- 1School of Law, University of International Business and Economics, Beijing, China

- 2Irvine Valley College, Irvine, CA, United States

- 3School of Finance, Shandong Institute of Business and Technology, Yantai, China

- 4CPC Guizhou Provincial Party School, Zunyi, China

- 5School of Finance, Central University of Finance and Economics, Beijing, China

- 6Department of Humanities Management, Seoul National University of Science and Technology, Seoul, Republic of Korea

This paper employs panel data from 227 prefecture-level cities in China spanning the period from 2000 to 2020 to investigate the effects and influences of local government debt policies on the financial ecological environment. Considering regional economic foundation, financial development, government governance, and the construction of the social credit system, our analysis reveals the following outcomes regarding debt level and debt structure: Firstly, we find that higher debt levels and an increased proportion of hidden debt at the local government level have impacts on various dimensions of the financial ecological environment. Specifically, debt expansion facilitates regional economic foundations and financial development but hampers government governance and the construction of the social credit system, leading to a deterioration in the development of the financial ecological environment. Furthermore, employing a threshold regression model, we have not identified a significant nonlinear relationship in this context. Secondly, local government debt exhibits a reverse spatial spillover effect on the financial ecological environment of surrounding regions, contrasting with the effects observed within the local area. This effect manifests as the enhancement of the financial ecological environment in neighboring areas.

Introduction

Local government debt plays a crucial role in promoting the development of the financial ecosystem. However, the continuous expansion of debt size has resulted in the accumulation of financial risks in local fiscal systems, posing a significant threat to regional economic development, financial security, and social stability. The burgeoning debt size hampers the improvement and optimization of the financial ecological environment. Due to the needs of local development, local governments rely on financing to obtain funds for regional development. In recent years, the imbalance between local government revenue and expenditure in China has intensified, and the risk of local government debt has decreased under national regulatory control. However, the repayment capacity of local government debt varies across regions, and some areas have a significant scale of hidden debt.

According to the Chinese government’s “2022 Government Work Report,” the proactive fiscal policy stance will continue, and with the additional demand for funds from existing projects, the annual quota for new local government debt will remain at a high level of 4.37 trillion yuan. Among them, the quota for new special-purpose debt slightly decreased by 0.1 trillion yuan to 3.65 trillion yuan, while the scale of explicit debt continued to increase rapidly. By the end of 2022, the stock of local government debt had reached 35.1 trillion yuan. Entering the post-pandemic era, global debt issues have increased risks and uncertainties, while China’s debt issues mainly manifest as the scale and structural risks of local government debt.

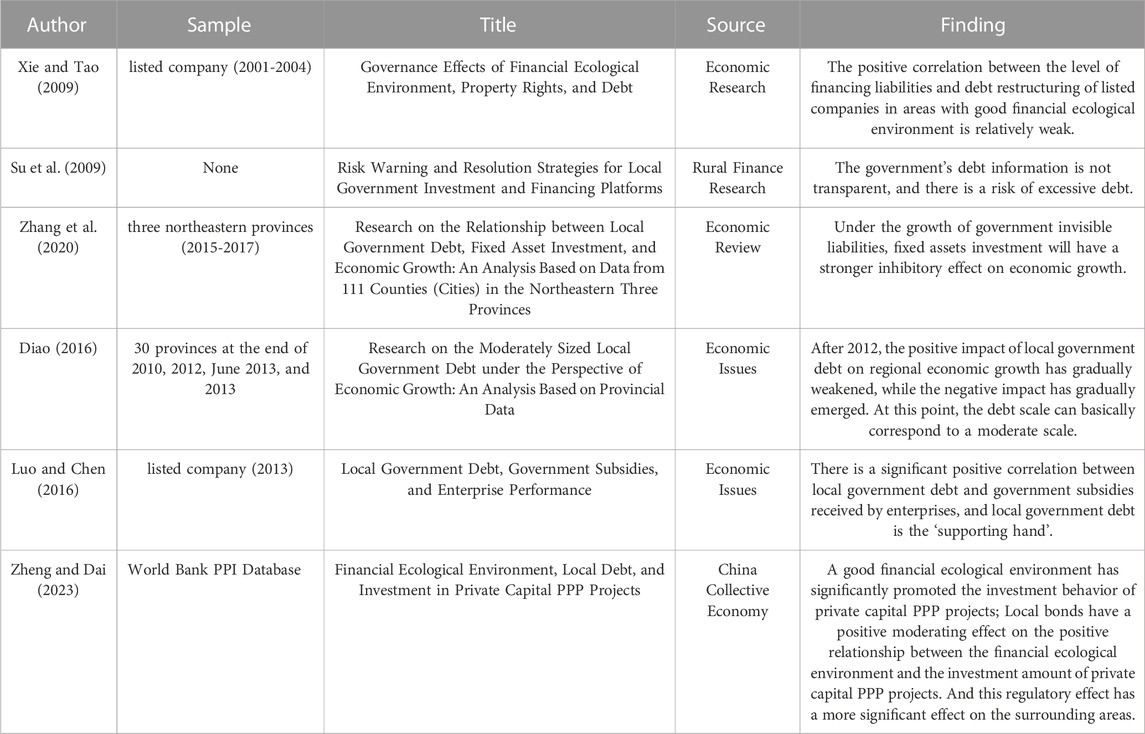

Over the past two decades, scholars have paid extensive attention to the management and effects of government debt. Summarizing existing literature, the focus of research on the impact of government debt policies has primarily centered on platform financing risks (Xie and Chen, 2009), risk warning and mitigation (Su et al., 2009), risk managment (Diao, 2016), economic growth (Zhao, 2014), and corporate performance (Luo and Chen, 2016). However, there has been limited attention to their impact on the Financial Ecological Environment, with financial environment only mentioned in the context of government debt and economic development (Zheng and Chen, 2023). On the one hand, some scholars argue that government borrowing weakens its capacity to formulate counter-cyclical policies in response to economic crises, thereby affecting overall socio-economic stability (Siddiqiai and Malik, 2001). On the other hand, some suggest that government bond issuance and fiscal deficit policies can effectively boost domestic demand, promoting regional economic development (Hildreth and Miller, 2002).

Additionally, other scholars assert that the effects of financing through bond issuance and taxation are consistent, and local government debt issuance does not affect factors such as social resources, investment, and labor supply, supporting the debt neutrality view (Barro, 1974; Greiner, 2012). Furthermore, some scholars have focused on empirical research. Panizza and Presbitero (2014) found that government debt can promote economic development to some extent in both the short and long terms. Cohen (1993) estimated that for every 1% increase in the debt ratio, the social investment rate decreases by 0.3%, indicating a negative correlation between government debt and economic growth. Kumar and Woo (2010) narrowed their study to developed countries and found that a 10% increase in the government debt ratio (debt-to-GDP ratio) leads to a 0.2% reduction in per capita real GDP. With the enrichment of empirical tools and data sources, many scholars have discovered a non-linear relationship between government debt and economic growth. Some argue that there is a clear threshold effect, with significantly different impacts when government debt is below or above this threshold. Pattillo et al. (2002) found a “U”-shaped relationship between government debt and economic growth. Checherita Westphal and Rother (2012) focused on 12 eurozone countries and identified a clear threshold effect between government debt and economic growth, resulting in a typical inverted “U”-shaped relationship (Reinhart and Rogoff, 2010) established a threshold for government debt at 0.9, indicating that the relationship starts to deteriorate when the government debt ratio rises above 0.9, showing a pronounced negative correlation.

In light of the above, previous research has primarily approached the analysis of government debt from a single static perspective, focusing on its impact on the economy. The concept of the financial ecosystem encompasses a wide array of participants and institutions within the financial market, ranging from traditional banks to financial technology innovation enterprises, meeting the need for an understanding of the complex interactive relationships within the financial system. Traditional financial perspectives often overly emphasize single elements, whereas the financial ecological environment underscores the interconnectedness of different elements. Through this concept, we can conduct a more comprehensive analysis of financial issues, considering the interactions between different elements and how these interactions affect the stability and efficiency of the entire financial system.

In this context, this paper directly investigates the impact of local government debt policies on the regional financial ecological environment. Exploring the effects of changes in the scale and structure of local government debt on the financial ecological environment and analyzing the underlying mechanisms can provide insights into promoting the enhancement of financial ecological environment quality through local government debt support, thereby better supporting high-quality economic and financial development.

Literature review

Research on government debt

In past studies, research on government bonds has consistently been a focal point for scholars. Since China allowed local governments to directly issue bonds and implemented debt substitution policies in 2015, academia has continuously engaged in in-depth research and investigation on this topic. Many scholars have primarily focused their studies on local government bonds in China. For instance, Xie and Chen (2020) conducted research on the structure of bond issuance and found that stronger local governments with higher leverage tend to opt for public issuance. Fu and Wang (2020) analyzed the theoretical mechanisms of local government debt reform practices from the perspective of budget constraints. They argued that during the period of economic new normal and stagnant real estate prices, general constraints rather than strict ones might be the optimal choice for preventing local government bankruptcy costs. Cheng and Ye (2020) discussed the latest developments in government debt substitution and suggested enhancing financial risk prevention and control. Qiu et al. (2022) found that local government bonds used for substitution could reduce the issuance scale of urban construction bonds through a “substitution effect.” On the other hand, debt substitution could lower the financing cost of urban construction bonds through an “implicit guarantee effect,” thereby weakening the “substitution effect.”

Regarding the impact of debt substitution on commercial banks, Jia (2017) conducted a study on the influence and effects of local government debt substitution on commercial banks, suggesting that while debt substitution could have short-term impacts on banks, it could fundamentally change local governments’ financing behavior and financing methods, thereby influencing banks’ long-term development models. Kong and Xie (2020) empirically examined the impact of local government bonds on the rate of return on commercial bank wealth management before and after debt substitution, discovering that local government bonds lowered and raised the rate of return on commercial bank wealth management respectively before and after debt substitution. Liang et al. (2020) found that debt substitution significantly altered the asset structure of commercial banks and improved their liquidity, with the change in liquidity being influenced by the absolute scale of debt substitution and the relative proportion of debt issuance. Wu and Xu (2017), using Jingdezhen City as an example, studied the positive effects of local government debt substitution on commercial banks and analyzed the adverse effects of local government debt substitution on the transformation and development of commercial banks. However, some scholars have expressed concerns regarding the risks associated with debt substitution. Liang and Hao (2019), using a five-sector DSGE model, found that while extending the debt term structure through debt substitution could alleviate debt accumulation and mitigate macroeconomic risks to some extent, it could also reduce the effectiveness of fiscal policy.

Scholars from developed countries have continually conducted in-depth research and exploration on banks’ holdings of government bonds, offering diverse perspectives that provide valuable insights. Fratianni and Marchionne (2017) found that banks worldwide adjusted their asset composition by replacing loans with securities to reduce overall regulatory credit risk in response to subprime and sovereign debt crises. Gennaioli et al. (2018) discovered that during normal times, there was a significant volume of bond holdings, and during sovereign defaults, there existed a strong negative correlation between banks’ holdings of government bonds and their loans. Crosignani (2021) found that if sovereign risk is sufficiently high, low-capital banks will reduce loans to the productive sector and further increase their holdings of domestic government bonds. Affinito et al. (2019) found that the high liquidity and high yield of government bonds, along with their convenience in terms of capital cost, make them suitable to meet banks’ needs during periods of declining bank liquidity, profitability, and loan quality. However, some scholars hold dissenting views on banks’ holdings of government bonds. Gros (2017) argues that the notion of allowing banks to purchase a substantial amount of their own sovereign bonds to stabilize the market in crises is flawed. Banks are intermediaries for private savings, and their financing costs exceed those of sovereign banks. Thus, purchasing bonds in large quantities during crises might exacerbate financial market pressure, rather than alleviate the crisis. Instead, governments should facilitate direct holdings of government debt by households (and other genuine monetary investors).

Research on financial ecological environment

The financial ecological environment is a concept with distinct Chinese characteristics. Since Zhou Xiaochuan (2004) first proposed the financial ecological environment, Chinese scholars have basically formed a consensus: the financial ecological environment refers to the general term for the external basic environment of economy, politics, culture, society, law, and other factor on which various economic entities rely for survival and development. It is a multi-dimensional and complex system formed by the interaction and mutual influence of various factors relying on the fund chain and credit chain. In measuring the development quality of the financial ecological environment, most studies have chosen indicators such as economic foundation, financial development, credit and legal environment, local government public services, and social security to construct an evaluation system for the financial ecological environment (Deng and Chen, 2014). These indicators are considered key factors in maintaining and optimizing the financial ecological environment at the regional level. However, there is a lack of research that specifically analyzes the role of local government debt as a variable in the construction and optimization of the financial ecological environment. Existing studies mostly indirectly analyze the impact of local government debt on economic and financial development or analyze it from the perspective of local government behavior.

Research on the impact of government debt on the financial ecological environment

Firstly, it is difficult to draw a consistent conclusion on the impact of local government debt on financial ecological environment. Local government debt stimulates economic growth by supplementing local financial resources and promoting infrastructure development (Martins, 2021). However, the expansion of debt leads to long-term changes in the fund structure and interest rates, resulting in crowding-out effects on commercial bank loans and private capital investment. This, in turn, has a negative impact on capital accumulation and economic growth (Demirci et al., 2019; Cheng et al., 2022; Johnson and Yushkov, 2022).

Local government debt has different effects on regional economic growth due to variations in its scale, structure, and types. Furthermore, the impact of local government debt on regional financial stability follows two paths: first, it operates through the transmission channel of local government debt—shadow banking—financial risk securitization—systemic financial risk (Yarba and Güner, 2020; Hassan et al., 2022). Second, the spiral growth of local government debt and dependence on land finance drives the expansion of the real estate asset price bubble, potentially triggering systemic financial risk (Gelpern and Gerding, 2016; Chang et al., 2022; Tian, 2022). Lastly, according to Xingzhi and Wang (2009), the fundamental cause of the differences in the financial ecological environment among Chinese regions lies in the behavioral intervention of the central and local governments. Government behavior plays a crucial and dominant role in the evolution of the financial ecological environment but also leads to its deterioration. This is mainly manifested in the strengthening of administrative tendencies in financial resource allocation, a reduction in the efficiency of market-based allocation of financial resources, the speed of innovation in the financial industry, and risk resistance capabilities, as well as an increase in moral hazard issues (Zhang and Dai, 2007).

According to Table 1, significant progress has been achieved in related studies. There are still limitations and further areas of exploration. First, there is a lack of direct research on the impact of local government debt on the regional financial ecological environment. It is necessary to further explore the mechanisms and effects of the role of local government debt in the financial ecological environment from a systemic perspective. Second, it has been indicated in some literature that the debt structure and its efficiency of use also require attention. Third, previous research has confirmed the spatial spillover effects of local government debt, but the spatial impact of local government debt growth on the financial ecological environment needs to be examined. Based on these considerations, this study will examine the impact of local government debt on the financial ecological environment from the dual perspectives of debt scale and structure, and derive relevant insights. This will contribute to a better understanding of the role of local government debt in financing the construction of the financial ecological environment and provide valuable references for future policy-making.

Research assumptions

From the perspective of the connotation and composition of the financial ecological environment, the main components of the financial ecological environment system in a region include the economic foundation, financial development status, local government governance, legal system construction, and social trust guarantee. Therefore, the influence of local government debt on the optimization of the regional financial ecological environment structure and its functional performance can be discussed based on the constituent elements of the financial ecological environment.

From the perspective of building the economic foundation of the financial ecological environment, the funding support from local government debt for infrastructure construction contributes to enhancing the local economic foundation. In China, a significant portion of local government debt funds is used in public investment areas such as municipal construction projects. This allocation not only contributes to the increase in local GDP and capital accumulation but also indirectly improves people’s livelihoods, creates employment opportunities, and accelerates the process of urbanization and industrialization. As a result, it establishes a strong economic foundation for building a favorable financial ecological environment in the region (Kormendi, 1983). The accumulation of government debt has beneficial and distinctive impacts on the economy. By reducing economic uncertainty, government expenditures contribute to boosting economic activity levels, facilitating resource circulation, and ultimately encouraging a more robust debt system (Ma and Qamruzzaman, 2022). However, in recent years, the continuous expansion of local government debt has also triggered a series of issues, increasing risk factors in the economic system. Firstly, the expansion of debt scale can push up market interest rates, increase financing costs for enterprises, and result in crowding-out effects on private sector investment, leading to reduced capital accumulation and economic efficiency. Secondly, excessive allocation of debt funds to infrastructure projects can lead to redundant construction, inhibit investment in innovation activities, create crowding-out effects on expenditure for technological progress and innovative projects, and hinder long-term sustainable economic growth. Additionally, compared to urban areas, a portion of local government debt funds needs to be allocated for rural economic growth (Qian et al., 2022), which is not conducive to narrowing the urban-rural gap and comprehensively improving people’s livelihoods. Based on the above analysis, under controllable risks, moderate growth of local government debt plays a positive role in enhancing the foundation of local economic development. However, excessive debt growth can lead to misallocation and wastage of credit resources, diminish the quality of economic growth, and thus have a negative impact on the optimization of the financial ecological environment.

From the perspective of regional financial development, the expansion of local government debt influences regional financial development by increasing the total volume of finance in the region, enhancing financial innovation capabilities, and impacting regional financial risks. On one hand, the process of debt expansion creates new debt financing methods and gives rise to new financial instruments and products, which, to some extent, promote financial innovation, facilitate the transformation of local government bond issuance models (Li et al., 2022), and foster the diversified development of financial markets, thereby contributing to increasing the overall volume of finance.

On the other hand, the expansion of local government debt increases the leverage ratio of the real economy and contributes to the increase in real estate market prices, which, in turn, affects regional financial risks. After fiscal reform, local governments gradually developed debt models such as “land finance + local financing platforms” and “land finance + implicit debt” (Pan et al., 2017). They borrowed from commercial banks and issued urban investment bonds through the establishment of local financing platforms, or they improperly raised debt through channels such as shadow banking, public-private partnerships (PPP), and government-guided funds (Liang et al., 2017). This continuous increase in government and corporate leverage ratios has accumulated risks in the financial ecological environment. The main manifestations are as follows: a significant amount of debt funds being directed towards long-term, low-yield infrastructure projects, which increases liquidity risk and maturity mismatch risk for commercial banks. The land finance financing model excessively relies on the development of the real estate market. In the event of a market downturn, fiscal risks transform into financial risks, thereby raising the levels and ratios of non-performing loans in commercial banks. The excessive dependence of local governments on bond financing may affect the financing structure of the private sector and give rise to bond deflation risks, particularly in situations where the bond market mechanism is not yet mature and there are limited opportunities for commercial banks to increase holdings.

Simultaneously, the dominant impact of the cost-effectiveness of government borrowing signifies that an expansion of government expenditures could lead to a reduction in bank loans to private enterprises (Zhang et al., 2023). This helps improve the inefficiencies in resource allocation within the banking sector, creating economic opportunities for increased financial access and social development. Government borrowing can also enhance credit supply to small and medium-sized enterprises. The development of certain financial technology firms, equipped with advanced technologies such as big data, artificial intelligence, biometrics, and blockchain (Xu L. et al., 2023; Wen and Liu, 2023), can offer financial services that are more personalized, convenient, and consumer-centric than traditional services (Muganyi et al., 2022).

From the perspective of local government governance, the expansion of local government debt not only helps to supplement local financial resources but also increases the debt repayment pressure and credit risks faced by local governments. A moderate scale of local government debt, by supplementing local financial resources, expands the space for tax reduction and fee reduction, thereby promoting corporate investment and household consumption. It enhances the performance of local government governance and contributes to the construction of the financial ecological environment. However, the debt-driven economic development model possesses inherent vulnerabilities. Firstly, the pressure of debt repayment, including principal and interest payments, continuously increases the scale of fiscal deficits, reducing the elasticity and sustainability of local fiscal expenditures, thus weakening the fiscal stimulus to the economy (Tang, 2022). Moreover, debt expansion interferes with the credit financing structure of real businesses, constrains investment decisions and operational efficiency, and indirectly diminishes the local government’s tax revenue capacity. Furthermore, both local government bond financing and bank credit financing relying on financing platforms inherently contribute to the continuous expansion of government credit. This intensifies the risk interconnection among local finance, financial institutions, and central finance, ultimately reducing government governance capabilities and the overall social credit level. It poses deeper risks and hazards to the optimization of the financial ecological environment (Cunha and Ornelas, 2018).

From the perspectives of legal system construction and social trust and guarantee, the establishment and development of a social credit system are aimed at improving the construction of the financial ecological environment, establishing a new trust mechanism, and thereby enhancing the operational efficiency and reducing risks in the financial ecological environment. On the one hand, in order to strengthen legal constraints and prevent local governments from using their credit advantages and soft budget constraints to increase intervention in financial activities, which in turn leads to moral risks in financial discipline and debt management, the disguised borrowing behavior of local governments has prompted the central government to continuously improve relevant legal system construction. This includes revising and implementing the new “Budget Law,” strengthening the disclosure of government debt information, and regulating the financial legal environment and financial order, thereby continuously improving the construction of the financial ecological environment. Debt financing expands the funds available for local public goods and service investment, resulting in increased funds for the construction of social public services such as education, healthcare, and sanitation. It provides social relief and social insurance services to alleviate social wealth disparities, urban-rural conflicts, and various risks, playing the role of an “inherent stabilizer” in smoothing economic cycles. It also helps reduce information asymmetry, externalities, and transaction costs. On the other hand, excessive debt burden on local governments may increase debt repayment pressures and even lead to default risks, thereby affecting the stability and confidence of the financial market. This may result in a decrease in credit ratings of local government bonds by investors and the market, impacting the normal operation of the bond market and even triggering a chain reaction in the financial system. Additionally, if local government debt involves various aspects such as legal compliance, debt management, and risk prevention, it may lead to irregular or excessive debt behaviors by local governments, and even corruption, which obstructs the construction of the social credit environment and undermines the financial ecological environment (Jia et al., 2018).

Based on the above analysis, the expansion of local government debt has had an impact on various dimensions of the financial ecological environment, and the ways and effects of these impacts differ significantly, thereby exerting a comprehensive effect on the overall financial ecological environment. While actively controlling risks, local government borrowing and financing, through the integration of social resources and the improvement of capital utilization efficiency, play a positive role in economic foundation and financial development (Liu et al., 2022). However, the expansion of local government debt may increase the debt repayment pressure and credit risk of local governments, thus negatively affecting government governance. Simultaneously, the accumulation of financial risks and non-performing assets may have a negative impact on the stability and reliability of the financial system, thereby adversely affecting the social credit system. Therefore, the increase in local government debt may potentially contribute to the deterioration of the financial ecological environment, and the associated risks need to be taken into account while aiming for risk prevention and control. To evaluate the net effect of local government debt expansion on the financial ecological environment, this article

H1. Local government debt expansion ultimately inhibits optimization financial ecological environment.

To investigate the impact of local government borrowing on the financial ecological environment, it is essential to consider not only the effects of the accumulated scale of local government debt but also the effects of the types and structural characteristics of such debt. Existing literature indicates that the effects of local government debt are also related to its structural changes. From the perspective of risk mitigation, implicit debt mainly refers to debt incurred by local governments through financing platforms, shadow banking, public-private partnerships (PPP), and other means to evade regulatory constraints. Implicit debt tends to have a relatively high scale and poses greater regulatory challenges, making it more likely to generate risks for local government finances and the financial system. Building upon these observations, this article proposes

H2. Higher proportion implicit debt more unfavorable optimization financial ecological environment.

From the perspective of the spatial spillover effects between local government debt and the financial ecological environment, there exists irrational competition among local governments under the promotion incentive mechanism. Local officials pursue the benefits of promotion, which stimulates the continuous increase in the scale of borrowing. Moreover, under fiscal and financial decentralization, local governments constantly innovate their borrowing and financing methods. The expansion of local government debt supports local fiscal expenditures, whether they are productive or welfare-oriented. This is beneficial for the establishment and improvement of the local financial ecological environment and may have a spatial spillover effect on the construction of the financial ecological environment in neighboring areas.

Significant variations in environmental efficiency among resource cities stem from differing policies regarding support for renewable energy sources (Xiu et al., 2023). Some cities have successfully broken the cycle through appropriate debt policies, while others have fallen into a path dependency associated with coal-related industries (Zhang and Chen, 2023). A higher carbon price corresponds to lower expected returns on purchases, significantly offsetting the demand for carbon assets by businesses in the region (Liu et al., 2023). However, the economic foundation and financial development in the local area often trigger supply chain and industry spillover effects. This means that economic activities in the local area not only promote its own growth but also attract businesses and investments from neighboring regions. This interactions can boost economic activity in the surrounding areas, consequently enhancing their financial ecosystem. Additionally, the dissemination of best practices in financial regulation and risk management can occur between different regions. This dissemination facilitates the improvement of the overall quality of the financial system. In essence, while the primary focus may be on the local area, the economic foundation and financial development therein generate ripple effects that extend to neighboring regions. These effects can lead to increased economic activity and improvements in the financial ecosystem of the surrounding areas. Therefore, this article proposes

H3. Impact local government debt on regional financial ecological environment has spatial effect.

Data and methods

In recent years, China has been affected by factors such as slowing economic growth, population aging, and the COVID-19 pandemic. As a response, China has not only introduced special anti-pandemic bonds but has also significantly increased the quota for new local government bonds. While these measures have played a role in mitigating the impact of the pandemic, expanding effective investments, and promoting stable macroeconomic operation to some extent, they have also led to an increase in the scale and burden of local government debt. The optimization and development of the financial ecological environment and support for high-quality local economic development still face significant challenges (Federspiel et al., 2022). Investigating the impact of local government debt on the financial ecological environment, focusing on Chinese prefecture-level cities, is of great significance and value in analyzing whether the expansion of local government debt will lead to systemic risks in the Chinese financial system. Therefore, this study selects a sample of 227 prefecture-level cities in China and uses panel data from 2000 to 2020.

Data

The local government debt data includes estimates of both explicit and implicit debt. The explicit debt is represented by the balance of local government bonds issued by cities since 2009. However, for the years 2009–2014, where city-level data was not available on the Ministry of Finance website and only provincial-level data was provided, we followed the approach of Mao Jie and Huang Chunyuan (2018) to allocate the provincial bond balance to individual cities based on their respective GDP contribution to the provincial GDP. As for implicit debt, bank loans generated by local financing platforms constitute the main component. Therefore, in estimating the scale of implicit debt, we selected the interest-bearing debt of financing platforms as a proxy indicator for implicit debt balance. This approach avoids underestimating the size of local government debt by solely considering local government financing vehicle bonds, thus maximizing coverage of local government implicit debt.

For the financial ecological environment data, a regional financial ecological environment evaluation system was constructed, incorporating four primary indicators: economic foundation, financial development, government governance, and social credit foundation. It also included 13 secondary indicators such as economic development level, economic vitality, and economic openness. In selecting specific tertiary indicators, we adhered to principles of scientific validity, objectivity, comprehensiveness, comparability, and measurability based on indicator data. For some indicators lacking data sources, such as the closure rate of financial cases, their exclusion would not fundamentally affect the evaluation of the financial ecological environment and could be considered as a technical adjustment. Data for this study was collected from various official sources including the “China Statistical Yearbook,” “China Financial Yearbook,” “China City Statistical Yearbook,” as well as the websites of local statistical bureaus and the Ministry of Finance of China.

The entropy method is an objective weighting method that can determine the weight of indicators based on the size of the information provided by the observed values of various indicators. It avoids the bias caused by human subjective factors and ensures that the results can be better explained. Therefore, the entropy method is used to assign weights and scores to the financial ecological environment evaluation system constructed for 227 prefecture-level cities in China. Based on normalized and standardized data, the calculation formulas for the weight

In formula (1),

Baseline regression

Taking the panel data of 227 prefecture-level cities in China as an example, this study conducts an in-depth investigation into the relationship between local government debt and the financial ecological environment. It analyzes the scale and structural effects of local government borrowing on the financial ecological environment and further explores the regional heterogeneity of the impact of local government debt expansion on the financial ecological environment. Accordingly, based on Hypothesis 1 and Hypothesis 2, the following benchmark regression models are constructed to examine the relationship between the size and structure of local government debt and the financial ecological environment:

Where

Spatial econometric model

The expansion of local government debt not only affects the development of the financial ecological environment in the region but may also have an impact on surrounding areas. Therefore, according to

Where

Results

Correlation analysis

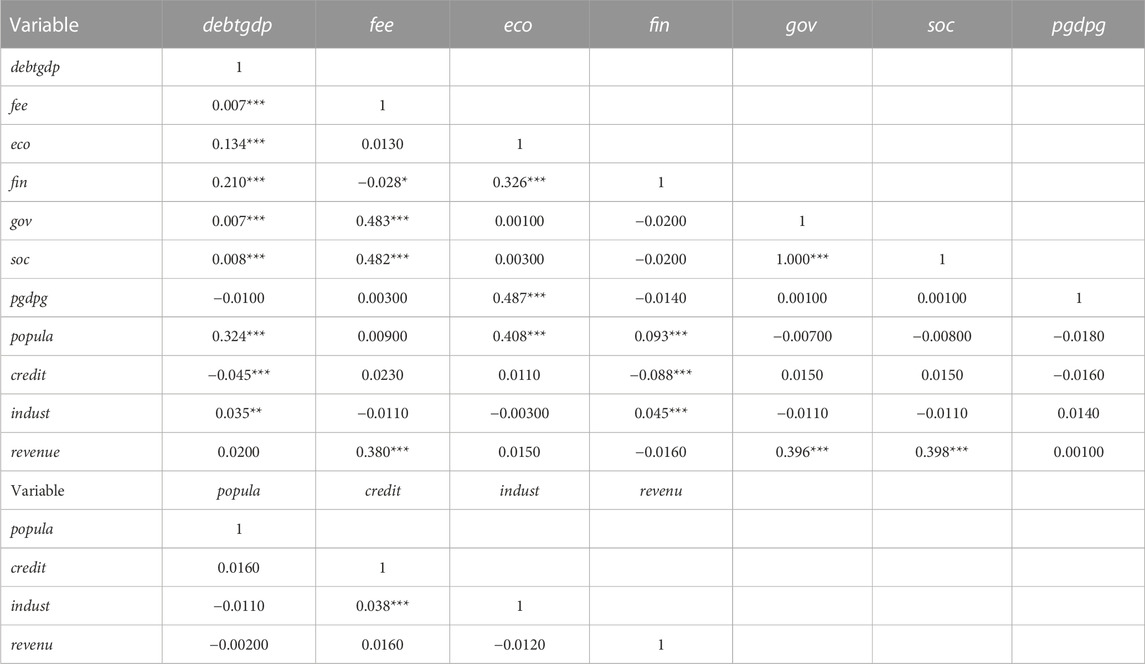

Table 2 presents the Pearson correlation coefficients for the main variables. Notably, there is a significant positive correlation at the 1% level between local government debt (debtgdp) and the financial ecological environment index (fee). This suggests an initial indication that local government debt is conducive to promoting the financial ecological environment. Furthermore, local government debt (debtgdp) shows a significant positive correlation at the 1% level with economic foundation (eco), financial development (fin), government governance (gov), and social credit basis (soc). This preliminary evidence suggests that local government debt enhances the financial ecological environment by fostering economic foundation, financial development, government governance, and social credit basis. Regarding control variables, most of them exhibit significant correlations with local government debt at the 1% level, indicating the reasonability of the chosen control variables. Moreover, the correlation coefficients among variables are all below 0.5, implying the absence of severe multicollinearity issues among variables.

Baseline regression results

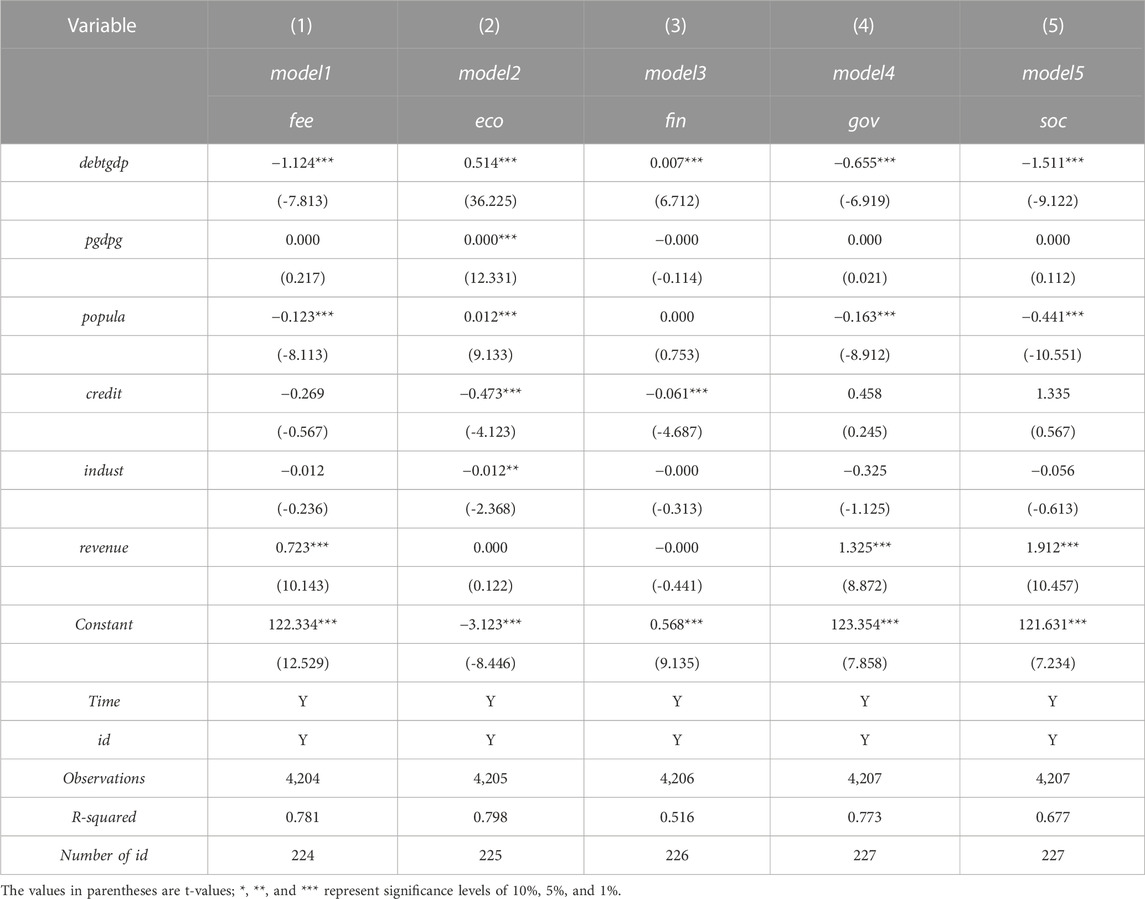

The test for multicollinearity shows that the variance inflation factor (

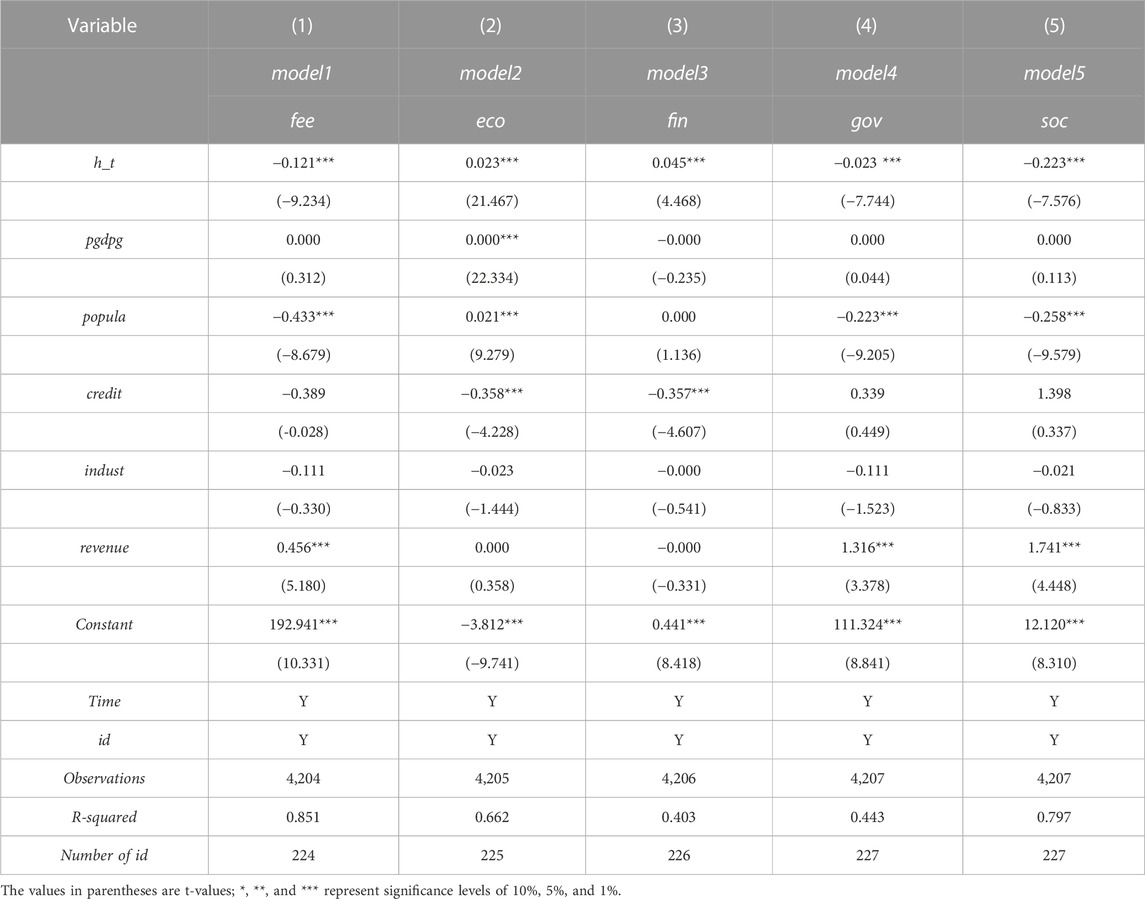

Table 4 reveals that, in terms of debt structure, a higher proportion of implicit debt is detrimental to the optimization of the financial ecological environment, which is statistically significant at the 1% level and aligns with the inference of Hypothesis 2. This could be attributed to the increased repayment and interest pressure faced by local governments as the proportion of implicit debt rises, impeding their investments in projects supporting innovation, talent attraction, and industrial structure upgrading. Consequently, local government credit and governance capacity are compromised, regional financial risks are heightened, and the quality of the local financial ecological environment is diminished. Specifically, the debt structure variables exhibit significant negative correlations with the social environment and government governance, highlighting the threatening nature of local government implicit debt to the sustainable and healthy development of the financial ecological environment. Furthermore, it exerts a notable inhibitory effect on the local social environment and government efficiency. The main reason behind this lies in the close association between local government implicit debt, borrowed through financing platforms and shadow banking, and local financial institutions. The inherent problems of implicit debt, such as low investment returns and uncertain repayment funds, may diminish the asset quality of financial institutions, increase their liquidity risks, and raise their non-performing loan ratios, thereby hindering local financial development and the optimization of the financial ecological environment. On the other hand, local government implicit debt can facilitate economic foundations and financial development. This is mainly attributed to the fact that local government implicit debt, primarily obtained through urban investment bonds, enables land financing. Subsequently, local governments utilize land finance for real estate development, thereby stimulating the local economy and economic growth. However, since the inhibitory effect of the former is significantly greater than the latter, the expansion of local government implicit debt overall suppresses the favorable development of the regional financial ecological environment.

Taking into account the potential variations in the impact of changes in local government debt on the financial ecological environment, we further employ the threshold regression model proposed by Hansen to examine whether the effect of local government debt scale exhibits a threshold effect. Based on the results of both single and double threshold tests, the F-statistic and its corresponding p-value suggest that the null hypothesis cannot be rejected. This implies that there is no threshold effect of local government debt on the financial ecological environment during the sample period. This relationship is consistently maintained in a linear manner.

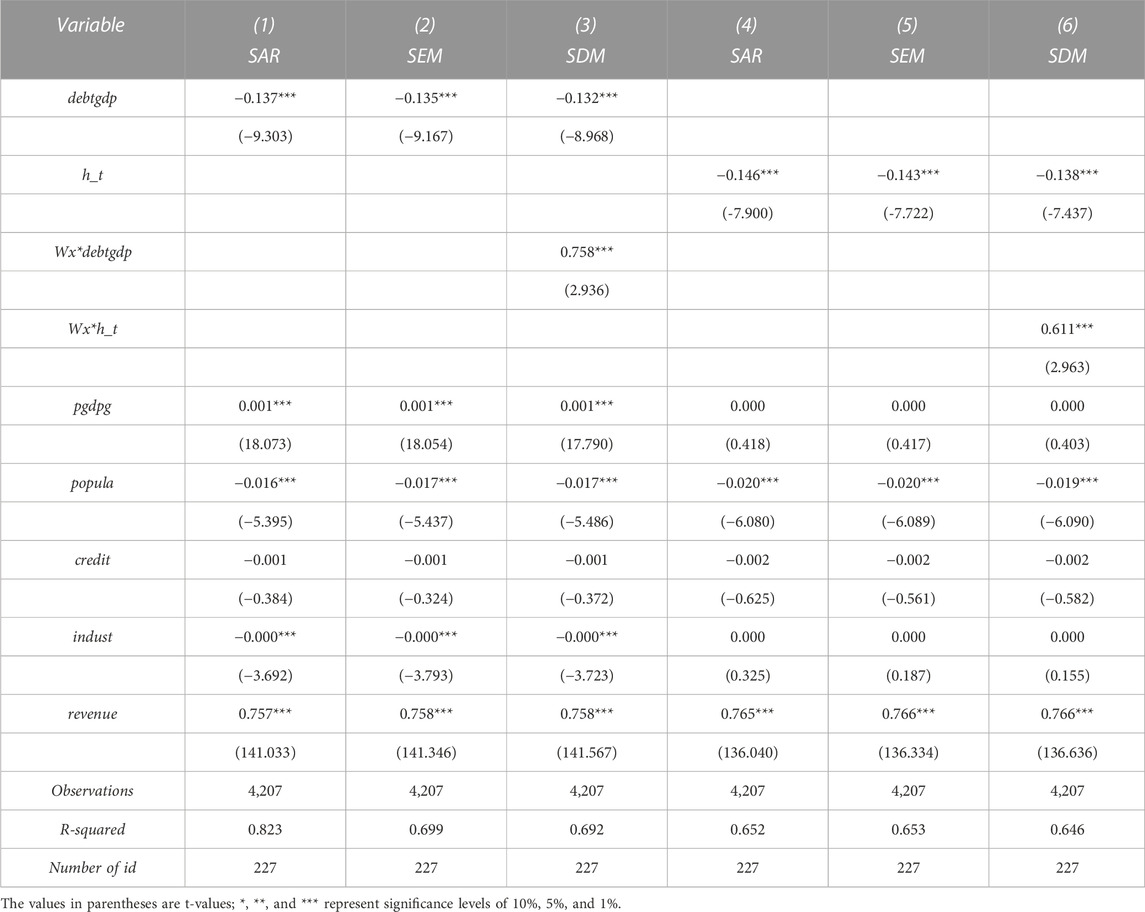

Spatial effect analysis

The spatial autocorrelation test reveals significant results for the global Moran’s I index of the financial ecological environment across 227 prefecture-level cities nationwide, indicating the presence of spatial correlation in the regional financial ecological environment. Subsequently, through LM, Hausman, and LR tests, we determine the adoption of the spatial Durbin model (SDM) with time and space fixed effects. For comparison purposes, Table 5 reports the regression results of both the spatial autoregressive (SAR) and spatial error (SEM) models. Columns (1) to (3) demonstrate that the coefficients of local government debt obtained from different regression models are negative and significant at the 1% level. The spatial lag term also passes the significance test, indicating positive spatial spillover effects of debt expansion on the development of financial ecological environments in other regions. Columns (4) to (6) reveal a negative relationship between debt structure indicators and the financial ecological environment. In all model regressions, the coefficients of the proportion of implicit debt are significantly negative, while the spatial lag term coefficients are positive. This suggests that as the proportion of implicit debt increases, local government debt expansion becomes detrimental to the optimization of the local financial ecological environment. However, it can promote the development of financial ecological environments in neighboring regions. A higher proportion of implicit debt implies greater debt burdens and financial risks, which hinders credit construction and impedes the development of financial ecological environments. Nevertheless, the expansion of implicit debt in the local region may indirectly drive financial resources in neighboring areas, thereby stimulating the development of financial ecological environments in those regions as well.

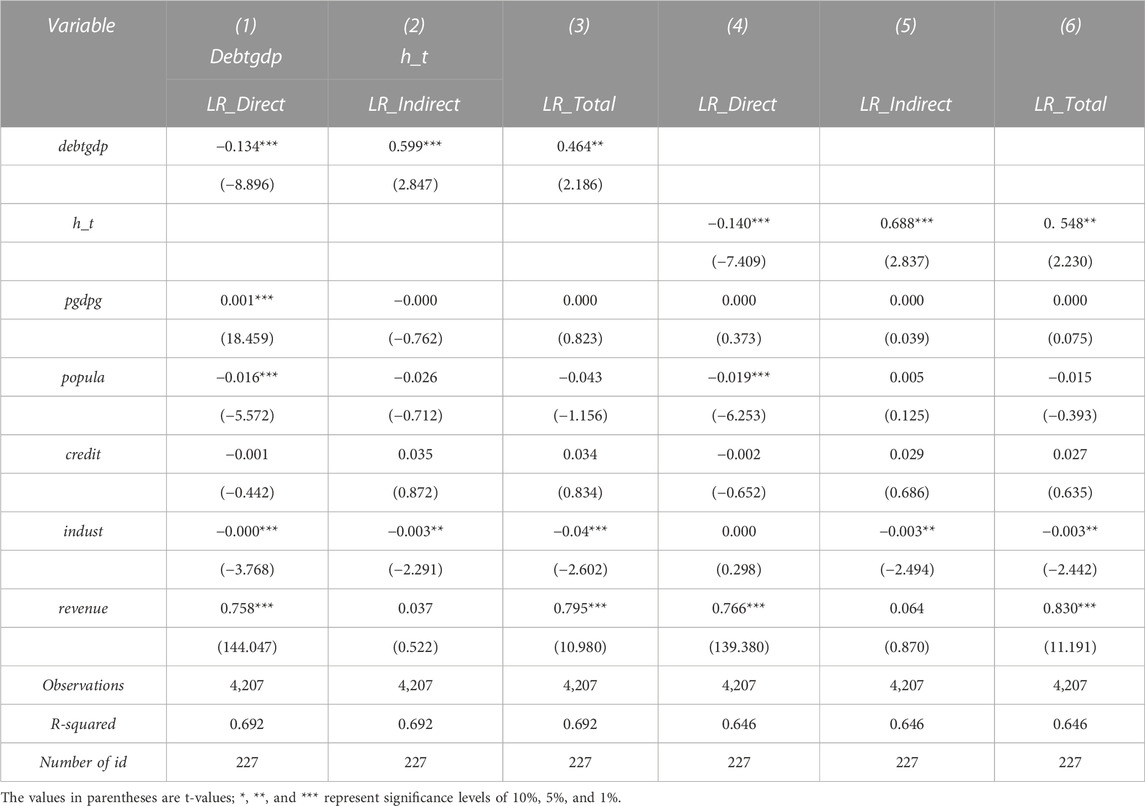

To further understand the spatial impact of local government debt on the financial ecological environment, Table 6 presents the decomposition results of the direct effect, indirect effect, and total effect of the SDM model. The results indicate a significant spatial spillover effect of local government debt on the regional financial ecological environment. During the observation period, the expansion of local government debt scale significantly inhibits the development of the local financial ecological environment while promoting the construction of financial ecological environments in neighboring regions. Moreover, an increase in the proportion of implicit debt also hinders the continuous optimization of the financial ecological environment in the local region while stimulating the development of financial ecological environments in adjacent areas.

Robustness test

Endogeneity

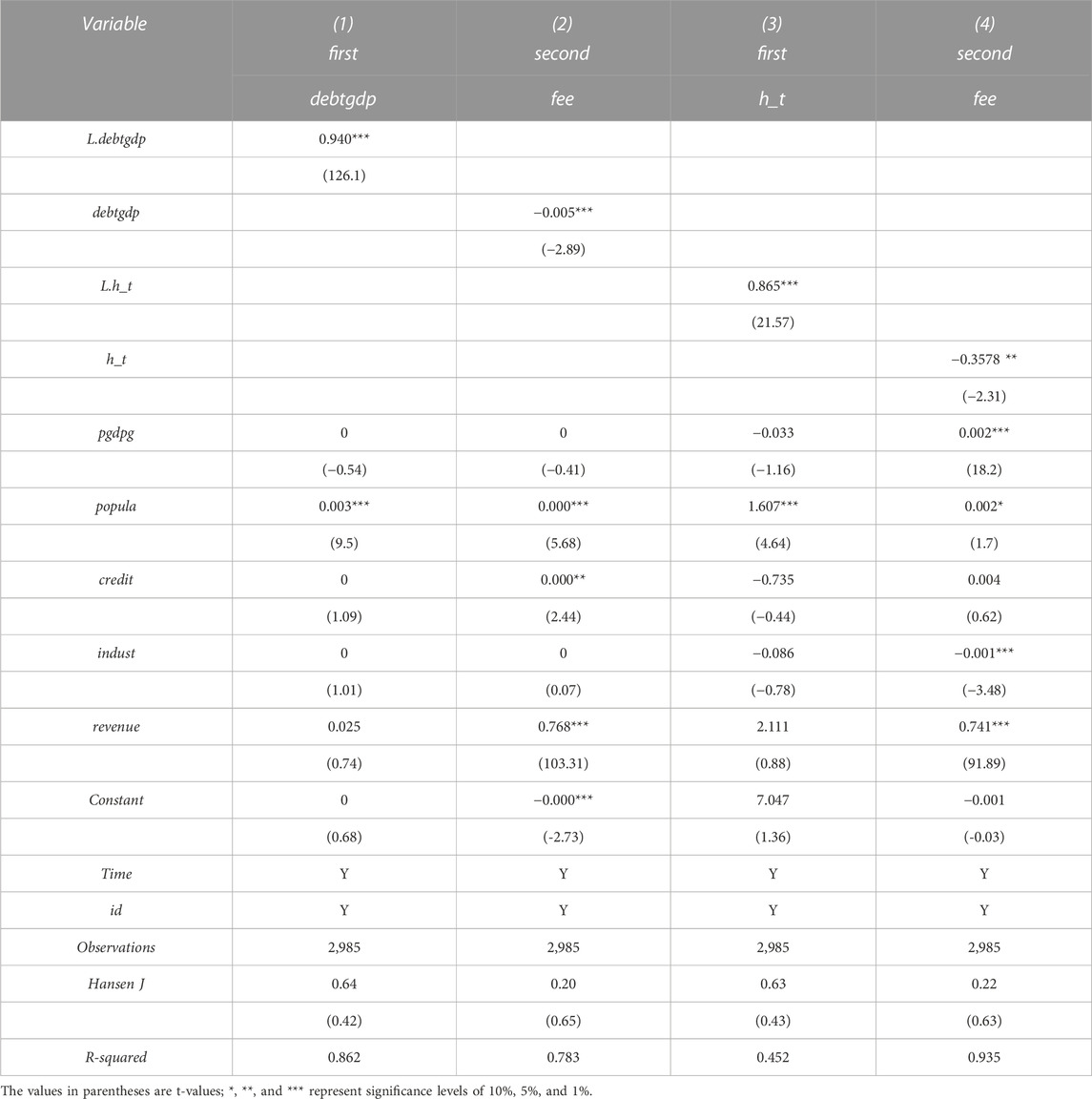

To address the endogeneity issue resulting from the bidirectional causal relationship between local government debt and the financial ecological environment, this study employs instrumental variable (IV) approach to conduct endogeneity tests. Lagged values of debt scale and debt structure are introduced as instruments, and the two-stage least squares (IV-2SLS) method is applied for regression analysis. Firstly, there is a strong correlation between the lagged one-period local government debt and the current-period local government debt, as they exhibit a time-series relationship. Secondly, the lagged one-period local government debt reflects debt incurred in previous periods and is unrelated to the current-period error term (the impact of financial environment). The lagged one-period variables for debt scale and debt structure meet the requirements of correlation and independence1. The decision-making regarding local government debt is typically influenced by factors such as policies, economic cycles, and fiscal planning. Unobservable factors that lag by one period result from past economic and policy events. Therefore, they are relatively independent over time and should not exhibit serial correlation. The results are presented in Table 7. The first stage results show that both the local government debt ratio and the proportion of implicit debt are significantly positively correlated with their lagged values. In the second stage, after controlling for endogeneity issues, the local government debt ratio is found to be negatively correlated with the financial ecological environment, and the proportion of implicit debt is also negatively correlated with the financial ecological environment. These results pass the significance test at the 1% level, and are consistent with the baseline regression model, further confirming the robustness of the regression results.

Replacing core explanatory variables

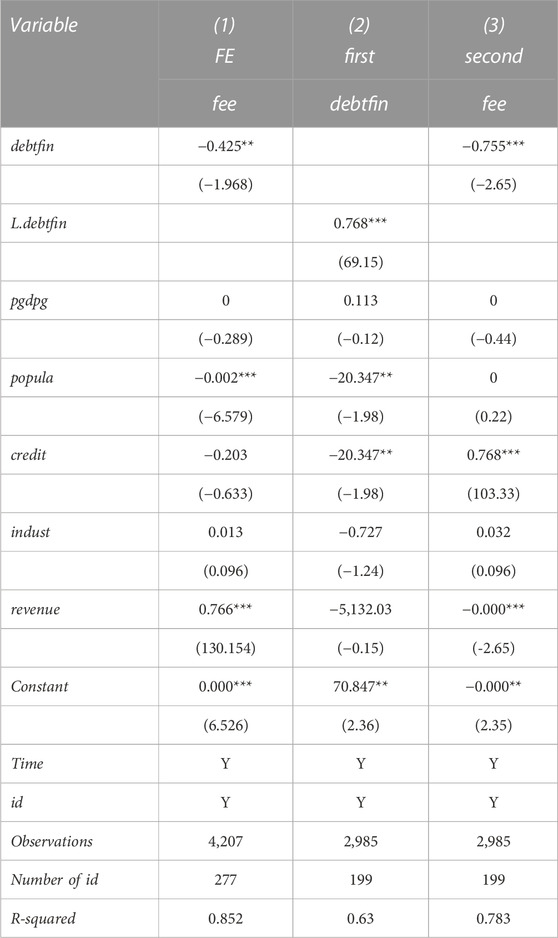

To improve the reliability of the regression analysis results, this study replaces the debt ratio indicator with the debt-to-GDP ratio and retests Eq. 2. According to Table 8. The results indicate that the estimated coefficients of the debt-to-GDP ratio variable, after replacing the core variable, exhibit similar signs and levels of significance compared to the baseline regression results. Additionally, the significance of some control variables is enhanced. These findings confirm the robustness of the baseline regression results.

Changing spatial weight matrix

To enhance the robustness of the spatial effects analysis on the impact of local government debt on the financial ecological environment, further regression verification was conducted using an economic distance weight matrix. The regression results are presented in Table 9. After replacing the spatial weight matrix with the economic distance matrix, the estimated coefficients of the main core explanatory variables obtained from the regression remain consistent with the previous results, thus confirming the reliability of the earlier findings.

Results

Based on theoretical analysis, this study empirically examines the general and spatial effects of local government debt on the financial ecological environment using panel data from 227 prefecture-level cities in China. The following conclusions are drawn: First, the expansion of local government debt inhibits the construction and development of the local financial ecological environment, manifested by its negative impact on social environment and government efficiency. No significant threshold effect has been found in this regard. Second, the examination of debt structure reveals that a higher proportion of hidden debt is detrimental to the optimization of the financial ecological environment, indicating that hidden debt poses risks similar to explicit debt, primarily impeding the stable development of local finance. Third, local government debt exhibits significant spatial spillover effects on the financial ecological environment. The expansion of debt in one region simultaneously promotes the development of the financial ecological environment in neighboring regions. Moreover, an increase in the proportion of hidden debt also contributes to the continuous improvement of the financial ecological environment in both the local region and other neighboring regions.

Based on the above conclusions, this study provides the following insights:

First, it is crucial to pay close attention to the negative impact of local government debt risks on the development of the financial ecological environment and strengthen the dual-risk management of debt scale and structure. It is necessary to allow local governments to moderately borrow within the specified limits, fully leverage the role of special bonds in stimulating effective investment and promoting stable growth, while also regulating the borrowing practices of local governments. Accelerating the market-oriented transformation of local financing platforms, resolutely curbing the growth of hidden debt, prudently resolving existing debt, and guarding against the expansion of hidden debt risks are essential.

Second, it is important to enhance the role of local government debt in supporting the financial ecological environment by strengthening performance management and directing debt funds appropriately. This can be achieved through the development of digital finance, the establishment of intelligent cloud platforms and information systems for local government debt management, as well as innovative and sound debt management mechanisms. Norms and improvements in government and social capital cooperation should be promoted to advance the construction of public welfare infrastructure, utility projects, and industrial development using fiscal funds integrated with social capital. Properly guiding the allocation of debt funds and utilizing local government borrowing to support the improvement of the overall quality of the regional financial ecological environment and promote development across all dimensions of the financial ecological environment are crucial.

Third, attention should be given to the spatial linkages between local government debt and the financial ecological environment, and reforms should be made to the existing performance evaluation criteria for local government officials. By designing a more reasonable performance evaluation system, adjusting evaluation criteria in multiple aspects related to the financial ecological environment, and incorporating more indicators beyond GDP, a collaborative mechanism can be established to facilitate the rational utilization of debt funds by different local governments to improve the construction of the financial ecological environment.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://pan.baidu.com/s/1LJXAlxRnmDi9uZ7z2eZMtA.

Author contributions

The data collection and analysis for this study were conducted by ZW, JY, SX, ZY, and YH. The revision and guidance for the manuscript were provided by XZ.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1To assess the exogeneity of instrumental variables, we conducted an over-identification test using the Hansen J-test. The results indicate that the over-identification test is passed, supporting the null hypothesis that all instrumental variables are exogenous.

References

Affinito, M., Albareto, G., and Santioni, R. (2019). Purchases of sovereign debt securities by banks during the crisis: the role of balance sheet conditions. J. Bank. Finance 138, 105575. doi:10.1016/j.jbankfin.2019.06.007

Barro, R. (1974). Are government bonds net wealth? J. Political Econ. 82 (06), 1095–1117. doi:10.1086/260266

Chang, J., Yang, T., and Shi, Y. (2022). Finance leases: in the shadow of banks. Rev. Finance 26 (3), 721–749. doi:10.1093/rof/rfab037

Checherita Westphal, C., and Rother, P. (2012). The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur. Econ. Rev. 26 (06), 1392–1405. doi:10.1016/j.euroecorev.2012.06.007

Cheng, H., and Ye, N. (2020). Recent progress and risk prevention of local government debt replacement. Banker 2020 (7), 107–110.

Cheng, Y., Jia, S., and Meng, H. (2022). Fiscal policy choices of local governments in China: land finance or local government debt? Int. Rev. Econ. Finance 80 (2022), 294–308. doi:10.1016/j.iref.2022.02.070

Crosignani, M. (2021). Bank capital, government bond holdings, and sovereign debt capacity. J. Financial Econ. 141 (2), 693–704. doi:10.1016/j.jfineco.2021.04.005

Cunha, A. B., and Ornelas, E. (2018). The limits of political compromise: debt ceilings and political turnover. J. Eur. Econ. Assoc. 16 (3), 781–824. doi:10.1093/jeea/jvx025

Demirci, I., Huang, J., and Sialm, C. (2019). Government debt and corporate leverage: international evidence. J. Financial Econ. 133 (2), 337–356. doi:10.1016/j.jfineco.2019.03.009

Deng, Q., and Chen, R. (2014). A research of constructing regional financial ecological main bodies’ indicator system and competitiveness evaluation. Int. Bus. Manag.

Diao, W. (2016). Research on the moderately sized local government debt under the perspective of economic growth: an analysis based on provincial data. Econ. Issues (03), 50–54. doi:10.16011/j.cnki.jjwt.2016.03.010

Federspiel, F., Borghi, J., and Martinez-Alvarez, M. (2022). Growing debt burden in low-and middle-income countries during COVID-19 may constrain health financing. Glob. Health Action 15 (1), 2072461. doi:10.1080/16549716.2022.2072461

Fratianni, M., and Marchionne, F. (2017). Bank asset reallocation and sovereign debt. J. Int. Financial Mark. Institutions, Money 47, 15–32. doi:10.1016/j.intfin.2016.11.011

Fu, L., and Wang, X. (2020). Theoretical study on local government debt securitization: an analysis based on budget constraints. Shanghai Finance 2020 (2), 71–80.

Gennaioli, N., Martin, A., and Rossi, S. (2018). Banks, government bonds, and default: what do the data say? J. Monetary Econ. 98, 98–113. doi:10.1016/j.jmoneco.2018.04.011

Greiner, A. (2012). Debt and growth: is there a non - monotonic relation[R]. Work. Pap. Econ. Manag. Bielefeld Univ.

Hassan, M. K., Karim, M. S., and Kozlowski, S. E. (2022). Implications of public corruption for local firms: evidence from corporate debt maturity. J. Financial Stab. 58 (2022), 100975. doi:10.1016/j.jfs.2022.100975

Hildreth, W. B., and Miller, G. J. (2002). Debt and the local economy: problems in benchmarking local government debt affordability. Public Budg. Finance 22 (04), 99–113. doi:10.1111/1540-5850.00091

Jia, X. (2017). Analysis of the impact path and effect of local government debt replacement on commercial banks. West. Finance 2017 (1), 81–83.

Jia, Z., Deng, L., and Xu, R. (2018). How does debt structure influence stock price crash risk? J. Syst. Sci. Complex. 31 (2), 473–492. doi:10.1007/s11424-016-6105-1

Johnson, C. L., and Yushkov, A. (2022). On the determinants of regional government debt in Russia. Eurasian Geogr. Econ. 64, 484–522. doi:10.1080/15387216.2022.2042350

Kong, D., and Xie, G. (2020). Local government bonds, debt replacement, and commercial bank wealth management yield. Contemp. Finance 2020 (9), 66–75.

Kormendi, R. C. (1983). Government debt, government spending, and private sector behavior. Am. Econ. Rev. 73 (5), 994–1010.

Li, Z., Tuerxun, M., Cao, J., Fan, M., and Yang, C. (2022). Does inclusive finance improve income: a study in rural areas. AIMS Math. 7 (12), 20909–20929. doi:10.3934/math.20221146

Liang, H., Chen, Q., Liao, T., et al. (2020). How does local government debt replacement affect bank money creation? An empirical analysis of 141 commercial banks. Regional Finance Res. 2020 (4), 42–49.

Liang, Q., and Hao, Y. (2019). Research on local government debt replacement and macroeconomic risk mitigation. Econ. Res. 54 (4), 18–32.

Liang, Y., Shi, K., Wang, L., and Xu, J. (2017). Local government debt and firm leverage: evidence from China. Asian Econ. Policy Rev. 12 (2), 210–232. doi:10.1111/aepr.12176

Liu, P., Zhao, Y., Zhu, J., and Yang, C. (2022). Technological industry agglomeration, green innovation efficiency, and development quality of city cluster. Green Finance 4 (4), 411–435. doi:10.3934/gf.2022020

Liu, Y., Sun, H., Meng, B., Jin, S., and Chen, B. (2023). How to purchase carbon emission rights optimally for energy-consuming enterprises? Analysis based on the optimal stopping model. Energy Econ. 124, 106758. doi:10.1016/j.eneco.2023.106758

Luo, D., and Chen, F. (2016). Local government debt, government subsidies, and enterprise performance. Econ. Issues (10), 85–91. doi:10.16011/j.cnki.jjwt.2016.10.017

Ma, R., and Qamruzzaman, M. (2022). Nexus between government debt, economic policy uncertainty, government spending, and governmental effectiveness in BRIC nations: evidence for linear and nonlinear assessments. Front. Environ. Sci. 10, 952452.

Martins, L. F. (2021). The US debt–growth nexus along the business cycle. North Am. J. Econ. Finance 58, 101462. doi:10.1016/j.najef.2021.101462

Muganyi, T., Yan, L., Yin, Y., Sun, H., Gong, X., and Taghizadeh-Hesary, F. (2022). Fintech, regtech, and financial development: evidence from China. Financ. Innov. 8 (29), 29. doi:10.1186/s40854-021-00313-6

Pan, F., Zhang, F., Zhu, S., and W´ojcik, D. (2017). Developing by borrowing? interjurisdictional competition, land finance and local debt accumulation in China. Urban Stud. 54 (4), 897–916. doi:10.1177/0042098015624838

Panizza, U., and Presbitero, A. F. (2014). Public debt and economic growth: is there a causal effect. J. Macroecon. 41 (04), 21–41. doi:10.1016/j.jmacro.2014.03.009

Qian, M., Cheng, Z., Wang, Z., and Qi, D. (2022). What affects rural ecological environment governance efficiency? Evidence from China. Int. J. Environ. Res. Public Health 19 (10), 5925. doi:10.3390/ijerph19105925

Qiu, Z., Wang, Z., and Wang, Z. (2022). Local government debt replacement and new implicit debt: an analysis based on the scale and pricing of urban investment bonds. China Ind. Econ. 2022 (4), 42–60.

Reinhart, C. M., and Rogoff, K. S. (2010). Growth in a time of debt. Am. Econ. Rev. 100 (02), 573–578. doi:10.1257/aer.100.2.573

Siddiqai, R., and Malik, A. (2001). Debt and economic growth in count Asia. Pak. Dev. Rev. 50 (12), 677–688.

Su, X., Wang, B., and Feng, W. (2009). Risk warning and resolution strategies for local government investment and financing platforms. Rural Finance Res. 12, 29–32.

Tang, Z. (2022). Local government debt, financial circle, and sustainable economic development. Sustainability 14 (19), 11967. doi:10.3390/su141911967

Tian, X. (2022). Uncertainty and the shadow banking crisis: estimates from a dynamic model. Manag. Sci. 68 (2), 1469–1496. doi:10.1287/mnsc.2020.3916

Wen, H., and Liu, Y. (2023). Can fintech lead to the collaborative reduction in pollution discharges and carbon emissions? J. Sustain. 15 (15), 11627. doi:10.3390/su151511627

Wu, X., and Xu, M. (2017). Empirical reflection on the impact of local debt replacement on commercial banks: a case study of jingdezhen city. Wuhan. Finance, 2017(1), 60–61.

Xie, D., and Chen, Y. (2009). Governance effects of financial ecological environment, property rights, and debt. Econ. Res. 44 (05), 118–129.

Xingzhi, L., and Tao, W. (2009). Regional differences in competitiveness of commercial banks and local government behavior: an analysis based on regional financial ecological environment differences. China Adm. (2), 57–60.

Xiu, J., Zang, X., Piao, Z., Li, L., and Kim, K. (2023). China’s low-carbon economic growth: an empirical analysis based on the combination of parametric and nonparametric methods. Environ. Sci. Pollut. Res. 30 (13), 37219–37232. doi:10.1007/s11356-022-24775-y

Xu, L., Guo, P., and Wen, H. (2023). Increasing short-term lending for long-term investment under environmental pressure: evidence from China’s energy-intensive firms. Environ. Sci. Pollut. Res. 30 (6), 14693–14706. doi:10.1007/s11356-022-23190-7

Yarba, ˙I., and Güner, Z. N. (2020). Leverage dynamics: do financial development and government leverage matter? Evidence from a major developing economy. Empir. Econ. 59, 2473–2507. doi:10.1007/s00181-019-01705-5

Zhang, X., Zhang, C., Fu, L., Tsang, L., Jiang, X., and Chan, H. (2020). Dedifferentiation-reprogrammed human mesenchymal stem cells for treating ischaemic stroke: abridged secondary publication. Mod. Finance Econ. 40 (1), 41–45. doi:10.16528/j.cnki.22-1054/f.202008100

Zhang, Y., Chen, Z., Chen, H., et al. (2023). Exploring the impact of “double carbon target” on environmental efficiency of coal cities in China. Front. Environ. Sci. 11, 248.

Zhang, Z., and Dai, L. (2023). The bank loan distribution effect of government spending expansion: evidence from China. Int. Rev. Financial Analysis 89, 102778. doi:10.1016/j.irfa.2023.102778

Zhao, Q. (2014). Risk warning, management of local government debt, and the emergence of fiscal risk regulatory system. Reform (04), 61–70.

Keywords: local government debt, debt structure, financial ecological environment, spatial spillover effect, government debt

Citation: Wang Z, Yan J, Xu S, Yi Z, Huang Y and Zhang X (2023) Analysis of the impact of local government debt policy on the financial ecological environment-based on debt level and debt structure perspectives. Front. Environ. Sci. 11:1218505. doi: 10.3389/fenvs.2023.1218505

Received: 07 May 2023; Accepted: 11 October 2023;

Published: 26 October 2023.

Edited by:

Huaping Sun, Jiangsu University, ChinaCopyright © 2023 Wang, Yan, Xu, Yi, Huang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuedong Zhang, emhhbmd4ZHp4ZDEyQDE2My5jb20=

Zejun Wang1

Zejun Wang1 Jiale Yan

Jiale Yan ShaoKang Xu

ShaoKang Xu