023.100793

Ligorio, L., Lippolis, S., Leopizzi, R., and Imperiale, F. (2022). How Does War Impact Socially Responsible Companies’ Stocks? Event Study Ukraine Confl. Available at: https://ssrn.com/abstract=4156262.

Lim, W. M., Chin, M. W., Ee, Y. S., Fung, C. Y., Giang, C. S., Heng, K. S., et al. (2022). What is at stake in a war? A prospective evaluation of the Ukraine and Russia conflict for business and society. Glob. Bus. Organ. 41 (6), 23–36. doi:10.1002/joe.22162

Pajuste, A., and Toniolo, A. (2022). Corporate response to the war in Ukraine: Stakeholder governance or stakeholder pressure? Cambridge, Massachusetts: Hardvaard Univercity. Available at SSRN 4183604. doi:10.2139/ssrn.4183604

Singh, A., Patel, R., and Singh, H. (2022). Recalibration of priorities: Investor preference and Russia-Ukraine conflict. Finance Res. Lett. 50, 103294. doi:10.1016/j.frl.2022.103294

Sonnenfeld, J., Tian, S., Zaslavsky, S., Bhansali, Y., and Vakil, R. (2022). It pays for companies to leave Russia. Cambridge, Massachusetts: Hardvaard Univercity. Available at SSRN 4112885. doi:10.2139/ssrn.4112885

Sun, M., and Zhang, C. (2022). Comprehensive analysis of global stock market reactions to the Russia-Ukraine war. Appl. Econ. Lett., 1–8. doi:10.1080/13504851.2022.2103077

Tank, A., and Ospanova, A. (2022). Economic impact of Russia-Ukraine war. Int. J. Innovative Res. Sci. Eng. Technol. 11, 3345–3349. doi:10.15680/IJIRSET.2022.1104025

Tosun, O. K., and Eshraghi, A. (2022). Corporate decisions in times of war: Evidence from the Russia-Ukraine conflict. Finance Res. Lett. 48, 102920. doi:10.1016/j.frl.2022.102920

Zahid, R. A., Khan, M. K., Anwar, W., and Maqsood, U. S. (2022). The role of audit quality in the ESG-corporate financial performance nexus: Empirical evidence from Western European companies. Borsa Istanb. Rev. 22, S200–S212. doi:10.1016/j.bir.2022.08.011

Zahid, R. A., Taran, A., Khan, M. K., and Chersan, I. C. (2023a). ESG, dividend payout policy and the moderating role of audit quality: Empirical evidence from western Europe. Borsa Istanb. Rev. 23 (2), 350–367. doi:10.1016/j.bir.2022.10.012

Keywords: Russo-Ukrainian war, economic uncertainty, ESG, social scores, regression

Citation: Dincă MS, Vezeteu C-D and Dincă D (2023) Does withdrawal from/remaining in an aggressor country affect companies’ ESG ratings? Case study of the Russia-Ukraine war. Front. Environ. Sci. 11:1225084. doi: 10.3389/fenvs.2023.1225084

Received: 18 May 2023; Accepted: 11 July 2023;

Published: 26 July 2023.

Edited by:

Muhammad Abdul Kamal, Abdul Wali Khan University Mardan, PakistanReviewed by:

R. M. Ammar Zahid, Yunnan Technology and Business University, ChinaCopyright © 2023 Dincă, Vezeteu and Dincă. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Marius Sorin Dincă, bWFyaXVzLmRpbmNhQHVuaXRidi5ybw==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.